#rsi indicator guide

Text

What is RSI Indicator and how to use it in stock market trading?

What is RSI Indicator and how to use it in stock market trading?

You may know what RSI Indicator is.

You may know that RSI is a very popular and widely used indicator.

But do you know how to use it properly in live trading?

I don’t know what you are thinking.

But I can say that most people don’t know how to use it properly.

Most people know RSI is above 70 means over-bought and below 30 means over-sold of the stock.

But we may know a lot more by reading RSI…

View On WordPress

#does rsi indicator work#how to set the rsi indicator#how to use rsi indicator#rsi indicator#rsi indicator above 50#rsi indicator above 60#rsi indicator accuracy#rsi indicator analysis#rsi indicator combination#rsi indicator divergence#rsi indicator divergence example#rsi indicator explained#rsi indicator for options trading#rsi indicator for swing trading#rsi indicator guide#rsi indicator how to use#rsi indicator in kite#rsi indicator in tradinview#rsi indicator in upstox#rsi indicator in zerodha#rsi indicator leading or lagging#rsi indicator levels#rsi indicator mt4#rsi indicator mt5#rsi indicator pdf download#rsi indicator settings#rsi indicator strategy#rsi indicator technical analysis#rsi indicator trading strategy#rsi indicator tutorial

0 notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

How to Choose a Medical Device Regulatory Consultant in India ?

Choosing the right regulatory consultant for your medical device in India is crucial to ensure compliance with local regulations and smooth market entry. Here’s a guide to help you make an informed decision.

Understanding Regulatory Consulting Services

Regulatory consulting services assist companies in navigating complex regulatory requirements for medical devices. These services include preparing documentation, obtaining necessary approvals, and ensuring compliance with regulations set by authorities like the Central Drugs Standard Control Organization (CDSCO).

What is the Role of a Regulatory Affairs Consultant?

A regulatory affairs consultant helps ensure that medical devices meet all regulatory requirements. Their tasks include:

Preparing and submitting regulatory documents

Liaising with regulatory authorities

Advising on regulatory strategies

Ensuring ongoing compliance with regulations

Key Factors to Consider When Choosing a Consultant

Experience and Expertise

Look for a consultant with extensive experience in the Indian medical device market.

Ensure they have worked with devices in your specific classification (Class A-D as per CDSCO).

2. Reputation and References

Check for references from past clients.

Research their reputation in the medical device industry. Positive reviews and testimonials indicate reliability.

3. Service Range

Ensure the consultant offers the specific services you need, such as documentation, clinical trials, and post-market surveillance.

Verify if they have a team of experts with diverse skills to cover all regulatory aspects.

4. Communication and Support

Assess their communication style and responsiveness. Clear and timely communication is essential for effective collaboration.

Determine their availability for ongoing support and updates.

5. Membership in Professional Organizations : Check if the consultant is a member of professional organisations, which can indicate their commitment to staying updated with industry standards and practices.Examples include:

Regulatory Affairs Professionals Society (RAPS): RAPS

Association of Indian Medical Device Industry (AIMED): AIMED

6. Cost and Fees

Understand the consultant’s fee structure. Compare it with others in the industry to ensure you are getting fair value for the services provided.

Clarify any additional costs that might arise during the regulatory process.

Benefits of Hiring a Regulatory Consultant

Expert Guidance: Consultants provide valuable insights and strategies to navigate regulatory requirements efficiently.

Time and Cost Efficiency: With their expertise, consultants can expedite the approval process, saving time and reducing costs associated with delays.

Compliance Assurance: Ensuring compliance with all regulations helps avoid legal issues and market entry barriers.

Conclusion:

Choosing the right medical device regulatory consultant in India can significantly impact your product’s success. Look for experience, a good reputation, comprehensive services, clear communication, and reasonable fees. By partnering with a knowledgeable consultant, you can streamline the regulatory process and focus on bringing your medical innovations to market.

Why Choose RSI?

Regulatory Solutions India (RSI) is a leading medical device regulatory consulting firm in India. With extensive experience and in-depth knowledge of the Medical Device Rules, 2017, RSI can guide you through the CDSCO registration process efficiently. Our expertise ensures a smooth and compliant process, enabling your medical device development and evaluation activities.

Partner with RSI for expert guidance and support in navigating India’s regulatory landscape.

0 notes

Text

How to Be a Great Trader: A Comprehensive Guide

Financial market trading can be a lucrative venture, but it also calls for strategy, discipline, and understanding. This tutorial will take you through the fundamentals of being a great trader, regardless of your level of experience.

Knowing the Fundamentals of Trading

What is Trading?

To turn a profit, trading entails purchasing and selling financial products like stocks, bonds, commodities, or currencies. In contrast to investing, which usually has a longer time horizon, trading concentrates on the market's short-term fluctuations.

Types of Trading

Purchasing and selling assets on the same trading day is known as day trading.

Swing trading is the practice of holding assets for a few days in order to profit from anticipated changes in the market.

Position trading is the practice of maintaining positions based on longer-term trends for weeks or months.

Scalping: Executing a lot of minor trades throughout the day in order to build up gains.

To Becoming A Great Trader Join Now

Essential Skills for Successful Trading

Analytical Skills

The ability to interpret charts, financial data, and market patterns is essential for successful trading. Gaining analytical proficiency enables you to recognize trading opportunities and make wise choices.

Patience and discipline

To stay true to your trading plan and steer clear of irrational decisions, trading demands unwavering discipline. Additionally, waiting for the appropriate moment can have a big impact on your achievement, therefore patience is essential.

Hazard Assessment

Controlling risk is an essential part of trading. This entails not risking more than a tiny portion of your trading money on any one deal and placing stop-loss orders to limit possible losses.

Developing a Trading Plan

Setting Goals

Prior to beginning trading, it is crucial to establish attainable goals. Whether it's a precise profit goal or a % return on your cash, decide what you want to achieve..

Choosing a Trading Style

Choose a trading style based on your risk tolerance, lifestyle, and personality. Different time commitments and methods are needed for each trading strategy.

Creating a Strategy

Create a thorough trading plan that includes your entry and exit points, risk management strategies, and trade selection criteria. This approach needs to be supported by extensive study and backtesting.

Acquiring and Applying Technical Analysis

Knowledge: Recognizing Patterns and Charts

In technical analysis, future price movements are predicted by examining price charts and patterns. Head and shoulders, multiple tops and bottoms, and flags are typical patterns.

Using Indicators

Technical indicators that assist traders in identifying trends and possible reversal points include moving averages, Bollinger Bands, and the relative strength index (RSI). Technical analysis requires the ability to apply these signs effectively.

Mastering Fundamental Analysis

Analyzing Financial Statements

Fundamental analysis involves evaluating a company's financial health by analyzing its income statement, balance sheet, and cash flow statement. Understanding these documents helps you determine a company's intrinsic value.

Keeping Up with Market News

For basic research to be effective, one must be up to date on geopolitical events, economic data, and market news. These elements have a big impact on trading opportunities and market patterns.

