#kite zerodha

Text

Trading is related to buying and dealing with securities to make silk stockings based on daily price changes. However, if you want to trade in the share request, you should have a good grasp of the fundamentals of share trading. Investing is essential these days, as more than savings is required to beat the odds and fulfill all our financial goals. Trade is a primary profitable concept involving the buying and selling supplies good and services and the compensation a buyer pays a dealer. In another case, trading can exchange goods and services between parties. For example, trade can be made between directors and consumers within a company.

Trading is related to buying and dealing with securities to make silk stockings based on daily price changes. However, if you want to trade in the share request, you should have a good grasp of the fundamentals of share trading. Investing is essential these days, as more than savings is required to beat the odds and fulfill all our financial goals. Trade is a primary profitable concept involving the buying and selling goods, supplies, and services and the compensation a buyer pays a dealer. In another case, trading can exchange goods and services between parties. For example, trade can be made between directors and consumers within a company.

Highlights of trading

1. Trade involves the exchange of goods and services substantially in return for money.

2. Trade can happen within a country or amongst trading nations. In the case of transnational trade, the proposition concerning relative advantage speculates that trade benefits all parties; however, critics contend that it leads to a position within countries in reality.

3. Economists recommend free trade among nations, but protectionism like tariffs might present itself because of political motives.

Types of Trading Platforms in India

When performing seamless stock trading without encountering the fences of time and distance, using the best trading platforms for stock trading is relatively apparent. One can do online trading through 3 virtual interfaces that are given below.

There are mainly three types of online trading platforms in India that top dealers and investors exploit.

Mobile- Based

Browser- based

Desktop- based

1. Mobile- based Mobile App

As its name represents, this type of trading platform can be suitable to use through smart phones. Over time, the rapid penetration of mobile devices in India has made this trading platform the best online platform in India 2023. The significant reasons are ease of usage, portability, and no physical barriers.

2. Browser-based/ Web

A browser-based trading platform can be on a web browser like Internet Explorer, Mozilla Firefox, and Google Chrome. This platform is suitable when smart phones and desktops aren't accessible.

For example, if you're from home without a laptop, your trading account can be entered through a web cyber surfer. However, it is usually believed that this type of trading platform is slower than a desktop-based trading platform.

3. Desktop-based

This platform can be downloaded and installed on a desktop or laptop. Though this is undoubtedly the best trading platform in India, you can use if you're between those traders and investors who desire to place quick buy/ sell orders.

The known thing about this trading platform is that consumers can use shortcut keys to carry out different activities like F1 to buy and F2 to sell etc.

Goods Fundamental characteristics of a best trading platform In India

· Quick continuous execution

· Front line and sharp innovative highlights

· Top-level security

· Simple to-utilize interface

· Simple arrangement of exchanges.

List of Best Trading Platforms in India:-

Zerodha Kite Trading Platform

ICICI Direct All-in-1 App

FYERS ONE Trading Platform

Sharekhan Trade Tiger

Angel Broking Speed Pro

Trade Station Trading Platform

Trade Eye Trading Platform

Upstox Pro Trading Platform

Trader Terminal (TT)

10. NSE Now Trading Platform

1. Zerodha Kite

Zerodha Kite is the flagship trading platform of Zerodha, a leading reduction broker in India. Known as one of the best trading platforms in India, it is connected using next-gen technology to match the different requirements of all types of investors. In addition, the platforms offer a wide assortment of features like charting tools, data widgets, integration with third-party apps, etc., to make trading simple and quick.

Pros

1. Multiple Market Watch

2. Comprehensive charting with further than 100 pointers and six map orders

3. Floating Order window

4. Progressive order types are similar as classes with detector entry and cover with limit entry

5. Unified instrument search for quick search over 90,000 stocks and F&O contracts

6. Live ticks, quotes, and order admonitions

7. Ideal integration with Quant tool for carrying out fundamental analysis using geste

8. Analytics

9. Mixing with other investment apps erected by Zerodha consorts

Cons

1. No extent for strategy backtesting

2. Separate after office with the name Zerodha Q

3. Brokerage Charges – Zero brokerage charges, RS 20 per order for intraday

4. Website – Zerodha Kite

2. ICICI Direct All-in-1 App

The ICICIDirect App is an advanced trading and investing platform designed to simplify investment and trading. The simplified UI and UX make the investment process a breeze. Get access to over 50 products and services across all product categories.

Taken as one of the best trading platforms in India among traders and investors, the operation strives to do online trading a lot easier and quicker for users.

Pros

1. Analyze your app's live data and F&O, NSE Nifty 50, & BSE Sensex charts to know your investment status.

2. Please get the latest news, movements, and trends to assess how they affect your investments.

3. Offers multiple watchlists of various investment products like shares, stocks, mutual funds & IPO to track your being and future investments.

4. Use your curated watch list to place your buy and sell orders in your chosen share request securities in seconds.

5. On the exclusive charting tool, compare various scrips, track ongoing and upcoming events, corporate actions, etc...

6. Make guided investing decisions after assessing trending, expertly curated investment ideas.

7. Generate instant limits with the shares in your DEMAT account.

8. Get instant money in your account within 5 minutes of dealing shares withe-ATM

9. Use MTF( Margin Trading Funding) to buy stocks now and pay latterly anytime within 365 days at seductive interest rates.

