#form1099

Text

Prepare anywhere and finish at any time with Form1099online.com

Prepare your Form 1099 conveniently from anywhere with Form1099online.com. Our platform allows you to start your filing process anytime and complete it at your convenience. Enjoy a hassle-free, efficient way to manage your 1099 forms online.

#Form1099#Form1099online#TaxFiling#OnlineTax#TaxPreparation#EasyFiling#TaxCompliance#EFile1099#ConvenientFiling#TaxSeason

0 notes

Text

Make tax filing stress-free with Form1099online.com!

Our platform ensures a seamless experience for filing Form 1099 online. Enjoy peace of mind knowing your taxes are in good hands.

0 notes

Text

youtube

Form 1099 is a series of information returns used to report various types of income, including payments made to independent contractors, rents, royalties.

Click here to watch full video: https://www.youtube.com/watch?v=xiCD9APz5l4

#1099#form1099#Form1099MISC#MeruAccounting#TaxFilingTips#accounting#bookkeeping#india#bookkeepingcompany#uk#bookkeepingtips#accountingservices#bookkeepingservices#bookkeepers#Youtube

0 notes

Text

Supreme Trainer is one of the best Form 1099 Online Training Course Providers in the United States of America. Form 1099 reporting has always been tricky, and changes in 2020 and 2021 continue to increase the reporting burden. Tucked away in the American Rescue Plan was a change to reporting on a form called a 1099-K, which has an interaction with contract labor reported on the 1099-NEC. More and more contractors are taking payments via apps such as Venmo – how are those payments reported? Or are they reported at all? These are among the things you’ll learn in this fast-paced, 1-hour webinar. Visit- https://www.supremetrainer.com/product/new-form-1099-reporting-in-2022/

#KirkCousins#Eagles#Jalen#Bills#DariusSlay#Titans#Diggs#Jefferson#WWERaw#IndustryHBO#SKOL#DWTS#QuantumLeap#education#onlinewebinar#form1099#seminar

0 notes

Text

Requirements for 1099 Reporting in the Tax Year 2022

1099 forms are essential for a company's income and expense information to be reported. Employee compensation, payments to independent contractors, attorney fees, and other expenses are all tracked throughout the year. These transactions are recorded on 1099 forms to assist the IRS in matching the data and processing the tax.

If you're self-employed or operate a business, you're well aware of how stressful tax season can be. While filing is only one aspect of the process, the preparation, internal audits, reviews, validation, and other critical activities that lead up to filing season may be rather chaotic.

And if you're sick of searching the internet for the filing information for each of your 1099 forms, we've got some good news for you.

This blog will walk you through the filing requirements for all 1099 forms (all in one place), providing you with the much-needed quick information and insights to help you navigate the upcoming filing season.

So let's get started.

What Are 1099 Forms and How Do I Use Them?

The IRS refers to 1099 forms as "information returns," which are a series of tax information reporting forms. The IRS receives certain payments and income information from businesses and self-employed individuals via these information returns. Taxpayers must prepare and file full 1099 forms by particular deadlines, according to the IRS.

What Are the Different Types of 1099 Forms?

1099 forms come in a multitude of variations, including 1099-MISC, 1099-NEC, 1099-DIV, 1099-K, and so on. In terms of reporting a variety of information to the IRS, each of these information returns has a distinct purpose.

The procedure of all 1099 forms is essentially the same. All 1099 forms are classified as "information returns" because they provide the IRS with certain information about the taxpayer.

The table below lists 1099 forms and their information reporting purposes. This will assist you in comprehending each 1099 form.

1099 Form 1099 Form Description

1099-A Acquisition or Abandonment of Secured Property

1099-DIV Dividends and Distributions

1099-INT Income

1099-K Merchant Card and Third-Party Network Payments

1099-MISC Miscellaneous Income

1099-NEC Nonemployee Compensation

1099-R Distributions from Pensions, Annuities, Insurance Contracts, etc.

1099-S Proceeds From Real Estate Transactions

Is it necessary to file 1099 forms?

