#staker art

Text

I am completely normal about this man

I just escaped from artblock 😭

#stephen merchant#wheatley#Peter Ian staker#hot fuzz#hot fuzz fanart#greg Dillard#extras#Darren lamb#Wheatley art#portal 2#portal 2 art#digital art#ibs paint x#I’m grasping for tags here#HELP#art block#i love him#smerch#portal#the outlaws 2021#Stephen merchant fanart

30 notes

·

View notes

Text

這邊也放一下!小白罐x小蟲!

18 notes

·

View notes

Text

I like this take on Vampirism as a desecration of the dead’s body and soul, as an insult practically; And that to undo the Vampire is to undo this unholy mark, and find peace for the afflicted, as good for the ‘victim’ as it is for the staker. It really touches my heart to know that Lucy’s soul wasn’t irreparably doomed, that Van Helsing confirmed it’s now been saved and sent to heaven where it belongs; Lucy DID rest, actually, and getting the sense that things were made right deeply settled my pain, as it did for the suitors, VH, and Mina.

Likewise, I appreciate VH giving Arthur that closure, hence his insistence on including him, even with the risk that Art might not believe Van Helsing and react rashly; He wasn’t just determined to save Lucy but to save Arthur too, in a sense! To give him and all of us a peace of mind; That maybe Arthur failed to save Lucy’s physically, but it’s not too late to do so spiritually. It feels as if our protagonists did manage to right a wrong done by Dracula, and actually undo his damage to an extent; It’s a relief. And the fact that Arthur got his kiss with Lucy after all... Impeccable. It’d have been more practical to stake Lucy ASAP, but it’s more compassionate for Bleeding Heart VH to wait for Arthur to participate!

And I love that we’re in the “Let’s get this bastard” phase of every monster movie; Where once our protagonists have been accustomed and exposed to the beast, once a sacrificial life has been given so we can see how it works, in that scientific study like VH and Seward’s professions... Now’s the time to strike back. We have our information. We’ve gathered together, all of the victims handing with one another in solidarity. We’ve suffered and lost, now it’s our turn to inflict some pain, and form a game plan! All the pieces are coming into place, the gang is coming together in a crossover/team up event to outdo Avengers Infinity War!

49 notes

·

View notes

Note

I feel like a stalker going through all your past art but HOLY FUCKING SHIT!!!! I LOVE it ALL so much!! 🥰🥰❤️🔥 I just keep reblogging them, even ones I've done before cuz everyone needs to see these beauties!

Oh man, don't feel like a stalker. Coming to my blog and seeing someone reblog them all is the best feeling ever. Don't let anyone say otherwise :D I'd be a staker too as I do the same on my supersekret reblogging account *shhh it's a secret*

15 notes

·

View notes

Text

Investing in Gold vs. Crypto Staking

When it comes to investing, gold, and cryptocurrency represent two distinctly different classes of assets. Both have their unique attributes and risks, making them suitable for different types of investors. This blog post explores the merits and challenges of investing in both, with a specific look at Spider Swap’s crypto staking function as a modern crypto investment tool.

Understanding Gold as an Investment

Historical Reliability: Gold has been a reliable store of value for thousands of years. Its intrinsic value is driven by its rarity and the universal appeal of its physical properties. Investors often turn to gold as a hedge against inflation and economic instability.

Stability and Tangibility: One of the major advantages of gold is its tangible nature. You can hold gold coins, bars, or jewelry. It’s less volatile compared to many digital assets and is often considered a ‘safe-haven’ during turbulent economic times.

Liquidity and Universal Value: Gold is highly liquid and can be sold virtually anywhere in the world. Its value is recognized globally, and it does not depend on any specific financial system or government.

Exploring Cryptocurrency as an Investment

High Potential Returns: Cryptocurrency is known for its high volatility but also its potential for significant returns. Early investors in major cryptocurrencies like Bitcoin have seen their investments grow exponentially over the years.

Innovation and Utility: Unlike gold, many cryptocurrencies are not just stores of value; they serve specific purposes within digital ecosystems. For example, Ethereum enables smart contracts, which automate transactions and agreements, opening up a range of practical uses beyond mere investment.