Managing Your Emotions

Controlling Fear and Greed

Emotions like fear and greed can have a big influence on trading decisions. Greed might drive you to overtrade or hold losing positions for an extended period of time, while fear can force you to abandon transactions early. Trading well requires the ability to regulate these emotions.

To Becoming A Great Trader Join Now

Developing a Positive Mindset

Maintaining a positive outlook keeps you engaged and motivated even while you're losing. Embrace setbacks as teaching moments and maintain faith in your trading plan.

Practicing with a Demo Account

Benefits of Demo Trading

You can practice trading without risking real money by using a demo account. It's a great method to put your trading technique to the test, get experience, and boost your confidence.

Transitioning to Live Trading

After achieving consistent gains in your demo account, you can begin actual trading with a modest starting stake. Increase your investment gradually as you gain comfort and self-assurance.

Choosing the Right Broker

Evaluating Broker Services

Making the correct broker choice is essential to your trading performance. Think about things like trading platforms, costs, customer support, and the variety of financial instruments that are available.

Making Certain Security

Make certain that a respectable financial authority regulates your broker. Your trading capital is somewhat secured and protected as a result.

To Becoming A Great Trader Join Now

Constant Improvement and Learning

Continuous Learning and Improvement

Staying Educated

Since the financial markets are always changing, it is essential to keep learning new things. Read books, follow market analysts, go to seminars, and keep up with the newest developments in trading technology and tactics.

Reviewing and Refining Your Strategy

Review your trading results on a regular basis, and as you gain expertise, adjust your approach. To keep track of your trades, evaluate your gains and losses, and make the required corrections, keep a trading notebook.

Networking with Other Traders

Joining Trading Communities

Making connections with other traders might offer insightful information and encouragement. Participate in trade forums, social media communities, or local trading associations to share ideas and gain knowledge from others' experiences.

Learning from Mentors

Having a mentor can help you learn more quickly. Seek for seasoned traders who are eager to impart their wisdom and help you navigate the challenges of buying

Implementing Advanced Trading Techniques

Algorithmic Trading

Computer algorithms are used in algorithmic trading to carry out trades according to predetermined standards. This can reduce emotional decision-making and increase trade efficiency.

Leveraging

By using leverage, you can trade bigger positions with less money. Profits may be increased, but there is also a greater chance of suffering big losses. Use leverage sensibly and be aware of the consequences.

Handling Losses and Drawdowns

Accepting Losses

Trading always ends in losses. Keep them out of your mind and accept them as a necessary component of the process.

Managing Drawdowns

A drawdown occurs when the balance in your trading account drops from its maximum. By following your risk management strategy, abstaining from excessive trading, and keeping a diversified portfolio, you can minimize drawdowns.

Diversifying Your Portfolio

Benefits of Diversification

Reducing risk and raising the possibility of consistent returns can be achieved by diversifying your portfolio among several asset classes and industries.

Implementing Diversification

Divide your trading money among a range of financial items, including currencies, equities, bonds, and commodities. By doing this, risk is distributed and the effects of a performing asset are reduced.

Building Long-Term Wealth

Compounding Profits

Reinvesting the money you make from trading can greatly increase your wealth over time. Over time, the force of compounding enables your gains to yield higher profits.

Focusing on Sustainable Growth

Aim for long-term growth as opposed to rapid, high-risk gains. Trading with consistency and discipline can result in long-term success and reliable earnings.

Conclusion

It takes a combination of knowledge, dedication, and ongoing improvement to become a great trader. You may confidently traverse the financial markets by learning the fundamentals of trading, honing critical abilities, and putting winning methods into practice. Recall to control your feelings, remain knowledgeable, and put risk management first at all times. You can accomplish your trading objectives and create long-term profit if you are committed and persistent enough.

To Becoming A Great Trader Join Now

1 note

·

View note

Text

Mastering Technical Analysis: A Comprehensive Guide

In the dynamic world of financial markets, traders employ a variety of tools and techniques to analyze price movements, identify trends, and make informed trading decisions. Among these, technical analysis stands out as a popular approach that relies on historical price data, volume, and other market statistics to forecast future price movements. In this comprehensive guide, we'll delve into the principles, methods, and practical applications of technical analysis, exploring how traders use it to navigate the complexities of the markets.

Understanding Technical Analysis

At its core, technical analysis is based on the belief that past price movements and market trends can provide valuable insights into future price direction. Unlike fundamental analysis, which focuses on examining the intrinsic value of an asset based on economic, financial, and qualitative factors, technical analysis primarily concerns itself with analyzing price charts and market data.

Key principles of technical analysis include:

Price Discounts Everything: Technical analysts believe that all relevant information about an asset, including fundamental factors such as earnings, news, and economic indicators, is already reflected in its price. As such, they focus on analyzing price movements to identify patterns and trends.

History Tends to Repeat Itself: Another fundamental premise of technical analysis is that price patterns and trends tend to repeat over time due to human psychology and market dynamics. By studying historical price data, technical analysts aim to identify recurring patterns and predict future price movements.

Market Trends Exist: Technical analysis recognizes the existence of market trends, which can be classified as uptrends, downtrends, or sideways (range-bound) trends. Traders seek to identify and capitalize on these trends by employing various technical indicators and charting techniques.

Methods and Tools of Technical Analysis

Technical analysis encompasses a wide range of methods and tools, each designed to analyze different aspects of price movements and market behavior. Some of the most commonly used tools include:

Chart Patterns: Chart patterns, such as triangles, flags, head and shoulders, and double tops/bottoms, are visual representations of price movements that indicate potential trend reversals or continuations.

Technical Indicators: Technical indicators are mathematical calculations applied to price data to generate trading signals or insights into market momentum and trend strength. Examples include moving averages, relative strength index (RSI), stochastic oscillator, and MACD (Moving Average Convergence Divergence).

Support and Resistance Levels: Support and resistance levels are price levels at which a security tends to find buying (support) or selling (resistance) pressure. Traders use these levels to identify potential entry and exit points and to gauge the strength of market trends.

Volume Analysis: Volume analysis examines the trading volume accompanying price movements to assess the strength or weakness of a trend. Increasing volume during price advances suggests bullish momentum, while decreasing volume during price declines may signal weakening demand.

Practical Applications of Technical Analysis

Technical analysis is widely used by traders and investors across various financial markets, including stocks, forex, commodities, and cryptocurrencies. Some practical applications of technical analysis include:

Trend Identification: Technical analysis helps traders identify the direction and strength of market trends, allowing them to align their trading strategies with the prevailing market sentiment. By identifying uptrends, downtrends, and sideways movements, traders can make more informed decisions about buying, selling, or holding positions.

Entry and Exit Points: Technical analysis provides traders with specific entry and exit points based on chart patterns, technical indicators, and support/resistance levels. Traders may enter long positions during uptrends or bullish reversals and short positions during downtrends or bearish reversals, using stop-loss orders to manage risk.

Risk Management: Technical analysis aids traders in managing risk by identifying potential price targets, stop-loss levels, and risk-reward ratios. By setting appropriate stop-loss orders and position sizes based on technical analysis, traders can limit losses and preserve capital in volatile market conditions.

