#semiconductor shortage

Text

ASML chip machines blocked from export to China

Cutting-edge chip manufacturing machines from Dutch semiconductor giant ASML have been blocked from export to China, according to the firm, amid a report of US pressure in the strategic sector.

ASML said in a statement late Monday the Dutch government had recently revoked a licence for shipping an unspecified number of machines “impacting a small number of customers in China.”

Semiconductors,…

View On WordPress

#ASML ban#ASML chip#ASML chip blocked#ASML chip machines#china chip ban#chip ban#chip machine#chip shortage#semiconductor#semiconductor shortage#us chip ban

0 notes

Text

Semiconductor Shortage in Auto Industry | Future of Chip Manufacturers | Blog by Avalon Global Research

The COVID-19 pandemic unleashed many challenges for the auto segment, the key concerns being decline in sales and shortage of semiconductors. While the growth momentum in order books is returning gradually, the short supply of semiconductors has compelled several OEMs to either shut shop or remodel products by eliminating certain key features, in their bid to cater to demand.

The gap between the demand and supply of chips has widened significantly over the last two years, with rising demand for consumer products running on chips aggravating the situation. Besides automotives, semiconductors are used in wireless and wired communication, PCs, storage, GPUs, peripherals, industrial, and consumer electronics. Sale of consumer goods and automobiles dropped significantly in 2020 but picked up in the second half of 2021. During the same period, demand for chips from the auto sector remained subdued, while that from the technology segment increased. Furthermore, the rise in remote working contributed to the growth in demand for wireless connectivity and PCs. Moreover, demand from the automotive segment started to recover once lockdowns eased, contributing to the shortage.

Amid the shortage of semiconductors globally, assembly line operations came to a grinding halt worldwide. Major car manufacturers and OEMs announced a cut in production that hit their revenues. During the pandemic, auto sales dropped around 80% in Europe, 70% in China and 50% in the US. Two other factors worsened the shortage: winter storms in the US resulting in the closure of chip manufacturing plants in Texas; and a major fire outbreak at chip manufacturer Renesas Electronics’ factory in Japan. Together these factories accounted for 50% of the semiconductor chips used in cars globally.

Capacity exhaustion

The semiconductor industry is growing at a robust rate in terms of revenues. However, capacity addition has failed to keep pace, lagging behind. Over the years, the industry has matured, with capacity growing around 4% annually. Utilisation, at or above 80% in the past decade, reached 90% in 2020. Although production has increased nearly 180% since 2000, total semiconductor capacity stands exhausted, given the high utilisation rate currently.

Impact of Russia-Ukraine War

The Russian invasion of Ukraine has put additional strain on existing supplies. Ukraine accounts for 25–35% of the supply of purified neon gas globally, while Russia caters to 25–30% of the demand for palladium, a rare metal used in semiconductors.

Stock piling and disruption in supply chain

Amid rising geopolitical tensions and regional disturbances within nations, consumer electronics manufacturers are resorting to stockpiling inventory as a hedge against potential supply disruptions. Due to stockpiling, prices have gone up by 5–10%. Moreover, semiconductors are largely transported by air. Therefore, an increase in the cost of transportation, amid the rise in fuel prices worldwide, has aggravated the situation.

Manufacturers usually resort to just-in-time (JIT) manufacturing, a widespread practice in the auto industry, to minimise waste and keep inventory levels low. However, the efficacy of JIT inventory management rests on accuracy of forecasts. In case of unforeseen shortages, the practice could severely disrupt the supply chain.

Impact of chip shortage on the auto sector

In 2021, due to the short supply of chips, the global automotive industry raked in just $200 billion in revenues. The demand for semiconductors from the auto segment in India totalled $24 billion at the beginning of 2022; it is expected to continue growing at a fast pace in the coming years.

Conclusion

Some of the large chip manufacturers in the US and Europe are expanding manufacturing capacities, which may aid recovery in the automotive industry from mid-2023. Investments in chip manufacturing in Southeast Asia are also likely to help in addressing the semiconductor shortage. In fact, chip giants in Taiwan and South Korea have earmarked significant investments for capacity expansion over the next few years. Many OEMs are adopting supply chain management technologies to leverage and forecast demand effectively. Moreover, several manufacturers are renewing contracts for a period of 15–18 months to efficiently cater to the demand. However, the current geopolitical environment and macroeconomic uncertainties globally, coupled with growing demand-supply gap, continue to pose concerns. In this scenario, it will take some time for the new processes and procedures (adopted by manufacturers) to address supply disruption-related issues effectively. Until then, for another couple of years or so, the shortage of semiconductors will continue to plague industries worldwide, especially the automotive segment.

Author –

Prasanth Radhakrishnan, Associate Director, Avalon Global Research

Contact us at https://www.avalonglobalresearch.com/contact-us

0 notes

Text

Sales of passenger cars in India increased by 40% in June as semiconductor supply improved

Sales of passenger cars in India increased by 40% in June as semiconductor supply improved

According to the Federation of Automobile Dealers Associations, passenger car registrations increased to 2,60,683 units last month, compared to 1,85,998 units in June 2021.

Sales of passenger cars in the country increased by 40 percent in June, indicating an improvement in semiconductor products as demand, especially for SUVs, remained strong, FADA said on Tuesday.

According to the Federation of…

View On WordPress

#automobile news#automobile sales india#Business News#car sales india#chip shortage#commercial vehicles sales#inflation in india#retail sales#semiconductor shortage

0 notes

Text

PM Modi At Semiconductor Conference

PM Modi At Semiconductor Conference

Prime Minister Narendra Modi on Friday inaugurated the three-day SemiconIndia Conference, 2022, which will be held from April 29 to May 1.

It’s a collective aim to establish India as one of the key partners in the global semiconductors supply chain, Modi said.

India will provide support for companies looking to invest in semiconductor manufacturing, he addded.

“We have shown that India means…

View On WordPress

#chip makers#chip shortage#Featured#global chip shortage#Semiconductor#Semiconductor plants#Semiconductor shortage

0 notes

Text

8 Regional Microelectronics Hubs Across US To Bolster Chip Industry

The U.S. Defense Department is establishing eight regional microelectronics hubs in seven states across the country aimed at helping spur manufacturing innovation to bolster the domestic semiconductor-industrial base.

View On WordPress

0 notes

Text

breaking out my ic card holder again 😌

#mine#also glad i brought mine bc apparently they stopped selling new ic cards indefinitely due to a semiconductor shortage @__@

1 note

·

View note

Text

Autoenshittification

Forget F1: the only car race that matters now is the race to turn your car into a digital extraction machine, a high-speed inkjet printer on wheels, stealing your private data as it picks your pocket. Your car’s digital infrastructure is a costly, dangerous nightmare — but for automakers in pursuit of postcapitalist utopia, it’s a dream they can’t give up on.

Your car is stuffed full of microchips, a fact the world came to appreciate after the pandemic struck and auto production ground to a halt due to chip shortages. Of course, that wasn’t the whole story: when the pandemic started, the automakers panicked and canceled their chip orders, only to immediately regret that decision and place new orders.

But it was too late: semiconductor production had taken a serious body-blow, and when Big Car placed its new chip orders, it went to the back of a long, slow-moving line. It was a catastrophic bungle: microchips are so integral to car production that a car is basically a computer network on wheels that you stick your fragile human body into and pray.

The car manufacturers got so desperate for chips that they started buying up washing machines for the microchips in them, extracting the chips and discarding the washing machines like some absurdo-dystopian cyberpunk walnut-shelling machine:

https://www.autoevolution.com/news/desperate-times-companies-buy-washing-machines-just-to-rip-out-the-chips-187033.html

These digital systems are a huge problem for the car companies. They are the underlying cause of a precipitous decline in car quality. From touch-based digital door-locks to networked sensors and cameras, every digital system in your car is a source of endless repair nightmares, costly recalls and cybersecurity vulnerabilities:

https://www.reuters.com/business/autos-transportation/quality-new-vehicles-us-declining-more-tech-use-study-shows-2023-06-22/

What’s more, drivers hate all the digital bullshit, from the janky touchscreens to the shitty, wildly insecure apps. Digital systems are drivers’ most significant point of dissatisfaction with the automakers’ products:

https://www.theverge.com/23801545/car-infotainment-customer-satisifaction-survey-jd-power

Even the automakers sorta-kinda admit that this is a problem. Back in 2020 when Massachusetts was having a Right-to-Repair ballot initiative, Big Car ran these unfuckingbelievable scare ads that basically said, “Your car spies on you so comprehensively that giving anyone else access to its systems will let murderers stalk you to your home and kill you:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

But even amid all the complaining about cars getting stuck in the Internet of Shit, there’s still not much discussion of why the car-makers are making their products less attractive, less reliable, less safe, and less resilient by stuffing them full of microchips. Are car execs just the latest generation of rubes who’ve been suckered by Silicon Valley bullshit and convinced that apps are a magic path to profitability?

Nope. Car execs are sophisticated businesspeople, and they’re surfing capitalism’s latest — and last — hot trend: dismantling capitalism itself.

Now, leftists have been predicting the death of capitalism since The Communist Manifesto, but even Marx and Engels warned us not to get too frisky: capitalism, they wrote, is endlessly creative, constantly reinventing itself, re-emerging from each crisis in a new form that is perfectly adapted to the post-crisis reality:

https://www.nytimes.com/2022/10/31/books/review/a-spectre-haunting-china-mieville.html

But capitalism has finally run out of gas. In his forthcoming book, Techno Feudalism: What Killed Capitalism, Yanis Varoufakis proposes that capitalism has died — but it wasn’t replaced by socialism. Rather, capitalism has given way to feudalism:

https://www.penguin.co.uk/books/451795/technofeudalism-by-varoufakis-yanis/9781847927279

Under capitalism, capital is the prime mover. The people who own and mobilize capital — the capitalists — organize the economy and take the lion’s share of its returns. But it wasn’t always this way: for hundreds of years, European civilization was dominated by rents, not markets.

A “rent” is income that you get from owning something that other people need to produce value. Think of renting out a house you own: not only do you get paid when someone pays you to live there, you also get the benefit of rising property values, which are the result of the work that all the other homeowners, business owners, and residents do to make the neighborhood more valuable.

The first capitalists hated rent. They wanted to replace the “passive income” that landowners got from taxing their serfs’ harvest with active income from enclosing those lands and grazing sheep in order to get wool to feed to the new textile mills. They wanted active income — and lots of it.

Capitalist philosophers railed against rent. The “free market” of Adam Smith wasn’t a market that was free from regulation — it was a market free from rents. The reason Smith railed against monopolists is because he (correctly) understood that once a monopoly emerged, it would become a chokepoint through which a rentier could cream off the profits he considered the capitalist’s due:

https://locusmag.com/2021/03/cory-doctorow-free-markets/

Today, we live in a rentier’s paradise. People don’t aspire to create value — they aspire to capture it. In Survival of the Richest, Doug Rushkoff calls this “going meta”: don’t provide a service, just figure out a way to interpose yourself between the provider and the customer:

https://pluralistic.net/2022/09/13/collapse-porn/#collapse-porn

Don’t drive a cab, create Uber and extract value from every driver and rider. Better still: don’t found Uber, invest in Uber options and extract value from the people who invest in Uber. Even better, invest in derivatives of Uber options and extract value from people extracting value from people investing in Uber, who extract value from drivers and riders. Go meta.

