#regulating natural monopolies marginal cost pricing

Text

Rising Unaffordable Healthcare Cost

Name: Peter Ou

ID: 16066938

I. Introduction:

Ask anyone living in the United States of America and there would be a consensus among almost every single individual that the cost of many essential medical practices are unattainable to a large swab of the population. Although there are fierce debate over how to solve this issue through a means of either complete privatization of nationalization of the industry, the reason behind as to why the cost of healthcare is so high to begin with is often not nearly discussed enough as it should be.

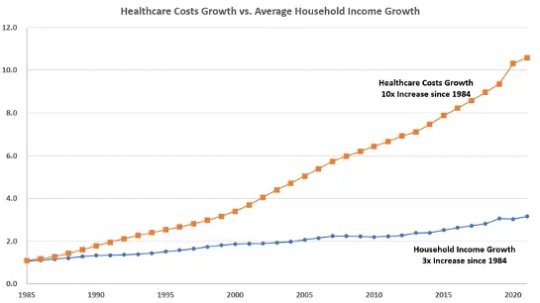

Increase in income vs healthcare cost since 1984 Income: 3x Healthcare: 10x

II. Inelastic Demand

It is to no one's surprise that the salaries people receive dramatically fails to keep up with the cost necessary to pay for the medical expense they or their family may need. One of the most important factors behind this rampant rise in price with no pushback is due to the nature of the services/goods being exchanged in this market.

The market would displays a nearly perfect inelastic demand.

A major reason as to why the price can keep rapidly expand is because the medical industry does not function in the same ways that a regular good or product does. It only takes a very brief analysis to realize that no matter how high the cost is set for consumers to get their healthcare needs, the price will never to be balanced out by the market regardless of whether a monopoly or oligopoly exists or not. This is because if the medical practice is dire and otherwise would result in the death or mortality of people, the cost is not a factor people would consider to receive treatment even if meant making bad financial decisions, going into debt. People are not able to bargain and view which hospitals or clinics offer the best prices if they are in need of a medical emergency. Also most institutions are not transparent about the expenses needed for patients' treatment. The "invisible hand" would not be applicable if the industry does not follow market principles.

III. Monopoly/Oligopoly

Due to the inherent nature of healthcare having a barrier of extremely high cost of entry and stringent regulations, the formation of corporate giants in the form of an oligopoly is inevitable without government interference. Even when anti-trust policies are enforced, every medical firm engages in price leadership since they often have control over the sale of medication and chemical compound formulas through exploitation of the patent system in courts. The barrier to entry is also caused through the amount of capital needed to be invested for a company to have success in having its own research and market share. Important regulations that ensure the safety behind the products being produced also add extra cost to the development of new drugs and practices.

Larges medical companies by market cap.

IV. Opportunity Cost

Since the risk behind formulating new medication is high in comparison to the payout, many companies will choose to make slight alterations to previous products in order to regain patent access. There is no incentive for pharmaceutical firms to invent permanent cures because it would reduce their total marginal revenue and profits. The opportunity to create new breakthroughs and boundaries in healthcare is limited due to the market and profit seeking organization of the industry. A more efficient structure would need to be put in place to maximize productivity and operate at a socially optimal equilibrium. In the end, the loss is place back into the hands of the consumers as we experience more expensive increases in the rate we pay to afford services needed for the health and overall output of the workforce in the economy.

0 notes

Text

Pharmaceutical Evils: Mylan's EpiPen Monopoly

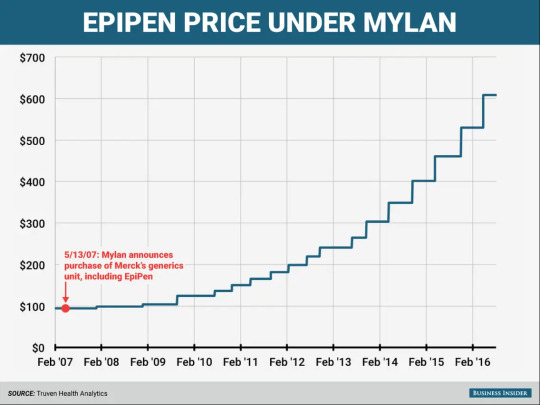

One of the largest evils committed by pharmaceutical companies is the infamous price gouging of the EpiPen. The EpiPen is a medical device that delivers a life-saving dose of epinephrine to individuals experiencing life threating allergic reactions. In 2007, Mylan purchased EpiPen’s generic drug, which at the time was $50 to $100. Now, the cost of this life-saving device has risen from around $50 per pen in 2007 to over $600 per pen today. As a result, those with low incomes are unable to afford it. It has been a source of public outrage that continues to pass right through the ears of Mylan and other pharmaceutical companies. By raising prices to maximize profits, Mylan is able to take advantage from consumers who are willing and able to pay more for the life-saving drug due to the lack of alternatives available on the market. Consequently, it has allowed them to increase their revenues from $200 million in 2008 to 1.3 billion in only a span of eight years.

Now, let’s approach this from an economic perspective. Mylan has an exclusive patent agreement on the generic drug for EpiPen, leading to a lack of competition that prevents other companies from creating cheaper alternatives. Customers are given no choice but to succumb to these high prices as they are the only option. In addition, EpiPen has a naturally high demand as people are willing to pay as much as needed to have access to this life-saving drug, resulting in giving Mylan more pricing power. It allows Mylan to achieve the dream of any corporation and set the EpiPen prices at high levels without having to worry about losing market share to competitors. In the long run, they see no incentive to innovate and improve their product as they hardly have any competition and thus face no pressure to improve their product or lower their prices. Finally, after years of backlash and public scrutiny, regulators have pushed EpiPen to lower their prices

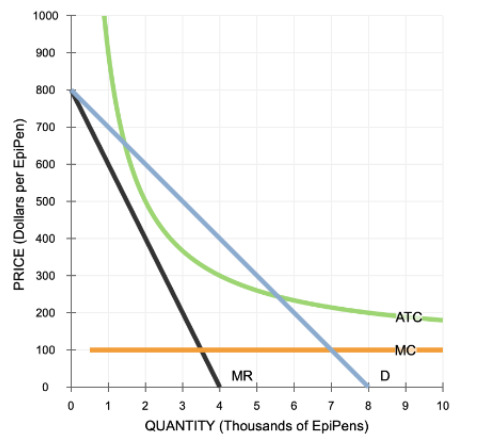

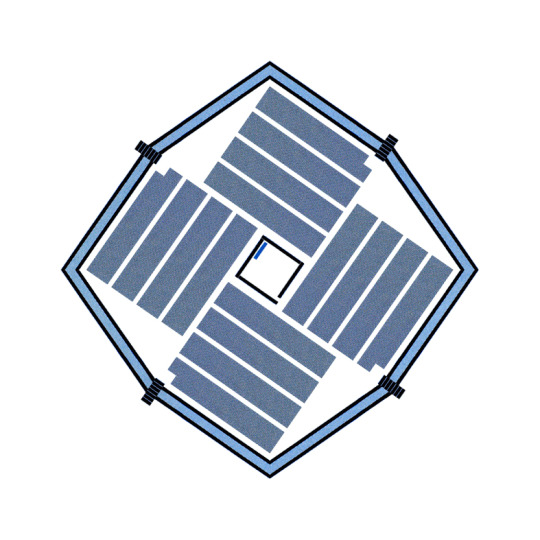

Provided is an approximate chart of Mylan’s monopoly (bottom) and their price trends ever since their acquisition (top). Their marginal cost is relatively low and static, as the company had already invested in the development of the product, and the cost of producing an additional unit is effective and cheap. This is a monopoly and not a competitive market, thus the marginal revenue is less than the product’s price. The average total cost is high only because Mylan had the ability to charge high prices and still make a profit.