If you earned $600 or more in the previous year and/or paid $600 or more to an entity or independent contractor in exchange for their services, you must file 1099 forms for that year.

Is it necessary for you (the payer) to send 1099 forms to your payees?

The transactional information is captured and reported on 1099 forms when a business pays an independent contractor for their services.

The payer (the business) is required by the IRS to provide a copy of the 1099 forms to the payee (freelancer, independent contractor, or vendor) and have the information authenticated. Once both parties have agreed on the tax information reported on the 1099 papers, the payer files the reports with the IRS.

Yes, once again. You must send a copy of the 1099 form to your payee if you paid them $600 or more in a tax year and reported it on your 1099 forms.

What Is The 1099 Form's Minimum Reportable Amount?

The Minimum Amount Reported for 1099-NEC non-employee compensations is $600. You don't required to submit a copy of the 1099-NEC to the payee if you paid your vendors less than $600. But hold on! You must still report it and file it with the IRS. The IRS utilizes this information to double-check the recipient's income information (payee).

When Do 1099 Forms Have To Be Filed With The IRS?

Taxpayers must file their information returns by a certain date, according to the IRS. The 30-day automatic extension of certain 1099 forms has been abolished as a result of the reintroduction of Form1099-NEC, which has accelerated the 1099 filing deadlines.

Form1099Online, an IRS-approved agent, enables businesses like yours to electronically generate, validate, and file 1099 and other information returns.

All of your tax information reporting needs are fulfilled efficiently on one platform with elegant security features, real-time TIN Matching, W-9 Manager, access to 24x7 tax help, Scheduled E-File, and timely reminders.

#1099 nec#1099 misc#1099 div#1099 int#1099 k#1099 r#1099 a#1099 s#form 1099 online#file form 1099#efile form 1099#1099 online filing#1099 printable form#tin matching#1099 forms#1099 efile

0 notes

Photo

The 1099 form is used to document and track payments made for services provided by independent contractors.

Understanding the requirements of this tax form can help your business stay compliant with IRS rules. It ensures that ICs accurately report their income on taxes and provide you a new perspective into how they operate outside of work hours compared to full-time employees.

If you hire ICs to perform services for your business, you should be aware of these basic guidelines. Read here to learn more: http://ow.ly/UAd050EAiyN

#1099form#independetcontractor#taxform#form1099#businessservices#personalservices#paymentservices#legalfees#entity#taxpayers#IRS#familybusinesslawyer#lasvegasattorney#greggordillo#gordillolawfirm

0 notes

Photo

To qualify for and claim the Earned Income Credit you must: Have earned income; and. Have been a U.S. citizen or resident alien for the entire tax year; and. Have a valid Social Security number (not an ITIN) for yourself, your spouse (if filing jointly), and any qualifying children on your return. #eitc #child #earnincome #parents #parenthood #workingclass #workingclasswoman #selfemployeed #enterpreneur #support #smallbusinessowner #tax #taxseason2020 #finacialfreedom #financialliteracy #taxplanning #largerthanlife #nochildren #formw2 #form1099 #incomestatement #financialadvisor #financialstatements #marriedlife #marriedfilingjointly #headofhousehold #workkngprofessional #supermom #superdad #sbts (at Linden, New Jersey) https://www.instagram.com/p/B6YNBVBlERm/?igshid=1pxb9tvjvu918

#eitc#child#earnincome#parents#parenthood#workingclass#workingclasswoman#selfemployeed#enterpreneur#support#smallbusinessowner#tax#taxseason2020#finacialfreedom#financialliteracy#taxplanning#largerthanlife#nochildren#formw2#form1099#incomestatement#financialadvisor#financialstatements#marriedlife#marriedfilingjointly#headofhousehold#workkngprofessional#supermom#superdad#sbts

0 notes

Text

IRA Distribution Basics – Taxation of Distributions

By Beverly DeVeny

Chief IRA Analyst at Ed Slott and Company

Follow Us on Twitter: @theslottreport

Most IRA accounts hold pre-tax contributions and rollover amounts from employer plans. For purposes of this blog, I am going to assume that there are no after-tax amounts held in any IRA, including SEP and SIMPLE IRAs.

