#forex robot

Video

youtube

The Best Scalping EA of 2024: Turbocharge Your Forex Trading

0 notes

Text

Understanding Forex Robots: Automated Trading Made Simple

In the realm of forex trading, technology has revolutionized the way investors approach the market. Among the innovative tools that have gained popularity are Forex Robots, also known as Expert Advisors (EAs). These are automated trading systems designed to analyze the market, execute trades, and manage positions on behalf of traders. Here, we delve into the essence of forex robots, exploring their functionalities, benefits, and considerations for traders.

Functionality: Forex robots operate based on pre-defined algorithms programmed to identify trading opportunities and execute trades accordingly. These algorithms can range from simple rule-based strategies to complex machine learning models. They continuously monitor the market, analyzing various indicators and price movements to make informed trading decisions.

Benefits: One of the primary advantages of using forex robot is their ability to trade without emotional interference. Unlike human traders who may succumb to fear, greed, or indecision, robots stick to their programmed rules consistently. This eliminates the psychological biases that often plague manual trading, leading to more disciplined and objective decision-making.

Moreover, forex robots can execute trades swiftly, 24/7, across different time zones, ensuring that trading opportunities are not missed. They can also backtest strategies using historical data, allowing traders to evaluate performance and optimize their algorithms for better results.

Considerations: While forex robots offer numerous benefits, it's essential for traders to approach them with caution. Not all robots are created equal, and blindly relying on automated systems without understanding their underlying strategies can be risky. Traders should thoroughly research and test any robot before deploying it in live trading environments.

Additionally, market conditions can change rapidly, and algorithms that perform well in one market environment may falter in another. Therefore, it's crucial to regularly monitor and adapt the robot's settings to evolving market dynamics.

Furthermore, while forex robots can enhance trading efficiency, they are not a substitute for sound trading principles. Traders should still have a solid understanding of fundamental and technical analysis and exercise proper risk management practices.

In conclusion, forex robots have emerged as powerful tools for traders looking to automate their trading processes and capitalize on market opportunities. By leveraging advanced algorithms, these systems offer the potential for increased efficiency, consistency, and profitability in forex trading. However, it's essential for traders to approach them thoughtfully, understanding their functionalities, benefits, and limitations to make informed decisions.

1 note

·

View note

Text

Mastering the Art of Forex Trading: Strategies for Success

Mastering the art of Forex trading is an exhilarating journey, full of potential for personal and financial growth. Forex, or foreign exchange, is the world's largest financial market, where currencies are traded 24 hours a day, five days a week. It's a marketplace where fortunes can be made and lost in the blink of an eye, and success is often a product of strategy, discipline, and a keen understanding of market dynamics. This article explores various strategies for achieving success in Forex trading, focusing on the positive aspects and growth opportunities it offers.

Understanding the Market

The first step to mastering Forex trading is gaining a solid understanding of the market. The Forex market is influenced by a myriad of factors, including economic indicators, political events, and market sentiment. Successful traders are those who spend time studying market trends, understanding the factors that influence currency values, and staying informed about global events. Knowledge is power in Forex trading, and the more informed you are, the better equipped you'll be to make smart trading decisions.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in the Forex market. This strategy should be based on thorough research and should align with your risk tolerance and financial goals. There are various trading strategies to explore, from day trading, where positions are entered and exited within the same day, to swing trading, which involves holding positions for several days to capitalize on expected market moves. The key is to find a strategy that suits your style, stick to it, and refine it as you gain more experience and market insight. Amplify your trading skills with Trendonex. Visit https://trendonex.com/

Risk Management

Risk management is a critical component of successful Forex trading. The market is volatile, and while this volatility can lead to high returns, it also increases the risk of loss. Effective risk management involves setting stop-loss orders to limit potential losses, managing the size of your trades, and never investing more than you can afford to lose. By managing risk effectively, you can ensure that you stay in the game long enough to benefit from your trading strategies.

Psychological Discipline

The psychological aspect of Forex trading is often underestimated. Trading can be an emotional rollercoaster, with the potential for high stress and emotional decision-making. Successful traders are those who have mastered the art of emotional discipline. This means not allowing fear or greed to drive trading decisions, staying patient, and maintaining a level head even in the face of losses. Developing a strong psychological discipline can significantly improve your chances of success in the Forex market.

