#a.d. 550 b.c.

Text

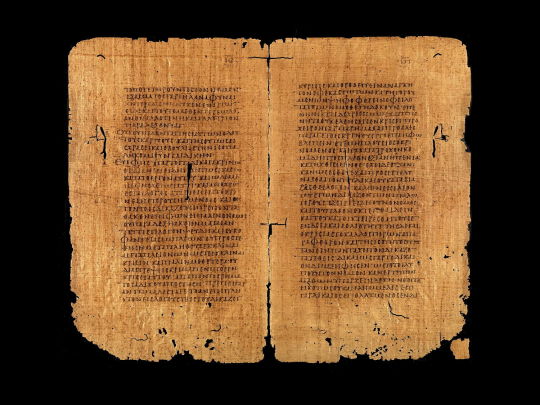

~ Literary Papyri: Cyril of Alexandria, On Adoration and Worship in Spirit and in Truth.

Date: A.D. 550-614

Period: Byzantine

Place of origin: El-Deir (Fayoum, Egypt) (?)

#history#museum#archeology#archaeology#papyri#byzantium#byzantine#Cyril of Alexandria#Egyptian#Egypt#a.d. 550 b.c.#a.d. 614

549 notes

·

View notes

Text

Sprawling 2,000-Year Old Cemetery Discovered in France

In the middle of the first century B.C. — more than 2,000 years ago — scattered graves were dug next to a roadside in France.

For the next 600 years, what started as a few burials evolved into a sprawling cemetery filled with various types of graves and teeming with burial treasures. About 1,300 years ago, the site finally fell out of use, and its contents were left alone.

That is until now.

The development of a park near what is now the village of Saint-Vulbas led archaeologists to the discovery of the huge burial site in 2018, according to a Jan. 22 news release from the Institut national de recherches archéologiques préventives (INRAP). Since then, they’ve discovered more than 1,000 funerary structures — including 550 burials, 200 cremations, 30 funerary enclosures and 200 structures of an unknown nature.

After the initial burials, the cemetery, which was delimited by ditches and the road, became more densely populated toward the end of the first century B.C. and the start of the first century A.D., officials said.

The majority of these early burials belonged to toddlers. Archaeologists said they discovered 160 child graves. Most children were buried in a container made of wood or stone. Four children were cremated.

An area of pyre pits that was used through the second century was also found at the site, archaeologists said. Later, graves appeared closer to the edges of the site, marked by ditches, and were organized in rows.

Experts said they found evidence of both burials and cremations. Early on, burials were most common, but cremations became more popular between 60 A.D. and 100 A.D. before declining and mostly disappearing by the start of the fourth century A.D.

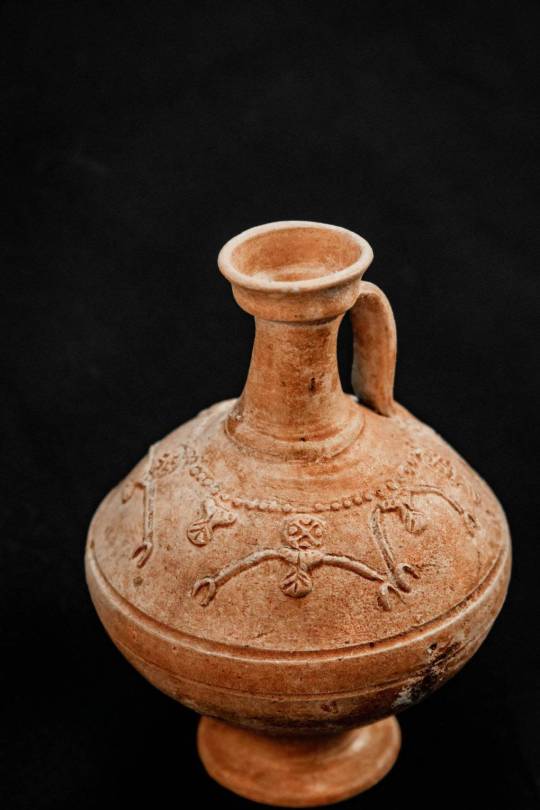

Cremated remains were usually found in single containers — such as a vase or box — but there were some double and triple containers, according to officials.

A variety of burial types were discovered at the site. Archaeologists unearthed some burials from the ground, but they also found covered pits and coffins.

Some burials were full of treasures, including an abundance of furniture and small vases, experts said.

Archaeologists found more furniture and grave deposits in child graves in early period burials at the cemetery.

However, the connection between age and burial treatment seemed to weaken over time. Ceramic objects and small pieces of furniture were found in later burials of all aged people.

A ditch at the site was also excavated, and researchers found a trove of cooking pots and jugs that might have been used to bring food and drinks for funeral meals or commemorations at the cemetery, officials said.

Saint-Vulbas is about 300 miles southeast of Paris.

By Moira Ritter.

#Sprawling 2000-Year Old Cemetery Discovered in France#village of Saint-Vulbas#ancient graves#ancient tombs#ancient artifacts#archeology#archeolgst#history#history news#ancient history#ancient culture#ancient civilizations

37 notes

·

View notes

Text

The article lists those who have written the bible!. Look at the age they lived and what they actually did? It makes them sound like the bottom of the barrel so called "expert's" Trump and the GOP trot out! LMAO! Hilarious!

Genesis, Exodus, Leviticus, Numbers, Deuteronomy - 1400 B.C. by Moses, an Egyptian prince

Joshua - 1350 B.C. by Joshua, leader of the Hebrews

Judges, Ruth, 1 Samuel, 2 Samuel - 1050 - 900 B.C. by Samuel, Hebrew leader and prophet, with Nathan and Gad, also prophets

1 Kings, 2 Kings, Jeremiah, Lamentations - 600 B.C. by Jeremiah, prophet

1 Chronicles, 2 Chronicles, Ezra, Nehemiah - 450 B.C. by Ezra, priest and scribe

Esther - 400 B.C. by Mordecai, king's advisor

Job- 1400 B.C.by possibly Job or Elihu, philosophers, or Moses, or Solomon

Psalms - 1000 - 400 B.C. by several authors, many by King David

Proverbs, Ecclesiastes, Song of Solomon - 900 B.C. by King Solomon

Isaiah - 700 B.C. by Isaiah, a prophet

Ezekiel - 550 B.C. by Ezekiel, a prophet

Daniel - 550 B.C. by Daniel, member of the royal court

Hosea - 750 B.C. by Hosea, a prophet

Joel - 850 B.C. by Joel, a prophet

Amos - 750 B.C. by Amos, a prophet and shepherd

Obadiah - 600 B.C. by Obadiah, a prophet

Jonah - 700 B.C. by Jonah, a prophet

Micah - 700 B.C. by Micah, a prophet

Nahum - 650 B.C. by Nahum, a prophet

Habakkuk - 600 B.C. by Habakkuk, a prophet

Zephaniah - 650 B.C. by Zephaniah, a prophet

Haggai - 520 B.C. by Haggai, a prophet

Zechariah - 500 B.C. by Zechariah, a prophet

Malachi - 430 B.C. by Malachi, a prophet

Matthew - A.D. 55 by Matthew, a tax collector

Mark - A.D. 50 by John Mark, a scribe

Luke, Acts - A.D. 60 by Luke, a physician

John, 1 John, 2 John, 3 John, Revelations - A.D. 90 by John, a fisherman

Romans, 1 Corinthians, 2 Corinthians, Galatians, Ephesians, Philippians, Colossians, 1 Thessalonians, 2 Thessalonians, 1 Timothy, 2 Timothy, Titus, Philemon, Hebrews - A.D. 30-60 by Paul, a tentmaker and rabbi

James - A.D. 45 by James, a high priest

1 Peter, 2 Peter - A.D. 60 by Peter, a fisherman

Jude - A.D. 60 by Jude, a carpenter and priest

0 notes

Text

A mineral exploration firm called GoldMining Inc. concentrates on buying, exploring, and developing gold properties in the Americas. Additionally, it manages a diverse portfolio of asset gold and gold-copper properties in Brazil, Colombia, Peru, Canada, and the United States.

The main projects of the firm include the La Mina Gold Project, the Titiribi Gold-Copper Project, the Whistler Gold-Copper Project, and the So Jorge Gold Project, all of which are in northeastern Brazil's State of Pará.

Brazil Resources Inc. was the company's previous name; in December 2016, it changed to GoldMining Inc. Vancouver, Canada serves as the corporate headquarters of GoldMining Inc., which was founded in 2009.

Overview Of Historical Gold Prices

Gold has been a significant metal for thousands of years, but it wasn't utilized as money till about 550 B.C. People used to carry gold or silver money at first. If they discovered gold, they could ask the government to manufacture coins that could be traded.

When Emperor Augustus, who ruled the Roman Empire between 31 B.C. to 14 A.D., set a price of gold at 45 pieces to the pound, it had a significant influence across the whole Roman Empire. In 1257, the price of a gold ounce was regulated by Great Britain at 0.89 pounds.

An ounce of gold cost $40 when it was depegged from of the dollar, but often in than 10 years, its price climbed to $2,249 in relation to the dollar by 1980.

What Is The Target Price For The GLDG?

The average GLDG stock forecasts $5.25, with the best and worst GLDG stock forecasts both coming in at $5.25, according to one Wall Street expert that has GLDG stock forecasts for the next year.

By August 12th, 2023, the Wall Street analyst expected stock price GLDG to reach $5.25. From of the present GLDG stock price of $1.06, the consensus GLDG stock forecasts sees a possible increase of 395.28%.

How Do I Get GLDG Stock?

Any online trading account can be used to buy shares of GLDG stock. WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, as well as Charles Schwab are a few well-known online brokerages providing access to the American stock market.

Choose an online brokerage to purchase Goldmining stock. Don't worry; we have examined a large number of online brokerage firms and apps to assist you in making this decision. establishing a brokerage account Join the top-rated brokerage we have found for 0% charge trading. The best spot to purchase GLDG stock is here.

Adding funds to your investment account Add your details after selecting your payment option. Check out the Goldmining stock. Purchase your GLDG here: Choose whether to purchase GLDG stock using a stop orders to acquire GLDG stock so at specific price or at the market's current price.

What Is The Current Stock Price Of Goldmining Inc.?

There are 156.43 million shares of GLDG stock price today issued as of November 21, 2022. GLDG has a market capitalization of $165.81M. 4.66 million GLDG shares were moved throughout the course of the last day.

GLDG is the current ticker for GoldMining Inc. on the NYSE. At the present time, one stake of GLDG stock price roughly $1.06. The GLDG stock forecasts is now traded on the NYSE under the ticker GLDG.

The stock of GoldMining has a buy consensus rating. Based on 6 purchase ratings, 0 hold scores, and 0 sell ratings, the mean score score is. GoldMining is not a brand-new junior; it has been working for ten years and expanding its portfolio.

GLDG Stock: Should I Trade It Today?

GoldMining Inc. can be a successful investment choice. At 2022-11-22, the GoldMining Inc. quotation is worth 1.060 USD. The GLDG stock forecasts on 2027-11-17 is 1.323 USD based on our GLDG stock forecasts; a long-term growth is anticipated. The anticipated revenue after a 5-year investment is roughly +24.77%. Your $100 investment GLDG stock price today might be worth up than $124.77 in 2027.

GLDG Stock Price Forecast

The median GLDG stock forecasts among the two analysts who are providing 12-month price projections for GoldMining Inc.

is 3.47, with an upper figure of 3.83 as well as a anything between of 3.11. From the most recent price of 1.05., the median GLDG stock forecasts a +230.17% rise.

On the NYSE, GoldMining Inc. is categorized as (NYSE:GLDG). One Wall Street analyst tracking (NYSEMKT: GLDG) has recommended buying the stock, on average.

Who Does GLDG Partner With?

Gold Royalty Corp., an integral part of GoldMining. Additionally, the business has added Gold Royalty Corp. as a completely owned subsidiary. The goal is to immediately provide the funding required to advance the projects the company is working on.

Theoretically, that is a great advantage, but the finance is still a huge challenge and makes me wary. If it were that easy, I would expect that more gold companies would follow suit.

One benefit for GLDG investors is that, in the event that GoldMining divests a few of its properties, shareholders will continue to receive royalties whereas a current buyer developed the project.

Invest In GLDG In 2022?

Excellent junior exploration company: GoldMining The business plan could currently be regarded as low-risk because the organization has been operational for a long time It is simple to get swept up, but it is crucial to realize that exploration involves significant financial risk.

The business will probably depend on finance, which means that shareholders' interests will likely be diluted. As a result, invest cautiously. With support falling between $2 and $1.90 and resistance between $2 and $2.25, GLDG forms a falling wedge pattern.

Selling a third of your futures contract at $2.25 and waiting for a pullback below or above $2.00 are the two steps in the trading technique. The GLDG stock forecasts may finally surpass $2 (breakdown) and test its 200MA at $1.70 if the GLDG stock price of gold turns bearish the next week.

Who Does GLDG Invest In?

By purchasing 1,481,481 NevGold shares at a cost of C$0.675 per share for a total of C$1.0 million in subscription fees, the Company has concluded its initial decision to invest in NevGold.

GoldMining and NevGold had also decided to enter into an investor rights contract on customary terms in link with the closing of a initial option grant as well as the strategic investment.

This clinch for, among many other things, this same grant from certain generally pro privileges by NevGold to GoldMining as well as the right to nominate one top executive of NevGold, provided the Organization keeps an equity stake in NevGold above 4.99%.

GLDG And Bank Of Montreal Partnership

The "Facility" will continue to be held by the Bank of Montreal until October 27, 2023. In order to lower the overhead cost on unused amounts, the Company decided to cut the Facility's overall size from US$20 to ten million dollars. million.

There is currently only US$7 million borrowed on the Facility, that is due to the Company's repayment of US$3 million that was previously announced in order to increase financial flexibility.

The three month USD Adjusted Terms Secured Night Financing Rate (SOFR) and furthermore 5.65% is the interest rate that applies to the Facility. The Facility is subject to usual conditions and margin terms, including additional advances.

Who Owns The GLDG?

Directors at GLDG have still not purchased or sold the shares during the previous 12 months. There are certain large stockholders. We can list them as follows.

Van Eck Associates Corporation, Ruffer, Rathbones Group, Renaissance Technologies, Hollencrest Capital Management, Millennium Management, Susquehanna International Group, Royal Bank of Canada, Jane Street Group, Virtu Financial LLC.

What Is The Anticipated Stock Price For Goldmining In 2023?

The price of GoldMining's stock at the start of the year was $1.20. Since then, the price of GLDG stock has dropped by 20.4% to $0.9549.

2 Over GoldMining's shares, Wall Street research experts have projected prices for the next year. Their range for the price of GLDG stock forecasts is $5.

25 to $5.25. They anticipate that over the course of the next 12 months, the stock price GLDG will average $5.25.

This indicates a potential increase from of the stock's current stock price GLDG of 449.8%.

Gold Price Forecast 2025

When it concerns to investable assets, gold is among the most well-established and developed markets available. It has historically been a valuable commodity, and its main use are in jewelry and electronics, but as a marketplace, it is frequently seen as a wonderful place of refuge for a variety of reasons.

Gold is a fantastic buffer against financial difficulties due to its role as a safe haven commodity, one that frequently moves in anti-correlation towards the traditional markets, but it is also an investment that has demonstrated consistent and solid growth in revenue for a long period.

The price of gold will reach $2,000 by the end of 2023 and $2,500 by the end of 2025, according to the most recent long-term estimate. Within the years 2028, 2029, and 2031, gold will increase to $3,000, $3,500, and $4,000, respectively.

Estimated Gold Price For The Next Ten Years (Until 2030)

Looking yet further ahead inside the GLDG stock forecasts, even the price of GLDG stock forecasts chart for the next ten years appears positive for the resource as the overall GLDG stock forecasts still holds true that its valuation will only increase. Especially given that a financial crisis is on the horizon.

And we can observe what occurred in the ten years that followed 2008 and the looming financial crisis. The 2008 global crisis, in Dohmen Capital Research's opinion, is a suitable recent example. As credit became more restricted, the crisis intensified.

And a stampede to cash in on all assets began, gold fell by 31%. For bulls who were unaware that a financial meltdown leads all assets to fall in value, that was terrible. But at the bottom, it also produced a fantastic purchasing opportunity.

Finance For GLDG

Positive financial indicators: GLDG's debt to equity ratio is around 0.1, which is minimal. Just on GLDG balance sheet, short-term assets outnumber long-term liabilities. Negative Financial Indicators: The GLDG balance sheet shows that there are more brief liabilities than short-term assets.

GLDG has a 6916092 cash burn. It lacks the liquidity and short-term investments necessary to cover this. GLDG holds $2.91M in short-term investments and cash. This is insufficient to fund its $6.92M yearly cash burn.

Price Of Gold Today

The GLDG stock price today below its most recent high, but it is holding above supports and may be preparing to enter another rising phase. The desire for safe haven assets and worries about an oncoming recession have contributed to the recent economic spurt.

But the most recent epidemic in the world has also had an impact and contributed to the dread and uncertainty that now permeates the financial markets. Gold was made to feel despised and required in the last ten years well before fear of something like the recession.

But this is primarily since it played a significant part in 2008 when the GLDG stock forecasts financial crisis hit, however as the economy is recovering. The Performance score for GLDG is 29, which is higher than the Gold industry standard. GLDG is passing only two out of ten checks for due diligence.

What Will Happen To Gold?

Risk and the possibility of loss will always exist in the world if investing. Gold is no exception, but still it also represents one of the safest forms of investment. It is a resource that is always going to be demand, whether for its use in jewelry or electronics. Central banks and investors both want it.

