#texas property tax rate

Text

What is the property tax rate in Texas?

Property taxes in Texas is the seventh highest in the U.S. The average effective property tax rate in Texas is given as 1.69%. To learn more, visit https://www.poconnor.com/when-are-property-taxes-due-in-texas

0 notes

Text

Why property taxes are higher in Texas

Property taxes in Texas have been one of the highest in the USA. Why are property taxes so high in texas and how can American Finance & Investment Company, Inc, help you with the Texas tax rate? Read on for more info.

Why are taxes so high in Texas?

Does texas have property tax? Yes, and the Texas tax rate does not come cheap. So, why is property tax so high? The first reason why property tax in Texas is so high is that the Texas county is dependent on revenue from the Texas property tax rate. But, how much is property tax in texas? It can reach a maximum limit of 8.25% and it is a vital source of revenue for the Texas government. The high tax rate in Texas is simply to make up for the lack of other government revenue.

The Austin property tax rate is calculated to account for money used for resources such as public schools, libraries, emergency services, road maintenance, and community safety measures. Another reason the house taxes in Texas are so high is that the value of Texas property is increasing. Property tax is determined as a percentage of your home’s value. The value of homes in Texas is rising.

why are property taxes so high in texas

You cannot avoid the Texas high property taxes. The next time you are wondering “why are my property taxes so high”, remember the tax rate is set at a local government level. This means the state cannot change the tax rate.

So, does Texas have high taxes? Absolutely but luckily there are property tax lenders such as AFIC who can help you to settle your property bill quickly.

To contact qualified tax lenders for your property taxes in Texas, contact us today!

#why are property taxes so high in texas#property tax in texas#property taxes in texas#texas tax rate#texas property tax rate#tax rate in texas

1 note

·

View note

Text

3 Reasons Why Property Taxes are Higher in Texas

Property taxes in Texas have been one of the highest in the USA. Why are property taxes so high in Texas and how can American Finance & Investment Company, Inc, help you with the Texas tax rate? Read on for more info.

Taxes in Texas

The first reason why the Texas property tax rate is so high is that the Texas county is dependent on revenue from property taxes. How much is taxes in Texas? It can reach a maximum limit of 8.25% and it is a vital source of revenue for the Texas government. The property tax is simply to make up for the lack of other government revenue.

What do the taxes in Texas pay for? The money is used for resources for public schools, libraries, emergency services, road maintenance, and community safety measures. The Texas tax rate, therefore as high as it is, contributes to the facilities that many Texas citizens use and need.

Another reason tax is so high is because of property values. Property tax is determined as a percentage of your home’s value. The value of homes in Texas is rising.

The third reason is that taxes are set at the local government level. This means the state cannot change the tax rate.

Luckily there are property tax lenders such as AFIC who can help you to settle your property bill quickly.

To contact qualified tax lenders for your property taxes in Texas, contact us today!

#Property Taxes in Texas#Texas Property Tax Rate#Property Tax in Texas#Texas Tax Rate#Taxes in Texas#How much is Taxes in Texas

1 note

·

View note

Text

What Are MUD Taxes: A Texas Homeowner’s Guide

As a property owner in Texas, you may have heard of “MUD taxes”. Let’s break down what they mean.

MUD, it’s Municipal Utility District, a special governmental entity that Texas established. It provides essential services like water, sewage, and drainage to areas without municipal services.

So, what are MUD taxes? These are property taxes that these districts charge to fund their infrastructure…

View On WordPress

#Funding MUD taxes#Homeownership costs Texas#How MUD taxes affect Texas homeowners#MUD tax rates#MUD taxes in Texas#MUD taxes Texas#Property tax management#property taxes in Texas#Property taxes Texas#Texas MUD board#Texas Municipal Utility District#Texas property owner guide#Texas utility infrastructure#Utility services funding

0 notes

Photo

How To Protest Property Taxes - O'Connor

Being charged more in taxes for not protesting yearly? This is true, and there are many ways to avoid this. Visit https://www.poconnor.com/how-to-protest-property-taxes/ to know how.

#property tax#property tax protest#O'Connor#o connor & associates#harris county appraisal#houston property tax#property tax reduction#Texas personal property tax#Texas property tax exemption#texas personal property tax Rate

0 notes

Link

Property taxes continue to be a point of contention for Texas residents following a new report that found almost all independent school districts (ISDs) rose faster than the preferred rate of growth this year.

A report from the Texas Public Policy Foundation (TPPF) last month found that Houston ISD's property tax grew 12.2% — $2 billion to $2.2 billion from 2016 to 2020. The combined population and inflation for the city grew by 5.3% during that time, resulting in a difference of 7%.

"If left unchallenged, these value increases have the potential to really take a bite out of taxpayers over the long haul,” TPPF’s policy director, James Quintero, said in a newsletter discussing property tax appraisals and how to protest them. “Taxpayers should be prepared to defend their wallets this year—first by protesting their property tax appraisals and then by pressuring their local elected officials to adopt lower tax rates.”

