#exchange-traded funds

Text

After Surpassing $65,000 Bitcoin Goes For New Record High - Technology Org

New Post has been published on https://thedigitalinsider.com/after-surpassing-65000-bitcoin-goes-for-new-record-high-technology-org/

After Surpassing $65,000 Bitcoin Goes For New Record High - Technology Org

Bitcoin surged to a two-year high, surpassing $65,000 on Monday and approaching record levels. Analysts say this cryptocurrency is going for a new record high.

Bitcoin – artistic impression. Image credit: Aleksi Räisä via Unsplash, free license

With a session peak of $65,537 in European trading, Bitcoin demonstrated a 4% increase, reaching $65,045. This follows its recent two-year high in Asian trading.

Bitcoin’s impressive 50% gain this year has been particularly notable in recent weeks, coinciding with a surge in inflows into U.S.-listed Bitcoin funds.

The approval of spot bitcoin exchange-traded funds in the United States has played a significant role in attracting new substantial investors, rekindling enthusiasm and momentum reminiscent of the 2021 rally to record levels.

Analysts note that investor confidence remains strong, contributing to sustained positive flows into the cryptocurrency.

In the week ending March 1, the net inflow into the ten largest U.S. spot bitcoin funds amounted to $2.17 billion, with over half of this capital directed toward BlackRock’s iShares Bitcoin Trust (IBIT.O).

Meanwhile, Ethereum, a smaller counterpart, has surged by 50% year-to-date, riding on speculation that it may soon witness increased inflows through the introduction of exchange-traded funds. On Monday, Ethereum traded at two-year highs, recording a 2.6% daily gain and reaching $3,518.

This cryptocurrency rally coincides with record-breaking performances in major stock indexes, including Japan’s Nikkei (.N225), the S&P 500 (.SPX), and the tech-heavy Nasdaq (.IXIC). Simultaneously, volatility indicators in equities (.VIX) and foreign exchange (.DBCVIX) have trended lower.

Analysts posit that in an environment where the Nasdaq is achieving new all-time highs, cryptocurrencies, particularly bitcoin, are likely to perform well, serving as a high-volatility tech proxy and a gauge of market liquidity. The prevailing market conditions reflect a return to a 2021-style market characterized by widespread optimism and upward trends.

Written by Alius Noreika

You can offer your link to a page which is relevant to the topic of this post.

#000#amp#Authored post#billion#bitcoin#BlackRock#cryptocurrencies#cryptocurrency#Environment#Ethereum#exchange-traded funds#Featured technology news#Fintech news#it#Japan#Link#monday#Nasdaq#Performances#Rally#Recording#Spotlight news#Tech#technology#time#Trends#trust#United States

0 notes

Text

Bitcoin's Potential Surge: Exploring the Crypto Super Cycle Phenomenon Post-Halving

The upcoming Bitcoin halving event has sparked diverse opinions among analysts, with Kyle Doops predicting a potential market peak amid the event. Doops, known for his analytical approach, highlighted Bitcoin's four-year cycles and urged investors to consider the halving's impact on price volatility. He expressed optimism about an ongoing upward trend, possibly leading to a "crypto super cycle."

However, Crypto Busy, another respected crypto analyst, has offered a cautionary perspective. He alerted investors to the Bitcoin halving, advising them to "keep stacking" while emphasizing the need for caution based on historical price declines preceding such events.

In contrast, IntoTheBlock, an on-chain analytics platform, presented a bullish outlook for Bitcoin's future. Their forecast, based on critical factors like the halving event, rising ETF demand, changes in monetary policy, US elections, and institutional acceptance, suggests the potential for Bitcoin to reach new price heights in the next six months. The report highlighted historical data showing significant price drops before previous halvings but indicated that the upcoming halving could kickstart a bullish cycle by tightening supply and boosting demand.

The approval and launch of spot Bitcoin ETFs in the US have contributed significantly to Bitcoin's price momentum, with over $4 billion in inflows within the first month. Additionally, the Federal Reserve's contemplation of softer monetary policies, in response to subdued inflation, is expected to enhance Bitcoin's position as a preferred hedge against inflation. The prospect of reduced interest rates could provide liquidity, benefiting both Bitcoin and equity markets as investors seek assets to safeguard portfolios against inflationary pressures.

