#uae bank account for non residents

Text

Get Business Loan in Dubai | UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#open business account online uae#best bank account for small business in uae#zero balance business account in uae#rak bank zero balance business account#business account opening in uae#emirates nbd business account#current account in dubai

0 notes

Text

0 notes

Link

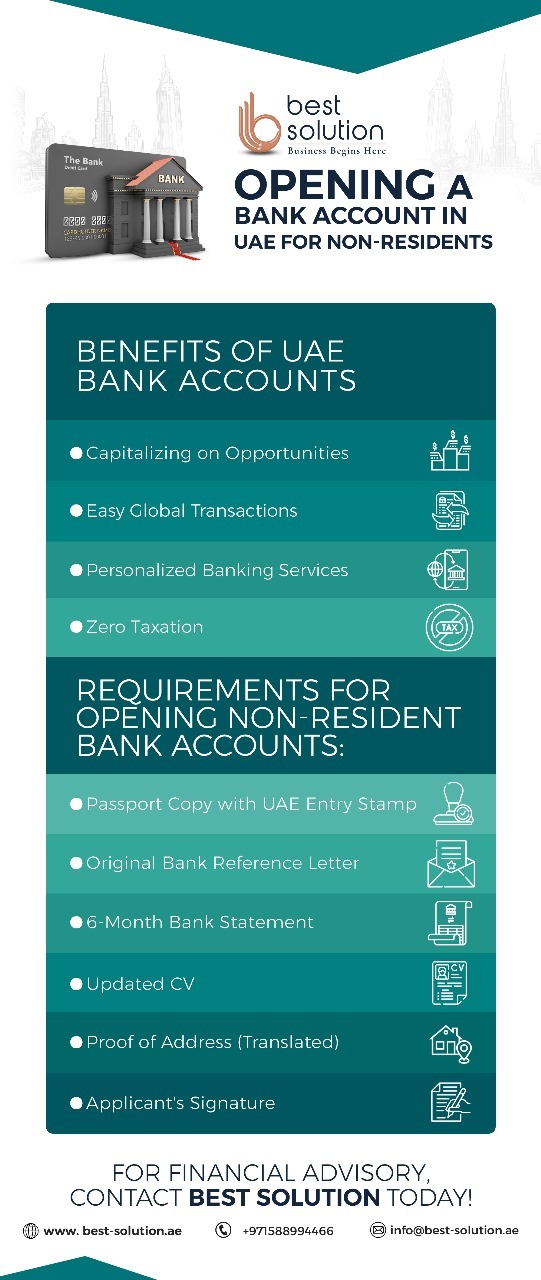

A non-resident bank account in the UAE, People may want to open an account in the UAE for a variety of reasons, including spending a lot of time there or getting regular payments in dirhams, or it may be part of their savings strategy.

0 notes

Text

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Non Resident Bank Account UAE | Setup firm

Enhance your banking experience with Set Up Firm's supplementary services for Non-Resident Bank Accounts UAE. Beyond personal account setup, we provide assistance with debit card applications, online banking setup, and additional value-added services. Explore our tailored solutions for Corporate Bank Accounts, Private and Priority Banking, Non-Residency Account Solutions, Digital Account Services, and Corporate Bank Advisory. Trust Set Up Firm to optimize your banking experience and meet your diverse financial needs. For more details visit us our services online at https://www.setupfirm.com/banking-solution

0 notes

Text

How to start a used car trading business in Dubai, UAE

As the new car market experiences a downturn, the pre-owned car sector in Dubai and the rest of the UAE is witnessing significant growth. In 2019, the UAE saw the sale of approximately 830,000 pre-owned vehicles, equating to 3.5 used cars for every new car sold. Predictions indicate that by 2025, the sales of used cars will surpass the one million mark annually.

This burgeoning sector, valued at USD 20 billion last year, is anticipated to expand at an 11% compound annual growth rate (CAGR) from 2022 to 2027, reaching an estimated value of USD 32 billion.

With vehicle ownership in Dubai reaching record levels and continuing to rise with the population, the prospects for launching a used car trading enterprise in the UAE are promising.

How to Establish a Pre-owned Car Dealership in Dubai

UAE Initiating a business within the UAE is designed to be a swift and simple process, yet it necessitates familiarity with the nation’s commercial regulations. Thus, consulting with a regional specialist is recommended before embarking on this venture.