10. Apply to the rearmost IPO in a few simple ways with the enhanced user experience and interface.

11. Build low-cost, long- term and diversified portfolios with the One Click Equity.

Cons

· Many features similar to Flash Trade and Easy options have yet to be available (Available on ICICI Direct Markets App). However, it'll be available shortly.

Brokerage Charges –0.1 for equity delivery

Website – ICICI Direct

3. FYERS One

It's the best trading platform in India for desktops and allows users to invest in stock from the comfort of their homes. It's declared Fyers the best trading software in India, with striking features that professionals and beginners can use for stock trading.

The trading software is also known for its speed and superb performance that fluently aligns with its easy and precious features.

Pros

1. Advanced charting point

2. Stock screeners

3. Offers free equity delivery trading.

4. Advanced charting with further than 65 specialized pointers

5. In- erected Live Scanner & Trend Scanner

6. Accepts UPI payments

7. Workshop on low bandwidth

Cons

1. No access to exploration reports and trading tips

2. Reliance on 3rd party merchandisers like Omnesys API and Trading View for charting

3. Brokerage Charges – Flat Rs 20 or0.03 per order

4. Website – FYERS One

4. Sharekhan Trade Tiger

Sharekhan Trade Tiger is foremost considered the best online trading platform in India. It's a terminal-based trading software that needs to be downloaded and installed on a desktop or laptop. The application allows dealers and investors to invest across various portions – Equity, Commodity, Currency, and derivations.

Pros

1. Easy access to reports, tips, and signatures by Sharekhan Research.

2. Association with 14 banks for easy online finance transfer to the trading account.

3. Admit direct share request feeds on a real-time basis across NSE, BSE, MCX, etc.

4. Various helpful calculators include Brokerage Calculator, Span Calculator, and Premium Calculator.

5. One-click order placement option.

6. Pre-loaded with over 30 trading approaches

Cons

1. No availability of 3- in- one account

2. No version for Mac notebooks

3. Collective funds aren't available

4. Brokerage Charges –0.50 or 10 paise per share for equity delivery

5. Website – Sharekhan Trade Tiger

5. Angel Broking Speed Pro

Regarding finding the best online trading platform in India, the available options will only be sufficient with the addition of Speed Pro by Angel Broking. The trading platform is known for offering its users a single-window trading experience along with perceptive trade evaluation features.

Another plus point with Speed Pro is the double-quick prosecution of orders and real-time monitoring.

Pros

1. Scrip addition points for various parts, including F&O, Commodity, and Currency

2. The combined best five – get a quick look at the top five bids for buying and selling across BSE and NSE

3. Open Live Market in Excel with an incredible refresh rate

4. Seamless access to insightful summaries and reports

5. Enables customization of the interface to a specific level

Cons

1. Not available for Mac

2. Little scope for improvement in terms of the software user interface

3. One needs a PC with an excellent configuration for the software to perform better

Brokerage Charges – Zero brokerage on delivery trading

Website – Angel One Trade

6. Trade Station

5Paisa Trade Station App is one of the most feature-loaded and high-tech trading software top dealers in India use. This one of the best trading platforms in India is designed for predominantly active dealers. Still, it isn't like that, as this software is inversely salutary for punk dealers and investors.

Pros

1. Despite being a reduction broker, Trade Station provides easy access to trading calls and recommendations to its guests.

2. This trading platform from 5Paisa updates itself generally, bringing new features every time and dealing with the bugs or problems from the former performances.

3. The trading app is set up to work indeed an introductory internet connection, which is a big plus.

4. Option to register for the rally session

5. Allows investors to trade in the equity member or stock request and joint finances and insurance orders.

Cons

1. Low internet bandwidth may delay the lading of maps

2. Only the Windows interpretation is available

3. The app isn't responsive and can be viewed best on a desktop or laptop. However, the view may need improvement on a mobile or laptop.

Brokerage Charges – Variable brokerage charges

Website – Trade Station

7. Trade Eye

Trade Eye by Wisdom Capital is an Android-grounded trading app that allows investors to trade between several segments through one app. The app is registered with BSE, NSE, MCX, MCX- SX, and NCDEX exchange. It's considered one of the best trading software in India.

Pros

1. A simple trading application that runs fluently using mobile internet

2. Erected for Android druggies along with touch features

3. Option to add multiple request watches

4. Examiner positions in the trade book and order book

5. Get access to various maps and specialized index tools

6. Installation to place aftermarket order

7. Instructional charting functionality for insightful technical stock analysis

8. Fast, secure, and flawless fund transfer

Cons

1. No support for iOS users

2. Introductory interface

Brokerage Charges – Zero brokerage charges, Trade for free

Website – Trade Eye

8. Upstox Pro

This is one of the best trading software in India by Upstox, known as RKSV. Being a responsive trading operation, there's no need to download or install the app. Also, it allows a user to directly access the trading tools through a laptop, desktop, mobile, or tablet.

Considered one of the best trading platforms in India among traders and investors, the application strives to do online trading a lot easier and quicker for users.

