#which is great b/c i've been struggling with that recently

Text

I know a lot of people have drawn Astarion in the Fallen Angel pose but I think it suits Wyll just as nicely, especially considering his story arc & relationship with his father

#i've had this idea bouncing around my head for a while#and i'm. so proud of it???#i think i've really captured what I want my art to look like with this one#which is great b/c i've been struggling with that recently#anyway there needs to be more wyll love#and i will happily provide it#bg3#bg3 fanart#bg3 art#wyll ravengard#bg3 wyll#fallen angel#wyll fanart#my art#digital art#fanart

3K notes

·

View notes

Note

headcanons ask for chief and minish :D

Oh no... Fiiiine /giggles

A) What I think realistically?

Both games are super sweet, super lovely games with some intensely creepy bad guys who are I think really well-done almost cosmic horror level entities. Spirit Tracks goes a LOT harder on it than Minish Cap, but honestly there is a baseline default here where I am staunchly on the side of "These boys have the sweetest temperaments ever, full stop."

B) What I think is funny?

Minish Cap Link being a cryptid is, frankly, the funniest shit ever to me and you will pry it from my cold, dead hands. Tiny boy giving everyone jump-scares and climbing the walls might be nightmare fuel to YOU, but to me it's the most adorable thing he could do.

The funniest headcanon I have for Spirit Tracks Link is one I've been recently entertaining which is that, based on everything we see in the game there's probably a state religion to support the whole magic bits of the Spirit Tracks infrastructure? So this kind of hard-core trains and engineering game (just roll with it) also means this guy has like a metaphysics degree to go with it. By necessity.

C) What I enjoy crushing my friend's spirits with?

Minish getting fucked up into a cryptid at sixteen, and the whole fiasco of learning to walk again and struggling to advocate for himself when he's also nearly non-verbal to begin with. Best angst, absolute tragedy. He's a beloved child and best friend, and now he's also a monster.

Spirit Tracks Link being basically an EMT. Honestly I don't do enough with it, but I love it as a headcanon because it makes sense if you think about the job implications enough: he works with heavy machinery. Crush injuries are a big thing. He travels in uninhabited wilderness, between small towns. Having medical training makes sense. But that means he's first responder to a lot of horrible, horrible shit and so he's seen things he can't unsee.

D) What makes me say "Fuck You" to Canon?

I take the "Minish Cap Link is a sweetheart" bits of the game's tone and discard the rest. The time limit to save Zelda? Dead serious. He nearly failed. Tingle? He gets to die horribly because I said so. I just cannot with how saccharine this game is, so everything gets to be taken in the worst light possible, thanks.

TBH I don't really violate canon in Spirit Tracks that much? It's not quite as saccharine as Minish Cap so I don't usually fuck with it too hard, but I do also slot him into other games so I can build things up more. The sweetness with Zelda is great, and most of the rest, as listed above, isn't violations but extrapolations of canon. ("If train mechanic, then industrial first aid...")

I suppose bunny-man can go the same way as Tingle, but I will continue to let him live. So far.

#Spirit Tracks#Minish Cap#headcanons#LOZ: ST#LOZ: MC#Legend of Zelda: Spirit Tracks#Legend of Zelda: Minish Cap#ask games#don't mind me#That Broken Promise#my Link's Meet AU

10 notes

·

View notes

Note

Hi,

I love reading all your opinions and one thing that I see frequently is that Elain hasn't had enough development to warrant her own book yet and it's an argument that Gwynriels use a lot in their posts. It doesn't make much sense to me, but what do you think?

Hello!

Thanks so much.

Of course I've seen this strange argument before, and it's confusing. Because,

a. when do we only read books with 'developed' characters? Isn't the whole idea of picking up a new book is to discover new characters? Go on their journey with them?

Was Feyre a developed character when we picked up ACOTAR? Hardly. That's why we became intrigued and decided to see what happens with her and to her. That's kind of the point of reading?

b. The blueprint for Elain's story has literally been spoon fed to the readers. She is a mystery, with undiscovered, mammoth powers, she is a Seer, she is mated to a man she doesn't like and she wants another man, who also wants her. That's the story. THAT's what's going to be 'developed'. And we'll follow her and see how it's resolved.

Conversely, how exactly was Nesta developed, for example, prior to ACOSF? We knew that she was kind of spiraling out of control a bit in ACOSAF, cut off her family, 'broke up' with Cassian, struggled with her powers, had some kind of internal crisis. That's not development. That's set up. Just like Elain has her set up as well (see paragraph above). So following THAT blueprint, we then had ACOSF.

c. The same people who claim that Elain is underdeveloped and cannot have her own book are saying that Azriel will be the MC (along with Gwyn, naturally) of the next book? If Elain isn't developed, then he is underdeveloped x 10.

d. Lastly, speaking of Gwyn--her 'development' was around Nesta. She was a vehicle for Nesta's story--Nsta's story of training, developing friendships, learning to navigate the world, and creating a purpose for herself with the Valkyrie plot, and going through the BD. Gwyn's story has never been a separate story from Nesta's--she was never a standalone character, and everything that has happened to her has been in connection with Nesta. Training, Valkyrie, BD, Library.

Truthfully, i absolutely see Emerie getting a story before Gwyn. She already has a life that's her own, separate from Nesta and the Library, she lives in a hostile environment, she is a Carynthian (something that by her own admission Gwyn doesn't care about, because it's not her culture), she is a female, we assume she is gay, and she exists in a sexist, male-dominated society, she has plenty of trauma (a prerequisite) and if there ever will be a Valkyrie/Illyria plot, it will definitely be centered on Emerie and not Gwyn. She has a much richer blueprint for a story (and that's not even mentioning a Mor connection, which may or may not happen) than Gwyn does.

Finally, if Gwyn is a developed character, why would we read about her AGAIN, when we have a ton of characters whose story we haven't even touched yet? Not just Elain, but Mor, and Lucien, and Az, etc. With 2 books left, we are going to spend an entire book on Nesta's friend, while Elain Archeron, the Morrigan, the Shadowsinger, the Heir of Day/Wiley Fox are languishing in obscurity? Sounds fake, but okay.

My Elriel colleague @silverdreamscapes just recently had a great post about 'development' that you can read here

27 notes

·

View notes

Note

oh gosh. oh gosh. I've been thinking about getting evaluated for ADD/ADHD myself recently but I'm scared & anxious. I don't know who to go to - is any regular psychiatrist/psychologist ok or would I need to find one who specializes?? What if I'm diagnosed but they can't do anything about it?? What if I'm MISdiagnosed so they can make money?? What if they tell me I'm just an attention-seeking narcissist and there's nothing wrong with me at all?? 1/2

All I can share is my experience, which is unique to a) me, b) my area, and c) my country’s healthcare system. I mentioned my frustrations with my concentration/focus (or lack thereof) with my primary care physician-- the person who does my annual check ups. They should be your first stop, if you’re in the American healthcare system, as insurance companies often require referrals for specialist appointments, and even if you aren’t in the American healthcare system, your PCP should be able to point you in the right direction of where to go next.

I have a really great relationship with mine-- she’s been treating me for my entire adult life. She referred me to a neurologist for ADD/ADHD evaluation. When I arrived, the cute intake girl asked me a shit ton of questions about my symptoms. And in talking to her it really hit home how much and how long I’ve been struggling.

And the neurologist took one look at my intake form and said “you definitely hit the markers for ADD.” (and maybe adhd? It kinda blurred at that point, because ha-hey guess who’s having focus/attention issues?)

Next step? Medication.

Medication is where the stigma kicks in again. Picture this: I am at the neurologist looking for help. There is literally no other reason for me to be there. I am struggling, I need help, and still-- STILL-- when he mentioned Aderall my brain and my heart immediately wanted to bolt. Like, what the hell else did you think he was going to suggest, numbskull?

So next steps are getting a brain scan/EEG, to make sure I don’t have any other brain issues they need to worry about, and then I’m starting a low dose of Adderall, which is faster acting than some of the other options. By the neurologist’s words, I could be seeing improvement by the end of next week.

