#kotak securities login

Text

Trading is related to buying and dealing with securities to make silk stockings based on daily price changes. However, if you want to trade in the share request, you should have a good grasp of the fundamentals of share trading. Investing is essential these days, as more than savings is required to beat the odds and fulfill all our financial goals. Trade is a primary profitable concept involving the buying and selling supplies good and services and the compensation a buyer pays a dealer. In another case, trading can exchange goods and services between parties. For example, trade can be made between directors and consumers within a company.

Trading is related to buying and dealing with securities to make silk stockings based on daily price changes. However, if you want to trade in the share request, you should have a good grasp of the fundamentals of share trading. Investing is essential these days, as more than savings is required to beat the odds and fulfill all our financial goals. Trade is a primary profitable concept involving the buying and selling goods, supplies, and services and the compensation a buyer pays a dealer. In another case, trading can exchange goods and services between parties. For example, trade can be made between directors and consumers within a company.

Highlights of trading

1. Trade involves the exchange of goods and services substantially in return for money.

2. Trade can happen within a country or amongst trading nations. In the case of transnational trade, the proposition concerning relative advantage speculates that trade benefits all parties; however, critics contend that it leads to a position within countries in reality.

3. Economists recommend free trade among nations, but protectionism like tariffs might present itself because of political motives.

Types of Trading Platforms in India

When performing seamless stock trading without encountering the fences of time and distance, using the best trading platforms for stock trading is relatively apparent. One can do online trading through 3 virtual interfaces that are given below.

There are mainly three types of online trading platforms in India that top dealers and investors exploit.

Mobile- Based

Browser- based

Desktop- based

1. Mobile- based Mobile App

As its name represents, this type of trading platform can be suitable to use through smart phones. Over time, the rapid penetration of mobile devices in India has made this trading platform the best online platform in India 2023. The significant reasons are ease of usage, portability, and no physical barriers.

2. Browser-based/ Web

A browser-based trading platform can be on a web browser like Internet Explorer, Mozilla Firefox, and Google Chrome. This platform is suitable when smart phones and desktops aren't accessible.

For example, if you're from home without a laptop, your trading account can be entered through a web cyber surfer. However, it is usually believed that this type of trading platform is slower than a desktop-based trading platform.

3. Desktop-based

This platform can be downloaded and installed on a desktop or laptop. Though this is undoubtedly the best trading platform in India, you can use if you're between those traders and investors who desire to place quick buy/ sell orders.

The known thing about this trading platform is that consumers can use shortcut keys to carry out different activities like F1 to buy and F2 to sell etc.

Goods Fundamental characteristics of a best trading platform In India

· Quick continuous execution

· Front line and sharp innovative highlights

· Top-level security

· Simple to-utilize interface

· Simple arrangement of exchanges.

List of Best Trading Platforms in India:-

Zerodha Kite Trading Platform

ICICI Direct All-in-1 App

FYERS ONE Trading Platform

Sharekhan Trade Tiger

Angel Broking Speed Pro

Trade Station Trading Platform

Trade Eye Trading Platform

Upstox Pro Trading Platform

Trader Terminal (TT)

10. NSE Now Trading Platform

1. Zerodha Kite

Zerodha Kite is the flagship trading platform of Zerodha, a leading reduction broker in India. Known as one of the best trading platforms in India, it is connected using next-gen technology to match the different requirements of all types of investors. In addition, the platforms offer a wide assortment of features like charting tools, data widgets, integration with third-party apps, etc., to make trading simple and quick.

Pros

1. Multiple Market Watch

2. Comprehensive charting with further than 100 pointers and six map orders

3. Floating Order window

4. Progressive order types are similar as classes with detector entry and cover with limit entry

5. Unified instrument search for quick search over 90,000 stocks and F&O contracts

6. Live ticks, quotes, and order admonitions

7. Ideal integration with Quant tool for carrying out fundamental analysis using geste

8. Analytics

9. Mixing with other investment apps erected by Zerodha consorts

Cons

1. No extent for strategy backtesting

2. Separate after office with the name Zerodha Q

3. Brokerage Charges – Zero brokerage charges, RS 20 per order for intraday

4. Website – Zerodha Kite

2. ICICI Direct All-in-1 App

The ICICIDirect App is an advanced trading and investing platform designed to simplify investment and trading. The simplified UI and UX make the investment process a breeze. Get access to over 50 products and services across all product categories.

Taken as one of the best trading platforms in India among traders and investors, the operation strives to do online trading a lot easier and quicker for users.

Pros

1. Analyze your app's live data and F&O, NSE Nifty 50, & BSE Sensex charts to know your investment status.

2. Please get the latest news, movements, and trends to assess how they affect your investments.

3. Offers multiple watchlists of various investment products like shares, stocks, mutual funds & IPO to track your being and future investments.

4. Use your curated watch list to place your buy and sell orders in your chosen share request securities in seconds.

5. On the exclusive charting tool, compare various scrips, track ongoing and upcoming events, corporate actions, etc...

6. Make guided investing decisions after assessing trending, expertly curated investment ideas.

7. Generate instant limits with the shares in your DEMAT account.

8. Get instant money in your account within 5 minutes of dealing shares withe-ATM

9. Use MTF( Margin Trading Funding) to buy stocks now and pay latterly anytime within 365 days at seductive interest rates.

10. Apply to the rearmost IPO in a few simple ways with the enhanced user experience and interface.

11. Build low-cost, long- term and diversified portfolios with the One Click Equity.

Cons

· Many features similar to Flash Trade and Easy options have yet to be available (Available on ICICI Direct Markets App). However, it'll be available shortly.

Brokerage Charges –0.1 for equity delivery

Website – ICICI Direct

3. FYERS One

It's the best trading platform in India for desktops and allows users to invest in stock from the comfort of their homes. It's declared Fyers the best trading software in India, with striking features that professionals and beginners can use for stock trading.

The trading software is also known for its speed and superb performance that fluently aligns with its easy and precious features.

Pros

1. Advanced charting point

2. Stock screeners

3. Offers free equity delivery trading.

4. Advanced charting with further than 65 specialized pointers

5. In- erected Live Scanner & Trend Scanner

6. Accepts UPI payments

7. Workshop on low bandwidth

Cons

1. No access to exploration reports and trading tips

2. Reliance on 3rd party merchandisers like Omnesys API and Trading View for charting

3. Brokerage Charges – Flat Rs 20 or0.03 per order

4. Website – FYERS One

4. Sharekhan Trade Tiger

Sharekhan Trade Tiger is foremost considered the best online trading platform in India. It's a terminal-based trading software that needs to be downloaded and installed on a desktop or laptop. The application allows dealers and investors to invest across various portions – Equity, Commodity, Currency, and derivations.

Pros

1. Easy access to reports, tips, and signatures by Sharekhan Research.

2. Association with 14 banks for easy online finance transfer to the trading account.

3. Admit direct share request feeds on a real-time basis across NSE, BSE, MCX, etc.

4. Various helpful calculators include Brokerage Calculator, Span Calculator, and Premium Calculator.

5. One-click order placement option.

6. Pre-loaded with over 30 trading approaches

Cons

1. No availability of 3- in- one account

2. No version for Mac notebooks

3. Collective funds aren't available

4. Brokerage Charges –0.50 or 10 paise per share for equity delivery

5. Website – Sharekhan Trade Tiger

5. Angel Broking Speed Pro

Regarding finding the best online trading platform in India, the available options will only be sufficient with the addition of Speed Pro by Angel Broking. The trading platform is known for offering its users a single-window trading experience along with perceptive trade evaluation features.

Another plus point with Speed Pro is the double-quick prosecution of orders and real-time monitoring.