Pros

1. Unified search tool to discover easy and complex stocks

2. Contact predefined watch- list of Nifty 50 and other indices

3. Reach NSE cash, Futures and Options, and Currencies scrips

4. Apply 100 specialized pointers on real-time maps

5. Define unlimited price cautions for quick updates

6. Figure a total number of customized watchlists

7. Advanced charting tools that standard assiduity norms

8. Get real-time request word to stay ahead

Cons

1. The specialized support isn't over to the mark

2. Limited features in comparison to its counterparts.

3. The desktop outstation of Upstox needs high speed and stable internet connectivity.

4. Call and Trade installations are chargeable; Upstox charges Rs 20 when placing an order through the phone.

Brokerage Charges – Rs 20 or2.5 whichever is smallest for equity delivery

Website – Upstox Pro Web

9. Trader Terminal (TT)

IIFL Trader Outstations is among the best trading software in India and is also known for its intuitive interface and many features. The trading platform has many shortcut keys that let dealers and investors perform various functions quickly and smartly.

Pros

1. IIFL Call feature – that provides intraday tips to place intraday orders

2. Allows the placement of AMOs (After request orders), which can get reused the coming business day

3. Access LIVE television which includes ET Now

4. Access to a daily report by the name "Weekly Wrap."

5. Easy fund transfer with top banks like ICICI, HDFC, Axis Bank, Citi Bank, UTI, etc.

Cons

1. Not available for iOS users

2. For those who are in need to trade in the F&O member, a written application needs to be submitted along with income proofs.

Brokerage Charges – Rs 20 per trade for delivery

Website – Trade Terminal

10. NSE Now

Contrary to other trading platforms developed by corresponding stockbrokers, this trading platform – Here and Now (Neat on Web), has been considered by the National Stock Exchange of India( NSE). It's one of the most stylish trading platforms in India.

This trading app allows investors to trade across various parts, including Equity, derivations, and currency.

Pros

1. Customized alerts and notifications as defined by the users

2. Request watch to chase stocks, cover trends, sectors, and indicators

3. 15 maps with over 80 specialized pointers

4. Easy fund transfer to several leading banks

5. Diurnal stock tips

Cons

1. Comparatively tough to understand

2. Many stockbrokers levy operation charges for NSE NOW

3. A PC needs to have an excellent configuration for the operation to perform well

Brokerage Charges – Flat Rs 20 for intraday and F&O

Website – NSE Now

FAQs about Best Trading Platform in India

Ques- Which trading platform is best for India?

Answer- Zerodha Vampire is India's best online trading platform, presently operating in the stock broking script. Zerodha continuously pushes invention in its products and provides dealers with the needed products and services. Zerodha's, besides the lowest brokerage rates, boasts of a full-fledged magazine of trade products and confederated services.

Ques: Which trading platform offers the best advisory and stock tips installation?

Answer: IIFL, an acronym for India Infoline, is accepted by traders as the best trading platform that offers the best advisory and free tips facility. This fact is strengthened by the company's accurate stock predictions in the past.

Ques: Which trading is most profitable?

Answer: According to trade experts, Intraday trading is the most profitable because you can buy and vend stocks on the same day. It reduces threat as stocks price don't go up or down so far in a single day, and you should always use the safest and best online trading platform for intraday trading.

Ques: Which factors make a stock broking establishment the best in India?

Answer-numerous stock broking companies try to deliver top-notch trading and stock advisory services to the guests, but only a many of them are suitable to stand- out impeccably. We see low brokerages, an easy-to-use interface, and varied platform presence as essential features of an excellent stock broking establishment.

Source - Choose the best Trading Platform in India 2023

#best forex trading platform in india#best trading platform in india#best online trading platform in india#paytm share price#zerodha kite#kite zerodha#groww#angel broking#zerodha kite login#sharekhan login#zerodha brokerage calculator#zerodha margin calculator#edelweiss share price#kotak securities login#iifl share price#angel broking share price#no brokerage#upstox brokerage calculator#groww brokerage calculator

5 notes

·

View notes

Text

Best Stock Broker in India 2023 - Are you searching for the best stockbroker in India? Count on the best stock broker and browse through details of the top 10 stockbrokers in India

#best stock broker in india#stockmarket#zerodha calculator#zerodha kite#kite zerodha#finance#zerodol

1 note

·

View note

Text

Zerodha: एक-एक ग्राहक को फोन करके कामत खुद खोलते थे अकाउंट, अब कंपनी की वेल्यूएशन अरबों में

Zerodha: एक-एक ग्राहक को फोन करके कामत खुद खोलते थे अकाउंट, अब कंपनी की वेल्यूएशन अरबों में

नई दिल्ली. ज़ेरोधा (Zerodha) के फाउंडर नीतिन कामत (Nithin Kamath) आज किसी परिचय के मोहताज नहीं है. उनकी कंपनी इस समय भारत की सबसे बड़ी डिस्काउंड ब्रोकर फर्म है. परंतु नीतिन और उनकी कंपनी के इस मुकाम तक पहुंचने में कई साल और कड़ी मेहनत लगी है.

