#out of what would have otherwise been their annual bonus fund

Text

So subsequent to being a robodebt victim I sort of fell into this funk of ‘not only is there no point in trying, but in fact it’s better if I don’t, bc every time I have ever tried to do something good it’s backfired horrifically, so I’m just going to make like a tree and exist, no trying to do anything for myself, just drink some water, get some sunlight, and that is all’. And recently, after a few years of living a tree-like existence, I thought ‘you know, this is illogical, like there is no rational correlation between ‘trying’ and the universe taking a big shit on you, let’s just try again, yeah?’ So I signed up for a one hour a week job and the Australian government took that as an excuse to call up all of my previous employers of the last decade to ask for payslips and as an aside tell them all I’m homeless. Additionally all my online government accounts are being overrun with entirely fake income data from a century ago, not to mention apparently thousands of dollars in superannuation I have never had. And the logical part of me is just like ‘ok cool yeah, obviously they’re mistaken, someone just got their wires crossed, it’ll work out’, but that’s exactly what I told myself the last time a whole bunch of fabricated data was flying around my government accounts bc of robodebt, so I already know what’s coming. In conclusion: irrational belief system confirmed✅

#I guess the Australian government figures they swept the robodebt scandal far enough under the rug by now they can resume their bullshit#especially irt the robodebt victims who caused all this hassle for them in the first place#ngl I was expecting this since the class action kicked off#bc the Australian government does not just graciously accept defeat in anything#it doesn't matter if it's coalition or labor#they're literally just two sides of the same coin#they both protecting the same interests#which is the well-being of their own tax-payer funded bank accounts#like hell would they just close the book on a bunch of people who had them cough up $1.9 billion#out of what would have otherwise been their annual bonus fund#robodebt victims been marked since day one of this scandal#that's why it ain't been in the media#why the biggest class action in Australian history is so widely unknown about#even to this day#they been preparing for revenge#that's literally it#auspol#australia#corruption#authoritarianism

8 notes

·

View notes

Link

via Politics – FiveThirtyEight

Graphics by Jasmine Mithani

Congress is back in session, and it has a weighty task before it — figuring out what to do about the economy as COVID-19 infections spike across the country and states roll back their reopenings. One central point of tension: the $600-per-week supplemental unemployment insurance benefit that was enacted in March as part of the CARES Act and is set to expire on July 31.

Democrats have proposed extending the payment until jobless rates in states fall below a certain threshold. Republicans, meanwhile, are leery of continuing the full payments, saying they will discourage people from returning to work. And it’s true that research has shown that many workers are making more money on the beefed-up benefits than they would be at their old jobs.

But in the latest installment of our regular survey of quantitative macroeconomic economists,1 conducted in partnership with the Initiative on Global Markets at the University of Chicago Booth School of Business, the 33 economists in our study collectively thought there was a 59 percent chance that either keeping the payment steady or increasing it to above $600 per week would be most beneficial to the economy. They said there was about a 33 percent chance that reducing the weekly payment to less than $600 would most benefit the economy, and only a 7 percent chance that letting the program completely lapse would be most beneficial. This makes sense considering that another recent IGM survey found that most economists blamed high unemployment on companies that weren’t hiring — not on people choosing not to work because of unemployment payments.

Jonathan Wright, an economics professor at Johns Hopkins University who has been consulting with FiveThirtyEight on the design of the survey, pointed out that some extension of unemployment insurance is important because many workers are still out of a job. States can continue to offer benefits regardless of what the federal government does, but those don’t last forever, either — and some states are less generous than others.

How should Congress handle unemployment insurance?

Likelihood that each federal policy choice would most benefit the entire economy over the rest of 2020, according to economists

Option Probability Keep the weekly payment at $600 37% Reduce the weekly payment to less than $600 33 Increase the weekly payment to more than $600 22 Allow federal pandemic unemployment insurance to completely lapse 7

The survey of 33 economists was conducted July 17-20.

Source: FIVETHIRTYEIGHT/IGM COVID-19 ECONOMIC SURVEY

Of course, the perspectives on Congress’s response are nuanced, and many of the economists think the benefits should ideally be phased out as the economy improves, assuming there are no logistical hurdles. When we drilled into some of the ways that federal policymakers could aid jobless workers, the experts thought there was a 37 percent chance that the best strategy would be to continue paying jobless workers $600 weekly for now but peg federal unemployment benefits to key economic indicators so they become gradually less generous as the economy improves. They said there was a 26 percent chance it would benefit the economy more if the workers were paid less than $600 per week for a fixed period of time, and a 22 percent probability that it would be better to continue paying jobless workers $600 a week even if it meant some would make more than they did while working.

Deborah Lucas, an economist at MIT, said she would opt for temporarily leaving the weekly payment at $600, or even increasing it a bit, although she said the payments should ramp down if the economy improved enough. “The fact that a considerable number of people are making more this way than when they were working seems like a good thing,” she said, adding that this will only be true for low earners, who might otherwise feel pressure to take jobs that would endanger their health. “In effect, it enhances social insurance protections and is a step towards universal basic income, both policies I think would improve social welfare even in the absence of a pandemic.”

Not all of the economists were a fan of expanding or maintaining the $600 weekly payment, though. Annette Vissing-Jørgensen, an economist at the University of California, Berkeley, said it was fundamentally unfair that some essential workers were making less money than nonessential workers who were out of a job. She added that while she’s concerned overall about making it more financially attractive for workers to stay home from their jobs, particularly if hiring starts to pick up again, there “could be a role for continuing some level of extra benefits” in states that are less generous. Others noted that while the extra payment made sense as a short-term stimulus measure, economists might approach the long-term consequences of such a generous supplement differently.

Still, it was notable that the least popular response to the question above was an alternative to the $600-per-week payment that’s been floated by some Republicans, who have proposed a “back to work bonus” for people who return to their jobs instead of continuing to supplement workers’ unemployment benefits. Economists thought there was only a 16 percent chance this would do the most to benefit the economy.

“Continued unemployment support has the twin benefits of alleviating poverty for jobless workers and sustaining consumer demand in the economy,” said Allan Timmermann, professor of finance and economics at the University of California, San Diego. Timmermann has also been consulting with us on the survey. “[It] is viewed as a highly effective tool to prevent the economy from stalling.”

Along similar lines, we asked economists how they would allocate $1 trillion in a hypothetical COVID-19 stimulus package if they wanted to do the most good for the entire economy (with the assumption that the health crisis itself would be addressed with a separate bill). The economists ranked their top three priorities and gave unemployment insurance the highest share of No. 1 responses. But though that benefit was in the top three of priorities for a majority of the experts, at 67 percent, it didn’t see the highest share of overall top-three responses. By that measure, the clear priority according to economists was funding state and local governments — which is consistent with a previous survey in which they thought one of the most likely causes of economic disaster would be an unwillingness to bail out those governments. In this week’s survey, 85 percent of respondents thought that should be among lawmakers’ top three priorities, and 36 percent said it should be No. 1.

What should be the priorities of a federal stimulus?

Priorities for a hypothetical federal stimulus package in order to have the greatest overall economic benefit, ranked by economists

Share of economists who ranked it as priority … Category No. 1 No. 2 No. 3 In Top 3 State and local governments 36% 21% 27% 85% Jobless workers (via unemployment insurance) 39 15 12 67 Small businesses 6 21 21 48 Public K-12 schools 12 15 18 45 Individuals (via stimulus checks) 3 21 12 36 Health care institutions 0 6 9 15 Other 3 0 0 3 Higher education 0 0 0 0 Large corporations 0 0 0 0

The survey of 33 economists was conducted July 17-20.