0 notes

Text

A Nebraska lawmaker whose north Omaha district has struggled for years with a housing shortage is pushing a bill that, if passed, could make Nebraska the first in the country to forbid out-of-state hedge funds and other corporate entities from buying up single-family properties.

Sen. Justin Wayne’s bill echoes legislative efforts in other states and in Congress to curtail corporate amassing of single-family homes, which critics say has helped cause the price of homes, rent and real estate taxes to soar in recent years. Wayne said that has been the case in his district, where an Ohio corporation has bought more than 150 single-family homes in recent years — often pushing out individual homebuyers with all-cash offers. The company then rents out the homes.

Experts say the scarcity of homes for purchase can be blamed on a multitude of factors, including sky-high mortgage interest rates and years of underbuilding modest homes.

RISING RENT PRICES PUSH RECORD NUMBER OF AMERICANS TOWARD HOUSING CRISIS, PROMPTING LEGISLATIVE ACTION

Wayne's bill offers few specifics. It consists of a single sentence that says a corporation, hedge fund or other business may not buy single-family housing in Nebraska unless it's located in and its principal members live in Nebraska.

"The aim of this is to preserve Nebraska's limited existing housing stock for Nebraskans," Wayne said this week at a committee hearing where he presented the bill. "If we did this, we would be the first state in the country to take this issue seriously and address the problem."

A 14-page bill dubbed the End Hedge Fund Control of American Homes Act has been introduced in both chambers of Congress and would impose a 10-year deadline for hedge funds to sell off the single-family homes they own and, until they do, would saddle those investment trusts with hefty taxes. In turn, those tax penalties would be used to help people put down payments on the divested homes.

Democratic lawmakers in a number of other states have introduced similar bills, including in Minnesota, Indiana, North Carolina and Texas, but those bills have either stalled or failed.

The housing squeeze coming from out-of-state corporate interests isn't just an Omaha problem, said Wayne Mortensen, director of a Lincoln-based affordable housing developer called NeighborWorks Lincoln.

Mortensen said the recession of 2008 and, more recently, the economic downturn driven by the COVID-19 pandemic made single-family housing a more attractive corporate investment than bond markets.

"When that became the case, housing was commoditized and became just like trading any stock," he said. "Those outside investors are solely interested in how much value they can extract from the Lincoln housing market."

Those corporations often invest no upkeep in the homes, he said.

"And as a result of that, we're seeing incredible dilapidation and housing decline in many of our neighborhoods because of these absentee landlords that have no accountability to the local communities," Mortensen said.

Currently, about 13% of single-family homes in Lincoln are owned by out-of-state corporate firms, he said.

As in other states, Wayne's bill likely faces an uphill slog in the deep red state of Nebraska. At Monday's hearing before the Banking, Insurance and Commerce Committee, several Republican lawmakers acknowledged a statewide housing shortage, but they cast doubt on Wayne's solution.

"You know, you can set up shell companies, you set up different layers of ownership. You can move your domicile base. There's just a ton of workarounds here," Omaha Sen. Brad von Gillern said. "I also — as just as a pure capitalist — fundamentally oppose the idea."

14 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Jan. 9, 2024

"Almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that."

Nearly every state and local tax system in the U.S. is fueling the nation's inequality crisis by forcing lower- and middle-class families to contribute a larger share of their incomes than their rich counterparts, according to a new study published Tuesday.

Titled Who Pays?, the analysis by the Institute on Taxation and Economic Policy (ITEP) examines in detail the tax systems of all 50 U.S. states, including the rates paid by different income segments.

In 41 states, ITEP found, the richest 1% are taxed at a lower rate than any other income group. Forty-six states tax the top 1% at a lower rate than middle-income families.

"When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least," said ITEP research director Carl Davis. "And yet when we look around the country, the vast majority of states have tax systems that do just that."

"There's an alarming gap here between what the public wants and what state lawmakers have delivered," Davis added.

In recent years, dozens of states across the U.S. have launched what the Center on Budget and Policy Priorities recently called a "tax-cutting spree," permanently slashing tax rates for corporations and the wealthy during a pandemic that saw billionaire wealth skyrocket and company profits soar.

A report released last week, as Common Dreamsreported, showed ultra-rich Americans are currently sitting on $8.5 trillion in untaxed assets.

According to ITEP's new study, tax systems in just six states—California, Maine, Minnesota, New Jersey, New York, and Vermont—and the District of Columbia are progressive, helping to reduce the chasm between rich taxpayers and other residents.

Massachusetts, which has one of the more equitable tax systems in the nation, collected $1.5 billion in revenue last year thanks to its recently enacted millionaires tax, a measure that improved the state's ranking by 10 spots in ITEP's Tax Inequality Index. Minnesota has also ramped up its taxes on the rich over the past several years while expanding benefits for lower-income families, ITEP's study observes.