नीतिन कामत जब 17 साल के थे, तब उनका परिचय स्टॉक ट्रेडिंग की दुनिया से हुआ था. शुरुआती दिनों में उन्होंने उसी तरह पैसा बर्बाद किया, जैसे कि हर नया ट्रेडर…

View On WordPress

#Kite Zerodha#Nikhil Kamath#Nithin Kamath#Nithin Kamath Success Story#Nitin Kamat#Share market#Zerodha#Zerodha Success Story

0 notes

Text

How To Scrape Zerodha Kite Real-Time Stock Prices Using Python

This blog entails the Python usage to scrape Zerodha Kite real-time stock prices for informed trading decisions. Extract vital market insights and gain a competitive edge with data-driven strategies.iscover how to use Python to extract stock price data from Zerodha Kite website software. This project will guide you in building a utility code to download stock price data in CSV format. Follow the step-by-step process to initiate your journey!

know more:

#How To Scrape Zerodha Kite Real#Zerodha Kite Data Scraping#web scraping service#Scraping Stock Price data from Zerodha#Zerodha Kite API

0 notes

Text

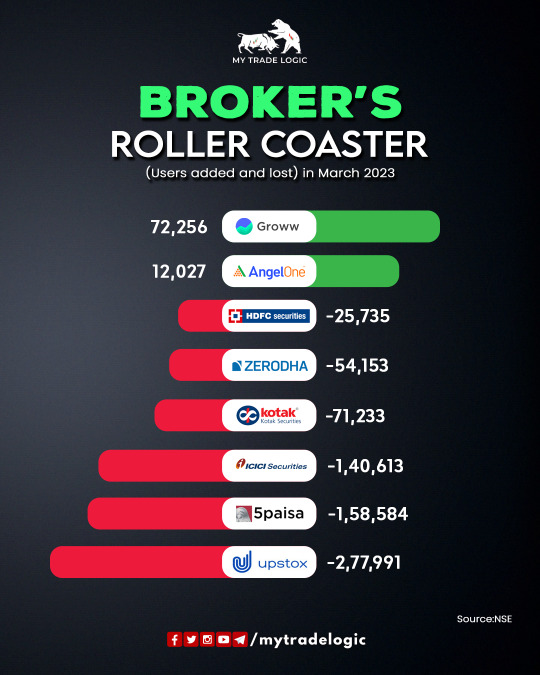

Broker's Roller Coaster in India | My Trade Logic

0 notes

Text

#Kite Zerodha Login#Zerodha Kite 2023#How to login to Kite Zerodha#Kite Zerodha updates 2023#Trading on Kite Zerodha#Kite Zerodha login problems#Kite Zerodha platform review

0 notes

Text

Best Trading App in India in 2023

In today’s post-pandemic era, stock trading has been led mainly by smartphones by today’s young generation of traders and investors. According to a study, over 60% of stock trading takes place through smartphone apps. The main reasons are ease of access, faster trade execution, anytime anywhere trading, and lots more There are hundreds of trading apps in the app market to choose from. Whether you are a new investor looking to try sock investment or an expert trader or investor looking to book big profits, choosing the best share market application is crucial. This helps you understand the market deeper and make sound investment decisions for better growth on investment.

From industry professionals to small businessmen, entrepreneurs, housewives, and even people who have just started earning, stock trading apps offer a plethora of investment opportunities other than stocks like mutual funds, IPOs, fixed deposits, insurance, and others. If you want to ensure the best results from your investment in stocks, it is necessary that you choose the best trading app in India for beginners in 2023.

Below are some of the top-rated stock trading apps in India.

Zerodha Kite

Kite by Zerodha has been around in the market since the year 2010. Just like how Zerodha changes the dynamics of stock trading by introducing discount brokerage services, Zerodha Kite has brought unprecedented levels of ease and value to mobile-based stock trading for traders and investors. The share market application is primarily known for its clean & intuitive UI which is also swift to work on.

Some of the major features of the Zerodha Kite mobile app are:

Login through fingerprints and Face ID

Dark mode feature

Faster order updates & push notifications

Performs well even in low-bandwidth internet connection

Fund transfer facility

Angel One by Angel Broking

Angel One is another popular mobile app for stock trading and investments. The app allows users to get real-time market data, invest in mutual funds, commodities, IPOs, US stocks, and others, stock recommendations, advanced charts, and others.

Its major features are:

Digital payment facility with 40+ banks

Stock advisory

Intraday charts with indicators

Multiple watchlists with categories

Option chain feature

Free reporting & learning tools

Upstox Pro

The next on the list is Upstox Pro which promises to deliver an easy and seamless stock trading experience to users. Since this trading app is built on HTML5 technology, it is impressively fast and easy to use. It also allows trading across various segments like stocks, futures & options, and currencies, etc.

Some of its salient features are:

Next-gen charting tools with 100+ indicators

One-stop platform for trading in stocks, currencies, futures & options

Option to trade right from the charts

Create multiple watchlists

Get real-time market information

Define unlimited price alerts and receive quick updates

Groww Trading App

Groww trading app offers a seamless trading experience to users. Mainly, with the app, you can invest in stocks and mutual funds, IPOs, and equity under flat-fee brokerage schemes. With a 1 Cr+ userbase on Google Play Store, Groww is counted among the best stock trading apps in India in 2023. The app was initially launched as a mutual fund investment platform and since then it has maintained its supremacy in the segment.

One of the simplest apps presently in the category

Single-click stock trading with buying and selling feature

Advanced charts, historical stock performance, and real-time market data

High levels of security standards

Direct mutual fund investments

5 Paisa Mobile App

5Paisa mobile app is one of the most widely chosen trading apps in India and offers a host of features to users. It allows traders and investors to invest in various financial instruments like bonds, mutual funds, ETFs, IPOs, stocks, and currencies, etc. The 5Paisa mobile application has several smart features that let investors and traders conduct efficient and successful trading in stocks, mutual funds, and other financial products. 5paisa mobile trading app is accessible on both iOS and Android mobile devices.

