#Step 2: Link Your Debit Card

Text

Enter Your Details to have a Chance to Win a $100 Cash App Now!

#100 days of productivity#new york#Step 1: Sign Up for Cash App#The first step is to sign up for Cash App. It's a mobile payment app that allows you to send and receive money from friends and family. Plu#when you sign up using someone's referral code#you can earn a $5 sign-up bonus.#Step 2: Link Your Debit Card#To start earning money on Cash App#you'll need to link your debit card. This will allow you to send and receive money#as well as make purchases using the Cash Card.#Step 3: Refer Friends#One of the easiest ways to earn free money on Cash App is by referring friends. When you refer someone and they sign up using your referral#you'll both get a $5 bonus. Plus#for each successful referral (who makes at least a $5 transfer)#you can get a $15 bonus.#Step 4: Use Cash Boosts#Cash Boosts are special discounts that you can use when you make purchases using your Cash Card. They can save you money on things like cof#groceries#and even gas. By using Cash Boosts#you can keep more money in your pocket and earn free money on Cash App.#Step 5: Participate in Sweepstakes and Giveaways#Cash App sometimes offers sweepstakes and giveaways that you can enter for a chance to win free money. Keep an eye out for these opportunit#and make sure to follow the rules and instructions for entering.#So#there you have it#my friend. A simple and easy-to-follow guide on how to earn $100 in free money on Cash App. Just remember#to make the most of these opportunities#you gotta understand how Cash App works#and utilize all the features it offers. Good luck#and happy earning!

1 note

·

View note

Text

How to SUCCESSFULLY VERIFY YOUR PAYPAL ACCOUNT using GCash Mastercard

(This tutorial is applicable geographically in the Philippines only. You may watch this tutorial on YouTube! You can also watch how to link GCash Mastercard to your GCash account.)

PayPal revamps its website, so the old process of verifying your account is not applicable anymore. So I made this tutorial to help you in verifying your account using their new website.

Before you proceed: you MUST already have a Fully Verified Account on GCash; your GCash Mastercard; and an account in Paypal. You must have your mobile phone around so you can immediately access the messages that will be sent to your mobile number. You must also have at least a 200PhP available balance on your GCash account because Paypal will deduct 100PhP plus some other fees.

To fully verify your GCash account, you may click here to see the detailed process. To register a Paypal account, you may go to their official website. You can either choose “Personal Account” or “Business Account”. This tutorial follows the “Personal Account” category. Considering you are living in the Philippines, you may purchase the GCash Mastercard on MiniStop branches, 7-11 branches, Globe Offices, among others. You will have to pay 150PhP for the card. I bought mine from a MiniStop branch near my area.

So after completing it, you may now move to the next step. By the way, you will know if you are already “Fully Verified” by checking the “Profile” tab on your GCash app.

STEP 1: Activate your GCash Mastercard.

There are two ways to do this. The first one is through the app and the second one is through the *143# Menu.

To link your card to the GCash app, go to “My Linked Accounts”. Tap on “GCash Mastercard”. Tap on “Link Card”. You will be then asked to enter your 16-digit card number. No spaces or letters or characters, only numbers. After typing, tap on “Link Card”. Now, you can use your GCash Mastercard to withdraw money from your GCash account.

To link via *143# (APPLICABLE FOR GLOBE NETWORK USERS ONLY!):

Dial *143# on your phone's keypad.

Select "GCash".

Select "GCash Card".

Select "Activate Card"

Key in your GCash MPIN.

Type in the 16-digit number of you GCash Mastercard.

If you choose the later, you will receive an SMS to notify you of successful activation.

STEP 2: Log in to your PayPal account and go to the “Wallet” tab.

You will see an option to either link a bank account or a card (credit/debit card). Since we are using the GCash Mastercard, we will choose "Link a card".

STEP 3: Linking your GCash Mastercard.

After clicking on “Link a card”, you will be prompted to fill in the details of your GCash Mastercard. Credit card number is at the front of your card. The card type is Mastercard. However, while typing your card number, it will be automatically filled in. The expiration date is the “Valid thru” on your card. Security code is at the back of your card. It will be the three digits. After filling in the details, click on "Link card".

STEP 4: Confirming your GCash Mastercard.

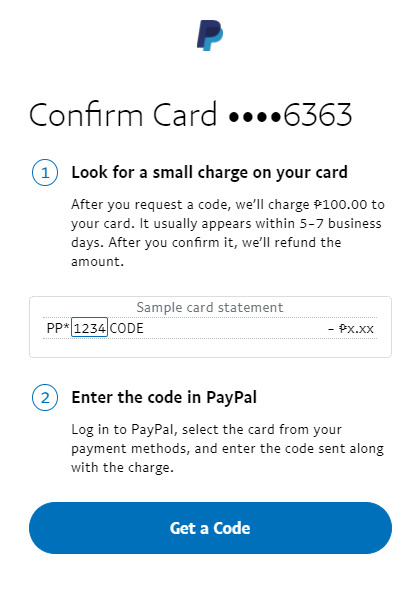

After linking, you will be back on the “Wallet” tab. Click on the card, under the "PayPal balance", and click on "Confirm your card". You will see this prompt in getting your code.

Click on "Get a Code", and you will see a message that says your code is on the way. After clicking “Done”, you will be back again to your “Wallet” page.

