#online invoice

Text

Why Should You Prefer Invoice Maker Software?

0 notes

Text

GET INVOICE AUTOMATION SERVICES - CENTELLI

#invoice#online invoice#invoice automation#automation services#accounting#bookkeeping#finance#outsourcing#tax#offshore#startup#accounting softwares#netsuite#freshbooks

0 notes

Photo

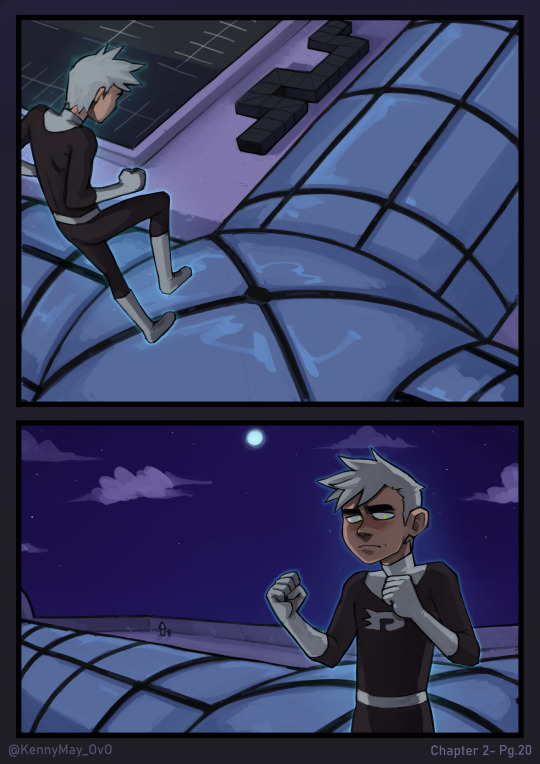

ECTOBER NIGHT - PAGE 20

[ First ] - [ Prev ] - [ Next ]

Aww Danny yah gonna get foot prints all over the dang glass man, it's such a pane to clean.

Scoots in last second to post a new page-aHA mADE IT! OOooo we inch closer and closer to a page I just cannot wait to show you guys!~ 💖

#Danny Phantom#Ectober Night#Ectober Comic#KennyMay_OvO#Danny Phantom Fan comic#Danny Phantom comic#Oh my god okay now I go lie down#Been replying to peeps and sending on invoices the last two days and man has my body fought me every minute of it#yOU WILL LEARN TO DO THIS WITHOUT FREAKING OUT BODY SO HELP ME GOD#50/50 chance i'm bedridden tomorrow but if I am i'll just be back at it the moment I'm better 😤😤😤#If it's not gonna stop i'm just gonna have to learn to push through it anyway if I want to have a life and a living online 💖#Yah'll make it worth it#I live for the tags and comments yah'll leave on my work

487 notes

·

View notes

Text

hey, regular reminder that if you get someone in your inbox (that you have never interacted with before/has never been following you) asking you to reblog a post on their blog (sob story asking for donations, usually about a pet to make it extra guilt-trippy) and they specifically ask you to answer this ask privately (for a vague and weak reason, why wouldn't they want more eyes on this post?) and then you go to their blog and their account is days old at most (and they're even claiming they have an old account that got shadowbanned ((?? being "shadowbanned" on tumblr does not mean you can't still post from that account?)) but never mention the url of that old blog) and all their reblogs are straight from the op and not from anyone they might be following who reblogged the post first (indicating they just quickly searched a semi-popular fandom tag to reblog some innocuous fanart to make the blog seem lived in)-

this is probably a scam :/ keep your eye out for odd details, inconsistency, and a glaring lack of credibility. stay safe out there everypony.

#ugh#yucky#bad taste in my mouth#this specific format of ask has also just been previously proven to be a scam tactic#so anybody trying to use it legitimately to fundraise is begging not to be taken seriously srry#they've clearly been in other peoples' inboxes with the same guilt-trippy copypasta#bc the ~200 notes they got are filled with ppl saying they cant donate rn but will signal boost it#ughhh#i'm rereading the exact wording of this post and getting so mad it doesn't make any sense#one of the pictures included is a vet invoice but they say they haven't gone to the vet yet but also the cat is pictured in a cone already#it does not make sense#said vet is also “the only one in the area that will take donations over the phone” but “needs to be paid upfront”#so. you cant have taken the cat to the vet yet. bc you dont have the money. which you are asking to be donated directly to ur paypal#thats not over the phone. thats. what?#MAYBE they mean an online payment but like.#then why do u have an invoice and the cat is clearly bandaged and in a cone already!!#then they also say the cat is already on antibiotics and only has days left if they dont get further treatment#and then a paragraph later claim the cat needs antibiotics!#im SO tempted to email this vet#i wont#im gonna put this to bed now

7 notes

·

View notes

Text

BuT AmAzOn iS So eViL

Amazon kriegts wenigstens hin die Rechnunsgadresse die ich eingebe auch zu verwenden. Vollidioten.

#salad-txt#german stuff#I stg every second german online shop I use fucks -something- up#I entered only my workplace address for invoice and shipping#but no those dipshits pulled my home address from my paypal transaction and now I can see if I can eat the 40€

5 notes

·

View notes

Text

fully convinced printers are petty little creachers that can smell when you're in a hurry and will stop working out of spite

#PLEASE I NEED TO MAKE A COPY OF THIS INVOICE NOWW#and i kinda look like an idiot standing next to it waiting for it to come back online 🧍🏻

4 notes

·

View notes

Text

I hate school exams SO. MUCH.