This is your brain on the four-hour-work-week, passive income mind-virus. In Techno Feudalism, Varoufakis deftly describes how the new “Cloud Capital” has created a new generation of rentiers, and how they have become the richest, most powerful people in human history.

Shopping at Amazon is like visiting a bustling city center full of stores — but each of those stores’ owners has to pay the majority of every sale to a feudal landlord, Emperor Jeff Bezos, who also decides which goods they can sell and where they must appear on the shelves. Amazon is full of capitalists, but it is not a capitalist enterprise. It’s a feudal one:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

This is the reason that automakers are willing to enshittify their products so comprehensively: they were one of the first industries to decouple rents from profits. Recall that the reason that Big Car needed billions in bailouts in 2008 is that they’d reinvented themselves as loan-sharks who incidentally made cars, lending money to car-buyers and then “securitizing” the loans so they could be traded in the capital markets.

Even though this strategy brought the car companies to the brink of ruin, it paid off in the long run. The car makers got billions in public money, paid their execs massive bonuses, gave billions to shareholders in buybacks and dividends, smashed their unions, fucked their pensioned workers, and shipped jobs anywhere they could pollute and murder their workforce with impunity.

Car companies are on the forefront of postcapitalism, and they understand that digital is the key to rent-extraction. Remember when BMW announced that it was going to rent you the seatwarmer in your own fucking car?

https://pluralistic.net/2020/07/02/big-river/#beemers

Not to be outdone, Mercedes announced that they were going to rent you your car’s accelerator pedal, charging an extra $1200/year to unlock a fully functional acceleration curve:

https://www.theverge.com/2022/11/23/23474969/mercedes-car-subscription-faster-acceleration-feature-price

This is the urinary tract infection business model: without digitization, all your car’s value flowed in a healthy stream. But once the car-makers add semiconductors, each one of those features comes out in a painful, burning dribble, with every button on that fakakta touchscreen wired directly into your credit-card.

But it’s just for starters. Computers are malleable. The only computer we know how to make is the Turing Complete Von Neumann Machine, which can run every program we know how to write. Once they add networked computers to your car, the Car Lords can endlessly twiddle the knobs on the back end, finding new ways to extract value from you:

https://doctorow.medium.com/twiddler-1b5c9690cce6

That means that your car can track your every movement, and sell your location data to anyone and everyone, from marketers to bounty-hunters looking to collect fees for tracking down people who travel out of state for abortions to cops to foreign spies:

https://www.vice.com/en/article/n7enex/tool-shows-if-car-selling-data-privacy4cars-vehicle-privacy-report

Digitization supercharges financialization. It lets car-makers offer subprime auto-loans to desperate, poor people and then killswitch their cars if they miss a payment:

https://www.youtube.com/watch?v=4U2eDJnwz_s

Subprime lending for cars would be a terrible business without computers, but digitization makes it a great source of feudal rents. Car dealers can originate loans to people with teaser rates that quickly blow up into payments the dealer knows their customer can’t afford. Then they repo the car and sell it to another desperate person, and another, and another:

https://pluralistic.net/2022/07/27/boricua/#looking-for-the-joke-with-a-microscope

Digitization also opens up more exotic options. Some subprime cars have secondary control systems wired into their entertainment system: miss a payment and your car radio flips to full volume and bellows an unstoppable, unmutable stream of threats. Tesla does one better: your car will lock and immobilize itself, then blare its horn and back out of its parking spot when the repo man arrives:

https://tiremeetsroad.com/2021/03/18/tesla-allegedly-remotely-unlocks-model-3-owners-car-uses-smart-summon-to-help-repo-agent/

Digital feudalism hasn’t stopped innovating — it’s just stopped innovating good things. The digital device is an endless source of sadistic novelties, like the cellphones that disable your most-used app the first day you’re late on a payment, then work their way down the other apps you rely on for every day you’re late:

https://restofworld.org/2021/loans-that-hijack-your-phone-are-coming-to-india/

Usurers have always relied on this kind of imaginative intimidation. The loan-shark’s arm-breaker knows you’re never going to get off the hook; his goal is in intimidating you into paying his boss first, liquidating your house and your kid’s college fund and your wedding ring before you default and he throws you off a building.

Thanks to the malleability of computerized systems, digital arm-breakers have an endless array of options they can deploy to motivate you into paying them first, no matter what it costs you:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Car-makers are trailblazers in imaginative rent-extraction. Take VIN-locking: this is the practice of adding cheap microchips to engine components that communicate with the car’s overall network. After a new part is installed in your car, your car’s computer does a complex cryptographic handshake with the part that requires an unlock code provided by an authorized technician. If the code isn’t entered, the car refuses to use that part.

VIN-locking has exploded in popularity. It’s in your iPhone, preventing you from using refurb or third-party replacement parts:

https://doctorow.medium.com/apples-cement-overshoes-329856288d13

It’s in fuckin’ ventilators, which was a nightmare during lockdown as hospital techs nursed their precious ventilators along by swapping parts from dead systems into serviceable ones:

https://www.vice.com/en/article/3azv9b/why-repair-techs-are-hacking-ventilators-with-diy-dongles-from-poland

And of course, it’s in tractors, along with other forms of remote killswitch. Remember that feelgood story about John Deere bricking the looted Ukrainian tractors whose snitch-chips showed they’d been relocated to Russia?

https://doctorow.medium.com/about-those-kill-switched-ukrainian-tractors-bc93f471b9c8

That wasn’t a happy story — it was a cautionary tale. After all, John Deere now controls the majority of the world’s agricultural future, and they’ve boobytrapped those ubiquitous tractors with killswitches that can be activated by anyone who hacks, takes over, or suborns Deere or its dealerships.

