#amazon discount product price

Text

Are you searching for the things that are useful in your daily kitchen? Then we have searched the best kitchen items for you from the AMAZON which have the best reviews by the customers and are good to use. Just check it out the link and order the best item for your kitchen

#best price#discount#savings#online shopping#amazon#kitchen items#skincare#beauty products#baby products#kids toys

0 notes

Text

Amazon’s financial shell game let it create an “impossible” monopoly

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

For the pro-monopoly crowd that absolutely dominated antitrust law from the Carter administration until 2020, Amazon presents a genuinely puzzling paradox: the company's monopoly power was never supposed to emerge, and if it did, it should have crumbled immediately.

Pro-monopoly economists embody Ely Devons's famous aphorism that "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’":

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

Rather than using the way the world actually works as their starting point for how to think about it, they build elaborate models out of abstract principles like "rational actors." The resulting mathematical models are so abstractly elegant that it's easy to forget that they're just imaginative exercises, disconnected from reality:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

These models predicted that it would be impossible for Amazon to attain monopoly power. Even if they became a monopoly – in the sense of dominating sales of various kinds of goods – the company still wouldn't get monopoly power.

For example, if Amazon tried to take over a category by selling goods below cost ("predatory pricing"), then rivals could just wait until the company got tired of losing money and put prices back up, and then those rivals could go back to competing. And if Amazon tried to keep the loss-leader going indefinitely by "cross-subsidizing" the losses with high-margin profits from some other part of its business, rivals could sell those high margin goods at a lower margin, which would lure away Amazon customers and cut the supply lines for the price war it was fighting with its discounted products.

That's what the model predicted, but it's not what happened in the real world. In the real world, Amazon was able use its access to the capital markets to embark on scorched-earth predatory pricing campaigns. When diapers.com refused to sell out to Amazon, the company casually committed $100m to selling diapers below cost. Diapers.com went bust, Amazon bought it for pennies on the dollar and shut it down:

https://www.theverge.com/2019/5/13/18563379/amazon-predatory-pricing-antitrust-law

Investors got the message: don't compete with Amazon. They can remain predatory longer than you can remain solvent.

Now, not everyone shared the antitrust establishment's confidence that Amazon couldn't create a durable monopoly with market power. In 2017, Lina Khan – then a third year law student – published "Amazon's Antitrust Paradox," a landmark paper arguing that Amazon had all the tools it needed to amass monopoly power:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

Today, Khan is chair of the FTC, and has brought a case against Amazon that builds on some of the theories from that paper. One outcome of that suit is an unprecedented look at Amazon's internal operations. But, as the Institute for Local Self-Reliance's Stacy Mitchell describes in a piece for The Atlantic, key pieces of information have been totally redacted in the court exhibits:

https://www.theatlantic.com/ideas/archive/2024/02/amazon-profits-antitrust-ftc/677580/

The most important missing datum: how much money Amazon makes from each of its lines of business. Amazon's own story is that it basically breaks even on its retail operation, and keeps the whole business afloat with profits from its AWS cloud computing division. This is an important narrative, because if it's true, then Amazon can't be forcing up retail prices, which is the crux of the FTC's case against the company.

Here's what we know for sure about Amazon's retail business. First: merchants can't live without Amazon. The majority of US households have Prime, and 90% of Prime households start their ecommerce searches on Amazon; if they find what they're looking for, they buy it and stop. Thus, merchants who don't sell on Amazon just don't sell. This is called "monopsony power" and it's a lot easier to maintain than monopoly power. For most manufacturers, a 10% overnight drop in sales is a catastrophe, so a retailer that commands even a 10% market-share can extract huge concessions from its suppliers. Amazon's share of most categories of goods is a lot higher than 10%!

What kind of monopsony power does Amazon wield? Well, for one thing, it is able to levy a huge tax on its sellers. Add up all the junk-fees Amazon charges its platform sellers and it comes out to 45-51%:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Competitive businesses just don't have 45% margins! No one can afford to kick that much back to Amazon. What is a merchant to do? Sell on Amazon and you lose money on every sale. Don't sell on Amazon and you don't get any business.

The only answer: raise prices on Amazon. After all, Prime customers – the majority of Amazon's retail business – don't shop for competitive prices. If Amazon wants a 45% vig, you can raise your Amazon prices by a third and just about break even.

But Amazon is wise to that: they have a "most favored nation" rule that punishes suppliers who sell goods more cheaply in rival stores, or even on their own site. The punishments vary, from banishing your products to page ten million of search-results to simply kicking you off the platform. With publishers, Amazon reserves the right to lower the prices they set when listing their books, to match the lowest price on the web, and paying publishers less for each sale.

That means that suppliers who sell on Amazon (which is anyone who wants to stay in business) have to dramatically hike their prices on Amazon, and when they do, they also have to hike their prices everywhere else (no wonder Prime customers don't bother to search elsewhere for a better deal!).

Now, Amazon says this is all wrong. That 45-51% vig they claim from business customers is barely enough to break even. The company's profits – they insist – come from selling AWS cloud service. The retail operation is just a public service they provide to us with cross-subsidy from those fat AWS margins.

This is a hell of a claim. Last year, Amazon raked in $130 billion in seller fees. In other words: they booked more revenue from junk fees than Bank of America made through its whole operation. Amazon's junk fees add up to more than all of Meta's revenues:

https://s2.q4cdn.com/299287126/files/doc_financials/2023/q4/AMZN-Q4-2023-Earnings-Release.pdf

Amazon claims that none of this is profit – it's just covering their operating expenses. According to Amazon, its non-AWS units combined have a one percent profit margin.

Now, this is an eye-popping claim indeed. Amazon is a public company, which means that it has to make thorough quarterly and annual financial disclosures breaking down its profit and loss. You'd think that somewhere in those disclosures, we'd find some details.

You'd think so, but you'd be wrong. Amazon's disclosures do not break out profits and losses by segment. SEC rules actually require the company to make these per-segment disclosures:

https://scholarship.law.stjohns.edu/cgi/viewcontent.cgi?article=3524&context=lawreview#:~:text=If%20a%20company%20has%20more,income%20taxes%20and%20extraordinary%20items.

That rule was enacted in 1966, out of concern that companies could use cross-subsidies to fund predatory pricing and other anticompetitive practices. But over the years, the SEC just…stopped enforcing the rule. Companies have "near total managerial discretion" to lump business units together and group their profits and losses in bloated, undifferentiated balance-sheet items:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2021/dec/crouching-tiger-hidden-dragons

As Mitchell points you, it's not just Amazon that flouts this rule. We don't know how much money Google makes on Youtube, or how much Apple makes from the App Store (Apple told a federal judge that this number doesn't exist). Warren Buffett – with significant interest in hundreds of companies across dozens of markets – only breaks out seven segments of profit-and-loss for Berkshire Hathaway.

Recall that there is one category of data from the FTC's antitrust case against Amazon that has been completely redacted. One guess which category that is! Yup, the profit-and-loss for its retail operation and other lines of business.

These redactions are the judge's fault, but the real fault lies with the SEC. Amazon is a public company. In exchange for access to the capital markets, it owes the public certain disclosures, which are set out in the SEC's rulebook. The SEC lets Amazon – and other gigantic companies – get away with a degree of secrecy that should disqualify it from offering stock to the public. As Mitchell says, SEC chairman Gary Gensler should adopt "new rules that more concretely define what qualifies as a segment and remove the discretion given to executives."

