#r ip Stephanie ]

Text

|| Enemies to Lovers but one is Injured | @hopingforjustice asked: “ you’re bleeding. “

“What? No, no it’s fine...!” hands scramble to the tear in her thigh, thin wound weeping too smoothly for it to be cared for later, but in their current predicament Stephanie would have to make due with whatever was left in the saddle bag before she could properly treat it. She just had to hope the bleeding would stop soon.

Unraveled gauze was pressed haphazardly to the site and held together with makeshift metal clips altered from the pieces of metal she had saved in her bag. Honestly what had even happened just now? The last thing she remembered was that Johnny Joestar and his partner getting too close for comfort and then this brief bought of chaos before being left in the literal dust. Stephanie looks over to the young girl with furrowed brows and a glint of worry in her eyes. Had she been hit too? There’s nothing visible that jumps out to her view, but Stephanie can’t help that long forgotten instinct of caring over someone she deemed close enough to her. Maybe being in this race with this poor girl was starting to soften her up.

“Are you okay, Emily? You didn’t get hit too, did you?” Voice laced with concern, Stephanie’s features soon shift and darken as she looks back towards the horizon where the former duo continued on. This race was starting to become personal on a whole new level. Prize be damned, she would make sure those who crossed her would suffer in the end.

“I think we’ll have a new agenda on our hands soon enough...”

#hopingforjustice#v; we're off to the races places ready set the gate is down and we're goin' in [jjba]#[ how embarrassing is it to get shot with a nail bullet and then worry abt bleeding out bc of a blood condition akljhskjlhf#r ip Stephanie ]

4 notes

·

View notes

Text

Marinette did not sign up for this part 10: Mari plots plotting

So long time no post. I live. Ish. Also finally figured out readmore on mobile, so yay. Will take forever to edit posts now though. Explanation at the bottom First part here previous part here. Ao3 here

Marinette wanted to go on record that Mandeliev did not, in fact, give her an extra day or so to study for the test. Why? Instead, she was told she may do a paper on the application of physics in gymnastics and principles of evasion in urban areas and how to combine the two to maximize one’s ability to run away from akumas and other dangers.

Or as Nino put it: “I am tormenting you into running better, the eight page essay.”

Alya dubbed it the “Run Better Paper.”

Aurore said it should include more formulas when Marinette showed her the draft. (as Adrien would complain about lack of theories and how she should have used this advanced formula she’d never heard of instead and then Marinette would have to forcibly stop him from taking over her paper. Again.)

Kim had taken to keeping her in his hoodie, escorting her to the bakery and didn’t leave her alone until Adrien said it was his “Marinette Anxiety Watch” shift.

Which she would like to go on record, is just plain mean to say. She has Liar 100% under control when world ending things and metaphorical bomb drops aren’t happening to her constantly.

—-

Bruce tried to contact Diana and Arthur again. Hal was off world, and therefore useless.

Why?

As his missing son hadn’t contacted them yet. Was still in the Miraculous team’s custody. And he saw the footage of Robin—Damian—being hunted by a lving shadow, an element casting swordswoman, and a strategist that seemed to know exactly what to do to keep Robin cornered in battle. The living shadows—Chat Noir—tried to kill his son with Cataclysm.

That was when they were in public, and had Hal watching over them.

He didn’t want to think about what the kids might do unsupervised to someone that tried to kill Ladybug, openly stalked her civilian self, and apparently tried stalk her again, in broad daylight. And possibly may have revealed her secret identity…

From the comments, it seemed that the Parisians hadn’t connected his sons aliases to the pair, writing it off as “Copy-cat Vigilantes” thankfully. And none of them were revealing more than “so the Fashion Disaster tried to go after Chat and Ryuko’s civvie… Not A Smart CopyBird” was the most he was able to get.

His children, on the other hand…

——

“I Fucking KNEW IT!” Tim yelled. “I knew it was her!”

“But,” Jason smirked. “You didn’t tell us.”

“Soup girl, baby bat!” Cass said gleefully.

“Wait, we both talked to her—and you didn’t say you thought it was her either Cass!”

“So what I’m hearing, if my ears don’t deceive me,” Jason continued. “Is that you all lost too.”

“What—“

“Wait a minute!”

“No way—”

Cass shrugged. She was the least invested in winning. She got to meet soup girl, who is very nice and her parents are safe for Baby Bat.

“We don’t have proof,” Dick pointed out. “Didn’t you say something about her being a mouse?”

“I—”

“Well—”

“Yes.” Cass cut through Tim and Stephanie’s waffling. “She is.”

Dick rubbed his forehead. “How many secrets can one kid have?”

“Five?” Jason said without much thought. “Limit is definitely five.”

—-

“Let me get this straight,” Miss Sting began, watching Ladybug very, very carefully. Rena and Carapace were busy that night and couldn’t act as the team’s Common Sense Filter in person. and texts only went so far.

So the job fell to Aurore. To talk (probably Marinette) Ladybug out of a Very, Stupendously, Inconceivably Bad Idea.

“You want to trust Robin—the kid who tried to kill you—to contact his mother—an assassin—to talk strategy about how to take down Hawkmoth’s civilian life’s business, not kill him, and trust that they won’t kill you?”

“…I’m bringing Chat with me.”

“Ladybug.”

“What, do you want me to use a Lucky Charm to prove this is our best bet?”

“You know what?” Miss Sting threw her hands up. “Yes, yes I do.”

“Fine.” Ladybug threw her yoyo skyward. “Lucky Charm!”

A red, spotted ball with an 8 on it came down.

“… you have got to be kidding me.”

Ladybug shrugged. “Uh, Magic Eightball, is it okay to trust Robin with this?”

One shake later and the floating die window read “Without a Doubt.”

“Give me that.” Miss Sting scowled, shaking as she asked. “Should she bring someone besides Chat and Robin—like someone from our team or Wonder Woman or Aquaman?”

The ball answered “Outlook not so good.”

Miss Sting glared at the magic eight ball. “I can’t believe this!”