Your questions in your first ask are all anxiety, plain and simple (and guess how ADD can sometimes present in adult women? Ding ding ding! Anxiety).

A specialist will be the best person to help you, so even if they can’t a) they may at least be able to tell you what it isn’t, b) can point you in a new direction, and c) at least you’re taking steps to help yourself-- which is huge.

Lately I’ve come to suspect that the school fear about “overmedication” is an early split from what eventually became the anti-vaxxer movement, and fuck those guys. And keep in mind-- our conversation here is not about the virtues of forcing kids to sit still in a classroom for 7-8 hours a day, and the need for medication to help them do so. We are adults, struggling to exist as adults. If there is a tool out there to help us function more easily, we are entitled to use it, just as we are entitled to use anti-depressants or pain-relief.

(And PS if you’re wondering if you’re an attention-seeking narcissist, you’re not a narcissist, because narcissists don’t think about that sort of thing. I’ve had similar concerns seeking therapy and that came straight from my therapist’s mouth, so)

If you do seek help for it, I can warn you right now that it’s going to be a mixed bag of emotions. Yes, it’s a relief, to have a name and reason for why you/your brain does X, but at the same time? I had a cry session last night because if the diagnosis is correct, then-- I’ve been fighting it for twenty-plus years. Twenty years where my potential has been throttled by a condition I wasn’t aware of. Twenty years I’ll never get back.

And that’s heartbreaking.

The one thing about my appointment with the neurologist that sticks in my craw is something he asked me towards the end as we were wrapping up. He asked me “Why did you wait so long to get help?”

He meant it good-naturedly, and I was still reeling and dealing with the anxiety of everything suddenly happening quickly, so I didn’t claw his eyes out right then and there. But it still rankles even now.

I’m sorry, how in the world was I supposed to know that my wandering brain and hyperfixation on writing and skating (the only two activities in my life I can focus on with zero distraction), wasn’t NORMAL? My doctor asks for my weight every goddamn visit but at no point has she ever asked me how my focus is. No one ever asked me how many times I need to go back to my apartment in the morning to get the keys/sunglasses/breakfast I keep forgetting.

No one ever asked me how many times a week I forget my wallet in my other bag. Until my visit yesterday, no one ever asked me how often I talk over someone before they’re finished speaking, or finish their sentences for them. No one ever asked whether I fidget in meetings or if I can hold a goddamn conversation without my brain spooling out to think about that one story/movie/figure skating program/”if I have my protein bar early and skip the late session at the rink I can go to that one place I like for dinner tonight I think I’ll get the fish”.

So, someone please tell me how I was supposed to recognize any of this as not normal.

Long story short, here’s my takeaway: If you are struggling with anything that impairs your ability to function on a basic level, you deserve to seek treatment. If you read something online about a condition that rings true to you and your experience, you have every right to mention it to your doctor.

You deserve to live at your full potential.

28 notes

·

View notes

Note

(2 q's, pt 1) Hi, I have a couple of q's: 1) I know that saying male/female is seen as transphobic, but I like using them b/c there's no age implied. I'm in an age range where I don't know whether to refer to my peers as boys/girls or men/women, and I can't help worrying that "young lady/young man" will be seen as condescending. Should I still avoid male/female? 2) I've been questioning for a while now. Most things I've read say "you're bi if you FEEL bi" etc., and while this can be reassuring,

(2 q's, pt. 2) while this can be reassuring, I prefer to make decisions based on data points, not in terms of how I feel. I hate and kind of fear the idea/possibility of being wrong in my conclusion, so I want to make sure I "get it right". And while I would never ask another bi person how many crushes or "experiences" they've had with various genders to "test their bi-ness", and I know I don't necessarily (?) need experiences of my own, I am a bit bothered by the fact that I can't

(2 q's, pt. 3) that I can't point to a trend of "yes, here are the crushes I've had on girls" to confirm the idea to myself. I can only really say (mostly) for sure that I've had an "almost-crush" on a girl recently, and I didn't really "allow" that to become a full crush b/c she was straight. Should I just "buckle down" and identify as bi? Is my attitude horribly bi-phobic? Do my q's make me sound like a terrible person? (Ok, more than 2 q's. My apologies, and thank you for your time)

Hey, I’ll try to get through your message bit by bit...

“male” and “female” as adjectives are only partially problematic. It really comes down to context. Of course you can say things like “my male friend” if your friend identifies as a man. But yes, transphobes and te/rfs will use these words against trans people, so you should be aware of the context in which you use it. For example don’t say “male genitalia” when you mean “penis”. A trans woman can have a penis and then it’s “female genitalia”!!! A vagina can be “male genitalia” if it belongs to a trans man. And non-binary people have genitals as well which are neither “male” nor “female” because the people they belong to aren’t..... I guess you see where I’m going at here.It also gets kinda even more problematic (and it is my biggest pet peeve) when people nominalize the adjectives to “males” and “females”. This is not just te/rf-speak but also makes it sound like you are talking about animals. Humans are men or women or non-binary people - not “males” and “females”. That just sounds dehumanizing and like you are dividing us based on the shape of our genitals - at least in English it does (and in German), maybe not in every language. I don’t know.There really isn’t a clear line or a certain age when everyone should be called “man” and “woman” versus “boy” and “girl”. There are people in their 20s, 30s or even older, referring to their friends as “girls” and “boys”. It’s okay. Try not to make too big a deal out of it because it doesn’t really matter much. It’s part of growing up to be unsure of these things but it’s not a problem if you say “I’m going out with the girls tonight” and they’re all in their 20s already. Just... language is weird, my friend. Just say what you want but... yeah... be aware of the way “males” and “females” as nouns sound like. If someone talked about me as “eine Weibliche” (= “a female”) I’d probably kick their misogynist ass. You could also say “my friend” or “a person” when you tell a story about someone of unspecified age (also has the great advantage of being gender neutral on top of that). It’s really... not that difficult to avoid saying “males” and “females”.

And I fear I will not be able to give you any data points to figure out whether or not you are bisexual. We always quote or paraphrase Robyn Ochs when people ask for the definition of bisexuality, which is acknowledging your potential to be sexually and/or romantically attracted to more than one gender. It is intentional that she added “acknowleding your potential” in there because you do. not. need. to prove it. You don’t have to have a certain amount of crushes on various genders. You do not have to have sex with people of different genders. Even if you just as much as theortically think you could fall for people of more than one gender - that’s enough. That is acknowledging your potential to be bisexual!

I understand the need to “know for sure” but... you gotta accept that you may never know for sure. It’s okay to identify as something and change it later if you realise it’s not right. It doesn’t necessarily mean you were wrong before - you may just have changed or learned more about yourself. But even being wrong is not the end of the world. That’s normal. That’s human. You grow, you change, your preferances can shift and your sexuality can be fluid. Maybe, if you just accept the bi label for now - without any kind of ‘proof’ that it’s ‘right’ - you will see if it feels good or not. This can be your way of collecting data, if you wanna call it like that. Look at it as an experiment: you identify as bisexual for a certain amount of time and then when the time is over you evaluate whether or not it felt good and right to identify as bi. If it did - continue for another time period. If it didn’t - go over to the next label and evaluate that after a certain time.

And your attitude isn’t “horribly biphobic” in the sense that it makes you a bad person who harms the bi community and doesn’t deserve anything good. You’re struggling and that’s, again, human. It’s good that you are asking for help!But it does sound big time like internalised biphobia - and you are the person that suffers most from that. Here’s a list of things I recommend you try to get rid of it. It might take a long while but it’s worth it and you will find your peace one day - be it in the bi label or something else.