Accessibility and Growth: Investing in cryptocurrency is accessible to anyone with an internet connection, and the market operates 24/7. The blockchain technology underlying cryptocurrencies is still growing and evolving, presenting ongoing investment opportunities.

Challenges of Each Investment

Volatility: While the potential for high returns exists, cryptocurrencies can be extremely volatile. Prices can fluctuate wildly based on market sentiment, regulatory news, and technological developments.

Security Risks: Cryptocurrency investments are susceptible to cyber threats. Exchange hacks, phishing attacks, and other security breaches can result in significant losses for investors.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still in flux, which can lead to market instability and risks for investors. Gold, by contrast, is a well-understood and universally accepted commodity with a stable regulatory framework.

Spider Swap’s Crypto Staking Function

Enhancing Crypto Investments: Spider Swap offers a unique feature in the crypto space: staking. Staking involves locking up a certain amount of cryptocurrency to support the operation and security of a blockchain network. In return, stakers earn additional cryptocurrency as rewards.

Benefits of Staking with Spider Swap: Investors can earn passive income from their cryptocurrency holdings by staking with Spider Swap. This is akin to earning interest in a traditional bank account but potentially at higher rates. Spider Swap’s platform is designed to be user-friendly, making it accessible even for those new to cryptocurrency.

Security and Innovation: Spider Swap uses state-of-the-art security measures to protect staked assets. Furthermore, it introduces innovative features like yield farming, where users can earn rewards by providing liquidity to different trading pairs, enhancing their potential earnings.

Conclusion

Choosing between investing in gold and cryptocurrency depends largely on your risk tolerance, investment goals, and interest in engaging with technology. Gold offers stability and a tried-and-true investment path, while cryptocurrency offers higher risk, higher potential returns, and exciting opportunities in digital finance.

Investors interested in cutting-edge blockchain opportunities might find Spider Swap’s staking functions appealing for generating passive income while supporting the crypto ecosystem’s growth and stability. Both gold and cryptocurrency have their place in a diversified investment portfolio, each offering unique advantages and challenges.

0 notes

Text

Ethereum Blockchain News Online and Blockchain Innovations in Cryptocurrency

Introduction

The world of cryptocurrency and blockchain technology is ever-evolving, with Ethereum at the forefront of groundbreaking developments. As the second-largest cryptocurrency by market capitalization, Ethereum has consistently captured the attention of investors, developers, and enthusiasts. In this article, we'll explore the latest Ethereum blockchain news online and delve into the exciting innovations occurring in the broader cryptocurrency space.

Ethereum Blockchain News Online

Ethereum 2.0 Upgrade: One of the most anticipated developments in the Ethereum ecosystem is the Ethereum 2.0 upgrade, also known as Eth2 or Serenity. This upgrade aims to transition Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. The upgrade is expected to enhance scalability, security, and energy efficiency while providing stakers with an opportunity to earn rewards by participating in network validation.

DeFi Explosion: Decentralized Finance (DeFi) has been a driving force behind Ethereum's growth. DeFi platforms offer a wide range of financial services without the need for traditional intermediaries. Ethereum has witnessed a surge in DeFi projects, allowing users to lend, borrow, trade, and earn interest on their crypto assets. The TVL (Total Value Locked) in DeFi protocols on Ethereum has surpassed impressive milestones, highlighting the community's confidence in these platforms.

NFT Boom: Non-Fungible Tokens (NFTs) have taken the art, gaming, and entertainment worlds by storm. Ethereum serves as the primary blockchain for NFT creation and trading, thanks to its robust smart contract capabilities. The digital art market has exploded, with multimillion-dollar NFT sales making headlines. Artists, musicians, and creators are increasingly turning to Ethereum to tokenize and monetize their creations.

Layer 2 Scaling Solutions: Ethereum's scalability challenges have prompted the development of Layer 2 scaling solutions like Optimistic Rollups and zk-Rollups. These solutions aim to alleviate network congestion and reduce transaction fees, making Ethereum more accessible for users and developers. These innovations are critical for the long-term success and mass adoption of Ethereum.

Blockchain Innovations in Cryptocurrency

Interoperability: The cryptocurrency space is witnessing efforts to improve interoperability between different blockchain networks. Projects like Polkadot, Cosmos, and ICON are working on creating bridges that allow assets and data to move seamlessly between blockchains. This innovation holds the potential to unlock new possibilities for cross-chain DeFi, asset tokenization, and more.