2 notes

·

View notes

Text

Free Invoice Generator with Online Templates

Would you like to Generate a Free invoice?

Zozo online invoicing software and templates make it simple to create a free invoice in Australia. Online templates for pre-made invoices are available for use. You can edit many of these templates for free to add your information. Millions of people trust us as your original Invoice Generator. With our eye-catching invoice template, Invoice Generator allows you to quickly create invoices right from your web browser. Create an invoice online customized for your brand or business using a Zozo free online invoice template.

Contact Us - https://www.zozo.com.au/contact-us

Regsiter - https://www.zozo.com.au/register

Website - https://www.zozo.com.au/

Our Plans - https://www.zozo.com.au/plans

2 notes

·

View notes

Text

Parlor Management software by HRsoftBD

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

3 notes

·

View notes

Text

Een correcte factuur opmaken, hoe doe je dat?

In het dagelijkse bedrijfsleven zijn facturen niet weg te denken. Facturen zijn namelijk één van de belangrijkste documenten voor een ondernemer aangezien zij dienen als bewijsdocument voor zowel de koper als de verkoper. Een goede administratie en een efficiënt beheer van de facturen kunnen ook een grote impact hebben op je cashflows.

Maar wat is een factuur nu precies? En wie, wanneer en hoe moet je eigenlijk een factuur opmaken?

by Plutus Accountants & Advisors

https://www.plutus.be/post/factuur-opmaken

#accountant#accounting#tax#invoice#plutus#plutus accountants#plutus accountants & advisors#peppol#digital#e-invoicing#odoo#exact online#octopus boekhouden#billit#billtobox#onfact#ubl#xml#robotic accounting#ai#ocr

2 notes

·

View notes

Text

as someone who hates being filmed without knowing it or without my permission, i really hope everyone who filmed Isaiah Bates at his surprise party did so knowing he'd be ok with it. I was a shy kid too and at Isaiah's age, I probably would've had an internal breakdown if I walked into a surprise party with that many cameras in my face 😬

#for real though#i get the icks every time i see the terminally online siblings try to invoice isaiah in their bs#i recognize that look of horror on his face every time lol#isaiah bates#*involve

16 notes

·

View notes

Text

Why E-Invoicing is in Focus nowadays

The government has initiated the trial of the e-way bill system from 15 January 2018 for the generation of e-way bills for intra-state and Interstate movement of goods but the system is expected to be rolled out soon and make it mandatory for transporters and organizations to generate the new e-way bill online according to the law of GST and in compliance with rules of the CGST rules.

Every taxpayer or every registered person who transferred his goods or causes to the movement of goods of value exceeding ₹50,000 concerning supply or the reasons which are other than supply or for inward supply from an unregistered person then e-way bill generation is necessary.

The relevance of GST E-invoicing software plays a role, as it is well known that E-invoicing is not a new technology but its relevance has grown multiple folds in recent times.

For choosing the best E-invoicing software india, users must keep an eye out for one of the features for choosing E-invoicing software is its ability to integrate with an accounting system.

This software allows the users to see where your operating funds were channeled and for that, you can also determine where your business finances are headed and in which direction.

E-way bill portal has also released the e-way bill APIs to license GST Suvidha providers for helping large transporters or large organizations automate the entire process by integrating their solution within an ERP taxpayer or an existing e-way bill system for generating new e-way bills online in real-time.

A user can generate the bulk E-way bill from the system by using software or when the user needs to generate multiple bills available in one shot they can generate the bulk E-way Bill by adopting touchless technologies of e-invoicing.

The concept of an E-way bill to generate online under GST was to abolish the Border Commercial Tax post to avoid the evasion of tax in India.

So it is crucial to know every aspect related to the E-way bill system under GST. The E-way bill system is very much important for both parties whether it would be for the government or the business industry.

For More Information

Call +91-7302005777

Or visit https://unibillapp.com/

#e way bill generate online#best e invoicing software#gst e invoicing software#eway bill generate online#generate e way bill online#e invoice software free#gst e way bill software#e invoicing software india#e invoicing software free#e invoicing software download

2 notes

·

View notes

Text

I listened to one lecture on freelancing as a business and it's got me googling if EVERYTHING will count as a business expense for tax deduction purposes

#taxes in january are gonna be a nightmare and im weirdly excited for it#i can deduct the thousands ive spent on these online classes?? i can deduct the paypal invoicing fees???#i can deduct the second monitor i bought 'so editing would be easier'????#this feels like cheating#overwhelmed by the feeling of regret for not saving ever receipt i've ever gotten ever though

5 notes

·

View notes

Text

My Etsy Shop

Hello,

I recently opened an Etsy shop to make ends meet. I really would love some feedback, and honestly I would love to chat. if you are not interested in my items but do know someone, please do send it to them. Help me gain exposure.

thank you in advance.

#etsy small business#etsyseller#etsyuk#etsystore#etsy shopping#shopsmall#small business#small business owners#small business trends#small business support#online store#smallbiz#online business#online shopping#small business help collecting invoices#small business website design#smallbuisnessowner#planner#planner community#planner spread#planner inspo#bulletjournal#planner love#stationery#planner stickers#calendar download#calendar design

3 notes

·

View notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes