#Collateral 4.1

Text

the chicken reviews

after time war 3 i began rating gallifrey episodes based on how many chickens appeared in them. last night i found the reviews again, so i figured i'd post them here so i can continue the tradition when war room 2 comes out :D

(quick disclaimer: these are just fun reviews, not to be taken too seriously)

enjoy :)

time war 4

time war 4.1: deception

no actual chickens, but there is a reference to a Large Beast when leela's trying to get back to the tardis. no description is given, so it is entirely possible it was a Very Large Chicken. but, given the lack of description, we can't know for sure. 1/10.

time war 4.2: dissolution

once again, no chickens, despite them being on a luscious green planet. no chickens are mentioned. if you listen carefully, you can hear some birds chirping in the background, but none of them are chickens. disappointing. 0/10.

time war 4.3: beyond

no physical chickens yet. however, it's made clear the ravenous can possess characteristics of that which they eat, so it's possible a ravenous that ate a chicken has characteristics of a chicken, but we don't know for sure. 0.5/10

time war 4.4: homecoming

no chickens appear. no chickens are mentioned. there aren't even any animals i could try to headcanon as chickens. rassilon probably killed all the chickens. -100/10.

war room 1

the last days of freme: -100/10

no chickens, and whatever chickens may have been there previously, died. very disappointing.

the passenger: 0/10

no chickens. no places there could plausibly have been chickens :( once again left disappointed.

collateral victim: 0.01/10

once again, no chickens :( however, there was the POTENTIAL for chickens, and i will give it .01 points for that.

the first days of phaidon: 0.01/10

same as the previous story: no chickens, but there is potential for chickens, and therefore it gets the .01 points.

12 notes

·

View notes

Text

Marathon Repaid $30m to Silvergate, Freeing up BTC Pledged as Collateral

Marathon Digital Holdings, a prominent player in digital asset mining, recently announced the full repayment of a $30 million loan obtained from Silvergate Bank in December 2022. The loan, secured by BTC pledged as collateral, has been promptly settled, thereby freeing up these funds for Marathon's discretionary use.

This repayment reflects Marathon's proactive approach to managing its debt obligations amidst ongoing challenges in the cryptocurrency industry due to the prevailing bear market. The company's strategy includes reducing debt through timely payments or restructuring, aligning with similar initiatives undertaken by fellow bitcoin miners.

Marathon currently holds a substantial portfolio of 12,232 bitcoins, with 7,815 available for unrestricted sale. Additionally, the company mined an additional 475 bitcoins in December 2022, significantly increasing its holdings compared to the period before the FTX collapse in November 2022.

Despite these developments, Marathon's shares have experienced a 4.1% decline. Nevertheless, the company remains committed to expanding its mining operations, boasting a fleet of 69,000 mining rigs with a computing power of 7 exahashes per second. Anticipating further growth, Marathon aims to achieve 23 exahashes of installed computing power by mid-2023.

Notably, Silvergate Bank's involvement with Marathon traces back to prior financing arrangements, including a revolving credit agreement and a longer-term loan, with ties to the now-defunct crypto exchange, FTX. These debt securities have played a pivotal role in Marathon's operational and financial strategies.

0 notes

Text

Catalogue vs Brochure: Making the Right Marketing Choice

In the ever-evolving landscape of marketing, businesses face the constant challenge of choosing the most effective tools to showcase their products or services. Among the myriad options available, catalogues and brochures stand out as popular choices. But which is better? Let’s delve into the details to help you make an informed decision about your marketing strategy.

1. Introduction

Understanding the fundamental differences between catalogues and brochures.

2. Purpose of Catalogues and Brochures

Exploring the distinct purposes each serves in marketing campaigns.

2.1 Catalogue Purpose

Catalogs are comprehensive product showcases for detailed product information.

2.2 Brochure Purpose

Brochures are concise promotional materials for quick overviews.

3. Design Elements

Analyzing the visual and design aspects is crucial for both catalogues and brochures.

3.1 Catalogue Design

Focus on layout, images, and comprehensive product details.

3.2 Brochure Design

Emphasis on eye-catching visuals, brief content, and a call-to-action.

4. Target Audience

Understanding the audience preferences for each piece of marketing collateral.

4.1 Catalogue Audience

Appealing to customers seeking in-depth product knowledge.

4.2 Brochure Audience

Catering to individuals looking for a quick snapshot of products or services.

5. Printing Costs

Comparing the costs associated with printing catalogues and brochures.

5.1 Catalogue Printing

Factors influencing costs and strategies to optimize expenses.

5.2 Brochure Printing

Understanding cost-effective printing solutions for brochures.

6. Distribution Channels

Exploring the distribution options for both catalogues and brochures.

6.1 Catalogue Distribution

Leveraging physical and digital channels for maximum reach.

6.2 Brochure Distribution

Strategies for distributing brochures efficiently to target audiences.

7. Impact on Brand Image

Assessing how catalogues and brochures contribute to brand perception.

7.1 Catalogue Brand Impact

Building a reputable image through detailed and informative content.

7.2 Brochure Brand Impact

Creating a lasting impression with concise and visually appealing material.

8. Environmental Considerations

Evaluating the ecological footprint of catalogues and brochures.

8.1 Catalogue Sustainability

Exploring eco-friendly options for catalogue production.

8.2 Brochure Sustainability

Minimizing environmental impact in brochure creation.

9. Case Studies

Real-world examples showcasing successful marketing campaigns with catalogues and brochures.

9.1 Catalogue Success Stories

Highlighting businesses that thrived with a catalogue-centric approach.

9.2 Brochure Success Stories

Examining brands that excelled through strategic brochure usage.

10. Making Your Decision

Summarizing key factors to consider when choosing between a catalogue and a brochure.

#entrepreneur#branding#business growth#marketing#printing press#digital printing#printingindustry#catalogue design#pamphlet marketing#printingservices

0 notes

Text

Empowering Growth through MSME Registration in India

Introduction:

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy, contributing significantly to employment generation and industrial growth. Recognizing the pivotal role of MSMEs, the Indian government has designed various schemes and subsidies to foster their development. This guide explores how MSMEs can unlock a plethora of opportunities by registering and strategically leveraging government initiatives.

Understanding MSME Classification:

1.1 Significance of MSME Classification

Before delving into government schemes, it's essential to comprehend the criteria for classifying businesses as micro, small, or medium enterprises. These classifications are based on the amount invested in plant and machinery or equipment and the turnover of the enterprise. Accurate classification is crucial as it determines eligibility for specific benefits.

The MSME Registration Process:

2.1 Online Registration on the Udyam Portal

The Udyam Registration portal (https://msme-registration.in/) is the gateway for MSME registration. Business owners can navigate the user-friendly interface and provide necessary details, including PAN, Aadhaar, and other relevant information. The online registration process is streamlined, making it accessible for entrepreneurs across the country.

2.2 Offline Registration at District Industries Centres (DIC)

For those who prefer traditional methods, offline registration can be pursued at District Industries Centres (DIC) or local MSME offices. Business owners can obtain the required forms, submit a duly filled application, and provide supporting documents for verification.

2.3 Documentation for MSME Registration

Critical documentation includes the Aadhaar card of the business owner(s), PAN card of the business, address proof, and details of plant and machinery or equipment. Ensuring the completeness and accuracy of these documents is crucial for a smooth registration process.

Benefits of MSME Registration:

3.1 Financial Assistance and Credit Facilities

MSME registration opens doors to financial assistance and credit facilities at favorable terms. Recognizing the importance of these enterprises, financial institutions offer loans with lower interest rates, easing the financial burden on entrepreneurs.

3.2 Market Access and Government Procurement Preferences

One of the significant advantages of MSME registration is the preferential treatment in government procurement. MSMEs are often given priority in government tenders, providing them with a valuable opportunity to secure contracts and expand their market reach.

3.3 Technology Upgradation and Subsidies

MSMEs are the driving force behind innovation and technology adoption. The government, through various schemes, encourages MSMEs to upgrade their technology by offering subsidies for the adoption of new and advanced processes. This not only enhances the efficiency of the enterprises but also contributes to the overall growth of the sector.