"The regressive state tax laws we see today are a policy choice, and it's clear there are better choices available to lawmakers."

But the full picture of U.S. state and local systems is grim. In 44 states, tax laws "worsen income inequality by making incomes more unequal after collecting state and local taxes," ITEP found.

Florida has the most regressive tax code in the U.S., with the richest 1% paying a mere 2.7% tax rate while the poorest 20% pay 13.2%.

Florida is among the U.S. states that don't have personal income taxes, which forces them to rely on consumption and property taxes that are "nearly always regressive," ITEP notes in the new analysis.

"Eight of the 10 most regressive tax systems—Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana—rely heavily on regressive sales and excise taxes," the study says. "As a group, these eight states derive 52% of their tax revenue from these taxes, compared to the national average of 34%."

Aidan Davis, ITEP's state policy director, said that "we've seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest."

The report points to Kentucky's adoption of a flat tax and repeated corporate tax cuts, which "delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides."

Davis said that "we know it doesn't have to be like this," arguing there is a "clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off."

"The regressive state tax laws we see today are a policy choice," said Davis, "and it's clear there are better choices available to lawmakers."

#regressive tax code#progressive tax code#tax the rich#wealth inequality#income inequality#tax law#politics#itep#public policy

9 notes

·

View notes

Text

fic: Do You Kiss Your Momma With That Mouth? Chapter 7

Picture credit: x

Do You Kiss Your Momma With That Mouth? Chapter 7

Published: 2024-02-14 Words: 4084 Chapters: 7/11

by catnipster

Rating: Explicit

Archive Warning: No Archive Warnings Apply

Category: M/M

Fandom: Supernatural (TV 2005) RPF

Relationships: Jensen Ackles/Jared Padalecki, Stephen Amell/Jared Padalecki, Jensen Ackles/Alexander Calvert, Misha Collins/Original Character(s)

Characters: Jim Beaver, DJ Qualls, Jeffrey Dean Morgan, Hilarie Burton, Danneel Harris, Emily Perkins, Steven Williams (Supernatural RPF), Sterling K. Brown, Ty Olsson, Samantha Ferris, Chad Lindberg, Dee Wallace, Katie Cassidy, Genevieve Cortese, Lisa Berry, Alona Tal, Jon Gries

Additional Tags: Alternate Universe, Jensen is a Chef, Jared is a Property Developer, Class Differences, Trailer Trash Jensen, Bottom Jensen Ackles/Top Jared Padalecki, Lovers to enemies to lovers, Food, Drinking, Recreational Drug Use, Porn Video, jensen has a mustache, long-haired jensen ackles, Lies, Secrets, Happy Ending

Language: English

Summary:

Jensen, 39, is a down-on-his-luck weed dealer in Garden, Texas. Garden is a former ranching town gentrified by an influx of Silicon Valley exiles that work in the shiny, new office buildings built by JPX, Inc.

Jensen unexpectedly inherits a trailer park from his uncle. But what Jensen really wants to do is open a food truck selling refined comfort food. The decommissioned ice cream van sitting on blocks in front of his trailer is a daily reminder of his unfulfilled dreams.

Jared, 35, is the rich owner of JPX, Inc. who wants to tear down the trailer park to put up a ritzy mall. Jared’s ex-boyfriend, Stephen Amell, is in town from New York City: to force Jensen and the lovable residents of Garden Gardens to sell by using his usual arsenal of dirty tricks.

But when Jared meets Jensen at the Farmer’s Market where Jensen is trading weed for pickles with his best friend Danneel, it’s love at first sight. At least, until Jensen finds out who Jared is.

Chapter 7 Summary:

JPX, Inc. buys the tax lien. How desperate will Jensen get to find the money to pay it off? Jared and Jeff help Jensen move. Misha has unsavory suggestions. Jensen learns about things Jared was keeping from him.

5 notes

·

View notes

Text

Hi there, this is sissydavida, and I live in a small town in Texas called Jacksboro . It's between Mineral Wells and Wichita Falls. Most of the people are Republican. They hate any type of change from letting new businesses come in.

Afraid that the crime rate will go up to property taxes will rise. There are no transgender people, CD's, or sissies because the people are nosey and gossipy and if there are, they must be hiding for fear of being ridiculed and humiliation

6 notes

·

View notes

Text

Texas Property Tax Benefits | Cut My Taxes

Texas property tax rate bothering you? Not anymore, Don't overpay a penny! Sign up with the largest property tax consultant to lower your taxes. Reach us at https://www.cutmytaxes.com/

0 notes

Text

A War of Misinformation

Public School taught me that the Mexican-American war was an intervention. To save the country from a dictator, Santa Anna. The US Army rallied to save the oppressed people of Mexico as Santa Anna had taken Texas by force.

Counterpoint: The Mexican-American War was a war supported by false and misconstrued information.