Maddie

4 notes

·

View notes

Text

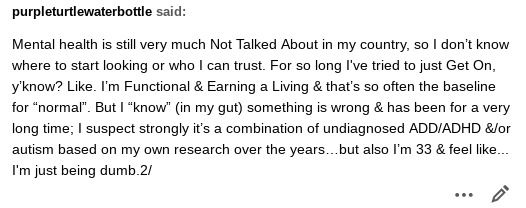

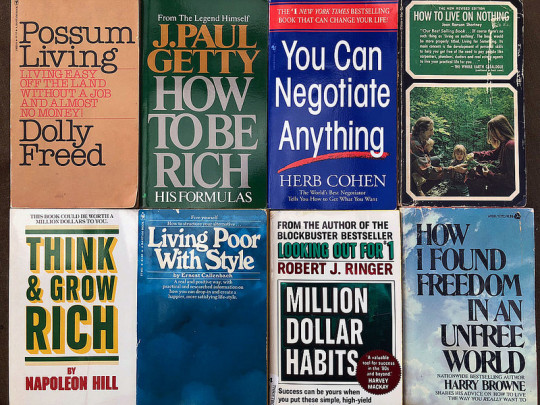

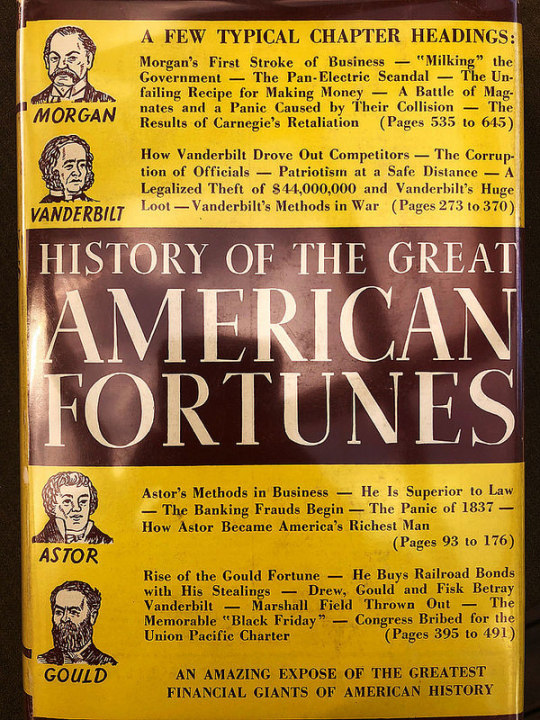

An index to every money book I've reviewed during the past twelve years

147 Shares

I read a lot of money books. As a result, a large section of my large library is devoted to books about personal finance. (And if I hadn't purged hundreds of money books when I sold this site in 2009, I'd have even more books and no place to put them.)

Last week, a GRS reader named Lindsay dropped a line with an interesting question:

I'm really enjoying your work back at GRS, the email newsletter, and your most recent FB live video! I'm wondering: Do you have a list of all the money books you've reviewed? I've been poking around to try and find one)?

As it happens, I've been wanting a list of reviews myself. I know I have a million billion different projects around here, but one that I'd like to pursue is a free nicely-formatted PDF download that compiles every review I've written.

To answer Lindsay's question and to satisfy my own curiosity I sifted through the GRS archives yesterday to compile a list of every money book I've reviewed during my 12+ years at this site. In this post, I've linked to those reviews, plus I've included a short summary of each book.

Note: I'm certain that about half of the reviews are missing from the archives. The folks who purchased this site from me unpublished hundreds of articles (including many book reviews, apparently) during the time they owned GRS. Those reviews still exist, and I'll eventually find them and list them here, but it's far too cumbersome to find them at the moment.

For each book below, I've included a link to Amazon. I've also assigned each a book a letter grade and, in some cases, a star .

My letter grades might seem harsh. That's because I've tried to really think about these on a sort of curve, where the vast majority of books are average and only a few merit As or Fs. As a result, some important titles get average (or low) grades despite their contribution to the field.

If I grade a book an A, I think it's excellent. It offers excellent advice with no real flaws.If I give a book a B, it's a good book with good advice, but something about it holds it back. Maybe it's poorly written or maybe it's off-base on a topic or two.If I give a grade of C, the book is average. That means it gives reasonable money advice in a typical way. There's nothing drastically wrong with the book, and it's worth reading.If I give a D grade, the book is flawed in some major way. It still has some value to it maybe a core concept that you can't find elsewhere but I'm hesitant to recommend this to average folks.If I give a book and F, I don't think it has any sort of value. I don't give many Fs because I think nearly every book has some nugget of wisdom in it.

Note that all of my letter grades were assigned today. They're based on who I am and what I know now, not when I wrote the reviews. And they're based on how valuable the book's info will be to a modern reader. (Some money books that were awesome in 1978 haven't aged well because their advice is specific to that era.)

When I've marked a book with a star , that indicates I believe regardless of my grade, the title should be considered part of a core personal-finance library. (I don't have a review of Dave Ramsey's Total Money Makeover here. If I did, it'd get a C or lower because the book's quality is mixed and it has certain drawbacks. But the book would also merit a star because it should be in any serious library of money books.)

Ultimately, though, you shouldn't let the letter grades and stars guide your decision to read a book. Use my reviews instead. They're much more nuanced than an arbitrary grade. The grades are meant as a sort of quick reference.

Finally, I've sorted the titles into roughly reverse-chronological order based on year of publication. I think most readers are interested in recent titles. (Because of my hiatus from money-blogging, there's a gap here between 2010 and 2016.) If, like me, you prefer older money books, you'll find them closer to the end of this list.

That's enough explanation. Here then is a list of (nearly) all of the book reviews from the archives here at Get Rich Slowly!

Get Money by Kristin Wong (2018)Get Money is all about applying game-playing principles to money management. Most money books tend toward boring and stale. Not this one. Get Money is both funny and wise, packed with practical tips for how to play the game of money and win. It's a useful money manual from a favorite former GRS staff writer. [my review] BThinking in Bets: Making Smarter Decisions When You Don't Have All the Facts by Annie Duke (2018)For a long time, Ive argued that the best money books are often not about money at all. Thinking in Bets is an example of this. Duke says that there are exactly two things that determine how our lives turn out: The quality of our decisions and luck. She uses plenty of personal finance examples, but the book itself is about self-improvement. Its not specifically about personal finance, yet the info here could have a profound impact on your financial future. [my review] A-Meet the Frugalwoods: Achieving Financial Independence through Simple Living by Elizabeth Willard Thames (2018)Meet the Frugalwoods isnt a money manual. It isnt fiction. Its memoir. The book covers ten years in the lives of Liz and her husband Nate, from their post-college job-hunting experiences in Kansas to purchasing a 66-acre homestead in Vermont. Through their story, Liz shows readers its possible to move from a life of consumerism to a life built around frugality and purpose. My chief complaint? The Frugalwoods didn't achieve financial independence through frugality; they achieved it through a high income. [my review] CYou Need a Budget by Jesse Mecham (2017)You Need a Budget is a simple book, but its excellent. It doesnt try to throw the entire world of personal finance at you. Its laser-focused on one thing: building a better budget. Because Mecham has been reading and writing about budgets since 2004, hes learned a lot about what works and what doesnt. Hes constantly receiving feedback from the tens of thousands of people who follow his program. This book is a culmination of that experience, and it shows. If you need a budget, I highly recommend this book. [my review] A The Simple Path to Wealth by J.L. Collins (2016)The Simple Path to Wealth presents the advice from the author's blog in a coherent, unified package. Its an easy-to-understand primer on stock-market investing and financial independence. Although the book is intended to offer wide-ranging advice about the journey to financial freedom, I think its at its best when Collins covers retirement investing. [my review] B+ Early Retirement Extreme by Jacob Lund Fisker (2010)Imagine a personal-finance book written by a theoretical physicist. What would it be like? Full of formulas and figures, right? Well, thats what you get with Early Retirement Extreme. This feels like a book written by an engineer for other engineers. This isnt a bad thing, but it is unique. Some people will love it; others will hate it. Also, this book could use a professional editor. These caveats aside, ERE is packed with excellent information, and is one of the key books in the Financial Independence movement. [my review] B The Simple Dollar by Trent Hamm (2010)This book isnt really about personal finance. Theres personal finance in it, sure, but like Hamms blog, The Simple Dollar is about personal and professional transformation. This is a book about change. The information in the book is good, and its sure to be useful to many people, but the content is so jumbled that its difficult to see the Big Picture. [my review] C-Mind Over Money by Ted and Brad Klontz (2009)Mind Over Money wont teach you how to budget and it doesnt ever mention index funds. This isnt a book about the nuts-and-bolts of personal finance. Its a book about how we relate to money. The strength of the book isnt in the answers it provides, but in the questions it provokes. If you're looking for a book about the psychology of personal finance, this is worth reading. [my review] CEscape from Cubicle Nation by Pam Slim (2009)Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with whats important to you. At times, this almost seems touchy-feely. Almost. Thankfully, the book packs in ton of practical info on how to start a successful small business that matches you and your lifestyle. [my review] B+The Happiness Project by Gretchen Rubin (2009)On paper, The Happiness Project may seem sort of lame. Rubin decided to spend one year consciously pursuing happiness. Each month, she tackled one specific aspect of life marriage, work, attitude, and so on and during that month, she attempted to meet a handful of related resolutions she hoped would make her happier. Fortunately, the book isnt lame. Rubins style is warm and engaging, and the material here is useful. [my review] BI Will Teach You to Be Rich by Ramit Sethi (2009)This book is great, but its not for everyone. First of all, its targeted almost exclusively at young adults. If youre under 25 and single, and if you make a decent living, this book is perfect. But if youre 45 and married with two children, and if you struggle to make ends meet, this book is less useful. That said, it's packed with solid advice, cites its sources, and provides scores of tactical tips for managing money. [my review] A- Spend Til the End by Scott Burns and Larry Kotlikoff (2008)Burns and Kotlikoff analyze dozens of hypothetical scenarios as they seek to discover which choices provide the greatest lifetime living standard per adult. Their aim is to find a way to balance today and tomorrow, to pursue what's known as consumption smoothing. Much of the books advice is geared toward those nearing retirement, but theres still plenty for readers of every age. [my review] C+Increase Your Financial IQ by Robert Kiyosaki (2008)The problem with the standard financial advice is that its bad advice. Youve been told to work hard, save money, get out of debt, live below your means, and invest in a well-diversified portfolio of mutual funds. But this advice is obsolete so argues Robert Kiyosaki in Increase Your Financial IQ. I'll be blunt: Kiyosaki is full of shit. I worry about his financial IQ. [my review] D-

