#how to open a bank account in dubai online

Text

Get Business Loan in Dubai | UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#open business account online uae#best bank account for small business in uae#zero balance business account in uae#rak bank zero balance business account#business account opening in uae#emirates nbd business account#current account in dubai

0 notes

Text

Business Setup: Your Guide to Launching in Dubai!

Are you considering setting up a business in Dubai, one of the fastest-growing business hubs in the world? With its strategic location, business-friendly environment, and robust infrastructure, Dubai offers unparalleled opportunities for entrepreneurs and investors alike. Whether you're a startup founder or an established business owner looking to expand into new markets, Dubai provides a wealth of advantages. In this comprehensive guide, we'll explore everything you need to know about setting up a business in Dubai and how to navigate the process successfully.

Understand the Legal Landscape: It's critical to become familiar with the legal framework governing business activities in Dubai before beginning the process of setting up a business. The Department of Economic Development (DED) oversees business registration and licensing in Dubai, while certain free zones offer specialized regulations and incentives for specific industries. Conduct thorough research or seek guidance from legal experts to ensure compliance with local regulations and requirements.

Choose the Right Business Structure: Dubai offers several business structures, each with its own set of advantages and considerations. Options include sole proprietorship, partnership, limited liability company (LLC), and free zone company setup, among others. Consider factors such as liability protection, ownership restrictions, and tax implications when selecting the most suitable structure for your business.

Select a Strategic Location: Dubai's diverse landscape includes mainland areas as well as numerous free zones, each offering unique benefits for businesses. Mainland areas provide access to the local market and government contracts but may require a local sponsor or partner. Free zones offer 100% foreign ownership, tax exemptions, and streamlined registration processes, making them attractive options for international businesses. Evaluate your business needs and objectives to determine the most advantageous location for your venture.

Complete the Registration Process: Once you've chosen a business structure and location, it's time to initiate the registration process. This typically involves reserving your business name, obtaining necessary licenses and permits, and submitting required documents to the relevant authorities. Working with a reputable business setup consultant can streamline the registration process and ensure compliance with regulatory requirements, saving you time and effort.

Set Up Banking and Financial Systems: Establishing banking and financial systems is crucial for managing your business operations effectively. Open a corporate bank account with a reputable financial institution in Dubai to facilitate transactions and manage your finances efficiently. Consider factors such as banking fees, currency exchange options, and online banking services when selecting a banking partner.

Build Your Network and Marketing Presence: Networking plays a vital role in the success of your business in Dubai. Attend industry events, join business associations, and connect with local entrepreneurs and professionals to expand your network and forge valuable partnerships. Invest in marketing strategies tailored to the Dubai market, including digital marketing, social media advertising, and localized content to reach your target audience effectively.

Stay Informed and Adapt: Dubai's business landscape is dynamic and constantly evolving, presenting both opportunities and challenges for entrepreneurs. Stay informed about market trends, regulatory changes, and emerging technologies to remain competitive and adapt your business strategies accordingly. Continuously assess your business performance, solicit feedback from customers, and be willing to pivot your approach as needed to stay ahead in the ever-changing business environment.

Setting up a business in Dubai offers boundless possibilities for growth and success. By understanding the local business landscape, choosing the right structure and location, and leveraging the support of experts and resources available, you can embark on a journey toward entrepreneurial success in this vibrant city. With determination, perseverance, and the right strategy, your business dreams can flourish in the thriving business ecosystem of Dubai.

Visit our website for more details: https://anishagroup.com/business-set-up/

For inquiries, contact us:

Call (or) WhatsApp: 0542421523

Email: [email protected]

Tags:#BusinessSetup, #DubaiBusiness, #Entrepreneurship, #StartupDubai, #BusinessRegistration, #UAEBusiness, #SmallBusinessDubai, #BusinessConsultancy, #FreeZoneSetup, #BusinessLicenseDubai

0 notes

Text

How to Obtain a Police Clearance Certificate in Dubai

Understanding the Importance of a Police Clearance Certificate in Dubai

A Police Clearance Certificate (PCC), known as a Good Conduct Certificate in Dubai, is an official document provided by the Dubai Police. It serves as a confirmation of your criminal history in the United Arab Emirates (UAE).

The significance of the PCC lies in its ability to affirm that you maintain a clean criminal record, indicating an absence of any charges or convictions during your time in the UAE, whether as a resident or visitor.

Why Different Organizations Require a Good Conduct Certificate

Employers

In Dubai and across the UAE, many employers include a PCC as part of their pre-employment screening process. This step aids them in evaluating your suitability for a role while ensuring they hire individuals with clean backgrounds.

Immigration Authorities

When applying for a visa or residency permit in Dubai or the UAE, immigration authorities often request a PCC. This serves the purpose of verifying your criminal history to determine any potential security risks.

Other Organizations

Various institutions such as educational establishments and licensing bodies may also demand a PCC for different reasons. For instance, universities may require it for international students, while professional licensing bodies might need it before granting practice licenses.

Instances Where a Police Clearance Certificate is Necessary

Several common scenarios necessitate the acquisition of a police clearance certificate in the UAE:

Employers in Dubai frequently use PCCs during their pre-employment screening processes. Universities or educational institutions might mandate PCCs for international students enrolling in their programs. Immigration authorities in Dubai typically request PCCs when applying for visas or residency permits. Professional licensing bodies may require PCCs before granting practice licenses in various fields. During the adoption process in Dubai, authorities might request PCCs to evaluate suitability. Dubai authorities might require PCCs from owners or key personnel depending on the type of business establishment. Some banks in Dubai might request PCCs, especially for high-value accounts, when opening new accounts.

Eligibility & Documents Needed for Obtaining a PCC Certificate

Obtaining a Police Clearance Certificate (PCC) in Dubai generally does not have specific eligibility criteria. As long as you have a record in the UAE’s criminal database, you can apply for a PCC, regardless of your current residency status or criminal history (though a clean record is what the PCC verifies).

