#Revenue Department

Text

#bcreservation#Formpublicbuilding#Governmentcertificate#legaldocuments#licencesforpublicbulding#Publicbuildinglicence#ReservationinTamilNadu#revenuecertificates#revenue department#TamilNadupublicbuilding

0 notes

Text

CM ROLLS OUT ANOTHER CITIZEN CENTRIC INITIATIVE BY LAUNCHING WEBSITE TO ENROLL KHANGI TAQSEEM (FAMILY PARTITION)

CM ROLLS OUT ANOTHER CITIZEN CENTRIC INITIATIVE BY LAUNCHING WEBSITE TO ENROLL KHANGI TAQSEEM (FAMILY PARTITION)

MOVE AIMED AT FACILITATING THE PEOPLE FOR SUBMITTING APPLICATIONS REGARDING KHANGI TAQSEEM THROUGH A SINGLE CLICK

Chandigarh, October 12-

In a significant decision aimed at facilitating the citizens of the state by digitalizing the functioning of the Revenue Department, the Punjab Chief Minister Bhagwant Mann on Wednesday launched a website to further streamline the process to enroll Khangi…

View On WordPress

0 notes

Text

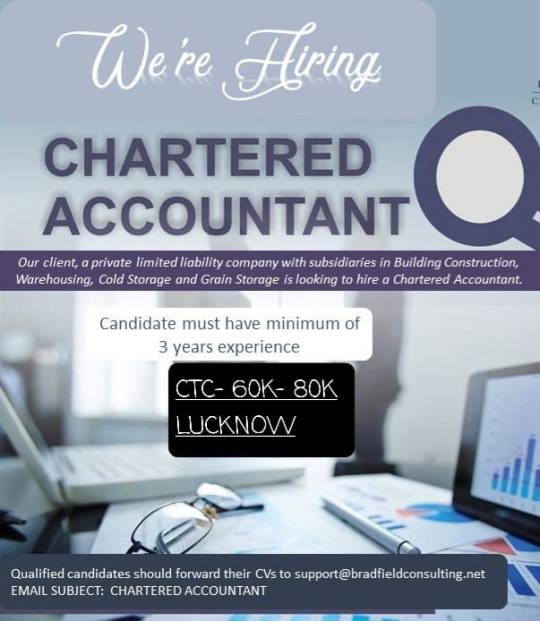

Call at 7355656798

Description, Duties, Responsibilities

Post- Accountant. Vacancy- 3. Experience - 2 -3 years. Location - Maharashtra/ Baijnath. CTC - 2 Lakh to 2.5 Lakh.

Education Qualification

Key Skills:

Should be perfect in Tally and GSTN.

Core skills include :

-TALLY and GSTN.

-Taxation, regulatory compliance, budgeting and forecasting.

-Supervised internal and external audit.

-Adept at analytics and in-depth reporting service.

-Maintain accuracy of general, revenue, and expenditure ledgers and subsidiary financial systems.

-Reconcile financial ledgers and records, prepare financial statements and reports, ledgers, research and resolve discrepancies.

-Review and audit all accounts payable, purchase orders, cash receipts, utility billing, and other accounting records and transactions; ensure money is posted to correct.

#tallyoncloud#tallysolutions#gst return filing#gst compensation#gst slabs#account#accountant#promote#consulting#payroll#content#audit#chartered engineer#career#recuitment#management#taxation#budgeting#revenue department#revenue collections

0 notes

Text

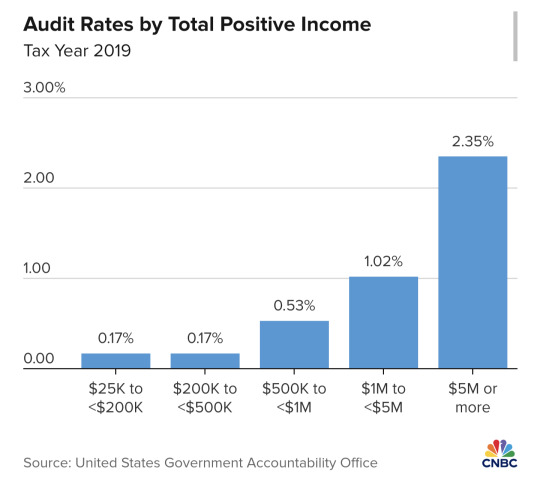

The nation’s millionaires and billionaires are evading more than $150 billion a year in taxes, adding to growing government deficits and creating a “lack of fairness” in the tax system, according to the head of the Internal Revenue Service.