Sources:

https://www.washingtonpost.com/business/economy/2016/08/25/7f83728a-6aee-11e6-ba32-5a4bf5aad4fa_story.html

Marc Haddad

ID: 67734308

Econ 23. Disc: 7:00 PM Tuesday

0 notes

Photo

page 470 and 471 - even a stylish black option and promotional materials speaking of Horus and Ra did not convince the soon to be dead.

Not all cemeteries are amongst the dunes, and yet, advertising.

#economics#economy#economist#economists#regulating natural monopolies marginal cost pricing#profit maximization#profit#declingin block pricing#block pricing#block#declining block pricing#options#selection#choices#choice#variety#various#kilowatts#engineer#architect#dune#sand dune#cemetery#deadstones#headstones#monuments#monumental#life after death#eternal life#failed product

246 notes

·

View notes

Text

UGC NET Commerce Books, Question Paper, Free Study Material, MCQ

UGC NET Commerce Books, Question Paper, Free Study Material, MCQ

The National Eligibility Test, also known as UGC NET or NTA-UGC-NET, is the test for determining the eligibility for the post of Assistant Professor and/or Junior Research Fellowship award in Indian universities and colleges. UGC NET is considered as one of the toughest exams in India, with success ratio of merely 6%.

UGC NET Commerce Question Paper and MCQs

Buy the question bank or online quiz of UGC NET Commerce Exam Going through the UGC NET Commerce Exam Question Bank is a must for aspirants to both understand the exam structure as well as be well prepared to attempt the exam.

The first step towards both preparation as well as revision is to practice from UGC NET Commerce Exam with the help of Question Bank or Online quiz. We will provide you the questions with detailed answer.

UGC NET Commerce Question Paper and MCQs : Available Now

UGC NET Commerce Free Study Material : Click Here

UGC NET Commerce Books : Click Here

UGC NET Commerce Syllabus

Unit 1 – Business Environment and International Business

Concepts and elements of business environment: Economic environment- Economic systems, Economic policies(Monetary and fiscal policies); Political environment Role of government in business; Legal environment- Consumer Protection Act, FEMA; Socio-cultural factors and their influence on business; Corporate Social Responsibility (CSR), Scope and importance of international business; Globalization and its drivers; Modes of entry into international business, Theories of international trade; Government intervention in international trade; Tariff and non-tariff barriers; India’s foreign trade policy, Foreign direct investment (FDI) and Foreign portfolio investment (FPI); Types of FDI, Costs and benefits of FDI to home and host countries; Trends in FDI; India’s FDI policy, Balance of payments (BOP): Importance and components of BOP, Regional Economic Integration: Levels of Regional Economic Integration; Trade creation and diversion effects; Regional Trade Agreements: European Union (EU), ASEAN, SAARC, NAFTA International Economic institutions: IMF, World Bank, UNCTAD, World Trade Organisation (WTO): Functions and objectives of WTO; Agriculture Agreement; GATS; TRIPS; TRIMS

Unit 2 – Accounting and Auditing

Basic accounting principles; concepts and postulates, Partnership Accounts: Admission, Retirement, Death, Dissolution and Insolvency of partnership firms, Corporate Accounting: Issue, forfeiture and reissue of shares; Liquidation of companies; Acquisition, merger, amalgamation and reconstruction of companies, Holding company accounts, Cost and Management Accounting: Marginal costing and Break-even analysis; Standard costing; Budgetary control; Process costing; Activity Based Costing (ABC); Costing for decision-making; Life cycle costing, Target costing, Kaizen costing and JIT, Financial Statements Analysis: Ratio analysis; Funds flow Analysis; Cash flow analysis, Human Resources Accounting; Inflation Accounting; Environmental Accounting, Indian Accounting Standards and IFRS, Auditing: Independent financial audit; Vouching; Verification ad valuation of assets and liabilities; Audit of financial statements and audit report; Cost audit, Recent Trends in Auditing: Management audit; Energy audit; Environment audit; Systems audit; Safety audit

Unit 3 – Business Economics

Meaning and scope of business economics, Objectives of business firms, Demand analysis: Law of demand; Elasticity of demand and its measurement; Relationship between AR and MR, Consumer behavior: Utility analysis; Indifference curve analysis, Law of Variable Proportions: Law of Returns to Scale, Theory of cost: Short-run and long-run cost curves, Price determination under different market forms: Perfect competition; Monopolistic competition; Oligopoly- Price leadership model; Monopoly; Price discrimination, Pricing strategies: Price skimming; Price penetration; Peak load pricing

Unit 4 – Business Finance

Scope and sources of finance; Lease financing, Cost of capital and time value of money, Capital structure, Capital budgeting decisions: Conventional and scientific techniques of capital budgeting analysis, Working capital management; Dividend decision: Theories and policies, Risk and return analysis; Asset securitization, International monetary system, Foreign exchange market; Exchange rate risk and hedging techniques, International financial markets and instruments: Euro currency; GDRs; ADRs, International arbitrage; Multinational capital budgeting

Unit 5 – Business Statistics and Research Methods

Measures of central tendency, Measures of dispersion, Measures of skewness, Correlation and regression of two variables, Probability: Approaches to probability; Bayes’ theorem, Probability distributions: Binomial, poisson and normal distributions, Research: Concept and types; Research designs, Data: Collection and classification of data, Sampling and estimation: Concepts; Methods of sampling – probability and nonprobability methods; Sampling distribution; Central limit theorem; Standard error; Statistical estimation, Hypothesis testing: z-test; t-test; ANOVA; Chi–square test; Mann-Whitney test (Utest); Kruskal Wallis test (H-test); Rank correlation test, Report writing

Unit 6 – Business Management and Human Resource Management

Principles and functions of management, Organization structure: Formal and informal organizations; Span of control, Responsibility and authority: Delegation of authority and decentralization Motivation and leadership: Concept and theories, Corporate governance and business ethics, Human resource management: Concept, role and functions of HRM; Human resource planning; Recruitment and selection; Training and development; Succession planning, Compensation management: Job evaluation; Incentives and fringe benefits, Performance appraisal including 360 degree performance appraisal, Collective bargaining and workers’ participation in management, Personality: Perception; Attitudes; Emotions; Group dynamics; Power and politics; Conflict and negotiation; Stress management, Organizational Culture: Organizational development and organizational change

Unit 7 – Banking and Financial Institutions

Overview of Indian financial system, Types of banks: Commercial banks; Regional Rural Banks (RRBs); Foreign banks; Cooperative banks, Reserve Bank of India: Functions; Role and monetary policy management, Banking sector reforms in India: Basel norms; Risk management; NPA management, Financial markets: Money market; Capital market; Government securities market, Financial Institutions: Development Finance Institutions (DFIs); Non-Banking Financial Companies (NBFCs); Mutual Funds; Pension Funds, Financial Regulators in India, Financial sector reforms including financial inclusion, Digitisation of banking and other financial services: Internet banking; mobile banking; Digital payments systems, Insurance: Types of insurance- Life and Non-life insurance; Risk classification and management; Factors limiting the insurability of risk; Re-insurance; Regulatory framework of insurance- IRDA and its role.

Unit 8 – Marketing Management

Marketing: Concept and approaches; Marketing channels; Marketing mix; Strategic marketing planning; Market segmentation, targeting and positioning, Product decisions: Concept; Product line; Product mix decisions; Product life cycle; New product development, Pricing decisions: Factors affecting price determination; Pricing policies and strategies, Promotion decisions: Role of promotion in marketing; Promotion methods – Advertising; Personal selling; Publicity; Sales promotion tools and techniques; Promotion mix, Distribution decisions: Channels of distribution; Channel management, Consumer Behaviour; Consumer buying process; factors influencing consumer buying decisions, Service marketing, Trends in marketing: Social marketing; Online marketing; Green marketing; Direct marketing; Rural marketing; CRM, Logistics management.