However, to apply for the PCC, you’ll need certain documents to verify your identity and residency (if applicable). These may include:

Your Passport (original and copy) UAE visa (original and copy, if applicable) Emirates ID (original and copy, if applicable) Application form Payment receipt for the PCC fee The exact requirements and application process may vary slightly depending on whether you’re applying within Dubai, another emirate in the UAE, or from your home country.

How to Get a Police Clearance Certificate

There are two primary methods to apply for a Police Clearance Certificate in Dubai: online or in person.

Online Application for the PCC

This is the preferred and generally faster method. Here’s a step-by-step guide:

Access the Application Platform

You can apply through the Dubai Police website or the Ministry of Interior’s website (https://moi.gov.ae/en/)

Register or Login

New users must register for an account using their UAE Pass. Existing users can log in with their credentials.

Select the PCC Service

Locate the “Police Clearance Certificate” or “Good Conduct Certificate” service on the platform.

Complete the Application Form

Fill out the online application form accurately, providing details such as passport information, visa details (if applicable), and reason for needing the PCC.

Attach Required Documents

Upload scanned copies of necessary documents, which may include your valid passport, Emirates ID (if applicable), a recent passport-sized photograph, and your last UAE visa copy (if applicable).

Pay the Processing Fee

Pay the processing fees associated with your PCC application online, typically using debit cards, credit cards, or e-Dirham.

Submit Your Application

Review all information, then submit your application electronically.

Track Your Application

Use the provided reference number to track your application status.

Receive Your PCC

Upon approval, you’ll receive the PCC electronically via email or download it directly from the application platform.

In-Person Application

Though online application is preferred, you can also apply in person at designated locations:

Visit a Dubai Police Service Center

Locate a nearby Dubai Police service center that handles PCC processing.

Collect Application Form

Obtain a PCC application form from the service center.

Prepare Required Documents

Gather the same documents required for the online application.

Submit Application and Pay Fees

Fill out the application form, attach your documents, and submit them to the service center representative. Pay the processing fees.

Collect Your PCC

You’ll be informed about the collection process for your PCC, which may involve receiving it directly or returning at a designated pick-up time.

Police Clearance Certificate (PCC) for Non-Residents

Non-residents can also obtain a PCC, provided they have previously spent time in Dubai as a visitor or resident. Additionally, they’ll need a fingerprint card issued by their current country’s police department, attested by the UAE Embassy there.

Required Documents for Non-Residents:

Valid Passport Fingerprint card issued by the police department in your current country of residence (mandatory) Previous UAE visa (if applicable) Two passport-sized photographs PCC application form The application process for non-residents is similar to residents. After preparing the required documents, including the attested fingerprint card, they can apply online.

Cost of PCC Certification in Dubai

The Dubai Police Clearance Certificate fee varies depending on residency status and the application method:

Residents: AED 200 (approximately USD 54.45)

Non-Residents: AED 300 (approximately USD 81.70)

Citizens (UAE Nationals): AED 100 (approximately USD 27.22)

Knowledge Fee of AED 10 (approximately USD 2.72) and an Innovation Fee of AED 10 (approximately USD 2.72) apply to all applicants.

An additional delivery fee of AED 100 (approximately USD 27.22) might apply for receiving a hard copy of the PCC through a service center instead of electronic delivery.

Arabic Certificate: 50 AED

English Certificate: 150 AED

For comprehensive assistance with legal requirements, especially if planning to establish a business in Dubai, consider consulting experts such as Private Wolf Business Setup.

Duration of Obtaining a PCC Certificate in Dubai

The processing time for obtaining a Dubai Police Clearance Certificate is typically 24 hours but can vary depending on residency status and other factors.

The PCC remains valid for three months from the date of issue, applicable to both residents and non-residents.

Get Your Dubai Business Up and Running Faster with Private Wolf Business Setup

Acquiring a Police Clearance Certificate in Dubai is a straightforward process, whether you’re a resident or a non-resident. This crucial document verifies your criminal background and is often required for various purposes such as employment, immigration applications, and company formation.

For assistance in meeting all legal requirements when moving your business to Dubai, consider seeking expert guidance from professionals like Private Wolf Business Setup.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain

Private Wolf | facebook | Instagram | Twitter | Linkedin

#Police clearance certificate#pcc in dubai#establish business in dubai#how to get pcc#how to get police clearance certificate#private wilf

0 notes

Text

How to Incorporate a Media Company in the Dubai, UAE

Lights, Camera, Action! A Guide to Incorporating Your Media Company in the UAE

The UAE's media landscape is a vibrant tapestry of diverse voices and narratives. Are you a visionary filmmaker, a passionate publisher, or an innovative digital media entrepreneur ready to contribute to this dynamic arena? But before your story unfolds, navigating the legalities of incorporating a media company in the UAE can feel like a complex script. Fear not! Aristotle Tax Consultancy, your trusted guide through the UAE's business landscape, is here to demystify the process and help you launch your media masterpiece.

Understanding the Landscape:

First, let's break down the media universe in the UAE:

Print Media: Newspapers, magazines, and other printed publications require a license from the Ministry of Culture and Information.

Broadcast Media: TV and radio channels fall under the purview of the National Media Council (NMC), which issues specific licenses based on content type and broadcasting platform.

Digital Media: Online publications, websites, and mobile apps may require licensing from either the NMC or the Telecommunications Regulatory Authority (TRA), depending on content and functionality.

Charting Your Course:

Once you understand the media category your company falls under, the incorporation journey begins:

Choose Your Legal Structure: Mainland companies offer local market access but require a local sponsor (except for specific activities). Free zones like Dubai Media City (DMC) and Twofour54 provide 100% foreign ownership and cater specifically to media businesses.

Secure Approvals: Obtain initial approval from the relevant authority (Ministry of Culture, NMC, or TRA). Free zone companies may need additional approvals within the zone.

Prepare Documentation: Gather your Memorandum of Association (MOA), shareholder and director identification documents, a detailed business plan, and any specific approvals or clearances required by your chosen media category.

Register Your Company: Submit documents and fees to the chosen authority. Expect additional steps like company formation meetings and licensing interviews.