0 notes

Text

Jeremy Abelson: Pioneering the Path of Investment Excellence with Irving Investors

In the ever-evolving world of finance and investment, having a visionary leader who can navigate the complexities of the market is a game-changer. Jeremy Abelson, the founder of Irving Investors, is one such financial luminary. With a track record of success and a commitment to innovative investment strategies, Jeremy Abelson has made a significant impact on the investment landscape. In this…

View On WordPress

0 notes

Text

Pros and Cons of Investing in ETFs

Exchange-traded funds, or ETFs, have gained significant popularity among investors in recent years. These investment vehicles offer a simple and cost-effective way to diversify your portfolio, but they also come with their own set of pros and cons. In this article, let’s take a closer look at both sides of the ETF coin to help you make an informed investment decision.

Pros of Investing in ETFs

1. Diversification

ETFs are designed to track a specific index, commodity, or asset class. By investing in an ETF, you gain exposure to a diversified basket of assets, reducing the risk associated with individual stocks or bonds. This diversification can help protect your investments from market volatility.

Also Read: How To Start A Small Business In India

2. Liquidity

ETFs trade on stock exchanges just like individual stocks. This means you can buy or sell them throughout the trading day at market prices. This liquidity provides flexibility, allowing you to react quickly to market changes and take advantage of trading opportunities.

3. Lower Expenses

ETFs typically have lower expense ratios compared to mutual funds. This means you'll pay less in management fees, which can have a significant impact on your long-term returns. Lower expenses leave more money in your pocket.

4. Transparency

ETFs disclose their holdings on a daily basis, so you always know what assets are in the fund. This transparency can help you make more informed investment decisions and avoid surprises.

Cons of Investing in ETFs

1. Commissions

While ETFs offer low expense ratios, you may incur trading commissions when buying or selling them. These costs can add up, particularly if you frequently trade ETFs. However, many brokers now offer commission-free ETF trading.

2. Intraday Volatility

The liquidity and intraday trading of ETFs can be a double-edged sword. While it provides flexibility, it can also lead to increased intraday price volatility. This can be challenging for investors who are not accustomed to monitoring the markets throughout the trading day.

3. Tracking Error

While ETFs aim to replicate the performance of their underlying index or asset class, there can be small discrepancies known as tracking errors. This difference can be caused by various factors, including fees and the fund's trading strategy.

4. Limited Active Management

ETFs are primarily designed to passively track an index. If you prefer active management or believe in the skills of a particular fund manager, ETFs may not align with your investment philosophy.

Also Read: How To Choose a Correct Lender for Taking Any Loan in India?

Conclusion

ETFs offer diversification, liquidity, and cost-efficiency, but they come with potential downsides like trading costs and tracking errors. To decide if ETFs are right for you, consider your investment goals and risk tolerance. Like any investment, they can be a valuable tool when used wisely.

0 notes

Text

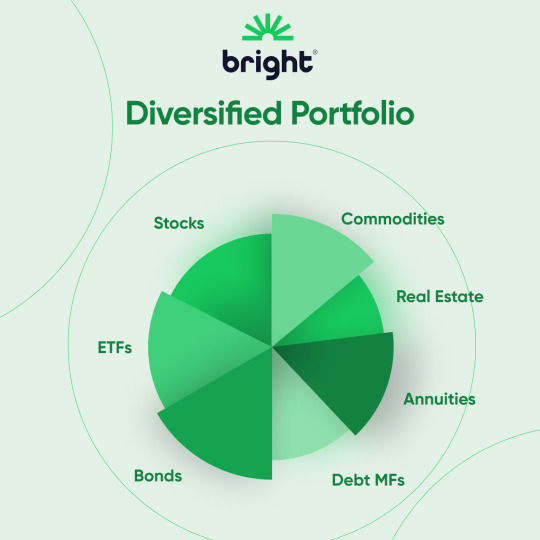

Investment strategies and portfolio management

Discover the importance of diversifying your investment portfolio to minimize risk and maximize returns. Learn how to implement effective diversification strategies to achieve long-term financial success.

Discover the importance of diversifying your investment portfolio to minimize risk and maximize returns. Learn how to implement effective diversification strategies to achieve long-term financial success.

