#semiconductor shortage in auto industry

Text

Semiconductor Shortage in Auto Industry | Future of Chip Manufacturers | Blog by Avalon Global Research

The COVID-19 pandemic unleashed many challenges for the auto segment, the key concerns being decline in sales and shortage of semiconductors. While the growth momentum in order books is returning gradually, the short supply of semiconductors has compelled several OEMs to either shut shop or remodel products by eliminating certain key features, in their bid to cater to demand.

The gap between the demand and supply of chips has widened significantly over the last two years, with rising demand for consumer products running on chips aggravating the situation. Besides automotives, semiconductors are used in wireless and wired communication, PCs, storage, GPUs, peripherals, industrial, and consumer electronics. Sale of consumer goods and automobiles dropped significantly in 2020 but picked up in the second half of 2021. During the same period, demand for chips from the auto sector remained subdued, while that from the technology segment increased. Furthermore, the rise in remote working contributed to the growth in demand for wireless connectivity and PCs. Moreover, demand from the automotive segment started to recover once lockdowns eased, contributing to the shortage.

Amid the shortage of semiconductors globally, assembly line operations came to a grinding halt worldwide. Major car manufacturers and OEMs announced a cut in production that hit their revenues. During the pandemic, auto sales dropped around 80% in Europe, 70% in China and 50% in the US. Two other factors worsened the shortage: winter storms in the US resulting in the closure of chip manufacturing plants in Texas; and a major fire outbreak at chip manufacturer Renesas Electronics’ factory in Japan. Together these factories accounted for 50% of the semiconductor chips used in cars globally.

Capacity exhaustion

The semiconductor industry is growing at a robust rate in terms of revenues. However, capacity addition has failed to keep pace, lagging behind. Over the years, the industry has matured, with capacity growing around 4% annually. Utilisation, at or above 80% in the past decade, reached 90% in 2020. Although production has increased nearly 180% since 2000, total semiconductor capacity stands exhausted, given the high utilisation rate currently.

Impact of Russia-Ukraine War

The Russian invasion of Ukraine has put additional strain on existing supplies. Ukraine accounts for 25–35% of the supply of purified neon gas globally, while Russia caters to 25–30% of the demand for palladium, a rare metal used in semiconductors.

Stock piling and disruption in supply chain

Amid rising geopolitical tensions and regional disturbances within nations, consumer electronics manufacturers are resorting to stockpiling inventory as a hedge against potential supply disruptions. Due to stockpiling, prices have gone up by 5–10%. Moreover, semiconductors are largely transported by air. Therefore, an increase in the cost of transportation, amid the rise in fuel prices worldwide, has aggravated the situation.

Manufacturers usually resort to just-in-time (JIT) manufacturing, a widespread practice in the auto industry, to minimise waste and keep inventory levels low. However, the efficacy of JIT inventory management rests on accuracy of forecasts. In case of unforeseen shortages, the practice could severely disrupt the supply chain.

Impact of chip shortage on the auto sector

In 2021, due to the short supply of chips, the global automotive industry raked in just $200 billion in revenues. The demand for semiconductors from the auto segment in India totalled $24 billion at the beginning of 2022; it is expected to continue growing at a fast pace in the coming years.

Conclusion

Some of the large chip manufacturers in the US and Europe are expanding manufacturing capacities, which may aid recovery in the automotive industry from mid-2023. Investments in chip manufacturing in Southeast Asia are also likely to help in addressing the semiconductor shortage. In fact, chip giants in Taiwan and South Korea have earmarked significant investments for capacity expansion over the next few years. Many OEMs are adopting supply chain management technologies to leverage and forecast demand effectively. Moreover, several manufacturers are renewing contracts for a period of 15–18 months to efficiently cater to the demand. However, the current geopolitical environment and macroeconomic uncertainties globally, coupled with growing demand-supply gap, continue to pose concerns. In this scenario, it will take some time for the new processes and procedures (adopted by manufacturers) to address supply disruption-related issues effectively. Until then, for another couple of years or so, the shortage of semiconductors will continue to plague industries worldwide, especially the automotive segment.

Author –

Prasanth Radhakrishnan, Associate Director, Avalon Global Research

Contact us at https://www.avalonglobalresearch.com/contact-us

0 notes

Text

Lansheng Technology: Automotive chips become bright spot

Rising sales of electric vehicles -- which tend to use more semiconductors than gasoline-powered cars -- combined with greater automation in all vehicles have kept car chip makers busy. Tesla CEO Elon Musk said last week that the long-term outlook for the market appeared to be strong, detailing his car company's plan to expand annual vehicle production to 20 million vehicles by 2030 from about 1.3 million in 2022 car.

Chip executives say the growth in the number of chips used in cars is staggering. By 2021, the average car will have about 1,200 chips, twice as many as in 2010, and that number is likely to rise, executives said.

Including Dutch automotive chip company NXP, German chip company Infineon, Japanese company Renesas and American companies TI and ADI are important players in this market.

Auto-related revenue should grow more than 30% in the current quarter, even as the company's overall revenue is expected to shrink, Matthew Murphy, chief executive of Marvell Corp of America, said on Thursday. The company's auto-related chip sales could reach $500 million in the next few years, up from about $100 million now, he said.

NXP's automotive chip sales rose 25 percent last year, and the company said it expects growth of about 15 percent in the first quarter of this year. Renesas' automotive business grew nearly 40 percent last year, and analysts expect more growth this quarter. Nearly a quarter of Analog Devices' sales come from the automotive industry, which grew 29 percent last year.

It’s not just the cars themselves that are getting more chip-intensive; semiconductor executives say so is auto production as manufacturers adopt greater automation to cope with labor shortages and try to keep costs down.

Chip companies are generally preparing to increase production capacity to meet rising automotive demand and expect a rebound in other industries such as PCs and smartphones. Texas Instruments said last month it would build an $11 billion chip factory in Lehi, Utah, and NXP said it was considering expanding in Texas.

Lansheng Technology Limited is a global distributor of electronic components that has been established for more than 10 years, headquartered in Shenzhen China, who mainly focuses on electronic spot stocks.

2 notes

·

View notes

Text

Global Top 3 Companies Accounted for 7% of total Power Rental Systems market (QYResearch, 2021)

Power rental, also known as power on hire comes with numerous advantages over the other counterparts. Power rental refers to the facility of temporarily renting power plants or generators for supplying energy to industrial units. It delivers functioning power equipment along with various scalable components, which are installed in power stations. It also offers reliability, flexibility, speed and cost-effectiveness to businesses for coping with brief shortages of power. The power rental services are aimed to stabilize utility power grids and provide additional energy to industries and support communities. Owing to this, it finds extensive application across the construction, mining, and oil & gas industries.