Trading across all segments under one window

Robo advisory which enables an automated trading advisory system

Track profit & loss across segments

Option to pick different time settings from one minute to a month

Avail document-less loan in no time

The Conclusion

The role of a mobile trading app is quite important in making stock trading easier, faster, and more effective. This is why it is suggested to choose the best trading app in India in 2023 to get the best outcomes. With so many powerful trading apps out in the market, it is better to compare all the available options and choose the one that meets your needs the best.

Source - https://medium.com/@deepakcomparebroker/best-trading-app-in-india-in-2023-55c01c8e69a9

Relatives - https://comparebrokeronline.com/

#best share market application#best trading app in India#Zerodha Kite#Angel One#Angel Broking#Stock advisory#Upstox Pro#Groww Trading App#5 Paisa Mobile App

1 note

·

View note

Text

Zerodha App kya hai? इसके फीचर्स और चार्जेज क्या हैं?

Zerodha App kya hai? इसके फीचर्स और चार्जेज क्या हैं?

आज हम जानेगें की Zerodha App kya hai? इसके फीचर्स और चार्जेज क्या हैं? इससें पैसे कैसे कमायें जातें हैं। और अगर आप share market में नए हैं और आप अपनें लिए best free broker की तलास कर रहें हैं तो आप सहीं जगह पर आयें हैं।

अगर आप भी stock market में invest करतें हैं, तो आपकों यह पता होना चाहियें की आपकें लिए कोनसा broker best हैं। आज की तारीख़ में zerodha india का number वन डिस्काउंट broker…

View On WordPress

0 notes

Text

What is RSI Indicator and how to use it in stock market trading?

What is RSI Indicator and how to use it in stock market trading?

You may know what RSI Indicator is.

You may know that RSI is a very popular and widely used indicator.

But do you know how to use it properly in live trading?

I don’t know what you are thinking.

But I can say that most people don’t know how to use it properly.

Most people know RSI is above 70 means over-bought and below 30 means over-sold of the stock.

But we may know a lot more by reading RSI…

View On WordPress

#does rsi indicator work#how to set the rsi indicator#how to use rsi indicator#rsi indicator#rsi indicator above 50#rsi indicator above 60#rsi indicator accuracy#rsi indicator analysis#rsi indicator combination#rsi indicator divergence#rsi indicator divergence example#rsi indicator explained#rsi indicator for options trading#rsi indicator for swing trading#rsi indicator guide#rsi indicator how to use#rsi indicator in kite#rsi indicator in tradinview#rsi indicator in upstox#rsi indicator in zerodha#rsi indicator leading or lagging#rsi indicator levels#rsi indicator mt4#rsi indicator mt5#rsi indicator pdf download#rsi indicator settings#rsi indicator strategy#rsi indicator technical analysis#rsi indicator trading strategy#rsi indicator tutorial

0 notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

Zerodha Review 2023

यावेळी झिरोधा हा सर्वोत्तम स्टॉक ब्रोकर आहे. ते एक उत्कृष्ट ऑनलाइन ट्रेडिंग प्लॅटफॉर्म ऑफर करतात, कमी ब्रोकरेज फी आकारतात आणि सर्वात पारदर्शक स्टॉक ब्रोकर म्हणून ओळखले जातात. सतत सुधारणा आणि नावीन्यपूर्णतेने त्यांना भारतातील सर्वात वेगाने वाढणारी फिनटेक कंपनी बनवली. Zerodha ची मुख्य शक्ती येथे आहेतः

सक्रिय क्लायंट, मार्केट व्हॉल्यूम आणि नवीन ग्राहक संपादनाद्वारे सर्वात मोठा स्टॉक ब्रोकर.

यापैकी एक सर्वात सुरक्षित, सर्वात विश्वासार्ह आणि विश्वासार्ह दलाल.

सर्वात प्रगत ऑनलाइन ट्रेडिंग टूल्स ऑफर करते.

इक्विटी डिलिव्हरी आणि म्युच्युअल फंडांसाठी शून्य ब्रोकरेज शुल्क आकारते.

जास्तीत जास्त ब्रोकरेज आकारले जाते 20 रुपये प्रति व्यापार. पारंपारिक ब्रोकर्सच्या तुलनेत ब्रोकरेजवर तुम्ही ६०% ते ९०% बचत करता.

इंट्राडे ट्रेडिंगवर 20x पर्यंत लीव्हरेज ऑफर करते.

ऑफर झिरो कमिशन डायरेक्ट म्युच्युअल फंड.

सक्रिय आणि निष्क्रिय गुंतवणूकदार, नवशिक्या, सक्रिय व्यापारी आणि अल्गो ट्रेडर्ससह सर्व प्रकारच्या गुंतवणूकदारांसाठी योग्य.