The IRS, with billions of dollars in new funding from Congress, has launched a sweeping crackdown on wealthy individuals, partnerships and large companies. In an exclusive interview with CNBC, IRS Commissioner Danny Werfel said the agency has launched several programs targeting taxpayers with the most complex returns to root out tax evasion and make sure every taxpayer contributes their fair share.

Werfel said that a lack of funding at the IRS for years starved the agency of staff, technology and resources needed to fund audits — especially of the most complicated and sophisticated returns, which require more resources. Audits of taxpayers making more than $1 million a year fell by more than 80% over the last decade, while the number of taxpayers with income of $1 million jumped 50%, according to IRS statistics.

“When I look at what we call our tax gap, which is the amount of money owed versus what is paid for, millionaires and billionaires that either don’t file or [are] underreporting their income, that’s $150 billion of our tax gap,” Werfel said. “There is plenty of work to be done.”

“For complex filings, it became increasingly difficult for us to determine what the balance due was,” he said. “So to ensure fairness, we have to make investments to make sure that whether you’re a complicated filer who can afford to hire an army of lawyers and accountants, or a more simple filer who has one income and takes the standard deduction, the IRS is equally able to determine what’s owed. And to us, that’s a fairer system.”

Some Republicans in Congress have ramped up their criticism of the IRS and its expanded enforcement efforts. They say the wave of new audits will burden small businesses with unnecessary bureaucracy and years of fruitless investigations and won’t raise the promised revenue.

The Inflation Reduction Act gave the IRS an $80 billion infusion, yet congressional Republicans won a deal last year to take $20 billion of the funding back. Now they’re pressing for further cuts.

The Treasury Department said last week it estimates greater IRS enforcement will result in an additional $561 billion in tax revenue between 2024 and 2034 — a higher projection than it had initially stated. The IRS says that for every extra dollar spent on enforcement, the agency raises about $6 in revenue.

The IRS is touting its early success with a program to collect unpaid taxes from millionaires. The agency identified 1,600 millionaire taxpayers who have failed to pay at least $250,000 each in assessed taxes. So far, the IRS has collected more than $480 million from the group “and we are still going,” Werfel said.

On Wednesday, the agency announced a program to audit owners of private jets, who may be using their planes for personal travel and not accounting for their trips or taxes properly. Werfel said the agency has started using public databases of private-jet flights and analytics tools to better identify tax returns with the highest likelihood of evasion. It is launching dozens of audits on companies and partnerships that own jets, which could then lead to audits of wealthy individuals.

Werfel said that for some companies and owners, the tax deduction from corporate jets can amount to “tens of millions of dollars.”

Another area that is potentially rife with evasion is limited partnerships, Werfel said, adding that many wealthy individuals have been shifting their income to the business entities to avoid income taxes.

“What we started to see was that certain taxpayers were claiming limited partnerships when it wasn’t fair,” he said. “They were basically shielding their income under the guise of a limited partnership.”

The IRS has launched the Large Partnership Compliance program, examining some of the largest and most complicated partnership returns. Werfel said the IRS has already opened examinations of 76 partnerships — including hedge funds, real estate investment partnerships and large law firms.

Werfel said the agency is using artificial intelligence as part of the program and others to better identify returns most likely to contain evasion or errors. Not only does AI help find evasion, it also helps avoid audits of taxpayers who are following the rules.

“Imagine all the audits are laid out before us on a table,” he said. “What AI does is it allows us to put on night vision goggles. What those night vision goggles allow us to do is be more precise in figuring out where the high risk [of evasion] is and where the low risk is, and that benefits everyone.”

Correction: The IRS has collected $480 million from a group of millionaire taxpayers who had failed to pay. An earlier version misstated the amount collected.