Source: Secondary Sources and Global Info Research, 2021

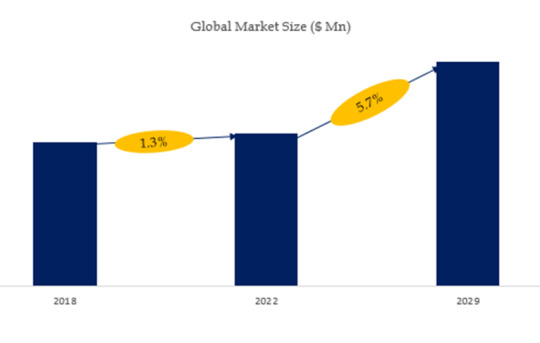

According to the new market research report “Global Power Rental Systems Market Report 2023-2029”, published by QYResearch, the global Power Rental Systems market size is projected to reach USD 28.23 billion by 2029, at a CAGR of 5.7% during the forecast period.

Figure. Global Power Rental Systems Market Size (US$ Million), 2018-2029

Based on or includes research from QYResearch: Global Power Rental Systems Market Report 2023-2029.

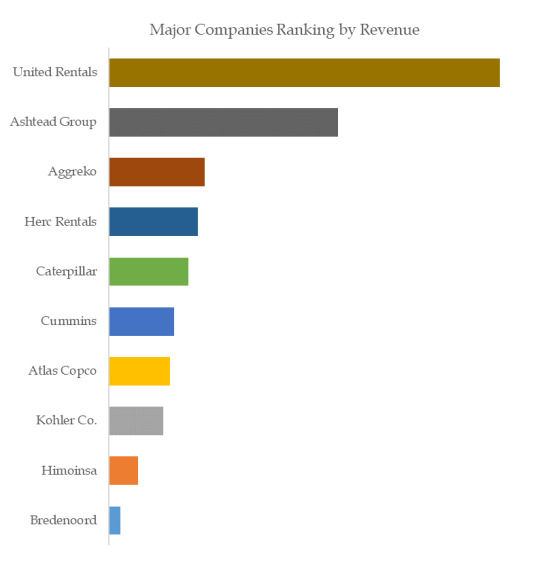

Figure. Global Power Rental Systems Top 10 Players Ranking and Market Share(Continually updated)

Based on or includes research from QYResearch: Global Power Rental Systems Market Report 2023-2029.

The global key manufacturers of Power Rental Systems include United Rentals, Ashtead Group, etc. In 2021, the global top three players had a share approximately 7.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

The Future of Electronic Vehicles: Motor Finance Trends To Watch

Post-pandemic auto financing has undergone significant alterations, but only those who have closely studied understand that this is not the result of the pandemic alone but of a long-term overhaul of auto financing driven by the pandemic. This makes these modifications critical and unavoidable in all cases for auto loan businesses to survive.

This blog will teach you everything you need to know to succeed during this change phase: the important trends in motor finance.

● Digitalisation

Disposable income has risen dramatically in developing countries. As a result, demand for vehicles has soared, prompting additional auto financing. Traditional methods are insufficient to meet this demand, and digitisation effectively replaces them, reducing the time required to execute loans from days to minutes. The rapid adoption of digital payments has facilitated vehicle finance by supplying alternate data to traditional credit information sources.

● Online Buying Experience

Customers have chosen an online shopping experience due to its convenience, time savings, and, most importantly, openness. According to a poll by leading organisations, purchasers spend 10% less time at dealerships.

The main reason is the ability to perform more accurate monthly credit calculations, apply for financing, select F&I products, examine and sign final contracts online, and evaluate various possibilities to get the best. This transparency has brought together lenders and borrowers who previously did not have independent ties. Online lending platforms can achieve this at a never-before level, pushing auto financing to rise as an industry.

● Increasing Ticket Sizes

Phenomenal gains in EV sales, supply chain restrictions, semiconductor shortages, and customers choosing mid-segment and higher-end vehicles have increased ticket sizes by 20-25%. Auto financiers are required to fund more than they previously did. This provides them with a higher profit but also more danger. Risk may be reduced with the right technology, rules, and processes, making this predicament a good opportunity.

● Increased Leasing of Vehicles

Loans for purchasing a car, account for most auto financing. However, loans for leasing a vehicle are growing in popularity due to convenience and cost savings. The advent of ride-sharing has also helped to expand this category. Ride-sharing firms are proving to be the most important customers for vehicle finance. With the introduction of self-driving cars, the demand for financing through leasing automobiles is likely to increase over time.

Conclusion

The increase in motor finance over the years has successfully led to car companies selling vehicles of every kind to the people. Almost every family owns a personal vehicle for their daily travel needs, all thanks to the availability of motor loans.

For more details about Vehicle Finance Please visit our website: vehiclefinance.today

0 notes

Text

The Ripple Effects of the Chip Shortage on Automobile Insurance Claims

The modern world has come to rely heavily on semiconductors, the tiny yet mighty chips that power everything from smartphones to microwaves, and yes, our vehicles. The recent shortage of these critical components has sent shockwaves through various industries, with the automotive sector being one of the hardest hit. As cars have evolved into computers on wheels, the dearth of chips has had a domino effect, leading to production halts, delivery delays, and a host of other challenges. But there’s an angle to this saga that hasn’t been as widely discussed: the impact on automobile insurance claims.

When the Well Runs Dry

Imagine a scenario where your trusted car, a vital part of your daily routine, needs repair. But there’s a catch – the parts required are just not available. This isn’t a hypothetical situation; it’s a reality for many due to the ongoing global chip shortage. The ramifications of this shortage stretch beyond mere inconvenience, spilling over into the realm of auto insurance. Let’s delve into how this shortage is reshaping the landscape of automobile insurance claims and what it means for consumers and insurers alike.

Understanding the Chip Shortage

Before we explore the implications for automobile insurance, it’s crucial to understand the root of the chip shortage. The demand for chips surged unexpectedly as the world adapted to the pandemic, with remote work and education driving up the need for electronics. Coupled with that, manufacturing disruptions and supply chain constraints exacerbated the shortfall. The automotive industry, which had cut chip orders anticipating a decrease in car sales, was caught off-guard as demand rebounded.

Increased Repair Times and Insurance Claims

One direct consequence of the chip shortage is the increased time it takes to repair vehicles. Cars today are replete with advanced technology that relies on these chips. When an accident occurs, replacing these high-tech components can take much longer than before. For automobile insurance companies, this means claims remain open for extended periods, potentially leading to higher costs and longer wait times for customers.

The Challenge of Total Loss Decisions

The scarcity of chips has led to a surge in vehicle values, and deciding whether to repair or declare a vehicle a total loss is more complex. With the cost of replacement parts skyrocketing, automobile insurance providers must meticulously weigh the expenses against the car’s value. This delicate balance can sometimes result in more vehicles being considered a total loss, affecting both insurers’ bottom lines and consumers’ pockets. For more details visit us at https://www.thejordaninsuranceagency.com/.

Premium Adjustments on the Horizon

As the industry grapples with these heightened costs, there’s a possibility that automobile insurance premiums could see adjustments. Insurers may need to account for the increased risk and expense associated with the chip shortage. Consequently, this could lead to higher premiums for consumers, as insurance companies aim to maintain their financial stability in a landscape altered by the scarcity of semiconductors.

