#capitalgains

Text

What are "Capital Gains", Explained in Simple Terms

Understanding How Investments are Taxed in the United States

Investing in stocks, bonds, real estate, or other assets can be a great way to build wealth over time. But when it comes time to sell those investments, you might encounter a term that can be a bit confusing: capital gains. So, what exactly are capital gains, and how are they taxed in the United States? Let's break it down in simple terms.

What Are Capital Gains?

Imagine you bought a painting for $500, and a few years later, its value has increased to $1,000. If you decide to sell the painting for $1,000, you've made a profit of $500. This profit is what's known as a capital gain.

In essence, a capital gain is the increase in the value of an asset from the time you bought it to the time you sold it. It's the difference between what you paid for the asset (the "basis" or "cost basis") and what you sold it for.

Types of Capital Gains

Capital gains can be categorized into two types: short-term and long-term.

- Short-term capital gains: These are gains from assets held for one year or less before selling. They are taxed at ordinary income tax rates, which can range from 10% to 37%, depending on your total income.

- Long-term capital gains: These are gains from assets held for more than one year before selling. Long-term capital gains are typically taxed at lower rates than short-term gains. As of 2021, the tax rates for long-term capital gains range from 0% to 20%, depending on your income level.

How Are Capital Gains Taxed?

Now, let's delve into how capital gains are taxed in the United States.

- Calculate Your Gain or Loss: As mentioned earlier, your capital gain is the difference between the selling price of the asset and its basis (the amount you paid for it). If the selling price is higher than the basis, you have a capital gain. If it's lower, you have a capital loss.

- Determine Whether It's Short-Term or Long-Term: The next step is to determine whether your capital gain is short-term or long-term based on how long you held the asset.

- Apply the Appropriate Tax Rate: Depending on whether your gain is short-term or long-term, it will be taxed at the corresponding tax rate mentioned earlier.

- Consider Additional Taxes: In addition to federal capital gains tax, some states also impose their own capital gains taxes. Make sure to check the specific tax laws in your state.

- Offset Gains with Losses: If you have capital losses from other investments, you can use them to offset your capital gains, potentially reducing your tax liability.

Conclusion

In summary, capital gains are the profits earned from selling investments such as stocks, bonds, or real estate. They are taxed at different rates depending on how long you held the asset. Understanding how capital gains are taxed can help you make informed investment decisions and manage your tax liabilities more effectively. Remember to consult with a tax professional for personalized advice tailored to your financial situation.

Read the full article

0 notes

Text

Cash Flow vs Capital Gains

Cash flow and capital gains are two vital aspects of real estate investing, and knowing the difference can make or break your investment strategy!

Cash Flow: Think of cash flow as the money you pocket each month from your investment property after subtracting all expenses like mortgage payments, taxes, insurance, and maintenance costs. Positive cash flow means you’re making money regularly, providing financial stability and passive income.

Capital Gains: On the other hand, capital gains refer to the profit you make when selling a property for more than you paid for it. This is often seen as the ‘big win’ in real estate investing and can result in substantial returns, especially in appreciating markets.

So why is it crucial to understand both? Well, cash flow ensures your investment stays afloat and provides ongoing income, while capital gains offer the potential for significant wealth accumulation over time. Balancing these two factors helps you build a robust investment portfolio that generates steady income while also growing your wealth.

Whether you’re a seasoned investor or just dipping your toes into real estate, knowing the difference between cash flow and capital gains is essential for making informed decisions and achieving your financial goals!

0 notes

Text

Navigate Your Investment Journey with Expert Tax Guidance from Elite Accounting.🚀

Are you investing in shares or venturing into forex trading? It's crucial to grasp the intricacies of your tax obligations to avoid any unwelcome surprises.📈 Whether you're a seasoned trader or just dipping your toes into the market, our tailored tax planning and advisory services ensure you navigate the complexities with confidence.🧭

From understanding capital gains tax implications to optimizing deductions, we're here to ensure you don't pay a penny more than necessary. 💰With our seasoned team by your side, you'll gain clarity on the unique tax rules governing these activities, ensuring compliance and maximizing returns.✨

Don't let tax complexities hinder your financial aspirations – partner with us for tailored tax planning and advisory services today. 🤝

To get more information, visit https://eliteaccounting.co.nz/industries/shares-forex/.