Confirmation and Validation: Technical analysis can be used to confirm or validate signals generated by other forms of analysis, such as fundamental analysis or sentiment analysis. For example, a bullish chart pattern or technical indicator signal may be confirmed by positive news or improving fundamentals, strengthening the conviction of traders.

Challenges and Limitations

While technical analysis offers valuable insights into market trends and price movements, it also has its limitations and challenges:

Subjectivity: Technical analysis relies on interpretation and subjective judgment, leading to potential biases and differences in opinion among traders.

False Signals: Technical analysis indicators and patterns may generate false signals, leading to losses if traders rely solely on them without considering other factors.

Market Noise: Market noise and random fluctuations can obscure meaningful patterns in price data, making it difficult to distinguish between genuine trends and temporary price movements.

Overfitting: Overfitting occurs when traders optimize technical analysis parameters based on historical data, leading to inflated performance results that may not generalize well to future market conditions.

Conclusion

Technical analysis is a powerful tool used by traders and investors to analyze price movements, identify trends, and make informed trading decisions. By studying historical price data, chart patterns, technical indicators, and support/resistance levels, traders can gain valuable insights into market dynamics and develop effective trading strategies. While technical analysis has its limitations and challenges, it remains a fundamental aspect of financial markets, offering traders a systematic approach to navigating the complexities of price movements and market trends. As with any form of analysis, it is important for traders to use technical analysis in conjunction with other forms of analysis and to practice proper risk management to maximize its effectiveness.

0 notes

Text

The Five Pillars of Crypto Analytics

Cryptocurrency analytics is a multifaceted domain that empowers investors and traders with insights to navigate the volatile crypto markets. Understanding the five main elements of crypto analytics can significantly enhance decision-making processes. Here's a brief overview of these critical components:

Fundamental Analysis: This involves evaluating the intrinsic value of a cryptocurrency by examining its underlying factors, such as market supply and demand, project fundamentals, economic indicators, and the impact of news events.

Technical Analysis: A statistical approach that analyses past market data, price charts, and volume trends to forecast future price movements. It employs various tools like moving averages, RSI, and Fibonacci retracements.

Sentiment Analysis: By assessing the mood of market participants through social media monitoring and investor sentiment tools, sentiment analysis provides a gauge of the market's bullish or bearish tendencies.

Transaction Analysis: This includes scrutinizing the blockchain for transaction values, fees, hash rates, and active addresses to understand the network's health and activity levels.

Intermarket Analysis: This involves examining the correlations between cryptocurrencies and other financial markets to predict how external factors may influence crypto prices.

These elements form the backbone of crypto analytics, each offering unique perspectives and contributing to a holistic view of the market's dynamics. For anyone looking to delve deeper into the world of crypto trading, mastering these analytics components is essential.

For further reading on how to leverage these analytics elements in crypto trading, you may explore detailed guides and educational resources available online.

0 notes

Text

Unleash Algorithmic Trading Potential: A Review of the MetaTrader 5 Programming Masterclass Digital Membership

My recent enrollment in the MetaTrader 5 Programming Masterclass Digital Membership Area has significantly enhanced my approach to algorithmic trading. This comprehensive program caters to a broad range of traders, from those new to MQL5 programming to seasoned practitioners seeking to refine their automated strategies.

Structured Learning for a Solid Foundation

The Masterclass curriculum is meticulously designed, offering a structured learning path for individuals with varying levels of coding experience. Beginners are introduced to the core principles of MQL5, the programming language used within MetaTrader 5. The initial modules provide a strong foundation, meticulously explaining essential concepts like data types, variables, and control flow statements. This initial hand-holding proved particularly valuable, ensuring a clear understanding of programming fundamentals before diving deeper.

Progressive Learning: From Indicators to Strategies

As the course progresses, the complexity increases incrementally. Participants delve into the creation of technical analysis indicators, learning to code popular tools such as moving averages and the Relative Strength Index (RSI) from the ground up. This practical application of MQL5 solidifies understanding of the language and its functionalities within the trading platform.

Building a Custom Trading Arsenal

The true strength of the Masterclass lies in its exploration of custom trading strategy development. The course meticulously breaks down the process into manageable steps, guiding participants through backtesting and optimization techniques. Key concepts explored include coding entry and exit signals, money management rules, and integrating position sizing logic into strategies. This hands-on approach empowered me to experiment and construct basic algorithmic trading systems aligned with my personal trading style and risk tolerance.

A Collaborative Learning Environment

The Digital Membership Area significantly enhances the learning experience. Access to a dedicated online forum fosters a collaborative environment. Participants can connect with peers, share their progress, and pose questions. The forum's active involvement by instructors ensures prompt and insightful guidance whenever needed. This sense of community fosters a supportive learning atmosphere, keeping participants motivated and engaged throughout the program.

Investing in Algorithmic Trading Expertise

The MetaTrader 5 Programming Masterclass Digital Membership Area represents a strategic investment in your trading future. It empowers you to transition from manual trading to the dynamic world of algorithmic trading. Whether you are a seasoned professional seeking to refine your approach or a newcomer curious about automation, this program offers a comprehensive learning experience. The well-structured modules, practical exercises, and supportive online community make the Masterclass an exceptional resource for any trader aiming to elevate their algorithmic trading capabilities.

#Unleash Algorithmic Trading Potential#rwby#succession#super mario#taylor swift#ted lasso#margot robbie#welcome home#deliverable

0 notes

Text

How do I do intraday on stocks?

Intraday trading, also known as day trading, involves buying and selling stocks within the same trading day, with the goal of profiting from short-term price movements. Here's a basic guide to get started with intraday trading on stocks:

Understand the Risks: Intraday trading can be highly volatile and risky. Prices can fluctuate rapidly, and there's a risk of losing money quickly. Make sure you're aware of these risks before you begin.

Choose a Broker: You'll need to open an account with a brokerage firm that offers intraday trading services. Look for a broker that provides low commission fees, a user-friendly trading platform, and access to real-time market data.

Learn Technical Analysis: Intraday traders often use technical analysis to make trading decisions. Technical analysis involves studying price charts, patterns, and indicators to identify potential entry and exit points. Learn about common technical indicators such as moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence).

Develop a Trading Strategy: Define a trading strategy that suits your risk tolerance and trading style. This could involve scalping (taking small profits from small price movements), momentum trading (riding the momentum of strong price moves), or breakout trading (trading based on breakouts from key levels). Test your strategy on paper or with a demo account before risking real money.

Set Entry and Exit Points: Determine your entry and exit points before you enter a trade. This helps you stick to your trading plan and avoid making impulsive decisions based on emotions.

Manage Risk: Implement risk management techniques to protect your capital. This could involve setting stop-loss orders to limit potential losses, sizing your positions appropriately, and avoiding over-leverage.

Stay Informed: Keep yourself updated on market news, economic events, and company announcements that could impact stock prices. Stay disciplined and avoid trading based on rumors or emotions.