Amazon is the poster-child for monopoly run amok. As Yanis Varoufakis writes in Technofeudalism, Amazon has actually become a post-capitalist enterprise. Amazon doesn't make profits (money derived from selling goods); it makes rents (money charged to people who are seeking to make a profit):

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Profits are the defining characteristic of a capitalist economy; rents are the defining characteristic of feudalism. Amazon looks like a bazaar where thousands of merchants offer goods for sale to the public, but look harder and you discover that all those stallholders are totally controlled by Amazon. Amazon decides what goods they can sell, how much they cost, and whether a customer ever sees them. And then Amazon takes $0.45-51 out of every dollar. Amazon's "marketplace" isn't like a flea market, it's more like the interconnected shops on Disneyland's Main Street, USA: the sign over the door might say "20th Century Music Company" or "Emporium," but they're all just one store, run by one company.

And because Amazon has so much control over its sellers, it is able to exercise power over its buyers. Amazon's search results push down the best deals on the platform and promote results from more expensive, lower-quality items whose sellers have paid a fortune for an "ad" (not really an ad, but rather the top spot in search listings):

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

This is "Amazon's pricing paradox." Amazon can claim that it offers low-priced, high-quality goods on the platform, but it makes $38b/year pushing those good deals way, way down in its search results. The top result for your Amazon search averages 29% more expensive than the best deal Amazon offers. Buy something from those first four spots and you'll pay a 25% premium. On average, you need to pick the seventeenth item on the search results page to get the best deal:

https://scholarship.law.bu.edu/faculty_scholarship/3645/

For 40 years, pro-monopoly economists claimed that it would be impossible for Amazon to attain monopoly power over buyers and sellers. Today, Amazon exercises that power so thoroughly that its junk-fee revenues alone exceed the total revenues of Bank of America. Amazon's story – that these fees barely stretch to covering its costs – assumes a nearly inconceivable level of credulity in its audience. Regrettably – for the human race – there is a cohort of senior, highly respected economists who possess this degree of credulity and more.

Of course, there's an easy way to settle the argument: Amazon could just comply with SEC regs and break out its P&L for its e-commerce operation. I assure you, they're not hiding this data because they think you'll be pleasantly surprised when they do and they don't want to spoil the moment.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

Image:

Doc Searls (modified)

https://www.flickr.com/photos/docsearls/4863121221/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#amazon#ilsr#institute for local self-reliance#amazon's antitrust paradox#antitrust#trustbusting#ftc#lina khan#aws#cross-subsidization#stacy mitchell#junk fees#most favored nation#sec#securities and exchange commission#segmenting#managerial discretion#ecommerce#technofeudalism

591 notes

·

View notes

Text

#Offer💥 offer 💥offer 💥 * Only 2 days left * !#Jawdropping discount prices! The sale is going to Close in 2 days. it's a limited time offer 𝐊𝐁𝐊 𝐇𝐞𝐫𝐛𝐚𝐥𝐬 brand has 50% discount on all our#Conditions apply.#All our products are 100 % Natural and Herbal.#✨ Available on Amazon#Meesho and Flipkart or shop at 50% off from the link below.#👇👇👇👇👇👇#𝐇𝐮𝐫𝐫𝐲! 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐓𝐢𝐦𝐞 𝐨𝐟𝐟𝐞𝐫 🛒𝐧𝐨𝐰#Product Links:#Contact us at +91 8142651426

0 notes

Text

Now that holiday shopping season is upon us, please remember to use camelcamelcamel to confirm whether or not an Amazon sale is actually a deal or not.

Often enough "sale" prices are regular discounts that products have year round, Amazon just hopes that holiday hype makes you buy things under the assumption that they are limited time deals.

Also it's common for Amazon listings to have a base price increases to make discounts look good when in reality the items have not changed in price at all.

The most bullshit reason to watch out is that sometimes the base price increase totally outweighs the sale, which makes an item cost MORE than it did before the "sale".

explanation on how camelcamelcamel helps under the cut

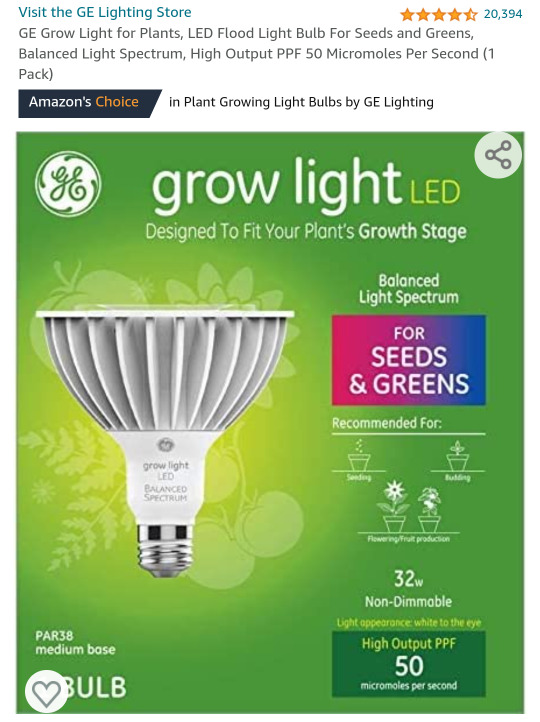

Here is an example product I was looking at. These grow bulbs are good but stupid expensive. The normal price is $39.58 but the current sale price of $21.65 is more than I paid for one a few years ago. I wanted to see if this was really a good sale or not.

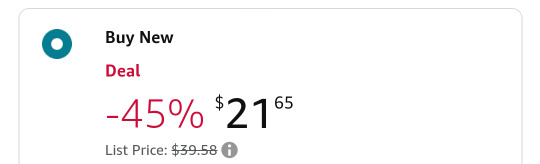

This is the price graph provided by camelcamelcamel. As you can see, a few years ago the price dipped dramatically but the current sale price is better than what the bulb has cost the majority of the year. (For items with very volatile price changes, you can reduce the scope of the graph to cover the last few months. this makes the line easier to read.)

So in this case, the sale price is not bullshit. This is probably the best price I'm going to see for one of these bulbs nowadays.

That's really all there is to it. Just double check that the graph doesn't peak with the item's current "sale" price.

2K notes

·

View notes

Text

“Seller services,” as Amazon refers to these and other sources of revenue, are a large and growing part of Amazon’s revenue — larger than Amazon Web Services and quite profitable. They also mean that letting a seller market off-brand products on your platform is often going to be more profitable than selling your own discount brands: Undercutting an independent seller’s small coffee-grinder business is, it turns out, a bad look and, in the big picture, maybe not worth the trouble.

Sellers serve a lot of purposes for Amazon and joke among themselves about the free labor they provide. In exchange for access to the largest sales channel on the internet, they do a lot more than just pay Amazon its fees. They perform market research, obsessively investigating review data and marketplace trends to figure out what’s going to be popular on the platform next. (Recent red-hot third-party product types include miniature waffle-makers, reading lights that drape around your neck, and dog puzzles.) They handle customer service. They exert downward price pressure on one another, and they absorb a lot of risk (dozens of dog-puzzle sellers fail so that one may thrive). No matter what happens to them, whether their own businesses succeed or fail, Amazon makes money.

This is a great deal for Amazon, and over the years it has become Amazon’s main deal — in 2021, the company estimated that activities on its marketplace created “more than 1.8 million U.S. jobs” and shared success stories from its hundreds of thousands of American sellers, some of whom had become millionaires. It was a slow and, in hindsight, astounding transformation in which the “everything store” substantially outsourced its store.

-John Hermann, The Junkification of Amazon

86 notes

·

View notes

Note

“My sense is that Meghan's market is more of the TJ Maxx demographic.” Interesting assessment of Meghan’s market. From a business perspective, brands who end up at TJMaxx, Marshalls, etc. (owned by the same company TJX) are typically bought in due to 1) supplier has made too much (overstock) and it isn’t selling 2) it’s getting close to the end of its expiration dates (close out) and it sold in at a much cheaper cheaper price to TJX. She’d still need a regular place to sell before she tries to offload (usually at a much lower margin / maybe even a loss) to TJX. I’m basing this on my experience with working in food industry and resorting to these retailers for the same reasons.