Continuous Learning and Adaptation

The Forex market is constantly evolving, and what worked yesterday may not work tomorrow. Successful traders are those who are committed to continuous learning and adaptation. This involves staying up-to-date with market trends, refining your trading strategies, and learning from both successes and failures. The willingness to adapt and learn is what separates the best traders from the rest.

Leveraging Technology

Technology plays a significant role in modern Forex trading. From advanced charting software to automated trading systems, technology can provide traders with a significant advantage. Successful traders leverage technology to analyze market trends, execute trades, and manage their portfolios more efficiently. While technology should not replace fundamental trading skills, it can enhance your ability to make informed decisions and improve your overall trading performance.

Building a Support Network

Trading can be a solitary activity, but that doesn't mean you have to go it alone. Building a support network of fellow traders can provide you with valuable insights, strategies, and emotional support. Whether it's through online forums, trading groups, or mentoring relationships, connecting with other traders can enhance your learning and contribute to your success. Sharing experiences and strategies with others can open up new perspectives and help you avoid common pitfalls.

Conclusion

Mastering the art of Forex trading is a journey that requires dedication, discipline, and a continuous desire to learn and adapt. By understanding the market, developing a solid trading strategy, managing risk effectively, maintaining psychological discipline, leveraging technology, and building a support network, you can significantly increase your chances of success. The Forex market offers immense opportunities for growth and financial success. With the right approach, you can navigate the complexities of the market and achieve your trading goals.

0 notes

Text

Enormous Benefits of Using Forex Robots

The world of foreign exchange (forex) trading has evolved dramatically over the years, with technological advancements paving the way for automated trading solutions. Among these innovations, forex robot stand out as powerful tools designed to streamline trading processes and enhance profitability. In this comprehensive guide, we'll delve into the myriad benefits that forex robots offer to traders of all levels.

Understanding Forex Robots

Forex robots, also known as expert advisors (EAs), are software programs designed to execute trades in the forex market automatically. These algorithms are based on predefined trading strategies and criteria, eliminating the need for manual intervention by traders. By utilizing complex mathematical algorithms and historical data analysis, forex robots aim to identify lucrative trading opportunities and execute trades with precision and speed.

Enhanced Efficiency and Speed

One of the most significant benefits of using forex robots is their ability to operate with unparalleled efficiency and speed. Unlike human traders, who may be prone to emotions and fatigue, these automated systems can monitor multiple currency pairs simultaneously and execute trades within milliseconds. This rapid response time is crucial in the fast-paced forex market, where price movements can occur in a matter of seconds.

Elimination of Emotional Biases

Emotions such as fear, greed, and hesitation often plague human traders, leading to irrational decision-making and potential losses. Forex robots, however, operate based on predefined parameters and algorithms, completely devoid of any emotional biases. By removing human emotions from the trading equation, these automated systems can execute trades objectively and consistently, thereby minimizing the impact of psychological factors on trading outcomes.

Backtesting and Optimization Capabilities

Forex robots typically come equipped with robust backtesting and optimization features, allowing traders to assess the performance of their trading strategies using historical data. Through backtesting, traders can evaluate the effectiveness of their strategies under various market conditions and make necessary adjustments to optimize performance. This empirical approach enables traders to refine their trading strategies systematically and enhance their overall profitability over time.

24/7 Market Monitoring

The forex market operates 24 hours a day, five days a week, spanning multiple time zones around the globe. For human traders, staying vigilant and monitoring the market continuously can be a challenging task. However, forex robots excel in this aspect, as they can tirelessly monitor market conditions round the clock without the need for rest or breaks. This ensures that traders never miss out on lucrative trading opportunities, regardless of their geographic location or time zone.

Diversification and Risk Management

Forex robots offer traders the ability to diversify their trading portfolios across multiple currency pairs and strategies simultaneously. By spreading risk across different assets and trading approaches, traders can mitigate the impact of adverse market movements on their overall portfolio. Additionally, many forex robots incorporate advanced risk management features, such as stop-loss and take-profit orders, to protect capital and minimize potential losses during volatile market conditions.

