#mavericsystems

Text

Beyond Boundaries: Unveiling THINK NXT – The Career Catalyst in Tech

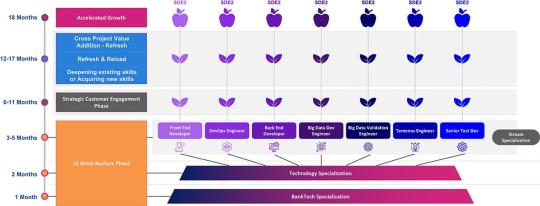

In a world where the pace of technological change is relentless, standing still is the fastest way to move backward. Enter THINK NXT, Maveric's avant-garde initiative, designed to keep up with the times and redefine them. THINK NXT is more than a program; it's a movement, a collective stride towards a future where tech careers are not just about coding but about creating, not just about solutions but about revolutions.

Charting Uncharted Careers: The Genesis of THINK NXT

In today's volatile job market, where a staggering 43% of millennials are ready to quit their jobs within two years for more fulfilling opportunities, as per the 2021 Deloitte Millennial Survey, Maveric saw not just a gap but an opportunity. This insight birthed THINK NXT, an industry-first, hyper-personalized career acceleration journey that catapults experienced professionals to new heights ahead of their peers in big brand tech providers. THINK NXT answers the monotony and stagnation that often plague large tech companies, offering a dynamic, engaging, and enriching career trajectory.

Hyper-Specialization: The New Career Currency

In the sunrise sectors of BankTech, EdTech, Biotech, and RegTech, hyper-specialization is not just advantageous; it's essential. With THINK NXT, hyper-specialization starts from Day 1. As per a report by McKinsey, organizations focusing on domain specialization are 33% more successful in talent retention than those that don't. THINK NXT taps into this insight, offering domain specialization that ensures your career isn't just moving but leaping forward in sectors poised for exponential growth.

Nurturing Niche Technologists: A Peek into THINK NXT’s Tech Specialization

In an era where technology evolves by the minute, THINK NXT recognizes the need for niche specialization. A study by PwC indicates a 60% technology skill gap in Asia-Pacific companies, a gap that THINK NXT aims to bridge with its focused tech specialization modules. The program is not about creating generic technologists but about nurturing maestros of technology, individuals whose expertise is not just recognized but revered in the industry.

Mentorship Magic: The Human Touch in Technology

In the labyrinth of technology, a guiding hand can make all the difference. THINK NXT's mentorship opportunities are not just about learning; they're about evolving. With industry leaders offering their insights and experiences, the program ensures that its participants are technically sound and equipped with the soft skills and strategic thinking critical for future leadership roles.

Client Engagement: The Real-World Classroom

While theoretical knowledge is foundational, real wisdom comes from experience. With THINK NXT, direct client engagement isn't an exception; it's the norm. This approach ensures that participants understand the technical aspects of their projects and grasp the nuances of client needs and market dynamics, a critical skill in today's client-centered business landscape.

The THINK NXT Trajectory – Shaping the Technologists of Tomorrow

THINK NXT is not just a program; it's a promise of growth, innovation, and excellence. It represents a strategic shift from the conventional, challenging the status quo and setting new standards in tech career development. As Maveric continues to evolve and expand THINK NXT, the focus remains on staying ahead of the curve, ensuring that the program is relevant for today and pioneering the path for tomorrow.

Best practices such as maintaining a solid focus on hyper-specialization, nurturing a culture of mentorship and continuous learning, and fostering real-world client engagement will continue to be the pillars of THINK NXT. Moreover, keeping a pulse on emerging technologies and industry trends will ensure that THINK NXT prepares tech professionals for the present challenges and equips them for future opportunities.

In a world teeming with potential, THINK NXT is the compass that guides tech professionals toward a horizon brimming with possibilities. It's an invitation to embark on a journey of growth.

THINK NXT catapults professionals with 0-4 years of experience at least 1.5 years ahead of their peers in big brand tech companies.

About Maveric

Established in 2000, Maveric Systems has positioned itself as a leading Banking Technology partner, forming successful collaborations with top global and regional banks across three continents. The company's distinctive approach involves integrating extensive banking domain knowledge with transformative technology to craft solutions that are future-ready.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

0 notes

Text

Designing a World-Class Tech Upskilling Program? 4 Crucial Components

In the rapidly evolving landscape of technology, the need for continuous upskilling has become paramount for both individuals and organizations. A world-class tech upskilling program is a strategic imperative to stay ahead in the competitive tech-driven arena.