Central Bank Digital Currencies (CBDCs): Several countries are exploring the creation of their own Central Bank Digital Currencies (CBDCs) on blockchain technology. CBDCs aim to digitize traditional fiat currencies, providing benefits like faster cross-border payments, increased transparency, and reduced costs. These projects have the potential to reshape the global financial landscape.

Privacy Enhancements: Privacy coins and privacy-focused blockchains are continuously evolving to provide enhanced anonymity and confidentiality for users. Technologies like zero-knowledge proofs (ZKPs) and ring signatures are being integrated into various blockchain networks to protect user data while preserving transaction transparency.

Smart Contract Platforms: Ethereum's success has inspired the development of numerous smart contract platforms. Competitors like Binance Smart Chain, Cardano, and Solana are challenging Ethereum's dominance by offering faster transactions and lower fees. These platforms are pushing the boundaries of what's possible in the world of decentralized applications.

Conclusion

The Ethereum blockchain continues to be a hub of innovation, with Ethereum 2.0, DeFi, NFTs, and Layer 2 scaling solutions driving its growth. Beyond Ethereum, the cryptocurrency space as a whole is evolving rapidly, with innovations in interoperability, CBDCs, privacy, and smart contract platforms reshaping the industry. As the world embraces blockchain technology and cryptocurrencies, staying updated on the latest news and innovations is essential for anyone looking to participate in this dynamic and transformative space.

0 notes

Text

Apecoin DAO commits $12.5 million to the Digital Art Movement, and announces the launch of a novel governance token, $DAM.

The APE Foundation has greenlighted a pivotal investment in the Digital Art Movement (DAM), earmarking a hefty 11 million ApeCoins—a valuation of $12.5 million—for the venture. Orchestrated by community leader Machi Big Brother Jeffrey Huang, the proposition gained massive approval (64.92% votes) from ApeCoin’s governance community.

The transaction involves DAM’s significant outlay of 70% of the newly acquired ApeCoins to secure non-fungible tokens (NFTs) from renowned creators YugaLabs. The remaining 30% is slated for investment in other high-caliber initiatives within the digital art ecosystem.

"OFFICIAL: The ApeCoin DAO AIP-304 proposal has gone through with 64.92% of the votes in favor."Meaning…

11MM $APE ($12 MM) will likely be spent on Yuga NFTs.When the going gets tough…

The tough get going…(to sweep their own floors)🙄#web3 pic.twitter.com/fQwHQmFzHX— jg_xyz (@jg_xyz_) September 22, 2023

Strategic implications and artistic aims

Two key outcomes are anticipated from this large-scale acquisition. First, it offers a chance to elevate the profile of NFTs in the global artistic landscape through the enrichment of exhibitions. Second, it opens doors for NFT assets donations to art-focused institutions, thereby serving as a catalyst for digital art proliferation on an international scale.

During the community voting process, the proposal amassed substantial backing, rallying 16 million $APE tokens in support. Machi Big Brother’s notable influence manifested in his hefty contribution of 4.1 million $APE votes. Still, it’s essential to acknowledge that there was dissent in the ranks, with a non-trivial 8.6 million $APE tokens cast in opposition.

DAM is also set to launch its own governance token, dubbed $DAM. The token has been designed with an inherent fairness model, electing not to allocate any tokens to the development team at its outset. Initial disbursements of $DAM will incentivize long-term commitment by being directed at ApeCoin holders who agree to lock in their holdings for up to half a decade.

As for the $DAM distribution scheme, ApeCoin stakers will receive an initial 30% of the tokens over five years, using a frontloaded distribution model. This method will reduce the distribution rate biannually. The treasury will manage the residual 70% of tokens, pending specific allocation parameters, to be decided by a community vote.

Overall, this can prove to be a significant boost for ApeCoin. The token’s price has been constantly declining throughout the last quarter, and 96% of APE holders were at a loss last month. Since then, the token is further down by 25% – causing significant worries among its holders.

Source

0 notes

Text

The emergence of Web3 has brought about a decentralized web, one that relies on blockchain technology and smart contracts to create a more open and inclusive digital ecosystem. With this shift, investors have a unique opportunity to tap into a diverse range of investment strategies in the web3 landscape. In this article, we will explore some of these strategies and how to navigate this emerging field.

1. Understanding the Web3 Ecosystem:

Before delving into investment strategies, it is essential to gain a comprehensive understanding of the web3 ecosystem. Web3 is built on blockchain technology, allowing for secure and transparent transactions. It encompasses decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized applications (dApps), and much more. Each of these sectors presents investment opportunities, but it is crucial to understand the specific nuances and underlying technology of each sector before making any investment decisions.

2. Investing in Established Cryptocurrencies:

The most common and straightforward investment strategy in the web3 landscape is investing in well-established cryptocurrencies like Bitcoin and Ethereum. These cryptocurrencies have proven track records and are widely accepted within the web3 ecosystem. By investing in these cryptocurrencies, investors can benefit from the overall growth of the web3 space.

3. Exploring Decentralized Finance (DeFi):

DeFi has gained significant attention within the web3 landscape, revolutionizing traditional financial systems by eliminating intermediaries and introducing decentralized lending, borrowing, and trading. Investors can explore various DeFi projects by providing liquidity or yield farming, where they earn rewards in native tokens. However, caution is advised, as DeFi is a rapidly changing and highly speculative space, susceptible to hacks and smart contract bugs.

4. NFTs and the Digital Art Market:

Non-fungible tokens (NFTs) have become a cultural phenomenon, allowing for the ownership and trading of unique digital assets. The NFT market has exploded in recent years, with artists, musicians, and other creatives leveraging this technology to monetize their work directly. Investors can participate in this market by buying and selling NFTs, investing in NFT marketplaces, or supporting NFT projects and creators.

5. Investing in Decentralized Applications (dApps):

Decentralized applications (dApps) are another promising area within the web3 space. These applications are built on blockchain and operate without a central authority. Investors can identify promising dApps that aim to disrupt traditional industries, such as gaming, supply chain management, healthcare, or social media. Investing in dApps can involve purchasing tokens or investing in the underlying infrastructure supporting these applications.

6. Staking and Governance Tokens:

Staking is another investment strategy that has gained traction within the web3 landscape. Many blockchain networks require users to stake their tokens to support network security and validate transactions. In return, stakers receive rewards in the form of additional tokens. Staking can generate passive income for investors, but it also requires careful consideration of the associated risks and potential returns.

7. Research and Due Diligence:

As with any investment, thorough research and due diligence are essential before committing funds to any project or asset. This includes understanding the team behind the project, the technology, tokenomics, market trends, and any associated risks. Web3 is a relatively new and rapidly evolving field, so staying updated with the latest developments is crucial to make informed investment decisions.

Navigating the web3 landscape can be both exciting and challenging. The decentralized nature of this ecosystem opens up numerous investment opportunities, but it also comes with inherent risks. Diversifying one's portfolio across various sectors and projects can help mitigate these risks.

As with any investment, it is crucial to approach the web3 landscape with a long-term perspective and to thoroughly understand the underlying technology and market dynamics to make informed investment decisions.

0 notes

Text

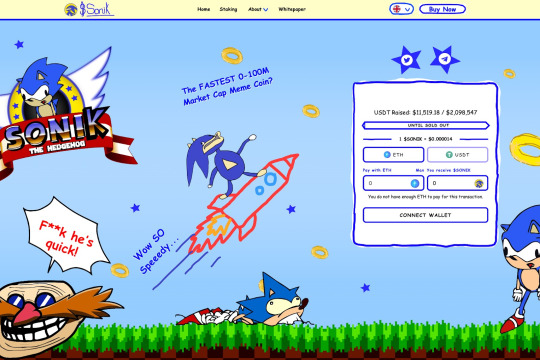

Can New Crypto Presale Sonik Coin 50x? This Stake to Earn Meme Coin Expects a Race to $100M MCAP

Can New Crypto Presale Sonik Coin 50x? This Stake to Earn Meme Coin Expects a Race to $100M MCAP

Source / Sonik

Tuesday, August 15, 2023 – Sonik Coin is the newest meme coin cryptocurrency, and it aims to be the fastest crypto to reach a $100 million market cap.