1 note

·

View note

Text

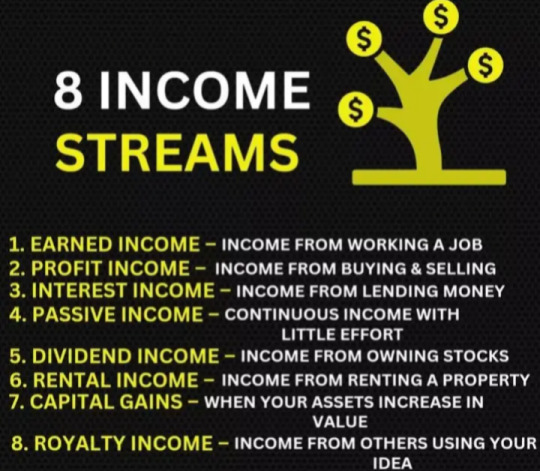

#newdaynewopportunities#successmindset#money#incomestreams#capitalgains#dividends#interestincome#profitincome#earnedincome#rentalincome#royaltyincome#businessowner#letsgo#getitdone#growth#potd#Tumblr

0 notes

Text

Trusted Online ITR for Capital Gains in Delhi

File your capital gains tax returns online in Delhi with Taxgoal. Our seamless online ITR platform simplifies the process, ensuring accuracy and compliance with tax regulations. With expert guidance and user-friendly interfaces, Taxgoal makes managing your capital gains taxes hassle-free. Maximize your tax savings and minimize errors by trusting Taxgoal for your online ITR needs in Delhi. Start your filing today for a stress-free tax season. To know more visit here: https://taxgoal.in/service/itr-filing-capital-gain/

0 notes

Text

Big Changes to Taxes: What You Need to Know!

#alternativeminimumtax #capitalgains #charitablecontributiondeduction #childtaxcredit #EarnedIncomeTaxCredit #medicalexpensededuction #mortgageinterestdeduction #standarddeduction #taxlaws #TaxpayerCertaintyandDisasterReliefActof2022

#Business#alternativeminimumtax#capitalgains#charitablecontributiondeduction#childtaxcredit#EarnedIncomeTaxCredit#medicalexpensededuction#mortgageinterestdeduction#standarddeduction#taxlaws#TaxpayerCertaintyandDisasterReliefActof2022

0 notes

Text

youtube

Unveiling the Secrets of Main Residence Exemption and the 6-Year Rule

#MainResidenceExemption#PropertyTax#TaxRules#CapitalGains#TaxExemption#RealEstate#6YearRule#TaxPlanning#Youtube

0 notes

Text

Top Tax Hacks for Capital Gains

Maximize your profits and minimize taxes! Dive into our infographic for top tax hacks for capital gains —expert advice, strategic insights, and more. Ready to make the most of your profits? Contact Allen Mayer for personalized guidance

1 note

·

View note

Photo

Collectibles or cash? Learn about the special 28% capital gains tax rate for selling collectibles. Art lovers, this one's for you! Dial +1 (813) 322-3936 or Visit skfinancial.com to get in touch with experts

0 notes

Text

Navigating Tax Guidelines for Financial Securities: A Comprehensive Guide

🛡️"Securities" commonly denote financial instruments such as bonds, debentures, and other investments generating interest income. Explore crucial tax guidelines influencing your securities and investments. 🏢✨

Step-by-Step Procedure for Navigating Tax Guidelines for Financial Securities:

Understand Your Securities: Familiarize yourself with your financial securities, such as bonds, debentures, and investments generating interest income.

