Text

Market Sentiment Analysis: Predicting Trends in Trading

In the fast-paced world of Forex trading, where currencies fluctuate with the pulse of global events, understanding market sentiment is akin to wielding a powerful compass in a turbulent sea. It's a skill that transcends charts and data points, offering traders a deeper insight into the collective psyche of the market. This article explores the art and science of market sentiment analysis and its pivotal role in predicting trends in trading.

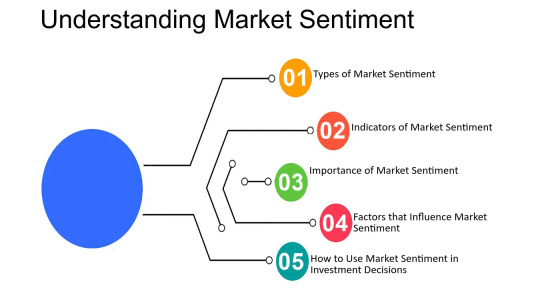

Deciphering Market Sentiment

Market sentiment, often described as the mood or attitude of traders, encapsulates the prevailing emotions driving buying and selling decisions. It's a complex interplay of optimism, fear, greed, and uncertainty that shapes the trajectory of currency pairs. While fundamental and technical analysis provide fundamental insights, market sentiment offers a nuanced understanding of the underlying dynamics at play. Read More

0 notes

Text

Navigating Forex Trading in the Age of Algorithms and Big Data

In the world of finance, Forex trading stands as a beacon of opportunity, offering the potential for lucrative returns to those who understand its intricacies. Yet, as technology advances, so too does the landscape of trading. In the era of big data, algorithms have become a driving force behind decision-making processes, reshaping the way Forex markets operate. Let's delve into the realm of algorithmic trading and its impact on Forex, exploring key takeaways for both seasoned traders and newcomers alike.

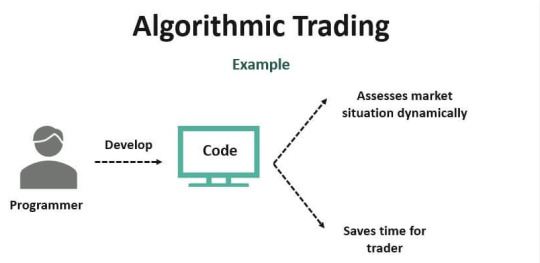

Algorithmic Trading Unveiled

Algorithmic trading, also known as algo-trading or automated trading, involves the use of computer programs to execute trading strategies with precision and speed. These algorithms analyze vast amounts of data, including market trends, economic indicators, and historical price movements, to make informed trading decisions in milliseconds.

The allure of algorithmic trading lies in its ability to eliminate human emotions from the equation, thereby reducing the risk of impulsive or irrational trading decisions. Instead, algorithms rely on logic and statistical analysis to identify profitable opportunities and execute trades with minimal human intervention. Read More

0 notes

Text

Mastering Forex Trading with MACrossoverPro: A Comprehensive Guide

In the ever-evolving world of finance, Forex trading stands out as one of the most dynamic and potentially lucrative avenues for investors. However, navigating the complexities of the Forex market requires more than just intuition; it demands strategic analysis and the right tools. Enter MACrossoverPro, a powerful software solution designed to enhance your Forex trading experience. In this comprehensive guide, we delve into what MACrossoverPro offers, its key features, and the invaluable benefits it brings to traders.

What is MACrossoverPro?

MACrossoverPro is a sophisticated trading tool built to assist Forex traders in making informed decisions by utilizing moving average crossovers. It employs a blend of technical analysis and automation to identify optimal entry and exit points, helping traders capitalize on market opportunities with precision. Read More

0 notes

Text

Forex Trading Volatility: Strategies for Turbulent Markets

In the fast-paced world of financial markets, volatility is both a boon and a challenge for traders. Nowhere is this more apparent than in the foreign exchange (forex) market, where currency values can fluctuate wildly in response to geopolitical events, economic data releases, and shifts in investor sentiment. Trading in volatile markets requires a nuanced approach and a keen understanding of risk management strategies. In this blog, we'll explore some effective strategies for navigating turbulent forex markets.

