#KKRs

Text

#KKR's Andre Russell BREAKS Massive Sachin Tendulkar IPL Batting Record | Cricket News #TATAIPL #IPL24

#IPL24 #

In a spectacular display of power-hitting, Kolkata Knight Riders (KKR) all-rounder Andre Russell surpassed the legendary Indian cricketer Sachin Tendulkar in the all-time run-scoring charts of the Indian Premier League (IPL). This milestone was achieved during the IPL match against Delhi Capitals (DC) in Visakhapatnam. Russell, aged 35, showcased his vintage prowess during the game by…

View On WordPress

0 notes

Text

The long, bloody lineage of private equity's looting

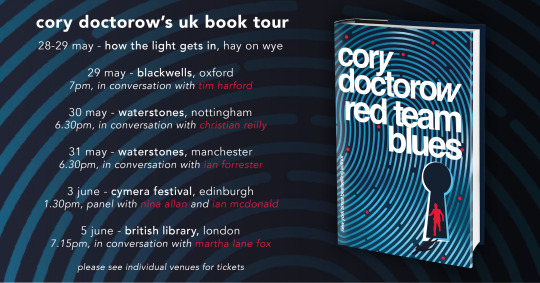

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

@pscentral event 17: vibrance

KOHATSU KOKORO

PSYCHIC FEVER from EXILE TRIBE

template

#kohatsu kokoro#psychic fever from exile tribe#userdramas#jpopnetedit#jpopedit#usermare#usergooseras#userfext#psychic fever#exile tribe#jpop#flashing tw#m.gif#*psyfe#*kkr#psc#i did not plan this but here i am 6 hours later

118 notes

·

View notes

Text

MY LITTLE HARA BHARA KEBABS MIGHT WIN TODAYYY?!?!?!

15 notes

·

View notes

Text

My thoughts on the current ipl points table that absolutely no one asked for :

(part-1)

1. They're the og champions...very chill, very fun vibes.

soo happy to see them on top. They really be feeling like royalty rn lol.

Also in the end, I'm just a girl 🎀💖 some I absolutely adore their jersey.

2. Yaar.... I know Hyderabad is a great team and everything but.... Do you guys have to go this hard?

Other teams come to play a match, this team comes to crack open your morale and bring you to your knees.

Baki teams khel rahi hai, Yeh log toh seedha gunda gardi kar rahe hai Yaar.

Watching Abhishek, our Indian player, a youngster, bat like that feels amazing tho.

3. Kolkata.... Man.

Gautam bhai aaye, and suddenly Sabka Chris Gayle bahar aagya.

I feel like sunil will take both purple and orange caps this year and gambhir bhai has already planned on picking the trophy this year so... Yea.

PS : once gautam bhai is done someone pls convince him to come as ICT's coach.

4. Chennai = 7 letters = thala for a reason.

They're doing great, but their recent performances makes me worried about what will happen to this team when Mahi Bhai retires.

If they don't start taking more responsibility now there's a good chance csk will crash land in the bottom next year. Hope thT doesn't happen tho.

5. LSG, you beauty....

They look like they are a weak team but they've defeated rcb, gt, pbks and...sabse importantly.... CSK.

But their next matches are quite tough too... So we'll see where they end up after 2 - 3 more matches.

The way kl Rahul hits sixes is just beautiful.

6. Mumbai.

I...... Have no idea what mysterious substance this management was on tbh.

If you want to remove someone from the captaincy, there's gotta be a better way to do that so the fans aren't offended and the player also isn't disrespected. Look how kohli left rcb's captaincy for example.

Then, if you wanted to look towards the future, Bumrah and Surya, both who have captained team India and have stayed with the franchise despite having so many opportunities to earn more if they leave should have been considered.

Or they could have just choosen Ishan. Just like csk and gt choose youngsters, Ishan could have been a good option too. Plus He's captained his team during u-19 in 2016.

But no. They choose Hardik.

Tbh, I feel so sorry for him cause in his mind, when MI offered him captaincy and called him back, he would have been happy to go back to his old team...like going back home.

