#home loan without map

Link

Home Loan Eligibility

Every lender, be it a bank or a housing finance company, assesses borrowers' home loan eligibility before sanctioning a home loan eligibility is mandatory that are conducted by several banks and financial institutions. . This is especially important since home loans are high-value loans. Typically, lenders provide finance ranging from 60% - 85% of property value as a housing loan amount and the loaned amount can be somewhere between several lakhs to a few crores.

Therefore, lenders need to ensure whether borrowers have repayment capability or not and that the loan will be repaid on time, without any defaults or missed payments. Below are the factors that help lenders to determine whether a borrower is eligible for the home loan:

Salaried Individual Eligibility Criteria

Under the home loan eligibility criteria; Individuals in permanent service in the government or reputed companies.

Applicants must be above 21 years of age at the time of loan application and up to the age of 60 years at the time of loan maturity. Moreover, you can check the amount you need to pay as EMI with the home loan EMI calculator.

Professionals Eligibility Criteria for home loan

Professionals such as doctors, engineers, chartered accountants, architects, chartered accountants, company secretaries and management consultants are eligible for a home loan.

Applicants above 21 years of age at the time of home loan interest rate application and below 65 years or less at the time of home loan maturity meet our home loan eligibility criteria.

Self-employed individuals eligible for home loan

Any individual filing income tax returns can apply

Applicants should be above 21 years of age at the time of the commencement of the home loan and up to 65 years or less at the time of maturity of the home loan

Applicant must be above 21 years of age at the time of application and below 65 years of age at the time of maturity of the home loan.

#home loan eligibility#home loan interest rate#home loan#home loan without map#home construction loan#nri home loan#business loan#financeseva

2 notes

·

View notes

Text

Apply Loan against Property - INR Plus: Your Path to Financial Freedom!

Introduction

Are you in need of funds to start a business, pursue higher education, or fulfill your dreams? Look no further than Apply Loan against Property - INR Plus! This innovative financial solution allows you to put your property to work for you, unlocking its value and providing you with the funds you require. In this article, we'll delve into the intricacies of Apply Loan against Property - INR Plus, exploring its unique advantages, the application process, and addressing the most commonly asked questions.

So, without further ado, let's dive into the world of Apply Loan against Property - INR Plus, where financial opportunities await!

Apply Loan against Property - INR Plus: What sets it apart?

Why choose Apply Loan against Property - INR Plus? Here are four compelling reasons to consider this financial option:

Unrestricted Utility: With Apply Loan against Property - INR Plus, you have the freedom to utilize the funds as you see fit. Whether it's expanding your business, renovating your home, or funding your child's education, the flexibility allows you to pursue your ambitions with ease.

Competitive Interest Rates: INR Plus understands the value of your property and offers highly competitive interest rates on Apply Loan against Property - INR Plus. This ensures that you can access the funds you desire without significantly burdening your finances.

Extended Repayment Tenure: Apply Loan against Property - INR Plus provides extended repayment tenures, giving you ample time to repay the loan comfortably. This flexibility is particularly advantageous when undertaking long-term projects or investments.

Lenient Eligibility Criteria: INR Plus believes in assisting individuals from a wide range of financial backgrounds. Hence, Apply Loan against Property - INR Plus features lenient eligibility criteria, making it accessible to a broader segment of borrowers.

The Application Process: From Inquiry to Disbursement

The application process for Apply Loan against Property - INR Plus is designed to be simple, efficient, and hassle-free. Let's take a closer look at the steps involved:

Initial Inquiry: Start by reaching out to INR Plus and expressing your interest in Apply Loan against Property - INR Plus. The friendly customer service team will guide you through the initial inquiry process, addressing any questions or concerns you may have.

Document Submission: Once you decide to proceed, gather the necessary documents such as property papers, income proof, identification documents, and other requested paperwork. Ensure your documents are in order, as this will expedite the approval process.

Property Valuation: INR Plus will assess the value of your property to determine the loan amount you are eligible for. Expert appraisers will evaluate your property based on various factors such as location, market value, and condition.

Loan Approval: Following a successful valuation, INR Plus will review your application, verify the provided documents, and perform a credit assessment. If everything aligns with the requirements, you will receive loan approval!

Disbursement: Upon loan approval, the funds will be disbursed directly to your account. Seamlessly access the funds you need to… [insert transitional phrase] take the next step towards achieving your financial goals!

FAQs: Addressing Your Concerns

Q: Can I continue to occupy the property while availing Apply Loan against Property - INR Plus?

A: Absolutely! You can continue to reside in your property while enjoying the benefits of Apply Loan against Property - INR Plus. There's no need for a change in your living arrangement.

Q: What happens if I default on my loan repayments?

A: Defaulting on loan repayments can have serious consequences. INR Plus advises borrowers to maintain regular repayments to avoid penalties, including possible legal action and damage to your credit score.

Q: How long does the approval process for Apply Loan against Property - INR Plus usually take?

A: The timeline for approval may vary based on factors such as document submission, property valuation, and the complexity of your application. However, INR Plus strives to process applications as quickly as possible, aiming for a prompt turnaround time.

Q: Is it necessary to have a high credit score to be eligible for Apply Loan against Property - INR Plus?

A: A high credit score is not a mandatory requirement for Loan against Property - INR Plus. INR Plus considers various factors such as property valuation, income proof, and repayment capacity while evaluating eligibility.

Q: Can I prepay my loan partially or in full before the tenure ends?

A: Yes, you have the option to prepay your loan partially or in full before the agreed tenure. However, it's essential to check with INR Plus regarding any prepayment penalties or charges that may apply.

Conclusion

Unlocking the value of your property has never been easier with Apply Loan against Property - INR Plus. Gain access to funds, enjoy competitive interest rates, and achieve your dreams with the flexibility of this innovative financial solution. Whether you have aspirations of starting a business or need assistance with major expenses, Apply Loan against Property - INR Plus empowers you to take charge of your financial journey.

So, why wait? Apply for Loan against Property - INR Plus today and harness the power of your property to unlock a world of possibilities!

FOR APPLY LOAN AGAINST PROPERTY APPLIACTION NOW

Visit: https://www.inrplus.in/

Contact: +91-9891751729

Mail At: [email protected]

Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075

#Loan Against Lal Dora Property#Loan Against Property without map#loan against industrial property#loan against rented property#loan against property in gurgaon#Home loan against property dwarka Delhi

0 notes

Text

4 + 1

pairings: bodyguard!joel miller x f!reader

summary: the apocalypse didn't happen. joel shift jobs into becoming a bodyguard for a billionaire’s wife. four times joel realized he's in love and the one time he actually did something about it.

word count: 3.8k

warnings: explicit (18+), p in v, no protection, infidelity, implied domestic abuse (not by joel)

notes: this is my fav to write by far ♡ if ur a writer or loves reading, chat me up and let's be moots

Clementine hues of orange sauntered in through the slick frame of her kitchen windows, causing a layer of tinted filtering to be added throughout the boring beige paints littered all around. Everything was in honeyed tones, beautiful and soothing. He had to admit that there was something godly about your kitchen. Something he couldn’t resist.