Exactly my point. The TJX brand is the end of the line for so much product and merch these days (especially fast fashion) that it's inevitable Meghan's products will end up there if this turns into the deal she wants to be. The key thing is that she needs product first. That she launched without a real product is very telling.

To me, what I think it says is that she's not getting the investors or partners that she wants so she launched ASAP to use the media's hype as part of her negotiation or recruitment strategy. (In addition to taking advantage of Kate's absence, of course.)

I made a suggestion in an earlier post that Meghan's competitors are the socialite/influencers that are launching their own brands or already have brands. A great many of those brands use print-on-demand dropship merch. They save on overstock storage and production fees by only keeping a limited selection in stock and marking up their own prices to cover "demand."

I see Roop heading in that direction. If they can't find a distribution vendor (e.g., Kohls, Target, Macy's, etc.), they'll do dropshipping but at such low quantities they always sell out - which is the same tactic Meghan uses when she wants to be a fashion influencer (she wears something already heavily discounted and with so little stock that she can take credit for "selling out").

What is interesting, and why I think Roop has a good argument for exclusivity with TJX companies, is Rae Dunn. Most of her product is sold exclusively through TJX and she has a deal with a company called Magenta Inc., an online retailer that's thought to be behind Rae Dunn products in places like Amazon and Walmart.

So there's precedent for Meghan/Roop to sell exclusively with TJX, with perhaps a side deal for an online storefront like Magenta offers. But that's not the audience or market Meghan wants (even though she herself is the "wine mom" elder millennial motivational-quote-spouting stereotype that buys Rae Dunn and shops at TJX stores so it's a natural fit). She wants Roop in luxury marketplaces that prices out the very people who would actually buy Meghan's product.

She's stuck between a rock and a hard place. I think she realizes it now while watching the metrics on social media plateau from a total lack of engagement and total absence of content (hence throwing Mandana under the bus in Page Six). Which is surprising. Given the way she rolled out Sussex.com with the IG Vancouver kickoff - four or five days straight of new Sussex content and material - I expected the same thing with Roop; 1st day - social media launch, 2nd day - lunch papwalk, 3rd day - product launch, 4th day - "checking out my product" charity visit/papwalk, 5th day - Netflix cooking show promo, and so on.

I know, I know. Stop giving her ideas. I'm trying!

26 notes

·

View notes

Text

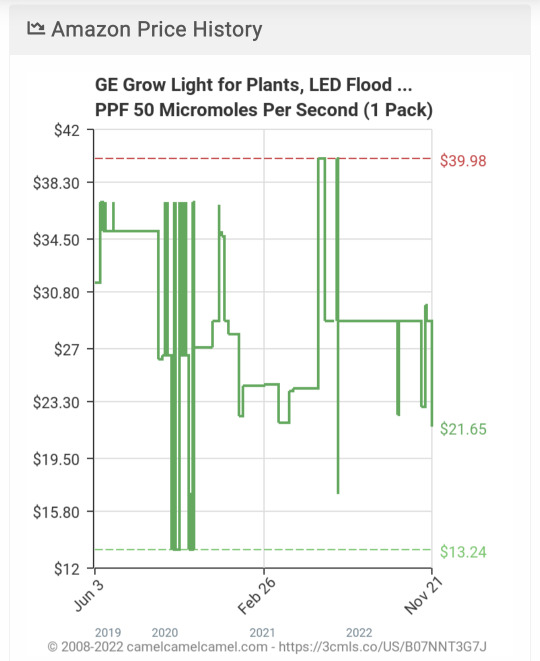

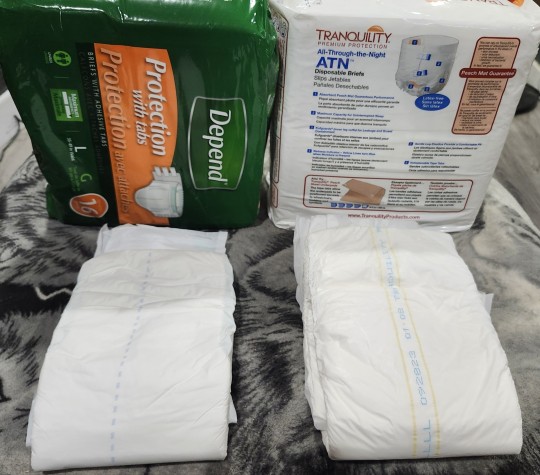

Tranquility Vs Depends

Both would be considered a discount product.

But one is definitely far better than the other and ironically it's cheaper.

The Depends product, definitely isn't the greatest at one time they were a decent product but not anymore, they are very thin, the tapes are poor quality and they do tend to rip in quite awkward spots.

In so many ways they rip just while doing your day-to-day, activities or even sitting down or bending over.

The Tranquilities, on the other hand, have definitely not slacked on quality over the years, for being a discount product, they definitely hold up very well, from their tapes to the actual material used, very good quality for the price.

Now let's talk about price, all prices are in Canadian Dollars, based off of Amazon listings.

Depends, $16.42 Per Bag with a -15% Discount

They are, Packs of 16

Tranquility, $129.98 Per Case $16.24 Per Bag

Cases of 8, 12 Per Bag

For me, a Case will last 3 Months

30 notes

·

View notes

Text

Thread by @primarycatdad

A McDonalds hamburger costs $2.09 at the register.

McDonalds internal documents show that the raw materials (patty, bun, etc.) cost $0.34. A McDonalds employee makes $11/hr on average with a shift manager making $15/hr. Shifts are 8 people on average. That means McDonalds pays $77 + $15/hr in wages to a shift (total $92). The average McDonalds makes $2.7 million/year in sales. That is $308/hour, or roughly 147 hamburgers every hour at $2.09. Subtracting the wage of the workers ($92) and cost of materials ($49.98), this means there is $166 in surplus value accumulated every hour by the capitalist. If we take the value of the 147 hamburgers and distribute it among the workers who completed them and placed them into circulation, we get $258.02 ($308-$49.98) divided among 8 workers for $32/worker/hour as compared to their $11/hr wages.

The rate of exploitation of the McDonald’s workers is thus, when the raw materials are taken as constant capital and not variable capital, is 32:11, roughly 3:1. This means, that of each hamburger, if 34 cents is raw material and the sale price is $2.09, there is $1.75 attributable to the work of the McDonalds employees in the store. We can divide that value among the 8 workers, and we’d come up with 21 cents per hamburger created by each one. However, let’s look a little more carefully, not merely from the point of view of the McDonald’s capitalist, but from the point of view of the imperialist.

The beef patty in a McDonald’s hamburger weighs 1.6 ounces. According to the corporation, the meat is a combination of chuck ($4/lb), sirloin ($9/lb), and round ($7/lb). The prices of these meats is from the US beef markets. We can take the average of these three prices: $6.50/lb. For the amount contained in a hamburger (1.6 ounces), this comes to roughly .65 cents ($6.50/16 = .40). As you can see, this is more than the entire value of the raw materials in the McDonald’s hamburger. Even if they receive a twenty-five per-cent discount for bulk operations, that’s still 49 cents per hamburger.

One of the top countries supplying beef to McDonalds is Brazil, which shouldn’t be a surprise: the Brazilian ranching industry supplies a huge amount of worldwide beef, and grows it on land assarted from the Amazon. A Brazilian livestock handler makes 16 reals/hr, which is $3.21 USD. Brazilian beef costs a mere $1.76 and $2/lb. We can see why. The price of Brazilian beef is so much lower because the Brazilian worker’s wage is so much lower. Why is that? Imperialism.