Innovative Responses from Insurers

Despite these challenges, there’s a silver lining as some automobile insurance companies are getting creative. They are exploring alternative parts, such as after-market or refurbished chips, and even reassessing how they handle claims altogether. These innovative responses are not only helping to keep the wheels of the insurance process turning but also ensuring customers aren’t left in the lurch.

Conclusion: Navigating Uncharted Territory

The chip shortage has undoubtedly introduced a new set of challenges in the world of auto insurance claims. From elongated repair times to the reevaluation of total loss decisions, the effects are being felt across the board. As we continue to feel the ripples of this shortage, both insurers and consumers will need to adapt to this evolving situation. While it’s uncertain how long these conditions will persist, one thing is clear: the need for flexibility and innovation has never been more critical in the automobile insurance industry.

In wrapping up, we can see that the chip shortage isn’t just a temporary hiccup; it’s a significant hurdle that’s reshaping how automobile insurance claims are processed, how premiums are calculated, and how the industry as a whole responds to unforeseen challenges. Through adaptation and innovation, the industry can aim to mitigate the impact and steer toward a more resilient future.

Read More:

Automobile Insurance Claim Process

0 notes

Text

Automotive semiconductor effort builds momentum - Technology Org

New Post has been published on https://thedigitalinsider.com/automotive-semiconductor-effort-builds-momentum-technology-org/

Automotive semiconductor effort builds momentum - Technology Org

In a step that will enable the University of Michigan researchers to collaborate closely with one of the world’s largest semiconductor research institutes, Belgium-based Imec has announced plans to establish a local presence in Ann Arbor.

This represents another step forward for a broad, Michigan-based effort to lead the development of semiconductors for the auto sector.

Imec noted the development as part of a broader U.S. expansion announcement late last week, released in conjunction with a visit to the Midwest, including U-M, with Flemish Minister-President Jan Jambon.

Imec’s Michigan presence will be designed to help propel the Michigan Semiconductor Talent and Automotive Research (STAR) initiative, led by a founding consortium that includes U-M, semiconductor company KLA, Imec, the Michigan Economic Development Corp., Washtenaw Community College and General Motors. STAR is part of a broader memorandum of understanding announced in May.

In November, the Michigan legislature approved $10 million to assist in moving STAR forward.

“The University of Michigan’s collaboration with Imec brings the automotive and semiconductor industries together at an important time and place. To fulfil the most revolutionary promises of advanced mobility, we need to develop more reliable, energy-efficient and powerful semiconductor solutions that are tailored for tomorrow’s transportation,” said U-M President Santa Ono.

“We’re grateful to Imec for catalyzing this effort and excited to lend our decades of research and educational expertise to moving it forward.”

For nearly 50 years, automakers have been increasingly embracing electronics to improve vehicle performance, efficiency, safety, comfort and convenience. Mass-market semiconductors have done the jobs—as long as they were available. The global chip shortage illuminated not only the demands of today, but also critical needs on the horizon for specialty semiconductors to enable next-generation autonomous, connected and electric mobility technology.

Essentially, tomorrow’s automotive industry needs high-performance computing platforms that can operate in vehicles. They need ultra efficient, fast chips that are capable of running on a battery and processing a vast volume and velocity of data from dozens or even hundreds of sensors in real time.

To enable self-driving decisions and support true autonomy, next-gen architectures and algorithms must be able to seamlessly sense and compute not only on the fly, but on the vehicle rather than in the cloud.

Effective vehicle-to-vehicle and vehicle-to-everything (or V2X) connectivity requires rapid communication and robust data protection to maintain security and privacy. And modular “chiplet” systems could offer customization, but with enough flexibility to avoid supply chain kinks.

“The innovation needs of the automotive industry present a completely new set of opportunities for the semiconductor community. After smartphones and wearables, automotive is positioned to become the next computing platform,” said Valeria Bertacco, the Mary Lou Dorf Collegiate Professor of Computer Science and Engineering at U-M and leader of the Michigan Advanced Vision for Education and Research in Integrated Circuits, or MAVERIC, collaborative.

“The auto industry needs advances such as high performance, extremely low power computation, and AI acceleration on board vehicles—comparable to running a data center on a battery. It needs devices and circuits that offer high reliability on a much longer time horizon than traditional systems, and can sustain extreme temperatures and high vibration. It’s clear the automotive platform will drive innovation for the next decade, and provide opportunities for new industry players.”

Source: University of Michigan

You can offer your link to a page which is relevant to the topic of this post.

#ai#Algorithms#automotive#automotive industry#battery#board#chip shortage#chips#Cloud#collaborate#Collaboration#collaborative#college#communication#Community#computation#computer#Computer Science#computing#computing platforms#connectivity#data#Data Center#data protection#development#devices#economic#education#efficiency#electronic

0 notes

Text

Foreign policy had existed in an exalted sphere of grand strategy, with residual traces of the era when diplomats wore tails and sipped from coupes, a realm filled with abstruse taxonomies about idealists and realists. The discipline had tried to insulate itself from domestic politics, from concerns about how its policies implicated the average citizen. The Carnegie report argued for shattering the intellectual barriers that separated foreign and domestic policy. It proposed a new slogan, which Sullivan made his own: A Foreign Policy for the Middle Class. Obvious implications flowed from the slogan. Rather than pursuing free trade for its own sake, the government should practice a once-fashionable doctrine known as industrial policy. That is, the government should explicitly boost its native firms and domestic industries. Globalization had dispersed supply chains across nations, a widget here, a battery there. Instead, the state should seek to concentrate those supply chains at home, or spread them among allies. That was a lesson of the pandemic, when the United States didn’t have domestic capacity to produce its own surgical gloves or ventilators. And it was the harsh reality of a semiconductor shortage that struck America in the first months of the Biden administration, as auto manufacturers had to temporarily close plants because they didn’t have the chips to install into the vehicles sitting on the assembly lines.

Franklin Foer

0 notes

Text

Best Automobile Industry in Chandigarh

DIFFERENCES WITHIN THE AUTOMOTIVE INDUSTRY

In order to compete with Japanese manufacturers and fulfill impending government rules on emissions control and safety, the U.S. car industry is currently experiencing a challenging, if not unprecedented, period of competition and capital spending. These pressures are being placed on a sector that is already struggling to deal with significant losses brought on by the 1990–1991 recession and the struggle for market share.

Since 1981, fuel economy has not been a significant source of market competition. Consumers can now concentrate on vehicle costs, performance, comfort, and style thanks to the historically low gas prices. However, businesses that can offer all of these features as well as improved fuel efficiency should have an advantage over those who can't. Whatever the future fuel economy requirements are, American manufacturers will have to face the fact that the Japanese seem to be focusing specifically on increased fuel efficiency.

Although well-crafted fuel economy standards wouldn't necessarily put American automakers at a competitive disadvantage, new fuel economy requirements that are very expensive to implement or that significantly alter the industry's typical product cycle would put a tremendous financial burden on domestic automakers. As a result, the discussion of new fuel economy targets centers on the effects on the industry.

