#Cryptocurrency Crash

Text

Crypto crash: Matrixport talks about possible altcoin crash

At least $3.4 billion worth of crypto is likely to be sold by FTX so it can return fiat currency to its users instead of tokens, which should create an overhang for altcoins for the rest of the year

0 notes

Text

Bitcoin Crash: क्रिप्टोकरेंसी बिटकॉइन की कीमत गिरकर 21 हजार डॉलर के नीचे पहुंची, जानिए, कहां तक और टूटेगा?

Bitcoin Crash: क्रिप्टोकरेंसी बिटकॉइन की कीमत गिरकर 21 हजार डॉलर के नीचे पहुंची, जानिए, कहां तक और टूटेगा?

Photo:FILE

Bitcoin

Highlights

नवंबर 2021 में 68,000 डॉलर पर पहुंच गया था बिटकॉइन

12 हफ्ते से लगातार गिर रही है बिटकॉइन की कीमत

बिटकॉइन में अगले 6 महीनों में और बड़ी गिरावट की आशंका

Bitcoin Crash: शीर्ष क्रिप्टोकरेंसी बिटकॉइन (बीटीसी) मंगलवार को लगभग 21,000 डॉलर प्रति सिक्का तक गिर गया। लगभग पांच साल पहले बिटकॉइन इस स्तर पर थी। वैश्विक क्रिप्टो बाजार कमजोर मैक्रोइकॉनॉमिक वातावरण और क्रिप्टो…

View On WordPress

#bitcoin#Bitcoin Crash#bitcoin fall#cardano#crypto#crypto crash#crypto market crash#Cryptocurrency#Cryptocurrency Crash#Cryptocurrency Prices#Cryptocurrency Prices Today#dogecoin#ethereum#Ethereum Crash#क्रिप्टोकरंसी#बिटकॉइन की कीमत गिरकर 21 हजार डॉलर के नीचे पहुंची#बिटकॉइन गिरा#महंगाई

0 notes

Text

6 Lessons YOU Can Learn from the Silicon Valley Bank Crash

Keep reading.

If you found this helpful, consider joining our Patreon.

8 notes

·

View notes

Text

I've seen millions of recommendation but None is trustworthy or reliable compared to the @hackvoktech on Instagram, indeed there are truly a life saver. Contact them for cyber services..

#cryptoscam#woman scammed out of £27k by ‘astronaut’ who convinced her he’d marry her if she could pay his ‘rocket landing fees’#online scams#insurance scams#scam#disabled#recovery#help plz#send help#banned#bitcoin scam bitcoin crash bakkt xrp cardano ripple bitcoin bottom bull run should i buy bitcoin digibyte binance basic attention token btc#bitcoin#crypto scams#cryptocurrency

9 notes

·

View notes

Text

Cryptocurrency is a cult.

#personal stuff#dougie rambles#vent post#political crap#anti crypto#anti nft#fuck crypto#fuck nfts#kill cryptocurrency now#crypto crash#cryptocurrency#NFTs

4 notes

·

View notes

Photo

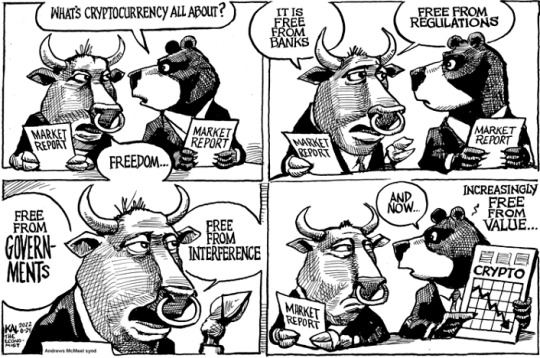

Crypto is an anarcho-libertarian Ponzi scheme. Creating pretend currencies is not a rational economic strategy.

7 notes

·

View notes

Text

Let's get ready to secure your future with advanced Doxy 2.0!!

Play Daily Fantasy Sports with Doxy Finance.

✅Join Now👉www.doxyfinance.com

#blockchain technology#crypto#defi#cryptocurrencies#eth#ethereum#soccer#ps4#advertising#marketing#decentralized finance#crypto news#latest crypto updates#cryptocurrency news#crypto latest news#bitcoin latest news#coinbase#bitcoin news#bitcoin exchange#bitcoin crash#bitcoin updates

3 notes

·

View notes

Text

Placing my bets now: cryptocurrencies are going to drop again in the last few days of July or the first few days of August, and then totally crash in October.