Pros

1. Scrip addition points for various parts, including F&O, Commodity, and Currency

2. The combined best five – get a quick look at the top five bids for buying and selling across BSE and NSE

3. Open Live Market in Excel with an incredible refresh rate

4. Seamless access to insightful summaries and reports

5. Enables customization of the interface to a specific level

Cons

1. Not available for Mac

2. Little scope for improvement in terms of the software user interface

3. One needs a PC with an excellent configuration for the software to perform better

Brokerage Charges – Zero brokerage on delivery trading

Website – Angel One Trade

6. Trade Station

5Paisa Trade Station App is one of the most feature-loaded and high-tech trading software top dealers in India use. This one of the best trading platforms in India is designed for predominantly active dealers. Still, it isn't like that, as this software is inversely salutary for punk dealers and investors.

Pros

1. Despite being a reduction broker, Trade Station provides easy access to trading calls and recommendations to its guests.

2. This trading platform from 5Paisa updates itself generally, bringing new features every time and dealing with the bugs or problems from the former performances.

3. The trading app is set up to work indeed an introductory internet connection, which is a big plus.

4. Option to register for the rally session

5. Allows investors to trade in the equity member or stock request and joint finances and insurance orders.

Cons

1. Low internet bandwidth may delay the lading of maps

2. Only the Windows interpretation is available

3. The app isn't responsive and can be viewed best on a desktop or laptop. However, the view may need improvement on a mobile or laptop.

Brokerage Charges – Variable brokerage charges

Website – Trade Station

7. Trade Eye

Trade Eye by Wisdom Capital is an Android-grounded trading app that allows investors to trade between several segments through one app. The app is registered with BSE, NSE, MCX, MCX- SX, and NCDEX exchange. It's considered one of the best trading software in India.

Pros

1. A simple trading application that runs fluently using mobile internet

2. Erected for Android druggies along with touch features

3. Option to add multiple request watches

4. Examiner positions in the trade book and order book

5. Get access to various maps and specialized index tools

6. Installation to place aftermarket order

7. Instructional charting functionality for insightful technical stock analysis

8. Fast, secure, and flawless fund transfer

Cons

1. No support for iOS users

2. Introductory interface

Brokerage Charges – Zero brokerage charges, Trade for free

Website – Trade Eye

8. Upstox Pro

This is one of the best trading software in India by Upstox, known as RKSV. Being a responsive trading operation, there's no need to download or install the app. Also, it allows a user to directly access the trading tools through a laptop, desktop, mobile, or tablet.

Considered one of the best trading platforms in India among traders and investors, the application strives to do online trading a lot easier and quicker for users.

Pros

1. Unified search tool to discover easy and complex stocks

2. Contact predefined watch- list of Nifty 50 and other indices

3. Reach NSE cash, Futures and Options, and Currencies scrips

4. Apply 100 specialized pointers on real-time maps

5. Define unlimited price cautions for quick updates

6. Figure a total number of customized watchlists

7. Advanced charting tools that standard assiduity norms

8. Get real-time request word to stay ahead

Cons

1. The specialized support isn't over to the mark

2. Limited features in comparison to its counterparts.

3. The desktop outstation of Upstox needs high speed and stable internet connectivity.

4. Call and Trade installations are chargeable; Upstox charges Rs 20 when placing an order through the phone.

Brokerage Charges – Rs 20 or2.5 whichever is smallest for equity delivery

Website – Upstox Pro Web

9. Trader Terminal (TT)

IIFL Trader Outstations is among the best trading software in India and is also known for its intuitive interface and many features. The trading platform has many shortcut keys that let dealers and investors perform various functions quickly and smartly.

Pros

1. IIFL Call feature – that provides intraday tips to place intraday orders

2. Allows the placement of AMOs (After request orders), which can get reused the coming business day

3. Access LIVE television which includes ET Now

4. Access to a daily report by the name "Weekly Wrap."

5. Easy fund transfer with top banks like ICICI, HDFC, Axis Bank, Citi Bank, UTI, etc.

Cons

1. Not available for iOS users

2. For those who are in need to trade in the F&O member, a written application needs to be submitted along with income proofs.

Brokerage Charges – Rs 20 per trade for delivery

Website – Trade Terminal

10. NSE Now

Contrary to other trading platforms developed by corresponding stockbrokers, this trading platform – Here and Now (Neat on Web), has been considered by the National Stock Exchange of India( NSE). It's one of the most stylish trading platforms in India.

This trading app allows investors to trade across various parts, including Equity, derivations, and currency.

Pros

1. Customized alerts and notifications as defined by the users

2. Request watch to chase stocks, cover trends, sectors, and indicators

3. 15 maps with over 80 specialized pointers

4. Easy fund transfer to several leading banks

5. Diurnal stock tips

Cons

1. Comparatively tough to understand

2. Many stockbrokers levy operation charges for NSE NOW

3. A PC needs to have an excellent configuration for the operation to perform well

Brokerage Charges – Flat Rs 20 for intraday and F&O

Website – NSE Now

FAQs about Best Trading Platform in India

Ques- Which trading platform is best for India?

Answer- Zerodha Vampire is India's best online trading platform, presently operating in the stock broking script. Zerodha continuously pushes invention in its products and provides dealers with the needed products and services. Zerodha's, besides the lowest brokerage rates, boasts of a full-fledged magazine of trade products and confederated services.

Ques: Which trading platform offers the best advisory and stock tips installation?

Answer: IIFL, an acronym for India Infoline, is accepted by traders as the best trading platform that offers the best advisory and free tips facility. This fact is strengthened by the company's accurate stock predictions in the past.

Ques: Which trading is most profitable?

Answer: According to trade experts, Intraday trading is the most profitable because you can buy and vend stocks on the same day. It reduces threat as stocks price don't go up or down so far in a single day, and you should always use the safest and best online trading platform for intraday trading.

Ques: Which factors make a stock broking establishment the best in India?

Answer-numerous stock broking companies try to deliver top-notch trading and stock advisory services to the guests, but only a many of them are suitable to stand- out impeccably. We see low brokerages, an easy-to-use interface, and varied platform presence as essential features of an excellent stock broking establishment.

Source - Choose the best Trading Platform in India 2023

#best forex trading platform in india#best trading platform in india#best online trading platform in india#paytm share price#zerodha kite#kite zerodha#groww#angel broking#zerodha kite login#sharekhan login#zerodha brokerage calculator#zerodha margin calculator#edelweiss share price#kotak securities login#iifl share price#angel broking share price#no brokerage#upstox brokerage calculator#groww brokerage calculator

5 notes

·

View notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

Kotak Trading Account Login

In today's fast-paced financial landscape, managing investments efficiently is crucial for individuals aiming to capitalize on market opportunities. Kotak Securities, a renowned name in the realm of financial services, offers a seamless trading experience through its intuitive online platform. With the Kotak Trading Account Login, investors gain access to a plethora of investment options, real-time market insights, and robust trading tools, empowering them to make informed decisions and maximize their returns.

Introduction to Kotak Trading Account:

Established as a subsidiary of Kotak Mahindra Bank, Kotak Securities has emerged as a trusted partner for investors seeking reliable brokerage services. The Kotak Trading Account serves as a gateway to the world of stocks, derivatives, commodities, currencies, and more. Whether you're a seasoned trader or a novice investor, the platform caters to diverse investment needs with its user-friendly interface and comprehensive features.

Key Features of Kotak Trading Account:

Secure Login Credentials: Kotak Securities prioritizes the security of its clients' accounts. Upon registration, users receive unique login credentials, ensuring secure access to their trading accounts.

Intuitive Interface: Navigating through the complexities of the stock market is made effortless with Kotak's intuitive interface. Users can easily monitor their portfolios, track market trends, and execute trades with just a few clicks.

Real-time Market Updates: Stay ahead of the curve with real-time market updates provided by Kotak Securities. From stock prices to global market news, investors can access timely information to make informed investment decisions.

