#Treynor

Text

Barely legal teen Jaclyn Jordan gets asshole filled in XXXtreme gangbang

Hentai 3D Umemaro 3D Vol.14 Cheeky Girl 1080p HD

Novinha ruiva mostrando sua beleza

Two big tits Asian tranny fucked a new tourist in ass

Big booty Ebony Riding Til she squirts

SEX ON THE AIRPLANE

Dana DeArmond and Wolf Hudson Fuck

Hot milf and young boy have sex

Hot exchange student fucks her masseur

Fake Taxi Sexy Brunette Princess Jas and her big tits fucked under the sun

#Diplopoda#jerseyed#restrainers#Treynor#evited#fenter#all-informing#fairyish#lahar#subarrhation#Strother#chapter's#overhang#conferrer#sesquiseptimal#triangle-leaved#aurification#oversweeten#scarious#unimaginability

1 note

·

View note

Text

Eu enfiando consolo no cuzinho

Cute guy on snapchat jacking off

Pretty teen pussy and anal ripped by BBC

Esposa putinha bebendo porra na frente do maridao

Hot MILFs hardcore Pissing gangbang - GGGDevot

SEGUNDA PARTE DE ESCLAVA SODOMIZADA ,FISTING , MUCHO ANAL , CASTIGO Y HUMILLACION

Anime Hot Sisters Fuck Each Other Shemales Fuck

Horny sexy lesbian girlfriends scissor fuck

Milf teacher ass fucked first time When we arrived, even though the

Danny Moon hardcore anal plug day training she cry in pain

#skerret#Regalecus#furfuration#alterer#wicked-minded#digitated#tragicomedies#position#submas#ginger-colored#brise#polyhistoric#Diplopoda#jerseyed#restrainers#Treynor#evited#fenter#all-informing#fairyish

0 notes

Text

Gains of Being Treated By a Webster Certified Chiropractor in Carter Lake and Treynor, IA

An expectant mother needs special care. From the moment of conception to giving birth and months afterward, the new mom has to be looked after carefully. True, the gynecologist will advise the patient but reducing the stress along with several niggling issues that may or may not be natural is essential too. One of the best ways to put the mind and body at ease before giving birth is to opt for care by an experienced Webster certified chiropractor in Carter Lake and Treynor, IA.

Well, chiropractic care is quite a popular present. Most individuals believe it is more suitable for pain relief and weak joints. While this notion is true, it is essential to understand that a chiropractor addresses almost all problems in the human body. Pregnancy is not out of its forte either.

The patient and family would be well advised to discuss the matter in detail with the professional before resorting to chiropractic care. The following facts that come to light after such discussions are pleasing to the expectant/new mother and the entire family:-

Webster Technique

Well, this is a chiropractic practice that involves adjustment and realignment of the sacrum and pelvic joint. The focus is on balancing the pelvic area's bones, muscles, and ligaments. The would-be mother's pelvic function is thus optimized and remains natural. This technique also helps to reduce the pain felt in the lower back, back of the thighs, and pubis. Almost all pelvic problems are addressed and solved during the extent of pregnancy.

Effect on Labor

The intense discomfort and associated pain are addressed suitably by this technique. The chiropractic adjustment of the pelvic joint balances the pelvis and reduces the tension in the ligaments. Failing to do this may result in long and uncomfortable labor that becomes painful as well.

Effect on the Baby

Since it is the mother who tries to expel the baby through the birth canal, the baby is likely to be affected, too. The concerned technique can be helpful here too. A perfectly adjusted and balanced pelvis will provide plenty of room for the baby, who remains comfortably snug inside the mother's body. Moreover, positioning the baby's head during the birth process will be natural, with the birth process being easy for both the mother and child.

Best time to consider the Webster technique

While there is no specific time to visit a chiropractor, a pregnant woman will benefit when the expert examines her early and provides proper advice. A rule of thumb is to see the chiropractor as often as going to the gynecologist or midwife with complaints that require relief. The certified professional can help the patient as needed, even when the expectant mother chooses chiropractic care during the third trimester.