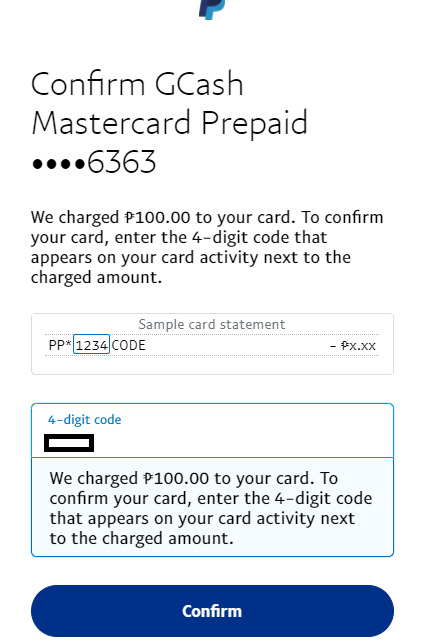

Once you have the code, you will go back to your PayPal account and click on the "Wallet" tab. Click on the "Enter the code to confirm your card", and type in the code. You will see a textbox that says PayPal will charge 100PhP to your card. Click on "Confirm".

After hitting the “Confirm”, you will get this message. Click on "Done".

After you confirm your card, you will receive an email from PayPal that they are lifting your account limit. Now, you are done and that's hitting two birds with one stone! You can now use PayPal to your hearts content; as long as you have enough funds in your GCash account. You may now receive money to your PayPal account and withdraw it to your GCash account.

I saw an error that says "Your card was declined by the issuing bank. Please try a different card or contact your card issuer with questions."

This error signals you have type in a different information in your GCash and PayPal account. Take note that prior to linking, your information in these two accounts must CONTAIN THE SAME information, including spelling. Failure to do so will result to that error message.

Where can I get the code?

You will receive the four digit code through your SMS. GCash will sent a text on your mobile phone number. You will identify this after the asterisk symbol.

I paid 100PhP, will I get that back?

Yes! PayPal will revert it back to you after one week of your successful linking.

That's the end of my tutorial. I hope this help you in verifying your PayPal account.

(Originallly posted at lifeofaie.wordpress.com on March 27, 2021.)

Last update: August 8, 2021 - added links to my YouTube video of the same tutorial.

Last update: February 14, 2023 by the same author. - revamp the contents and added questions at the end

#GCash Mastercard#How to verify PayPal account#How to verify PayPal account using GCash Mastercard#philippines

5 notes

·

View notes

Text

How to transfer money from apple pay to cash app

First what is Apple pay?

It is an app made by Apple.inc specifically for IOS users to pay bills,purchase an app from the app store, purchase anything on web using safari. It's compatible with all IOS devices which includes an iPhone,iPad, MacBook,iWatch. The app is only available to iOS users and cannot be found on the internet or on any third party sites for download.Apple pay uses security features build in the hardware and software of your device to make the transaction encrypted.

Now that this is clear let's move to Cash App

What is a Cash App?

It's an app made by Block.inc for Android and iOS users to make there mobile banking experience better.The app is used for transferring money from one mobile to another,to pay bills etc.The only downside of the app is that it is only available in USA and UK so people living in other countries can't use the app.The app uses cut edge encryption and fraud detection technology to make your transactions safe and secure.

Now these are two separate apps manufactured by two separate companies.

So is it possible to transfer money from apple pay to cash app?

Yes it's possible but, indirectly because apple pay does not allow it's users to transfer the money to any other banking apps expect apple pay.

So there is only one and the best method to transfer your money from apple pay to cash app

Step 1 : Transfer money from your apple pay to your bank account ( in some cases this method can take upto 1-3 business days)

Make sure you have your card or bank account information where you want to transfer your money.

If you are using an iPhone

Go to your apple pay application

Tap on apple cash card

Then tap on the '+' icon

If you are using an iPad

Go to configuration>apple pay/wallet>apple cash card

Select the 'Transfer To Bank' option

Enter the amount to deposit then click Next

Click on instant transfer

Confirm the transaction by Face ID or Touch ID or password.

Now that you have transferred your money to your bank account let's transfer it to the Cash App

Step 2 : Transfer money from your bank account to Cash App

Tap on the banking tab on the Cash app homescreen.

Press add cash.

Choose an account.

Tap Add.

Use Face ID,Touch ID, Password to enter your pin.

Other questions:

Now is it possible to transfer money from Cash App to Apple Pay?

No it's not possible to do it because apple pay is a wallet app and not a bank account.It's an electronic wallet which is linked with your debit or credit card

Can I transfer money from Apple cash to an Android phone

No this is also not possible to do so both devices should be running IOS operating system

7 notes

·

View notes

Text

Unraveling the Mystery of MPO777: A Comprehensive Overview

MPO777 is a popular online gambling platform offering a wide array of casino games and sports betting opportunities. With its user-friendly interface and diverse gaming options, MPO777 attracts players from around the world. If you're looking to join the excitement and thrill of online gambling on MPO777, this comprehensive guide will walk you through the registration process step by step. mpo777 daftar

Step 1: Accessing the MPO777 Website

The first step to register on MPO777 is to access their official website. You can do this by typing "MPO777" into your preferred search engine or by directly entering the website's URL into your browser's address bar.

Step 2: Creating an Account

Once you're on the MPO777 website, locate the "Sign Up" or "Register" button, usually located prominently on the homepage. Click on it to initiate the registration process.

Step 3: Providing Personal Information

To create your MPO777 account, you'll need to provide some personal information. This typically includes your full name, email address, phone number, date of birth, and a username/password combination. Make sure to use accurate information, as it will be used for verification and account management purposes.

Step 4: Verifying Your Account

After providing your personal information, MPO777 may require you to verify your account. This usually involves clicking on a verification link sent to the email address you provided during registration. Follow the instructions in the email to complete the verification process.

Step 5: Making a Deposit

Once your account is verified, you'll need to make a deposit to start playing. MPO777 supports various payment methods, including credit/debit cards, e-wallets, and bank transfers. Choose the payment method that suits you best and follow the instructions to make your deposit.

Step 6: Exploring the Games

With your account funded, you're now ready to explore the wide range of games offered on MPO777. Whether you're into slots, table games, or sports betting, MPO777 has something for everyone. Take your time to browse through the available options and find the games that pique your interest.