Tech Upskilling Programs: Navigating the Future of Work

A tech upskilling program has become a crucial strategy for individuals and organizations. Tech upskilling refers to acquiring new or enhancing existing technical skills to stay relevant and competitive in the ever-changing world of technology.

Crucial Importance for upskilling programs

1. Job Security: In a dynamic job market, where roles are evolving, individuals who invest in upskilling ensure their relevance and, consequently, job security.

2. Innovation and Productivity: Organizations that prioritize upskilling foster a culture of innovation and increased productivity. Employees with the latest skills contribute more effectively to the company's success.

3. Future-Proofing: Tech upskilling is a proactive approach to future-proofing individuals and organizations against technological disruptions, ensuring they can thrive in the future job market.

As technology advances, embracing a mindset of continuous learning becomes beneficial and essential for professional growth and organizational success.

Let's delve into the critical components of a cutting-edge tech upskilling initiative.

1. Domain Fundamentals: Building a Strong Foundation

A robust upskilling program begins with a focus on domain fundamentals. Providing employees with a comprehensive understanding of their industry's core principles and practices ensures a solid foundation. Whether it's finance, healthcare, or manufacturing, domain-specific knowledge is the bedrock upon which tech proficiency can be effectively built.

Recent Example: Microsoft's AI Business School offers domain-specific courses, empowering professionals to integrate AI solutions seamlessly into various industries.

2. Tech Muscle: Hands-on Technological Mastery

The heart of any upskilling program lies in honing technical skills. Practical, hands-on training in the latest technologies equips employees to navigate the dynamic tech landscape. Whether coding, data analytics, or cybersecurity, a program that emphasizes hands-on experience fosters a culture of continuous learning.

Recent Example: Google's IT Support Professional Certificate on Coursera provides hands-on training, preparing individuals for roles in IT support.

3. Industry Specialization: Tailoring Skills to Industry Needs

An effective upskilling program recognizes the unique demands of different industries. Tailoring the curriculum to address industry-specific challenges ensures that employees acquire skills directly applicable to their professional context. This industry specialization enhances the relevance and impact of the upskilling initiative.

Recent Example: IBM's Digital - Nation Africa program offers industry-relevant courses to empower African youth with digital skills aligned with local market needs.

4. Mentorship: Nurturing Talent Through Guidance

Mentorship is a cornerstone of successful upskilling programs. Pairing employees with experienced mentors facilitates knowledge transfer, accelerates skill development, and provides invaluable insights. Mentorship programs create a supportive learning environment where individuals can navigate challenges with guidance from seasoned professionals.

Recent Example: Salesforce's Trailhead platform includes a mentorship component, connecting learners with experienced professionals for personalized guidance.

Benefits for Employees Seeking Employment:

For job seekers, engaging with a company that offers a comprehensive upskilling program signals a commitment to employee development. Access to cutting-edge training enhances marketability and demonstrates a forward-thinking organizational culture. Employees gain a competitive edge by entering the workforce with up-to-date skills, making them attractive candidates for employers seeking tech-savvy talent.

The THINK NXT Program: A Gateway to Accelerated Career Growth

It is a groundbreaking initiative designed by Maveric to catapult experienced professionals from 0 to 4 years old to new heights in their careers. The program promises to deliver an accelerated career trajectory through personalized mentorship and robust learning and development opportunities. THINK NXT is not just another training program; it's a transformative journey that unlocks untapped potential, empowering participants to stand out in a competitive job market.

Conclusion.

A world-class tech upskilling program integrates domain fundamentals, tech mastery, industry specialization, and mentorship. Companies that invest in these components foster a culture of continuous learning and innovation. As the tech landscape continues to evolve, embracing these best practices ensures that organizations and individuals thrive in the face of technological disruption.