An experienced sports injury chiropractor in Council Bluffs and Carter Lake, IA, is needed to alleviate the pain and restore full functionality of the injured joints, muscles, and ligaments as required. This may be done in addition to conventional treatment.

#Webster certified chiropractor in Carter Lake and Treynor#IA#sports injury chiropractor in Council Bluffs and Carter Lake

0 notes

Text

Pildom kriptovaliutų portfelį ir jį analizuojam

Beveik prieš dvejus metus mes suformavom dviejų kriptovaliutų portfelį, susidedantį tik iš bitcoin ir ethereum. Tada mes svarstėme, į kurią

#cryptocurrency #bitcoin #ethereum #ripple #cardano #axieinfinity #skymavis #investment #investingstrategy #btcusd

Beveik prieš dvejus metus mes suformavom dviejų kriptovaliutų portfelį, susidedantį tik iš bitcoin ir ethereum. Tada mes svarstėme, į kurią kriptovaliutą investuoti. Pasirinkome abi iš karto, kaip ilgalaikį portfelį ir sukūrėme portfelio pildymo strategiją. Dabar mes nusprendėme portfelį papildyti.

Continue reading Untitled

View On WordPress

#Axie Infinity#Bitcoin#BTCUSD#Cardano#Ethereum#Investavimas#Kriptorinka#Kriptovaliuta#Money#Pinigai#Ripple#Šarpo rodiklis#Show-Me-The-Money#Sky Mavis#Stablecoin#Treynor Ratio

0 notes

Text

Campbell Insurance Agency Inc. is a family-owned and operated insurance company. We offer high-quality insurance and risk management solutions in the greater Council Bluffs, IA, area. We work with you to find the best home, life, auto, and health policies while providing excellent customer service.

0 notes

Note

#9 for anna & james

Write about your ship getting dressed up in fancy outfits together.

@anderfels

--

"You sure they won't be there when we arrive?" Anna called out from the bathroom as James pulled on the dress shirt and started buttoning it up.

"I'm sure. Alenko said he's going to keep the Admiral busy until at least seven. That's plenty of time."

Finishing applying her eyeliner, Anna gave her make-up a once over before gently brushing away a smudge. Satisfied, she cleaned up the counter before adjusting her outfit to make sure everything wasn't twisted up.

James turned as the door to the bathroom opened and broke into a smile, seeing Anna in the black jumpsuit with a slit up the leg and silver straps to highlight the top. "You clean up pretty good." he said, circling an arm around her waist as she passed by to draw her closer to him. His hand brushed against the silver fabric and felt how rough it was, flecks of glitter sticking to his palm.

"I just did my make-up." Anna playfully leaned away from him and turned her head so James couldn't kiss her. She took a few steps towards the door before pausing and giving him a once over. "You look pretty fancy yourself."

"I do know how to clean up." James said as he followed her out of the room and toward the closet where their coats were.

Soon they were stepping out of the cab and walking up the stone path that led to the Admiral's house. James let Anna go in first, pressing a light hand against the small of her back as they walked over the threshold. Taking off his jacket, he took Anna's and went to put them away in the hall closet that Kaidan said they could store them in. Walking back into the living room, he saw that Anna was already going through the bottles that had arrived along with the makeshift bar-tending station. "Anything you need me to do before I help start setting up?" he asked as the door opened again and the voices of more Normandy crew members filtered down the hall.

"Ice." Anna replied, placing two ice buckets on the countertop.

"Yes ma'am." James smiled before grabbing the buckets. When he returned Anna was pouring something into a glass. "What's that?" he asked, eyes on the blue and purple liquid.

"Galaxy lemonade and vodka." Anna replied, putting some ice in the drink before setting the glass in front of James. "It's just butterfly pea powder with some purple syrup, lemonade, and vodka. Tell me what you think."

James looked at the glass and looked at the blue and purple swirls for a moment before taking a sip. "That's pretty damn good."