Welcome to this comprehensive guide on investment portfolio diversification, an essential element of personal finance and investing. In this article, we will delve deep into the importance…

View On WordPress

#Asset Allocation#asset classes#Bonds#commodities#company size diversification#domestic markets#economic downturns#exchange-traded funds#geographical diversification#Index funds#international markets#Investing#investment goals#investment portfolio diversification#long-term financial success#Market Volatility#maximizing returns#minimizing risk#Mutual Funds#Personal Finance#real estate#Risk Management#risk tolerance#sector diversification#Stocks#time horizon

1 note

·

View note

Text

These biotech stocks look cheap — and analysts give 2 more than 100% upside

These biotech stocks look cheap — and analysts give 2 more than 100% upside

U.S. biotech stocks have been on the up recently. The S & P Biotechnology Select Industry Index is up more than 6% in the past week. The Nasdaq Biotechnology Index , meanwhile, is up almost 4% over the same period and 8.5% over the past month. “Biotech looks to be strengthening materially in recent days, and is a key part of the reason why Healthcare likely shows strong 4Q [fourth quarter]…

View On WordPress

#BioNTech SE#Biotech and Pharmaceuticals#business news#Chimerix Inc#Cullinan Oncology Inc#Exchange-traded funds#Health care industry#iShares Biotechnology ETF#Iteos Therapeutics Inc#Moderna Inc#NASDAQ Biotechnology Index#S&P 500 Index#united states

0 notes

Text

5 Tips to Diversify Your Investment Portfolio

5 Tips to Diversify Your Investment Portfolio

Investment Portfolio: Portfolio diversification refers to the spread of your investments around so that your exposure to any one kind of asset is limited. This practice helps to reduce the volatility of your portfolio over time. One of the keys to successful investing is learning how to balance your security with risk against your time horizon. This article presents five amazing tips to diversify…

View On WordPress

#best investment portfolio investment portfolio examples pdf#commodities#exchange-traded funds#Investment Portfolio#investment portfolio builder#investment portfolio examples#investment portfolio for beginners#investment portfolio pdf#investment portfolio tracker#my investment portfolio

0 notes

Text

Playing the sustainable energy transition

Playing the sustainable energy transition

Earlier this month, the Biden administration took a major step in combating the climate crisis with the passage of the Inflation Reduction Act, which includes roughly $370 billion in energy and climate incentives – mostly in the form of tax credits, according to Goldman Sachs.

But with potential ripple effects on global supply chains as the domestic economy shifts toward a more energy-efficient…

View On WordPress

#Blue Horizon BNE ETF#business news#Exchange-traded funds#Guggenheim Solar ETF#Investment strategy#iShares Global Clean Energy ETF#Markets#Stock markets#Tesla Inc

0 notes

Text

Playing the sustainable energy transition

Playing the sustainable energy transition

Earlier this month, the Biden administration took a major step in combating the climate crisis with the passage of the Inflation Reduction Act, which includes roughly $370 billion in energy and climate incentives – mostly in the form of tax credits, according to Goldman Sachs.

But with potential ripple effects on global supply chains as the domestic economy shifts toward a more energy-efficient…

View On WordPress

#Blue Horizon BNE ETF#business news#energy#Exchange-traded funds#Guggenheim Solar ETF#Investment strategy#iShares Global Clean Energy ETF#Markets#playing#Stock markets#sustainable#Tesla Inc#Transition

0 notes

Text

The Age of Exchange Traded Funds & Launch of Single Bond ETFs

The Age of Exchange Traded Funds & Launch of Single Bond ETFs

If you’ve ever bought a bond and then wondered why the price was so low, it might be time to think again. Bond ETFs offer investors the benefits of diversification without the risk of losing their entire investment. Several reasons for buying an ETF have been noted, including tax efficiency, liquidity, and investment diversification.

Bond ETFs

The emergence of exchange-traded funds, or ETFs,…

View On WordPress

0 notes

Text

What is an investment vehicle?

What is an investment vehicle?

An investment vehicle is almost anything you can buy or invest in to earn a profit.

Financial advice has its own special language, loaded with terms and phrases that aren’t easy to decipher. “Investment vehicles” is one of those industry phrases, and it’s easy to translate into everyday English.

What is an investment vehicle?

An investment vehicle is almost anything you can buy or invest in to earn a profit.