It was much different compared to the heavy smell of paint and cement he’s smothered in back when he’s still dwelling in construction. Instead of the constant buzz of drilling and swings of hammers into wooden panels, he’s now embraced in an endless collection of Jazz. His shoes are now polished— he could even see his own beaming reflection in the shiny black. A fitted tuxedo snug against the broad of his chest— a total 180° change from his Texan classic style of flannels and denims.

Joel used to think that he’s all too ill-mannered to be participating in the posh bullshit rich families are prone to, but when he saw the ads your husband was posting out, he couldn’t possibly decline the offer. The pay was enough to get Sarah all the way through university without picking up loans and it came with barely a risk.

He was just there to follow a billionaire’s pretty little wife around, carry your bags of impulsive purchases, and drop you off to go drink martinis with your girlfriends. The gun tucked into his back pocket was merely for show. After all, his dirty scowl is usually enough to set people aside. So, he signed the contract and was tied to what he envisioned to be a snobby flashy gal.

But you were an anomaly.

You were the opposite of the few descriptive words your husband mapped you out as, which he recalled to be ‘bimbo’ and ‘a pain in the ass’. You were lovely. The kind of girl that’d bake your husband a sweet tray of apple pie in your cute little dotted blue apron. He was guilty of watching your every move. Every bend, perk, curve of your body. Because, duh, he had to make sure you weren’t harming yourself. What if you accidentally set a fire off in the stove? At least, that’s what he’s telling himself to fend upon his guilt.

“Come on. Open your mouth, Joel!” you cheered excitedly at the sight of your glistening apple pie, cut open into perfectly eight slices. As the fork pierced through the warm, flaky crust of the apple pie, the sweet aroma of cinnamon and baked apples filled the air. The crust crumbled ever so slightly as the fork lifted a generous slice, revealing the warm, gooey filling. A persuasive look keen on your face as you raised your fork forward, just a few inches away from his pursed lips.

“I don’t think I should, ma’am.”

“Why not?”

“Your husband’s coming home soon..” he trailed off, uneasy about the increasingly delicate situation.

“So? Married people can’t have friends now?”

You could closely watch his determination waver, because god did your apple pie look good even from a distance. But he shouldn’t be doing this on the job, right? Playing kitchen with you out of all people.

“We’re not friends.”

“Oh, we’re not?”

“No,” he shook his head.

Only to entertain you and play into your own rhythm of things, Joel sank his teeth into the tender apples and buttery crust, sweet flavors exploded on his tongue. The warm, rich filling oozed out of the pie and coated his palate in a heavenly blend of spices and sweetness. What made it better was the shy smile you had on your face, unmarred by what the world had to offer. Your eyes twinkle fondly, sparking what felt like fireworks in his belly.

“Good?”

He simply nodded. Joel chewed slowly, averting his gaze away from you because who knows what he might start to imagine if he’s constantly being presented that view of you.

“Mr. Waterford’s gonna like it,” he reassured.

“Wait. Joel. What does that spell out?”

You enquired, brows furrowed as you tried to make sense of the word he’d just put together on the tiled board. Your lips pursed and you tilted your head slightly to the side, as if trying to get a different perspective. It seemed that your feigned innocence managed to work wonders in your bodyguard’s head, because his brows knitted along with yours, seemingly worried that he might actually get the word incorrectly. It may have been the nth time that you toyed around with him childishly, but it’s not your fault he always had such a silly expression to share each time.

“Darling,” he read the word aloud innocently. Texas twang dripping from every syllable.

“Yes, honey?”

Joel looked away bashfully at your playful banter. You could tell he’s raking his head to find ways to try and guide the conversation back into a safe spot. To maintain professionalism, where his heart doesn’t have to race a million times per second and his palms doesn’t have to turn all clammy from a childish joke. But he’s failing. Miserably at that. He tried to muster up the courage to respond in kind, but his mind went blank, leaving him tongue-tied.

“I’m just joking. You’re not mad, are you?”

Of course, he’s not mad. He could never be angry at you even if you sometimes do the weirdest things he could ever think of, like that one time last week where you decided you should try out every single barbeque sauce available in the supermarket. You’re just too sweet to be angry at. Snow could melt if you were there beaming that same dear smile of yours, miracles could happen if it was you. Joel thought that this was his punishment. A karma for all the terrible things he did throughout his twenties, the girls he fiddled and the money he possibly swindled. It’s hard to watch you and not be able to put his hands on you. It’s unfair.

“No,” he whispered vaguely as he drew more tiles from the messy pile. Joel looked amazingly dedicated for a bodyguard who’s being forced to play Scrabble with his employer’s wife— you found it hilarious, which resulted in the delicate giggle you uttered.

“Why don’t you hang out with your actual friends, Mrs. Waterford?”

You frowned.

“First of all, never call me by his name. Second, why do you care so much about who I hang out with?” you seethed out petulantly.

Even when you’re throwing a silly tantrum, he still looked at you as if you held out the sun and the moon. As if you’re the beginning and the end, but you weren’t going to assume what might just be a figment to your foolish imaginations.

“Sorry. I just.. I don’t have to play the dutiful, elegant wife when I’m here. I don’t have to pretend like I enjoy tea times and chalky macarons.”

You hate playing dress up when you’re just there to be your husband’s little pet. Ready to serve him at your every move. It’s suffocating to pretend like you’re content with how your life turned out to be, to giggle at condescending jokes other wives make, or to let your husband degrade you in front of other members of the high society. You felt like a mannequin and you’d rather be here, comforted in your own qualms with Joel. Simple ol’ Joel from Texas who took such good care of you.

“I can’t say I understand.”

Joel chuckled, thinking back to his rather ordinary background. He didn’t think he ever had to participate in any social events unwillingly, except when his mom dragged him to church on Sundays when he was younger, but that was different. You were in another realm. Someone who’s not equal to him.

“Although, I’m glad you feel at ease with me.”

He’s so good with his words, you sometimes wonder if those sweet compliments actually meant a thing. You simmered at his encouragement.

