#termplan

Text

Want to secure your dream future? Look no further! Get in touch with us today at @Prahiminvestment for guaranteed financial success and peace of mind.

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahiminvestments#generalinsurance#insurance#childinsurancepolicy#termplan#terminsurance#TermInsurancePolicy#healthinsuranceplan#BesthealthInsurance#healthinsuranceadvisor#dreambig#DreamFuture#finacialfreedom#financialplanning#FinancialEmpowerment

0 notes

Text

Are you searching for the top term insurance plan advisor in Delhi or the top term insurance plan consultant in Noida? Look no further than Prahim Investments! Prahim is a company that has both years of experience and success in helping clients find the right term insurance plan. We are the ones you should approach for expert advice on finding the best insurance options.

Why Choose Prahim Investments?

Prahim Capital is renowned for its proficiency in risk management. Our company comprises insurance plan advisors who are specializing in term insurance plan(s) in Delhi and term insurance plan consultants (insurance advisors) in Noida; as such, we are committed to serving our customers individually. It is worth noting that everyone is special and that is why our recommendations are based on the particular needs of every person.

Our advisors have exhaustive knowledge of their market segments. They can be of great use in the process of choosing the best option among those many plans that can both be in compliance with your budget and meet your needs. Prahim Investments, you can count that you have chosen the right place for investment.

What Sets Us Apart?

At Prahim Investments, we trust in building long-term connections with our clients. We give you the time to let us analyze your financial objectives, risk appetite, and planning before coming up with a term insurance. It is our individualized approach that makes us stand out among other advisors and consultants in the business.

In addition, the customers will be served by a team of professionals who give a great deal of customer service attention. You are always welcome to talk to us if you have any questions, we will attend to your concerns and give you guidance on the selection process of a term insurance plan. Your satisfaction is truly our most important goal.

How Can We Be of Service to You?

Whatever your motivation - whether it is securing the financial future of your family or becoming the asset owner of a business against unforeseen events - we have the solution for you. We will carry out an analysis of your needs and then proceed to provide a term insurance plan that gives you the right coverage that you can afford. We will also help you in completing all the application formalities. On top of this, we will make sure that you read and understand all of the policy terms and conditions.

Through Prahim Investments, you will have the assurance that your family will be covered if any unfortunate situation should occur. Don't postpone until it's too late – drop us a line today to set up a meeting with one of our top-rated advisors.

Conclusion

When searching for the best term insurance advisor in Delhi or the best term insurance consultant in Noida, Prahim Investments is the one to look for. We have an experienced team of professionals, committed to assist you to pick the right policy that works for your needs and pocket. Contact us today to get started on the way towards securing your financial future.

#prahiminvestments#insurance#investment#insurancebroker#businessinsurance#lifeinsurance#termplan#terminsurance#best term insurance advisor in Delhi#best term insurance consultant in Noida

0 notes

Text

Zero cost term insurance is a type of life insurance policy that does not require you to pay any premiums during the policy's term. Instead, the insurance company covers the cost of the policy, making it "zero cost" for the policyholder.

0 notes

Photo

There must not be any compromise on the quantum of Life Insurance coverage that you are taking. It is inevitable and indispensable to secure the future of our Loved ones. Life Insurance is the most convenient to protect your family's financial needs... #lifeinsurance #lumpsum #love #loveones #compromise #quantum #insurance #termplan (at Mumbai, Maharashtra) https://www.instagram.com/p/CpGJ3cvtN7C/?igshid=NGJjMDIxMWI=

0 notes

Text

Insurance | An attractive mode of investment

When we think about Insurance, we do not think of it as an investment,

We are more concerned about the fund returns and gains we will receive in case we have to face the risks attached or just because the reference has insisted us stating there will be lot more advantages with it. Come to think of it, Insurance is a very fancy product in all our investment bucket.

Diversifying your investment with insurance will only profit you. At the same time neglecting it for all the deniable reasons will only mitigate to you. All the aims you have made a goal for in life, why risk it all. Insuring your vehicle is mandatory, let us also put a mandate on self-health, life and travel. This might sound very generic, but the most attractive mode investment is insurance because it will surely help to gain tax benefit. This is what it sounds like a very attractive mode of investment.

Let us see the benefit of insuring in these aspects:

Investment in ‘Life Insurance’

“Jaan he to Jahan he!!!”

To ensure you insure your life should be the biggest goal of a person. Life insurance as investment will surely secure you and your family in reimbursement over all your other tax liabilities. Depending on the income tax slab you can buy a policy which reduces the policy cost and enhances the cash value. A person who invests in bonds or F.D.’s enjoys short term capital gain. When he buys a life insurance, the owner is sheltered from paying the income tax as it just wraps all other mode of investments.

1 note

·

View note

Photo

Term insurance is a pure life insurance product, which provides financial protection to the policyholder.