Another resource with an erratic but limited availability is gold. Additionally, because of the constant reduction in supply, both demand and price will continue to increase.

Additionally, the Covid-19 situation will make the variables that influence gold's price projection in the future even more significant. We

do not score this category because Goldmining seems to have no recent history of dividend payments.

0 notes

Text

A mineral exploration firm called GoldMining Inc. concentrates on buying, exploring, and developing gold properties in the Americas. Additionally, it manages a diverse portfolio of asset gold and gold-copper properties in Brazil, Colombia, Peru, Canada, and the United States.

The main projects of the firm include the La Mina Gold Project, the Titiribi Gold-Copper Project, the Whistler Gold-Copper Project, and the So Jorge Gold Project, all of which are in northeastern Brazil's State of Pará.

Brazil Resources Inc. was the company's previous name; in December 2016, it changed to GoldMining Inc. Vancouver, Canada serves as the corporate headquarters of GoldMining Inc., which was founded in 2009.

Overview Of Historical Gold Prices

Gold has been a significant metal for thousands of years, but it wasn't utilized as money till about 550 B.C. People used to carry gold or silver money at first. If they discovered gold, they could ask the government to manufacture coins that could be traded.

When Emperor Augustus, who ruled the Roman Empire between 31 B.C. to 14 A.D., set a price of gold at 45 pieces to the pound, it had a significant influence across the whole Roman Empire. In 1257, the price of a gold ounce was regulated by Great Britain at 0.89 pounds.

An ounce of gold cost $40 when it was depegged from of the dollar, but often in than 10 years, its price climbed to $2,249 in relation to the dollar by 1980.

What Is The Target Price For The GLDG?

The average GLDG stock forecasts $5.25, with the best and worst GLDG stock forecasts both coming in at $5.25, according to one Wall Street expert that has GLDG stock forecasts for the next year.

By August 12th, 2023, the Wall Street analyst expected stock price GLDG to reach $5.25. From of the present GLDG stock price of $1.06, the consensus GLDG stock forecasts sees a possible increase of 395.28%.

How Do I Get GLDG Stock?

Any online trading account can be used to buy shares of GLDG stock. WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, as well as Charles Schwab are a few well-known online brokerages providing access to the American stock market.

Choose an online brokerage to purchase Goldmining stock. Don't worry; we have examined a large number of online brokerage firms and apps to assist you in making this decision. establishing a brokerage account Join the top-rated brokerage we have found for 0% charge trading. The best spot to purchase GLDG stock is here.

Adding funds to your investment account Add your details after selecting your payment option. Check out the Goldmining stock. Purchase your GLDG here: Choose whether to purchase GLDG stock using a stop orders to acquire GLDG stock so at specific price or at the market's current price.

What Is The Current Stock Price Of Goldmining Inc.?

There are 156.43 million shares of GLDG stock price today issued as of November 21, 2022. GLDG has a market capitalization of $165.81M. 4.66 million GLDG shares were moved throughout the course of the last day.

GLDG is the current ticker for GoldMining Inc. on the NYSE. At the present time, one stake of GLDG stock price roughly $1.06. The GLDG stock forecasts is now traded on the NYSE under the ticker GLDG.

The stock of GoldMining has a buy consensus rating. Based on 6 purchase ratings, 0 hold scores, and 0 sell ratings, the mean score score is. GoldMining is not a brand-new junior; it has been working for ten years and expanding its portfolio.

GLDG Stock: Should I Trade It Today?

GoldMining Inc. can be a successful investment choice. At 2022-11-22, the GoldMining Inc. quotation is worth 1.060 USD. The GLDG stock forecasts on 2027-11-17 is 1.323 USD based on our GLDG stock forecasts; a long-term growth is anticipated. The anticipated revenue after a 5-year investment is roughly +24.77%. Your $100 investment GLDG stock price today might be worth up than $124.77 in 2027.

GLDG Stock Price Forecast

The median GLDG stock forecasts among the two analysts who are providing 12-month price projections for GoldMining Inc.

is 3.47, with an upper figure of 3.83 as well as a anything between of 3.11. From the most recent price of 1.05., the median GLDG stock forecasts a +230.17% rise.

On the NYSE, GoldMining Inc. is categorized as (NYSE:GLDG). One Wall Street analyst tracking (NYSEMKT: GLDG) has recommended buying the stock, on average.

Who Does GLDG Partner With?

Gold Royalty Corp., an integral part of GoldMining. Additionally, the business has added Gold Royalty Corp. as a completely owned subsidiary. The goal is to immediately provide the funding required to advance the projects the company is working on.

Theoretically, that is a great advantage, but the finance is still a huge challenge and makes me wary. If it were that easy, I would expect that more gold companies would follow suit.

One benefit for GLDG investors is that, in the event that GoldMining divests a few of its properties, shareholders will continue to receive royalties whereas a current buyer developed the project.

Invest In GLDG In 2022?

Excellent junior exploration company: GoldMining The business plan could currently be regarded as low-risk because the organization has been operational for a long time It is simple to get swept up, but it is crucial to realize that exploration involves significant financial risk.

The business will probably depend on finance, which means that shareholders' interests will likely be diluted. As a result, invest cautiously. With support falling between $2 and $1.90 and resistance between $2 and $2.25, GLDG forms a falling wedge pattern.

Selling a third of your futures contract at $2.25 and waiting for a pullback below or above $2.00 are the two steps in the trading technique. The GLDG stock forecasts may finally surpass $2 (breakdown) and test its 200MA at $1.70 if the GLDG stock price of gold turns bearish the next week.

Who Does GLDG Invest In?

By purchasing 1,481,481 NevGold shares at a cost of C$0.675 per share for a total of C$1.0 million in subscription fees, the Company has concluded its initial decision to invest in NevGold.

GoldMining and NevGold had also decided to enter into an investor rights contract on customary terms in link with the closing of a initial option grant as well as the strategic investment.

This clinch for, among many other things, this same grant from certain generally pro privileges by NevGold to GoldMining as well as the right to nominate one top executive of NevGold, provided the Organization keeps an equity stake in NevGold above 4.99%.

GLDG And Bank Of Montreal Partnership

The "Facility" will continue to be held by the Bank of Montreal until October 27, 2023. In order to lower the overhead cost on unused amounts, the Company decided to cut the Facility's overall size from US$20 to ten million dollars. million.

There is currently only US$7 million borrowed on the Facility, that is due to the Company's repayment of US$3 million that was previously announced in order to increase financial flexibility.

The three month USD Adjusted Terms Secured Night Financing Rate (SOFR) and furthermore 5.65% is the interest rate that applies to the Facility. The Facility is subject to usual conditions and margin terms, including additional advances.

Who Owns The GLDG?

Directors at GLDG have still not purchased or sold the shares during the previous 12 months. There are certain large stockholders. We can list them as follows.

Van Eck Associates Corporation, Ruffer, Rathbones Group, Renaissance Technologies, Hollencrest Capital Management, Millennium Management, Susquehanna International Group, Royal Bank of Canada, Jane Street Group, Virtu Financial LLC.

What Is The Anticipated Stock Price For Goldmining In 2023?

The price of GoldMining's stock at the start of the year was $1.20. Since then, the price of GLDG stock has dropped by 20.4% to $0.9549.

2 Over GoldMining's shares, Wall Street research experts have projected prices for the next year. Their range for the price of GLDG stock forecasts is $5.

25 to $5.25. They anticipate that over the course of the next 12 months, the stock price GLDG will average $5.25.

This indicates a potential increase from of the stock's current stock price GLDG of 449.8%.

Gold Price Forecast 2025

When it concerns to investable assets, gold is among the most well-established and developed markets available. It has historically been a valuable commodity, and its main use are in jewelry and electronics, but as a marketplace, it is frequently seen as a wonderful place of refuge for a variety of reasons.

Gold is a fantastic buffer against financial difficulties due to its role as a safe haven commodity, one that frequently moves in anti-correlation towards the traditional markets, but it is also an investment that has demonstrated consistent and solid growth in revenue for a long period.

The price of gold will reach $2,000 by the end of 2023 and $2,500 by the end of 2025, according to the most recent long-term estimate. Within the years 2028, 2029, and 2031, gold will increase to $3,000, $3,500, and $4,000, respectively.

Estimated Gold Price For The Next Ten Years (Until 2030)

Looking yet further ahead inside the GLDG stock forecasts, even the price of GLDG stock forecasts chart for the next ten years appears positive for the resource as the overall GLDG stock forecasts still holds true that its valuation will only increase. Especially given that a financial crisis is on the horizon.

And we can observe what occurred in the ten years that followed 2008 and the looming financial crisis. The 2008 global crisis, in Dohmen Capital Research's opinion, is a suitable recent example. As credit became more restricted, the crisis intensified.

