#duedates

Text

Maximize the QBI deduction before it’s gone

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big tax saver.

Deduction basics

The QBI deduction is written off at the owner level. It can be up to 20% of:

QBI earned from a sole proprietorship or single-member LLC that’s treated as a sole proprietorship for tax purposes, plus

QBI from a pass-through entity, meaning a partnership, LLC that’s treated as a partnership for tax purposes or S corporation.

How is QBI defined? It’s qualified income and gains from an eligible business, reduced by related deductions. QBI is reduced by: 1) deductible contributions to a self-employed retirement plan, 2) the deduction for 50% of self-employment tax, and 3) the deduction for self-employed health insurance premiums.

Unfortunately, the QBI deduction doesn’t reduce net earnings for purposes of the self-employment tax, nor does it reduce investment income for purposes of the 3.8% net investment income tax (NIIT) imposed on higher-income individuals.

Limitations

At higher income levels, QBI deduction limitations come into play. For 2024, these begin to phase in when taxable income before any QBI deduction exceeds $191,950 ($383,900 for married joint filers). The limitations are fully phased in once taxable income exceeds $241,950 or $483,900, respectively.

If your income exceeds the applicable fully-phased-in number, your QBI deduction is limited to the greater of: 1) your share of 50% of W-2 wages paid to employees during the year and properly allocable to QBI, or 2) the sum of your share of 25% of such W-2 wages plus your share of 2.5% of the unadjusted basis immediately upon acquisition (UBIA) of qualified property.

The limitation based on qualified property is intended to benefit capital-intensive businesses such as hotels and manufacturing operations. Qualified property means depreciable tangible property, including real estate, that’s owned and used to produce QBI. The UBIA of qualified property generally equals its original cost when first put to use in the business.

Finally, your QBI deduction can’t exceed 20% of your taxable income calculated before any QBI deduction and before any net capital gain (net long-term capital gains in excess of net short-term capital losses plus qualified dividends).

Unfavorable rules for certain businesses

For a specified service trade or business (SSTB), the QBI deduction begins to be phased out when your taxable income before any QBI deduction exceeds $191,950 ($383,900 for married joint filers). Phaseout is complete if taxable income exceeds $241,950 or $483,900, respectively. If your taxable income exceeds the applicable phaseout amount, you’re not allowed to claim any QBI deduction based on income from a SSTB.

Other factors

Other rules apply to this tax break. For example, you can elect to aggregate several businesses for purposes of the deduction. It may allow someone with taxable income high enough to be affected by the limitations described above to claim a bigger QBI deduction than if the businesses were considered separately.

There also may be an impact for claiming or forgoing certain deductions. For example, in 2024, you can potentially claim first-year Section 179 depreciation deductions of up to $1.22 million for eligible asset additions (subject to various limitations). For 2024, 60% first-year bonus depreciation is also available. However, first-year depreciation deductions reduce QBI and taxable income, which can reduce your QBI deduction. So, you may have to thread the needle with depreciation write-offs to get the best overall tax result.

Use it or potentially lose it

The QBI deduction is scheduled to disappear after 2025. Congress could extend it, but don’t count on it. So, maximizing the deduction for 2024 and 2025 is a worthy goal. We can help.

© 2024

0 notes

Text

GSTR-3B Guide: Return Filing, Format, Revision, and Due Dates

Explore the essentials of GSTR-3B, covering return filing procedures, format details, revision guidelines, and important due dates for efficient compliance in 2023.

Read Our Detailed article in the below link 👇- https://www.mygstrefund.com/GSTR-3B-Return-Filing-Format-RevisionandDueDates/

THANKS FOR READING!

We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com

Contact Us: - +91 9205005072

Mail- [email protected]

0 notes

Text

Moving forward by going back (and sideways)

A rumination of rooms and adjusting deadline goals to be more practical, and how organizing work can be work in itself. #indiedev #gamedev

Another month down, another bunch of TODOs done, rearranged, filled out, and added to.

Way back in Dec I thought to myself;

“I’ll launch a modest version of the game on April 1st, which means it’ll have to be basically ‘done’ on March 1st, so I can test & polish & bugfix while also promoting it.

But to do this, I’ll have to stick to keeping it simple.”