Following an initial consultation to grasp your objectives, we will assist you through the subsequent steps:

1- Choosing and Registering Your Business Name

Selecting a name for your pre-owned car business in Dubai is crucial. It’s important to avoid any names that might be deemed offensive or that resemble existing entities too closely.

Your chosen business name must be available for registration. It’s wise to have alternative names ready in case your preferred name is taken. We will handle the submission of your trade name registration for you.

2 — Obtaining a Business License

The next step involves applying for a license to trade pre-owned cars. The application process varies slightly between setting up on the mainland and in a free zone.

For free zones, the respective authority manages the license application, while the Dubai Department of Economic Development oversees mainland applications.

Our team at Private Wolf will advise on the optimal setup based on your specific needs and manage the licensing process on your behalf.

3 — Processing Your Visa

In addition to a trade license, you will need a visa to reside and conduct business in the UAE. The visa process includes medical and fitness tests, a blood test, a chest x-ray, and submitting biometric data for your Emirates ID.

We at Private Wolf will assist you through each step to streamline your visa application. Holding a UAE residency visa also allows you to sponsor dependents for their visa applications.

4 — Setting Up a Corporate Bank Account

The final hurdle before commencing your business operations is opening a corporate bank account in the UAE, which can be challenging for non-GCC citizens.

Private Wolf simplifies this process, leveraging our relationships with numerous UAE banks to recommend the best one for your banking needs.

Starting a pre-owned car trading venture in Dubai comes with an initial license fee of AED 13,800. Yet, this is just the beginning of the financial considerations. Entrepreneurs must also budget for visa expenses, premises rental, and hiring staff if necessary. Additionally, operating on the mainland might entail securing extra permits to commence trading. For a detailed and customized cost analysis, engaging with Private Wolf’s team can provide clarity and guidance.

Expanding Your Used Car Trading Enterprise in Dubai

To escalate your used car business in Dubai swiftly, conduct thorough market research to identify the most sought-after vehicles. For instance, SUVs represent a significant portion of the used car market in the UAE, suggesting a higher demand for these over smaller cars. Popular Japanese brands, especially Toyota, dominate the pre-owned car market, alongside other favored brands like Nissan, Mitsubishi, and Hyundai. Setting competitive prices by understanding market rates can accelerate sales and build customer trust. Moreover, considering expansion beyond the UAE offers lucrative opportunities, given Dubai’s strategic location that facilitates easy vehicle exports.

Profitability of the Used Car Market in Dubai

The used car sector in Dubai is undeniably profitable, with the average vehicle listing price hovering around AED 102,000. With a slowdown in new car production, the value of used cars is anticipated to climb. Profit margins can be increased by importing cars from Asian markets or exporting to burgeoning markets in North Africa.

The Viability of Car Flipping in Dubai

Car flipping in Dubai presents a viable business opportunity for those with a knack for finding deals. The profitability of flipping depends on various factors such as the car’s model, condition, and market demand. With the right strategy, there’s substantial potential for success in the Dubai used car market.

How Private Wolf Can Assist

Private Wolf excels in facilitating business setups in Dubai, offering comprehensive support for launching your used car dealership. Our international team guides you through every stage of the formation process, ensuring a smooth, cost-effective, and efficient setup. We handle license and visa applications, liaise with government departments, and navigate the regulatory landscape, allowing you to concentrate on preparing for business operations. Discover more about Private Wolf’s services and receive a tailored quote by visiting www.privatewolf.ae.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your journey to becoming a recognized freelancer in Dhabi, ensuring a smooth and informed licensing process.

M.Hussnain

Private Wolf | facebook | Instagram | Twitter | Linkedin

#used car business#used car auction business#auction business in dubai#used car business in dubai#used cars dubai#how to start a used car business#cost of used car business#business setup in dubai#business setup#business#private wolf#cost calculator

0 notes

Text

Dubai Free Zone Business Consultant: Arab Expertise

In the thriving landscape of global commerce, Dubai Free Zone Company has emerged as a beacon for entrepreneurs and businesses seeking a strategic gateway to the Middle East and beyond. One of the most attractive avenues for setting up a business in this vibrant city is through the establishment of a Free Zone Company. Leveraging the expertise of Arab Business Consultants, this article delves into the nuances and advantages of initiating a company within Dubai's Free Zones.