IRA distributions where the check is made payable to the IRA owner or the funds are transferred to a non-IRA account are almost always taxable. There are, of course, exceptions. If some or all of the distribution is rolled over within 60 days to another retirement account and no other rollovers were done in the prior 12 months, there is no tax on the rolled over amount. If the IRA owner or beneficiary, who is 70 ½ or older, does a qualified charitable distribution (which is actually a transfer, not a distribution), there is no tax. If you take a distribution to correct an excess or unwanted IRA contribution by the deadline, only the net income attributable would be taxable, not the contribution amount.

All other IRA distributions are taxable.

There is no exception to the income tax due for economic hardship, not even for extreme economic hardship. There is no exception to the income tax due for reasons of disability.

In the case of a divorce, IRA funds can be transferred to an ex-spouse, but only when this is directed by the divorce decree or separation agreement and after it has been approved by a court. The IRA owner who takes a distribution of IRA funds and then turns them over to the ex-spouse will have a taxable distribution. The ex-spouse will not have an IRA.

A distribution from the IRA to pay income taxes is itself taxable. If you owe the IRS $10,000 and take a distribution from your IRA to pay the IRS, you have satisfied the $10,000 bill but you have also added $10,000 to your income for the current year.

Using IRA funds for an alternative investment has tripped up a lot of taxpayers over the years. In order to invest in real estate, master limited partnerships, other hard-to-value assets, gold, or anything other than publically traded stocks, bonds, and mutual funds, the IRA must purchase the asset. The IRA owner cannot take a distribution from the IRA, use the funds to purchase an asset, and then put that asset into an IRA. Simply titling an asset in the name of the IRA is not enough to make an asset an IRA asset. The entire purchase process, from start to finish must be done in the name of the IRA and be between the IRA (and the IRA custodian) and the “seller.” Be wary of promoters who assure you that their asset can be held in an IRA and tell you to just send the money. IRA assets must be held by an IRA custodian.

When the IRA custodian issues a 1099-R showing a distribution from an IRA, don’t ignore it, even if you are 100% sure that your transaction is not taxable. Not including a 1099-R on a tax return is a sure invitation to a polite request from IRS to pay any taxes owed.

This article was originally published by Ed Slott and Company, LLC in The Slott Report on IRAhelp.com on 7/12/17. Click here to view the original publication and read more articles: http://bit.ly/2ua5mjs

1 note

·

View note

Text

Trust File 1099 Forms Online for accurate and reliable tax filing services.

Our team of experts is dedicated to helping you navigate the complexities of tax season with ease.

0 notes

Link

大陆直连看禁闻:https://git.io/jww

作者:长沙罗刚

好多朋友问我,小崔这个事后续会怎么发展,什么结果。

我说,有很多可能发生。

但是有一个结果,不会发生。

就是大家最期盼的结果,绝不会发生。

相关部门彻查,这某人,那某人,税务或上市公司的违规。

这个人那个人都被罚款都被处理,甚至抓人,行业内幕彻底的暴光晾晒,甚至整肃。

深度报道,持续跟进,各种大快人心……

以上总总,不会发生。

为什么。

因为过去发生的,一定会再次发生。

对一个人来说,如此。

对一个社会来说,如此。

霹雳雷霆手段,干净麻利的处理,你见过?

对肮脏的丑恶的全行业的揭露,你见过?

对真相不留死角的挖掘暴光,你见过?

有人说,这次不同。

这次彻查,很多欠款被抄没到国库呀。有利自然会发力去做啊。

这次事情动静太大,肯定要做出事情,群众都看着呢。

不会!