Key Government Schemes and Subsidies

4.1 Credit Linked Capital Subsidy Scheme (CLCSS)

The CLCSS is a flagship scheme aimed at promoting technology upgradation by providing capital subsidies to MSMEs. This scheme facilitates access to credit for purchasing new machinery and equipment, thereby enhancing productivity and competitiveness.

4.2 Pradhan Mantri Employment Generation Programme (PMEGP)

Designed to promote self-employment, the PMEGP is a credit-linked subsidy program that encourages entrepreneurs to set up micro-enterprises by providing financial assistance. This scheme not only creates employment opportunities but also fuels economic growth at the grassroots level.

4.3 Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE)

The CGMSE is a game-changer for MSMEs, offering collateral-free credit facilities. Entrepreneurs can avail of loans without providing traditional collateral, making it easier for them to access the much-needed capital for business expansion.

Udyam Registration: Revised Criteria

5.1 Micro, Small, and Medium Classifications

As of July 1, 2020, the government revised the criteria for classifying enterprises. Micro-enterprises are those with investments up to Rs. 1 crore and turnover up to Rs. 5 crore. Small enterprises can have investments up to Rs. 10 crore and turnover up to Rs. 50 crore, while medium enterprises can have investments up to Rs. 50 crore and turnover up to Rs. 250 crore. Adhering to these classifications is vital for accessing various schemes and subsidies.

Supportive Institutions

6.1 District Industries Centres (DIC)

District Industries Centres play a pivotal role in supporting MSME development. They act as local agencies that provide guidance, information, and assistance in navigating the intricacies of government schemes. Entrepreneurs are encouraged to engage with their local DIC for personalized support.

6.2 National Small Industries Corporation (NSIC)

The NSIC is another key institution dedicated to fostering the growth of MSMEs. It offers a range of support services, including marketing assistance, raw material assistance, and credit facilitation. MSMEs can leverage the expertise of the NSIC to enhance their competitiveness in the market.

Technology and Quality Upgradation Support

7.1 Lean Manufacturing Competitiveness Scheme (LMCS)

To boost competitiveness, the government introduced the LMCS, focusing on promoting lean manufacturing techniques. MSMEs can avail of financial support to implement these techniques, leading to improved efficiency and reduced operational costs.

7.2 Quality Management Standards & Quality Technology Tools (QMS/QTT)

Attaining product certifications is crucial for gaining consumer trust and accessing new markets. The government supports MSMEs in obtaining certifications through the QMS/QTT scheme, emphasizing the importance of quality in manufacturing processes.

Research and Development (R&D) Support

8.1 Support for Entrepreneurial and Managerial Development of MSMEs

Recognizing the need for continuous learning and skill development, the government provides support for entrepreneurial and managerial development. MSMEs can access training programs to enhance their leadership and management skills, fostering sustainable growth.

8.2 Financial Support to MSMEs in ZED Certification Scheme

The Zero Defect Zero Effect (ZED) Certification Scheme encourages MSMEs to adopt environmentally friendly manufacturing processes. Financial support is provided to enterprises striving for ZED certification, aligning business practices with global sustainability standards.

Digital MSME Scheme

9.1 Assistance for Technology Upgradation

In the digital age, technology plays a pivotal role in the success of businesses. The Digital MSME scheme aims to assist MSMEs in adopting information and communication technology (ICT). Financial support is provided to encourage the integration of digital tools for improved operational efficiency.

9.2 Importance of Digital Transformation

Embracing digital transformation is not just a trend but a necessity for MSMEs looking to stay competitive. The Digital MSME scheme empowers businesses to streamline processes, reach a wider audience, and adapt to the changing business landscape.

Export Promotion and Market Development

10.1 Market Development Assistance Scheme for MSMEs

Global markets offer immense opportunities for MSMEs to expand their reach. The Market Development Assistance Scheme provides financial support for participating in international trade fairs and exhibitions. This exposure facilitates networking, collaboration, and the exploration of new business avenues.

10.2 Strategies for Market Expansion

Entering international markets requires strategic planning. MSMEs can leverage the Market Development Assistance Scheme to devise and execute market expansion strategies, ensuring a sustainable presence on the global stage.

Skill Development Initiatives

11.1 Technology and Quality Upgradation Support under CLCSS

Skill development is at the core of sustainable business growth. The CLCSS not only provides financial support for technology upgradation but also emphasizes skill development. MSMEs can invest in training programs to enhance the capabilities of their workforce.

11.2 The Role of Skill Enhancement

A skilled workforce is an invaluable asset for any business. MSMEs can benefit from government support by focusing on skill enhancement, creating a workforce that is adaptable, efficient, and capable of driving innovation.

Challenges and Solutions

12.1 Lack of Awareness

Challenge: Many MSMEs are unaware of the numerous government schemes available to them.

Solution: Conduct awareness campaigns through government agencies, industry associations, and digital platforms. Establish a dedicated information dissemination system to keep MSMEs informed about the latest opportunities.

12.2 Complex Application Processes

Challenge: Cumbersome application procedures can discourage MSMEs from applying for schemes.

Solution: Simplify application processes by introducing user-friendly online platforms, providing step-by-step guides, and offering dedicated helplines or assistance centers to address queries.

Monitoring and Evaluation

13.1 Performance and Credit Rating Scheme for MSMEs

To enhance creditworthiness, the government has introduced the Performance and Credit Rating Scheme. MSMEs can undergo credit rating assessments, showcasing their financial stability and reliability to potential investors and lenders.

13.2 Importance of Continuous Evaluation

MSMEs should view monitoring and evaluation as ongoing processes. Regularly assess the impact of government schemes on business operations, make necessary adjustments, and stay informed about updates and changes to maximize benefits.

Conclusion:

In conclusion, MSME registration in India is not just a regulatory requirement; it is a gateway to a myriad of opportunities provided by the government. By understanding the classifications, navigating the registration process, and strategically leveraging the array of schemes and subsidies available, MSMEs can position themselves for sustainable growth. The key lies in staying informed, actively participating in supportive networks, and embracing the spirit of innovation and continuous improvement that defines successful MSMEs in India. The government's commitment to fostering the growth of these enterprises reflects a collective effort to build a robust and resilient economic foundation for the nation.

Learn more from: https://msme-registration.in/

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update#msme loan

0 notes

Text

What is a Loan Term? - Guide to Loan Terms

what is loan term policy

In today's financial landscape, loans are a common way for individuals and businesses to access funds. But understanding the intricacies of loans, including the loan term, is crucial before you dive into the borrowing process. In this comprehensive guide, we'll break down everything you need to know about loan terms, from the basics to the fine details.

1. Introduction

Welcome to our comprehensive guide on loan terms! If you've ever wondered what loan terms are, how they work, and how to choose the right ones, you're in the right place. Whether you're considering a personal loan, a mortgage, or a business loan, understanding loan terms is essential for making informed financial decisions.

In this article, we'll dive deep into loan terms, exploring their significance, various types, factors influencing them, and how to negotiate and select the most suitable terms for your needs.

2. Understanding Loan Terms

2.1 What Are Loan Terms?

Loan terms refer to the specific conditions and parameters set by lenders when borrowing money. These terms dictate the interest rate, duration, repayment schedule, and other crucial aspects of the loan. Essentially, they outline the rules of the borrowing agreement between the lender and borrower.

2.2 Importance of Loan Terms

Understanding loan terms is vital because they directly impact your financial commitments. Properly structured loan terms can save you money and make loan repayment manageable. On the other hand, unfavorable terms can lead to financial stress and even default.

2.3 Common Loan Terminology

Before we delve further, let's familiarize ourselves with some common loan terminology:

- Principal: The initial amount borrowed.

- Interest Rate: The cost of borrowing money, expressed as a percentage.

- Loan Duration: The period over which you'll repay the loan.

- Amortization: The process of gradually paying off both principal and interest.

- Collateral: An asset used to secure a loan.

3. Types of Loan Terms

There are different loan term options available, each catering to specific financial needs and goals.

3.1 Short-Term Loans

Short-term loans typically have a duration of less than one year. They are ideal for covering immediate expenses or seizing short-lived opportunities. Examples include payday loans and bridge loans.

3.2 Medium-Term Loans

Medium-term loans have durations ranging from one to five years. They are often used for business expansion, equipment purchases, or debt consolidation.

