#Financial Empowerment

Text

the beginner's guide to making money by investing in stocks (hot girl version)

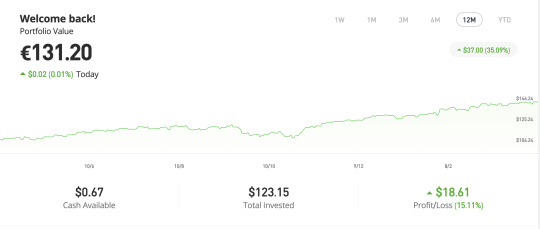

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

7 notes

·

View notes

Text

An open letter to the U.S. Senate

Improve disabled American's financial stability with S.4102 - SSI Savings Penalty Elimination Act

In the words of David Goldfarb on behalf of the Arc of the United States, "…we enthusiastically endorse S. 4102, the SSI Savings Penalty Elimination Act, which would raise the amount of savings a Supplemental Security Income (SSI) recipient can keep for the first time in over thirty years. The mission of the Arc is to promote and protect the human rights of people with intellectual and developmental disabilities (IDD) and actively support their full inclusion and participation in the community throughout their lifetimes.

"SSI provides an extremely modest cash benefit, a maximum of $841 a month in 2022, for certain individuals with disabilities and older adults. In March 2022, nearly 7.6 million people: 4.3 million working-age individuals with disabilities; 1 million children with disabilities; and 2.3 million older adults relied on the program.

"Many individuals with IDD rely on the SSI program. In 2017, SSA estimated that approximately 19% of working-age SSI recipients possessed an intellectual disability. For many people with IDD, SSI is their only source of income without which they could become institutionalized or homeless.

"Unfortunately, the benefit’s low, outdated resource limit of $2,000 for individuals/$3,000 for couples does not allow people to save for emergencies, such as a leaky roof, car repair, or other unexpected expense. To make matters worse, the $2,000 limit does not adjust for inflation every year, and it has remained the same since 1989.

"The SSI Savings Penalty Elimination Act would significantly improve the lives of SSI recipients, including people with IDD, by raising the asset limit to $10,000 per individual/$20,000 per couple. The legislation also adjusts that number for inflation every year, a critical element in 2 today’s inflationary environment. This will allow SSI beneficiaries to use their own savings to address needed emergencies when they arise.

"Thank you again for this critical legislation."

Truly his letter is phenomenal and applicable to many American citizens. I hope you too appreciate his mastery of diction, his compassion for his fellow American, and the truth in his words.

📱 Text SIGN PYLYME to 50409

🤯 Liked it? Text FOLLOW IVYPETITIONS to 50409

#ivy petitions#Supplemental Security Income#SSI#SSI Reform#Disability Rights#Financial Security#social security#activate your activism#human rights#Inclusion#Community Support#Public Policy#economic justice#Inclusive Society#IDD#UBI#universal basic income#empowerment#Disability Community#Government Support#Financial Empowerment#Legislation#Asset Limits#Financial Assistance#Advocacy#Equality#Senate Bill#s.4102#Savings Penalty Elimination Act#Federal Programs

5 notes

·

View notes

Text

🚀 To Gain expertise in the world of cryptocurrency and revolutionize your financial future! 📈🔒 📚 Join Crypto Quantum Leap exclusive Crypto Currency Course to understand the principles, strategies, and latest trends in the digital asset indusry. Led by industry experts, this comprehensive program equips you with the knowledge to navigate cryptocurrency markets with confidence. 💡 Unlock the potential of blockchain technology, learn about decentralized finance, and explore investment opportunities. From Bitcoin to altcoins, this course covers it all! 👉 Don't miss out on this opportunity to become a savvy crypto investor! Enroll in their course today! 🎓💰

Click on link given below

#Cryptocurrency course#Investing in cryptocurrency#Cryptocurrency Education#Blockchain Technology#Financial Empowerment#Become A Savvy Investor

2 notes

·

View notes

Text

Navigating Financial Empowerment With LWL and Nuvama

Embark on a journey to financial empowerment with LWL and Nuvama Wealth. Unlock the mysteries of personal finance and gain confidence in managing your wealth. Explore topics from budgeting to investment strategies in our workshops. Meet the experts from Nuvama Wealth, dedicated to guiding you towards a secure future. Learn about portfolio planning, investment essentials, and decoding the stock market. Join us for insightful Q&A sessions and real-life case studies. Stay tuned for upcoming workshops and take the first step towards financial freedom. Let's build a resilient foundation for lasting prosperity together. Join LWL and Nuvama Wealth on this empowering venture today!