我看明白了,每次,最不应该不了了之的,总是不了不之,这是不断上演的剧情。

曾经上演,就一定不出意外继续上演。

最大的两种结果。

一、事情会奇怪的戛然结束,莫名其妙的结束。

二、或者,事情会拖沓的便秘一般的慢慢发展,无结果又好像有点结果,直到不再被高度关注,然后慢慢归于平静。

过程中,大家会听到一些看起来很果敢有利的处理方案,对人对行业。

好像很猛烈的样子,但是你看明白就知道,雷声大而已。

信我话吗。

我可以和任何人打赌

双方里字据。

绝对兑现。

延伸阅读:

Kevin在纽约:【为什么美国没人用��“阴阳合同”逃税?】

很简单,美国有一种税表叫“Form1099”,1099表是任何个人或者机构,只要给了你钱,付款方必须搜集你的信息,向美国国税局IRS汇报你有了这笔收入。任何一份1099表都和收到这笔收入的个人SSN(社会安全号码)对应,他们把1099寄给IRS后,同时还需要寄给你一个副本。

所以,国税局的电脑系统里就有了你收到的所有1099表的信息,由于计算机系统的进步,所有的这些信息都由IRS电脑系统自动核对,任何一笔没有申报的1099,首先是归责于付款人,对付款人重罚,然后再罚收款人。

税法这样定死后,再做“阴阳合同”就变得没有任何意义。

最后一个重点也必须得说,美国国税局也是独立执法的,如果敢逃税,你爸是总统也没有办法,司法和媒体都盯着你,该重罚的重罚,该坐牢的坐牢,谁都跑不掉。

所以在美国,你可以不怕FBI,不怕CIA,但你不可能不怕国税局IRS,老川竞选的时候就被他们查了个底朝天的,财大气粗脾气爆的老川,也只能乖乖配合。

@骆新:不能就此搞有罪推定

大量影视剧和明星参加的电视节目涉嫌洗钱,这个存在已久的秘密,被“崔永元事件”引爆之后,或导致权力部门出手,行业大地震。

但这两天有些被广泛转发的视频和文章,拿明星跟贫困的老兵、科技工作者比,说后者之所以不受尊重,乃是因为前者太受关注……

我觉的,转发并点赞这类文章的人,思维状态都属于义和团和塔利班,他的逻辑是“我之所以过的很惨,是因为你过的太好”,当然,一个社会若只羡慕大官和明星,说明这个社会的道德水平已不堪到何等地步,但是,明星也是一个合法产业中的一部分,他挣钱的背后也是打造了一条庞大的产业链,让更多的人挣到了钱。

明星偷漏税,说明我们的法律和监督制度出了问题,而不能就此搞有罪推定,认为影视圈里没好人——崔永元本人不也在这个圈里吗?

至于老兵或某些科研工作者,如果存在生活困难(先不论贫困者在职业人群中所占比例有多大),你怎么就认为,这是明星造成的呢?社会制度没有问题吗?公共政策是不是要修改?

把一批人的倒霉,归咎于另一批人的发达,这就是典型的中国式思维:我弱你就不能強,我懒你不能勤,我丑你就不能美……

按照这个逻辑推论:把明星都抓起来,让他们挣不到钱,一贫如洗,我们的生活,就会因此变得更好吗?

我记得,希特勒就是这个思路,只不过他的方式是“枪毙”或“关进集中营”。

中国人难道在文革中没试够这套手段?我们打倒了右派,资本家、地主、地方或部门的党委当权派,最后实在没人可整了,把知识分子当成工农兵的改造对象,最后情况又如何?

唉,愚蠢。

@五岳散人:如果合法财产不能得到保护,比少一些税收可要严重多了。

非要说现在是关乎是否“偷税漏税”,所以已经与“公共利益”有关。行吧,趁着红烧肉还在锅里,给诸位聊聊这个。

聊之前呢,希望您查一下税率。为啥这么说呢?您起码应该知道个人所得、劳务所得、企业所得税率是多少,以及减免额度。

一般来说,高收入者不喜欢交个人所得税或者劳务所得税,那个实际缴税额度高。企业所得税可以冲抵,象个人工作室这种类型的企业,反正也要雇人啥的,能冲抵当然最好。

化妆师一个月八万咋了?难道就不许高技术、高工资了?总不能跟邓紫棋似的,造型师跟她貌似有仇吧?