And a stampede to cash in on all assets began, gold fell by 31%. For bulls who were unaware that a financial meltdown leads all assets to fall in value, that was terrible. But at the bottom, it also produced a fantastic purchasing opportunity.

Finance For GLDG

Positive financial indicators: GLDG's debt to equity ratio is around 0.1, which is minimal. Just on GLDG balance sheet, short-term assets outnumber long-term liabilities. Negative Financial Indicators: The GLDG balance sheet shows that there are more brief liabilities than short-term assets.

GLDG has a 6916092 cash burn. It lacks the liquidity and short-term investments necessary to cover this. GLDG holds $2.91M in short-term investments and cash. This is insufficient to fund its $6.92M yearly cash burn.

Price Of Gold Today

The GLDG stock price today below its most recent high, but it is holding above supports and may be preparing to enter another rising phase. The desire for safe haven assets and worries about an oncoming recession have contributed to the recent economic spurt.

But the most recent epidemic in the world has also had an impact and contributed to the dread and uncertainty that now permeates the financial markets. Gold was made to feel despised and required in the last ten years well before fear of something like the recession.

But this is primarily since it played a significant part in 2008 when the GLDG stock forecasts financial crisis hit, however as the economy is recovering. The Performance score for GLDG is 29, which is higher than the Gold industry standard. GLDG is passing only two out of ten checks for due diligence.

What Will Happen To Gold?

Risk and the possibility of loss will always exist in the world if investing. Gold is no exception, but still it also represents one of the safest forms of investment. It is a resource that is always going to be demand, whether for its use in jewelry or electronics. Central banks and investors both want it.

Another resource with an erratic but limited availability is gold. Additionally, because of the constant reduction in supply, both demand and price will continue to increase.

Additionally, the Covid-19 situation will make the variables that influence gold's price projection in the future even more significant. We

do not score this category because Goldmining seems to have no recent history of dividend payments.

0 notes

Text

The city was occupied for around two millennia, from about 500–300 B.C. to around A.D. 1200–1450. Its location between trading routes enabled it to gain prominence in the early Classic period (A.D. 300–550), according to INAH, which says the city became wealthy during the beginning of the Puuc region’s development in the sixth century.

1 note

·

View note

Photo

Ancient History : Kings of Persia ~ The ancient Persian empire has a rich history. It began c. 550 B.C. and fell to Alexander the Great in 331 B.C. The #Bible mentions this kingdom and the names of some of its kings in many books of the Old Testament (Chronicles, Ezra, Nehemiah, Esther, and Daniel). In fact, the very first king of Persia is clearly spoken of by Isaiah the Jewish prophet. Though the ancient empire was founded on Zoroastrianism, the Arabs brought the religion of Islam to the country in 641 A.D. The country we know today as Iran accepts Persia as its official alternative name.

* * * References for Further Study:

Persia Timeline – Ancient History Encyclopedia ~ www.ancient.eu/timeline/Persia

List of the Kings of the Persian Empire – Old Testament Charts (BibleHistory Online) ~ www.bible-history.com/old-testament/persian-kings.html

The Achaemenid Persian Empire (550–330 B.C.) | Essay | HeilbrunnTimeline of Art History | The Metropolitan Museum of Art ~ www.metmuseum.org/toah/hd/acha/hd_acha.htm

0 notes

Text

Harmony assistant cannot delete ornaments on drums

The Armenian kingdom, whose power and size had been enlarged considerably in particular by king Tigranes I called the Great (ca. The independence of Armenia from the Seleucids was not gained until 189 B.C.-by Artaxias and Zariadres. (see above)), then Alexander and the Seleucids. we find the first attestation of the name of the country in OPers. Apart from interruptions of varying duration Armenian was to bear the yoke of the respective Iranian leading power for more than a thousand years, for after the Medes followed the Persian Achaemenids (550-330 B.C. and so had become part of the Median Empire, the conditions had been provided for the intensive influence of Iranian culture and customs on the Armenians and their language. Since these Armenian highlands had been subdued by Cyaxares about 600 B.C. In some parts of the area the Armenians constituted the majority of the population, in others only its upper classes, but they were everywhere the unifying element that maintained the culture and language of the whole region. In ancient times the name “Armenia” designated the entire highland, which in spite of all political and historical changes in the course of time such as the temporary separation of certain districts or even the complete disintegration of the country, was defined by the Taurus mountains in the south, the upper Euphrates River in the west, the Caucasus mountains in the north, and Media Atropatene, the modern Azerbaijan in the east. letters are here transliterated according to the system proposed by Schmitt, 1972: a b g d e z ê ə ṭʿ ž i l x c k h j ł č m y n š o čʿ p ǰ ṟ s v t r cʿ w pʿ kʿ ô f, and the digraph ow for. Only this aspect of the history of the Arm. Mesrop Maštocʿ) and which is characterized from the very beginning of the literary documentation by a large number of Iranian loanwords. (after the invention of the Armenian alphabet by St. ARMENIAN, the language of the Armenians, which is attested in written sources since the 5th century A.D.

0 notes

Text

Xia Dynasty (unconfirmed)(ca. 2100–1600 B.C.)

Shang Dynasty (ca. 1600–ca. 1050 B.C.)

Zhou Dynasty (ca. 1050–256 B.C.)

-Western Zhou (ca. 1050–771 B.C.)

-Eastern Zhou (ca. 771–256 B.C.)

-Spring and Autumn Period(770–ca. 475 B.C.)

-Warring States Period(ca. 475–221 B.C.)

Qin Dynasty(221–206 B.C.)

(Western) Han Dynasty (206 B.C.–220 A.D.)

Six Dynasties (220–589) A.D.

-Eastern Wu dynasty (222–280)

-Eastern Jin dynasty (317–420)

-Liu Song dynasty (420–479)

-Southern Qi dynasty (479–502)

-Liang dynasty (502–557)

-Chen dynasty (557–589)

Three Kingdoms (220–265) A.D.

Wei

Wendi 220–226 A.D.

Mingdi 227–239 A.D.

Shaodi 240–253 A.D.

Gao Gui Xiang Gong 254–260 A.D.

Yuandi 260–264 A.D.

Wu

Wudi 222–252 A.D.

Feidi 252–258 A.D.

Jingdi 258–264 A.D.

Modi264–280 A.D.

Shu Han

Xuande 221–223 A.D.

Hou Zhu 223–263 A.D.

Western Jin Dynasty (265–317) A.D.

Sixteen Kingdoms (304 - 439) A.D

-Han Zhao (304-329) A.D.

-Cheng Han (304-347) A.D.

-Later Zhao (319-351) A.D.

-Former Liang (320 - 376) A.D.

-Former Yan ( 337–370) A.D.

-Former Qin ( 351–394) A.D.

-Later Yan ( 384–409 ) A.D.

-Later Qin ( 384–417 ) A.D.

-Western Qin (385–400, AD 409–431) A.D.

-Later Liang (386-403) A.D.

-Southern Liang (397–404, AD 408–414) A.D.

-Northern Liang ( 397–439 ) A.D.

-Southern Yan ( 398–410 ) A.D.

-Western Liang ( 400–421) A.D.

-Hu Xia (407–431) A.D.

-Northern Yan ( 407–436) A.D.

Eastern Jin (317-420) A.D.

Period of Northern and Southern Dynasties 386–589 A.D.

-Northern Wei ( 386–535) A.D.

-Eastern Wei ( 534–550) A.D

-Western Wei

Sui Dynasty (581–618)

Tang Dynasty (618–906)

Five Dynasties (907–960)

-Later Liang

Taizu 907–910

Modi 911–923

-Later Tang

Zhuangzong 923–926

Mingzong 926–934

Feidi 934–935

-Later Jin

Gaozu 936–944

Chudi 944–947

-Later Han

Gaozu 947–948

Yindi 948–951

-Later Zhou

Taizu 951–954

Shizong 954–960

Liao Dynasty (907–1125)

Song Dynasty (960–1279)

-Northern Song (960–1127)

Taizu 960–976

Taizong 976–997

Zhenzong 998–1022

Renzong1023–1063

Yingzong 1064–1067

ShenzongZhezong 1086–1100

Huizong 1101–1125

Qinzong 1126–1127

-Southern Song (1127–1279)

Gaozong 1127–1162

Xiaozong 1163–1189

Guangzong 1190–1194

Ningzong 1195–1224

Lizong 1225–1264

Duzong1265–1274

Gongti 1275–1276

Duanzong 1276–1278

(Di Bing)1278–1279

Yuan Dynasty (1279–1368)

Ming Dynasty (1368–1644)

Qing Dynasty (r. 1644–1911)

0 notes

Text

In the footsteps of the Incan ancestors

Peruvian children in traditional clothing

Peru means “land of abundance”(in Aymara language) and that is a perfectly chosen word to describe this rich, diverse and colourful country. It is the third largest country in South America after Brazil and Argentina.

Peru has big amounts of mineral, agricultural and marine resources that have long served as its economic foundation.