Step 7: Responsible Gaming

As you start playing on MPO777, it's essential to practice responsible gaming. Set a budget for yourself and stick to it, avoid chasing losses, and take regular breaks to avoid fatigue. Remember that gambling should be a form of entertainment, and it's essential to gamble responsibly. mpo777 daftar

Conclusion:

Signing up for MPO777 and starting to play is a straightforward process that can be completed in just a few easy steps. By following this comprehensive guide, you'll be able to create your account, make a deposit, and start enjoying the exciting world of online gambling on MPO777. Remember to gamble responsibly and have fun!

0 notes

Text

A Comprehensive Guide to MPO777 Registration: How to Sign Up and Start Playing

MPO777 is a popular online gambling platform offering a wide array of casino games and sports betting opportunities. With its user-friendly interface and diverse gaming options, MPO777 attracts players from around the world. If you're looking to join the excitement and thrill of online gambling on MPO777, this comprehensive guide will walk you through the registration process step by step. mpo777 daftar

Step 1: Accessing the MPO777 Website

The first step to register on MPO777 is to access their official website. You can do this by typing "MPO777" into your preferred search engine or by directly entering the website's URL into your browser's address bar.

Step 2: Creating an Account

Once you're on the MPO777 website, locate the "Sign Up" or "Register" button, usually located prominently on the homepage. Click on it to initiate the registration process.

Step 3: Providing Personal Information

To create your MPO777 account, you'll need to provide some personal information. This typically includes your full name, email address, phone number, date of birth, and a username/password combination. Make sure to use accurate information, as it will be used for verification and account management purposes.

Step 4: Verifying Your Account

After providing your personal information, MPO777 may require you to verify your account. This usually involves clicking on a verification link sent to the email address you provided during registration. Follow the instructions in the email to complete the verification process.

Step 5: Making a Deposit

Once your account is verified, you'll need to make a deposit to start playing. MPO777 supports various payment methods, including credit/debit cards, e-wallets, and bank transfers. Choose the payment method that suits you best and follow the instructions to make your deposit.

Step 6: Exploring the Games

With your account funded, you're now ready to explore the wide range of games offered on MPO777. Whether you're into slots, table games, or sports betting, MPO777 has something for everyone. Take your time to browse through the available options and find the games that pique your interest.

Step 7: Responsible Gaming

As you start playing on MPO777, it's essential to practice responsible gaming. Set a budget for yourself and stick to it, avoid chasing losses, and take regular breaks to avoid fatigue. Remember that gambling should be a form of entertainment, and it's essential to gamble responsibly. mpo777 daftar

Conclusion:

Signing up for MPO777 and starting to play is a straightforward process that can be completed in just a few easy steps. By following this comprehensive guide, you'll be able to create your account, make a deposit, and start enjoying the exciting world of online gambling on MPO777. Remember to gamble responsibly and have fun!

0 notes

Text

How to Add Funds To Your Instantpay Business Wallet

Managing your business finances efficiently is crucial for sustainable growth and success. Instantpay's Business Wallet offers a convenient and secure platform to handle your business payments. This comprehensive guide will walk you through the process of adding funds to your Instantpay Business Wallet, ensuring a smooth and seamless experience

A business wallet typically refers to a financial account or a digital wallet specifically designed for managing business finances. It serves as a centralized platform where businesses can store funds, make payments, receive payments, track expenses, and manage their overall financial transactions. It also helps in separating personal and business expenses. This demarcation is crucial for accounting purposes, tax filings, and financial clarity.

Link your bank account to your Instantpay Business Wallet through the following steps:

Step 1. Click on your display picture, then navigate to 'My Profile.'

Step 2- Navigate to 'My Profile.'

Step 3. Enter your PIN for verification.

Step 4. Click on 'Linked Accounts.'

Step 5. Select 'Add Bank Account.'

Step 6. Enter your bank name and account number, click on verify, and successfully link your bank account.

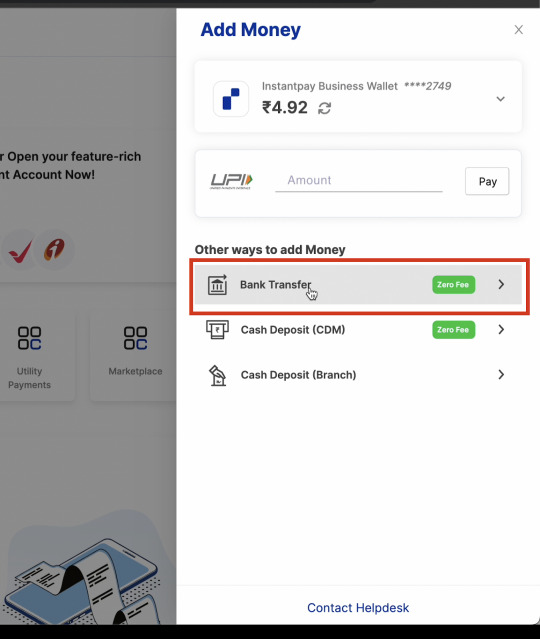

Step-by-Step Guide to Adding Funds to your Business wallet

Step 1. Navigate to the Instantpay Dashboard

Step 2. Click on 'Add Money' or the ₹ icon located at the top left corner.

Step 3. Choose 'Bank Transfer' as your preferred method.

Step 4. Select your bank from the available options.

Step 5. Transfer funds directly from your bank account to your Instantpay Business Wallet.

Learn More:

- How Instantpay helps businesses simplify employee payments

- Instantpay Account Creation Process for Corporates

- A Guide to Efficient Payment Collection

What are the Methods to Add Funds to your Business Wallet?

Instantpay offers various methods to suit different business needs:

Bank Transfer

Bank transfer is one of the most common and convenient methods for adding funds to your Instantpay business wallet. To initiate a bank transfer, you need to link your business bank account with your Instantpay wallet. Once linked, you can transfer funds from your bank account to your Instantpay wallet instantly. This method is ideal for businesses that prefer electronic transactions and want to streamline their fund management process.