The 4-Hour Workweek by Timothy Ferriss (2007)When I picked up The 4-Hour Workweek, I was worried it was some sort of get rich quick book. Ferriss makes a lot of bold promises, and some of the details along the way read like the confessions of an internet scammer. Ultimately, though, I found tons of value that I could apply to my own entrepreneurial ventures. In fact, this has become one of my most-bookmarked books of all time! An intelligent reader can easily extract a wealth of useful here, which is why it's become a modern classic. [my review] B- The Quiet Millionaire by Brett Wilder (2007)The Quiet Millionaire is different from most of the other money books I review. Though Wilder includes behavioral finance and life planning concepts, this is a numbers book. It's like a textbook for personal finance. It isnt really a book for beginners. Its targeted at folks who are out of debt and building wealth. I suspect many people will find this book boring. But then, smart personal finance is boring. [my review] BDebt Is Slavery by Michael Mihalik (2007)Debt is Slavery is a deceptively simple book. Its short. Its advice seems basic. And its self-published, so how good can it be? Well, I think its great. In fact, I found myself wishing that I had written it. Mihaliks advice is spot-on, and he covers a lot of topics that other authors shy away from, such as the effects of advertising, the weight of possessions, and the soul-sucking misery that comes from a bad job. This book may be short, but its sweet. Especially great for recent graduates, I think. [my review] B+Overcoming Underearning by Barbara Stanny (2007)Overcoming Underearning isn't what I expected it to be. When I read the title, I expected a book about how to stretch your dollars and how get more from what you do earn. This book is about asking for more, creating more, and working your way through the psychological pitfalls that lead to being satisfied with less in the first place. But the book contains few actionable steps that will help you make more money or invest well. If you need a how-to book, keep looking. If you need to get started, or are started, but have hit a wall and you dont know why, this might be the book for you. [my review] C-The Secret by Rhonda Byrne (2006)The Secret is all about the so-called Law of Attraction, which is not actually a law of anything. The Law of Attraction states that your life is a result of the things you think about. From a psychological perspective, this notion has some merit. But this book offers no evidence of any kind: no scientific discussion, no experimentation only scattered cherry-picked anecdotes. Its the worst kind of pseudo-scientific baloney. And its money advice is actively harmful rather than helpful. [my review] FThe Millionaire Maker by Loral Langmeier (2006)The Millionaire Maker attempts to codify Langemeiers proprietary Wealth Cycle Process. She believes there are better places to put your money than in mutual funds. This book is a mixed bag. While it preaches what ought to be preached, and Langemeier provides more specifics than some authors, her message sounds hollow. There is some good information here, but theres stuff that raises red flags, too. [my review] D+Work Less, Live More: The Way to Semi-Retirement by Bob Clyatt (2005)For years, Work Less, Live More has been my go-to book for info about early retirement. I give away copies several times a year. I recommend it when replying to email. I refer to it myself when I have questions. I like this book because it strikes a balance between the high-level Big Picture stuff and the low-level nitty-gritty numbers crunching. (See also: Bob Clyatt's guest post here at GRS about his life since writing the book.) [my review] A All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Tyagi (2005)This book was written by the mother-daughter team of Elizabeth Warren and Amelia Warren Tyagi. (Warren is now a U.S. Senator from Massachusetts!) The authors dont get bogged down in the details of frugality and investing. Theyre more interested in changing behavior, in fixing the big stuff. They offer a framework around which the reader can build lasting financial success. The book's advice is solid, if sometimes flawed. To me, its lasting legacy is the introduction of the Balanced Money Formula (which some now call the 50-30-20 budget), a concept I promote extensively in my public speaking gigs. [my review] B- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth by T. Harv Eker (2005)Many people would dismiss Secrets of the Millionaire Mind as useless. Theres not a lot of concrete information here about how to improve the details of your financial life. (Though the scant advice presented is sound). Instead, this book encourages readers to adopt mental attitudes that facilitate wealth. Its about changing your psychological approach to money, success, and happiness. (This book is the source of my money blueprint concept.) [my review] CMoney Without Matrimony: The Unmarried Couple's Guide to Financial Security by Sheryl Garrett and Debra Neiman (2005)As difficult as marriage and money can be, things are even tougher for unmarried couples, both gay and straight. Its difficult for these folks to get good advice in a society thats geared toward married couples. Money Without Matrimony is a great book with sound suggestions. Its non-judgmental, practical, and packed with advice. If youre in a committed unmarried relationship, I highly recommend you track down a copy. [my review] AThe Automatic Millionaire by David Bach (2005)David Bach is perhaps best known for coining the term the latte factor, a phrase that has almost become a joke in personal finance circles. Thats too bad, really, because Bach has some good ideas. And the latte factor is a marvelous concept, applicable to many people who casually spend their future a few dollars at a time. This book encourages readers to eliminate debt, to live frugally, and to pay themselves first. But the core of his book is unique: rather than develop will power and self-discipline, Bach says, why not bypass the human element altogether? Why not make your path to wealth automatic? [my review] C Luck Is No Accident: Making the Most of Happenstance in Your Life and Career by John D. Krumboltz and Al S. Levin (2004)Luck Is No Accident is a short book. Nothing in it is groundbreaking or revolutionary. Yet its common-sense wisdom is a powerful motivator. Whenever I read it, I cannot help but come away inspired, ready to make more of my situation, and to try new things. If youre the sort of person who wonders why good things only happen to other people, I encourage you to read it. [my review] B+The Random Walk Guide to Investing: Ten Rules for Financial Success by Burton Malkiel (2003)Malkiels advice can be stated in a few short sentences: Eliminate debt. Establish an emergency fund. Begin making regular investments to a diversified portfolio of index funds. Be patient. But the simplicity of his message does not detract from its value. If you want to invest but dont know where to start, pick up a copy of this book. [my review] A-

