#difference between Sum insured vs sum assured

Text

Sum insured vs sum assured

Sum insured is the coverage for damage whereas Sum assured is a pre-defined sum payable to nominee. Learn the difference between sum insured vs sum assured at SBI Life.

#Sum insured vs sum assured#Sum insured and sum assured#difference between Sum insured vs sum assured

0 notes

Text

Life Insurance vs Health Insurance: Key Differences for Informed Choices

Planning for the future is a cornerstone of responsible living, and if you're a forward-thinker, considering Life and Health Insurance policies should be your next strategic move. Let's embark on a journey to comprehend the nuances of these policies, exploring the key differences that set Life Insurance and Health Insurance apart.

Understanding the Contrast of Life Insurance vs Health Insurance

Life insurance and health insurance serve disparate purposes, acting as financial safeguards in distinct scenarios. Here's a detailed breakdown of the differences:

FeaturesLife InsuranceHealth InsuranceCoverage TypeComprehensive, lifelong coverage, pays at policyholder's deathPrimarily covers medical expenses, health needsPremiumsFixed and flexible premiums, investment plans availableOnly fixed premiums, no investment, prioritizes medical needsDurationLong-term plan with fixed tenureShort-term plan, typically renewed annuallyTerminationUsually ends with policy expirationRenewed annually to ensure continuous health coverageBenefitsProvides financial protection to family upon policyholder's demiseCovers medical expenses and hospitalization during the policy termSurvival BenefitsOffers both survival and death benefits at the end of the insurance termNo survival benefits, focuses on addressing medical needs

Unveiling Life Insurance

Life insurance is essentially a contractual agreement between a policyholder and an insurance company, promising to provide the insured amount to the bereaved family after the policyholder's demise. This coverage serves as a pillar of financial stability for the entire family and supports future plans or investments.

Types of Life Insurance

- Whole Life Insurance: Featuring fixed premium payouts and tax-free, fixed sum assured, it is a cost-effective option with a lower risk profile.

- Universal Life Insurance: Blending investment and death benefits, this option offers flexible premiums and higher returns, albeit with increased risk.

Advantages and Disadvantages of Life Insurance

Pros - Cost-Effective: Less expensive than permanent policies.

Affordable Large Death Benefit: Provides substantial coverage at a reasonable cost.

Online Accessibility: Easy quotes and application process available online.

Convertible Policies: Some can convert to permanent policies without new medical exams.

Health-Based Premiums: Future premiums based on current health for convertible policies.

- Temporary Coverage: Ends once the term expires.

Cost Increase at Renewal: Buying a new policy at term end can be expensive.

Limited Options After Term: Difficulty securing new coverage if health declines.

No Cash Value: Lacks a cash value accessible during the policyholder's lifetime.

Decoding Health Insurance

Health insurance steps into action when health issues arise, requiring medical attention and hospitalization. Policyholders pay fixed premiums for health protection, and the coverage varies based on the chosen health insurance plan.

Types of Health Insurance

- Individual Health Insurance: Tailored for individual needs, covering medical expenses, illnesses, accidents, and emergencies.

- Family Floater Health Insurance: An umbrella coverage for all household members under one premium, addressing various medical expenses.

- Senior Citizens Health Insurance: Customized for those aged 60 and above, accounting for specific needs like domiciliary care and critical illnesses.

Advantages and Disadvantages of Health Insurance

Pros - Financial Security in Critical Illness

Cashless Hospitalization

Network Hospitals for Cashless Services

No Claim Bonus for Increased Sum Insured

Add-ons or Riders for Customization

Financial Protection in Case of Death or Disability

Peace of Mind and Focus on Quality Healthcare

Affordable Healthcare with Comprehensive Coverage

- High Costs, Especially for the Self-Employed

Pre-Existing Conditions Have Waiting Periods

Waiting Periods for Certain Benefits

Age-Dependent Increase in Premiums

Co-Pay Requirements for Insured Customers

Complexity in Comparing Coverage and Premiums

Life Insurance vs. Health Insurance

The decision to invest in life or health insurance hinges on individual needs. While life insurance ensures family financial security in the event of the policyholder's death, health insurance addresses medical expenses during the policyholder's lifetime.

Key Distinctions

- Why Invest?

- Life Insurance: Ensures family financial security in case of sudden death.

- Health Insurance: Shields against rising medical expenses, eliminating out-of-pocket costs.

- Core Benefit:

- Life Insurance: Pays the promised sum to the beneficiary.

- Health Insurance: Covers treatment expenses, subject to conditions.

- Additional Benefits:

- Life Insurance: Various add-ons like maturity benefits, surrender benefits, and loyalty additions.

- Health Insurance: Some policies provide free health check-ups, and no claim bonuses may apply.

- Types of Covers:

- Life Insurance: Individual and group covers, with plans like term, savings, child-related, and retirement.

- Health Insurance: Individual, family, and group coverage, including comprehensive plans and critical illness cover.

- Tax Benefits:

- Life Insurance: Under Section 80C and Section 10(10D) of the Income Tax Act.

- Health Insurance: Under Section 80D of the Income Tax Act.

In your financial portfolio, Life Insurance and Health Insurance play distinct roles. Making an informed decision based on your unique requirements will unlock the full potential of each.

The Benefits Unveiled

Benefits of Life Insurance Plans

- Financial security and protection.

- Tax-free payouts.

- Guaranteed death benefit.

- Tax benefits as per prevailing tax laws.

Both Life Insurance and Health Insurance are indispensable for those concerned about the future, family, and well-being. Health insurance safeguards your medical affairs, while life insurance ensures your family's security in your absence.

In the uncertain journey of life, it's prudent to protect yourself and your loved ones before it's too late. Both these insurance policies are crucial, and the choice between them is now a personal one. Consider your needs, weigh the options, and secure a better future for yourself and your family.

Read the full article

0 notes

Text

Family Floater vs. Individual Health Insurance Making the Best Choice for Your Loved Ones

Health insurance is an indispensable aspect of financial planning, providing a safety net against the rising costs of medical care. When it comes to securing the health of your loved ones, the choice between a family floater and individual health insurance is a crucial decision.

Each type of policy has its own merits and considerations, and understanding the differences can help you make an informed choice tailored to your family's unique needs.

Family Floater Health Insurance

Family floater health insurance is a comprehensive policy designed to cover the entire family under a single umbrella. This type of policy allows you to insure not just yourself but also your spouse, children, and in some cases, even dependent parents. The sum assured is shared among all family members, providing flexibility in managing healthcare expenses.

Advantages of Family Floater Health Insurance

Cost-Effective

One of the primary advantages of a family floater plan is cost-effectiveness. Premiums for family floater policies are generally lower than the combined premiums of individual policies for each family member.

Single Policy, Multiple Benefits

Managing a single policy for the entire family simplifies administrative tasks. From premium payments to policy renewals, dealing with a single policy streamlines the process.

Flexibility in Coverage

Family floater plans offer flexibility in terms of coverage. As family members grow or change, you can easily add or remove individuals from the policy.

Individual Health Insurance

Individual health insurance, on the other hand, provides coverage for a single person. Each family member requires a separate policy, and the sum assured is dedicated solely to that individual. This type of policy is tailored to meet the specific healthcare needs of each person.

Advantages of Individual Health Insurance

Tailored Coverage

Individual health insurance allows for personalized coverage. You can choose a policy that addresses the specific health concerns and requirements of each family member.

Independence of Coverage

Each family member has an independent policy, which means their coverage is not affected by the health conditions or claims of other family members.

