#financial journal

Text

What I bought in 2023

this is the first in a series of posts in which i reflect on my 2023 from a financial perspective, using data from my financial journal.

initially i wanted to just list everything i paid for chronologically, but then i realized that data without analysis is not going to be much useful. so here is all i bought in 2024, divided in categories!

these are all unnecessary purchases (so no groceries, rent, etc).

material stuff

a kpop photocard. i’ve already talked about this, i think. there were a couple of months at the beginning of the year in which i desperately wanted to collect photocards of this particular kpop artist. i already had 2 but when i finally decided to buy this third one, i realized that i was quite underwhelmed. i do appreciate them and look at them from time to time but the itch to spend even more money on them disappeared. i’m glad i did buy it, though, because otherwise i would have spent months obsessively thinking about wanting to buy one. giving in once meant peace of mind afterward.

plastic reusable water bottle. kind of a fail. i would love to use it more, but i’d need to hand wash it (if i don’t want the water to taste like soap) and i just can’t be bothered. i’m sure i’ll use it while traveling. also, it was super cheap for a reason! the nozzle is too big and uncomfortable. oh well, you live and learn.

new passport photos. that was unfortunately necessary & they are horrible photos too. frustrating.

socks. i was on a trip and forgot to bring socks, so i had to buy some there.

jewelry box. got it secondhand on Vinted after much thought. i don’t have much of a jewelry collection (if any) but i’d like to. i also wanted to get rid of all the small boxes and condense everything in 1 place. which worked for a while, but then someone gifted me more boxes and i can’t get rid of those ones, so that was kind of a fail.

2 secondhand books. i seriously do not need more books (i own like 20 that i haven’t read yet) but i have already read & resold one book so i’m not bothered about it. my rules with book buying are: 1) only if it’s secondhand, 2) only one for every secondhand bookshop i visit, 3) only stuff from my TBR list (that’s a more flexible rule, though). i’d say that it pretty much worked.

1 manga volume. I've been collecting this series for years because i love the art but, i've come to realize, not so much the story. i've decided to not purchase the next volume and am debating whether to sell the whole series as well.

yarn. i bought yarn for a sweater, for socks (three times), and for a cardigan (and its pattern). all in all, i’m satisfied with this amount. knitting can get expensive but i only bought yarn for planned projects, used my stash for at least another small 5 projects and i don’t think i’ll have to buy sock yarn for a while! money wise, i only had one doubt. a friend who also crochets told me that the website i buy my garment yarn at is too expensive compared to others. i thought long and hard about it & finally remembered that my friend’s cheaper yarn is super itchy. which is fine for her, as she mostly crochets bags, but i don’t knit bags! i knit sweaters! i’m fine with my yarn being a bit pricier if it makes for a comfier sweater.

25 padded envelopes. i used them when i sell my stuff online. i bought them new but secondhand on Vinted for a good price.

gifts. i bought 1 gift for a birthday and 2 for graduations. at the end of the year i tried to be smart and knit 2 gifts, but then i had to pay for shipping anyway so it didn’t save me any money. still, you know. it’s gifts and it’s my friends and i won’t be cheap with them.

immaterial stuff & experiences

i ate out with friends 3 times this year. the other times we just met and sat on a bench and talked.

movie ticket for Barbie. my only cinema going experience this year. that’s depressing. i’d love to go more in 2024.

underground ticket. that one time i forgot my underground card. ugh.

subscription to one of the secondhand book-selling websites i use. it’s the only one i pay for and it’s only 2€ a year. basically, it allows you to list more than 50 books at a time. i have 63 right now, so i’ll have to pay again this year, but hopefully in 2024 i will sell enough books to get under 50 & not have to pay again in 2025 :D

a very small charity donation. i sold more books than usual that month and decided to contribute a little to (hopefully) make the world a better place. it felt really good and i would like to do it again in 2024. but i need to set some rules or i might end up donating all of my savings.

trips

i went on 3 trips this year.