Obtain Licenses: Receive your official license to operate based on your media category and chosen platform. Remember, specific content-related approvals may be necessary.

Open a Corporate Bank Account: Choose a bank and complete account opening procedures.

Fulfill Ongoing Requirements: Maintain licenses and registrations, file annual reports (if applicable), comply with visa and immigration requirements for employees, and adhere to content regulations specific to your media category.

Media-Specific Nuances:

Operating in the media space comes with additional considerations:

Content Approval: Depending on your chosen media category, specific content approval processes may exist. Be aware of and comply with all regulations concerning content type, language, and cultural sensitivities.

Data Privacy: Ensure your operations adhere to UAE data privacy laws, especially if collecting user data.

Intellectual Property: Protect your creative content through appropriate intellectual property registrations.

Embrace Expert Guidance:

While this guide provides a roadmap, incorporating a media company in the UAE involves intricate legalities and regulatory nuances. Partnering with Aristotle Tax Consultancy brings peace of mind and success to your media venture. Our experts:

Offer tailored advice based on your specific media category and chosen platform.

Navigate complex regulations and licensing procedures on your behalf.

Liaise with relevant authorities to ensure smooth approvals.

Help you choose the right mainland location or free zone for your needs.

Advise on content compliance and data privacy regulations.

The UAE's media landscape awaits your unique story. With careful planning, the right legal framework, and expert guidance from Aristotle Tax Consultancy, you can confidently navigate the incorporation process and turn your media vision into a thriving reality. Contact us today and let's create a successful script for your media journey!

#aristotle tax consultancy#company incorporation in dubai#accounting firm in dubai#accounting services#accounting services in dubai#company registration#business setup consultant in dubai

0 notes

Text

Renting Property in Dubai. Not an Issue

Rent your property in Dubai

Brimming with innovation and modernity, Dubai attracts people seeking a lifestyle that seamlessly blends tradition with cutting-edge experiences. If the lifestyle interests you, one of the first steps to making your Dubai dream come true is choosing the perfect property.

1- Specify your needs and financial constraints

Clearly describe your needs before you join the market. Think about your dream apartment's size, features, location, and budget. You will be able to successfully narrow down your options with the help of a clear set of criteria.

2- Explore and choose a neighborhood

Dubai has a wide variety of neighborhoods, each offering a unique lifestyle. Consider areas depending on your choices for work, schools, public transport and community services. Downtown Dubai is perfect for those looking for an urban vibe with iconic skyscrapers, luxury shopping and city life. Marina is ideal if you want to be at the beach and in a tropical environment all year round. Those looking for more exclusive living can explore villa communities such as Arabian Ranches, Dubai Hills Estate and many others that offer tranquility amidst lush landscapes. With its wide range of options, Dubai ensures that you will find the perfect home in the heart of the city and action, on the coast or in an exclusive villa community.

3- Hire a trustworthy real estate broker

Negotiate the quickly changing Dubai real estate market with the help of a reliable real estate agent like us. A skilled real estate representative can arrange house showings, provide advice, and assist with negotiations. In the Dubai real estate market, look for agents who have a strong track record and excellent feedback.

4- Verify the legal requirements

Make sure you fulfil all the legal conditions in order to rent an apartment in Dubai. A valid resident visa, an Emirates ID, proof of work, and a bank statement are usually included in this. You can get assistance from your agent with all the necessary documentation and visa processes.

5- Financial planning and budgeting

Establish a clear budget that accounts for rent as well as other expenses like energy bills, agency fees, and security deposits. Being aware of the big picture financially will help you avoid unpleasant surprises while leasing a property.

6- Viewing properties

Plan to view properties after narrowing down the list of possible apartments. Pay attention to the condition, amenities and neighborhood of the property. Take your time to ask questions and gather all the relevant information about the property.

7- Rental agreement

After choosing the ideal apartment, analyze the rental agreement in detail. A tenancy agreement is usually for 12 months and describes the terms of your tenancy. Make sure you understand all the clauses before signing. If in doubt, ask for advice.

8- Payments and security deposits

Pay the required amount, which should include the security deposit and any up-front rent. If the property is in good condition and the lease is ended, the security deposit is refundable. Laws, rules, industry norms, and requirements set forth by the Dubai Land Department mandate a security deposit of 5% for unfurnished homes and 10% for furnished ones. The deposit safeguards the rights of the tenant and the landlord.

9- Registration for Ejari

Fill out the Ejari registration form. In Dubai, this system governs the interaction between landlords and tenants. Tenancy contract registration with the Real Estate Regulatory Agency (RERA) is a necessary step in the leasing procedure.

How to register your rental in Dubai Ejari process

- Visit the Ejari online portal - Open your preferred web browser and navigate to the Ejari website. Make sure you have all the necessary documents.

- Gather your documents - You'll need a copy of your passport, visa, Emirates ID, and the signed tenancy contract. Ensure the contract includes all the essential details, like the rental amount, duration, and both parties' signatures.

- Fill in the online form - Create an account on the Ejari portal and accurately fill in the required details. Upload the necessary documents, including your tenancy contract and personal identification.

- Pay the registration fee - Once you've submitted the form, you'll be prompted to pay the Ejari registration fee. This can typically be done online through various payment methods.

- Receive your Ejari certificate - After payment confirmation, your Ejari certificate will be generated. This document officially registers your tenancy and is crucial for various transactions, such as obtaining utility services.

10- Move in and enjoy your new home

Once all the paperwork is done, it's time to move in and start enjoying your new Dubai home. Meet the local community, discover the amenities and enjoy the unique Dubai lifestyle.

Renting an apartment in Dubai can go smoothly with proper planning and advice. These steps will help you find a comfortable and pleasant place to live in this dynamic city.