The cold Peruvian current where upwelling brings abundant nutrients to the water surface there the beneficial effects of the sunlight results in plankton growth, which make these waters one of the world's greatest fishing grounds.

In spite of Peru's tropical location in the Southern Hemisphere it has enormous differences in climate, economical activities and ways of life.Peru is normally divided into three main geographic zones. The Andean highlands, the arid coastline and the largely unpopulated Peruvian Amazon, the rainforest.

This large geographical diversity gives Peru one of the greatest biodiversities in the world. In the upcoming section we will follow the footsteps of the Peruvian forefathers to discover more about this great and colourful country.

First footstep:👣

Our first footstep is the pre Incan culture.

The civilization “Caral” marks the beginning of the Peruvian, as well as the rest of the American continent’s history.

It is estimated to be as old as 5000 years, making it contemporary with the civilizations of Mesopotamia, Egypt, China and India.

Nevertheless, without leaving much trace of evidence of its existence the caral civilization suddenly disappeared and was replaced by the “Chavin” civilization.

In that way the history kept repeating itself and civilization followed civilization, some disappeared by themselves others were conquered by stronger ones.

Nasca Lines, Peru

Second Footstep:👣👣

Our second footstep is the Nazca. The Nazcas predated the Incas by as much as 2000 years, in other words 800 B.C and are most famous for having drawn the Nazca lines.

These are huge drawings representing a hummingbird, spider, fish, condor, heron, monkey, lizard, cat, dog and a human or some of the lines are just lines. By making shallow incisions in the desert floor, removing stones and leaving differently coloured dirt exposed, the lines they drew have been preserved during thousands of years due to the extreme environmental circumstances that have helped to preserve them.

The purpose of the lines is unclear but experts presume their purposes are religious.

Lake Titicaca, Peru

Third Footstep:👣👣👣

The third footstep is Lake Titicaca. This important lake has a maximum depth of 280 meters and is shared by Peru and Bolivia and is situated high up in the Andes at 3.812 metres. It is the world's highest navigable lake and it is said to be the birthplace of the Incas. The waters of lake Titicaca are famously still and brightly reflexive.

This fresh water lake, that also is one of South America’s largest lakes, is shaped as a puma, herefrom its name Titicaca meaning puma in Aymara language. Today we can see floating villages made of reeds on the lake, where the Uros people live. They rely on fishing and tourism for survival.

We also find protected aquatic wildlife by the lake, special and unique are the giant frogs.

Statue of Pachacutec, Aguas Calientes, Peru

Fourth Footstep:👣👣👣👣

The forth footstep are the Incas.

The Incan Empire was the last chapter of thousands of years of Andean civilization directly preceded by two other large scale Empires, the Tiwanaku 300-1100 A.C in the lake Titicaca region and the Wari or Huari 600-1100 A.C near the city of Ayacucho.

As said earlier the Incan civilization was born by the shores of lake Titicaca and grew to become an Empire, at the time known as “realm of the four parts”. It was the largest Empire in pre-Columbian America.

No monetary currency was used in the Incan Empire but exchange of goods and taxes consisted of a labour obligation of a person to the Empire. Another interesting fact is that they used knotted strings or so called “ quipus” for record keeping and written communication.

The Incas rose to power in the early 13th century and their last stronghold was conquered in 1572 by Spanish conquerors.

Ruins of the Empire can be found across Peru today, some of which are hidden by the rainforest's intense vegetation.

Machu Picchu, Peru

Fifth Footstep:👣👣👣👣👣

One of these ruins and our fifth footstep is Machu Picchu.

Machu Picchu the city in the clouds.

Machu Picchu is one of the only Inca towns to have survived the Spanish conquest.

Believed to have been built in the 1400’s Machu Picchu got the nickname “the lost city of the Incas” because it is said that the Spanish never set foot there.

Because of its position up of two fault lines it experiences frequent earthquakes but thanks to the combination of its intelligent design and sturdy building materials it has survived through time.

There are 150 buildings in this old site and they vary from temples to bathhouses.

Without doubt one of the most impressive architectural features of Machu Picchu is the renowned staircase with 100 steps that have been carved out of one single piece of stone.

On top of that and as far as we know the Incas didn’t have any wheels thus it had to have been hauled to the summit by hand or carved out of the mountain itself.

Machu Picchu translated from Quechua means “old mountain “or “old peak” and it was cleverly built to withstand earthquakes and to avoid landslides. Water collecting systems were built under the buildings inside the mountains.

These systems collected water in drainage basins and the water was later redistributed throughout Machu Picchu and surroundings.

Roads leading to and from Machu Picchu were connected to the Empire’s transport system including paths, bridges and mountain tracks that stretched all over Peru.

Rainbow Mountains

Sixths Footstep:👣👣👣👣👣👣

Even though our sixth footstep doesn’t involve the country’s history it is a remarkably beautiful footstep.

The rainbow mountains.

The colour of these mountains resembles that of a rainbow, here from the name, they are also called “Montaña de siete colores” (the seven coloured mountain). It is situated in the Andean mountain chain at 5.200 meters above sea level.

These beautifully multicoloured mountains with tones of turquoise, lavender,gold, terracotta and red, contain 14 different colours in total. The mountains have got their colours from weathering and mineralogy. The dissimilar colouration developed due to different environmental conditions and mineralogy when the sediment was originally deposited and later día genetically altered. The temperature here is 0 degrees celcius at night. It is one of the world’s most amazing natural wonders!

Chan Chan, Peru

Seventh Footstep:👣👣👣👣👣👣👣

The seventh and last footstep is a combination of some small, scattered and interesting locations.

Framed by three volcanoes and built primarily from white volcanic stones, Arequipa is one of Peru’s most charming colonial cities.

It is here that we find “Santuarios Andinos “ , a small museum with a grisly secret, the mummified remains of the young victims offered as human sacrifices in the peak overlooking the city.

The 550 years old “ice maiden “ Juanita is the best preserved of the mummies.

Even though the south of Peru is a land of Misty volcanoes here we also find one of the world's deepest canyons “Colca” with a depth of 3.250 meters, where mighty condors live. The tribe”los collaguas” who also lived here in the high part of the canyon, used to bury their dead by digging a hole along the steep rocky canyon and marking it with red paint. Faint red stains can still be found today when driving along the canyon on the roads on the tops of the mountains.

In the northern parts of Peru where the Moche civilization had its stronghold around 300 A.D, we find the Lord of Sipán (señor de Sipán). His remains were found not too long ago as the first of a group of mummies found at Huaca Rajada, Sipán.

Lord of Sipán was 35-45 years old when he died but it is his treasures that amazed the world as most of his ornaments were either gold, silver, bronze or semi precious stones.

The Incan bath houses are situated in Cajamarca, it is centred on a spa which uses thermal spring water with medical and therapeutic benefits.

It is said to have been the favourite place of the Incan Lord Atawallpa.

Another remarkable location is the Chanchan cultures sand houses in the capital of the Chimu kingdom, they are from the 15th century and still standing today.

Gold Treasures

Conclusion:

Having followed the footsteps, we have reached the end of our mountain trail. This marks the finish line of our journey in Peru leaving us with the conclusion.

Peru, as the rest of Latin America, are rich and abundant countries. They are also known for centuries to have been rich in precious metals such as gold and silver.

It is not difficult to imagine where the rumours of “ El dorado” come from.

Whether it is imaginary, based on legends or somewhat truth based.

One can ask himself if there was nothing else behind Columbus' voyage to the “ new world”.

Al khashkhash ibn Said ibn Aswad , an Andalusian citizen from Còrdoba, traveled with a group of friends by ship and crossed the “sea of darkness”(that’s what the Arabs used to call the Atlantic Ocean). On his return in 889 A.C he shared his stories about what he saw and the people he met.

Imam al Shabi, wrote in one of his books 600 A.C about a land behind al Andalus, as far away from there as “we” are from al Andalus.

In any case, they were not the only ones to have discovered the”big land”.

According to the Arabs the Africans, to be more precise the Malians, also traveled to Latin America, they as well as the Arabs went to the Americas in pre-Columbian times.

Mali was one of the richest and most developed countries in Africa in the 14th century.

Could Columbus have been so confused or misinformed or was it a “cover up expedition” as an excuse to conquer and plunder “the big land”???

Information obtained from;

Etapas históricas del Perú www gob.pe gobierno del Perú,

National Geographic’s Megastructures,

Historical Arabic sources, and

A special thanks to a dear friend for providing insight and support.

#travel#history#peru#south america#inca#colombus#writblr#writers#writers on tumblr#machu picchu#rainbow mountain#rainbow#titicaca#lake titicaca#nazca#nazca lines

29 notes

·

View notes

Text

Namaste 🙏.

• Pre-history

1 China

a) One of the earliest agrarian societies, has had a long history of problems with nomadic tribes of the Eurasian steppes. The Chinese were experienced in battle with the nomads and eventually drove them westward.