Source: FIVETHIRTYEIGHT/IGM COVID-19 ECONOMIC SURVEY

“State and local is going to be a huge drag on the economy because they are a sizable share of spending, cannot really run much in the way of deficits, their tax revenue is badly hit and Congress has done little to help so far,” Wright said. So cushioning states and localities could do a lot to support the economy, he said.

Other areas of focus that frequently came up among the economists’ top three priorities were funding for small businesses (48 percent) and public K-12 schools (45 percent) and another round of individual stimulus checks (36 percent). None of our economists, however, thought funding either large corporations or colleges and other institutions of higher learning was a priority.2

In addition to our usual questions about gross domestic product in the second and fourth quarters, we asked the economists to forecast third-quarter real GDP growth in this installment of the survey. The results shed some light on just how much the prospect of a true “second wave” of coronavirus in the winter could slow down economic growth.

On average, economists thought real GDP in the second quarter of 2020 — which ended June 30, with an advance GDP estimate set to be released later this month — declined by an annualized rate of 27 percent compared with the first quarter. They also thought real GDP would grow by about 8 percentage points quarter-over-quarter in the third quarter, with an upper-bound estimate of 17 percent and little chance of negative growth again. But their forecasts looked bleaker for the fourth quarter, with a median forecast of 3 percent growth, a 90th-percentile forecast of 9 percent and a 10th-percentile forecast in the red again (at -3 percent) — all more pessimistic than in the third quarter.

Some of that reflects the increased economic activity of the summer (relative to the early spring), even with the virus circulating around the country; the likelihood of some kind of third-quarter bounce back was high, given how bad economists think second-quarter GDP will end up. But the forecast also speaks to the uncertain course that the virus — and therefore, the economy — might take over the rest of 2020.

Robert Barbera, an economist at Johns Hopkins University, said part of the problem in forecasting quarterly shifts is that month-to-month change can be so extreme. His forecast for the third quarter was less optimistic because he expected most of the initial bounce back to happen in May and June, which are both part of the second quarter. The third quarter might see an uptick in August and September and look quite a bit better than the second quarter, he said, but that’s partially because the second quarter was so bad. Predicting the fourth quarter is even more difficult — in part because a bounce back in the economy is so dependent on Americans’ willingness to resume ordinary life.

However the course of the recession plays out, our economists think America could be due for a massive wave of personal bankruptcies in the second half of the year. During the first half of 2020, total bankruptcy filings — the vast majority of which were by individuals — were actually down 23 percent relative to the first half of 2019, according to court data from Epiq AACER. But don’t be fooled: That was almost certainly because of the heavy use of grace periods and extensions by creditors, which will eventually expire (if they haven’t already). In our survey, 67 percent of economists thought total filings would increase significantly in the second half of 2020 relative to the second half of 2019; only 6 percent thought they would see the same kind of year-over-year decrease in the second half of 2020 that they saw in the first half.

Taken as a whole, the economic picture painted by this week’s survey is no brighter than in previous installments. The panel’s predictions for future GDP have scarcely budged over the past two weeks, and the experts remain wary that whatever gains the economy is making over the summer could be wiped out by the virus before year’s end. But they also clearly think Congress has a few tools at its disposal to avoid making the recovery harder than it needs to be. The big question is — will policymakers use them?

3 notes

·

View notes

Text

Structuring a Playschool Business in India

Taking up play school business is a stance that is gaining popularity among the entrepreneurs of India. The primary reason this venture as a business is gaining popularity is because of its lucrative nature in terms of low investment, even lesser legal compliances and huge outcome. Makoons, a popular chain of playschool franchisee provider quotes an ROI on its franchisee to be 200% in 4 years; such is the outcome of this business. Once settled, this business does not give you the stress like recessions and low impacts.

Analysis of the Market

Indian Pre-School/Childcare Market to Grow at 19% during 2019-2024, Propelled by Rising Women Working Population

The business model has a good cash inflow and potential of seeing substantial growth based on the entrepreneurial drive driving it. The potential of growth in this sector is humongous. Following are a few graphs that will show the potent growth in this business filed. The following graph shows how the return on human capital investment as a function of age is.

Structuring a playschool business in India – Process Chart

But no matter how lucid and easy going business field one might be in, one certainly needs a good business plan to grow aggressively in the market. As it is commonly said, a stagnant business/product is as good as a dead business. Therefore, to start a business too, one needs a good business structure. Here are a few items that are supposed to be in the checklist in starting a playschool business:

Selecting a business model

When one plans to start a playschool business in India, he has two options in hand i.e. either start his own venture or take up a franchise. Both of them have their own set of advantages and disadvantages.

On getting a franchisee, there are certain benefits like there are certainly advantages like:

· There is no requirement of aggressive marketing or campaigning that is taken care of by the brand-name holder.

· The terms set out in the agreement for setting up a business model is easier and has very low investment criteria.

Let us take a look at the top franchisors and the criteria they site

· Required investment for Kidzee Playschool is just Rs. 15 to 20 lakhs and the required floor area is 2500 – 5000 square feet

· The net investment to open a Makoons play school franchise in India is also under Rs. 12 -15 lakhs and the minimum required area is 1500- 2000 square feet.

· A Euro Kids play school is about Rs. 15 lakhs, and the required floor area is a minimum of 3000 square feet.

· One needs a minimum investment of Rs. 6 lakhs to open a Shemrock franchise preschool in India as well as a floor area of 2500 square feet.

· The cost of opening Bachpan franchise is 12-15 lakhs and area required is 2000 square feet.

· The return on Investment assured by this franchise is easy to achieve and are considerably high. The risk factor involved in such franchise business is very less.

· Professional support in terms of setting up the school (pre-defined infrastructure, staff and administration), managing it, getting market recognition etc. are some advantages of having a brand franchise.

Advantages

· One gets to handcraft one’s own business model. One can choose a partner and a scale of business investment of his choice.

· There is a certain degree of freedom as he is not bound by a standard form of agreement.

· He gets to apply his own expertise, entrepreneurial ideas into it and design an innovative venture.

Commercials

One of the important aspects before venturing into legal formalities is to have the commercial structure clear. What could be the source of funds? How much of debt or equity needs to be injected in the business:

Investment Required

1. Land and Building – Ranging from 1500 square feet to 2500 square feet

2. Capital Investment – Ranging from Rs. 8,00,000 to 10, 00,000 (depends on the scale of business.)

3. Furniture like plastic chairs, tables and classroom equipment’s amounting to 40,000- 80,000

4. Play equipment’s like rockers, slide etc. Also book racks, wall hangings and staff furniture needs to be considered

5. Appropriate Human Resources qualified to man the organisation. Minimum wages that need to be paid out is 80 rupees per day. 1 staff per 10 students and 1 teacher per 8 students. A venture like this typically has 30 -50 students large infrastructure can have up to 170 students.

The Return on Investment as quoted from famous franchises is approximately 2 to 3 years depending on the franchise and the scale of the business. Setting up a franchise is easier.

The process is as follows:

· A simple forms needs to be filled in their website.

· They are going to conduct the survey if one meets their criteria to select a favourable location, do the marketing and campaigning.

· You will be able to start a playschool with their guidance at every step.

· There are several portals which provide gateways to apply to these playschool franchises. Like www.startingfranchise.in

· But if the venture is one’s own, then certain factors have to be kept in mind before making an investment in order to reach an ROI. The factors that need to be taken care of are as follows:

· Geography – Parents till the initial stages of the growth of the child do not want to send their children far, therefore it has to be in a residential area with open spaces around. Again depends on the locality.

· Demographic Profile – Once the location is fixed, than one needs to look for the demography of the area. A place with a nuclear family would be more likely to send their children to play school than places with joint family where the child mostly gets its education from elders. Also it is advisable to keep a tap on the type of income group people that live there. It will help set the fee structure.