Tonight marks the evening of the Annual Spring Ball. Joel, being the country boy that he is, didn’t have much clue regarding what significance this particular event held. Although, he guessed that it was a big thing considering the pile of dresses you’ve dumped carelessly in front of your walk-in closet. You’re always so messy. Maybe he liked that about you.

He stood aimlessly, feeling like a nervous boy waiting for his prom partner to reveal themselves. It crept from inside his stomach and the grip it had on his throat grew tighter and tighter the longer you took in that damned dressing room. You’re not even going with him to this presumptuous event. You’re going with your damn husband, so why is he getting ahead of himself?

“What do ya think?”

You came bursting out of the pale blue curtains like a ray of sunshine, cladded with a long fitted evening gown. He was convinced that black belonged to you. The gown was made of flowing, luxurious fabric that draped elegantly down the womanly curves of your hips.

He couldn’t help but take a peek down your classic plunging neckline, like a fucking pervert. A flattering scoop that showed off your delicate collarbone and décolletage. Viewing a glimpse of your soft mounds propped up by the tailored bodice had him shifting from one leg to the other. God, you looked like a goddess blessed you personally. Waterford is a lucky man having you by his side.

“Is it too much?”

“No. It’s just..”

Joel swallowed thickly. How he wished he could say how you’d stolen his heart and robbed him of common sense.

“You look beautiful. Mr. Waterford would’ve-”

“Can we not speak of my husband?”

You interrupted bitterly. He wasn’t sure if he saw it correctly, but he could see a look of solemn ghosting over your sweet features. How you suddenly stop being all chirpy and instead, settle on chewing your inner lip. Joel was worried and it took all of him not to prod into whatever it is you’re hiding behind all the kind and warm facade. He was simply your bodyguard and that’s all he’ll ever be so why impose?

“Will you help me with my pearls?”

“Of course.”

He swiftly walked over to the jewelry case he’s grown accustomed to, not because he ever had thoughts of stealing your precious belongings, more so because you’ve allowed him to enter and assist you in your bedroom way too often. He’s memorized every inch of the blush tinted room without fail, maybe because he was a good help or maybe.. because he’s undeniably infatuated in you. With much precision, he held the shiny pearls in between his rough fingers. Only to gently clasp the chain around your neck. The ghost of his fingers on your bare skin made you shudder in anticipation.

He might’ve overstepped his boundaries by tracing over the exposed skin of your back, feeling the bumps of your spinal cords as if he’s a professional harpist. His gaze settled on where you felt the most plush and smooth. How he wished he could feel more of you; was the rest of your unexposed skin this delicate? Did you like this?

A pregnant silence enveloped the both of you. A mutual understanding. You were nervous, enough that you could listen to how your heart pumped blood into your increasingly warm cheeks.

“What is this?”

He broke the sacred silence at the irregular hues blooming from beneath the velvet fabric. Blues, purples, some were still inflamed, red marring your sacred skin. You were bruised. Bad. His eyes went wide at the sight of permanent scars shaped like a long rod buried deep in your skin, the new skin much lighter than your skin tone. If he weren’t attentive, he would’ve missed the way it hid underneath the hemlines.

The worst part was you didn’t say anything. Just showcasing him the same ol’ smile as you turned.

Ever since he saw your marks, the ones you’ve tried your very best to cover and withheld from the world, you’ve avoided him more than ever. Joel Miller was specifically assigned to you. To cater to your every need and protect you from the danger you might encounter, but it’s hard to do his job properly when the danger was from within.

He’s seen the way you lock your doors in his presence, leaving him uneasy as he guarded in front of your door. He’s also noticed how you stopped baking sweet apple pies, quit picking the juicy strawberries in your garden, and were lost in your own thoughts more often than anything. Maybe you’ve had enough of playing house with the lousy bodyguard he was. Maybe he was too old, too wrinkly, and too nosy for your taste.

“Joel?”

“Yes,” he answered almost too eagerly at the pleasant call of his name. His puppy-like brown eyes peaked through the small crack of your door.

“Come in. I have a surprise for you.”

A surprise for him? Didn’t you hate him? Joel looked almost entranced at the sudden knowledge. He took a determined step into your room, your wooden door creaking close behind him. You narrowed your eyes to strengthen your vision towards his striking figure. Without shame, you took in all of him. You’ve missed him as much as you hated to admit. Joel was a crucial part to your daily life. He’s a breath of fresh air. The only thing keeping you alive when you’re caged in this mansion.

“Winter’s coming.”

“It is,” he spoke softly, out-of-breath at the sight of you in your nightgown. His pupils dilated erratically at what you’ve blessed him with.

“I knitted you and Sarah matching scarfs.”

You pulled out the most beautiful pair of scarfs out of your side table, decorated with your favorite shades of ballet pink and powder blue. It wasn’t the cleanest work out there. A few loose and uneven threads here and there, but it was the most someone has ever done to him in a very long time.

It felt sincere and heartfelt. You even knitted one for his daughter who he’d only mention briefly during your time together. Once during your weekly Scrabble game and the other time when he entertained you during a house party. He smoothed the thick fabric down, tears pricking his eyes from the emotions budding from within.

“Are you seriously crying?”

You chuckled at the sight, arms crossed in front of your chest at the sight of your tough and grouchy bodyguard tearing up over some scarf. Joel meant more to you than you could ever admit. Maybe this’ll show him that part of you, just enough that your husband would never notice and you could still play it off as an act of kindness.

“That’s so lame, Joel.”

Fact is.. you were magnetic. The sweetest thing he’s ever witnessed in his long thirty six years of life, yet you’re stuck here playing wife of Waterford. Joel wanted to be your knight in shining armor and bring you to safety where he’d cherish you all his life, but what could he do? Should he just witness you wither away into an empty shell? The thought brought up the long awaited bravado and he was already bringing you up into his arms. Wrapping you in a tight embrace where all he could feel was you and only you. The softness of your pliant body, the smell of strawberries and cinnamon, and your undeniable warmth.

“You’re not happy,” he muttered underneath his breath, brows knitted and wrinkles evident.

“I will be.”

You paused.

“I have to be.”

You reassured him, pulling away from his grasp slightly. Your longing eyes bored into him with a tinge of emotion he couldn’t quite decipher, but it all became clear when you finally kissed him. You tasted better than he could ever imagine.

“Tell me you don’t want this.”

His voice was tantalizing, the rough bristles of his scruff tickling the curve of your earlobes in a manner that made you feel small. You couldn’t really pipe up a sweet comeback to what he had to say. Not when you’re pinned face down onto your fresh floral sheets, the same one you’ve spent countless nights with your estranged husband.

The crisp fabric felt cool and smooth on your squished cheek, you could even smell the lingering notes of softener wafted through the air. Joel caged you in like some sort of feral animal. Thick muscular thighs pressing next to your own as he loomed over you.