End of July because of interest rate increases, October because it's a new quarter. We've seen crypto-related businesses frantically pumping the value up at 11:59 pm the last day of the quarter to make it look like they're not screwed, and if they can't do that again it's going to be bad.

So anyway, my guess is that other than a few bounces crypto is going to be on its last legs by the end of the year. It'll never go away entirely of course, but this is a good start.

6 notes

·

View notes

Text

Let's Get Ready To Join A Smart Platform for Better Future and Better Growth.

What are you waiting for??

✅Register Now👉 https://bit.ly/7rootofficial

✅Join our Telegram Channel For more Details👉https://t.me/sevenroot

#blockchain#business#crypto#crypto world#cryptocurrencies#finance companies#banking#crypto market#crypto trends#crypto crash#bitcoin latest news#coinbase#crypto regulation#bitcoin#btc#cryptocurrency#crypto price#eth

2 notes

·

View notes

Text

1 note

·

View note

Text

Cardano's Robust Whales Hint at Possible 30% Price Rebound

The Market Value to Realized Value (MVRV) ratio provides a lens through which Cardano's investment potential comes into focus. At present, the MVRV ratio stands at -10%, indicating a 10% loss for investors who entered the ADA market in the last 30 days. Historical trends suggest that when the MVRV ratio falls within the -8% to 18% range, it often precedes a market rally, positioning ADA within an 'opportunity zone' for investors seeking entry points.

Market data paints a picture of Cardano in recovery, with the altcoin currently trading at $0.53, steadily bouncing back from the 17.61% decline witnessed over the past four weeks. The potential formation of a double bottom pattern, a bullish reversal indicator, suggests the prospect of a 30% rally. Successful rebounding from the $0.51 support level could propel ADA toward the targeted price of $0.68.

However, a note of caution is warranted, as the risk of a downward trend persists. A breach below the $0.51 support line could trigger a potential descent to the $0.43 stop-loss mark, aligning with the 50-day Exponential Moving Average (EMA). Such a scenario could undermine the current bullish outlook and introduce additional uncertainties into Cardano's short-term trajectory.

In conclusion, Cardano's present positioning, fortified by robust market performance and strategic whale activities, coupled with insights from the MVRV ratio, suggests a potentially bullish trajectory. The cryptocurrency's resilience in maintaining critical support levels and the indications of an opportunity zone within the MVRV ratio hint at the possibility of a significant recovery rally for ADA in the near term.

#Cardano#ADA#price stability#cryptocurrency market#market resilience#market crash#ADA whales#Cryptocurrency#Cryptotale

0 notes

Text

REXBOX مسؤول أوكراني استولى على 1.5 مليون دولار من العملات المشفرة المختلسة

REXBOX

أمرت المحكمة العليا لمكافحة الفساد في أوكرانيا بمصادرة 1.5 مليون دولار من العملات المشفرة من حساب يوري شيهول، الرئيس السابق لخدمة الاتصالات الخاصة في أوكرانيا، المتهم باختلاس الأموال العامة.

الاستيلاء على العملات المشفرة في أوكرانيا بعد الاختلاس

وفقًا لصحيفة كييف إندبندنت، أمرت المحكمة العليا لمكافحة الفساد في أوكرانيا (HACC) بمصادرة مبلغ 1.5 مليون دولار على شكل عملات مشفرة من حساب يخص…

View On WordPress

#bitcoin news today#crypto crash#crypto market news#crypto market update#crypto news latest#crypto news today live#crypto regulation#cryptocurrency news

0 notes

Text

Is The Crypto Winter Close To An End? - Technology Org

New Post has been published on https://thedigitalinsider.com/is-the-crypto-winter-close-to-an-end-technology-org/

Is The Crypto Winter Close To An End? - Technology Org

Crypto experts agree that after months of downturn, the crypto sector might be rising again. With Bitcoin being once again the poster boy, analysts believe that the market will be resurrected quite soon. Significant movements in the value of leading digital currencies like Bitcoin and Ethereum point that the crypto winter may draw a close. 2023 has been a rather bullish year, and new projects have entered the market.

2022 brought a disturbing market crash, and numerous projects capitulated mid-battle. Even Bitcoin, the king of crypto, registered a 75% drop in value, and most altcoins lost over 90% of their market capitalization. The crypto winter culminated with the collapse of FTX, which caused digital currencies’ prices to fall even deeper into a bear market. However, the projects with real-life utilities regained their strength and brought some good price action during the first months of 2023.