· Market Survey – Conduct a survey to find out the potential number of students and the preference of the kind of playschool.

Break Even Point

Step 1:

· From the industry standard, let us keep the Break Even Point (where both Fixed Cost and Variable Cost are absorbed) at 1.5 years

· The Fixed Cost is assumed at initial stage as INR 10, 00,000 (FC)

· The Variable Cost is expected to be 4, 00,000 (TVC)

· Also, we set a target to break-even our business in 1.5 years.

Step 2:

· Find out the annual fees that your competitors are charging to estimate your fees.

· Let’s assume that the fees charges would be INR 25,000 per student and the number of students to be X. Therefore the Total Revenue (TR) would be INR25, 000X.

Step 3:

Contribution = TR – TVC

· 25,000X — 4, 00,000.’

Step 4:

· We have kept the break even timeline as 1.5 years. Whatever is earned over and above our variable costs, will be used to cover the fixed expenses. Post that all earnings would be to be profits of the institution

· Divide FC by Contribution to get your breakeven period in years.

· Therefore we get the following equation:

· 700,000 / (25,000X — 400,000) = 1.5.

· The value of X stands as 34.67.

· Thus we need at least 35 students for first 1.5 years to realise all costs.

· Even after the breakeven point, the profit will be INR 4, 75,000.

3. Legal Formalities

In case of playschools, the legal compliances are very minimalistic. Thus the cost of litigation that may arise out of such process is also very less.

1. The Shops and Establishments Act is not applicable

In case of playschools, the Act is silent and one can run your playschool without a registering under Shops and Establishment Act.

Labour laws:

The following labour laws have to be kept in mind:

1. Provident Fund payments – If there are more than 20 employees the organisation has to abide by provident fund rules otherwise may be subject to penal provision under 14B of the Act of 1952.

Checklist of the same could be found at https://unifiedportal-emp.epfindia.gov.in/epfo/

2. The Minimum Wages Act, 1948 – The minimum wages for primary schools is Rs. 80.

3. As per the Payment of Bonus Act, 1965 – If there are more than 20 employees, one needs to pay a 1 month at any time during the year.

Forming the entity:

If you start your own institution, it can be done either as a partnership or as a Section 8 company or even an NGO under a trust. It is usually easier to form a partnership, and cheaper and quick to register. Forming a company can take up to 4 weeks, and costs around Rs. 35000. Be careful with the formation of the partnership deed and the profit sharing.

LLP in India has certain regulations which need to be abided by, according to the LLP Act, 2008 in India. Although the regulations are more than partnership firms but less than floating a company given the ever increasing regulations for companies under Companies Act.

Running it in a residential area:

Most playschools are located in residential areas. The first thing that needs to be looked into is whether the rental agreement permits it. Also, if it is an apartment or consortium or society apartment, the bye-laws of the apartment/association/ society consortium should be looked into for permits to run a playschool. Otherwise, there is no running a playschool in residential premises. Requisite permission has to be taken from the society it is operating in.

It has been decided by Courts in different states that a chartered accountant, yoga teacher and lawyer can carry on their work in residential premises so there is no reason why a playschool cannot be carried on as well, as long as the disturbance to neighbours is minimized.

Maharashtra Preschool Centres (Regulation of Admission) Act of 1996 or Tamil Nadu Private School Education Act:

These Acts provide for compulsory registration of preschools in certain state. Only in a few states, one needs permission from appropriate authority for starting preschool in Maharashtra. It should be education officer of Municipal Corporation who will provide with the certificate. However this is the only state where you need such permission. The procedure is broadly as follows:

· Name the institution. It should not duplicate

· Define your budget.

· Develop a preschool curriculum

Deciding a curriculum

The final step to see the business set up to reach its initial stage is setting up a curriculum for the day school. Most of the franchisee have international affiliations with Early Child Education curriculums which depends upon the type of playschool being formed Children of this age group are mostly very active and require engage in various activities. Their mindset is set to explore, observe and grasp and learn quickly. Their socio economic backgrounds may be different and so shall be their languages thus every child is different in terms of energy and understanding.

There can be different programs based on the age group:

Mother Toddler program for 13 months and 2 years of age: Mother Toddler program again is designed to help mothers understand child’s socialisation needs and help them develop their skills while playing.

Early Childhood Teacher training program (E.C.C)/Nursery teacher training program:

Such programs are aimed towards training students to be ready for pre primary or early school. Theory plus practical courses of 7 months are advisable for this stage.

Day Care center curriculum – It is a different sort of set up. Most of the parents are working and are unable to provide teaching time to their kids. Such parents look for quality preschools where their child could get proper early childhood education.

An ideal playschool curriculum fulfils all the requirements of a child. A typical preschooler’s curriculum includes a good mix of reading, preschool worksheets, writing and math exercises along with colourful fun preschool activities. Such wide scale of activities helps children in learning and developing their skills in all the fields. Children are quite fascinated by playful activities and colourful objects and also appreciate the playful moments. There are professional advisors who can help in developing a good playschool curriculum. It is advised to consult them because it is the first learning stage of the child and should not be dealt with.

For free consultation on starting your preschool call us at 1800 5721 530

#playschool#preschool#earlychildhoodeducation#kindergarten#schoolfranchise#school startup#education#best play#school#franchise

2 notes

·

View notes

Text

The Wealth Of Nations and 21st Century Socialism

If we were to seriously consider the socialist prerogatives suggested by Alexandria Ocasio-Cortez and her supporters in New York City, we would stand on Adam Smth's Wealth of Nations as a platform in refuting and ridiculing the notion that a capitalist nation such as America could change its historic course as a paradigm of free trade, division of labor and national productivity. Ocasio-Cortez supports progressive policies such as a government-controlled medical industry, tuition-free public college and trade school, federal job guarantees, guaranteed family leave, the abolition of the US Immigration and Customs Enforcement and the privatization of prisons. They would also be a revision of gun control statutes, and an energy policy relying on 100% renewables. She also plans to use Modern Monetary Theory as an economic strategy to provide funding and enable implementation of these goals. In this discussion we shall examine the absurdity of these goals and the historic and economic precedents that condemn these notions to futility.

The arguments against a government-controlled medical industry are overwhelming. For starters we must ask why the best and brightest scholars from around the planet come to America to realize their destinies. In most cases it is not the aesthetics of our modernized nation or its bill of rights. Rather it is the opportunity to be rewarded for their genius and the opportunity to find a rewarding career. A lifetime of contribution in socialist nations such as China and Russia provide little more than improved housing, extended social privileges and exponential material rewards. The State sets ages and rewards according to its need, and anything sought by the applicant exceeding the standard will be arbitrarily rejected by the bureaucracy. Once Cortez's State controls are in place, the engineers, technicians and physicians will head to greener pastures, in all likelihood the European Union or Israel.

Once the American medical industry has become lobotomized, the socialist government will join those at the international auction block seeking the cheapest prices for products and services. No longer will American citizens benefit from state-of-the-art equipment, the world's best facilities or the latest pharmaceutical discoveries or medical treatments. Those who have devoted their lives to research and development will not seek compensation according to a socialist pay scale.

Skeptics will do well to consider the medical industry in Canada or the government-controlled Veterans' Administration in America. Canadian patients find themselves shortchanged by voucher systems, unable to schedule appointments at overbooked facilities, or obtain needed products and supplies at local facilities. American military veterans find themselves in similar predicaments in the majority of cases. Legislation in certain states has provided out-of-network services for veterans that allow them to seek medical aid outside of the government system. Otherwise they find themselves victimized by identical State-run institutions on both sides of the border.