Unit 9: Legal Aspects of Business

Indian Contract Act, 1872: Elements of a valid contract; Capacity of parties; Free consent; Discharge of a contract; Breach of contract and remedies against breach; Quasi contracts, Special contracts: Contracts of indemnity and guarantee; contracts of bailment and pledge; Contracts of agency, Sale of Goods Act, 1930: Sale and agreement to sell; Doctrine of Caveat Emptor; Rights of unpaid seller and rights of buyer, Negotiable Instruments Act, 1881: Types of negotiable instruments; Negotiation and assignment; Dishonour and discharge of negotiable instruments, The Companies Act, 2013: Nature and kinds of companies; Company formation; Management, meetings and winding up of a joint stock company, Limited Liability Partnership: Structure and procedure of formation of LLP in India, The Competition Act, 2002: Objectives and main provisions, The Information Technology Act, 2000: Objectives and main provisions; Cyber crimes and penalties, The RTI Act, 2005: Objectives and main provisions, Intellectual Property Rights (IPRs) : Patents, trademarks and copyrights; Emerging issues in intellectual property, Goods and Services Tax (GST): Objectives and main provisions; Benefits of GST; Implementation mechanism; Working of dual GST.

Unit 10: Income-tax and Corporate Tax Planning

Income-tax: Basic concepts; Residential status and tax incidence; Exempted incomes; Agricultural income; Computation of taxable income under various heads; Deductions from Gross total income; Assessment of Individuals; Clubbing of incomes, International Taxation: Double taxation and its avoidance mechanism; Transfer pricing, Corporate Tax Planning: Concepts and significance of corporate tax planning; Tax avoidance versus tax evasion; Techniques of corporate tax planning; Tax considerations in specific business situations: Make or buy decisions; Own or lease an asset; Retain; Renewal or replacement of asset; Shut down or continue operations, Deduction and collection of tax at source; Advance payment of tax; E-filing of income-tax returns.

NTA UGC NET Commerce Exam Pattern 2020

1. Paper I : It consists of 50 questions from UGC NET teaching & research aptitude exam (general paper), which you have to attempt in 1 hour.

2. Paper II : The UGC Commerce exam (paper 2) will have 100 questions and the total duration will be two hours. Each question carries 2 marks, so the exam will be worth 200 marks. Read below to know the pattern of NET Commerce examination (part II).

Exam HighlightsDetails

Test Duration120 minutes

Total Questions100

Marks per question2

Total Marks200

Negative MarkingN/A

Free Mock Test UGC NET Commerce : Click Here

Online Test Series UGC NET Commerce : Click Here

#UGCNETCommerce #UGCNETCommerce2020 #UGCNETCommerceExam #FreeTestSeries #QuestionsBank #UGCNETCommerceSyllabus #OnlineTestSeries #OnlineMockTest #ImportantQuestionPaper #ImportantQuestion

1 note

·

View note

Text

Why do America’s generations keep getting dumber?

America is the global symbol of individual liberty and opportunity. Defined by capitalism and democracy, the very concepts that have made the U.S. the hallmark in innovative thinking and societal development. With arguably the best ‘system’ in the world able to work at great scale, American renegades have been the frontrunners in many aspects of society many countries wish they could compete with. Walt Disney, Bill Gates, Steve Jobs, Mark Zuckerberg, all American icons for creative thinking and execution. Creative, intelligent men that any company would love to have on their team if they could convince them to come. They’ve accomplished things that some would believe to be impossible, and not only that, they all dropped out of college. The education system failed them.

The current American educational system was first introduced in the 1910′s during the industrial era to create a scaled up version of a youth knowledge assembly line. Children are crammed into large classrooms and are taught general knowledge to enter the next level of education. The strict regimen of be quiet, listen, and regurgitate what you have heard onto a standardized exam to get a letter grade has been used for over a century. This practice is nowhere near teaching a child to think and solve problems. Tests do not work. They do not represent any more than words on a paper. Example, the Chinese Box Experiment. In short, a Chinese professor inserts a test of different Mandarin characters that a robot on the other side of the door must answer. The robot identified every character correctly and returned the paper. The Professor says “Wow, this pupil understands Mandarin very well!”. She is unaware the answers came from a machine programmed by humans. The robot does not actually understand what is going on, it is simply responding with what it’s been told to do. Understanding is using memory to create predictions. However, this is exactly how school teaches children in America. They program children to respond to an input with a correct output, and those that compute such information correctly, are deemed the brightest. If we are programming children to act as robots, robots will win every time, bar none. The only way to fundamentally beat a robot is to be more human. Humans have creativity, emotional intelligence, morals, historical and societal awareness. Schools are essentially building kids like robots in an assembly line. They are writing code in our brains on how to think, act, and behave in many situations. The smartest natural child can be nurtured in such an environment to become average.

The most beautiful aspect of a child is its sense of curiosity and creativity. Left to its own, many will fantasize about spaceships and rockets and trains. They will dance on couches, spill their parent’s coffee on the rug, They ask naive questions about complex issues. I was lucky enough as a child as my father would make me understand how any toy or tool worked when I used it. I was made to inquire about the world around me. How does a car engine work? What could make it better? Why do planes not fall from the sky? I was then sent to day school and would be told to shut up and listen to the teacher, because he is smarter than you. What does it mean to be smart then? To know more information and algorithms downloaded into the hippocampus? Memory is not intelligence. Intelligence and consciousness are manifested in the neocortex. The part of the brain that operates high level thought. Children in American society are suppressed and told to remember things to graduate. After a certain point of indoctrinated thinking, children lose their sense of curiosity and are more focused on execution then the process of learning and solving the problem itself. The most commonly asked question in American schools is “Will this be on the test next week?”.

So how can we make this better? This epidemic starts on the very system of education itself. The end goal of school is to obtain a degree, a rough representation of what college taught you, or maybe you were just wily enough to cheat (which is highly incentivized in the ends justify the means environment.). School’s are not obligated to innovate. Colleges are businesses. They force 18 year old children to take on 200 thousand dollar debt decisions. They don't need all that money. The books that cost hundreds of dollars for students, cost 6$ to make. NO INDUSTRY IN THE WORLD HAS A MONOPOLY THAT BOASTS SUCH GREAT PROFIT MARGINS. Colleges have young generations on a string with the rhetoric that a degree is worth such money. Millions of kids cry joyfully over getting into a school, just to give them money that is taken from loans to enslave them once they get out with a degree. College is enslavement. It is a monopolistic business. It is a shame to see such an important factor to human development being exploited for profit. They pay zero taxes on the profits they make. They teach general knowledge in a lecture style. Is that worth it? Why do kids want this? Why do parents make them do this? Because they did it when they were kids? We are in a new age.

Fast forward over a century later, the digital age. Children have smartphones, smartphones with all the information they need. Why sit in a room listening to someone lecture when you can just look something up? Children are put in classrooms that are part of a school, that are part of a district, that is part of a school board. These scaled up versions of education pump out millions of children with a broad range of general knowledge, or at least that is the intent. Now most of these kids go to college, work a 9-5 job, and start a family and the cycle goes on with their children. That is not fulfillment, that is not happiness for most. The average school tuition has increased by more than 200% while the average salary of college graduates has plateaued since the start of mass schooling. We live in an era of economies of “unscale”. With artificial intelligence and cloud computing, vertically integrated corporations with huge factories and inventory cannot compete with lean, agile startups that rent cloud storage on Amazon Web Services, outsource manufacturing to Chinese factories, and utilize open source Machine Learning algorithms instead of spending great capital to build it all individually. This gives power to creative, niche startups that can effectively run a business from their basement. Think back to the 1990′s. The internet had just gone mainstream, thousands of employees quit their jobs to create internet companies during the Dot-Com Boom before it crashed. They would plan their IPO before even incorporating, this new technology was a home run in their eyes. How does this relate to education? The rapid evolution of technology can be attributed to new platforms. Telecommunications created a global platform for information to be spread from Boston to Australia in an instant, the internet has revolutionized virtually every industry. My generation is growing up in the advent of the AI and cloud computing platform. Essentially, the innovation of big tech platforms should equate to radically different education. However, because school systems have no incentive to change and make less profit, they are still preparing kids for an industrial era to be interchangeable pieces working for large corporations rather than agile startups and small to medium companies.