"Good enough for Admiral Shepard's wedding though?" Anna rested her arms on the bartop, still not sure that it was the right drink for the evening.

"She'll love it, trust me." James took another sip while giving Anna wink before setting it down and going to help Garrus and Treynor move furniture and set up chairs.

Anna watched James walk away and tried to push away the gnawing anxiety that she'd had ever since he'd told her about the Admiral's wedding. Taking a deep breath, she shoved the feeling down and focused on finishing up organizing the bar for the party afterwards.

#don't worry things'll work out#this is only part of a larger chapter that I'm slowly working on#anonymous#mass effect#james vega#annabel ryder#vega/ryder#fanfic#my writing#better version of me

7 notes

·

View notes

Text

Baldurs gate three has spoiled me in terms of romance in rpg games. I've been playing Mass Effect 3 and the people you romance just have no different dialogue options once you've become official? Like I romanced Treynor and still every time I try to talk to her it's just the one "Commander" line no matter what. No different dialogue, no different actions. I'm not comparing them, they are two very different games but man, Larian has spoiled me.

#baldurs gate 3#Baldurs gate#Baldurs gate three#Baldurs gate romance#Mass effect#Mass effect franchise#Mass effect 3#Mass effect three#samantha traynor#Traynor romance#Mass effect romance#Mass effect 3 romance

8 notes

·

View notes

Text

Name: Elise Dufour

Japanese: エリーゼ・デュフール (Erīze de~yufūru)

Quote: "Are you getting stressful? Have a bite of the cake."

Age: 16 y.o

Birthday: September 24th

Star Sign: Libra

Height: 164 cm

Race: Human

Species: None

Homeland: Dreamy City

Family:

Treynor Dufour (Father)

Caterina Posey (Mother)

Carlos Posey (Uncle)

Christopher Possey (Uncle)

Unnamed grandparents

Unnamed relatives

Nicknames / Aliases:

Lizzie (by her family and friends)

Cupcake (by the Demon Lord of Gluttony)

Little angel (by the powerless Archangel)

Liz-chan (by Cater)

Gâteau fille (by Rook Hunt; means "Cake Girl" in French)

School Facts and Fun Facts

Dorm: Dragonroyal

Occupations: Student

Baker, barista & employee of the Sweet Crumbs Bakery / Bunny's Tea House

Magicam influencer

Best Subject: Culinary Arts

Worst Subject: Ballroom Dance

Club: RFA Podcast Club

Dominant Hand: Right-handed

Favourite Colors: Baby blue, Sky blue and Light green

Favourite Food: Carrot cake | Sweets

Least Favourite: Bad mixed foods

Likes: Baking, brushing teeth, odorless, gothic, popular vibes, part-time jobs, helping people, her family, her bestie Jennifer, games, novels, making scrapbooks and journal, her puppy, making coffee

Dislikes: Mechanic toothbrushes, didn't brush her teeth, odor, too dark, thieves, pickpockets, annoyed, have a step-family someday, ignored, mess up her room, clumsiness

Hobbies: Reading novels, painting, listening to classic music, watching movies, baking, sewing, making bottle ships

Talents: Baking, identifying the coffee, strategic, fast speed

Etymology

Elise is a girl's name that comes from Latin, meaning “God's promise.” Elise first came around in the Middle Ages, originally as a shortened version and nickname of the French name Elizabeth.

Dufour is a nickname for a baker from du four 'of the oven'. habitational name with fused preposition and definite article du 'from the' for someone from Le Four the name of several places in various parts of France. Compare Defer, Dufer and Dufur. It also the most common surname in global.

Character Inspired

Kiko (Winx Club)

Simeon (Obey Me)

Tiana (Disney's Princess and the Frog)

Chino Kaafu (Is the Order a Rabbit)

#twisted wonderland#twst#rfa#regal fairytale academy#twst oc#twisted wonderland oc#dragonroyal#lizzie dufour

6 notes

·

View notes

Text

The Treynor ratio is a risk-adjusted performance measure used in finance to evaluate the returns of an investment in relation to the systematic risk it carries, particularly applicable in the context of mutual funds. Named after economist Jack Treynor, this ratio provides investors with insight into how effectively a mutual fund manager has utilized market risk to generate returns.