Portability

Individual health insurance provides portability, allowing family members to retain their coverage even if they move or if there are changes in family structure.

Making the Best Choice

Assess Family Dynamics

Consider the size and dynamics of your family. If you have a nuclear family with relatively similar health profiles, a family floater plan might be more cost-effective. On the other hand, if family members have distinct health needs, individual policies may be more suitable.

Evaluate Premiums and Coverage

Compare the premiums of family floater and individual policies, taking into account the coverage offered. Consider factors such as pre-existing conditions, maternity benefits, and other specific needs.

Future Planning

Anticipate changes in your family structure and health needs. If you expect additions to the family or have elderly dependents, choose a plan that allows flexibility in coverage.

Review Policy Terms

Carefully review the terms and conditions of each policy, including waiting periods, exclusions, and the network of hospitals covered. Understanding these details is crucial to avoiding surprises during a medical emergency.

Conclusion

Selecting between family floater and individual health insurance involves a careful consideration of your family's health needs, budget constraints, and future expectations. There is no one-size-fits-all solution, and the right choice depends on your unique circumstances.

By weighing the advantages and disadvantages of each option, you can make an informed decision that ensures the well-being of your loved ones. Remember, investing time in understanding your insurance options today can pave the way for a healthier and financially secure future for your family.

0 notes

Text

Annuity Plans vs. Assured Income Plans: Understanding the Difference

When it comes to securing your financial future and ensuring a steady stream of income, annuity plans and assured income plans are two popular options. Both serve the purpose of providing financial stability, but they differ in how they work and what they offer.

What are Annuity Plans?

Annuity plans are financial products designed to provide you with regular, periodic payments in exchange for a lump sum or periodic premium payments. They are typically used as a means of generating retirement income. Annuities come in various forms, such as immediate annuities that start payments right away, and deferred annuities that delay payments until a future date. Annuity plans can be fixed, offering a predetermined payout, or variable, where the payout depends on the performance of underlying investments.

What are Assured Income Plans?

Assured income plans are insurance policies that promise a regular income for a specified period or until a certain age, offering financial protection to you and your loved ones. These plans are structured to provide a guaranteed income, and they are often used as a form of life insurance with added income benefits. If the policyholder survives the policy term, they receive a lump sum or regular payments, ensuring financial security.

Difference Between Annuity Plans and Assured Income Plans

Here are the key differences between annuity plans and assured income plans presented in bullet points:

Nature of the Plans:

Annuity Plans: Annuity plans are financial contracts, typically offered by financial institutions, designed to provide regular payments in exchange for a lump sum or periodic premium payments.

Assured Income Plans: Assured income plans are insurance policies that offer a guaranteed income for a specified period or until a certain age. They function as insurance policies with added income benefits.

Income Stream:

Annuity Plans: Annuity plans provide periodic payments, and they can be immediate or deferred. The income generated may be fixed or variable, depending on the plan type.

Assured Income Plans: Assured income plans promise a regular income, and the payments are typically guaranteed. These plans are designed to provide financial security, and they often include a lump sum payout or regular income.

Purpose:

Annuity Plans: Annuity plans are commonly used for generating retirement income, managing savings, or converting a lump sum into a periodic payment stream.

Assured Income Plans: Assured income plans serve as a form of life insurance with added income benefits. They provide financial protection and a guaranteed income, especially if the policyholder survives the policy term.

Providers:

Annuity Plans: Annuity plans are usually offered by financial institutions, including banks, insurance companies, and investment firms.

Assured Income Plans: Assured income plans are typically provided by insurance companies and are structured as insurance policies.

Payout Flexibility:

Annuity Plans: Annuities offer flexibility in choosing immediate or deferred payouts and can have variable returns based on underlying investments.

Assured Income Plans: Assured income plans offer guaranteed and structured payouts, often including lump-sum payouts upon policy maturity.

Use Cases:

Annuity Plans: Annuities are suitable for individuals looking to secure retirement income, manage their savings, or convert a lump sum into regular payments.

Assured Income Plans: Assured income plans are ideal for those seeking financial protection with guaranteed income, especially to secure their family's financial future.

Understanding these differences will help you determine which plan aligns better with your financial goals and needs, whether it's planning for retirement or ensuring financial security.

Conclusion

The choice between annuity plans and assured income plans depends on your specific financial goals and preferences, whether it's optimizing retirement income or providing financial security.

0 notes

Text

Term insurance vs ULIP – Top 12 Major Differences

Term insurance and ULIP (Unit-Linked Insurance Plan) are two of the most popular types of life insurance policies in India. While both provide financial security to policyholders, there are several key differences between the two. In this article, we will discuss the top 12 major differences between term insurance and ULIP.

Premiums

The premium for term insurance is generally lower than that for ULIP. This is because term insurance provides only pure life coverage, whereas ULIP offers a combination of life coverage and investment benefits.

Coverage

Term insurance provides only life coverage, whereas ULIP provides both life coverage and investment benefits. The investment component of ULIP allows policyholders to invest in equity or debt funds, depending on their risk appetite.

Maturity Benefit

Term insurance does not provide any maturity benefit to the policyholder. On the other hand, ULIP provides maturity benefits, which are calculated based on the performance of the underlying funds.

Flexibility

Term insurance offers little flexibility in terms of policy features and benefits. ULIP, on the other hand, offers a wide range of investment options, riders, and other policy features that can be customized to suit the policyholder's needs.

Investment Options

Term insurance does not offer any investment options. ULIP, on the other hand, offers a variety of investment options, including equity funds, debt funds, and balanced funds.

Returns

The returns on term insurance are limited to the sum assured in case of the policyholder's death. ULIP offers potentially higher returns, depending on the performance of the underlying funds.

Risk

Term insurance carries very little investment risk, as it provides only life coverage. ULIP carries investment risk, as the policyholder's returns are linked to the performance of the underlying funds.

Premium Payment

Term insurance premiums are paid for the duration of the policy term. ULIP premiums can be paid for a limited period or throughout the policy term, depending on the policyholder's preference.

Tax Benefits

Both term insurance and ULIP provide tax benefits under section 80C of the Income Tax Act. However, the tax benefits for ULIP are subject to certain conditions.

Surrender Value

Term insurance does not provide any surrender value. ULIP provides a surrender value, which is calculated based on the performance of the underlying funds.

Charges

Term insurance carries very few charges, such as mortality charges and administrative charges. ULIP carries several charges, including mortality charges, administrative charges, fund management charges, and surrender charges.

Transparency

Term insurance is generally considered to be more transparent than ULIP, as the policy features and benefits are straightforward and easy to understand. ULIP, on the other hand, can be more complex, as it offers a range of investment options and policy features that require careful consideration.

In conclusion, both term insurance and ULIP provide financial security to policyholders. However, term insurance is a pure life coverage policy, whereas ULIP provides a combination of life coverage and investment benefits. The choice between the two depends on the policyholder's financial goals, risk appetite, and investment preferences. It is important to carefully review the policy features and benefits of both before making a decision.

https://myrwealth.com/term-insurance-vs-ulip/

0 notes

Text

Insurance vs Assurance – Let’s have a brief difference

Insurance and assurance are two types of common products which are widely sold in the market these days. But both insurance and assurance are two completely different products offering more or less the same thing which is confusing and misunderstood.

Here in this article, we will discuss insurance vs assurance which will help you to learn the key differences between both and how these two are separated from each other.