Cash Deposit (CDM)

For businesses that deal with cash transactions, a cash deposit is another viable option for adding funds to their Instantpay wallet. Instantpay allows businesses to deposit cash at designated partner locations, such as retail outlets or kiosks. To facilitate cash deposits, businesses are issued a Karur Vysya card. They simply present this card at a partner outlet, where it functions like a debit or credit card. The card is swiped, enabling seamless deposit of funds. Once the deposit is made, the funds are instantly credited to the business wallet, providing businesses with immediate access to their funds.

Cash Deposit from Branch

In addition to cash deposits at partner locations, Instantpay also offers the option for businesses to deposit cash directly from their branch offices. This method is particularly beneficial for businesses with multiple locations or branches spread across different geographical areas. To initiate a cash deposit from a branch, businesses need to deposit the cash using IFSC code and bank account details, which will facilitate the deposit process and ensure seamless transfer of funds to the business wallet.

Doorstep Cash Collection

For businesses that operate in remote or underserved areas where access to banking services is limited, doorstep cash collection offers a convenient solution for adding funds to their Instantpay wallet. Instantpay provides businesses with the option to schedule doorstep cash collection services, where a designated representative will visit the business premises to collect cash and credit it to the business wallet. This method not only ensures the safety and security of cash transactions but also provides businesses with the flexibility to manage their funds efficiently.

Why should you trust Instantpay with your business finances?

Compliance and Security for Businesses

Instantpay understands the importance of adhering to regulatory standards and safeguarding sensitive financial information. As a result, Instantpay's Business Wallet is designed with robust compliance measures and security protocols to protect businesses and their assets.

Compliance: Instantpay complies with all relevant financial regulations and standards to ensure transparency and accountability in financial transactions. By adhering to regulatory requirements, Instantpay provides businesses with a trusted and compliant platform for managing their funds, mitigating the risk of regulatory fines or penalties.

Security: Instantpay employs state-of-the-art security measures to safeguard business funds and sensitive data. This includes encryption technologies, multi-factor authentication, and secure servers to prevent unauthorized access or data breaches. Additionally, Instantpay regularly conducts security audits and updates its systems to address emerging threats, ensuring a secure environment for businesses to conduct their financial activities.

By prioritizing compliance and security, Instantpay instills confidence in businesses, allowing them to focus on their core operations without worrying about financial risks or security breaches. Instantpay's commitment to compliance and security sets it apart as a reliable partner for businesses seeking a safe and efficient platform for managing their finances.

Winding Up

Empower Your Business Finances

Managing business finances efficiently shouldn't be a chore. Instantpay's Business Wallet provides a secure and all-encompassing solution with various funding options tailored to your needs.

By following the steps outlined in this guide, you can easily add funds to your Instantpay Business Wallet and choose from various funding options such as bank transfers, cash deposits, and doorstep cash collection. Instantpay's commitment to compliance, security, and convenience makes it a trusted partner for businesses looking to streamline their fund management processes and focus on growth and success. From bank transfers to doorstep cash collection, we make it easy to add funds and gain control of your finances. Plus, our robust compliance and security measures ensure your money and data are protected.

Frequently Asked Questions

What is Instantpay's Business Wallet?

Instantpay's Business Wallet is a financial account or digital wallet specifically designed for managing business finances. It offers a centralized platform for storing funds, making payments, receiving payments, tracking expenses, and managing financial transactions.

How do I add funds to my Instantpay Business Wallet?

- Link your bank account to your Instantpay wallet by navigating to 'My Profile,' then 'Linked Accounts,' and selecting 'Add Bank Account.'

- Once your bank account is linked, navigate to the Instantpay Dashboard, click on 'Add Money,' choose 'Bank Transfer' as your preferred method, select your bank, and transfer funds from your bank account to your Instantpay Business Wallet.

Is there a maximum limit on the amount I can add to my Instantpay Business Wallet?

Instantpay allows you to add funds as per your own will. There is no such limit on the account you want to add.

How long does it take for funds to reflect in my Instantpay Business Wallet after a successful transfer?

Typically, funds transferred via bank transfer or cash deposit are credited to your Instantpay Business Wallet within an hour. However, the processing time may vary based on the funding method, banking hours, and external factors such as bank processing times.

What funding options does Instantpay offer for adding funds to the Business Wallet?

Instantpay offers various funding options tailored to different business needs:

- Bank Transfer: Instantly transfer funds from your linked bank account to your Business Wallet.

- Cash Deposit (CDM): Deposit cash at partner locations using a Karur Vysya card.

- Cash Deposit from Branch: Deposit cash directly from your branch office using IFSC code and bank account details

- Doorstep Cash Collection: Schedule cash collection services at your business premises for added convenience.

Why should I trust Instantpay with my business finances?

Instantpay prioritizes compliance and security, ensuring transparency, accountability, and protection of sensitive financial information. Compliance measures and security protocols are in place to mitigate risks and provide businesses with a trusted platform for managing their finances securely.

How can Instantpay's Business Wallet empower my business finances?

Instantpay's Business Wallet empowers businesses by providing a secure and comprehensive solution with various funding options. It simplifies fund management and ensures compliance and security, allowing businesses to focus on their core operations without financial worries.

Can I withdraw funds from my Instantpay Business Wallet to my bank account?

Yes, Instantpay allows you to withdraw funds from your Business Wallet to your linked bank account. Simply navigate to the withdrawal section in the Instantpay app or website, enter the withdrawal amount, and follow the prompts to initiate the transfer.

What security measures does Instantpay employ to protect my Business Wallet and transactions?

Instantpay employs industry-leading security measures, including encryption technologies, multi-factor authentication, secure servers, and regular security audits. These measures safeguard your Business Wallet and transactions, protecting them from unauthorized access, fraud, and data breaches.

Can I track and monitor my business transactions within Instantpay's Business Wallet?