Research Tax Laws: Stay informed about your jurisdiction's latest tax regulations related to financial securities.

Review Investment Portfolio: Assess your investment portfolio and identify securities subject to specific tax guidelines.

Consult Tax Experts: Seek guidance from tax professionals to clarify doubts and get personalized advice.

Keep Records: Maintain detailed records of your securities, transactions, and relevant financial documentation.

Documents Required for Navigating Tax Guidelines for Financial Securities:

Copies of financial securities

Transaction statements

Investment contracts

Tax identification documents

Benefits of Complying with Tax Guidelines:

Legal Compliance: Avoid legal complications by adhering to tax regulations.

Financial Optimization: Maximize returns by strategically navigating tax guidelines for financial securities.

Peace of Mind: Ensure peace of mind by staying on the right side of tax laws.

Latest 15 Questions and Answers:

1. How are interest earnings from bonds taxed?

Interest earnings are generally subject to income tax.

2. Are there specific tax benefits for long-term investments?

Yes, long-term investments often enjoy favourable tax treatment.

3. How does capital gains tax apply to securities?

Capital gains tax is applicable when selling securities at a profit.

4. Can losses from securities be used to offset other income?

In some cases, yes. Consult with a tax expert for specifics.

5. What is the tax treatment for dividends received from securities?

Dividends may be subject to tax, depending on various factors.

6. Are there tax exemptions for certain types of securities?

Some securities may qualify for tax exemptions; check the applicable laws.

7. How often should I review my investment portfolio for tax implications?

Regularly review your portfolio, significantly when tax laws change.

8. Can I claim deductions for investment-related expenses?

Certain expenses related to managing your investments may be deductible.

9. What are the tax implications of selling securities at a loss?

Offsetting capital gains is sometimes possible using capital losses.

10. Are there special considerations for foreign securities?

Yes, tax implications may vary for international investments.

11. How do tax-deferred investments affect my tax liability?

Tax deferral allows you to postpone paying taxes until later.

12. Are there tax credits available for specific types of investments?

Investigate potential tax credits for certain investments.

13. Can I minimize taxes through strategic timing of security sales?

Strategic timing can impact the amount of capital gains tax.

14. What reporting obligations do I have regarding my securities for tax purposes?

You may need to report income and transactions to tax authorities.

15. How can I ensure compliance with changing tax laws for securities?

Stay informed, seek professional advice, and update your strategy accordingly.

Conclusion:

Navigating tax guidelines for financial securities is a nuanced process. By understanding the rules, maintaining accurate records, and seeking professional guidance, you can optimize your financial position and ensure compliance with tax laws. Remember, knowledge is key to making informed financial decisions. 📊💡 #TaxGuidelines #FinancialSecurities #SmartInvesting

Related Keywords:

#TaxGuidelines #FinancialSecurities #TaxTips #InvestmentTax #CapitalGains #TaxPlanning #FinancialAdvice #WealthManagement #TaxationRules #SecuritiesInvestment #TaxEfficiency #AssetManagement #TaxStrategy #InvestmentStrategies #FinancialLiteracy

#TaxGuidelines#FinancialSecurities#TaxTips#InvestmentTax#CapitalGains#TaxPlanning#FinancialAdvice#WealthManagement#TaxationRules#SecuritiesInvestment#TaxEfficiency#AssetManagement#TaxStrategy#InvestmentStrategies#FinancialLiteracy

0 notes

Text

Year-End Tax Planning Strategies

As the year draws to a close, you might find yourself asking, “How can I optimize my taxes before the year ends?” This guide will walk you through some of the best strategies for year-end tax planning. These tips can help you reduce your tax liability, maximize your potential savings, and start the new year on a positive financial footing.