Control over repair isn’t limited to gouging customers on parts and service. When a company gets to decide whether your device can be fixed, it can fuck you over in all kinds of ways. Back in 2019, Tim Apple told his shareholders to expect lower revenues because people were opting to fix their phones rather than replace them:

https://www.apple.com/newsroom/2019/01/letter-from-tim-cook-to-apple-investors/

By usurping your right to decide who fixes your phone, Apple gets to decide whether you can fix it, or whether you must replace it. Problem solved — and not just for Apple, but for car makers, tractor makers, ventilator makers and more. Apple leads on this, even ahead of Big Car, pioneering a “recycling” program that sees trade-in phones shredded so they can’t possibly be diverted from an e-waste dump and mined for parts:

https://www.vice.com/en/article/yp73jw/apple-recycling-iphones-macbooks

John Deere isn’t sleeping on this. They’ve come up with a valuable treasure they extract when they win the Right-to-Repair: Deere singles out farmers who complain about its policies and refuses to repair their tractors, stranding them with six-figure, two-ton paperweight:

https://pluralistic.net/2022/05/31/dealers-choice/#be-a-shame-if-something-were-to-happen-to-it

The repair wars are just a skirmish in a vast, invisible fight that’s been waged for decades: the War On General-Purpose Computing, where tech companies use the law to make it illegal for you to reconfigure your devices so they serve you, rather than their shareholders:

https://memex.craphound.com/2012/01/10/lockdown-the-coming-war-on-general-purpose-computing/

The force behind this army is vast and grows larger every day. General purpose computers are antithetical to technofeudalism — all the rents extracted by technofeudalists would go away if others (tinkereres, co-ops, even capitalists!) were allowed to reconfigure our devices so they serve us.

You’ve probably noticed the skirmishes with inkjet printer makers, who can only force you to buy their ink at 20,000% markups if they can stop you from deciding how your printer is configured:

https://pluralistic.net/2022/08/07/inky-wretches/#epson-salty

But we’re also fighting against insulin pump makers, who want to turn people with diabetes into walking inkjet printers:

https://pluralistic.net/2022/06/10/loopers/#hp-ification

And companies that make powered wheelchairs:

https://pluralistic.net/2022/06/08/chair-ish/#r2r

These companies start with people who have the least agency and social power and wreck their lives, then work their way up the privilege gradient, coming for everyone else. It’s called the “shitty technology adoption curve”:

https://pluralistic.net/2022/08/21/great-taylors-ghost/#solidarity-or-bust

Technofeudalism is the public-private-partnership from hell, emerging from a combination of state and private action. On the one hand, bailing out bankers and big business (rather than workers) after the 2008 crash and the covid lockdown decoupled income from profits. Companies spent billions more than they earned were still wildly profitable, thanks to those public funds.

But there’s also a policy dimension here. Some of those rentiers’ billions were mobilized to both deconstruct antitrust law (allowing bigger and bigger companies and cartels) and to expand “IP” law, turning “IP” into a toolsuite for controlling the conduct of a firm’s competitors, critics and customers:

https://locusmag.com/2020/09/cory-doctorow-ip/

IP is key to understanding the rise of technofeudalism. The same malleability that allows companies to “twiddle” the knobs on their services and keep us on the hook as they reel us in would hypothetically allow us to countertwiddle, seizing the means of computation:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

The thing that stands between you and an alternative app store, an interoperable social media network that you can escape to while continuing to message the friends you left behind, or a car that anyone can fix or unlock features for is IP, not technology. Under capitalism, that technology would already exist, because capitalists have no loyalty to one another and view each other’s margins as their own opportunities.

But under technofeudalism, control comes from rents (owning things), not profits (selling things). The capitalist who wants to participate in your iPhone’s “ecosystem” has to make apps and submit them to Apple, along with 30% of their lifetime revenues — they don’t get to sell you jailbreaking kit that lets you choose their app store.

Rent-seeking technology has a holy grail: control over “ring zero” — the ability to compel you to configure your computer to a feudalist’s specifications, and to verify that you haven’t altered your computer after it came into your possession:

https://pluralistic.net/2022/01/30/ring-minus-one/#drm-political-economy

For more than two decades, various would-be feudal lords and their court sorcerers have been pitching ways of doing this, of varying degrees of outlandishness.

At core, here’s what they envision: inside your computer, they will nest another computer, one that is designed to run a very simple set of programs, none of which can be altered once it leaves the factory. This computer — either a whole separate chip called a “Trusted Platform Module” or a region of your main processor called a secure enclave — can tally observations about your computer: which operating system, modules and programs it’s running.

Then it can cryptographically “sign” these observations, proving that they were made by a secure chip and not by something you could have modified. Then you can send this signed “attestation” to someone else, who can use it to determine how your computer is configured and thus whether to trust it. This is called “remote attestation.”

There are some cool things you can do with remote attestation: for example, two strangers playing a networked video game together can use attestations to make sure neither is running any cheat modules. Or you could require your cloud computing provider to use attestations that they aren’t stealing your data from the server you’re renting. Or if you suspect that your computer has been infected with malware, you can connect to someone else and send them an attestation that they can use to figure out whether you should trust it.