Yes, Instantpay provides comprehensive transaction tracking and monitoring tools within the Business Wallet. You can view transaction history, monitor incoming and outgoing payments, generate financial reports, and gain insights into your business finances for better decision-making.

0 notes

Text

How to Order ONIC SIM Online Step by Step Guide

Onic Sim Online Online, launched in 2023, is a novel mobile telecom service situated in Pakistan. It stands out as a trailblazing provider offering SIM cards and mobile plans managed exclusively through the ONIC application. Onic Sim is a venture under the ownership of Pak Telecom Mobile Limited, an affiliate of the Government of Pakistan. Step-by-Step Instructions for Ordering ONIC Sim Online

To make an online order, simply follow these straightforward steps:

Visit the official ONIC Pakistan website

Explore ONIC Sim Pakistan’s user-friendly website to discover a diverse range of packages tailored to meet your specific needs. Designed for easy navigation, their website ensures a seamless user experience, simplifying your search for the perfect package.

Browse and Select Your Perfect Package

Discover the perfect plan tailored to your requirements by exploring our diverse range of options. Whether you prioritize ample talk time, generous data allowances, or a balanced combination of both, we have the ideal plan waiting for you.

Please fill out the Online Order Form in its entirety.

After reaching a decision, proceed to the Online Order Form, designed for simplicity and efficiency. To facilitate smooth and prompt delivery, furnish all necessary details along with an accurate delivery address. Registration using the same email ID linked to your Google Play Store account is required.

Choose Your Preferred Payment Method

We suggestion a variety of fee choices to provide to your suitability. Select the one that suits you best, and proceed with your transaction confidently, knowing it’s secure.

Relax and Take Pleasure

Enjoy this relaxing moment while you anticipate the arrival of your ONIC Sim card. Thanks to their efficient delivery process, you’ll soon have your Sim card delivered right to your chosen location.

Price of a new SIM card

For the price of just PKR 300, the plan includes the following terms:

Validity: 30 days

Data: 30GB

Minutes: 500 (all networks)

SMS: 1000 (all networks)

Plan Price: Rs.300/-

Physical SIM Price: Free

Biometric Verification during delivery: Free

Delivery Cities: Karachi, Lahore

Delivery: Free

Introducing Our Latest SIM Packages

This network provides a wide range of daily, weekly, and monthly packages for calls, internet, and SMS. Furthermore, its new SIM packages are affordable and come with attractive incentives, specifically designed for promotional purposes.

The app is accessible solely to residents of Karachi and Lahore.

Access to the app is limited to Android phones.

Features such as E-sim and Keep Your Number are currently unavailable.

The email address used for signing up on ONIC and Google Play must match.

Only debit and credit card payments are accepted during the beta version testing phase.

Upgrade to ONIC App Beta Version

An invitation for beta testing the app on Apple iPhones via Test Flight will soon be dispatched to iOS users. When juxtaposed with Ufone’s pricing of Rs. 2500/- and Jazz’s hefty Rs. 5000/- charge, which lacks transferability, our offering emerges as the most cost-effective eSIM option in Pakistan upon the activation of the eSIM feature within the app. Furthermore, we’ve successfully tested the functionality of a non-PTA phone’s physical ONIC SIM.

Frequently Asked Questions (FAQs) about ONIC SIM:

1. What is a ONIC SIM?

A ONIC SIM is a SIM card issued by the Overseas Pakistanis Foundation (OPF) for Pakistani expatriates. It allows them to stay connected with their homeland while abroad.

2. How can I get a ONIC SIM?

Pakistani expatriates can apply for a ONIC SIM through the OPF office in their respective country of residence. The process usually involves providing necessary documents and fulfilling certain criteria set by the OPF.

3. What are the benefits of a ONIC SIM?

ONIC SIM offers various benefits, including affordable call rates to Pakistan, access to local Pakistani networks, and special packages tailored for expatriates.

4. Can I use a ONIC SIM in any phone?

Generally, ONIC SIM cards are compatible with unlocked GSM phones. However, it’s essential to ensure that your device supports the frequencies used by Pakistani mobile networks.

5. Is a ONIC SIM different from a regular SIM card?

Yes, a ONIC SIM is specifically designed for Pakistani expatriates and offers unique features and benefits tailored to their needs, such as discounted international calling rates and special packages.

6. Can I use a ONIC SIM in Pakistan?

Yes,

Conclusion

In conclusion, ONIC Pakistan offers a seamless online ordering process for their SIM cards, tailored to meet the diverse needs of Pakistani expatriates. With user-friendly navigation and a variety of packages, customers can easily find the perfect plan for them. The affordability, convenience of delivery, and range of services make ONIC SIM cards a compelling option for staying connected with Pakistan, whether abroad or within the country.Flick Radar

#Flick Radar#Tech News#Fashion#Lifestyle#Travel#Business#Sports#Politics#Recipes#Onic SIM#mobile network#esim

1 note

·

View note

Text

A Brief Guide To Alternative Payment Methods

In today's ever-evolving digital market, simply relying on traditional credit card payment solutions may not suffice. That's where Alternative Payment Methods (APMs) step in to offer a more diverse range of options. High Risk merchant solutions specialize in providing tailored APMs, specifically designed to cater to businesses deemed high risk payment processing. This brief guide dives into the world of Alternative Payment Methods (APMs), exploring the growing popularity of these options and how they can benefit your business. APMs can unlock a whole new customer base, streamline your checkout process, and boost your sales in today's dynamic market. Read on.

What Are Alternative Payment Methods?

Alternative payment methods are simply different ways to pay for things besides using credit or debit cards. They offer more options for paying online and can include things like digital wallets (like PayPal or Apple Pay), bank transfers, mobile payments, cryptocurrencies (like Bitcoin), and buy now, pay later plans. These methods give people more choices and make paying for things online easier and more convenient. Furthermore, having an alternative payment methods lets your customers pay as per their preferred way (Whether dealing with high risk payment processing or forex payment processing) which leads to a stronger bond with your customers. However, there are various types of APMs which we will discuss in below section meticulously.