PERFORMANCE IN FINANCES

Regardless of any adjustments to fuel economy requirements, domestic manufacturers will still face significant financial challenges. The domestic auto sector is well-developed and extremely cyclical; the ups and downs in vehicle demand largely correspond to economic activity. Despite diversifying into non-automotive businesses including financial services, defense electronics, and car rental companies, North American vehicle production still accounts for a sizable portion of total sales for Chrysler, Ford, and General Motors. Profitability is primarily influenced by the level of vehicle demand, although market share, the mix of automobiles and trucks, and the size of small and large cars also have an impact.

Market Trends

Any government policy that imposes additional costs on the industry that hit domestic manufacturers harder than foreign manufacturers or that imposes costs significant enough to significantly lower overall vehicle demand could have a negative impact on the competitive situation of the domestic industry.

Workforce Trends

Regardless of any action on fuel economy standards, employment in the domestic car sell in Chandigarh is projected to continue to fall since the 1990s. Additionally, the existing overcapacity in the industries will result in significant job losses.

A lack of chips leads to fewer features.

Due to the chip shortage, it is believed that Indian automakers may follow the example of their international competitors and eliminate some glitzy features. Many current automobile functions depend on chips.

The production of Indian automakers has been reduced, and prices have increased. This caused orders to be delayed and increased interest in automobile types that required fewer chips.

Indian companies may follow the lead of American automaker General Motors (GM) and eliminate features like voice-assist, an in-built internet connection, and the 360-degree camera. Heated seats are a popular feature in countries with colder climates, but GM eliminated them due to a shortage of semiconductors.

Requirements of Automobile:

Certain conditions should be met by the vehicle's body. It ought to

Use a soft touch.

have a minimal amount of parts.

possess a lengthy, tired existence.

have a load that is evenly dispersed.

have enough room for bags and passengers.

Have easy access to the suspension and engine.

When cars are running, there should be very little vibration.

have the least amount of air resistance.

Be inexpensive and simple to manufacture.

able to see clearly through glass spaces all around.

possess a pleasing shape and hue.

Also Read: automobile in chandigarh, automobiles near me, Sell Cars in Chandigarh, Used Cars in Chandigarh, Automobile Industry in Chandigarh, automobiles in panchkula, car sell in zirakpur

0 notes

Text

The ongoing global shortage of semiconductor chips has had a severe effect on automotive manufacturing and sales since 2020. This comprehensive guide examines how the chip crisis arose, the many repercussions across the auto industry, how long the issues may persist, and what the future implications may be.

What Led to the Devastating Chip Shortage?

The automotive chip shortage emerged from several converging factors:

Surging chip demand from multiple sectors - IT hardware, consumer electronics, and telecommunications industries were undergoing rapid growth and gobbling up global chip fabrication capacity before and during the pandemic.

Supply chain disruptions - Factory shutdowns and logistics bottlenecks resulting from COVID-19 severely constrained supply chains and chipped away at inventories.

Weather events - Drought in Taiwan and winter storms in Texas impaired production at major semiconductor fabrication plants in 2021, squeezing capacity further.

Overly lean inventory management - To reduce costs, many automakers relied on just-in-time chip delivery, keeping only 1-2 weeks of inventory on hand rather than stockpiling. This left OEMs highly exposed when shortages hit.

The combination of soaring chip demand with crippled supply chains and inventory buffers depleted to dangerously low levels sparked the severe auto chip drought.

Dramatic Impacts of the Shortage on Automotive Industry

The global chip deficit has detrimentally impacted automakers, dealers, and car buyers:

Millions of Vehicles Cut from Production Schedules

Automakers have been forced to make steep cuts to vehicle production schedules, forecasting roughly 10 million fewer vehicles built globally in 2022 versus pre-shortage levels.

Inventory Levels Have Plummeted

Dealer lots sit nearly empty, with average new car inventories dropping below 20 days’ supply in mid-2022 - an unprecedented low. This is around a third of normal stock.

Buyers Face Limited Selection and Long Waits

Consumers have far fewer vehicle choices and often wait months for delivery as supply trickles in. Popular models can sell out instantly.

Automakers Are Taking Drastic Steps to Cope

OEMs have reconfigured vehicles to remove non-essential electronics and reprogrammed ECUs to use alternate chips when possible.

Many have prioritized high-margin trucks and SUVs over cars to maximize limited chip supply.

Model launches have been delayed and production suspended at some plants.

Car Prices Continue Rising

Showroom prices keep climbing as demand outpaces constrained supply, with buyers paying thousands over MSRP for in-demand models.

The automotive chip famine has created a desperate scenario of depleted dealer lots, long waits, and little price relief for nearly two years and counting.

How Much Longer Could the Auto Chip Shortage Last?

Predictions on when the semiconductor shortage might ease span from later 2022 into 2024 as the situation remains dynamic:

Intel CEO Pat Gelsinger expects the shortage to persist into 2024 as demand continues outpacing supply.

IHS Markit analysts project gradual improvement over 2022, but full equilibrium between supply and demand may not arrive until early 2023.

VW CEO Herbert Deiss forecasts shortages continuing through the end of 2022, impacting production rates.

Some analysts speculate resolving backlogs of orders for chips and production equipment could take up to two years.

Though short-term chip delivery is improving slightly, it appears automakers will continue wrestling with inadequate semiconductor supplies for the foreseeable future.

Are Any Long-Term Solutions on the Horizon?

Increasing production capacity and improving supply chain resilience will be key to avoiding future shortages:

Ramping Up Fabrication Capacity

Major chip makers like Intel and Samsung are investing billions to build new se

miconductor fabrication plants in the U.S. and globally that will significantly boost output down the road.

Diversifying Supply Chains

Automakers seek to reduce overreliance on a small number of chip manufacturers by broadening their supplier base. This limits exposure to one region.

Increasing Stockpiles

OEMs now aim to keep a minimum of 4-6 weeks of chip inventory in reserve at all times versus the previous 1-2 weeks. This provides a buffer against short-term disruptions.

While the chip drought persists at least into 2023, these strategies over the next 2-4 years should improve resilience and help avoid recurrences of such extreme shortages.

What Are the Wider Implications for the Auto Industry?

The shortage illuminates risks auto companies must now urgently address regarding:

Overdependence on Limited Suppliers

Single sourcing critical components like semiconductors leaves automakers highly vulnerable to disruptions, as the shortage revealed.

Inflexible Manufacturing Processes

Heavily automated assembly lines with zero buffer inventory of parts have little room for pivoting when shortages strike. Production grinds to a halt.

Strained Relationships with Dealers

As inventory dried up, OEMs channeled the few vehicles built toward their most profitable dealers at the expense of others. This will have lasting effects.

Accelerated Technology Investments

To reduce long-term chip reliance, automakers are hastening R&D into technologies like software-defined vehicles and chip design.

This unprecedented supply shock has exposed how brittle and susceptible to disruption automotive manufacturing and logistics networks have become after years of efficiency obsession. Difficult lessons have been learned that will reshape strategies moving forward across the entire auto sector.