Inspired by the Sonic the Hedgehog character, Sonik is a riotously funny meme coin with a difference – it is a stake-to-earn coin where depositors into its staking smart contract receive rewards for sticking with the project.

The Sonik coin project offers a juicy annual percentage yield (APY) for its stakers to help boost $SONIK’s quest to reach the moon. Sonik is the world’s first stake-to-speed crypto!

Buyers can start staking and earning right now. Of the total token supply, 40% has been allocated to community staking rewards, to be paid out over four years.

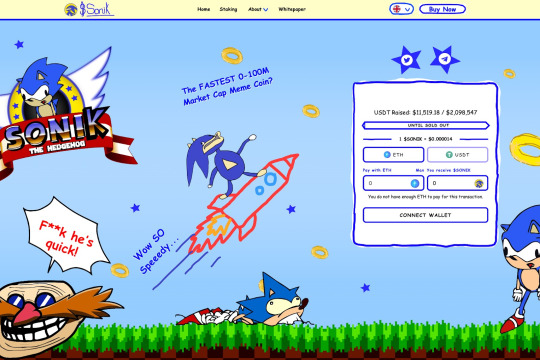

At the time of writing 90 million $SONIK tokens have already been staked at an APY of 26,648%, although that rate will reduce as more stakers deposit into the smart contract.

The team has set a modest low-cap target of only $2 million ($2,098,547), so expect this coin to sell out sooner rather than later.

Source / Sonik

$SONIK Staking Dampens Listing Sell Pressure and Incentivizes Long-Term Holding

The staking concept is burrowing its way deep into the meme coin and ‘version 2’ themed coin space.

A new coin called BTC20, which has recreated the block production history of bitcoin on Ethereum by going back in time to 2011 when BTC was valued at $1, has seen a massive take up of its staking service.

Approximately two-thirds of BTC20 token holders are staking their bags. Minutes into its listing, BTC20 went up in price 6x.

There’s no reason why Sonik could not repeat that staking achievement, providing prospective buyers with another selling point to consider when making their purchase decision.

Also, the staking utility means there will be far less selling pressure on the coin when it launches on the Uniswap decentralized exchange (DEX), providing an added source of comfort for buyers.

But it is advised not to hang around for too long when deciding whether to invest because the presale will likely sell out in two weeks or less.

Stay up-to-date with Sonik news and be the first to know when it lists by following the X (formerly Twitter) account and joining the Telegram group.

X / SONIKcoin

‘Gotta Go Fast’ – SONIK Could Be Another Pepe Coin

Setting it apart, Sonik has the viral potential of one of the most likable and well-known characters in gaming, helped by the unique meme art creations it is sure to encourage.

The highly meme-friendly characters shown on the website provide a feel for the endless fun artists will have with Sonik and friends.

There is no limit to how high Sonik coin could go, but you’ve ‘gotta go fast’ to be sure to be among the price-pump winners.

It could be another Pepe coin, but with the accent on fun and earning while you laugh.

$SONIK is priced at just $0.000014, so a $1,000 investment could quickly turn into $50,000 or even $100,000 if Sonik kills some zeros and returns 50x or 100x to its early buyers.

The token supply is a little shy of 300 billion, at 299,792,458,000. But why that random-looking supply amount?

Well, 299,792,458,000 meters per second is, of course, the speed of light, so catch Sonik if you can.

YouTube crypto analyst Jacob Crypto Bury is first out of the gate with an initial 10x price prediction for $SONIK.

Japan and Asia Love ‘Sonic’ and Will Jump at the Chance to be Part of the SONIK Coin Community

Sonik is expected to secure considerable traction in Asian markets because of the Japanese provenance of the Sonic the Hedgehog character created by the Sega team of Yuji Naka, Naoto Ohshima, and Hirokazu Yasuhara.

Although Sonik has no affiliation with Sega’s Sonic, it will probably find an enthusiastic audience of followers in the crypto market of Japan and other Asian countries.

According to sources, the website will be rolling out translations into Japanese, Simplified Chinese, and Korean, alongside other languages.

Asia remains one of the hottest and most engaged regional markets for crypto.