To calculate the Treynor ratio for a mutual fund, one typically divides the excess return of the fund (the return above the risk-free rate) by its beta. The beta represents the fund's sensitivity to market movements. Mathematically, the formula for the Treynor ratio is:

A higher Treynor ratio indicates that the fund has generated higher returns per unit of systematic risk taken. Hence, a good Treynor ratio signifies that the fund manager has efficiently utilized market risk to achieve superior returns.

Interpreting the Treynor ratio requires understanding the concept of systematic risk. Unlike unsystematic risk (which can be diversified away), systematic risk cannot be eliminated through diversification. It is inherent to the entire market or a particular segment of it. Therefore, by focusing on systematic risk, the Treynor ratio helps investors assess whether the fund manager has been successful in generating returns relative to the market's risk.

A "good" Treynor ratio depends on the investor's risk tolerance, investment objectives, and the prevailing market conditions. Generally, a higher Treynor ratio is preferred as it indicates better risk-adjusted performance. However, investors should consider other factors such as the fund's investment strategy, volatility, and consistency of returns before making investment decisions solely based on this ratio.

0 notes

Text

Quantifying the Returns of ESG Investing: An Empirical Analysis with Six ESG Metrics

Quantifying the Returns of ESG Investing: An Empirical Analysis with Six ESG Metrics. “ We find that aggregating individual ESG ratings improves portfolio performance. In addition, we find that a portfolio based on Treynor-Black weights further improves the performance of ESG portfolios.” By Florian Berg, Andrew W. Lo, Roberto Rigobon, Manish Singh. All are associated with the Massachusetts…

View On WordPress

0 notes

Text

What Investment Benchmarks Do You Use?

As an AI language model, I don't have personal investments or use specific investment benchmarks. However, investors commonly use various benchmarks to evaluate the performance of their investments and compare them against relevant market indices or peer groups. Some commonly used investment benchmarks include:

Stock Market Indices: Investors often compare their portfolio returns to major stock market indices such as the S&P 500, Dow Jones Industrial Average (DJIA), Nasdaq Composite, or specific sector indices. These indices represent the performance of a broad market or specific segments of the market.

Bond Indices: For fixed-income investments, investors may benchmark their portfolio returns against bond indices such as the Bloomberg Barclays U.S. Aggregate Bond Index or the ICE BofA Merrill Lynch U.S. Corporate Bond Index.

Mutual Fund or ETF Benchmarks: Investors may compare the performance of their mutual funds or exchange-traded funds (ETFs) to relevant benchmarks such as the Lipper Category Average, Morningstar Category Average, or an appropriate market index that closely aligns with the fund's investment objectives and asset allocation.

Peer Group Comparisons: Investors may benchmark their portfolio returns against the performance of similar investment strategies or peer group portfolios. This approach helps investors assess how their portfolio stacks up against others with similar investment objectives, risk profiles, and asset allocations.

Risk-Adjusted Performance Measures: Investors often use risk-adjusted performance measures such as the Sharpe ratio, Treynor ratio, or Jensen's alpha to evaluate the risk-adjusted returns of their portfolios relative to a chosen benchmark. These measures take into account both returns and risk levels to assess portfolio performance more comprehensively.

Customized Benchmarks: Some investors may create customized benchmarks tailored to their specific investment objectives, asset allocation strategies, or investment mandates. These benchmarks reflect the investor's unique goals and investment philosophy and serve as a yardstick for measuring portfolio performance.

