#valuer

Text

How to Become Valuer in India

IOV Registered Valuers Foundation incorporated under section 8 of Companies Act, 2013 and governed by a Board of Directors is a recognized Registered Valuers Organisation by the Insolvency and Bankruptcy Board of India. IOV RVF is a subsidiary company of Institution of Valuers.

According to Section 247 of the Companies Act, 2013 only those professionals who have been given 50 Hrs. M.EP. shall be registered as Valuer. IOV RVF has launched Valuation courses with approval from IBBI to certify valuation professionals in three categories namely

Land & Building

Plant & Machinery

Securities or Financial Assets

The registration process has already begun and the application form is available on the website along with the eligibility criteria and other necessary details. The applicant shall be trained for Valuation as per the syllabus prescribed by the IBBI and then shall be eligible to appear for an examination to be conducted by the IBBI in order to practice as a Registered Valuation professional (Valuer)

OBJECTIVES

The 50 hours. Educational Course will help the members to enhance their knowledge and to

successfully achieve comprehensive insights pertaining:

To identify and apply various valuation approaches to value property, stocks, debentures,securities, goodwill net worth or any other assets and liabilities of companies.

To understand the techniques for identifying the risks associated with business valuation.

To normalize the financials for extraordinary items, non-recurring, and restructuring changes to calculate recurring underlying earnings of the target company.

To practice modelling valuation using DCF. Net asset value, market price liquidation value, weighted average and comparable/based method etc.

To adjust market multiples for risk factors such as size, growth, and other parameters.

To understand the balance sheet impact of acquisitions and mergers, prepare pro-forma financial models and to value companies for mergers and acquisitions.

To model integrated financial statements

IOV-RVF being a recognized Registered Valuers Organisation, provides a wide platform for the practicing Registered Valuers in India. Our objective is to promote and establish the profession of valuers by inculcating knowledge along with education in the field of valuation. IOV-RVF imparts this education with the guidance of eminent Educationalists and Professionals. We aim to provide professional education through an interactive platform like arranging seminars, conferences, and online batches.

How to Become Valuer in India

1 note

·

View note

Text

Well now that I let all the bad emotions out let's talk about things I liked with first of all MURIEL literally the best characters just look hoorph such a cutie it save my day ♡♡♡

#good omens#muriel#they're just perfect#i love them#justt hmmm ut fell my heart with joy#lets all appreciate muriel at they're just valuer ♡#♡♡♡#good omens s2#good omens season 2#good omens spoilers

41 notes

·

View notes

Text

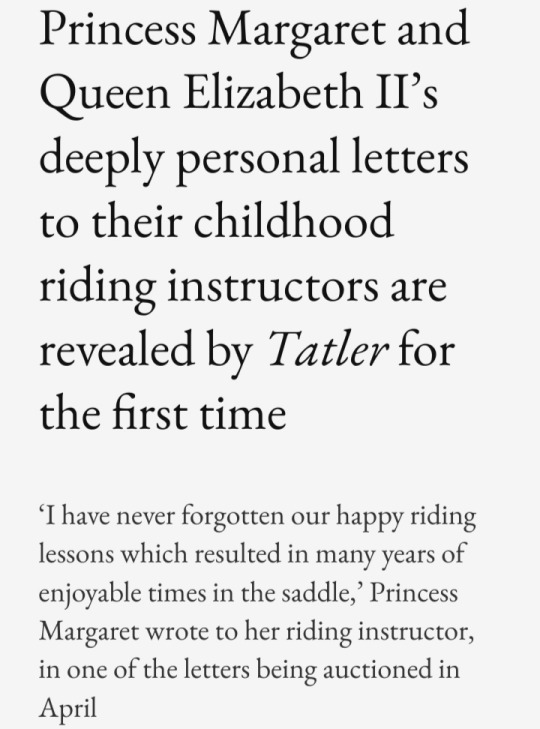

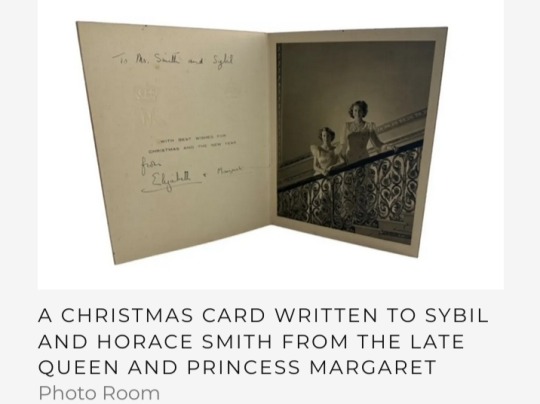

Letters from the late Queen Elizabeth II and Princess Margaret to their childhood riding instructors are to be auctioned in April, Tatler can exclusively reveal.