Access to Advanced Trading Strategies

Forex robots enable traders to access and implement advanced trading strategies that may be difficult to execute manually. These strategies may involve complex technical indicators, statistical models, or machine learning algorithms that require computational power beyond the capabilities of human traders. By harnessing the analytical prowess of forex robots, traders can capitalize on sophisticated trading techniques and potentially unlock new avenues for profit generation.

Reduced Time Commitment

Trading the forex market can be a time-consuming endeavor, requiring traders to devote significant hours to market analysis, research, and trade execution. Forex robots offer a solution to this challenge by automating the majority of these tasks, thereby reducing the time commitment required from traders. This allows traders to focus on other aspects of their lives or pursue additional trading opportunities without being tethered to their screens.

Accessibility and Ease of Use

Advancements in technology have made forex robots increasingly accessible to traders of all levels, regardless of their technical expertise or experience in the financial markets. Many forex robot providers offer user-friendly interfaces and intuitive design features that make it easy for novice traders to deploy and configure automated trading strategies with minimal effort. Additionally, comprehensive documentation and customer support services are often available to assist traders in navigating the intricacies of forex robot usage.

Continuous Improvement and Innovation

The field of automated trading continues to evolve rapidly, driven by ongoing advancements in technology and algorithmic trading techniques. Forex robot developers are constantly refining and enhancing their software to adapt to changing market conditions and incorporate the latest innovations in trading technology. As a result, traders who utilize forex robots can benefit from continuous improvement and innovation, ensuring that their automated trading strategies remain competitive and effective in the ever-evolving forex landscape.

Conclusion

In conclusion, the benefits of using forex robot are vast and compelling, offering traders a powerful arsenal of tools to enhance their trading efficiency, profitability, and overall success. From improved speed and efficiency to emotion-free trading and advanced strategy implementation, forex robots empower traders to navigate the complexities of the forex market with confidence and precision. As automated trading technology continues to evolve, the role of forex robots in shaping the future of forex trading is poised to expand, offering traders new opportunities for growth and prosperity in the dynamic world of foreign exchange.

0 notes

Text

Unlocking the Power of Forex Robots: Your Ultimate Guide

Are you tired of constantly monitoring the forex market, trying to catch the perfect moment to trade? Have you ever wished for a trading assistant that works tirelessly on your behalf, analyzing market trends, and executing trades with precision? Well, your wish might just have come true with the advent of forex robot!

In this comprehensive guide, we'll delve into the world of forex robots, exploring what they are, how they work, and whether they're the right tool for you to achieve your trading goals.

Understanding Forex Robots

What exactly are forex robots?

Forex robots, also known as Expert Advisors (EAs), are automated trading systems designed to execute trades in the forex market without the need for human intervention. Think of them as your personal trading assistants, programmed to follow specific trading strategies and criteria to enter and exit trades.

How do they work?

These robots utilize advanced algorithms and mathematical models to analyze market data, identify trading opportunities, and execute trades based on predefined parameters set by the trader. By harnessing the power of technology, forex robots aim to remove emotions from trading decisions, thereby potentially reducing human errors and biases.

Are they suitable for all traders?

While forex robots offer the allure of automated trading, they may not be suitable for everyone. Traders who prefer a hands-on approach and enjoy the thrill of making trading decisions themselves may find them less appealing. However, for those seeking to streamline their trading process and minimize the time spent in front of screens, forex robots can be a game-changer.

Advantages of Using Forex Robots

24/7 Trading

One of the most significant advantages of forex robots is their ability to trade round the clock. Unlike human traders who need rest, these robots tirelessly monitor the market, ensuring no trading opportunities are missed, even while you sleep.

Emotion-Free Trading

Emotions can often cloud judgment and lead to impulsive trading decisions. Forex robots eliminate this psychological aspect by executing trades based solely on predefined criteria, without being influenced by fear or greed.

Backtesting Capabilities

Before deploying a forex robot in live trading, traders can conduct extensive backtesting to assess its performance under various market conditions. This allows for optimization and fine-tuning of trading strategies, potentially enhancing profitability in the long run.

Speed and Efficiency

In today's fast-paced market environment, speed is crucial. Forex robots can execute trades in milliseconds, ensuring swift entry and exit from positions, thus capitalizing on fleeting market opportunities that might otherwise be missed by human traders.