The Bountiful Container by Rose Marie Nichols McGee and Maggie Stuckey (2002)The Bountiful Container beats most gardening books hands-down in several key areas. It focuses on growing plants that give a beginning gardener the most bang for the buck, plants that are both edible and decorative and can be grown with limited space. It is splendidly organized and easy to read, and has a great index, too. And the level of detail is just right for almost any skill level, and the writing is pleasant to read and easy to understand. [my ex-wife's review] B+The Four Pillars of Investing by William Bernstein (2002)In this book, Bernstein describes how to build a winning investment portfolio. He doesnt focus on the details he tries to explain fundamental concepts so that readers will be able to make smart investment decisions on their own. The Four Pillars of Investing is challenging in places, but it provides an excellent introduction to the theory, history, psychology, and business of investing. If youre able to finish, youll have a better grasp of investing than 99% of your peers. [my review] B Why We Buy: The Science of Shopping by Paco Underhill (2000)In this book, Paco Underhill an environmental psychologist describes what he learned through years of research into consumer behavior and retail marketing. Like it or not, youre manipulated all of the time while youre shopping, and in ways you dont even suspect. But by taking Underhills lessons for marketers and flipping them around, you can make yourself immune to marketers manipulations. (Well, maybe not immune, but less likely to succumb to their ploys, anyhow.) [my review] BWhy Smart People Make Big Money Mistakes (and How to Fix Them) by Gary Belsky and Thomas Gilovich (1999)In this short book, Belsky and Gilovich catalog a menagerie of mental mistakes that cause people to spend more than they should. What might have been a boring topic becomes fascinating thanks to an engaging style and plenty of anecdotes and examples. This book covers a couple dozen psychological barriers to wealth. [my review] B+ The Millionaire Next Door by Thomas Stanley and William Danko (1998)The Millionaire Next Door has earned its place in the canon of personal-finance literature. It's built on years of research, on a body of statistics and case studies. It doesnt make hollow promises. That said, the book is a flawed classic. It offers a fascinating portrait of the wealthy, but it buries this beneath mountains of detritus. The book is poorly organized, repetitive, and dull. (The section on car-buying seems to go on forever.) A patient reader will be rewarded with a glimpse at what it takes to become a millionaire, but I cant help but feel this book could have been something more. Warning: Avoid the audiobook, which suffers even more in the tedious sections. [my review] C+ Yes, You Can Achieve Financial Independence by James Stowers (1992)Yes, You Can Achieve Financial Independence is informative without being dense. Its accessible without being condescending. Its advice is solid. The book is filled with investment advice, but it gives equal time to thrift and savings. Best of all, it asks as many questions as it provides answers. It prompts the reader to think, to evaluate his priorities. Its message is that yes, you can achieve Financial Independence, but you cant get there overnight, and you cant get there without setting goals and making sacrifices. [my review] A-How to Retire Young by Edward M. Tauber (1989)How to Retire Young is one of the oldest books Ive found on the subject of early retirement. Taubers premise is that many people can retire early if they plan and remain dedicated to the plan. I wish I could say that this is a great book. Sadly, its not. Its good (dont get me wrong), but it suffers from being first. [my review] C-Cashing In on the American Dream: How to Retire at 35 by Paul Terhorst (1988)Cashing In on the American Dream is a seminal early retirement book and its advice was spot-on for 1988. But that strength is now its weakness. Some of the advice is thirty years out of date. If you dont need specific advice but are instead interested about theory (and story), then seek out this title. (The last half of the book is filled with stories from folks who made early retirement happen.) [my review] BHow to Get Out of Debt, Stay Out of Debt, and Live Prosperously by Jerrold Mundis (1988)How to Get Out of Debt is built on the principles of Debtors Anonymous, a twelve-step program founded in 1971 to help those who struggle with compulsive debt. Mundis was himself a debtor, and he based this book on his own experience. This isnt purely theoretical information from the mind of some Wall Street finance whiz who has never struggled; this book contains real tips and real stories from real people. [my review] A- You Can Negotiate Anything by Herb Cohen (1980)Whether you like it or not, your life is filled with negotiations. You negotiate your salary, for the price of a car, for the cost of a couch. You negotiate with your wife about where to spend your summer vacation, with your husband about what color to paint the babys bedroom, with your daughter about what time she should be home from the football game. Of all the books Ive recommended at Get Rich Slowly over the years, You Can Negotiate Anything is one of the best. [my review] A How to Get Rich and Stay Rich by Fred J. Young (1979)This book is built around a single principle: Spend less than you earn and invest the difference in something that you think will increase in value and make you rich. It reads like homespun advice from your favorite uncle. While theres plenty of good advice in these pages and lots of amusing anecdotes, theres very little polish. [my review] CThe Incredible Secret Money Machine by Don Lancaster (1978)Though the title smacks of get-rich-quick schemes, The Incredible Secret Money Machine is really about starting and running a small business. To Lancaster, a money machine is any venture that generates nickels. Nickels are small streams of revenue from individual customers. If your goal is simply to earn a comfortable income for yourself by doing something you love, then this book can help you explore the idea of business ownership. Its not going to help you launch the next Google or Microsoft, though. Lancaster is all about nickels, not about dollars. [my review] C+Hard Times: An Oral History of the Great Depression by Studs Terkel (1970)In 1970, writer Studs Terkel published Hard Times: An Oral History of the Great Depression, which features excerpts from over 100 interviews he conducted with those who lived through the 1930s. Terkel spoke with all sorts of people: old and young, rich and poor, famous and not-so-famous, liberal and conservative. The book is fascinating. Its one thing to read about the Great Depression in textbooks, or to hear it used as leverage in political speeches, but its another thing entirely to read the experiences of the people who lived through it. [my review] A-

That's it! If you find any reviews I missed, let me know so that I can add them to this index.

I consider this a living article. I plan to add to it with time. As I re-publish old reviews that are currently unpublished, I'll add them here. And as I write new reviews in the future, those will get added to the list too.

Know of a money book that I should read and review? Drop a line to let me know!