Research and Analysis Tools: Gain valuable insights into market trends and stock performance with Kotak's research and analysis tools. From technical charts to fundamental analysis reports, investors have access to a plethora of resources to refine their investment strategies.

Multiple Trading Options: Whether you prefer equity trading, derivatives, commodities, or currency trading, Kotak Securities offers a wide range of investment options to suit your preferences and risk appetite.

Personalized Alerts: Never miss out on lucrative trading opportunities with personalized alerts from Kotak Securities. Set up custom alerts for price movements, news updates, or important events to stay informed at all times.

Mobile Trading App: Manage your investments on the go with Kotak Securities' mobile trading app. Available for both Android and iOS devices, the app allows users to trade seamlessly from anywhere, anytime.

How to Login to Your Kotak Trading Account:

Logging in to your Kotak Trading Account is a straightforward process:

Visit the Kotak Securities Website: Open your preferred web browser and navigate to the Kotak Securities website.

Locate the Login Section: On the homepage, locate the login section, typically found at the top right corner of the screen.

Enter Your Credentials: Enter your unique login ID and password in the respective fields. Ensure that the information entered is accurate to avoid login issues.

Security Verification: As an additional security measure, you may be prompted to complete a security verification step, such as entering an OTP (One-Time Password) sent to your registered mobile number or email address.

Access Your Account: Once the login credentials are verified, you will gain access to your Kotak Trading Account dashboard, where you can view your portfolio, analyze market trends, and execute trades.

Tips for Maximizing Your Trading Experience with Kotak Securities:

Stay Informed: Keep yourself updated with the latest market news, trends, and analysis provided by Kotak Securities' research team.

Diversify Your Portfolio: Spread your investments across different asset classes to mitigate risk and maximize returns.

Utilize Trading Tools: Take advantage of Kotak's advanced trading tools and technical analysis charts to identify trading opportunities and trends.

Set Realistic Goals: Define your investment objectives and risk tolerance level to devise a well-thought-out trading strategy.

Monitor Your Investments: Regularly monitor your portfolio performance and make necessary adjustments based on market conditions and your financial goals.

Conclusion:

In conclusion, the Kotak Trading Account Login offers investors a convenient and feature-rich platform to navigate the complexities of the financial markets. With its user-friendly interface, real-time market updates, and robust trading tools, Kotak Securities empowers investors to make informed decisions and optimize their investment portfolios. Whether you're a seasoned trader or a novice investor, Kotak Securities provides the necessary tools and resources to embark on your investment journey with confidence. So, log in to your Kotak Trading Account today and unlock a world of investment opportunities.

0 notes

Text

🇮🇳Indian public for invest Money Has Earn Money Login Mobile Number Aadhar Trading Account,daily,week,Month,Year National Securities deposit,Central DSL Given Profit from Deposit🇮🇳india ltd industries,download app kotak Securities,JM Financial Blink,5paisa,icici,SBI,Lifetime...- Namdev Kishan Bajgire

1 note

·

View note

Text

The Kotak – 811 & Mobile Banking app

The Kotak – 811 & Mobile Banking app is an app that helps you stay in touch with all your banking needs on the go. With over 180 features, you can pay bills, shop, invest, manage your credit and debit cards, recharge your mobile and FASTag and do a lot more at any time, from anywhere. Go ahead and download the app today to experience the ease of mobile banking at your fingertips.

Why choose a Kotak 811 savings account?

Your Kotak 811 savings account comes with unlimited validity and unrestricted deposits and spends. With the Kotak app, you enjoy benefits like

• In-app virtual Kotak 811 debit card

• Zero balance account with no penalties for not maintaining a minimum balance

• Savings account with up to 4%* interest p.a.

• Free online Fund transfers (UPI, NEFT, IMPS, RTGS)

• Kotak 811 #DreamDifferent credit card with no joining and annual fee

What else can I do with my Kotak mobile app?

You can shop, pay bills, manage your credit and debit cards, invest and do a lot more with just a few taps on the Kotak app. There are 180+ features that you can enjoy on the Kotak App.

Here are a few of the 180+ features that you can enjoy:

• Check your savings account balance

• Get a Dream Different Debit Card or Image Debit Card

• Request a chequebook

• Open a term deposit

• Transfer funds using BHIM UPI

• Apply for a 811 #DreamDifferent Credit Card

• Regenerate PINs

• Switch credit/debit cards on or off

• Recharge mobile and DTH subscription

• Recharge FASTag

• Pay utility bills with BillPay

• Avail an instant personal loan

• Book train tickets, flights, hotel rooms, and cabs

• Shop at Kaymall (travel, shopping, grocery, electronic)

• Purchase and redeem mutual funds

• Avail a Kotak personal loan

• Use ‘Pay Your Contact’ to pay beneficiaries with just a phone number

• BharatQR 3(scan and pay)

• Keya chat boat

• Get insurance

• Apply for FASTag

Download the Kotak App today to discover a whole new exciting world of banking digitally with Kotak.

How to get started?

Completing your sign-up on the Kotak app is easy. All you need are a few bank account details such as your credit/debit card PIN and your Net Banking password. You will go through a one-time activation process as you login for the first time on the Kotak app.

How do I get my 811 #DreamDifferent Credit Card?

Want to get your very own 811 #DreamDifferent Credit Card? It’s really easy. Just follow these 3 quick steps –

Open a Kotak 811 savings account

Book a fixed deposit of a minimum amount of ₹10,000

Apply for free credit card against FD

That’s it!

Security

With the Kotak app, you do not have to worry about security. We place utmost importance on our customers’ privacy and security. We make sure that your data will never be shared with a third-party without your consent.

Permissions of Kotak banking app users

The Kotak app would require the following permissions from its users:

• Contacts: To permit access to mobile numbers for mobile / DTH recharge or sharing IFSC/MMID

• Location: For branch / ATM locator

• Photos / Media / Files / Camera: To access gallery and set images

• Phone: To contact customer service

• SMS: To auto activate the device during activation process (read SMS will be applicable for select customers and basis customer consent)

The Kotak app will access device level alternate data for credit risk assessment and make decisions for better product offering.

Giving Aadhaar details is voluntary.

Issuance of credit cards is at the sole discretion of Kotak Mahindra Bank Limited. All features and benefits are subject to Credit Card Terms and Conditions. Please read the Credit Card terms and conditions carefully provided on the bank website www.kotak.com

Mutual Fund investments are subject to market risks. Please read all documents carefully before investing.

Credit at sole discretion of Kotak Mahindra Bank Ltd. and subject to guidelines issued by RBI from time to time. Bank may engage the services of marketing agents for the purpose of sourcing loan assets.

#Kotak#india news#india business#india budget 2022: digital rupee and crypto tax announced cnn#mumbai indians#India#india

1 note

·

View note

Text

kotak Securities Reviews 2020

kotak Securities Reviews 2020

A subsidiary of Kotak Mahindra Bank, Kotak Securities Limited is the stock broking and distribution arm of the Kotak Mahindra Group and was established in 1994. They offer services like stock broking and even provide financial products in India. Apart from that, they have a business interest in life insurance, commercial banking, mutual funds, and investment banking. With 1209 branches,…

View On WordPress

#kotak mahindra securities#kotak securities#kotak securities customer care#kotak securities login#kotak securities online trading account login

0 notes

Photo

If you want to open a DEMAT account in Kotak Securities, then you must know all the basic details & information on Kotak Securities Login. You must visit Trading Fuel where you can find the detailed explanation & step by step process for all the login information and execute the same with the instructions mentioned.

0 notes

Text

Tips untuk pengguna iPhone

Berikut tips untuk iPhone. AZA kini menggunakan iPhone 8.