Zerodha review 2023

Zerodha भारतातील सर्वात तांत्रिकदृष्ट्या प्रगत स्टॉक ब्रोकर आहे. त्याने आपल्या ग्राहकांसाठी एकाधिक ट्रेडिंग सॉफ्टवेअर तयार केले आहेत. हे आहेत:Zerodha Kite (वेब आणि मोबाइल ट्रेडिंग अॅप),नाणे (म्युच्युअल फंड गुंतवणूक व्यासपीठ), विद्यापीठ (गुंतवणूकदार शिक्षण कार्यक्रम), ट्रेडिंग प्रश्नोत्तरे आणि इतर अनेक साधने. Zerodha स्मॉलकेस (थीमॅटिक इन्व्हेस्टमेंट प्लॅटफॉर्म), स्ट्रीक (अल्गो आणि स्ट्रॅटेजी प्लॅटफॉर्म), सेन्सिबुल (ऑप्शन ट्रेडिंग प्लॅटफॉर्म), गोल्डनपी (बॉन्ड ट्रेडिंग प्लॅटफॉर्म) आणि डिट्टो (विमा) देखील ऑफर करते.

2 notes

·

View notes

Text

Best Trading Apps to Watch Out for in India's Booming Stock Market Scene in 2023

In today's fast-paced world, trading apps have become a necessity for anyone looking to invest in the stock market. With so many options available, it can be overwhelming to choose the best app that suits your needs. Whether you're a beginner or an experienced trader, having the right trading app can make all the difference in your investment journey. In this blog post, we'll be discussing some of the best trading apps in India for 2023 that cater to every type of investor - from no brokerage apps like Zerodha Kite and Groww to traditional full-service brokerages like Angel Broking and Sharekhan Login. So let's dive right into it!

Angel broking login

Angel Broking is one of the oldest and most trusted full-service brokerages in India, with a legacy that dates back to 1987. They offer an easy-to-use trading platform that caters to both beginners and experienced traders alike. The Angel Broking login process is simple and can be completed within minutes.

To start trading on Angel Broking's platform, you need to first create an account by providing your basic details such as name, email address, phone number etc. Once you have created your account, you can log in using the credentials provided by Angel Broking.

The login process is secure and ensures that all your personal information is kept confidential. You can access various features like market watchlists, real-time stock prices & charts, research reports etc through the dashboard post-login.Angel Broking also offers a mobile app for Android and iOS users which makes it easier for traders to manage their investments on-the-go. The Angel Broking platform provides a seamless experience for anyone looking to trade in Indian stocks without any hassles or complexities involved.

Zerodha calculator

Zerodha, the leading discount broker in India, is known for its innovative tools and features that help traders and investors make informed decisions. One such tool is the Zerodha Calculator.

The Zerodha calculator is a free online tool that helps traders calculate their brokerage charges, margin requirements, and other expenses associated with trading. This tool can be used by both beginners and experienced traders to plan their trades effectively.

One of the best things about the Zerodha calculator is that it offers complete transparency when it comes to calculating brokerage charges. Traders can enter their trade details like order type, quantity traded, exchange-traded on, amongst others; and get an accurate calculation of how much they would have to pay in brokerage fees.

In addition to this feature, the Zerodha calculator also provides information on other important parameters like STT (Securities Transaction Tax), stamp duty fees, GST (Goods and Services Tax), etc., which are charged on every transaction carried out by a trader.

If you're looking for a reliable and transparent way to calculate your trading expenses before making any trade decisions; then using the Zerodha calculator could prove really beneficial for you!

Source — https://hmatrading.in/

Related — https://sites.google.com/view/besttradingapp2023

#zerodha kite#kite zerodha#groww#share market#angel broking login#upstox login#sharekhan login#zerodha calculator#nifty bees share price#upstox pro#probo#old mumbai chart#nifty bees#iifl share price#angel broking share price#alice blue login#no brokerage#gold bees share price

1 note

·

View note

Text

Best algo trading software in India | Algoji

In the dynamic world of stock trading, staying ahead of the curve is essential. This is where algorithmic trading comes into play, revolutionizing the way traders operate in the Indian market. With the right algorithmic trading software, investors can automate their strategies, optimize execution, and capitalize on market opportunities swiftly. But with numerous options available, finding the best algo trading software in India can be daunting. Fear not! In this comprehensive guide, we’ll explore the top picks to empower your trading journey.

Why Choose Algorithmic Trading Software? best algo trading software in India offers a plethora of benefits, making it an indispensable tool for modern traders:

Speed and Efficiency: Execute trades at lightning speed, leveraging algorithms to capitalize on even the slightest market movements.

Elimination of Emotions: Emotion-driven decisions often lead to suboptimal results. Algorithmic trading removes emotions from the equation, relying on pre-defined criteria and strategies.

Backtesting and Optimization: Test your strategies on historical data to assess their viability before deploying them in live markets. best algo trading software in India facilitates extensive backtesting and optimization, ensuring robustness.

Diversification: With algorithmic trading, you can diversify your portfolio across multiple strategies and asset classes, reducing risk and enhancing returns.

24/7 Market Monitoring: Algorithmic trading systems tirelessly monitor the markets round the clock, seizing opportunities across different time zones and asset classes.

The Best best algo trading software in India: Let’s delve into the top picks for algorithmic trading software tailored for the Indian market:

Zerodha Streak: Zerodha, one of India’s leading discount brokers, offers Streak, a powerful algorithmic trading platform. With an intuitive interface and a plethora of technical indicators, Streak enables traders to create and backtest complex strategies effortlessly. Whether you’re a beginner or a seasoned trader, Streak’s user-friendly interface and robust features make it a top choice.