i bought train tickets and meals while there. i didn’t have to pay for accommodation as thankfully i went to visit friends and stayed at their houses. i also bought some souvenirs (in moderation!), like a fridge magnet and a christmas tree ornament.

in conclusion & plans for next year

well, damn. i spent way less than i thought or expected! there were even 2 months in which i actually spent 0€. which i’m sure felt great at the time, but i quickly forgot about it & thought i'd never accomplish something like that, ever. queue to feeling guilty over spending money.

my only true indulgencies were while i was on a trip. and i remember feeling quite guilty about spending money while there, as well.

but that’s why i save money: to buy expensive yarn and enjoy myself while traveling. so why should i feel guilty about doing exactly that?

basically, i want to spend a bit more money next year if it will make my life easier or happier, without feeling guilty. I've tried to do that during december already but finding the balance between overspending and being a Scrooge is going to be tough.

7 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

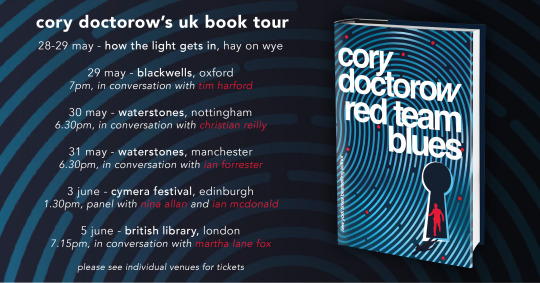

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

on a post about "bringing back trophy wives" ...... i hope we all explode

#1. rape and violence against women are more likely to happen in the home and be perpetrated by 'the man of the house' than anywhere else#2. u cant be equal if ur depending on a man for financial security like thats not how it works#this is actually making me sick#journal

25 notes

·

View notes

Text

I am very much a bargin bin collector and just follow market prices so I know when something I find is a good deal. I could hardly ever afford anything over a few hundred dollars even saving up for a while (at the end of the day I still prefer to save money for practical expenses and emergencies), but I like to think outside the box and find more obscure but nice quality pieces or broken/damaged stuff I can restore or have restored. It's helped a ton for getting nice pieces within my budget and I feel like my collection is more "me" because it's not the big show pieces but a lot of little things that add up to to one big curated collection with a lot of extra love in it.

#that plus just being a collector for 30 years and knowing a ton of cool friends and sellers who've helped me get a lot of awesome stuff#like it's a labor of love for sure#I love sharing my collection but I'm not wealthy by any means#I collect a lot of generally cheap stuff plus some bigger pieces sprinkled in#but the most I've ever spent on anything non-practical was like $700 or so?#and that was still after saving for a few montns#you gotta be in it for the long haul and know your market fod good deals#the time investement is honestly more than the financial one in most cases 😭#jackal's journal

65 notes

·

View notes

Text

The amount of glow up I’ve had since 2020 is actually insane… I’ve had people not even recognize me in public anymore. A girl I used to work with straight up asked me in the middle of the produce section at Whole Foods what work I’d done to my face/lips (none btw, just religious skincare and healthy weight loss). I was like nerdy cute before but now that I’ve actually committed myself to being the best that I can be it’s been pretty miraculous. I can’t imagine what’s going to happen when I finally finish my metamorphosis (although we all know it never ends, upward progression is a constant and beautiful journey).

#not just physically too but career/education/financially/mentally/emotionally#and it keeps getting better#I’m so excited#also mentality is literally everything too I think it’s doin something for me in a real way#the affirmations and the journaling and the subliminals are working for sure

72 notes

·

View notes

Text

Bon jour , bonne semaine à tous ☕️ 📰

Les Beatles et The Financial Times 🇬🇧 Londres 1963

Photo de Norman Parkinson

#photooftheday#black and white#photographie#vintage#norman parkinson#the beatles#londres#journal#newspaper#bonjour#bonnesemaine#fidjie fidjie#financial times