Major Types of Alternative Payment Methods

In the world of online transactions, credit cards have reigned supreme for a long time. However, with the evolving digital landscape and changing consumer preferences, (APMs) are gaining serious ground. These APMs offer multiple options for customers to pay for goods & services. Let's look at some major types of alternative payment methods:

1. Digital Wallets:

Convenience is king! Digital wallets store users' credit card, debit card, or bank account information securely, allowing for swift and hassle-free checkouts. Gone are the days of manually entering details at every purchase. A simple tap or click with your phone using Apple Pay, Google Pay, or PayPal is all it takes.

2. Buy Now, Pay Later (BNPL):

Offering greater flexibility to customers, BNPL services let them split their purchases into smaller, manageable installments. Often, these services come with zero interest charges if the balance is paid within a predetermined timeframe. Klarna and Afterpay are popular examples of BNPL providers.

3. Bank Transfers:

This method offers a direct and secure way to transfer funds. Customers can initiate a direct bank transfer from their bank account to the merchant's account, ensuring a smooth and transparent transaction.

4. Mobile Wallets:

Similar to digital wallets, mobile wallets offer a convenient payment option. However, they are typically linked to a specific telecommunications provider. Users can pay for goods and services by charging the amount to their mobile phone bill, adding a layer of convenience.

5. Cash on Delivery (COD):

This traditional method caters to customers who prefer to pay with physical cash upon receiving their order. While offering a sense of security for some, COD can add logistical complexities for businesses.

Benefits of Alternative Payment Methods:

The key benefits of alternative payment methods are as follows:

1. Convenience:

Alternative payment methods offer users the flexibility to make purchases anytime, anywhere, using their preferred payment option, whether it's a digital wallet, bank transfer, or mobile payment.

2. Security:

Many alternative payment methods use advanced encryption and security protocols to protect users' financial information, reducing the risk of fraud and unauthorized transactions.

3. Accessibility:

Alternative payment methods cater to a wider range of consumers, including those who may not have access to traditional banking services or credit cards.

4. Cost Savings:

Some alternative payment methods offer lower transaction fees or no fees at all, helping businesses reduce their payment processing costs and potentially increase their profit margins.

5. International Reach:

Alternative payment methods often support cross-border transactions, making it easier for businesses to reach global markets and for consumers to shop from international merchants.

Why Should You Consider Alternative Payment Methods?

While credit cards have been the trusty steed of online transactions for a long time, there's a growing herd of (APMs) galloping into the picture. But why should you, as a business owner or entrepreneur, consider offering these new options? Here's a breakdown of the major reasons to embrace APMs:

Expand Your Customer Base:

Not everyone has a credit card, or some might prefer not to use them online. By offering APMs like digital wallets (Apple Pay, Google Pay) or buy now, pay later (BNPL) options (Klarna, Afterpay), you open your doors to a whole new segment of potential customers.

Boost Sales & Reduce Cart Abandonment:

A smooth checkout process is like a frictionless highway to sales conversions. APMs like digital wallets allow customers to pay with a single click, eliminating the hassle of entering card details. This translates to a faster and more convenient experience, reducing cart abandonment rates and leading to more completed purchases.

Enhanced Security Features:

Security is paramount in the online world. Some APMs offer advanced security measures like multi-factor authentication, adding an extra layer of protection against fraud. This not only safeguards your business from financial losses but also instills trust and confidence in your customers.

Catering to Diverse Preferences:

Not everyone fits the same pot. APMs offer a wider range of payment options to cater to individual preferences. Whether a customer prioritizes speed (digital wallets), flexibility (BNPL), or the familiarity of cash on delivery (COD), APMs provide the freedom to choose from, leading to a more satisfying customer experience.

Conclusion:

In a gist, embracing APMs is crucial in today's evolving digital landscape. While credit card payment solutionshave been the norm, APMs offer a plethora of benefits. From a successful high risk payment expanding your customer base to reducing cart abandonment rates, these methods enhance convenience, security, and accessibility for both businesses and customers. By considering APMs, you are not just adapting to change but also positioning your business for sustained growth and success in the competitive online marketplace.

Source url: https://paymentsprocessing.blogspot.com/2024/03/a-brief-guide-to-alternative-payment.html

0 notes

Text

Login to Tivit Bet online casino

Access to a quality casino is key for many players. In this context, Tivit Bet acts as a safe gaming space. The establishment offers a convenient platform for games and bets. First you need to log into the casino.Let's look at the steps to login to Tivit Bet. Registration consists of several steps.

Tivit Bet platform

Tivit Bet at the link: https://tivitbets.in/ provides unique opportunities for gambling and betting lovers. The main focus, of course, is on the casino. The platform offers interesting sporting events. This creates a unique combination of entertainment.

After logging in, you are taken to an attractive interface. It features an extensive catalog of casino games and upcoming sporting events. This provides users with a wide variety of entertainment options. Enjoy a variety of content in real time.

Tivit Bet has extensive betting functionality. Place bets on your favorite sports. View statistics are available to make more informed decisions.

The Tivit Bet platform divides its content into gaming and sports sections. The Sports section offers an extensive list of events with detailed information. This allows you to bet on your favorite teams or sporting events. Live gaming tables are available in the gaming section.

Tivit Bet provides many entertainment options. The platform provides its users with a wide selection of content. Enjoy sporting events in a convenient format.

Account registration

Registering with Tivit Bet is a simple process. Here's a step-by-step guide:

Go to the official Tivit Bet website.

On the Tivit Bet home page, find the registration button.

Fill out the registration form. Provide personal information about yourself. You will also need to choose a unique username. Create a password for your account.