Today, there’s a cool remote attestation technology called “PrivacyPass” that replaces CAPTCHAs by having you prove to your own device that you are a human. When a server wants to make sure you’re a person, it sends a random number to your device, which signs that number along with its promise that it is acting on behalf of a human being, and sends it back. CAPTCHAs are all kinds of bad — bad for accessibility and privacy — and this is really great.

But the billions that have been thrown at remote attestation over the decades is only incidentally about solving CAPTCHAs or verifying your cloud server. The holy grail here is being able to make sure that you’re not running an ad-blocker. It’s being able to remotely verify that you haven’t disabled the bossware your employer requires. It’s the power to block someone from opening an Office365 doc with LibreOffice. It’s your boss’s ability to ensure that you haven’t modified your messaging client to disable disappearing messages before he sends you an auto-destructing memo ordering you to break the law.

And there’s a new remote attestation technology making the rounds: Google’s Web Environment Integrity, which will leverage Google’s dominance over browsers to allow websites to block users who run ad-blockers:

https://github.com/RupertBenWiser/Web-Environment-Integrity

There’s plenty else WEI can do (it would make detecting ad-fraud much easier), but for every legitimate use, there are a hundred ways this could be abused. It’s a technology purpose-built to allow rent extraction by stripping us of our right to technological self-determination.

Releasing a technology like this into a world where companies are willing to make their products less reliable, less attractive, less safe and less resilient in pursuit of rents is incredibly reckless and shortsighted. You want unauthorized bread? This is how you get Unauthorized Bread:

https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/amp/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

[Image ID: The interior of a luxury car. There is a dagger protruding from the steering wheel. The entertainment console has been replaced by the text 'You wouldn't download a car,' in MPAA scare-ad font. Outside of the windscreen looms the Matrix waterfall effect. Visible in the rear- and side-view mirror is the driver: the figure from Munch's 'Scream.' The screen behind the steering-wheel has been replaced by the menacing red eye of HAL9000 from Stanley Kubrick's '2001: A Space Odyssey.']

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#shitty technology adoption curve#unauthorized bread#automotive#arm-breakers#cars#big car#right to repair#rent-seeking#digital feudalism#neofeudalism#drm#wei#remote attestation#private access tokens#yannis varoufakis#web environment integrity#paternalism#war on general purpose computing#competitive compatibility#google#enshittification#interoperability#adversarial interoperability#comcom#the internet con#postcapitalism#ring zero#care#med-tech

4K notes

·

View notes

Text

The semiconductor supply chain has evolved into a significant strategic asset in geopolitics Russia restricted the export of noble gases, including neon, a critical component in chip manufacturing thus taking a strategic stance towards rectifying global chip shortage.

#india chip manufacturing#chipshortage#chip shortage#chip manufacturing companies#indian chip manufacturing companies#chinese chip manufacturer#chinese semiconductor industry#chinese chip manufacturing#chips in usa#chips in america#global chip shortage

0 notes

Text

Electronics Will Cost More In 2023. 7 Electronic Devices? Used In Daily Life

Electronics Will Cost More In 2023. 7 Electronic Devices? Used In Daily Life:- Although we are used to new generations of electronic products that cost almost as much as the previous generation, the electronics segment is not immune to inflation.

Electronics Will Cost More In 2023. 7 Electronic Devices? Used In Daily Life:- Although we are used to new generations of electronic products that cost almost as much as the previous generation, the electronics segment is not immune to inflation. With recent announcements of semiconductor price hikes starting in 2023, consumers should move quickly to secure lower prices during back-to-school and…

View On WordPress

#are electronics prices going up#chip shortage price increase#chipmakers tsmc umc and samsung plan to raise prices#consumer electronics inflation#electronic component cost trends#electronics price increase 2022#electronics price index#electronics will cost more CA#electronics will cost more in USA#electronics will cost more Switzerland#electronics will cost more U.S#electronics will cost more UK#price of electronic components#semiconductor price increase#tsmc price increase 2022#tsmc to initiate about 6 price hike in 2023#tsmc wafer price#umc price increase#will electronic prices go down

0 notes

Text

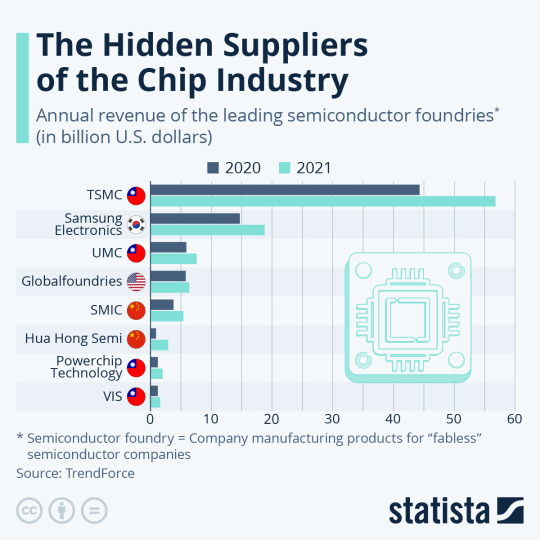

Who are the Top Chip Manufacturers in the World?

Who are the Top Chip Manufacturers in the World?

You will find more infographics at Statista

Who are the top chip manufacturers in the world?