2 Invasion

b) Unlike the western agrarians, the Chinese likely knew Nomadic culture, their migration routes, and how to engage and defeat them in battle

1. Eventually the Chinese defeated the nomads, and forced them out of the region

2. The nomads relied on their mobility for protection. they were only part time specialists in fighting, and were no match for the recourses of agrarian China.

c) As these nomadic tribes, moved westward, they found agrarian societies who were no match for them.

* We see these classic (moving target v.s. still target) episodes which would dominate the conflicts of this era. Nomads could invade, loot, and destroy villages and then retreat back into the grasslands. For the agrarian societies to rebel, they had to go out and find these nomads who could be anywhere, making offensive military campaigns almost impossible. 2. only in later centuries do the western agrarians come to understand nomadic military tactics, and later defeat those not already in the process of becoming agruarianized.

3 Empire of the white Huns (350-550)

a) In the year 350 the Huns (the first of the many nomadic tribes from the grasslands [steppes] of northwest China) arrive in the region of Transoxania.

1. Transoxania is a region located south of the Aral sea. It is named after the river that runs through it, the Oxus river (now called Amu Darya) Oxus is only a Historic name.

1.1 A Greek colony existed here in the times B.C. however was thought to be destroyed by Indians and had no influence on Hun culture

1.2 This is a research frontier, in the history of Transoxania.

b) As the Huns move toward the Caspian sea and farther South, they drive the Persians south, or may have absorbed them (into Hun culture).

The Persians and Huns get involved in many conflicts over the years, before forming any alliances.

1. In 392 A.D. the Huns aid the Persians in an attack on Roman Mesopotamia.

c) Over time many other tribes appear in what is now south Russia. They are believed to be offspring of the Huns and or other nomadic tribes from the east. These tribes include the Bulgars, Avars, Uguars, and Khazars*. see arrows on map ‘pre-history’

d) The greatest leader of the Hun Empire was Attila, His death in 550 A.D. causes the empire to fall.

4 Western Turkish [Tirkut] {AKA Turkut*} Kingdom (550-650)

a) Attila’s death creates a power vacuum for eastern Europe. These various pastoral nomads are longer are forced to pay tribute to the Huns. This allows for less energy devoted to doing so. For pastoral societies to pay tribute, Trade for currency as well as giving up actual livestock must take place. If tribute isn't given the threat of a Hun army invasion, accompanied with fellow tribes under the same Hun tutelage is eminent.

1. The Avars and Uigurs move westward, the Avars then occupy the northern shores of the Danube River.

2. The Khazars are contempt with their occupied region, located between the Black Sea and the Caspian Sea.

2.1 With good reason; The Khazars frequently raid the region south of them, Georgia. They would raid cities and collect rich plunder, for the area wasn’t occupied by either Rome or Persia.

2.2 The Khazars do not move westward.

b) The various pastoral (Turkish) tribes soon realize the need to form an alliance, to defend themselves against the threats offered by Byzantium and other ‘civilized’ societies.

They form what became known as the Western Turkish Empire, aka Turkut Kingdom. The leader of this kingdom was called a *Kagan, the Khazars were to adopt this name and use it in reference to their rulers.

1. This (Turkish empire) was really nothing more than a mere continuation of the Hun empire. The map shows both empires side by side, however; please note that one preceded the other.

c) During this time (in 627 A.D.) the Roman [or east Roman AKA Byzantium] Empire began to campaign against Persia. Under the Emperor Heraclius. They invaded the Persian provinces of eastern Mesopotamia. The Khazars (still part of the Turkish Empire - not yet fully independent) sent 40,000 horsemen to the aid of the East Roman (Byzantium); see on map ‘pre-history’

1. The Kagan (Khazar Ruler) became impatient with the cautious(slow) pace of the Romans, and left to invade Tbilisi. The raid on Tables (now the capital of Georgia[the former soviet republic; not the southern U.S. state] was unsuccessful, and the Khazars returned home.

1.1 The Georgians had suffered Khazar invasions for several years, and got wise to the situation, they fortified their capital city> Tbilisi.

d) Rise of Islam (632-633) under the Arab conquests.

1. A year after Prophet Muhammad’s death [pabbuh] 632 A.D. ; ten years after the Hegira (the migration of the Muslim community from Mecca to Madinah ([then called Yathrib] 622 A.D.) and starting point of the Islamic [lunar] calendar; the Muslims conquered the Arabian peninsula, and parts of north Africa and Asia Minor, as well as Persia (now called Iran).

1.1. The region was now transformed by three new superpowers; The Byzantine Empire, The Umayyad Caliphate, and the emerging Khazarian Empire.

1.2. In 680 A.D. the Grandson of Prophet (Hussayen) is slaughtered at Karbala. The Party of Prophets son in law {Ali ibn Abi Talib} is born. The party (Shiat-Ali) or Shi’ias begin their struggle for independence from the Umayyad Caliphate. They play a key role in the political situation involving the Arab-Khazar wars. The Arabs may have ‘turned back’ in 737 [the Arabs defeated the Khazars and reached Darband, (Derbant) but decided not to take over, but rather to leave the area north of the Caucasus] because of internal problems with the Caliphate. These ‘problems’ likely involved Shi’ia uprisings in their city Kufa, now located in Iraq, also called An-Najaf

• Rise of Khazaria

1 - Hellenization / The Greek influence

a) It is often presumed the Khazars learned Agriculture from the Greeks living in the area around the Euxine (Black Sea). The Greeks developed several colonies in the area during the 700’s. Most of these colonies were located on the Crimean Peninsula.

1. These include; Theodosia, Kimmerikon, Nymphaion, Hermonassa, Phanagoria, Mirmekion, Tyritake, and Pantikapaion.

1.1 These colonies served as cornerstones for cities like Dores, Kirch, and Tamatarkha.

b) As agriculture developed the Khazars were able to develop settlements, Build Castles and establish a permanent foothold in the region.

2 - Caste

a) Over time the Khazars developed a stratified social system. Two economic classes emerge within the culture.

1. The higher class; the Ak-Khazars and the lower class; the Kara Khazars There are many different theories pertaining to this aspect of The Khazar Heritage. Some suggest this Caste was nothing more than a class system; not strictly divided by birth status.

2. The Ak-Khazars or ‘White Khazars’ were said to be fair skinned and beautiful like women, with long braided hair. The Kara-Khazars (according to Arab writers) were described as ugly and as dark as Indians

3 - Arab-Khazar wars

a) The Soviet historians have given the Khazars their place in history as a people who fought Arab invasion and the Proselytization of Islam. For many years their conversion to Judaism was ignored by Russian historians.

b) The wars began in 651 and ended in 737 with Arab victory.

c) The Abbasid Caliphate began to suffer from internal conflicts, and in 737 A.D., their armies were called back, and a campaign against eastern Europe never got under way

d) In 730 the Khazars began their destructive campaign on the Chalphate. The Khazars attacked the city of Ardabil, and got as far as Mosul. (see map ‘Rise of Khazaria’)

e) The Khazar army was finally pushed back by a fresh Army while on their way to Dimasq (Damascus).

f) In 732 The future Emperor Constantine V married a Khazar princess. Their son Leo IV, known as Leo the Khazar ruled the throne.

4 - Expansion

a) With the Arab wars of the early 700s behind them, the Khazars could now direct their attention to the north. They began several conquests in the Dnieper River valley. The Khazars extracted tribute from several nations stretching (at one time or another) to the Aral sea, the Urals and as far west as the Danube. Eventually they sacked Kiev in 840, extracting rich tribute from its Slavic population

5 - Conversion to Judaism

b) Bulan The first Khazar Kagan [King] and his conversion story. The story first appears in the Kazari published in 1700s*?

c) many different story lines exist to tell the story.

1. Yehudah ha-Levi (c. 1080-1141).

1.1 an angel appears to Bulan and tells him "Your way of thinking is pleasing to God, but not your way of acting."

1.2 Bulan consults a philosopher, and informs him of his idea; that either the Christian or Muslim religion is the right way of ‘acting’

1.3 Bulan consults a christen sage and says "I do not see any logical conclusion here; indeed, logic rejects most of what you have said.... I cannot accept these things... My duty is to investigate further."

1.4 He then invited an Islamic mullah [to his court], questioning him regarding his doctrine and observance. After talking to the Mullah he said "Indeed, I see myself compelled to ask the Jews, because they are the relic of the Children of Israel. For I see that they constitute in themselves the evidence for the divine law on earth."

1.5 (after inviting the rabbi) The rabbi replied: "I believe in the God of Abraham, Isaac, and Israel, who led the children of Israel out of Egypt with signs and miracles;

1.6 After this [conversation] the Khazar king traveled to the caucuses (mountains) and came upon a cave where Jews had observed the Sabbath. The King was circumcised. The King only revealed this to his special friends and when his community of Jews had increased (several more upper-class Khazars then converted) he made the affair public

d) Another story involves the Khazar king inviting three sages to his court. A Christian, Muslim and Jewish sage were summoned. The Jew was said to already be at his disposal [Koestler] and only the other 2 were summoned. The three of them argued and the story goes.......**

e) The other theory is based on a Jewish manuscript that said the Khazars converted when an Army general became king.