#us politics#news#cnbc#2024#irs#internal revenue service#Danny Werfel#taxes#tax evasion#private jets#audits#Inflation Reduction Act#treasury department#Large Partnership Compliance#eat the rich#tax the rich#tax the 1%

15 notes

·

View notes

Text

#us politics#2022#memes#shitpost#donald trump#mar a lago#fbi#fbi raid#president joe biden#biden administration#dark brandon#irs#internal revenue service#department of justice

71 notes

·

View notes

Text

My Tav is just running around with somebody’s BGDOR Correspondence letter in their bag next to the prism.

7 notes

·

View notes

Text

Everything is legal if you don't do your taxes

#be gay do crimes#go on the run from the law#if you don't do your taxes they can't get ya#arson?#legal#robbery?#tis legal#breaking and entering?#that too#tax fraud?#babygirl you already know what i'm going to say#text post#for all intents and purposes this is a joke#internal revenue service#they're doing their best#their entire department was gutted so they can't properly enforce the law upon people who abuse the tax system#aka rich people#tax the rich#don't trust turbotax#they legally have to provide a free option of filing your taxes#but they hide it from general searches and redirect you to a page full of paywalls#the irs has a page on their website of places you can file for free#otherwise#(don't) commit tax fraud

6 notes

·

View notes

Text

Oregon Department of Revenue delinquent taxpayer list.

https://revenueonline.dor.oregon.gov/tap/_/#1

1 note

·

View note

Text

Anyway, so they just posted some revenue analyst positions at work. (This is the job title those of us working on the former revenue integrity team were promised; anyway, I did a whole long rant about what a clusterfuck that all turned out to be.) I found out yesterday by asking my supervisor if she had any update on the positions and whether they had been posted, and she said they had just posted the analyst roles, but the idea was for the manager to be hired first, so they could be involved in the hiring process. I had been hemming and hawing about applying but was leaning toward doing so even though I figured I had about a 2% chance of making the team (there are only four openings, and even if the only candidates are from the old team, that’s around fifteen people, some of whom have waaaaay more experience and credentials than me). Honestly, I need to update my resume, and I’ve been procrastinating it, so like 80% of my motivation for applying was to force myself to finally do that. Plus, if I don’t apply, I have 0% chance of getting an analyst position.

I was honestly a bit down yesterday. My eval went really well; I have no complaints there. I’m even getting a bonus out of it. But realizing they had posted the positions and there were so few was deflating. I figured there was no harm in throwing my application on the pile, but that it would likely come to nothing unless most of the applicants were people with lower job titles than my own. This is high level work and I’ve only been here three years, and there will likely be employees applying who have been here for decades. Also, one of the reasons I was so pissed about my earlier work rants was not just because it was a lot of getting jerked around while management was a revolving door, but because I really wanted an analyst role; it’s not only a promotion, but work that I enjoy.

Then I get a call earlier this evening from my first boss, the one who hired me originally to the department (I’m on my fourth supervisor since October, to give a really quick summary of the upheaval in our department), who is now the head of the revenue cycle. She wants to know if I’ve had time to check our job listings and see that the analyst roles have been posted. I said I hadn’t seen them, but I had learnt through my supervisor that they had just been posted. She says she really strongly encourages me to apply because I have always excelled in everything I’ve ever been handed and that I have great aptitude and she really thinks this would be an excellent position for me, and that she will personally back me as a candidate. Which. Kind of sounds like if I want an analyst role, I’ve pretty much got one. She’s the head of the revenue department now. Even if she gives the manager of the team absolute final say no matter what, the manager is someone she’ll be hiring, they’re probably not going to go, “Hey, I know you’ve got a lot of experience in this and you’re my boss and you’re personally recommending this person, but pound sand because I refuse to hire them.”

Anyway, this validation is very delicious.

#personal#i kind of wonder if she already has in mind who she wants for the team#i dunno#the validation was very nice#but also i really really respect her#and knowing that after all the people she's worked with#she personally wants me as one of four people for a team that will be involved in analyzing and troubleshooting issues across#the entire revenue department#was just a huge confidence booster#i'm sure my imposter syndrome will be along in a minute to be like 'hey just curious how you tricked her into thinking you're competend'#lmao

11 notes

·

View notes

Text

ગુજરાત મહેસુલ વિભાગમાં 6000 પોસ્ટ પર ભરતી

સ્પર્ધાત્મક પરીક્ષાની તૈયારી કરતા ઉમેદવારો માટે સારા સમાચાર:ગુજરાત મહેસુલ વિભાગમાં ૬૦૦૦ પદો પર ભરતી