3.3 Long-Term Loans

Long-term loans extend beyond five years and are common in mortgages and business loans. They provide lower monthly payments but result in higher overall interest costs.

4. Factors Influencing Loan Terms

Several factors come into play when lenders determine the terms of a loan.

4.1 Credit Score

Your credit score significantly influences the interest rate and loan approval. A higher credit score generally leads to more favorable terms.

4.2 Interest Rates

Interest rates are a critical component of loan terms. They can be fixed or variable, affecting the predictability of your payments.

4.3 Loan Amount

The amount you borrow can impact the terms. Larger loans may come with more stringent conditions.

4.4 Collateral

Secured loans, backed by collateral, often have more flexible terms and lower interest rates.

5. Choosing the Right Loan Terms

Selecting the appropriate loan terms requires careful consideration of your financial situation and goals.

5.1 Assessing Your Financial Situation

Evaluate your income, expenses, and financial stability to determine what you can afford.

5.2 Understanding Your Goals

Consider whether you want to minimize monthly payments, pay off the loan quickly, or balance both.

5.3 Consulting with Financial Experts

Seek advice from financial advisors or loan specialists to make informed decisions.

6. Negotiating Loan Terms

Negotiating loan terms can lead to more favorable conditions.

6.1 Interest Rate Negotiation

Explore opportunities to lower the interest rate based on your creditworthiness.

6.2 Loan Duration Negotiation

Negotiate the loan duration to align with your repayment capabilities.

6.3 Repayment Options Negotiation

Discuss flexible repayment options, such as bi-weekly payments or interest-only periods.

7. Loan Term FAQs

Let's address some common questions about loan terms.

7.1 What Is an Amortization Period?

The amortization period is the time it takes to fully repay the loan through regular installments.

7.2 Can Loan Terms Be Modified?

In some cases, loan terms can be modified through refinancing or loan modifications.

7.3 How Do I Calculate Loan Payments?

You can calculate loan payments using loan calculators or formulas that take into account the principal, interest rate, and loan duration.

8. Conclusion

In this comprehensive guide, we've explored the intricacies of loan terms, from their definition to the factors that influence them. Armed with this knowledge, you can confidently navigate the world of borrowing, making informed choices that align with your financial goals.

Remember that loan terms play a significant role in your financial well-being, so take the time to research, analyze, and negotiate for the best terms possible. Whether you're a first-time borrower or a seasoned investor, understanding loan terms is key to financial success.

Read the full article

0 notes

Text

Trade LINA before it's too late on KoinBX’s Crypto Trading App!

Lina on Crypto Trading App

LINA is a functional multi-utility governance token used in a Crypto Trading App and a native token and economic incentives that are distributed to encourage users to contribute and participate in the Linear ecosystem. This creates a conjointly beneficial system where every participant is fairly compensated for their efforts. LINA is an integral and indispensable part of Linear as without LINA, there would be no incentive for users to disburse resources to participate in activities or provide services for the benefit of the whole ecosystem on Linear.

In addition, LINA will be awarded to a user based on their actual usage, and contribution efforts and/or equivalent to the frequency and volume of transactions, users and holders who did not actively participate will not receive any LINA incentives. LINA is an ERC-20 token that runs on the Ethereum blockchain. The main purpose of LINA is it can be used as collateral and also used for community control of the Linear Network protocol. All LINA holders are allowed to access the Linear DAO and vote on various proposals and initiatives, assisting to shape the development of the Linear ecosystem.

Founders

In 2020, Drey Ng and Kevin Tai co founded Linear Finance with a small team. Drey Ng is the Chief Product Officer of Liquefy, a crypto platform providing access to tokenized collaterals with lower barriers. Holding several years of experience in the fintech industry, Drey is also a blockchain instructor in Hong Kong. Kevin Tai was the vice president of Credit Suisse Bank in Hong Kong and an investment banker. Graduated from Harvard Business School, Kevin holds more than a decade of experience in the economy sector.

Uniqueness

In addition to digital assets, Linear enables customers to access traditional assets through dynamic price feeds to solve the systemic issues with Decentralized Exchange (DEX) protocols. LINA tokens serve as the base collateral for minting Liquids. But, customers can also use other digital assets to cover 20% of this base collateral. The Linear Exchange provides unlimited liquidity for Liquids and reduces the settlement timeframe to one second per block making it suitable for high-frequency traders and users running algorithmic trading software. Users of Linear Finance could access synthetic traditional assets and equities in the near term. The cross-chain technique aids Linear networks to reduce fees and solves the Oracle frontrunning issue happening with existing protocols on the Ethereum network.

The unique feature of Linear Finance is its proposed liquidation mechanism operating based on community governance. LINA holders can select the transaction fees and the amount to be owed to the insurance fund, through voting.

Security

Linear uses Proof-of-Work (POW) mining networks to protect its tokens as an ERC-20 token established on the Ethereum Network. The LinearDAO was created to empower LINA holders to vote on proposals that ensure the development of the Linear Finance ecosystem along the path desired by its users. The actual Linear Finance protocol is trustless and can be updated based on Ethereum smart contracts whenever required.

Tokenomics

Token Name: Linear Finance

Ticker Name: LINA

Total Supply: 10 Billion

Circulating Supply: 4.1 Billion

Max Supply: 10 Billion

Market Cap: 6.5 Billion

Conclusion

The main objective of the LINA token is to provide a superior user experience with high speed and scalability due to the cross-chain capabilities of the Linear Finance protocol. Linear Finance aims to provide a simple solution for users looking for acquaintance with traditional assets while benefiting from blockchain technology.

How to Buy LINA?

Follow the below steps to buy LINA coins,

1. Signup with KoinBX.

2. Fill in the required details to create an account.

3. Complete your KYC verification process.

4. Add your bank account.

5. Deposit Fiat to your KoinBX account.

6. Click Buy LINA to start buying LINA with Indian rupees (INR) & Tether (USDT).

How to Sell LINA?

Follow the below steps to sell LINA coins,

1. Signup with KoinBX IOS App.

2. Complete your KYC verification process.

3. Add your bank account.

4. Click the Sell option to find a buyer for LINA.

Once a buyer for LINA is found, you can start selling LINA with Indian rupees (INR) & Tether (USDT).

How to Trade LINA?

Buy LINA with INR

Buy LINA with USDT

To make your LINA trade anywhere, anytime with the great trading experience with KoinBX Android and iOS app.

Download here >> KoinBX Android App

Download here >> KoinBX IOS App

0 notes

Text

Asset-Based Lending: Unlocking Financial Opportunities for Businesses

In the world of business financing, asset-based lending (ABL) has emerged as a valuable financial solution for companies looking to leverage their assets to secure funding. This article will delve into the concept of asset-based lending, its workings, the benefits it offers to businesses, and the role of asset-based financing companies. We will also explore the landscape of ABL financing in Texas, showcasing the opportunities it presents for businesses in the region.

2. What is Asset-Based Lending

Asset-based lending is a type of financing where businesses use their assets, such as accounts receivable, inventory, equipment, or real estate, as collateral to obtain a loan. Unlike traditional forms of lending that primarily rely on creditworthiness, ABL focuses on the value and quality of the assets being pledged. It allows businesses to unlock the inherent value in their assets to secure funding.

3. How Asset-Based Lending Works

The process of asset-based lending typically involves the following steps:

Evaluation of Assets: The asset-based lender assesses the value, quality, and marketability of the assets being offered as collateral. This evaluation helps determine the loan amount that can be extended to the business.

Loan Agreement: Once the assets are evaluated, the lender and the borrower enter into a loan agreement that outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any additional fees or requirements.

Collateral Monitoring: Throughout the duration of the loan, the lender actively monitors the collateral. This may involve periodic audits, inventory appraisals, and accounts receivable verifications to ensure the value of the collateral remains sufficient to support the loan.

Loan Advances: As the business requires funds, it can request loan advances based on the value of the eligible collateral. The lender disburses the approved amount, providing the business with the necessary working capital.

Repayment: The borrower repays the loan according to the agreed-upon schedule, which may include regular principal and interest payments. As the loan is repaid, the borrowing capacity against the collateral is replenished.