Understanding Dubai Free Zones

Dubai's Free Zones are designated areas offering foreign investors numerous incentives and advantages for company formation. These zones provide 100% ownership to foreign entities, exemption from import and export duties, tax benefits, streamlined processes, and robust infrastructure, fostering an environment conducive to business growth and expansion.

Why Choose a Free Zone Company Setup?

The allure of a Free Zone Company lies in its flexibility and advantages. Business owners can benefit from:

1. 100% Foreign Ownership: Unlike mainland companies in the UAE, Free Zone entities allow complete ownership to non-residents, eliminating the need for a local partner or sponsor.

2. Tax Benefits: Companies within Free Zones often enjoy tax exemptions on corporate and personal income tax for extended periods, contributing significantly to profitability.

3. Simplified Procedures: Setting up a business in Free Zones involves streamlined processes, quicker registrations, and minimal bureaucratic hurdles, enabling swift market entry.

4. Strategic Location: Dubai's strategic location at the crossroads of East and West offers unparalleled access to regional and international markets, fostering business expansion opportunities.

Arab Business Consultants: Your Partner in Success

Arab Business Consultants specialize in facilitating the establishment and growth of businesses within Dubai's Free Zones. Their expertise spans various industries, offering tailored solutions to entrepreneurs seeking to capitalize on the city's economic potential.

Services Offered by Arab Business Consultants:

1. Strategic Guidance: From initial feasibility studies to business plan development, consultants provide comprehensive guidance at every stage of company setup.

2. Legal Compliance: Ensuring adherence to local regulations and legalities, consultants navigate the complexities of licensing, permits, and documentation.

3. Corporate Services: Assistance in choosing the most suitable Free Zone, company registration, visa processing, and ongoing support for administrative tasks.

4. Financial Advisory: Providing insights into financial planning, accounting services, and banking procedures, ensuring compliance and fiscal stability.

Steps to Establish a Free Zone Company with Arab Business Consultants

1. Consultation: Initiate the process by consulting with Arab Business Consultants to assess business goals and determine the most suitable Free Zone.

2. Documentation and Registration: Compile necessary documents and proceed with company registration, guided by the consultants through each step.

3. Visa Processing: Facilitate visa applications for business owners, employees, and dependents, streamlining the relocation process.

4. Operational Support: Post-setup, benefit from ongoing support for administrative tasks, compliance, and further expansion strategies.

Conclusion

In a dynamic business landscape, establishing a Dubai Free Zone Company through Arab Business Consultants presents an unparalleled opportunity for entrepreneurs seeking growth, profitability, and market expansion. The strategic advantages coupled with expert guidance pave the way for a successful venture, capitalizing on Dubai's unrivaled position as a global business hub. Collaborate with Arab Business Consultants to embark on your journey toward business excellence in Dubai's flourishing economy.

0 notes

Text

A Comprehensive Guide to Opening a Bank Account in the UAE

The United Arab Emirates (UAE) is renowned for its thriving economy, global business hub, and a high standard of living. If you are considering relocating or doing business in the UAE, one of the first steps you'll need to take is opening a bank account. This process is streamlined and efficient, reflecting the country's commitment to fostering a business-friendly environment. In this guide, we will walk you through the essential steps and requirements for opening a bank account in the UAE.

Types of Bank Accounts:-

Before diving into the process, it's crucial to understand the types of bank accounts available in the UAE. The most common accounts include:-

Personal Savings Account:- Ideal for individuals looking to save money and earn interest on their deposits.

Current Account:- Suited for day-to-day transactions, offering features like checkbooks, debit cards, and online banking.

Business Account:- Essential for entrepreneurs and businesses, providing various services like business loans, payroll services, and corporate credit cards.

Fixed Deposit Account:- Offers higher interest rates for a fixed term, making it an attractive option for those looking to grow their savings.

Requirements for Individuals:-

Valid Passport:- A copy of your valid passport with a residence visa is usually required.

Residence Visa:- Non-residents may need to provide a residence visa, while residents must present a valid Emirates ID.