咱先不说演艺人员签的合同是不是明确标明税后收入,就说这种所谓“阴阳合同”。

我没看到那个“阴合同”的具体条款,但个人估计大概率是工作室签的,算是避税手段之一。如果不是工作室签,大概率是为了躲打击高额片酬什么的。

可这事儿从法律上您说不出不对,人家说我就是制片,在现场指导了一下机位,您能咋着呢?

所以,您何苦让我评论这个嘛。这都啥年头儿了,雇几个技法娴熟的会计师,这种麻烦轻松躲开。

至于说为啥能赚这么多……各位,市场经济就这样,您信不信名气通过这事儿再大一点儿,下次赚的更多。

另外说几句正经话:各国收税最头疼的问题之一,就是有钱人总有办法“合理避税”,社会的中下层人士避无可避,这是个学问,而且平稳运转的社会不能用强抢的方式。

我个人其实完全不在乎这些人赚多少钱、多长时间赚到,我更在乎的是,万一人家至少在法律层面合法的话,会不会因为社会看不惯他们有这样的能力与资源避税,而强迫其接受惩罚。

您看清楚了,我说的是“万一是合理避税”,可不是下了论断。

为什么呢?因为那就等于合法财产,想征收就要立法,而不是看着赚得多或者手法巧妙(其实谁都会的手艺)就觉得应该拿走一部分。

如果合法财产不能得到保护,比少一些税收可要严重多了。

中国最先进监控可见范围1.2公里 技术来自美国

阿富汗塔利班领导人呼吁与美国直接对话

美国总统接受美国之音采访谈美朝峰会内容

“美国在台协会”新馆揭幕 蔡英文出席

金融危机十年:硅谷在美国毕业生心中取代华尔街

美国艺术家拿啤酒罐当画板

美参议员敦促美国政府制定对抗中国反民主行为的战略

揭密:美国总统御用车有哪些配备?

川金会后 朝鲜或成美国新投资热土?

原文链接:长沙罗刚:你期盼的那个结果 绝不会发生 - 新闻评论

本文标签:便秘, 合同, 国税局, 工作室, 所得税, 明星, 美国, 长沙, 阴阳合同

0 notes

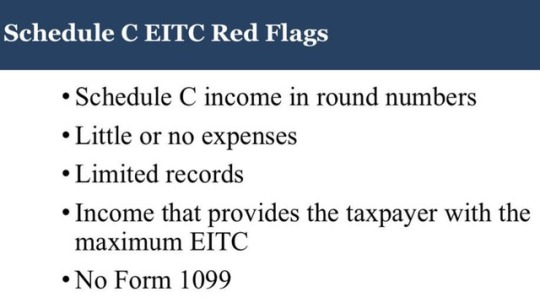

Photo

#schedulec #income #roundingnumbers #little #or #noexpenses #limitedrecords #maximum #eitc #no #form1099 #stephensbrostaxservice https://www.instagram.com/p/Bumoe2En8l5/?utm_source=ig_tumblr_share&igshid=1l55y6mxdn8xo

#schedulec#income#roundingnumbers#little#or#noexpenses#limitedrecords#maximum#eitc#no#form1099#stephensbrostaxservice

0 notes

Text

8 Things to Know Before the October 16 Recharacterization Deadline

By Sarah Brenner, JD

IRA Analyst at Ed Slott and Company

Follow Us on Twitter: @theslottreport

Did you convert your traditional IRA to a Roth IRA in 2016 and now you are reconsidering that move? Did you make a 2016 traditional IRA contribution and later discover the contribution was not deductible? Did you contribute to a Roth IRA, not knowing that your income was above the limits for eligibility? If you answered, “yes” to any of these questions, there is a deadline rapidly approaching that you will want to know about. That is the October 16, 2017, deadline for recharacterizing 2016 conversions and IRA contributions. Here are 8 things you need to know about recharacterization:

1. A recharacterization is a tax-free transfer of funds from one kind of IRA to another.

2. The deadline for recharacterizing a 2016 tax year contribution or conversion is October 16, 2017, for taxpayers who timely file their 2016 federal income tax returns. This is true even if you do not have an extension.

