#CPA audit

Text

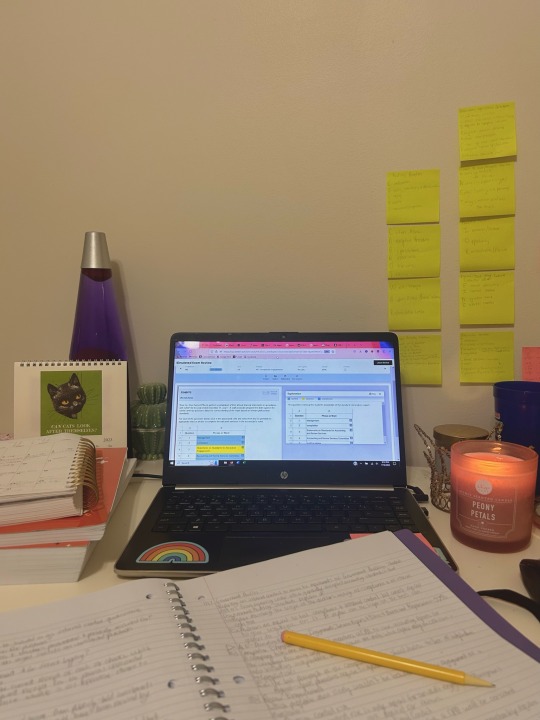

July 16th:

Decided to take it easy today. I did two and a half hours reviewing my mistakes from the second simulated exam. I wrote down the multiple choice questions I missed and worked through what I got wrong on the task based simulations and now feel like I'm understanding my mistakes better. I'll review a bit more tomorrow and then take the final review simulated exam since the actual exam is this Wednesday.

Today's accounting topic: In a review engagement of a nonissuer, assessment of control risk is not required.

Other activity: I got tired of being sleepy today and decided to sleep until I wasn't tired anymore. I slept until I physically couldn't anymore and then went to studying. It was a lot easier to focus.

#CPA exam review#CPA#cpa exam#study hard#audit#CPA audit#studyblr#study inspiration#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#short sweet and to the point#its because i really didn't do anything rip#im going back to bed

129 notes

·

View notes

Text

Elevate Your Financial Strategy: CPA Firms in India from Mas LLP

In the intricate landscape of financial management, businesses seek expertise and reliability to navigate complex regulations and optimize their financial strategies. That's where Certified Public Accountant (CPA) firms play a crucial role. At Mas LLP, we offer top-notch CPA services tailored to meet the diverse needs of businesses in India. Let's delve into the significance of CPA firms and how Mas LLP stands out in delivering exceptional financial solutions. Why Choose CPA Firms in India?

1. Expertise and Accreditation: Certified Public Accountants are professionals with extensive training and accreditation in accounting, auditing, taxation, and financial management. Choosing a CPA firms in India ensures access to highly skilled professionals who can provide expert advice and guidance on a wide range of financial matters.

2. Comprehensive Financial Services: CPA firms in India offer a comprehensive suite of financial services, including audit and assurance, tax planning and compliance, financial reporting, and advisory services. Whether you're a small startup or a large corporation, CPA firms provide tailored solutions to address your specific financial needs and challenges.

3. Regulatory Compliance: In today's regulatory environment, compliance with accounting and tax regulations is essential for businesses to avoid penalties and legal repercussions. CPA firms help businesses stay compliant with applicable laws and regulations, ensuring accurate financial reporting and tax filings.

4. Strategic Planning: Beyond compliance, CPA firms in India assist businesses in strategic financial planning and decision-making. By analyzing financial data and market trends, CPAs help businesses identify growth opportunities, mitigate risks, and optimize their financial performance for long-term success.

