Text

Cultivating Employee Drive – One Step at a Time

In the dynamic world of bank technology, Maveric is a beacon of innovation and excellence, driven by a workforce that embodies the essence of drive and determination. At the core of Maveric's success are four pillars that foster employee drive: building deep domain, technical, and leadership competencies; openly seeking feedback for reflection and development; challenging the status quo, and working through ambiguity. Through the experiences of Gradesh Patidar, Hrushikesh Karawade, Sandhya Shankar, and Sakshi Priyadarshi, we explore how these pillars shape their professional journeys and contribute to Maveric's distinctive culture.

The Journey of Drive at Maveric

Gradesh Patidar, Associate Software Engineer: Embracing Challenges and Continuous Learning

Gradesh's journey at Maveric began with the ThinkNXT Project, transitioning later to the Data Business Unit. This path allowed him to explore and embrace new concepts, highlighting Maveric's commitment to fostering an environment where individual drive and integrity are celebrated. Gradesh's experience underscores the importance of continuous learning and the dynamic, collaborative work environment at Maveric, where the organizational hierarchy feels almost invisible, promoting an inclusive culture of open dialogue and camaraderie.

Hrushikesh Karawade, Software Engineer: The Power of Camaraderie and Leading by Example

Hrushikesh reflects on his rewarding two-year experience at Maveric, marked by continuous learning and camaraderie. His story of receiving support from a team lead during relocation exemplifies Maveric's unity and mutual support culture. Observing leaders at Maveric, Hrushikesh learned valuable lessons in commitment and integrity, further illustrating how Maveric's leadership style fosters an environment of growth and respect.

Sandhya Shankar, Software Engineer: Accelerated Growth through Learning and a Positive Work Environment

Sandhya's path to accelerated growth at Maveric involved learning new technologies like Kafka and Snowflake and implementing them in real-world scenarios. This experience highlights Maveric's learning ecosystem, which encourages continuous learning and adaptability. The positive work environment and the supportive relationships with colleagues, mentors, and peers at Maveric have been instrumental in her professional development.

Sakshi Priyadarshi: From Intern to Business Consultant

Sakshi's journey from an intern to a Business Consultant at Maveric showcases the limitless possibilities within the company. Her involvement in challenging projects and a mentorship program highlights Maveric's commitment to nurturing talent and fostering a learning environment that encourages transparent communication and meeting deadlines. Sakshi's experience reflects Maveric's dedication to providing opportunities for growth and development.

Leading Corporates: The Impact of Employee Drive

Companies like Apple and Tesla have demonstrated how cultivating employee drive can lead to groundbreaking innovations and transformative changes in company culture. Apple's emphasis on challenging the status quo and Tesla's commitment to working through ambiguity has propelled them to the forefront of their industries and cultivated cultures celebrating innovation, resilience, and continuous improvement.

The Four Pillars of Drive at Maveric Elaborated

Building Deep Domain, Technical, and Leadership Competencies

At Maveric, building competencies go beyond mere skill acquisition; it's about mastering the intricacies of the banking technology sector, understanding the technical depths, and developing leadership qualities that inspire teams. This comprehensive approach ensures that employees are proficient in their roles and visionary leaders who can guide Maveric toward future successes.

Openly Seeking Feedback for Reflection and Development

Maveric fosters a culture where feedback is encouraged and seen as a vital tool for personal and professional development. This openness to feedback ensures that employees continuously reflect on their performance, learn from their experiences, and strive for excellence in every endeavor.

Challenging the Status Quo

The drive to challenge the status quo is ingrained in Maveric's DNA. Employees are encouraged to think creatively, question existing processes, and propose innovative solutions. This leads to improved efficiencies and innovations and fosters a culture of continuous improvement and adaptability.

Working Through Ambiguity

Navigating uncertainty requires resilience and a forward-thinking mindset, qualities that Maveric instills in its employees. By embracing ambiguity, Maveric's team learns to adapt, innovate, and find clarity in complex situations, driving the company forward in the ever-evolving bank tech landscape.

Conclusion.

In sum, Maveric's culture of cultivating employee drive through its four foundational pillars has not only contributed to the professional growth of individuals like Gradesh, Hrushikesh, Sandhya, and Sakshi but has also propelled the company to new heights in the bank tech industry. By embracing challenges, fostering continuous learning, and promoting a supportive and dynamic work environment, Maveric exemplifies how cultivating employee drive is a step toward achieving unparalleled success.

About Maveric

Started in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

0 notes

Text

Beyond Boundaries: Unveiling THINK NXT – The Career Catalyst in Tech

In a world where the pace of technological change is relentless, standing still is the fastest way to move backward. Enter THINK NXT, Maveric's avant-garde initiative, designed to keep up with the times and redefine them. THINK NXT is more than a program; it's a movement, a collective stride towards a future where tech careers are not just about coding but about creating, not just about solutions but about revolutions.

Charting Uncharted Careers: The Genesis of THINK NXT

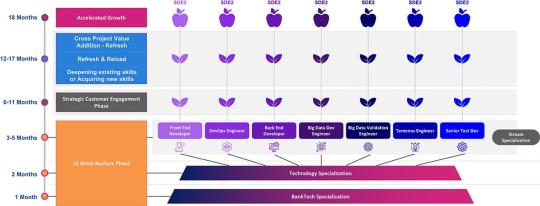

In today's volatile job market, where a staggering 43% of millennials are ready to quit their jobs within two years for more fulfilling opportunities, as per the 2021 Deloitte Millennial Survey, Maveric saw not just a gap but an opportunity. This insight birthed THINK NXT, an industry-first, hyper-personalized career acceleration journey that catapults experienced professionals to new heights ahead of their peers in big brand tech providers. THINK NXT answers the monotony and stagnation that often plague large tech companies, offering a dynamic, engaging, and enriching career trajectory.

Hyper-Specialization: The New Career Currency

In the sunrise sectors of BankTech, EdTech, Biotech, and RegTech, hyper-specialization is not just advantageous; it's essential. With THINK NXT, hyper-specialization starts from Day 1. As per a report by McKinsey, organizations focusing on domain specialization are 33% more successful in talent retention than those that don't. THINK NXT taps into this insight, offering domain specialization that ensures your career isn't just moving but leaping forward in sectors poised for exponential growth.

Nurturing Niche Technologists: A Peek into THINK NXT’s Tech Specialization

In an era where technology evolves by the minute, THINK NXT recognizes the need for niche specialization. A study by PwC indicates a 60% technology skill gap in Asia-Pacific companies, a gap that THINK NXT aims to bridge with its focused tech specialization modules. The program is not about creating generic technologists but about nurturing maestros of technology, individuals whose expertise is not just recognized but revered in the industry.

Mentorship Magic: The Human Touch in Technology

In the labyrinth of technology, a guiding hand can make all the difference. THINK NXT's mentorship opportunities are not just about learning; they're about evolving. With industry leaders offering their insights and experiences, the program ensures that its participants are technically sound and equipped with the soft skills and strategic thinking critical for future leadership roles.