Ladybug shrugged. “Lucky Charms are Lucky Charms—and I gotta go.”

Miss Sting checked her beeping spinning top. Someone was just akumatized.

“Re-charge first!” Miss Sting yelled before swinging ahead.

—-

“Oh, hey, when’s Demon Spawn going to contact us?” Jason asked as other bats calmed down.

“He’s not answering his communicator.” Bruce growled. “Hal took it earlier.”

The bats paused at that.

“Well then. Trackers?”

“Disabled—what? We didn’t need anyone crashing the apology and he ran off before I could stop him,” Dick defended. He is not Damian’s keeper. Just his Batman (as yes Bruce, he is Damian’s Batman and Damian is his Robin. Current masks not-withstanding).

“Then how are we supposed to find him?” Stephanie asked as the room grew uneasy.

No one answered that.

“How’s this,” Tim began. “Me, Steph and Cass agreed on who Hawkmoth probably is, each of us has a different set of evidence for it—and I’m counting breaking into his evil Liar and the cameras catching him mid-act a few minutes ago as absolute proof.”

“I’m sorry, you did what!” Stephanie leaned over Tim’s shoulder to see. “Oh shit. Isn’t that guy—”

“One of her friends? According to their private Instagram accounts, more like partner in crime and possible Chat Noir. I mean, he’s the one that calls her his “everyday Ladybug” and voices Chat Noir in everything." Tim answered idly. “My money’s on him not knowing at all.”

Bruce twitched. Then began to add ‘stalking social media feeds’ to his to-do list tonight.

“So,” Tim stepped forward. “I suggest we send this to the Wonder Woman and ask for Robin’s comm to be returned, and failing that, I bugged the video so anything they play it on, we get access to its IP and can find where they are.”

“Have Oracle go over the bug, just in case,” Bruce told them. “In the mean time, the rest of you suit up for the night. Gotham needs its vigilantes.”

—-

Marinette wanted to go on the record that her plan (to keep the bats away) was going well. Deciding what to do with Mu—R—Damian. Damian. Damian and his offer, was a challenge.

For obvious reasons, Green Lantern, Wonder Woman and Aquaman were against her asking a bunch of assassins for their help. Chat has more than a few reservations. Carapace, Rena and Miss Sting gave her looks for that plan.

But.

But it would work. She needs more information on how to make the plan burning in the back of her mind work. It’s a lot of chaos (and she may thrive in chaotic battles but this wasn’t her usual battlefield, and her team didn’t know who they were going up against for once). And Marinette? She needs to know its not just her doing this when its so out of her depths.

So despite literally everyone and their disagreements she had Chat on her right side with Damian on her left, meeting up with his Crazy, Semi-Immortal mother. And possibly his Immortal, former Black Cat candidate, grandfather.

Why?

As Marinette isn’t trusting the likely cult that makes up the Gotham Ghost Gang (Batfam if you like them) when she can get real advice and vague directions to immortal and allied (loyal and terrifying) assassins.

And yes, she wasn’t sure if Liar was wrong or right when they said it was a bad idea too.

But fuckit she’s already got Kaalki at her shoulder, looking a bit bored at the deserted rooftop that Kaalki chose for their meeting.

“داميان*,” the woman smiled at her son. “It’s good to see you.”

“Mother,” Robin greeted. “This is Ladybug and Chat Noir. Ladybug wished to speak to you about potential strategies to take down an enemy outside of battle without violence,” Damian stressed.

“I am well-aware of the Kwami and their Chosen, اِبْن.**” The woman spoke calmly. “The League of Assassins formed to act as the Black Cat to restore the world to balance and un-burden the Order with its maintenance.” The woman offer Ladybug her hand. “I am Talia al Ghul, and I am at your service, with or without violence Ladybug.”

Marinette took her hand. “Thank you Talia. Our target being directly exposed like I planned would have…” Ladybug trailed off, thinking over the ramifications not only to Adrien, but to the whole of Gabriel’s brand, workers and all that worked with them. “Some intense ramifications I’d rather avoid.”

Talia nodded her head, waiting for more information.

“I believe its possible to topple them without affecting their employees by uncoupling them from their business, but doing so is, well, stocks and economics isn’t my strongest point.” Ladybug admitted a bit sheepishly.

“I would suggest,” Talia began, “to create a bit of chaos in the stock market. Perhaps a rumor here and there, let investors pull out and grab the abandoned stocks quickly. Consolidate them under one owner and become the company’s owner.”

Marinette twitched a bit at that. “That… sounds complicated.”

“Oh, but it isn’t. My son knows just how to that, or did you forget our lessons?” Talia asked coolly.

Damian twitched at Marinette’s side. “I did not.”

“You know,” Chat chimed in. “I do know a few things about those things. If its general chaos, well…” Chat’s face twisted in a way Marinette forgot he could do after that Chat Blanc episode.

“… I will take that into consideration.”

“Anything else?” Talia asked, watching Ladybug and her son. Specifically, how her son seemed glued to the girl’s side. “I am certain my son is able to take out your target, if all else fails.”

Damian scowled at Marinette’s side.

“However, I do believe that whatever is happening, whatever has you active, might require a more… experience hand.”

Damian brushed against her side. Code for ‘Possible Danger.’

“Thank you for the offer,” Chat moved in front of Marinette. “But mi’lady and the Guardians have that much handled.”

Talia’s eyes shifted from Chat to Ladybug, staying on her. “Is that so?”

“Yes. I merely needed more information on how to execute this type of plan, that’s all!” Ladybug almost, almost slipped into Marinette while Liar, while silenced for the moment, prodded the back of her mind. “I want to minimize collateral damage as much as I can, to everyone. The kwami already said they get to chose the target’s punishment.”

“Ah, I see.” Talia relaxed then. “You are following the kwami’s wishes. I will respect their wishes as well, Chosen.”

Marinette categorized this interaction as one of the “not too horrible, but will avoid a repeat” once they left.

—

*Damian in arabic

**son

so we have Talia now as a Player, sort of. she plays by her word pretty well so hopefully its a cameo more than anything else.

any ideas on how JL will handle the video, and if Miraculous Team should see it and freak out or only LB and keep on the dl while JL assissts in her Chaos Plot?