“You’re driving me insane, darlin’. Bending over with that silly knitted dress of yours.”

He murmured out into the junction of your neck. Always so careful with you, he made sure to smooth down every inch of your pristine skin, over each and every one of your scars and marks. His fingers were electric, jolting you every time he made bare contact.

You whined a soft tone when he pulled the wool hem of your dress upwards. Leaving your perky butt exposed to the cold air with nothing on but the panties you’ve chosen specifically for him. The one with the pretty pink bow and lace rimming each side; the one you knew he’s secretly pocketed a few times.

“Fuck. Such a pretty cunt. Is this for me or for Waterford?”

You were just too good to be true. Someone so perfect like you was willing to let him have a taste of what heaven on earth was, even when your husband was downstairs mingling with the other party guests. Joel was ecstatic at the thought. His eyes twinkled with obsession as he pulled your panties aside, probing a finger into your sloppy hole. One of his fingers was swallowed whole by your throbbing cunt and all he could hear was the loud squelching noise it made. It was as if you hadn’t been filled to the brim for a very long time. What a waste.

“For you. Only for you, Joel.”

Joel couldn’t hide the smugness running deep in his expression, pulling onto each corner his mustache. The constant need to prove himself to you tipped him over the edge. He wanted to be gentle with you, to be kind and cautious, because you were his everything, but it’s harder when he’s already leaking in his boxers. Seven inch, uncut, and sensitive. His fat cock thrived at the thought of you aching beneath him.

“He didn’t fuck you well, did he? Left you all wet for me.”

He teased sweetly as he unzipped his pants eagerly, only to tug at his waistband swiftly. Joel felt the adrenaline rushing through his headspace. It might be fucked up but somehow he wanted to prove how good he is for you, how he’d let your husband barge in if it meant proving how you’re such a good fit for his girth.

At the thought, Joel leaned forward to nip at your pulse point. You whined for more. He cooed softly, making sure you were slick enough as he flicked his cock along your needy slit. His thick raspy groans were heavenly, yet sinful for you to hear. You’re married for goodness sake.

“Put it in me, Joel. Fuck me. Please. Now.”

Your incoherent begging was music to his ears, enough that he gave in to your requests. He prodded his leaking tip into your entrance. Joel was unable to hide his pleasure, lashes fluttering as he rolled his hips in one sharp movement. He had to stop immediately once he’s buried deep in your velvety walls. Knowing he’d burst if he was to continue. He let out a breathy chuckle, grounding himself with all his might.

“Joe-el!”

That’s all you could muster as you pushed your hips further back into his, babbling hopeless pleads in hopes that he’d move and solve the everlasting coiling need. Such a slut.

“I got you, darlin’”

He held you steady by the small of your hips, adding ample pressure to have you arching back nicely. Joel fulfilled his promise by sheathing himself entirely within you. Slick and sloppy, he pounded into you. You’re on cloud nine. Desperately muffling his name into your bed sheets as if it’d make a difference in the boundaries you’ve crossed on this eventful day.

The golden ring band encircling your finger taunted you whilst it glimmered underneath the dim lights: all about your failing marriage and your stupid affair. You knew this wasn’t going to last long. Hell, things could fall apart if your husband caught a whiff of Joel’s cedar cologne on you.

“Stay with me, please, darlin’”

Joel looped his tough arms over your chest, effectively straightening you upright against his firm chest. His tip probed deeper inside you at the new position, exploring places you didn’t think was possible. You couldn’t see him and you thought it might be better. For you didn’t have to remember how unbelievably hot he looked while fucking you from behind; you’d worry his name would slip in your head when Waterford finally required you to cater to his needs.

“Run away with me.”

He tried once more and you had to say, it was quite a romantic gesture to attempt when he’s twitching vulgarly inside you. There was a sense of need in his voice. He’s begging you to leave all this luxury and royalty behind for the love he had to offer. What was it.. modern times Romeo & Juliet? You let out an airy moan in response, backing up even further to fulfill your burning desire. The coily dark trim on the base of his slick cock scraped your soft skin. He’s inside you entirely. Without any barrier because god did he secretly want to pump you full of cum. Maybe he'll let you wander back onto your husband's arms with his cum still stuffed deep within you.

“I can’t.”

You shook your head, a soft gasp slipping past your lips as his grip tightened around your wrist. His nails dug out crescent shape marks into your skin uncomfortably.

“Joel. Shit. Don’t move.”

He obeyed. A small grin taking over when he witnessed the shake of your legs and how you looked heavenly even when you’re seconds away from climaxing. He relished in the way your tongue cutely darted out like a dog in heat. You’re still cute even when you’re all spread out for him.

“I love you.”

He whispered once more, voice fleeting against your ear. Joel needed to kiss you. Needed to feel your soft lips on him for what might be the last time. His nimble fingers gently guide your jaw to turn his way, wrapping you in such an emotional kiss. As if you’d wither away if he didn’t hold you down tight enough.

“Please say it back, darlin’. Please?”

And just like that, he submitted to your wishes and let the mighty dam fall apart. A soft groan you’ve never heard before mused out his parted lips. He’s filling you up so full with a taste of him to the point that it’s leaking out each side of your thighs. A white rim left behind. Tonight he thought that maybe white belonged to you as well, just like black did.

“I love you too, Joel.”

#joel miller x reader#joel miller x you#joel miller fic#joel miller#joel miller tlou#tlou#the last of us#the last of us fic#the last of us imagine#joel miller smut

629 notes

·

View notes

Text

The Democratic primary for U.S. Senate in Maryland is rapidly devolving into one of the most bitter intra-party contests of the 2024 election cycle.

WHY IT MATTERS: Whoever emerges from the bruising May 14 primary will likely face an electoral juggernaut in Republican former Maryland Gov. Larry Hogan.

• Republicans hope that making the seat competitive – albeit still likely Democratic, according to the Cook Political Report – will force Democrats to defend more territory than expected in an already difficult 2024 map.

• Rep. Jamie Raskin (D-Md.) said Maryland Democrats are "all committed to dampening down the negativity and preparing to support whoever wins."

• "This is so much bigger than any individual's ego or career ambitions. This really is about the future of the country. We cannot afford to lose a Senate seat," he told Axios.

STATE OF PLAY: Rep. David Trone (D-Md.) is running against Prince George's County Executive Angela Alsobrooks to replace retiring Sen. Ben Cardin (D-Md.).

• Trone, the wealthy owner of Total Wine, has loaned his campaign at least $54 million, per FEC filings.

• But Alsobrooks, who would make history as Maryland's first Black senator, has the backing of most of Trone's colleagues in the state's congressional delegation.