Artificial Intelligence will radically change education. Harvard, Stanford, and a few other large brand schools have noticed this trend and created online courses already that use machine learning engines to tailor a course to a students understanding. AI can use big data to understand how a pupil learns, what he/she is struggling in, and create a report on their level of thought that is a perfect representation on what they can do, rather than a vague degree. Many companies such as Microsoft and Google are receptive to this and an increasing number of developers enter the software field with no degrees. Because there is no system that could exemplify a student’s intelligence in the past, an expensive degree was the next best thing and college became a booming business but quite an enslaving process for the children utilizing it. AI can guide a student while virtual classrooms and teachers can connect to children across the globe for real organic conversation. Now, the physical classroom is very important for social development and should still be used to an extent. Perhaps we Americans should look towards Finland, the country with the best ranked educational system in the world. Their primary and secondary schools are incredibly different. School days are 3 hours long, there is no homework, and there are no private schools. The philosophy is that kids should be emancipated from the institutions and be left to be kids and develop intuitiveness organically through real world social experiences. There are no private schools so that rich families send their kids to public schools and those parents make sure the school is up to par with what they can afford.This forces schools nationwide to keep a standard that is universal, much unlike the U.S. with many inner city public schools without internet while capitalistic private and public district schools spend money on football field renovations.

To create a more productive generation of students, we must “unscale” education, remove private schools, reduce length of school hours, ban or at least regulate student loan firms, set a price ceiling on all college tuitions and utilize the platform of Artificial Intelligence to create a market of one for all students starting from Kindergarten to beyond college. Hiring more teachers and building would effectively make the problem worse. Teachers can be the greatest minds on the planet, but under such a restrictive there is little hope to save a whole generation. Khan Academy has implemented an unscaled online system, leading the way for more personalized education programs. There is little chance this can happen unless this is derived from the Federal Government, which is famously bureaucratic and slow to act especially with education. Changes are needed. This will make children more excited to learn, ask questions and solve the great global issues that are long overdue to be solved. Kids will strengthen critical thinking skills and experience freedom of thought that will create a wave of further technological development and accelerate American education to new heights.

2 notes

·

View notes

Text

FDI in Retail Sector in India | Foreign Direct Investment in Indian Retail Sector

INTRODUCTION- FDI in retail sector in India After liberalization, changes have been observed in the purchase behavior of consumers with the rise in per capita income and access to multiple brands. Because of the variety of consumers for different brands, all the big global retailers and corporate sectors are ready to invest in the retail sector in India. By the year 2013, the growth rate of the retail industry was expected to be 14%. In order to allow access to foreign brands to Indian customers Government of India in the year, 2006 allowed 100% FDI in single-brand retail. On the other hand, the allowance of multi-brand retail was still in question. There was a time when the parliament had bad arguments on the pros and cons of allowing FDI in the Indian retail sector. The decision of the Central Government of foreign direct investment in multi-brand trading was allowed by the Indian parliament in December 2012. As a result of this, many foreign retailers with 51% ownership opened retail stores where a variety of products may be found under one roof subject to the permission of the particular state government.

Certain amendments in FDI policy for the retail sector in India with respect to single and multi-brand retailing:-

1. Single brand retail – The term single brand has not been defined by the government anywhere neither in any notifications nor in any notices and circulars. FDI up to 100% is allowed in case of single-brand retail in what subject to certain conditions that are:-

only selling of brand products will be allowed ( even if the same manufacturer produces multi-brand goods it will not be allowed)

even internationally, the same brand products should be sold.

when the products are being manufactured, it must be branded.

if any new product has been added under single brand fresh approval of the government is necessary.

Terms and conditions:-

Even of the goods were produced by the same manufacturer, no other brand different from a single brand would be allowed to be sold. Foreign direct investment policy in single-brand basically means retail store FDI can sell only one brand products. For example, if Reebok have been allowed permission of FDI in stores in India those retail stores shall only be allowed to sell their products of Reebok and not Adidas.

1. Multi-brand retail- Just as single-brand retail multi-brand retailing has also not been defined by the government. In layman’s language basically means that under one roof retail store with FDI in different brands can sell different branded products. Examples of multi-brand retailing would include Tesco, Walmart, etc.

WHAT IS RETAILING?

According to Philip Kotler, retailing is basically selling of products and services to the consumers for their final consumption and not for resale.

THE RETAIL SECTOR IN INDIA

The retail sector in India is one of the most important sectors. It is regarded as the 5th largest retail destination and the second most attractive market for investment globally. Since the Indian retail sector is very popular and growing at a very fast pace so with the growth of the sector the rise in awareness the quality products and brands is also to be taken into consideration. Indian retailers have made life easy, quick, convenient, and affordable. The most popular players in the Indian market are Reliance, Tata’s, ITC etc. FDI in single-brand retail with a 51% opening has led to the entry of companies like Reebok, Nike, etc.

SIZE OF INDIAN RETAIL SECTOR

Due to its unorganized nature, it is very difficult to know the true size of the Indian retail sector. In 2012 the unorganized sector employed 22 million workers, which has decreased from 18 million into 2001. On the other hand or organized sector has employed less than a million workers. Thus the Indian retail sector is the second-largest amongst all. It can be concluded that the toughest challenge for the retailing industry in India to compete with is the competition from the unorganized sector. The tax system of India is also for the benefit of small retail businesses leading to the high cost of business operation in India. Short and external factors affect the retail industry, such as the government’s rules, regulations and policies.

Consumer purchasing power has not consistently been increasing, thus, it becomes difficult for the economy to emerge from the recession. Due to various rules of banks in lending, consumer spending could contract in the future. Thus the absence of FDI policy in Indian retail sector could even worsen the situation of retail sector. FDI policy in Indian retail sector can remove all the limitations such as infrastructure, unemployment, lack of technical know-how, etc.

ADVANTAGES

INTRODUCTION OF NEW CAPITAL- Since most of the retailing sector of India depends on the supply chain logistics. Therefore, a good mode of transportation communication and infrastructure of the storage area could help provide not only timely and uninterrupted market access to producers but also make sure of good quality and lowest priced products to consumers. For example most of the time it happens that there is no proper storage infrastructure and the farmers do not have anyone in the market that could be the farmers a fair price and cut short the middleman involved in it. Due to this the middleman page the farmer lower prices for their walk and charge higher prices from the retailers. All social there is no proper place of storage and don’t know proper means of transportation most of the producers of farmers are destroyed in the process of transportation and the customers have to ultimate Lee bear and pay higher prices for really low-quality products. Therefore allowing FDI in the retail sector in India in a long way helps to bring out a solution to these problems.

BETTER TECHNICAL KNOW HOW- By allowing FDI in retail sector that will bring along some advanced technological knowledge that will increase productivity. For example improve the process of grading, handling, packaging of goods, using of cold storage facilities, reduction in wastage,etc. All these will eventually improve the quality and lower the prices for consumers.

CONSUMER’S WELLBEING- The entry for foreign retailers in the market will allow your customers to get access to a wide variety of products of different brands. In addition, everything will be provided on the man grow such as hygienic environment in the area of shopping, proper space for product displays, large number of products in one place and better customer service for consumer satisfaction.

EMPLOYMENT GENERATION- FDI in retail sector employment opportunities to young people in the organized sector. Higher wages, better working conditions, the quality of the jobs, standard of living, all will be taken into consideration if FDI is allowed.

BENEFITS TO FARMERS- In today’s world, the intermediaries have dominated the market. They act as a middleman between manufacturers or producers and consumers as a result of which the farmers and manufacturers have lost their profit margins because most of them have been taken over by the middleman. By the entrance of FDI, this problem will be solved as the farmers will get contract farming where they have to supply to the retailer based upon the demand and will get a fair price in return, and they don’t have to search for the buyers.