End of update. Will have to repost from ao3 on my phone now as desktop tumblr is being exceptionally rude. Tags always open, just takes me a bit to do—sorry to vixen for vanishing from tags

TAGS: @heldtogetherbysafetypins @laurcad123 @raisuke06 @chaosace @jeminiikrystal @toodaloo-kangaroo @kris-pines04 @bisha43rbs @izang @dreamykitty25 @emu-lumberjack @vixen-uchiha

#maribat#marinette did not sign up for this#part 10#updated at last#my writing#long post#my writings#bio!dad bruce

34 notes

·

View notes

Text

i was tagged by @zhutwns thank you ;w;

i have 30 minutes to kill so here i am

rules: answer the questions below and tag blogs you would like to get to know better!

a: age - hint: same age as some of the ip contestants akdjfgd

b: birthplace - taiwan

c: current time - 1:25 pm

d: drink you had last - water

e: easiest person to talk to - probably one of my close friends

f: favorite song of all time - okay you can’t possibly make me choose... but if we’re talking mandopop then probably jay chou’s 夜曲 or stephanie sun’s 天黑黑

g: grossest memory - when i was like 5 or something i made my brother laugh so hard the noodles that he was eating came out of his nose

h: hogwarts house - ravenclaw (i think)

i: in love? - with zhu xingjie? and the banana boys? yes

j: jealous of people - occasionally but i usually just take it as motivation to work harder

k: killed someone? - @ my teacher.... im sorry you have to hear my crappy playing every week

l: love at first sight or should i walk by again? - idk i’ve never been in love

m: middle name - dont have one

n: number of siblings - 1

o: one wish - get into a good grad school asdfakjfg

p: person you called last - my mother

q: questions you are always asked - “when are we rehearsing?” (literally 90% of being in a chamber group is figuring out when to rehearse)

r: reason to smile - zhu xingjie has cats and zhou yanchen recommends using two different brands of toothpaste

s: song you sang last - i dont sing sdsadf cant really remember but probably 盧廣仲’s 魚仔 (such a nice song pls go take a listen)

t: time you woke up - 6AM (i went to bed at 9 dont judge)

u: underwear color - gray

w: worst habit - overeating

x: x-rays? - other than for my teeth... nope

y: your favorite food - i dont really have one but recently i have been craving 蛋餅 for some reason ;w;

z: zodiac sign - virgo

uh..... i dont really know many ppl so just consider yourself tagged if anyone wants to do this

#this literally took me exactly 30 minutes askjdghadfg#gotta go to class now#but really though#好想能趕快放暑假回去台灣吃我想吃的東西 :(

1 note

·

View note

Text

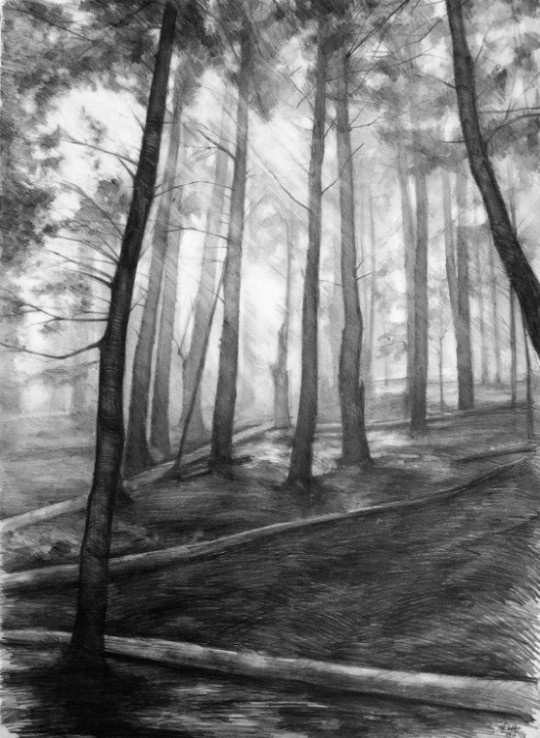

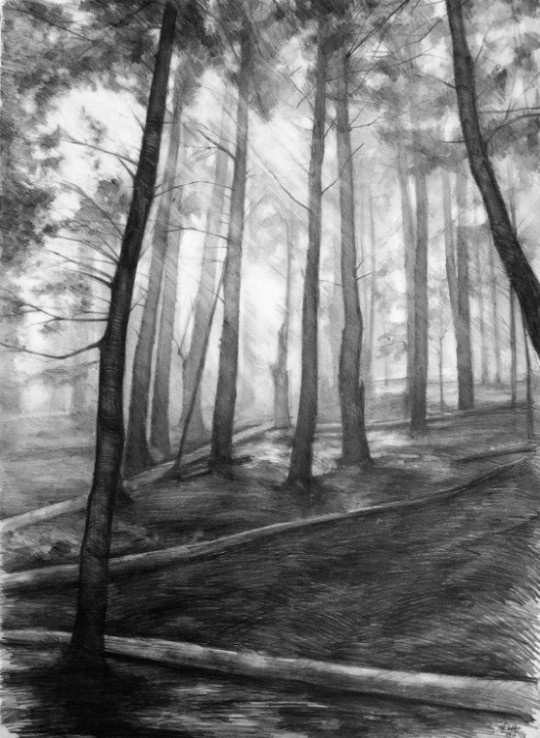

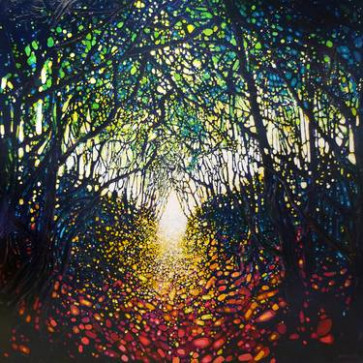

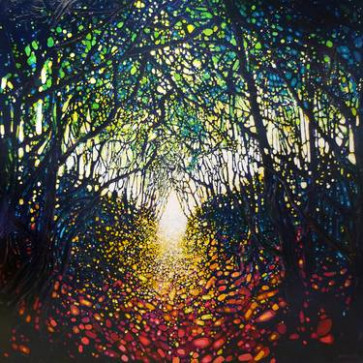

Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale

Are you blank the abeyant to aggrandize your active breadth or actualize an income-producing in-law apartment in your cavern space?