THE LATEST: Trone has courted controversy and outrage in recent weeks with a series of inflammatory comments.

• After Trone inadvertently used a racial slur at a committee hearing in March, several Congressional Black Caucus members got off the sidelines to endorse Alsobrooks.

• Last week, Trone ran an ad in which a Black local official said of Alsobrooks: "The U.S. Senate is not a place for training wheels." The ad was rebroadcast without the line following backlash from Black women.

• On Saturday, dozens of local and state officials signed onto statements slamming Trone for referring to Alsobrooks' endorsers in her home county as "low-level folks."

WHAT WE'RE HEARING: These incidents have caught some of Trone's colleagues who endorsed Alsobrooks off guard.

• The "training wheels" ad "indicated to me that Alsobrooks really does have a lot of momentum," Raskin said. "I don't think they wanted to go negative ... that feels like a reaction to some bad news."

• Rep. Glenn Ivey (D-Md.), in reference to the "low-level" comment, noted that he and former House Majority Leader Steny Hoyer (D-Md.) both represent Prince George's County and support Alsobrooks.

• "I was a little surprised to hear a comment like that ... some people think Congress is a high-level office," he told Axios.

THE OTHER SIDE: "Our opponent and their supporters have been attacking David Trone for nearly a year, and now a Super PAC backed by a Larry Hogan donor is airing negative attacks to distract Maryland voters," the Trone campaign said in a statement.

• "David Trone is the only candidate in this race who can beat Larry Hogan, that's why his own donors are propping up outside attacks to deliver Mitch McConnell's chosen candidate their preferred opponent."

• State Sen. Jill Carter, who is Black, argued it is "deeply hypocritical" to claim the race is "about making history" because "no ire" was directed at Sen. Chris Van Hollen (D-Md.) for defeating a Black woman to claim his seat in 2016.

• Alsobrooks supporters should "move beyond the dagger throwing so we can focus on defeating Larry Hogan," Carter told Axios.

WHAT TO WATCH: Trone's "low-level" remark appears to be reverberating beyond the Senate race and creating tension within the Maryland delegation.

• Ivey told Axios that Trone and the rest of the delegation had "been able to work together," but "I don't know if that's changed in the wake of his ... strange comment."

#us politics#news#Democrats#2024#2024 elections#axios#us senate#Larry Hogan#Cook Political Report#Rep. David Trone#Angela Alsobrooks#Sen. Ben Cardin#Rep. Jamie Raskin#fec#total wine#racism#Rep. Glenn Ivey#rep. Steny Hoyer#Jill Carter#Sen. Chris Van Hollen#maryland

5 notes

·

View notes

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure.

— Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

6 notes

·

View notes

Text

Underfamily Playlist

These are songs we feel fits the Underfamily characters. Many of these songs were inspiration for their story, but we can't really remember which ones. ^^; so just have the entire playlist instead!

The lyrics in these songs are all very important for the characters. Some made us cry QwQ

Frisk's songs

Lost Control (Alan Walker)

Medicine Man (Alec Benjamin)

The Doctor Said (Chloe Adams)

Toxic Thoughts (Faith Marie)

I Can't Carry This Anymore (Anson Seabra)

Dreamy Night (Lilypichu/Comfi Beats)

Never Enough (The Greatest Showman)

The Dark (Beth Crowley)

Frisk's songs (about/to their lost loves)

Secret Love Song Pt || (Little Mix)

Too Young (Sabrina Carpenter)

Running Up That Hill (Katie Bush)

Maps (cover by Max and Alyson Stoner)

Wake Up (EDEN)

Hymn For The Missing (Red)

Dead Hearts (Cover by Alec James Milewski)

You Are My Sunshine (Jasmine Thompson)

Dancing WIth Your Ghost (Sasha Loan)

Broken Records (He Is We)

Everything (Diamond Eyes)

Hindenburg Lover (Anson Seabra)

Dancing In The Sky (Dani & Lizzy)

Living Without You (Beth Crowley)

Frisk & Their brain buddies

Evelyn Evelyn (Evelyn Evelyn)

Camilo's Interlude [Stripped version] (Laureli Amadeus)

Frisk & Chara

Little Game (Benny)

Disappear (acoustic version, Dear Evan Hansen)

A Whole New World (cover by Reinaeiry)

A Million Dreams (The Greatest Showman)

Only Us (cover by Reinaeiry)

Autumn (Reinaeiry)

Something Good (Beth Crowley)

Skin And Bones (Beth Crowley)

Chara & Asriel/Flowey's songs

Lose Somebody (Kygo) -Asriel/Flowey/Chara's song to eachother-

Archer (Taylor Swift) -Asriel/Flowey's song to Chara-

Sweeter Than Fiction (Taylor Swift) -one of Chara's songs to Frisk-

Don't Think Just Run (Beth Crowley) -one of Chara's songs to Frisk-

Frisk's & Skelebros

Issues (Julia Michaels)

Home (Vanessa Carlton)

Flashlight (cover by Bri Heart)

Found/Tonight (DEH/Hamilton)

Skelebros songs

Hey Little Brother (Daniel Shaw) -Sans's song to Paps-

Be Somebody (Thousand Foot Krutch) -Papy's song to Sans-

Home (Cavetown) -Papy's childhood song-

Color Outside The Line (He Is We) -Papy's teenage song-

In My Arms (Plumb) -Sans to Papy & Frisk-

Talk To Me (Cavetown) -a song to Frisk-

I Lived (OneRepublic) -a song to Frisk-

Home (Phillip Phillips) -a song to Frisk-

Other Characters

In The Bedroom Down The Hall (DEH) -Frisk's moms' song-

Wherever You Will Go (Charlene Soraia) -Frisk's lost loves' song to them-

#playlist#music#underfamily#undertale#undertale au#frisk#frisk gaster#sans#skelebros#utdr#papyrus#charisk#charaxfrisk#theme songs#chara x frisk#ask blog#sans gaster#papyrus gaster#polyamory

11 notes

·

View notes

Text

Job Loss: Manage Your Finances Wisely

Staying within budget is an important task, especially when you're pounding the pavement in search of a job.

But, from cross-town interviews to looking professional, the job hunt can become pretty pricey in itself. Luckily, there are ways to cut costs while searching for a new job so you don't break your budget.

Job Hunt With a Buddy

Not only is a job-hunting friend great moral support when you're jumping around town from one interview to the next, they're also a great way to cut traveling costs in half. In other words, when it comes to transportation, carpooling is a budget lifesaver.