Proof of Address:- Utility bills or a rental agreement can serve as proof of your residential address.

Reference Letter:- Some banks may request a reference letter from your employer or a known financial institution.

Minimum Deposit:- Depending on the type of account, a minimum deposit may be required.

Requirements for Businesses:-

Trade License:- A copy of the business's trade license is typically mandatory.

Memorandum of Association (MOA):-For corporations, the MOA outlines the company's objectives and structure.

Partnership Agreement:- If applicable, a partnership agreement may be required for businesses with multiple partners.

Board Resolution:- A board resolution authorizing specific individuals to open and operate the account on behalf of the business.

Proof of Address:- Similar to personal accounts, businesses may need to provide proof of their registered address.

Selecting a Bank:-

The UAE boasts a diverse range of local and international banks, each offering various services. Research and compare the services, fees, and account features before selecting a bank that aligns with your needs.

The Application Process:-

Visit the Bank:- Schedule an appointment or visit the bank branch to initiate the account opening process.

Documentation:- Prepare all required documents, ensuring they meet the bank's criteria.

Application Form:- Complete the bank's application form, providing accurate and up-to-date information.

Verification:- The bank will verify your documents and may conduct a brief interview.

Account Approval:- Once the verification is complete, your account will be approved, and you'll receive your account details.

Opening a bank account in the UAE is a straightforward process, provided you have the necessary documentation in order. By understanding the types of accounts available and the specific requirements, you can navigate the process efficiently. Choosing a reputable bank that suits your financial goals is essential for a successful banking experience in the UAE. Whether you're an individual or a business entity, the UAE's banking sector is well-equipped to cater to your diverse financial needs.

FOR MORE INFORMATION:-

UAE Bank Account Opening

0 notes

Text

Seamless UAE Company Formation for Business Success

Unlock the potential of the United Arab Emirates (UAE) with our streamlined company formation in UAE . Navigating the intricate landscape of regulations and requirements, we ensure a hassle-free process for establishing your business. From Dubai's free zones to broader UAE company formation, our expertise guides you every step of the way. As dedicated company setup consultants, we offer tailored solutions and insights into costs and regulations. Experience a smooth transition, including the convenience of opening a bank account in Dubai for non-residents. Choose us for a seamless company setup in the UAE, laying the foundation for your business success.

1 note

·

View note

Text

Acquire Your UAE's Golden Visa With A Bank Deposit Of 2 Million AED

The UAE golden Visa has been a goal for some individuals across the globe. Key area, extraordinary foundation, worldwide open doors, and a well disposed charge structure, have just increased its allure throughout the long term.Customarily, property buy or business arrangement was the famous technique for getting a visa. Be that as it may, in a bid to make this visa more open to everybody, the public authority has sent off a few drives, one of which is a bank deposit. In view of your justification for moving to UAE, the top Golden Visa Consultants in Dubai can assist you with the appropriate administrative work and legalities.

What is the AED 2 Million Bank deposit Plan?Under this choice, individuals hoping to get a UAE golden Visa need to deposit AED 2 Million into a substantial bank. This deposit is then secured for a time of 2 years and can bring interest on the deposit going from 3.9% to 5%. It is vital to take note of that a few banks might require a more drawn out secure in period. To guarantee you get the greatest interest on the least deposit residency, make certain to connect with the main firm for golden visa services in Dubai.The notoriety of this plan comes from a few elements. For inhabitants, for example, consultants who may not need a conventional business arrangement, this open door is great. Further, a many individuals are not anxious to purchase property in another country. This might be because of lawful worries or stresses over property estimation changes. For such occupants, a bank deposit is by all accounts a more secure choice to get a UAE golden Visa. Furthermore, as the deposit acquires revenue, occupants should rest assured that not exclusively will they get their assets back after the residency period, yet they can likewise procure alluring profits from their deposits.Moves toward Secure a golden VisaThe bank deposit technique is ideal for retired folks, specialists, and other non-land people hoping to get a golden Visa. Here are the moves toward secure your visa:Associate with the top golden visa consultants in Dubai to realize which banks are certify to offer this plan. Recognize the save money with the best residency and loan cost blend.deposit AED 2 million in a bank deposit and sign the important records committing the sum for the necessary lock-in time of at least 2 years. This report will contain all fundamental subtleties, for example, the loan cost and should be concentrated cautiously prior to marking. Joining forces with the best consulting firm in Dubai can be helpful to get the best arrangement.The licensed bank will furnish you with a letter in regards to your deposit which then should be submitted to the movement authorities for handling.You can likewise acquire the ward golden Visa for your life partner or kids in light of the terms pertinent.When supported, the most extreme legitimacy for the golden Visa is 10 years and can be recharged from now on.EndThe allure of the golden Visa has just expanded, and the new bank deposit plot opens up open doors for non-business and non-land competitors also. Interface with a presumed firm for golden Visa administrations in Dubai for additional subtleties and direction.