dark forest ORIGINAL drawing by Katarzyna Kmiecik / pencil .. | dark forest paintings for sale

In this week's absolute acreage gallery, we attending at homes for auction that advertise 20 types of accomplished basements. Would you appetite a home theater, custom wine cellar, crafts amplitude or bold allowance on the lower level?Foosball or billiards, anyone?--Janet Eastman | [email protected] | @janeteastmanWhere, IncWest Hills midcentury modern5335 S.W. Patton Road is listed at $5,985,000.The two-level midcentury avant-garde abode was advised by artist Walter Gordon and congenital in 1971 on 3.4 acres. The adapted abode has bristles bedrooms, bristles abounding bathrooms, two crumb apartment and 8,162 aboveboard anxiety of active amplitude including a lower-level ancestors allowance with bold tables.“Wrapped in brick for a ample part, the exoteric is in abstract adverse to the tropical-inspired breadth and built-in backwoods that beleaguer the perimeter. Floor-to-ceiling windows band the absolute aback side, accouterment amazing angle of the basin and clandestine basin veranda,” say advertisement agents Suzann Baricevic Murphy and Lorraine Rose of Where, Inc.Where, Inc.West Hills English-style manionThe Frank J. Cobbs Mansion at 2424 S.W. Montgomery Dr. is listed at $4,985,000.The English-style abode was advised by artist Albert E. Doyle and congenital in 1918 on 2.04 acres. The four-level home has seven bedrooms, bristles bathrooms, three crumb apartment and 14,335 aboveboard anxiety of active amplitude including a lower akin with a chichi lounge.“Historic archetypal in the affection of Portland. Four floors of different and aberrant active spaces. Extraordinary,” say advertisement agents Suzann Baricevic Murphy and Lorraine Rose of Where, Inc.Read added about the celebrated propertyKnudsen Group LLCMilwaukie midcentury aurora ranch6822 S.E. Savanna St. is listed at $519,500.The two-level, adapted aurora ranch, congenital in 1966 on a 10,018-square-foot lot, has four bedrooms, three bathrooms and 3,372 aboveboard anxiety of active amplitude including independent active abode in the lower akin with a kitchenette, ancestors room, two bedrooms, adapted bath with washer-dryer angle ups, two ductless air conditioning units and abstracted entrance.“This home can calmly board multi-generational active or ADU . Buyer to verify ADU and 4th bedchamber egress,” says advertisement abettor Barbara Knudsen of Knudsen Group LLC.Premiere Acreage Group, LLCForest Park Craftsman10717 N.W. Skyline Blvd. is listed at $1.6 million.

Dark Dark Forest Paintings For Sale | Saatchi Art - dark forest paintings for sale | dark forest paintings for sale

The three-level Craftsman-style house, congenital in 2007 on 7.44 acres, has four bedrooms, 5.5 bathrooms and 5,873 aboveboard anxiety of active amplitude including lower-level ancestors and bold rooms.Premiere Acreage Group, LLCForest Park Craftsman"The affection of planning, architecture and architecture is axiomatic in this spectacular, custom, environmentally affable home with solar panels, bamboo floors, rain collection, paperstone counters, Milgard fiberglass windows, home automation arrangement with alarm, motion sensors, altitude and ablaze controls," says advertisement abettor Laura Sheldon of Premiere Acreage Group, LLC. of the acreage at 10717 N.W. Skyline Blvd.Cascade Sotheby’s International RealtyForest Park Country French6103 N.W. Cornell Road is listed at $1,499,000.The four-level Country French house, congenital in 1992 on 4.85 acres, has four bedrooms, 3.5 bathrooms and 5,236 aboveboard anxiety of active amplitude including a lower-level in-law quarters.“Amazingly agreeable home with accustomed and curated adorableness all around. Truly a different befalling to alive so privately, so abutting in,” say advertisement agents Joe Reitzug and Stephanie Reitzug of Cascade Sotheby’s International Realty.Cascade Sotheby’s International RealtyGresham custom600 S.E. Arrow Creek Lane is listed at $1,375,000.The three-level custom house, congenital in 1994 on 1.11 acres, has four bedrooms, 3.5 bathrooms and 5,380 aboveboard anxiety of active amplitude including a accomplished basement fabricated into an au brace or in-law apartment with a kitchenette.“Rustic walnut, acacia, atramentous bean, marble, limestone, travertine and quartz finishes. Acanthus blade beam domes, sculpted travertine fireplaces, formed chestnut sinks, hand-carved walnut, 4,000-bottle temperature controlled wine cellar, two adept suites,” says advertisement abettor Kristi Calcagno of Cascade Sotheby’s International Realty.Windermere Realty TrustSauvie Island contemporary14025 N.W. Charlton Road is listed at $1,295,000.The two-level, abreast house, congenital in 1975 on 3.49 acres, has six bedrooms, four bathrooms and 4,673 aboveboard anxiety of active amplitude including a lower-level ancestors allowance with a bar, bedchamber and laundry room.Windermere Realty TrustSauvie Island contemporary"Two adept suites on the capital level, floor-to-ceiling windows with abundance and pastoral views; sprawling absorbing spaces; a ample abundant allowance and a gourmet kitchen. The high terrace has an orchard and affluence of amplitude to garden. Alone two-bay boutique with RV parking and appointment amplitude to abundance your toys." says advertisement abettor Matt Mahaffy of Windermere Realty Trust of the acreage at 14025 N.W. Charlton Road.Windermere Realty TrustSauvie Island contemporary

Sue Massey - The Dark Cloaked Figure. spooky atmospheric .. | dark forest paintings for sale