4. Benefits of Asset-Based Lending

Asset-based financing companies offers several benefits to businesses, including:

4.1. Increased Access to Funding

ABL provides businesses with an alternative financing option, especially for those with limited credit history or facing challenges in obtaining traditional loans. By leveraging their assets, businesses can access the funding they need to support operations, growth initiatives, and strategic investments.

4.2. Flexible Financing

Asset-based lending offers flexibility in terms of loan amounts and repayment structures. The loan amount is based on the value of the assets, allowing businesses to access a higher loan value compared to traditional lending. Additionally, repayment terms can be tailored to align with the business's cash flow, ensuring manageable repayments.

4.3. Working Capital Optimization

By using assets as collateral, businesses can unlock the value tied up in their accounts receivable, inventory, or equipment. This influx of working capital can be used to cover operational expenses, invest in new projects, seize growth opportunities, or manage cash flow fluctuations.

4.4. Improved Cash Flow Management

ABL financing can help businesses improve cash flow by converting illiquid assets into immediate funds. This enables businesses to meet their financial obligations, pay suppliers, and seize business opportunities without delays caused by lengthy payment cycles.

5. Asset-Based Financing Companies

Asset-based financing companies specialize in providing ABL solutions to businesses. These companies have expertise in evaluating assets, structuring loan agreements, and offering customized financing options. When choosing an asset-based financing company, businesses should consider factors such as industry experience, reputation, customer service, and the range of financing options available.

6. Asset-Based Lending in Texas

Texas, known for its vibrant business landscape, offers ample opportunities for asset-based lending. Many asset-based financing companies operate in Texas, providing businesses across various industries with access to flexible financing solutions. Whether it's manufacturing, energy, technology, or agriculture, businesses in Texas can leverage ABL to unlock the value of their assets and fuel their growth.

7. ABL Financing: Empowering Businesses

Asset-based lending serves as a powerful financial tool for businesses of all sizes and industries. By utilizing their assets as collateral, businesses can secure the funding they need to thrive and succeed. With increased access to funding, flexibility in loan structures, optimized working capital, and improved cash flow management, businesses can seize growth opportunities and navigate financial challenges with confidence.

8. Conclusion

Asset-based lending texas offers businesses a strategic approach to financing by leveraging their valuable assets. Through ABL, businesses can unlock the potential in their accounts receivable, inventory, equipment, or real estate to access working capital, support growth initiatives, and manage cash flow. With the support of asset-based financing companies and the opportunities available in regions like Texas, businesses can harness the power of asset-based lending to fuel their success and achieve their financial goals.

0 notes

Text

It has been brutal week for oil costs, regardless of a Friday rebound. Slides in earlier periods led crude futures to shut out their third straight week of losses.The S&P 500 Power Choose Sector ETF (XLE) additionally rebounded throughout Friday's buying and selling day, but it ended the week down 5.7%.Recession fears drove a lot of the the downward motion in prior periods. On Wednesday, the Federal Reserve raised rates of interest by 25 foundation factors. The transfer is predicted to additional press the brakes on the financial system.This week's slide performed out in tandem with the regional banking turmoil. As regional banks got here beneath stress, oil costs tanked."If we get a debacle within the monetary markets, it would undoubtedly have collateral injury in oil," OPIS international head of power evaluation Tom Kloza just lately informed Yahoo Finance Stay. Drilling rigs function at sundown in Midland, Texas, U.S., February 13, 2019. Image taken February 13, 2019. REUTERS/Nick Oxford"Power worth actions are in line with rising market expectations for a recession," Will Compernolle, FHN Macro Strategist wrote in a notice to buyers this week.The EIA’s just lately launched Weekly petroleum Standing Report confirmed declining demand for gasoline and jet gasoline within the week ending April twenty eighth.Whereas China reopening is predicted to be a optimistic for oil, the demand hasn't been linear. China manufacturing unit exercise unexpectedly cooled in April, decreasing demand expectations."I feel from a requirement facet perspective, the Chinese language story from an industrial capability perspective continues to be to play out all year long," Murray Auchincloss, chief monetary officer of BP (BP), mentioned throughout the power large's earnings name earlier this week."It is why we're constructive on oil costs searching by means of the remainder of the yr," he added.On Friday, West Texas Intermediate (CL=F) rose 4.1% whereas Brent (BZ=F) crude gained 3.9%. WTI and Brent closed out the week with a decline of seven.1% and 5.3% respectively.Ines is a senior enterprise reporter for Yahoo Finance. Observe her on Twitter at @ines_ferreClick on right here for the newest inventory market information and in-depth evaluation, together with occasions that transfer sharesLearn the newest monetary and business news from Yahoo Finance

https://guesthype.co.uk/?p=5662&feed_id=13174&cld=645594ba1e339

0 notes

Text

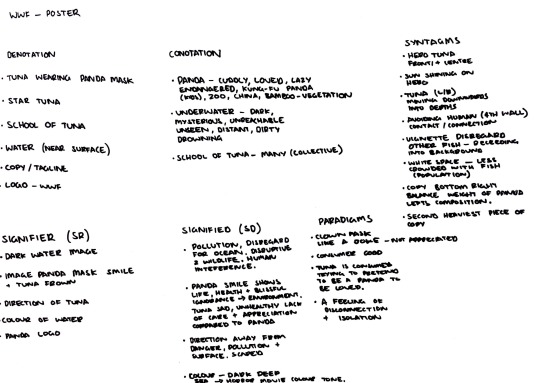

Studio – 4.1

Today Marcos gave us a presentation about semiotics and visual literacy. Designers are often communicating through image. Images represent meaning, and they miss the syntactical structure of spoken and written language.

We worked as a group to break down the semantics of an advertisement from a slideshow presentation. Our group chose to analyse the ad by WWF advocating for awarenesss about the endangered status of the Bluefin Tuna (Shown above).

We discussed some really interesting points after deeply observing and reading into the meaning of the advertisement above. We came to conclusions such as a sense of disconnection and isolation shown through the ad. Also use of colour is important as it is a dark mysterious teal colour with a strong vingette which is often associated with hollywood or horror movies.

There is also a contrast between the smile on the panda mask and the frowning or deadpan expressions of the fish swimming around it.

We learned about the 4th wall which is direct eye contact through collateral. However, in this instance all of the fish are avoiding eye contact with the viewer. They are swimming past the human and avoiding them at all costs.

We made a connection that the plastic panda mask was likely a consumer good which was purchased from a zoo and ended up in the ocean due to human disregard for the environment. This demonstrates human interference and strengthens the message that tuna in this instance are just as much a consumer good as the panda mask and are being consumed themselves like objects. We would care if it was a panda but we don’t care if it’s a fish.

0 notes

Link

0 notes

Text

Collateral 4.1

Too many possibilities to consider. I’d collapse in a nervous heap if I considered all of the threats arrayed against me.

One thing at a time. I was good at working mindlessly on a task. I enjoyed it, even, being able to set my body to something repetitive and easy, while letting my mind roam.

Something crude I could use against Faerie. Assuming the building didn’t count as something crude and roughshod, where could I get a natural sort of barrier untouched by human hands?

What other trouble could I run into? There was enchantment, enchantresses. If the Duchamps wanted to screw me over, they could do something with the connections to me. One of them had already done something to sic Aunt Laura and Callan on me. How easy would it be for them to attack me here and drive me out into the cold again? Causing trouble for Joel until I had to get kicked out?

Or making Joel hate you.

Yeah he is in a really bad place. I’m surprised he isn’t suicidal.

I moved my futon, dragging it across the floor, and set up the tape at the base of the wall.

Steadily, I made my way to the far right of the living room, taping as I went.

“Blake,” Rose called out, from the other room.

Ah, she speaks!

I stood, stretching where being hunched over had made my back kink up, and I passed by my bedroom to reach the bathroom. There wasn’t any glass on the counter or the floor, but some lingered at the edges of the frame.

“Hey Rose. We need to get you some mirrors.”

“He was playing you, you know.”

“The lawyer kid?”

“Yeah.”

“Yeah.”

“That’s what my gut says,” she said. “All of that, even the information he gave you, it’s part of a long term scheme to win you over. They’re obviously doing this with some strategy in mind.”

“Obviously. Making me read the book, setting me up with a young lawyer I can identify with.”