#Golden Visa Consultants in Dubai#top golden visa consultants in Dubai#consulting firm in Dubai#golden visa services in Dubai

0 notes

Text

Is Your Business Ready for the Changes in Corporate Tax for 2023?

The government of the United Arab Emirates said on January 31, 2022, that a new company tax will be implemented. Historically, the United Arab Emirates has not taxed corporate earnings, with the exception of a small number of businesses including international banking and resource exploitation. However, a large number of businesses operating in the territory will have to start paying the new 9% corporation tax rate as of the fiscal year that starts on June 1, 2023.

Not every firm in the UAE will be impacted by the new corporation tax, and many will be exempt from paying it altogether.

Features of the Corporate Tax Regime

Dubai’s business tax regime consists of a variety of laws, such as corporate taxes, VAT systems, tax-free zones, and the lack of federal income tax.

· Who can be taxed?

Tax will be imposed on legal entities with illustrious legal persons, such as LLCs, PSCs, PJSCs, LLPs, and others. Furthermore, any foreign legal entity that resides in the United Arab Emirates and generates money will be subject to charges. While corporations operating in free zones will pay no corporate taxes as long as they adhere to all regulations, this also applies to free zone businesses that transact business with the mainland. Corporate taxation laws may also apply to UAE citizens and non-residents.

Tax rates

Businesses that make less than AED 375,000 are subject to 0% tax; those that earn more than that amount are subject to 9% tax. Additionally, bigger international corporations with differing business circumstances will be subject to a separate tax rate.

Who is exempted?

A participation exemption from corporation tax is provided under corporate tax legislation when dividends are received or shares of a subsidiary firm are sold. Additionally, corporations that are held entirely by the government, charitable organizations, public benefit organizations, investment funds, and firms involved in the exploitation of minerals and oil are not subject to corporate taxes.

Calculating taxable income

Typically, the tax rate and income are ascertained using the account net profit or loss that is displayed in the business’s financial statements. If the firm experiences a loss, it may deduct up to 75% of the value from its taxable income in subsequent years.

Groups

It could be possible for a collection of businesses to create a tax group where they might all be considered as one single taxable entity. In order to accomplish this, a business or subsidiary must not register in a free zone or be an exempted party.

Tax credits

The system will permit a credit in tandem with foreign tax paid in a foreign jurisdiction against foreign tax revenue that has not been exempted in an effort to prevent double taxation.

Will businesses operating in free zones pay taxes?

How companies operating in free zones will be affected by the new UAE corporation tax is still up in the air. The government has announced that enterprises operating in free zones will continue to enjoy the benefits of the pre-agreed incentives relevant to their individual free zone. Free zones could, however, elect to alter the regulations in the future and perhaps even impose a levy.

Free zone corporations are often required to pay corporate tax on the revenues they make from doing business with mainland enterprises.

Free zone businesses won’t really have to pay any taxes, but they will still need to register and file a corporation tax report.

Dubai’s Corporate Tax Advisory Services

Being Al-Ahram Investment corporate tax advisers in Dubai, we have extensive knowledge of Dubai’s tax rules and regulations and can help firms maximize their tax strategies, reduce their tax payments, and ensure compliance. Together with our corporate tax specialists in Dubai, we can provide you with the assistance and guidance you need to meet your financial goals and make wise decisions while navigating the intricacies of corporate taxes in the area.

1 note

·

View note

Text

What are the requirements for NRIs to rent property in Dubai?