About Maveric

Established in 2000, Maveric Systems has positioned itself as a leading Banking Technology partner, forming successful collaborations with top global and regional banks across three continents. The company's distinctive approach involves integrating extensive banking domain knowledge with transformative technology to craft solutions that are future-ready.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

About THINK NXT

Maveric's Think NXT Leadership program is a uniquely crafted training initiative aimed at creating a differentiated talent pool that can help us realize our aim to be the top 3 BankTech solutions specialist while retaining the ability to be agile enough to adopt technological shifts quickly. Our differentiated talent with layered competency – deep domain and emerging tech leadership, supported by a culture of ownership, energy, and commitment to customer success, has been highly instrumental in creating strong customer trust for over two decades.

0 notes

Text

Ways of Working - Commitment

The Power of Commitment – How Remarkable Companies Leverage it as Part of Their Value Proposition.

In today's competitive business landscape, companies often strive to differentiate themselves by offering unique value propositions to their customers. One powerful element that resonates with consumers is a company's commitment. When a company commits a core part of its value proposition, it can bring numerous customer benefits. In this blog post, we will explore the advantages customers gain from companies that prioritize commitment, and we will examine recent examples of big tech companies that have demonstrated exceptional commitment as a discipline.

Maveric, a two-decade niche bank-tech services provider, embraces commitment as a core value to deliver next-gen solutions for leading banks and regional leaders.

1. Building Trust and Loyalty:

Commitment is a crucial factor in building trust and fostering customer loyalty. When companies genuinely commit to their customers, they establish a sense of reliability and dependability. This creates a foundation of trust that encourages customers to engage with the company's products or services. Companies can earn and maintain customer loyalty by consistently delivering on their promises, translating into long-term customer relationships and increased lifetime value.

Recent Example: Apple's Commitment to Privacy

Apple, one of the leading tech giants, has significantly emphasized privacy as a commitment to its customers. Apple has demonstrated its dedication to safeguarding user data through features such as App Tracking Transparency and privacy-focused design. This commitment has resonated with customers, as they value their privacy and appreciate a company that proactively protects it.

2. Enhanced Customer Experience:

Commitment-driven companies prioritize delivering exceptional customer experiences. They understand that they can differentiate themselves from competitors by investing in customer satisfaction. Companies that demonstrate commitment take proactive measures to understand their customers' needs and preferences, tailoring their products, services, and support accordingly. This personalized approach enhances the overall customer experience, increasing customer satisfaction and advocacy.

Recent Example: Amazon's Commitment to Customer Service

Amazon has consistently demonstrated its commitment to customer service by setting high standards and going the extra mile to meet customer expectations. Its dedication to fast and reliable shipping, hassle-free returns, and responsive customer support has earned Amazon a reputation for exceptional service. This commitment has contributed to the company's success and has made it a go-to choice for many customers when it comes to online shopping.

3. Continuous Innovation and Improvement:

Companies that prioritize commitment are driven to innovate and improve their offerings continually. They understand that customer needs and preferences evolve, and by staying committed to meeting those changing demands, they can stay ahead of the competition. These companies actively seek customer feedback, utilize data analytics, and invest in research and development to identify areas for improvement and innovation. As a result, customers benefit from enhanced products, services, and solutions.

Recent Example: Google's Commitment to Innovation

Google's commitment to innovation is exemplified by its dedication to developing cutting-edge technologies and introducing new product features. From search algorithms to artificial intelligence advancements, Google consistently pushes the boundaries to deliver innovative solutions. This commitment to innovation benefits customers by providing access to state-of-the-art tools and services that enhance their daily lives and work processes.

4. Social and Environmental Responsibility:

Companies that prioritize commitment understand the importance of social and environmental responsibility. They recognize their impact on society and the environment and strive to operate sustainably and ethically. By incorporating sustainability practices, supporting social causes, and promoting ethical business conduct, these companies are committed to making a positive difference in the world. Such commitments resonate with customers who value responsible and ethical business practices.

Recent Example: Microsoft's Commitment to Sustainability

Microsoft has committed to sustainability by setting ambitious goals to become carbon-negative and water positive by 2030. The company has implemented various initiatives, such as investing in renewable energy, reducing waste, and increasing recycling efforts. Microsoft's commitment to sustainability benefits the environment and appeals to customers who prioritize doing business with socially responsible companies.