In summary, the severe automotive chip shortage sparked by the pandemic appears likely to persist at least into 2023, continuing to disrupt vehicle production, sales, and pricing for the foreseeable future until crucial capacity expansions and supply chain adjustments help rebalance the semiconductor market.

FAQs

How many cars have been lost due to the chip shortage?

The global chip shortage has caused the automotive industry to lose more than $200 billion in 2021, and 7.7 million vehicles were not produced due to the shortage.

What is the reason for the chip shortage in the auto industry?

The chip shortage in the auto industry is due to several factors, including the COVID-19 pandemic, factory shutdowns, and disruptions in consumer demand. The auto industry relies on a growing number of electronics, and as cars become smarter, they require more microchips. However, the industry only uses 5% to 10% of annual semiconductor production, with most chips going to consumer electronics.

When will the chip shortage end?

The chip shortage is expected to persist for some time, with some experts predicting it could stretch into 2023. Automakers and chip firms have differing outlooks on when the chip shortage will end, prolonging uncertainty about the industry's recovery from the pandemic.

How is the chip shortage affecting car prices?

The chip shortage has caused production slowdowns, leading to fewer cars being available for consumers to purchase. This has resulted in higher prices for both new and used cars, making it more difficult to buy a car.

What are car manufacturers doing to deal with the chip shortage?

Car manufacturers are taking several steps to deal with the chip shortage, including ordering surplus semiconductors, prioritizing production of high-demand models, and reducing the number of features in some models to conserve chips. Some manufacturers are also exploring alternative sources for chips, such as using chips from different suppliers or developing their own chips.

#Wiack #Car #CarInsurance #CarRental #CarPrice #AutoLoans

0 notes

Text

The ongoing global shortage of semiconductor chips has had a severe effect on automotive manufacturing and sales since 2020. This comprehensive guide examines how the chip crisis arose, the many repercussions across the auto industry, how long the issues may persist, and what the future implications may be.

What Led to the Devastating Chip Shortage?

The automotive chip shortage emerged from several converging factors:

Surging chip demand from multiple sectors - IT hardware, consumer electronics, and telecommunications industries were undergoing rapid growth and gobbling up global chip fabrication capacity before and during the pandemic.

Supply chain disruptions - Factory shutdowns and logistics bottlenecks resulting from COVID-19 severely constrained supply chains and chipped away at inventories.

Weather events - Drought in Taiwan and winter storms in Texas impaired production at major semiconductor fabrication plants in 2021, squeezing capacity further.

Overly lean inventory management - To reduce costs, many automakers relied on just-in-time chip delivery, keeping only 1-2 weeks of inventory on hand rather than stockpiling. This left OEMs highly exposed when shortages hit.

The combination of soaring chip demand with crippled supply chains and inventory buffers depleted to dangerously low levels sparked the severe auto chip drought.

Dramatic Impacts of the Shortage on Automotive Industry

The global chip deficit has detrimentally impacted automakers, dealers, and car buyers:

Millions of Vehicles Cut from Production Schedules

Automakers have been forced to make steep cuts to vehicle production schedules, forecasting roughly 10 million fewer vehicles built globally in 2022 versus pre-shortage levels.

Inventory Levels Have Plummeted

Dealer lots sit nearly empty, with average new car inventories dropping below 20 days’ supply in mid-2022 - an unprecedented low. This is around a third of normal stock.

Buyers Face Limited Selection and Long Waits

Consumers have far fewer vehicle choices and often wait months for delivery as supply trickles in. Popular models can sell out instantly.

Automakers Are Taking Drastic Steps to Cope

OEMs have reconfigured vehicles to remove non-essential electronics and reprogrammed ECUs to use alternate chips when possible.

Many have prioritized high-margin trucks and SUVs over cars to maximize limited chip supply.

Model launches have been delayed and production suspended at some plants.

Car Prices Continue Rising

Showroom prices keep climbing as demand outpaces constrained supply, with buyers paying thousands over MSRP for in-demand models.

The automotive chip famine has created a desperate scenario of depleted dealer lots, long waits, and little price relief for nearly two years and counting.

How Much Longer Could the Auto Chip Shortage Last?

Predictions on when the semiconductor shortage might ease span from later 2022 into 2024 as the situation remains dynamic:

Intel CEO Pat Gelsinger expects the shortage to persist into 2024 as demand continues outpacing supply.

IHS Markit analysts project gradual improvement over 2022, but full equilibrium between supply and demand may not arrive until early 2023.

VW CEO Herbert Deiss forecasts shortages continuing through the end of 2022, impacting production rates.

Some analysts speculate resolving backlogs of orders for chips and production equipment could take up to two years.

Though short-term chip delivery is improving slightly, it appears automakers will continue wrestling with inadequate semiconductor supplies for the foreseeable future.

Are Any Long-Term Solutions on the Horizon?

Increasing production capacity and improving supply chain resilience will be key to avoiding future shortages:

Ramping Up Fabrication Capacity

Major chip makers like Intel and Samsung are investing billions to build new se

miconductor fabrication plants in the U.S. and globally that will significantly boost output down the road.

Diversifying Supply Chains

Automakers seek to reduce overreliance on a small number of chip manufacturers by broadening their supplier base. This limits exposure to one region.

Increasing Stockpiles

OEMs now aim to keep a minimum of 4-6 weeks of chip inventory in reserve at all times versus the previous 1-2 weeks. This provides a buffer against short-term disruptions.

While the chip drought persists at least into 2023, these strategies over the next 2-4 years should improve resilience and help avoid recurrences of such extreme shortages.

What Are the Wider Implications for the Auto Industry?

The shortage illuminates risks auto companies must now urgently address regarding:

Overdependence on Limited Suppliers

Single sourcing critical components like semiconductors leaves automakers highly vulnerable to disruptions, as the shortage revealed.

Inflexible Manufacturing Processes

Heavily automated assembly lines with zero buffer inventory of parts have little room for pivoting when shortages strike. Production grinds to a halt.

Strained Relationships with Dealers

As inventory dried up, OEMs channeled the few vehicles built toward their most profitable dealers at the expense of others. This will have lasting effects.

Accelerated Technology Investments

To reduce long-term chip reliance, automakers are hastening R&D into technologies like software-defined vehicles and chip design.

This unprecedented supply shock has exposed how brittle and susceptible to disruption automotive manufacturing and logistics networks have become after years of efficiency obsession. Difficult lessons have been learned that will reshape strategies moving forward across the entire auto sector.

In summary, the severe automotive chip shortage sparked by the pandemic appears likely to persist at least into 2023, continuing to disrupt vehicle production, sales, and pricing for the foreseeable future until crucial capacity expansions and supply chain adjustments help rebalance the semiconductor market.

FAQs

How many cars have been lost due to the chip shortage?

The global chip shortage has caused the automotive industry to lose more than $200 billion in 2021, and 7.7 million vehicles were not produced due to the shortage.

