#businessstartup

Text

How can one visualize and achieve business success?

Visualizing and achieving business success requires a combination of setting clear and realistic goals, developing a strategic plan to reach those goals, and consistently taking action towards those objectives. Some key steps include:

Define your vision: What does success mean for your business? What are your long-term goals?

Conduct market research: Know your target audience, competition, and industry trends.

Develop a solid business plan: Outline your strategy for reaching your goals, including marketing, operations, and financial planning.

Set measurable and achievable goals: Break down your long-term goals into smaller, short-term objectives with deadlines.

Build a strong team: Surround yourself with talented and dedicated employees who can help you execute your plan.

Focus on your strengths: Identify and invest in your unique selling points to stand out in the market.

Monitor and adjust your plan regularly: Keep track of your progress and make necessary changes to ensure success.

By consistently following these steps, you can increase the likelihood of achieving success in your business.

#entreprenuership#entrepreneur#entreprenuerlife#entrepreneurspirit#entreprise#startupindia#startup#how to start business#ownbusiness#startownbusiness#businessstartup#business tips#businesskills#success#successful#businessuccess#successtips#successkills

17 notes

·

View notes

Text

#linkinbio#smallbusiness#coffee#barista#coffeeshop#coffeetalk#crowdfunding#gofundme#love#signalboost#smallbusinessowner#supportlocal#alaska#baristadaily#baristasofinstagram#bartenders#businessowner#businessstartup#chilkootcharlies#christmas#pennsylvania#mobilecart#trailer#speakeasy

7 notes

·

View notes

Text

🎉 Hey Tumblr, we're Credit4Hire, and we're excited to join the community! 🎉

We're on a mission to help you: 📈 Improve your credit score 📝 Dispute credit report inaccuracies 💡 Launch your dream business

Our secret weapon? A FREE AI chatbot that offers personalized guidance for credit repair and business startup! 🤖

Plus, we've got a blog filled with expert advice on financial management, credit repair strategies, and business growth hacks. 💼

We can't wait to connect with all of you, share our journey, and learn from your experiences! 😊

Do you have a financial challenge or an amazing business idea? Share your thoughts in the comments below or reblog with your story! 👇 Let's build a supportive community and create a brighter financial future, together! 💪

Visit www.credit4hire.com to access our free resources and kickstart your financial transformation today!

#Credit4hire#CreditRepair#BusinessStartup#FinancialFreedom#ai chatbot#finance#marketing#merchant cash advance#funding#us politics

2 notes

·

View notes

Video

youtube

A herbal medicine business is a type of business that focuses on the production, distribution, and sales of herbal medicines. These medicines are made from natural sources such as plants, minerals, and animal products. Herbal medicine is an age-old tradition in India and has been used for centuries to treat various ailments.

#business#businessstartup#medicine#startup#startupideas#businessnews#startupindia#herbalmedicinebusiness#ayushlicense#businessidea#businesstips#legal#legalcompliences#ayushherballicense

2 notes

·

View notes

Text

3 notes

·

View notes

Text

If you want to learn how to start a business in Dubai? Read this blog...

2 notes

·

View notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes

Text

Simplify Your Startup: Easy Online Sole Proprietorship Registration...

#legalcy#legalcyy#legalcypvtltd#legalcyprivatelimited#SoleProprietorship#Registration#EasyProcess#OnlineProcess#BusinessOwner#Entrepreneurship#SmallBusiness#Startup#LegalCompliance#BusinessRegistration#BusinessLicense#BusinessFormation#SelfEmployed#BusinessOwnerLife#BusinessStartup#BusinessRegistrationOnline#BusinessOwnerJourney#BusinessLegal#BusinessCompliance#BusinessSuccess

0 notes

Text

Skills that successful entrepreneurs possess, and how can I develop them?

There are many skills that can contribute to the success of an entrepreneur, but here are ten of the most important:

Creativity: Entrepreneurs need to be able to think outside the box and come up with new and innovative ideas. This skill can be developed by practicing brainstorming techniques, exposing yourself to different industries and experiences, and constantly challenging your assumptions.

Communication: Effective communication is crucial for entrepreneurs, whether it's pitching an idea to investors, negotiating with suppliers, or leading a team. Improving your communication skills can involve practicing active listening, honing your public speaking skills, and seeking out feedback.

Adaptability: Entrepreneurs must be able to adapt to changing circumstances and pivot their strategies when necessary. Developing this skill involves being open to feedback, staying current on industry trends, and learning from past failures.

Resilience: Starting a business can be tough, and entrepreneurs must be able to weather the ups and downs that come with it. Building resilience can involve developing a support network, practicing self-care, and focusing on the long-term vision for your business.