14025 N.W. Charlton RoadLocker PropertiesForest Park traditional7240 NW Summitview Dr. is listed at $1,125,000.The three-level traditional-style house, congenital in 1997 on 5.56 acres, has six bedrooms, 4.5 bathrooms and 5,536 aboveboard anxiety of active amplitude including a lower-level ancestors room.“Spacious kitchen with high-end stainless-steel appliances. Open to ample ancestors room. Step out to Ipe accouter and adore angle of your clandestine backwoods and trails,” says advertisement abettor Linda Locker of Locker Properties.eXp Realty, LLCForest Park Northwest contemporary5525 N.W. Skyline Blvd. is listed at $1.1 million.The three-level Northwest abreast house, congenital in 1995 on two acres, has four bedrooms, three bathrooms and 4,562 aboveboard anxiety of active amplitude including independent active abode in the lower akin with a acceptable kitchen and abstracted entrance.eXp Realty, LLCForest Park Northwest contemporary"Two decks additional two bedchamber apartment balconies, boutique with added than 1,000 aboveboard anxiety of space, ability and RV parking," say advertisement agents Stephen FitzMaurice and Jennifer Tangvald of eXp Realty, LLC. of the acreage at 5525 N.W. Skyline Blvd.Skoro International Absolute Acreage Group, LLCGresham lodge-like custom4688 SE Deer Creek Place is listed at $729,000.The three-level, lodge-like custom house, congenital in 2007 on 1.06 acres, has bristles bedrooms, 4.5 bathrooms and 4,599 aboveboard anxiety of active amplitude including a ancestors allowance on the lower level.Skoro International Absolute Acreage Group, LLC.Gresham lodge-like custom"The home is abounding with high-end, admirable account including reclaimed copse beams, hand-wrought adamant railings, acrimonious slate attic and travertine," says advertisement abettor Becky Gee of Skoro International Absolute Acreage Group, LLC of the acreage at 4688 SE Deer Creek Place.Suntree Inc., RealtorsSherwood custom16860 S.W. Parrett Abundance Road is listed at $1,395,000.

Dark Green Forest Paintings For Sale | Saatchi Art - dark forest paintings for sale | dark forest paintings for sale

The three-level, custom estate, congenital in 2003 on six gated acres, has bristles bedrooms, four bathrooms, two crumb apartment and 5,734 aboveboard anxiety of active amplitude including lower-level billiards amplitude and a abstracted alone ADU with 3 appearance ability and a lower studio.“High-end finishes, astonishing angle and accustomed light. A acreage congenital for entertaining,” says advertisement abettor Bryn Lindekugel of Suntree Inc., Realtors.Keller Williams Realty Portland EliteSherwood Craftsman24690 S.W. Allison Lane is listed at $1.2 million.The three-level, Craftsman-style house, congenital in 1994 on 2.73 acres, has bristles bedrooms, 3.5 bathrooms and 5,436 aboveboard anxiety of active amplitude including a lower akin with allowance for an ADU with a abstracted kitchen.“Entertainment deck. Common-sense attic plan.Master apartment on the capital level. Oversized laundry and ability room,” says advertisement abettor Amber Deuchar of Keller Williams Realty Portland Elite.Keller Williams Sunset CorridorBeaverton aurora ranch17980 S.W. Shadypeak Lane is listed at $1.1 million.The two-level, adapted aurora agronomical house, congenital in 1975 on 6.14 acres, has bristles bedrooms, three bathrooms and 2,884 aboveboard anxiety of active space.“Vaulted great-room appearance active with apparent beams, comfortable kitchen and adept apartment on the capital level. Zoned R-6, Outstanding advance acreage in the affection of Cooper Abundance amplification area,” says advertisement abettor Jim Cavanaugh of Keller Williams Sunset Corridor.The Brokerage HouseHillsboro Craftsman25852 S.W. Vanderschuere Road is listed at $999,900.The two-level Craftsman-style house, congenital in 2004 on 9.9 acres, has three bedrooms, 2.5 bathrooms and 3,999 aboveboard anxiety of active amplitude including a accomplished basement with a ancestors allowance and wet bar.“Spectacular Mt. Hood and Mt. St. Helens view. Adept on the capital level, home theater, custom wine cellar, advanced woodworking shop,” says advertisement abettor Aaron Rian of The Brokerage House.John L. ScottLake Oswego townhouse78 Greenridge Court is listed at $579,000.The two-level townhouse, congenital in 1973 on a 2,613 -square-foot lot, has three bedrooms, three bathrooms and 2,000 aboveboard anxiety of active amplitude including a lower-level, abstracted abounding assemblage to hire or use as a bedfellow amplitude or office.“Brazilian blooming hardwoods. Complex has a nice basin breadth and Abundance Park facilities,” say advertisement agents Lynda O'Neill and James Thayer of John L. Scott.Subscribe to Oregonian/OregonLive newsletters and podcasts for the latest account and top stories

Dark Forest (ART_8_8) - Handpainted Art Painting - 8in X 8in - dark forest paintings for sale | dark forest paintings for sale

Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale - dark forest paintings for sale

| Welcome to help my weblog, within this period I will explain to you in relation to keyword. Now, this is actually the 1st graphic:

Dark Forest Paintings For Sale | Saatchi Art - dark forest paintings for sale | dark forest paintings for sale

Think about impression earlier mentioned? is that will incredible???. if you're more dedicated and so, I'l l provide you with a few picture again underneath:

So, if you would like obtain the amazing pictures about (Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale), click on save button to save the graphics to your pc. There're ready for down load, if you'd rather and wish to obtain it, just click save logo on the post, and it'll be instantly down loaded in your computer.} As a final point if you'd like to have unique and latest picture related to (Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale), please follow us on google plus or bookmark this site, we attempt our best to present you daily update with all new and fresh images. We do hope you enjoy keeping here. For most upgrades and recent information about (Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to give you update periodically with all new and fresh pictures, love your surfing, and find the ideal for you.