The labor market of Brazil is artificially depressed by fascists like Bolsonaro, who are put into power by US interests to keep prices low. US monopoly capital also destroys the quality of life in imperialized countries because this is how the socially necessary labor time is determined for reproducing the labor force.

If the Brazilian beef costs 34 cents for 1.6 ounces while the reproduction cost of the Brazilian ranch hand is $3.21 an hour, then we may establish a ratio - roughly $3/hr to 30 cents or $1/hr to 10 cents. If the ranch hand made $11/hour just as the metropolitan workers do, this would be an increase of 3 and a half times, increasing the Brazilian beef cost to $1.19 for 1.6 ounces.

If we wished to maintain the price equilibrium by which the hamburger is sold at $2.09, this would require an equalization of wages between the metropolitan worker and the peripheral worker. That is to say, because the hamburger is worth $1.75 in labor ($1.75+$0.34=$2.09) from the metropolitan worker, we must equalize the $1.75 in metropolitan labor with the $0.34 in peripheral labor.

If we were to divide these into two equal parts, that is, $1.04 worth of peripheral labor crystallized in the meat and $1.04 worth of labor in the metropole for the finishing of the meat into a final product, that is a change of $0.71 in favor of the peripheral worker. For each hamburger made, the metropolitan worker is paid 3x the wage of the peripheral worker. The metropolitan worker cooking the burger on the grill, assembling the worker, dealing with angry customers, and selling the burger; the ranch hand is enduring near-slave conditions on the Brazilian plain.

The metropolitan worker is directly paid 3 times more for their labor, the hamburger’s cost is depressed for all metropolitan workers, the metropolitan capitalists (the monopoly capitalists) provide other social safety benefits to keep the class consciousness of the metropolitan workers from developing, and they also concentrate the high-waged, final finishing work for products and the management positions within the metropole. These are the wages of imperialism. Lots of quote tweets etc. demanding I account for credit, interest payments, advertising, salaries for HR and executives, franchising fees, rent, machinery, etc.

I didn't factor in any of the standard constant capital valuations for a reason: it obscures the point, which is the law of unequal development and the imperialist forced underdevelopment of the periphery. The pay for the entire cavalcade of non-productive or marginally productive executives, HR reps, advertising, etc., etc., all comes out of the 11 hamburgers sold after the first 7. So do the salaries of the CEOs.

Rent actually isn't a factor for a McDonalds because the corporation owns the ground. The franchisee pays the corporate office rent, but the corporate office pays no one. These costs are all marginal - as are the electricity and water costs and the degradation of the grill, etc. The grill itself costs around $3,000 but can make an untold number of hamburgers, imparting to the hamburger a mere fraction of a fraction of a cent. The typical annual mcdonalds power bill is $40,000. That works out to $4.5/hour or 3 cents per burger at the average rate of 147 burgers per hour.

The cost of upper management is mostly faux frais which can be eliminated, or non-productive labor which is parasitic, etc. There is still PLENTY of value to cover the necessary work at higher levels. And obviously there are things other than burgers made at a McDonalds - each product has a different individual rate of exploitation for the workers (for example, the soda is hugely exploitative and mostly mark-up).

Important, however, is that most of the profit is not from MARKUP (charging more than a thing is worth) but from THEFT (stealing and refusing to compensate the legitimate labor of the worker).

#mcdonalds#imperialism#wage#i disagree with the point of 'theft' as has already been quite exhaustively detailed by marx#but otherwise broadly good demonstration of the basic mechanisms of exploitation i'd say

603 notes

·

View notes

Text

The lawsuit alleges that Amazon is illegally undermining competition in two markets — the company's online superstore that most consumers are familiar with, as well as the market for online marketplace services bought by sellers.

Amazon uses anti-discounting techniques to deter online retailers from offering lower prices than those available on Amazon, according to the government. The retailer will "bury discounting sellers so far down in Amazon's search results that they become effectively invisible," the FTC alleges.

The lawsuit also contends that Amazon pushes sellers to use its expensive fulfillment service in exchange for obtaining "Prime" eligibility for their products, which the FTC noted is a "virtual necessity for doing business on Amazon."

26 Sep 23

39 notes

·

View notes

Text

Forbes article: "How Struggling College Bookstores Found A Way To Beat Amazon"

Oct 20, 2023,06:30am EDT

A new sales model adopted by hundreds of universities limits students’ ability to shop around for textbooks.

By Lauren Debter, Forbes Staff

As fall semester dawned at Texas Christian University in Fort Worth, senior Olivia McFall turned to Amazon to shop for books — not only because its prices were better for certain titles, but so she could get her course materials quickly. The campus bookstore could sometimes take a week or two. Unacceptable.

“Teachers will start assigning reading on the first day,” McFall, a 22-year-old fashion-merchandising major, told Forbes. “You get behind if you don’t have that textbook. If I buy it on [Amazon], it’s usually because I can get it faster than the bookstore.”

For decades, Amazon’s lower prices and speedier delivery have blown a crater in the college bookstore business. Given the option to shop around, students only buy about one-third of their course materials at the campus store.

Now the bookstores are fighting back. They say they’ve hit on a plan that would, almost magically, quash competition from online rivals like Amazon. T.C.U. is among the colleges considering a model that would automatically charge students for textbooks on their tuition bills, which can be covered by financial aid, and get them to students by the time classes begin. Books are typically discounted 30% or more, said the bookstores, who negotiate volume discounts. Students must return materials at the end of the semester.

Despite reservations from education advocates who worry it limits purchasing options for students, the plan, dubbed Inclusive Access, is spreading like kudzu. It rose out of a 2015 rule from the U.S. Department of Education that permitted universities to include the cost of textbooks with tuition, as long as prices were under competitive market rates and students could opt out.

Bookstores latched onto the idea during the pandemic. They were looking to boost sales at a time when they were hamstrung by closures, declining enrollment numbers and the seismic shift to digital textbooks — and still are.

In the 2022-23 academic year, Inclusive Access already captured the business of 44% of students, worth an estimated $1.4 billion annually, according to the National Association of College Stores.

Illinois-based Follett Corp., a privately held company (annual sales: $1.6 billion) that operates roughly one-third of college bookstores, said the number of its campuses that have adopted the Inclusive Access model has tripled to 450 since 2019. New Jersey-based Barnes & Noble Education (annual sales: $1.5 billion), which spun out of the bookseller chain in 2015 and also runs a third of campus bookstores, said it has over 150 schools signed up for Inclusive Access, up from just four in 2019. (The colleges themselves operate the other one-third of campus bookstores.)

Overnight, schools that switched to Inclusive Access brought guaranteed revenue to booksellers. Sell-through rates, which measure the percentage of course materials students purchase at the campus bookstore, skyrocketed from about 30% before Inclusive Access to north of 80 or 90%, according to Follett and Barnes & Noble Education. Few students opt out, the companies said, because they like the prices and convenience.

It’s a clever way to beat Amazon. Unable to compete, Follett and Barnes & Noble Education separated their customers from the open marketplace and bundled their products with something Amazon couldn’t sell — college tuition. The bookstore gets the customer without ever having to go up against the online behemoth, which is currently being sued by the Federal Trade Commission for its own alleged anti-competitive practices. (Amazon has said it disagrees with the allegations, and will contest the lawsuit.)

“It’s a significant volume increase because you’re capturing all of the course material market share in an institution,” Jonathan Shar, who oversees campus stores operated by Barnes & Noble Education, told Forbes. “Plus, it’s much more predictable.”