Santa Anna had rallied an army to take Texas. These 300 families of Austin would not stop importing slaves into Texas. The problem is that slavery was illegal in Mexico. Yet these American immigrants insisted upon it despite Mexico's stance.

Mexico would offer opportunities for emancipation. They banned the purchasing and selling of people in 1823. Mexico also passed a law that gave blacks born in Mexico automatic citizenship. This meant that these Anglo-Texan immigrants wouldn't be able to own a slave's child. A custom often practiced in the United States. Yes, if you were a slave and had children, they weren't your children. They were your master's children.

If you're familiar with Reactionary sentiment, they don't take too well to the word "no." So to make concessions for these adult toddlers, Mexico exempted Texas. Texans could own slaves until 1830. The abolitionist sentiment was prevalent within Mexico. It was so prevalent that slavers would force slaves to sign contracts. "No, no they weren't slaves. They were working to pay their debt off."

What I am saying is that if you had to report the crime rate in Texas around the 1830s. White American immigrants would be the biggest sources of crime. They were a backward group of people. While Mexico progressed and attempted to dismantle slavery, White Americans would insist. They would insist upon their draconian and archaic customs despite their surrounding conditions. Would defy the face of a modernizing world in favor of their Manifest Destiny. Manifest Destiny, a crusade against non-Americans. The goal is to gain exclusive ownership of land by any means necessary. Yet it was Mexico who needed an intervention?

I'm only pointing out that some more Conservative media outlets will demonize Mexicans. Some older sources would demonize Catholics. Yet it was Mexicans that founded a country that would abolish slavery before the US.

Slavery was a practice that was becoming irrelevant in the mid-19th century. A practice that would become an issue that killed millions of Americans in a civil war. Yet Mexico needed the intervention?

Because American immigrants were becoming the biggest source of crime in Mexico. Mexican Congress took action to enforce its abolition policy. Congress would reintroduce property taxes which discouraged further immigration. Import Tariffs would slam down on American-imported products. If you're going to insist upon your archaic practice, you can at least pay for it. It's not like you're paying your slaves.

In response, the Texans would declare independence from a country they immigrated to. So yes, Santa Anna brought an Army to suppress an insurrection in Mexico’s country. If Mexicans tried to do the same thing in Texas, New Mexico, or Arizona, the response would be just as forceful. Tucker Carlson would be freaking out in an “I’m not racist but” line of dialogue.

Douglas Hales, "Free Blacks", Handbook of Texas Online, accessed 12 Aug 2009

Douglas W. Richmond, "Vicente Guerrero" in Encyclopedia of Mexico, Chicago: Fitzroy Dearborn 1997, p. 617. Santoni, "U.S.-Mexican War", p. 1511.

After Santa Anna had taken the Alamo, the Texans would defeat and capture him. This was what these terrorists explained to Santa Anna. Sign the treaty to confirm Texas' sovereignty or get shot. Under duress, Santa Anna would sign the treaty. Now, remember: U.S. propaganda portrays the Mexican Army as bloodthirsty or cruel. They would never surrender or see reason.

So Santa Anna signing the treaty is quite uncharacteristic to what the US said. James Polk insisted that the bloodthirsty Mexicans came over to shoot them. That they only wanted war and conquest, like their Conquistador ancestors. I'm joking, I doubt most Americans could pronounce Conquistador.

Santa Anna brought this treaty back to Mexican Congress. Congress denied this treaty. Now, if you're following American propaganda, of course they denied it. Those bastards will never give up. They're sneaky and two-faced and only want American blood...no, that's not what Congress said.

Yes, many express frustrations about rebels taking Mexican territory that wasn't theirs. The main reason are the conditions in which the treaty took place. Santa Anna signing the treaty was not the negotiation of two nations. Santa Anna signing the treaty had done so ONLY by threat of force. You'll find the United States using this method for many more "treaties." This treaty was not a treaty validated by two nations, this was a hostage situation.

On top of that, the Texas Revolution wouldn't stop in Texas. These militias would send excursions into Arizona and New Mexico which. The Mexican Army had thwarted. Oh...and as far as Santa Anna being this totalitarian snake who ruled Mexico with an iron fist.

The Presidency had changed 4 times, the War Ministry 6 times, and the Finance Ministry 16. Mexico was a volatile country at this point. Politics were getting heated and it was affecting the people living within it. One thing that did unite Mexican politicians was the cession of Texas. They weren't willing to do it. As far as they're concerned, the militias are terrorists fighting for slavery.

Donald Fithian Stevens, Origins of Instability in Early Republican Mexico (1991), p. 11.

Rives, George Lockhart (1913). The United States and Mexico, 1821–1848: a history of the relations between the two countries from the independence of Mexico to the close of the war with the United States. Vol. 2. New York: C. Scribner's Sons.

James Polk decided that the U.S. should go to war with Mexico. It was not a popularly-supported decision at the beginning. Many members of the Whig Party were abolitionists. They knew that by accepting Texas as a part of the United States, Texas would come in as a Pro-Slavery territory.