👉 A “term” plan not only offers financial security to your family but also is capable of fulfilling its future needs such as your child’s higher education, child’s marriage, etc.

🔘 Coverage at an Affordable Premium.

🔵 Easy to comprehend functional features.

🔘 Coverage for critical and terminal illnesses.

🔵 Cover for the accidental outcome.

🔘 Flexibility to customize Death Benefit pay- out.

🔵 Life stage augmented coverage.

🔘 Option to add a spouse for the joint coverage.

🔵 Option to choose Return of Premium.

🔘 Augmented coverage with additional riders.

🔵 Income Tax exemptions.

Know More Visit us: https://creditmoney.co.in/

Mail us - [email protected]

Call/Whatsapp - +91-9643051489

#insurance#policy#lifeinsurance#HealthInsurance#investment#finacne#creditmoney#creditmoney11#terminsurance#termplan#panindia#Banking#financialplanning#Financialfreedom#protection#mediclaim#economy#vendors#tumblr#Twitter#instagram#neobank#digitalindia#marketplace

0 notes

Photo

You plan second income & bad time #termplan #RedmilBusinessMall #invest #anushkabuzmall (at Ghaziabad, India) https://www.instagram.com/p/Ci5jF7kPUmM/?igshid=NGJjMDIxMWI=

0 notes

Photo

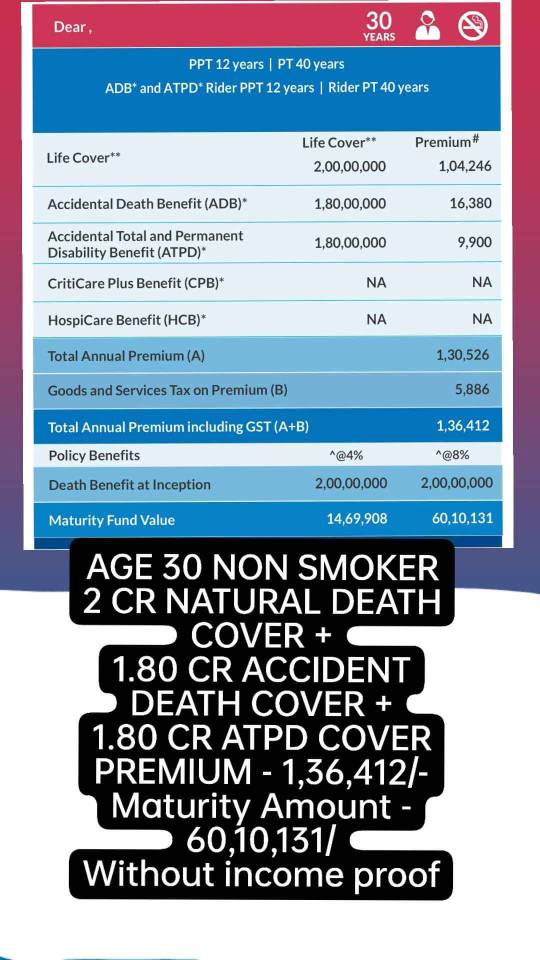

2 Crore Cover Term Insurance ( Term Plan ) Without Income Proof + 4 Times Maturity Amount

99982 90742

Call Or Whatsapp For Details

#insurance#lifeinsurance#life insurance policy#termplan#terminsurance#bigsumassured#maturityamount#protection#wealthprotection#famiyProtection

0 notes

Text

Child Insurance fact check :-

Myth: There are no benefits of a child plan.

Fact: A child education plan offers significant tax-saving benefits.

For more information get in touch with us.

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahiminvestments#generalinsurance#medicalinsurance#childinsurance#insurance#childinsurancepolicy#medicalemergency#medicalinsuranceplan#healthylife#termplan#terminsurance#TermInsurancePolicy#healthinsurance#healthinsuranceplan#BesthealthInsurance#healthinsuranceadvisor

0 notes

Text

Ensuring your family's financial security even in tough times is crucial. Invest in a term plan and secure their future. Contact us now for guidance!" Send me a message or Call today If you have Question Ask us : 093157 11866

#prahim#prahiminvestments#financialsecurity#termplan#FamilyProtection#investsmart#securefuture#toughtimes#familyfirst#insurancematters#peaceofmind#futureplanning#investinyourfamily#ProtectYourFamily#financialstability#SecureYourFuture#familysafetynet

0 notes

Text

Best Term Insurance Plan for Planning Dream Future

Cover your all financial need with Term Insurance, secure your tomorrow and protect your family happily. Here you can know all top class Term Insurance plans with numbers of benefits of plan. A best term insurance plan helps you to fix all financial problems in every situation.