Amazon Prices

An Amazon spokesperson declined to comment on the impact Inclusive Access is having on its textbook sales. Amazon said it may offer discounts to schools that buy books in bulk, but it’s been winding down certain aspects of its textbook business. In April, it stopped renting physical textbooks to students and in 2020 it stopped buying textbooks back from students.

Last year, 37% of students purchased books from Amazon. That’s down from 46% in 2019, according to the National Association of College Stores.

Selling textbooks isn’t the business it used to be. A decade ago, students spent $4.8 billion a year on textbooks, according to research firm Words Rated. Today, it’s about $3.2 billion. During the 2022-23 school year, students spent an average of $285 on course materials, the lowest figure since the National Association of College Stores began tracking spending 16 years ago.

That’s partly the result of a rapid shift to lower-cost digital textbooks, with 55% of course materials now digital, up sharply from 15% prior to the pandemic, according to Emmanuel Kolady, Follett’s CEO. More textbooks are being made available online for free from sites like OpenStax, too. Nearly three-quarters of students say they were assigned at least one free course material in the latest academic year, according to the National Association of College Stores.

Company’s ‘Cornerstone’

Barnes & Noble Education, a publicly traded company that runs 800 campus bookstores, has described Inclusive Access to investors as a “cornerstone” of its plan to return to profitable growth, noting that course-material revenue rises more than 80% and gross profit nearly doubles after schools switch to the new model.

The company has lost a cumulative $600 million since 2018. Last year’s sales were 23% below pre-pandemic levels. This summer, it had to negotiate an extension on its loan payments because it couldn’t come up with enough cash. As part of the deal, it gave up two board seats and said it would explore selling the company. Its stock price has lost 90% of its value in the last two years, tumbling to less than $1 a share.

“It feels like this is their first, second and third priority,” said Ryan MacDonald, an analyst at Needham who covers Barnes & Noble Education, referring to Inclusive Access, which the company calls “First Day Complete.”

Benefits For Students

The booksellers claim the program saves students money. Follett said that students spend an average of 30% less than if they were to buy new books and are better equipped for classes as Inclusive Access gets them their materials before the semester begins.

At New York University, for instance, where Follett runs bookselling, students are automatically billed for books unless they opt out. Most are digital rentals. A textbook for an introductory biology class is priced at $36.75, which gives students access to a digital copy for the semester. That’s 20% less than if they went directly to the publisher’s website and rented it for the term. It’s 40% less than on Amazon, which only offers the option to buy the digital version, not rent it.

The math, however, is not always transparent. According to a report from the U.S. PIRG Education Fund, which analyzed 52 book-buying contracts, it’s “hard, if not impossible” to figure out how deep the discounts are because schools don’t make it clear what the discount is based on.

Savings can be less meaningful for students who would have otherwise bought used books or borrowed books, said Nicole Allen, director of open education at SPARC, a nonprofit that advocates for more course materials to be free. The one-quarter of students who intentionally skip buying certain books each semester, usually because they don’t think they need it, are also charged, she said. As more schools migrate to Inclusive Access, Allen questions whether discounts will disappear since publishers have a long history of raising prices.

“This is already a captive market because students are told what to buy,” Allen told Forbes. “Inclusive Access makes it an even more captive market by telling students how they’re going to buy it.”

Even without Inclusive Access, students can be limited in their comparison shopping. More and more professors are assigning books with single-use access codes, available for an additional fee, which students use to access quizzes, homework and other materials online. Promoted by publishers who benefit from the new revenue stream, they’re often sold exclusively by the campus bookstore and cannot be resold.

Follett’s president Ryan Petersen predicts that a newer variant of the model called Equitable Access, where students pay a flat fee for their materials regardless of the courses they’re taking, will be adopted by most schools in the next five years.

“We’re having this conversation with every campus we can,” Petersen told Forbes, “potentially even to campuses who are sick of hearing about it.”

43 notes

·

View notes

Note

You say you want to be accessible and affordable. Well I found your gootoobz on Amazon for cheaper.

In the case of the GooToobz, the supplier we purchased from had us sign a contract which sets a minimum price for us to charge - we are actually selling them as low as we’re allowed to. This actually means they need to be exempt from discounts, otherwise we’d be breaching contract.

The Amazon listing you saw likely purchased from a different supplier or is in a different country where their contract is different.

I will say though that sometimes our prices won’t beat Amazon. We are a small business and because we can’t buy in the quantities that they can, they have significantly lower product costs.

Irene and I have spent a lot of time figuring out how low we can price our products while still being able to cover overhead costs. There are a lot of things that need to be taken into consideration beyond the basic cost of products from our suppliers, such as the packaging materials, money lost from chargebacks or parcels disappearing, where we have to re-send them out at our cost. We also had to purchase all the drawers and shelving for the products and other various things.

Irene and I aren’t even actually paid anything at this time. We are solely focused on building the business. We want this to be sustainable down the line which means as much as we wish we could make stuff cheaper, we can only go so far without having our business go under.

I normally wouldn’t respond to an ask like this and I realize a lot of businesses wouldn’t talk about this but I do think it’s important info for anyone else wondering to know.

52 notes

·

View notes

Text

Hello Everyone!!

We are here to provide you best essentials products you use in your daily life and that are available on your favourite shopping sites with great reviews and deals available. It will make easier for you to get your worthy product without comparing prices on other sites, we will help you to get the product with amazing deals and discount. Visit our website (https://visionbest.in/) and shop with us. We are happy to serve you.

#savings#online shopping#discount#best price#amazon#daily essentials#kitchen items#baby products#kids toys#beauty products#skin care#hair care#current household#men grooming

1 note

·

View note

Text

Meatspace twiddling

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me next weekend (Mar 30/31) in ANAHEIM at WONDERCON, then in Boston with Randall "XKCD" Munroe (Apr 11), then Providence (Apr 12), and beyond!

"Enshittification" isn't just a way of describing the symptoms of platform decay: it's also a theory of the mechanism of decay – the means by which platforms get shittier and shittier until they are a giant pile of shit.

I call that mechanism "twiddling": this is the ability of digital services to alter their business-logic – the prices they charge, the payouts they offer, the particulars of the deal – from instant to instant, for each user, continuously:

https://pluralistic.net/2023/02/19/twiddler/

Contrary to Big Tech's own boasting about its operations, the tricks that tech firms play to siphon value away from business customers and end-users aren't very sophisticated. They're crude gimmicks, like offering a higher per-hour wage to Uber drivers whom the algorithm judges to be picky about which rides they'll clock in for, and then lowering the wage by small increments as a way of lulling the driver into gradually accepting a permanent lower rate:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

This is a simple trick. The difference is that tech platforms like Uber can play it over and over, and very quickly. There's plenty of wage-stealing scumbag bosses who'd have loved to have shaved pennies off their workers' paychecks, then added a few cents back in if a worker cried foul, then started shaving the pennies again. The thing that stopped those bosses was the bottleneck of payroll clerks, who couldn't make the changes fast enough.

Uber plays crude tricks – like claiming that a driver isn't an employee because the control is mediated through an app – and then piles more crude tricks on top – this algorithmic wage discrimination gambit.

Have you ever watched a shell-game performed very slowly?

https://www.masterclass.com/articles/how-to-do-penn-tellers-famous-cups-and-balls-trick-in-12-steps

It's a series of very simple gimmicks, performed very quickly and smoothly. Computers are very quick and very smooth. The quickness of the hand deceives the eye: do crude tricks with superhuman speed and they'll seem sophisticated.

The one bright spot in the Great Enshittening that we're living through is that many firms are not sufficiently digitized to to these crude tricks very quickly. Take grocery stores: they can get up to a lot of the same tricks as Amazon – for example, they can charge suppliers for placement on the most prominent, easiest-to-reach shelves, reorganizing your shopping based on which companies pay the biggest bribes, rather than offering the best products and prices.