Client Engagement: The Real-World Classroom

While theoretical knowledge is foundational, real wisdom comes from experience. With THINK NXT, direct client engagement isn't an exception; it's the norm. This approach ensures that participants understand the technical aspects of their projects and grasp the nuances of client needs and market dynamics, a critical skill in today's client-centered business landscape.

The THINK NXT Trajectory – Shaping the Technologists of Tomorrow

THINK NXT is not just a program; it's a promise of growth, innovation, and excellence. It represents a strategic shift from the conventional, challenging the status quo and setting new standards in tech career development. As Maveric continues to evolve and expand THINK NXT, the focus remains on staying ahead of the curve, ensuring that the program is relevant for today and pioneering the path for tomorrow.

Best practices such as maintaining a solid focus on hyper-specialization, nurturing a culture of mentorship and continuous learning, and fostering real-world client engagement will continue to be the pillars of THINK NXT. Moreover, keeping a pulse on emerging technologies and industry trends will ensure that THINK NXT prepares tech professionals for the present challenges and equips them for future opportunities.

In a world teeming with potential, THINK NXT is the compass that guides tech professionals toward a horizon brimming with possibilities. It's an invitation to embark on a journey of growth.

THINK NXT catapults professionals with 0-4 years of experience at least 1.5 years ahead of their peers in big brand tech companies.

About Maveric

Established in 2000, Maveric Systems has positioned itself as a leading Banking Technology partner, forming successful collaborations with top global and regional banks across three continents. The company's distinctive approach involves integrating extensive banking domain knowledge with transformative technology to craft solutions that are future-ready.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

0 notes

Text

Accelerating Digital Transformation in Banking in 2024

In the ever-evolving banking industry landscape, digital transformation has ceased to be a mere buzzword; it's the lifeline for survival and success. As we navigate the complexities of 2024, banks are compelled to embrace digital transformation and accelerate their efforts to stay relevant, competitive, and responsive to customers' evolving needs. This journey necessitates a profound shift in mindset, strategies, and operations, encapsulated in the three guiding principles: Conscious Contextualization, Comprehensive Competence, and Core Commitment.

The Urgency for Acceleration

The BFSI sector is witnessing a seismic shift, underscored by a digital revolution that has only been hastened by external forces such as the COVID-19 pandemic. Hesitant banks must recognize the urgency to pursue digital transformation more rapidly, as highlighted by recent findings indicating that those lagging behind risk becoming obsolete.

Banks are increasingly drawing valuable insights from the success stories of fintech disruptors, recognizing the imperative to adapt and adopt agile practices. Artificial intelligence (AI) and genetic algorithms (GenAI) are shaping the future of retail banking, with the transformative potential to revolutionize customer experiences, streamline operations, and optimize decision-making.

Conscious Contextualization: Aligning Strategy with Reality

Conscious Contextualization involves meticulously understanding customers' needs and expectations in the digital age. The shift to digital channels demands a seamless and personalized user experience. This requires not just adopting digital tools but integrating them thoughtfully into the customer journey.

For instance, the Commonwealth Bank of Australia stands out as a noteworthy example. The bank has been at the forefront of leveraging big data analytics to mine meaningful insights into customer behavior, preferences, and pain points. Commonwealth Bank tailors its offerings by understanding the context in which customers interact with digital platforms, ensuring a more meaningful and relevant engagement.

Comprehensive Competence: Navigating the Digital Ecosystem

Comprehensive Competence extends beyond acquiring specific technological tools. It involves cultivating a holistic understanding and mastery of the entire digital ecosystem. This encompasses upskilling the workforce, fostering a culture of innovation, and forging strategic partnerships with fintech companies.

DBS Bank in Singapore provides a compelling illustration of Comprehensive Competence. Recognizing the need for a cultural shift, DBS has undergone a massive digital transformation journey. The bank has embraced agile methodologies, upskilled its workforce, and fostered a culture of innovation. This comprehensive approach has enhanced operational efficiency and positioned DBS as a leader in digital banking.

Core Commitment: Infusing Digital into the Organizational DNA

Core Commitment is the linchpin that ensures the sustainability of digital transformation initiatives. It involves instilling a commitment to digital excellence at the core of the organizational culture. This commitment starts at the leadership level, where a clear vision for digital transformation is articulated and championed.

BBVA in Spain serves as an exemplary case of Core Commitment. The bank's leadership has driven a cultural shift towards innovation and agility. BBVA has embraced technologies like blockchain, cloud computing, and AI, infusing digital into its organizational DNA. This commitment permeates every layer of the organization, from the frontlines of customer service to the back-end operations.

Navigating the Digital Frontier

In conclusion, accelerating digital transformation in banking demands a conscious contextualization of strategies, the cultivation of comprehensive Competence in navigating the digital ecosystem, and a core commitment to infuse digital into the organizational DNA. These best practices are not just technological imperatives but represent a profound shift in mindset and culture.

The ways ahead involve a relentless pursuit of understanding customer needs, fostering a culture of continuous learning, and ensuring digital excellence is not just a project but a perpetual commitment. Banks that consciously contextualize, comprehensively compete, and commit to digital transformation will not only thrive in 2024 but will shape the future of banking and set innovation standards, customer experience, and sustainable growth. As we navigate the digital frontier, let these best practices and examples from banks like Commonwealth Bank of Australia, DBS Bank, and BBVA serve as a guiding compass, ensuring that banks survive and thrive in the transformative landscape ahead.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist that partners with global banks to solve their business challenges through emerging technology. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. We have been the partner of choice for world’s top 10 financial institutions and top 50 regional banks, delivering banking technology solutions around customer experience, connected core, regulatory compliance, and digital operations.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US.

Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

0 notes

Text

Accelerating Your RegTech Strategy – 4 Crucial Considerations

In the dynamic landscape of banking, Regulatory Technology (RegTech) has emerged as a cornerstone for financial institutions seeking to navigate the complex web of compliance requirements efficiently.

A RegTech (Regulatory Technology) strategy for banks involves systematically leveraging technology solutions to enhance regulatory compliance and risk management processes. It integrates innovative technologies to streamline and automate various aspects of regulatory adherence, addressing the challenges posed by the ever-evolving regulatory landscape.

Here's a breakdown of crucial components constituting an effective RegTech strategy for banks:

1. Advanced Analytics and Artificial Intelligence (AI): Incorporating advanced analytics and AI-driven tools enables banks to analyze vast datasets efficiently. Machine learning algorithms can predict potential compliance risks, identify patterns in regulatory changes, and automate decision-making processes.

2. Cloud-Based Solutions: Embracing cloud computing is fundamental to a modern RegTech strategy. Cloud-based solutions offer scalability, agility, and real-time data access. This ensures banks adapt swiftly to changing regulatory requirements and maintain a centralized repository for compliance-related data.

3. Blockchain Technology: The immutability and transparency offered by blockchain make it a valuable asset in ensuring data integrity and traceability, critical for regulatory reporting. It provides a secure and decentralized way of recording transactions, reducing the risk of data manipulation.