Maximize Your Retirement Contributions

Firstly, one of…

View On WordPress

#CapitalGains#CharitableContributions#Deductions#HealthSavingsAccount#RetirementAccounts#TaxCredits#TaxLossHarvesting#TaxPlanning#TaxStrategies#YearEnd

0 notes

Text

youtube

Ask Me Anything "EPISODE 29" | Erica Endyke

Question: Do I have to pay capital gains taxes on inherited property?

Answer: Capital gains tax is the tax you pay on the growth of an asset.

So say you buy a stock and you sell that stock, you will be taxed on the difference between your purchase price and the sale price.

The same thing can happen to a house and that is based on what we call your basis. That is what you bought the property for minus any improvements. So say you purchase property at $500,000 and you later sold it for $700,000, your basis is the $500,000 minus any improvements.

And the gains would be on the difference between the $500,000 and the $700,000. That's your capital gains exposure.

But what happens when you inherit a property? You didn't buy that property. Well, there's something called a step up in basis that someone who inherits property receives. And that step up in basis is the value of the property on the date that you received it.

So in that same prior example, if you inherited the property at $700,000. Well, there may not be any capital gains exposure. There may be if you hold onto the property and later sell it.

But a lot of people want to avoid it and there are ways to avoid that exposure. One way obviously is to sell the property for either at or less than the value that you inherited. And if you sell it for less than the value that you inherited the property at, there is an option to take that as a loss on your tax return.

If you have any questions that we can help you with, I'll be glad to address them with you. Thanks so much!

For more AMA videos, subscribe to us at https://bit.ly/20westlegalAMAvideos

"Protect what matters most, no matter what."

#Youtube#capitalgainstax#capitalgains#taxes#inheritedproperty#inheritance#assetmanagement#financialplanning#estateplanning#financialtips#sudburylawfirm#20westlegal

0 notes

Text

💎 PRO TIP 💎

20% Pass-Through for business

Allows small-business owners to deduct an extra 20% of their net income. The allowed deduction is the lesser of:

✔️ Your “combined qualified business income” OR

✔️ 20% of the excess of taxable income over the sum of any net capital gains

#protip#smallbusiness#taxableincome#20%passthrough#capitalgains#commercialrealestate#sagestreetrealty#realestate#commercial#financialeducation#commercialinvesting#investment

0 notes

Photo

“Sell Your Sickness” 2/27/23 - #sell #sickness #sellyoursickness #latestagecapitalism #neoliberalism #sellyourself #whoreyourself #capitalgains #capitalism #drawing #sketchbook #drawingoftheday #photooftheday #sketchoftheday #artistofinstagram #collage #coloredpencil #ink #inkdrawing #art #artwork #artschool #artistlife #radicalhonesty #watercolor #markers #alcoholmarkers #sellyoursoul #theamericandream #fuckeverything https://www.instagram.com/p/CpMLh-VMet2/?igshid=NGJjMDIxMWI=

#sell#sickness#sellyoursickness#latestagecapitalism#neoliberalism#sellyourself#whoreyourself#capitalgains#capitalism#drawing#sketchbook#drawingoftheday#photooftheday#sketchoftheday#artistofinstagram#collage#coloredpencil#ink#inkdrawing#art#artwork#artschool#artistlife#radicalhonesty#watercolor#markers#alcoholmarkers#sellyoursoul#theamericandream#fuckeverything

0 notes

Text

Budget 2023 Highlights: Direct Tax

Generally, the budget before general elections is always a much-anticipated one with everyone hoping for big, bold moves. But most budgets tend to fall short on the surprise factor. This year’s budget was no exception as it was mostly just a repackaging of old schemes with additional fund allocation. But salaried taxpayers were in for a surprise. They got the much needed tax break. Various tax…

View On WordPress

#agniveer#agniveercorpusfund#budget#budget2023#capitalgains#coperativesociety#financeminister#fundamentalanalysis#highlights#newtaxregime#nirmala#nirmalasitaraman#oldtaxregime#regime#research#startup#stockmarket#taxbenefit#taxes

0 notes