0 notes

Video

youtube

Company formation in Dubai, Bur Dubai (Dubai mainland) or in Free Trade ...

https://www.youtube.com/watch?v=r5BzCDhlZak

company formation in Dubai free zone

company formation in Dubai

company formation in Dubai free zone

company formation in Dubai cost

company formation in Dubai mainland

company registration in Dubai

company setup in Dubai

company registration in Dubai free zone cost

business formation in Dubai

company registration in Dubai municipality

company creation in Dubai

company formation in Dubai cost

cost of opening a company in Dubai free zone

online company registration in Dubai

cheapest company registration in UAE

Dubai mainland company formation cost

UAE company registration cost

Dubai company setup packages

online company registration in UAE

register company in Dubai from India

Dubai company formation cost

Dubai company formation

Dubai company registration

Dubai company setup packages

Dubai company formation with bank account

Dubai company search

Dubai company registry

Dubai company job

Dubai company setup

Dubai company jobs online apply

UAE company formation cost

UAE company formation

UAE company registration cost

UAE company setup

UAE company search

UAE company registration number

UAE company name

UAE company visa cost

UAE company registration online

UAE company list

how to make company in Dubai

how to setup company in Dubai

how to open company in Dubai free zone

how to make business in Dubai

how to establish company in Dubai

how to open a company in Dubai from India

how to open limousine company in Dubai

how to open LLC company in Dubai

how to open cleaning company in Dubai

how to open investment company in Dubai

company formation in Dubai cost

cost of opening a company in Dubai free zone

online company registration in Dubai

cheapest company registration in UAE

Dubai mainland company formation cost

UAE company registration cost

Dubai company setup packages

online company registration in UAE

register company in Dubai from India

company formation in Dubai UAE

business setup in Dubai - company setup UAE

UAE company formation cost

types of company formation in Dubai

cheapest company formation in UAE

companies in UAE

how to make company in Dubai

how to make business in Dubai

how to start cleaning company in Dubai

how to start construction company in Dubai

how to start a company in Dubai from India

how to get company license in Dubai

how to start tourism company in Dubai

how to start trading company in Dubai

how to start a company in Dubai free zone

how to start insurance company in Dubai

how to make general trading

how to get general trading license in Dubai

how to start a general trading company

how to make trading profitable

how to learn trading from scratch

how to make free zone company in UAE & Dubai

how to start a free zone company in Dubai

what are free zone companies

companies in free zone Dubai

how to register a company in Dubai free zone

cost of free zone company in UAE

free zones in Dubai

free zone company in Dubai

free zone

free zone in UAE

free zone company meaning

free zone in India

free zone company in Dubai cost

free zones in Sharjah

free zone establishment

free zone vs mainland Dubai

0 notes

Text

Navigating the Dubai Business Banking Landscape for Foreign Investors

Dubai's rise to prominence as a worldwide center of business has been nothing short of spectacular. It is crucial for foreign investors contemplating the potential this Emirate offers to comprehend the business banking environment. Ensuring smooth financial operations is one of the first steps towards a successful venture. The intricacies of business banking in Dubai are explored in this essay, with particular emphasis on the prerequisites for company setup in Dubai.

Understanding the Banking Infrastructure

Dubai has a strong and advanced banking system that supports its goal of becoming a major player in the world economy. Global and local international banks are well-represented here, providing a wide range of services to suit various corporate requirements. It is crucial for those thinking about setting up a business in Dubai to collaborate with banks who are knowledgeable about the laws and nuances of the area. The banking industry in Dubai is prepared to assist companies of all sizes and industries, offering anything from corporate accounts to specialist trade finance solutions.

Regulatory Framework and Compliance

Notwithstanding the evident charm of Dubai's business-friendly atmosphere, regulatory compliance must always be taken seriously. The banking industry is governed by the UAE Central Bank, which maintains stability, security, and openness. Initiating company setup in Dubai for foreign investors entails complying with particular papers, due diligence procedures, and regulatory criteria. Working with financial and legal professionals can expedite this process and guarantee that companies take advantage of the advantages provided while adhering to the law.

Banking Solutions Tailored for Startups and SMEs

Dubai's banks have developed specialized programs for startups and SMEs because they understand how crucial these organizations are to fostering innovation and economic expansion. The focus lies in fostering and assisting emerging enterprises through the provision of specialized relationship managers, flexible lending arrangements, and favorable interest rates. These specialist banking options might be crucial in enabling a seamless entrance and long-term growth trajectory for international investors considering setting up a business in Dubai.

Digital Transformation and Fintech Initiatives

The banking industry in Dubai is leading the way in embracing digital change. The banking experience has been completely transformed by the use of fintech technologies, online banking platforms, and digital payment systems, which provide efficiency, speed, and convenience. Leveraging these digital technologies can give international investors thinking about company setup in Dubai a competitive edge by facilitating smooth transactions, real-time financial management, and increased operational efficiency.

To sum up As a foreign investor, navigating Dubai's business banking scene may be a lucrative but challenging experience. Investors can set up their businesses for success by comprehending the financial infrastructure, emphasizing regulatory compliance, looking into customized solutions for startups and SMEs, and embracing digital transformation. Being knowledgeable and proactive when making financial selections is still essential for long-term success as the Emirate promotes an atmosphere that is favorable for corporate expansion.

0 notes

Text

FOR IMMEDIATE RELEASE : Emopay Unveils Exciting New Updated Program to Revolutionize Experience

UAE, Dubai, 24th October] – [Emopay], a leading Digital Currency institution, is thrilled to announce the upcoming launch of its highly anticipated, innovative and updated program to transform how customers engage with their finances. This groundbreaking update reaffirms Emopay's commitment to delivering excellence in the Digital Currency Space and coming up with lots of new initiatives.

With the world rapidly advancing in the digital age, Emopay recognizes the importance of adapting to the evolving needs of its customers. The new program is designed to offer a seamless and enhanced banking experience, focusing on convenience, accessibility, and customer-centric features.

EMO Bank and EMOPay's old Versions will merge

The existing user has to Sign Up again on the new version and create a wallet address.

Existing users EMO’s will be transferred to the New Version of EMOPAY with new staking from the backend as per the request. User has to fill out the Google form and follow the instructions for the same.

Key Updates of the Upcoming EMOPAY 2.0 Program:

EMOPAY Staking Program 4.0

The New Staking program starts on the new version of EMOPAY

Users can choose from the following Plans for Staking.