The Democrats held a strong belief in Manifest Destiny, citing it as a reason to take Texas. The Monroe Doctrine was a policy motivated by Manifest Destiny. This doctrine would claim dibs on North America. This was in response to European powers encroaching on modern-day Oregon. The United States didn't want to contend with European Empires for the land they wanted. Manifest Destiny was a sense of entitlement for these White Americans. God himself had defined this land as theirs. This nationalist mythology would set the West Coast as the final destination. As the world knows, that wouldn't be the end of American exceptionalism.

The Whig opposition to the war wouldn't last. Senators like John Quincy Adams and Abraham Lincoln would debate the validity of the war. Lincoln went as far as to ask Polk for the exact location of the skirmish. Can Polk point out on a map where the Mexican soldiers shot the Texan settlers? If these was to be a cassus beli, the least he could do is provide proof. Polk couldn't produce the proof, so him and his War Hawks turned to more misinformation.

Despite the anti-war rhetoric, the Whigs would vote for the war. Good to know that politicians voted for war even back in 1840. It's a relief to know that politicians then weren't any different than now. So when one says "this is the worst it's ever been" it wasn't. We have fancier toys, but the human condition is still the same.

There were some principled people against the war and they weren’t politicians. Law enforcement arrested Henry David Thoreau for refusing to pay a tax for the war effort. He wrote an essay known as Civil Disobedience, an influential work.

See O'Sullivan's 1845 article "Annexation" Archived November 25, 2005, at the Wayback Machine, United States Magazine and Democratic Review. https://xroads.virginia.edu/~Hyper2/thoreau/civil.html

“I heartily accept the motto, "That government is best which governs least"; and I should like to see it acted up to more rapidly and systematically. Carried out, it finally amounts to this, which also I believe- "That government is best which governs not at all"; and when men are prepared for it, that will be the kind of government which they will have. Government is at best but an expedient; but most governments are usually, and all governments are sometimes, inexpedient. The objections which have been brought against a standing army, and they are many and weighty, and deserve to prevail, may also at last be brought against a standing government. The standing army is only an arm of the standing government. The government itself, which is only the mode which the people have chosen to execute their will, is equally liable to be abused and perverted before the people can act through it. Witness the present Mexican war, the work of comparatively a few individuals using the standing government as their tool; for, in the outset, the people would not have consented to this measure.”

I'd recommend further reading. In another part he compares voting to wishing for change to happen instead of being the change. This essay would influence Martin Luther King Jr and Gandhi. It would also influence lesser-known figures like Alice Pauls. Pauls had campaigned for Women's Suffrage in the United States. This essay also influenced Tolstoy when he wrote War and Peace. It inspired Upton Sinclair when he exposed the lack of sanitation in meat packing.

Maynard, W. Barksdale, Walden Pond: A History. Oxford University Press, 2005 (p. 265). .

My point on leaving this on Civil Disobedience. Many feel limited by their surrounding conditions. It's very easy to do. The United States would commit the public to a war of annexing Mexican territory. It's because they didn't do enough to counter the misinformation. It's because we fear we'll waste our time. We treat our nations as if we have no stake in them. We treat the politicians as another body separate from the people. We slump our heads thinking the nation will act with or without our consent

The process of revolution is not narrowed down to a single war or battle. You can achieve a meaningful difference with a holistic approach. Revolution isn't only cannon fodder and blood. Revolution is a mindset. This is why nations try to censor information. This is why Propaganda exists. It doesn't exist to inform, but rather the opposite. If the collective knowledge of the public wasn't important it wouldn't receive funding. The United States defunds its education while pouring money into News outlets. Europe enacts vehement scapegoating of Reactionaries while riling anti-Russian sentiment.

They depend on our fear for us to do their bidding. Knowledge is an axe to these intentions. Debate is a grindstone to sharpen our axe. Groups and communities are the forges that provide us with the tools we need.

You are all capable of action. You're all brilliant in your ways. You'll devise solutions that nobody else can think of. Thomas Paine didn't fight one battle in the American Revolution. John Adams didn't have the Military career Alexander Hamilton did. It was Adams who chartered recognition from European powers.

American Council of Education. (2019, March 11). White House proposes significant cuts to education programs for FY 2020. News Room. Retrieved November 25, 2022, from https://www.acenet.edu/News-Room/Pages/White-House-Proposes-Significant-Cuts-to-Education-Programs-for-FY-2020.aspx

bureaus, M. V. I. A. T. T. E. A. U. with A. F. P. (2022, March 11). 'get the hell out': Wave of Anti-Russian sentiment in Europe. Barron's. Retrieved November 25, 2022, from https://www.barrons.com/news/get-the-hell-out-wave-of-anti-russian-sentiment-in-europe-01647018307

Camera, L. (2022, March 9). Congress set to cut funds that made school meals free - US news & world ... US News. Retrieved November 25, 2022, from https://www.usnews.com/news/education-news/articles/2022-03-09/congress-set-to-cut-funds-that-made-school-meals-free