• Fall of Khazaria

I do not have a good set of notes ready at this time that I can show - dealing with the fall of the empire. To truly understand the downfall, and how and why the events took place, one would have to understand the complicated political intricacies that played a part, even before the Vikings showed up on the scene.

The map labeled 'the fall of Khazaria' (click image right) should be self explanatory. I used The Thirteenth Tribe by Arthur Koestler, and The Khazaria Info Center hosted by Kevin Brook to make that map. It will show step by step the campaign made by the Vikings as they conquered the scene.

The following are a series of historic maps depicting various periods of time in Khazarian history.

Note: The borders shown on these maps are approximate borders; the actual line of control often fluctuated from year to year. Areas marked as 'tributaries' are the outmost regions the Khazars extracted tribute from, but did not necessarily 'govern' or claim rights to for any serious length of time. The outmost regions the Khazars retrieved plunder are far beyond the tributaries.

The "Muslim Victory" shown on the map deals with the Khazar Muslims and their war with the Vikings (a revenge campaign against the Vikings for invading the Caspian Sea and pillaging Muslim communities within land accessible by the Caspian Sea). I wanted to make clear this battle [which took place in the Volga Delta] was not fought by the Abbasid Caliphate.

3 notes

·

View notes

Photo

A Treasure Trove of Artifacts Below a Mexican Pyramid Sheds New Light on Ancient Rites

Teotihuacan, Mexico, - More than a decade after Sergio Gomez began excavating a tunnel under a towering Mexican pyramid, the archeologist still spends most of his time studying the massive cache of sacred artifacts carefully placed there by priests some 2,000 years ago.

The volume and variety of objects hidden in the sealed tunnel under Teotihuacan's ornate Feathered Serpent Pyramid has shattered records for discoveries at the ancient city, once the most populous metropolis of the Americas and now a top tourist draw just outside modern-day Mexico City.

Over 100,000 artifacts from the tunnel have been cataloged so far, ranging from finely-carved statues, jewelry, shells, and ceramics as well as thousands of wooden and metallic objects that mostly survived the passage of time intact.

On a recent tour of the tunnel and conservation workshops where his 30-member team pores over the trove, Gomez showed off some of the dig's most spectacular and until now unreported finds - all part of ceremonial offerings left along the 100-meter-long (330 ft) tunnel, which ended in three chambers directly under the pyramid's mid-point.

"Can you see it?" Gomez asked, shining the light of his cellphone on a tennis-ball-sized carved amber sphere he picked up from a workshop table. Illuminated, it looks like molten lava.

It is the first time an ornament made from amber has turned up in Teotihuacan. Found with a small top and residue inside that awaits further analysis - Gomez speculates it may be tobacco - it likely hung around a priest's neck.

As in other ancient Mexican societies, the priests who entered the tunnel likely ingested hallucinogenic plants or mushrooms as part of rituals, Gomez said.

The tunnel, which is tall enough in most places to walk through and is around 12 meters (40 ft) underground, was designed to dazzle, he explained. The walls and even the floor were coated with fine bits of iron pyrite, popularly known as fool's gold due to its resemblance to the precious metal.

"We can imagine when the priests entered with a torch how it would have sparkled as the flame moved," said Gomez, who believes the tunnel was made to recreate the underworld of their cosmovision and used to initiate new rulers.

Scientific dating shows that the damp, never-looted space was in use for more than two centuries through 250 A.D.

Teotihuacan, a wealthy contemporary of ancient Rome and Han China, thrived from about 100 B.C. to 550 A.D. and was home to up to 200,000 people mostly living in multi-family stone compounds painted with colorful murals.

Much is unknown about them, including what language they spoke and whether they developed a system of writing akin to that of the Aztecs, who dominated the area some eight centuries after Teotihuacan's fall and revered the ruins.

FINAL DISCOVERY

Walking through the now-empty tunnel, Gomez stops where a large offering was found. He describes 17 separate layers of shells meticulously laid down by priests, one on top of the other, with the bottom layers crushed.

"But that's because they themselves were stepping on them," he said.

Gomez stresses that his dozen-year excavation of the tunnel, which had filled with mud over the centuries, was equally meticulous, so much so that bits of human hair and even skin were likely recovered.

It appears that ceremonies in the tunnel involved the offering of gifts to the lords of the underworld, and to the city's main deity, the storm god. Several dozen nearly-identical shiny black jars sculpted to resemble the latter have been discovered.

Among the richest offerings are hundreds of objects made of so-called imperial jade, one of the world's most expensive gems, including ear spools, necklaces and pendants - one in the form of a crocodile.

Several thousand once-glittering iron pyrite pieces were unearthed. Possibly imported from as far away as Honduras, they include beads, disks and even the bottom half of a cup.

Around 8,000 wooden objects - plates, bowls and more - were unearthed, as well as the skulls and claws of some three dozen animal species, especially predators like jaguars and pumas.

Beyond traditional restoration work, Gomez's team is also developing three-dimensional digital recreations of the artifacts as they originally would have appeared, so they can eventually be accessed online.

The final physical discovery made in late July proved especially satisfying for Gomez.

In a circular pit carved into the tunnel floor previously missed by laser scans, priests had tossed four bunches of flowers. On top, they placed a heap of wood, handfuls of corn, chile, and nopal seeds, plus a miniature stone carved pyramid.

Finally, they set it all on fire.

Thanks to the charred wood, Gomez will soon be able to pinpoint the year the smoky ritual took place.

The flowers were unprecedented, the first time intact plant remains have been found at Teotihuacan.

"It's just so unique," he said, hunching down just off the pit, wiping his brow.

"It makes you feel so close to the people who were here."

Reporting by David Alire Garcia; Editing by Dave Graham and Rosalba O'Brien.

#A Treasure Trove of Artifacts Below a Mexican Pyramid Sheds New Light on Ancient Rites#archeology#Feathered Serpent Pyramid#Teotihuacan#Mexico City#Temple of Quetzalcoatl#aztec#aztec gods#Maya#history#history news#ancient civilizations#treasure

64 notes

·

View notes

Text

In Maya, ca means “two”, lak means “adjacent”, and mul signifies any artificial mound or pyramid, so Calakmul is the “City of the Two Adjacent Pyramids”. In ancient times, the city core was known as Ox Te’ Tuun, meaning “Three Stones”. The city existed for twelve centuries from (550 B.C. – 900 A.D.).

Calakmul’s southern location in the state of Quintana Roo places it in the center of the Peten Mayan Region. The inhabitants were influenced from both the north and south and belonged to a coalition that included the Maya settlements of El Mirador, Nakbé, and Uaxactún in the Maya lowlands. Calakmul was the largest and most powerful settlement in the coalition. This alliance was in constant conflict with its southern neighbors, especially Tikal located across the contemporary border of Guatemala.

During its heyday in the Classic Period 500 A.D. to 800 A.D., Calkmul was a powerhouse, with over 50,000 inhabitants, 6700 structures and various sacbes for commerce. The entire site is over 70 square kilometers (27 sq mi), though only a portion is open to the public. It is thought that the governing body of Calamkul had direct influence over settlements located up to 150 kms away, growing its direct impact from 50,000 inhabitants to over 200,000. If additional outer lying areas are included, Calakmul influenced over 1.5 million people. How the settlement was structured and built feels similar to Coba in the Yucatan, with a main plaza that led to various secondary urban centers. Its influence stood over 12 centuries and is thought to have more structures than any other excavated Maya settlements in the region.

2 notes

·

View notes

Text

A mineral exploration firm called GoldMining Inc. concentrates on buying, exploring, and developing gold properties in the Americas. Additionally, it manages a diverse portfolio of asset gold and gold-copper properties in Brazil, Colombia, Peru, Canada, and the United States.

The main projects of the firm include the La Mina Gold Project, the Titiribi Gold-Copper Project, the Whistler Gold-Copper Project, and the So Jorge Gold Project, all of which are in northeastern Brazil's State of Pará.

Brazil Resources Inc. was the company's previous name; in December 2016, it changed to GoldMining Inc. Vancouver, Canada serves as the corporate headquarters of GoldMining Inc., which was founded in 2009.

Overview Of Historical Gold Prices

Gold has been a significant metal for thousands of years, but it wasn't utilized as money till about 550 B.C. People used to carry gold or silver money at first. If they discovered gold, they could ask the government to manufacture coins that could be traded.

When Emperor Augustus, who ruled the Roman Empire between 31 B.C. to 14 A.D., set a price of gold at 45 pieces to the pound, it had a significant influence across the whole Roman Empire. In 1257, the price of a gold ounce was regulated by Great Britain at 0.89 pounds.