Conclusion

Customers reap several benefits when companies commit to a discipline and embed it in their value proposition. These benefits include building trust and loyalty, enhancing the customer experience, driving continuous innovation, and promoting social and environmental responsibility. Recent examples from big tech companies such as Apple, Amazon, Google, and Microsoft demonstrate how commitment can be effectively implemented to meet customer needs and exceed expectations. By prioritizing commitment, companies can forge strong and lasting relationships with their customers, ultimately leading to mutual success and a positive global impact.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with top global banks to solve business challenges through emerging technology. 23 years of singularly focused subject matter expertise, that comes from years of immersion in the banking technology space enables Maveric experts to provide a more profound and meaningful context. This context is invaluable for informed decision-making, problem-solving, and understanding the subject matter within a broader perspective.

Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. Let’s check out what’re Maveric’s Business Value Propositions reflect on the accelerated career growth for Maveric associates:

1. Company Mission and Values: By integrating vast banking domain knowledge with deep transformational tech, Maveric’s primary goal is to create future-ready solutions that enable financial organizations to navigate disruption and drive enterprise value. This essentially means that we enable our associates well trained on the emerging technologies to be able to not only deliver but go all out and experiment, without fear of failure.

2. Culture and Work Environment: Our Ways of Working are:

| Commitment

Taking ownership of your Work

Going beyond stated responsibilities to create value

Persisting to ‘make it happen’.

| Drive

Building deep domain, technical and leadership competencies

Openly seeking feedback for reflection and development

Challenging the status-quo

Working through Ambiguity

| Care

Creating an environment of freedom and accountability

Actively listening (personal and professional)

Recognizing and appreciating people

Giving responsibilities ahead of time

| Integrity

Respecting each other

Driving transparency at work

Making and fulfilling commitments

3. Growth and Opportunities:

Our vision is to create a learning organization that is adventurous enough to go on uncharted paths in search of innovation. At the core of our mission lies the belief in Lifelong learning. We seek to instil this enduring habit in all our talents, transforming them to & responsible global citizens. In today's volatile, uncertain, complex, & ambiguous (VUCA) world, we aim to prepare them both professionally & personally.

4. Compensation and Benefits: Are absolutely on par with industry simply because we understand that our associates perform with absolutely no qualms, focus on learning, committed to clients and hence ensuring growth for themselves, teams, and organization. 5. Social Responsibility: Maveric Systems instil sense of purpose among the associates through our partnerships, ensuring they contribute to causes that resonate with their personal values.

Career at Maveric is not just work but have a fulfilling journey, every passing day. We make it our business to live it every day.

At Maveric’s we are not called employees. At all levels, we call ourselves associates, and all of us together ensure that Maveric’s brand promise is delivered to each of our associates. Endorsing the culture of learning and adventure, Maveric has launched industry’s first niche domain technology upskilling program, Think NXT, where we aim to move beyond the paradigm of ‘building skills to perform well in existing roles’, our focus is to rewire corporate learning so that revolutionary changes are made possible by technological advances.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US.

Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

Know more – https://maveric-systems.com/careers

#mavericsystems#maveric#acceleratenext#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation#customersatisfaction#brandadvocacy#customerexperience

0 notes

Text

AI in Banking

The AI revolution in banking is shaping a new era of excellence

Why must banks continuously innovate with AI?

In today's rapidly evolving banking landscape, the importance of continuous AI innovation cannot be overstated. Artificial Intelligence (AI) is metamorphosing the banking sector, revolutionizing customer experiences, operational efficiency, and risk management. This blog will explore the significance of ongoing AI innovation in banking, supported by recent examples and statistics.

The AI Revolution in Banking

AI has become the driving force behind banking's digital transformation. It empowers banks to analyze vast amounts of data, automate routine tasks, and deliver personalized services. This innovation is reshaping the industry in several ways:

Core Commitment with Maveric Systems

Given the experimental nature of AI and other deep tech in Banking, banks realize that along with domain expertise and a niche practice, partnering with organizations that bring a strong culture of ownership and high flexibility is crucial. Most transformation journeys only succeed with the 'people' aspect. After all, finding and maintaining the correct relationship ethos is a rare skill. As trust is established between the various teams – business and technology, banks and systems aggregators, the chances of innovations multiply.

Enhanced Customer Experiences

AI-powered chatbots and virtual assistants provide instant customer support, answering queries and resolving issues 24/7. Banks like Wells Fargo have successfully implemented AI chatbots to improve customer interactions.