81 notes

·

View notes

Text

Patreon’s planner page for February 🐉✨

It’s the year of the dragon wohooooo! Join my Patreon to get hi-res download of this - available in a digital or printable format 🐲

#illustration#art#trans artist#digital art#financial support#artists on tumblr#artist support#queer artist#commissions open#planner#calendar#bullet journal#artist on patreon#year of the dragon#chinese new year#dragon#fantasy creature#fantasy illustration#dragon art#trans owned business#queer illustrator#illustration art#original drawing#original art#original illustration#downloadable content

8 notes

·

View notes

Text

I slide down the chute to the real

May 10, 2016 6:15pm Tuesday. Starbuck's

One long sigh ago, in the year 2000, most of the people who work in this Star Bucks were 2 or 0 or 4

OMG—I forgot, today is my 19th anniversary of meeting my partner Jim!

Our collective huge dream pours out and pools on the street. (Some of our things were placed in the street in front of my house for removal)

I told Favian, my personal trainer, today I have no place to go but a boat. His face lit up. He loved it.

A friend helping me clean thinks the house will be ready to list in a week or two. My realtor will check Friday. Maybe list then.

So—huge—massive, Cleansing, Healing, Change in the air.

Another friend paid $100 for the back yard clay pots today.

Deeply sad ---blue sad.

It’s like props of endearment are being ripped away. Gone.

But, relief ensues. My life rushes in. MY life. I slide down the chute to the real.

End of entry

Note;

This entry was written at a low point in my life.

Money was tight. My tax debt was probably mounting and I felt I had no choice but to sell my house and move to living on a boat.

I had no boat and no leads on one.

The friend who bought the pots encouraged me not to sell the house. She wondered why I was getting rid of my things? It was probably a reaction to my partner Jim's death in the house in 2009 of liver failure.

In the end, I stayed in the house. Since then, my financial situation is much improved . Glad I stayed home.

#journaling#writing#gay relationship#financial pressures#feeling forced to leave#living on a boat#mourning#reaction to death of a partner#friendship#friend's emotional support#5/10/2016

10 notes

·

View notes

Text

I know it doesn't seem like it, but things really are starting to get a little better for me. My health isn't, but I'm working on it. My next big disability hearing is on October 24th or 28th (I forget which)— this is when I'll find out if I'm approved or if I have to appeal again.

I can't say that I feel particularly great about my chances or my current preparedness as far as evidence goes, but I am feeling relatively optimistic about life in general, and I have been becoming increasingly more functional (mentally/executive dysfunction-wise), too. We're in the process of moving me and Arlo out of the basement and into what is currently the craft room upstairs. I've been sleeping up there with him for about a month now, but we haven't switched the furniture yet. I suspect the basement was contributing to how sick I've been at least a little bit, so I'm happy to have Arlo out of there.

Somehow I feel like I can see the light at the end of the tunnel, even though it doesn't feel likely that we'll win this round of disability, which is going to wreak havoc on my current survival support system as Tyrell has made it very clear that she cannot do this for another year if I have to appeal again. Trying not to think about that and focus on the things I need to do to strengthen my case instead... between me & the thousands of you I really thought my lawyer would be more helpful/more involved/offer more guidance than he is. At this point there's just not a lot of time left for more doctor's appointments. Being entirely nonfunctional through the whole of 2022 really set me back.

It's weird because things should be looking quite bleak from my perspective, but for some reason, they don't.

#the thing is that if i am denied again i may lose tyrell's financial support entirely#which means losing my car and such#more on that another time#i'm gonna try to design and sell blank journals on amazon#i already have one listed but the lines are REALLY tight#bc i got the math wrong#it's still useable if you right small - my bff rosie has one#write**#i was gonna offer you the link but i can't remember how to find it at the moment lol#i'll reblog with what it looks like though in the meantime

13 notes

·

View notes

Text

As I write this, my stomach is killing me because I had to stay up late and drink a RedBull and eat some donuts. What was I thinking? Anyway, onto my thoughts this morning.