Senarai pecahan tajuk

1. Safari

2. Emoji

3. Battery

4. Compass

5. Camera

6. Multitasking Menu

7. Data

8. Network

9. Fungsi Tap Pada Paparan Masa

10. Shortcuts untuk cepat taip

11. Apps

12. Sound

13. Sticker

14. iOS update AUTO/MANUAL

15. Calendar

16. Add Widget

17. Fetch / Push

18. To edit text

19. Reminders

20. Calculator

21. Call back

22. Customize your replies

23. Settings

TITLE 1 - Safari

1. Reading pane - Pada di hujung ruangan URL safari terdapat icon reading pane. Jika anda tap icon yang simbolnya garisan yang berbentuk seperti perenggan tersebut, anda dapat lihat paparan standard untuk apa jua page yang anda baca di internet.

2. Bookmark - Taipkan pada ruangan URL safari alamat website yang ingin anda lawati dan tap butang "Go" pada keyboard anda. Bila page tersebut berjaya anda lawati, tap pada butang safari yang ada simbol anak panah dan tap pada bookmark. Last but not least, tap butang "Done" pada keyboard anda. Ianya akan secara automatik berada dalam senarai "Favorites" anda.

3. Multipage - Icon multipage yang mempunyai simbol dua kotak segi 4 bertindih pula akan memaparkan pelbagai page yang anda lawati. Jika anda mahu clear 100% paparan tersebut hanya perlu tap pada icon multipage dan swipe ke kiri. Jika 100% clear telah dilakukan, maka ianya akan memaparkan pelbagai bookmark "Favorites" anda. Anda hanya perlu tap pada mana-mana icon "Favorites" tersebut untuk lawati page tanpa perlu menaip sepanjang mana pun alamat URL lagi.

4. Clear history safari

Tap Setting > Safari > tap pada "Clear history". Alang-alang tap juga pada "Clear Cookies and Data". Maka history, cookies dan data 100% clear.

5. Block cookies

Tap Setting > Safari > Block Cookies > pilih "Always".

TITLE 2 - Emoji

Guna emoji untuk gambarkan emosi suka, sedih, dan sebagainya.

Tap Settings > General > Keyboard > Add New Keyboard > Emoji.

TITLE 3 - Battery

1. Nak cepat penuh charge iPhone? , hanya aktifkan "flight safe mode". Swipe paparan dari bawah skrin menghala ke atas. Pilih button airplane mode, cara terpantas tak nak ganggu solat (JANGAN LUPA OFF ALARM sebab tetap akan bunyi walau flight safe mode), nak charge mobile phone cepat penuh, nak putus hubungan melalui mobile phone sebentar.

2. Nak bateri tahan lebih lama?

Tap Setting > General > Spotlight search > untick yang kurang penting.

3. Paparan battery percentage icon

Tap Setting > General> Usage > "on" battery percentage.

Jenis lithium-ion adalah lebih baik lebih kerap di cas untuk memastikan jangka hayat bateri lebih lama. Masa terbaik untuk charge adalah ketika tahap bateri berada pada kadar 10-20%. Ianya akan memanjangkan jangka hayat bateri dari 400-600 cycle kepada 1000-1100 cycle. Ini bermakna jangan charge bateri ketika tahap bateri berada lebih dari 20%.

Sekali setiap 3 bulan pastikan bateri anda 0% dan pada kadar yang segera mulakan untuk di recharge sehingga penuh 100% bagi memastikan komponen bateri digunakan 100% setiap 3 bulan.

TITLE 4 - Compass

Compass bukan sahaja untuk compass, tapi boleh berfungsi sebagai pengukur ketepatan keseimbangan. Anda hanya perlu swipe ke kiri setelah aktifkan compass.

TITLE 5 - Camera

1. Nak focus gambar tanpa hilang focus yang membuatkan gambar anda blur? Hanya tekan pada screen beberapa saat sehingga keluar indication "AF Locked", kemudian anda boleh gerakkan kamera anda tanpa hilang focus.

2. Nak snap photo tanpa tekan pada butang di screen? Gunakan butang "volume" untuk snap photo.

TITLE 6 - Multitasking Menu

1. Nak cepat clear background apps? Hanya gerakkan 3 jari anda ke atas pada "multitasking menu" maka 3 background apps dapat anda clear serentak.

2. Apa jua aktiviti anda pada iPhone anda, nak clear hanya pergi ke "multitasking menu". Cara paling cepat untuk ke "multitasking menu" adalah dengan "double press" butang iphone.

TITLE 7 - Data

Anda nak jimatkan data? Pergi ke "setting>mobile data" dan pilih apps penting sahaja gunakan data anda, yang kurang penting anda tetapkan untuk bila ada sambungan Wi-Fi sahaja.

TITLE 8 - Network

Network macam tak kuat? Dapatkan ketepatan kekuatan network di mana anda berada ketika itu dengan dial *3001#12345#* dan tekan butang call. Jika result adalah -50 adalah bagus maka -100 adalah kurang bagus.

TITLE 9 - Fungsi Tap Pada Paparan Masa

1. Auto scroll up - Bila kita baca content di internet, terutama content yang panjang, cara mudah untuk kita naik ke paparan teratas adalah tap pada paparan masa yang terletak pada bahagian tengah teratas skrin mobile phone anda. Kalau website tiada button auto scroll up pun tak jadi masalah.

2. Teknik ini juga untuk mengecilkan paparan penuh yang melindungi button seperti back's button, multiple pages, bookmark dan sebagainya pada safari.

TITLE 10 - Shortcuts untuk cepat taip

Nak cepat typing?

Tap Setting > General > Keyboard > Text Replacement > + > sampai kat stage ni, anda nak shortcut untuk apa? katakan "Alhamdulillah ;)". Siap ada emoji lagi selepas text Alhamdulillah . So pada bahagian phrase dan shortcuts taipkan seperti berikut dan save.

Phrase > Alhamdulillah ;)

Shortcuts > alh

Tap save.

Later bila anda taip "alh" jer terus keluar perkataan lengkap "Alhamdulillah ;)" seperti yang telah anda setting. Mudah dan pantas. Standard kan semua shortcuts anda gunakan huruf kecil sahaja dan 3 huruf sahaja dengan menggunakan 3 huruf terawal pada perkataan yang anda mahu tetapkan.

TITLE 11 - Apps

1. Banyak Apps penyebab anda tak alert? Gunakan Apps berbeza untuk tujuan yang berbeza.

AZA gunakan WhatsApp untuk one-to-one communication. Telegram Messenger untuk group discussion. Ada perkara nak group chat, masa tu sahaja AZA gunakan Telegram Messenger. Group chat tak perlu notification sebab real time chat. Berbanding one-to-one chat yang memerlukan immediate respond bila sahaja dapat notification. Manakala Google Plus untuk integrated dengan Blogger. Ketiga-tiga Apps ini AZA gunakan untuk stay in touch dengan anda.

2. Versi iPhone anda tak sesuai dengan Apps version? Tak perlu nak lakukan perkara pelik jika anda tak boleh nak download apps kerana mobile phone version. Mari AZA ajarkan anda cara mudah untuk anda masih boleh download apps tersebut dengan menggunakan older apps version.

Step 1

Login iTune pada komputer anda dengan menggunakan Apple ID anda seperti apple ID iPhone anda bila anda nak download apa-apa apps di Apps Store.

Step 2

Download Apps yang tak boleh nak download pada iPhone anda tadi kerana kali ni pasti boleh kerana anda download ke komputer anda.

Step 3

Bila dah berjaya download guna iTune, kali ni cuba anda download apps tersebut guna iPhone anda. Kenapa kali ni boleh? Ini adalah cara yang betul tanpa perlu lakukan perkara yang pelik. Welcome to Apple family ;).

TITLE 12 - Sound

Receive call anda tak dengar apa-apa sound? Check button pada iPhone anda adakah anda lupa switch button "silent-ringer" yang terletak pada bahagian atas button volume.

TITLE 13 - Sticker

Suka dengan sticker yang dikirim oleh rakan anda? Anda juga boleh gunakan sticker tersebut tanpa anda perlu bersusah payah untuk edit. Bagaimana?