Leadership: Entrepreneurs must be able to inspire and motivate their team, as well as make difficult decisions when necessary. Developing leadership skills can involve studying successful leaders, seeking out mentorship, and practicing decision-making in a variety of contexts.

Time management: With so many tasks to juggle, entrepreneurs must be able to prioritize effectively and manage their time efficiently. Improving time management skills can involve setting clear goals and deadlines, delegating tasks when appropriate, and utilizing productivity tools and techniques.

Financial management: Entrepreneurs need to be able to manage their finances effectively, from creating a budget to forecasting future expenses. Developing financial management skills can involve studying basic accounting principles, seeking out advice from financial experts, and keeping track of key financial metrics.

Marketing: Entrepreneurs need to be able to effectively market their products or services to potential customers. Developing marketing skills can involve studying successful marketing campaigns, experimenting with different channels and tactics, and seeking out feedback from customers.

Sales: Entrepreneurs need to be able to close deals and generate revenue for their business. Developing sales skills can involve practicing active listening, mastering the art of persuasion, and seeking out sales training and mentorship.

Networking: Entrepreneurs must be able to build relationships with potential investors, customers, and partners. Developing networking skills can involve attending industry events, joining professional organizations, and seeking out opportunities to connect with others in your field.

To develop these skills, you can start by reading books and articles on entrepreneurship and leadership, attending seminars and workshops, seeking out mentorship and advice from experienced entrepreneurs, and practicing your skills in real-world situations. Additionally, consider joining a startup accelerator or incubator program, which can provide you with valuable resources, mentorship, and networking opportunities.

#entrepreneur#entreprenuerlife#entrepreneurspirit#entreprenuership#business tips#how to start business#ownbusiness#businessstartup#successtips#StartUpBusiness#successkills#businessuccess

5 notes

·

View notes

Photo

🥹🥳WE BROKE 50% 🥳🥹 I’m doing a “WE DID IT” dance! 🗣️SHOUT OUT TO MICHAEL 🗣️ Thank you so much for your pledge! I appreciate your contribution in helping create the foundation of my small business! I can’t wait to make everyone proud and show you everything I am capable of! 🤗🥳 🙌Without your support, I couldn’t do this. 🙌 I’m so proud of this journey and where it’s going! I can’t wait to be a proud business owner and to have the opportunity to serve you all 🥹 If you’ve been contemplating being a partner in supporting The Bree's Knees Coffee Co. you can pledge now and commit later. 🤔 ‼️ Have the freedom to CANCEL YOUR PLEDGE AT ANYTIME. ‼️ 💵 YOU can become a founder of The Bree's Knees Coffee Co. for just $1 💵 🗣️Click the link below to get started or search “Wake Up: The Brees Knees Coffee Co. Traveling Coffee Cart” on Kickstarter.com🗣️ https://kickstarter.com/projects/breeskneescoffeeco/wake-up-the-brees-knees-coffee-co-traveling-coffee-cart 🤗*photos courtesy of Pinterest*🤗 📈*Graph progress courtesy of you* 📈 #smallbusinessowner #baristadaily #smallbusinesslove #smallbusinesssupport #businessstartup #perkup #madewithlove #womanownedbusiness #coffeeshop #signalboost #smallbusiness #fundraiser #fundraising #latteart #barista #coffee #baristasofinstagram #outfits #linkinbio #like #hotcoffee #icedcoffee #2023 #christmasgiftideas #supportlocal #coffeereels #coffeecup #espresso #Thankyou https://www.instagram.com/p/CnEKpEJO25B/?igshid=NGJjMDIxMWI=

#smallbusinessowner#baristadaily#smallbusinesslove#smallbusinesssupport#businessstartup#perkup#madewithlove#womanownedbusiness#coffeeshop#signalboost#smallbusiness#fundraiser#fundraising#latteart#barista#coffee#baristasofinstagram#outfits#linkinbio#like#hotcoffee#icedcoffee#2023#christmasgiftideas#supportlocal#coffeereels#coffeecup#espresso#thankyou

2 notes

·

View notes

Text

Social Media Marketing Agency:

Enter social media marketing agencies – instrumental entities recognized for their pivotal role in steering businesses through the intricacies of the digital realm. This surge in demand has created an opportune moment for individuals harboring aspirations of launching their social media marketing agency. In the pages that follow, we aim to unravel the intricacies of this dynamic field, providing valuable insights and practical tips for those who aspire to initiate their journey into the world of social media marketing agencies.

#SocialMediaMarketing#DigitalMarketing#MarketingAgency#SocialMediaAgency#WebDevelopment#BusinessStartup#8 Tips for Initiating

0 notes

Text

Startup Investment | Investors for Startups

Attention all startup founders! Are you looking to secure investment for your business? Here are 7 crucial steps to follow for a successful startup funding round. From crafting a solid business plan to building a strong network, these strategies will help you attract potential investors and grow your business. Don't miss out on this valuable advice from industry experts.