Nearly every form of contemporary computing gadget we currently depend on to operate our daily lives is powered by silicon chips. These range from automobiles and home appliances to a number of medical gadgets, and space vehicles in addition to cell phones and computers. A large portion of our modern…

View On WordPress

#semiconductor chips#semiconductor chips for cars#semiconductor chips manufacturers#semiconductor chips manufacturing process#semiconductor#chips big name#semiconductor chips big name#semiconductor chips company#computer chips#semiconductor chips shortage#semiconductor chips 2022

0 notes

Text

Is the Chip Shortage Easing? Some CEOs Says Yes

Is the Chip Shortage Easing? Some CEOs Says Yes

The semiconductor (chip) shortage has been a problem for the print industry for well over a year, with the chips required for not only for printers and copier/MPFs, but for toner and ink cartridges.

Whether the shortage is easing, or is continuing, depends on who you ask. Following is a look at some current opinions and experiences.

Deloitte Consulting

As recently as December, Deloitte…

View On WordPress

0 notes

Text

Ford announces electric drive.

Ford announces electric drive.

Ford announces electric drive. Subscribe to Electric Vehicle News Bitesize Podcast for FREE!

One of Britain’s most popular cars is about to retire as car giant Ford announces its move to electric vehicles.

Email Address:

Subscribe

Ford will reportedly stop production after the famous Ford Fiesta model “runs out of gas.” With more than 16 million sales, the Fiesta is one of the most popular…

View On WordPress

#Climate change activists#Electric Vehicle News#Electric Vehicle News UK#Ernst & Young#European Commission#European Electric Vehicle market#European Parliament#European Union#Ford#Ford Europe#Ford Fiesta#Global semiconductor shortages#Podcast#The Times

0 notes

Text

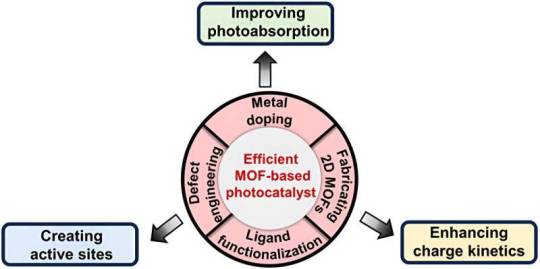

Strategies to engineer metal-organic frameworks for efficient photocatalysis

The ever-increasing global energy shortage and the worsening of the environment urgently require the substitution of conventional fossil-based energy for green and sustainable energy.

As one of the renewable energy sources, solar energy is clean and abundant and can be a satisfying option. Photocatalysis is a highly promising technology that effectively transforms solar energy into chemical energy. This technology has numerous applications, such as water splitting, CO2 reduction, organic synthesis, and pollutant degradation.

Although inorganic semiconductors are the initial and the most widely studied photocatalysts, metal-organic frameworks (MOFs), a class of porous crystalline material constructed from metal ions/clusters interconnected with multi-dentated organic ligands, are recently emerging as a new type of promising photocatalysts.

Read more.

14 notes

·

View notes

Text

EVERYONE RECALLS THE SHORTAGES of toilet paper and pasta, but the early period of the pandemic was also a time of gluts. With restaurants and school cafeterias shuttered, farmers in Florida destroyed millions of pounds of tomatoes, cabbages, and green beans. After meatpacking plants began closing, farmers in Minnesota and Iowa euthanized hundreds of thousands of hogs to avoid overcrowding. Across the country, from Ohio to California, dairies poured out millions of gallons of milk and poultry farms smashed millions of eggs.

The supply chain disruptions continue. Last year, there was a rice glut, and big box stores like Walmart and Target complained of bloated inventories. There was a natural gas glut in both Europe and in India, as well as a surfeit of semiconductor chips in the tech sector. Florida cabbages, microchips, and Asian rice may not seem like they have much in common, but each of these stories represents a fundamental if disavowed aspect of capitalism: a crisis of overproduction.

All economic systems have problems of scarcity, but only capitalism also has problems of abundance. The reason is simple: the pursuit of profit above all else leads capitalism to produce too much of things that are profitable but socially destructive (oil, private health insurance, Facebook) and not enough of things that are socially beneficial but not privately profitable (low-income housing, public schools, the ecosystem of the Amazon rainforest). For over a century, from the Industrial Revolution through the Great Depression, crises of overproduction were the target of criticism from across the political spectrum—from aristocratic conservatives like Edmund Burke who feared the anarchy of markets was corroding the social order to socialist radicals like Eugene Debs who thought it generated exploitation and poverty.

But the idea of capitalism’s inherent predilection for overproduction has almost completely disappeared from economic discourse today. It seldom appears in the popular press, including in stories about producers destroying surpluses, a problem that is instead explained away by pointing to freak accidents, contingencies, and unforeseen dislocations. To be sure, many gluts of the past few years have been the result of the pandemic and the war in Ukraine. But overproduction preceded 2020 and shows no signs of going away. Revisiting historical arguments about the problem can help us better understand the interlocking crises of supply chain disruption, deliquescent financial markets, and climate change. The history of overproduction and its discontents offers a set of tools and ideas with which to consider whether “market failures” like externalities and inventory surpluses really are exceptions or are intrinsic to commercial society, whether markets ever actually do equilibrate, and whether the drive for growth is possible without continual excess and waste.

20 notes

·

View notes

Text

SEOUL, South Korea — In fried-chicken-obsessed South Korea, restaurants serving the nation's favourite fast-food dish dot every street corner.

But Kang Ji-young's establishment brings something a little different to the table: a robot is cooking the chicken.

Eaten at everything from tiny family gatherings to a 10-million-viewer live-streamed "mukbang" -- eating broadcast -- by K-pop star Jungkook of BTS fame, fried chicken is deeply embedded in South Korean culture.

Paired with cold lager and known as "chimaek" -- a portmanteau of the Korean words for chicken and beer -- it is a staple of Seoul's famed baseball-watching experience.