Okay, so you lost your job. Maybe you knew it was going to happen and you weren’t surprised, maybe you had no clue and it was a total shock. However you got here, the truth is you are out of work and it’s time to start your job search. Click To Tweet

Taking turns driving to interviews and splitting the cost of gas helps save money while looking for a job. Likewise, if you're searching for a job with a friend in a big city, splitting the cost of a taxi is a great way to reduce expenditures.

Either way, a friend at your side is a great thing to have come interview day.

Pack a Lunch

Grab your favorite lunchbox and make a sandwich, because bringing lunch on the job search will cut restaurants and fast food out of the cost equation. Plus, eating a healthy lunch will keep your energy level up from interview to interview.

In addition, stay well-fed and hydrated throughout the day by bringing portable snacks and refreshments.

Nuts, granola, and a couple of bottles of water won't take up much room in your purse or briefcase, but they will help you go the extra mile while staying under budget.

Arrange Multiple Interviews Per Outing

If you really want to get the most bang for your job hunting buck, try to fit at least two interviews in a day. Not only will it raise your chances of finding a job faster, but you also won't waste the time and money it takes to drive back home.

So, if possible, try to arrange multiple interviews with companies on the same side of town. But, give yourself plenty of time between interviews to recoup and also eat that lunch you brought along for the ride.

Learn the Bus Schedule

In the world of public transportation, city buses are definitely the most affordable option. Likewise, taking the bus as opposed to a taxi or the subway is more affordable and much more convenient.

Because most city bus transit systems have hundreds of routes and thousands of stops, you're more likely to get to interviews faster and without many roundabouts walking. But, you must familiarize yourself with your city's bus system before it becomes a viable interview-hopping option.

Look the Part for Cheap

Looking professional is of the utmost importance when it comes to interviewing, but it's also costly to look the part, especially because interviewing could last weeks. That said, there are a few frugal ways to look great for each and every interview.

"You’d never set out on a cross-country road trip without consulting a map. Likewise, you can’t expect to reach your financial goals without developing a plan for spending and saving.

Budgets play a critical role in helping consumers pay off debt, build their nest egg and make the most of their hard-earned dollars." - Bankrate.com

First of all, buy one nice outfit and take care of it. Considering you'll only see the majority of interviewers once, a well taken care of suit will definitely last you until you land a job. Likewise, instead of visiting a professional hairdresser every other week, visit a beauty school for discount haircuts and trims. If you do need a loan, check out a licensed money lender in Singapore.

By following the tips above, you'll stay within budget until that next payday rolls around.

Budgeting 101: From Getting Out of Debt and Tracking Expenses

$15.99

$11.89

This clear and simple guide provides tons of practical advice for keeping track of your finances. With useful tips on setting financial goals, reducing debt, finding ways to save money, and creating and following a budget plan, you’ll have your dollars and cents under control in no time.

Buy from Amazon.com

Buy from Walmart.com

We earn a commission if you click this link and make a purchase at no additional cost to you.

06/02/2024 09:31 am GMT

Read the full article

0 notes

Text

Achieve Your Own "F.I.R.E." Through Real Estate | Eric Vogel & Jay Conner

Private Money Academy Conference:

Free Report:

Eric Vogel left his career after 8 years as a high school band director to focus on renovating their rental properties and flips.

He enjoys helping others find their path to financial independence, hiking, playing guitar, spending time with his family, and home renovation projects.

Real estate investors Tiffany and Eric Vogel are the founders of www.onpurposeinvestor.com. In 2017 they began their real estate investment journey after just one year of dating – before they even got married!

They bought their first property with an FHA loan and zero equity. Both have a unique set of strengths that they bring to their partnership.

Eric often uses his Army National Guard experience and discipline to help with mapping out goals and paths.

Tiffany found that she didn’t want to completely abandon working in the corporate world, so she continues to consult part-time, in addition to her real estate investing.

After achieving FIRE (financial independence retire early), they set their vision to share their story with others and help them pursue their ideal lives.

Timestamps:

00:01 - Raising Private Money Without Asking For It

04:40 - Achieved financial freedom after 3 years of renovating.

07:49 - Be cautious of vanity metrics in real estate.

11:49 - Focus on ethical, legal, and mindset change.

15:57 - Cultivate a spirit of giving for financial independence.

20:16 - Recommend reading "Making It Big on Little Deals."

24:13 - Focus on gratitude, reflection, and personal growth.

27:53 - Visit https://onpurposeinvestor.com/privatemoney for materials and webinars. 50% discount available with code RPM24.

28:39 - The Program provides extensive support and community resources.

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

What is Private Money? Real Estate Investing with Jay Conner

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

youtube

YouTube Channel

Apple Podcasts:

Facebook:

#youtube#flipping houses#jay conner#private money#raising private money#real estate#real estate investing#real estate investing for beginners#foreclosures#passive income

0 notes

Text

Description

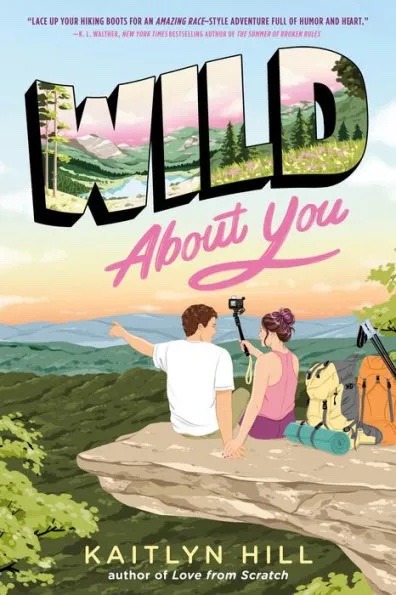

Two total opposites. One race through the Great Outdoors. In this grumpy-sunshine teen romance from the author of Love from Scratch and Not Here to Stay Friends, the trail to true love doesn't always come with a map.

Natalie Hart has always been loud, unfiltered, and unapologetically herself. But then comes her freshman year of college, when she loses her merit scholarship and gains one pesky little anxiety diagnosis.

Hesitant to take out more student loans, Natalie decides to shoot her shot and applies to Wild Adventures, a popular outdoorsy reality show. Sure, Natalie prefers her twelve-step skincare routine to roughing it on the Appalachian Trail while competing in challenges against other college kids, but that scholarship prize money is calling her name. High risk, high reward, right?

Enter Finn Markum, her randomly assigned, capital-O Outdoorsy teammate whose growl could rival a black bear. These partners have more friction than a pair of new hiking boots. Or is it flirtation? Turns out falling in love might be the wildest adventure of all...