Minimum Amount 1000 EMO for staking

540 days - 1.5% Monthly Rewards

1080 days - 2% Monthly Rewards

1800 days - 3% Monthly Rewards

2520 days - 4% Monthly Rewards

3600 days - 5% Monthly Rewards

For Staking Rewards: Open your ID and click the claim button to receive a daily reward bonus.

To keep the community involved and interested in the digital currency, a user has to log in with EMOPAY ID everyday and click on the Claim button on the dashboard to receive his daily staking returns. If any day, user forgets to click the button, user will receive 50% of the value as a reward.

P2P Transfers to Users

This much-awaited feature will be back in function with certain algorithms and monthly user limits. This will help in increasing the community of EMO Wallet holders and will continue until we reach 2 million users. The user has to follow these steps to Open the Pay to User and P2P facility in local currency.

Create an EMO Wallet and Purchase EMO from EMO Community

- Refer 3 people using there referral link.

- Help these referral to buying EMO from the community.

Congratulations, you are now eligible to transfer EMO to other Users and a P2P swap in local currency will also open once it is live. This condition is temporarily on Limited monthly restrictions and increases accordingly.

Generate EMPLOYEE Code

Those EMOians who want to work and help the community to increase its strength can generate their Employee code and this helps them to generate income for themselves too.

For this, they have to raise a working code request on the my business page at emopay.org

Cutting-Edge Security: Emopay is dedicated to ensuring the highest level of security for its customers' financial information. The updated program will feature state-of-the-art security measures to protect against fraud and cyber threats.

EmoBank and EMOPAY are going to merge.

Personalized Financial Insights

Customers will have access to in-depth financial analysis and recommendations, empowering them to make informed decisions about their money.

Your funds are 100% safe.

The principal amount of EMOPAY and EMO bank will automatically transfer to the new version. The staked amount will be staked and the Emopay wallet amount will be in Emo wallet (These conditions are applied on every emoians).

Digital Account Management

Account management is easier than ever with online account opening, More Security, and seamless fund transfers between accounts.

Peer to peer: transfer of emo will start with certain conditions with certain limit

Customer Support

Emopay remains dedicated to providing top-tier customer service. The updated program includes improved customer support channels, including live chat and more responsive email services.

New referral scheme (Join 3 people)

Emopay recognizes the importance of staying ahead of the curve in an ever-changing financial landscape. This new program represents a significant step towards modernizing the banking experience, ensuring that customers can effortlessly manage their finances from the palm of their hand.

Every emoians needs to sign up again

Emopay, CEO expressed enthusiasm about the Updated launch: "We're thrilled to introduce this new program to our customers. It's been carefully crafted with their needs in mind, and we believe it will set a new standard for Fintech convenience and security."

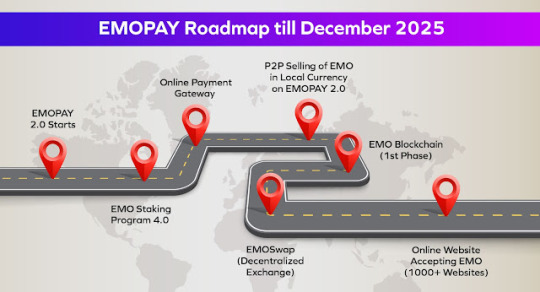

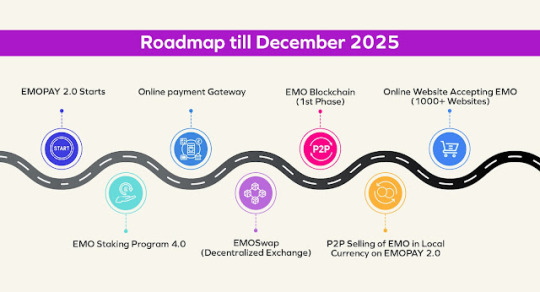

Emopay Roadmap till December 2025

Roadmap till December 2023

EMOPAY 2.0 - November 2023

EMO Staking Program 4.0 - November 2023

Online payment Gateway - December 2023

P2P Selling of EMO in Local Currency on EMOPAY 2.0 - December 2023

Roadmap till 2025

EMO Blockchain (1st Phase)

EMOSwap (Decentralized Exchange)

Online Website Accepting EMO (10000+ Websites)

The launch of this exciting program is scheduled for 01-11-2023. Emopay encourages its valued customers and the broader community to join in this journey towards a more convenient and secure experience.

For more information, follow our social medias, visit our website at Emopay or contact our media relations team at [email protected] .

About Emocoin:

Emopay is a renowned financial institution dedicated to providing exceptional services to its customers. With a history of innovation and a commitment to customer satisfaction Emocoin continues to lead the way in the financial industry.

For media inquiries, please contact:

Email ID

Social Media

Emonews

FORM LINK 👉 ( For existing users to transfer IDs into new Emopay 2.0 )

Check out this article on EmoNews

1 note

·

View note

Text

How to open a bank account in dubai islamic bank

Opening a bank account in Dubai Islamic Bank (DIB) is a straightforward process that caters to individuals seeking Sharia-compliant banking services in the vibrant city of Dubai. DIB, one of the leading Islamic banks in the UAE, offers a range of financial products and services designed to align with Islamic principles. If you're interested in opening an account with Dubai Islamic Bank, here is a step-by-step guide to help you through the process.

Eligibility and Documentation: Before you proceed with opening an account, ensure that you meet the eligibility criteria. DIB typically requires the following documents from individual account applicants:

A valid passport with a UAE residence visa for expatriates or a valid Emirates ID for UAE nationals.

Proof of your residential address, such as a utility bill or a rental agreement.

Proof of your income or employment, like a salary certificate or bank statements.

Choosing the Account Type: Dubai Islamic Bank offers a variety of accounts, each tailored to meet different financial needs. Consider your requirements and choose the type of account that best suits you. Options may include savings accounts, current accounts, or fixed-term deposit accounts.