Frugality is a hard necessity to master. Or maybe I'm just stressing because it's the 1st of the month, and I'm paying off some debts while watching our paycheck shrink just hours after it hit the bank. The first thing we did was pay back my sister and our neighbor: $300 and $420, respectively. They are great lifelines for loans when we need them, and I don't want to jeopardize anything like that. Someone who will lend you a few hundred bucks until payday without interest is just indispensable in these times.

The second thing I did was pay off the phone bill entirely. I had been making half payments on it for a while, but it didn't stop them from cutting it off last week. So this paycheck, I doubled up and paid everything off, past due $108, and current due $118, so I don't owe anything more until May. Having a phone is very important, even if I never leave my house. Also saw a notice that they are raising their base prices on my bill. Fun.

The third bill to be taken care of this morning is the electric bill. I'm still so miffed that last month, TXU charged me $25 because they charged my empty debit card instead of using the checking account I know I had set up in their app. I blame them, but I probably missed a step or a button somewhere.

After paying the electric bill, I took care of the Xfinity bill for $144 since it was due on the 3rd anyway.

I sat down and started going over our monthly pet supply order from Chewy. The dog needs new supplements, and we have to buy different cat food this time since it seems like the little girl cat throws up with the current brand. We're switching from Iams to PurinaOne this month to see how it does, and it's also on sale for a good price.

Funny thing, while I was doing my Chewy order, it said, "Orders over $100 get a free $30 gift card," so I used the promo code, and it increased my total amount. They charged me more tax and also took away my other discounts for brand loyalty with our American Journey dog food. My order was $280 before the promo and $285 after it. I opted to keep the promo, though, because I'm still ahead $25 with how it all shakes out, and the gift card will definitely be used in May.

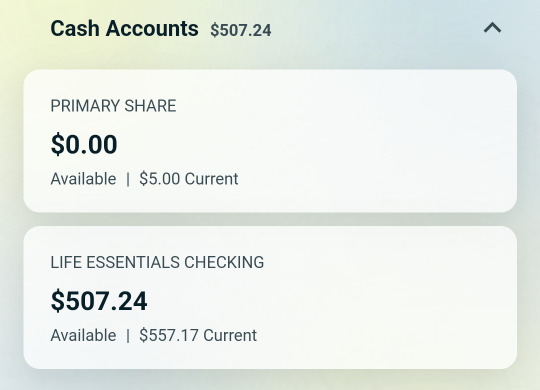

That just leaves rent for $897, four credit card payments of about $50 each, and various small subscriptions like Hulu ($9), PS Plus ($17), YouTube ($25), and my FFXIV subscription ($15). I'm also aiming to put $100 in savings. So that leaves about $557 for the month for food, household items, or anything else that may come up. I definitely don't want to spend that entire remainder if I don't have to.

Side note: Absolutely forgot we have to return the old comcast equipment, still. Some of that stuff has been in our closet a year.

3 notes

·

View notes

Text

My balance after placing an order for Gamersupps. I chose the dragonfruit flavor! It should be here within a week or so, I'm guessing. I read it could take up to 12 business days. :)

4 notes

·

View notes

Text

I fear that culturally we're too anti-intellectual for this conversation, but I wish we could talk about how academics are in a similar position to writers/actors/musicians in that we do all the labor for institutions like universities AND academic presses and do not get the pay, treatment, or residuals that we deserve while it all gets funneled to the higher up admin and for-profit entities

#how long can we say 'email the author of a paper if you dont have access to a journal ' before we finally grapple with the fact#that scholars do not own or financially benefit from their work#and in fact often have to PAY for a greater number of people to have access to their work through open access#also I do not think that anyone who does not work in academia has any idea just hot little professors/instructors/lecturers/etc are paid#like as an undergrad I would have guessed that faculty make low six figures#and that felt very reasonable to me#now that i'm a phd candidate i know thats a DREAM number that most people will never see#we talk about how little public school teachers are paid and most faculty make less#if youre a college student think about how much you pay in tuition and know that your teacher would be lucky to make half that in a year#as an adjunct i taught two sections of 30 students each and made less than 4000 TOTAL for the semester#even as a phd candidate at an R1 I make roughly 15 percent of the tuition paid for each class I teach#and that's as instructor of record. not a teaching assistant#anyway there is no separate struggle. all labor is exploited under capitalism