Sonik Smart Contract is Being audited, So No Security Worries

Security should be a significant consideration when deciding whether to invest in a presale project.

On that score, the team is listening to the broader crypto community, where many new meme coins that appear on Uniswap and elsewhere don’t bother to get their smart contract audited.

Again, Sonik is different in that respect by submitting its contract for audit. The audit report will be published soon and available for all to read on the website.

Sonik is a fair presale, where 50% of the total token supply is allocated for sale to the public. Forty percent is set aside for staking rewards and 10% for exchange liquidity.

The coin will list on the Uniswap DEX directly after the presale. Buyers will need ETH or USDT to buy the tokens.

Connect your wallet at the Sonik website to make your purchase, but hurry to make sure you don’t miss out.

Buy Sonik Here

.Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/can-new-crypto-presale-sonik-coin-50x-stake-earn-meme-coin-expects-race-100m-mcap-htm/

0 notes

Photo

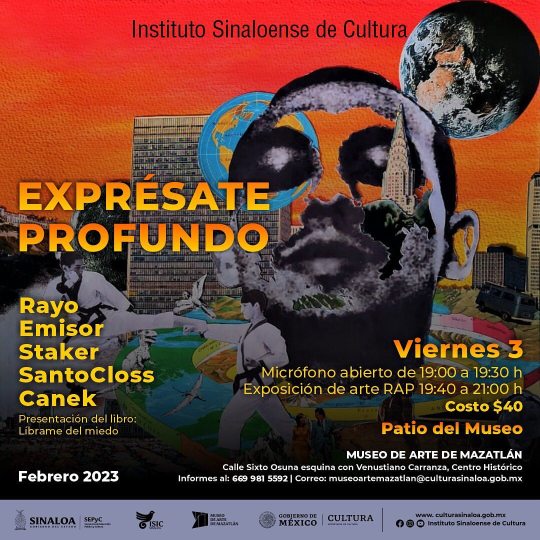

El Instituto Sinaloense de Cultura, a través de su Delegación Sur, en el Museo de Arte de Mazatlán, invita al público en general a asistir al evento titulado “Exprésate profundo”, en el que habrá diversas expresiones de rap, micrófono abierto y presentación del libro de poemas “Líbrame del miedo”, por parte de Ismael Canek, que se realizará el viernes 3 de febrero en el patio del Museo de Arte de Mazatlán. El evento comenzará en punto de las 19:00 horas y comenzará con un micrófono abierto, antes de darle cabida a los raperos invitados, que son Rayo, Staker, Emisor, SantoCloss y el mismo Canek, autor del libro que se presentará en la recta final del evento, como adicional a su disco “Ce-k Merka Freska”, con la finalidad de cerrar el espectáculo. (en Museo de Arte de Mazatlán) https://www.instagram.com/p/CoNWoTlOBZ6/?igshid=NGJjMDIxMWI=

0 notes

Text

Why Some SushiSwap Stakers Are Jumping Ship

Why Some SushiSwap Stakers Are Jumping Ship

Decrypting DeFi is Decrypt’s DeFi email newsletter. (art: Grant Kempster)

SushiSwap, the popular decentralized exchange, made a tough call this week as it navigates the ongoing bear market.

On December 5, project lead Jared Grey proposed that all staking fees on the platform be redirected to the project’s treasury for a year. He added that a new tokeonomics model for the project is also “on the…