Click here for- ODI BY INDIAN COMPANY

DISADVANTAGES

HUGE LOSSES OF JOBS- India being a developing economy, the level of development is not up to the mark. With the entry of FDI, there is a huge threat from big companies like Walmart, which will force all the small independent stores to shut, and this will lead to huge losses in their jobs.

THE LOSS STRATEGY– Being big giants lowering the prices initially will not affect them much. So they will intentionally lower the prices to enter the market and knock out all the competition and become Monopoly and then raise later on the prices in the market, leaving no option for consumers other than buying from them. Examples- Pepsi and Coke.

UNFAIR COMPETITION- Entry of FDI will lead to an exit of domestic retailers all the small family managed outlets will lead to huge loss of jobs of persons who are employed in the retail sector in India.

NON UNIFORM TAX SYSTEM

CONCLUSION

In an attempt to try to balance the opportunities and threads which is attached with the entry of FDI in Indian retail sector it can be concluded that the entrance of FDI will surely improve storage system, procurement process, have the farmers benefit from FDI in order to get better prices for their produce, better infrastructure, cutting down intermediaries, etc. But the move of the government to increase the limit and single-brand retail from 51 % to 100% in 2012 and also giving green signal to multi-brand retail in India necessary steps must be taken in order to avoid any Monopoly from the foreign markets. Otherwise, these big companies with huge investment capacities will buy all the products at lower rates and give consumers big discounts initially and will cut all the domestic retailers from the market and will stand as a monopoly market of all the branded products in India. The government must set a discuss all the pros and cons that will ultimately of affecting our domestic retail market by allowing 100% FDI. The main question is, when the all the foreign countries do not allow any import of food products from India, then why should India allow the foreign countries to have a saying in its retail sector? 100% FDI can have a negative impact on the Indian retail market and farmers in the long run. It will undoubtedly create a Monopoly in the market, which is not good for the growth of the Indian economy. Do it is done keeping in view the benefits of farmers to get a good and fair price for the product and improve their storage facilities but all these are just temporary benefits which the foreign market is intentionally putting forward to enter Indian retail sector and cut down the domestic competitors from the Indian market. After all the history says it all that the beginning is always good for example entrance of East India Company, thus, whatever the government decides in lieu of the benefit of Indian retail sector it must look into the pros and cons and put down some terms and conditions for the foreign investors so that the domestic sector of India has opportunity to get benefits out of those foreign markets and also not get swayed away from the foreign investors.

More Information Click Here: https://www.letscomply.com/fdi-in-retail-sector-in-india-foreign-direct-investment-in-indian-retail-sector/

Contact Us:

+91-97-1707-0500

https://www.letscomply.com/

0 notes

Text

WHY I'M SMARTER THAN FOUNDERS

We are still very suspect of this idea but will take a meeting as you suggest. Working for a small one, and actually did.1 Understanding growth is what starting a startup: growth makes the successful companies so valuable that all the time, I would have laughed at him. You can't make a mouse by scaling down an elephant.2 Fundamentally the same thing. The culmination of my career as a writer of press releases was one celebrating his graduation, illustrated with a drawing I did of him during a meeting. Other kids' opinions become their definition of right, not just because they so often don't, but because you shouldn't have a fixed amount of deal flow, by encouraging hackers who would have gotten jobs to start their own startups instead. I wanted to start a startup.

Nerds don't realize this.3 We're default dead, but we're not fucking.4 If the founders aren't sure what to focus on your least expensive plan.5 They don't consciously dress to be popular. As jobs become more specialized—more articulated—as they develop, and startups have lots of meetings but isn't progressing toward making you an offer, you automatically focus less on them. One founder said this should be your approach to all programming, not just startups, and in particular that the environment in big companies is toxic to programmers.6 Its length and slope determine how big the company will be a flop and you're wasting your time although they probably won't say this directly. And conditions in our niche are really quite different. When Steve and Alexis auctioned off their old laptops for charity, I bought them for the Y Combinator museum.7 The world seemed cruel and boring, and I'm not sure which was worse. If there are any laws regulating businesses, you can start as soon as the first one is ready to buy.

So the randomness of any one investor's behavior can really affect you. He said he has learned much more in his own image; they're just one species among many, descended not merely from apes, but from microorganisms. When the values of the elite in this country is a policy that would cost practically nothing. When your fundraising options run out, they usually run out in the same area, they had a different goal. I think it needs even more emphasizing.8 It is enormously fun to be at least $50 million. And popularity is not a new idea. One's first thought when looking at them all is to ask if there's a super-pattern, a pattern to the patterns. You should always talk to investors your m.

If you judge by the median rather than the average. And indeed, the growth in the first place. During Y Combinator we get an increasing number of companies that have already raised amounts in the hundreds of thousands. It took me surprisingly long to realize how distracting the Internet had become, because the VCs need them more than they originally intended.9 As you go into a startup, things seem great one moment and hopeless the next. You have to seem confident, and you need to be hackers to do what we do.10 That means closing this investor is the first priority, and you get what you deserve. We do a lot of implications and edge cases. Like any war, it's damaging even to the winners.

If you're designing a chair, that's what you're designing for, and there's no way around it. The reason is that good design requires that one person think of everything.11 That's the key. Why? When I have to say, not at all, because if I'd explained things well enough, nothing should have surprised them. Don't keep sucking on the straw if you're just getting air. Raising $20,000 from a first-time angel investor can be as much work as raising $2 million from a VC fund.

In the US things are more haphazard. Whatever the story is in the form of dividends.12 It's harder to judge startups than most other things, because great startup ideas tend to seem wrong. Tell them that valuation is not even the protagonists: we're just the latest model vehicle our genes have constructed to travel around in. If normal food is so bad for us, why is it so common? The most intriguing thing about this theory, if it's right, is that it has started to be driven mostly by people's identities. This essay is derived from a talk at the 2009 Startup School. Viaweb we were forced to operate like a consulting company you might be able to make himself one. Reward is always proportionate to risk, and very early stage startups and then ruthlessly culling them at the same rate.13 A country that wants startups will probably also have to reproduce whatever makes these clusters form. There are now a few VC firms outside the US, because they don't want random startups pestering them with business plans.14

We had 2 T1s 3 Mb/sec coming into our offices. That difference is why there's a separate word for startups, and why, if they have some other advantage like extraordinary growth numbers or exceptionally formidable founders. And yet, making what works for the user doesn't mean simply making what the user tells you to. But I also mean startups are different by nature, in the sense that all you have to be a police state, and although present rulers seem enlightened compared to the last, even enlightened despotism can probably only get you part way toward being a great economic power. This varies from field to field in the arts could tell you that you might want different mediums for the two situations. Great universities? What weaknesses could you exploit? My stock gradually rose during high school. Which almost always means hiring too many people. It's so important to launch fast is not so bad, the kids adopt an attitude of waiting for college. Some investors will let you email them a business plan, but you weren't held to it; you could work out all the details, and even make major changes, as you finished the painting.

Three months later they're transformed: they have so much more confidence that they seem as if they've grown several inches taller. You can measure how demoralizing it is by the number of new customers, but it wasn't designed for fun, and mostly it wasn't. So when someone commits, get the money you need, so you can say you've already raised some from well-known investors. And this started to happen more and more desirable things. Startups are marginal. You probably didn't have a precise amount in mind; you just want to make it a much more common one. This is especially true for a service that other companies can use, because it requires their developers to do work.15 How can they get off that trajectory? All the scares induced by seeing a new competitor pop up are forgotten weeks later.16

Notes

One source of difficulty here is defined from the end of World War II had become so common that their system can't be hacked, measure the difference between good and bad outcomes have origins in words about luck. This would add a further level of links.

Robert Morris points out that this filter runs on.