Available Editions

EDITION Other Format

ISBN 9780593650950

PRICE $12.99 (USD)

PAGES 384

Available on NetGalley

NetGalley Shelf App (EPUB)

Send to Kindle (EPUB)

Download (EPUB)

My Review

5 ⭐️⭐️⭐️⭐️⭐️

I thoroughly enjoyed this story. It was so entertaining, full of many laugh out loud moments, making new friends, learning new skills, and falling hard for each other along the way. Their adventures and competitions are taxing from day to day but as they grow more dependent upon each other their feelings for each other grow. There is so much more to this sunshine/ grumpy trope than I thought there would be going in on my first book by Kaitlyn Hill and I fell hard for these two opposites.

This is Natalie and Finn’s story

Natalie and Finn are paired up together by finding the same color backpacks on the first day of the Wild Co-EdVentures reality show. They will have to make their way along a 170 mile stretch of the Appalachian Trail, competing each day for a chance to win $100,000 in scholarship money for each partner of the winning pair.

I could totally relate to Natalie and her lack of any experience in the great outdoors. But I felt that to be 19 years old and to be trying to help her situation by going on this competition was so brave, especially with anxiety and without any support system at home except for her friends. Meeting handsome, grumpy, Finn is her savior in this competition. He had it going on with most of the challenges and his outdoor experience saved them for sure. But it was the banter between them and their communication that really made me swoon for Finn.

“It’s a kiss that shows everyone else what we already knew—that we won long before we got to the finish line.”

There was no room for anything but good vibes inside me, while I read this story. It was so full of happiness, desire, attraction, relief, all bubbling together. From them climbing trees, coming face to face with a black bear, crossing a string bridge, it was their ability to bring out the best in each other. If you are a fan of camping or not, you will love this fabulous adventure!

I Loved This!!! Get your copy now!

I received an early copy and this is my honest review!

0 notes

Text

Deep Library Cuts

Summary:

If you asked Alex’s high school teachers, they’d be shocked to learn that she was regarded as an extremely detail-oriented and historically accurate author. (Or the one where Alex is an author and Harper is her librarian best friend)

Alex beat out her siblings for the role of the family wizard. When it came time to take the title, she couldn’t do it. It wasn’t a question of who deserved it. It wasn’t even a question of who wanted it. To Alex, it was a question of who needed it. The only answer was Justin.

She could never take that part of his identity away from him. It was an intrinsic part of Justin - built into the very fabric of who he was as a person. Some people were born to do certain things, and Justin was born to be a wizard.

On the other hand, Alex still needed to find out what she wanted. Despite her love for fashion, she wasn’t sure that corrupting that love by turning it into a career was the right move.

Plus, with Justin in the wizarding world, Alex could be the first Russo to go to college. Wouldn’t that be just desserts? Also, if she can clear a path for Max to follow, that would be a pretty cool legacy.

Sitting down with her parents at the beginning of her senior year of high school, Alex learned about the SUNY system and how to make it affordable with loans (and starting at a Community College for her gen-eds). Her mom was essential in helping her map out a path. (Her mom had considered pursuing night classes to secure a business degree, but ended up not moving forward with it yet.)

In Alex’s first year at community college, she learned to apply herself to her studies. It was one thing to slack off when you were required to go to school. It was something altogether different when you spent a significant portion of your time working to afford to go to school. She had plenty of motivation to stay on top of her schoolwork. Eat your heart out, Justin.

It wasn’t easy. As Justin jumped into the wizarding world without looking back, Alex was proud of him. But she missed him. Harper chose to go to college in the middle of nowhere in the Midwest. Thank goodness for Alex’s parents. That’s a sentence she never thought she’d use.

After fighting tooth and nail for her education, Alex graduated with a Bachelor’s degree in English, a job at a publishing house, and several book ideas in her head. It took some time, but once her financial situation was more stable, Alex moved out of her family home. And, immediately into an apartment with four other women (New York rent was no joke). There was a little bit of a culture shock, moving from a home with her family’s idiosyncrasies as opposed to these strangers’ lifestyles. Alex adjusted.

By this point, Max was taking business night classes alongside her mom. He was interested in taking over the family Sub Shop. Alex was more than happy for him to have it. She spent her time working on her first manuscript. She got so sucked into it that she almost missed when Harper returned to the city.

Returning with her Master’s in librarian studies, Harper secured a coveted job in the New York Public Library system - a highly competitive spot. Alex (jokingly, mostly) asked who she had to kill to get it. When Harper refused to answer, Alex burst out laughing.

With Harper back in the city, Alex spent all her time with her. Even when Harper was working. Harper became Alex’s go-to for help researching her novel. As Alex put the finishing touches on her manuscript, she started shopping it around.

Thankfully, Alex got a bite! From there, it was like the floodgates opened. She rode the wave of this book and even started writing a second book while the publishing process started.

A few years later, she had four historical murder mysteries on the New York Times Best Sellers List. If you asked Alex’s high school teachers, they’d be shocked to learn that she was regarded as an extremely detail-oriented and historically accurate author.

“You should consider publishing your work,” Harper said one day out of the blue.

“I have?”

“No, silly.” Harper lightly slapped Alex on the shoulder. “You know what I mean.”

#wowp#wizards of waverly place#alex russo#harper finkle#technically fits in the canon#jk no it doesnt#Alternate Universe#librarian!Harper#Alex is Agatha Christie#Author!Alex#harper finkle/alex russo#Harper is her librarian best friend

0 notes

Link

Home Loan Eligibility

Home loan eligibility criteria has common parameters across all banks and Non-Banking Financial Companies (NBFCs). However, there could also be specific criteria that is applicable for each lender according to their requirements.

It is essential to understand the criteria that is required to be eligible for a home loan eligibility. It helps to ensure that the process of application becomes smoother and easier for you.

Eligibility Criteria for Home Loan

Age 18 – 70 Years

Income Rs. 25,000

Credit Score Above 750

Employment Status Salaried or Non-Salaried

Work Experience 2 Years

Loan Amount Decided by the Lender

Residence Type Permanent resident or Non-resident Indian (NRI)

LTV Ratio Up to 90%

Property Type Completed /Under Construction Project, Land/Plot, build on own Land, Buy Land and Build Home

What are the Factors Affect Home Loan Eligibility?

Age Limit: The limit of age foremost factor a lender/ financier considers when one applies for a housing loan. Normally, financial institutions attempt to limit the house loan term to the primary applicant's age of superannuation.

Income: The applicant falls into, a steady and regular source of income is a must. Basically, there are fewer risks in loaning money if the applicant is an earning individual.

Rate of Interest: Home finance eligibility is always inversely proportional to the rate of interest. If the rate is higher, eligibility will be less and vice versa.