But Amazon takes this to a whole different level – beyond simply organizing their product pages based on payola, they do this for search. You ask Amazon, "What's your cheapest batteries?" and it lies to you. If you click the first link in a search-results page, you'll pay 29% more than you would if you got the best product – a product that is, on average, 17 places down on the results page. Amazon makes $38b/year taking bribes to lie to you:

https://pluralistic.net/2023/11/06/attention-rents/#consumer-welfare-queens

Amazon can do more than that. Thanks to its digital nature, it can continuously reprice its offerings – indeed, it can simply make up each price displayed on every product at the instant you look at it – based on its surveillance data about you, estimating your willingness to pay. For sellers, Amazon can continuously re-weight the likelihood that a given product will be shown to a customer based on the seller's willingness to discount their products, even to the point where they go out of business:

https://www.businessinsider.com/sadistic-amazon-treated-book-sellers-the-way-a-cheetah-would-pursue-a-sickly-gazelle-2013-10

Twiddling, in other words, lets digital services honeycomb their servers with sneaky wormholes that let them siphon value away from one kind of platform user and give it to another (as when Apple silently began spying on Iphone owners to create profiles for advertisers), or to themselves.

But hard-goods businesses struggle to do this kind of twiddling. Not for lack of desire – but for lack of capacity. Jeff Bezos, owner of Amazon Fresh – an online grocery store – can change prices and layout millions of times per day, at effectively zero cost. Jeff Bezos, owner of Whole Foods – a brick-and-mortar grocer – needs a army of teenagers on rollerskates with pricing guns to achieve a fraction of this agility.

So hard-goods businesses are somewhat enshittification-resistant. It's not that their owners are more interested in the welfare of their customers, workers and suppliers – they merely lack the capacity to continuously rejigger the way their business runs.

Well, about that.

Grocers have been experimenting with "electronic shelf labels" in order to do "dynamic pricing" – that means that prices change quickly, in response to circumstances:

https://www.npr.org/2024/03/06/1197958433/dynamic-pricing-grocery-supermarkets

This doesn't have to be bad! As @planetmoney points out, it's a little weird that grocers don't discount milk whose sell-by date is drawing near. That milk is worth less to shoppers, because they have to use it more quickly lest it expire. Instead of marking down the price of perishable goods – day-old lettuce, yesterday's bread, etc – grocers put them on the shelves next to fresher, more valuable products, leading to billions of dollars' worth of food-waste and and unimaginable quantities of methane-producing, planet-cooking landfill.

In Norway, ESLs are pretty well established and – at least according to Planet Money's reporting – they are used exclusively to offer discounts in order to reduce waste. They make everyone better off.

But towards the end of the story, they note that Norway's grocery sector – which alters prices up to 2,000 times per day – has been accused of using ESLs to rig prices, hiking them and blaming them on pandemic supply-chain problems and loose monetary policy. Greedflation, in other words.

Greedflation is rampant in the grocery sector, all around the world. Remember when the price of eggs doubled and they blamed in on bird-flu, even as the CEO of the one company that owns every egg brand you've ever heard of boasted about how he could hike prices and suckers would just pay it?

https://pluralistic.net/2023/01/23/cant-make-an-omelet/#keep-calm-and-crack-on

In Canada, grocers rigged the price of bread, the most Les-Mis-ass form of corporate crime you can imagine (do you want guillotines, Galen Weston? Because this is how you get guillotines):

https://en.wikipedia.org/wiki/Bread_price-fixing_in_Canada

EU grocers – another highly concentrated industry – also collude to rig prices:

https://pluralistic.net/2023/09/17/how-to-think-about-scraping/

Which is all to say that while these companies don't have to use the twiddling capabilities that come with ESLs to enshittify their stores, we'd be pretty fucking naive to assume that they won't.

And here's the bad news: US grocers like Whole Foods (owned by Amazon, the company that wrote the enshittification playbook) are already experimenting with ESLs. So is Alberstons/Safeway, the massive, inbred conglomerate that has already demonstrated its passion for using twiddling to fuck over their workers:

https://knock-la.com/vons-fires-delivery-drivers-prop-22-e899ee24ffd0/

Economists love "price discrimination" – where prices change based on circumstance, trying to match the perfect price with the perfect customer. On paper, that sounds plausible: if I need a quart of milk for a recipe I'm making tonight and I get a 50% discount on some about-to-expire 2%, then everyone's better off. I get a discount and the grocer gets some money for milk they'd have to throw away at the end of the day.

But these elegant, self-licking ice-cream cones only emerge if the corporation offering the deal is constrained. Perhaps they're constrained by competition – the fear that you'll go elsewhere. Or perhaps they're constrained by regulation – the fear that they'll be punished if they use twiddling-tech to cheat you.

The grocery sector, dominated by a cartel of massive companies that routinely collude to rip us off, is not constrained by competition. And for years, regulators let them get away with ripping us off (though finally that might be changing):

https://www.nytimes.com/2024/03/21/us/politics/grocery-prices-pandemic-ftc.html?unlocked_article_code=1.ek0.t2Pr.g4n2usbxEcoa

For neoclassical economists, the answer to all this is "caveat emptor" – let the buyer beware. If you want to make sure that ESLs are only used to offer you discounts and not to gouge prices, all you need to do is note the price of everything you buy, every time you buy it, and triple-check it every time you go back to the grocery store. Just be eternally vigilant!

Thing is, the one thing computers are much better at than humans is vigilance. With ESLs and other twiddling mechanisms, you're a fish on a hook, and the seller is tireless in giving you a little more slack, then a little less, until you finally drop your guard.

Economists desperately want these elegant models to work, but "efficient market hypothesis" is a brain-worm that always turns into apologetics for fraud. Dynamic markets sound like a good idea, but they are catnip for cheaters. "Just be eternally vigilant" is miserable advice, and no way to live your life:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

In his brilliant novel Spook Country, @GreatDismal describes augmented reality as "cyberspace everting" – that is, turning inside-out:

https://memex.craphound.com/2007/07/31/william-gibsons-spook-country/

The extrusion of twiddling technology from digital platforms into the physical world isn't cyberspace everting so much as it is cyberspace prolapsing.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/26/glitchbread/#electronic-shelf-tags

#pluralistic#fraud apologetics#caveat emptor#twiddling#competition#groceries#price discrimination#norway#electronic shelf tags#planet money#enshittification#constraints#greedflation#efficient market hypothesis brain-worms