View On WordPress

0 notes

Text

Cryptocurrencies What Lido staking supremacy might indicate for Ethereum's future Abdulrasaq Ariwoola · 1 month back · 2 minutes read The Ethereum neighborhood has actually raised worries of lido staking supremacy causing centralization. What does that mean for ETH 2.0? 2 minutes read Updated: July 24, 2022 at 11: 47 pm Cover art/illustration through CryptoSlate Lido DAO token holders have actually begun voting to figure out whether the DeFi platform must decrease its staking swimming pool. The vote is a follow-up to a governance proposition launched on June 24. The ballot procedure arises from a month-long consideration over Lido's staking supremacy and whether it ought to restrict itself to suppress prospective centralization dangers. Lido presently holds 31% of all staked Ether on the Ethereum proof-of-stake blockchain, the Beacon chain. The staking supremacy has actually raised worries within the Ethereum neighborhood, and critics fear it will threaten Ethereum's decentralization. The vote is anticipated to end on July 1, and the outcome will figure out whether Lido will self-limit or not. Must most of citizens vote in favor, another vote will occur on how the self-limiting procedure need to work.Cryptocurrencies Concerns over stETH supremacy In the governance proposition, Lido mentioned that its staking supremacy would offer it more voting power once the Beacon chain goes live. As a platform that began to counter central exchanges, it argued that such central ballot power postures an existential risk to the blockchain. The Ethereum neighborhood has actually raised comparable worries about the centralization of voting powers. The DeFi platform presently has around one-third of all staked Ether, which might provide voting utilize once the shift to the Beacon chain is total. Vitalik Buterin, the Ethereum co-founder, has actually argued that no single procedure must have a bulk in staking ETH. He suggested that such supremacy, integrated with Lido's governance structure, is possibly a hazardous point of centralization. Further, it specified the proposal is postulated on the belief that other liquid staking procedures would likewise restrict their direct exposure. This would efficiently permit smaller sized procedures to satisfy the supply deficiency. What Lido staking supremacy indicates for ETH2.0 Ethereum's shift to a PoS blockchain implies it will count on validators to verify deals on the blockchain. Unlike a PoW blockchain that needs miners to use up excess energy to fix complicated mathematical issues. However, to run a validator node, a user should transfer 32 ETH, which is a long shot for numerous users. Lido, on the other hand, as a staking provider, permits users to bypass this requirement and make staking benefits. According to information from Etherscan, approximately 12.6 million ETH is staked in the ETH2.0, which totals up to 10.6% of the distributing supply of ETH. Of the 12.6 million ETH staked, roughly 4.2 million have actually been staked through Lido by 73,369 stakers, making Lido the most pre-owned staking swimming pool on Ethereum. This suggests, must Ethereum shift to its PoS blockchain with Lido still having the lion's share of the staking supremacy, it would provide the DeFi platform extreme impact over deal confirmation which numerous alert might position a danger. Some issues consist of validator slashing, governance attacks, and clever agreement exploits. On the other hand, Lido's staking supremacy might assist avoid a takeover by a central exchange and make sure the blockchain stays decentralized.Cryptocurrencies stETH stays depegged The staked Ether, which is expected to be pegged to ETH, stays depegged after a wave of huge sell-offs. Speculations have actually profused about the security of the token and whether its depegging might spell more mayhem for the crypto environment. On June 16, Alameda Capital, among the biggest holders of stETH, discarded its stETH holdings, a huge $57 million.

This is combined with the ongoing monetary problems of Celsius and Three Arrows Capital, both big holders of stETH. As of the time of press, stETH has actually not gotten parity with ETH and is trading at $1,173 Read More

0 notes

Photo

“OH SHIT! IMMINENT BLOWOUT, RUN MARKED ONE! HELL IS ABOUT TO BREAK LOSE AHHHHHHHHHHHHHHH!!“ - Professor Madlad Kruglov

#ms paint#mouse art#stalker#s.t.a.l.k.e.r.#S.t.a.l.k.e.r shadow of chernobyl#shadow of chernobyl#professor kruglov#emission#blowouts#staker art#stalker fanart#kruglov#fanart#art#Krita#Сталкер#videogame art#tardar art

167 notes

·

View notes

Photo

a little doodle =3=

Lawrence and Stalker (Damon)

Stalker from br<3ken colors ( @inkly-heart )

9 notes

·

View notes

Photo

I always feel like somebody’s watching me! #ialwaysfeellikesomebodyswatchingme #staker #watch #party #fun #dance #home #share #art #vintage #follow #photography #photooftheday #cinematography #mood (at New York, New York) https://www.instagram.com/p/B7pe5AqpYMD/?igshid=y65oe3f0c8jv

#ialwaysfeellikesomebodyswatchingme#staker#watch#party#fun#dance#home#share#art#vintage#follow#photography#photooftheday#cinematography#mood

0 notes

Photo

Midwestern Haiku (circle), Pamela Staker

Expressive meditations on nature.

https://www.saatchiart.com/art/Collage-Midwestern-Haiku-circle/62287/2957534/view

2 notes

·

View notes