4. Collaboration and Industry Standards: Collaboration with other financial institutions, regulatory bodies, and industry consortia is pivotal. Establishing common frameworks and standards helps create interoperable solutions, fostering a collective approach to regulatory challenges.

5. Cybersecurity Measures: Robust cybersecurity is integral to any RegTech strategy. As banks increasingly rely on technology for compliance, safeguarding sensitive data from cyber threats becomes paramount. Encryption, multi-factor authentication, and continuous monitoring are essential components.

6. Comprehensive Data Management: Efficient data management is at the core of regulatory compliance. RegTech solutions should provide capabilities for data aggregation, validation, and reporting. This ensures accuracy in compliance reporting and reduces the likelihood of errors.

7. Regulatory Reporting Automation: Automating the regulatory reporting process helps banks meet reporting deadlines and ensures accuracy. RegTech solutions can parse through vast datasets, extract relevant information, and generate reports in a standardized format, minimizing manual errors.

8. Training and Skill Development: Investing in employee training programs is crucial. Ensuring that teams possess the necessary skills to operate and manage RegTech solutions fosters a culture of compliance and innovation within the organization.

An effective RegTech strategy is dynamic, staying attuned to the evolving regulatory landscape and technological advancements. It empowers banks to navigate compliance challenges efficiently, reduce operational costs, and position themselves as proactive contributors to the industry's regulatory evolution.

As we accelerate into the next phase of technological evolution, understanding the crucial considerations for an effective RegTech strategy becomes imperative.

1. Integration of Advanced Analytics

To Accelerate Next in RegTech, financial institutions must harness the power of advanced analytics. By incorporating artificial intelligence and machine learning, RegTech solutions can provide predictive insights, enabling banks to address compliance challenges proactively. For instance, leading banks like JPMorgan Chase have leveraged AI in their RegTech strategies, streamlining risk management processes and ensuring compliance with evolving regulations.

2. Embracing Cloud-Based Solutions

RegTech 2024 demands a shift towards cloud-based solutions for enhanced agility and scalability. Cloud computing facilitates seamless data management and enables real-time compliance monitoring. Banks like Bank of America have embraced cloud-based RegTech solutions to improve data security and regulatory reporting, setting a precedent for the industry.

3. Collaboration and Industry Standards

Accelerating your RegTech strategy necessitates collaborative efforts and adherence to industry standards. Banks must actively engage in partnerships and consortia to establish common frameworks and best practices. The International RegTech Association (IRTA) exemplifies this collaborative spirit, fostering a global community committed to advancing the RegTech ecosystem.

4. Robust Cybersecurity Measures

RegTech and cybersecurity go hand in hand. To Accelerate Next, banks must fortify their RegTech strategies with robust cybersecurity measures. Incorporating technologies like blockchain ensures data integrity and immutability, which is crucial for maintaining compliance standards. Notable institutions like Goldman Sachs have prioritized blockchain in their RegTech initiatives, enhancing cybersecurity and regulatory adherence.

What It Means for a Bank?

For a bank, embracing an advanced RegTech strategy signifies a transformative journey toward efficiency, agility, and sustained compliance. It translates into streamlined operations, reduced compliance costs, and a proactive approach to evolving regulatory landscapes. By adopting cutting-edge technologies and collaborative frameworks, banks position themselves as innovators and leaders in the financial ecosystem.

Challenges Ahead and Approaches to Success

The path to successful RegTech implementation is challenging. Data privacy concerns, regulatory complexities, and the need for upskilling teams pose significant hurdles. Banks can overcome these challenges by investing in robust training programs, establishing clear regulatory frameworks, and fostering a culture of adaptability. Collaboration with RegTech solution providers and active participation in industry forums can provide invaluable insights and support.

Conclusion.

Accelerating Your RegTech Strategy demands a holistic approach that integrates advanced analytics, embraces cloud-based solutions, promotes collaboration, and prioritizes cybersecurity. For banks, this journey translates into a future-ready stance, where compliance is not just a requirement but a catalyst for innovation and sustainable growth.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist that partners with global banks to solve their business challenges through emerging technology. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. We have been the partner of choice for world’s top 10 financial institutions and top 50 regional banks, delivering banking technology solutions around customer experience, connected core, regulatory compliance, and digital operations.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US.

Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

Know more – https://maveric-systems.com/

#mavericsystems#maveric#acceleratenext#digitalbanking#regtech#innovation#cybersecurity#Banktech#customerexperience

0 notes

Text

Designing a World-Class Tech Upskilling Program? 4 Crucial Components

In the rapidly evolving landscape of technology, the need for continuous upskilling has become paramount for both individuals and organizations. A world-class tech upskilling program is a strategic imperative to stay ahead in the competitive tech-driven arena.

Tech Upskilling Programs: Navigating the Future of Work

A tech upskilling program has become a crucial strategy for individuals and organizations. Tech upskilling refers to acquiring new or enhancing existing technical skills to stay relevant and competitive in the ever-changing world of technology.

Crucial Importance for upskilling programs

1. Job Security: In a dynamic job market, where roles are evolving, individuals who invest in upskilling ensure their relevance and, consequently, job security.

2. Innovation and Productivity: Organizations that prioritize upskilling foster a culture of innovation and increased productivity. Employees with the latest skills contribute more effectively to the company's success.

3. Future-Proofing: Tech upskilling is a proactive approach to future-proofing individuals and organizations against technological disruptions, ensuring they can thrive in the future job market.

As technology advances, embracing a mindset of continuous learning becomes beneficial and essential for professional growth and organizational success.

Let's delve into the critical components of a cutting-edge tech upskilling initiative.

1. Domain Fundamentals: Building a Strong Foundation

A robust upskilling program begins with a focus on domain fundamentals. Providing employees with a comprehensive understanding of their industry's core principles and practices ensures a solid foundation. Whether it's finance, healthcare, or manufacturing, domain-specific knowledge is the bedrock upon which tech proficiency can be effectively built.

Recent Example: Microsoft's AI Business School offers domain-specific courses, empowering professionals to integrate AI solutions seamlessly into various industries.

2. Tech Muscle: Hands-on Technological Mastery

The heart of any upskilling program lies in honing technical skills. Practical, hands-on training in the latest technologies equips employees to navigate the dynamic tech landscape. Whether coding, data analytics, or cybersecurity, a program that emphasizes hands-on experience fosters a culture of continuous learning.

Recent Example: Google's IT Support Professional Certificate on Coursera provides hands-on training, preparing individuals for roles in IT support.

3. Industry Specialization: Tailoring Skills to Industry Needs

An effective upskilling program recognizes the unique demands of different industries. Tailoring the curriculum to address industry-specific challenges ensures that employees acquire skills directly applicable to their professional context. This industry specialization enhances the relevance and impact of the upskilling initiative.

Recent Example: IBM's Digital - Nation Africa program offers industry-relevant courses to empower African youth with digital skills aligned with local market needs.