5. Audit and Assurance Services: For businesses requiring independent assurance on their financial statements, CPA firms in India provide audit and assurance services to verify the accuracy and reliability of financial information. Audited financial statements enhance transparency and credibility, instilling confidence among stakeholders and investors. Mas LLP: Your Trusted CPA Firms in India At Mas LLP, we combine expertise, experience, and dedication to deliver unparalleled CPA services to businesses across India. Here's why Mas LLP stands out as your premier choice:

1. Expert Professionals: Our team comprises highly skilled and experienced CPAs who possess in-depth knowledge of Indian accounting standards, tax laws, and regulatory requirements.

2. Customized Solutions: We understand that every business is unique, which is why we offer personalized solutions tailored to meet your specific financial needs and objectives.

3. Commitment to Excellence: We are committed to delivering excellence in everything we do, from providing expert advice and guidance to delivering timely and accurate financial services.

4. Client-Centric Approach: At Mas LLP, we prioritize client satisfaction and strive to exceed expectations by delivering exceptional service and value.

5. Industry Experience: With years of experience serving clients across various industries, we have the expertise to address the unique challenges and opportunities facing your business. In conclusion, choosing a CPA firm like Mas LLP can help businesses in India navigate complex financial landscapes, achieve compliance, and optimize their financial performance. Contact us today to learn more about our CPA firms in India and how we can help elevate your financial strategy.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#CPA firms in India

2 notes

·

View notes

Video

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Text

also im taking next section of the cpa exam on friday (two days!!!!). abt to do my corrections on my first two practice exams and then take the third (final!!!) practice exam…. I don’t feel ready lol

#my practice exam scores feel deceptively high bc I literally feel like I know nothing#like my practice exam scores were 71 and 75 and they kinda say anything over a 67 is good for this section#and two of my friends failed this section once before and neither of them had scores in the 70s#so like ???? maybe ?????#idk y’all I’m sooooo nervous#failing this section would throw off my study plan a lot tbh#bc they’re changing the format of the exam next year (January) and I start full time work this august#idk hopefully I just pass this one and can get the other shorter one out of the way in august#cause I think 3ish months should be good for the big one#but if I don’t pass this one idk what I’ll do#cpa exam#the section im taking Friday is audit btw if anyone here is familiar w the cpa exam

2 notes

·

View notes

Text

Inventory Audit Services in Kochi

Inventory auditing is a key part of collecting evidence, particularly for manufacturing and retail organizations. Our dedicated auditing team provides you excellent Inventory Audit Services in Kochi, Kerala. Inventory audits on a regular basis improve your understanding of your stock flow, assist you in accurately calculating earnings and losses, and keep your firm operating efficiently.

Our auditing procedure involves the following:

Audit of inventory and damaged products

Stock inspection and reporting on a regular basis

Maintenance of Fixed Assets records and stock verification

Accounting records are checked on a regular basis for accuracy and completeness.

#audit#accounting#tax#accountant#finance#business#bookkeeping#taxes#incometax#iso#accountants#taxseason#cpa#smallbusiness#payroll#entrepreneur#accountingservices#auditor#taxconsultant#gst#money#taxplanning#bookkeeper#ca#businessowner#taxreturn#taxation#management#charteredaccountant#taxprofessional

4 notes

·

View notes

Text

hrsoftwarebd

Accounting Software Development

#hrsoftbd#incometax#quickbooks#account#cpa#tax#accountant#cma#audit#taxreturn#payroll#cga#bookkeeping#charteredaccountant#auditor#accountantsalary#accountspayable#accountingsoftware#financialaccounting#corporationtax#cpas#theacountant#whatisaccounting#managementaccounting#costaccounting#taxpreparation

2 notes

·

View notes

Text

Resolving IRS Issues with Confidence: The Importance of IRS Problems & Representations Services

Dealing with IRS problems can be overwhelming and stressful for individuals and businesses alike. Fortunately, SAI CPA Services is here to provide expert assistance with our IRS problems & representations services.

Our team of experienced professionals understands the complexities of IRS procedures and regulations. Whether you're facing an audit, tax debt, or other IRS issues, we have the knowledge and expertise to represent you effectively and resolve the situation in your favor.

We work closely with our clients to understand their unique circumstances and develop personalized strategies to address their IRS challenges. From negotiating settlements to navigating complex tax laws, we handle all aspects of IRS representation with precision and professionalism.