The domestic market -- the world's third largest, after the United States and China -- is worth about seven trillion won ($5.3 billion).

However, labour shortages are starting to bite as South Korea faces a looming demographic disaster due to having the world's lowest birth rate.

Around 54 percent of business owners in the food service sector report problems finding employees, a government survey last year found, with long hours and stressful conditions the likely culprit, according to industry research.

Korean fried chicken is brined and double-fried, which gives it its signature crispy exterior, but the process -- more elaborate than what is typically used by US fast food chains -- creates additional labour and requires extended worker proximity to hot oil.

Enter Kang, a 38-year-old entrepreneur who saw an opportunity to improve the South Korean fried chicken business model and the dish itself.

"The market is huge," Kang told AFP at her Robert Chicken franchise.

Chicken and pork cutlets are the most popular delivery orders in South Korea, and the industry could clearly benefit from more automation "to effectively address labour costs and workforce shortages," she said.

Kang's robot, composed of a simple, flexible mechanical arm, is capable of frying 100 chickens in two hours -- a task that would require around five people and several deep fryers.

But not only does the robot make chicken more efficiently -- it makes it more delicious, says Kang.

"We can now say with confidence that our robot fries better than human beings do," she said.

Investing in 'foodtech'

Already a global cultural powerhouse and major semiconductor exporter, South Korea last year announced plans to plough millions of dollars into a "foodtech" fund to help startups working on high-tech food industry solutions.

Seoul says such innovations could become a "new growth engine," arguing there is huge potential if the country's prowess in advanced robotics and AI technology could be combined with the competitiveness of Korean food classics like kimchi.

South Korea's existing foodtech industry -- including everything from next-day grocery delivery app Market Kurly to AI smart kitchens to a "vegan egg" startup -- is already worth millions, said food science professor Lee Ki-won at Seoul National University.

Even South Korea's Samsung Electronics -- one of the world's biggest tech companies -- is trying to get in on the action, recently launching Samsung Food, an AI-personalised recipe and meal-planning platform, available in eight languages.

Lee predicted South Korea's other major conglomerates are likely to follow Samsung into foodtech.

"Delivering food using electric vehicles or having robots directly provide deliveries within apartment complexes, known as 'metamobility,' could become a part of our daily lives," he said.

"I am confident that within the next 10 years, the food tech industry will transform into the leading sector in South Korea."

'Initially struggled'

Entrepreneur Kang now has 15 robot-made chicken restaurants in South Korea and one branch in Singapore.

During AFP's visit to a Seoul branch, a robot meticulously handled the frying process -- from immersing chicken in oil, flipping it for even cooking, to retrieving it at the perfect level of crispiness, as the irresistible scent of crunchy chicken wafted through the shop.

Many customers remained oblivious to the hard-working robotic cook behind their meal.

Kim Moon-jung, a 54-year-old insurance worker, said she was not sure how a robot would make the chicken differently from a human "but one thing is certain -- it tastes delicious."

The robot can monitor oil temperature and oxidation levels in real time while it fries chicken, ensuring consistent taste and superior hygiene.

When Kang first started her business, she "initially struggled" to see why anyone would use robots rather than human chefs.

"But after developing these technologies, I've come to realise that from a customer's perspective, they're able to enjoy food that is not only cleaner but also tastier," she told AFP.

Her next venture is a tip-free bar in Koreatown in New York City, where the cocktails will feature Korea's soju rice wine and will be made by robots.

youtube

Entrepreneur aims to improve South Korea's dish using robot

11 September 2023

#South Korea#chimaek#fried chicken#beer#Korean fried chicken#Robert Chicken#Kang Ji-young#advanced robotics#AI technology#Samsung Food#Samsung Electronics#metamobility#Youtube#robot

9 notes

·

View notes

Text

All roads lead to Phoenix. On the gravy train of greenfield investment riding on the back of Inflation Reduction Act legislative incentives in the United States, no county ranks higher than Arizona’s Maricopa. The county leads the nation in foreign direct investment, with Taiwan Semiconductor Manufacturing Corp. (TSMC), Intel, LG Energy, and others expanding their footprint in the Grand Canyon State. But Phoenix is neither the next Rome nor the next Detroit. The reasons boil down to workers and water.

First, the labor. America’s skilled worker shortage has been well documented since before the Trump-era immigration slump and pandemic border closures. Especially in the tech industry—the United States’ most productive, high-wage, and globally dominant sector—a huge deficit in homegrown engineering talent and endlessly bungled immigration policies have left Big Tech with no choice but to outsource more jobs abroad.

Arizona dangled its low taxes and sunshine, but TSMC has had to fly in Taiwanese technicians to jump-start production at the 4 nanometer chip plant that was meant to be completed by 2024, but has been delayed until 2025 at the earliest.

The salvage operation calls into question whether the more advanced and miniaturized 3 nanometer plant—scheduled to open in 2026 will stay on course. (With two-thirds of its customer base—including Apple, AMD, Qualcomm, Broadcom, Nvidia, Marvell, Analog Devices, and Intel—in the United States, it’s no wonder TSMC wants to speed things up.)

From electric vehicles to gaming consoles, the forecasted demand for the company’s industry-leading chips is projected to rise long into the future—and its market share is already north of 50 percent. Given the geopolitical risks it faces in Asia, a well-trained U.S. workforce could give it the comfort to establish the United States as a quasi-second headquarters. After all, Morris Chang, the company’s founder, had a long first career with Texas Instruments.