0 notes

Photo

Get Your Term Insurance Today! Buy online & get a 5% discount throughout your policy term. Life Cover + Multiple Benefits in 1 plan

Sign Up here : MyPolicyJunction

1 note

·

View note

Link

What is a life insurance premium? In simple words, the premium is the amount that you pay towards your insurance policy. But there are certain aspects of premium that usually people don’t understand. Such as what should be the frequency to pay the premiums? What are the different types of premiums? What to do if you forget to pay it? Are premiums eligible for tax benefit amongst others?

Overall, you should have a basic knowledge of all such aspects to select and maintain your life insurance policy.

Discount on premiums

Premiums differ across various insurance policies. The amount of premium is usually based on the sum assured, tenure of the policy, your income and age of the applicant. There are different modes for paying term insurance premium and frequency of paying life insurance premiums depending on the payment option offered in the policy and the type of insurance policy chosen. Many times, insurance companies offer discounts on the rate of premium based on the insurance coverage amount and the mode of premium payment. These discounts in insurance language are known as rebates.

Discount on life insurance premium payment frequency

Policy premiums can be paid periodically that is – annually, half-yearly, quarterly, or monthly. The policyholder can choose any of these depending on his or her convenience. However, higher the frequency of the premium payment higher will be the premium rate due to the high cost of servicing that includes collection, processing and cost of administration. Hence, if the premium gets paid at one go for the entire year that is annually, then it comes less expensive than premiums paid monthly. In case of policies wherein premiums are paid one time, or there is a limited premium payment policy, this discount is already included in the rate of premium.

Discount on online paying term insurance premium

If the premium is paid online, then its servicing cost for the insurance company is much less than if paid physically. The companies also save on paying commission to the agents if the policy is bought online. Hence, depending on the insurer, discounts might have already included in the premiums before the online premium payment rates are quoted.

Add-on premiums

The regular premiums are meant for those who only opt for standard insurance policies. In case people go for riders because of the risk of their health problems, or if they are involved in a hazardous occupation, then the insurer charges an extra the premium for the chosen add-on benefit over and above the normal premium rate.

Non-payment or late paying term insurance premium

In case the policyholder does not pay the life insurance premium on the due date, then the policy is considered lapsed, and the insured loses all its benefits. However, most of the policies provide a grace period to the policyholder after the due date to make the premium payment. During this period the policyholder can pay the premium without any additional charge. If the policy gets lapse, then it can be revived by paying the overdue premiums with

interest along with a declaration about the insured person’s health or a fresh medical examination. But thus, can be done only if the policyholder agrees to do so.

Tax benefit on the premiums paid

The premiums paid towards the life insurance premium comes under section 80C of the Income Tax Act, which means that the amount paid for the premiums are eligible for deduction from taxable income. However, the premiums paid for the insurance policies in the name of any third party such as parents or in-laws other than spouse or children, are not eligible for tax benefit under section 80C. If the policyholder is paying a premium for more than one insurance policy, then he or she can include all the premiums paid.

Therefore, if you are paying the term insurance premium, then do keep in mind all the pointers as mentioned above, such that you completely understand the concept of term insurance and select the right one. To get further clarity on your any prevalent confusion, you can visit BimaKaro.in or speak to their financial experts for better understanding.

Source: https://bimakaro.in/ik/term-life-insurance/what-should-you-know-about-paying-term-insurance-premium-2106

1 note

·

View note

Photo

#fatafatmoney #fatafatmoney_social_media_post ⭐TERM PLAN 👉Secure family against uncertainty. ⭐UNIT LINKED INSURANCE 👉👉PLAN Insurance bhi, Investment bhi. ⭐CHILD PLAN 👉Higher Education Support. ⭐ENDOWMENT PLAN 👉Insurance & Savings Combo. ⭐RETIREMENT PLAN 👉Retire With Financial Independence. #termplan #insurancebroker #insurance #insuranceagent #goodday #good_day #msme #loanindelhi #loans #smallbusiness #businessloan #personalloan #vocal4local #vocalforlocalindia #vocalforlocal #motivationalquotes #motivation #staypositive #savelives #staysafe #staystrong #stayhealthy #stayfit #stayfitstayhealthy Follow us on Social Media Platforms. Please visit www.fatafatmoney.com Find Us on Facebook: bit.ly/Fatafat_Money Follow Us on Instagram: bit.ly/FatafatMoney Contact Us: [email protected] (at India) https://www.instagram.com/p/CaGlsPcJSCf/?utm_medium=tumblr

#fatafatmoney#fatafatmoney_social_media_post#termplan#insurancebroker#insurance#insuranceagent#goodday#good_day#msme#loanindelhi#loans#smallbusiness#businessloan#personalloan#vocal4local#vocalforlocalindia#vocalforlocal#motivationalquotes#motivation#staypositive#savelives#staysafe#staystrong#stayhealthy#stayfit#stayfitstayhealthy

0 notes