Tuition-free public college and trade school are also a socialist pipe dream. All scholars know that the upper-level paper trail starts with the thesis essay. At this juncture they know that their success is precipitated by their writing skills. On the doctorate level, they are required to submit an essay that is deemed worthy of publication. From thereon, their acceptance as an associate professor at a college or university will require them to publish on a regular basis. Here they realize that their work can earn money on the open market. Only in America can a scholar hope to bring his credentials from his homeland and possibly receive a million-dollar signing bonus.

Obviously every scholar coming to the USA cannot expect a major score just by accepting a position at a major university. Yet he can continue to publish and hope that his dreams will be realized. During that time, his track record at his workplace gives him the authenticity he needs in order to pursue his goals. This allows American colleges to reap the benefits as these unsung innovators await discovery. If these opportunities were not available, these pedants would seek broader horizons. An entry-level socialist wage would never attract the kind of scholar that American colleges do now.

Let us digress to the dawn of man when primitive tribes of neanderthals were bartering as their villages expanded to where their proximity became too close to ignore. A tribal chief bringing a sack of potatoes to the border would expect his counterpart to bring him a bag of carrots of the same size. When a third tribe makes its presence known, they will accept his offering of wheat. Only the day comes when his offer shifts, and this is where socialism fails.

The wheat offerer brings loaves of baked bread, and here is where the discourse changes. We now have the labor cost of the bakers who produced the bread. It is doubtful that the chiefs will reject the offer of bread, so now the bread chief will have the opportunity to name his price. And so it goes. The only option for a socialist system will be for the villages to join together to make the bread as equal a trading option as the produce. The bread chief would be a fool to agree. And only by violence could he be forced to submit.

As Adam Smith pontificates, there is no point where a sovereign body will acquiesce to their detriment. They will demand reciprocation for their contribution. Paradoxically, this is the opposite of what America has done since the turn of the century. We have given excruciatingly more in building empires and propagating democracy than any nation in history. The only reciprocations have been political: we expect our allies to vote our way at the United Nations and provide access to trade routes or staging areas for military operations. Only we have gotten less and less in return over the decades. Finally Donald Trump has come to collect some old debts. Cortez wishes to maintain the status quo for everyone but Americans.

Federal job guarantees will do nothing more than assure Americans of greater sub-standard government agency service than ever. Since the end of World War II, Federal and State agencies have been increasingly filled by those seeking job security and, in many cases, permanency. It has long been a standard maxim that, once acquiring a government job, one is set for life. The benefits are guaranteed for as long as the government exists. The starting pay is competitive; however, the annual raises leave much to be desired. As a result, most move on to the private sector in time. Those who remain do so for lasting job stability.

This results in an overabundance of workers unable or unwilling to achieve higher stations in life. Added to such ranks are unemployed workers conveyed directly into the application process. Many have failed in previous endeavors and were expecting to receive benefits before being siphoned back into the workforce. In both cases, their attitudes are reflected in their level of customer service. Most citizens needing government assistance will minimize their contact with such personnel, leading to a lighter burden for the agencies to bear.

This endemic philosophy of the bureaucracy has plagued the greater socialist nations such as Russia and China. Their citizens grow desperate in seeking government assistance only to find little or none forthcoming. It is little wonder why the black market thrives in such conditions, or unlicensed providers are able to flourish. We can also invoke Adam Smith's principles in citing the need for overachievement in the private sector. An enterprise that does not seek to compete or improve the quality of its products or services is doomed to failure. Workers who have no tangible interest in the success or failure of their employer soon become disenthused. Soon they grow mechanical in satisfactorily completing their daily assignments. If Americans are dissatisfied with government bureaucracy at this point, under Cortez it may well become far worse.

Guaranteed family leave is a Pandora's Box that, included with socialist policies including pro-choice agendas, might well result in profligation by way of the most sinister of ulterior motives. It is well known that socialists in the US are advocating the most extreme policies, including the abortion option at any point up to the time of delivery. This disregard for the sanctity of human life is further reflected by discussion as to whether or not a mother and her physician could agree to withhold life sustaining treatment. In essence, this means leaving the newborn alone to die. This can be legitimized by any possibility of risk to the mother's health, either physical or mental. A woman fearing post-partum depression can exercise the right at will.

We cannot rule out the possibility of recipients taking advantage of this system. A female could well plan a pregnancy to be termed in advance, filing a claim for paid leave of absence. Most doctors will agree to recommend extended time off for the patient to recuperate. This conveniently allows one to carry the fetus up to a planned time, in which they can have the abortion before taking leave.

The abolition of the US Immigration and Customs Enforcement seems to be in conjunction with the New World Order's objective of establishing a globalist system. Without a Federal enforcement agency in place to prosecute immigration law offenders, it overburdens an already overwhelmed bureaucracy. In essence, it creates a porous border system that has already been proven relatively ineffective in preventing the ongoing alien invasion. Repeat offenders routinely include drug smugglers, human traffickers and career criminals. According to Adam Smith, our inability to protect our workers and our industries of these hazards will inevitably result in unsustainable loss.

One of the greatest dilemmas facing agriculturalists is that of illegal immigration. For over a half century, farmers have been able to employ undocumented workers en masse to meet market demand and lower their operating costs. One factor is the reluctance of Americans to accept arduous labor jobs for minimum wage. Another is the economy of paying workers off the books in cash for a set price. Most workers are glad to receive enough cash to provide for their families, and the employer is relieved of having to comply with legal obligation. If the socialists succeed in disrupting the system, it may prove disastrous to the entire agriculture industry.

What Cortez and her associates fail to realize is one of Adam Smith's basic concepts. The merchant must always factor in his overhead costs in order to generate a reasonable market price. The labor costs, material costs and all other opportunity costs are taken into consideration. When the merchant is able to compete on the open market, it is reasonable to assume that his costs and prices are similar to those of his competitors. If his prices exceed those on the market, his options are extremely limited. He may find a remote area free of competition. He may rely on his reputation and customer allegiance for a short time. Other than that, he may well be forced out of business.

When the floodgates are open and aliens are granted citizenship status, they will be able to rely on equal opportunity laws to improve their wages. This will force agriculturalists into compliance, greatly increasing their labor costs. This would result in a reciprocal increase in prices, which is eventually passed on to consumers. If the farmer experiences a 25% rise in overhead, the cost of a basket of peppers may go from a dollar to $1.25. This may cause griping but little ado among customers. However, when the cost of a gallon of milk goes from $3 to $4, there will be wailing and gnashing of teeth across America.

Needless to say, it will be impossible for merchants to provide health insurance for field workers. This places an incalculable strain on the government-controlled health insurance system being promoted by Cortez. Millions of aliens may well apply within the first year of a socialist takeover. The impact on lower-class families depending on health care might well be catastrophic.

Regardless of the health care scenario, the spike in agricultural costs would have a ripple effect across the American economy. A rise in crop prices would create a surge in the livestock industry. Although cattle ranchers would not be immediately affected, the cost of pork and poultry would escalate along with the cost of feeding the animals. Even the fuel industry would feel the pinch as the increasing use of ethanol would be affected by a sharp rise in corn prices.

Abolishing the use of privatized prisons would have a seismic effect on the government budget as well. It is estimated that nearly 15% of US prisons are privatized, representing a 50% increase since the turn of the century. The number of unemployed workers would be the least of Cortez' problems. Of greater concern would be the number of prisoners that would be injected into the Federal and State penal systems. A recent estimate shows as many as 125,000 inmates would be displaced.

The immediate problem would be the overcrowding effect as the prisoners are redistributed to facilities across the country. Most penologists would concur that overcrowding is one of the main contributing factors to prison violence. The quick fix solution offered by leftist State administrations over the decades has been an early release for inmates to reduce the prison population. Often this has been granted to violent felons who have demonstrated a pattern of good behavior. If this policy was extended to those showing borderline behavior, the possible consequences of releasing recividists could be grievous at best.