Insurance vs assurance

Definition

Insurance can be defined as the financial arrangement in which the insurance company commits or enters into an agreement to indemnify the loss of an insured person due to any kind of natural calamity or any personal mishappening that happens to the insured person.

In that case, the insurance amount might be small, or some percentage of this loss caused to the insured, or else it can also be a lump sum amount of money for which the insured has subscribed for.

On the other hand, assurance can be defined as an agreement between the insurance company and the insured person that the company will provide cover for an event that may likely happen sooner or later in the life of the person getting insured.

Objective

Insurance provides financial stability in case of any uncertainties where an assurance pays out predetermined money when an event takes place.

Allowable Number of Claims

One major difference between insurance and assurance is that all policyholders associated with insurance can file several claims, whereas those with assurance can only file one.

Different Types of Policies

Insurance generally includes things like car insurance, health insurance, and mobile phone insurance, among other things while Assurance involves life insurance, term insurance, endowment plans, ULIPs, and other financial products.

Principle

The primary principle of Insurance is the principle of indemnity on the other hand assurance is based on the principle of certainty.

Policy Duration

Insurance policies are usually for short-term whole life while the policies primarily based on assurance are usually long term.

The Nature of Risks

Another primary difference between insurance and assurance is that theft, burglary, catastrophes, fire, accidents, and other unknown risks are generally covered by insurance, while assurance only covers death.

Conditions

Insurance plans have several conditions on which the company decides what kinds of loss or damages are covered within that policy. Along with that, the amount is definitely payable.

On the other hand, an assurance general comes with specific plans or paths to save and protect a definite benefit at maturity. Thus they are usually life insurance plans, for example, whole life insurance, endowment plans, and to a specific degree term insurance.

Claim payment

The claim payment is approximately equal to the amount of loss in the case of insurance. For example, the cost of repair and replacement of vehicle parts, hospitalization bills, etc. are generally covered by insurance.

Whereas Pre-decided amounts are generally covered for a specific event in case of assurance. For example, a major illness such as cancer, the death of the policyholder, etc.

Conclusion

Although insurance and assurance are two similar things as they both provide financial compensation, both of them are quite different from each other in their scope and usage.

So it is very important for you to know, understand, and be well acquainted with all these terms if you want to purchase insurance.

Understanding the meaning and significant difference between insurance and assurance can surely assist you in better way to comprehend the insurance plan’s benefits.

0 notes

Text

Sum Insured vs. Sum Assured in Group Health Insurance

Before you choose a group health insurance for your company, it is important to research the difference between insurance policies. Insurance policy documents contain several technical terms that a policyholder needs to understand. For more information visit here: - https://www.ethika.co.in/blogs/sum-insured-vs-sum-assured-in-group-health-insurance/

0 notes

Text

Should you revive your old term insurance policy or buy a new one?

The world we live in has changed completely over the past two years. The pandemic, and the millions of deaths it has caused, has made us realise how uncertain life is.

And as people worldwide keep succumbing to the deadly COVID-19 disease, the perspective around life insurance, too, has changed. It is now necessary for everyone to ensure that no matter what happens tomorrow, their future, and that of their family, is secure.

Policy lapses and renewals

When it comes to securing your family’s future, life insurance is key. You may have a policy in place, but it’s quite possible you miss a premium payment for some reason or the other and the policy lapses. The good news is that you have the option of reviving the policy. Even so, it’s important to understand what works better for you — reviving your lapsed policy or buying a new one altogether. Let’s understand this in detail.

When does a policy lapse

Benefits of the term insurance plan are available to nominees of the policyholder as long as the premiums are paid on time and the policy remains active. If, for some reason, a policyholder fails to pay the premium before the due date, he or she can do so within 15–30 days’ grace period. In case the premium is not paid even during the grace period, the policy lapses.

How to revive a policy

The lapsed policy can be revived within five years of the last date of its first unpaid premium. To revive a lapsed policy, one needs to pay the accumulated unpaid premiums along with interest and taxes. Depending on the policy terms and conditions, the policyholder may also have to pay a penalty and revival charges. If more than six months have passed since the policy lapsed, the policyholder may also need to undergo medical tests. Under certain special schemes, they can get a discount on these charges.

Reviving a lapsed policy vs buying a new one

It’s possible that a policyholder may have been unable to pay the insurance premium for some reason or may have even forgotten to do so, causing the policy to lapse. At a later point of time, he or she may again feel the need to possess life cover. In such a situation, the policyholder has two options — reviving the old term insurance policy or buying a new one. This dilemma is confronted by many and there is no single solution. The choice varies from case to case.

Because reviving the lapsed policy attracts additional costs apart from the unpaid premium, these must be taken into account while making a choice. On the other hand, buying a new policy would mean a higher premium because you bought your lapsed policy when you were younger and with years having passed, the new premium would most likely be higher. There is, however, a possibility of getting good cover at an affordable price with technology making insurance policies cheaper, especially when you buy online. So one must compare insurance plans offered different insurers to get the best deal.

Having taken all these factors into account, one would realise that sometimes it makes more sense to renew your lapsed policy and at others, it is better to buy a new one.

In cases where the old policy was bought a long time ago and lapsed a short while back, it often makes more sense to revive the policy since the difference in premium between the lapsed policy and a new one would be too wide. In some cases, insurers offer to waive interest and penalty charges to revive a policy. This is a good opportunity to revive the old policy and it makes financial sense.

If the old policy was bought recently and not many premiums were paid, it may make more sense to opt for a new one as the cost of reviving it may outweigh the benefits of staying with it. Better options at comparable premiums may be available from other insurers.

Enhancing coverage with a new policy

If a policyholder is not satisfied with the coverage offered by the lapsed policy, which could be due to an inadequate sum assured or absence of riders, he or she may consider buying a new one. It would make more sense to enhance the coverage to suit your evolved needs.

Most insurance companies keep coming up with new features to cater to the consumer-centric insurance market. If, at the time of buying the policy, you could not opt for a useful feature that is available now, you may opt for a new policy. For instance, some policies now come with an exit option where if you want to discontinue your policy, you would be paid back all the premiums that you have paid until then for the base protection. Some policies also come with a benefit wherein, if the policyholder dies, a life cover will start in his/her spouse’s name which will be half the life cover of the policyholder and the nominee will receive the sum assured. Such factors need to be taken into account when you decide whether to revive a lapsed policy or purchase a new one.

In conclusion, the choice between reviving an old policy and buying a new one will vary on a case-to-case basis. The best option is always to ensure that your policy remains active and the premiums are paid on time. If, for some reason, your policy lapses, get yourself covered as soon as possible irrespective of whether you choose to revive your old policy or decide to opt for a new one.

#lifehealthadvisors #areteautomation #financialfreedom #retirementplanning

Credits: Sajja Praveen

Date: June 1, 2022

Source: https://www.moneycontrol.com/news/business/personal-finance/should-you-revive-your-old-term-insurance-policy-or-buy-a-new-one-8615861.html

0 notes

Link

Critical illness is something which can happen to any individual, and its treatment requires a lot of financial support. Indians are at an expanding danger of life-threatening infections, and there are numerous who are experiencing ailments like cardiovascular ailment and cancer, and that too, at a young age. In such a case, how can you get yourself secured financially against all such diseases?

Here comes the significance of critical illness spread, which is increasing due to the rising number of patients suffering from ailments like heart attack, cancer and organ failures. Because of the long tenure of treatment and the high expense of non-clinical and clinical costs, the critical illness cover is needed. The sum guaranteed is paid promptly based on the terms and conditions of the policy.