The collection includes Christmas cards, invitations, telegrams and handwritten notes from the late Queen and Princess Margaret to their riding instructors, father-and-daughter duo Horace and Sybil Smith.

It reveals a lifelong connection that started when the two young princesses first sat in the saddle.

Horace and Sybil Smith provided riding classes at Cadogan Riding School in Belgravia, an internationally famous institution fit for two young royals with a budding love of horses.

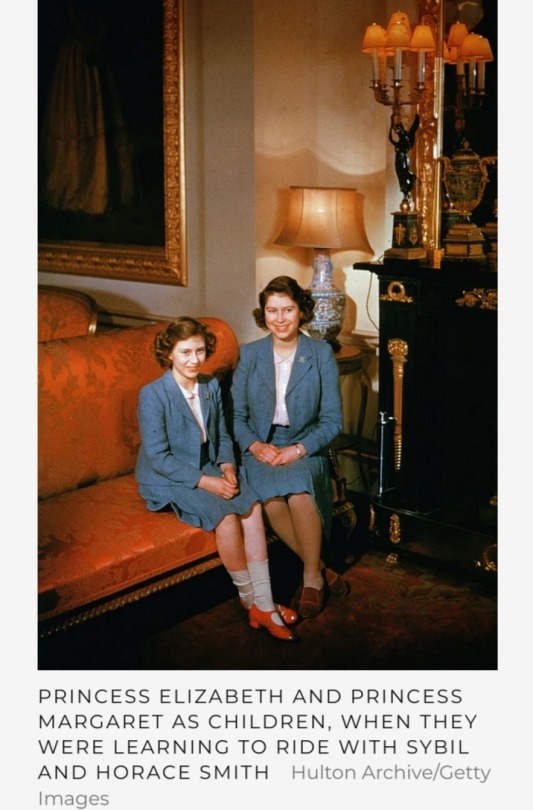

By 1938, 12-year-old Princess Elizabeth and 9-year-old Princess Margaret were attending lessons there, both being taught how to ride by the Smiths.

These lessons stayed with them for life: both the late Queen and Princess Margaret were keen riders, with the Queen riding on horseback at Trooping the Colour and remaining in the saddle into her 90s.

Both Princess Margaret and the Queen stayed in contact with their beloved riding teachers, the Smiths, throughout their lives.

Their letters show their deep affection for the instructors, along with gratitude for the lessons they taught them.

They sent Christmas cards almost every year, along with telegrams of thanks: the collection includes 30 Christmas cards from the mid 1940s until early 1990s.

Princess Margaret also sent them an invitation to her wedding to Anthony Armstrong Jones in 1960, and the Queen invited them to the Thanksgiving Service of her 25th wedding anniversary to Prince Philip in 1972 - both of which are included in the collection.

In 2016, the Royal Windsor Pageant had a re-enactment of the princesses receiving lessons from the Smiths as a tribute to the role they played in the lives of the young princesses.

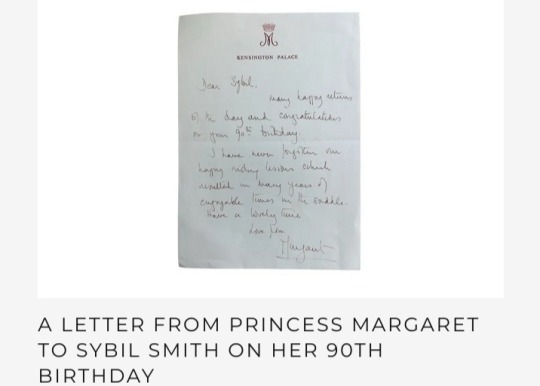

On Sybil’s 90th birthday, Princess Margaret sent a letter which read:

‘Many happy returns of the day, and congratulations on your 90th birthday. I have never forgotten our happy riding lessons which resulted in many years of enjoyable times in the saddle. Have a lovely time. Love from, Margaret.’