Visit the Branch: To initiate the account opening process, visit your nearest Dubai Islamic Bank branch. The bank has a wide network of branches across the UAE, making it easily accessible for potential customers.

Account Application Form: You will be provided with an account application form at the branch. Fill out this form carefully, ensuring that all the required information is accurate and complete. If you have any questions, the bank staff will be happy to assist you.

Minimum Balance Requirement: Dubai Islamic Bank may require you to maintain a minimum balance in your account. Be sure to inquire about this and ensure that you can meet this requirement.

Sharia Compliance: Dubai Islamic Bank operates under Islamic finance principles, ensuring that its services are Sharia-compliant. This means they do not engage in interest-based transactions. Be prepared for your account to be subject to these principles, which prohibit earning or paying interest.

Signature Verification and Biometrics: Your signature and biometric data, such as fingerprints, may be collected for account security and verification purposes. This is a standard procedure.

Initial Deposit: Depending on the type of account you're opening, you may need to make an initial deposit. Ensure you have the required funds available.

Wait for Approval: After submitting your application, the bank will review your documents and information. This may take a few days, and the bank will contact you once your account is approved.

Receiving Your Account Details: Once your account is approved, you will receive your account details, including your account number and any associated documents or cards.

Online and Mobile Banking: Dubai Islamic Bank provides convenient online and mobile banking services, allowing you to access your account and perform transactions from anywhere.

Visa Debit Card: Depending on your account type, you may also receive a Visa Debit Card, which you can use for shopping and ATM withdrawals.

In conclusion, opening a bank account with Dubai Islamic Bank is a well-structured process, and the bank's staff is typically helpful in guiding you through the necessary steps. By ensuring that you meet the eligibility criteria, providing the required documents, and understanding the Sharia-compliant nature of the bank, you can start enjoying the benefits of Islamic banking services in Dubai. Whether you are a resident or an expatriate, DIB provides a variety of options to meet your financial needs while adhering to Islamic principles.

1 note

·

View note

Text

How to open a bank account in dubai islamic bank

Opening a bank account in Dubai Islamic Bank (DIB) can be a straightforward process if you follow the necessary steps and provide the required documentation. Whether you're a resident or a non-resident, Dubai Islamic Bank offers a range of account options to suit your financial needs. Here's a step-by-step guide on how to open a bank account with Dubai Islamic Bank.

Research and Choose the Right Account Type: The first step is to research and select the type of account that best suits your needs. Dubai Islamic Bank offers various accounts, including savings accounts, current accounts, and business accounts. Consider your financial goals and requirements to make an informed choice.

Gather the Required Documents: Before visiting the bank, ensure you have all the necessary documents. Generally, you will need a valid passport, a visa, and proof of residence (such as a utility bill or rental agreement). Non-residents may require additional documentation.

Visit a Branch: Locate the nearest Dubai Islamic Bank branch and visit during their business hours. You will need to meet with a bank representative to open the account. If you are a non-resident, check whether the branch you plan to visit is authorized to open accounts for non-residents.

Meet with a Bank Officer: Once at the bank, inform the bank officer that you want to open an account. They will guide you through the process and provide you with the necessary application forms.

Complete the Application Form: Fill out the application form with accurate and up-to-date information. Be prepared to provide personal information, contact details, and your source of income.

Deposit Funds: To activate your account, you will need to make an initial deposit. The required minimum balance varies depending on the type of account you choose. Dubai Islamic Bank may offer accounts with zero balance requirements for some categories.

Sign the Necessary Agreements: You'll be required to sign various agreements and contracts related to your account, such as the Terms and Conditions of the bank and any specific terms for your chosen account.

Receive Your Debit Card and Chequebook: Depending on the account type, you will receive a debit card and a chequebook. These are essential for conducting day-to-day banking transactions.

Set Up Online and Mobile Banking: Dubai Islamic Bank provides online and mobile banking services. Ensure you have access to these services to manage your account more conveniently.

Familiarize Yourself with Islamic Banking Principles: Dubai Islamic Bank operates under Sharia-compliant principles. Familiarize yourself with these principles, as your account will adhere to Islamic banking rules.

Activate Your Account: Once you have completed all the necessary paperwork and your initial deposit has been processed, your account will be activated. You will receive confirmation from the bank.

Start Banking: With your Dubai Islamic Bank account active, you can start making deposits, withdrawals, transfers, and payments according to your financial needs.

Opening a bank account with Dubai Islamic Bank is a manageable process when you have the necessary documentation and follow these steps. Keep in mind that the bank may update its requirements or processes, so it's advisable to check their official website or contact a branch directly for the most current information. Dubai Islamic Bank's services provide a Sharia-compliant way to manage your finances, making it an appealing choice for individuals and businesses seeking Islamic banking solutions in the United Arab Emirates.

1 note

·

View note

Text

Best Tips for When Select Best forex broker

There are many online forex brokers battling for your business if you are a trader in the foreign exchange market. If you visit any financial news website, you'll probably be inundated with an overload of forex broker internet adverts. The five factors you should take into account when choosing the broker who is best for you are covered in this post.

1. Regulatory Compliance

When choosing a forex broker, look into their reputation first. A reliable forex broker in the US will belong to the National Futures Association (NFA), which serves as the futures industry's self-regulatory body. Additionally, it will be registered with the Commodity Futures Trading Commission (CFTC), which oversees the American markets for commodity futures and options.

2. Account Features

Different account types are available from each forex broker. When evaluating broker features, keep the following four things in mind: leverage and margin, commissions and spread, minimum initial deposits, and ease of deposits and withdrawals.

The spread, which is the distinction between a currency pair's bid and ask prices, can be charged by a broker who accepts commissions at a set percentage. Instead of charging commissions, several brokers use bigger spreads to generate revenue. Understand how your broker generates revenue and compare prices.

There are distinct account withdrawal and funding policies for every forex broker. Account holders may be able to fund their accounts online with a credit card, an ACH payment, PayPal, a wire transfer, a bank cheque, or a personal or corporate cheque, according to the broker.