Understanding Volatility

Volatility refers to the degree of variation in a trading instrument's price over time. In forex trading, volatility can be influenced by a variety of factors, including interest rate decisions, geopolitical tensions, and economic indicators. While high volatility can present lucrative trading opportunities, it also carries increased risk, as prices can swing rapidly in either direction. Read More

0 notes

Text

Today, I made a profit by utilizing the Trendometer indicator.

0 notes

Text

Stablecoins Trading: Understanding Stable-Value Cryptocurrencies

In the ever-evolving realm of cryptocurrency trading, stability is often seen as the holy grail amidst the tumultuous waves of volatility. Enter stablecoins - a class of cryptocurrencies designed to provide a reliable, stable store of value in an otherwise unpredictable market. In this article, we'll delve into the nuances of stablecoins trading, unraveling the intricacies of these stable-value cryptocurrencies.

What Are Stablecoins?

Stablecoins are a subset of cryptocurrencies engineered to maintain a stable value by pegging it to external assets like fiat currencies, commodities, or other cryptocurrencies. Unlike their volatile counterparts such as Bitcoin or Ethereum, stablecoins offer a reliable means of transacting and storing value without the rollercoaster ride of price fluctuations. Read More

0 notes

Text

The Role of Central Banks in Forex Trading

Introduction to Forex Trading

forex trading, the global marketplace for exchanging currencies, operates 24/5, offering ample opportunities for traders to profit from fluctuations in exchange rates. In this dynamic arena, understanding the role of central banks is paramount for successful navigation and informed decision-making.

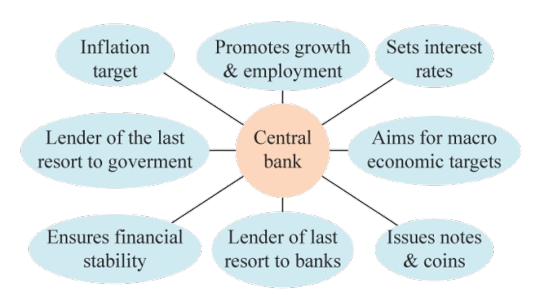

The Role of Central Banks

Central banks, the monetary authorities of countries or regions, wield significant influence over currency values and exchange rates through various policy tools and interventions. Read More

#trendometer#forex indicators#forex trading#ai#bots#mt4#forextrading#forexsignals#cryptocurreny trading

0 notes

Text

Options Trading for Income Generation Strategies and Tips

In the dynamic world of finance, forex trading stands out as a lucrative avenue for income generation. The Foreign Exchange market, with its daily trading volume surpassing $6 trillion, offers ample opportunities for traders to profit from fluctuations in currency pairs. Among the myriad approaches within Forex trading, options trading emerges as a sophisticated strategy for income generation. Let’s delve into the world of Forex options trading, exploring strategies, tips, and key takeaways for aspiring traders.

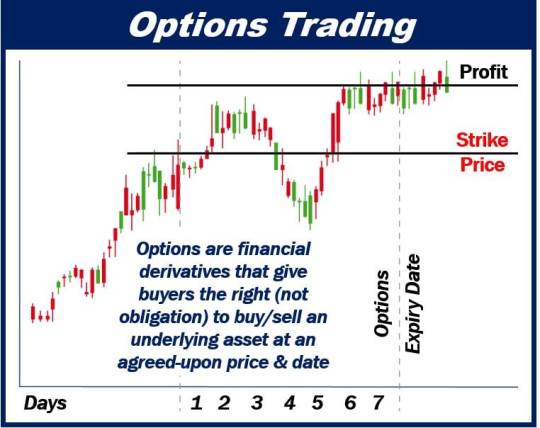

Understanding Forex Options Trading

Forex options trading grants traders the right, but not the obligation, to buy or sell a specific currency pair at a predetermined price within a specified time frame. Unlike spot trading, where traders execute trades immediately at prevailing market prices, options trading allows for more strategic maneuvers, capitalizing on price movements while mitigating risks. Read More