147 Shares

https://www.getrichslowly.org/money-books-index/

0 notes

Text

The Return Of Girls Gone Write Further unmistakable evidence that women, by and large, are the superior writers: the former George W. Bush press secretary and current Fox News host Dana Perino's my-life-with-my-dog-Jasper memoir Let Me Tell You About Jasper...: How My Best Friend Became America's Dog and the large-screen sprite Anna Kendrick's personal/professional memoir Scrappy Little Nobody. These two books are, frankly, flat-out joys to read, the former being a frequently warmhearted, often humorous, always heartfelt telling of her life and experiences with her pet dog Jasper, who, as she convincingly claims, has become the real and true star of the Perino family; the latter being an engaging, sprightly, consistently witty literary self-examination of one of the modern-day American cinema's most succulent and most appealing chicks. To partake of these tomes consecutively, both from beginning to end, is to spend quality time with a pair of delightfully quirky, keenly aware, firmly articulate she-babes who, each in her own way, have a marvelous sense of proportion, a marvelous refusal to see themselves as having any kind of Greatness. Before getting into just exactly why these superb books are superb, allow me to go into how I first became aware of Kendrick (If you'll remember, Perino first came into my life via her first-rate within-the-George W. Bush-administration memoir And The Good News Is...: Lessons and Advice from the Bright Side). Kendrick caught my attention, as do many other other folks and things these days, via YouTube. Specifically, first, during a compilation of Kathie Lee/Hoda's "best" Today "celebrity moments," wherein, when Kendrick was asked whether or not she'd like to play a game, she facetiously mimicked Nader and replied mock-earnestly: "No! I hate games! I hate fun, I hate laughing!" (Later, she was shown doing some mock-dirty dancing with said girls); second, during a trailer for one of Kendrick's more recent theatrical films, namely Get A Job, the aforementioned trailer's two highlights, for me, being 1) this scene where Kendrick's filmic character, Jillian by name, is sitting on the floor lamenting the fact that she spent almost all of the money she had on a BITCHIIN' pair of shoes, while clad in a pair of equally bangin' black toreador pants that, given her sitting position, magnificently show off her magnificently long, lean legs and her magnificently-proportioned bare feet; and 2) a long shot of Kendrick adorned in a man's white shirt and tie and black high heels and again displaying those stylishly long, lean legs. Thus I was already primed, due to being previously turned on by Kendrick, to favor her tome. It's here where I'll deal with the highlights of both books, the places where our memoirists especially grab ahold of and, simultaneously, charm and delight us. .Perino, on the vast network of fans/friends that has developed due to her having Jasper: "It is a bit wonderful that through television and social media, Jasper and I became friends with so many people across the country. I enjoy interacting with my followers and fans, and I really feel that we have modern-day friendships--people I've never met, but that I've come to know over time through short digital interactions. It has widened my circle of people I talk to, and it's deepened my appreciation for people from all walks of life. I now get a chance to communicate with people I wouldn't have ever known; the Internet has given us a way to connect and network that didn't exist before. We're all neighbors now (with the proper amount of fencing to keep things friendly). "Often this new group of people has cheered me up or warmed my heart just when I needed it. Working in politics and live cable television can be stressful, and switching off at the end of the day isn't always easy. Jasper's following has actually given me a way to set aside the work portion of my day and exchange some messages with my electronic friends, which helps me keep grounded and cheerful." .Kendrick, on her brother Mike: "My brother is my hero. I've idolized him since the day I was born and I still do. He's responsible for at least sixty percent of my personality, for better or worse. I'm told that if you're an only child, you grow up thinking you're the center of the universe, and if you have tons of siblings you grow up with a healthy perspective on how small you are in the grand scheme of things. I'd like to think that my brother told me I was a worthless brat often enough that I got the same effect... "Mike's main interests [when we were kids] were watching Star Wars, playing Magic: The Gathering, and avoiding his annoying little sister. The only time he happily included me was when he wanted to play 'Pro Wrestling Champions,' as I was an ideal partner on which to inflict moderate injury." .Perino, on Jasper's television debut: "Jasper made his debut on The Five [Perino's Fox News political talk show] as a sleepy puppy at just two months old, and a star was born. I brought him on set and when we were back from commercial break, I showed him off for the camera. He looked right into the lens with his deep blue eyes (a Vizsla [Jasper's breed] is born with blue eyes that eventually turn amber). He snuggled into me. Hearts melted. "Jasper has tons of personality and is as photogenic as any dog I've known. On Jasper's birthday, my [The Five] producer lets him come on the show and he sits on a chair, for the most part, wearing a bow tie collar, and you would think he knows exactly what he's doing when he looks into the teleprompter. He's certainly better behaved than [Five co-host Greg] Gutfield." .Kendrick, on her early period as an actor: "Starting in theater gave me a basic work ethic that I may not have gotten if I started in film and television. I worked six days a week, eight shows a week (two shows on Wednesdays and Saturdays, Mondays off). It wasn't so much the schedule--I worked in accordance with child labor laws--it was that I was held accountable for my work. "Once, during rehearsals, our director was playing with the shape of a musical number that involved most of the cast--which jokes should stay, where they should go, etc. He decided to try reinstituting a small joke I'd had in a previous draft, and we started the number again from the top. I lost where we were in the music and I opened my mouth to say the line, a measure too late. He was already shaking his head and signaling the pianist to stop. "'Anna just lost a line. Let's go back to how it was before and start again.'" .Perino, on her period as W.'s press secretary: "[B]ecoming the White House press secretary was the best thing that ever happened to my career. I learned so much--about policy, world affairs, management, and politics. "But the most important lesson I learned working for President Bush was about character and how to conduct myself under stress and attack. I found out how to be productive despite obstacles, and appreciated how a communicator can help calm a situation, advance a negotiation, or lead to a solution. "The press secretary is the pinnacle for a public relations professional--it was the opportunity of a lifetime. "But having worked in politics for so many years, I'd built up a fairly tough exterior. The daily battles can wear a person out, and in some ways, I became edgier and harder than I'd ever been. "It was also a lofty position, and the surest way you can lose your way in Washington, D.C., is to let any of that power or prestige go to your head. "Throughout those years [first dog] Henry kept me from losing sight of what was important in life: appreciation and gratitude for my health and blessings, and the love I shared with [hubby] Peter and our dog." .Kendrick, on her early life as a struggling actor: "The next pilot season [for television series] was starting up, which meant I was usually sent on one to four auditions a day. I discovered MapQuest and wrote down directions by hand since I didn't have a printer. Between that and my growing knowledge of the city, I was only getting lost, like, six times a day. Pilot season is grim because you're sent in for everything, no matter how wrong you are for it. I kept a mountain of clothes and accessories in my trunk so I could go from the fourteen-year-old goth daughter on a TNT drama to the spoiled twenty-two-year-old receptionist on a workplace comedy. It's obvious now that splitting my focus made it responsible for me to do well on any of them, but I was in no position to turn down auditions. "How do I describe my personal life during this time? I met funny, interesting people. I went to art galleries downtown, I performed a one-woman show for free on the street corner. Except none of that's true. I spent most of my time trying to find ways to occupy myself without spending money or ingesting calories." .Perino, on what she terms Jasper's "protest pee": "When I wrote And the Good News Is... I received a lot of gifts for Jasper, including an embroidered quilt with the Great Seal of the United States. It is beautiful and functional. [Peter and I] take it with us to our friends' homes if we are invited to stay the night, because, well, you try telling Jasper he can't sleep on the bed. With the quilt, we're covered. Literally and figuratively. "When we're at our place in South Carolina, leaving him in the house is even more stressful. For a while, whenever we'd go out, we'd come home and find that he'd peed on the floor. As soon as we'd walk in, we'd know something happened, because Jasper would grab a toy as he always does, but instead of frantic joy and butt wagging, his tail would be down and he'd look guilty. It was hard to discipline him because you're supposed to catch them in the act. [Hubby] Peter would get pretty made at Jasper, and I'd feel terrible. "'He's so scared to be left alone,' I'd say. "'No, he's being a brat,' Peter responded." .Kendrick, on behavior at showbiz events: "There's a campaign called #AskHerMore, which was started by some thoughtful, intelligent females (Lena Dunham, Reese Witherspoon, Shondra Rimes, etc.). It aims to ensure that when women attend events, they are asked about more than their dresses. Men don't answer questions about their clothes; why should we [women]? A simple and understandable request. "However, if people could ask me less, that would be great. I would love it if we could limit my red carpet topics to my favorite colors, what sound a duck makes, and my thoughts on McDonald's All-Day Breakfast--blessing or curse?" Also: Nearly the final half of Perino's book consists of various @FiveFanPhotoshops pictures that very humorously show Jasper in a collection of quite colorful poses--Jasper painting a portrait of Perino's former boss, W.; Jasper as a race-car driver; Jasper and Perino involved in the Kentucky Derby with the latter on top of the former, et al. And Kendrick's tome closes with a "Bonus Reading Group Guide," wherein there are "a few questions to help you get the most out of your reading experience."(As an addend, Kendrick wittily 1] apologizes for the "fact" that her "Guide" offers no red meat for those of us who "happen to run a trashy celebrity news blog that requires you to peruse the content of privileged cretins like me"; and 2] gives us permission to "use these questions [in the "Guide"] as a template for creating misleading but juicy headlines." She winds up by, also wittily, summing up what she, so she claims, is conveying: "[F]amous white girls are really fun to be mad at") Among the queries asked in the "Guide": .."Though every page of Scrappy Little Nobody is perfect in every way, which part is your favorite? Make a list (it can be a Post-it that says, 'Every part is my favorite') and tape it to your chest for the rest of the day." .."When Anna compares Zac Efron to Charles Manson, is she making a joke or trying to warn us about a potential murderous mastermind?" .."In the sections about Alexa Chung and Olivia Palermo, the author viciously maligns two innocent and very fashionable girls. Is Anna a shady, basic bitch, or the shadiest, basic-est bitch?" .."Anna makes a lot of bad decisions. Can you think of a time when you've made a bad decision? Oh wow, really? We're gonna pretend you can't think of a single example? YOU THINK YOU'RE BETTER THAN ME?!" And thus there are the books of Dana Perino and Anna Kendrick, the former being a greatly stylish, consistently witty, always loving paean to a dog who is not only a beloved pet but, as Perino very convincingly limns, one of the most well-known and well-regarded personalities in America (easily, happily, well above and beyond any yammering about "animal rights"); the latter being an engagingly lively, undeniably honest, unrelievedly funny self-portrait of a celebrity gal who is obviously on the sides of life and living, whose unflinchingly upbeat, never-say-die attitude comes through in literally every paragraph. In the much-lauded theatrical film The Magic of Belle Isle, the single Mom Charlotte O'Neill (Virginia Madsen), during an evening dinner with her daughters and that evening's guest, the renowned Western novelist Monte Wildhorn (Morgan Freeman), asserted: "I've always felt that a book does something no friend could: Stay quiet when you want to think." To partake of the Perino and Kendrick tomes as they "[s]tay quiet" is to have you "wanting to think" about them--always favorably and, very often, with unsheathed laughter.