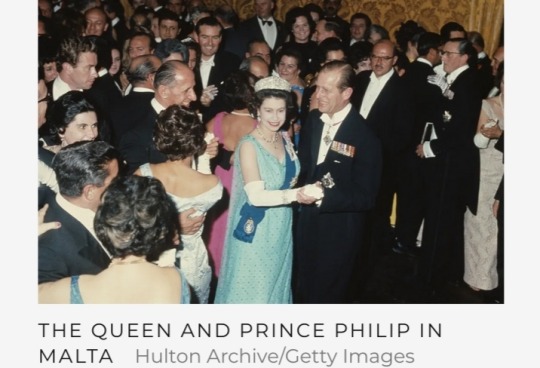

In 1950, the then Princess Elizabeth sent Horace Smith a letter from Malta, where she was visiting Prince Philip.

She wrote:

‘I send my sincere thanks to you and Sybil for your message of good wishes for my birthday, which I much appreciate.

It is lovely out here and I have become a great polo fan - I even took it up mildly myself when I was out here last year.

It is extremely good for one’s riding, I find, as all the ponies are so quick that the unexpected turn, which they are inclined to do, has one off in a moment!’

Letters from the Queen and Princess Margaret to the Smiths were all kept by Sybil Smith, who passed them onto a friend when she died.

They are to be auctioned on 18 April 2023 by Griffin’s Auctioneers and Valuers based in Warwick.

The total estimate for whole collection is around £3000 to £5000.

Ben Griffin, director at Griffin’s told Tatler:

‘We are delighted to be able to offer this large and significant collection of correspondence from the late Queen and other members of the Royal family that were sent to Sybil and her father over the span of five decades.’

He added:

‘The Malta letter in particular gives an fascinating insight to the Queen's life during the earliest days of her marriage to The Duke of Edinburgh, a period she herself referred to as “the happiest days in her life”.’

#Queen Elizabeth II#Princess Margaret#British Royal Family#Horace and Sybil Smith#Cadogan Riding School#Royal Windsor Pageant#Prince Philip#Anthony Armstrong Jones#Malta#Griffin’s Auctioneers and Valuers

36 notes

·

View notes

Text

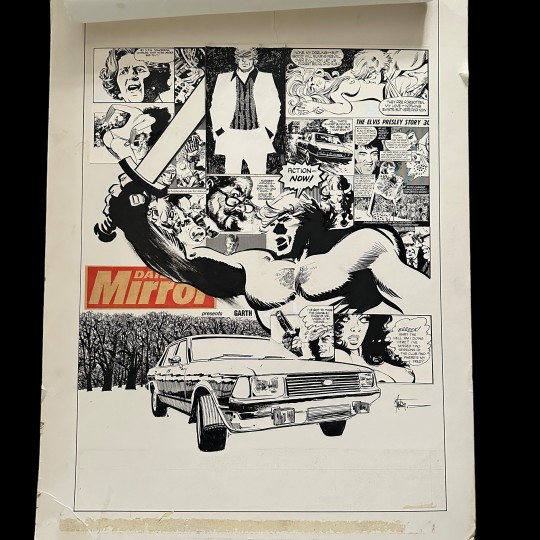

"Garth" art by Martin Asbury, rare Dudley D. Watkins original, to be offered at auction next week

Warwick-based Griffin's Auctioneers and Valuers has included a number of original British comic artworks in its upcoming Antiques, Interiors & Collectables auction next week

View On WordPress

#Ace Brave#Auction News#Daily Mirror#Dan Dare#Danny Longlegs#downthetubes News#Dudley D. Watkins#Eric Parker#Garth#Gerry Embleton#Griffin&039;s Auctioneers and Valuers#Martin Asbury#Newspaper Strips#Ranger#Ron Turner#SF Comics#Sir Osbert Lancaster#The Dandy

3 notes

·

View notes

Text

Leoch have a wealth of experience in the production of small-size batteries, and the factories use advanced processes and automated equipment. 🚛

Leoch supports the customized demands.🔋

Leoch supplies a full range of small-size battery production for all types of power scenarios. 🏭

#SmallSizeBattery#BatteryProduction#FullScenario#Customization#BatteryFactory#BatteryPlant#LeochBatteries#SmallSizeBatteries#PowerScenarios#AdvancedProcesses#AutomatedEquipment#ValueRealization#ProductionCapacity#CustomizedDemands#BatteryManufacturer

3 notes

·

View notes

Text

Somethings weird about me now. I havent cried since thursday but i feel like this

Hormones? Did a switch flip and im just....on the next stage of getting over it?

#i still want to talk to him every day#also its important to know thursday was PATHETIQUE i was laying my head on a letter crying because i missed him and wanted to be close#oh maybe its because i changed my apartment round and the tv broke and a valuer is coming on thursday and im sewing so my brain is just too#static to focus on grief?#thats fake though why pick going to jb for a tv around a public holiday instead of.....twn years#of love and companionship#oh its because i can just buy a new tv and problem solved probably

1 note

·

View note

Text

Property Valuer vs. Real Estate Appraiser: Understanding the Distinctions

When it comes to the world of real estate, there are often terms that seem interchangeable but actually represent distinct roles and functions. One such comparison is between a experience property valuer in christchurch and a real estate appraiser.

While both professions deal with determining the value of properties, there are nuances that set them apart. Let's delve into these differences to gain a clearer understanding of each role.

What is a Property Valuer?

A property valuer is a professional who specialises in assessing the value of real estate properties. They undergo specific training and education to understand various factors that contribute to property valuation, including market trends, property conditions, location, and comparable sales data.

Property valuers typically work for property valuation firms, government agencies, or as independent consultants.

The Role of a Property Valuer

The primary responsibility of a property valuer is to determine the fair market value of a property. They conduct thorough inspections, gather relevant data, and analyse market trends to arrive at an accurate valuation.

Property valuers consider factors such as the property's size, condition, location, amenities, and recent sales of similar properties in the area.

Skills and Qualifications of a Property Valuer

Becoming a property valuer requires a combination of education and practical experience. Many property valuers hold degrees in fields such as real estate, finance, or economics.

Additionally, they may obtain professional certifications or licenses to practice in their respective jurisdictions. Strong analytical skills, attention to detail, and knowledge of local market conditions are essential for success in this role.

Real Estate Appraiser: How Does It Differ?

While the role of a real estate appraiser shares similarities with that of a property valuer Christchurch, there are notable distinctions.

A real estate appraiser is typically focused on providing valuation services for mortgage lenders, banks, and financial institutions. Their evaluations are crucial in determining the value of a property for lending purposes.

Key Differences Between a Property Valuer and a Real Estate Appraiser

One significant difference between a property valuer and a real estate appraiser lies in their clientele and the purpose of their valuations.

While property valuers may work for a variety of clients, including individuals, businesses, and government entities, real estate appraisers primarily serve financial institutions and lenders.

Conclusion

While both professions involve the valuation of real estate properties, the roles of a property valuer Christchurch and a real estate appraiser serve different purposes within the industry. Property valuers focus on providing comprehensive valuations for various clients, considering a range of factors to determine fair market value.

On the other hand, real estate appraisers specialise in valuations for lending purposes, primarily catering to financial institutions. Understanding these distinctions is essential for anyone involved in the real estate industry, whether as a buyer, seller, investor, or professional practitioner. Whether you require a valuation for investment purposes or financing, knowing which expert to consult can ensure you receive an accurate assessment of your property's worth.

Next time you're in need of a property valuation, remember the vital role that a property valuer plays in helping you make informed decisions about your real estate assets. Their expertise and insight can be invaluable in navigating the complex landscape of property valuation.

#Property Valuer Christchurch#Property Valuation Christchurch#House Valuation Christchurch#Home Valuation Christchurch

0 notes

Text

In the realm of construction and woodworking, the choice of materials can make all the difference between a mediocre project and a masterpiece. Among the myriad options available, one material stands out for its exceptional qualities: white wood.

0 notes

Text

Unlocking the Hidden Value: A Guide to Property Valuation on the Sunshine Coast

As property valuers, we understand the allure of this breathtaking region and the nuances that make it unique. Whether you're a homeowner, investor, or real estate enthusiast, understanding property valuation on the Sunshine Coast is essential for making informed decisions. In this guide, we'll explore the intricacies of property valuation in this dynamic market and provide insights to help you unlock its hidden value.

Understanding the Sunshine Coast Market:

The Sunshine Coast boasts a diverse property market, ranging from coastal retreats and suburban neighborhoods to rural hinterlands. Factors such as proximity to amenities, beach access, views, and lifestyle offerings heavily influence property values. Additionally, the region's strong population growth, infrastructure developments, and economic opportunities contribute to its buoyant real estate market.

Methods of Valuation:

When it comes to valuing properties on the Sunshine Coast, several methods are commonly used:

Comparative Market Analysis (CMA): This approach involves analyzing recent sales data of similar properties in the area to determine a property's market value. Factors such as location, size, condition, and features are taken into account to assess comparable accurately.

Income Approach: Primarily used for investment properties, this method evaluates the income potential of a property through rental income or potential earnings. Investors keen on rental properties or commercial ventures often rely on this approach to determine value.

Cost Approach: This method calculates a property's value based on the cost of replacing or reproducing it, adjusted for depreciation and obsolescence. It's commonly used for new constructions or unique properties where comparable sales data may be limited.

Challenges and Considerations:

While valuing properties on the Sunshine Coast offers tremendous opportunities, it also presents unique challenges. Factors such as environmental regulations, zoning laws, land restrictions, and market volatility can impact property values. Additionally, the region's popularity among tourists and seasonal fluctuations may influence rental yields and demand dynamics.

Tips for Property Valuation Success:

To navigate the intricacies of property valuation on the Sunshine Coast effectively, consider the following tips:

Work with Local Experts: Engage the services of experienced property valuers Sunshine Coast who possess in-depth knowledge of the Sunshine Coast market. Their expertise and local insights can provide invaluable guidance throughout the valuation process.

Conduct Thorough Research: Stay informed about market trends, property sales, and development projects impacting the region. Understanding the market dynamics will help you make informed decisions and identify opportunities for value appreciation.

Consider Future Potential: Look beyond the present condition of a property and assess its potential for growth and enhancement. Factors such as proximity to infrastructure projects, urban development plans, and lifestyle amenities can significantly influence future value.

Factor in Sustainability: With increasing emphasis on sustainability and eco-conscious living, properties with energy-efficient features, eco-friendly designs, and proximity to green spaces are gaining traction in the market. Consider these aspects when evaluating properties for long-term value.

Property valuation on the Sunshine Coast requires a nuanced understanding of its unique characteristics, market dynamics, and potential for growth. By leveraging the right methodologies, insights, and expertise, you can unlock the hidden value of properties in this vibrant region. Whether you're buying, selling, or investing, a comprehensive understanding of property valuation will empower you to make informed decisions and capitalize on opportunities in the ever-evolving Sunshine Coast market.

0 notes

Text

Unlocking the Hidden Value: A Guide to Property Valuation on the Sunshine Coast

As property valuers, we understand the allure of this breathtaking region and the nuances that make it unique. Whether you're a homeowner, investor, or real estate enthusiast, understanding property valuation on the Sunshine Coast is essential for making informed decisions. In this guide, we'll explore the intricacies of property valuation in this dynamic market and provide insights to help you unlock its hidden value.

Understanding the Sunshine Coast Market:

The Sunshine Coast boasts a diverse property market, ranging from coastal retreats and suburban neighborhoods to rural hinterlands. Factors such as proximity to amenities, beach access, views, and lifestyle offerings heavily influence property values. Additionally, the region's strong population growth, infrastructure developments, and economic opportunities contribute to its buoyant real estate market.

Methods of Valuation:

When it comes to valuing properties on the Sunshine Coast, several methods are commonly used:

Comparative Market Analysis (CMA): This approach involves analyzing recent sales data of similar properties in the area to determine a property's market value. Factors such as location, size, condition, and features are taken into account to assess comparable accurately.