Step 1 > Tap pada sticker tersebut. Kemudian akan dipaparkan dialog box dan anda pilih simbol "bintang" pada dalong box tersebut. Secara automatik anda dah boleh gunakan sticker tersebut untuk dikirimkan kepada rakan anda yang lain. Bagaimana?

Step 2 > Tap pada ruangan untuk anda taip message yang kebiasaannya anda gunakan untuk whatsapp rakan anda. kemudian anda tap pula pada simbol sticker yang terletak di penjuru kanan ruangan untuk anda taip message tadi. Anda akan dipaparkan simbol "jam", "bintang", "love" dan beberapa sticker yang anda dah download (jika ada). Tap pada simbol "bintang". Di situ tersimpan sticker yang anda copy dari rakan anda tadi.

TITLE 14 - iOS update AUTO/MANUAL

Setting > General > Software Update > Off. Tak nak auto update sebab kalau update cepat sangat, pastu baru tahu ada security flaws pada update terbaru tersebut kan naya. Bukan boleh percaya sangat ngan Apple tu. Dah banyak kali mereka release update tapi kemudian baru tahu ada security flaws.

TITLE 15 - Calendar

Gunakan app “calendar” yang ada pada iPhone anda sebagai reminder

TITLE 16 - Add Widget

Gunakan juga app add widget iaitu “up next” utk auto paparan semasa apa yg telah anda tetapkan pada calendar termasuk alarm.

TITLE 17 - Fetch / Push

Pastikan apps yang anda gunakan setting ke "fetch" bukan "push" email bagi memastikan bateri anda kurang buat kerja yang sebenarnya tak perlu kerap. Go to setting> Password & Accounts > fetch new data > OFF "Push" button. Go to fetch and select either manually/hourly/every 30 or 15 minutes.

TITLE 18 - To edit text

Click and hold the space bar. “you can move the cursor instead of trying to drag the cursor itself with your fat thumb”.

TITLE 19 - Reminders

Gunakan app Reminders yang terdapat pada iPhone anda untuk remind anda Birthday dan pelbagai perkara yang boleh anda asingkan ke pelbagai tab mengikut kategori yang anda cipta sendiri.

TITLE 20 - Calculator

Instead of resetting your baby maths from the start, just swipe left or right on the calculator to erase the last number you typed.

TITLE 21 - Call back

Hit the green phone picture on your handset. This will automatically bring up the last number you dialed.

TITLE 22 - Customize your replies

Simply go to Settings > Phone > Respond with text and set up your own customized responses. Easy!

TITLE 23 - Settings

SETTINGS > GENERAL > RESET > RESET ALL SETTINGS

SETTINGS > IF (YOU HAVE SIGN IN TO YOUR IPHONE) > NAME, PHONE NUMBERS, EMAIL

SETTINGS > IF (YOU HAVE SIGN IN TO YOUR IPHONE) > PASSWORD & SECURITY

SETTINGS > IF (YOU HAVE SIGN IN TO YOUR IPHONE) > PAYMENT & SHIPPING

SETTINGS > IF (YOU HAVE SIGN IN TO YOUR IPHONE) > ICLOUD > OFF

SETTINGS > IF (YOU HAVE SIGN IN TO YOUR IPHONE) > ITUNES & APP STORE > OFF (ALL)

SETTINGS > AIRPLANE MODE > OFF

SETTINGS > WI-FI > OFF

SETTINGS > BLUETOOTH > OFF

SETTINGS > MOBILE DATA > ON

SETTINGS > MOBILE DATA > MOBILE DATA OPTIONS > ROAMING OFF

SETTINGS > MOBILE DATA > PERSONAL HOTSPOT > OFF

SETTINGS > MOBILE DATA > NETWORK SELECTION > AUTOMATIC > ON

SETTINGS > MOBILE DATA > ON (ONLY IMPORTANT APPS) such as Safari, Phone, etc

SETTINGS > MOBILE DATA > WIFI ASSIST > OFF

SETTINGS > PERSONAL HOTSPOT > OFF

SETTINGS > NOTIFICATIONS > SHOW PREVIEWS > NEVER

SETTINGS > SOUNDS & HAPTICS > ON (SYSTEM HAPTICS ONLY)

SETTINGS > DO NOT DISTURB > OFF (ALL)

SETTINGS > SCREEN TIME > ALWAYS ALLOWED > PHONE, MESSAGE

SETTINGS > GENERAL > ACCESSIBILITY > DISPLAY ACCOMMODATIONS > AUTO BRIGHTNESS > OFF

SETTINGS > GENERAL > KEYBOARD > AUTO CORRECTION > OFF

SETTINGS > GENERAL > BACKGROUND APP REFRESH > OFF

SETTINGS > CONTROL CENTRE > ACCESS WITHIN APPS > OFF

SETTINGS > DISPLAY & BRIGHTNESS > OFF (ALL)

SETTINGS > WALLPAPER > CHOOSE A NEW WALLPAPER > SELECT BLACK & WHITE

SETTINGS > SIRI & SEARCH > OFF (ALL)

SETTINGS > TOUCH ID & PASSCODE > USE TOUCH ID FOR > ON (ALL)

SETTINGS > TOUCH ID & PASSCODE > VOICE DIAL > OFF

SETTINGS > TOUCH ID & PASSCODE > ALLOW ACCESS WHEN LOCKED > OFF (ALL)

SETTINGS > TOUCH ID & PASSCODE > ITUNES & APP STORE > ON

SETTINGS > TOUCH ID & PASSCODE > TURN PASSCODE ON > ENTER YOUR DESIRE 6 DIGITS PASSCODE

SETTINGS > EMERGENCY SOS > OFF (ALL)

SETTINGS > BATTERY > BATTERY PERCENTAGE > ON

SETTINGS > PRIVACY > LOCATION SERVICES > OFF

SETTINGS > PRIVACY > ANALYTICS > SHARE IPHONE ANALYTICS > OFF

SETTINGS > PRIVACY > ADVERTISING > LIMIT AD TRACKING > ON

SETTINGS > ITUNES & APP STORE > OFF (ALL)

SETTINGS > PASSWORD & APP PASSWORDS > OFF (ALL)

SETTINGS > MAIL > OFF (ALL)

SETTINGS > CONTACT > OFF (ALL)

SETTINGS > CALENDAR > OFF (ALL)

SETTINGS > NOTES > DEFAULT ACCOUNT > ON MY IPHONE

SETTINGS > REMINDERS > DEFAULT LIST (SELECT ONE OF TAB YOU CREATED)

SETTINGS > VOICE MEMOS > OFF (ALL)

SETTINGS > PHONE > CALL BLOCKING & IDENTIFICATION > (THOSE CONTACT YOU HAVE BEEN BLOCKED)

SETTINGS > MESSAGE > SEND AS SMS > ON

SETTINGS > FACETIME > ON

SETTINGS > MAPS > OFF (ALL)

SETTINGS > COMPASS > OFF (ALL)

SETTINGS > SAFARI > OFF (ALL)

SETTINGS > STOCKS > OFF (ALL)

SETTINGS > MUSIC > OFF (ALL)

SETTINGS > TV > OFF (ALL)

SETTINGS > PHOTOS > OFF (ALL)

SETTINGS > CAMERA > AUTO HDR > ON

SETTINGS > BOOKS > OFF (ALL)

SETTINGS > PODCASTS > OFF (ALL)

SETTINGS > GAME CENTER > OFF (ALL)

SETTINGS > APPS (THOSE YOU HAD PURCHASE)

CONTACTS

PHOTOS

MICROPHONE

CAMERA

SIRI & SEARCH

NOTIFICATIONS

BACKGROUND APP REFRESH

MOBILE DATA

LOCATION

Kebanyakkan setting kena pilih DISABLE/OFF supaya bateri tak cepat habis, privacy atau memang tak guna pun fungsi yang banyak-banyak tu.

