#payment methods

Photo

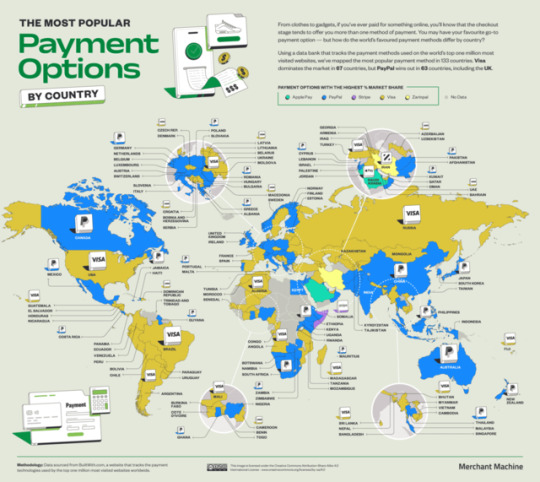

The Most Popular Payment Method in Each Country

The world of online shopping is riddled with different payment methods. At checkout, many customers have the option to pay with a card, PayPal, Apple Pay, or even a whole host of different Buy Now, Pay Later (BNPL) options that have cropped up in recent years. But the payment method you use regularly might not be the same one someone uses just down the road. In fact, a well-known option in one country might not even exist in another.

So what are the most popular payment options around the world?

Using data from the top one million websites in the world, this new study from Merchant Machine reveals

the most popular upfront and BNPL payment methods in each country.

Source: https://merchantmachine.co.uk/most-popular-payment-methods/

91 notes

·

View notes

Text

3 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

3 Reasons to Allow Your Customers to Change Payment Methods After Purchase

Think again if you think allowing customers to change payment methods after purchase isn't worth it.

What is the one thing you never want a customer to feel after completing your checkout process through the best online payment gateway? Dread.

Unfortunately, when they realise they've used the wrong card or account and may face a penalty or fee, that's exactly what hits them in the pit of their stomach. They want to avoid that as soon as possible. To do so, they must change the payment method after making the purchase. What your store should ask is if you want to let them in and be a part of the solution to this problem. Or, if you don't have the option, the customer will be forced to consider cancelling the order.

It's not the most common scenario, but it's one with a clear win-win outcome when done correctly. Let's take a look at how to approach the problem and why you might want to take the time to offer a solution.

Allow Payment Method Changes Sooner – Rather than Later

Payment errors occur for a variety of reasons. Someone may have selected the incorrect card on your smartphone wallet. While they are distracted, their browser auto-fills payment information. Or they've simply spent too much money that day and want to avoid an overdraft. None of these are issues with the store, but you can be the solution.

If you want to allow customers to change payment methods after they've made a purchase, start by talking with your payment processors and platforms about their capabilities. See what you can do and collaborate with them to clearly define the process. Then, to your customers, state it as clearly as possible.

Make sure to inform customers of any restrictions. One thing to keep in mind is that it is often only possible before the goods enter the shipping process. Make it a point to state clearly what you can and cannot do in the offer, at checkout, and in customer service chat or support. If you can find a way to offer this, here are a few reasons why it might be worth the effort.

Reason 1: It’s Great Customer Service

When considering payment changes, most businesses ask themselves, "Why does the customer need to make the change?" However, it may be more appropriate to inquire whether this is even relevant.

It's a customer service opportunity when someone asks for assistance in changing a payment and protecting their wallets. You can assist them in correcting their errors and earning their loyalty by making the process as simple and stress-free as possible.

If you make a mistake, treat others the way you would like to be treated. It helps to ensure that they complete the purchase without requesting a refund, which increases your retention rates. Existing customers are up to 70% more likely to purchase from you than new visitors, and repeat customers spend 67% more than new customers. Why not provide a fantastic service that also increases your revenue?

Reason 2: Reduces Your Pain and Risk of Loss

Supporting payment method changes is not only good customer service; it can also help to reduce lost sales. This is due to the fact that not supporting payment method changes may cause the customer to cancel the order. This is especially true if they discover that using a specific card or account will result in a problem.

According to one survey, 10% of people who cancelled an online order did so because they needed more room on their credit card or were trying to avoid an "insufficient funds" error.

Cancellations have a negative impact on your business in a variety of ways. Cancellations can result in a loss of revenue. If you begin internal actions before cancelling, such as picking orders and printing shipping labels, you are obligated to pay those costs. If an order is cancelled after it has been shipped, you will need to begin the costly returns process, which will generally cost your business — useful returns policies are a very different but important customer service tool.

There are additional areas where cancellations may be detrimental. Multiple factors are used to evaluate companies selling on online marketplaces.

According to consultants, if your cancellation rate is greater than 2% in a 14-day period, you may be at risk as a seller. If the order is cancelled after the payment process, your ecommerce platform or online payment gateway India provider may charge a small fee.