With SAI CPA Services on your side, you can face IRS issues with confidence, knowing that you have a dedicated team advocating for your best interests. Don't let IRS problems overwhelm you—contact us today to learn more about our IRS problems & representations services and take the first step towards resolution.

Stay tuned for more insights into our comprehensive range of accounting and financial services, designed to help individuals and businesses achieve financial peace of mind.

Connect Us: https://www.saicpaservices.com/contact-us/

908-380-6876

1 Auer Ct

East Brunswick, NJ 08816

#SAI CPA SERVICES#irs#irs audit#taxes#tax season#us taxes#irsforms#taxation#financial#finances#accounting

1 note

·

View note

Photo

Diving into the Accounting World: Navigating Toronto's Accounting Landscape Embark on an illuminating journey into the dynamic accounting industry of Toronto! This blog post delves into the riv... https://bit.ly/4cj8Ou6/

#Canada#accounting#Advisory#auditing#business#careeradvancement#CGA#consulting#CPA#finance#financialaccounting#FinancialReporting#IndustryInsights#jobs#Taxation#Toronto

0 notes

Text

Understanding Corporation Tax: A Comprehensive Guide to Regulations, Compliance, and Strategic Planning

Introduction: Corporation tax is a direct tax levied on the profits earned by companies and corporations operating within a country's jurisdiction. It is a crucial source of revenue for governments worldwide and plays a significant role in funding public services, infrastructure development, and economic growth. In this guide, we will delve into the intricacies of corporation tax, covering key concepts, regulatory frameworks, compliance obligations, and strategic planning considerations for businesses.

Key Concepts of Corporation Tax:

Definition: Corporation tax is a tax imposed on the taxable profits generated by companies, including both domestic and foreign corporations operating within a country's borders.

Taxable Income: The taxable income subject to corporation tax includes profits derived from business activities, investments, capital gains, and other sources, after deducting allowable expenses, allowances, and reliefs.

Tax Rates: Corporation tax rates may vary based on factors such as the company's legal structure, size, industry, and jurisdiction. Governments often set progressive tax rates, with higher rates applying to larger companies or higher profit levels.

Taxable Period: Companies typically report their taxable income and pay corporation tax on an annual basis, following the fiscal year-end of their financial statements.

Regulatory Framework and Compliance Obligations:

Legal Framework: Corporation tax laws and regulations are established by the government and administered by the tax authorities or revenue agencies responsible for tax collection and enforcement.

Compliance Requirements: Companies are required to comply with various statutory obligations, including registration for corporation tax, maintenance of accurate accounting records, filing of tax returns, payment of tax liabilities, and adherence to reporting and disclosure requirements.

Penalties and Enforcement: Non-compliance with corporation tax laws may result in penalties, fines, interest charges, and other enforcement actions by tax authorities. Companies are subject to audits, investigations, and scrutiny to ensure adherence to tax laws and regulations.

Strategic Planning and Tax Optimization:

Tax Planning Strategies: Businesses can adopt various tax planning strategies to minimize their corporation tax liabilities, maximize tax efficiency, and optimize their overall tax position. These strategies may include:

Utilization of tax allowances, reliefs, and incentives available under the tax laws.

Structuring business operations, investments, and transactions to minimize tax exposure.

Implementation of tax-efficient financing arrangements, capital investments, and asset management strategies.

Transfer Pricing: Multinational corporations must adhere to transfer pricing regulations to ensure arm's length pricing in transactions between related entities. Transfer pricing compliance helps mitigate the risk of tax disputes and adjustments by tax authorities.

Tax Credits and Incentives: Governments may offer tax credits, incentives, or exemptions to encourage certain activities, such as research and development, innovation, export promotion, and investment in specific industries or regions. Businesses can leverage these incentives to reduce their corporation tax burden and promote growth.