Practice Patience: Intraday trading requires discipline and patience. Not every trade will be a winner, and it's important to accept losses as part of the trading process.

Remember that successful intraday trading requires time, effort, and experience. It's essential to continuously learn and adapt your strategies based on market conditions and your own trading performance.

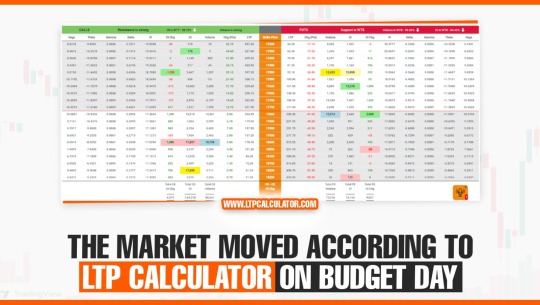

LTP Calculator Overview

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

How to Learn Technical Analysis in Indian Stock Market

IntelliInvest is your go-to destination for comprehensive stock market analysis and insights. In today's dynamic market environment, mastering technical analysis is essential for traders seeking to make informed decisions and achieve consistent success. Whether you're a beginner investor or professional trader, this guide will provide you with practical steps to learn and apply technical analysis techniques in the Indian stock market.

Understanding Technical Analysis

Technical analysis is a method of evaluating securities based on statistical analysis of historical price and volume data. Unlike fundamental analysis, which focuses on company financials and economic indicators, technical analysis relies on charts and patterns to forecast future price movements.

Key Concepts in Technical Analysis

Before diving into how to learn stock market technical analysis, let's explore some fundamental concepts:

Price Action: Price action refers to the movement of a security's price over time. Analyzing price action involves studying patterns, trends, support and resistance levels, and chart formations to identify trading opportunities.

Indicators: Technical indicators are mathematical calculations based on price and volume data. They help traders analyze market trends, momentum, volatility, and other aspects of price behavior. Common indicators include moving averages, relative strength index (RSI), stochastic oscillator, and Bollinger Bands.

Chart Patterns: Chart patterns aulre recurring formations that appear on price charts and signal potential changes in market direction. Examples of chart patterns include head and shoulders, double tops and bottoms, triangles, and flags.

Support and Resistance: Support and resistance levels are key price levels where buying and selling pressure is concentrated. Support levels represent areas where buying interest is strong enough to prevent prices from falling further, while resistance levels denote areas where selling pressure outweighs buying pressure, causing prices to stall or reverse.

Read More: How to Learn Technical Analysis in Indian Stock Market

0 notes

Text

Enhancing Your Trading Strategy With A Crypto Bot: The Ultimate Guide

The crypto sector glows almost like pulsating blood coursing through its veins, prices changing all the time and hopes peeping in like a firefly when the night is dark. In the end, however, a question arises - how is it possible to seize those immediately passing economic benefits?

Being glued to the screen the whole day also has been proven to be a difficult thing to do. Welcome to the world of cryptocurrency trading bots - your fixed and forever unemotional helpers who can battle the charts and master the ever-changing market conditions.

Crypto Bots: Automating Your Path to Profit

A crypto trading bot is software designed to automatically execute your trading strategies. You determine the rules, the bot is ultimately your servant. It mercilessly follows market data, performs transactions by your set rules, and when the market changes, it acts at an inhumanly fast speed.

Beyond Human Limits: How Bots Supercharge Your Strategy

Crypto bots offer several distinct advantages that elevate your trading game:

Emotional Samurai: In crypto markets, volatility leads to growth, sometimes in a blink of an eye. Thus, hasty decision-making during ups or downs may end up in the ruin of your portfolio. The bots are disciplined with the strategy and do not fail in their following of your strategy.

Market Vigilance Never Sleeps: Whereas you are as human as you are, a bot will never get tired of watching the market for you. It senses, seizes, and exploits the fleeting windows that otherwise may pass by because of poor timing, sleep, or other responsibilities.

Lightning Strikes Twice (or More): Bots study market data and conduct trades at unmatched speed. That implies they can take maximum advantage of temporary jumps in the rates, which you as a human trader would fail to notice.

The Past Informs the Present: A lot of chatbots have a backtesting option. You will be able to apply your strategies to historical data and, in this way, you will be able to specify your approach before real funds can be committed

Trading with Discipline: The ability to stick to a well-delineated plan is one of the bases for success. Bots stand in for you by instilling your predefined regulations such as following a specific trading strategy even when you are inclined to take a break.

Choosing Your Weapon: Trending Crypto Bot Strategies

It is important to create a trading strategy and methodology before releasing the bot to the market. undefined

Riding the Wave: Trend Following: This strategy makes money by profiting from existing trends in the market. The bot reacts only to upward movements and sells accordingly as the downtrend continues.

Arbitrage: Exploiting Market Inconsistencies: It aims at discovering the disparity in supply and demand across exchanges. The chatbot, for example, buys a coin on a cheaper exchange and immediately sells it on a pricier exchange, thus receiving an instant profit from a difference in the prices.

Market Making: Liquidity Is the Keyword: At these prices, orders to buy or sell are put on the market. Throughout the trading process, the bot adjusts its orders to find a balance between liquidity and making a little profit on each of all the trades.

Technical Analysis: Numbers Tell a Story: Last, this method involves the use of technical indicators like moving averages, RSI, and MACD in detecting trading signals. The bot can automatically buy or sell using technical indicators as guidance.

Wielding the Bot Wisely: Considerations Before Deployment

While crypto bots have multiple gains, they are not the source of all money in forex trading. undefined

Research is Your Armor: Not all bots are treated the same. Pick up a bot that is already known to have a good relationship with its users, and has a dev team backing it up.

The Risk is Real: Technically, the crypto market is hazardous, and bots cannot promise the outcomes. Make sure to try out your strategy on real-time data as well and generally set some risk management measures such as stop-loss orders.

Don't Be a Passenger: Keep your relationship with the bot balanced and don't proceed with it too much. Assess its performance often, adapt the strategies when required, and keep yourself up-to-date on the latest market movements.

Start Small, Scale Gradually: Do not spend all your money on the bot-trading game. Effectively start with a small amount. Then, slowly and gradually build up your investment as you become more experienced and confident.

Conclusion: Bots as Your Crypto Companions

Crypto Trading Bots can be used as a powerful tool for your crypto conquest. Automating tasks, eliminating human feelings from the process, and speeding up execution allow bots to maximize profits in the market that may be difficult to do otherwise. Nevertheless, be aware that taking the trading bot to the next level involves careful forecasting, risk management, and continuous monitoring. By understanding crypto bots' potential and their boundaries, you can make yourself a smarter and more strategic trader in the crypto market.