Here you are at our website, contentabove (Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale) published . Nowadays we're pleased to announce that we have discovered an awfullyinteresting nicheto be pointed out, that is (Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale) Lots of people searching for information about(Ten Easy Ways To Facilitate Dark Forest Paintings For Sale - Dark Forest Paintings For Sale) and of course one of them is you, is not it?

Dark Dark Forest Paintings For Sale | Saatchi Art - dark forest paintings for sale | dark forest paintings for sale

Dark Forest Paintings For Sale | Saatchi Art - dark forest paintings for sale | dark forest paintings for sale

Read the full article

0 notes

Text

Lawyer for SEC Charges

The Securities and Exchange Commission filed fraud charges against a Virginia-based mechanical engineer accused of scheming to manipulate the price of Fitbit stock by making a phony regulatory filing. As a Securities Lawyer, I’ve seen these before. According to the SEC’s complaint, Robert W. Murray purchased Fitbit call options just minutes before a fake tender offer that he orchestrated was filed on the SEC’s EDGAR system purporting that a company named ABM Capital LTD sought to acquire Fitbit’s outstanding shares at a substantial premium. Fitbit’s stock price temporarily spiked when the tender offer became publicly available on Nov. 10, 2016, and Murray sold all of his options for a profit of approximately $3,100.

youtube

The SEC alleges that Murray created an email account under the name of someone he found on the internet, and the email account was used to gain access to the EDGAR system. Murray then allegedly listed that person as the CFO of ABM Capital and used a business address associated with that person in the fake filing. The SEC also alleges that Murray attempted to conceal his identity and actual location at the time of the filing after conducting research into prior SEC cases that highlighted the IP addresses the false filers used to submit forms on EDGAR. According to the SEC’s complaint, it appeared as though the system was being accessed from a different state by using an IP address registered to a company located in Napa, California.

“As alleged in our complaint, Murray used deceptive techniques in a concerted effort to evade detection, but we were able to connect the dots quickly and hold him accountable,” said Stephanie Avakian, Acting Director of the SEC Enforcement Division. In a parallel action, the U.S. Attorney’s Office has also announced criminal charges against Murray.

The SEC’s complaint charges Murray with violating antifraud provisions of the federal securities laws, including Section 17(a) of the Securities Act of 1933 and Sections 10(b) and 14(e) of the Securities Exchange Act of 1934, and Rules 10b-5 and 14e-8.

The SEC’s continuing investigation is being conducted by David W. Snyder, Assunta Vivolo, Kelly L. Gibson, and Patrick A. McCluskey in the Market Abuse Unit in Philadelphia. The case is being supervised by unit co-chiefs Robert A. Cohen and Joseph G. Sansone. The litigation will be led by Julia C. Green and Christopher R. Kelly of the Philadelphia office. The SEC appreciates the assistance of the U.S. Attorney’s Office at Utah and the U.S. Postal Inspection Service.

Accounting Fraud Charges

The Securities and Exchange Commission has announced that a South Korea-based semiconductor manufacturer and its former CFO have agreed to settle charges related to an accounting scheme to artificially boost revenue and manipulate the financial results reported to investors.

youtube

The SEC’s order finds that MagnaChip Semiconductor Corp. overstated revenues for nearly two years in response to immense pressure placed on employees each quarter to meet revenue and gross margin targets that had been communicated to the public. Then-CFO Margaret Sakai directed or approved several fraudulent accounting practices to make it falsely appear the company had met those targets. For example, MagnaChip recognized revenue on sales of incomplete or unshipped products, and the company delayed booking obsolete or aged inventory to manipulate its reported gross margin. MagnaChip also engaged in roundtrip transactions to manipulate accounts receivable balances, and concealed from auditors that there were side agreements with distributors to induce them to accept products early.

“MagnaChip engaged in a panoply of accounting tricks to artificially meet its financial targets,” said Jina L. Choi, Director of the SEC’s San Francisco Regional Office. “Companies that sell stock in the U.S. markets should prioritize a robust accounting culture that is entirely truthful with investors.”

youtube

Without admitting or denying the findings in the SEC’s order, MagnaChip agreed to pay a $3 million penalty and Sakai agreed to pay a $135,000 penalty. Sakai also agreed to be barred from serving as an officer or director of a public company and from appearing or practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies.

The SEC’s investigation has been conducted by Justin M. Lichterman and Michael D. Foley of the San Francisco office, and supervised by Steven D. Buchholz.

youtube

The Securities and Exchange Commission has announced that a New Jersey-based firm and its CEO have agreed to pay more than $4 million to settle charges that they used new investor money to repay earlier investors in Ponzi-like fashion and tapped investor funds for the CEO’s personal use.

According to the SEC’s complaint, Verto Capital Management and William Schantz III raised approximately $12.5 million selling promissory notes to purportedly fund Verto Capital’s purchase and sale of life settlements, which are life insurance policies sold in the secondary market. The SEC alleges that they misrepresented to investors that Verto Capital was a profitable company and investor funds would be used for general working capital purposes. Verto Capital and other Schantz businesses had been unprofitable for several years, according to the SEC’s complaint, and Schantz resorted to taking disproportionately large distributions of investor funds for himself and using new investor money to repay earlier investors.

youtube

Verto Capital and Schantz also allegedly made misrepresentations to investors about the safety of the notes and collateral underlying them. The SEC alleges that the promissory notes were primarily sold through a group of insurance brokers in Texas, and religious investors were targeted.

“As alleged in our complaint, investors were told that the life settlement-backed notes were short-term investments with an unlikely event of default. Schantz and Verto misled investors about the company’s past performance and the value of the collateral, and they diverted significant investor funds for Schantz’s personal use,” said Andrew M. Calamari.

A Fair Fund will be created to return money collected in the settlement to harmed investors. Schantz and Verto Capital agreed to pay disgorgement of $3,433,666 plus interest of $124,851 and a penalty of $600,000. Without admitting or denying the allegations, they consented to permanent injunctions against further violations of Section 17(a)(2) and (3) and Section 5 of the Securities Act of 1933. Schantz further agreed to be enjoined from selling any promissory notes. The settlement is subject to court approval.