3. Currency Pairs Offered

While a large number of currencies are available for trading, only a select few receive the majority of attention and, as a result, trade with the most liquidity. The key pairs also include USD/JPY and USD/CHF in addition to the previously mentioned EUR/USD and GBP/USD pairs. A broker may provide a huge range of forex pairs, but what matters most is that they provide the pairings that appeal to you as a trader.

4. Customer Service

The customer service of a broker should be accessible at all times because forex trading happens around-the-clock. Also take into account how simple it is to reach a real person on the phone. You may get a sense of the kind of customer service a broker offers and the typical wait times by giving them a quick call.

5. Trading Platform

The trading platform serves as the investor's entry point to the markets. Trading platforms and software should therefore provide the technical and fundamental analytical tools that traders want, and transactions should be simple to enter and exit.

A well-designed trading platform will include obvious buy and sell buttons, and some even offer a "panic" button that automatically terminates all open positions. This last point is very crucial. On the other side, a shoddy interface could result in expensive order entry errors.

Conclusion:

You'll be able to give analysis and creating forex strategies more time and attention if you have faith in your forex broker. For More information kindly visit RightFX or Contact us at [email protected]

Right Fx is Best forex broker Award Winning in Forex Expo Dubai 2022

0 notes

Text

How To Get Access To The New Business Setup In Dubai?

When it comes to business setup services in the UAE, there are several reputable options to consider. These services encompass various aspects of establishing a new business or expanding an existing one. Here are some of the best business setup services in the UAE:

Company Formation: These services guide you through the process of choosing the right legal structure for your business and assist with the preparation and submission of necessary documents for registration.

Documentation and Paperwork: Reputable service providers help you with the preparation, filing, and management of essential documents required for business setup, including contracts, agreements, and compliance-related paperwork.

Location and Office Setup: They provide support in selecting an appropriate location for your business, negotiating lease agreements, and ensuring a smooth setup of your office space, including infrastructure and facilities.

Banking and Financial Services: Trusted service providers assist in opening a business bank account, obtaining necessary financing, and offering guidance on financial management, budgeting, and tax-related matters.

Visa and Immigration Services: These services facilitate visa applications and processing for business owners, partners, employees, or investors who need to enter and work in the UAE.

To access the best new business setup services in the UAE, consider following these steps:

Clearly define your business requirements, including the industry, specific services needed, budget, and timeline.

Conduct thorough online research to identify reputable business setup service providers in the UAE. Explore their websites, review their services, and gather information about their expertise, experience, and track record.

Seek recommendations and referrals from trusted sources such as other business owners, colleagues, or industry experts who have firsthand experience with business setup in the UAE.

Evaluate the expertise and experience of the service providers you are considering. Look for firms with in-depth knowledge of the UAE business landscape, local laws, regulations, and licensing requirements. Consider their track record in assisting businesses similar to yours.

By carefully considering these factors and choosing a reputable business setup service provider, you can ensure a smooth and successful process for establishing your New Business in The UAE.

0 notes

Video

youtube

Company formation in Dubai, Bur Dubai (Dubai mainland) or in Free Trade ...

company formation in Dubai free zone

company formation in Dubai

company formation in Dubai free zone

company formation in Dubai cost

company formation in Dubai mainland

company registration in Dubai

company setup in Dubai

company registration in Dubai free zone cost

business formation in Dubai

company registration in Dubai municipality

company creation in Dubai

company formation in Dubai cost

cost of opening a company in Dubai free zone

online company registration in Dubai

cheapest company registration in UAE

Dubai mainland company formation cost

UAE company registration cost

Dubai company setup packages

online company registration in UAE

register company in Dubai from India

Dubai company formation cost

Dubai company formation

Dubai company registration

Dubai company setup packages

Dubai company formation with bank account

Dubai company search

Dubai company registry

Dubai company job

Dubai company setup

Dubai company jobs online apply

UAE company formation cost

UAE company formation

UAE company registration cost

UAE company setup

UAE company search

UAE company registration number

UAE company name

UAE company visa cost

UAE company registration online

UAE company list

how to make company in Dubai

how to setup company in Dubai

how to open company in Dubai free zone

how to make business in Dubai

how to establish company in Dubai

how to open a company in Dubai from India

how to open limousine company in Dubai

how to open LLC company in Dubai

how to open cleaning company in Dubai

how to open investment company in Dubai

company formation in Dubai cost

cost of opening a company in Dubai free zone

online company registration in Dubai

cheapest company registration in UAE

Dubai mainland company formation cost

UAE company registration cost

Dubai company setup packages

online company registration in UAE

register company in Dubai from India

company formation in Dubai UAE

business setup in Dubai - company setup UAE

UAE company formation cost

types of company formation in Dubai

cheapest company formation in UAE

companies in UAE

how to make company in Dubai

how to make business in Dubai

how to start cleaning company in Dubai

how to start construction company in Dubai

how to start a company in Dubai from India

how to get company license in Dubai

how to start tourism company in Dubai

how to start trading company in Dubai

how to start a company in Dubai free zone

how to start insurance company in Dubai

how to make general trading

how to get general trading license in Dubai

how to start a general trading company

how to make trading profitable

how to learn trading from scratch

how to make free zone company in UAE & Dubai

how to start a free zone company in Dubai

what are free zone companies

companies in free zone Dubai

how to register a company in Dubai free zone

cost of free zone company in UAE

free zones in Dubai

free zone company in Dubai

free zone

free zone in UAE

free zone company meaning

free zone in India

free zone company in Dubai cost

free zones in Sharjah

free zone establishment

free zone vs mainland Dubai

0 notes

Text

SIM Card Funding International Cybercrime

The rise of cybercrime is a growing concern globally. Criminals are using increasingly sophisticated tactics to carry out their illegal activities, leaving people vulnerable to identity theft, financial fraud, and other online crimes. In recent years, India has become a hotbed for such activities, and the latest bust by the cybercrime unit in Vadodara highlights the gravity of the situation.