0 notes

Text

Embracing Blockchain and Decentralization

In the ever-evolving landscape of financial markets, forex trading stands out as a dynamic realm where fortunes are made and lost in the blink of an eye. With the rise of digital technologies, the future of forex trading is poised for transformation, with blockchain and decentralization emerging as key disruptors. Let's delve into how these technologies are reshaping the forex trading landscape and explore some key takeaways for traders navigating this exciting terrain.

Blockchain: Revolutionizing Forex Trading

Blockchain technology, heralded as the backbone of cryptocurrencies like Bitcoin, has transcended its origins to revolutionize various industries, including finance. Its decentralized and immutable nature offers unparalleled transparency and security, making it a natural fit for forex trading. By leveraging blockchain, forex transactions can be executed directly between parties without the need for intermediaries, streamlining processes and reducing costs.

One of the most significant impacts of blockchain on forex trading is the potential to eliminate counterparty risk. Traditional forex trading involves intermediaries such as banks and clearinghouses, exposing traders to counterparty risk in case of default or insolvency. With blockchain-based trading platforms, transactions are recorded on a distributed ledger, ensuring that trades are settled securely and transparently, mitigating the risk of default.

Moreover, blockchain enables real-time settlement of forex trades, eliminating the need for lengthy clearing and settlement processes associated with traditional trading systems. This instant settlement capability not only enhances liquidity but also reduces operational risks and costs for traders. Read More

0 notes

Text

Cryptocurrency Options Trading: A Beginner’s Guide

In the vast world of financial markets, cryptocurrency options trading has emerged as a lucrative opportunity for traders seeking diversity and potential high returns. With the rise of digital currencies like Bitcoin, Ethereum, and others, options trading has expanded beyond traditional assets. For beginners stepping into this realm, understanding the basics is crucial. Let's delve into the realm of cryptocurrency options trading and explore some key takeaways for those starting their journey.

Understanding Cryptocurrency Options Trading

Options trading involves contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. In the case of cryptocurrency options trading, the underlying asset is a digital currency like Bitcoin or Ethereum. Read More

0 notes

Text

Mastering Forex Trading: Strategies for Success in Futures Contracts

In the realm of financial markets, forex trading stands out as one of the most dynamic and lucrative arenas. With its vast scope for profit and a plethora of strategies, forex trading, particularly through futures contracts, offers ample opportunities for those who are adept at navigating its complexities. Futures contracts, in particular, represent agreements to buy or sell assets at a predetermined price at a specified future date. In this blog, we delve into the strategies that can pave the path for success in forex trading through futures contracts.

Understanding Futures Contracts

Before diving into strategies, it's essential to grasp the fundamentals of futures contracts. These contracts entail buying or selling a specified quantity of a financial instrument or commodity at a predetermined price on a specified date in the future. Unlike options contracts, futures contracts obligate the parties involved to fulfill the terms of the agreement. Forex futures contracts are standardized agreements traded on exchanges, offering traders a regulated environment to engage in currency trading. Read More

0 notes

Text

Exploring Opportunities in Decentralized Finance (DeFi) Trading

In recent years, the world of finance has witnessed a paradigm shift with the rise of Decentralized Finance (DeFi) trading. Traditional financial systems are being challenged by decentralized alternatives that offer greater accessibility, transparency, and autonomy to traders and investors. Forex trading, in particular, has seen a significant impact from the advent of DeFi, opening up new avenues for profit and innovation. In this blog, we'll delve into the world of DeFi trading and explore the opportunities it presents for forex traders.