4. Mentorship: Nurturing Talent Through Guidance

Mentorship is a cornerstone of successful upskilling programs. Pairing employees with experienced mentors facilitates knowledge transfer, accelerates skill development, and provides invaluable insights. Mentorship programs create a supportive learning environment where individuals can navigate challenges with guidance from seasoned professionals.

Recent Example: Salesforce's Trailhead platform includes a mentorship component, connecting learners with experienced professionals for personalized guidance.

Benefits for Employees Seeking Employment:

For job seekers, engaging with a company that offers a comprehensive upskilling program signals a commitment to employee development. Access to cutting-edge training enhances marketability and demonstrates a forward-thinking organizational culture. Employees gain a competitive edge by entering the workforce with up-to-date skills, making them attractive candidates for employers seeking tech-savvy talent.

The THINK NXT Program: A Gateway to Accelerated Career Growth

It is a groundbreaking initiative designed by Maveric to catapult experienced professionals from 0 to 4 years old to new heights in their careers. The program promises to deliver an accelerated career trajectory through personalized mentorship and robust learning and development opportunities. THINK NXT is not just another training program; it's a transformative journey that unlocks untapped potential, empowering participants to stand out in a competitive job market.

Conclusion.

A world-class tech upskilling program integrates domain fundamentals, tech mastery, industry specialization, and mentorship. Companies that invest in these components foster a culture of continuous learning and innovation. As the tech landscape continues to evolve, embracing these best practices ensures that organizations and individuals thrive in the face of technological disruption.

About Maveric

Established in 2000, Maveric Systems has positioned itself as a leading Banking Technology partner, forming successful collaborations with top global and regional banks across three continents. The company's distinctive approach involves integrating extensive banking domain knowledge with transformative technology to craft solutions that are future-ready.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

About THINK NXT

Maveric's Think NXT Leadership program is a uniquely crafted training initiative aimed at creating a differentiated talent pool that can help us realize our aim to be the top 3 BankTech solutions specialist while retaining the ability to be agile enough to adopt technological shifts quickly. Our differentiated talent with layered competency – deep domain and emerging tech leadership, supported by a culture of ownership, energy, and commitment to customer success, has been highly instrumental in creating strong customer trust for over two decades.

0 notes

Text

Cultural Attributes for Successful Companies

In the dynamic landscape of business, the culture within a company serves as the heartbeat, influencing every facet of its existence. Legendary companies that stand the test of time and consistently outperform competitors share distinctive cultural attributes contributing to their enduring success.

Corporate culture is the amalgamation of various elements that collectively shape a company's identity, values, and behaviors. These elements contribute to the unique character and atmosphere that defines the workplace environment. Understanding the critical components of corporate culture is essential for fostering a positive and productive organizational ethos.

1. Leadership Style:

Top-Down Influence: Leadership sets the tone for the entire organization—the leadership style, whether authoritative, collaborative, or visionary, significantly influences the culture. A strong and positive leadership style can inspire employees and shape a culture of trust and innovation.

2. Values and Beliefs:

Core Principles: A company's foundational beliefs and values form the bedrock of its culture. These are often articulated in a company's mission and vision statements. Aligning actions and decisions with these core principles reinforces a consistent culture.

3. Communication Practices:

Openness and Transparency: Communication norms play a crucial role, including how information is shared. Open and transparent communication fosters trust and collaboration. In contrast, a lack of transparency can contribute to a culture of uncertainty and distrust.

4. Workplace Environment:

Physical and Virtual Spaces: The physical layout of offices or the virtual setup for remote work contributes to the culture. A collaborative and inclusive physical or virtual environment can enhance teamwork and creativity.

5. Employee Engagement:

Recognition and Rewards: Recognizing and rewarding employees for their contributions reinforces positive behaviors and creates a culture of appreciation. Employee engagement initiatives, including training and development programs, also contribute to a vibrant culture.

6. Organizational Structure:

Flat or Hierarchical: The organization's structure impacts how decisions are made and authority is distributed. A flat structure encourages collaboration and quick decision-making, while a hierarchical structure may have a more formal and controlled culture.

7. Diversity and Inclusion:

Equity and Fairness: A commitment to diversity and inclusion shapes a culture that values different perspectives and backgrounds. It fosters an environment where employees feel accepted and loved, contributing to a positive workplace culture.

8. Rituals and Traditions:

Shared Experiences: Rituals, traditions, and shared experiences contribute to a sense of belonging and camaraderie. Whether it's regular team-building activities or annual events, these rituals help build a cohesive culture.

9. Adaptability and Innovation:

Embracing Change: A culture that encourages adaptability and innovation is vital in today's dynamic business landscape. Companies that value learning, experimentation, and resilience create a culture that thrives in the face of challenges.

A strong and coherent culture enhances employee satisfaction and contributes to organizational success and resilience in a rapidly evolving business environment. Let's delve into these cultural traits and explore how they shape the narrative of some of the world's most renowned organizations.

Captain of the Ship: Leadership as the Guiding Force

The phrase "Captain of the Ship" encapsulates the essence of solid leadership, where leaders steer the company with a clear vision and unwavering determination. Apple Inc., under the leadership of Steve Jobs, exemplifies this attribute. Jobs' visionary leadership laid the foundation for innovation and creativity, fostering a culture that continues to drive Apple's success today.

Collective Magnet: Attracting and Retaining Top Talent

Successful companies act as Collective Magnets, drawing in top talent inspired by the organization's values and mission. Google is a prime example, consistently ranking globally as one of the best workplaces. Google's emphasis on innovation, diversity, and employee well-being creates a magnetic effect, attracting individuals seeking a workplace aligned with their values.

The World is My Oyster: Embracing a Global Perspective

Companies with a global outlook embrace the mantra "The World is My Oyster." Amazon, led by Jeff Bezos until 2021, epitomizes this cultural attribute. Amazon's relentless focus on customer-centricity and its expansion into diverse markets reflect a worldview that transcends geographical boundaries, contributing to its unparalleled growth.

Be Better Every Day: Continuous Improvement as a Cultural Pillar

The commitment to "Be Better Every Day" characterizes companies prioritizing continuous improvement. Toyota, renowned for its Toyota Production System, embodies this cultural trait. Toyota's relentless pursuit of efficiency, waste reduction, and quality improvement has set industry benchmarks and sustained its position as a leader in the automotive sector.

The Society of Givers: Fostering a Culture of Philanthropy

Companies that engage in philanthropy and community service create a "Society of Givers." Under Marc Benioff's leadership, Salesforce stands out in this regard. Salesforce not only prioritizes customer success but also actively participates in philanthropic endeavors. The 1-1-1 model, pledging 1% of product, equity, and employee time to charitable causes, showcases a commitment to making a positive impact beyond business goals.

What It Means for Prospective Employees

For employees seeking opportunities with such companies, it signifies a chance to be part of something more significant than a job. It means joining a workplace that values leadership, embraces diversity, thinks globally, fosters continuous growth, and actively contributes to societal well-being. These companies become platforms for personal and professional development, providing an environment where employees can thrive.