0 notes

Text

Happy International Women's Day! Today, we commemorate the achievements, progress, and resilience of women around the world. International Women's Day serves as a call to action and a reminder of the continuous fight for gender equality in addition to being a day of celebration. In this blog, we will delve into the history of Women's Day, the importance of empowering women, and the strides made towards a more equitable world.

#achievements of women#breaking barriers#breaking gender stereotypes#breaking stereotypes#breaking stereotypes in india#economic empowerment#empowering women through education#empowering women through fashion#exclusive women's day offers#facts about international women's day#facts about women's day#financial empowerment#financial empowerment tips#gender based issues in india#gender equality#global challenges faced by women#inspirational story for women's day#international women's day#journey of women's day#list of women's issues#societal stereotypes#women's choices and expectation#women's day 2024

0 notes

Text

Unlock Financial Opportunities with Prefr Loans – A Comprehensive Guide

Unlocking Financial Opportunities: A Deep Dive into Prefr Loans

In the ever-evolving realm of financial services, Prefr stands tall as a reliable and accessible provider of credit solutions. Let’s embark on a comprehensive journey to explore the various facets of Prefr loans, understanding why this NBFC (Non-Banking Financial Company) is not just a lender but a financial ally.

Prefr Loans: A…

View On WordPress

#Prefr Loans#NBFC#Salaried Professionals#Self-Employed Entrepreneurs#Loan Flexibility#Repayment Tenure#Competitive Interest Rates#Transparent Processing Fee#Net Take-Home#Age Criteria#Digital Process#Responsible Borrowing#Credit Solutions#Prefr Features#Financial Solutions#Financial Empowerment#cibil score#personal finance#Financial Inclusion#loan application

0 notes

Text

Budgeting Like a Boss: My No-Nonsense Guide to Financial Fierceness

Budgeting doesn’t have to be boring, sis! Join me on Fierce Millennial as we explore a no-nonsense approach to financial fierceness. Ditch the guilt, embrace mindful spending, and achieve your goals! #FinancialFreedom #MillennialMoney #BlackGirlMagic #FinancialFierceness #FierceMillennial

Write about your approach to budgeting.

Let’s get real: budgeting isn’t always IG-worthy, but for fierce women like us navigating real financial challenges, it’s the key to unlocking freedom and living life on our own terms.

Ditch the unrealistic expectations and restrictive rules. My approach to budgeting is all about empowerment, flexibility, and finding what works for YOU. It’s about…

View On WordPress

#Black women#budgeting#dailyprompt#dailyprompt-1851#FIERCE MILLENNIAL#financial empowerment#Financial Fierceness#financial freedom#financial literacy#Gen-X women#millennial women#money management#personal finance

0 notes

Text

What is a Financial Coach, and What do They do Exactly?

Discover the multifaceted role of a financial coach and how they serve as invaluable guides on the path to financial stability and prosperity. Explore the diverse services they offer and the transformative impact they can have on your financial well-being.

#Financial coach#Personal finance guidance#Budgeting assistance#Debt management strategies#Wealth building techniques#Financial education#Investment planning#Retirement preparedness#Financial empowerment#Money mindset transformation#Financial goal setting#Financial literacy#Financial wellness support#Savings tactics#Accountability in finances#Money management skills enhancement#Financial independence coaching#Comprehensive financial planning#Benefits of financial coaching#Gateway of Healing#dr.chandnitugnait

0 notes

Text

Unlock Financial Empowerment: Navigating the Digital Landscape of Making Money Online from Home.

In the contemporary landscape of technology, the concept of making money online from the comfort of one's home has evolved into a profound phenomenon. The internet, a vast marketplace of ideas and commerce, has democratized opportunities, paving the way for diverse income streams. Freelancing platforms connect skilled individuals with projects globally, while e-commerce platforms enable entrepreneurs to reach customers without the confines of a physical storefront.

Virtual marketplaces have burgeoned, offering everything from digital services to handmade crafts. Remote employment has surged, allowing professionals to contribute their expertise from any corner of the world. Online courses and content creation have become lucrative pursuits, turning passions into profitable ventures.

However, navigating this digital frontier demands adaptability and resilience. It requires individuals to stay abreast of evolving trends, master new skills, and cultivate a proactive entrepreneurial spirit. Success in making money online often hinges on strategic branding, effective marketing, and building a trustworthy online presence.

