#federal budget

Text

x

#401(k)#savings#tax-advantaged retirement#bipartisan legislation#wealth gap#federal budget#financial industry#lobbying#retirement security#tax law#retirement savings#bipartisan#wealth disparities#federal deficit#financial services industry#tax-advantaged accounts#tax breaks#Congress#lobbyists#Social Security#Medicare

15 notes

·

View notes

Text

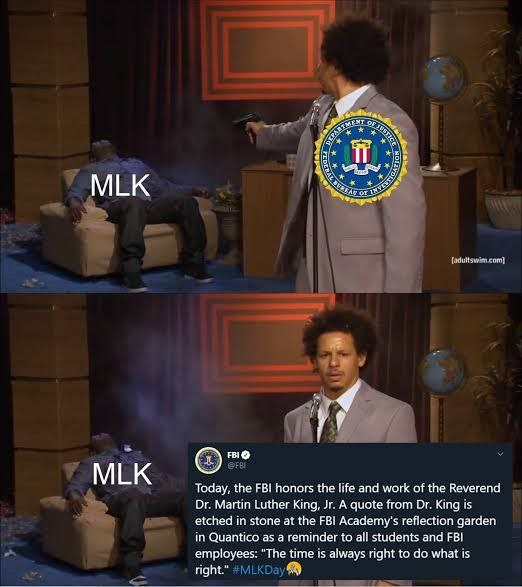

#fbi corruption#fbi cbs#how mob boss john gotti had paul castellano assassinated while he watched nearby – and how fbi bugs finally caught him#fbi most wanted#fbi#federal bureau of control#federal bureau of investigation#federal budget#mlk jr#mlk day#mlk#martin luther king jr#martin luther king day#martin luther king quotes#murder#usa 2023#usa news#usa#united states#united nations#unitedstateofamerica#unitedsnakes#native american#america#all cops are bastards#1312#class war#ftp#161#fuck the police

27 notes

·

View notes

Text

"The American government’s big pile of IOUs is about to get even bigger.

That was the conclusion of the latest report from the Congressional Budget Office, which forecast this week that the US is on track to add $19 trillion to its national debt by 2034, with payments on that debt totalling some $12 trillion as higher interest rates increase the burden of the nation’s borrowing.

Serious interest

In the latest fiscal year, which ran to the end of September, the federal government raked in more than $4.4 trillion in receipts from individual taxpayers, with nearly half of that sum stemming from individual income taxes ($2.18 trillion). But, as many of us can surely relate to, the government's spending appetite consistently outpaces its income, resulting in a deficit of $1.7 trillion.

The magnitude of the national debt, currently ~$34 trillion in total, means that the government is shelling out nearly $2 billion a day on interest payments (~3% of GDP) just to service the debt. Were the government to somehow magically wipe out its debt — leaving it with no interest to pay — it would have saved a whopping ~$660 billion last year, though that still wouldn't be enough to get the overall federal budget back into the black.

The CBO forecasts have sparked a national conversation about the right level of federal spending, raising questions that beg political answers, rather than definitive economic ones."

17 notes

·

View notes

Text

“Public cash sloshing about with minimal oversight has proven to be a bonanza for those who are adept at inventing ever more sneaky ways to steal it or finding avenues to turn their public duties into easy wealth.”

#leadership#democracy#government#american history#conspiracy#corruption#crime#Deceit#elites#federal budget#government reform#government spending#law enforcement#politics#protest#voter anger

46 notes

·

View notes

Text

The Conservatives have introduced more than 900 amendments to the federal government's budget and are promising to do whatever it takes to halt its passage through Parliament unless the government meets two key demands.

"We will continue to fight for these two demands — a plan to balance the budget to lower interest rates and inflation, and no new carbon tax hikes," Conservative Leader Pierre Poilievre said Monday.

"If the government does not meet these demands, we will use all procedural tools at our disposal to block the budget from passing, including 900 amendments, lengthy speeches and other procedural tools that are in our toolkit."

Full article

Tagging: @politicsofcanada

#cdnpoli#canadian politics#canadian news#canadian#canada#pierre poilievre#conservatives#federal budget

43 notes

·

View notes

Text

By Sharon Parrott

It’s tempting to ignore a budget resolution released just days before the start of the fiscal year that it’s meant to guide, and amid the chaotic debate around a short-term extension of government funding to avoid a shutdown. But House Budget Committee Chair Jodey Arrington’s proposed budget is important for what it illustrates about House Republicans’ disturbing vision for the country: health care stripped away from millions of people, higher poverty and hunger, capitulation to climate change, more tax cheating by high-income people, and large-scale disinvestment from the building blocks of opportunity and economic growth—from medical research to education to child care. It would narrow opportunity, worsen racial inequities, and make it harder for people to afford the basics. It reflects the wrong priorities for the country and should be roundly rejected.