What are the most common types of investment vehicles?

Stocks

Bonds

Mutual funds

Exchange-traded funds

Cash equivalents

How can Bright help?

Bright is a good place to start before investing. With our patented Money Science™ AI, Bright studies your finances, learns about your goals, then builds a personalized financial plan, a step-by-step guide to financial stability. read more

0 notes

Text

Milestone Achieved: Record-Breaking User Holdings for Ethereum and Tether

The blockchain landscape is witnessing significant milestones, with Ethereum's holder count reaching an unprecedented peak, signaling the growing mainstream acceptance of blockchain technology. Tether, the stalwart stablecoin, also plays a vital role in the cryptocurrency market, with its increasing user base providing stability and liquidity in the midst of market volatility.

Ethereum's recent achievement of 114.95 million holders is a testament to the burgeoning confidence and investment in this leading blockchain platform. Simultaneously, Tether's remarkable growth, boasting 5.22 million holders, underscores its pivotal role in navigating the unpredictable cryptocurrency market.

Santiment, a platform offering on-chain and social metrics for cryptocurrencies, has provided insights into these record-breaking holder counts. As Ethereum and Tether gain widespread adoption, an intriguing trend emerges with the rise of Exchange-Traded Funds (ETFs) tracking these digital assets. Investors are increasingly turning to ETFs for exposure to cryptocurrencies, potentially leading to a decrease in active wallets on the underlying networks. This shift signifies a change in investor preferences, favoring the convenience and safety offered by ETFs.

As these trends unfold, the impact on direct participation through active wallets becomes a focal point. This transformation has the potential to reshape the investment landscape, opening avenues for portfolio diversification.

While Ethereum's bullish activity propels its price beyond the $2,900 mark, Tether, currently valued just under $1.00 at $0.09997, presents an intriguing investment opportunity. With a market capitalization of $97.80 billion and a substantial daily trading volume of $61.48 billion, Tether emerges as a compelling option for capitalizing on market fluctuations.

The Ethereum price chart reflects robust bullish momentum, with ETH briefly reaching $2,931 in recent trading, indicating a 5% increase over the past week amid a broader market upturn. Technical indicators, such as the Relative Strength Index (RSI) hovering around 72, suggest potential overbought conditions. Additionally, the Moving Average Convergence Divergence (MACD) indicator, with the MACD line surpassing the signal line, further supports the bullish sentiment. The upward movement of the 20 Simple Moving Average and the 50-day SMA ahead of the 200-day MA reinforces the favorable market mood.

In summary, Ethereum's soaring holder count and Tether's resilience amid market fluctuations signify a maturing blockchain ecosystem. The evolving trend of cryptocurrency ETFs adds a layer of complexity to the landscape, paving the way for a nuanced approach to digital asset investment.

0 notes

Text

GOP Presidential Hopeful Ramaswamy Sued Over Strive’s Practices | Bloomberg

In separate lawsuits, two former employees at the candidate’s Strive Asset Management claim that the anti-ESG investment firm pressured them to violate securities laws.

Vivek Ramaswamy has been rising in presidential polls partly on the strength of his business accomplishments. Before he started running for the Republican nomination, where polling averages now put him in third place behind Donald Trump and Ron DeSantis, Ramaswamy founded and ran a drug development company, Roivant, which he took public in 2021. Then he started an asset management firm, Strive, presenting it as a conservative answer to the ESG movement’s focus on investments’ environmental, social and governance impacts. Strive’s motto, meant as a contrast to ESG, is “invest in excellence.”

But two former employees have filed lawsuits in recent months against the investment firm as well as Ramaswamy and his co-founder Anson Frericks that suggest practices at the company were something less than that. They accuse Ramaswamy and Frericks of aggressively pushing employees to violate securities law and of mistreating staff. They also suggest that the company has struggled to meet lofty growth goals for its “anti-ESG” investments.

Christopher Lenzo, a lawyer for plaintiff Joyce Rosely, said the two suits raised questions about Ramaswamy’s seriousness as an asset manager. Strive “was founded, in retrospect, largely as a PR mechanism for the presidential campaign of Ramaswamy,” he said. “Not a lot of thought was given to running it as an investment firm.”