Reason 3: Avoids Complications of Reorders

If you don't let people change their payment methods after they've made a purchase, your only chance of recouping a related cancellation is if they decide to order from you again. That's a lot to ask of a dissatisfied or concerned customer.

Supporting payment changes can help you avoid the entire problem. Instead, a customer must contact you and their payment option (bank, credit card company, or PayPal) to stop payment; they only need to work with your customer service agents to make a minor change. It's easier for both the customer and your operations.

Reorders also necessitate a significant amount of work within your inventory and order management tools to ensure that everything is properly cancelled and that no fulfilment is duplicated. This saves your warehouse team time picking and packing an order that is later cancelled. This prevents SKUs from being pulled from inventory and then added back to your count. If you have manual inventory processes, pulling and replacing goods frequently necessitates a stock count.

When you work with a 3PL, or third-party logistics company, all of those cancellations and reorders become more complicated. Your service-level agreement will have fulfilment cutoff times, and the cancellation must arrive just in time if you want to avoid the picking process starting. Bring them into your payment discussions, and they may be able to assist you in avoiding complications even if someone shifts payment after an order has been fulfilled.

Allowing payment changes after purchase also helps you keep your revenue predictable by reducing cancellations and reorders. Simultaneously, you are reducing complex warehouse work and partner efforts. It adds layers of security while keeping customers satisfied.

After Purchase Payment Changes Benefit You and Your Customers

The simpler your website's payment process, the better for everyone involved. Allowing payment changes after purchase — and making it easy to do so — is one way to avoid sales losses and extra work for your teams. Offer it, and you'll be able to help make a customer's stressful day a little less stressful while also increasing the security of your revenue. It's a win-win situation that you can achieve with the help of your online payment gateway and processor partners.

#Banking#online payment#digital wallets#payment methods#purchase#merchants#customers#UPI#processor#payment gateway#online business#credit cards#e-commerce

3 notes

·

View notes

Text

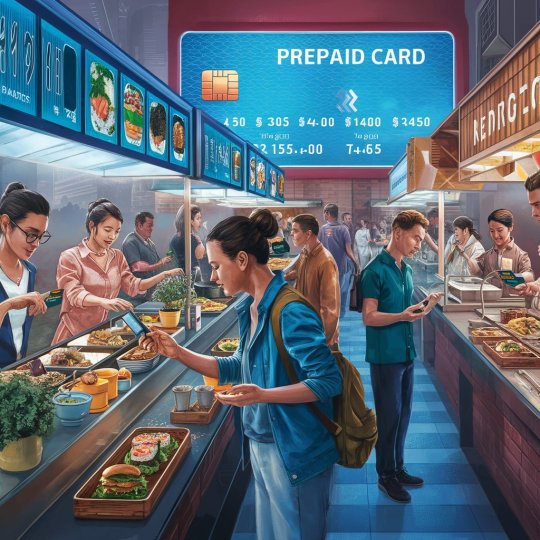

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

Choose from Convenient Payment Methods

With our wide variety of payment options, select the method that best suits your needs and preferences, whether it’s using your credit card, debit card, or mobile payments.

0 notes

Text

New Payment Options at The Game Crafter

We recently upgraded the PayPal integration on our site and so you'll notice a slightly different user experience during checkout if you use PayPal as your payment method. In addition, this allowed us to support 2 new payment methods: Venmo & Pay Later.

0 notes

Text

Do any sites exist where you can get paid for posting your blogs or articles? If so, what type of payment methods do they use?

Yes, there are a number of sites where you can get paid for posting your blogs or articles. Some of the most popular sites include:

Medium: Medium is a blogging platform that allows anyone to publish articles. Medium has a Partner Program that pays writers based on the number of reads their articles receive.

HubPages: HubPages is another blogging platform that pays writers based on ad revenue and affiliate marketing commissions.

NewsBreak: NewsBreak is a local news platform that pays writers for publishing articles about local news and events.

WordCandy: WordCandy is a freelance writing platform that pays writers for publishing articles on a variety of topics.

Indeni: Indeni is a technical writing platform that pays writers for publishing articles about AWS, Azure, and Terraform.

Payment methods vary by site, but most sites pay via PayPal or direct bank transfer.

Here are some additional sites where you can get paid for posting your blogs or articles:

Contently

Freelance Writing

ProBlogger

The Write Life

BloggingPro

Did you find this information helpful? If so, please upvote, comment, and like this answer. I would also love to hear if you have any other questions about getting paid for blogging.

0 notes

Photo

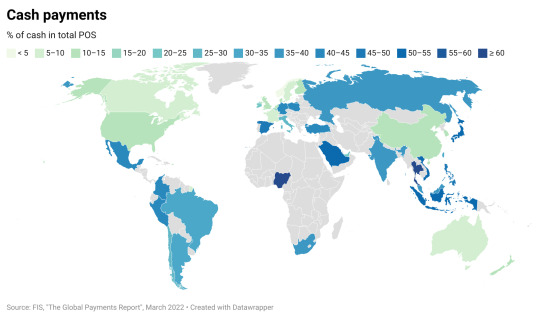

Where in the world is cash still the most common payment method?