But the sad truth is, MI management saw how successful he was in gt, winning in the first year and then reaching the finals in 2nd year....and it pissed them off that their player is doing well in some other team. So they brought him back.

Despite so much backlash from fans, so much hatred and trolling against Hardik, this shitty management never held one press conference to clear up misunderstandings and give answers to their fans honestly. Because they knew, if the truth comes out, they'll be on the receiving end of this hate.

Fuck them.

The only mistake Hardik did was leaving gt. But... Oh well.

(I ended up ranting lol.)

#desiblr#indian cricket team#ict#cricket#ipl2024#ishan kishan#ishman#shubhman gill#hardikpandya#kl rahul#rohitsharma#csk#kkr#rr#mi#ms dhoni#gautamgambhir#srh#pat cummins#lsg

12 notes

·

View notes

Text

*any csk batsman gets out*

csk fans: oh no

*ms dhoni on the field*

the entire stadium: OH YES

#csk#ipl#ipl2024#csk vs kkr#desi#desiblr#just desi things#it always happens#ms dhoni#msd#the man the myth the legend himself

11 notes

·

View notes

Text

cannot hate anymore on RCB rn than I already am 🤧

#im a fan but nahi this is just undone#like what are you guys doing? absolutely “nothing”#aisa kaun karta hai yaar kuch bhi nahi karte ho- phir din bhar troll hote ho and raat ko humiliating way se haarte ho#i demand more from you as a team#ye kuch bhi chala raha and ab I can't take it 😭#rcbfans#rcb vs kkr#ipl2024#ipl24#royal challengers bangalore#royal challengers bengaluru#viratkohli#rcb#desiblr#indian premier league#ipl

11 notes

·

View notes

Text

Just opened the match and Jadu bhaiya took a wicket 🤌🤌🤌🤌🤌🤌

#kya matlab main lucky charm hu#my men in yellow#Csk jeetegi#Cskvs kkr#10 rupay ka makhan shreyas bhai dhakan (sorry bhaiya maar mat dena

7 notes

·

View notes

Text

Ipl 2024 starts on Saturday.. if you are watching which team you are supporting..

9 notes

·

View notes

Text

Union pensions are funding private equity attacks on workers

On October 7–8, I'm in Milan to keynote Wired Nextfest.

If end-stage capitalism has a motto, it's this: "Stop hitting yourself." The great failure of "voting with your wallet" is that you're casting ballots in a one party system (The Capitalism Party), and the people with the thickest wallets get the most votes.

During the Cultural Revolution, the Chinese state would bill the families of executed dissidents for the ammunition used to execute their loved ones:

https://www.quora.com/Is-it-true-the-Chinese-government-makes-the-families-of-executed-people-pay-for-the-cost-of-bullets

In end-stage capitalism, the dollars we spend to feed ourselves are used to capture the food supply and corrupt our political process:

https://pluralistic.net/2023/10/04/dont-let-your-meat-loaf/#meaty-beaty-big-and-bouncy

And the dollars we save for retirement are flushed into the stock market casino, a game that is rigged against us, where we are always the suckers at the table:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

Everywhere and always, we are financing our own destruction. It's quite a Mr Gotcha moment:

https://thenib.com/mister-gotcha/

Now, anything that can't go on forever will eventually stop. We are living through a broad, multi-front counter-revolution to Reaganomics and neoliberal Democratic Party sellouts. The FTC and DOJ Antitrust Division are dragging Big Tech and Big Meat and Big Publishing into court. We're seeing bans on noncompete clauses, and high-profile government enforcers are publicly pledging never to work for corporate law-firms when they quit public service:

https://pluralistic.net/2023/09/09/nein-nein/#everything-is-miscellaneous

And of course, there's the reinvigoration of the labor movement! Hot Labor Summer is now Perpetual Labor September, with 75,000 Kaiser workers walking out alongside the UAW, SAG-AFTRA and 2,350 other groups of workers picketing, striking or protesting:

https://striketracker.ilr.cornell.edu/

But capitalism still gets a lick in. Union pension plans are some of the most important investors in private equity funds. Your union pension dollars are probably funding the union-busting, child-labor-employing, civilization-destroying Gordon Gecko LARPers who are also evicting you from the rental they bought and turned into a slum, and will then murder you in a hospice that they bought and turned into a slaughterhouse:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Writing for The American Prospect, Rachel Phua rounds up the past, present and future of union pension funds backing private equity monsters:

https://prospect.org/labor/2023-10-04-workers-funding-misery-private-equity-pension-funds/