Past Me, setting up Future…

View On WordPress

1 note

·

View note

Photo

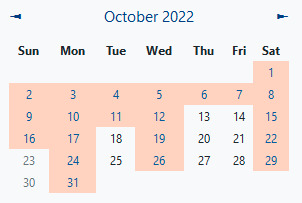

Once I start filling in #CourtDates and #DueDates, #FilingDates, #VisitDates, and #IncidentDates... A lot of those other holidays, birthdays, and special occasions dates disppear by themfuckingselves. I dont know how they can coexist in men. #GetDisgusted #ThisSocietyDoesntDeserveGoodMen #ManDisgusted #DisgustedDads https://www.instagram.com/p/CmpT7_rPIvz/?igshid=NGJjMDIxMWI=

#courtdates#duedates#filingdates#visitdates#incidentdates#getdisgusted#thissocietydoesntdeservegoodmen#mandisgusted#disgusteddads

0 notes

Text

I very rarely, if ever, post wips on my main, but I feel kinda bad bc it's been Actually Forever since I posted something so here you go, some wips and doodles to show that I still live! alksjdklaj

(also bonus, I love giving fem!yami/yugi big lion hair for s0, but I also like the idea that they decide to tie it up during Duel Monsters, and when tied up it forms the star shape! Kinda like a cool punk rockstar!)

#edit: changed pics bc you could count the pixels#also this may be weird but im like#really proud of male yami's expression???#he looks PISSED. can't believe i drew that XD#anyways im leaving for smth tomorrow so rip no comic progress#end of september is still my duedate tho! i won't give up!!!!! (dies)#yugioh season zero#yugioh#ygo#yami yuugi#wip#jounouchi katsuya#genderbend

127 notes

·

View notes

Text

badly need to do my assignments as i have one Due Tonight At Midnight but like i dont want to and i cant get off tumblr so im going to go draw and see if that helps i guess

#specifically work on commission stuff. for the record#fior the past few weeks thats what has motivated me to do so many assignments so maybe now that i ahve a pending duedate ill do my fucking#actual work that has money involved and then spit out two responses to these dumb fuck discussion posts at like eleven

6 notes

·

View notes

Text

Wapakoneta Air, Space And Worm Museum and Ballpark

(image made in kidpix)

playlist made for the blaseball fanmix exchange! the prompt i was given was a beautiful description of the eponymous museum (slash ballpark of the ohio worms) and a kind of bittersweet nostalgia associated with it.

i am a paleontologist - they might be giants

and all the kids who wanna see 'em can check 'em out at the museum!

this is THE kid-going-to-a-museum song to me. it literally mentions museums!! it's they might be giants!! it invokes the joy and wonder of childhood. also it's talking about things buried in the dirt which is, you know. pretty ohio.

2. lapis's tower - steven universe

the twinkling of stars. the space between. the wonder of the universe. mostly beautiful, but a touch of sadness.

3. distant stations - the mountain goats

i found an old rock in the dry dirt outside the door of my motel room

i felt like a mountain goats song would be fitting for this playlist somehow and, ngl, i picked this one partially because it mentioned dirt, but mostly because of the sense of wistfulness and loss in it, and also because of the name. what are the "distant stations"? radio stations? space stations? either way, i felt it was fitting

4. planetary ambiance - japanese breakfast

a spacelike, dreamlike ambient track, this time with a little more distortion and strangeness. there was always something weird about that museum, when you look back on it.

5. oh, susquehanna - defiance, ohio

we walk at the paths at the banks of the mighty susquehanna

with our feet made muddy by your tributaries that trickle their way to the chesapeake

the song is literally by a band called defiance, ohio, how could i not? a song about dirt, ohio, and looking back on your childhood with mixed feelings.

6. to the workers of the rock river valley region, i have an idea concerning your predicament, and it involves an inner tube, bath mats, and 21 able-bodied men - sufjan stevens

first of all i love this title so much. second of all, i know it's from a album called illinoise, but i just felt like it fit. one last instrumental track for the road: quiet, a little melancholy, but with that sparkling star-noise still in the background.

#wow look something original!!#will not be here to post this on the duedate so i'm scheduling it in advance#i hope my recipient enjoys!!#fan: gnym!!

4 notes

·

View notes

Text

heehoo

13 notes

·

View notes

Text

Where are all the November mama's?