What is the reason for the chip shortage in the auto industry?

The chip shortage in the auto industry is due to several factors, including the COVID-19 pandemic, factory shutdowns, and disruptions in consumer demand. The auto industry relies on a growing number of electronics, and as cars become smarter, they require more microchips. However, the industry only uses 5% to 10% of annual semiconductor production, with most chips going to consumer electronics.

When will the chip shortage end?

The chip shortage is expected to persist for some time, with some experts predicting it could stretch into 2023. Automakers and chip firms have differing outlooks on when the chip shortage will end, prolonging uncertainty about the industry's recovery from the pandemic.

How is the chip shortage affecting car prices?

The chip shortage has caused production slowdowns, leading to fewer cars being available for consumers to purchase. This has resulted in higher prices for both new and used cars, making it more difficult to buy a car.

What are car manufacturers doing to deal with the chip shortage?

Car manufacturers are taking several steps to deal with the chip shortage, including ordering surplus semiconductors, prioritizing production of high-demand models, and reducing the number of features in some models to conserve chips. Some manufacturers are also exploring alternative sources for chips, such as using chips from different suppliers or developing their own chips.

#Wiack #Car #CarInsurance #CarRental #CarPrice #AutoLoans

0 notes

Text

Automotive Industry Challenges and Threats: Overview

Originally Published on: Spendedge | Auto Parts Manufacturers

The global automotive market, valued at nearly $3 trillion, faces a significant hurdle due to parts shortages. A notable concern is the enduring chip crisis, resulting from production disruptions in China and Taiwan, which is projected to extend well into the future. However, this predicament is just one among several menacing threats confronting the automotive sector. Within this landscape, the lack of transparency into inventory movement, coupled with the inability to precisely quantify specific procurement activities beyond the mere purchase price, collectively exerts a substantial and accumulative impact on companies' bottom lines. Auto industry giants have initiated mass recalls of vehicles, addressing issues ranging from brake fluid leaks to faulty airbags and even instances of rust risk. These recalls not only draw negative public attention but also translate into billions in retrofitting expenditures. Additionally, compromised quality control processes and the use of substandard inputs, including at supplier sites, further undermine the integrity of product quality.

Key Challenges in the Automotive Industry

Addressing Input Shortages and Beyond

The robust demand for automobiles sustains strong automotive sales, yet the shortage of critical components, like semiconductors, remains a persistent concern. Despite worldwide fabs operating at 70-80% capacity, challenges in the automotive industry extend beyond logic chips. The scarcity of dockworkers amplifies supply chain disruptions and exacerbates parts shortages due to port congestion. EVs heavily depend on lithium battery packs, predominantly shipped from China, a global leader in battery modules. Despite a three-fold surge in production over the past decade, the gap between demand and supply for lithium minerals is projected to exceed 1 million metric tons by 2035.

Navigating Complex Supply Chains

Auto industry participants contend not only with parts scarcity but also with a more intricate challenge: the absence of a unified view of goods movement, tasks, activities, and data across the supply chain. Inaccurate data heightens the risk of pilferage, counterfeit goods, and unauthorized sales. The inability to capture the full scope of supply chain interactions hampers effective information sharing with suppliers, resulting in missed opportunities and strained relationships. These challenges can potentially impede business efficiency and profitability.

Quality Struggles and the Pursuit of Solutions

Quality concerns remain a pivotal issue for most auto manufacturers, leading to costly recalls. The deficiency in tracing products back to suppliers is a weak point in supplier quality management. Moreover, the pressure to meet deadlines compels some suppliers to compromise on quality. Even minor deviations in quality can necessitate reworking and error correction, resulting in additional costs and potential damage to brand reputation. Auto manufacturers, perpetually chasing tight deadlines, face the challenge of defective parts hindering their efforts.

Proposed Solutions for Industry Challenges and Threats

• Given the looming threats, such as the protracted chip shortage, automotive businesses may consider a pragmatic approach: shipping vehicles without certain add-on features, with the option for buyers to incorporate them later. Rewriting vehicle software to optimize chip usage is another strategy being explored. To secure critical materials, automakers are establishing exclusive contracts for battery-grade lithium with major metal producers. The adoption of roll-on roll-off (RoRo) ships and advanced tracking technologies can alleviate port congestion and enhance supply chain visibility. Equipping assets in transit with web-enabled smart devices embedded with sensors enables real-time measurement and monitoring, reducing the risk of supply disruptions. In light of frequent vehicle recalls, auto manufacturers must not only adhere to quality management standards (e.g., ISO/TS 16949) but also ensure supplier compliance with defect-prevention specifications.

Choosing SpendEdge: Enabling Strategic Advancement

SpendEdge offers a range of solutions to address challenges and threats in the automotive industry. By improving demand forecasting accuracy, businesses can manage supply risks while upholding quality standards. With extensive expertise in procurement, IoT technologies, and market analysis within the automotive industry, SpendEdge empowers businesses with enhanced supply chain visibility. Through supplier performance tracking and quality management processes, companies can enhance compliance and overall supply chain quality.

Conclusion

The automotive industry is beset by multifaceted challenges, encompassing supply shortages, quality concerns, and the shifting landscape of the market. However, strategic solutions and expert guidance can empower the industry to overcome these obstacles, ensuring its continued resilience and prosperity. To learn more about how SpendEdge can assist your automotive business in overcoming supply chain challenges and maintaining a competitive edge in this dynamic sector, do not hesitate to reach out to us today.

Contact SpendEdge for help with your supply chain.

0 notes

Text

Will the Chip Shortage End in 2023?

Will the Chip Shortage End in 2023?

A global shortage of semiconductors has had a major impact on the automotive supply chain, forcing automakers around the world to cut production over the last two years due to the lack of these crucial parts. As COVID-era regulations begin to relax, some – but not all – industry insiders speculate that the chip shortage may come to an end in 2023.Get more news about Original New Automotive Grade Chip,you can vist our website!

Automotive manufacturers are still dealing with the effects of the microchip shortage that began in 2020. Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions, told reporters that he believes the industry will see 2-3 million units cut from production in 2023.

This figure highlights the continued production difficulties that manufacturers face. However, if Fiorani’s estimate holds true, it would mark a significant improvement for the industry.

More than 10.5 million vehicles were cut from production in 2021, according to Auto News. In 2022, automakers around the world cut an estimated 4.3 million cars from their production schedules. Losing 2-3 million units would still be a hardship for manufacturers, but it would indicate that supply chain issues are beginning to ease.

Many key players in the semiconductor industry are feeling positive about the direction of the chip shortage in 2023, according to a recent poll. Multinational accounting firm KPMG and the Global Semiconductor Alliance (GSA) conducted the 18th annual global semiconductor survey in Q4 of 2022.

The poll asked 151 semiconductor executives about their outlook for 2023 and into the future. Of those executives, more than half represent companies posting more than 1 billion USD in annual revenue.