Private equity and hedge funds have destroyed 1.3 million US jobs:

https://united4respect.org/press-release/people-who-work-at-walmart-sears-amazon-formerly-toys-r-us-more-join-forces-together-as-united-for-respect-2-2-2-2-5-3/

They buy companies and then illegally staff them with children:

https://www.dol.gov/newsroom/releases/whd/whd20230217-1

They lobby against the minimum wage:

https://pestakeholder.org/wp-content/uploads/2021/04/Insire-Brands-memo-on-15-wage.pdf

They illegally retaliate against workers seeking to unionize their jobsite:

https://www.hoteldive.com/news/dc-hotel-workers-enlist-us-representatives-to-fight-sofitel-union-busting/650396/

And they couldn't do it without union pension funds. Public service union pensions have invested $650 million with PE funds. In 2001, the share of public union pensions invested in PE was 3.5%; today, it's 13%:

https://docs.google.com/spreadsheets/d/1B0vv26VEFmwtfw5ur6dSDMY8NftvZKij/

Giant public union funds like CalPERS are planning massive increases in their contributions to PE:

https://www.calpers.ca.gov/page/newsroom/calpers-news/2023/calpers-preliminary-investment-return-fiscal-year-2022-23

This results in some ghastly and ironic situations. Aramark used funds from a custodian's union to bid against that union's members for contracts, in an attempt to break the union and force the workers to take a paycut to $11/hour:

https://www.bloomberg.com/news/articles/2012-11-20/pension-fund-gains-mean-worker-pain-as-aramark-cuts-pay

Blackstone's investors include the California State Teachers Retirement System (CalSTRS). The PE ghouls who sucked Toys R Us dry were funded by Texas teachers.

Then there's KKR, one of the most rapacious predators of the PE world. Half of the investors in KKR's Global Infrastructure Investors IV fund are public sector pension funds. Those workers' money were spent to buy up Refresco (Arizona Iced Tea, Tropicana juices, etc), a transaction that immediately precipitated a huge spike in on-the-job accidents as KKR cut safety and increased tempo:

https://www.osha.gov/ords/imis/establishment.inspection_detail?id=1675674.015

Petsmart is the poster-child for PE predation. The company uses TRAPs ("TrainingRepaymentAgreementProvision") clauses to recreate indentured servitude, forcing workers to pay thousands of dollars to quit their jobs:

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Why would a Petsmart employee want to quit? Petsmart's PE owner is BC Partners, and under BC's management, workers have been forced to work impossible hours while overseeing cruel animal abuse, including starving sick animals to death rather than euthanizing them, and then being made to sneak them into dumpsters on the way home from work so Petsmart doesn't have to pay for cremation. 24 of BC Partners' backers are public pension funds, including CalSTRS and the NYC Employees' Retirement System:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

PE buyouts are immediately followed by layoffs. One in five PE acquisitions goes bankrupt. Unions should not be investing in PE. But the managers of these funds defend the practice, saying they "facilitate dialog" with the PE bosses on workers' behalf.

This isn't total nonsense. Once upon a time, public pension fund managers put pressure on investees to force them to divest from Apartheid South Africa and tobacco companies. Even today, public pensions have successfully applied leverage to get fund managers to drop Russian investments after the invasion of Ukraine. And public pensions pulled out of the private prison sector, tanking the valuation of some of the largest players.