Conte, M. (2021, December 8). US announces funds to support independent journalism and reporters targeted for their work | CNN politics. CNN. Retrieved November 25, 2022, from https://www.cnn.com/2021/12/08/politics/blinken-summit-democracy-journalism/index.html

Rob Portman Press Release. (2016, December 23). President signs Portman-Murphy Counter-propaganda bill into law. Senator Rob Portman. Retrieved November 25, 2022, from https://www.portman.senate.gov/newsroom/press-releases/president-signs-portman-murphy-counter-propaganda-bill-law

Ferling, John E. (1992). John Adams: A Life. Knoxville, TN: University of Tennessee Press. ISBN 978-0-87049-730-8.

Thoreau argued against any revolution coming “too soon.” Be realistic, what can you finish? Acting reckless without real support does nothing but cause unnecessary risk. Finding truth outside propaganda is our responsibility. We'll inevitably fall prey to one form of propaganda. There are many factions we're a part of. This will come with many biases. Instead of denying bias, be cognizant of it when you approach a topic. Find out what's supported by fact and what's propped by bias.

Thoreau acted when the surrounding society wouldn’t substantiate his belief. This doesn’t make him wrong. You don't owe apathy a consideration. You don't owe a palatable approach to those that have a problem with your conviction. You will take the time to consider all angles while they only accept their confirmation bias. The time for apathy needs to meet its end. We can do so via a fervent pursuit of truth. Do not let them discourage you, keep marching. They'll pick a tune and flag to march to in the end.

Also, let me recommend Howard Zinn’s book People’s History of the United States. He does more justice to American history from the people’s perspective than I ever could.

The Chapter referring to the Mexican-American war is “Thank God it wasn’t taken by Conquest.”

Origins of Instability in Early Republican Mexico (1991), p. 11. Rives, George Lockhart (1913). The United States and Mexico, 1821–1848: a history of the relations between the two countries from the independence of Mexico to the close of the war with the United States. Vol. 2. New York: C. Scribner's Sons.

See O'Sullivan's 1845 article "Annexation" Archived November 25, 2005, at the Wayback Machine, United States Magazine and Democratic Review. https://xroads.virginia.edu/~Hyper2/thoreau/civil.html

Maynard, W. Barksdale, Walden Pond: A History. Oxford University Press, 2005 (p. 265). Ferling, John E. (1992). John Adams: A Life. Knoxville, TN: University of Tennessee Press. ISBN 978-0-87049-730-8.

Origins of Instability in Early Republican Mexico (1991), p. 11. Rives, George Lockhart (1913). The United States and Mexico, 1821–1848: a history of the relations between the two countries from the independence of Mexico to the close of the war with the United States. Vol. 2. New York: C. Scribner's Sons. http://www.historyisaweapon.com/defcon1/zinntak8.html

#history#united states#united states of america#book recommendation#class warfare#imperialism#anti imperialism#mexico#mexican#mexican american war#manifest destiny#monroe doctrine#american history#civil disobedience#martin luther king jr#gandhi#slavery#abolition#education#no child left behind#campism#colonialism#social justice#texas#war and peace#Santa Anna#european union#europe#russia#propaganda

22 notes

·

View notes

Text

Republican Texas Gov. Greg Abbott said he won’t consider pardons for low-level marijuana offenders after President Joe Biden called on governors across the country to consider pardons.

“Texas is not in the habit of taking criminal justice advice from the leader of the defund police party and someone who has overseen a criminal justice system run amuck with cashless bail and a revolving door for violent criminals,” Abbott spokesperson Renae Eze said in a statement Thursday.

The statement came after Biden announced a pardon of all prior federal offenses of simple possession of marijuana. He also called for a review of marijuana’s current status as a Schedule 1 drug and asked governors to consider pardons of low-level weed offenders.

“Just as no one should be in a federal prison solely for possessing marijuana, no one should be in a local jail or state prison for that reason, either,” Biden tweeted.

Abbott spokesperson Eze explained the process of issuing pardons in Texas in her statement, saying Abbot would not consider pardons.

“The Governor of Texas can only pardon individuals who have been through the Texas Board of Pardons and Paroles system with a recommendation for pardon,” she said.

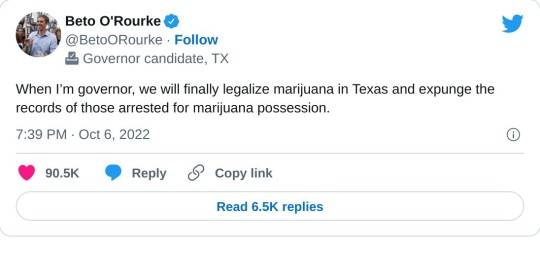

Meanwhile, Democratic candidate for Texas governor Beto O’ Rourke has promised to legalize weed in the state should he be elected.