Yet, amidst the allure of flexibility and global connectivity, aspiring online earners must exercise caution. The digital realm, while abundant with opportunities, also harbors scams and pitfalls. Therefore, a discerning approach and due diligence are essential.

In essence, making money online from home is not merely a financial endeavor; it represents a paradigm shift in how individuals can shape their professional destinies, fostering a sense of empowerment, autonomy, and the potential for self-discovery in the vast landscape of the digital age.

Discover the world of online earning today! Join the digital revolution by clicking the link below. Start making money online from home – your journey to financial empowerment begins now!

#Online earning#Digital landscape#Financial empowerment#Home-based income#Internet opportunities#Freelancing platforms#E-commerce ventures#Virtual marketplaces#Remote employment#Online courses#Content creation#Entrepreneurial spirit#Strategic branding#Effective marketing#Trustworthy online presence#Global connectivity#Adaptability#Self-discovery#Paradigm shift#Caution in online ventures.

0 notes

Text

How I Crushed $20,000 in Student Loans and Achieved Debt-Free Bliss!

Shaina Tranquilino

January 31, 2024

Student loans have become a harsh reality for millions of graduates worldwide. The burden of debt can be overwhelming, hindering our financial freedom and future aspirations. However, with determination, discipline, and these practical tips that helped me pay off my $20,000 student loan debt, you too can find your path to becoming debt-free.

1. Create a Solid Repayment Plan:

The first step towards paying off any debt is to create a well-structured repayment plan. Start by evaluating your overall financial situation and set realistic goals for yourself. Determine how much you can afford to put towards loan payments each month without sacrificing essentials or other necessary expenses. Having a clear roadmap will help keep you focused and motivated throughout the journey.

2. Prioritize Your Payments:

While it's essential to make minimum monthly payments on all outstanding debts, prioritizing higher-interest loans can save you significant money in the long run. By directing additional funds towards loans with high-interest rates, you'll reduce the overall interest accrued and expedite your debt payoff process.

3. Cut Back on Non-Essential Expenses:

Consider adopting a frugal lifestyle while paying off your student loans. Identify areas where you can cut back on non-essential spending to free up more money for loan repayments. Assess your monthly budget meticulously; small sacrifices like reducing dining out frequency or cancelling unnecessary subscriptions can go a long way in accelerating your debt repayment journey.

4. Generate Additional Income Streams:

Increasing your income is an effective strategy to speed up loan repayment. Explore opportunities to generate extra cash through side hustles or part-time jobs aligned with your skills or hobbies. Consider freelancing, tutoring, or monetizing specific talents online – every additional cent earned helps chip away at your student loan balance faster.

5. Utilize Windfalls Wisely:

If fortune smiles upon you with unexpected cash inflows, like tax refunds or bonuses, refrain from splurging on luxuries. Instead, allocate these windfalls towards paying off your student loans. While it may not be as thrilling as a spontaneous shopping spree, the satisfaction of reducing your debt burden will far outweigh any temporary materialistic indulgence.

6. Seek Loan Forgiveness or Repayment Assistance Programs:

Investigate loan forgiveness and repayment assistance programs available for specific professions or industries. Depending on your field of work, you might qualify for programs that forgive a portion of your loans after a certain number of years of service or offer repayment assistance in exchange for working in underserved areas.

7. Refinance Your Loans:

Consider refinancing your student loans to secure lower interest rates and flexible repayment terms. Research different lenders' offerings and compare their interest rates, fees, and borrower benefits before making a decision. However, carefully assess whether refinancing is the right choice for you based on your financial goals and circumstances.

8. Stay Positive & Celebrate Milestones:

Paying off significant amounts of debt can feel like an arduous journey at times. It's crucial to stay positive throughout the process by celebrating milestones along the way – no matter how small they may seem! Recognize each accomplishment and reward yourself modestly to maintain motivation and keep pushing forward.

Becoming debt-free is an empowering achievement that opens doors to financial freedom and peace of mind. Remember that everyone's journey is unique, so don't compare yourself to others; focus on what works best for you. By creating a solid plan, practicing frugality, increasing income streams, exploring loan forgiveness options, refinancing when beneficial, staying positive through challenges, and celebrating milestones – you'll pave your own path to debt freedom just as I did with my $20,000 student loan payoff.