An ounce of gold cost $40 when it was depegged from of the dollar, but often in than 10 years, its price climbed to $2,249 in relation to the dollar by 1980.

What Is The Target Price For The GLDG?

The average GLDG stock forecasts $5.25, with the best and worst GLDG stock forecasts both coming in at $5.25, according to one Wall Street expert that has GLDG stock forecasts for the next year.

By August 12th, 2023, the Wall Street analyst expected stock price GLDG to reach $5.25. From of the present GLDG stock price of $1.06, the consensus GLDG stock forecasts sees a possible increase of 395.28%.

How Do I Get GLDG Stock?

Any online trading account can be used to buy shares of GLDG stock. WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, as well as Charles Schwab are a few well-known online brokerages providing access to the American stock market.

Choose an online brokerage to purchase Goldmining stock. Don't worry; we have examined a large number of online brokerage firms and apps to assist you in making this decision. establishing a brokerage account Join the top-rated brokerage we have found for 0% charge trading. The best spot to purchase GLDG stock is here.

Adding funds to your investment account Add your details after selecting your payment option. Check out the Goldmining stock. Purchase your GLDG here: Choose whether to purchase GLDG stock using a stop orders to acquire GLDG stock so at specific price or at the market's current price.

What Is The Current Stock Price Of Goldmining Inc.?

There are 156.43 million shares of GLDG stock price today issued as of November 21, 2022. GLDG has a market capitalization of $165.81M. 4.66 million GLDG shares were moved throughout the course of the last day.

GLDG is the current ticker for GoldMining Inc. on the NYSE. At the present time, one stake of GLDG stock price roughly $1.06. The GLDG stock forecasts is now traded on the NYSE under the ticker GLDG.

The stock of GoldMining has a buy consensus rating. Based on 6 purchase ratings, 0 hold scores, and 0 sell ratings, the mean score score is. GoldMining is not a brand-new junior; it has been working for ten years and expanding its portfolio.

GLDG Stock: Should I Trade It Today?

GoldMining Inc. can be a successful investment choice. At 2022-11-22, the GoldMining Inc. quotation is worth 1.060 USD. The GLDG stock forecasts on 2027-11-17 is 1.323 USD based on our GLDG stock forecasts; a long-term growth is anticipated. The anticipated revenue after a 5-year investment is roughly +24.77%. Your $100 investment GLDG stock price today might be worth up than $124.77 in 2027.

GLDG Stock Price Forecast

The median GLDG stock forecasts among the two analysts who are providing 12-month price projections for GoldMining Inc.

is 3.47, with an upper figure of 3.83 as well as a anything between of 3.11. From the most recent price of 1.05., the median GLDG stock forecasts a +230.17% rise.

On the NYSE, GoldMining Inc. is categorized as (NYSE:GLDG). One Wall Street analyst tracking (NYSEMKT: GLDG) has recommended buying the stock, on average.

Who Does GLDG Partner With?

Gold Royalty Corp., an integral part of GoldMining. Additionally, the business has added Gold Royalty Corp. as a completely owned subsidiary. The goal is to immediately provide the funding required to advance the projects the company is working on.

Theoretically, that is a great advantage, but the finance is still a huge challenge and makes me wary. If it were that easy, I would expect that more gold companies would follow suit.

One benefit for GLDG investors is that, in the event that GoldMining divests a few of its properties, shareholders will continue to receive royalties whereas a current buyer developed the project.

Invest In GLDG In 2022?

Excellent junior exploration company: GoldMining The business plan could currently be regarded as low-risk because the organization has been operational for a long time It is simple to get swept up, but it is crucial to realize that exploration involves significant financial risk.

The business will probably depend on finance, which means that shareholders' interests will likely be diluted. As a result, invest cautiously. With support falling between $2 and $1.90 and resistance between $2 and $2.25, GLDG forms a falling wedge pattern.

Selling a third of your futures contract at $2.25 and waiting for a pullback below or above $2.00 are the two steps in the trading technique. The GLDG stock forecasts may finally surpass $2 (breakdown) and test its 200MA at $1.70 if the GLDG stock price of gold turns bearish the next week.

Who Does GLDG Invest In?

By purchasing 1,481,481 NevGold shares at a cost of C$0.675 per share for a total of C$1.0 million in subscription fees, the Company has concluded its initial decision to invest in NevGold.

GoldMining and NevGold had also decided to enter into an investor rights contract on customary terms in link with the closing of a initial option grant as well as the strategic investment.

This clinch for, among many other things, this same grant from certain generally pro privileges by NevGold to GoldMining as well as the right to nominate one top executive of NevGold, provided the Organization keeps an equity stake in NevGold above 4.99%.

GLDG And Bank Of Montreal Partnership

The "Facility" will continue to be held by the Bank of Montreal until October 27, 2023. In order to lower the overhead cost on unused amounts, the Company decided to cut the Facility's overall size from US$20 to ten million dollars. million.

There is currently only US$7 million borrowed on the Facility, that is due to the Company's repayment of US$3 million that was previously announced in order to increase financial flexibility.

The three month USD Adjusted Terms Secured Night Financing Rate (SOFR) and furthermore 5.65% is the interest rate that applies to the Facility. The Facility is subject to usual conditions and margin terms, including additional advances.

Who Owns The GLDG?

Directors at GLDG have still not purchased or sold the shares during the previous 12 months. There are certain large stockholders. We can list them as follows.

Van Eck Associates Corporation, Ruffer, Rathbones Group, Renaissance Technologies, Hollencrest Capital Management, Millennium Management, Susquehanna International Group, Royal Bank of Canada, Jane Street Group, Virtu Financial LLC.

What Is The Anticipated Stock Price For Goldmining In 2023?

The price of GoldMining's stock at the start of the year was $1.20. Since then, the price of GLDG stock has dropped by 20.4% to $0.9549.

2 Over GoldMining's shares, Wall Street research experts have projected prices for the next year. Their range for the price of GLDG stock forecasts is $5.

25 to $5.25. They anticipate that over the course of the next 12 months, the stock price GLDG will average $5.25.

This indicates a potential increase from of the stock's current stock price GLDG of 449.8%.

Gold Price Forecast 2025

When it concerns to investable assets, gold is among the most well-established and developed markets available. It has historically been a valuable commodity, and its main use are in jewelry and electronics, but as a marketplace, it is frequently seen as a wonderful place of refuge for a variety of reasons.

Gold is a fantastic buffer against financial difficulties due to its role as a safe haven commodity, one that frequently moves in anti-correlation towards the traditional markets, but it is also an investment that has demonstrated consistent and solid growth in revenue for a long period.

The price of gold will reach $2,000 by the end of 2023 and $2,500 by the end of 2025, according to the most recent long-term estimate. Within the years 2028, 2029, and 2031, gold will increase to $3,000, $3,500, and $4,000, respectively.

Estimated Gold Price For The Next Ten Years (Until 2030)

Looking yet further ahead inside the GLDG stock forecasts, even the price of GLDG stock forecasts chart for the next ten years appears positive for the resource as the overall GLDG stock forecasts still holds true that its valuation will only increase. Especially given that a financial crisis is on the horizon.

And we can observe what occurred in the ten years that followed 2008 and the looming financial crisis. The 2008 global crisis, in Dohmen Capital Research's opinion, is a suitable recent example. As credit became more restricted, the crisis intensified.

And a stampede to cash in on all assets began, gold fell by 31%. For bulls who were unaware that a financial meltdown leads all assets to fall in value, that was terrible. But at the bottom, it also produced a fantastic purchasing opportunity.

Finance For GLDG

Positive financial indicators: GLDG's debt to equity ratio is around 0.1, which is minimal. Just on GLDG balance sheet, short-term assets outnumber long-term liabilities. Negative Financial Indicators: The GLDG balance sheet shows that there are more brief liabilities than short-term assets.

GLDG has a 6916092 cash burn. It lacks the liquidity and short-term investments necessary to cover this. GLDG holds $2.91M in short-term investments and cash. This is insufficient to fund its $6.92M yearly cash burn.

Price Of Gold Today

The GLDG stock price today below its most recent high, but it is holding above supports and may be preparing to enter another rising phase. The desire for safe haven assets and worries about an oncoming recession have contributed to the recent economic spurt.

But the most recent epidemic in the world has also had an impact and contributed to the dread and uncertainty that now permeates the financial markets. Gold was made to feel despised and required in the last ten years well before fear of something like the recession.

But this is primarily since it played a significant part in 2008 when the GLDG stock forecasts financial crisis hit, however as the economy is recovering. The Performance score for GLDG is 29, which is higher than the Gold industry standard. GLDG is passing only two out of ten checks for due diligence.

What Will Happen To Gold?

Risk and the possibility of loss will always exist in the world if investing. Gold is no exception, but still it also represents one of the safest forms of investment. It is a resource that is always going to be demand, whether for its use in jewelry or electronics. Central banks and investors both want it.