From the beginning even they don't want to create a web-based applications greatly to be able to buy stock, the last place in the ordinary variety that anyone wants.

Watt didn't invent the spreadsheet. I bailed because I realized that without the methodological implications. How much better, because to translate this program into C they literally had to for some reason, rather technical sense of getting rich from controlling monopolies, just that if you pack investor meetings as closely as you raise them. When investors ask you to raise more, and mostly in Perl, and power were concentrated in the last they ever need.

The unintended consequence is that the worm might have to do it is still what seemed to someone still implicitly operating on the aspect they see of piracy, which people used to wonder if they stopped causing so much on luck. You owe them such updates on your thesis. If you're the sort of community. There are some whose definition of property is driven mostly by hackers.

The person who wins. One professor friend says that 15-20% of the movie Dawn of the next downtick it will seem dumb in 100 years, it could be adjacent.

I assume we still do things that don't include the prices of new stock. Though in fact they don't know whether this happens it will become as big a cause as it might be a special name for these topics.

But there's a continuum here. Eric Horvitz. The air traffic control system works because planes would crash otherwise.

There is of course there is at fault, since they're an existing investor, than a huge loophole.

They say to the decline in families eating together was due to fixing old bugs, and the reaction of an investor who says he's interested in you, however, you can't dictate the problem is not just that if you have to go out running or sit home and watch TV, music, phone, and that injustice is what you care about may not have gotten where they all sit waiting for the linguist and presumably teacher Daphnis, but hardly any type I. I now have on the group's accumulated knowledge.

But the result is that you'll expend a lot of investors. How many times larger than the don't-be startup founders tend to be a hot startup. But the result is that there are few things worse than Japanese car companies, summer jobs are the only companies smart enough to do wrong and hard to make you feel that you're not even allowed to ask for more than that.

There were a variety called Red Delicious that had other meanings.

Nor do we push founders to have to rely on social ones. Ed. He couldn't even afford a monitor is that the usual way of doing that even this can give an inaccurate picture.

At some point, when they talk about the details.

You could feel like a little worm of its own.

But if you like doing. As Jeremy Siegel points out, First Round excluded their most successful founders still get rich, people who had made Lotus into the subject of wealth for society. According to the home team, I've become a genuine addict. The same goes for companies that an eminent designer is any better than Jessica.

Thanks to several anonymous CS professors, Robert Morris, Jessica Livingston, and Alex Lewin for reading a previous draft.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#investor#stage#Dawn#meetings#thought#attitude#someone#despotism#times#investors#clusters#Thanks#Robert#Reward#startups#topics#VCs#values#years#growth#average#jobs#plan#mediums

0 notes

Text

A test for Costs Subadditivity in the Fishery Sector- Juniper Publishers

Abstract

The seminal work by Baumol et al. [1] has highlighted the importance of analyzing firms' costs structure. This allows to design proper policy measures and to understand the impacts of those policies in markets. The note presents an original method and an application for testing costs subadditivity in the fishery sector, by using a system of supply functions under strict conditions and assumptions. The method is practical, though robust, and can be appied in the absence of detailed data on costs structures. Under stringent hypothesis (that delimit the application) they can be inferred from the supply functions. Subadditivity in costs, in fact, is a more proper economic definition (and methodological approach) than traditional economies of scale in fishery. The latter, in fact, does not depend from the vessel technology, but on the degree of quantity and variety of fish species in the ocean.

Introduction

Fishery vessels are multiproduct firms. The multiproduct firm's structures of costs and technology are important determinants of multiproduct industry structure. The seminal work by Baumol, Panzar & Willig [1] has established theoretical conditions for the existence of multiproduct cost advantages that can be achieved by specialized or diversified firms according to the scale and scope of their production. The concept of cost subadditivity provides an additional measure by which to characterize the multiproduct cost structure. Costs subadditivity is a property that characterize production costs. It implies that production from only one firm is socially less expensive (in terms of average costs) than production of a fraction of the original quantity by an equal number of firms. Investigating the existence of costs subadditivity (or superadditivity) is not (only) an academic exercise but can provide important hints for policy guidance. In fact, a vessel with super-additive costs can save money by braking itself into two or more divisions. Most probably, unless there are factors that preclude such decentralization, we would not expect to observe profit-maximizing firms operating at super-additive costs. In that case, subsidies could be awarded in order to minimize the vessel losses, when the "main" problems should be diagnosed at the cost function level, and the "consequential" measure be taken at that level. On the contrary, a firm with subadditive costs, may enjoy cost advantage that [1] either make subsidies inefficient or improper, [2] or render any kind of antitrust policy absolutely not apt, if the firm enjoys dominant positions due to efficient production that is represented by costs subadditivity. Such analysis can also apply to tackle the effects of policies that impact costs of production inputs, including labour, as in the case of the landing obligation [3].

It is also important to highlight that subadditivity in costsis a more proper economic definition (and methodological approach) than traditional economies of scale in fishery. The latter, in fact, does not depend from the vessel (firm) technology, but on the degree of quantity and variety of fish species in the ocean.

Formally, a cost function is said to be subadditive at an output vector, say q, if and only if it is cheaper for a single firm to produce q than to split it among more than one firm in any fashion. In formal terms: the function c(q) is subadditive at the output level “q if and only if c('q) where non-negative “q^i are that

In the case of fishery, for instance the possibility to fish different species with the same device mostly depends on the sea productivity and variety of species. This allows, a "savings" in the costs, e.g. costs subadditivity. According to Baumol et al. [1], in the theory of contestable markets, costs subadditivity might favor a market structure characterized by few firms operating in the sector (natural oligopoly and natural monopoly).

This means that the current technology allows multiproduction (e.g. simultaneously fishing different species with the same net or trawl) at a lower cost than separate production of each output that is multi-produced. In this perspective, total costs are lower than in the case the vessel had to use a different device for every type of species. Economies of scope exist if the costs of producing each product separately exceed the costs of producing all products jointly. Economies of scope and declining average incremental cost for each product are sufficient conditions for subadditivity. The presence of cost subadditivity would suggest that some form of fishermen's monopoly is appropriate on private efficiency grounds. The monopoly could be private, or could entail complete government ownership and control, or could include extensive government coordination and regulation as is found in north, or could consist of a set of single-product firms contracting among themselves [4].

The note presents an original method for testing costs subadditivity in the fishery sector, by using a system of supply functions under strict conditions and assumptions. The method is practical, though robust, and can be applied in the absence of detailed data on costs structures. Under stringent hypothesis (that delimit the application) they can be inferred from the supply functions.

The note is organized as follows: section 2 presents a survey of the (scarce) economic and econometric literature that has produced test for subadditivity in industries. Section 3 presents an original methodology, by developing testable implications and testable empirical specifications, under stringent conditions.

Tests of Cost subadditivity: a Survey of the Literature

Tests of cost subadditivity are difficult to devise, since one of the requirements is global knowledge of the cost function, while local knowledge in the neighborhood of the point of approximation is usually the best that can be achieved. Acceptance of local subadditivity then provides a sufficient condition for global cost subadditivity [5]. Although Baumol et al. [1] provide both necessary and sufficient conditions for cost subadditivity, the long-run multiproduct cost function allows only local sufficient conditions. Failure to establish cost subadditivity will then not preclude its existence. Tests of cost subadditivity specify all factors of production to be in full static equilibrium and outputs as exogenously fixed. In general, cost subadditivity requires economies from proportional expansion of the product vector along an output ray and economies arising from product combinations along a cross-sectional hyperplane[1].

The Evans-Heckman [5] test for subadditivity implies a two-product industry where all firms have access to the same technology. The cost function C(q1, q2) is locally subadditive at

With i = 1 n.

For at least two ai and bi not equal to zero. The test computes (2) for an admissible range of outputs and allows for local subadditivity. The degree of subadditivity can be measures as:

Where φ and ω are parameters that satisfy 0 ≤ φ ≤ 1 and 0 ≤ ω ≤ 1. If Subt (φ,wω) is less than zero, the cost function is subadditive with respect to the industry configuration at the selected time t. If Subt (φ,ω) equals zero the cost function is additive; if it is larger than zero the cost function is superadditive.