#women#superior writers#Dana Perino#Let Me Tell You About Jasper...#anna kendrick#scrappy little nobody#pet dog#jasper#and the good news is...#youtube#get a job#the five#AskHerMore#@FiveFanPhotoshops#the magic of belle isle#Virginia Madsen#Morgan Freeman#unsheathed laughter

0 notes

Text

An index to every money book I've reviewed during the past twelve years

Shares 139

I read a lot of money books. As a result, a large section of my large library is devoted to books about personal finance. (And if I hadn't purged hundreds of money books when I sold this site in 2009, I'd have even more books and no place to put them.)

Last week, a GRS reader named Lindsay dropped a line with an interesting question:

I'm really enjoying your work back at GRS, the email newsletter, and your most recent FB live video! I'm wondering: Do you have a list of all the money books you've reviewed? I've been poking around to try and find one)?

As it happens, I've been wanting a list of reviews myself. I know I have a million billion different projects around here, but one that I'd like to pursue is a free nicely-formatted PDF download that compiles every review I've written.

To answer Lindsay's question and to satisfy my own curiosity I sifted through the GRS archives yesterday to compile a list of every money book I've reviewed during my 12+ years at this site. In this post, I've linked to those reviews, plus I've included a short summary of each book.

Note: I'm certain that about half of the reviews are missing from the archives. The folks who purchased this site from me unpublished hundreds of articles (including many book reviews, apparently) during the time they owned GRS. Those reviews still exist, and I'll eventually find them and list them here, but it's far too cumbersome to find them at the moment.

For each book below, I've included a link to Amazon. I've also assigned each a book a letter grade and, in some cases, a star .

My letter grades might seem harsh. That's because I've tried to really think about these on a sort of curve, where the vast majority of books are average and only a few merit As or Fs. As a result, some important titles get average (or low) grades despite their contribution to the field.

If I grade a book an A, I think it's excellent. It offers excellent advice with no real flaws.If I give a book a B, it's a good book with good advice, but something about it holds it back. Maybe it's poorly written or maybe it's off-base on a topic or two.If I give a grade of C, the book is average. That means it gives reasonable money advice in a typical way. There's nothing drastically wrong with the book, and it's worth reading.If I give a D grade, the book is flawed in some major way. It still has some value to it maybe a core concept that you can't find elsewhere but I'm hesitant to recommend this to average folks.If I give a book and F, I don't think it has any sort of value. I don't give many Fs because I think nearly every book has some nugget of wisdom in it.

Note that all of my letter grades were assigned today. They're based on who I am and what I know now, not when I wrote the reviews. And they're based on how valuable the book's info will be to a modern reader. (Some money books that were awesome in 1978 haven't aged well because their advice is specific to that era.)

When I've marked a book with a star , that indicates I believe regardless of my grade, the title should be considered part of a core personal-finance library. (I don't have a review of Dave Ramsey's Total Money Makeover here. If I did, it'd get a C or lower because the book's quality is mixed and it has certain drawbacks. But the book would also merit a star because it should be in any serious library of money books.)

Ultimately, though, you shouldn't let the letter grades and stars guide your decision to read a book. Use my reviews instead. They're much more nuanced than an arbitrary grade. The grades are meant as a sort of quick reference.

Finally, I've sorted the titles into roughly reverse-chronological order based on year of publication. I think most readers are interested in recent titles. (Because of my hiatus from money-blogging, there's a gap here between 2010 and 2016.) If, like me, you prefer older money books, you'll find them closer to the end of this list.

That's enough explanation. Here then is a list of (nearly) all of the book reviews from the archives here at Get Rich Slowly!

Get Money by Kristin Wong (2018)Get Money is all about applying game-playing principles to money management. Most money books tend toward boring and stale. Not this one. Get Money is both funny and wise, packed with practical tips for how to play the game of money and win. It's a useful money manual from a favorite former GRS staff writer. [my review] BThinking in Bets: Making Smarter Decisions When You Don't Have All the Facts by Annie Duke (2018)For a long time, Ive argued that the best money books are often not about money at all. Thinking in Bets is an example of this. Duke says that there are exactly two things that determine how our lives turn out: The quality of our decisions and luck. She uses plenty of personal finance examples, but the book itself is about self-improvement. Its not specifically about personal finance, yet the info here could have a profound impact on your financial future. [my review] A-Meet the Frugalwoods: Achieving Financial Independence through Simple Living by Elizabeth Willard Thames (2018)Meet the Frugalwoods isnt a money manual. It isnt fiction. Its memoir. The book covers ten years in the lives of Liz and her husband Nate, from their post-college job-hunting experiences in Kansas to purchasing a 66-acre homestead in Vermont. Through their story, Liz shows readers its possible to move from a life of consumerism to a life built around frugality and purpose. My chief complaint? The Frugalwoods didn't achieve financial independence through frugality; they achieved it through a high income. [my review] CYou Need a Budget by Jesse Mecham (2017)You Need a Budget is a simple book, but its excellent. It doesnt try to throw the entire world of personal finance at you. Its laser-focused on one thing: building a better budget. Because Mecham has been reading and writing about budgets since 2004, hes learned a lot about what works and what doesnt. Hes constantly receiving feedback from the tens of thousands of people who follow his program. This book is a culmination of that experience, and it shows. If you need a budget, I highly recommend this book. [my review] A The Simple Path to Wealth by J.L. Collins (2016)The Simple Path to Wealth presents the advice from the author's blog in a coherent, unified package. Its an easy-to-understand primer on stock-market investing and financial independence. Although the book is intended to offer wide-ranging advice about the journey to financial freedom, I think its at its best when Collins covers retirement investing. [my review] B+ Early Retirement Extreme by Jacob Lund Fisker (2010)Imagine a personal-finance book written by a theoretical physicist. What would it be like? Full of formulas and figures, right? Well, thats what you get with Early Retirement Extreme. This feels like a book written by an engineer for other engineers. This isnt a bad thing, but it is unique. Some people will love it; others will hate it. Also, this book could use a professional editor. These caveats aside, ERE is packed with excellent information, and is one of the key books in the Financial Independence movement. [my review] B The Simple Dollar by Trent Hamm (2010)This book isnt really about personal finance. Theres personal finance in it, sure, but like Hamms blog, The Simple Dollar is about personal and professional transformation. This is a book about change. The information in the book is good, and its sure to be useful to many people, but the content is so jumbled that its difficult to see the Big Picture. [my review] C-Mind Over Money by Ted and Brad Klontz (2009)Mind Over Money wont teach you how to budget and it doesnt ever mention index funds. This isnt a book about the nuts-and-bolts of personal finance. Its a book about how we relate to money. The strength of the book isnt in the answers it provides, but in the questions it provokes. If you're looking for a book about the psychology of personal finance, this is worth reading. [my review] CEscape from Cubicle Nation by Pam Slim (2009)Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with whats important to you. At times, this almost seems touchy-feely. Almost. Thankfully, the book packs in ton of practical info on how to start a successful small business that matches you and your lifestyle. [my review] B+The Happiness Project by Gretchen Rubin (2009)On paper, The Happiness Project may seem sort of lame. Rubin decided to spend one year consciously pursuing happiness. Each month, she tackled one specific aspect of life marriage, work, attitude, and so on and during that month, she attempted to meet a handful of related resolutions she hoped would make her happier. Fortunately, the book isnt lame. Rubins style is warm and engaging, and the material here is useful. [my review] BI Will Teach You to Be Rich by Ramit Sethi (2009)This book is great, but its not for everyone. First of all, its targeted almost exclusively at young adults. If youre under 25 and single, and if you make a decent living, this book is perfect. But if youre 45 and married with two children, and if you struggle to make ends meet, this book is less useful. That said, it's packed with solid advice, cites its sources, and provides scores of tactical tips for managing money. [my review] A- Spend Til the End by Scott Burns and Larry Kotlikoff (2008)Burns and Kotlikoff analyze dozens of hypothetical scenarios as they seek to discover which choices provide the greatest lifetime living standard per adult. Their aim is to find a way to balance today and tomorrow, to pursue what's known as consumption smoothing. Much of the books advice is geared toward those nearing retirement, but theres still plenty for readers of every age. [my review] C+Increase Your Financial IQ by Robert Kiyosaki (2008)The problem with the standard financial advice is that its bad advice. Youve been told to work hard, save money, get out of debt, live below your means, and invest in a well-diversified portfolio of mutual funds. But this advice is obsolete so argues Robert Kiyosaki in Increase Your Financial IQ. I'll be blunt: Kiyosaki is full of shit. I worry about his financial IQ. [my review] D-