Smarter Fraud Detection

AI algorithms can identify unusual transaction patterns and flag potential fraud in real-time. JPMorgan Chase utilizes AI to detect fraudulent activities and has seen a significant reduction in fraud-related losses.

Personalized Financial Advice

Banks are leveraging AI to offer personalized financial advice and investment recommendations. Capital One, for instance, uses AI-driven robo-advisors to help customers make informed investment decisions.

Efficient Risk Management

AI-driven predictive analytics enable banks to assess credit risk more accurately. Bank of America uses AI models to evaluate customer creditworthiness and streamline loan approval.

Recent Examples of AI Success in Banking

1. HSBC's AI-Driven Chatbot: HSBC introduced Amy, an AI-driven virtual assistant, to assist customers with basic banking inquiries. Amy has significantly reduced customer service response times.

2. Citibank's Fraud Detection AI: Citibank employs AI algorithms that analyze transaction data to identify fraudulent activities swiftly. This AI-driven system has saved millions in potential losses.

3. DBS Bank's Virtual Recruiter: DBS Bank uses an AI-powered virtual recruiter to screen job applications and assess candidates' suitability. This has streamlined the hiring process and improved efficiency.

4. Barclays' Smart Contracts: Barclays has implemented AI-driven smart contracts to automate and expedite complex financial transactions, reducing manual errors and increasing efficiency.

Recent statistics highlight the critical role of AI in banking:

- According to a McKinsey report, AI could contribute up to $1 trillion in annual economic value to the banking sector.

- A study by Accenture found that 79% of banking executives believe AI will revolutionize customer interactions

- AI-driven chatbots have been shown to resolve 80% of customer inquiries without human intervention, significantly reducing response times and improving customer satisfaction

Three Solid Ways Forward

1. Invest in AI Talent: Banks should continue to invest in AI talent and expertise. Hiring data scientists, machine learning engineers, and AI specialists is essential for driving innovation.

2. Collaborate with Fintech Partners: Fintech companies can accelerate AI adoption. Fintech firms often specialize in cutting-edge AI solutions that banks can integrate into their systems.

3. Focus on Ethical AI: As AI becomes more prevalent in banking, it's crucial to prioritize ethical AI practices. Ensuring transparency, fairness, and data privacy is essential to maintain customer trust.

Conclusion

Continuous AI innovation is an option and a necessity in the modern banking industry. Recent examples and statistics demonstrate the transformative power of AI in enhancing customer experiences, reducing risks, and improving operational efficiency. Banks that embrace and adapt to this AI-driven future will thrive and lead the industry into a new era of banking excellence.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, that partners with global banks to solve their business challenges through emerging technology. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. We have been the partner of choice for world’s top 10 financial institutions and top 50 regional banks, delivering banking technology solutions around customer experience, connected core, regulatory compliance, and digital operations.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US. Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

#mavericsystems#maveric#acceleratenext#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation#airevolution#aiinbanking#customerexperience#userexperience

0 notes

Text

Wealth Management in the Digital Age - Trends and Challenges

In the ever-evolving landscape of Asset and Wealth Management (AWM), the tides of transformation have never been more relentless. As disruptive technologies, including GPT-AI and emergent solutions, wash ashore, the significant question is, "What separates the winners from the has-beens?" This thought-provoking exploration delves into the challenges and trends shaping Wealth Management's future. Drawing from industry examples in the US, Europe, and Asia, we unveil the strategies defining success in this digital era.

The Vital Role of Technological Contextualization

Amid these rapid changes, 'technological contextualization' is critical in ensuring client satisfaction and long-term loyalty. Wealth managers must utilize technology not merely for its own sake but to enhance the client's experience. For instance, using AI-driven tools to provide real-time, context-aware insights can help advisors have more meaningful conversations with their clients. When clients feel understood and heard, it fosters trust and loyalty.

The ability to harness technology effectively while maintaining a human touch in wealth management is where firms' future success will be determined. The winners in this digital age will be those who integrate technology seamlessly into their client relationships, ensuring that it enhances the client's wealth management journey rather than detracting from it.

As GPT-AI and emergent tech disrupt the AWM landscape, what will separate the winners from the has-beens?