“They’re looking forward enough to figure out what they’re going to ask you for next time, and letting you know now so you can convince yourself it’s not so bad, and maybe ask for help a little more quickly next time.”

“Yeah,” I said. “I get that.”

Yeah I would so die in his situation... Thank you Rose and Blake for being more savvy than I.

“You okay?” she asked.

“Tired,” I said. “But I want to get at least one layer of defenses up before we go any further.”

“I’ve been bringing some books over, trying to do my part.”

“From the house?”

“Yeah. No problem getting past the barrier. I either don’t pass through the barrier, or I move so fast that being slowed to a fraction doesn’t make a difference.”

“Bring some books,” I said. “Not too many, okay? We know some Others can reach into the mirror, and besides, we don’t want to lose access to the books if we can’t get to this apartment again.”

“Shit. Good point. Maybe if I carry them with me?”

“Maybe,” I said. “Did you hear that bit in the car? About the safeguards we’ll need?”

“Some.”

“We’ll need a protective sign on the ceiling. And this wasn’t his recommendation, but it’d be good to find a way to stay off the Duchamp’s radar, and deal with any Faerie they send our way.”

Oh yeah, it is super great they have access to the books. They’d be super fucked without it.

“Okay,” Rose said. “I can get on that. We’ll need something crude?”

“Mm hmm,” I said.

“And we’ll need-”

A sharp knock interrupted me.

“Conquest’s messenger?” Rose asked.

“I don’t know,” I said. “That’d be a pretty fast arrival.”

“Go,” she said.

I went.

Not Conquest I don’t think... maybe just his landlord?

It wasn’t the Lord’s herald or anything like that. It was my landlord. Joel. Heavy without being fat, bald, with hipster glasses and bushy eyebrows, he had a way of looking perpetually worried.

AYY I was right.

He looked especially worried right now. With me.

“Hey you,” he said. “I thought I heard furniture moving, and I couldn’t think of who it might be.”

“Just got back,” I said. “You get your car back?”

He nodded. “Police returned it. I’m sorry it broke down on you.”

I shook my head. Not your fault.

“What happened? I did a search online, you were local front page news, there. You inherited a house?”

“A very valuable house, yes. And the town’s residents summarily evicted me,” I said. “For all intents and purposes.”

“You look like you’ve been through hell. It’s only been a week.”

“Has it?” I asked. “Damn.”

“I can’t help but think of the pictures of U.S. presidents before and after they take office. They look drained, aged by years. You look like that.”]

He seems like a nice enough guy, for a landlord. Pleaaase don’t kick Blake out (or die).

And ha, no, he hasn;t been through hell yet. But people have sure tried to put him there.

Oh wow I just realized that he can’t miss council meetings! He has to go back to Jacob’s Bell in what like, 3 weeks?

“Probably fitting,” I said.

“Some of the others have been asking about you. They’ll want to see you, hear about what’s happened.”

My first instinct was to leap at the chance. My second was to say no, to take the time to prepare.

“Great,” I said, going with my first and third instincts. “I’m exhausted, though, I won’t be very good company. If you want to invite people over, maybe we can keep it short, keep numbers down?”

“Yeah,” he said. “We can definitely do that.”

“Also, I don’t have much, except what I had in the fridge.”

“When you didn’t show after a few days, I cleaned out the perishables, and I cleaned up your bathroom while I was at it,” he said.

What the hell that is so nice. Though I guess he didn’t want the place to stink.

Had it been anyone else, I might have been offended. “Thanks. Did you keep the glass?”

“It’s in a bucket under the sink, why?”

“I’m in a strange frame of mind,” I said.

“Does that include talking to yourself?” he asked. When I gave him a look, he said, “Thin walls.”

“Yeah,” I said. “Talking to myself, I guess.”

I guess Rose was quieter. Be careful Blake you’re around normals again.

“And taping up the floor?” he asked, pointing down the length of my apartment hallway to where I’d abandoned the taping project.

“Yeah,” I said. “I don’t know if I could explain, even. Something for peace of mind.”

“I’m not judging,” he said, “But your reaction before you left, talking to yourself, this tape project just after you got home, the damage you did to your bathroom-”

“One mirror,” I said

“One mirror,” he agreed.

We let the silence hang in the air for long moments.

“I’d like to think I can roll with the punches,” Joel said, in response to my silence. “And you know the others can too. When Natty had trouble-”

“I know,” I said.

“We adapted.”

“I know,” I said, again. “I hear you. I’m thankful, but it’s mostly stress, and it’s me dealing the way I have to deal.”

“You’re not going to put paint on those hardwood floors, are you?”

“No paint,” I promised. “Not if I can help it.”

Paint would be nice though...

“Okay,” he said. “Lemme call up the others. You want me to tell them to show for a specific time? Have you eaten? Should I bid them to bring snacks, drink, foodstuff?”

“I ate, but I could eat a live horse right now,” I said. Against my better judgment, I added, “They can show whenever, bring whatever’s easy to bring. Just let them know I might have to run.”

“Run?”

“Appointment, could happen at any time. Five minutes from now, or a week, I don’t know.”

He nodded, then extended a hand, keys in the palm.

“Thanks Joel,” I said, as I grabbed my bike keys. “You saved my life, giving up your car like that.”

“You shaved a year off mine,” he answered. “Showing up like you did. Freaking out when the lights died. Take care of yourself, eh?”

“Eh,” I said. “I’m trying.”

From an outsider’s PoV, it probably appears Blake is developing schizophrenia.

Joel left, and I took ten minutes to rinse off, get myself shaved and get presentable, changing clothes so I wouldn’t smell of sweat. I stowed the diabolism book in a drawer of clothes, then set to getting dressed in the clothes the lawyer had brought. Fresh outfit, minus the sweat and bits of Glamour. Nicer than anything I owned, but it suited my style.

Eerie.

I pulled the locket from the pocket of my jeans and, after a moment’s debate, wound it around my hand as I had before. Positioning it so the locket itself was bound in place, the thin chain uncomfortable.

I stuffed June Cleaver’s handle down my pants leg, so the side of the blade pressed against my hipbone, the blade itself pointing forward, and pulled my shirt down around her so it was covered. Leonard-in-a-bottle found a spot on top of the fridge, out of easy reach. But if I wanted him, I could hop up and grab.

I found blue-tack, and I found the bucket of mirror-shards, and I began setting them up, sticking the larger pieces to walls at Rose’s eye-level.

“Who’s Natty?”

I kept my voice lower, this time. “Was a friend of the group for a while. Split off when she dated and broke up with certain people, found another group of friends. See her from time to time, no problems.”

“Were you one of the ones she dated?”

“No,” I said. “I haven’t dated or done much of anything since high school.”

“Since before you ran away.”

I nodded. “She started hearing voices. Joel’s not-so-subtly telling me that if I’m in the same boat, well, precedent says they can deal.”

Well there you go.

Those mirror shards are gonna look very weird to outsiders so be careful.

“Oh.”

“Which is cool,” I said. “Might be easier to let them think I’ve lost it, so long as I can assure Joel that the rent will keep getting paid.”

“I’m sorry, that you’d have to do that.”

I shrugged. I put up another piece of mirror. “How’s that?”

“It’s okay,” she said. “Not great, but okay. Is this wise? Inviting people?”

“I don’t know,” I said. “No clue at all. But I’m drained, and if I’m supposed to recover personal power, reaffirm my identity and refuel myself where I was drained, well, getting my bike keys back made me feel a hundred times better than any night’s sleep I’ve had this past week. Maybe seeing my friends will help.”

“I can get behind it, if that’s your reasoning,” she said. “Since I’m obviously not socializing, I can sit and read.”

“Sure,” I said. “Please do. But if you happen to want to look up from a book, and if you maybe want a bit of a clue about who I am and where I come from… at least now you can peek.”

“Alright,” she said. “That’s… really nice of you. But maybe we should get the defenses up.”

I guess the shards are super small?

I looked at the unfinished border of tape. I was tired enough I wasn’t connecting dots. Doing too many jobs, leaving each one unfinished. Getting ready, preparing things for Rose, the defenses, trying to get my story straight in my head, and talking to Rose. It seemed so natural while I was doing it, but I was fucking up.

“Are you sure you’re up for this?” Rose asked.