9 notes

·

View notes

Text

I was finally prepared to do homework, but instead immediately proceeded to dump juice on everything. So then I have to dedicate 10 minutes to quickly cleaning juice off of all of my most precious objects: most of which are books or technology which are not known for their water proofing.

#surprisingly everything came out fine#also apparently my priority was save Marcy's Journal#so apparently hyperfixation beats financial worries in a moment of crisis?#probably reason for concern but I'm going to run with it#anyway I'm going to reactivate homework mode!#wren rambles

4 notes

·

View notes

Text

#gofundme#lord#donatetoday#enola holmes#trend#viral#newyear#journal#new york#new rp#art#lords in black#christmas#please donate#fundraiser#fundraising#mutual aid#financial aid#help

4 notes

·

View notes

Text

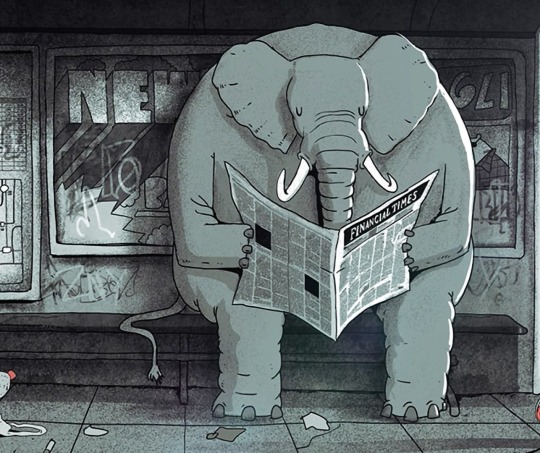

📰 Financial Times 📰

Illustration 🖍🎞🖌 de Steve cutts extrait de son petit film "The Turning Point"

Bel après-midi 🙋♀️

#artwork#art et talent#illustration#steve cutts#journal#newspapers#financial times#animation#belaprèsmidi#fidjie fidjie

42 notes

·

View notes

Text

The tech guys are hanging out in my office again and chatting about $10,000 week long vacations like this is normal.

#Journal shit#Ah yes the life i gave up to be a grunt 3D generalist working on the lowest of the low entertainment \o/#A lot of my friends here get mad at my dad for not being supportive#And i myself get frustrated at him for being insulting about my general life failure#But like....he has a point#I dont think he needed to treat me like yesterdays trash over it but#He was right i probably should have taken a programming job#But poor dad he got saddled with a child who is stubborn and tragically not financially motivated like at all#I mean he is the exact same damn way i feel like my dad forgets that it was just me and him for four years there#I saw how he lived without certain influences and he did not give a crap about status or money or fancy things#It wasnt until the rich bitch came along and started making him like...update his furniture every few years because *style*#and making him buy new designer coats every year so he doesn't embarrass himself in front of the other volleyball parents#Im just saying prior to the introduction of Steves Wife to our family these things just didnt exist to us#It does greatly entertain me that Steves Wife is not allowed to come to the ohio farm because everybody agreed that she just...#Could Not Handle The Poor#Anyway thats my dads idea of a vacation going to visit grandma on the farm this summer#And two guesses he and grandma will just sit around reading and doing puzzles and watching tennis#Pretty much exactly what i did when i went on vacation to visit her#I want to ask my dad if you think i am a failure what do you think of yourself i am exactly fucking like you for better or worse#Well i mean except i also did a lot of drawing of hockey players and grandma would lean over my shoulder#Saying things like *he looks like a nice young man*#yes grandma and he also racks up the penalty minutes like you wouldnt believe

10 notes

·

View notes