Conclusion.

Legendary companies serve as cultural pioneers, setting benchmarks for success that extend beyond financial metrics. By embodying these cultural attributes, companies can weather the challenges of a dynamic business environment and become beacons of inspiration for the next generation of corporate leaders.

About Maveric

Established in 2000, Maveric Systems has solidified its position as a specialized Banking Technology partner, collaborating with top global and regional banks across 3 continents. Our distinctive approach involves integrating extensive banking domain knowledge with transformative technology to craft solutions that are future-ready. At Maveric, we don't just see ourselves as employees; at every level, we exuberantly embrace the title of "associate" with immense pride. Together, we ensure that Maveric’s brand promise is delivered to each of our associates.

Here are the four pillars that define Maveric's primary ways of working, fostering an environment of constant learning that encourages our associates to experiment fearlessly:

| Commitment

Taking ownership of your Work

Going beyond stated responsibilities to create value

Persisting to ‘make it happen’.

| Drive

Building deep domain, technical and leadership competencies

Openly seeking feedback for reflection and development

Challenging the status-quo

Working through Ambiguity

| Care

Creating an environment of freedom and accountability

Actively listening (personal and professional)

Recognizing and appreciating people

Giving responsibilities ahead of time

| Integrity

Respecting each other

Driving transparency at work

Making and fulfilling commitments

Maveric actively promotes a culture of learning and adventure, as evidenced by its groundbreaking niche domain technology upskilling program, Think NXT. This program goes beyond traditional skill-building, aiming to rewire corporate learning for revolutionary changes facilitated by technological advances. Through these initiatives and values, Maveric Systems continues to shape an environment that encourages innovation, learning, and excellence, fostering the next generation of BankTech specialists.

#mavericsystems#maveric#acceleratenext#bankingrevolution#wealthmanagement#retailbanking#customerneeds#corporatebanking#bankinginnovation

0 notes

Text

Ways of Working - Commitment

The Power of Commitment – How Remarkable Companies Leverage it as Part of Their Value Proposition.

In today's competitive business landscape, companies often strive to differentiate themselves by offering unique value propositions to their customers. One powerful element that resonates with consumers is a company's commitment. When a company commits a core part of its value proposition, it can bring numerous customer benefits. In this blog post, we will explore the advantages customers gain from companies that prioritize commitment, and we will examine recent examples of big tech companies that have demonstrated exceptional commitment as a discipline.

Maveric, a two-decade niche bank-tech services provider, embraces commitment as a core value to deliver next-gen solutions for leading banks and regional leaders.

1. Building Trust and Loyalty:

Commitment is a crucial factor in building trust and fostering customer loyalty. When companies genuinely commit to their customers, they establish a sense of reliability and dependability. This creates a foundation of trust that encourages customers to engage with the company's products or services. Companies can earn and maintain customer loyalty by consistently delivering on their promises, translating into long-term customer relationships and increased lifetime value.

Recent Example: Apple's Commitment to Privacy

Apple, one of the leading tech giants, has significantly emphasized privacy as a commitment to its customers. Apple has demonstrated its dedication to safeguarding user data through features such as App Tracking Transparency and privacy-focused design. This commitment has resonated with customers, as they value their privacy and appreciate a company that proactively protects it.

2. Enhanced Customer Experience:

Commitment-driven companies prioritize delivering exceptional customer experiences. They understand that they can differentiate themselves from competitors by investing in customer satisfaction. Companies that demonstrate commitment take proactive measures to understand their customers' needs and preferences, tailoring their products, services, and support accordingly. This personalized approach enhances the overall customer experience, increasing customer satisfaction and advocacy.

Recent Example: Amazon's Commitment to Customer Service

Amazon has consistently demonstrated its commitment to customer service by setting high standards and going the extra mile to meet customer expectations. Its dedication to fast and reliable shipping, hassle-free returns, and responsive customer support has earned Amazon a reputation for exceptional service. This commitment has contributed to the company's success and has made it a go-to choice for many customers when it comes to online shopping.

3. Continuous Innovation and Improvement:

Companies that prioritize commitment are driven to innovate and improve their offerings continually. They understand that customer needs and preferences evolve, and by staying committed to meeting those changing demands, they can stay ahead of the competition. These companies actively seek customer feedback, utilize data analytics, and invest in research and development to identify areas for improvement and innovation. As a result, customers benefit from enhanced products, services, and solutions.

Recent Example: Google's Commitment to Innovation

Google's commitment to innovation is exemplified by its dedication to developing cutting-edge technologies and introducing new product features. From search algorithms to artificial intelligence advancements, Google consistently pushes the boundaries to deliver innovative solutions. This commitment to innovation benefits customers by providing access to state-of-the-art tools and services that enhance their daily lives and work processes.

4. Social and Environmental Responsibility:

Companies that prioritize commitment understand the importance of social and environmental responsibility. They recognize their impact on society and the environment and strive to operate sustainably and ethically. By incorporating sustainability practices, supporting social causes, and promoting ethical business conduct, these companies are committed to making a positive difference in the world. Such commitments resonate with customers who value responsible and ethical business practices.

Recent Example: Microsoft's Commitment to Sustainability

Microsoft has committed to sustainability by setting ambitious goals to become carbon-negative and water positive by 2030. The company has implemented various initiatives, such as investing in renewable energy, reducing waste, and increasing recycling efforts. Microsoft's commitment to sustainability benefits the environment and appeals to customers who prioritize doing business with socially responsible companies.

Conclusion

Customers reap several benefits when companies commit to a discipline and embed it in their value proposition. These benefits include building trust and loyalty, enhancing the customer experience, driving continuous innovation, and promoting social and environmental responsibility. Recent examples from big tech companies such as Apple, Amazon, Google, and Microsoft demonstrate how commitment can be effectively implemented to meet customer needs and exceed expectations. By prioritizing commitment, companies can forge strong and lasting relationships with their customers, ultimately leading to mutual success and a positive global impact.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with top global banks to solve business challenges through emerging technology. 23 years of singularly focused subject matter expertise, that comes from years of immersion in the banking technology space enables Maveric experts to provide a more profound and meaningful context. This context is invaluable for informed decision-making, problem-solving, and understanding the subject matter within a broader perspective.

Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. Let’s check out what’re Maveric’s Business Value Propositions reflect on the accelerated career growth for Maveric associates:

1. Company Mission and Values: By integrating vast banking domain knowledge with deep transformational tech, Maveric’s primary goal is to create future-ready solutions that enable financial organizations to navigate disruption and drive enterprise value. This essentially means that we enable our associates well trained on the emerging technologies to be able to not only deliver but go all out and experiment, without fear of failure.