The revision of gun control statutes would pose a significant challenge to citizens' Constitutional rights. In cities such as Chicago and New York where regulations are among the strictest, it has been said that the only ones bearing arms are the cops and the criminals. For decades NYC had a law that provided for residents to possess rifles in their homes. The thought of a person having to bring a rifle to bear in the event of a home invasion is as comedic as it is pathetic. Gun permits are available, but the requirements are so stringent and the process so tedious that few even bother to apply. The bottom line is that the socialists want to remove as many firearms from citizens' possession as possible.

What is perceived as ambiguity in the Second Amendment has been debated by pro-gun and anti-gun activists for decades. It seems inconceivable that no amendment has been made or a ruling by the Supreme Court to clarify the law. The Second Amendment of the United States Constitution reads: "A well regulated militia, being necessary to the security of a free State, the right of the people to keep and bear arms shall not be infringed." Polemicists have been dissecting this poorly-worded sentence for over a century. To most, it seems clear that 'the right of the people to keep and bear arms shall not be infringed'. To others, the 'well-regulated militia' is the key phrase, providing for those active in the militia to be scrutinized by authorities.

Therein lies the conundrum. For National Rifle Association advocates, the right of all citizens to bear arms is inalienable. For anti-gun lobbyists, 'regulation' opens the door for arbitrary restrictions as determined by State (and eventually Federal) governments. Convicted felons and mental defectives have already been prohibited from owning firearms in many states. If the socialists ever seize power, there will assuredly be more categories and situations to follow.

When we view this from Adam Smith's perspective on a microcosmic scale, we see the inherent risks and perils with the socialist line of thinking. If a merchant, or a community of merchants, is subject to robbery and burglary that threatens his merchandise, his lives or property, there is an obligation by one and all to resist the predatory force. In the case of the American colonies being victimized by authorities, the option to resist becomes a matter of survival. It is hard to imagine Adam Smith standing alongside socialists in restricting the rights of merchants to defend their property.

This brings us back to a previous argument concerning socialists' position on open borders. Ranchers along the southern border have dealt with rampant trespassing issues as aliens have violated their perimeters and crossed their property. For these citizens, they may well have their lives and those of their family and their animals placed at risk by Cortez socialists. Do we doubt that traffickers facing lengthy jail time (until further alterations are made by Cortez) would not use deadly force to avoid capture? If these criminals sought to use private property as a shortcut to their inland destinations, the land would be repeatedly violated with no chance by the homeowner to interfere. They might reach out to ICE, but under Cortez, that option would no longer exist.

The energy policy relying on 100% renewables is something Adam Smith could not foresee. One of the major battlegrounds is West Virginia, where an area the size of Manhattan is being cleared for a solar energy plant. Thousands of acres of woodland are being chopped down to make room for this project. The elimination of refuge for wildlife is the least of the socialists' concerns. They feel it will create a milestone for other states on their path to clean energy. As for West Virginians, they are already being impacted by the streams and other bodies of water that are being polluted, diverted or dried up. Once the actual construction begins, they can only expect things to worsen. We know of the nihilistic maxim: one must destroy in order to create. Adam Smith would ask: what is it that the State has the right to destroy at the expense of society?

The bottom line as regards Cortez's Modern Monetary Theory is simple. The State's budget is dictated by the amount it invests in the public sector as opposed to the money it receives by means of taxation. If it spends more than it taxes, there is a deficit as is common for Republican administrations. This indicates that more money has gone to bank accounts in the private sector than to the Treasury. If it taxes more than it spends, a surplus is created. This is common among Democratic administrations as we last saw under the Clinton regime. Cortez has already announced plans to increase taxes in her New York dominion up to 70%. This may work well for NYC millionaires, of which only a small percentage of their income is taxable. But what of the rest of America that may disagree with socialist policy. Adam Smith may point to a quote from the American Revolution: taxation without representation is tyranny.

In summation, history shows that a socialist government had never achieved a noteworthy stage of security and solvency. If millenials and illegal voters are able to carry Cortez down that slope, Christian Americans will be the ones to blame for the consequences. Let us hope that the Moral Majority will be able to save the day. Otherwise, Wealth Of Nations by Adam Smith may, like the Bible, be another prophetic book we chose to ignore.

#American politics democratic socialism#alexandria ocasio-cortez#adam smith wealth of nations#christian america

5 notes

·

View notes

Text

Winter Economy Plan: The latest coronavirus government support for tradespeople

In the latest Winter Economy Plan, the government has included measures to support UK businesses that are facing decreased demand or are legally required to close their premises, due to the coronavirus (or COVID-19) pandemic. We’ve summarised the initiatives available for small and medium-sized (SME) trades businesses below.

Self-Employment Income Support Scheme (SEISS) extension

What is it?

The government has extended the SEISS, which was due to end in November 2020. The SEISS now includes two more direct cash grants.

The first grant will cover 40% of your average monthly trading profits, capped at £3,750 in total. It’ll be paid as a single instalment, covering the three-month period from November 2020 to the end of January 2021. The second grant will also cover a three-month period, from the start of February to the end of April 2021. The government is set to release more information soon about how much the second grant will be.

Both grants are taxable income and are subject to National Insurance contributions.

Who’s eligible?

Anyone who’s self-employed, or a member of a partnership, that:

Was previously eligible for the SEISS. However, you don’t need to have actually claimed it. The SEISS eligibility criteria is:

A trading profit of less than £50,000 in 2018-19 or an average trading profit of less than £50,000 from 2016-17, 2017-18 and 2018-19.

You must have traded in the 2018-19 tax year and submitted your Self-Assessment tax return for that year, on or before 23rd April 2020.

You must have traded in the 2019-20 tax year.

You must intend to continue trading in the 2020-12 tax year.

More than half of your income during 2018-19, 2019-20 and 2020-21 tax years must have come from self-employment.

Declares that they intend to continue to trade moving forward, and:

Is actively trading but is impacted by reduced demand due to coronavirus, or

Was previously trading but is temporarily unable to do so due to coronavirus.

If you trade through a limited company or trust, then you won’t be eligible for the SEISS extension.

How can I access it?

Applications aren’t open yet. HMRC will provide more guidance soon – we’ll keep this article up to date.

Bounce Back Loan Scheme extension

What is it?

The government has introduced a new Pay As You Grow option, to allow all businesses that used the scheme to repay their loan over a period of up to 10 years, instead of the 6 years initially offered. This will cut average monthly repayments by almost half.

The extension also allows businesses to temporarily move to interest-only payments for periods of up to six months, up to three times. Repayments can also be paused entirely for up to six months, but only once and only after you’ve made six payments.

If you haven’t applied for a Bounce Back Loan yet, then the application deadline has been extended until Monday 30th November 2020. The Bounce Back Loan offers SMEs that are negatively affected by coronavirus a loan of £2,000 to £50,000, capped at 25% of their total turnover. This will be based on the calendar year 2019, or new businesses can estimate.

No repayments need to be made for the first 12 months of the loan, and the government will cover the first 12 months’ interest payments. After 12 months, you’ll be charged a fixed 2.5% annual interest. You can read more details about the scheme on our Trade Advice Centre.

Who’s eligible?

UK businesses established before 1st March 2020, that are currently trading and have been negatively affected by coronavirus. Banks, insurers, reinsurers, public-sector bodies, further education establishments that are grant-funded and state-funded primary and secondary schools are excluded.