But the next slowdown they may face is Arizona’s dwindling water supply. In just the past year, Scottsdale cut off water to Rio Verde Foothills, an upscale unincorporated suburb on its fringes, due to the region’s ongoing megadrought and its curtailed allocation of Colorado River water. This was followed by Phoenix freezing new construction permits for homes that rely on groundwater.

Forced to find other sources, industry players have stepped up buying water rights from farmers, essentially bribing them to stop growing food that would serve the region’s fast-growing population. Then there are the backroom deals involved in an Israeli company receiving the green light for a $5.5 billion project to desalinate water from Mexico’s Sea of Cortez and pipe it 200 miles uphill through deserts and natural preserves to Phoenix.

Water risk brings political risk for companies. Especially in Europe, governments are carefully weighing the short-term benefits of corporate investment versus the climate stress it exacerbates. They have good reason to be suspicious: Firms such as Microsoft have been notoriously inconsistent in reporting their water consumption, and promises to replenish consumed water haven’t been delivered on. And even if data centers are becoming more efficient, growing demand just means more of them. Some European provinces have blocked data center development, pushing them to locations with high heat risk.

Europe’s regulatory stringency has long been off-putting to foreign investors, which is what makes European officials so weary of Washington’s aggressive Inflation Reduction Act, CHIPS and Science Act and Infrastructure Investment and Jobs Act.

But to fulfill its promise of putting the United States on a path toward sustainable industrial self-sufficiency, these policies need to better align investment with resources, matching companies to geographies that best suit their needs. It would be better to direct capital allocation to climate resilient regions than to throw good money after potentially stranded assets.

If any company ought to know better on all these matters, it’s TSMC. In Taiwan itself, the industry’s huge energy and water consumption are a source of controversy and difficulty. Not only have droughts on the island occasionally slowed production, but the company’s own water consumption rose 70 percent from 2015-19.

Furthermore, Taiwan knows that its real special sauce is precisely the technically skilled workforce that the United States lacks. Yet TSMC has doubled down on Phoenix, a place without a reliable long-term water supply for industry, little in the way of renewable energy, and a construction freeze that will make it challenging to house all the workers it needs to import.

With all the uncertainty over both water and workers, this begs the question of whether the semiconductor company the entire world is courting would have been better off establishing its U.S. beachhead in the upper Midwest or northeast instead? Ohio, upstate New York, and Michigan rank high in greenfield corporate investments, resilience to climate shocks, and are abundant in quality universities and technical institutes.

Amid accelerating climate change and an intensifying war for global talent, how can those devising U.S. industrial policy better select the appropriate locations to steer investment to?

States with higher climate resilience than Arizona are starting to flex for greater investment. According to recent data, Illinois has climbed to second place nationally for corporate expansion and relocation projects. The greater Chicago area and state as a whole are touting their tax benefits, underpriced real estate, growth potential, and grants to prepare businesses to cope with climate change.

Other parts of the Great Lakes region, such as Michigan and Ohio, are also regaining confidence in their industrial revival, pitching heavily for both domestic and foreign commercial investment while emphasizing their affordability and climate adaptation plans.

Just over the border, Canada has been wildly successful in poaching foreign skilled workers unable to secure or maintain green card status in the United States while also investing heavily in economic diversification—all with the benefit of nearly unlimited natural resources and energy supplies. While Canada hasn’t yet rolled out Inflation Reduction Act-style tax breaks to lure investors, it abounds in critical minerals for EV batteries (nickel, cobalt, lithium and rare earths such as neodymium, praseodymium, and niobium) as well as hydropower.

The more that climate change warps the United States, the more grateful it should be that its most natural and staunch ally occupies the most climate resilient real estate on the North American continent, even taking into account the raging wildfires of this summer. But rather than covet Canada the way China does Russia—as a vast and depopulated resource bounty—the United States and Canada should cooperate far more proactively on a continental scale industrial policy that would bring about true self-sufficiency from the Arctic to the Caribbean.

This is where geopolitical interests, economic competition, and climate adaptation converge. As Canada’s population surges by up to 1 million new permanent migrants annually, a more unified North American system would be more self-sufficient in crucial commodities and industries, less vulnerable to supply chain disruptions abroad, and avoid unnecessary carbon emissions from excessive inter-continental trade. Thirty years after the NAFTA agreement, it seems more sensible than ever to graduate toward a more formal, autarkic North American Union.

One can easily imagine Greenland joining one day—the country already enjoys autonomy from its colonizer (Denmark) and is now pushing for complete independence, driven partly by the desire to control more of the riches that climate change has revealed it to possess.

Meanwhile, in Taipei, there are far more complex geopolitical consequences to consider. TSMC has long been considered Taiwan’s “silicon shield,” a leader of industry so important that a conflict that took it offline would be a major own-goal for China. But it is precisely the combination of the China threat, environmental stress, and pandemic-era supply chain disruptions that convinced TSMC’s customers that its home nation represents too large a concentration risk.

Now TSMC and its rivals are expanding production from Japan to the United States, Europe, and India. This globally diversified set of chip manufacturers is easier for China to exploit as countries more susceptible to Chinese pressure become less rigid in compliance with U.S.-led export controls over advanced technologies.

At the same time, if the United States no longer depends on Taiwan itself for the majority of its semiconductor supply in just five to seven years, will it be as willing to defend Taiwan militarily? This, not Ukraine, is what Beijing is watching for as it pursues its own “Made in China” quest for self-sufficiency.

Industrial policy is back in vogue as a national security and economic strategy. But to get it right requires aligning investment into industry and infrastructure with the geographies of resources and resilience. The countries that build climate adaptation into their strategies will be the ones that build back better.

10 notes

·

View notes