1. The Rise of AI and Data Analytics

AI and data analytics have become the backbone of modern wealth management. With AI's ability to analyze vast datasets and provide actionable insights, financial advisors can make more informed decisions. For instance, Morgan Stanley's partnership with Machine Learning company Kensho. Through this collaboration, Morgan Stanley is leveraging AI to help advisors respond to client inquiries more effectively, enhancing service quality.

2. Customization and Personalization

Client expectations have evolved significantly. They now demand personalized, tailor-made solutions that cater to their unique financial needs and goals. Europe's largest asset manager, Amundi, recognized this shift and implemented an ambitious digital transformation strategy. By adopting cutting-edge technologies, Amundi has empowered its advisors to offer personalized investment solutions, enhancing client satisfaction and loyalty.

3. Cybersecurity and Data Privacy

As AWM becomes more digital, the vulnerability to cyber threats increases. Firms must not only provide robust cybersecurity measures but also prioritize data privacy. For example, JPMorgan Chase's investment in cybersecurity is a testament to the industry's commitment to safeguarding client data. It's a clear recognition of the risks involved in the digital age.

4. Robo-Advisors and Hybrid Models

Robo-advisors, such as Betterment and Wealthfront, are reshaping the AWM landscape. These platforms offer automated portfolio management at a fraction of the cost. Recognizing this trend, traditional wealth management firms adopt hybrid models combining human expertise with AI-driven efficiency. UBS, for instance, introduced its SmartWealth platform, aiming to cater to both tech-savvy and traditional clients.

5. Regulation and Compliance

In the digital age, regulatory compliance is a growing concern. Recent examples of regulatory changes in the US include the SEC's Regulation Best Interest (Reg BI). This rule aims to enhance the standard of conduct for financial advisors. Navigating these regulations while delivering top-notch service is a challenge, but it's crucial to maintain trust and integrity in the industry.

Conclusion.

Today's digital era presents intricate challenges and opportunities for the Asset and Wealth Management industry. Firms that harness the power of AI, prioritize personalization, ensure robust cybersecurity, adapt to changing regulatory landscapes, and master the art of technological contextualization will stand out as the leaders in this dynamic landscape. As the world continues to change at an unprecedented pace, the winners in the AWM sector will be those who skilfully navigate these complexities and emerge as the trusted advisors of the future.

The ability to technologically contextualize the evolution of ecosystems is paramount and serves as the foundational pillar for driving innovation and harnessing the potential of cutting-edge technologies. By understanding how technology integrates into the broader ecosystem, organizations can adapt, evolve, and ultimately lead in the era of innovation and digital transformation.

About Maveric

Started in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with top global banks to solve business challenges through emerging technology. 23 years of singularly focused subject matter expertise, that comes from years of immersion in the banking technology space enables Maveric experts to provide a more profound and meaningful context. This context is invaluable for informed decision-making, problem-solving, and understanding the subject matter within a broader perspective. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Pune, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

#mavericsystems#maveric#acceleratenext#wealthmanagement#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#bankingawareness#financialawareness#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation

0 notes

Text

Harnessing Data Analytics for Smarter Financial Decision-Making

In the modern financial world, data is undeniably the heartbeat, and its potential is immense. However, to truly leverage the vast volumes of data generated daily, the key lies in possessing comprehensive competencies focused on making it work for the ecosystem. Data alone is valuable, but it's in the ability to extract actionable insights, adapt to changing landscapes, and align data-driven strategies with the broader ecosystem that the real power of data in the financial industry is harnessed. Those with the expertise to navigate this data-driven landscape can drive innovation, make informed decisions, and stay competitive in the rapidly evolving financial sector. Big Data & Analytics (BD&A) is the key and having comprehensive technological competencies is needed to unlock it’s potential.

Comprehensive BD&A Competencies for Next-Gen Banks

In today's fast-paced and data-driven financial landscape, the significance of comprehensive domain competencies in Big Data and analytics (BD&A) cannot be overstated. Next-generation banks are facing unprecedented challenges and opportunities, and the ability to harness data effectively is the key to seizing a competitive advantage.