Conclusion: Corporation tax is a complex and dynamic area of taxation that requires careful consideration, strategic planning, and compliance with regulatory requirements. By understanding the fundamental concepts, regulatory framework, and strategic planning considerations outlined in this guide, businesses can navigate the complexities of corporation tax effectively, optimize their tax position, and contribute to their long-term financial success and sustainability.

#Corporation tax#corporation tax services#efiletax#taxes#financial#cpa#tax#account#tax accountant#cma#audit#tax returns#payroll#bookkeeping

0 notes

Text

Exploring Excellence in Certified Public Accounting

Welcome to Granick and Gendler CPA, where tradition merges seamlessly with innovation in the dynamic world of certified public accounting. 🌟

With a history steeped in resilience and dedication, our firm's roots trace back over 80 years to a group of returning World War II veterans. 🎖️ Their ethos of perseverance continues to drive our commitment to excellence today.

From multinational corporations to cherished family-owned businesses, Granick and Gendler CPA serves clients of all sizes with tailored financial solutions. 💼 Our expertise spans the preparation of diverse financial statements and navigating certified audits, including adept handling of government audits.

But what truly sets us apart is our unwavering dedication to each client. 🤝 We prioritize personalized attention and care at every step of the journey, ensuring that your financial goals are met with precision and professionalism.

At Granick and Gendler CPA, trust, integrity, and excellence aren't just words – they're the cornerstones of our brand's legacy. 💼 We take pride in delivering enduring results that reflect our commitment to your success.

Experience the Granick and Gendler CPA difference today – where tradition meets innovation in the world of certified public accounting. 💼✨

1 note

·

View note

Text

The Benefits of Working with Price Kong, the Best Construction CPA Firm in Phoenix, AZ

Working with Price Kong, the best construction CPA firm in Phoenix, AZ, can bring you many benefits. Here are some of them:

You can save time and money by outsourcing your accounting functions to them.

You can get accurate and timely financial reports that help you make informed decisions.

You can reduce your tax liability and maximize your deductions with their tax planning and preparation services.

You can improve your cash flow and profitability with their cash management and budgeting services.

You can enhance your reputation and credibility with their audit and assurance services.

#construction accountants#construction accounting firm#construction CPA firm#construction audit firms#construction CPAs#construction CPAs phoenix

0 notes

Text

June 14th:

I finally got some motivation to study today! Granted it was only three and half hours but that's way better than the past couple of days. I don't know if its because I had coffee or what but I was finally able to take the mini exam for the first two sections in my study course. I needed a 50 to be what the course considers "exam day ready" and I ended up making a 64! I spent the past two days reviewing the information in areas one and two and even though I didn't cover everything I do think it was enough to push me over that 50 and even higher. I meant to start the third area today but I decided that I had gotten a lot done and I could do the first three modules of area 3 tomorrow. I just hope my motivation stays up tomorrow!

Today's accounting topic: When auditors are given financial information they recalculate some numbers and match other numbers to supporting documents to make sure these numbers are correct. Next to these numbers they put little marks called tickmarks that an experienced auditor should be able to look at and understand what the other auditor did with the number the tickmark is indicating. (I feel like this is stupid since the tickmarks are usually required to be described in detail at the bottom of the workpaper but whatever lol).

Other activity: I went by my favorite coffee shop today and tried a new drink and I think it might have been better than my old favorite drink they got rid of!

#CPA exam review#CPA#cpa exam#study hard#audit#CPA audit#studyblr#study inspiration#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#I definitely think it was the coffee btw haha I was cold tired and hungry and that coffee just rejuvenated me lol#tomorrow I have a work out scheduled for 9 a doctors appointment at 9:45 and tennis lesson scheduled for 2#idk if im going to get much studying done but i do think the tennis lesson will be rained out which will probably be a good thing haha

136 notes

·

View notes

Text

Let Capex CPA be your trusted partner in conducting thorough financial statement audits and regularly reviewing budget engagements. With our expert CPA consultants, we'll help you effectively manage your business finances, ensuring transparency, compliance, and optimal financial performance. Contact us today for personalized financial expertise.

Contact us : +1 416 903 4040

0 notes

Text

Address: 200 S Park Rd # 305, Hollywood, FL 33021, USA

Phone: 954-516-2245

Website: https://www.knightbusinesscpa.com/

We are Knight Business CPA. From Bookkeeping to Small Business Accounting to Payroll services, Auditing, Tax Planning and Prep, CPA Services and much more, we are the company that you can rely on for optimum results for your business. You will be paired with the relevant, highly qualified and experienced CPA for your needs so that your business finance processes have continuity, efficiency, and effectiveness. Please feel welcome to contact us to find out more about how we can support you!

Hours: Monday to Friday 9:00 am - 6:00 pm

https://www.instagram.com/knightbizcpa/

https://twitter.com/KnightBizCPA

https://www.pinterest.com/KnightBizCPA/

#Tax Planning and Prep#Bookkeeping#Payroll Services#Small Business Accounting#CPA Services#Auditing Services

1 note

·

View note

Text

Unraveling the Complex Tapestry: Accounting Firms and Chartered Professional Accountants

In the intricate landscape of finance, there exists a realm inhabited by the architects of financial brilliance—Accounting Firms and Chartered Professional Accountants (CPAs). This article serves as a guide to decode their multifaceted roles, delve into the extensive range of services they provide, and unearth the myriad advantages of forging a connection with these financial masterminds.

The Diverse Spectrum of Services

Accounting Firms are the virtuosos orchestrating a symphony of financial harmony, offering a diverse palette of financial services. Here's a glimpse into their extensive offerings:

Financial Planning Excellence

Consider them the architects of your financial dreams, crafting comprehensive plans that navigate you towards your fiscal goals.

Tax Mastery

They possess a profound understanding of the intricate world of taxation, ensuring you comply with tax laws while optimizing your financial position.

Auditing Expertise

For businesses, they meticulously orchestrate financial audits, ensuring transparency, accuracy, and adherence to financial standards.

The Art of Bookkeeping

They execute the delicate choreography of bookkeeping, ensuring that your financial records are a masterpiece of precision.

Financial Insight Prodigies

They transform into financial wizards, providing valuable insights based on complex data to empower your decision-making.

On the flip side, Chartered Professional Accountants are the strategists in the realm of finance, mastering the art of financial navigation. Here's a glimpse into their world:

Financial Strategists

CPAs transcend the boundaries of financial wisdom, offering expert financial counsel to shape your financial destiny.

Risk Navigators

They sail through the turbulent waters of financial risk, ensuring individuals and businesses reach their financial destinations securely.

Guardians of Compliance

CPAs uphold financial regulations, ensuring individuals and businesses operate within the boundaries of financial legality.

Cost Management Conductors

They orchestrate the symphony of cost management, assisting businesses in achieving a harmonious balance between expenses and profits.

Financial Sleuths

When financial enigmas unfold, CPAs transform into financial detectives, investigating discrepancies and uncovering the truth behind financial complexities.

The Advantages of Collaboration

Now that we've unveiled the spectrum of services, let's dive into the array of benefits that accompany collaboration with an Accounting Firm or Chartered Professional Accountant:

Financial Expertise

With these professionals by your side, you gain access to a wealth of financial wisdom that empowers your financial journey.

Time and Cost Efficiency

By entrusting your financial responsibilities to these experts, you free up time and resources to focus on your core endeavors.

Compliance and Accuracy

These financial custodians ensure your financial records and tax filings are not only accurate but also compliant with all legal requirements.

Peace of Mind

With these guardians of your wealth overseeing your financial affairs, you can rest easy, knowing your financial matters are in capable hands.

Strategic Guidance

CPAs offer the compass that guides your business ship through the turbulent financial seas, helping you make informed decisions.

Audit Preparedness

With Accounting Firms and Chartered Professional Accountants on your side, you're always prepared for unexpected financial audits.

Frequently Asked Questions (FAQs)

What is the primary role of an Accounting Firm?

Accounting firms are financial conductors, providing a wide range of services, including tax management, auditing, and financial analysis.

What distinguishes Chartered Professional Accountants from other financial professionals?

CPAs are financial virtuosos, offering expert financial counsel, risk management, compliance assurance, and cost optimization.

How can these professionals benefit my business or personal finances?

They save you time and money, ensure financial compliance, offer peace of mind, provide strategic insights, and prepare you for financial audits.

Are the services provided by Accounting Firms and Chartered Professional Accountants expensive?

The costs may vary, but the advantages far outweigh the expenses, helping you save and grow your wealth.

Are Accounting Firms only for businesses, or can individuals also benefit from their services?

Both individuals and businesses can benefit from the services of Accounting Firms, as they tailor their expertise to specific needs.

How can I select the right Accounting Firm or Chartered Professional Accountant for my needs?

Look for firms with a strong reputation, specialized expertise, and a commitment to guiding you toward your financial goals.

In Conclusion

In the complex world of finance, having an Accounting Firm or Chartered Professional Accountant by your side is akin to having a trusted ally for your financial well-being. Their expertise, dedication, and commitment to your financial success make them invaluable. Whether you're an individual seeking financial guidance or a business in need of comprehensive financial solutions, these professionals are your key to financial prosperity. Don't hesitate—take the first step towards financial success by engaging with an Accounting Firm or Chartered Professional Accountant today.

#AccountingFirms#CPA#FinancialServices#TaxManagement#FinancialMastery#FinancialWisdom#FinancialExperts#FinancialCompliance#FinancialStrategy#FinancialAdvisors#Auditing#CostManagement#FinancialSolutions#FinancialNavigation#FinancialProfessionals#FinancialEnlightenment#FinancialAudit#BusinessFinance#PersonalFinance#FinancialSuccess#FinancialPlanning#FinancialCounsel#FinancialSecurity#FinancialEfficiency#FinancialAccuracy#FinanceManagement#FinancialInsights#FinancialConsultants#FinancialStrategies#FinancialRisk

0 notes

Text

Detailed and Comprehensive Role of the Chandler Accountant

Dealing with your money is not a joke whether you are a business person or an individual. Therefore, in either case, you need assistance from professionals. And that will make a difference in your financial handling process. Let's get introduced to the Chandler accountant, one of the reputed ones who ensures stability in your fiancés. At the same time, follow strategic planning and work in compliance. Therefore, let's move on and check out how they are offering assistance .

Offering Full expertise in dealing with the taxation process

The Chandler accountant knows how to navigate the intricate domain of taxation well. They are well-versed in local, state, and federal tax laws. Thus, it assists businesses and individuals in reducing liabilities and increasing deductions. And also make them learn to stay compliant with tax regulations.

Chandler accountant assists with a comprehensive budget

The Chandler accountant provides excellent insights into budgeting and financial planning. They help clients to develop budgets and set financial targets based on reality. They even keep an eye on the progress as well. This prudent approach allows businesses or individuals to reach their desired financial goals quickly.

Account helping create strategy and growth in business

Accountants serve businesses as advisors who offer them strategic advice. They forecast the finances that quickly help the business make complex decisions, such as investment opportunities and expansion. Besides that, it also helps them manage costs quite effectively. Thus, the guidance they offer turns out to be instrumental in fostering business growth and development.

Having a complete record regarding record and bookkeeping

Chandler's accountant meticulously maintains the bookkeeping and documents. They help to keep an eye on financial records accurately and in the proper format. Also, it helps the companies carry out each transaction quite smartly. It even assists in maintaining the documents correctly. The experts also help estimate finances and prepare audits.

Final say

So these are the ways the Chandler CPA Firms can help you out. So call the Leading Tax Preparation Firm in Chandler for financial guidance.

#Chandler's accountant#Chandler accountant assists#Chandler CPA Firms#Tax Preparation Firm in Chandler#finances and prepare audits#Tax and Accounting Services#Business Tax Consulting#Chandler CPA Firms experts

0 notes