“Blake!” The cry was followed by a squeal, or a ‘squee’, as the slang went.

No! Finish your border! Ugh...

Amanda. My least favorite member of the group of my favorite people. Which wasn’t to say I disliked her. Only that she didn’t ‘get’ boundaries and I liked my boundaries.

That is a horrible horrible omen.

I’d left the door open, and both Amanda and ‘Goosh’ had let themselves in. Goosh was busy restraining Amanda with one arm around Amanda’s shoulders, so Amanda wouldn’t throw her arms around me in a violent, sudden hug. If she did, it wouldn’t be the first time. And if she did it with enough force that her head cracked into my ear, that wouldn’t be the first time either.

Goosh was a little taller than me, which put her above average height for a full-grown male, her blond hair cut short, cut badly, and tousled, her lipstick a little too red for her complexion. She was also a perfect counterpoint to Amanda, in personality and frame. Amanda, petite, was like the little dog that absolutely adored everyone and everything, her enthusiasm bubbling over to infectious degrees. Goosh was more like the mama bear.

Where Amanda would crumple at the slightest criticism, Goosh would tear heads off.

“You’re a millionaire!” Amanda said.

“Ah, you read the news. No, I’m not.”

“Almost-millionaire!” Amanda squealed.

“Not even,” I said. “I would be if I could sell the house, but I can’t.”

“Soon? Eventually?”

“I don’t know,” I said. “Hi Goosh, sorry about the show setup.”

“It’s okay. I one hundred percent understand,” Goosh said. “Joel told us about your cousin, my condolences.”

“Oh yeah,” Amanda said. “Shit, I’m sorry.”

I nodded. “Thanks. Your show went up without a hitch?”

“Small job. I wound up hiring the Sisters. Every time, I tell myself it won’t be so bad. Every time, they convince me otherwise.”

I nodded. I’d had to work with the Sisters several times on bigger projects. Stage setups for a play, a framework for an full-room art installation… they meant well, but they were people who couldn’t take criticism, and who acted like they sought out reasons to be offended. Worse, they played off each other. Get one a little upset, she’d turn to her sister, who would build up that negative emotion until it reached a critical point.

Oh man. He would be a millionaire. Cruel fate.

Not much to say except wow that last bit seems pretty unimportant now. We got bigger fish to fry.

Friend or enemy, you walked on eggshells around them, and you dealt with a minimum of one nervous breakdown or tantrum per project. But they were one of the only resources we had on hand.

“Blake!” a guy greeted me from the door. He was black, hair cut short to the point it was barely a shadow on his head and wiry, and he didn’t try to hide or take shame in his body type. He wore a suit jacket that was a bit tattered and skinny jeans with gray smudges on them.

“Hey Ty,” I said.

I was right, it was right. Friends, familiarity, faces I knew. I felt more at ease.

More like me, even with that big fat ‘practitioner’ piece jammed in the middle of the puzzle that was me and my identity.

“Beer?” he said, holding up a case so I could see over Amanda’s head.

“Beer!” Amanda’s eyes lit up.

“Fridge,” I said. “Should be lots of room. Thanks.”

Goosh let go of Amanda so Amanda could go get beer and talk to Ty.

“While they’re busy,” Goosh said, stepping closer, without intruding into my personal space. “Want me to run interference? Fill people in on anything, so you don’t have to keep answering the same question?”

This is nice, as in, Blake has friends that want to see him immediately as they were worried,

Less nice because he needs to finish this barrier.

Did I? Yeah.

“Yeah,” I said. “I’m not a millionaire, not like that. I’m stuck looking after a house that I can’t sell, a house that a lot of people want me to sell. And it’s ugly. There was talk, I’m pretty damn sure, down at the police station down there, that my cousin’s death wasn’t an accident.”

“No,” Goosh said, her voice a hush.

I shrugged. “Like I said, I don’t know. But for now, I’m laying low. I’ve got to go back in a few weeks, maybe sooner, to wrangle some stuff. I-”

“Hey, Blake,” Tyler interrupted me, from across the room. Amanda had attached herself to him. “What’s the tape thing?”

“It is what it is,” I said, too tired to come up with better. “I was doing that, it was sort of meditative, I stopped halfway. Was going to do all around the apartment.”

“Can I finish it?” he asked.

“Yeah, if you use the t-square to get the lines perfect,” I said. “And if there’s enough tape, maybe you could do triangles inside of triangles? If there’s enough. It’d look ugly if only half was done.”

And it would disrupt the border’s effectiveness.

“Eyeballing it, I’d say there’s enough tape.”

“Go for it,” I told him.

Okay wow actually this is great! I am waiting for the other shoe to drop though, as Wildbow would say.

I heard him tearing tape free from the roll.

Hooray for artist friends.

Hooray!

1 note

·

View note

Text

Empowering Growth: A Guide to Harnessing Government Schemes and Subsidies through MSME Registration in India

Introduction:

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy, contributing significantly to employment generation and industrial growth. Recognizing the pivotal role of MSMEs, the Indian government has designed various schemes and subsidies to foster their development. This guide explores how MSMEs can unlock a plethora of opportunities by registering and strategically leveraging government initiatives.

Understanding MSME Classification:

1.1 Significance of MSME Classification

Before delving into government schemes, it's essential to comprehend the criteria for classifying businesses as micro, small, or medium enterprises. These classifications are based on the amount invested in plant and machinery or equipment and the turnover of the enterprise. Accurate classification is crucial as it determines eligibility for specific benefits.

The MSME Registration Process:

2.1 Online Registration on the Udyam Portal

The Udyam Registration portal (https://udyamregistration.gov.in/) is the gateway for MSME registration. Business owners can navigate the user-friendly interface and provide necessary details, including PAN, Aadhaar, and other relevant information. The online registration process is streamlined, making it accessible for entrepreneurs across the country.

2.2 Offline Registration at District Industries Centres (DIC)

For those who prefer traditional methods, offline registration can be pursued at District Industries Centres (DIC) or local MSME offices. Business owners can obtain the required forms, submit a duly filled application, and provide supporting documents for verification.

2.3 Documentation for MSME Registration

Critical documentation includes the Aadhaar card of the business owner(s), PAN card of the business, address proof, and details of plant and machinery or equipment. Ensuring the completeness and accuracy of these documents is crucial for a smooth registration process.

Benefits of MSME Registration:

3.1 Financial Assistance and Credit Facilities

MSME registration opens doors to financial assistance and credit facilities at favorable terms. Recognizing the importance of these enterprises, financial institutions offer loans with lower interest rates, easing the financial burden on entrepreneurs.

3.2 Market Access and Government Procurement Preferences

One of the significant advantages of MSME registration is the preferential treatment in government procurement. MSMEs are often given priority in government tenders, providing them with a valuable opportunity to secure contracts and expand their market reach.

3.3 Technology Upgradation and Subsidies

MSMEs are the driving force behind innovation and technology adoption. The government, through various schemes, encourages MSMEs to upgrade their technology by offering subsidies for the adoption of new and advanced processes. This not only enhances the efficiency of the enterprises but also contributes to the overall growth of the sector.

Key Government Schemes and Subsidies

4.1 Credit Linked Capital Subsidy Scheme (CLCSS)

The CLCSS is a flagship scheme aimed at promoting technology upgradation by providing capital subsidies to MSMEs. This scheme facilitates access to credit for purchasing new machinery and equipment, thereby enhancing productivity and competitiveness.

4.2 Pradhan Mantri Employment Generation Programme (PMEGP)

Designed to promote self-employment, the PMEGP is a credit-linked subsidy program that encourages entrepreneurs to set up micro-enterprises by providing financial assistance. This scheme not only creates employment opportunities but also fuels economic growth at the grassroots level.

4.3 Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE)

The CGMSE is a game-changer for MSMEs, offering collateral-free credit facilities. Entrepreneurs can avail of loans without providing traditional collateral, making it easier for them to access the much-needed capital for business expansion.

Udyam Registration: Revised Criteria

5.1 Micro, Small, and Medium Classifications

As of July 1, 2020, the government revised the criteria for classifying enterprises. Micro-enterprises are those with investments up to Rs. 1 crore and turnover up to Rs. 5 crore. Small enterprises can have investments up to Rs. 10 crore and turnover up to Rs. 50 crore, while medium enterprises can have investments up to Rs. 50 crore and turnover up to Rs. 250 crore. Adhering to these classifications is vital for accessing various schemes and subsidies.