6 notes

·

View notes

Text

Theoretically I can do this. I've written 2 page essays in an hour before, writing paragraphs in a short amount of time isn't a big problem for me, but the problem is I have to read at least the majority of a 2532 line narrative poem(?) and THEN write the paper and THEN write a 400 word discussion post and THEN answer like 10 reading questions but all I want to do is sleep for a few hours

#she posted these assignments yesterday 😩#again its fine i can definitely get it done before the duedate but like.#im dying im upset im tired im lazy

7 notes

·

View notes

Text

small victory but i think this is the first semester where i actually managed to hand everything in

#again this is small ik its probably nbd for some people but gfhgjk#historically i always have problems#so#i even did some things Before the night prior to the duedate gfhgjh#who am i! who is this person who is on top of things! (barely gfhgj)

4 notes

·

View notes

Text

Tax-wise ways to take cash from your corporation while avoiding dividend treatment

If you want to withdraw cash from your closely held corporation at a low tax cost, the easiest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax efficient since it’s taxable to you to the extent of your corporation’s “earnings and profits,” but it’s not deductible by the corporation.

5 different approaches

Thankfully, there are some alternative methods that may allow you to withdraw cash from a corporation while avoiding dividend treatment. Here are five possible options:

1. Salary. Reasonable compensation that you, or family members, receive for services rendered to the corporation is deductible by the business. However, it’s also taxable to the recipient(s). The same rule applies to any compensation (in the form of rent) that you receive from the corporation for the use of property. In either case, the amount of compensation must be reasonable in relation to the services rendered or the value of the property provided. If it’s excessive, the excess will be nondeductible and treated as a corporate distribution.

2. Fringe benefits. Consider obtaining the equivalent of a cash withdrawal in fringe benefits that are deductible by the corporation and not taxable to you. Examples are life insurance, certain medical benefits, disability insurance and dependent care. Most of these benefits are tax-free only if provided on a nondiscriminatory basis to other employees of the corporation. You can also establish a salary reduction plan that allows you (and other employees) to take a portion of your compensation as nontaxable benefits, rather than as taxable compensation.

3. Capital repayments. To the extent that you’ve capitalized the corporation with debt, including amounts that you’ve advanced to the business, the corporation can repay the debt without the repayment being treated as a dividend. Additionally, interest paid on the debt can be deducted by the corporation. This assumes that the debt has been properly documented with terms that characterize debt and that the corporation doesn’t have an excessively high debt-to-equity ratio. If not, the “debt” repayment may be taxed as a dividend. If you make cash contributions to the corporation in the future, consider structuring them as debt to facilitate later withdrawals on a tax-advantaged basis.

4. Loans. You may withdraw cash from the corporation tax-free by borrowing money from it. However, to avoid having the loan characterized as a corporate distribution, it should be properly documented in a loan agreement or a note and be made on terms that are comparable to those on which an unrelated third party would lend money to you. This should include a provision for interest and principal. All interest and principal payments should be made when required under the loan terms. Also, consider the effect of the corporation’s receipt of interest income.

5. Property sales. You can withdraw cash from the corporation by selling property to it. However, certain sales should be avoided. For example, you shouldn’t sell property to a more than 50% owned corporation at a loss, since the loss will be disallowed. And you shouldn’t sell depreciable property to a more than 50% owned corporation at a gain, since the gain will be treated as ordinary income, rather than capital gain. A sale should be on terms that are comparable to those on which an unrelated third party would purchase the property. You may need to obtain an independent appraisal to establish the property’s value.

Minimize taxes

If you’re interested in discussing any of these ideas, contact us. We can help you get the maximum out of your corporation at the minimum tax cost.

© 2024

0 notes

Text

literal besties

#artists on tumblr#oc artwork#oc on the left is mine. yk the pink one.#art#artwork#digital art#oc#oc art#blorbo i made the fuck up#dorks and duedates#YEA THATS RIGHT DORKS N DUEDATES POSTING YEAAAAAAAAAAA#besties. literal besties.#red and blue

4 notes

·

View notes

Text

Blegh

5 notes

·

View notes

Note

Fuck,

I will. For you

3 notes

·

View notes

Text

It's time to report pro-rated Form 2290 for October used trucks! E-file Form 2290 by November 30, 2023, to stay ahead of the deadline.

#Tax2290#form2290#trucktax#efileform2290#proratedtax#duedate#deadlinealert#november30th#taxyear2023#hvut#schedule1copy#efilenow

0 notes