“When I’m Governor, we will legalize marijuana and expunge the records of those arrested for marijuana possession — and we’ll use the nearly $1 billion in new state revenue and reduced criminal justice costs to invest in public schools and reduce property taxes,” O’Rourke’s campaign website says.

After President Joe Biden announced pardons Thursday for Americans convicted of “simple possession” of marijuana, Beto O’Rourke reiterated his pledge to legalize the drug if elected Texas Governor.

The Democrat, who is challenging Gov. Greg Abbott this November, also said in a tweet that he would expunge the records of those arrested for marijuana possession.

O’Rourke has long pushed for the legalization of marijuana and even wrote a book about it. He says he doesn’t support the legalization of all drugs, and claims that he does have been proved false.

The former El Paso congressman has said legalizing marijuana would not only provide revenue for the state and economic opportunities for Texans, but also bring about criminal justice reform because Black and Hispanic residents are disproportionately jailed for and convicted of marijuana crimes.

“Right now we spend half a billion dollars a year locking people up for a substance that is legal in most of the rest of the country, most of the rest of the developed world,” O’Rourke said at a news conference in South Oak Cliff in April. “We also lose out on, conservatively speaking, half a billion dollars in tax revenue.”

In May, Abbott said his position has not changed beyond what he’s proposed in the past — reducing the criminal penalty for marijuana possession to a Class C misdemeanor, but not legalizing the drug.

“Texas is not in the habit of taking criminal justice advice from the leader of the defund police party and someone who has overseen a criminal justice system run amuck [sic] with cashless bail and a revolving door for violent criminals,” Abbott spokeswoman Renae Eze said in a prepared statement. “The Governor of Texas can only pardon individuals who have been through the Texas Board of Pardons and Paroles system with a recommendation for pardon.”

At an event in May, O’Rourke pointed out that Texans of all stripes use marijuana.

“Not only do Texans of every race, ethnicity and gender, use marijuana at the same rate,” he said, “but your big secret that I want to make sure we all hear out loud — Republicans use it just as much as Democrats.”

Since 2012, 19 states, Washington, D.C., and Guam have legalized marijuana for recreational use — something more than half of Texans have said they either support or strongly support, according to previous Dallas Morning News-University of Texas at Tyler polls.

And the numbers are even higher for medical use: 67% of those surveyed last month said they would either support or strongly support the legalization of marijuana in Texas to help treat illnesses. The Texas Legislature expanded the state’s medical marijuana program last year to include all forms of post-traumatic stress disorder and cancer.

But some legislators and governors, especially in red states, remain hesitant to legalize the drug.

Rhode Island became the 19th state to fully legalize marijuana in May, and more states, including Missouri and South Dakota, will vote on whether to legalize recreational use this November. Oklahoma’s referendum was delayed until at least 2023.

On Thursday, Biden also called on Governors to issue similar pardons for those convicted of state marijuana offenses, which reflect the vast majority of marijuana possession cases.

#us politics#news#huffington post#dallas news#gov. greg abbott#texas#beto o'rourke#gubernatorial races#2022 midterms#2022 elections#2022#legalize marijuana#legalize cannabis#marijuana#cannabis#decriminalize cannabis#biden administration#pardons#Renae Eze#gop#texas republicans#fuck republicans#Republicans#conservatives#Texas Board of Pardons and Paroles#vote blue

9 notes

·

View notes

Photo

Do you overpay your property taxes?

There is no reason to overpay property taxes when we are here to assist you! To learn more visit https://www.poconnor.com/commercial-property-tax-protection-program/

#o connor & associates#texas property tax code#texas personal property tax Rate#Property tax appeal houston#houston property tax protest

0 notes

Text

Encore energy streetlight outage map

ENCORE ENERGY STREETLIGHT OUTAGE MAP CODE

The Eastmark and Cadence Community Facility Districts (CFDs) were formed at the request of the property developers through the City of Mesa as a means of obtaining community funding for property development.

ENCORE ENERGY STREETLIGHT OUTAGE MAP CODE

2 and Cadence CFD, which are all located in zip code 85212. The City of Mesa currently has three Community Facilities Districts: Eastmark CFD No. (application may take a few seconds to load) City of Mesa CFD

Southeast Mesa Land Use & Transportation Planįor Questions regarding charges on your Maricopa County property tax bill for Eastmark Assessment Areas and Eastmark CFDs, email or call 48.

Trash/Recycling for Single Family Homes.

My Utility Account Security Information & System Availability.

Payment locations and hours of operation.