Understanding DeFi Trading:

DeFi trading refers to the use of decentralized platforms and protocols to conduct financial transactions without the need for intermediaries such as banks or brokerages. These platforms are built on blockchain technology, which ensures transparency, security, and immutability of transactions. Unlike traditional financial systems, where central authorities control the flow of capital, DeFi allows users to directly interact with smart contracts, enabling peer-to-peer trading and lending. Read More

0 notes

Text

What is a forex?

At its core, forex refers to the decentralized global marketplace where currencies are bought and sold. It operates 24 hours a day, five days a week, allowing for continuous trading across different time zones. The primary players in the forex market include governments, central banks, financial institutions, corporations, and individual traders.

Types of currency pairs

The heart of forex trading lies in currency pairs, where one currency is exchanged for another. There are three main types of currency pairs: major pairs, minor pairs, and exotic pairs. Read More

0 notes

Text

Investing in NFTs: A Complete Overview

Introduction to NFTs

Non-Fungible Tokens (NFTs) have surged in popularity as a form of digital asset representing ownership or proof of authenticity of unique items or content on the blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs are indivisible and cannot be exchanged on a like-for-like basis.

Understanding NFTs

NFTs can represent a wide range of digital and physical assets, including art, music, videos, virtual real estate, and collectibles. Each NFT is unique and has its own distinct value, determined by factors such as scarcity, demand, and the reputation of the creator. Read More

0 notes

Text

Understanding Economic Indicators and Key Takeaways

Forex trading, also known as foreign exchange trading, offers an enticing opportunity for investors to profit from the fluctuations in currency values. However, successful trading in the forex market requires a keen understanding of various economic indicators and their impact on stock markets. In this blog, we delve into the significance of economic indicators in forex trading and explore key takeaways for aspiring traders.

Impact of Economic Indicators on Stock Markets:

Interest Rates

One of the most influential economic indicators is interest rates. Central banks regularly adjust interest rates to control inflation and stimulate economic growth. Higher interest rates attract foreign capital, leading to an appreciation of the currency. Conversely, lower interest rates tend to depreciate the currency. Forex traders closely monitor central bank announcements regarding interest rate changes as they can significantly affect currency values. Read More

0 notes

Text

Social Trading Platforms: The Future of Investing

In the realm of financial markets, Forex trading, stands out as a dynamic and potentially lucrative venture. With the advent of technology and the rise of social media, a new dimension has been added to Forex trading – social trading platforms. These platforms are reshaping the landscape of investing, offering a unique blend of community, transparency, and accessibility. In this blog post, we'll explore the concept of social trading platforms, their significance in the world of Forex trading, and the key takeaways for investors.

Understanding Social Trading Platforms

Social trading platforms are online communities where traders can connect, share insights, and replicate the trades of experienced investors. These platforms leverage the power of social networks to democratize trading, allowing individuals with varying levels of expertise to participate in the financial markets. At the core of social trading platforms are features such as copy trading and mirror trading, which enable users to automatically mimic the trades of top-performing traders. Read more....

1 note

·

View note

Text

Navigating Forex Trading: Day Trading vs. Swing Trading

In the ever-evolving world of financial markets, forex trading stands out as a dynamic and lucrative arena for investors seeking opportunities. The ability to trade currencies around the clock, coupled with high liquidity and leverage, attracts both seasoned professionals and novices alike. However, within the realm of forex trading, there are two primary strategies: day trading and swing trading. Each approach comes with its own set of advantages and challenges, catering to different risk appetites and time commitments.

Day Trading: Seizing Opportunities in Real-Time

Day trading involves executing trades within the same trading day, with positions typically closed before the market closes. This strategy thrives on capturing short-term price movements, often relying on technical analysis and intraday charts to identify entry and exit points. Here are some key pros and cons of day trading in the forex market: Read More

0 notes