Firstly, comprehensive domain competencies involve a deep understanding of the specific intricacies of the banking sector. It's not just about collecting and analyzing data; it's about knowing what data matters, when it matters, and how to apply insights to decision-making. Take, for instance, the detection of fraudulent transactions. A bank with comprehensive domain competencies in BD&A can identify subtle patterns in transaction data, reducing fraud incidents and protecting the bank and its customers.

Furthermore, the competitive advantage in the next-gen banking arena is closely tied to personalized services. Banks with robust domain competencies can leverage data to offer tailored solutions that address individual customer needs and preferences. For instance, they can anticipate when a customer might need a mortgage or suggest investment opportunities aligned with their financial goals. This level of customization builds trust and loyalty, setting the bank apart from competitors.

This strategic approach to BD&A is rooted in a deep understanding of the banking domain, which is pivotal for achieving a competitive edge in the evolving BFSI landscape.

Latest developments in Big Data and Analytics powering the advances in AI-led Banking efforts in BFSI

1. Data-Driven Customer Insights

Customer-centricity is the heart of the BFSI industry. Understanding customer needs, behavior, and preferences is critical. US-based JPMorgan Chase has been at the forefront of utilizing BD&A to enhance their customer experience. They can predict customer needs by analyzing transaction data, offering personalized services, and tailored product recommendations. This not only improves customer satisfaction but also builds loyalty and trust.

2. Risk Management and Fraud Detection

Mitigating risk and preventing fraud is paramount in BFSI. European banks like Deutsche Bank have integrated BD&A into their risk management processes. They can quickly identify anomalies and potential risks by analyzing data sources in real time. This approach ensures proactive risk management, safeguarding the bank and its customers.

3. AI-Powered Investment Decisions

The future of banking lies in AI-led decision-making. Asian giant DBS Bank is a pioneer in this area. Their use of BD&A to support AI-driven investment decisions has resulted in better portfolio management and asset allocation. They can make real-time investment decisions that outperform traditional methods by processing vast market data.

4. Improved Operational Efficiency

Efficiency is a cornerstone of profitability in BFSI. Indian banks like ICICI Bank are leveraging BD&A to streamline operations. They've significantly reduced operational costs by automating routine processes and optimizing resource allocation. This approach is cost-effective and positions them as hubs of innovation.

5. Enhanced Cybersecurity

In the age of cyber threats, security is paramount. Wells Fargo, a US-based bank, is a strong example of how BD&A can bolster cybersecurity. They proactively detect and prevent cyberattacks by analyzing network traffic and identifying patterns. This commitment to security is essential when the threat of data breaches and cyber threats increases each day.

BD&A is the engine that powers these transformative changes, making BFSI more innovative and more efficient. But where is BD&A heading in the future? Let's delve into the crystal ball.

6. The Future of BD&A in BFSI

Real-time Insights: The speed of data analysis will be crucial. BFSI institutions will need to make decisions in real time. This is about analyzing historical data and understanding the present to shape the future.

AI Integration: AI and machine learning will be tightly integrated with BD&A. AI-driven predictive analytics will be the norm, enabling better customer service and decision-making.

Blockchain and Security: BD&A will play a significant role in blockchain adoption for secure transactions and fraud prevention. Security will remain a top priority.

Ethical Considerations: As BD&A becomes more pervasive, ethical use of data will be paramount. Banks must maintain customer trust and comply with regulations.

Personalization: Tailored financial services will be the key. Customers will expect highly personalized offerings based on their unique financial behavior.

Conclusion.

The Fintech sector is on the cusp of a data-driven revolution. BD&A is the catalyst that will drive this change, enabling banks to make smarter, more informed decisions. The latest developments in BD&A are already powering AI-led banking efforts in the US, Europe, and Asia. To stay ahead of the curve, banks must embrace BD&A as an essential tool for the future.

Started in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with top global banks to solve business challenges through emerging technology. 23 years of singularly focused subject matter expertise in the banking technology space enables Maveric experts to provide a more profound and comprehensive competencies in the Big-Data & Analytics, Core Banking, Digital Transformation and Quality Engineering. This context is invaluable for informed decision-making, problem-solving, and understanding the subject matter within a broader perspective.

Maveric’s 3000+ tech experts use proven frameworks to empower our global banking and Fintech customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Pune, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

#mavericsystems#maveric#acceleratenext#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#bigdata#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation#bigdataandanalytics

0 notes