Income Approach: Primarily used for investment properties, this method evaluates the income potential of a property through rental income or potential earnings. Investors keen on rental properties or commercial ventures often rely on this approach to determine value.

Cost Approach: This method calculates a property's value based on the cost of replacing or reproducing it, adjusted for depreciation and obsolescence. It's commonly used for new constructions or unique properties where comparable sales data may be limited.

Challenges and Considerations:

While valuing properties on the Sunshine Coast offers tremendous opportunities, it also presents unique challenges. Factors such as environmental regulations, zoning laws, land restrictions, and market volatility can impact property values. Additionally, the region's popularity among tourists and seasonal fluctuations may influence rental yields and demand dynamics.

Tips for Property Valuation Success:

To navigate the intricacies of property valuation on the Sunshine Coast effectively, consider the following tips:

Work with Local Experts: Engage the services of experienced property valuers Sunshine Coast who possess in-depth knowledge of the Sunshine Coast market. Their expertise and local insights can provide invaluable guidance throughout the valuation process.

Conduct Thorough Research: Stay informed about market trends, property sales, and development projects impacting the region. Understanding the market dynamics will help you make informed decisions and identify opportunities for value appreciation.

Consider Future Potential: Look beyond the present condition of a property and assess its potential for growth and enhancement. Factors such as proximity to infrastructure projects, urban development plans, and lifestyle amenities can significantly influence future value.

Factor in Sustainability: With increasing emphasis on sustainability and eco-conscious living, properties with energy-efficient features, eco-friendly designs, and proximity to green spaces are gaining traction in the market. Consider these aspects when evaluating properties for long-term value.

Property valuation on the Sunshine Coast requires a nuanced understanding of its unique characteristics, market dynamics, and potential for growth. By leveraging the right methodologies, insights, and expertise, you can unlock the hidden value of properties in this vibrant region. Whether you're buying, selling, or investing, a comprehensive understanding of property valuation will empower you to make informed decisions and capitalize on opportunities in the ever-evolving Sunshine Coast market.

0 notes

Text

https://justpaste.it/ehz9h

Get higher financial returns with Art Investment London! At Art Market Solutions, we help clients transform art into an alternative asset class. To get excellent art pricing services, simply approach us today! For more information, you can visit our website https://www.artmarketsolutions.co.uk/ or call us at 01462 612268

0 notes

Text

How to Use Tenants to Raise Extra Money

Many people are turning towards property investment to help with making it through these hard times and it looks like it's something having many upsides. When you have property that one could book you can not only aid in paying off your mortgage to the property but in addition put a little extra money into your wallet, however you should be careful when you are performing this. Here are some ideas that will help to book your property so you can have someone else lower your mortgage. Screening Your Tenants

Before you agree to letting someone book your house you will need to go through several screening strategies to make certain that they shall be the proper tenant to suit your needs. By going through various application processes and getting to find out your tenants financial background you could lay aside yourself a lot of headaches later on. When developing your application there are a few things you'll want to include from the application:

Name

Phone number

Reasoning behind their move

Amount of people moving with tenant

Whether they smoke or not

Pets

Credit details

References of previous landlords and in addition present

By your tenant fill out these necessary details you'll be able to get yourself a better feel to whom exactly you will end up renting to especially with their credit profile. You do not want to rent to a person who has a bad reputation failing their bills as this could leave you with an issue of deficiency of payments.

Also by requesting for his or her present and previous landlords contact information you'll have the opportunity to discuss with another landlords how the tenant was while renting their residence and when any problems aroused. If there are gonna be multiple adults transforming into a tenant be sure that each complete your application forms individually. This will help you get the background facts about each individual that'll be occupying your premises instead of just one. Meet using the Applicants

You should meet using the applicants and present them a tour from the property that they will be renting from you. When property management Richmond meet them ensure to look at for reactions for the property and listen in with a plans that they will think about while on a trip through your premises. This could allow you to have an improved feel of how they're going to treat your house of course, if they are going to care for it how you want.

You may encounter numerous tenants before you find the proper one and also this is to be expected. Avoid going using the first tenant that visits your premises and invest time to interview multiple people. You are generally planning to take on the method like you would bring in help to work for you personally. You want them to deal with your house the way you would, and that is with respect and care.