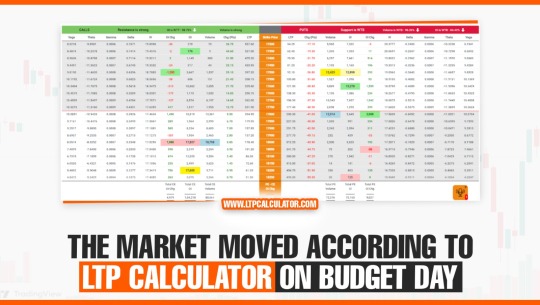

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

Ultimately, the choice of investment benchmark depends on the investor's objectives, investment strategy, asset allocation, and preferences. It's essential to select benchmarks that are relevant, appropriate, and meaningful for evaluating portfolio performance and tracking progress toward investment goals.

0 notes

Text

Measuring Investment Efficiency: The Significance of Risk-Adjusted Returns

Investing in financial markets involves navigating a complex landscape of risks and rewards. While achieving high returns is often the primary goal for investors, it's equally important to consider the level of risk taken to achieve those returns. This is where the concept of risk-adjusted return comes into play, offering a comprehensive measure of investment efficiency that accounts for both returns and risk. In this article, we'll delve into the importance of measuring investment efficiency through risk-adjusted returns and explore how investors can use this metric to make informed decisions.

Understanding Risk-Adjusted Return:

Risk-adjusted return is a financial metric that evaluates the return on an investment relative to the level of risk assumed to achieve that return. In essence, it quantifies the amount of return generated per unit of risk. While traditional return metrics such as absolute return and total return focus solely on the magnitude of returns, risk-adjusted return provides a more nuanced perspective by considering the riskiness of investment strategies.

The Importance of Investment Efficiency:

Investment efficiency refers to the ability of an investment strategy to generate returns in a manner that balances risk and reward effectively. While high returns are desirable, they should not come at the expense of excessive risk-taking. Investment efficiency ensures that investors are maximizing returns while minimizing risks, thereby optimizing the performance of their portfolios.

The Role of Risk-Adjusted Return in Investment Analysis:

Risk-adjusted return metrics such as the Sharpe Ratio, Treynor Ratio, and Jensen's Alpha are widely used by investors and portfolio managers to evaluate the efficiency of investment strategies. These metrics provide valuable insights into how well an investment performs relative to its risk exposure and can help investors make informed decisions about portfolio allocation and asset selection.

1. Sharpe Ratio: The Sharpe Ratio measures the excess return of an investment (or portfolio) relative to the risk-free rate per unit of volatility (or risk). A higher Sharpe Ratio indicates better risk-adjusted performance, as it reflects higher returns for a given level of risk. Investors often use the Sharpe Ratio to compare the risk-adjusted returns of different investment strategies and assess their efficiency.

2. Treynor Ratio: The Treynor Ratio evaluates the excess return of an investment (or portfolio) relative to its systematic risk, as measured by beta. It provides a measure of the return earned per unit of systematic risk. Similar to the Sharpe Ratio, a higher Treynor Ratio indicates better risk-adjusted performance, as it reflects higher returns for a given level of market risk.

3. Jensen's Alpha: Jensen's Alpha measures the excess return of an investment (or portfolio) relative to its expected return, based on the Capital Asset Pricing Model (CAPM). Positive Jensen's Alpha indicates that the investment has outperformed its expected return, while negative alpha suggests underperformance. Jensen's Alpha provides insights into how well an investment strategy has performed relative to its market risk and can help investors assess the efficiency of their portfolios.

Maximizing Investment Efficiency:

To maximize investment efficiency, investors should focus on constructing well-diversified portfolios that balance risk and reward effectively. Diversification across asset classes, sectors, and geographic regions can help mitigate risk and enhance risk-adjusted returns. Additionally, active risk management techniques such as setting stop-loss orders, employing hedging strategies, and periodically rebalancing portfolios can help investors optimize the efficiency of their investment strategies.

Conclusion:

In conclusion, measuring investment efficiency through risk-adjusted returns is essential for investors seeking to optimize the performance of their portfolios. Risk-adjusted return metrics provide valuable insights into how well an investment strategy performs relative to its risk exposure, enabling investors to make informed decisions about portfolio allocation and asset selection. By focusing on maximizing risk-adjusted returns and balancing risk and reward effectively, investors can enhance the efficiency of their investment strategies and achieve their financial goals over the long term.