And, if you already have a medical insurance policy whether its an individual or family floater plan, at that point you may consider including critical illness rider in your existing policy or even buy it separately. Let’s get into the detail of critical illness insurance policy to have a better understanding.

Critical illness insurance policy

Critical illness policies cover life-threatening diseases that could even extend to a longer period of time and require specialised treatment. So, if secured with such policy, the insured and the policy nominee get the coverage amount in lump-sum following the policyholder is diagnosed with a critical illness. This amount can be used for the costs not covered by conventional health insurance policies.

The main thing to note is that a critical illness cover is not like a standard health insurance plan. Under a critical illness cover, the insured will get the coverage as a lump-sum amount if the insured gets diagnosed with a critical ailment. That money will deal with the expense of medical treatment for the disease and even used for paying off any pending loans. Whereas in health insurance, you get the claim depending on your medical bills which is further subject to the terms and conditions of the policy. A critical illness plan pays you the whole total sum assured independent of your medical costs.

Critical illnesses that are covered under a critical illness insurance policy

Critical illness insurance policy or rider mostly cover severe diseases like heart attack, cancer, stroke, kidney failure or paralysis. Every insurance provider has its own list of critical illnesses which might or might not differ. So, while choosing a critical illness rider or policy, you should go through the list of diseases that it covers.

Who should all purchase a critical illness cover?

Those individuals who have a family history of critical illnesses should opt for such cover. Often, the primary reason for critical illnesses is hereditary. For example, the risk of cancer growth is higher in case you have a family background of the illness. And thus, as a proactive measure, you should get a critical illness spread for a protected future and avail the best possible medical treatment.

The individuals who are the sole earner in the family should opt for a critical illness cover. Suppose you are the primary earning member of the family. In that case, it is necessary to protect the whole family with a critical illness insurance policy as you will never want your loved ones to be in financial distress when you get diagnosed with a critical illness. The policy or rider coverage amount will take care of your treatment cost while saving your hard-earn money from draining out. Besides, a critical illness cover can likewise make up for your loss of salary while you are not in a situation to work because of your medical issue.

Critical Illness policy vs rider

When you choose to secure yourself against any critical illness, you should pick between the alternatives of a standalone policy or you can likewise decide on a critical illness rider that comes with your standard term insurance policy or health insurance plan. Whereas a rider will be accessible for a much-lesser cost and will offer similar advantages like an independent critical illness policy. However, you should know about the limitations and adaptability that accompany a rider regarding expanding your sum assured. Therefore, if affordability is not a challenge, then perhaps you can opt for a standalone critical illness insurance policy.

From where you can buy one

While picking the insurance provider, you must focus on the terms and conditions of the policy as well as add-on benefits that are accessible; so that you opt for the right coverage as per your requirement. Another factor to consider is the case settlement procedure which ought to be simple and hassle-free. Also do check their claim settlement ratio to know their reputation in the market.

Hence, if you are wondering whether to opt for critical illness coverage or not, then hopefully this blog will help you to clear out your concerns. You can visit BimaKaro.in or speak to their financial advisors to get expert advice on a critical illness insurance policy.

Source:https://bimakaro.in/ik/term-life-insurance/why-should-you-consider-buying-a-critical-illness-insurance-policy-2223

1 note

·

View note

Text

Life Insurance coverage in Singapore – The Fundamentals of Complete Life and Time period Insurance coverage

This entire insurance coverage factor actually does take some time to wrap your head round. The phrases “entire life insurance coverage” and “time period insurance coverage” don’t actually imply or clarify very a lot to the common individual.

The typical Singaporean can also be educated from a younger age to run away from individuals who wish to have such conversations with you, as in the event that they had been contaminated zombies. Nonetheless, in some unspecified time in the future in your adulting, you come to the dreadful realisation that insurance coverage isn’t avoidable for ever and that there’s worth to getting a minimum of some form of life insurance coverage coverage.

We’re right here to arm you with some primary data earlier than you face an insurance coverage agent, so you understand what you’re entering into.

Contents

Complete life vs time period insurance coverage – what’s the distinction?

Endowment vs investment-linked entire life insurance coverage insurance policies

What’s the distinction by way of premiums (value)?

Who should purchase entire life insurance coverage?

How does “restricted pay” work?

What’s “give up worth”?

What’s the distinction between entire life and time period insurance coverage?

An insurance coverage coverage supplies safety for monetary losses suffered from a selected occasion. Within the case of life insurance coverage, the “occasion” is the lack of your life, or within the case of complete everlasting incapacity (TPD). To place it merely, a life insurance coverage coverage is designed such that in the event you die, the insurer’s payout ought to be sufficient to your dependents to reside on when you’re gone.

However before you purchase any form of life insurance coverage, you’ll want to determine whether or not you’ll go for entire life insurance coverage or time period insurance coverage. What’s the distinction between them, and which is best for you?

Time period insurance coverage

Complete life insurance coverage (endowment)

Complete life insurance coverage (investment-linked)

Essential goal

Safety

Safety + potential to develop financial savings

Safety + potential to reap funding returns

Protection

Most plans cowl dying and complete everlasting incapacity (TPD)

Protection Interval

A selected time period interval or as much as a particular age

Normally as much as finish of life

Normally as much as finish of life

What’s paid upon dying of insured?

Sum assured

Sum assured + accrued bonuses if any

Sum assured + worth of models in fund

What’s paid if coverage is surrendered early?

Nothing, since there isn’t any money worth

Money worth (assured + non-guaranteed bonuses if any)

Worth of models in funding sub-fund

Each time period and entire life insurance coverage present safety within the occasion of complete everlasting incapacity (TPD) and dying. The 2 principal variations between them are: (a) how lengthy the coverage will cowl you and (b) how a lot cash you get again if nothing occurs to you.

Time period insurance coverage supplies you with safety just for a set time frame, say 20 or 30 years, after which the plan expires. If nothing occurs to you and also you don’t make a declare, you get nothing (aside from a letter thanking you for giving them cash for the final 30 years).

Such a protection is cheaper, and it is smart in the event you plan to offer to your dependants for a restricted time. For instance, till your youngest little one finishes tertiary schooling.

Alternatively, entire life insurance coverage covers you until the tip of your life, so long as you proceed to pay the premiums.

It’s rather more costly, but it surely has the potential to develop the cash you paid. The potential progress varies relying on whether or not your entire life insurance coverage is an endowment plan or an investment-linked coverage (ILP). Extra on these within the subsequent part.

In both case, the “benefit” of entire life insurance coverage over time period insurance coverage is that, even in the event you terminate and give up the coverage, you may get again a number of the financial worth.

]]>

Sponsored Message

Give your family members the monetary safety they deserve and luxuriate in nice financial savings. Singapore Life is providing as much as 15% off once you apply for a Time period Life or Important Sickness plan by 30th September. Discover out extra right here.

Again to prime

Endowment vs investment-linked entire life insurance coverage insurance policies

In Singapore, entire life insurance coverage often features a financial savings or funding part, named endowment and investment-linked coverage (ILP) respectively.

Resulting from these options, some individuals see their entire life insurance policies as an funding/financial savings plan as an alternative of simply being a plain previous safety plan. These added options make entire life insurance coverage costlier than time period insurance coverage.

Endowment Insurance policies

Endowment insurance policies are sometimes seen as a method that can assist you construct up monetary self-discipline because the financial savings part is constructed into the month-to-month insurance coverage premiums.