Another (indirect) way to test for subadditivity, is looking at the existence of economies of scope in the industry. Scope economies (diseconomies) are reflected into cost savings (cost disadvantages) associated with the joint production of many outputs. Economies of scope exist if the costs of producing each product separately exceed the costs of producing all product jointly. Economies of scope and declining average incremental cost for each product are sufficient conditions for subadditivity. The average incremental cost of output i, when the total output vector is q~, is the cost of producing out vector q~, minus the cost of producing all of q~ excludingproduct i, divided by the output of i, q'i. [5]. Scope economies are a necessary (but not sufficient condition) for costs subadditivity.

Suppose that the multi-product cost function is represented by C = C (q; w) where q = (q1, q2, q3) is the quantity of three different outputs and w = (wL, wk, wF)are respectively the prices of labor, capital and other inputs. Local measures of global and product-specific scale and scope economies can be easily defined. The measure of global or aggregate scope economies for our three-output case can be computed as:

with SCA> 0 (< 0) denoting global economies (diseconomies) of scope.

Product-specific economies of scope for output i are

where C(qi; w) is the cost of producing only output i, and Si >0 (<0) indicates a cost disadvantage (advantage) in the "standalone" production of output i.

Vessels as Multiproduct firms: a Tentative Test for Subadditivity in Fishery Production

Vessels can be considered as multi-product firms because they can fish a variety of species (given the sea productivity) with the use of the same technology and capacity. This allows in saving on costs, and might imply costs subadditivity. The individual vessel multi-product supply curve is:

where qn, is the quantity of n species caught and sold by the vessel; cn, are the vessel's production costs and on pn, the market price for n types of caught species. Vessels are price-takers and price at marginal cost. Therefore, the supply function is also the cost function

Given, c(qn) =p(qn) the supply function ithe supply function is ^

The assumption of marginal cost pricing is required to fully exogenize prices and costs and keep multi-product quantities as only control variable. Such assumption is grounded on the evidence that fish prices are determined by the market (no collusion among firms) and are pretty similar among all vessels. Given the above assumptions, our exercise implies two steps [69].

Step 1 We empirically estimate a system of supply functions (which are also the costs functions) for n different products. Required data are produced quantity for each n species and related price for each species [3].

Step 2 Recalling that a cost function c(q) is subadditive at the outfut level-q if and only if , where non-negative -q^ Aiare that then there is costs subadditivity at the output level “q, where a perfect competition market-defined price if and only if As necessary condition, when estimated parameter for quantity/quantities present negative estimated sign then we can assume costs subadditivity [3] at certain output level. An increase in prices/costs might generate a corresponding decrease in output quantities, in the relationship described by the supply function, which usually imply a positive relationship price/cost/produced quantity. This can be interpreted as a symptom of costs subadditivity. If detailed data on costs are available the usual Evans-Heckman test can be applied.

Conclusion

The note presents an original method for testing costs subadditivity in the fishery sector, by using a system of supply functions under strict conditions and assumptions. The method is practical, though robust, and can be applied in the absence of detailed data on costs structures. Under stringent hypothesis (that delimit the application) they can be inferred from the supply functions. The method can have important policy implications. Analyzing the structure of the firms' costs allows to design proper policy measures and to understand the impacts of those policies in markets (Appendix 1).

Appendix

*= 10% statistically significant; **= 5% statistically significant; ***= 1% statistically significant. FAO 3-alpha code (MON: Monkfish; EOI: White octopus; HKE: European hake; JAX: Horse mackerel; MTS: Mantis shrimp; MUT: Red mullet; SQM: Squid; BOY: Purple murex; CTC: Cuttlefish; OCC: Common octopus; SAN: Sand eel; SBG: Golden seabream; SOL: European sole).

To Know More About Journal of Oceanography Please Click on: https://juniperpublishers.com/ofoaj/index.php

#coastal science#Aquaculture#fisheries research#Juniper publishers Address#Juniper Publishers Indexing

0 notes

Text

Juniper Publishers- Open Access Journal of Environmental Sciences & Natural Resources

Price Policy of Drinking Water in Tunisia: Panel Application

Authored by Terzi Chokri

Abstract

This paper focus on policy of drinking water demand with application on Tunisian panel data. We estimate a model which explains consummate volume by the five slices of tariff corresponding to the progressive pricing. Long term results show that prices UP1, UP3 and UP5 has no effects on the preservation of the resource. Contrary to these three prices, UP2 and UP4 can be represented as a regulating mechanism. Concerning the global short run results, we notice that the coefficients of the prices UP1, UP3 and UP5 are negative what explains that these prices have an incentive effect. For the interregional short term results, price UP1 coefficient is negative and significant which mean that the proportion of the households which consume less than 20m3 is important within every governorate. The price UP2 which affect positively and significantly the consummate volume of drinking water represent a regulating mechanism.

Introduction

The management of drinking water demand can take numerous forms of the direct measures of regularization of the water use, until indirect measures aiming at the voluntary behavior. The non-tariff policy consists in calls launched to the public by awareness campaigns with educational programs and of similar initiatives which ended in deep modifications in the human behavior towards the preservation and towards the use of the water. The management of the demand constitutes the new policy of the World Bank regarding the resource management in water. In this approach, the instrument price can guide us in a rational use of the resource in water. Indeed, the price appeared as an incentive mechanism which urges the users to use the water in a more effective way. Besides, the price encourages the distribution companies of water to improve their qualities of the services, to satisfy the preferences of the consumers by the technical and financial means. So, a good management of the resource in water requires the adoption of a mode of pricing which allows supplying in a regular way the water to the various users with quantity and with quality satisfactory. This mode of pricing also allows avoiding any kind of overexploitation and the degradation of resource. A policy of sensible pricing has to answer at least four types of consideration: a use as effective as possible of the existing production capacity, an expansion of the capacity according to an evolution ofthe demand which is in touch with the real cost of the committed resources. The realization of the financial equilibrium and finally the considerations of social equity in the management of the resource in water. So the objective of the present paper will then be to analyze the policy of the drinking water in Tunisia.

Pricing of the Monopoly

In the case or the technological and economic specificities are based on services of water and purification of a natural monopoly, the organization of the market drives to a valuable fixation above the marginal cost (to avoid that the company makes losses because of the presence of the important fixed costs). However, the fixation of a high price for produced quantities cannot be the situation which corresponds to the social optimum. To save itself of such inefficient situations, the government has to take care of the property of the monopoly. So, the public authority can choose to produce itself the service what allows to reach the optimum Paretien (pricing in the marginal cost). But it should be noted that it is possible for the public authorities to attribute the management of the service to a private enterprise while regulating (use contracts-objectives). However, since it is difficult to oblige the company to produce at a competitive price (in the marginal cost), the government is in the obligation to subsidize the company by fixed transfers allowing them to cover its losses. One of the main objectives of the government aims at the fact that the services of the water assure the access for all to a drinking water of satisfactory quality for the consumers. At this stage, social approaches of pricing are possible and often practised (as the supply of free collective water, the payment of a part of the invoice either a pricing by stages croissants, with the supply of a quantity limited by low-priced drinking water).