Renting property in Dubai, United Arab Emirates (UAE), is a relatively straightforward process for both residents and non-residents, including Non-Resident Indians (NRIs). Here are the general requirements and steps for NRIs to rent property in Dubai:

1. Valid Visa: You need to have a valid UAE residence visa or a tourist visa. If you are an NRI living outside the UAE, you can rent property in Dubai with a valid tourist visa, but you may need to check if there are any restrictions on the duration of the lease.

2. Passport: A valid passport is required for identification and documentation purposes.

3. Budget: Determine your budget for renting a property, considering rent, security deposit, and other associated costs.

4. Property Search: Find a property that meets your needs and budget. You can use real estate websites, work with real estate agents, or visit property listings in person.

5. Lease Agreement: Once you find a suitable property, you'll need to sign a lease agreement with the landlord. Make sure you understand all the terms and conditions before signing.

6. Security Deposit: Typically, landlords in Dubai require a security deposit, which is usually equivalent to 5% of the annual rent for unfurnished properties and up to 10% for furnished properties. This deposit is refundable at the end of the lease.

7. Ejari Registration: The Ejari system is a mandatory online registration system for tenancy contracts in Dubai. Both the tenant and landlord should be registered on the Ejari platform, and the lease agreement should be submitted for approval. This ensures that the lease is legally binding and that you have certain rights and protections.

8. DEWA Connection: You will need to set up your electricity and water (DEWA) connection. You can do this online or at DEWA service centers.

9. Empower/Chiller Fees: If you're renting a property with central cooling or district cooling systems, you may need to pay cooling charges separately.

10. Agency Fees: Be prepared to pay a commission fee to the real estate agency that helped you find the property. This fee is typically equivalent to 5% of the annual rent.

11. Tenancy Contract: Ensure that you have a written tenancy contract that outlines all the terms and conditions of the lease, including rent, payment schedule, and responsibilities of both the landlord and tenant.

12. Post-Dated Checks: In Dubai, rent payments are often made using post-dated checks covering the entire rental period. Ensure you have enough checks and funds in your bank account to cover the rent.

13. Housing Fee: Dubai Municipality imposes a housing fee, typically 5% of the annual rent, which is usually paid by the tenant.Buy Property In Dubai

It's essential to be aware of the legal and contractual obligations when renting property in Dubai. It's advisable to seek legal advice or consult with a real estate expert to ensure you understand the local regulations and protect your rights as a tenant, especially if you are an NRI. Additionally, note that rules and regulations in Dubai can change, so it's always a good idea to verify the current requirements with the relevant authorities or a legal expert before rent property in Dubai.

0 notes

Text

CITIZENSHP BY INVESTMENT

CBI “Citizenship by Investment” programs are not a new concept rather been existing since 1984 by one of the Caribbean islands named St. Kitts & Nevis. CBI “Citizenship by Investment” program allows foreign investors and their families to obtain Alternate Citizenship and Passport(s) by Contributing to the economy of the host country.

To opt it there are several instruments such as contributions / donations in the countries approved national fund(s), investing in a Government approved real-estate option, or investing in a Government approved bond. As of today, over 100 countries in the world have some form of investment migration legislation in place, however, a few offers Citizenship by Investment (i.e., Antigua & Barbuda, Commonwealth of Dominica, Grenada, Malta, Montenegro, North Macedonia, St Kitts & Nevis, St Lucia, Türkiye, Vanuatu etc.)

The lowest possible contribution / investment starts with a one-time non-refundable contribution of USD 100,000 plus other related fees in a Government approved fund of the concerned country. The minimum contribution / investment may vary depending on the country of citizenship and the family size.

BENEFITS OF CITIZENSHIP BY INVESTMENT

In addition to letting you include your spouse, dependent (children, siblings, parents and grandparents) , these investment programs comes with multiple other benefits such as:

Global mobility allows passport holders to travel visa-free to over 145 countries and jurisdictions that include Hong Kong, Singapore, United Kingdom, and the Schengen Area (also Russia and China depending on the country offering Citizenship by Investment).

Citizenship by Investment programs are considered to be an Insurance policy or a Plan B for many individuals from underdeveloped countries, these programs help them avoid any political unrest and for the security of their loved ones and their investments. A second passport is the ultimate contingency plan against the risk of political or economic turbulence in one’s home country.