0 notes

Text

The Mystery: Understanding Oscillators in Technical Analysis

Subtitle - Insider Tips for Mastering Technical Analysis with Oscillators

Subtitle - A Comprehensive Guide to Technical Analysis - A Full Details

So, you have got the itch to turn out to be a pinnacle-notch dealer, huh? Well, you are successful! When it involves navigating the wild international of buying and selling, learning technical evaluation is your golden price tag. And wager what? Oscillators are like your secret guns on this thrilling adventure. In this manual, we are going to dive deep into magical gear like RSI, MACD, and Stochastic, uncovering their hidden gemstones and showing you how to use them like a seasoned pro. Ready to stage up your buying and selling recreation? Let's try this!

Technical evaluation has roots courting again to the 17th-century Dutch markets, however, it received prominence in the twentieth century with the improvement of charting techniques and signs.

Description:

Technical evaluation entails studying ancient market records, which include price and extent, to forecast destiny price movements. It specializes in styles, trends, and indicators to inform buying and selling decisions.

Importance:

Technical evaluation is vital for buyers to identify access and go-out factors, manage danger, and maximize earnings. It presents precious insights into market sentiment and allows buyers to make informed selections.

Advantages:

Some blessings of technical analysis include its simplicity, versatility throughout exceptional markets and timeframes, and its ability to complement other sorts of evaluation. It empowers traders with actionable records and complements their ability to navigate the complexities of the market.

2. Understanding Technical Analysis: Deciphering the Language of the Market JOIN NOW

Before we delve into the nitty-gritty details of oscillators, let's lay down the foundation with a short crash route on technical analysis. Think of it as getting to know the language of the market fluently.

What is Technical Analysis?

At its coronary heart, technical evaluation is all approximately reading the records of market information – suppose price actions and buying and selling volumes – to expect in which prices would possibly head within the future. It's like being a detective, piecing together clues from the beyond to assume what's coming next.

Reading Between the Lines

Imagine the marketplace as a massive puzzle, with each piece representing a chunk of statistics. Technical analysts are the puzzle solvers, interpreting patterns, trends, and alerts hidden within the chaos. It's all about spotting opportunities and making clever decisions based totally on what the data is telling us.

The Language of Patterns

Patterns are just like the vocabulary of technical analysis. They are available in all sizes and styles – from easy trends to complex formations – and each one tells a completely unique tale approximately the marketplace. By studying to understand these patterns, buyers can advantage of valuable insights into potential price actions.

Trendspotting

Trends are the spine of technical evaluation. They're just like the currents in the ocean, guiding the go with the flow of prices up or down. By identifying tendencies early on, investors can ride the wave and capitalize on profit opportunities.

Signals and Indicators

Think of indicators and signs as the site visitors' lighting fixtures of the marketplace. They provide treasured clues as to when to shop for, sell, or hold onto a function. From transferring averages to oscillators like RSI and MACD, those equipment assist traders navigate the twists and turns of the marketplace with self-belief.

Conclusion

So, there you have got it – a newbie's manual to the fascinating global of technical evaluation. By learning the art of analyzing the language of the marketplace, you'll be nicely geared up to make knowledgeable buying and selling selections and navigate the ever-converting landscape of finance like a pro. Ready to dive in? Let's get started out!

3. What are Oscillators? Unlocking the Secrets of Market Swings

Curious approximately those mysterious equipment called oscillators? Well, get prepared to find their secrets and techniques! Oscillators are like the weather forecasters of the marketplace, supporting us predict when conditions are ripe for an exchange.

Decoding Oscillators

Imagine oscillators as your personal marketplace radar, scanning for signs of trouble or possibility. They're a unique kind of technical indicator designed to identify when fees are stretched too skinny – both overbought or oversold – like a rubber band equipped to snap again into the region.

Boundaries and Ranges

Oscillators want to play within certain barriers, generally bouncing around between zero and 100 on their charts. It's like they may be dancing to the beat of the marketplace, transferring up and down in rhythm with charge adjustments. When they hit the intense ends of the variety, it's a signal that something massive is probably about to manifest.

Finding Balance

Think of oscillators because of the scales of justice for the market. They're continuously weighing the forces of buying and promoting, looking for that sensitive balance between bulls and bears. When one aspect receives too heavy, it's a clue that the tide is probably turning.

Reading the Signs

So, how do we recognize when an oscillator is attempting to tell us something? Look for the excessive stages – excessive or low – wherein the oscillator is pushing against the limits. It's like a warning signal flashing neon lights, alerting us to ability shifts inside the marketplace's mood.

The Power of Reversals

When an oscillator hits the excessive stages, it's like a pressure valve releasing steam. It shows that the market is probably due for a reversal – an exchange in the path that could suggest large possibilities for savvy investors.

Conclusion

Oscillators can also appear like mysterious creatures before everything, but after you understand their language, they become effective allies in your buying and selling adventure. By keeping an eye on these handy signs, you will be ready to navigate the United States and downs of the market with confidence. Ready to dive in and start deciphering those market swings? Let's try this!

4 - Relative Strength Index (RSI): Your Secret Weapon for Spotting Market Extremes

Ready to free up the power of the Relative Strength Index, or RSI? Buckle up, due to the fact this little gem is one of the freshest tools inside the buying and selling international, and it is about to become your new first-rate friend.

The RSI Demystified

Think of the RSI as your non-public market speedometer, constantly measuring the speed of rate actions. It's like having a radar gun for the stock marketplace, telling you whether matters are moving too rapidly or too slowly.

Spotting Extremes

Ever heard the saying "What goes up must come down"? Well, the RSI is your manual to knowing while that's about to manifest. When the RSI shoots above 70, it is like a pink flag waving inside the wind – a sign that prices might be getting a piece too warm. On the flip aspect, when the RSI dips underneath 30, it's like a flashing neon sign pronouncing "opportunity ahead" – a signal that fees can be due for a leap.

Reading the Signals

So, how do you recognize whilst paying attention to the RSI? Look for those magic numbers – 70 and 30 – in which the RSI crosses the road into overbought or oversold territory. It's like having an integrated alarm device for your trades, supporting you to stay in advance of the game.

Speed and Change

The RSI isn't just about where charges are – it's also about how fast they're transferring. By measuring each speed and trade, the RSI offers you an entire picture of market momentum, helping you are making smarter, extra-informed buying and selling decisions.

Your Trading Sidekick

With the RSI by your facet, you will never be caught off defend through market extremes again. Whether you are a seasoned seasoned or simply starting out, this accessible tool will help you navigate the American and downs of the market with self-assurance. So, what are you expecting? Begin bridling the power of the RSI and take your trading game to a higher level!

5. Mastering the Moving Average Convergence Divergence (MACD): Your Key to Riding Market Trends

Prepared to plunge into the field of the Moving Average Convergence Divergence or MACD? Prepare to be shocked, because this incredible asset is going to alter how you change.

Unveiling the MACD

Think of the MACD as your trusty compass within the tumultuous sea of the stock marketplace. It's like having a GPS for market tendencies, guiding you through the U.S.A.And downs readily.

Two Lines, One Mission

The MACD is made from two strains – the MACD line and the signal line. Together, they shape a dynamic duo, constantly reading market actions and signaling capacity changes in direction.