SEC Lawyer Free Consultation

If you’ve been charged by the SEC, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Don’t Miss Your Visitation Time

Divorce and Domestic Violence

Which Visitation Schedule is Right?

Divorce News

Hiring Employees for Your Business

Winning Sole Custody

Source: https://www.ascentlawfirm.com/lawyer-for-sec-charges/

0 notes

Text

Lawyer for SEC Charges

The Securities and Exchange Commission filed fraud charges against a Virginia-based mechanical engineer accused of scheming to manipulate the price of Fitbit stock by making a phony regulatory filing. As a Securities Lawyer, I’ve seen these before. According to the SEC’s complaint, Robert W. Murray purchased Fitbit call options just minutes before a fake tender offer that he orchestrated was filed on the SEC’s EDGAR system purporting that a company named ABM Capital LTD sought to acquire Fitbit’s outstanding shares at a substantial premium. Fitbit’s stock price temporarily spiked when the tender offer became publicly available on Nov. 10, 2016, and Murray sold all of his options for a profit of approximately $3,100.

youtube

The SEC alleges that Murray created an email account under the name of someone he found on the internet, and the email account was used to gain access to the EDGAR system. Murray then allegedly listed that person as the CFO of ABM Capital and used a business address associated with that person in the fake filing. The SEC also alleges that Murray attempted to conceal his identity and actual location at the time of the filing after conducting research into prior SEC cases that highlighted the IP addresses the false filers used to submit forms on EDGAR. According to the SEC’s complaint, it appeared as though the system was being accessed from a different state by using an IP address registered to a company located in Napa, California.

“As alleged in our complaint, Murray used deceptive techniques in a concerted effort to evade detection, but we were able to connect the dots quickly and hold him accountable,” said Stephanie Avakian, Acting Director of the SEC Enforcement Division. In a parallel action, the U.S. Attorney’s Office has also announced criminal charges against Murray.

The SEC’s complaint charges Murray with violating antifraud provisions of the federal securities laws, including Section 17(a) of the Securities Act of 1933 and Sections 10(b) and 14(e) of the Securities Exchange Act of 1934, and Rules 10b-5 and 14e-8.

The SEC’s continuing investigation is being conducted by David W. Snyder, Assunta Vivolo, Kelly L. Gibson, and Patrick A. McCluskey in the Market Abuse Unit in Philadelphia. The case is being supervised by unit co-chiefs Robert A. Cohen and Joseph G. Sansone. The litigation will be led by Julia C. Green and Christopher R. Kelly of the Philadelphia office. The SEC appreciates the assistance of the U.S. Attorney’s Office at Utah and the U.S. Postal Inspection Service.

Accounting Fraud Charges

The Securities and Exchange Commission has announced that a South Korea-based semiconductor manufacturer and its former CFO have agreed to settle charges related to an accounting scheme to artificially boost revenue and manipulate the financial results reported to investors.

youtube

The SEC’s order finds that MagnaChip Semiconductor Corp. overstated revenues for nearly two years in response to immense pressure placed on employees each quarter to meet revenue and gross margin targets that had been communicated to the public. Then-CFO Margaret Sakai directed or approved several fraudulent accounting practices to make it falsely appear the company had met those targets. For example, MagnaChip recognized revenue on sales of incomplete or unshipped products, and the company delayed booking obsolete or aged inventory to manipulate its reported gross margin. MagnaChip also engaged in roundtrip transactions to manipulate accounts receivable balances, and concealed from auditors that there were side agreements with distributors to induce them to accept products early.

“MagnaChip engaged in a panoply of accounting tricks to artificially meet its financial targets,” said Jina L. Choi, Director of the SEC’s San Francisco Regional Office. “Companies that sell stock in the U.S. markets should prioritize a robust accounting culture that is entirely truthful with investors.”

youtube

Without admitting or denying the findings in the SEC’s order, MagnaChip agreed to pay a $3 million penalty and Sakai agreed to pay a $135,000 penalty. Sakai also agreed to be barred from serving as an officer or director of a public company and from appearing or practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies.

The SEC’s investigation has been conducted by Justin M. Lichterman and Michael D. Foley of the San Francisco office, and supervised by Steven D. Buchholz.

youtube

The Securities and Exchange Commission has announced that a New Jersey-based firm and its CEO have agreed to pay more than $4 million to settle charges that they used new investor money to repay earlier investors in Ponzi-like fashion and tapped investor funds for the CEO’s personal use.

According to the SEC’s complaint, Verto Capital Management and William Schantz III raised approximately $12.5 million selling promissory notes to purportedly fund Verto Capital’s purchase and sale of life settlements, which are life insurance policies sold in the secondary market. The SEC alleges that they misrepresented to investors that Verto Capital was a profitable company and investor funds would be used for general working capital purposes. Verto Capital and other Schantz businesses had been unprofitable for several years, according to the SEC’s complaint, and Schantz resorted to taking disproportionately large distributions of investor funds for himself and using new investor money to repay earlier investors.

youtube

Verto Capital and Schantz also allegedly made misrepresentations to investors about the safety of the notes and collateral underlying them. The SEC alleges that the promissory notes were primarily sold through a group of insurance brokers in Texas, and religious investors were targeted.

“As alleged in our complaint, investors were told that the life settlement-backed notes were short-term investments with an unlikely event of default. Schantz and Verto misled investors about the company’s past performance and the value of the collateral, and they diverted significant investor funds for Schantz’s personal use,” said Andrew M. Calamari.

A Fair Fund will be created to return money collected in the settlement to harmed investors. Schantz and Verto Capital agreed to pay disgorgement of $3,433,666 plus interest of $124,851 and a penalty of $600,000. Without admitting or denying the allegations, they consented to permanent injunctions against further violations of Section 17(a)(2) and (3) and Section 5 of the Securities Act of 1933. Schantz further agreed to be enjoined from selling any promissory notes. The settlement is subject to court approval.

SEC Lawyer Free Consultation

If you’ve been charged by the SEC, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Don’t Miss Your Visitation Time

Divorce and Domestic Violence

Which Visitation Schedule is Right?