Chair Arrington made clear in his remarks the intent to extend the expiring tax cuts from the 2017 tax law, which included large tax cuts for the wealthy. In addition, the budget resolution itself would pave the way for unlimited, unpaid-for tax cuts that could go well beyond those extensions. The extensions alone would give annual tax breaks averaging $41,000 to tax filers in the top 1 percent and cost more than $350 billion a year, the Congressional Budget Office estimates. The budget reflects none of these costs and fails to explain how—or whether—they will be offset.

A shocking share of the spending cuts Chair Arrington specifies target people with low and moderate incomes, including $1.9 trillion in Medicaid cuts and hundreds of billions in cuts to economic security programs, such as cuts to assistance that helps people afford food and other basic needs. Just last week the Census Bureau released data showing that poverty spiked last year, more than doubling for children. Rather than proposing policies that could reverse this deeply troubling trend, the budget proposal would deepen poverty and increase hardship.

The budget would also make deep cuts in the part of the budget that is funded annually through appropriations bills. Disingenuously, the budget resolution shows that these cuts total more than $4 trillion over ten years—but hides the program areas that would be cut, labeling them “government-wide savings.” But this year’s House Appropriations bills—which include substantial cuts—make clear that cuts would fall on a wide range of basic functions and services that support families, communities, and the broader economy, including Social Security customer service, support for K-12 and college education, funding for national parks and clean air and water, rental housing assistance for families with low incomes, and more.

Chair Arrington claims the budget’s deep and damaging program cuts are in the name of deficit reduction. But the failure to identify a single revenue increase for high-income people or corporations—and in fact, to potentially shower them with more unpaid-for tax cuts—is an extreme and misguided approach. Moreover, calling for a balanced budget in ten years is merely a slogan that has little to do with addressing our nation’s needs—and the budget resolution resorts to gimmicks and games to even appear to get there, including $3 trillion in deficit reduction it claims would accrue from higher economic growth it assumes would be achieved by budget policies.

A budget plan should focus on the nation’s needs and lay out an agenda that broadens opportunity, invests in people and families, reduces the too-high levels of hardship and financial stress faced by households across the country, and raises revenues for those investments. But the Arrington budget blueprint would shortchange much-needed investments and lock in wasteful tax cuts to the already wealthy for the next decade.

House Republicans are pursuing a damaging agenda at every turn—first threatening the nation with default, and now demanding deep cuts in an array of priorities in this year’s appropriations debate, risking a government shutdown, and proposing a budget blueprint that would take the country in the wrong direction.

#us politics#news#common dreams#2023#republicans#conservatives#rep. Jodey Arrington#house budget committee#house republicans#us house of representatives#federal budget#trump tax cuts#trump 2017 tax cuts#congressional budget office#Medicaid cuts#social security cuts#House Appropriations committee#federal deficit#op eds#Sharon Parrott

20 notes

·

View notes

Text

#us politics#quotes#thom hartmann#democrats#debt ceiling#national debt#federal deficit#national deficit#118th congress#biden administration#donald trump#trump administration#trump tax cuts#taxes#federal budget#tax the 1%#2023

64 notes

·

View notes

Text

As the federal government announces their budget, in an attempt to make life more affordable, the government will be looking into "Halal mortgages."

In other words implementing Sharia law!🤦♂️

Bad policy after bad policy

#islamdaily#islamic#islamicreminders#muslim#muslimah#allah#alhamdulillah#halal#halal mortgage#sharia law#cdnpoli#cadpoli#canada first#Canada#budget#federal budget

4 notes

·

View notes

Text

Now can you pass it?

#spending deal#top-line spending#u.s. house of representatives#government shutdown?#congress#senate#house of representatives#appropriations#Federal Budget#White House#budget negotiations#should've happened six months ago#eleven days left#Speaker Mike Johnson (R-LA)#Speaker of the House#FY2024

2 notes

·

View notes

Text

Different Priorities

"Biden’s budget blueprint aims to cut federal budget deficits by nearly $3 trillion over the next decade. As part of the budget, Biden wants to increase the Medicare payroll tax on people making more than $400,000 per year, as well as impose a tax on households worth more than $100 million.