Neither lawsuit has been previously reported. Ramaswamy’s track record will be in focus during next week’s presidential debate, when DeSantis allies have signaled that he plans to concentrate attacks on Ramaswamy. “Strive intends to vigorously defend itself,” the company said in a statement. “Beyond that, it is our policy not to comment on active litigation.” Tricia McLaughlin, Ramaswamy’s communications director, didn’t comment on the lawsuit. She noted that Ramaswamy, who served as Strive’s executive chairman until earlier this year, left Strive when he decided to run for president. “Strive is completely separate from Vivek and his campaign,” she said.

The first suit, filed in Kansas by a regional sales chief who was dismissed as part of a reorganization in March, also says Ramaswamy misrepresented the company’s finances to employees and investors, exaggerating its growth when pitching venture capitalists and recruiting staff. The former employee, John Phillips, claims he was induced to leave a job at JPMorgan that would have paid him more than $1 million in 2022, based on promises made by Ramaswamy and others that Strive was well financed and that Ramaswamy was dedicated to the company.

In reality, according to the suit, Strive was “undercapitalized,” and Ramaswamy was planning a presidential bid. The suit was filed in June, three months after Phillips claims he was fired by Strive without cause. Strive has filed a motion to dismiss the case.

In the second suit, filed Aug. 8 in a Union County, New Jersey, court, Rosely claims she was fired as co-head of institutional sales in retaliation for raising concerns about sexual harassment at the firm and violations of securities laws. She contends she saw a Strive executive make aggressive sexual advances toward a more junior staffer.

When Rosely, a veteran of State Street and Goldman Sachs, complained to Frericks, Strive’s president, he told Rosely it was “none of his business,” according to her complaint. At the time, Frericks, a former beer distribution executive who went to high school with Ramaswamy, held the company’s most senior position.

Like Phillips, Rosely claims that Ramaswamy and Frericks pressured her to violate securities laws. She says she was asked to use sales materials that improperly promised future returns and urged to allow employees who were not yet registered to sell securities to pitch clients. Rosely also claims she complained about Ramaswamy’s social media posts, which she believed constituted unlawful securities sales.

Both Phillips and Roseley were fired in March, alongside another executive who Rosely says was also complaining about the securities law violations. She claims that Strive told her the firing was part of a reorganization but also that everyone who was dismissed as part of the reorganization was over 40 years old. Her suit alleges that she was the victim of age discrimination, as well as retaliation for raising concerns about harassment and securities law violations.

In April, a month after the dismissals, Matt Cole, Strive’s chief investment officer, was named chief executive officer. In a June memo, Cole acknowledged the departures of “underperforming members of the distribution team.” He also signaled that Strive, which manages exchange traded funds (or ETFs) with about $1 billion in total assets as of Aug. 17, according to data compiled by Bloomberg, would tone down its political rhetoric and focus on promoting “shareholder capitalism” instead of criticizing ESG. The memo, first reported by Semafor, said that growth in the firm’s funds had slowed in 2023 in part because investors had seen the firm as “political over investment oriented.” The memo said growth had resumed and would accelerate in a “‘hockey stick’ fashion” starting in 2025.

#us politics#news#bloomberg#Vivek Ramaswamy#republicans#conservatives#2023#2024 elections#Roivant#Anson Frericks#mistreatment of staff#violations of securities laws#strive#exchange traded funds#ESG movement#Environmental Social & Corporate Governance

12 notes

·

View notes

Text

Please help me kidney failure

#twitter#lotr#sonic prime#barbie#doodle#world cup#argentina#jensen ackles#ryan gosling#elon musk#donateformaged#helpmaged#gofundme#signal boost#exchange traded funds#go fund me#funds needed#fundraising#fundylive#found poetry#founder#scp foundation#fountainpen#donate#donations#donate if you can#marcille donato#donato giancola#donatella versace#please donate

7 notes

·

View notes

Text

#copy trade forex#exchange traded funds#traders#economy and trade#tradewar#world trade organization#moneymaking#i need money#wealth#cryptocurrencies#cryptid#crypto

3 notes

·

View notes

Text

Exchange all types of currencies with the best and lowest fee by Paypax exchange rate calculator

#business#developers & startups#exchange rate calculator#exchange traded funds#cryptocurrency news latest#crypto latest news

2 notes

·

View notes