2. Culture and Work Environment: Our Ways of Working are:

| Commitment

Taking ownership of your Work

Going beyond stated responsibilities to create value

Persisting to ‘make it happen’.

| Drive

Building deep domain, technical and leadership competencies

Openly seeking feedback for reflection and development

Challenging the status-quo

Working through Ambiguity

| Care

Creating an environment of freedom and accountability

Actively listening (personal and professional)

Recognizing and appreciating people

Giving responsibilities ahead of time

| Integrity

Respecting each other

Driving transparency at work

Making and fulfilling commitments

3. Growth and Opportunities:

Our vision is to create a learning organization that is adventurous enough to go on uncharted paths in search of innovation. At the core of our mission lies the belief in Lifelong learning. We seek to instil this enduring habit in all our talents, transforming them to & responsible global citizens. In today's volatile, uncertain, complex, & ambiguous (VUCA) world, we aim to prepare them both professionally & personally.

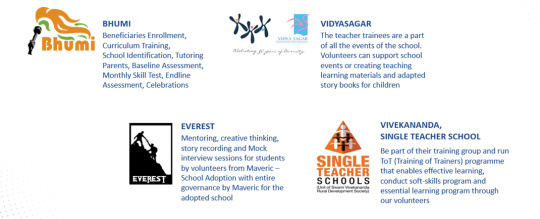

4. Compensation and Benefits: Are absolutely on par with industry simply because we understand that our associates perform with absolutely no qualms, focus on learning, committed to clients and hence ensuring growth for themselves, teams, and organization. 5. Social Responsibility: Maveric Systems instil sense of purpose among the associates through our partnerships, ensuring they contribute to causes that resonate with their personal values.

Career at Maveric is not just work but have a fulfilling journey, every passing day. We make it our business to live it every day.

At Maveric’s we are not called employees. At all levels, we call ourselves associates, and all of us together ensure that Maveric’s brand promise is delivered to each of our associates. Endorsing the culture of learning and adventure, Maveric has launched industry’s first niche domain technology upskilling program, Think NXT, where we aim to move beyond the paradigm of ‘building skills to perform well in existing roles’, our focus is to rewire corporate learning so that revolutionary changes are made possible by technological advances.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US.

Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

Know more – https://maveric-systems.com/careers

#mavericsystems#maveric#acceleratenext#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation#customersatisfaction#brandadvocacy#customerexperience

0 notes

Text

AI in Banking

The AI revolution in banking is shaping a new era of excellence

Why must banks continuously innovate with AI?

In today's rapidly evolving banking landscape, the importance of continuous AI innovation cannot be overstated. Artificial Intelligence (AI) is metamorphosing the banking sector, revolutionizing customer experiences, operational efficiency, and risk management. This blog will explore the significance of ongoing AI innovation in banking, supported by recent examples and statistics.

The AI Revolution in Banking

AI has become the driving force behind banking's digital transformation. It empowers banks to analyze vast amounts of data, automate routine tasks, and deliver personalized services. This innovation is reshaping the industry in several ways:

Core Commitment with Maveric Systems

Given the experimental nature of AI and other deep tech in Banking, banks realize that along with domain expertise and a niche practice, partnering with organizations that bring a strong culture of ownership and high flexibility is crucial. Most transformation journeys only succeed with the 'people' aspect. After all, finding and maintaining the correct relationship ethos is a rare skill. As trust is established between the various teams – business and technology, banks and systems aggregators, the chances of innovations multiply.

Enhanced Customer Experiences

AI-powered chatbots and virtual assistants provide instant customer support, answering queries and resolving issues 24/7. Banks like Wells Fargo have successfully implemented AI chatbots to improve customer interactions.

Smarter Fraud Detection

AI algorithms can identify unusual transaction patterns and flag potential fraud in real-time. JPMorgan Chase utilizes AI to detect fraudulent activities and has seen a significant reduction in fraud-related losses.

Personalized Financial Advice

Banks are leveraging AI to offer personalized financial advice and investment recommendations. Capital One, for instance, uses AI-driven robo-advisors to help customers make informed investment decisions.

Efficient Risk Management

AI-driven predictive analytics enable banks to assess credit risk more accurately. Bank of America uses AI models to evaluate customer creditworthiness and streamline loan approval.

Recent Examples of AI Success in Banking

1. HSBC's AI-Driven Chatbot: HSBC introduced Amy, an AI-driven virtual assistant, to assist customers with basic banking inquiries. Amy has significantly reduced customer service response times.

2. Citibank's Fraud Detection AI: Citibank employs AI algorithms that analyze transaction data to identify fraudulent activities swiftly. This AI-driven system has saved millions in potential losses.

3. DBS Bank's Virtual Recruiter: DBS Bank uses an AI-powered virtual recruiter to screen job applications and assess candidates' suitability. This has streamlined the hiring process and improved efficiency.

4. Barclays' Smart Contracts: Barclays has implemented AI-driven smart contracts to automate and expedite complex financial transactions, reducing manual errors and increasing efficiency.

Recent statistics highlight the critical role of AI in banking:

- According to a McKinsey report, AI could contribute up to $1 trillion in annual economic value to the banking sector.

- A study by Accenture found that 79% of banking executives believe AI will revolutionize customer interactions

- AI-driven chatbots have been shown to resolve 80% of customer inquiries without human intervention, significantly reducing response times and improving customer satisfaction

Three Solid Ways Forward

1. Invest in AI Talent: Banks should continue to invest in AI talent and expertise. Hiring data scientists, machine learning engineers, and AI specialists is essential for driving innovation.

2. Collaborate with Fintech Partners: Fintech companies can accelerate AI adoption. Fintech firms often specialize in cutting-edge AI solutions that banks can integrate into their systems.

3. Focus on Ethical AI: As AI becomes more prevalent in banking, it's crucial to prioritize ethical AI practices. Ensuring transparency, fairness, and data privacy is essential to maintain customer trust.

Conclusion

Continuous AI innovation is an option and a necessity in the modern banking industry. Recent examples and statistics demonstrate the transformative power of AI in enhancing customer experiences, reducing risks, and improving operational efficiency. Banks that embrace and adapt to this AI-driven future will thrive and lead the industry into a new era of banking excellence.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, that partners with global banks to solve their business challenges through emerging technology. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. We have been the partner of choice for world’s top 10 financial institutions and top 50 regional banks, delivering banking technology solutions around customer experience, connected core, regulatory compliance, and digital operations.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US. Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

#mavericsystems#maveric#acceleratenext#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation#airevolution#aiinbanking#customerexperience#userexperience

0 notes

Text

Technology Adoption in Finance - Core competencies

The financial industry, once characterized by traditional practices and conservative approaches, is undergoing a seismic shift. Adopting cutting-edge technologies has become the defining factor for success in this digital transformation era. The financial sector is profoundly evolving from blockchain to artificial intelligence (AI) and cloud computing. This opinion piece explores the dynamic landscape of technology adoption in finance, providing insights that resonate with the thought leadership and strategic vision of top Financial institutions.

The Historical Evolution of Finance and Technology

The integration of technology into the finance sector is a story that spans several decades, reflecting the industry's continuous pursuit of efficiency, innovation, and customer-centric solutions.

The Emergence of Computers and Automation

The journey began in the mid-20th century with the introduction of computers. Banks started adopting mainframe computers for core operations, such as ledger maintenance and transaction processing. This laid the foundation for automation and streamlined back-office processes.