Stay determined, disciplined, and committed - soon enough, you'll find yourself basking in the joy of being debt-free. Your future self will thank you!

#debt free journey#debt free#pay off student loans#student loan success#financial freedom#crushing debt#debt free goals#personal finance win#student loan victory#financial empowerment#debt free life#money milestone#student loans are now paid off#budget#financial responsibility#work hard

1 note

·

View note

Text

Navigating Debt: Strategies for Women to Achieve a Debt-Free Future

In the journey towards financial empowerment, managing and eliminating debt stands as a pivotal step, offering women the opportunity to secure a debt-free future and unlock financial liberation. Debt can be a formidable obstacle, but with strategic planning and commitment, women can take control of their financial destinies. Here, we delve into practical tips and strategies to guide women on…

View On WordPress

0 notes

Text

Embracing Early Initiatives: A Personal Journey to Financial Empowerment

What could you do differently?

Written by Delvin

As I reflect on my journey, I’ve come to realize that there are a few things I wish I had done differently earlier in life. One of the key areas I wish I had focused on is finances. Looking back, I see the value in starting to save and learn about finances much earlier. If I had taken those steps, I would have been in a much stronger position…

View On WordPress

0 notes

Text

Unlocking the Mystery: How to Find Your PF Account Number Easily

Description: "Discover the step-by-step guide on Registration Kraft to uncover your PF account number effortlessly. Don't let confusion linger—empower yourself with the knowledge to access your crucial financial information with ease.

#PF account number#provident fund#registration#financial empowerment#employee benefits#Registration Kraft

0 notes

Text

Financial Freedom Through Mindset: Secrets of Millionaires

Unlock the secrets to financial freedom through mindset mastery! 💰✨ Dive into the exclusive insights of millionaires and discover the path to abundance. 🚀 For the full blog, click the Link-in-Bio. #FinancialFreedom #MillionaireMindset #WealthBuilding

Do you want to achieve financial freedom and live the life of your dreams? Do you wonder how some people seem to have it all while others struggle to make ends meet? If you answered yes to these questions, then you need to learn the secrets of millionaires and how they use their mindset to create wealth and happiness.

In this blog post, I will share with you some of the most powerful principles…

View On WordPress

#Abundance#Achieving Freedom#Financial Empowerment#Financial Freedom#Financial Wisdom#Millionaire Lifestyle#Millionaires#Mindset Secrets#Mindset shift#Mindset transformation#Money Mastery#Money Mindset#Prosperity Principles#Success mindset#Success Strategies#Wealth building#Wealth creation

0 notes

Text

Liberating My Path: Building Generational Wealth and Financial Independence

Empowering the Next Generation

Our homeschooling journey is not just about academic subjects; it's about teaching financial literacy, entrepreneurship, and critical life skills

from upcoming Something Nubian Homeschool: Empowering Melanin Minds – Ebook + Workbook + Mini e-Course

By La Trecia Doyle Thaxton

keywords: Liberation, Generational Wealth, Stay-at-Home Mom, Financial Independence, Options Trading, Financial Education, Entrepreneurship, Balancing Roles, Homeschooling, Financial Literacy, Financial Empowerment, Family Finances, Financial Growth, Financial…

View On WordPress

#Balancing Roles#Building Wealth#Empowering Children#Entrepreneurship#Family Finances#Financial Education#Financial Empowerment#Financial Growth#Financial Independence#Financial Knowledge#Financial Literacy#Financial Resilience#Generational Wealth#homeschooling#Liberation#Lifestyle Choices#Money Management#Options Trading#Parenting and Finance#Stay-at-Home Mom

0 notes

Text

Micro-Business Empowerment: Unveiling 5 Key Insights into CGTMSE Loan Schemes for Sustainable Growth

Micro-Business Empowerment: Unveiling the Pros and Cons of CGTMSE Loan Schemes for Sustainable Growth: Key Insights into CGTMSE Loan Schemes for Sustainable Growth

India’s vast network of Micro, Small, and Medium Enterprises (MSMEs) forms the backbone of the nation’s economy. However, securing funding for these small businesses often proves challenging due to their perceived higher risk profile.…

View On WordPress

#Business Development#CGTMSE Loans#CMA Data#Credit Guarantee Fund Scheme#Empowerment#Entrepreneurship#Financial Consulting#Financial Empowerment#Loan Schemes#Micro-business#MSMEs#Project Reports#Pros and Cons#Small Business Financing#Sustainable Growth

0 notes