Your business must not have been ‘undertaking in difficulty’ on 31st December 2019. Also, if you’ve already secured a loan under the Coronavirus Business Interruption Loan Scheme, then you won’t be eligible. However, you can speak to your lender if you’d like to transfer a Coronavirus Business Interruption Loan of up to £50,000 into the Bounce Back Loan Scheme. This option is available until the end of November 2020.

How can I access it?

Applications are currently open until 30th November 2020. Fill in the online form on the British Business Bank website to apply.

Coronavirus Business Interruption Loan Scheme deadline extension

What is it?

A loan of up to £5 million. The government has extended the repayment term to 10 years as part of the Winter Economy Plan, to help businesses that may be otherwise unable to repay their loan. The first 12 months of interest payments and fees are also covered by the government.

A successor loan guarantees programme is also being set up to start in January 2021.

Who’s eligible?

UK-based businesses with an annual turnover of less than £45 million. You must also:

Have a borrowing proposal that the lender would consider practical, if not for the coronavirus pandemic.

Self-certify that you’ve been adversely affected by COVID-19.

Not be classed as a ‘business in difficulty’, if you’re applying to borrow £30,000 or more.

How can I access it?

Applications have been extended to 30th November 2020. To apply, visit the British Business Bank website.

New Payment Scheme for VAT deferrals

What is it?

Businesses which deferred their VAT due between March and June 2020 now have the option to spread their payments into 11 equal instalments over the 2021-22 financial year. This replaces the original deadline of the end of March 2021.

Who’s eligible?

All businesses that used the VAT deferral option.

How can I access it?

You’ll need to opt-in to the New Payment Scheme once it’s put in place in early 2021. We’ll share more information on how to do this once HMRC releases more details.

Enhanced Time to Pay service for Self-Assessment taxpayers

What is it?

A further deferral for Self-Assessment tax bills that were due on 31st July 2020, and those due in January 2021. This means that these Self-Assessment tax bills won’t need to be paid until 31st January 2022. There’s no penalty for using this service.

Who’s eligible?

Anyone that’s self-employed.

How can I access it?

Use HMRC’s Time to Pay service to secure a payment plan.

Job Support Scheme

What is it?

Replacing the Coronavirus Job Retention Scheme (also known as furlough) which is running from June to December 2020, the Job Support Scheme will be a government grant to help employers pay the full wages of employees that are working shorter hours. The scheme will begin in December 2020.

For each hour that an employee isn’t able to work, the employer and the government will each pay one third of the employee’s usual pay. The government contribution is capped at £697.92. So, the employee will get at least 77% of their pay, if the government cap isn’t reached.

You can claim both the Job Support Scheme and the Jobs Retention Bonus, which you can read more about in our Coronavirus: government support for construction businesses blog post.

Who’s eligible?

All SMEs are eligible for the Job Support Scheme.

To be eligible, employees must:

Be working at least 33% of their usual hours.

Not be on a redundancy notice.

As an employer, you must:

Have a UK bank account.

Have a UK PAYE scheme.

How can I access it?

The employer will be reimbursed in arrears for the government’s contribution. Further information on how to claim hasn’t been released yet. Keep an eye on this article for updates.

The team at Rated People are working hard to keep new job leads coming in. We’ve even seen a rise in demand for gardeners, painters, carpenters and more! Check out the latest job leads.

For more information on the government support available for construction businesses during the coronavirus pandemic, head to our Trade Advice Centre.

Note: If there’s a lockdown announced in the regional area(s) that you work or live in, in addition to the national lockdown, the government says that you must follow all instructions from the relevant local authority.

Note: The government has confirmed that there is no limit to the group size when you are meeting or gathering for work. But, workplaces should be set up to meet the COVID-secure guidelines – follow the government’s guidance on how to return to work safely.

Further coronavirus support from Rated People:

For more information on staying safe whilst working, check out our Coronavirus: How to keep safe whilst working article.

For FAQs about using our service, head to our Coronavirus: FAQs for tradespeople.

The pros and cons of walk-in showers

How to be productive when working from home

Feature walls: The do’s and don’ts

Gas Safety Week 2020: How to protect your home

Coronavirus: FAQs for homeowners

The best times of the year to post your home maintenance job

The post Winter Economy Plan: The latest coronavirus government support for tradespeople appeared first on Rated People Blog.

Winter Economy Plan: The latest coronavirus government support for tradespeople published first on https://fanseeaus.tumblr.com/

0 notes

Text

In Search Of FIRE: Financial Samurai Retirement Portfolio Review

It hit me the other day that I’ve got to get my act together if I plan to retire a second time soon.

The first attempt at retirement lasted for just under a year until I started feeling too sheepish telling anyone I was retired at 34. Although my retirement portfolio was generating about $80,000 a year in passive income at the time, I started itching for more.

Seven years later, I’m running out of steam. I’ve already conducted multiple calls with boutique investment banks, private equity shops, and larger media companies on the potential sale of Financial Samurai after its 10-year anniversary mark in July 2019.

I’ve also tentatively convinced my wife to go back to work once our son turns two years and five months old this Fall. Spending 29 months as a stay at home parent should be long enough to feel like a parent did the best he or she could without feeling too guilty for going back to work. But we shall see when the time comes.

The final thing I need to do is make sure our after-tax retirement portfolios are generating enough income to cover our desired living expenses just in case Financial Samurai is sold and my wife can’t get a reasonable job in a field of interest.

I feel blessed to be able to do all the things I love since leaving full-time work in 2012 – coaching high school tennis for the past three years, writing almost daily on Financial Samurai, traveling around the world, and spending time being a stay at home dad since early 2017.

But all good things come to an end. We must frequently adjust in order to keep the good times going for longer.

How To Build A Healthy Retirement Portfolio

Before discussing my retirement portfolio’s latest income figures, I’d like to share five tips for everyone to follow to build their own healthy retirement portfolio.

1) Save until it hurts each month. Most people think that saving for retirement in their 401(k) or IRA is enough, but it is not. In order to have the optionality of retiring early or ensuring a healthy retirement at a more traditional retirement age, it’s important to max out your 401(k) while also contributing at least 20% of your after-401(k), after-tax income to an after-tax investment portfolio.

The after-tax retirement portfolio really is the key to early retirement since most people can’t access their pre-tax retirement accounts without a 10% penalty before age 59.5.

2) Focus on income producing assets. After you’ve had your fill of high octane growth stocks as a young person, it’s time to focus on income producing assets as you get closer to retirement. Dividend generating stocks, certificates of deposit, municipal bonds, government treasury bonds, corporate bonds, and real estate should all be considered in your retirement portfolio.

When I was younger, my favorite type of semi-passive income was rental property income because it was a tangible asset that provided reliable income. As I grew older, my interest in rental property waned because I no longer had the patience and time to deal with maintenance issues and tenants. Instead, my interest in REITs and real estate crowdfunding grew since the income generated is 100% passive.

3) Start as soon as possible. Building a large enough early retirement portfolio takes a tremendously long time largely due to declining interest rates since the late 1980s. Gone are the days of making a 5%+ return on a short-term CD or savings account. You need to save early and often to make compounding work most for you.

I knew I didn’t want to work 70 hours a week in finance forever. As a result, I started saving every other paycheck and 100% of my bonus starting my first year out of college in 1999. By the time 2012 rolled around, I was earning enough passive income to negotiate a severance and retire early.

4) Calculate how much retirement income you need. It’s important to have a retirement income goal. Otherwise, it’s too easy to lose motivation and focus. A good goal is to try and generate retirement income to cover all basic living expenses such as food, shelter, transportation, and clothing. Once you hit that goal, focus on covering your wants.

If your annual expense number is $50,000, divide that figure by your expected rate of return or comfortable withdrawal rate to see how much capital you will need to save. If you expect to earn a 4% rate of return, then you would need at least a $2,000,000 after-tax retirement portfolio, and closer to $2,200,000 – $2,500,000 due to taxes.