244 notes

·

View notes

Text

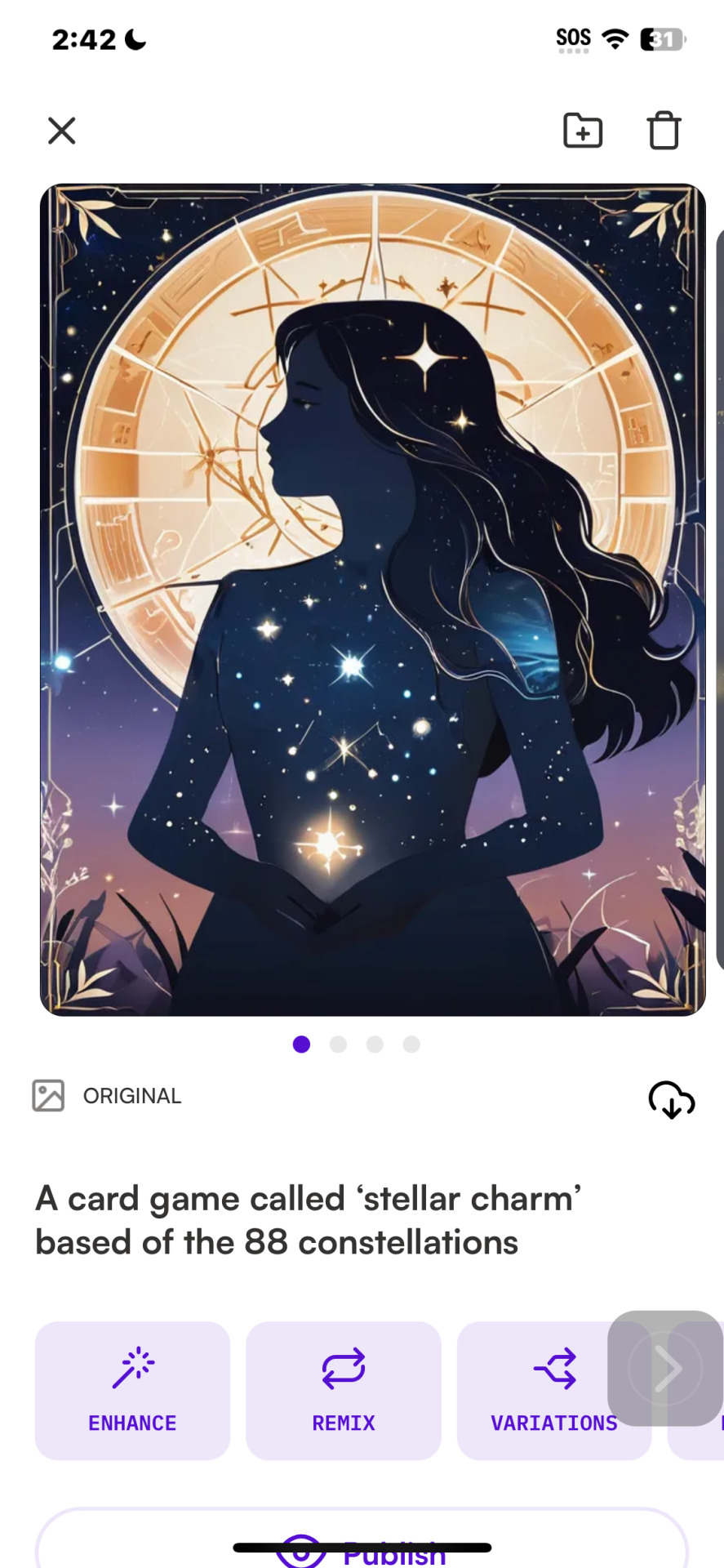

Business Model for

Stellar Charm:

Target Market: The target market for Stellar Charm will

be primarily young adults and teenagers

who are interested in strategy-based card games. The game will also appeal to astronomy enthusiasts and fans of fantasy and mythology.

Revenue Streams:

The primary source of revenue for Stellar Charm will be the sales of the game itself.

In addition, the game can generate revenue through expansion packs, limited edition cards, and merchandise such as t-shirts, posters, and figurines.

Distribution Channels: Stellar Charm will be sold through various distribution channels such as online marketplaces like Amazon and Etsy, as well as through brick and mortar stores specializing in board games and card games. The game will also be available for purchase directly from the company's website.

Marketing and Advertising: To reach the target market, Stellar Charm will utilize a mix of

digital and traditional marketing strategies. This will include

social media marketing, influencer partnerships, targeted online ads, and participation in gaming conventions and events. The game will also have a strong presence on popular gaming forums and communities.

Production and Manufacturing: The game will be produced and manufactured in-house to maintain quality control and minimize production costs. This will also allow for faster turnaround time for new expansions and updates.

Pricing Strategy: The price of the base game will be set at a competitive rate to attract customers. Expansion packs and limited edition cards will be priced slightly higher to appeal

to collectors and enthusiasts. Discounts and promotions will also be offered periodically to encourage sales.

Customer Support: Stellar Charm will have a dedicated customer support team to handle any queries or concerns from customers. This will ensure a positive customer experience

and help build brand loyalty.

Partnerships and Collaborations: In

order to increase brand awareness and reach a wider audience, Stellar Charm will collaborate with other popular games and brands. This can include cross-promotion, co-branded products, and special events.

Cost Structure: The main costs involved in running the business will include production and manufacturing

costs, marketing and advertising expenses, and operational

expenses such as rent, utilities, and salaries. The company will also invest in research

and development to continuously improve the game and create new expansions.

Future Plans: As the game gains popularity, the company can consider developing a digital version of Stellar Charm for mobile or computer platforms. This can open up new revenue streams and reach a larger audience. The company may also consider licensing the game to other countries to expand its market reach.

Play style

Card Name and Type: This feature displays the name of the battle card and its type, such as "Stellar Charm - Magical" or "Stellar Charm - Elemental". This helps the player identify the card and its category, which can be useful in planning their strategy.

Element: The

element of the card

is represented by a symbol or color and is crucial in determining its strengths and weaknesses. For example, a water element card

may be strong against fire but weak against lightning. The player must keep this in mind when using the card in battles.

Attack Points: This feature displays the attack points of the card, which represents its offensive power. The higher the attack points, the stronger the card's attack will be. The player can use this information to strategically choose when to use the card in battle.

Defense Points: The defense points of the card represent its defensive capabilities. The higher the defense points, the better the card can withstand attacks from the opponent. The player can use this feature to strategically defend against the opponent's attacks.

Special Ability: Some battle cards may have a special ability that can be activated during battle. This feature will describe the special ability, such as "Healing Aura" or "Double Attack",

and how it can be used in battle. The player must carefully consider when to use the special ability to gain an advantage over their opponent.

Fusion Requirements: The fusion requirements feature displays the elements or types of cards needed to fuse with the Stellar Charm card to create a more powerful card. This adds a layer of strategy to the game as the player must strategically choose which cards to fuse with the Stellar Charm card to create

the most advantageous outcome.

Lore: The lore of

the card provides a background story or description of the

card, which can help

the player understand the card's role in the game. This feature can also add an element of immersion and depth to the game, making it more engaging for the player.

The game would be called "Constellation Clash" and it would be a two-player strategy battle card game. The objective of the game would be to collect and control the most constellations by the end of the game.

Card Types:

Constellation Cards

These cards represent the 88 constellations and each one has its own unique abilities and strengths.

Zodiac Cards - These cards represent the

12 zodiac signs and

can be used to enhance the abilities of constellation cards.

Star Cards - These cards represent individual stars and can be used to boost the power of constellation cards.

Element Cards - These cards represent the four elements (fire, water, air, and earth) and

can be used to counter certain constellation cards.

Action Cards - These

cards have various

effects and can be used

to interrupt or change

the course of the game.

Card Styles:

Basic Cards - These

cards have a simple

design and represent

the less powerful

constellations.

Advanced Cards - These cards have a

more intricate design and represent the more powerful constellations.

Mythical Cards - These cards have a unique design and represent the rare and powerful constellations.

Gameplay:

Set-Up - Each player starts with a deck of 20 constellation cards, 10 zodiac cards, 10 star cards, and 5 element cards. Each player also starts with 5 action cards in their hand. The remaining action cards are placed in a separate deck.

Turn Sequence - The game is played in turns. Each turn, a player can perform the following actions in any order:

Play one constellation card from their hand onto the field.

Play one zodiac or star card from their hand onto the field,

and attach it to a

constellation card

already on the field.

Play one action card

from their hand and

resolve its effect.

Battle Phase - Once both players have finished their turns, a battle phase begins. The player who has the most stars attached to their constellation cards

has the first attack. Each player takes turns attacking and defending until all battles have been resolved.