Quran 2:204

"Dan di antara manusia ada orang yang tutur katanya mengenai hal kehidupan dunia, menyebabkan engkau tertarik hati (mendengarnya), dan ia (bersumpah dengan mengatakan bahawa) Allah menjadi saksi atas apa yang ada dalam hatinya, padahal ia adalah orang yang amat keras permusuhannya (kepadamu)."

"And of the people is he whose speech pleases you in worldly life, and he calls Allah to witness as to what is in his heart, yet he is the fiercest of opponents."

Kefahaman AZA

"Allah mengetahui apa yang tidak kita ketahui dan mengingatkan kita agar berhati-hati"

2 notes

·

View notes

Text

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price

0 notes

Text

Kotak Demat Login

In today's fast-paced digital age, managing investments has become increasingly convenient and efficient with online platforms. Kotak Securities, a leading brokerage firm in India, offers a seamless and user-friendly experience through its Kotak Demat Login portal. Whether you're a seasoned investor or just starting your investment journey, Kotak Demat Login provides you with the tools and resources you need to make informed decisions and grow your wealth.

Understanding Demat Accounts:

Before delving into the features and benefits of Kotak Demat Login, it's essential to understand what a Demat account is and its significance in the world of investing. A Demat (Dematerialized) account serves as an electronic repository to hold securities such as stocks, bonds, mutual funds, and other financial instruments in electronic form. It eliminates the need for physical share certificates and offers a secure and convenient way to trade and invest in the stock market.

Features of Kotak Demat Login:

Seamless Access: Kotak Demat Login provides users with easy access to their Demat accounts anytime, anywhere. Whether you're using a computer, tablet, or smartphone, you can log in to your account with ease.

Portfolio Management: The platform offers comprehensive portfolio management tools, allowing investors to track their investments, view holdings, monitor performance, and analyze portfolio diversification.

Trading Platform Integration: Kotak Demat Login seamlessly integrates with Kotak Securities' trading platform, enabling users to execute trades, buy/sell securities, and manage orders with just a few clicks.

Research and Analysis: Access to real-time market data, research reports, expert insights, and analysis tools empowers investors to make informed decisions and stay ahead of market trends.

Security and Privacy: Kotak Securities prioritizes the security and privacy of its users' information. Advanced encryption technologies and robust security measures ensure the safety of transactions and data on the platform.

Customer Support: A dedicated customer support team is available to assist users with any queries, technical issues, or assistance they may require while using the Kotak Demat Login portal.

Benefits of Kotak Demat Login:

Convenience: With Kotak Demat Login, investors can manage their investments conveniently from the comfort of their homes or on the go, eliminating the hassle of visiting physical brokerage offices.

Cost-Effectiveness: Online trading platforms often offer competitive brokerage rates and lower transaction fees compared to traditional brokerage firms, resulting in cost savings for investors.

Transparency: Transparency is key in the world of investing, and Kotak Demat Login provides users with transparent access to their investment portfolios, transactions, and account statements.

Flexibility: Whether you're a short-term trader or a long-term investor, Kotak Demat Login caters to investors of all types, offering a range of investment products and services to suit diverse investment objectives and preferences.

Educational Resources: Kotak Securities understands the importance of investor education and provides users with access to educational resources, webinars, tutorials, and market insights to enhance their investment knowledge and skills.

Getting Started with Kotak Demat Login:

Getting started with Kotak Demat Login is quick and easy. New users can follow these simple steps to open a Demat account and access the platform:

Visit the Kotak Securities website: Navigate to the Kotak Securities website and locate the option to open a Demat account.

Fill out the application form: Provide the required personal and financial information as prompted in the online application form.

Submit documents: Upload scanned copies of necessary documents such as identity proof, address proof, and income proof as per the KYC (Know Your Customer) requirements.

Verification: Once the application and documents are submitted, they will be verified by Kotak Securities' team.

Account Activation: Upon successful verification, your Demat account will be activated, and you will receive login credentials to access the Kotak Demat Login portal.

Log in and Start Investing: Log in to your Kotak Demat account using the provided credentials, explore the platform's features, and start investing in your favorite securities.

Conclusion:

In conclusion, Kotak Demat Login offers investors a robust and user-friendly platform to manage their investments efficiently and effectively. With its seamless access, comprehensive features, competitive pricing, and dedicated customer support, Kotak Demat Login is the go-to choice for investors looking to streamline their investment journey and achieve their financial goals. Whether you're a novice investor or an experienced trader, Kotak Demat Login empowers you to take control of your investments and navigate the complexities of the financial markets with confidence.

0 notes

Text

Forgot Kotak Crn

Forgot Kotak Crn. The password will be combined with your preferred email id and mobile number and sent as 6 letters. Once you click on it, this page will open up wherein you need to fill certain details.

Kotak Mahindra Bank Get your CRN from www.shorttutorials.com

To retrieve your customer id through hdfc bank, follow these steps. Enter crn in user id; (1) click on the app icon to launch the app.

Source: netbanking.in

Videos you watch may be added to the tv's watch history and influence tv. Enter crn in user id;

Source: twitter.com

How can i login to kotak internet banking without otp? Obtaining your crn through an online portal.

Source: www.youtube.com

Choose a six character password you like and you will have it emailed to your mobile device and emailed to your preferred email address. Enter user id (crn) 2.

Source: bankreception.com

I have opened a new account in kotak 811 app today. Compose a new message like shown below and send it to the given number.

Source: bankreception.com

If you need to change your net banking password or have forgotten the password, you can do the necessary alterations by the following these simple steps: Videos you watch may be added to the tv's watch history and influence tv.

Source: cleartax.in

Crn or the customer reference number is a number that can be found on your debit card/credit card under your name, it acts as a user id for each account that is specific to that one account. Getting started on kotak mobile banking app is very simple.

Source: thebankhelp.com

Now, get your phone and open the messaging app. Enter the password or click on the “forgot password” option available at the right corner of the box

Source: www.financesrule.com

Get kotak crn number through sms with mobile. Compose a new message like shown below and send it to the given number.

Source: tnesevai.in

Visit the kotak mahindra netbanking portal. Enter the password or click on the “forgot password” option available at the right corner of the box

Source: www.paisabazaar.com

Videos you watch may be added to the tv's watch history and influence tv. If you have never logged into the app:

Source: learn.quicko.com

Once you click on it, this page will open up wherein you need to fill certain details. Answer two of the seven mandatory questions by entering the user id crn.

Source: thebankhelp.com

Go to the net banking login page of hdfc bank, search for question mark (?) written as “forgot customer id?” icon just below the continue button and click on it. Crn or the customer reference number is a number that can be found on your debit card/credit card under your name, it acts as a user id for each account that is specific to that one account.

Source: www.financesrule.com

The password should be minimum 6 character length, and should have at least one special character, upper case letter and a number; Through this, one shouldn’t worry about how to recover forgot kotak bank crn number you are needed to follow these steps:

Source: netbanking.in

Log in to the mobile banking application and hit on service requests and select the profile option. Visit the kotak mahindra netbanking portal.

Source: www.financesrule.com

Compose a new message like shown below and send it to the given number. Getting started on kotak mobile banking app is very simple.

Source: www.shorttutorials.com

I have opened a new account in kotak 811 app today. Simply, sms crn to 9971056767 using your bank registered mobile number and you will receive an sms with your crn.

Source: bankreception.com

Net banking click2remit corporate salary upload gst compliance solution send money abroad securities wholesale banking fastag portal/recharge. Enter your crn (2) authenticate using debit/credit card or netbanking details (3) set your 6 digit mobile banking pin (mpin) (4) you will receive an activation code on your registered mobile number.

Source: thebankhelp.com

Enter the password or click on the “forgot password” option available at the right corner of the box I have opened a new account in kotak 811 app today.