Gujarat Revenue Department Bharati 2023

સ્પર્ધાત્મક પરીક્ષાની તૈયારી કરતા ઉમેદવારો માટે સારા સમાચાર સામે આવ્યા છે. ગુજરાતમાં ટૂંક સમયમાં 500 કે 1000 નહીં પરંતુ 6000 પદો પર બમ્પર ભરતી કરવામાં આવશે. હેડ ક્લાર્ક, જુનિયર ક્લાર્કની ભરતીને લઈને ગૌણ સેવા પસંદગી મંડળના સચિવ હસમુખ પટેલે મહત્વની માહિતી આપી…

View On WordPress

0 notes

Text

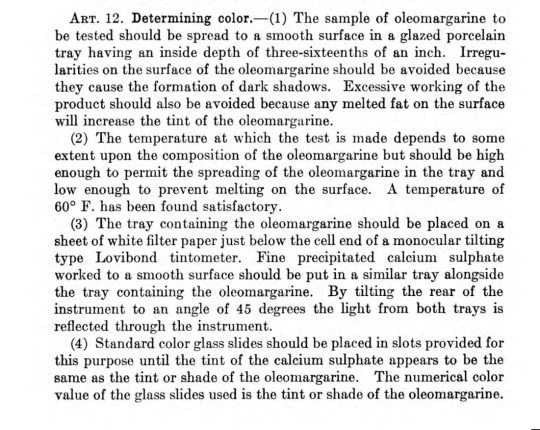

Regulations no. 9

Citation: United States. Office of Internal Revenue. (1936). Regulations no. 9 relating to the taxes on oleomargarine, adulterated butter and process or renovated butter under the acts of August 2, 1886 (24 Stat., 209), May 9, 1902 (32 Stat., 193), August 10, 1912 (37 Stat., 273), October 1, 1918 (40 Stat., 1008), July 10, 1930 (46 Stat, . 1022), March 4, 1931 (46 Stat., 1549) and February 24, 1933 (47 Stat., 902) Revised April 1936. Washington: U.S. Govt. print. Off.

Full text available via HathiTrust

Description: A report from the Bureau of Internal Revenue, summarizing the tax on oleomargarine, first enacted in 1886 and revised several times since then. Now in a report of the many tedious regulations for the original act and its revisions.

“[In regards to testing the coloring of oleomargarine, Art. 12 of 1886 tax] (7) The porcelain trays used in this test must be of the type generally used with the Lovibond tintometer for matching colors of powders”

The most interesting report I have found as there is intense detail on the definitions of butter and margarine. This seems to be a turning point in the production and distribution of food in the United States, as non-organic and processed preservatives are introduced to the food culture for the first time.

2 notes

·

View notes

Text

#bc reservation#Chief minister scheme#cmupt#Farmers Security Scheme#Government certificate#Reservation in Tamil Nadu#revenue certificates#revenue department#SFRBC#uzhavar pathukappu thittam

0 notes

Text

REVENUE STAFF CALLED OFF STRIKE AFTER ASSURANCE BY PUNJAB GOVERNMENT

REVENUE STAFF CALLED OFF STRIKE AFTER ASSURANCE BY PUNJAB GOVERNMENT

Chandigarh, June 8:

Following the assurance of Punjab Government led by Chief Minister S. Bhagwant Mann, the staff of Revenue Department, on Wednesday, called off their strike.

On the directions of the Chief Minister, Punjab Revenue Minister Mr. Bram Shanker Jimpa held a meeting with Punjab Revenue Officers Association here at Punjab Civil Secretariat-1.

While listening to their grievances,…

View On WordPress

#Bhagwant Mann#Bram Shanker Jimpa#brightpunjabexpress#PunjabChiefMinister#Punjabgovernment#Revenue department#strike.

0 notes

Text

Investigative Agencies of India

Know About The Investigative Agencies Of India

Any country that values its safety and defense establishes a significant focus on having top-notch intelligence expertise. There are numerous intel organizations in our country, specializing in different....