Divorce News

Hiring Employees for Your Business

Winning Sole Custody

Source: https://www.ascentlawfirm.com/lawyer-for-sec-charges/

0 notes

Text

Lawyer for SEC Charges

The Securities and Exchange Commission filed fraud charges against a Virginia-based mechanical engineer accused of scheming to manipulate the price of Fitbit stock by making a phony regulatory filing. As a Securities Lawyer, I’ve seen these before. According to the SEC’s complaint, Robert W. Murray purchased Fitbit call options just minutes before a fake tender offer that he orchestrated was filed on the SEC’s EDGAR system purporting that a company named ABM Capital LTD sought to acquire Fitbit’s outstanding shares at a substantial premium. Fitbit’s stock price temporarily spiked when the tender offer became publicly available on Nov. 10, 2016, and Murray sold all of his options for a profit of approximately $3,100.

youtube

The SEC alleges that Murray created an email account under the name of someone he found on the internet, and the email account was used to gain access to the EDGAR system. Murray then allegedly listed that person as the CFO of ABM Capital and used a business address associated with that person in the fake filing. The SEC also alleges that Murray attempted to conceal his identity and actual location at the time of the filing after conducting research into prior SEC cases that highlighted the IP addresses the false filers used to submit forms on EDGAR. According to the SEC’s complaint, it appeared as though the system was being accessed from a different state by using an IP address registered to a company located in Napa, California.

“As alleged in our complaint, Murray used deceptive techniques in a concerted effort to evade detection, but we were able to connect the dots quickly and hold him accountable,” said Stephanie Avakian, Acting Director of the SEC Enforcement Division. In a parallel action, the U.S. Attorney’s Office has also announced criminal charges against Murray.

The SEC’s complaint charges Murray with violating antifraud provisions of the federal securities laws, including Section 17(a) of the Securities Act of 1933 and Sections 10(b) and 14(e) of the Securities Exchange Act of 1934, and Rules 10b-5 and 14e-8.

The SEC’s continuing investigation is being conducted by David W. Snyder, Assunta Vivolo, Kelly L. Gibson, and Patrick A. McCluskey in the Market Abuse Unit in Philadelphia. The case is being supervised by unit co-chiefs Robert A. Cohen and Joseph G. Sansone. The litigation will be led by Julia C. Green and Christopher R. Kelly of the Philadelphia office. The SEC appreciates the assistance of the U.S. Attorney’s Office at Utah and the U.S. Postal Inspection Service.

Accounting Fraud Charges

The Securities and Exchange Commission has announced that a South Korea-based semiconductor manufacturer and its former CFO have agreed to settle charges related to an accounting scheme to artificially boost revenue and manipulate the financial results reported to investors.

youtube

The SEC’s order finds that MagnaChip Semiconductor Corp. overstated revenues for nearly two years in response to immense pressure placed on employees each quarter to meet revenue and gross margin targets that had been communicated to the public. Then-CFO Margaret Sakai directed or approved several fraudulent accounting practices to make it falsely appear the company had met those targets. For example, MagnaChip recognized revenue on sales of incomplete or unshipped products, and the company delayed booking obsolete or aged inventory to manipulate its reported gross margin. MagnaChip also engaged in roundtrip transactions to manipulate accounts receivable balances, and concealed from auditors that there were side agreements with distributors to induce them to accept products early.

“MagnaChip engaged in a panoply of accounting tricks to artificially meet its financial targets,” said Jina L. Choi, Director of the SEC’s San Francisco Regional Office. “Companies that sell stock in the U.S. markets should prioritize a robust accounting culture that is entirely truthful with investors.”

youtube

Without admitting or denying the findings in the SEC’s order, MagnaChip agreed to pay a $3 million penalty and Sakai agreed to pay a $135,000 penalty. Sakai also agreed to be barred from serving as an officer or director of a public company and from appearing or practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies.

The SEC’s investigation has been conducted by Justin M. Lichterman and Michael D. Foley of the San Francisco office, and supervised by Steven D. Buchholz.

youtube

The Securities and Exchange Commission has announced that a New Jersey-based firm and its CEO have agreed to pay more than $4 million to settle charges that they used new investor money to repay earlier investors in Ponzi-like fashion and tapped investor funds for the CEO’s personal use.

According to the SEC’s complaint, Verto Capital Management and William Schantz III raised approximately $12.5 million selling promissory notes to purportedly fund Verto Capital’s purchase and sale of life settlements, which are life insurance policies sold in the secondary market. The SEC alleges that they misrepresented to investors that Verto Capital was a profitable company and investor funds would be used for general working capital purposes. Verto Capital and other Schantz businesses had been unprofitable for several years, according to the SEC’s complaint, and Schantz resorted to taking disproportionately large distributions of investor funds for himself and using new investor money to repay earlier investors.

youtube

Verto Capital and Schantz also allegedly made misrepresentations to investors about the safety of the notes and collateral underlying them. The SEC alleges that the promissory notes were primarily sold through a group of insurance brokers in Texas, and religious investors were targeted.

“As alleged in our complaint, investors were told that the life settlement-backed notes were short-term investments with an unlikely event of default. Schantz and Verto misled investors about the company’s past performance and the value of the collateral, and they diverted significant investor funds for Schantz’s personal use,” said Andrew M. Calamari.

A Fair Fund will be created to return money collected in the settlement to harmed investors. Schantz and Verto Capital agreed to pay disgorgement of $3,433,666 plus interest of $124,851 and a penalty of $600,000. Without admitting or denying the allegations, they consented to permanent injunctions against further violations of Section 17(a)(2) and (3) and Section 5 of the Securities Act of 1933. Schantz further agreed to be enjoined from selling any promissory notes. The settlement is subject to court approval.

SEC Lawyer Free Consultation

If you’ve been charged by the SEC, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Don’t Miss Your Visitation Time

Divorce and Domestic Violence

Which Visitation Schedule is Right?

Divorce News

Hiring Employees for Your Business

Winning Sole Custody

0 notes