Property investment is a great idea for anybody which has time and energy to place involved with it, but ensure you are ready to not merely take care of your own house but cope with any conditions may arise within the property you are renting. You need to take many precautions having a property investment opportunity, and choosing the best tenants is how it'll all begin.

#property valuers Keilor#property valuers Taylors Lakes#property valuers Strathmore#property valuers Yarraville#property valuers Williamstown#property valuers Carlton North#property valuers Carlton#property valuers Essendon#property valuers Moonee Ponds#property valuers Aberfeldie#property management Kensington#property management Maribyrnong#property management Carlton North#property management Brunswick#property management North Melbourne#property management Moonee Ponds#property management Collingwood#property management Richmond#property management Carlton#property management Brunswick East

0 notes

Text

Commercial Property Valuation - Tanuj Kumar & Associates

Commercial Property Valuation-Get an accurate and up-to-date valuation of your commercial property with our trusted experts.

0 notes

Text

Unlocking the Secrets of Property Valuation: A Comprehensive Guide

In the intricate world of real estate, the term "property valuation" holds significant weight. Whether you're a buyer, seller, investor, or simply a curious homeowner, understanding the nuances of property valuation can empower you to make informed decisions.

In this comprehensive guide, let's delve into the realm of property valuation, uncovering its importance, methods, and the role of a property valuer.

Understanding Property Valuation

Property valuation is the process of determining the monetary value of a property, whether it's residential, commercial, or industrial. This valuation serves as a crucial tool in various real estate transactions, including buying, selling, financing, insurance, and taxation. At its core, Experienced Property Valuation Experts in Christchurch-wide involves assessing a property's worth based on factors such as location, size, condition, and market trends.

Key Factors Influencing Property Valuation

Location: The adage "location, location, location" rings true in property valuation. Proximity to amenities, schools, transportation hubs, and economic centres significantly impacts a property's value.

Property Size and Layout: The size, layout, and configuration of a property play a pivotal role in its valuation. Factors such as square footage, number of rooms, and floor plan efficiency are carefully evaluated.

Condition and Age: The condition and age of a property directly affect its value. Well-maintained properties with modern amenities typically command higher prices than those requiring significant repairs or renovations.

Market Trends: Real estate markets are dynamic and influenced by factors like supply and demand, economic conditions, interest rates, and local regulations. Property valuers closely monitor market trends to provide accurate valuations.

Comparable Sales: Comparative market analysis involves assessing similar properties recently sold in the area to gauge the subject property's value. This method helps property valuers establish a fair market value based on comparable sales data.

Methods of Property Valuation

Property valuers employ various methods to determine a property's value, including:

Sales Comparison Approach: This method involves comparing the subject property with similar properties recently sold in the area. Adjustments are made based on differences in size, condition, location, and amenities to arrive at an accurate valuation.

Income Approach: Commonly used for commercial and investment properties, the property valuer Christchurch evaluates a property's value based on its income-generating potential. This method considers factors such as rental income, expenses, and capitalisation rates.

Cost Approach: The cost approach calculates a property's value by estimating the cost to replace or reproduce it, considering depreciation and obsolescence. This method is particularly useful for new properties or those with unique features.

The Role of a Property Valuer

Property valuers play a vital role in the real estate ecosystem, providing unbiased and expert opinions on property values. Their responsibilities include:

Conducting thorough inspections and assessments of properties.

Analysing market data and trends to determine accurate valuations.

Utilising advanced valuation methods and techniques to assess property worth.

Providing comprehensive valuation reports for clients, including lenders, buyers, sellers, and government agencies.

Offering professional advice and insights to help clients make informed real estate decisions.

Final Words

In the dynamic world of real estate, property valuation serves as a cornerstone for informed decision-making. Whether you're buying, selling, or investing in property, understanding the intricacies of valuation is essential. By considering factors such as location, size, condition, and market trends and relying on the expertise of qualified property valuer Christchurch, individuals can navigate the real estate landscape with confidence and clarity. After all, in the realm of property valuation, knowledge is power.

#Property Valuer Christchurch#House Valuation Christchurch#Home Valuation Christchurch#Property Valuation Christchurch

0 notes