0 notes

Text

Beyond Returns: Why Risk-Adjusted Returns Matter in Investment Strategies

Take your investment game to the next level by understanding why risk-adjusted returns matter. Explore the metrics, including Sharpe and Treynor ratios, to make informed comparisons and ensure your investments align with your risk tolerance. Secure your financial future.

Read More:

0 notes

Text

Aligned Chiropractic is the ideal choice for those suffering from back pain, joint pain, or neck pain. Call us today for more details.

0 notes

Text

Treynor Rodiklis

Treynor koeficientas, taip pat žinomas kaip grąžos-volatilumo koeficientas, yra pajamingumo rodiklis, skirtas nustatyti, kiek perteklinės

#treynor #sharp #investing #strategy #investmentstrategy #economics #riskmanagement

Treynor koeficientas, taip pat žinomas kaip grąžos-volatilumo koeficientas, yra pajamingumo rodiklis, skirtas nustatyti, kiek perteklinės grąžos buvo gauta už kiekvieną prisiimtą rizikos vienetą. Dažniausiai skaičiuojamas investiciniam projektui. Bet galima ir atskiram instrumentui paskaičiuoti. Kaip ir Sharp rodiklis, neskaičiuojamas obligacijoms, nes, pagal apibrėžimą, obligacijos neturi…

View On WordPress

#Apple#Economics#Elektromobilis#Investavimas#Investavimo strategijos#Metaverse#Money#Pinigai#Sharpe Ratio#Treynor Ratio

0 notes

Text

Must-Have Insurance in Treynor, IA and Bellevue, NE

It is crucial to be protected from all eventualities by investing in good insurance in Treynor, IA, and Bellevue, NE. Sure, policies tend to differ, but the buyer must make sure to shop effectively by studying all associated pros and cons. Life comes with no guarantees, and although each individual is aware of being mortal, the possibility of meeting with an illness or encountering an accident are fears that need to be kept in mind. The varieties of insurance plans are too numerous to be counted, but it makes perfect sense to obtain insurance coverage for multiple life eventualities that may go wrong at any moment.

Most important insurance policies to consider

· Disability Insurance- True, but the thought of being disabled is frightening. It is essential to think of the worst as well as the best times ahead. It is heartening to note that the insurance coverage will pay up to 60% of the last salary earned by the insured person. However, such a claim does not guarantee compensation from Day 1. Instead, one must be prepared to wait for the stipulated period after a medical professional confirms the physical condition. Another important point is to note that a long-term disability may follow a short-term disability or may be diagnosed right away. The insured individual must qualify for the required disability to obtain financial assistance.

· Life Insurance- This is the most important insurance policy that an individual thinks of while remaining employed. The urge to take care of one's defendants is uppermost on one's mind when one is disturbed by the thought of being dead before the dependents can fend for themselves. There are several types of life insurance products available today. It helps to buy a policy that will replace the breadwinner's income. Moreover, it is advisable to factor in the funeral costs so that the heirs do not have to bear any additional financial burden afterward

· Health Insurance- An individual must think of buying adequate health insurance coverage when the employer does not bear the costs. Sure, the cost of such insurance coverage does not come cheap but trying to pay the medical expenses without health insurance can wipe out the entire savings at one go and put the concerned individual in debt too. Getting in touch with an experienced insurance company is advisable to find a plan that meets most of one's requirements without being cripplingly expensive.

· Homeowner's Insurance- A home happens to be an individual's greatest asset. It is vital to keep the stricture and possessions inside protected from unprecedented damages. The homeowner can thus find the funds to make repairs or replace the property or part of it courtesy of the insurance company. The money comes in handy when a natural disaster strikes the area.

One may also have to consider buying auto insurance mandated by the state. Having the required motorcycle insurance in Omaha and Bellevue, NE, can be beneficial too.

0 notes