Key Considerations Before Using Forex Robots

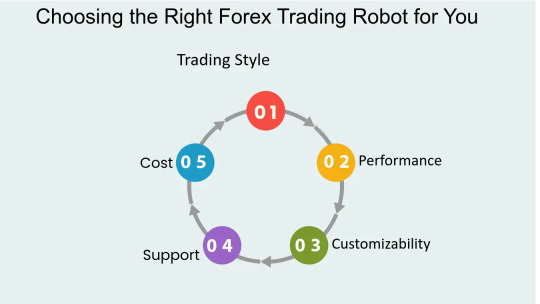

Choosing the Right Robot

With a plethora of forex robots available in the market, selecting the right one can be daunting. It's essential to conduct thorough research, considering factors such as performance history, strategy transparency, and user reviews before making a decision.

Understanding the Risks

While forex robots offer potential benefits, they also carry inherent risks. Markets are unpredictable, and even the most sophisticated algorithms may encounter losses under certain conditions. It's crucial to have realistic expectations and to only invest funds that you can afford to lose.

Monitoring and Maintenance

Contrary to popular belief, forex robots aren't entirely set-and-forget solutions. Regular monitoring is necessary to ensure they continue to perform as expected. Market conditions evolve, and adjustments to trading parameters may be required to adapt to changing dynamics.

Security Concerns

Given that forex robots involve automated trading, security is paramount. Choose reputable providers and ensure that the robot's software is regularly updated to mitigate the risk of cyber threats and vulnerabilities.

Conclusion

In conclusion, forex robots represent a revolutionary tool in the realm of forex trading, offering the promise of automated, emotion-free trading around the clock. However, they're not without their caveats. Before incorporating a forex robot into your trading arsenal, it's essential to weigh the potential benefits against the risks and to conduct thorough research to select the right one for your trading style and objectives.

Remember, while forex robots can enhance efficiency and potentially boost profitability, they should be viewed as a complement to, rather than a substitute for, sound trading knowledge and strategy. With the right approach and due diligence, forex robots have the potential to empower traders and unlock new possibilities in the dynamic world of forex trading.

youtube

1 note

·

View note

Text

Advanced Money Management

Take advantage of Botogon's trailing stop and breakeven features to protect your profits and minimize losses. With dynamic adjustments to stop-loss levels, Botogon ensures that your trades are always well-protected.

forex robot

0 notes

Text

Optimizing Profitability with the Most Recent Forex Robotics Technology

The forex trading industry has not lagged behind the rapid advancement of technology. The advent of forex robots has brought about a revolution in the trading industry by providing traders with a novel and effective approach to trade analysis and execution. These automated systems do not require human interaction in trading choices since they use artificial intelligence and sophisticated algorithms. These robots have changed the game for traders trying to optimize their profit potential because of their incredible speed at which they can process large amounts of data. The newest developments in forex robots and their potential to assist traders in reaching their financial objectives will be discussed in this article. In addition to discussing the many advantages and features of these state-of-the-art tools, we will offer advice on how to successfully integrate them into your trading approach. This article can act as a thorough guide to assist you understand the world of forex robots and realize their full potential for profit maximization, regardless of expertise level.

Maintain your market leadership

It is essential to keep ahead of market trends and changes if you want to succeed in the forex trading business and maximize your profit potential. Using the capabilities of forex robots is one efficient approach to achieve this. With accuracy and speed, these advanced automated trading systems can evaluate market data, spot lucrative possibilities, and carry out deals on traders' behalf. You may obtain a competitive edge and stay ahead of the curve in the fast-paced world of forex trading by implementing the newest advancements in forex robot technology into your trading approach. By reducing emotional decision-making and optimizing your trading process, these cutting-edge tools can improve your overall trading success. Trading professionals can improve their chances of success in the forex market by using the power of forex robots to help them make well-informed judgments based on real-time data.