So, investors cannot stop but wonder if 2023 will bring the end of crypto winter. To figure out if we’re anywhere close to the end of the bear market, it’s essential to understand what it brings.

Crypto winter – artistic impression. Image credit: stories via Freepik, free license

What should you know about crypto winter?

Crypto winters are periods of discontent in the sector. Would you be surprised to find out that the term was first used in context with the famous quote Winter is coming from the Game of Thrones? The HBO series used the phrase to signal that challenging times are nearing, and analysts have started using it to refer to periods when crypto assets struggle to maintain their values.

Since then, the term has been used to refer to periods of negative gains. 2022 brought the decline of cryptocurrencies and a series of dramatic events in the sector. Crypto winters are similar in concept to bear markets, another term used to define times of concern in financial sectors. As everyone knows, bears hibernate during winters, so assets won’t gain any value during these periods. Bear markets are opposite to bull markets when the assets’ prices spike. During the winter, cryptocurrencies lumber or even drop in value. Analysts use the term bear market to mark a period when assets’ value decline by at least 20% from their peak prices.

However, there are no specific metrics to determine when a crypto winter comes, and no regulatory entity or authority declares the start of such a period. But the market witnesses a general situation where investors and exchanges register continued declines of assets. Crypto winters bring the decline of most projects for periods of at least three months. Nevertheless, they don’t refer solely to lower values for cryptocurrencies but also to an overall reduction of trading value.

How does a crypto winter come to life?

The decline in the value of digital currencies and trading value over a longer period leads to a crypto winter. Besides these two factors, several others could cause the decline of digital currencies.

Similarly to traditional bear markets, investor confidence in the prospects of the market also plays a significant role in the pricing and evolution of a sector. A decline in confidence is often the result of negative sentiment about asset value and concerns about security and liquidity. Financial losses, like crypto-developing organizations declaring bankruptcy or ceasing operations, could also cause instability in the sector and lead to a crypto winter.

The present crypto winter has sprung from a series of unfortunate market events. In May 2022, the cryptocurrencies Luna and TerraUSD crashed, causing financial losses of billions of dollars among investors. The events led to a crisis of confidence in cryptocurrencies and affected the sector’s stability, dragging down the entire market. Then, the bankruptcy of FTX, which wiped out other billions of dollars, deepened the crisis. The FTX crash has had widespread effects on the crypto sector and caused the bankruptcy of other exchanges, like BlockFi, due to its connection to FTX commodities. And as expected, the collapse of these exchanges caused investors to lose significant amounts of funds and lose their trust in the sector.

Additionally, the market faces a fear of potential regulations that could bring a higher level of control over digital currencies.

How long does a crypto winter last?

Seasons last three months in North America and Europe because the Earth’s orbit around the Sun determines its length. However, the seasons in the financial markets have different lengths, depending on the sector and cumulus of factors that led to them. For example, an average bear market in the equity sector lasts around 289 days or 10 months.

Regarding crypto winters, there are no astronomical factors to determine their length. And as mentioned earlier, there are no metrics to use to point out when the seasons start and end. However, investors can keep an eye on the evolution of assets’ prices to determine if their values are going up or down.

Historically, the first winter in the sector started in 2018 and ended after 23 months, in December 2020. How long will the crypto winter that started in 2022 last, no one can say for sure, but the sector shows signs that it might regain its upward trajectory.

The four-year cycle hypothesis

The crypto sector worked in four-year cycles over the last few years, and we had three rounds of high prices and three of low values. Digital currencies’ prices rose from 2011 to 2013, then went downward in 2014. The period between 2015 and 2017 marked a growth in values, and 2018 brought another crash. Shortly after, in 2019, the prices spiked and continued to increase until 2022, when they plummeted again, and numerous crypto projects collapsed.

Bitcoin, the leading digital currency, goes through a halving event every four years, which causes great fluctuations in its price. As expected, it impacts all altcoins’ prices, so analysts have a hypothesis that the entire market goes through a four-year cycle together with Bitcoin. Post-halving periods usually increase prices because investors hurry to acquire Bitcoin before its supply shrinks even more.

Crypto winters are harrowing periods for investors, but it’s crucial to stick to their strategies to fight the negative sentiment and emerge back when the market regains its strength.