Have everything installed and need to set up service? If you live in an Oncor Electric Delivery service area and already have all the electrical equipment installed, the process for activating electricity service must be done through a retail electric provider (REP). For a list of all the Texas REPs, please go to our Texas suppliers pages. Transmission & Distribution Utility companies (TDUs), like Oncor, do not manage customer service related to plans, customer accounts, billing/payments, etc. To pay your bill, you must contact your retail energy provider (REP). Their headquarters address is: Oncor Electric Delivery Headquartersħ5202 Can I contact Oncor customer service for billing and payment? Oncor customer service : Dallas headquartersĬall their corporate office phone number at 1-21 to address any customer service concerns, claims, or file a formal complaint. If you are experiencing a power outage emergency, see if customers in the area contacted Oncor to report the outage using the Power Outage Map link under the table below.Ĭheck the Oncor Power Outage Map to see if your neighborhood may be affected by a power outage and the estimated time of repair. In the case of an electricity power outage, there are a few reporting resources to turn to depending on the type of emergency or customer service issue at hand. How to report electricity outages with Oncor customer service in Texas : Oncor Electric phone number and contact list Application Submission (by Physician to Oncor)īusinesses: Energy Efficiency Identification Notice Form info/questions Oncor customer service requests / General Inquiries / Questions on the C.C. Solar Implementation / Distributed Generation Solar Implementation / Distributed Generation, Residential or Commercial Help with New Construction, Residential or Commercial You can contact Oncor customer service by the following: Oncor customer service and Oncor phone number Need customer service help not relating to Oncor's services? Your chosen Retail Electric Provider (REP) (essentially the intermediary between customers and TDUs) is standing by to assist with stopping/setting-up/transferring electrical service, billing, payments, rates, and electricity plan concerns/questions.

(Non-Residential) Applying for designation as Critical Load Public Safety / Critical Load Industrial CustomerĬall Oncor customer serivce at 1-88 to report an outage or 911 for downed power lines, both available 24/7.

(Residential) Applying for designation as Critical Care / Chronic Condition (C.C.) Customer.

Looking for solar implementation resources.

Checking the status of an on-going project.

Adding a new structure on property that needs power (like a garage) and, if digging, call 811 beforehand.

New construction consisting of one or multiple buildings.

Building a new home - in an existing subdivision or on private property.

Builders: Assistance in navigating city/town inspection requirements.

Smart meter or analog meter disconnecting/reconnecting or reporting supspected tampering.

Reporting a potential hazard involving power lines.

Electrical emergencies: power outages, downed power lines, or streetlight outage.

Is Oncor the company to contact? Reasons to contact Oncor

2 notes

·

View notes

Text

Exploring the Real Estate Landscape: Houses for Sale in Corpus Christi

Corpus Christi, a coastal city nestled in the heart of Texas, boasts not only stunning waterfront views but also a vibrant real estate market. With its unique blend of culture, history, and natural beauty, it's no wonder that houses for sale in Corpus Christi attract both locals and out-of-state buyers alike.

Whether you're searching for a cozy bungalow, a spacious family home, or a luxurious waterfront estate, Corpus Christi offers a diverse range of options to suit every taste and budget. From charming historic neighborhoods to modern developments, the city's real estate market caters to a variety of preferences.

One of the most appealing aspects of buying a home in Corpus Christi is its affordability compared to other coastal cities. While waterfront properties may command a premium, there are plenty of affordable housing options available throughout the city and its surrounding areas. This affordability, combined with Texas's lack of state income tax, makes Corpus Christi an attractive destination for those looking to invest in real estate.

For those seeking a slice of history, neighborhoods like Heritage Park and Del Mar feature beautiful homes with historic charm. These areas boast tree-lined streets, well-preserved architecture, and a strong sense of community. Additionally, many of these historic homes have been lovingly restored and updated to offer modern amenities while retaining their original character.

If waterfront living is more your style, Corpus Christi's coastal communities offer an array of options for ocean lovers. From quaint beach cottages to expansive waterfront estates, there's something for everyone along the city's shoreline. Imagine waking up to panoramic views of the Gulf of Mexico or enjoying evening strolls along the beach right outside your doorstep.

For families, Corpus Christi boasts excellent schools, family-friendly amenities, and an abundance of recreational activities. Parks, playgrounds, and sports facilities are scattered throughout the city, providing endless opportunities for outdoor fun. Additionally, the city's low crime rate and strong sense of community make it an ideal place to raise a family.

Investors and second-home buyers are also drawn to Corpus Christi's real estate market. With its steady population growth, thriving economy, and booming tourism industry, the city offers ample opportunities for property investment. Whether you're looking for a vacation home, a rental property, or a long-term investment, Corpus Christi's real estate market has something to offer.

As with any real estate market, it's essential to work with a knowledgeable local agent who can guide you through the buying process. A seasoned agent can help you navigate the intricacies of the Corpus Christi market, identify the best neighborhoods and properties for your needs, and negotiate the best possible deal on your behalf.

In conclusion, houses for sale in Corpus Christi offer a blend of affordability, diversity, and opportunity that make the city a standout destination for homebuyers and investors alike. Whether you're drawn to its historic charm, coastal beauty, or family-friendly amenities, Corpus Christi has something for everyone in the market for their dream home. So why wait? Explore the real estate landscape of Corpus Christi today and discover the perfect place to call home.

1 note

·

View note