Apply cutting-edge trading technologies

Traders must use cutting-edge trading technologies to stay ahead of the curve as the forex market develops and becomes more competitive. A key component of this is using forex robots, which are highly automated programs made to precisely assess market data and execute trades. You may profit from these cutting-edge technologies' ability to spot profitable chances fast and execute trades in real-time by integrating them into your trading strategy. Forex robots make sure that all of your trading decisions are based only on data-driven analysis by removing the impact of human mistake and emotions. In the volatile forex market, you can improve your trading performance and increase your potential profit by utilizing cutting-edge trading technologies, such as forex robots.

Increase revenue through automated processes

Making the most of forex robots' capabilities is essential if you want to increase profits using automated systems. Based on pre-established parameters and market conditions, these sophisticated tools enable traders to execute transactions quickly and accurately. A more methodical and disciplined approach to trading is made possible by automating the trading process, which also removes the possibility of human error and emotional biases. Forex robots watch the market constantly, sifting through a tonne of data to find profitable opportunities and make well-informed trade selections. This improves the accuracy and productivity of your trading activity while also saving you significant time and effort. In the quick-paced world of forex trading, you may maximize your earning potential and obtain a competitive edge by utilizing automated systems.

Using the newest innovations and technology is essential for optimizing profit potential in today's fast-paced financial industry. Traders now have a strong instrument at their disposal to help them make strategic and well-informed decisions thanks to the development of sophisticated forex robots. By continuously changing and adjusting to market developments, these robots provide traders a competitive advantage. In order to stay competitive and meet their financial objectives, traders should keep up with the most recent advancements in forex robot technology. So why hold off? Use these innovative resources to your advantage and observe how they might improve your trading experience.

0 notes

Text

How to Optimize Your Forex Robot for Maximum Performance

In the world of forex trading, automation has become a game-changer, offering traders the ability to execute trades with precision and efficiency. Forex robots, also known as expert advisors (EAs), have emerged as indispensable tools for both novice and experienced traders alike. However, simply having a forex robot is not enough to guarantee success. To truly maximize its potential and achieve optimal results, it's crucial to optimize your forex robot for maximum performance. Here's how:

Selecting the Right Forex Robot

Before optimization can begin, it's essential to choose a forex robot that aligns with your trading style, risk tolerance, and objectives. Consider factors such as strategy, performance history, and user reviews. Look for a robot that offers customizable settings and robust features to facilitate optimization. read more

0 notes

Text

https://fxonbit.com/blog/Advantages-of-Using-Cryptocurrency-Screener

The Key Advantages of Utilizing a Cryptocurrency Screener

#crypto robot#forex#forex robot#forextrading#robots#trading robot#investment#ai generated#crypto#crypto screener

0 notes

Text

mt4

mt4

1 note

·

View note

Video

youtube

Best Scalping EA ! Top EA For Trading Forex And Making Profit

0 notes

Text

The Ascending Equity Forex Trading Bot is an advanced auto-trading tool that uses artificial intelligence to trade currency pairs. The Ascending Bot was designed to tilt the scales in favor of traders and give them a clear advantage when trading these markets.

1 note

·

View note

Text

Maximize Your Earnings with Forex Auto Trading Software: A Second Source of Income

FX Zippy

Forex auto trading software, also known as forex robots or expert advisors, can be a great tool for generating a second source of income. Second source of income means you can earn profit without putting in any effort. These programs are designed to automatically execute trades on your behalf, using algorithms and technical indicators to identify profitable opportunities in the market.

One of the key benefits of using forex auto trading software is that it can help to remove the emotional element from trading. Many traders struggle with fear and greed, which can lead to poor decision-making and costly mistakes. By using a program that is programmed to follow a specific set of rules, you can avoid these emotions and make trades based on objective criteria.

#Forex Trading robot#auto trading software#best trading software#AI forex trading#forex expert advisor#forex trading for beginners#forex robot#best forex robot#fxzippy#fx zippy bot#fx zippy

0 notes

Text

Freedom Exploring the Benefits of Using Forex Robots

In the ever-evolving landscape of financial markets, technological advancements have revolutionized trading practices. Among these innovations, forex robot have emerged as powerful tools, offering traders automated solutions to navigate the complexities of the foreign exchange market. This article delves into the myriad benefits of using Forex robots, shedding light on how they empower traders to optimize their strategies, enhance efficiency, and potentially unlock greater profits.