Based on the results, the Semiconductor Industry Confidence Index for 2023 currently stands at 56 out of 100. This score indicates that a small majority of respondents have a more positive outlook for 2023 than negative.The survey asked semiconductor executives when they think the chip shortage will subside. Of those, 65% said that they believe the shortage would end in 2023 while 20% said they believe that it would extend into 2024 or later. Around 15% of respondents said they believe chip supply and demand are currently balanced.

Executives were also asked when they believe there will be a net excess of semiconductors. Around 31% said they believe there will be a surplus by the end of 2023, while 24% stated that they believe there is already a semiconductor surplus. That means that over half of respondents think that we will see a surplus in this calendar year, if we haven’t already.

However, 36% believe that the next surplus won’t happen until between 2024 and 2026, and 9% said they believe the industry won’t see a surplus at any time in the next four years.

0 notes

Text

Chipping Away - A Semiconductor shortage

For a variety of industries, from autos to gaming consoles, the lack of semiconductors, which are crucial parts of electronic products, has caused supply chain disruptions and production delays. Moreover, as a consumer who was in the market for both computer components and automobiles, this shortage has induced disruptions from the consumer’s point of view.

We may go to the principles of supply and demand in basic economics to better understand what is happening and why. Since we utilize technology more frequently in our daily lives and as the COVID-19 pandemic forced people to engage in remote work and online activities, the demand for semiconductors has been rising quickly. At the same time, a number of issues, such as production delays brought on by the pandemic, trade disputes between the US and China, and extreme weather occurrences, have limited the supply of semiconductors.

Prices for semiconductors have increased as demand has surpassed supply, encouraging suppliers to increase production. But, boosting output is not always simple or quick, particularly when there are problems with the supply chain and a lack of raw materials. As a result, there can be a shortage if prices keep going higher while supply is still limited.

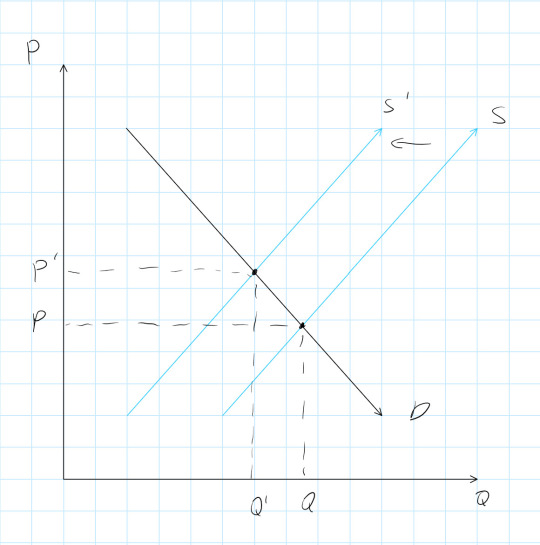

The link between the price of semiconductors and the quantity that consumers demand is depicted in Figure 1 by the demand curve (D). The link between the cost of semiconductors and the volume supplied by manufacturers is depicted by the supply curve (S). The intersection of these curves (point A), where the quantity supplied and demanded are equal, and the price is P*, reflects the market equilibrium.

However, the supply curve moves to the left to S' when there is a shortfall (such as the lack of semiconductor chips), as depicted in the graph. As a result, a new intersection point (point B) is formed where the price (P') is greater and the quantity demanded (Q') is lower. This shows that there aren't enough chips on the market.

For someone looking to purchase a new car, the semiconductor chip shortage resulted in higher prices and longer wait times for specific models. This is because modern cars are increasingly reliant on semiconductors for various features, including safety systems, infotainment systems, and advanced driver assistance systems (ADAS). As a result, manufacturers may have to delay production or prioritize certain models, which can lead to higher prices and longer wait times for specific models. Which in turn prevented my consumption within the market.

Although the market has been stabilizing, there are some things that can be done to help alleviate these issues. Suppliers increasing output and governments encouraging investment in the semiconductor sector could be one option. Another alternative is for consumers to modify their behavior and short-term decrease the demand for electronic devices. The shortfall of semiconductor chips is expected to last for some time, however, it will take time for either of these remedies to take effect.

"The global chip shortage is here to stay. Here's what you need to know" by Rachel Metz, CNN Business (https://www.cnn.com/2021/02/01/tech/global-chip-shortage-explainer/index.html)

"Why There's a Semiconductor Shortage (And Why It's So Hard to Fix)" by Timothy B. Lee, Ars Technica (https://arstechnica.com/gadgets/2021/02/why-theres-a-semiconductor-shortage-and-why-its-so-hard-to-fix/)

Figure 1

Sources:

"The global chip shortage is here to stay. Here's what you need to know" by Rachel Metz, CNN Business (https://www.cnn.com/2021/02/01/tech/global-chip-shortage-explainer/index.html)

"Why There's a Semiconductor Shortage (And Why It's So Hard to Fix)" by Timothy B. Lee, Ars Technica (https://arstechnica.com/gadgets/2021/02/why-theres-a-semiconductor-shortage-and-why-its-so-hard-to-fix/)

By:

Ralph Quiambao

ID:84321677

Discussion @ 7pm Tuesdays

0 notes

Text

Chipping Away - A Semiconductor shortage

For a variety of industries, from autos to gaming consoles, the lack of semiconductors, which are crucial parts of electronic products, has caused supply chain disruptions and production delays. Moreover, as a consumer who was in the market for both computer components and automobiles, this shortage has induced disruptions from the consumer’s point of view.

We may go to the principles of supply and demand in basic economics to better understand what is happening and why. Since we utilize technology more frequently in our daily lives and as the COVID-19 pandemic forced people to engage in remote work and online activities, the demand for semiconductors has been rising quickly. At the same time, a number of issues, such as production delays brought on by the pandemic, trade disputes between the US and China, and extreme weather occurrences, have limited the supply of semiconductors.

Prices for semiconductors have increased as demand has surpassed supply, encouraging suppliers to increase production. But, boosting output is not always simple or quick, particularly when there are problems with the supply chain and a lack of raw materials. As a result, there can be a shortage if prices keep going higher while supply is still limited.

The link between the price of semiconductors and the quantity that consumers demand is depicted in Figure 1 by the demand curve (D). The link between the cost of semiconductors and the volume supplied by manufacturers is depicted by the supply curve (S). The intersection of these curves (point A), where the quantity supplied and demanded are equal, and the price is P*, reflects the market equilibrium.

However, the supply curve moves to the left to S' when there is a shortfall (such as the lack of semiconductor chips), as depicted in the graph. As a result, a new intersection point (point B) is formed where the price (P') is greater and the quantity demanded (Q') is lower. This shows that there aren't enough chips on the market.

For someone looking to purchase a new car, the semiconductor chip shortage resulted in higher prices and longer wait times for specific models. This is because modern cars are increasingly reliant on semiconductors for various features, including safety systems, infotainment systems, and advanced driver assistance systems (ADAS). As a result, manufacturers may have to delay production or prioritize certain models, which can lead to higher prices and longer wait times for specific models. Which in turn prevented my consumption within the market.