Once completed, the platform will send you a confirmation email to your email address. Go to your email and find an email from Tivit Bet. Inside the email you will find a link to verify your account. Click on it to complete.

Once your account is verified, you will be able to log into your account on the Tivit Bet website. You will have access to all games and casino services.

Authorization on the site

Authorization gives access to all the functionality of the Tivit Bet platform. This process is quite user friendly. Here's how you can log in to the Tivit Bet website:

💥Step 1

Official site

Open your web browser. Enter the Tivit Bet website address.

✨Step 2

Login button

After loading the main page of the site, you will see a button to log in. Click on it.

⚡Step 3

Enter your credentials

Enter your username and password. You indicated them when registering on the Tivit Bet website.

🧨Step 4

Login confirmation

After entering your credentials, confirm your login.

⭐Step 5

Account access

You will be redirected to the Tivit Bet home page. Enjoy casino games and place bets. Use all other functions of the site.

The security of your account is very important. Make sure you use a strong password. Do not share your credentials with anyone.

Payment methods

Tivit Bet offers convenient payment methods. The platform provides maximum comfort for its clients. Here are some of the most popular:

Credit and debit cards

Tivit Bet accepts Visa and Mastercard payments. This is one of the most common methods for many users.

Mobile payments

Modern mobile payment applications are available here: Google PayPhonePe and PayTM. These apps make fast payments through mobile devices.

UPI

This is a popular payment system in India. It provides instant online transfers between bank accounts. Tivit Bet has UPI support for the convenience of its customers in India.

Cryptocurrencies

Tivit Bet allows you to pay using cryptocurrency. These payments provide a high level of anonymity and security.

The payment system on the Tivit Bet platform is able to satisfy user preferences. You can be confident in the safety of transactions on the Tivit Bet website.

Best slots

Tivit Bet offers the best slots. Their catalog is small but varied. The platform offers players a wide selection of slot machines. Here are a few of the most popular:

Age of the Gods

This slot will take you to the exciting world of ancient Greek mythology. Battle the gods and win great prizes.

Gates of Olympus

Immerse yourself in the world of the gods in this exciting slot.

XXXtreme Lightning Roulette

One of the most exciting roulette variants. Every spin can bring you huge winnings.

White King

Plunge into the world of wild nature. Exciting adventures await you!

Green Lantern

This slot will take you into the world of superheroes and battles.

Batman & The Joker Jewels

The slot offers exciting gameplay and huge winnings.

Cat Queen

Immerse yourself in the world of ancient Egyptian mysteries and secrets.

On the Tivit Bet platform, you can easily filter games by different themes. Don't forget to use the Tivit Bet bonus. It will increase your chances of winning!

0 notes

Text

Step-by-Step Guide: How to Purchase Crypto Using a Crypto Wallet

In recent years, cryptocurrencies have garnered significant attention as a lucrative investment opportunity. For beginners looking to dip their toes into the world of digital assets, understanding how to purchase crypto using a crypto wallet is crucial. In this step-by-step guide, we'll walk you through the process, from setting up your wallet to making your first purchase.

1. **Choose a Reliable Crypto Wallet**: The first step in purchasing crypto is selecting a reputable crypto wallet. There are various types of wallets available, including hardware wallets, software wallets, and mobile wallets. Research different options and choose one that aligns with your preferences and security needs.

2. **Set Up Your Wallet**: Once you've selected a wallet, follow the instructions to set it up. This typically involves creating an account, securing your private keys, and verifying your identity, depending on the platform's requirements. Be sure to use strong passwords and enable additional security features like two-factor authentication to protect your funds.

3. **Verify Your Identity (if required)**: Some platforms may require users to undergo a verification process to comply with regulatory requirements. This usually involves submitting identification documents such as a driver's license or passport. Follow the instructions provided by the platform to complete the verification process.

4. **Add Funds to Your Wallet**: With your wallet set up, it's time to add funds to it. You can usually do this by linking your bank account or credit/debit card to your wallet and initiating a transfer. Alternatively, you can purchase crypto from a peer-to-peer exchange or a cryptocurrency ATM and transfer it to your wallet.

5. **Research and Choose Your Cryptocurrency**: Before making a purchase, take the time to research different cryptocurrencies and their investment potential. Consider factors such as market trends, technology, and the project's team behind the cryptocurrency. Once you've chosen a cryptocurrency to invest in, proceed to the next step.

6. **Purchase Crypto**: Using your wallet, navigate to the buy/sell section and select the cryptocurrency you wish to purchase. Enter the amount you want to buy and review the transaction details, including fees and exchange rates. Once you're satisfied, confirm the transaction to initiate the purchase.

7. **Store Your Crypto Securely**: After completing the purchase, your crypto will be deposited into your wallet. Ensure that you store your crypto securely by keeping your private keys safe and implementing best security practices. Consider using a hardware wallet for an extra layer of protection, especially if you're holding a significant amount of crypto.

8. **Monitor Your Investment**: Congratulations! You've successfully purchased crypto using your crypto wallet. Now it's essential to monitor your investment regularly and stay informed about market developments. Consider setting price alerts and keeping track of your portfolio's performance using portfolio management tools or cryptocurrency tracking apps.

In conclusion, purchasing crypto using a crypto wallet is a straightforward process that can be completed in a few simple steps. By choosing a reliable wallet, conducting thorough research, and implementing proper security measures, beginners can start their crypto journey with confidence. Remember to stay informed, exercise caution, and only invest what you can afford to lose. Happy investing!

0 notes

Text

A Comprehensive Guide to MPO777 Registration: How to Sign Up and Start Playing

MPO777 is a popular online gambling platform offering a wide array of casino games and sports betting opportunities. With its user-friendly interface and diverse gaming options, MPO777 attracts players from around the world. If you're looking to join the excitement and thrill of online gambling on MPO777, this comprehensive guide will walk you through the registration process step by step. mpo777 daftar

Step 1: Accessing the MPO777 Website

The first step to register on MPO777 is to access their official website. You can do this by typing "MPO777" into your preferred search engine or by directly entering the website's URL into your browser's address bar.