Bullish vs. Bearish Signals

When the MACD line crosses above the sign line, it's like an inexperienced light signaling an uptrend beforehand. Bulls have a good time as prices climb better, developing opportunities for earnings. On the flip feature, while the MACD line crosses underneath the sign line, it resembles a mindfulness signal blazing red - a sign that a downtrend can be not too far off. Bears sharpen their claws as costs dip decrease, ready to pounce on capacity opportunities.

Riding the Trend Waves

With the MACD as your guide, you will be using the waves of marketplace traits like a pro. Whether it's a bullish flood or a negative retreat, you will be equipped to gain by potential outcomes and explore the exciting bends in the road of the market with confidence.

Your Trading Navigator/Your Exchanging Pilot

All in all, what are you looking for? Now is the ideal time to saddle the strength of the MACD and take your trading game to a higher level. With its potential to become aware of trends and sign capability modifications en route, this versatile tool turns into your mystery weapon for fulfillment inside the international of buying and selling. Let's embark on this journey collectively and liberate the total capability of the MACD!

6. Uncovering the Stochastic Oscillator: Your Vital aspect for Riding Business sector Energy JOIN NOW

Is it safe to say that you are prepared to jump into the intriguing worldwide of the Stochastic Oscillator? Lock in, because of the reality this viable marker is going to arise as your new pleasant buddy inside the worldwide of exchanging.

Understanding the Stochastic Oscillator/Figuring out the Stochastic Oscillator

Consider the Stochastic Oscillator your energy finder, ceaselessly checking the market for signs and side effects of solidarity or point of concern. It's like having an integrated radar system, supporting you navigate the highs and lows of marketplace momentum without problems.

The %K and %D Lines

The Stochastic Oscillator is produced using two strains - the %K line and the %D line. Together, they shape a unique pair, providing prized bits of knowledge into commercial center elements and capacity shifts in force.

Spotting Overbought and Oversold Conditions

Like the RSI, the Stochastic Oscillator permits overbought and oversold conditions in the commercial center. When readings climb above eighty, it's like a caution sign flashing red – a signal that charges can be overheated and due for a pullback. Conversely, when readings drop under 20, it is like a green light signaling capacity buying opportunities beforehand.

Riding the Momentum Waves/Riding the Force Waves

With the Stochastic Oscillator by your feature, you'll ride the rushes of market forces like an ace. Whether it is a flood in purchasing pressure or a plunge in selling pressure, you'll be equipped to gain conceivable outcomes and settle on informed exchanging decisions.

Your Momentum Navigator/Your Energy Pilot

Anyway, what are you expecting? Now is the right time to tackle the strength of the Stochastic Oscillator and take your trading game to the ensuing level. With its capacity to recognize energy moves and see overbought or oversold circumstances, this adaptable gadget transforms into your unmistakable advantage for satisfaction inside the quick-paced universe of trading. How about we leave this experience altogether and deliver the general limit of the Stochastic Oscillator?

7. Mastering Oscillators: Tips for Trading Success

So, you have got your fingers on some effective oscillators – now what? It's time to discover ways to wield this equipment like a seasoned and grow to be a master trader. Here are a few basic yet powerful clues to assist you with freeing the general capacity of oscillators and taking your exchanging game higher than ever.

1. Practice Makes Perfect/Careful discipline brings about promising results

Just like learning any skill, becoming gifted in technical analysis and oscillators calls for practice – and lots of it! Set aside time every day to research charts, tweak settings, and have a look at how oscillators behave in one-of-a-kind marketplace situations. The more you practice, the more intuitive your buying and selling decisions become.

2. Combine and Conquer

Oscillators are effective on their own, but they are even stronger whilst mixed with different technical indicators. Experiment with pairing oscillators with shifting averages, trendlines, and extent evaluation to create a comprehensive trading strategy. Look for confluence among signs to grow the reliability of your buying and selling alerts and enhance your success fee.

3. Discipline is Key

One of the most important pitfalls for investors is letting feelings dictate their selections. Stay disciplined and persist with your buying and selling plan, following your indicators religiously. Avoid the temptation to deviate out of your approach primarily based on fear or greed. Remember, the indicators are there to guide your decisions – consider them and live the course.

4. Never Stop Learning

The economic markets are continuously evolving, so it is important to stay up to date with the brand new traits and trends in technical analysis. Make it an addiction to attend seminars, study books, and follow official trading blogs to increase your understanding and stay in advance of the curve. The extra you analyze, the higher prepared you'll be to navigate the ever-changing panorama of the market.

With those simple but effective recommendations, you will be well for your manner of getting to know oscillators and becoming a successful trader. So, what are you waiting for? Start imposing those techniques nowadays and watch your trading prowess leap!

Conclusion

In the end, the journey to becoming a remarkable trader is simply no walk in the park. It calls for willpower, perseverance, and deep information on technical evaluation and oscillators. But worry no longer, for with this gear in your arsenal, you can tip the scales of achievement for your preference.

Always do not forget that buying and selling isn't always just about crunching numbers; it is also approximately gaining knowledge of the psychological thing of the sport. Stay disciplined in your approach, keep your attention sharp, and in no way underestimate the energy of non-stop gaining knowledge.

So, as you embark on your trading journey, may additionally your charts be clean, your signals be sturdy, and your profits be abundant. Here's to glad trading and to the exciting adventures that lie ahead in the international of finance!

0 notes

Text

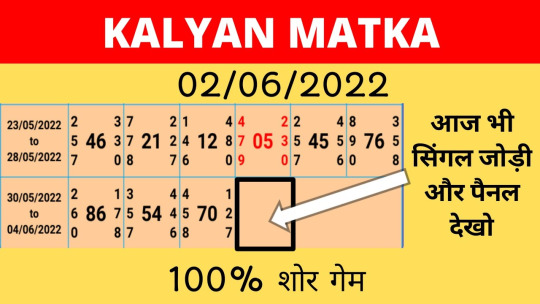

The Ultimate Guide to Decoding Kalyan Matka Patterns for Beginners

Are you intrigued by the world of Kalyan Chart and eager to understand its patterns? If you're new to this fascinating realm, fret not!

Deciphering Kalyan matka patterns might seem like a daunting task at first, but with a bit of guidance, you'll soon find yourself navigating through them with confidence.

In this comprehensive guide, we'll walk you through the basics, decoding common patterns and equipping you with the tools you need to kickstart your journey into the realm of the Kalyan Chart.

Understanding the Basics of Kalyan Chart

Before diving into the intricacies of Kalyan matka patterns, let's first grasp the fundamentals.

Kalyan matka refers to a graphical representation of data that showcases the trends and movements of specific elements over a set period. In essence, it's a visual tool used to analyze patterns and make informed decisions.

These charts are commonly used in various fields such as finance, statistics, and yes, even in certain recreational activities.