Holding a single Citizenship can curtail an individual’s ability to conduct business on a global scale, with dual nationality, individuals can enjoy Access to international business hubs, and it can assist them to grow their business on a global stage.

Most of the Caribbean countries offering Citizenship by Investment are home to the best United States offshore universities (Grenada for instance is home to St George’s University which is one of the finest medical, veterinary, and arts and sciences schools, and graduates train in some of the top hospitals in the United States and the United Kingdom and is internationally accredited). Having a Second Passport means Greater opportunities for better education for you, your spouse and or the kids.

Citizenship by Investment provides countless opportunities to extend your business in different jurisdictions, and it provides a better-quality life, with complete assets protection, access to healthcare services, luxury living locations, diversified culture, and much more.

Caribbean countries offering CBI programs are considered tax havens. There are ZERO taxes for inheritance, gifts, wealth, and no capital gains. There are also no taxes on income generated from earnings abroad.

Holding a single Citizenship limits you in diversifying your investment portfolio, opting for dual Citizenship enables you to invest in different jurisdictions, easily open a bank account, and ease of business.

About the Author

Imran Mirani, is an Independent Investment Advisor with over 14 years of RCBI “Residency / Citizenship by Investment” and Business Migration experience, he is a member of the IMC “Investment Migration Council”. Over the time he has been handling the portfolio of (ultra) high net-worth clients globally and have helped hundreds optimize their their residency and citizenship with strategic investment.

Mobile Phone: +971 50 288 0795 UAE | +92 322 824 5008

E-mail: [email protected] — www.investmenttoday.net

0 notes

Text

can non residents open a bank account in uae

Opening a bank account in the United Arab Emirates (UAE) as a non-resident has become increasingly accessible in recent years, thanks to the country's efforts to attract foreign investors and expatriates. The UAE is a global financial hub with a thriving economy, and its banking sector is known for its stability and efficiency. However, there are specific regulations and requirements that non-residents must navigate to open a bank account in the UAE.

Non-residents, including foreigners and international businesses, are permitted to open both personal and business bank accounts in the UAE. These accounts can be denominated in various currencies, making it convenient for individuals and companies engaged in international trade and investment.

To open a personal bank account in the UAE as a non-resident, several general requirements typically apply:

Valid Identification: You will need to provide a valid passport with a UAE entry visa or a tourist visa. Some banks may also require additional identification documents.

Proof of Address: While UAE residency is not mandatory, some banks may ask for proof of your overseas address, such as a utility bill or bank statement.

Minimum Deposit: Many banks in the UAE require a minimum initial deposit to open an account. This amount can vary from one bank to another and depends on the type of account you wish to open.

Resident Sponsor: Some banks may ask for a resident sponsor, who is a UAE resident with a valid visa, to vouch for you. This requirement can vary among banks and may not be mandatory for all non-resident accounts.

Source of Funds: You may be asked to provide information about the source of the funds you intend to deposit into your UAE bank account, to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Personal Appearance: In some cases, you may need to visit a branch in person to complete the account opening process.

For businesses or corporations looking to open a bank account in the UAE, the process is more complex and may vary depending on the type of company and its intended business activities. Generally, you will need to provide the following:

Company Documentation: This includes the company's incorporation documents, trade licenses, and legal registration papers.

Corporate Resolutions: The bank may require corporate resolutions authorizing the opening of the account, along with details about authorized signatories.

Business Plan: Some banks may request a business plan or explanation of the company's intended activities in the UAE.

Proof of Address: Similar to personal accounts, you may need to provide proof of the company's overseas address.

Minimum Deposit: A minimum deposit requirement is often applicable for business accounts as well.

It's important to note that banking requirements and regulations can change, so it's advisable to contact the specific bank you are interested in for the most up-to-date information on account opening procedures and requirements for non-residents. Additionally, working with a knowledgeable financial advisor or legal expert can help ensure a smooth process when opening a bank account in the UAE as a non-resident.

1 note

·

View note

Text

How to Open a Bank Account in UAE for Non-Residents?

Learn how to open a bank account in UAE for a non-resident. Find out what is necessary, what documentation is required, and the key steps.

#businesssetup#dubaibusiness#openabankaccountindubai#openbusinessbankaccountdubai#dubaibusinessbankaccount#dubainonresidents#uae

0 notes