For example, let’s say you pay a month-to-month insurance coverage premium of $250 to your endowment coverage. Of this quantity, $100 would possibly go into the insurance coverage safety part, and $150 will go into the financial savings part.

After a set interval of say 20 years, it is possible for you to to get again a number of the money worth accrued, relying on the assured and non-guaranteed advantage of your coverage.

Funding Linked Insurance policies (ILP)

For an ILP, the financial savings part will likely be changed with an funding part the place a part of the premiums go into shopping for models in funding funds.

In contrast to endowment insurance coverage insurance policies, ILPs often don’t include assured values. The worth of the ILP relies on the efficiency of the fund you’ve purchased into. So yeah, you could possibly get zilch if issues don’t go effectively and this represents a possible alternative value as you could possibly have made that cash work some place else for you.

Some customers like ILPs as a result of they like the concept they will make investments and have monetary safety by way of a single monetary product. There’s even have a variety of funds to select from that fits totally different funding targets and danger urge for food.

Whether or not you select to purchase a time period insurance coverage, endowment plan or ILP, the primary factor is to determine in case your selection fulfils your monetary goal and takes into consideration the long-term prices concerned.

Again to prime

Let’s evaluate the premiums for entire life vs time period insurance coverage

Whereas life insurance coverage was the “go-to” insurance coverage for most individuals, with elevated monetary literacy, extra individuals are open to getting time period insurance coverage as an alternative.

One of many best benefits of selecting a time period insurance coverage as an alternative of a life plan is the substantial financial savings you get from decrease premiums. So if you understand you want insurance coverage safety however are in a section of life the place you possibly can’t afford setting apart very a lot each month, this turns into your best option for now.

Right here’s a simulation of how a lot insurance coverage premium an individual pays for all times and time period insurance coverage based mostly on the next standards: 35-year-old man, non-smoker with sum assured of $500,000. Let’s name him Mr Siva.

Kind

Life insurance coverage coverage

Annual value

Whole quantity paid

Time period

FWD Insurance coverage Time period Life

$510

$510 x 30 years = $15,300

Time period

Nice Japanese Max Time period Worth

$840

$510 x 30 years = $25,200

Complete life

NTUC Restricted Pay Safety

$10,038

$10,038 x 29 years = $291,103

Complete life

AXA Life MultiProtect

$13,440

$13,440 x 30 years = $403,200

As you possibly can see, the distinction within the quantity of premiums paid between time period and entire life insurance coverage is big.

This is the reason some monetary advisors even advocate “purchase time period and make investments the remaining”. In different phrases, purchase a time period coverage for the required safety, after which use the cash you didn’t use to take a position. This can be a technique that has the potential to develop your cash in the event you make the appropriate funding selections.

Alternatively, some customers prefer to get an entire life coverage as a result of it presents some money worth do you have to determine to give up the coverage.

Primarily based on the assured give up worth (after 30 years) for the above entire life insurance policies, one can anticipate to obtain $246,000 and $307,000 for the NTUC and AXA plan respectively. Utilizing these values, it signifies that the full premiums paid to your entire life coverage will likely be diminished considerably this brings it extra on-par to time period plans by way of value.

One necessary consideration when selecting to take up a time period plan is that the protection time period could expire at a time the place you’ll proceed to wish safety (or want it most).

For the above case, the time period plan will expire when Mr Siva is 65 years previous. Relying on his state of affairs, Mr Siva could wish to proceed getting life insurance coverage protection for one more 20 years.

Nonetheless, relying on his well being at 65, some firms could think about him “uninsurable”. Even when he does qualify for a brand new insurance coverage plan, premiums are going to be very costly at that age, and he could not be capable of afford them throughout his retirement years.

Again to prime

Who should purchase entire life insurance coverage?

Whereas it might appear that the “purchase time period and make investments the remaining” mantra makes complete financial sense, there are cases the place shopping for entire life insurance coverage is usually a better option.

Whether or not you want life insurance coverage actually relies on your stage in life. If you’re a younger 20-something with no dependents and restricted obligations, you’ll possible not want an entire life insurance coverage coverage.

However say you’re 40-year previous, and the only breadwinner in a household with two younger youngsters and aged dad and mom. In such a case, entire life insurance coverage can assist to offer monetary safety to your family members whereas concurrently serving to you construct up some retirement funds to your golden years.

Life insurance coverage protection is a method of caring for your loved ones, since you don’t need them to endure when any misfortunate befalls you. In a survey by NTUC Revenue revealed in April 2019, 48% of 329 married adults surveyed expressed that they had been motivated to purchase life insurance coverage as a result of they need their family members to take care of the identical lifestyle when catastrophe strikes.

The opposite state of affairs the place entire life insurance coverage could make sense is to your younger little one. You would possibly assume, “why would my 2-year previous want entire life insurance coverage?”

For one, it ensures insurability and no-exclusions since most younger youngsters have a clear invoice of well being. Many dad and mom additionally take up an entire life coverage with endowment plan with a view to begin saving for his or her little one’s future schooling. Additionally, your little one is prone to get pleasure from decrease premiums when getting insured from a youthful age.

For those who’re getting an entire life coverage for a kid, selecting a restricted pay possibility will be a good suggestion. Your little one can get a life-long protection with premium funds for as quick as 12 years. It may well thus be a significant present for a younger little one as an alternative of saving cash in a financial institution deposit account that can’t beat inflation.

Again to prime

How does “restricted pay” work?

Getting a life insurance coverage with restricted pay interval means you solely have to pay premiums for a restricted variety of years in change for a lifetime’s protection.

Say for example, Andy (male, non-smoker, age 35) decides to make premium funds of S$250 per thirty days for under 15 years for his entire of life plan up until age 50.

For the subsequent 15 years, Andy pays about S$45,000 for a sum assured of S$100,000. The insurance coverage protection will proceed for remainder of his life even after he ends his premium cost at age 50. Relying on his insurer and plan, he’ll possible even be entitled to some accrued money worth if he surrenders his coverage when he reaches 65 years previous.

What is that this “give up worth” factor?

Once you purchase a life insurance coverage, you could have a give up proper – the chance to terminate your life insurance coverage contract in change for its money worth. You may solely do that in the event you’ve not made any claims earlier than.

Once you select to give up your coverage, you’ll hand over the remaining protection whereas your insurer presents you with a money give up worth, which is how a lot cash you’ll obtain in return.

Do observe that the give up worth of your coverage will likely be decrease than the dying profit payout. Which means you’ll obtain much less cash by surrendering your coverage as in comparison with having the dying profit once you move on. Thus, it’s usually not advisable to give up your coverage. Not solely will you lose out by way of financial worth, however taking over a brand new insurance coverage coverage at a later age will most likely incur the next premium cost.

In the end, there’s no proper or incorrect in selecting whether or not to get a time period plan or entire life insurance coverage – all of it relies on what you want and the way a lot you possibly can afford.

Complete life insurance coverage prices extra, however it may be a handy possibility for many who need each monetary safety in addition to a financial savings/funding part. Alternatively, a time period life insurance coverage plan presents a terrific cost-effective possibility for many who need (solely) pure safety.

What are your ideas on shopping for life insurance coverage? We wish to hear from you.

Associated articles

Well being Insurance coverage in Singapore – The whole lot You Must Know to Survive 2018

The Most cost-effective Automobile Insurance coverage Insurance policies in Singapore (UPDATED 2018)

The Finest Journey Insurance coverage in Singapore – 2018 Overview

]]>

Tags: Featured, Life Insurance coverage

from insurancepolicypro http://insurancepolicypro.com/?p=81

1 note

·

View note

Text

After a few years, a term plan may be changed to an endowment plan?