#StartUpSuccess#EntrepreneurLife#SmallBizJourney#HustleForGrowth#InnovativeVenture#BusinessLaunchTips#FutureCEOGoals#businessstartup#entrepreneurship#success

0 notes

Text

Company Registration in India.

more information to contact our expert

0 notes

Text

Registration for One Person Company.

Registering a One Person Company (OPC) is a straightforward process with a few key steps. Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN). Choose a unique name for your company and get it approved. Submit the required documents and forms to the Ministry of Corporate Affairs, scrutinize, and obtain the Certificate of Incorporation. Simplify your journey with [Your Company Name] as we assist at every step of the OPC registration process.

Website URL: https://taxcellent.in/company-registration-in-delhi/one-person-company-registration-india/

0 notes

Text

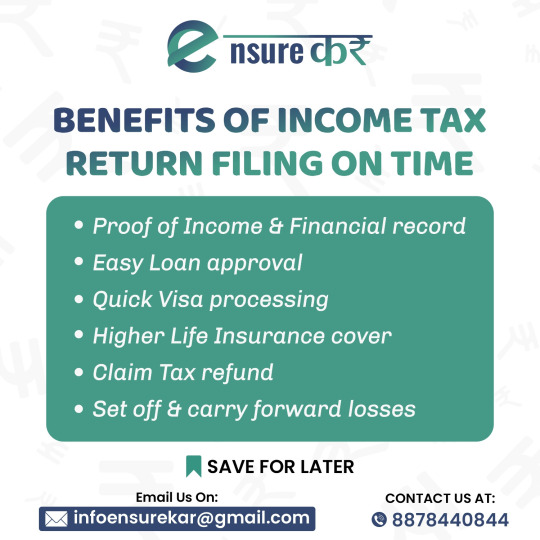

Don’t Miss Out: Unveiling the Benefits of Timely Income Tax Return Filing with Ensurekar

Tax season can be a stressful time, but it doesn’t have to be. Here at Ensurekar, we understand the importance of filing your income tax return on time and want to empower you with the knowledge of the many benefits that come with doing so.

Unlocking the Rewards of Timely Filing

While meeting deadlines might seem like the only reason to file on time, there’s a treasure trove of advantages waiting for you. Let’s delve into some of the key benefits:

Embrace the Power of Refunds: One of the most enticing rewards is the potential for a hefty tax refund. Filing promptly ensures you receive any tax credits or deductions you’re eligible for, putting that hard-earned money back in your pocket.

Streamline Loan Approvals: A timely tax return filing history demonstrates financial responsibility and stability. This can significantly improve your chances of securing loans for future endeavors, whether it’s a car loan, a mortgage, or a business loan.

Visa Applications Made Easy: For those seeking travel or work visas abroad, a clean and compliant tax record can be a crucial factor in the approval process. Timely filing demonstrates financial transparency and adherence to regulations, smoothing your path to international opportunities.

Avoid Penalties and Interest: Procrastination comes with a price. Delaying your tax return filing can result in penalties and accumulating interest on unpaid taxes. Filing on time allows you to avoid these unnecessary financial burdens.

Peace of Mind and Reduced Stress: Knowing your tax obligations are fulfilled gives you a sense of accomplishment and reduces the stress associated with looming deadlines and potential penalties.

Ensurekar: Your Partner in Timely Tax Filing

At Ensurekar, we are committed to simplifying the tax filing process for individuals and businesses. Our team of experienced professionals can guide you through the intricacies of tax regulations, ensuring your return is filed accurately and on time.

Benefits Beyond Timely Filing

In addition to the advantages mentioned above, Ensurekar offers a range of services to make your tax filing experience even smoother:

Tax Planning and Optimization: Our experts can help you strategize your finances throughout the year to minimize your tax burden and maximize potential refunds.

Investment Guidance: We can provide valuable insights on tax-efficient investment options to help you grow your wealth while minimizing your tax liability.

Audit Support: In the unlikely event of an audit, our team can provide dedicated support and representation, ensuring your rights are protected.

Don’t wait until the last minute. Take control of your tax filing today and unlock the numerous benefits of timely compliance. Contact Ensurekar and let us help you navigate the tax season with confidence.

Ready to file? Visit our website or call us at ENSUREKAR and connect with us over the phone at 8778440844 to schedule a consultation.

Ensurekar — Simplifying Taxes, Empowering Your Future!

#businessstartup#newbusiness#startup#dpiitregistration#companyincorporation#crowdfunding#legal#finance#fundraising#gstregistration#ensurekar.com#ensurekar

0 notes