Understanding Forex Robots

Before delving into their benefits, it's crucial to grasp the concept of Forex robots. Also known as Expert Advisors (EAs), Forex robots are software programs designed to execute trades on behalf of traders in the foreign exchange market. These algorithms are programmed to analyze market conditions, identify trading opportunities, and execute trades automatically based on predefined criteria. Essentially, Forex robots aim to remove emotional biases from trading decisions and capitalize on market movements with precision and speed.

Market Monitoring and Execution

One of the most significant advantages of using Forex robots is their ability to monitor the market 24 hours a day, 7 days a week. Unlike human traders who require rest, Forex robots can operate tirelessly, ensuring that no trading opportunity is missed, even in volatile or rapidly changing market conditions. This continuous monitoring enables traders to capitalize on lucrative opportunities across different time zones and maximize their potential profits.

Elimination of Emotional Biases

Emotions such as fear, greed, and indecision are common pitfalls that often plague human traders, leading to impulsive or irrational decisions. Forex robots, on the other hand, operate based on predefined algorithms without being influenced by emotions. By eliminating emotional biases from the trading equation, Forex robots can execute trades with discipline and consistency, thereby enhancing the overall trading strategy's effectiveness.

Backtesting and Optimization

Forex robots offer traders the ability to backtest and optimize their trading strategies with historical data. This feature allows traders to assess the performance of their strategies under various market conditions and fine-tune parameters to improve efficiency and profitability. Through rigorous backtesting, traders can identify patterns, trends, and correlations, enabling them to develop robust strategies that are better equipped to navigate dynamic market environments.

Enhanced Speed and Efficiency

In the fast-paced world of forex trading, speed is of the essence. Forex robots are capable of executing trades with lightning-fast precision, leveraging automation to capitalize on fleeting market opportunities instantly. By eliminating the need for manual intervention, Forex robots can execute trades at optimal prices and minimize slippage, thereby enhancing overall efficiency and profitability.

Diversification and Risk Management

Diversification is a fundamental principle of risk management in trading. Forex robots enable traders to diversify their trading portfolios across multiple currency pairs, markets, and strategies simultaneously. By spreading risk across various assets and trading approaches, traders can mitigate the impact of adverse market movements and potentially enhance their risk-adjusted returns. Additionally, Forex robots can incorporate advanced risk management techniques such as stop-loss orders and position sizing to minimize potential losses and preserve capital.

Accessibility and Convenience

Another significant benefit of using Forex robots is their accessibility and convenience. These software programs can be deployed on trading platforms, allowing traders to access their accounts and monitor performance from anywhere with an internet connection. Whether traders are at home, in the office, or on the go, Forex robots enable them to stay connected to the markets and seize opportunities in real-time, without being tied to their screens.

Psychological Well-being

Trading can be a psychologically demanding endeavor, often subjecting traders to stress, anxiety, and emotional turmoil. By automating trading processes, Forex robots can alleviate much of the psychological burden associated with manual trading, allowing traders to maintain a calmer, more balanced mindset. This psychological well-being can translate into better decision-making, improved performance, and a more sustainable trading career in the long run.

Conclusion:

In conclusion, the benefits of using forex robot are manifold, ranging from enhanced efficiency and profitability to improved risk management and psychological well-being. By harnessing the power of automation, traders can leverage Forex robots to streamline their trading processes, optimize strategies, and potentially unlock greater financial success in the dynamic world of forex trading. However, it's essential to recognize that Forex robots are not infallible and require careful consideration, monitoring, and customization to align with individual trading goals and risk tolerance levels. Ultimately, when utilized effectively, Forex robots can serve as invaluable tools in the arsenal of traders seeking to navigate the complexities of the foreign exchange market and achieve their financial objectives.

0 notes

Video

youtube

🔗 Visit FX JetBot EA Developer`s Website ᐈ

【 FX JetBot EA 】 ⚡ NEW Profitable Forex Robot for MT4 & MT5【 Best Grid Trading EA 】 • Trades on AUDUSD, EURJPY, EURGBP, USDCAD, EURUSD currency pairs • High Profitability Trade Win Rate 80% • Verified results on real accounts • Compatible with any brokers. • 30 day money back guarantee

0 notes