Introduction

Generally, most insurance policies do not allow conversion from one type of policy into another. However, some life insurance policies come with a convertible option, allowing you to change the type of policy after a few years. Insurance companies will charge an extra premium if you want to have the option to convert the policy at a later stage. When you convert from one kind of policy to another, your premium is revised to the applicant rate in the new policy.

Why convert?

When you start savings and investments at a young age, you may not have a lot of funds to spend on an insurance cover. In that case, you get the cheapest insurance with basic coverage only. As your career advances and income rises, you may want additional coverage in your insurance policy. At that stage, it is good to have the option to convert your policy. Insurance policies are long-term, often 10-20 years. Your financial situation could be completely different after a few years of entering into the policy. It is good to have an option to convert then. Between an insurance plan, you may even start a family, further accentuating the need for additional financial security.

Term insurance vs life insurance

When buying a life insurance policy for the first time, most youngsters take term insurance policies for insuring life. These policies have a fixed term for which the policy remains in effect. If the policyholder dies during the term, their nominee gets a pre-determined assured sum. Most policies also allow the choice to the nominee to opt for a monthly income instead of a lump sum. Apart from death, these policies could cover critical illness or disability for an extra premium. Term insurance plans are the cheapest and most-preferred life insurance plans.

The other form of life insurance is to get a traditional life insurance policy. In these policies, the life of the policyholder remains insured as long as regular premium payments are made. Such policies are indefinite and do not have a pre-determined term. Term insurance can be converted into regular life insurance if the same is possible as per your insurance contract.

Endowment plan vs term plan

An endowment policy is life insurance and a saving policy. Endowment policies usually have a term during which the life of the policyholder is insured. After the term is over, endowment plans provide you a lump sum or a monthly income based on your preference. Endowment plans generally have a much higher premium compared to a term plan. Under endowment plans, nominees usually do not get any benefits if the policyholder survives the term of the policy.

Conclusion

When buying a life insurance policy, you have multiple options, and they can be confusing at first. You need to assess your needs and then make an informed choice. If you think your needs will change in the future and you may want to change your policy, discuss it with your insurance provider beforehand. The extra premium paid for a conversion plan is often worth it so you can change your plans according to your future needs.

0 notes

Text

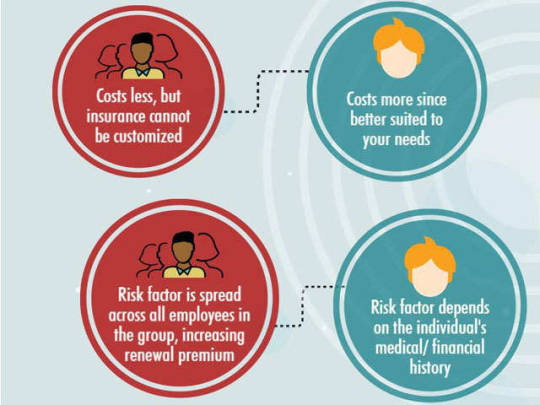

Group Health Insurance vs Individual Health Insurance

You’d think that the differences between group health insurance policies and individual insurance policies would be simple enough to understand. In truth, however, many people are uncertain of the nuances of group insurance and individual insurance. Comparing these two kinds of health insurance policies will provide you with useful information, thereby allowing you to pick what’s best for you.

Yes, it’s true that both types of insurance policies provide similar coverage, but they do differ in the details, sometimes quite prominently. Small businesses in particular need to assess the need for a group insurance plan, both for tax and employee-benefit purposes.

In order to better understand the differences between group insurance and individual insurance, and consequently make important decisions concerning it, it is necessary to know what they entail.

Having said that, let’s have a look at the differences between group and individual insurance.

Definitions

Group Insurance is simply an insurance package an organisation buys for the benefit of its employees. The organisation may design a self-insured plan itself or select a pre-planned insurance policy from an insurance company.

Individual insurance is self-explanatory too – it is the insurance package an individual buys for themselves, or for a group of people, such as for his or her family. Though the name suggests otherwise, it isn’t true that an individual insurance package covers only a single person.

The differences

Cost

Understandably, group insurance plans cost less and can be availed at low or no cost to the employee, much like buying in bulk sometimes gets you discounts. Each employee will not have to pay any additional fees unless anyone opts for additional benefits that are not offered to the group. Additionally, premium for group plans is deducted from the salary, as opposed to individual plans wherein premium is paid separately. This is why some may choose not to purchase an individual health insurance plan if they feel that the employer’s group health insurance package covers their needs.

Convenience and control

Although not too common a scenario, an individual may be denied the insurance package, for a variety of reasons, be it medical or financial history. However, with group insurance packages, every individual who is an employee of the company is eligible for the insurance package and is automatically granted approval for the insurance package.

This is also because with group insurance plans, the process of underwriting, wherein the to-be insured’s medical history is closely examined, is sometimes waived off. Thus, it’s a lot easier to obtain an insurance package through the organisation.

However, with individual insurance packages, the individual has full freedom to set the terms of the policy. Only you can choose for the policy to be discontinued. The policy can be decided on the basis of your own personal medical, financial and social situations, rather than spread over a number of individuals like in Group Insurance.

No Claim Bonus

With a group policy, even if you don’t make a claim throughout the tenure of the policy, you, as an individual, do not get any benefit. In contrast, with an individual insurance plan, if you do not make a claim throughout the tenue of the policy, you are eligible for a No Claim Bonus- which can be thought of as a reward for being healthy- and appears in the form of discounted renewal premium or incremental cover at no additional cost.

Additionally, if you do not make a claim but another individual covered under the group plan makes a claim on the ground of having a baby, having contracted a critical illness, etc., the overall cover being offered to the group may be reduced if the employer is unwilling to pay more premium on the group’s behalf.

Applicability

Unlike Individual Insurance plans that are applicable no matter at all times, Group Plans only offer cover for as long as you are employed and the employer is paying the premium. When you retire/resign, you may have an option to convert the group cover to an individual policy.

However, the conversion premium typically is much higher than that for a new individual life insurance policy. So it is advisable to convert only if the premium works out lower than a new policy or if you are otherwise uninsurable.

If you decide to convert, you will have to produce the certificate of coverage that your employer had given you under the group insurance policy.

Which should you choose?

Group insurance plans can be a real cost-saver for the company and the employee, making it more of a bargain, but affordable individual insurance packages are certainly a necessity that even those covered by their companies cannot afford to do without.

This is mainly because individual insurance policies allow you to choose exactly what’s covered and what is not. You can decide which critical llnesses and diseases you want to cover- based on your family’s and your medical history, how many members of your family you want to cover, and even how much of a sum you are assured.

In contrast, group insurance policies are constructed according to the company’s policies and the will of your employer.

Also, the group insurance cover through your employer only lasts as long as you continue working for your employer. If and when you switch jobs, you may or may not receive health insurance cover from your new employer as it is not mandatory for your employer to provide group health insurance cover.

Also, you will most likely not enjoy the same extent of cover as you had with your previous employer.

Lastly, you may find it difficult to get an individual health cover post retirement (if you don’t already have one), especially if you have developed any health issues. Even if you do get covered, the premium for such policies will invariably be quite high.

For the above reasons, it is advisable to get yourself an individual health insurance cover even if you are covered under a group plan through your employer.

0 notes

Text

Term Insurance and Life Insurance - Which Is Better?