5) Make sure you are properly diversified. The first rule of financial independence is to never lose money. We saw a lost decade for tech stocks between 2000 – 2010 after the first dotcom bust. For NASDAQ investors, it took 13 years to get back to even.

You always want to be moving forward on your journey to early retirement. Please do not confuse brains with a bull market.

Financial Samurai Retirement Portfolio Review

Since retiring the first time around in 2012, I have yet to stress test my after-tax retirement portfolios because I received a severance that paid out enough money to survive for five years.

While I was living off my severance income, my wife worked until she negotiated her own severance at the end of 2014. She is three years younger than me. Having her work and provide healthcare was very comforting and allowed me to reinvest 100% of our after-tax retirement portfolio income.

Then once both of us weren’t working full-time jobs in 2015, Financial Samurai started generating a livable income as well. This positive sequence of events is why planning is so important. It’s frankly why quitting your job to retire early is a suboptimal move.

Ideally, we want to live on between $15,000 – $18,000 a month in after-tax income to live our best lives while raising one or two children in expensive San Francisco or Honolulu. Using a 28% effective tax rate, we’re talking a target $250,000 – $300,000 a year in annual gross retirement income.

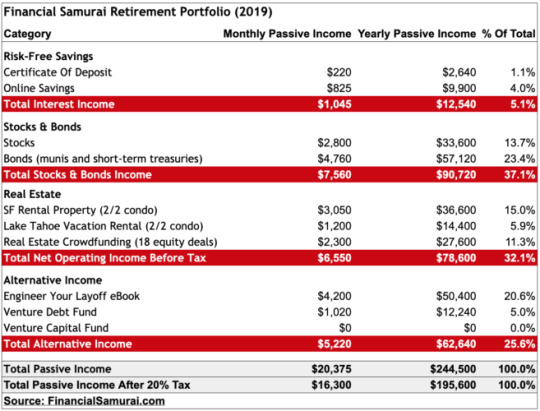

Here’s our latest source of income streams to fund our second retirement.

As you can see from the chart, we generate about $16,300 a month in after-tax retirement income if we use a 20% effective tax rate. The effective tax rate for investment income is lower than W2 wage income. This is something to think about when forecasting your own retirement income needs from investments.

$16,300 a month or $195,600 a year in after-tax retirement income should be more than enough to provide for our current family of three as our all-in housing cost is less than $6,000 a month. Once all our housing cost is covered, our costs for food, transportation, and everything else aren’t too bad.

$16,300 a month will also allow us to continue saving at least 30% a month for a rainy day (~$5,000). Because we’ve been in the habit of saving at least 50% of our after-tax income since graduating from college in 1999 and 2001, it would feel foreign to not continue saving in retirement.

The main anticipated increase in cost is preschool tuition starting this Fall at $1,800 a month. The other potential increase in cost is if we are blessed with another child. Ideally, we’d love to have two, but once you hit your late 30s or early 40s, the chances of a natural birth are only about 5%. Hence, we will consider fostering or adopting as well.

If we stay in San Francisco long term, our goal is to send our boy to public school after preschool if he can win the SF public school lottery system. If our son does not get into a reputable public school close by, then we’ll be forced to spend about $3,000 a month for elementary school and likely $5,000 a month for high school when the time comes.

These potential grade school tuition costs are the main reason why I’m striving towards $18,000 a month in after-tax retirement income, or ~$2,000 a month higher than current levels. I’ve got three years to make this goal a reality.

Below is an analysis of the major retirement income categories.

Risk-Free Savings: $1,045/month (5% of total)

I love risk-free savings, especially after the Federal Reserve hiked interest rates multiple times since the end of 2015.

To be able to earn ~2.45% risk-free after making massive gains in the stock market and real estate market since 2009 sparks joy! Gone are the days of pitiful 0.1% savings interest rates.

My target is to always have between 5% – 10% of my retirement income and net worth in risk-free investments. You just never know what might happen in the future.

Stocks & Bonds: $7,560/month (37%)

After a tremendous rebound in the stock market in 2019, I decided to asset allocate more towards 3-month treasuries in my main House Fund portfolio.

As of now, my House Fund portfolio is roughly 20%/80% stocks/bonds because my plan is to buy another property within the next 6-12 months.

The House Fund portfolio had a $400,000 swing (-13%, then +23%) and I want to ensure that I protect the principal going forward. My other main public investment portfolio is closer to 60% stocks / 40% bonds. I plan to gradually shift the weighting closer to 50%/50%.

Below is my public stock and bond portfolio performance +9.2% vs. the S&P 500 +15.9% year-to-date according to Personal Capital’s performance tracker. With the income from my existing bond holdings, I should have relatively no problem closing out a 10-11% total return for the year.

As I edge closer towards retirement, my main goal is to minimize volatility and try and achieve a 5% – 7% total return equal to 2X-3X the 10-year bond yield.

The rise in short-term interest rates has really been a boon to my bond portfolio income stream. I plan to continue actively investing in 3-month treasury bonds and saving about 80% of my monthly cash flow.

Real Estate: $6,550/month (32%)

Real estate used to dominate my retirement portfolio income (~60%) until I sold a significant SF rental house in 2017 for 30X annual gross rent.

I ended up reinvesting $600,000 of the proceeds in mostly dividend-paying stocks, $600,000 of the proceeds in mostly municipal bonds, and then $550,000 of the proceeds in real estate crowdfunding ($810,000 total) in order to not lose too much real estate exposure.

I did get a surprise $45,598.04 distribution on 4/16/2019 from the RS DME fund where I have a total of $800,000 invested. The fund has 17 investments, across 12 states, and 6 property types. My Class A Austin Multifamily property was sold for a 24.6% return over two years.

So far the fund is returning a 10% cash-on-cash return net of fees. I’m hoping the end IRR is much higher after the equity investments are sold within the next 2-3 years.

For retirement portfolio calculation purposes, although I received $45,598.04 in distribution, I’m only inputting the profits as passive income to stay conservative. Perhaps there will be another significant distribution later in the year.

Once about half my RS DME fund distributions are returned, I will look to reinvest about $300,000 in a couple Fundrise eREITs and around $100,000 in individual RealtyMogul sponsored commercial real estate investments. I already have a decent sized position in OHI and O, two publicly traded REITs.

So far I like the simplicity of investing in a real estate fund versus spending time trying to pick the best deals. But if I’m going to retire again, I’ll have more free time to do due diligence.

My goal is to always have at least 30% of my net worth exposed to real estate as it is my favorite asset class to build long term wealth.

I haven’t raised the rent on my SF 2/2 condo in almost three years. At $4,200 a month, the property is now under market value by $300 – $400 a month. But I plan to just keep the rent below market rate because they’ve been good tenants. I’ll wait until one or both decides to move out before raising the rent.

Our Lake Tahoe property is coming back to life! We’ve had a fantastic winter in 2018/2019, which has resulted in a roughly doubling of net rental income over last year.

As the storms have subsided, we plan to finally take our boy up to the mountains. Spending time with my own family has been a dream of mine since I first bought the property in 2007.

Alternative Income: $5,220/month

Online books sales for How To Engineer Your Layoff has steadily increased each year since the first edition was published in 2012. I wrote a new foreword for 2019 and updated some data.

My wife has spent the past four months updating the book for a 3rd edition launch in 2H2019. The 3rd edition will have even more case studies and strategies to guide people to better negotiate a severance. We will likely raise the book’s price by 15% as well.

The amount of positive feedback we continually get from readers who’ve successfully negotiated their severance has been tremendous. If you plan to retire early, it behooves you to try and negotiate a severance. You have nothing to lose.