Source: learn.quicko.com

Log in to the mobile banking application and hit on service requests and select the profile option. Visit the kotak mahindra netbanking portal.

Source: bankreception.com

Get kotak crn number through credit/debit card if you have your kotak account’s credit or debit card, it is easier to. Obtaining your crn through an online portal.

Getting Started On Kotak Mobile Banking App Is Very Simple.

Go to the net banking login page of hdfc bank, search for question mark (?) written as “forgot customer id?” icon just below the continue button and click on it. On the profile option, click on the “ mobile number update ” option. If you have never logged into the app:

Choose A Six Character Password You Like And You Will Have It Emailed To Your Mobile Device And Emailed To Your Preferred Email Address.

Get kotak crn number through sms with mobile. If you want to get your crn number you can sms crn to 9971056767 from the registered mobile number of your bank account, or you can find it on your credit card/debit card. Enter your crn (2) authenticate using debit/credit card or netbanking details (3) set your 6 digit mobile banking pin (mpin) (4) you will receive an activation code on your registered mobile number.

Crn And Debit Card Details Are Generated ,After That The Finding Option ,I Chose’’ I Will Do It Later.

Visit the kotak mahindra netbanking portal. The password should be minimum 6 character length, and should have at least one special character, upper case letter and a number; Answer two of the seven mandatory questions by entering the user id crn.

Crn Or The Customer Reference Number Is A Number That Can Be Found On Your Debit Card/Credit Card Under Your Name, It Acts As A User Id For Each Account That Is Specific To That One Account.

I have opened a new account in kotak 811 app today. One time password (otp) has been sent to your mobile number ending with , please enter the same to login. Simply, sms crn to 9971056767 using your bank registered mobile number and you will receive an sms with your crn.

If Playback Doesn't Begin Shortly, Try Restarting Your Device.

How can i get my kotak net banking password? You must answer two mandatory questions when you enter user id (crn). Enter your netbanking password and select “personal loan” from the “take me directly to” drop down menu.

forgot, kotak

0 notes

Text

🇮🇳Indian public for invest Money Has Earn Money Login Mobile Number Aadhar Trading Account,daily,week,Month,Year National Securities deposit,Central DSL Given Profit from Deposit🇮🇳india ltd industries,download app kotak Securities,JM Financial Blink,5paisa,icici,SBI,Lifetime...- Namdev Kishan Bajgire

1 note

·

View note

Text

Imperial Money Offers the Simple, Free, and Most Convenient Way of Investing In Mutual Funds

It’s all just on fingertips, No paperwork, No hassles, Invest in the best mutual funds using Imperial Money. All Indian mutual funds are available in one single app. In Imperial money, you can start SIP, lump-sum investment for free. Switching of the funds from one fund to another fund and Systematic withdrawal plan or funds from liquid to equity or equity to liquid while re-balancing the portfolio you can just do it here anytime anywhere you are.

Investing becomes easy with your fingertips

· Get Sign up in minutes,

· One time KYC process within the app

· Buy, Sell, Shift mutual funds within the fund family.

· Buying a Systematic investment plan or doing the STP or SWP is just simple and easy.

Invest in all mutual funds online for free

· You do not require paying any additional cost for buying funds from Imperial money!!

· Most researched Mutual funds baskets are available.

· Sell anytime – Money comes to your bank account directly

· Learn to invest in mutual funds with as low as Amount of Rs.500/- concerning your objective and planning of life the portfolio are the builder for giving one the states of art experience

Mutual Fund Investing for You:-

· Simple design, Easy to understand

· Made for beginners and experts both

· Financial planning you can do it here itself Invest in the researched and ready-made basket of mutual funds recommended by experts with years together experience bringing for you.

· Latest finance news and insights, notifications

· Most important is the teams of experts are available here to help you out with any type of Issue.

Steps After Imperial Money App Install:

Verify your KYC

If the KYC is not available then use the following process

PAN/KYC

Profile set up

Invest in sip or lumpsum

Need of KYC for mutual funds as per the process of the Government of India for making a Tax saving funds (ELSS mutual funds):

Invest in tax-saving mutual funds to get tax exemption under section 80c. The total exempt limit is 1.5 Lakhs. Invest in equity mutual funds – small-cap, large-cap, mid-cap, multi-cap – for the long term and higher returns. Check out SIP Calculator to know how many returns you can make.

Safe & Secure: We use the latest security standards to keep your data safe and encrypted.

IMPERIAL MONEY is secure and does not store any information on your device or SIM card. Download and stay connected to your Mutual Fund investments always. Imperial Money uses NSE (National Stock Exchange) for transactions. We support all RTAs – CAMS, Karvy, and Franklin.

Following AMC’s are supported on IMPERIAL MONEY Mutual Fund App:

SBI Mutual Fund, NIPPON Mutual Fund, ICICI Prudential Mutual Fund, HDFC Mutual Fund, Aditya Birla Sun Life Mutual Fund, Franklin Templeton Mutual Fund DSP Mutual Fund, Kotak Mutual Fund, Mirae Asset Mutual Fund, Axis Mutual Fund Motilal Oswal Mutual Fund, L&T Mutual Fund, IDFC Mutual Fund, INVESCO Mutual Fund UTI Mutual Fund, Sundaram Mutual Fund, Tata Mutual Fund, ITI MUTUAL FUND, BNP PARIBAS MUTUAL FUNDS, EDELWEISS MUTUAL FUND, HSBC MUTUAL FUND MAHINDRA MUTUAL FUND, PGIM MUTUAL FUND, PRINCIPLE MUTUAL FUND UNION MUTUAL FUND

IMPERIAL MONEY – KEY FEATURES

Access your investments across multiple Mutual Funds through a Single Gateway; No more managing multiple PINs, Folios numbers, log in ids,

Mobile PIN & Pattern login– Simplified your Imperial Money App login process now. Just pick your preferred login methods – Mobile PIN, Pattern or Password right away

Paperless Investing: Quick & paperless account creation and instant Activation. Within a couple of minutes, you are all set to ride the new wave of investing.

Instant SIP: Once you are registered. It takes less than a minute to start a SIP.

SIP Calculators: With the help of our calculators plan your investment needs to achieve your Financial Goals. Happy investing with Imperial money!!!

Happy Investing!!!

1 note

·

View note

Text

kotak Securities Reviews 2020

kotak Securities Reviews 2020

A subsidiary of Kotak Mahindra Bank, Kotak SecuritiesLimited is the stock broking and distribution arm of the Kotak Mahindra Group and was established in 1994. They offer services like stock broking and even provide financial products in India. Apart from that, they have a business interest in life insurance, commercial banking, mutual funds, and investment banking. With 1209 branches,…

View On WordPress

#kotak mahindra securities#kotak securities#kotak securities customer care#kotak securities login#kotak securities online trading account login

0 notes

Text

SQL Injection - DVWA

Hello!

Mungkin ketika mendengar kata ‘hacker’, yang terbesit adalah penjahat kriminal dalam konotasi negatif. Sebetulnya, hacker merupakan seseorang yang memiliki pengetahuan mengenai security dari suatu sistem komputer, sehingga ia bisa mencari celah keamanan dan menembus suatu sistem dengan memanfaatkan kelemahan dan celah tersebut. Tapi terkadang, hacking menjadi salah satu metode untuk mengecek apakah sistem milik kita sudah aman? Kalau hacker saja bisa menembus sistem tersebut, tandanya sistem kita belum cukup aman.

Saat ini banyak platform yang disediakan sebagai metode untuk mengetahui kelemahan suatu sistem. Dan pada post kali ini kita akan membahas sedikit dari DVWA.

Apa itu DVWA?