Supportive Institutions

6.1 District Industries Centres (DIC)

District Industries Centres play a pivotal role in supporting MSME development. They act as local agencies that provide guidance, information, and assistance in navigating the intricacies of government schemes. Entrepreneurs are encouraged to engage with their local DIC for personalized support.

6.2 National Small Industries Corporation (NSIC)

The NSIC is another key institution dedicated to fostering the growth of MSMEs. It offers a range of support services, including marketing assistance, raw material assistance, and credit facilitation. MSMEs can leverage the expertise of the NSIC to enhance their competitiveness in the market.

Technology and Quality Upgradation Support

7.1 Lean Manufacturing Competitiveness Scheme (LMCS)

To boost competitiveness, the government introduced the LMCS, focusing on promoting lean manufacturing techniques. MSMEs can avail of financial support to implement these techniques, leading to improved efficiency and reduced operational costs.

7.2 Quality Management Standards & Quality Technology Tools (QMS/QTT)

Attaining product certifications is crucial for gaining consumer trust and accessing new markets. The government supports MSMEs in obtaining certifications through the QMS/QTT scheme, emphasizing the importance of quality in manufacturing processes.

Research and Development (R&D) Support

8.1 Support for Entrepreneurial and Managerial Development of MSMEs

Recognizing the need for continuous learning and skill development, the government provides support for entrepreneurial and managerial development. MSMEs can access training programs to enhance their leadership and management skills, fostering sustainable growth.

8.2 Financial Support to MSMEs in ZED Certification Scheme

The Zero Defect Zero Effect (ZED) Certification Scheme encourages MSMEs to adopt environmentally friendly manufacturing processes. Financial support is provided to enterprises striving for ZED certification, aligning business practices with global sustainability standards.

Digital MSME Scheme

9.1 Assistance for Technology Upgradation

In the digital age, technology plays a pivotal role in the success of businesses. The Digital MSME scheme aims to assist MSMEs in adopting information and communication technology (ICT). Financial support is provided to encourage the integration of digital tools for improved operational efficiency.

9.2 Importance of Digital Transformation

Embracing digital transformation is not just a trend but a necessity for MSMEs looking to stay competitive. The Digital MSME scheme empowers businesses to streamline processes, reach a wider audience, and adapt to the changing business landscape.

Export Promotion and Market Development

10.1 Market Development Assistance Scheme for MSMEs

Global markets offer immense opportunities for MSMEs to expand their reach. The Market Development Assistance Scheme provides financial support for participating in international trade fairs and exhibitions. This exposure facilitates networking, collaboration, and the exploration of new business avenues.

10.2 Strategies for Market Expansion

Entering international markets requires strategic planning. MSMEs can leverage the Market Development Assistance Scheme to devise and execute market expansion strategies, ensuring a sustainable presence on the global stage.

Skill Development Initiatives

11.1 Technology and Quality Upgradation Support under CLCSS

Skill development is at the core of sustainable business growth. The CLCSS not only provides financial support for technology upgradation but also emphasizes skill development. MSMEs can invest in training programs to enhance the capabilities of their workforce.

11.2 The Role of Skill Enhancement

A skilled workforce is an invaluable asset for any business. MSMEs can benefit from government support by focusing on skill enhancement, creating a workforce that is adaptable, efficient, and capable of driving innovation.

Challenges and Solutions

12.1 Lack of Awareness

Challenge: Many MSMEs are unaware of the numerous government schemes available to them.

Solution: Conduct awareness campaigns through government agencies, industry associations, and digital platforms. Establish a dedicated information dissemination system to keep MSMEs informed about the latest opportunities.

12.2 Complex Application Processes

Challenge: Cumbersome application procedures can discourage MSMEs from applying for schemes.

Solution: Simplify application processes by introducing user-friendly online platforms, providing step-by-step guides, and offering dedicated helplines or assistance centers to address queries.

Monitoring and Evaluation

13.1 Performance and Credit Rating Scheme for MSMEs

To enhance creditworthiness, the government has introduced the Performance and Credit Rating Scheme. MSMEs can undergo credit rating assessments, showcasing their financial stability and reliability to potential investors and lenders.

13.2 Importance of Continuous Evaluation

MSMEs should view monitoring and evaluation as ongoing processes. Regularly assess the impact of government schemes on business operations, make necessary adjustments, and stay informed about updates and changes to maximize benefits.

MSME registration is a crucial step for small business owners looking to unlock a plethora of benefits and opportunities. From financial support and government incentives to market access and networking opportunities, the advantages of being a registered MSME are manifold. Governments worldwide are recognizing the significance of MSMEs in driving economic growth and employment, and as a result, initiatives and support systems for small businesses continue to evolve. Small business owners should seize the opportunity to register as an MSME to position their enterprises for sustainable growth and success in an increasingly competitive business landscape.

Conclusion:

In conclusion, MSME registration in India is not just a regulatory requirement; it is a gateway to a myriad of opportunities provided by the government. By understanding the classifications, navigating the registration process, and strategically leveraging the array of schemes and subsidies available, MSMEs can position themselves for sustainable growth. The key lies in staying informed, actively participating in supportive networks, and embracing the spirit of innovation and continuous improvement that defines successful MSMEs in India. The government's commitment to fostering the growth of these enterprises reflects a collective effort to build a robust and resilient economic foundation for the nation.

Learn more from: https://msme-registration.in/

#msme registration#msme#msme full form#msme certificate#msme loan#msme certificate download#msme registration online#what is msme#msme definition#msme samadhaan#msme registration certificate#small business

0 notes

Text

Tru-Art Sign Co Inc: The Art of 24-Hour Rush Digital Printing in in New York City

Need 24-Hour Rush Digital Printing Services in New York City? Look No Further!

Introduction:

In the fast-paced world of business, there are times when you require urgent printing services to meet crucial deadlines. Whether it's last-minute marketing materials, event banners, or important documents, having a reliable 24-hour rush digital printing service in New York City is essential. In this blog post, we will explore the benefits of availing such services and introduce you to TruArt Sign Co., your go-to partner for top-notch rush printing solutions. Read on to discover how TruArt Sign Co. can help you get your printing projects done quickly and efficiently, without compromising on quality..

The Importance of 24-Hour Rush Digital Printing Services:

1.1 Meeting Tight Deadlines: Why Speed Matters in Business

1.2 Emergency Printing Needs: Handling Unexpected Situations

1.3 Gaining a Competitive Edge: Timely Marketing Collaterals

Introducing TruArt Sign Co.:

2.1 Who We Are: A Trusted Name in Printing Solutions

2.2 State-of-the-Art Printing Infrastructure

2.3 Our Commitment to Quality and Precision

The Range of 24-Hour Rush Digital Printing Services:

3.1 Quick Turnaround on Marketing Materials

3.2 Event Signage and Banners at Your Fingertips

3.3 Fast-Paced Document Printing and Reproduction

Advantages of Choosing TruArt Sign Co. for Rush Printing:

4.1 Experienced Professionals: Skilled Team at Your Service

4.2 Customization and Personalization Options

4.3 Quality Assurance: Ensuring Perfection Every Time

Seamless Ordering Process:

5.1 Easy Online Ordering System

5.2 Customer Support: Guiding You Through the Process

5.3 Delivery Options: Flexibility for Your Convenience

Testimonials from Satisfied Customers:

6.1 Client Success Stories: Real-Life Examples of Our Work

6.2 Why Businesses Rely on TruArt Sign Co. for Rush Printing

Sustainability and Environmentally-Friendly Practices:

7.1 TruArt Sign Co.'s Green Printing Initiatives

7.2 Supporting Eco-Conscious Businesses

Conclusion:

When time is of the essence and you need high-quality printing solutions in a flash, TruArt Sign Co. is your trusted partner in New York City. Our 24-hour rush digital printing services are designed to meet your urgent printing needs without compromising on the excellence of the final product. Whether you require marketing materials, event signage, or important documents, our experienced team and state-of-the-art infrastructure ensure that your projects are completed efficiently and delivered to your satisfaction. Say goodbye to stress and missed deadlines—partner with TruArt Sign Co. for your rush printing requirements and experience top-tier printing services at your convenience.