155 notes

·

View notes

Text

How to enable Cash on Delivery?

Cash on Delivery (COD) is one of the manual payment methods for online businesses.

Cash on Delivery (COD), also known as “collect on delivery” or “payment on delivery” is a payment method that allows buyers to pay for their purchases at the time of delivery in cash, check, or electronic payment.

When customers select Cash on Delivery as a payment method at the checkout, they do not need to enter their payment details online; instead, they can pay with cash in person when they receive the product. This means that buyers can process their orders via COD if the order is virtual.

Learn more about how to enable Cash on Delivery.

1 note

·

View note

Text

https://www.echeckplan.com/understanding-merchant-services-in-real-estate/

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

1 note

·

View note

Text

Driving Success: How Digital Payment Solutions Propel Business Growth?

"Explore how digital payment solutions are revolutionizing business growth in this insightful Medium article. Discover the key drivers behind their success and how they empower businesses to thrive in today's dynamic market. From enhanced convenience to streamlined transactions, delve into the impact of digital payments on modern enterprises."

0 notes

Text

Mastering Accounts Payable: 15 Common Interview Questions and Expert Answers

Preparing for an Accounts Payable (AP) interview is a crucial step in securing a position in this vital finance function. To help you excel in your interview, we’ve compiled a comprehensive guide that covers the 20 most common AP interview questions, each paired with expert answers. In this article, you’ll gain valuable insights into the world of AP and enhance your chances of acing your…

View On WordPress

#Accounting#Accounting Software#Accounting Standards#Accounts Payable#Accuracy in AP#AP Interview#Cost Savings#data security#Disputed Invoices#Financial Regulations#Foreign Currency Transactions#Fraud Prevention#High Invoice Volume#Invoice Processing#Payment Methods#Tax Compliance#Urgent Payments#Vendor Onboarding#Vendor Relationships

0 notes

Text

Best CAD to INR conversion rates, XE

XE (CAD-INR): Transferring money online can be a complex task if you lack the necessary information. If you're looking to send money from Canada to India and secure the best CAD to INR conversion rates, XE is an excellent choice. As a leading international fintech company, XE offers competitive exchange rates for remittances to India. Their online transaction process is secure, fast, and efficient.

XE provides various payment methods with favorable CAD to INR exchange rates. You have the option to make a card payment using either a debit or credit card, or you can opt for a wire transfer or bank transfer. Regardless of the chosen payment method, the recipient will receive the funds in their bank account within approximately 4 to 5 business days. Cash pick-up services are not available. You can send up to $500,000 through XE. For transactions below $499, a small transfer fee of $3 is applied. However, transactions exceeding $499 are not subject to any transaction fees. It's worth noting that card transfers may not offer as competitive exchange rates as other methods.

#CAD to INR conversion rates#transfer money from Canada to India#competitive exchange rates#online transactions#payment methods#bank transfer

0 notes

Text

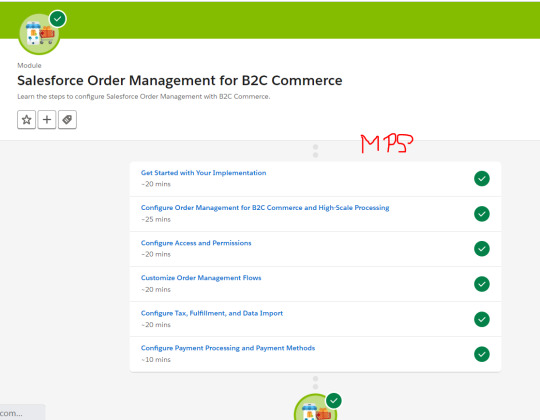

Module: Salesforce Order Management for B2C Commerce

Module: Salesforce Order Management for B2C Commerce

In this tutorial, we are going to cover the Module called “Salesforce Order Management for B2C Commerce“. In this lecture, you are going to Learn the steps to configure Salesforce Order Management with B2C Commerce. Solve the quiz on Trailhead.

#1.Get Started with Your Implementation

Solve these tests and get 100 points

Q1)True or False: The B2C Integration service user is also an internal…

View On WordPress

#Configure Access and Permissions#Configure Payment Processing#Customize Order Management Flows#Management for B2C Commerce#Payment Methods#Salesforce Order Management for B2C Commerce

0 notes

Text

After technological development and iteration for many years, pos machine has developed rapidly from wired to traditional wireless to now intelligent.

What do you think will be the development trends of POS machines in the future? Welcome to share your ideas with JTact.

1 note

·

View note