Getting Acquainted with Kalyan Chart Patterns

Now that you have a basic understanding of what Kalyan matka entails, it's time to explore the patterns that lie within. Patterns in Kalyan matka can be likened to the ebb and flow of the tide – they reveal trends, reversals, and potential opportunities. Some common patterns include:

Head and Shoulders

The head and shoulders pattern is one of the most recognizable patterns in Kalyan matka analysis. It typically signals a reversal in the current trend. Visualize it as three peaks – with the middle peak (the head) being the highest and the two outer peaks (the shoulders) being slightly lower. When this pattern emerges, it suggests that the prevailing trend is about to reverse.

Double Top and Double Bottom

As the name suggests, the double top pattern consists of two consecutive peaks of similar height, separated by a trough. Conversely, the double bottom pattern comprises two consecutive troughs, separated by a peak. These patterns indicate potential reversal points in the trend, offering traders an opportunity to enter or exit positions.

Triangles

Triangles in Kalyan matka come in various forms – ascending, descending, and symmetrical. Ascending triangles are characterized by a flat top and rising bottom trendline, while descending triangles have a flat bottom and falling top trendline. Symmetrical triangles, on the other hand, have both trendlines converging. These patterns often precede significant price movements, making them valuable for traders.

Analyzing Kalyan Chart Patterns: Tips and Tricks

Now that you can identify common Kalyan matka patterns, let's delve into some tips and tricks to enhance your analysis:

Patience is Key

Rome wasn't built in a day, and neither is expertise in Kalyan matkaa nalysis. Be patient with yourself as you learn to recognize patterns and interpret them accurately. Like any skill, it takes time and practice to master.

Combine Technical Indicators

While Kalyan Chart patterns offer valuable insights, they are most effective when used in conjunction with other technical indicators such as moving averages, relative strength index (RSI), and stochastic oscillators. Combining multiple indicators can help validate your analysis and enhance the probability of success.

Keep Emotions in Check

It's easy to get swept away by emotions when trading or analyzing Kalyan matka patterns. However, it's essential to remain calm and objective. Emotions can cloud judgment and lead to impulsive decisions. Stick to your trading plan and trust your analysis.

Putting It All Together: Practicing with Kalyan Chart

Now that you have a solid understanding of Kalyan matka basics, patterns, and analysis techniques, it's time to put your knowledge to the test. Open a Kalyan matka of your choice and start identifying patterns. Practice interpreting these patterns and predicting future price movements. Remember, practice makes perfect!

Conclusion

Deciphering Kalyan matka patterns may seem daunting at first, but with patience, practice, and perseverance, you can become proficient in this art.

By understanding the basics, recognising common patterns, and employing effective analysis techniques, you'll be well-equipped to navigate the dynamic world of Kalyan matka with confidence. So, dive in, explore, and unleash your potential in the realm of Kalyan matka analysis!

0 notes

Text

An Introductory Guide by Baron Learning Pvt Ltd

Introduction to Forex Trading

Forex trading, short for foreign exchange trading, is the activity of buying and selling currencies on the financial market. This form of trading involves pairs of currencies, where one currency is exchanged for another at an agreed-upon price. As one of the largest financial markets in the world, the forex market offers vast opportunities for investors to profit by leveraging fluctuations in currency values.

Why Trade Forex?

Forex trading attracts a multitude of participants, from individual retail investors to large financial institutions, due to several compelling benefits:

Liquidity: The forex market is the most liquid market in the world, with daily trading volumes exceeding $6 trillion. High liquidity means that large trades can be executed quickly and with minimal price slippage.

Accessibility: Unlike stock markets, the forex market operates 24 hours a day during weekdays, allowing traders to engage in trading activities at their convenience.

Leverage: Forex markets provide significant leverage, allowing traders to control large positions with relatively small amounts of capital. However, it’s important to note that while leverage can amplify profits, it also increases potential losses.

Basic Concepts in Forex Trading

Currency Pairs: Currencies are traded in pairs, such as EUR/USD, GBP/USD, or USD/JPY. The first currency in the pair is the base currency, and the second is the quote currency. The trading action involves buying one currency while selling the other.

Bid and Ask: The bid price is the price at which you can sell the base currency, while the ask price is the price at which you can buy it. The difference between these two prices is known as the spread.

Pips and Lots: A pip represents the smallest price move that a currency exchange rate can make based on market convention. Most currency pairs are priced to four decimal places, and a pip is one unit of the fourth decimal point. A lot is the standard unit size of a transaction. Typically, one lot is 100,000 units of the base currency.

Strategies for Successful Forex Trading

Technical Analysis: This involves analyzing historical price charts and market statistics to predict future movements. Traders use indicators like moving averages, MACD, and RSI to make informed trading decisions.

Fundamental Analysis: This strategy focuses on economic indicators, central bank decisions, political events, and other macroeconomic factors that can affect currency values.

Risk Management: Effective risk management is crucial in forex trading. This includes setting stop-loss orders to limit potential losses and adjusting the size of trades according to the volatility of the market.

Baron Learning’s Forex Trading Courses

At Baron Learning Pvt Ltd, we offer comprehensive forex trading courses designed to equip you with the knowledge and skills necessary to navigate the forex market successfully. Our courses cover everything from the basics of forex trading to advanced strategies and risk management techniques. Led by experienced traders, our programs are tailored to help both beginners and seasoned investors achieve their trading objectives.

Conclusion

Forex trading offers exciting opportunities for those willing to learn and adapt. With its high liquidity, accessibility, and potential for profitability, it is an attractive option for many traders. At Baron Learning Pvt Ltd, we are committed to providing high-quality education that empowers our students to excel in the forex market. Whether you’re starting out or looking to refine your trading techniques, our courses are designed to help you succeed.

0 notes

Text

Demystifying the Market: A Beginner's Guide to Trading with Trading DX

The world of trading can seem like a complex and intimidating space, filled with jargon, technical charts, and seasoned veterans who seemingly speak a different language. But fear not, aspiring trader! Trading DX is here to guide you on your journey from curious newcomer to confident market participant. This beginner's guide equips you with the fundamental knowledge and essential skills needed to navigate the world of trading and potentially make informed decisions.

Understanding the Basics: Assets, Markets, and Platforms

Before diving in, let's establish a foundation. Trading involves speculating on the price movement of an asset. This asset can be anything from stocks and bonds to currencies and commodities. In the world of Trading DX, we'll focus on a specific asset class: financial instruments. These can be stocks representing ownership in companies, foreign exchange (forex) pairs like USD/EUR, or even contracts tied to the price of commodities like gold or oil.

Next, we need a marketplace. Think of a trading platform as your online stock exchange, where buyers and sellers meet to trade these financial instruments. There are numerous online platforms available, each with its own features, fees, and security protocols. The course will guide you through choosing a platform that aligns with your needs and comfort level.

Placing Your First Trade: Orders and Terminology

Now, let's get down to brass tacks! How do you actually make a trade? This is where orders come in. An order instructs the platform to buy or sell a specific asset at a specific price or under certain conditions. We'll explore different order types:

Market Orders: These orders are executed immediately at the best available price in the market. They're simple and convenient, but the price you get might differ slightly from what you intended.

Limit Orders: These orders offer more control. You specify the price you're willing to buy or sell at. The order only gets executed if the market price reaches your desired level.