Battle Rules - During a battle, the attacking player chooses one of their constellation cards to attack with. The defending player

can choose to block

the attack with one of their constellation cards or take the full damage. If the attack is blocked, the defender's constellation card is discarded. If the attack is not blocked, the defender takes damage equal to the difference between the attacking constellation card's power and the defending constellation card's power.

Element Advantage - Certain constellation cards have an advantage over others based on their element. If a constellation card with a higher element attacks a constellation card with a lower element, the attacking card's power is increased by 50%.

Mythical Card Rule

If a player has a mythical card on the field, they can choose to activate its special ability once per turn during the battle phase.

End of Turn - After

the battle phase, the

player can choose to

discard any cards from

their hand and draw new

ones, up to their hand

limit of 5 cards.

End of Game - The game ends when one player has control of at least 10 constellations or when one player runs out of cards in their deck. The player with the most constellations under their control wins the game.

The phases of the game would develop as players strategically play their cards, trying to gain control of the most powerful constellations and using their

zodiac and star cards strategically to enhance their abilities. The game would also require players to carefully manage their resources and choose when to use their action cards for maximum impact. With the mythical cards adding

an extra element of

surprise, every game

would be unique and

challenging.

Zodiac Cards: These are the most powerful and rare cards in the game, representing the 12 zodiac signs. Each Zodiac Card has a unique ability and high attack and defense points.

Star Cards: These cards represent the stars within each constellation and

are the backbone of

any deck. They have

a balanced mix of

attack and defense points and can be used strategically to support other cards.

Mythology Cards: These cards are based

on the ancient stories and myths associated with each constellation. They have powerful abilities that can turn the tide of battle, but are limited in number and should be used sparingly.

Elemental Cards: There are 4 elemental card types in the game - Fire, Water, Earth, and Air, each representing

a different element

from the universe.

These cards have a rock-paper-scissors relationship with each other, with one element being strong against another and weak against the third. They can

be used to counter opponent's cards and add an element of strategy to the game.

Celestial Cards: These cards represent celestial objects such as planets, comets, and galaxies. They have powerful abilities that can affect multiple cards at once, but are also limited in number and should be used strategically.

Constellation Cards: These cards represent the constellations themselves and have a unique ability that can only be activated when

a player has a certain number of cards from the same constellation in their hand.

Support Cards:

These cards do not

have any attack or defense points, but instead, provide support to other cards in a player's hand. They

can boost attack or defense points, provide additional abilities, or even revive defeated cards.

Card Styles:

Standard Cards: These cards have a simple design with the constellation name and image on the front and the card type and stats on the back.

Foil Cards: These

are rare and valuable versions of the standard cards, with a metallic sheen and enhanced artwork.

Holographic Cards: These cards have a holographic design that changes depending on the angle they are viewed from. They are highly sought after by collectors.

Legendary Cards: These are the most powerful and rare cards in the game, with unique artwork and abilities. They are highly coveted and can only be obtained through special events or by trading with other players.

Promo Cards: These limited edition cards are only available through special promotions, such as tournaments or special edition sets.

Prism Cards: These cards have a prism design that creates a rainbow effect when viewed under light. They are highly prized by players for their unique design.

Cosmic Cards: These cards have a cosmic design, with images of galaxies, stars, and other celestial objects. They are considered the most visually stunning cards in the game.

#Business model#play styles#card types#rules#objectives#card elements#stellar charm#battle strategy card game#TCG#Stellar Charm Cards

9 notes

·

View notes

Text

Given Blu-ray Disc BOX

youtube

Hey everyone! This is an unofficial post made to spread information regarding the new GIVEN Disc Box containing recorded content of the GIVEN TV animation 11 episode series, Given: The Movie, and OVA Given: Uragawa no Sonzai. According to Given official website, the box will also contain an OAD "Uragawa no Sonzai" (Limited edition manga volume + 1 episode bonus content), this content has not been mentioned in other websites / is referred equivalent to Given OVA so keep an eye out for any updates as all product benefits and specifications may change without notice!

The box set comes with a limited edition jacket along with a special leaflet from Kizu-sensei, as well as an illustration card, and a bonus video containing non-credit opening and endings. A B2 announcement poster will also be handed out to customers who have purchased the Disc Box at target stores, in first-come, first-served basis. Once the stock of the poster runs out, it is all gone!

Target stores include : ANIPLEX, Studio Hibari / Lerche, Animate, Amazon. co. jp , Rakuten Books , Sofmap Animega, TSUTAYA Online, Toranoana Ikebukuro Store / Mail Order, Seven Net Shopping, AmiAmi Online Shop, WonderGOO / Shinseido, HMV, Tower Records, and Noitamina Shop

Non target stores such as CDJapan will not provide a B2 announcement poster as well as other special benefits.

🎸 Special Benefits:

Aniplex+: A4 clear file bag & smartphone shoulder strap

Studio Hibari/ Lerche (mail order): Original picture can badge & original picture postcard set

Animate: 4 square acrylic coaster set

Amazon . jp limited: Acrylic key chain & purse

Rakuten Books: Original name scene photobook + 5 piece acrylic stand set

TSUTAYA Online: 4 L sized bromide set

Sofmap Animega: 4 acrylic panel set

Seven net shopping: Eco bag

AmiAmi Online Shop: Character fine mat

Toranoana Ikebukuro store & mail order: A3 clear poster

Noitamina shop: CD Jacket style acrylic frame & Jacket card

As of present date, benefits and illustrations are currently in their printing process as the Disc BOX is set to release on November 15, 2023 for 29,700¥ tax included. As per usual, all underlined texts are hyperlinks, do check them out; especially as some of these websites offer for discounted prices, and are open for reservations!

#Given#Given DVD Box Set#Mafuyu Sato#Ritsuka Uenoyama#Akihiko Kaji#Haruki Nakayama#Murata Ugetsu#Hiragi Kashima#Shizusumi Yagi#Merch_GU#Youtube

17 notes

·

View notes

Text

Add your own recommendations & share!

Favorite Black Friday Deals

chronic illness/service dog edition

Spectra Laser Therapy (for dogs & people) - 25% off which is their biggest sale of the year

Lazarus Naturals CBD (for dogs & people) - 25% off and bigger discounts for large purchases

MYOS muscle formula (for dogs) - 20% off which is kind of their standard discount you can find throughout the year

Mary Ruth supplements and gummy vitamins (for people) - 30% off but I’ve noticed they have a hard time keeping things in stock so don’t plan on being able to set a routine easily with this brand

Muenster Dog Food & Freeze Dried Treats - discount varies by product but ranges from 25-70% off

If you want some cute wool socks, Darn Tough is a good brand with a lifetime warranty. If you get a hole in your sock you can swap it out for a new pair and it doesn’t matter where you buy them (although there are known counterfeits on Amazon so be careful but I think they’ll usually still honor that) Moosejaw is a great place to get them on sale. I recommend any of them that say “cushioned” as their regular socks are super thin dress sock style.

If you don’t know, a lot of the products on Chewy and Amazon are not actually on sale despite what they say. You have to watch the prices before the holidays to see if they actually go on sale or are artificially marked.

None of the products I usually recommend from those sites are actually on sale, but here’s a few honorable mentions:

Good quality dog sized fleece blankets for $7.99

This is a good quality budget dog bed IMO but it also goes on sale every chance it gets

Vanicream is an amazing skin care product line for people with chemical sensitivities. It’s always well priced but these are legitimate discounts as well. Can definitely recommend their: face wash, liquid cleanser (thin) or body wash (thick), shampoo, conditioner and I use their Vit C cream as face lotion and it’s amazing.

#black friday#chronic illness community#disabled community#disability resources#service dog community#service dogblr#dogblr#PSA

7 notes

·

View notes