Contact Us

Tru-Art Sign Co Inc.

📍 : 187 N Main St Freeport , NY 11520

📍 : Other Locations:

New York City, NY

Albany, NY

📞 Main: (516) 378-0066

📠 Fax: (516) 378-0175

📞 New York City: (718) 658-5068

📞 Albany, NY: (518) 487-4157

🌎 : https://www.truartsignco.com/

0 notes

Photo

A moodboard for the Winterhawk Big Bang fic:

Tethered, by Lissadiane

Length:15k

Pairing: Clint/Bucky

Summary: When Clint realizes the Winter Soldier is stalking him, he runs as far and fast as he can. He doesn’t expect to survive it if the world’s best assassin has been sent to kill him, but fuck it if anyone expects him to let Natasha or anyone else be collateral damage.

He doesn’t expect the Soldier to imprint on him like a duckling - a duckling whose eyes glow like an animal’s in the dark, who swims like a dolphin, who catches fish with his bare hands, and who seems more at home in the ocean than he does on land.

A selkie AU.

This was such a good fic! It had a fantastic moody vibe, and I was so pleased to get to try capture that visually! Go give the fic a read, if this is your jam!

Original, unmodified images live: 1, 2, 3.1, 3.2, 4.1, 4.2, 5, 6, 7, 8, 9

2 notes

·

View notes

Text

determined to be confusing

The commitment he has shown all these years is incredible. The amazing fact that he has been the same humble boy after achieving so much. I wish him well," World Cup winning Sri Lanka captain Arjuna Ranatunga said.. NEO: The NEO network does not provide for forks, since all bookkeepers decisions are final. To ensure that the transaction is confirmed, 66% of the bookkeepers must vote for it. The same applies to decisions regarding the development of the network the proposed changes should be supported by 66% of voting bookkeepers. Cheap Jerseys china The babyfaces and heels sat separately. One wrestler, Gene Moore, was trying to make points with a cheap jerseys young lady. Les promptly caught the attention of his waitress. "Promoting a safe and secure environment during any special event is our primary concern. After responding to a disturbance, the person in the video was being removed from the event by our officers for being disorderly. She was subsequently arrested for Battery on a Law Enforcement Officer and Disorderly Conduct/Breach of the peace. Cheap Jerseys china wholesale nfl jerseys from china The new studies should grab the attention of cities as well as states such as Tennessee and Virginia that still permit smoking in (at least certain sections of) bars, casinos, restaurants, and other public places. Overall, 32 states and many cities in the United States have passed some type of law prohibiting smoking in public spots. (You can check out the American Nonsmokers Rights Foundation to find out if your local community has a ban.) In addition, England, France, Ireland, Italy, Norway, and Scotland have passed such bans.. wholesale nfl jerseys from china cheap jerseys Comedian Vanessa Bayer ( Night Live is 36. Actor Russell Tovey ( is 36. Actor Cory Michael Smith ( is 31.. Bell rings. Penn stops. Sherk is still crumpled in the corner. 17:9 41 et seq., and regulates the securing of governmental deposits. These rules specify the collateral that is required by a depository to secure a deposit of public funds. 17:9 4.1 because it was determined to be confusing. cheap jerseys wholesale jerseys The proportions testing positive were 39% for New York State, 37% for New Jersey, and 77% for Connecticut. WN virus positive dead birds provided evidence of possible viral activity in four New York State counties, all five NYC boroughs, 16 New Jersey counties, and two Connecticut counties. Viral activity, as indicated by WN virus positive birds, spread from a central cluster in NYC and adjacent New York State counties in August (Figure 2a) to northeastern New Jersey and southwestern Connecticut in September (Figure 2b). wholesale jerseys The outline of the Justice Department case came one week before the trial against Menendez and his co defendant, Florida based ophthalmologist Salomon Melgen, begins on September 6 in federal court in Newark, New Jersey. Menendez and Melgen have been charged with 18 counts of fraud and bribery crimes. Both have entered a plea of not guilty.. cheap nfl jerseys At Alice Birney Elementary School in San Diego, school officials placed signs above fountains to warn children to avoid them. (Elissa Nu is an aversion to both the monetary cost of fixing the problem and also to the public relations cost of fixing the problem, said Yanna Lambrinidou, a Virginia Tech researcher who has long studied lead in schools drinking water. Idea that schools would have to disclose to parents that there lead flowing out of drinking water taps and have to deal with the alarm and outrage that naturally would come from that, and then the issues of distrust, and then parents and communities wanting to get more involved all of these things are a headache. cheap nfl jerseys Cheap Jerseys free shipping Williams certainly deserved consideration, but here would be my counterpoint. Although he didn't really get a chance to play until the seventh game of his rookie year in 1967, he returned four kickoffs for touchdowns and led the NFL with a 41.1 yard average. That's still the league record almost 50 years later. Cheap Jerseys free shipping Flipping the benchBy Dec. 26, there were 160 vacancies in the federal appeals and district courts including seats that aren't open yet but which judges have announced they're leaving and 50 nominees still awaiting action in the Senate. The cheap jerseys vacancies make up about 18 percent of active judgeships nationwide.. Cheap Jerseys from china But that realization didn't even have a chance to settle for Mimi Roldan before she found out her older son David then 17 was in custody. He, along cheap jerseys with three others, would be charged in his younger brother murder. "They didn't give me time to cry," https://www.wholesalejerseyslan.com Mimi Roldan said. Cheap cheap jerseys Jerseys from china wholesale jerseys from china "Let me hear you say Pa tri ots!" Germeil Smith says. Visitation hours at O'Brien Funeral Home across town were private, but remains a public spectacle in death. Convicted of first degree murder on April 15, 2015, and acquitted of a double homicide on April 14, 2017, he is soon to be cremated. wholesale jerseys from china wholesale nfl jerseys Rockets: It was Houston's first win over Atlanta since Nov. 27, 2013, snapping a streak of seven straight losses in the series. Harden had 11 assists for his fourth double double of the season. Clint Capela, who cheap jerseys had 12 points, answered a 10 0 run by Atlanta in the second period with three straight jams wholesale nfl jerseys.

1 note

·

View note

Text

Trapped in Watercolours 4.1/? [The Reality That Doesn’t Exist]

“Take it back.”

Trini blinks.

It is all fiery hot and a kind of anger she has only heard once when someone thought it would be okay to poke fun at Billy. Kim is, if anything, loyal to a tee and protective of Billy in a way Trini is of her brothers.

And it’s cute, adorable really, when Kim thinks prodding some six foot something, thousand-pound, linebacker is totally okay.

But it is a level of anger - rage - reserved for stupid and never once has Trini been on the receiving end. If she is honest, it doesn’t hurt, at least not in the way she thought it might, because it is all just confusing. Why should Trini take back anything? Does Kim not want her apology that much?

“Kim, what-”

Fingers dig into her side, desperate as they cling to her flesh.

Trini doesn’t feel the pain, in the physical sense anyways, because all she feels is the overwhelming wave of emotions and the way Kimberly’s eyes are watering. It hurts, and Trini just wants it to all go away, back to normal.

Whatever that might have been.

“Kim, I don’t understand. Please don’t cry, I really am sorry.”

Wiping away the tears feel like wiping away a part of her soul. Trini is just grateful Kim lets her because she isn’t quite sure her heart could last if Kim just walked away. It seems irrational, stupid really. But then again, Trini thought lying to Kim would be okay and this drunken blunder would stay her secret, as if that was somehow rational and remotely smart.

“T, I am only going to ask you this once and I swear to God if you lie to me… I don’t know what I’ll do but it will probably be stupid and emotional as all fuck so just don’t.”

Nodding is all Trini can really think to do. Her mouth feels drier than the Sahara and words just aren’t quite her thing.

“Was it a mistake?”

Sometimes, Trini wishes, her eyes wouldn’t sting, and her chest wouldn’t clench. And maybe, Trini thinks, just not feeling much of anything would be great because the way Kim speaks, all watery and unstable, feels like a bomb detonating somewhere in her chest and the collateral damage is simply immeasurable.

“No.”

It isn’t more than a whisper but Trini thinks - knows - it is enough.