Understanding basic trading terminology is key. You'll encounter terms like "bid" and "ask," which represent the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, respectively. The "spread" refers to the difference between these two prices.

Understanding Risk and Setting Expectations

The world of trading carries inherent risks. The value of financial instruments can fluctuate significantly, and there's always the possibility of losing money. It's crucial to set realistic expectations and never invest more than you can afford to lose.

Trading DX emphasizes the importance of risk management. We'll introduce you to concepts like stop-loss orders, which automatically sell your asset if the price falls below a certain level, helping you limit potential losses. Building a diversified portfolio, spreading your investments across different assets, is another key risk management strategy.

Technical Analysis: Reading the Market Tea Leaves

Experienced traders often rely on technical analysis to identify potential trading opportunities. This involves studying historical price charts and using technical indicators to gauge market sentiment and predict future price movements. While not a crystal ball, technical analysis can be a valuable tool in your trading arsenal.

The Trading DX course will introduce you to essential technical indicators like moving averages and the Relative Strength Index (RSI). We'll show you how to interpret charts and identify basic technical patterns that may signal potential buying or selling opportunities. Remember, technical analysis is a skill that takes time and practice to master.

The Psychology of Trading: Keeping Your Emotions in Check

Trading can be an emotional rollercoaster. Fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) can cloud your judgment and lead to impulsive decisions. The course emphasizes the importance of developing emotional discipline. Stick to your trading plan, avoid making hasty decisions based on emotions, and learn to accept losses as an inevitable part of the game.

Building Your Trading Strategy: Finding Your Path

There's no one-size-fits-all trading strategy. The best approach depends on your risk tolerance, time commitment, and financial goals. The course will introduce you to different trading styles, such as:

Day Trading: This involves buying and selling assets within a single trading day, aiming for small profits on short-term price fluctuations.

Swing Trading: This strategy holds assets for a few days or weeks, capitalizing on larger price swings.

Long-Term Investing: This approach involves holding assets for months or even years, with a focus on companies or sectors with strong long-term growth potential.

Also See:

Top 5 Meme coin for Bull Run

Crypto Trading Course 2024, How to trade for Beginners, Learn How to Trade in Crypto

8 Legit Ways to Boost Your Crypto Portfolio

Step-by-step Guide to Claim Airdrop on Binance, Earn Free Crypto on Binance

Subscribe to my channel for Knowledge Base content on CRYPTO - news, updates, education, Technical analysis, and much more.

0 notes

Text

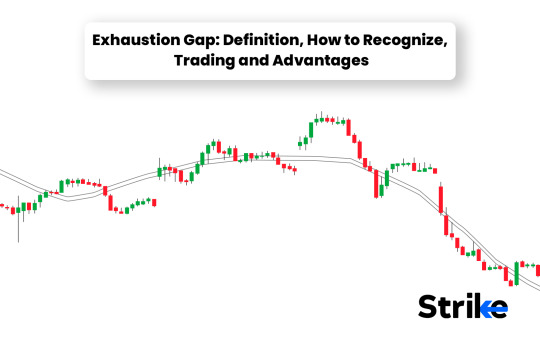

Understanding Exhaustion Gaps: A Trader's Guide to Market Psychology

In the world of finance and trading, understanding market patterns and signals is crucial for making informed decisions. Among the plethora of technical analysis tools available to traders, one concept that stands out is the exhaustion gap. Exhaustion gaps are intriguing phenomena observed in financial markets, indicating potential shifts in sentiment and momentum. In this comprehensive guide, we delve into the intricacies of exhaustion gaps, exploring their definition, characteristics, significance, and how traders can leverage them in their trading strategies.

What is an Exhaustion Gap?

An exhaustion gap is a price gap that occurs at the end of a sustained trend, signaling the culmination of investor enthusiasm or pessimism. It typically appears on a price chart as a gap between the previous day's closing price and the current day's opening price. Exhaustion gaps are often associated with heightened volatility and can occur in both bullish and bearish trends.

Characteristics of Exhaustion Gaps

Volume Discrepancy: One notable characteristic of exhaustion gaps is a significant disparity in trading volume. During the formation of an exhaustion gap, trading volume tends to be unusually high, reflecting intensified buying or selling pressure.

Breakaway Gap vs. Exhaustion Gap: It's important to distinguish between breakaway gaps and exhaustion gaps. Breakaway gaps occur at the beginning of a trend, signaling the start of a significant price movement, while exhaustion gaps emerge at the end of a trend, suggesting the potential exhaustion of prevailing market sentiment.

Price Action Context: Exhaustion gaps often appear after a prolonged trend, whether bullish or bearish, and are frequently accompanied by other technical indicators such as overbought or oversold conditions on oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator.

Significance of Exhaustion Gaps

Psychological Shift: Exhaustion gaps reflect a shift in market sentiment and participant psychology. In bullish trends, an exhaustion gap suggests that buying pressure has reached its peak, while in bearish trends, it indicates that selling pressure has become exhausted. This psychological shift can precede significant reversals or periods of consolidation.

Confirmation of Trend Reversal: While exhaustion gaps alone are not definitive signals of a trend reversal, they often serve as early warning signs. Traders typically look for additional confirmation through other technical indicators or chart patterns before considering entering a trade based on an exhaustion gap.

Opportunities for Contrarian Traders: For contrarian traders, exhaustion gaps present intriguing opportunities. Contrarian traders seek to capitalize on market sentiment extremes, and exhaustion gaps provide them with potential entry points for countertrend trades.

Trading Strategies Using Exhaustion Gaps

Confirmation with Candlestick Patterns: One common strategy involves confirming the validity of an exhaustion gap with subsequent price action and candlestick patterns. Traders look for reversal patterns such as engulfing patterns or doji candles forming after the exhaustion gap to validate the potential reversal.

Combining with Oscillators: Traders often complement exhaustion gap analysis with oscillators like the RSI or Stochastic Oscillator to gauge the strength of the prevailing trend and identify potential divergence between price and momentum, which could signal a trend reversal.

Risk Management: As with any trading strategy, risk management is paramount when trading exhaustion gaps. Traders should use stop-loss orders to limit potential losses and adhere to strict risk-reward ratios to ensure that winning trades outweigh losing ones.

Conclusion

Exhaustion gaps are intriguing phenomena observed in financial markets, indicating potential shifts in sentiment and momentum. By understanding the characteristics and significance of exhaustion gaps, traders can incorporate them into their trading strategies to identify potential trend reversals and capitalize on market inefficiencies. However, it's essential to exercise caution and employ proper risk management techniques when trading exhaustion gaps, as they can be accompanied by increased volatility and uncertainty. As with any trading strategy, thorough analysis and continuous learning are key to success in navigating the dynamic landscape of financial markets.

0 notes

Text

Intraday Trading Guide for Beginners in India

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day, with the aim of profiting from short-term price movements. Here's a guide for beginners in India interested in intraday trading:

Understand the Basics: Before diving into intraday trading, it's crucial to understand the basics of the stock market, including how it functions, key terminology, and trading mechanisms.