3. Recharacterization allows you to undo a conversion and move the funds back to a traditional IRA. A recharacterization is a dollar amount. You can choose to recharacterize the whole conversion amount or just a part of it.

4. You can also recharacterize a tax-year traditional IRA contribution from a traditional IRA to a Roth IRA or vice versa.

5. If you have decided that recharacterization is a good move for you, you will need to contact your IRA or Roth IRA custodian. You will need to provide the custodian with some information to conduct the transaction such as the amount you would like to recharacterize and the date of the contribution or conversion. Most custodians can provide you with a form to collect all the necessary information to complete a recharacterization.

6. Your IRA or Roth IRA custodian will directly move the funds you choose to recharacterize, along with the earnings or loss attributable to them, from the first IRA to the second IRA. This is a tax-free transaction, but both IRAs report the transactions to you and the IRS. You will receive a 2017 Form 1099-R from the first IRA and a 2017 Form 5498 from the second IRA.

7. There are restrictions on reconverting after a recharacterization. You may not reconvert the same funds until the beginning of the next taxable year following the year of the conversion, or if later, more than 30 days from the date of the recharacterization.

8. Deciding whether recharacterization is the right move for you can be complicated. If you are considering this strategy, consult with an advisor who is an expert in this area.

This article was originally published by Ed Slott and Company, LLC in The Slott Report on IRAhelp.com on 10/2/17. Click here to view the original publication and read more articles: http://bit.ly/2xLk4iM

0 notes

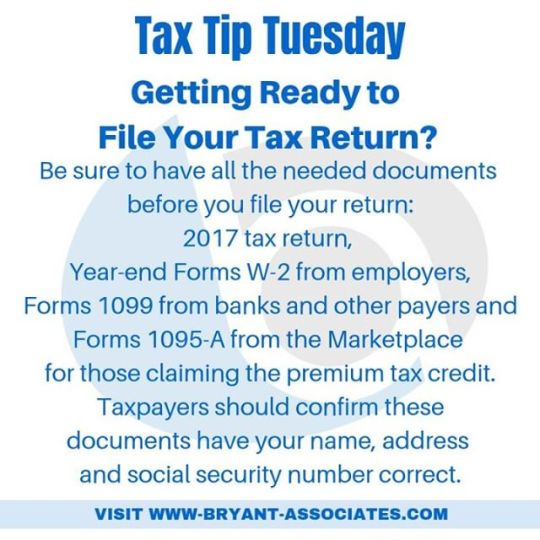

Photo

Getting Ready to File Your Tax Return?⠀ Be sure to have all the needed documents before you file your return: ⠀ 2017 tax return, Year-end Forms W-2 from employers, Forms 1099 from banks and other payers and Forms 1095-A from the Marketplace for those claiming the premium tax credit.⠀ Taxpayers should confirm these documents have your name, address and social security number correct.⠀ ⠀ #tax #taxes #taxtiptuesday #taxplanning #businesstip #CPA #smallbusiness #smallbusinessowner #smallbiz #smallbizowner #entrepreneur #bryantassociates #lnk #accountant #taxpreparer #taxreturn #taxseason #taxrefund #refund #w2 #form1099 #form1095a #ssn #address #name https://www.instagram.com/p/Bs8jWqjgenu/ via www.bryant-associates.com

0 notes

Text

Does Filing 1099 R Online with Form1099online.com secure?

Yes, e-filing 1099 Tax Forms with Form1099online.com is 100% safe and secure. Because it undergoes numerous screening tests and is approved by the IRS to participate in e-filing. So, start your returns with a free e-file account and enjoy multiple filings with a single account. Get started now and experience an easy-to-use interface with 100% accurate transmissions.

0 notes