Young individuals can avail a term insurance plan such as Bajaj Allianz Smart Protect Goal Term Insurance available at Finserv MARKETS which will provide coverage for a fixed number of years. Through the Term Insurance calculator available on the website of Finserv MARKETS, they can figure out that they are at an advantage when it comes to the premium rates. Once they reach middle age, they can consider opting for a whole life insurance plan.

Availing life insurance is an important part of managing your finances for your long term needs. Financial planning is essential in order to secure the lives of you and your family. The two most popular ways to fulfill the requirement of securing the future are getting term insurance and/or whole life insurance. Both plans have their own advantages and disadvantages. In order to decide which plan would suit you better, it is important to know the key differences between the two.

Term life Insurance and Whole Life Insurance are different from each other in the following aspects :

Premium : Term insurance plans come with a lower premium compared to whole life insurance plans.In a term plan, the entire premium amount is used to cover the insurance.You can calculate the premium rates for a Bajaj Allianz Term Insurance Plan available at Finserv MARKETS using a term insurance premium calculator available on the website of Finserv MARKETS.

On the other hand, in whole life insurance plans, a part of the premium is utilised for insurance coverage while the rest is used for investment.In the case of whole life insurance, if the policyholders withdraws,surrenders or lives up to the maturity period, the accumulated amount is returned at sum assured value. Among all types of life insurance, term insurance plans offer the lowest premium and hence, the premiums of term insurance plans are much more affordable. Contrary to this, whole life insurance plans have a much higher premium and become difficult to afford if you are seeking a high amount from the insurance.

Thus, due to the huge difference in premium rates of term insurance vs life insurance, availing term insurance might be a better option if you are looking for affordable coverage. With a whole life insurance plan, it becomes difficult to get sufficient coverage to meet long term future expenses due to their high premium rates. You can avail a Bajaj Allianz Term Insurance Plan available at Finserv MARKETS which offers a high insurance coverage at low premium, hence making it one of the most affordable options you have for your financial security.

Cash Value : In the whole life insurance plan, a part of the premiums is allocated to investment. Thus, a cash value gets generated over a period of time. Policyholders can take advantage of this cash value to take steps such as availing a loan at low interest rate. Term Insurance plans do not offer this benefit. In other words, term insurance plans do not have any saving element in it. So, if one intends to build an investment corpus, life insurance is a better option compared to term insurance.

On the other hand, a whole life insurance plan has a saving component in it. Whole life insurance plans offer a death benefit in case of death during the term or a maturity benefit if the policyholder survives the term. Contrary to this, the term insurance plan does not offer any maturity benefit.

Tenure : Term insurance plans offer insurance for a fixed period of time ranging from 5 to 30 years. Whole life insurance plans are flexible and can be applicable till the policyholder reaches 100 years of age. Thus your age is an important factor in deciding whether you should opt for a term insurance plan or whole life insurance plan. If you are young and have just started your career, a term insurance plan is a better option in terms of being much more affordable.

You have plenty of time to build financial security for you and your family, and term plans allow you to do that at a low cost. If you use the term insurance premium calculator on the website of Finserv MARKETS, you will observe that being younger also means lower premium rates.

0 notes

Text

Corona Kavach Vs Corona Rakshak – Which one to buy?

Corona Kavach Vs Corona Rakshak – Which one to buy? Getting confused right? Let us understand the difference between these two products for our better requirements. Due to the Corona pandemic, IRDA suggested all non-life insurers offer the standalone Corona related health insurance products to us.

Let us first understand the features of the both products in detail.

Corona Kavach Policy – Features and Benefits

What is the tenure of Corona Kavach Policy?

The policy period is 3 and half months, 6 and half months, and 9 and half months (including the waiting period). Hence it is always less than a year (which is the standard norm for all other health insurance products. Here, as it is a disease-specific, it is less than a year period.

How much it will cost?

Even though the product features are same across all insurers, the price vary based on the company to company. Hence, you have to check with individual companies before buying a product.

How much is the coverage?

There are two covers here. One is base cover and the second is optional cover.

Base Cover:-

1) Covid Hospitalization Expenses:-The hospitalization expenses incurred by the insured person for the treatment of Covid on Positive diagnosis of Covid in a Government-authorized diagnostic center. The coverages are as below.

a) Room, Boarding, Nursing Expenses as provided by the hospital or nursing home.

b) Surgeon, Anesthetist, Medical practitioner, Consultant, special fees (including the telemedicine) whether paid directly to the treating doctor or to the hospital.

c) Anesthesia, Blood, Oxygen, Operation theater charges, surgical expenses, ventilator charges, medicines and drugs, costs towards diagnostic, PPE kit, gloves, mask, and such other expenses.

d) ICU or ICCU expenses.

e) Ambulance expenses to the maximum of Rs.2,000 per hospitalization.

2) Home Care Treatment Expenses:-Health insurance will cover the costs of treatment of Covid incurred person on availing treatment at home maximum up to 14 days per incident provided that:-

a) The medical practioner advices the insured person to undergo treatment at home.

b) Continues active treatment and daily monitoring expenses.

c) Cashless home care benefit is available.

d) However, if the insured willing to take the service from non-network hospitals, a prior approval is required. Insurance company will respond to the same within 2 hours of receiving the request.

e) The expenses covered are-Diagnostic test undergone at home or at the diagnostic center, medicines prescribed in writing, consultation charges, nursing charges, medical procedure expenses or cost of a pulse oximeter, oxygen cylinder and Nebulizer.

3) Ayush Treatment

4) Pre-Hospitalization-Medical expenses incurred with respect to Covid prior to 15 days of hospitalization are also covered.

5) Post-Hospitalization-Medical expenses incurred after the discharge of up to 30 days is also covered under this insurance.

6) There is NO DEDUCTIBLE in this policy.

Optional Cover:-

Hospital daily cash-The company will pay 0.5% of sum insured per day for which 24 hours of continues hospitalization for treatment of Covid following an admissible hospitalization claim under this policy. This benefit will be payable for up to the maximum of 15 days during the policy period.

Whether individual or family floater?

This plan is available individually or as a family floater. Hence, it is acting like a typical health insurance product with this feature. Here, family means-Self, legally wedded spouse, parents and parents-in-law, and dependent Children (i.e. natural or legally adopted) between day 1 of age to 25 years. If the child above 18 years of age is financially independent, he or she shall be ineligible for coverage.

How much cover you can opt for?

The minimum coverage is Rs.50,000 and maximum cover is Rs.5,00,000.

What are the premium payment options available?

Only single premium payment option is available as it is limited for less than a year insurance.

What is the minimum and maximum entry age?

The minimum age is 18 years and maximum entry age is 65 years. However, Dependent Child / children shall be covered from Day 1 of age to 25 years subject to the definition of ‘Family’”.

Is it availble for lifelong renewable?

Lifelong renewability, migration and portability stipulated under Regulation 13 and 17 of IRDA (Health Insurance) Regulations, 2016 respectively are not applicable.

Is there any waiting period?

Yes, there is a waiting period of 15 days from the date of policy issued. The Company shall not be liable to make any payment under the policy in connection with or in respect of expenses till the expiry of waiting period.

What are the exclusions?

Below are the exclusions:-

# Expenses related to any admission primarily for diagnostics and evaluation purposes. Any diagnostic expenses which are not related or not incidental to the current diagnosis and treatment.

# Rest Cure, rehabilitation and respite care

# Dietary supplements and substances that can be purchased without prescription, including but not limited to Vitamins, minerals and organic substances unless prescribed by a medical practitioner as part of hospitalization claim or Home care treatment.