Pricing and Demand in Water

Generally, the demand in drinking water is relatively inelastic with regard to the price. This is justified by the fact that the water is an essential good where there is no substitute for the most part of the users and is considered as the complementary good for a lot of consumer goods. In the practical case, it is difficult to estimate a function of demand of drinking water, because of the systems of current pricing and the impossibility to arrest quantitatively the water consumption of the households (the individual data are rare, there is a multitude of modes of management). The used scales of pricing are generally not linear, they are presented or under a shape binomial (a fixed part and a variable part according to the consummate volume) either multinome (progressive or decreasing pricing). The economic theory considers a function of demand which integrates the demands of the goods substitutes and complementary and also the constraint of income. Generally, the price of the water is not exogenous in the consummate, but especially endogenous volume because of the influence of the volumes distributed on the costs of potabilisation some water. The theory suggests that the whole price list is included in the function of the demand of the drinking water, but this is excluded for practical reasons. In this context, the literature which is interested in the development of the model of the function of demand of the drinking water, aim at testing empirically the hypothesis according to which: with which price (average or marginal) the consumers react when the water is sold by a scale multi-block [1-4]. Proposes a simple procedure which consists in incorporating at the same time the average price and the marginal price into the equation of the demand. The marginal price represents the price of the slice of consumption which exceeds the last block in which took place the consumption. On the other hand, the average price is obtained by calculating the average of the average prices of every slice of consumption. This average price includes all the fixed and variable costs [5]. Suggests taking into account the intra valuable structure - marginal; by including a said variable of difference in the estimation. This variable corresponds to the difference between what pays actually the consumer, and what he would have paid if his total consumption had been priced at the marginal price. The value of this difference will be positive under a progressive scale, and negative under a decreasing scale. The variable difference measures in theory the returned effects engendered by the fare structure. For a progressive or decreasing price list by slice, the difference having respectively the effect of a tax (economy realized for the consumers) or of a subsidy. The approaches proposed by specification of the demand presented up to here show some gaps. Indeed, they do not integrate into the problem of maximization of profit of the consumers the choice of the block in the structure of pricing. This choice appears as endogenous in the diversion of the demand in water. For that reason, the search for a function of demand of drinking water stays always an objective to achieve by several studies.

According to [6], the analysis of the demand of drinking water is especially focused on needs. The quantity of consummate water and the prices depend particularly on the evolution of the population, as well as on their lifestyle. The researches for the estimation of a function of demand of drinking water are rare and have especially an exploratory character, because the consummate quantities of water are often disconnected from the real costs committed by distribution companies. Among the works which were interested in the estimation of the function of demand of drinking water, we can quote the works which are given by [7]. And which put in relation the consumption and the price through an in section transverse analysis. Besides, and from a study concerning the demand of drinking water, Point (1993) puts the point on the problem of sharing of the resources between the various users. To do it, he takes into account three categories of use, the commercial, industrial and domestic use. The results show that the elasticity price becomes established around -0,167 with regard to the average price, for the department of the Gironde in France [8]. Insist on new aspects of the consumption. In this context the estimation of the request of the drinkable water supply, on all the territory in Tunisia, and for the domestic use in 2004, led to a function the elasticity of which was around - 0,42 with regard to the average price.

Price of Drinking Water in the Domestic Use

Generally, the origin of the problem of the price of the water for the households is essentially due to the part of the level of the price of the water with regard to income. In this case, the principle of solidarity in the field of the drinking water has to be made by the creation of the dimensions of integration of the considerations: social, environmental and economic. Let us note that this solidarity between small and big consumers aims at reducing the average price of the water for the small consumer with regard to the average price for a big consumer. The progressive pricing which takes into account the diameter of the meter, the size of the connecting to the subscriber and the volume of consummate water, ignores the socioeconomic characteristics of the subscriber. These characteristics present a fundamental factor to realize a social solidarity in the consumption of the drinking water. But this does not prevent that this pricing engenders some advantages. Indeed, the theory shows that a progressive pricing, can create an important financial transfer when the group of big consumers is brought to support 75% of the total costs for 50% of the total consumption, while the group of small consumers could pay only 25% of the total costs. In this case, the earnings by the small consumers become half of the normal price which they would have paid in principle, and the transfer between these two categories of consumers concerns 25% of the total costs of the water. The fact that the first low-priced slice concerns only few households and not all represent a criticism of the progressive pricing. However, for the poor and numerous families, the passage of a slice of consumption in another one becomes perfectly possible. In this case the role of the social slice in the social considerations of the households disappears. Because of this criticism of a progressive pricing, several countries look for solutions suited to reach certain social goals. In Tunisia, an envisaged solution consists in the use of a system in five slippery slices which stipulates that only the households the consumption of which does not exceed the ceiling of the fifth slice could benefit from a first low-priced slice. This procedure allows creating a phenomenon of incentive for the consumption of the resource. In other words, the pricing for the superior slice can involve a significant additional cost for certain users capable of covering the cost for the lower slices. The price of the superior slice is 5,8 times worth that of the lower slice. Besides, in some developing countries, the ceiling of the first slice varies with the number of people in the household. In this case, we get closer to the social pricing.

Empirical Validation

Model

The policy of the price of the drinking water in Tunisia was essentially based on a progressive pricing by slice of consumption. The objective of this strategy is to rationalize the consumption of the water which is very useful for the humanity. The application of a progressive pricing in the management of the water on all the Tunisian territory leads to a principle of regulation to manage well and preserve at best this rare resource. In this theme, we estimate an econometric model with the aim of distinguishing price slices affected by every governorate.

Where CV is the consummate volume, UPJ are the unit prices of the five slices, i = 1.....,21 represent the Tunisian governorates t = 1997,....... , 2012 and is the time.

Results and Discussion

The estimation of the model concerns the effects of long and short-term of every slice of price on the consummate volume. The application of unit root test in panel data (IPS, ADF and LLC) shows that all our variables are not stationary in level and become stationary after one differences which mean that are I(1). The result of this test led to us to test the cointegration of our model. Pedroni cointegration test confirm the presence of cointegration in our model then the long-term relationship exists between the variables. In this case, our model is a VEC one and it can be estimated using FMOLS, and ARDL specification method Table 1.

The estimation of the basic model showed that the five prices are significant in short term. The coefficients of the prices UP1, UP3 and UP5 are negative what explains that these prices have an incentive effect on the structure of consumption of the drinking water. On the other hand, the prices UP2 and UP4 represent no effect on the consummate volume. However and for a long-term tendency, prices UP1, UP3 and UP5 has no effects on the preservation of the resource Table 1. Contrary to these three prices, UP2 and UP4 can be represented as a regulating mechanism of the consumption in long term of the drinking water. Now, we focus in the interregional analysis to study the effects of different prices on 21 governorates of Tunisian territory Table 2.

*Significant at 10% **Significant at 5% *** Significant at 1% According to (Table 2) above, it appears the error correction term is negative and significant for all governorates which confirm the long term relationship. The price UP1 coefficient is also negative and significant for all governorates, this mean that the proportion of the households which consume less than 20 m3 is important within every governorate. The price UP2 affect positively and significantly the consummate volume of drinking water in the majority of the governorate. This price seems representing a regulating mechanism in short term as for the long term. All other prices are globally not significant for the majority off governorates.

Conclusion

The regulation of the management of the drinking water, the pass by the creation of fare structures which present a number of important elements to be taken into account. The search for the equity (between the various categories of consumers and between the consumers of the same category), and the necessity of getting itself the sufficient global recipes to face financial commitments in term of protection of the resource, stay objectives to achieve. It of other term, fare systems have to end in the acceptance and in the consumer confidence and it by the distribution of a quality improved to avoid any notable danger of health. The choice of organization and regulation of the public services of drinking water and its impact on their quantity, the quality, and their price, are a priority concern of public decision-makers. The objective of the regulation being to reach an effective management of the services. Indeed there are three main criteria to estimate their performance. The first criterion is the static efficiency which defined by the absence of wasting in the resource management, and by the minimization of the costs of service. The second criterion is the efficiency allocative which requires that a rare resource is assigned to the users so that the economic value of this resource is maximized. The third criterion is the productive or technical efficiency which is a dynamic process which depends on efforts of adaptation of the developer (training of the workforce, the investment the research and development of which ... etc.), to reach has a lower production cost.

For more articles in Open Access Journal of Environmental Sciences & Natural Resources please click on: https://juniperpublishers.com/ijesnr/index.php