Loan Term: If you opt for a longer tenure, your eligibility will improve. EMIs too will be lesser and manageable. But the downside to this is, that you will end up paying more home loan interest rate.

#home loan eligibility#home loan interest rate#home loan#home loan without map#home construction loan#nri home loan#business loan#financeseva

2 notes

·

View notes

Text

Apply for Loan Against Rented Property anywhere in Delhi NCR through INR PLUS

Owning a property is an investment that can provide financial stability and security. However, not everyone has the luxury of residing in the properties they own. Many individuals in Delhi NCR choose to rent out their properties to earn a steady income. But did you know that you can leverage these rented properties to avail a loan? It's true! With INR PLUS, you can apply for a Loan Against Rented Property online, hassle-free.

INR PLUS Loan Service Provider is a renowned financial institution that provides a variety of loan options to suit the needs of individuals. Whether you need funds for personal expenses, business ventures, or any other financial requirement, INR PLUS has got you covered. Their Loan Against Rented Property is a unique offering that taps into the potential of your rented property and provides you with the liquidity you need.

Applying for a Loan Against Rented Property through INR PLUS is a simple and convenient process. With their user-friendly online platform, you can initiate the loan application from the comfort of your home or office. No more waiting in long queues or dealing with extensive paperwork. INR PLUS has streamlined the loan application process to ensure you have a hassle-free experience.

To apply for a Loan Against Rented Property, you can visit the INR PLUS website and provide the necessary details about your property and rental agreement. The INR PLUS loan provider team will evaluate your application and the potential of your property to determine the loan amount you are eligible for. Once your loan is approved, the funds will be disbursed to your account, providing you with the financial flexibility you need.

The benefits of opting for a Loan Against Rented Property with INR PLUS are numerous. Firstly, you can unlock the value of your investment without the need for a physical property sale. This allows you to retain ownership of your property while still meeting your financial requirements. Additionally, INR PLUS offers competitive interest rates, ensuring that you can avail of the loan at affordable terms.

Furthermore, INR PLUS understands the value of time and provides quick loan processing and disbursal. Their dedicated team of professionals works diligently to ensure that your loan application is processed promptly, allowing you to access the funds when you need them the most. With INR PLUS, you can experience a seamless and transparent loan application process from start to finish.

Whether you require funds for education expenses, medical emergencies, debt consolidation, or any other financial need, a Loan Against Rented Property through INR PLUS can come to your rescue. By leveraging the rental income from your property, you can access a substantial loan amount and manage your finances effectively.

INR PLUS is committed to providing customer satisfaction and strives to exceed your expectations. Their reliable customer support team is available to assist you at every step of the loan application process, ensuring that you have all the information and guidance you need.

So, if you own a rented property anywhere in Delhi NCR and require funds, look no further than INR PLUS. Apply for a Loan Against Rented Property online today and experience the convenience and flexibility of INR PLUS's loan offerings. Say goodbye to financial worries and unlock the potential of your property with INR PLUS.

Contact us for more details:-

Contact Number:- 9891751729

"Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075"

1 note

·

View note

Text

Understanding the Benefits and Risks of Reverse Mortgage Service

Reverse mortgage services offer a unique financial solution for homeowners, especially seniors, looking to tap into their home equity without selling their property. However, like any financial product, reverse mortgages come with both benefits and risks. This article aims to provide a comprehensive understanding of the advantages and disadvantages of reverse mortgage services.

Understanding Reverse Mortgages

Reverse mortgages allow homeowners aged 62 or older to convert a portion of their home equity into cash while retaining ownership of the property.

Unlike traditional mortgages, borrowers do not make monthly mortgage payments. Instead, the loan balance accumulates over time and is typically repaid when the borrower sells the home, moves out, or passes away.

Reverse mortgage loans are insured by the Federal Housing Administration (FHA) and subject to specific eligibility requirements and loan limits.

Benefits of Reverse Mortgage Services

Supplement Retirement Income: Reverse mortgages provide a source of tax-free income for retirees, allowing them to enhance their financial security and maintain their lifestyle.

No Monthly Payments: Borrowers are not required to make monthly mortgage payments, alleviating financial strain and providing flexibility in budgeting.

Stay in Your Home: Reverse mortgages enable homeowners to stay in their homes for as long as they wish, as long as they fulfill loan obligations such as property taxes and insurance.

Flexible Disbursement Options: Borrowers can receive funds in various ways, including a lump sum, monthly payments, line of credit, or a combination of these options, tailored to their needs.

Risks and Considerations

Accumulating Loan Balance: Since no monthly payments are required, the loan balance grows over time with accrued interest, potentially reducing the equity remaining in the home.

Impact on Heirs: Upon the borrower's death, heirs may inherit the property subject to repaying the reverse mortgage balance, which could limit their inheritance.

Costs and Fees: Reverse mortgages may entail upfront costs such as origination fees, closing costs, and mortgage insurance premiums, which can affect overall loan affordability.

Home Equity Erosion: Depending on loan terms and market conditions, the equity in the home may diminish over time, impacting future financial planning and housing options.

Eligibility and Qualifications

Age Requirement: Borrowers must be at least 62 years old to qualify for a reverse mortgage.

Homeownership Status: The property must be the borrower's primary residence and meet specific eligibility criteria, including property type and condition.

Financial Assessment: Lenders evaluate borrowers' income, credit history, and debt obligations to determine loan eligibility and suitability.

Counseling and Education

FHA mandates that prospective reverse mortgage applicants undergo counseling from HUD-approved counselors to ensure they understand the loan terms, risks, and alternatives.

Counseling sessions provide borrowers with an opportunity to ask questions, assess their financial situation, and make informed decisions about reverse mortgage services.

Summary

Reverse mortgage services offer a valuable financial tool for homeowners seeking to leverage their home equity in retirement. While these loans provide benefits such as supplemental income and flexibility, borrowers must carefully weigh the risks and considerations, including potential equity erosion and impact on heirs. By understanding the pros and cons of reverse mortgages and seeking guidance from qualified counselors, homeowners can make informed decisions that align with their long-term financial goals and housing needs.

Contact us,

Name: A and N Mortgage Services, Inc.

Address: 1945 N Elston Ave, Chicago, IL60642

Phone: (773) 305–5626

Map: https://maps.app.goo.gl/5v2R3EgZHUTr9fJA8

0 notes

Text

How to Write a Perfect Home Health Care Business Plan? - Technology Org

New Post has been published on https://thedigitalinsider.com/how-to-write-a-perfect-home-health-care-business-plan-technology-org/

How to Write a Perfect Home Health Care Business Plan? - Technology Org

The population of the world is aging. The World Health Organization estimates that by 2030 one in six people will be over 60.