Upstox Algo: Upstox, another prominent player in the Indian brokerage industry, provides Upstox Algo, an advanced algorithmic trading platform. With Upstox Algo, traders can automate their strategies using simple-to-understand conditions and indicators. Backed by Upstox’s reliable infrastructure, this platform ensures seamless execution and minimal downtime.

Trade Smart Online Smart API: Trade Smart Online offers Smart API, a comprehensive algorithmic trading solution catering to the needs of professional traders and institutions. With Smart API, traders can leverage advanced order types, real-time data feeds, and customizable execution algorithms to optimize their trading performance. Whether you’re executing high-frequency trades or implementing sophisticated strategies, Smart API empowers you to stay ahead of the competition.

Angel Broking ARQ Prime: Angel Broking’s ARQ Prime is an AI-powered algorithmic trading platform designed to simplify trading for investors of all levels. ARQ Prime utilizes cutting-edge machine learning algorithms to analyze market trends, identify trading opportunities, and execute trades with precision. With its user-friendly interface and intelligent recommendations, ARQ Prime empowers investors to make informed decisions and achieve their financial goals.

Kite Connect: Developed by Zerodha, Kite Connect is a high-performance API solution that enables developers to build custom algorithmic trading applications. With Kite Connect, traders can access real-time market data, execute trades across multiple exchanges, and implement complex trading strategies programmatically. Whether you’re a developer looking to build your trading platform or a trader seeking advanced customization options, Kite Connect offers the flexibility and reliability you need.

Conclusion: In the fast-paced world of stock trading, leveraging best algo trading software in India can give you a competitive edge. Whether you’re a novice investor or a seasoned trader, choosing the right algorithmic trading software is crucial for success in the Indian market. By opting for platforms like Zerodha Streak, Upstox Algo, Trade Smart Online Smart API, Angel Broking ARQ Prime, or Kite Connect, you can automate your strategies, optimize execution, and unlock your full trading potential. Embrace the power of algorithms and embark on a journey towards greater profitability and efficiency in your trading endeavors.

0 notes

Text

Comparing the Top Stock Brokers in India: Features and Benefits

Introduction

Choosing the right stock broker is crucial for investors in India, as it can significantly impact their trading experience and investment outcomes. With a plethora of options available, each offering unique features and benefits, it's essential to compare the best stock broker in India to make an informed decision that aligns with your investment goals and preferences.

Zerodha

Zerodha has emerged as one of India's leading discount brokers, known for its transparent pricing, innovative technology, and user-friendly platforms. With features like zero brokerage on equity delivery trades, low fees on other segments, and advanced trading tools like Kite and Coin, Zerodha has revolutionized the way retail investors trade in the Indian stock market.

ICICI Direct

ICICI Direct, a subsidiary of ICICI Bank, offers a full suite of brokerage services, catering to both beginners and experienced investors. With extensive research reports, personalized advisory services, and a wide range of investment options, including stocks, mutual funds, and derivatives, ICICI Direct provides comprehensive support to help investors make informed decisions.

Upstox

Upstox has gained popularity among traders for its advanced trading platforms, competitive pricing, and seamless user experience. With features like Upstox Pro Web and Upstox Pro Mobile, traders can execute trades quickly and efficiently while accessing real-time market data and technical analysis tools. Additionally, Upstox offers low brokerage fees and margin trading facilities, making it an attractive choice for active traders.

HDFC Securities

HDFC Securities, a subsidiary of HDFC Bank, is a trusted name in the Indian financial services industry, offering a wide range of investment options and advisory services. From equities and derivatives to mutual funds and IPOs, HDFC Securities provides investors with diverse opportunities to build and manage their portfolios. With robust research capabilities and personalized advisory support, HDFC Securities aims to help investors achieve their financial goals effectively.

Angel Broking

Angel Broking caters to investors of all levels, from beginners to seasoned traders, with its comprehensive suite of brokerage services and investment solutions. With user-friendly platforms like Angel Broking App and Angel SpeedPro, investors can trade across various segments seamlessly. Additionally, Angel Broking offers value-added services like research reports, portfolio management, and expert advisory, enhancing the overall trading experience.

Kotak Securities

Kotak Securities, a subsidiary of Kotak Mahindra Bank, combines traditional brokerage services with cutting-edge technology to provide a seamless trading experience. With platforms like Kotak Stock Trader and Kotak Securities Mobile App, investors can access markets in real-time, execute trades efficiently, and manage their portfolios with ease. Furthermore, Kotak Securities offers research reports, investment advisory, and personalized customer support to assist investors in making informed decisions.

5Paisa

5Paisa is a leading discount broker known for its affordable trading solutions and user-friendly platforms. With features like flat brokerage fees, advanced charting tools, and algorithmic trading capabilities, 5Paisa empowers retail investors to trade in the stock market efficiently. Additionally, 5Paisa offers research insights, mutual fund investments, and financial advisory services, making it a comprehensive platform for investors seeking cost-effective trading solutions.

Conclusion

In conclusion, choosing the best stock broker in India requires careful consideration of various factors, including brokerage fees, trading platforms, research and advisory services, and customer support. Whether you prioritize low costs, advanced technology, comprehensive services, or personalized support, there are stock brokers in India that cater to your specific investment needs. By comparing the features and benefits offered by the top brokers, investors can select the one that aligns with their goals and preferences, paving the way for a successful investing journey.