(more…)

View On WordPress

#12. Bureau of Police Research and Investigation (BPR&D)#Central Bureau of Investigation (CBI)#cid#CID India#crime investigation department#Deffence intelligence agency#Directorate of Enforcement#Directorate of Revenue Intelligence#indian investigative agency#intelligence bureau#Investigative agency of India#Joint Cipher Bureau#Narcotics Control Bureau#NatGrid#National counter terrorism center#National Crime Record Bureau#national intelligence grid#national investigative agencies (NIA)#research and analysis wing (RAW)#serious fraud investigation office

2 notes

·

View notes

Text

Ultrawealthy Americans enjoy so many ways to avoid taxes that Gary Cohn, former President Donald Trump’s director of the National Economic Council, once wisecracked, “Only morons pay the estate tax.”

On Monday, a group of four Democratic senators urged Treasury Secretary Janet Yellen to crack down on a host of specially-designed trusts and financial vehicles that allow the wealthiest individuals to shield their personal fortunes and pass down massive inheritances tax-free.

The letter, from Sens. Elizabeth Warren, Bernie Sanders, Chris Van Hollen, and Sheldon Whitehouse, laid out a series of potential IRS regulations that would make trusts, particularly, less attractive as tax shelters for the 1%.

“Billionaires and multi-millionaires use trusts to shift wealth to their heirs tax-free, dodging federal estate and gift taxes,” the senators wrote. “And they are doing this in the open: Their wealth managers are bragging about how their tax dodging tricks will be more effective in the current economy.”

Only about 0.1% of Americans pay estate taxes, despite thousands of families having fortunes larger than the current $25.48 million exemption.

When President Joe Biden promised on the campaign trail to raise taxes on the richest Americans, it unleashed a race to set up the kinds of legal tax shelters that would protect their inheritable assets from the estate tax.

They feared Biden would lower the estate tax exemption — which Republicans under Trump had raised to its all-time high — and resuscitate proposed IRS rules that make it more difficult to use trusts to avoid taxes on substantial inheritances.

But Democrats dropped their plans to raise inheritance taxes early on in the Biden administration. And in their letter, the lawmakers argued there is far more the IRS can do to crack down on the “shell games” the ultrawealthy use to shield huge generational wealth transfers from taxation.

Popular schemes they highlighted include families using special vehicles, called family limited partnerships, to understate the values of their estates; placing assets that will rise in value, such as a stock portfolio, inside a tax-shielded trust before the price can rebound; and cycling stocks and other assets through a grantor trust to avoid inheritance taxes.

The current economy, where stocks have lost double digits in value, actually supercharges some of these tax shelters because they shield appreciation from taxation.

“As the richest Americans celebrate and take advantage of these favorable tax opportunities, middle-class families struggle with inflation and Republicans threaten austerity measures and the end of Social Security and Medicare,” the lawmakers wrote.

They argued that the Treasury Department could crack down on these tax-avoidance vehicles without action from Congress.

It can revoke a rule that currently exempts transfers between grantors and grantor trusts from taxes, and it can require grantor trusts to hold a minimum value so they would be less useful as a pass-through for avoiding taxes. And it can clarify and rein in the kinds of asset sales and valuation practices tax planners have abused to wedge their clients’ enormous estates into various tax-shielded trusts and partnerships.

“Although the details of various trusts may differ, the result of wealthy individuals transferring millions in assets to heirs tax-free does not,” they continued. “The ultra-wealthy at the top of the socioeconomic ladder live by different rules than the rest of America.”

#us politics#news#huffington post#2023#tax the rich#tax the 1%#tax the wealthy#janet yellen#department of treasury#sen. elizabeth warren#sen. bernie sanders#sen. Chris Van Hollen#sen. sheldon whitehouse#irs#internal revenue service#estate taxes#tax shelters#biden administration

71 notes

·

View notes

Text

Remember the Chicago Bears $5 billion entertainment district? Bears now claim the land is "residential"

Several months ago, I wrote a short post on the Chicago Bears being angry at city officials for thinking the city could tax them just like everyone else. To catch everyone up on the story, the Bears bought property in Arlington Heights for $197 million in 2022. This year, the county assessor put a value on that land reflecting the amount paid by the Bears. This angered the team because they…

View On WordPress

#Arlington Heights#Athletic#Chicago#Chicago Bears#Chicago Tribune#Craig&039;s Chicago Business#Department of Revenue#Entertainment District#Illinois#Property Tax#Solider Field#Statista

1 note

·

View note