#2022#2023#America#assets#bitcoin#crash#crypto#cryptocurrencies#cumulus#december#digital currencies#earth#effects#equity#Ethereum#Europe#Events#Evolution#eye#fear#Fight#financial#Fintech news#FTX#game#growth#how#Impacts#it#LED

0 notes

Text

Everything You Need to Know About Investing

Investing is a vast and intricate world, filled with opportunities, pitfalls, and a plethora of information. Whether you're a seasoned investor or just starting out, there's always something new to learn. Let's dive into the essentials of investing and how you can navigate this financial journey with confidence.

The Foundations of Investing

Before diving deep into the strategies and nuances, it's crucial to understand the basics. Investing is essentially allocating resources, usually money, with the expectation of generating an income or profit. But where do you start?

1. Understanding Your Goals

Every investor has a unique set of objectives. Some might be saving for retirement, while others could be aiming to buy a home or fund their children's education. Knowing your goals will help you tailor your investment strategy accordingly.

2. Risk and Return

There's a fundamental principle in investing: the higher the potential return, the higher the risk. It's essential to assess your risk tolerance and align it with your investment choices. For a deeper dive into risk management, check out Investment Pitfalls Unveiled: How to Avoid Costly Mistakes.

3. Diversification

Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk. This strategy is beautifully explained in The Comprehensive Guide to Index Funds: A Powerful Tool for Diversification and Long-term Growth.

The World of E-commerce and Investing

E-commerce has revolutionized the way we shop and invest. With the rise of online platforms, investing has become more accessible than ever. Here's how the e-commerce landscape intertwines with the world of investing:

Retail Trends: The retail industry is ever-evolving, with new trends emerging regularly. For instance, the new retail trends in Qatar offer a comprehensive insight into the changing dynamics of the market.

Online Safety: As online transactions become more prevalent, it's crucial to ensure safety. Learn how to shop online safely to protect your investments and personal information.

The Magic of Customer Experience: In the world of e-commerce, customer experience is king. Dive into the enchanting e-commerce world and discover how it impacts investment decisions.

Cryptocurrency: The New Frontier

The rise of digital currencies, especially Bitcoin, has added a new dimension to investing. With its decentralized nature and potential for high returns, many are drawn to this digital gold. Explore the empowering world of Bitcoin banking and how it's reshaping the financial landscape.

Time: The Investor's Best Friend

Time is a crucial factor in investing. The power of compounding, where your investments earn returns on returns, can lead to exponential growth over time. Delve into the concept of compounding demystified to harness its potential.

In Conclusion

Investing is a journey, filled with learning, growth, and occasional setbacks. But with the right knowledge, tools, and mindset, it can lead to financial freedom and prosperity. As you embark on this journey, remember to stay informed, make informed decisions, and always keep your goals in sight.

For more insights, tips, and comprehensive guides on various topics, explore the vast collection of articles on Steffi's Blogs. Happy investing!

Note: Always consult with a financial advisor before making any investment decisions.

#Unlock Wealth Secrets#E-commerce Goldmine#Bitcoin Boom#Investing 101 Unveiled#Qatar's Retail Revolution#Risk or Reward? Find Out!#Dive into Digital Currencies#Time's Ticking: Compound Now!#Financial Freedom Fast-Track#Master the Market Mysteries#From Zero to Investment Hero#Online Shopping: Safe or Scam?#Cryptocurrency Craze: Join or Joke?#Diversify and Dominate#Retail Trends: Rise or Ruin?#Customer Experience: Cash or Crash?#Compounding: The Magic Formula#Steffi's Top Investment Tips#Navigate the Investment Labyrinth#E-commerce Explosion: Invest or Ignore?

1 note

·

View note

Text

“Dead NFTs: The Evolving Landscape of the NFT Market” is a new report from dappGambl, a community of experts in finance and blockchain technology. Upon analysis of 73,257 NFT collections, the authors found that 69,795 have a market cap of zero Ether (ETH), the second most-popular cryptocurrency behind Bitcoin. In practical terms, that means 95 percent of NFTs wouldn’t fetch a penny today — a spectacular crash for assets that reached a trading volume of $17 billion amid a frenzied bull market in 2021. The study estimates that some 23 million investors own these tokens of no practical use or value.

[...]

The “Dead NFTs” report observes that the nearly 200,000 NFT collections “with no apparent owners or market share” identified by the study caused carbon emissions equivalent to the annual output from 2,048 houses, or 3,531 cars.

10K notes

·

View notes