Step 2: Creating an Account

Once you're on the MPO777 website, locate the "Sign Up" or "Register" button, usually located prominently on the homepage. Click on it to initiate the registration process.

Step 3: Providing Personal Information

To create your MPO777 account, you'll need to provide some personal information. This typically includes your full name, email address, phone number, date of birth, and a username/password combination. Make sure to use accurate information, as it will be used for verification and account management purposes.

Step 4: Verifying Your Account

After providing your personal information, MPO777 may require you to verify your account. This usually involves clicking on a verification link sent to the email address you provided during registration. Follow the instructions in the email to complete the verification process.

Step 5: Making a Deposit

Once your account is verified, you'll need to make a deposit to start playing. MPO777 supports various payment methods, including credit/debit cards, e-wallets, and bank transfers. Choose the payment method that suits you best and follow the instructions to make your deposit.

Step 6: Exploring the Games

With your account funded, you're now ready to explore the wide range of games offered on MPO777. Whether you're into slots, table games, or sports betting, MPO777 has something for everyone. Take your time to browse through the available options and find the games that pique your interest.

Step 7: Responsible Gaming

As you start playing on MPO777, it's essential to practice responsible gaming. Set a budget for yourself and stick to it, avoid chasing losses, and take regular breaks to avoid fatigue. Remember that gambling should be a form of entertainment, and it's essential to gamble responsibly. mpo777 daftar

Conclusion:

Signing up for MPO777 and starting to play is a straightforward process that can be completed in just a few easy steps. By following this comprehensive guide, you'll be able to create your account, make a deposit, and start enjoying the exciting world of online gambling on MPO777. Remember to gamble responsibly and have fun!

0 notes

Text

How can I most quickly sell all my Robinhood stock at once?

To quickly sell all your Robinhood stock at once, follow these steps:-

Open Robinhood App/Web: Log in to your Robinhood account through the app or website.

Navigate to Portfolio: Go to the "Portfolio" section to see all your holdings.

Select Sell: Find the option to sell your stock. This is usually represented by a "Sell" button or icon.

Choose Quantity: Instead of selecting individual stocks, look for an option to sell all your shares at once. Robinhood usually offers the option to sell all shares with a single transaction.

Confirm Sale: Once you've selected the option to sell all your shares, review the details of the transaction carefully. Ensure that you're selling the correct stock and quantity.

Execute Sale: Confirm the sale to execute the transaction. Your shares will be sold, and the proceeds will be reflected in your account balance.

Monitor Confirmation: After the sale, check for a confirmation message or email from Robinhood to ensure that the transaction was completed successfully.

By following these steps, you can quickly sell all your Robinhood stock at once without having to individually sell each share. However, keep in mind that market conditions may affect the speed of the transaction and the price you receive for your shares.

I sold stock on Robinhood where is my money

Following a sale in your brokerage or retirement account for equities or options, the transaction usually needs to settle before you can withdraw the proceeds to your bank account. The settlement period for equities is the trade date plus 2 trading days (T+2), sometimes referred to as regular-way settlement.

How long does it take to get your money after selling a stock on Robinhood?

T+2 Settlement Rule for Stocks and ETFs: When you sell stocks on Robinhood, the proceeds from the sale go through a settlement period, which takes two business days (T+2). So, if you sell a stock on Monday, the cash from that sale will settle in your account on Wednesday.

Where does my money go when I sell stock on Robinhood?

Once the funds from your sold stock are settled and available in your Robinhood account, you have the option to withdraw the money to your linked bank account or reinvest it in other stocks or investment options on the platform. You can initiate a withdrawal by following the instructions within the app or website.

Why can't I withdraw all my money from Robinhood?

Users may occasionally encounter problems when withdrawing funds from Robinhood following a sale. It can be due to restrictions such as unresolved funds from recent transactions. Before attempting to withdraw, ensure all your recent trades are settled.

What does it cost to cash out of Robinhood?

Withdrawals. When withdrawing money from your spending or brokerage account, it depends on what type of account you're transferring money to: Standard bank transfer: No fee for withdrawals. External debit card account: Withdrawals have up to a 1.75% fee based on the amount being transferred out.

How to withdraw money from Robinhood?

Withdrawing money from your Robinhood account is a straightforward process. Here's how to do it:

Open the Robinhood App or Website: Login to your Robinhood account using the mobile app or website.

Access Account Settings: Navigate to the account settings section. On the app, you can typically find this by tapping on your profile icon at the top left corner of the screen. On the website, look for a similar option in the menu.

Select Banking or Transfers: Once in the account settings, find the option related to banking or transfers. This is where you'll manage your deposits, withdrawals, and linked bank accounts.

Link a Bank Account (If Not Already Linked): If you haven't already linked a bank account, you'll need to do so to withdraw funds. Follow the prompts to link your bank account securely.

Initiate Withdrawal: Choose the option to withdraw funds from your Robinhood account. You'll typically have the choice between a standard transfer (which may take a few days) or an instant transfer (which may come with a fee).

Enter Withdrawal Amount: Specify the amount of money you want to withdraw from your Robinhood account. Make sure you have sufficient funds available for withdrawal.

Review and Confirm: Review the withdrawal details, including the amount and destination bank account. Ensure that all information is accurate before confirming the withdrawal.

Authenticate Transaction (if required): Depending on your account security settings, you may need to authenticate the withdrawal using a verification method such as a PIN or biometric authentication.

Monitor Withdrawal: After confirming the withdrawal, monitor your account for updates. You should receive a confirmation of the withdrawal, and the funds will be transferred to your linked bank account according to the withdrawal method you selected.

By following these steps, you can easily withdraw money from your Robinhood account. Remember to consider any applicable fees and withdrawal processing times.

0 notes