But there's no evidence that this leverage is being applied to pensions' PE billions. It's not like PE is a great deal for these pensions. PE funds don't reliably outperform the market, especially after PE bosses' sky-high fees are clawed back:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3623820

Pension funds could match or beat their PE returns by sticking the money in a low-load Vanguard index tracker. What's more, PE is getting worse, pioneering new scams like inflating the value of companies after they buy and strip-mine them, even though there's no reason to think anyone would buy these hollow companies at the price that the PE companies assign to them for bookkeeping purposes:

https://www.institutionalinvestor.com/article/2bstqfcskz9o72ospzlds/opinion/why-does-private-equity-get-to-play-make-believe-with-prices

To inject a little verisimilitude into this obvious fantasy, PE companies sell their portfolio companies to themselves at inflated prices, in a patently fraudulent shell-game:

https://www.ft.com/content/646d00f4-af5d-4267-a436-54fb3bc1697b

What's more, PE funds aren't just bad bosses, they're also bad landlords. PE-backed funds have scooped up an appreciable fraction of America's housing stock, transforming good rentals into slums:

https://pluralistic.net/2022/01/27/extraordinary-popular-delusions/#wall-street-slumlords

PE is really pioneering a literal cradle-to-grave immiseration strategy. First, they gouge you on your kids' birth:

https://pluralistic.net/2021/10/27/crossing-a-line/#zero-fucks-given

Then, they slash your wages and steal from your paycheck:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3465723

Then, they evict you from your home:

https://pluralistic.net/2023/06/05/vulture-capitalism/#distressed-assets

And then they murder you as part of a scam they're running on Medicare:

https://pluralistic.net/2023/08/05/any-metric-becomes-a-target/#hca

As the labor movement flexes its muscle, it needs to break this connection. Workers should not be paying for the bullet that their bosses put through their skulls.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/05/mr-gotcha/#no-ethical-consumption-under-capitalism

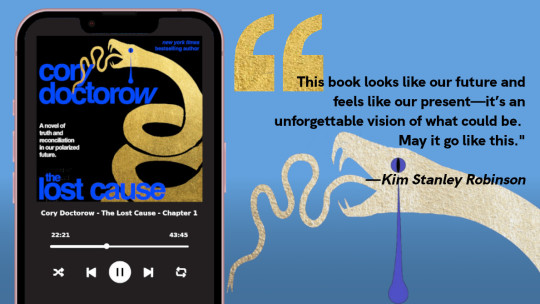

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#labor#pensions#finance#private equity#toys r us#Rachel Phua#kkr#bain capital#calpers#aramark#Private Equity Stakeholder Project#RefrescoArizona Iced Tea#CalSTRS#Roark Capital#child labor#blackstone#PSSI

174 notes

·

View notes

Text

how many times am i going to read "sakura's fight against sasori doesn't count because she was used as a puppet the entire time and would have died without chiyo"

nevermind the fact that factually

a.) she only gets steered at the very beginning when destroying hiruko and when fighting the third kazekage puppet, acting entirely on her own accord for the other 75% so much so that chiyo and sasori had even remarked on it separately

and

b.) chiyo would have died without her too that's why like over half of the other fights in the series it was a TEAM effort... what math is not mathing over here

#nonitxt#sasuke stans you can complain about her other 394834850 faults idc but leave kkr sakura alone#did chiyo make the antidote? did she destroy the third? did she escape the trap? did she prevent getting stabbed?#like its very obvious kishimoto wanted sakura to have the lime light too for once thats the point#why are you mad at the one time she was flawlessly written and used within the narrative#anyways chiyo and sakura will always remain a dream team to me. <3#relentless kkr arc apologist aprito

39 notes

·

View notes

Text

Andre Russell you're the only Russell worth supporting

3 notes

·

View notes

Text

context: KKR (investment firm who famously bought Toys R Us) bought Libby/Overdrive back in 2020.

15 notes

·

View notes

Text

i loved today's match sm

16 notes

·

View notes

Text

WHAT A MATCH the commentator said "stop writing thrillers, we're watching one" FRR

3 notes

·

View notes