The 4-Hour Workweek by Timothy Ferriss (2007)When I picked up The 4-Hour Workweek, I was worried it was some sort of get rich quick book. Ferriss makes a lot of bold promises, and some of the details along the way read like the confessions of an internet scammer. Ultimately, though, I found tons of value that I could apply to my own entrepreneurial ventures. In fact, this has become one of my most-bookmarked books of all time! An intelligent reader can easily extract a wealth of useful here, which is why it's become a modern classic. [my review] B- The Quiet Millionaire by Brett Wilder (2007)The Quiet Millionaire is different from most of the other money books I review. Though Wilder includes behavioral finance and life planning concepts, this is a numbers book. It's like a textbook for personal finance. It isnt really a book for beginners. Its targeted at folks who are out of debt and building wealth. I suspect many people will find this book boring. But then, smart personal finance is boring. [my review] BDebt Is Slavery by Michael Mihalik (2007)Debt is Slavery is a deceptively simple book. Its short. Its advice seems basic. And its self-published, so how good can it be? Well, I think its great. In fact, I found myself wishing that I had written it. Mihaliks advice is spot-on, and he covers a lot of topics that other authors shy away from, such as the effects of advertising, the weight of possessions, and the soul-sucking misery that comes from a bad job. This book may be short, but its sweet. Especially great for recent graduates, I think. [my review] B+Overcoming Underearning by Barbara Stanny (2007)Overcoming Underearning isn't what I expected it to be. When I read the title, I expected a book about how to stretch your dollars and how get more from what you do earn. This book is about asking for more, creating more, and working your way through the psychological pitfalls that lead to being satisfied with less in the first place. But the book contains few actionable steps that will help you make more money or invest well. If you need a how-to book, keep looking. If you need to get started, or are started, but have hit a wall and you dont know why, this might be the book for you. [my review] C-The Secret by Rhonda Byrne (2006)The Secret is all about the so-called Law of Attraction, which is not actually a law of anything. The Law of Attraction states that your life is a result of the things you think about. From a psychological perspective, this notion has some merit. But this book offers no evidence of any kind: no scientific discussion, no experimentation only scattered cherry-picked anecdotes. Its the worst kind of pseudo-scientific baloney. And its money advice is actively harmful rather than helpful. [my review] FThe Millionaire Maker by Loral Langmeier (2006)The Millionaire Maker attempts to codify Langemeiers proprietary Wealth Cycle Process. She believes there are better places to put your money than in mutual funds. This book is a mixed bag. While it preaches what ought to be preached, and Langemeier provides more specifics than some authors, her message sounds hollow. There is some good information here, but theres stuff that raises red flags, too. [my review] D+Work Less, Live More: The Way to Semi-Retirement by Bob Clyatt (2005)For years, Work Less, Live More has been my go-to book for info about early retirement. I give away copies several times a year. I recommend it when replying to email. I refer to it myself when I have questions. I like this book because it strikes a balance between the high-level Big Picture stuff and the low-level nitty-gritty numbers crunching. (See also: Bob Clyatt's guest post here at GRS about his life since writing the book.) [my review] A All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Tyagi (2005)This book was written by the mother-daughter team of Elizabeth Warren and Amelia Warren Tyagi. (Warren is now a U.S. Senator from Massachusetts!) The authors dont get bogged down in the details of frugality and investing. Theyre more interested in changing behavior, in fixing the big stuff. They offer a framework around which the reader can build lasting financial success. The book's advice is solid, if sometimes flawed. To me, its lasting legacy is the introduction of the Balanced Money Formula (which some now call the 50-30-20 budget), a concept I promote extensively in my public speaking gigs. [my review] B- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth by T. Harv Eker (2005)Many people would dismiss Secrets of the Millionaire Mind as useless. Theres not a lot of concrete information here about how to improve the details of your financial life. (Though the scant advice presented is sound). Instead, this book encourages readers to adopt mental attitudes that facilitate wealth. Its about changing your psychological approach to money, success, and happiness. (This book is the source of my money blueprint concept.) [my review] CMoney Without Matrimony: The Unmarried Couple's Guide to Financial Security by Sheryl Garrett and Debra Neiman (2005)As difficult as marriage and money can be, things are even tougher for unmarried couples, both gay and straight. Its difficult for these folks to get good advice in a society thats geared toward married couples. Money Without Matrimony is a great book with sound suggestions. Its non-judgmental, practical, and packed with advice. If youre in a committed unmarried relationship, I highly recommend you track down a copy. [my review] AThe Automatic Millionaire by David Bach (2005)David Bach is perhaps best known for coining the term the latte factor, a phrase that has almost become a joke in personal finance circles. Thats too bad, really, because Bach has some good ideas. And the latte factor is a marvelous concept, applicable to many people who casually spend their future a few dollars at a time. This book encourages readers to eliminate debt, to live frugally, and to pay themselves first. But the core of his book is unique: rather than develop will power and self-discipline, Bach says, why not bypass the human element altogether? Why not make your path to wealth automatic? [my review] C Luck Is No Accident: Making the Most of Happenstance in Your Life and Career by John D. Krumboltz and Al S. Levin (2004)Luck Is No Accident is a short book. Nothing in it is groundbreaking or revolutionary. Yet its common-sense wisdom is a powerful motivator. Whenever I read it, I cannot help but come away inspired, ready to make more of my situation, and to try new things. If youre the sort of person who wonders why good things only happen to other people, I encourage you to read it. [my review] B+The Random Walk Guide to Investing: Ten Rules for Financial Success by Burton Malkiel (2003)Malkiels advice can be stated in a few short sentences: Eliminate debt. Establish an emergency fund. Begin making regular investments to a diversified portfolio of index funds. Be patient. But the simplicity of his message does not detract from its value. If you want to invest but dont know where to start, pick up a copy of this book. [my review] A-