To generate $50,400 a year in almost passive online income from a book would require amassing a $1,008,000 portfolio generating 5%. Not needing to have capital is why I’m so bullish on building online real estate as well. There is almost no risk except for putting your education and creativity to use.

There’s not too much to report on my venture debt fund investments. I’m still waiting to get paid in full for my first venture debt fund from five years ago. The second venture debt fund just did a 25% capital call for a total of 92% of the capital committed.

Finally, I invested in my first venture capital fund. I did so because I believe in the main general partner who has a good investing track record. This is a 10-year fund by Kleiner, Perkins, Caufield, & Byers, where I don’t expect to see any income until perhaps year five.

Enough To FIRE

Based on this deep-dive analysis, my wife and I should have enough to live a comfortable retirement lifestyle in San Francisco or Honolulu.

Keeping lifestyle inflation at bay while steadily growing our investment income has been key to building our retirement portfolio. For example, we have the ability to buy a house 3X the cost of our existing house which we purchased in 2014 but have chosen not to do so, despite the addition to our family.

What I find most interesting is that even though it’s clear that mathematically I shouldn’t have a problem retiring, I still have trepidation about selling Financial Samurai and retiring from my second career.

Change is always hard, especially after you’ve spent a decade doing one thing. Giving up a steady income stream is also scary when you’ve been through the 2000 dotcom bubble and the 2009 financial crisis and now have a family to support.

Eventually, we’ll need to start spending our retirement portfolio income. But as of now, we plan to continue reinvesting 100% of the investment proceeds and saving 80% of our active income until a retirement decision is made.

Related: Ranking The Best Passive Income Investments For Retirement

Readers, any of you planning to retire within the next 12 months? If so, what type of deep dive retirement portfolio analysis have you done to ensure that financially everything will be OK once you retire? Do you see any holes in our retirement portfolio we need to work on shoring up? Featured art by Colleen Kong-Savage.

The post In Search Of FIRE: Financial Samurai Retirement Portfolio Review appeared first on Financial Samurai.

from https://www.financialsamurai.com/in-search-of-fire-financial-samurai-retirement-portfolio-review/

0 notes

Text

ViddX Review And Huge Bonus

ViddX Review-- Are you searching for more knowledge about ViddX? Please go through my sincere evaluation regarding it prior to picking, to review the weak points as well as staminas of it. Can it deserve your effort and time and money?

Exactly How to Earn Money on YouTube

Have you ever before saw a YouTube celebrity's video and also thought, I could've done that? Me neither. Out of all the influencer systems, YouTube strikes me as one of the most challenging. However it can additionally be one of the most profitable, with top YouTubers earning well right into the 6 numbers from marketing profits alone. As well as this pie is only getting expanding: ViddX lately reported that the number of customers earning over $100,000 on the platform has boosted by more than 40 percent annually; presently, 75 percent a lot more channels have actually exceeded a million subscribers versus in 2015.

Where eyeballs go, loan follows. "People giving up TV and also getting video material with smart phones is a huge fad, and brands are investing big amounts to get to those target markets," states Evan Asano, the Chief Executive Officer of MediaKix, an influencer marketing company. "It's a similar, otherwise larger market for influencers than Instagram." Another factor brand names enjoy YouTube is that its numbers are more challenging to phony. "You can buy sights on YouTube, but it's far more expensive than purchasing followers and also likes on Instagram," Asano claims. "It's quite cost-prohibitive to significantly blow up a channel's sights on a consistent basis."

YouTube also has a more autonomous allure. Unlike Instagram, where the biggest influencers are mainstream megastars in their very own right (Selena Gomez, Ariana Grande, Beyoncé), YouTube is controlled by homemade celebs, such as Jenna Mourey (a.k.a. Jenna Marbles), Mariand Castrejón Castañeda (a.k.a. Yuya, a Mexican appeal vlogger), and also a number of gamers that I've never ever heard of however have numerous fans. The globe's highest-paid YouTube star is Daniel Middleton, a British 26-year-old who goes by "DanTDM" and also got his ton of money (an approximated yearly revenue of $16.5 million, per Forbes) by uploading videos of himself playing ViddX. Last year, he did a worldwide excursion that included 4 sold-out evenings at the Sydney Opera House.

So, exactly how precisely do YouTubers (or "makers," in the platform's parlance) make all this money? Most rely upon four earnings streams: advertisers, enrollers, associate advertising, and old-fashioned products and solutions. (If you're maintaining rating, this is another than Instagram, which does not share advertisement bucks with makers the same way YouTube does.).

1. Marketing

Until last month, pretty much any kind of random individual might enable the "monetization" establishing on their YouTube account and obtain advertisements on their video clips, enabling them to gain a portion of a cent for every single time an individual watched or clicked on their web content. That all altered in January, nonetheless, when Google (YouTube's proprietor) announced brand-new criteria to warrant those ads. Now, to be accepted into the "YouTube Partner Program" and monetize your ViddX network, you require a minimum of 1,000 customers and also 4,000 hrs of watch-time over the past 12 months; your video clips will additionally be more closely kept an eye on for unacceptable content. Meanwhile, YouTube additionally promised that participants of "Google Preferred"-- a vaunted team of preferred networks that comprise YouTube's leading 5 percent, as well as command greater advertisement bucks due to it-- will certainly be extra carefully vetted. (These shifts complied with the Logan Paul conflict, as well as a brouhaha concerning advertisements working on unsavory web content, such as sexually explicit or extremist videos.).

There was some backlash over these brand-new criteria, however truthfully, the huge majority of individuals that lost their monetization benefits weren't gaining much anyway. Most networks make someplace in between $1.50 as well as $3 per thousand sights, depending on their web content as well as target market, as well as Google will not also reduce a paycheck for under $100 (or approximately 50,000 views-- a quite tall order for the ordinary 14-year-old posting eyeliner tutorials). Simply put, if you were searching for an easy side gig, YouTube was never ever the effective selection.

Instead, YouTube success requires time and also devotion. Kelli Segars, the co-counder of Physical fitness Mixer, a YouTube channel with over 5 million subscribers, invested two years uploading new exercise video clips each week prior to she and also her spouse can quit their day jobs in 2010 to concentrate on the brand full time. Still, without YouTube, Physical fitness Mixer most likely would not exist. "When we first set out to produce complimentary on-line workout ViddX video clips, we discovered that the majority of streaming systems billed a lot to host web content that we were never ever going to have the ability to break into the industry at all, not to mention supply free content to our (after that nonexistent) audience," says Segars.

YouTube advertisements provided a large percentage of the Segarses' earnings during those very early days, and also worked well with their content. "Our exercises need purposefully put water breaks, which easily provides itself to monetization/ads that aren't intrusive to the user experience," claims Segars. "Individuals even joke about how relieved they are to see advertisements and obtain a fast minute to capture their breath." Meanwhile, that earnings allowed them to take on a no-sponsor policy. "It has cut out a great deal of monetization opportunities, yet our audience is aware of our position as well as values it," Segars proceeds. "We assume that trust fund is a vital part of constructing a brand." Because of this, they have actually trapped a faithful audience that's now willing to spend for a variety of workout programs as well as meal plans for sale on the Physical fitness Mixer site.

2. Sponsorships as well as associate advertising

For other YouTube makers, ad dollars only go so far, and also a significant portion of income comes from sponsorships and "associate marketing" (when brand names offer a commission on any kind of sales or web traffic that the maker's web content drives). Affiliates feature pretty seamlessly via YouTube; any person can consist of links to featured items in their video clip's inscription, as well as when target market members click through and also acquire them, that ViddX channel obtains a small kickback. Numerous YouTubers prefer Amazon.com's affiliate program, "Amazon.com associates," although there are plenty even more to pick from.