Although the market has been stabilizing, there are some things that can be done to help alleviate these issues. Suppliers increasing output and governments encouraging investment in the semiconductor sector could be one option. Another alternative is for consumers to modify their behavior and short-term decrease the demand for electronic devices. The shortfall of semiconductor chips is expected to last for some time, however, it will take time for either of these remedies to take effect.

"The global chip shortage is here to stay. Here's what you need to know" by Rachel Metz, CNN Business (https://www.cnn.com/2021/02/01/tech/global-chip-shortage-explainer/index.html)

"Why There's a Semiconductor Shortage (And Why It's So Hard to Fix)" by Timothy B. Lee, Ars Technica (https://arstechnica.com/gadgets/2021/02/why-theres-a-semiconductor-shortage-and-why-its-so-hard-to-fix/)

Figure 1

Sources:

"The global chip shortage is here to stay. Here's what you need to know" by Rachel Metz, CNN Business (https://www.cnn.com/2021/02/01/tech/global-chip-shortage-explainer/index.html)

"Why There's a Semiconductor Shortage (And Why It's So Hard to Fix)" by Timothy B. Lee, Ars Technica (https://arstechnica.com/gadgets/2021/02/why-theres-a-semiconductor-shortage-and-why-its-so-hard-to-fix/)

By:

Ralph Quiambao

ID:84321677

Discussion @ 7pm Tuesdays

1 note

·

View note

Text

Maruti Suzuki expects the chip shortage to continue for a few more quarters

Maruti Suzuki India expects semiconductor shortage to continue for the next few quarters leading to a further increase in the order backlog of certain models, according to a senior company official.

The country's largest carmaker has seen its pending bookings stretch to 3.69 lakh units, with Ertiga leading the pack with close to 94,000 bookings.

Other models like Grand Vitara and Brezza have an order backlog of around 37,000 and 61,500 units, respectively.

Further, the company has received around 22,000 and 12,000 bookings, respectively, for Jimny and Fronx.

Due to the chip shortage, Maruti Suzuki India (MSI) has already witnessed a production loss of close to 46,000 units in the October-December period and is expecting some impact on production in the ongoing quarter as well.

"The semiconductor shortage still continues. Last quarter we lost 46,000 units due to this issue and this quarter also the problem continues for a few models," Maruti Suzuki India Senior Executive Officer (Marketing and Sales) Shashank Srivastava told PTI in an interaction.

The company expects the shortage to continue for a few more quarters, he noted.

"It is difficult to predict exact timelines when it will become normal because the visibility is not there," Srivastava said.

Commenting on the overall PV industry, he noted that the sports utility vehicle continues to lead with a share of 42.6%, and hatchbacks account for 35%.

"So far the passenger vehicle industry this fiscal year has witnessed sales of 35.5 lakh units. It seems the industry will end the year with 38.8 lakh units mark, the highest ever number till date," he said.

Last fiscal, the number stood at 30.7 lakh units, so the sales are expected to go up by around 26% this financial year.

He noted that the PV segment is expected to post a growth of 5-7% in the next fiscal year over 2022-23.

"Next year our projections are between 40.5-41 lakh units which is roughly a growth of 5-7%," Srivastava noted.

MSI is expected to perform better than the industry, he said adding that the market is witnessing some impact on demand with an increase in vehicle loan rates.

"Post the repo rate hike many banks have increased the loan rates...the rates are clearly going up and that obviously has an impact on the overall demand," he stated.

Srivastava noted that there were also certain positive factors helping mitigate the negative factors in the market.

''If the economy continues to grow, the impact may not be that severe..government spending on infrastructure has an overall positive impact on the demand scenario," he said.

On Jimny and Fronx, Srivastava noted that the production of the models would commence later this month in Gurugram and Gujarat respectively.

The overall passenger vehicle wholesales crossed the 3.35 lakh unit mark in February. It was also the highest-ever overall dispatches by companies to dealers in the month of February.

MSI's domestic wholesales rose 11% to 1,55,114 units in February as compared with 1,40,035 units in the same month last year.

The auto major has already dispatched 15.08 lakh units in the current fiscal so far, a growth of 23% from 12.27 lakh units in the April-February period of the last financial year.

Maruti Suzuki India expects semiconductor shortages to persist for the next few quarters and anticipates backlogs for certain models to continue to rise, company executives said.

The country's biggest automakers have outstanding bookings that have reached 3.69 million units, with the Ertiga leading the way with almost 94,000 bookings.

Other models such as the Grand Vitara and Brezza have backlogs of around 37,000 and 61,500 units, respectively.

In addition, the company has received approximately 22,000 and 12,000 bookings for the Jimny and Fronx, respectively.

Due to the chip shortage, Maruti Suzuki India (MSI) production has already fallen by almost 46,000 units in the October-December period and production is expected to be affected in the current quarter as well.

“The semiconductor shortage continues. Last quarter we lost 46,000 units due to this issue and we are still having issues with some models this quarter.

He said the company expects the shortage will continue for several more seasons.

"The lack of visibility makes it difficult to accurately predict when things will return to normal," Srivastava said.

Referring to the overall PV industry, he said sports cars will continue to lead with a 42.6 percent share and hatchbacks with 35 percent.

He said: The passenger car industry has sold 35.5 million units so far this fiscal year, and this industry will close with 38.8 million units, which is the highest ever.

After 307,000 units were sold last year, sales are expected to increase by around 26% this year.

He pointed out that the PV industry is expected to grow between 5 and 7 percent in the next fiscal year from 2022 to 2023.

"The forecast for next year is 40.5 to 41 million units, which is about 5 to 7 percent growth," Srivastava said.

He added that MSI is expected to outperform the industry and that the market had an impact on demand due to the rise in auto loan rates.

"Following the increase in repo rates, many banks have increased their lending rates ... rates are clearly rising, which is clearly having an impact on aggregate demand," he said.

Srivastava noted that there are also certain positive factors that help reduce the downside of the market.

“If the economy continues to grow, the impact may not be as severe. Government spending on infrastructure is having an overall positive impact on the demand scenario.

As for the Gemini and Fronx, Srivastava said production of the models will begin later this month in Gurugram and Gujarat, respectively.

Total gross sales of passenger cars exceeded 3.35 million units in February. Total company-to-dealer shipments also hit an all-time high in February.

MSI's domestic wholesale sales in February rose 11 percent to 1,55,114 units, compared to 1,40,035 units in the same month last year.

The auto giant has delivered 15.08 million vehicles so far this fiscal year, up 23 percent from 12.27 million units in April-February last fiscal year.

Read the full article

0 notes

Text

Tata Motors Reaches New Milestone, Crosses 50 Lakh Passenger Vehicle Production Mark

The company noted that it was able to stride ahead from 40 lakh cars to 50 lakh units within three years, despite COVID-19 and the semiconductor shortage crisis that plagued the global automotive industry.

source https://zeenews.india.com/auto/tata-motors-reaches-new-milestone-crosses-50-lakh-passenger-vehicle-production-mark-2579455.html

View On WordPress

0 notes