The racket involving the exportation of activated SIM cards from India to other countries is a well-organized operation that ensures the masterminds remain untraceable. The police stumbled upon this operation while investigating a cyber fraud case and found that local suspects were buying SIM cards in bulk using fake ID cards or identity documents belonging to their acquaintances. These SIM cards were then transported to Dubai, where they were sold to a middleman for a sum of Rs 2,000 to Rs 2,500.

Also Read: Kashmiri Brother-in-Law could not show Kamal, and pressure on Nagpur police failed

The middleman then sold these SIM cards to Chinese gangs who used them to create multiple accounts on Telegram and contact individuals with enticing investment schemes that offer high returns. The fraudsters also used the Indian SIM cards to set up bank accounts into which they transferred the stolen money from their victims. However, the investigation has hit a roadblock as the accounts are opened using fraudulent documents, and the associated SIM cards are registered under fictitious identities.

This revelation is alarming as it shows how organized cybercriminals have become in their approach to defrauding people. The use of Indian SIM cards by Chinese gangs is a worrying trend as it indicates that cybercrime is becoming a global problem that requires a concerted effort from all countries to combat it.

One of the challenges that law enforcement agencies face in such cases is the difficulty in tracking down these gangs. They operate in different countries, making it challenging to pinpoint their location and take up the matter officially with Interpol. This is where international cooperation and collaboration between law enforcement agencies become crucial.

Also Read: Cybercrime in Nagpur - Cyber Blackmailer Couple Arrested in Pune for Extorting Money

The investigation into the SIM card racket has highlighted the importance of being cautious while sharing personal information, particularly identity documents. People should remain vigilant and report any suspicious activity to the relevant authorities to help prevent such fraudulent practices. Additionally, there is a need for stricter laws and regulations to curb the sale of SIM cards without proper verification and identification procedures.

The responsibility of securing one's personal information is not solely on individuals. Telecom companies also have a crucial role to play in safeguarding their customers' data. They must ensure that proper verification procedures are in place while selling SIM cards to prevent the misuse of such cards.

In conclusion, cybercrime is a growing threat globally, and India is not immune to it. The bust by the cybercrime unit in Vadodara highlights the gravity of the situation and calls for stricter laws and regulations to combat such illegal activities. Individuals also have a responsibility to safeguard their personal information and report any suspicious activity to the authorities. Finally, international cooperation and collaboration between law enforcement agencies are essential to track down these gangs and bring them to justice. It is only through a collective effort that we can hope to eradicate cybercrime and make the internet a safer place for everyone.

Source: https://www.the420.in/how-your-sim-card-could-be-funding-international-cybercrime/

0 notes

Text

How to Register a Business Name in Dubai | Full Guide 2023

Understanding the Importance of a Business Name

Your business name is one of the most crucial aspects of your brand identity. It represents your business and helps your customers recognize your products and services. Your business name is also essential for legal and regulatory purposes. Before you start registering your business name in Dubai, it is essential to understand the importance of a good business name and the benefits it can bring to your business.

Types of Business Entities in Dubai

Before you can register your business name, you must first determine the type of business entity that you want to establish. Dubai offers several types of business entities, including:

Sole Proprietorship

Limited Liability Company (LLC)

Free Zone Company

Partnership

Branch Office

Representative Office

Each type of business entity has its unique requirements and regulations, and you should carefully consider your options before making a decision.

Choosing a Business Name

When choosing a business name, it is essential to choose a name that accurately reflects your business and is easy for your customers to remember. Your business name should also be unique and not infringe on any existing trademarks or copyrights. In Dubai, it is recommended to choose a business name that reflects the nature of your business, its activities, or its location.

Checking the Availability of Your Business Name

Once you have chosen a business name, you should check its availability with the Department of Economic Development (DED). The DED is responsible for registering and licensing all businesses in Dubai, and they maintain a database of registered business names. You can check the availability of your business name on the DED's website or by visiting their offices.

Registering Your Business Name with DED

To register your business name with DED, you will need to submit an application along with the necessary documents. The documents required for registering a business name may vary depending on the type of business entity you choose. However, the following documents are usually required:

Passport copies of all shareholders and partners

Proposed business name

Business activity

Proposed share capital

Memorandum and Articles of Association (for LLCs)

You can submit your application online or in person at the DED offices. Once your application is approved, you will receive a trade name reservation certificate.

Obtaining a Trade License

After registering your business name with DED, you will need to obtain a trade license to legally operate your business. The type of trade license you need will depend on the nature of your business activities. You can apply for a trade license through the DED's website or by visiting their offices.

Also Read :- How To Apply For Trade License In Dubai

Opening a Bank Account

To conduct business in Dubai, you will need to open a bank account in your company's name. This will allow you to deposit funds, receive payments, and manage your finances. You can choose to open a bank account with any of the leading banks in Dubai, and the process is relatively straightforward.

Also Read :- How to Open a Business Bank Account in Dubai | Full Guide (2023)

FAQs

Q : How long does it take to register a business name in Dubai?

A : The registration process typically takes between 3-7 working days.

Q : Can I register a business name without having a physical office in Dubai?

A : Yes, you can register a business name without having a physical office in Dubai by setting up a free zone company.

Q : Can I change my business name after registration?

A : Yes, you can change your business name after registration by submitting an application to DED.

Q : How much does it cost to register a business name in Dubai?

A : The cost of registering a business name varies depending on the type of business entity you choose.

Q : Do I need a local sponsor to register a business name in Dubai?

A : No, you do not need a local sponsor to register a business name in Dubai if you choose to set up a free zone company.

We hope that this article has provided you with valuable information on how to register a business name in Dubai. If you need further assistance, we recommend seeking advice from a professional business consultant.

Conclusion

Registering a business name in Dubai can seem daunting, but with the right guidance, it can be a straightforward process. It is important to carefully consider the type of business entity you want to establish, choose a unique and memorable business name, and ensure that your name is available for registration. Once you have registered your business name with DED and obtained a trade license, you can start conducting business in Dubai legally.

If you're looking for a reliable partner to help you start your business in Dubai, visit Recorporate.net to learn more about their services.

Reference URL :- How to Register a Business Name in Dubai | Full Guide 2023

0 notes