0 notes

Text

Forex Trading in India: A Comprehensive Guide

Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies in the global market. In India, forex trading has gained significant popularity due to its potential for high returns and the ease of accessibility provided by online trading platforms.

Regulations and Legal Framework

Forex trading in India is regulated by the Securities and Exchange Board of India (SEBI) and the Foreign Exchange Management Act (FEMA). These regulations ensure that forex trading activities comply with legal requirements and protect investors from fraudulent practices.

Popular Forex Trading Platforms in India

Several online platforms cater to forex traders in India, offering user-friendly interfaces and advanced trading tools. Some of the popular platforms include Zerodha Kite, Angel Broking, and Upstox Pro, among others.

Major Currency Pairs for Indian Traders

Indian traders commonly trade major currency pairs such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. These pairs offer ample liquidity and trading opportunities for investors in the Indian forex market.

How to Start Forex Trading in India

To start forex trading in India, one must open a trading account with a registered broker and undergo a verification process. Additionally, beginners should focus on learning market analysis techniques and risk management strategies.

Risk Management in Forex Trading

Risk management is crucial in forex trading to protect capital and minimize losses. Traders can implement stop loss and take profit orders, as well as proper position sizing techniques to manage risk effectively.

Common Strategies for Forex Trading

Forex traders employ various strategies to profit from currency fluctuations, including trend following, range trading, and breakout trading. Each strategy requires a thorough understanding of market dynamics and risk tolerance.

Psychology of Forex Trading

The psychological aspect of forex trading plays a significant role in success. Traders must learn to control emotions such as greed and fear, while maintaining patience and discipline in executing trades.

Tax Implications of Forex Trading in India

Forex trading profits in India are subject to taxation under the Income Tax Act. Traders must report their gains and losses accurately and adhere to tax regulations to avoid legal complications.

Forex Trading Tips for Beginners

Beginners should start with a demo account to practice trading without risking real money. Additionally, continuous education and learning from experienced traders can help improve trading skills and profitability.

Forex Trading Myths in India

There are several myths surrounding forex trading in India, such as the belief that it is a get-rich-quick scheme or akin to gambling. In reality, successful forex trading requires education, discipline, and risk management.

Understanding Forex Trading Charts

Forex traders analyze price movements using various chart types, including candlestick charts, line charts, and bar charts. Each chart type provides unique insights into market trends and price action.

Forex Trading Signals and Indicators

Traders use technical indicators and signals to identify potential trading opportunities. Common indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands, among others.

Forex Trading and Economic Events in India

Economic events and announcements in India, such as Reserve Bank of India (RBI) decisions and inflation rates, can impact currency prices and market volatility. Traders must stay informed about such events to make informed trading decisions.

Conclusion

In conclusion, forex trading in India offers lucrative opportunities for investors to profit from currency movements. By understanding market dynamics, implementing risk management strategies, and staying disciplined, traders can navigate the forex market successfully.

0 notes

Text

The Ultimate Guide to Algo Trading Software India

Algo trading, short for algorithmic trading, has gained significant traction in India's financial markets due to its efficiency and ability to execute trades at lightning speeds. The Ultimate Guide to Algo Trading Software in India encompasses various aspects crucial for traders looking to delve into this domain.

Algo trading software in India comes in diverse forms, catering to the needs of both individual retail traders and institutional investors. These platforms offer a range of features, including backtesting capabilities, real-time market data analysis, and customizable trading strategies. Popular choices include Zerodha's Kite Connect, Upstox Pro API, and Omnesys NEST.

One of the key elements of any algo trading software is its ability to execute trades automatically based on predefined criteria. Traders can develop their strategies using programming languages like Python or utilize built-in strategy builders offered by the software. These strategies can range from simple moving average crossovers to complex mathematical models.

Risk management is paramount in algo trading, and software often includes features to mitigate potential losses. This can include setting stop-loss orders, position sizing based on account equity, and monitoring for unusual market conditions.

Data is the lifeblood of algo trading, and access to accurate and timely market data is essential. Most algo trading software in India provides access to a wide range of market data, including stock prices, order book data, and economic indicators. Additionally, historical data is crucial for backtesting strategies to assess their viability before deploying them in live markets.

Integration with brokers is another critical aspect to consider. Seamless integration allows traders to execute trades directly from the algo trading software without the need for manual intervention. This requires robust APIs and reliable connectivity to ensure smooth operation during volatile market conditions.

Regulatory compliance is a significant consideration for algo traders in India. SEBI (Securities and Exchange Board of India) has established guidelines and regulations governing algo trading to ensure fair and orderly markets. Algo trading software must adhere to these regulations, including pre-trade risk checks and compliance reporting.

Cost is also a factor to consider when choosing algo trading software. While some platforms offer free access or a low-cost entry point, others may charge subscription fees or commissions based on trading volume. Traders should evaluate the cost-effectiveness of the software based on their trading frequency and capital.

In conclusion, the Ultimate Guide to Algo Trading Software in India covers various aspects essential for traders seeking to leverage algorithmic trading in the Indian financial markets. By considering factors such as features, data access, integration, compliance, and cost, traders can make informed decisions to enhance their trading strategies and optimize their performance.

0 notes