The Birth of Electronic Trading

In the 1970s and 1980s, electronic trading platforms revolutionized stock markets. The New York Stock Exchange (NYSE) introduced the Designated Order Turnaround (DOT) system, and the NASDAQ emerged as the world's first electronic stock market. This transition marked the shift from traditional trading floors to digital platforms.

The Internet and Online Banking

The Internet began to break into mainstream acceptance in the 1990s, opening new avenues for financial services. Online banking emerged, allowing customers to access their accounts, transfer funds, and pay bills with never-before convenience. This era also saw the rise of online brokerage platforms.

Mobile Banking and Fintech Disruption

The 2000s brought mobile banking, enabling customers to transact using their smartphones. Simultaneously, fintech startups began challenging traditional banking models. PayPal, founded in 1998, emerged as a pioneer in digital payments. This period marked a significant shift towards customer-centric, tech-driven financial services.

Big Data and Analytics

The 2010s witnessed the proliferation of big data and analytics. Banks started leveraging data to gain insights into customer behavior, manage risk, and personalize offerings. Machine learning and AI became essential tools for fraud detection, credit scoring, and investment strategies.

Blockchain and Cryptocurrencies

The 2010s also gave birth to blockchain technology and cryptocurrencies like Bitcoin. The decentralized nature of blockchain attracted the attention of financial institutions, leading to various use cases, including cross-border payments and smart contracts. This technology offered transparency and security, challenging traditional economic systems.

Domain-Led Tech Competence: The Game Changer

In an era of ubiquitous tech adoption, domain-led tech competence emerges as the game-changing strategy. Take the example of BNY Mellon, which has transformed into a tech-savvy financial institution. Their acquisition of fintech firm Milestone Group and subsequent development of AI-driven solutions for asset servicing exemplify how domain expertise and tech proficiency create a competitive edge. Another example is Maveric Systems with its’ 23 years of only banking technology focus, the domain-led core competencies built over two decades of building technology solutions that have been game changing for world’s top global and regional banks. Whether its building end-to-end Value Stream for a regional banking leader or proactively creating open banking systems that are scalable into multi geographic digital operations for a global banking giant, team Maveric has been a banking technology thought-leader and niche domain-led partner of choice for the top financial institutions.

These are just two of the apt examples among many such tech driven digital disruptions that are enabled over the last two decades.

The Road to Digital Disruption

1. Blockchain Revolution: Blockchain technology has transcended its cryptocurrency roots and revolutionized banking. JPMorgan's JPM Coin and the growing prominence of decentralized finance (DeFi) platforms showcase the transformative power of blockchain in payments, settlements, and smart contracts.

2. AI-Powered Insights: Artificial intelligence is the backbone of data-driven decision-making. Goldman Sachs' Marcus app employs AI to offer personalized financial advice and lending solutions, setting new customer experience and engagement standards.

3. Cloud Computing's Agility: The cloud reshapes infrastructure and operations. Deutsche Bank's partnership with Google Cloud exemplifies how cloud computing enables agility and scalability, driving cost-efficiency and innovation.

4. Open Banking Ecosystems: European banks like BBVA and HSBC embrace open banking, creating ecosystems that foster collaboration with fintech startups. These partnerships enhance customer offerings and accelerate innovation cycles.

5. Asia's Fintech Prowess: Asian banks like DBS are leading the digital transformation revolution, leveraging technologies to expand financial services. DBS's digital-first approach and award-winning digibank platform epitomize the region's fintech prowess.

Conclusion: Navigating the Future

As we navigate the uncharted waters of the digital age, technology adoption in finance is not merely an option but an imperative. Financial institutions must embrace innovation, foster domain-led tech competence, and forge strategic partnerships to thrive in this dynamic landscape. The future of finance is being shaped by those who dare to lead the charge into the digital frontier.

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, that partners with global banks to solve their business challenges through emerging technology. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. We have been the partner of choice for world’s top 10 financial institutions and top 50 regional banks, delivering banking technology solutions around customer experience, connected core, regulatory compliance, and digital operations.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work across 3 continents with delivery capabilities in India, Netherlands, Poland, Singapore, UAE, UK and US.

Our ecosystem-led solution approach is based on consciously contextualizing ever evolving banking landscape, comprehensive competencies built across various vendor transformation environments and committed organizational culture focused on accountability, all nurtured and developed over two decades of singular focus on banking domain.

#mavericsystems#maveric#acceleratenext#digitalbanking#digitalbankingsolutions#digitalbankingservices#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalbankingsystem#digitalfinancesolutions#fullstackdeveloper#TheNextBigThing#upskilling#regulatorycompliance#corebanking#FinanceTechnology#BigDataAnalytics#MobileBanking#FintechDisruption#Blockchain#Cryptocurrencies#deeptech

0 notes

Text

Regulatory Changes Affecting Fintech Startups – What You Need to Know

In the fast-changing FinTech climate, the role of regulatory changes is becoming increasingly crucial. As fintech startups continue to disrupt the traditional banking sector, staying abreast of these changes is essential for innovators and incumbents. This opinion piece will delve into the fast-changing regulatory climate across the developing world, focusing on the United States, Europe, and Asia. We will explore how these changes are affecting fintech startups and the promising mandate that RegTech firms hold.

Recently, the fintech industry has experienced a dynamic and evolving regulatory landscape that has significantly impacted startups in the sector. These changes reflect the growing importance of fintech and the need for robust regulatory frameworks to ensure its responsible growth and protect consumers.

One notable development is the increased focus on data privacy and security, influenced by regulations such as the European Union's General Data Protection Regulation (GDPR). Fintech startups have had to adapt to stringent data protection requirements, affecting their business models and data management practices.

Moreover, anti-money laundering (AML) and know-your-customer (KYC) regulations have been reinforced to combat financial crime. Startups must invest in advanced AML/KYC solutions to comply with these rules, impacting operational costs.

Fintech startups have also grappled with cryptocurrency regulations, especially as cryptocurrencies gained popularity. Some countries have embraced digital currencies, while others have imposed strict controls, requiring fintech firms to navigate a complex regulatory landscape.

Conscious Contextualization in Regulatory Tech

In this rapidly evolving landscape, domain-led tech competencies are indispensable. A prominent example is Goldman Sachs. They've transformed their Marcus digital lending platform into a stand-alone subsidiary with a tech-first approach. Their innovative lending strategies, backed by solid tech competencies, set a precedent for traditional banks seeking to compete in the fintech era. For any tech-player to be able to formulate the right strategy and deliver the right solution on time, they must first be able to consciously contextualize the problem statement (or statements; most of the times it’s more than one, as multiple systems work simultaneously to create seamless omnichannel yet bespoke customer experience) while have the necessary technical competencies. This combo of conscious contextualization and having tech-competencies, stays as a fundamental requirement, more so for niche domain technological requirements such as Banking and Finance.