"Biden will release his fiscal 2024 budget plan tomorrow and has faced pressure to cut spending by House Republicans, who have refused to raise the nation’s debt limit – setting up the risk of a national default.

"House Republicans, however, have yet to offer a blueprint to balance the federal budget, but nevertheless are reportedly planning to pursue cuts to the foreign aid budget, as well as health care, food assistance, and housing programs for poor Americans." (x)

#Federal budget#budget deficit#debt limit#Democratic plan#Republican plan#priorities#let those who can do so pay more vs. penalize US citizens

2 notes

·

View notes

Text

Opinion by Catherine Rampell and graphics by Youyou Zhou

The White House and Congress recently agreed to claw back more than $20 billion earmarked for the Internal Revenue Service. This deal was, ostensibly, part of a grand bargain to reduce budget deficits.

Unfortunately, it’s likely to have the opposite effect. Every dollar available for auditing taxpayers generates many times that amount for government coffers — and the rate of return is especially astonishing for audits of the wealthiest Americans, according to new research shared exclusively with The Post.

A team of researchers at Harvard University, the University of Sydney and the Treasury Department examined internal IRS data for approximately 710,000 in-person audits from 2010 to 2014. Here’s what they found:

Gift link: https://wapo.st/3NtUKDH

#irs#taxes pay for goods and services#federal budget#budget deficit#refusing to collect money from the richest americans but make poor people jump through hoops for pennies#is just the dumbest most futile exercise#beyond being shitty to poor people just because you can and it makes you feel good#which of course is why it's GOP policy

1 note

·

View note

Link

Lying that voting for a budget that provides necessary youth services makes you a pedophile is a way of deliberately trivializing and normalizing the sexual abuse of children.

2 notes

·

View notes

Text

Breakdown of the Omnibus Bill Proposal

The Omnibus 2023 $1.7 trillion Federal budget bill has officially been drafted and put before Congress to vote on today, and it is a doozy. At a whopping 4155 pages, how can one expect to be able to read it in a reasonable time before the vote. I for one am concerned as a responsible citizen about such a document being drafted and possibly passed with much nonsense going on inside of it. Both sides of the political spectrum need to stop doing this, but in any case we can at least have a laugh about some of the provisions it contains.

As detailed by Rep. Dan Bishop of North Carolina on his Twitter account, some of the more interesting budget allocations are:

$65 million for pacific coastal salmon recovery. The word salmon appears 48 times in the bill

$3 million for bee-friendly highways. “Carry out the Pollinator-Friendly Practices on Roadways and Highway Rights-of-Way Programs”. Who writes this stuff??

$65.7 million for international fisheries commissions

$4.1 million for various career programs in Fairfax county Virginia (one of the wealthiest counties in America)

$2.35 million for the maintenance/ support of the Iditarod Trail

Allocations for monuments for journalists and service animals

Plans to rename 25 post offices

$1.5 million for the restoration of the Albany, NY city hall. This isn’t a state and local issue?

Plus billions of more dollars in seemingly broad and overreaching categories. Our country’s politicians need to really clean it up and be more thoughtful and conservative with taxpayers’ money, but I personally don’t see it changing anytime soon. Oy vey

3 notes

·

View notes

Text

“We must recognize today’s debt crisis will be tomorrow’s debt apocalypse if we do not cut the federal budget now—regardless of the pain involved—in order to save America from ruin, and we dare not shirk this responsibility.”

#leadership#government#national debt#debt#debt crisis#federal budget#government spending#government shutdown#politics#taxes#Economics

9 notes

·

View notes

Text

Wednesday Feature: Budget Stuff...Cubed

Happy Hump Day! Busy day so far but wanted to sneak this post in, wrapping up the last two days of posts on budget (federal, Medicare) stuff. This being the third day and post on budgets (and last for a while, I promise), the title fits – cubed.

https://rhislop3.com/2024/04/15/monday-budget-day/

https://rhislop3.com/2024/04/16/medpac-report-to-congress-a-wrap-with-monday/

What follows is a…

View On WordPress

#Becker&039;s Hospital#Budget#CFO Report#Economics#Federal Budget#Happy Hump Day#Health Policy#Industry Outlook#Management#Medicaid#Medicare#Money#Policy#President Biden&039;s Budget#Strategy#Trends#Washington#Wednesday Feature

0 notes