Dari web DVWA, Damn Vulnerable Web App adalah aplikasi web PHP/MySQL yang sangat rentan dengan tujuan utamanya adalah untuk menjadi bantuan bagi profesional keamanan untuk menguji keterampilan dan alat mereka di lingkungan hukum, membantu pengembang web lebih memahami proses mengamankan aplikasi web dan membantu guru/siswa untuk mengajar/mempelajari keamanan aplikasi web di lingkungan ruang kelas. Meskipun begitu, ilmu yang telah kita dapat setelah bermain dengan DVWA tentunya harus digunakan dengan bijak. Dan pada kesempatan ini juga kita akan belajar sedikit dari DVWA hanya untuk pengetahuan, bukan untuk berbuat kriminal.

So here we go!

Untuk menginstall DVWA ada beberapa cara. Namun untuk yang sudah terbiasa dengan penggunaan docker, bisa install dengan melihat cara disini: https://github.com/opsxcq/docker-vulnerable-dvwa

Setelah terinstall dan telah login, kita dapat memilih beberapa case yang tersedia dengan 3 tingkatan kesulitan mulai dari low, hingga high. Dan pada kesempatan kali ini, kita akan membahas SQL Injection dengan tingkat kesulitan low.

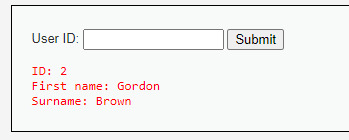

SQL INJECTION

SQL injection adalah teknik eksploitasi dengan cara memodifikasi perintah SQL pada form input aplikasi yang memungkinkan penyerang untuk dapat mengirimkan sintaks ke database aplikasi.

Ketika kita mengklik “SQL Injection”, halaman yang terlihat hanyalah berisi sebuah kotak di mana kita dapat memasukkan user ID. Seperti ketika kita memasukkan user ID 2, maka akan keluar output seperti ini:

Mari kita ulas beberapa injection yang telah dilakukan.

Menampilkan seluruh user yang terdaftar. Dalam SQL, ketika kita memasukkan query 1=1 artinya kita mengeluarkan semua jawaban karena dianggap semuanya always true. Biasanya query yang digunakan adalah 1=1-- di mana ‘--’ digunakan sebagai comment. Namun hal itu tidak berhasil kalau kita menuliskan comment ‘--’. Tapi ketika kita ganti dengan ‘#’, maka akan muncul hasil seperti ini:

Semua user ditampilkan! Dan seperti inilah contoh SQL injection. Namun yang kita lakukan belum termasuk tingkat kriminal karena query yang ditampilkan memang yang bisa ditampilkan. Mari lanjut ke injeksi kedua.

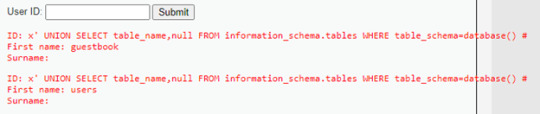

Menampilkan information_schema

Input yang dimasukkan: x’ UNION SELECT table_name,null FROM information_schema.tables #

Hasil:

Query ini bermaksud untuk menampilkan information_schema yang biasa bisa ditampilkan pada tabel SQL. Bukan sesuatu seperti injeksi sih, tetapi dengan ini kita bisa mengetahui struktur tabelnya dan bisa menjadi referensi injeksi lainnya. Dari struktur tabel ini kita bisa melihat dan menentukan informasi apa yang ingin kita gali. Biasanya password tidak bisa kita akses namun kali ini kita akan mencobanya karena main goal kita adalah melihat password setiap user.

Melihat table apa saja yang tersedia.

Input: : x’ UNION SELECT table_name,null FROM information_schema.tables WHERE table_schema=database #

Dalam query, wajib menggunakan ‘#’ karena tanpanya kita tidak bisa mengakses hal tersebut. Ini akan kita ulas di akhir postingan karena hampir query yang kita masukkan menyertakan ‘#’ di akhirnya.

Query ini mengembalikan semua nama tabel yang ada di database. Kita bisa melihat ada tabel guestbook dan users. Mari kita lihat tabel users karena biasanya disitulah disimpan data password.

Menampilkan password

Input: test' and 1=0 union select null, concat(first_name,0x0a,last_name,0x0a,user,0x0a,password) from users #

Hasil:

Ta-da! Baris paling bawah merupakan password masing-masing user yang telah dihash. Tentunya kita bisa mengetahui hashed password tersebut dengan meng-crack nya dengan sangat mudah. Salah satunya dengan menggunakan link https://crackstation.net/.

Kenapa kita bisa menginjeksi SQL tersebut? Seperti yang telah disebut sebelumnya, seluruh query milik kita selalu diakhiri dengan ‘#’. Hal ini karena input dari kita tidak divalidasi oleh SQL dan tidak ada pembatasan special character yang bisa dimasukkan. Coba ketika tidak diakhiri dengan ‘#’, maka akan muncul:

You have an error in your SQL syntax; check the manual that corresponds to your MariaDB server version for the right syntax to use near ''' at line 1

Sehingga untuk pemilik web, perhatikan validasi input pengguna dan gunakan pembatasan special character, jangan sampai ada beberapa karakter yang lolos (seperti yang kita lakukan barusan). Dan kalau perlu, tambahkan security protocol yang lebih agar terhindari dari berbagai SQL Injection.

Yak, sekian pembahasan SQL Injection - Low kali ini. Terima kasih dan ditunggu masukannya!

0 notes

Text

How can one set up his stop loss and target price through the Kotak Stock Trader app?

What is Stop Loss?

Stop loss is a fixed price limit that is set aside to reduce the loss of stockholders. In many cases, investors apply their withdrawal policy for a short period of time while on vacation or unable to inspect their stock. However, Stop Loss is useful if the market is declining in one place as well as in order. If the stock market collapses then Stop Loss may also draw a loss to stock traders.

Consider an example; a stock trader has a trademark of MM Company trading at INR 2000. . To protect itself from a big fall, the seller has imposed a Stop Loss policy on INR 1800. In the case of MM Company reduced to INR 480 then in this event, the termination order will be introduced and when the next payment will be made, the stock of the stockholder will be sold. For example, if the available price of MM Company is INR 1700 then, the stocks of the stockholder will be sold at that price.

How can one determine the Stop Loss?

As a trader or investor, you can set a stop loss of 5% or 10% below the price at which you bought stocks. However, technical analysts estimate the value of the linear regression, turning up, downward rotation and high rotation frequency or resistance level before determining the value for each stop order.

What is the target price?

Target Price is considered to be the best endpoint for financial planning. Target Price is the price paid which is the best possible outcome for investing traders to sell their stocks or shares, since according to them, they have got the most significant amount from the stocks.

Consider an example: two different stock traders who hold stocks of INR 1200. They may have different views on how much money they can earn from these stocks. One trader can limit his investment to INR 1350 and the other trader can keep it to INR 1500. Hence, the target price is associated with the risk tolerance of a stock trader and the duration of time till which they can hold the stocks.

How can one determine the Target Price?

Investors or clients can determine the target price by conducting a technical analysis. Determination of the appropriate price target can be made by applying a number of tools and techniques such as support and initial resistance, moving averages and Fibonacci addition.

How to put stop loss and target price in the Kotak Stock Trader app?

If you are a regular Kotak Stock Trader app and do your trading through Kotak Securities then, it is very easy for you to set your target and stop loss price while placing your order for certain stocks.

All you have to do is to follow the below basic steps:

· Open your Kotak Stock Trader app and login to your Kotak Trading account with your unique id and credentials details.

· After you have successfully logged in, choose the stocks which you want to trade.

· Now, click on the buy and sell button.

· A new buy window of stock will be opened.

· You can now add the quantity of stocks you want to buy and sell. Next choose the exchange and open the advanced order menu.

· Under the advanced order tab, you will find a stop loss and target price.

· Choose between stop loss and target price which you want to set.

· Add your prices accordingly.

· Finally, place your order and submit.

0 notes