Here are five critical areas that demand our attention:

1. Open Banking and Data Privacy Regulations

As data-driven fintech startups thrive, regulations surrounding open banking and data privacy are paramount. The EU's PSD2, California's CCPA, and various Asian data protection laws shape how personal financial data is accessed and shared. Leading banks, like JPMorgan Chase, are proactively adapting to these regulations by fostering secure data-sharing partnerships with fintech companies to enhance customer experience while maintaining data privacy.

2. Compliance and Anti-Money Laundering (AML)

In the fight against financial crime, regulatory bodies are tightening AML rules. The Bank Secrecy Act (BSA) and AML regulations are continuously updated in the US. Fintech firms like Stripe are developing advanced fraud detection and compliance tools to ensure they meet these stringent requirements while enabling seamless transactions.

3. Cryptocurrency and Digital Assets

The growth of cryptocurrencies and digital assets is pushing regulators to draft new frameworks. The SEC in the US and ESMA in Europe are working on regulating the digital asset space. Companies like Coinbase are actively engaging with regulators to shape the future of this industry while ensuring legal compliance.

4. Cross-Border Regulations

Fintech startups often operate across borders, which complicates regulatory adherence. As a solution, organizations like the Global Financial Innovation Network (GFIN) are forming to harmonize regulatory approaches. Citibank is leveraging its global presence to navigate this intricate web of cross-border regulations.

5. Consumer Protection and Financial Inclusion

As fintech startups expand access to financial services, consumer protection is vital. Regulatory bodies are introducing measures to ensure fair practices. Indian banks like HDFC collaborate with fintech companies to promote financial inclusion while adhering to Reserve Bank of India (RBI) guidelines.

Conclusion.

Staying ahead of regulatory changes is necessary for fintech startups, traditional banks, and RegTech firms. The banking industry is navigating a dynamic regulatory environment that demands adaptability and innovation. By keeping a close eye on these trends and fostering domain-led tech competencies, financial institutions can create a distinct innovation edge for long-term growth.

About Maveric

Established in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with top global banks to solve business challenges through emerging technology. 23 years of singularly focused subject matter expertise, that comes from years of immersion in the banking technology space enables Maveric experts to provide a more profound and meaningful context. This context is invaluable for informed decision-making, problem-solving, and understanding the subject matter within a broader perspective.

Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them. We have been the partner of choice for world’s top 10 financial institutions and top 50 regional banks, delivering banking technology solutions around customer experience, connected core, regulatory compliance and digital operations.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership. With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Pune, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.

#mavericsystems#maveric#acceleratenext#digitalbanking#fintech#fintechstartup#futureoffinance#futureofbanking#bankingandfinance#digitalfinance#financeindustry#bankingindustry#bankingawareness#financialawareness#fintechinnovation#fintechsolutions#bankingtechnology#bankingtransformation

0 notes

Text

Wealth Management in the Digital Age - Trends and Challenges

In the ever-evolving landscape of Asset and Wealth Management (AWM), the tides of transformation have never been more relentless. As disruptive technologies, including GPT-AI and emergent solutions, wash ashore, the significant question is, "What separates the winners from the has-beens?" This thought-provoking exploration delves into the challenges and trends shaping Wealth Management's future. Drawing from industry examples in the US, Europe, and Asia, we unveil the strategies defining success in this digital era.

The Vital Role of Technological Contextualization

Amid these rapid changes, 'technological contextualization' is critical in ensuring client satisfaction and long-term loyalty. Wealth managers must utilize technology not merely for its own sake but to enhance the client's experience. For instance, using AI-driven tools to provide real-time, context-aware insights can help advisors have more meaningful conversations with their clients. When clients feel understood and heard, it fosters trust and loyalty.

The ability to harness technology effectively while maintaining a human touch in wealth management is where firms' future success will be determined. The winners in this digital age will be those who integrate technology seamlessly into their client relationships, ensuring that it enhances the client's wealth management journey rather than detracting from it.

As GPT-AI and emergent tech disrupt the AWM landscape, what will separate the winners from the has-beens?

1. The Rise of AI and Data Analytics

AI and data analytics have become the backbone of modern wealth management. With AI's ability to analyze vast datasets and provide actionable insights, financial advisors can make more informed decisions. For instance, Morgan Stanley's partnership with Machine Learning company Kensho. Through this collaboration, Morgan Stanley is leveraging AI to help advisors respond to client inquiries more effectively, enhancing service quality.

2. Customization and Personalization

Client expectations have evolved significantly. They now demand personalized, tailor-made solutions that cater to their unique financial needs and goals. Europe's largest asset manager, Amundi, recognized this shift and implemented an ambitious digital transformation strategy. By adopting cutting-edge technologies, Amundi has empowered its advisors to offer personalized investment solutions, enhancing client satisfaction and loyalty.

3. Cybersecurity and Data Privacy

As AWM becomes more digital, the vulnerability to cyber threats increases. Firms must not only provide robust cybersecurity measures but also prioritize data privacy. For example, JPMorgan Chase's investment in cybersecurity is a testament to the industry's commitment to safeguarding client data. It's a clear recognition of the risks involved in the digital age.

4. Robo-Advisors and Hybrid Models

Robo-advisors, such as Betterment and Wealthfront, are reshaping the AWM landscape. These platforms offer automated portfolio management at a fraction of the cost. Recognizing this trend, traditional wealth management firms adopt hybrid models combining human expertise with AI-driven efficiency. UBS, for instance, introduced its SmartWealth platform, aiming to cater to both tech-savvy and traditional clients.

5. Regulation and Compliance

In the digital age, regulatory compliance is a growing concern. Recent examples of regulatory changes in the US include the SEC's Regulation Best Interest (Reg BI). This rule aims to enhance the standard of conduct for financial advisors. Navigating these regulations while delivering top-notch service is a challenge, but it's crucial to maintain trust and integrity in the industry.

Conclusion.

Today's digital era presents intricate challenges and opportunities for the Asset and Wealth Management industry. Firms that harness the power of AI, prioritize personalization, ensure robust cybersecurity, adapt to changing regulatory landscapes, and master the art of technological contextualization will stand out as the leaders in this dynamic landscape. As the world continues to change at an unprecedented pace, the winners in the AWM sector will be those who skilfully navigate these complexities and emerge as the trusted advisors of the future.

The ability to technologically contextualize the evolution of ecosystems is paramount and serves as the foundational pillar for driving innovation and harnessing the potential of cutting-edge technologies. By understanding how technology integrates into the broader ecosystem, organizations can adapt, evolve, and ultimately lead in the era of innovation and digital transformation.

About Maveric

Started in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with top global banks to solve business challenges through emerging technology. 23 years of singularly focused subject matter expertise, that comes from years of immersion in the banking technology space enables Maveric experts to provide a more profound and meaningful context. This context is invaluable for informed decision-making, problem-solving, and understanding the subject matter within a broader perspective. Maveric’s 3000+ tech experts use proven frameworks to empower our global customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Pune, Dubai, London, Amsterdam, Warsaw, Dallas, New Jersey, and Singapore.