# Expenses related to any unproven treatment, services and supplies for or in connection with any treatment. Unproven treatments are treatments, procedures or supplies that lack significant medical documentation to support their effectiveness. However, treatment authorized by the government for the treatment of COVID shall be covered.

# Any claim in relation to Covid where it has been diagnosed prior to Policy Start Date.

# Any expenses incurred on Day Care treatment and OPD treatment

# Diagnosis /Treatment outside the geographical limits of India

# Testing done at a Diagnostic center which is not authorized by the Government shall not be recognized under this Policy.

# All covers under this Policy shall cease if the Insured Person travels to any country placed under travel restriction by the Government of India.

Whether multiple policies allowed?

Yes, as you know this policy covers the maximum of Rs.5 lakh sum insured, one can buy multiple policies and cover the expenses beyond Rs.5 lakh.

If the amount to be claimed exceeds the sum insured under a single policy, the policyholder shall have the right to choose insurers from whom he/she wants to claim the balance amount.

Where an insured has policies from more than one insurer to cover the same risk on indemnity basis, the insured shall only be indemnified the hospitalization costs in accordance with the terms and conditions of the chosen policy.

Let me tabulate the whole features for your better understanding.

Premium Comparison of Corona Kavach

Let us now compare the premium rates for this plan. As you noticed it is a standard plan, the premium must be within the same range. However, if we go by below comparison done by Mint, you noticed that the premium varies a lot. I am not sure why such a huge variation when the product features are same.

For the age group of 31-35, the Future Generali offering you the sum insured to cover for Rs.436 and Rs.664 for 3.5 months and 9.5 months. However, the costliest one is from Go Digit General which is offering you the same cover at Rs.5,255 and Rs.8,085. This seems to be a huge difference.

I am not sure on what basis they are arriving at the premium. Even though we all can understand their profitability, risk management, and all those things, but as the underlying product is the same, why such a huge difference in premium?

Corona Rakshak – Features and Benefits

Let me explain you the features of Corona Rakshak features and beenfits with this below image.

Now if look at the premium rates, I found that majority of insurers are least bothering about this product. I am unable to find the premium quotes on the majority of websites. However, if we take the comparison of two companies, which I was able to find, then they are as below.

Future Generali-

9.5 months, age group 18-39 Yrs, Sum Insured Rs.2,50,000 is Rs.416 and for 40-59 years age group it is Rs.795.

IFFCO-TOKIO

9.5 months, age group 26-50 Yrs, Sum Insured Rs.2,50,000 is Rs.2,406 and for 51-65 years age group it is Rs.4,273.

Here also, you can notice the premium difference even though the underlying product is same.

Corona Kavach Vs Corona Rakshak – Which one to buy?

If you look at the features and the sum assured offered by both the plans, Corona Kavach is obviously the best choice for you to opt for. The reasons and few points from my side before you buy.

# Corona Kavach is an indemnity policy where they will replace the cost of the hospitalization up the sum insured opted. However, in the case of Corona Rakshak, it is a time claim payable on the diagnosis of Corona.

# Features of Corona Kavach are exhaustive than the Corona Rakshak.

# For the better features, you will end up in paying almost the same premium for both the policies, then why to opt for a lower product of Corona Rakshak.

# Corona Rakshak is offered to individuals ONLY. However, Corona Kavach is for a family.

# Sum assured under Corona Kavach is up to Rs.5 lakh but in case of Corona Rakshak, it is just 2.5 lakh.

Few more comparisons are listed below for your better understanding.

Conclusion:-The better choice between Corona Kavach Vs Corona Rakshak is obviously Corona Kavach. Hence, better you choose this policy. However, as you noticed, the premium variation is too much among insurers. Hence, do your own research for your age and accordingly opt for the company. As the basic features of the product are the same, the only option in your hand is to compare the premium and go ahead with the buying. The funniest part that I noticed from the Star Health Insurers that they quoted the premium for Corona Kavach for the age above 65 years. However, the maximum age of buying the policy is not more than 65 years.

Refer our latest posts:-

Latest BDA Plots E-auction July – August 2020 – How to apply?

HNIs or Institutional Investors – Retail Debt Mutual Fund Investors SILENT enemies

List of Index Funds in India 2020

Corona Kavach Vs Corona Rakshak – Which one to buy?

Top 5 Super Top-up Health Insurance Plans in India 2020

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS

The post Corona Kavach Vs Corona Rakshak – Which one to buy? appeared first on BasuNivesh.

Corona Kavach Vs Corona Rakshak – Which one to buy? published first on https://mbploans.tumblr.com/

0 notes

Text

A Guide to Take Advantage of ULIP plans

What are ULIPs? -

A unit-linked insurance plan (or ULIP full form) offers its policyholders the dual benefits of insurance and investment. Premiums paid by these policyholders are split between providing them with coverage and directing them towards investments. These investments are made after collecting all the policyholders’ individual investments and then collectively directing them towards varied financial securities keeping in mind said policyholders varied preferences. In this regard, ULIPs can be understood to have similar features to mutual funds. Read on to learn how to take advantage of a ULIP plan.

How to Take Advantage of ULIPs? -

ULIPs offer their policyholders tons of benefits that said policyholders ought to take advantage of. These include but aren’t limited to the following.

Flexibility – A vast majority of ULIPs on offer in the country allow policyholders the flexibility and freedom to select where they’d like their funds to be invested. Furthermore, policyholders are entitled to switch from one investment option to another keeping in mind market conditions. These switches pertain to equity, debt, and balanced fund options. By providing policyholders with this freedom, policyholders may make investments in accordance with their risk appetite. Furthermore, ULIPs allow policyholders to select between the sum assured or the premium based on their individual requirements.

Transparency – Ordinarily all ULIPs are transparent in their operations provided the plan on offer is run by a well-known insurance company. The pricing in place along with the anticipated value, tenure, and hoped-for return rates are all made clear from the get-go with ULIPs. Policyholders are clearly informed of where their funds will be directed. Quarterly and annual account statements in addition to the present status of a policyholder’s investment portfolio are also provided.

Option to liquidate – In the event of an emergency policyholders are entitled to withdraw money from their account. This means that this sum of money may also be seen as a contingency fund that provides financial security in the event of tough times. That being said, this withdrawal is permitted only once a holding period of 5 years following the date of the policy being activated has been fulfilled. It is important to note here that said withdrawals are tax-free.

Tax-free advantages – Double tax benefits imply that premiums paid on ULIPs are exempt from up to INR 1.5 Lakhs as per Section 80C of the Income Tax Act of 1961. Moreover, all payouts generated post maturity of the plan are exempt under Section 10 of the same act. It is important to note that as per FY 2021-2022’s budget, ULIP maturity proceedings that have an annual premium greater than INR 2.5 Lakhs don’t have any tax-exemptions in place.

Allow for goal-directed savings – With the aid of a ULIP, it is possible for policyholders to fulfill long-term goals which may range from buying a house to getting a new car. This is owed to the fact that ULIPs allow for a large corpus to be built in a systematic manner. Compounding only enhances the rates of return over vast stretches of time.

Conclusion –

As made clear above, ULIPs provide their policyholders with ample benefits that ought to be taken advantage of. When pitted against equity-linked savings schemes i.e., ULIP vs ELSS, there exist a number of differences. Visit Finserv MARKETS in order to acquire more knowledge on the same prior to availing of a particular plan.

0 notes

Text

Types of Money Market Instruments