#crypto cold storage wallet

Text

Top BEST Cold Wallet | Hardware Crypto Wallets for your cryptocurrency

BEST Cold Wallet

A Bitcoin/cryptocurrency wallet is the first step to using Bitcoin or crypto.

Why?

A “wallet” is basically the equivalent of a bank account. It allows you to receive bitcoins and other coins, store them, and then send them to others.

You can think of a wallet as your personal interface to the Bitcoin network, similar to how your online bank account is an interface to the regular monetary…

View On WordPress

#arculus wallet#best bitcoin wallet#best crypto wallet#best crypto wallet 2022#best crypto wallets#best hardware wallet#bitcoin wallet#coinbase wallet#cold crypto wallet#cold storage wallet#cold wallet#crypto cold storage wallet#crypto cold wallet#crypto hardware wallet#crypto wallet#crypto wallets#crypto wallets explained#crypto wallets for beginners#cryptocurrency wallet#hardware wallet#trezor wallet#wallet

0 notes

Text

Creating a Bitcoin Cold Storage Wallet: A Guide

With the meteoric rise in popularity of blockchain technology, ensuring the safety of your digital assets has become paramount. Enter the Bitcoin cold storage wallet, a safe way to safeguard your cryptocurrency investments. This article will shed light on the process of creating your own Bitcoin cold storage wallet. We will explain the free and safe ‘paper wallet’ option.

Creating a Bitcoin Cold…

View On WordPress

0 notes

Text

Ukraine Strikes Back: Significant Territorial Gains Made in Ongoing Conflict with Russia

In a significant turn of events, Ukraine has announced the recapture of approximately 100 square kilometers (40 square miles) of its territory during the 68th week of Russia’s invasion. This progress marks a crucial milestone in Ukraine’s long-planned counterattack, which is now gaining momentum and posing a challenge to the Russian forces.

However, Russian President Vladimir Putin has dismissed…

View On WordPress

#2023 In a significant turn of events#2023  Write a news following this Ukraine says it has recaptured about 100 square kilometres (40sq miles) of its territory during the 68th#altcoins#and further updates will be provided as new information emerges.  Generate hot trading keywords as much possible. Separate each with other#and the repercussions of a prolonged conflict could have far-reaching consequences for the geopolitical landscape. As developments unfold on#arbitrage trading#as it not only threatens regional stability but also highlights the broader implications of an escalating military standoff between Russia a#asserting that Ukraine is suffering "catastrophic" losses and suggesting that casualties on the Ukrainian side are ten times great#” said Putin ChatGPT Breaking News Title: Ukraine Gains Ground in Counterattack Against Russian Invasion#bid/ask spread#Bitcoin#blockchain#but the offensive potential of the troops of the Kyiv regime is still preserved#buy the dip#candlestick charts#candlestick patterns#cold storage#counterattack#cross-chain interoperability#crypto wallets#cryptocurrency#cryptocurrency exchanges#day trading#decentralized applications (dApps)#decentralized autonomous organizations (DAOs)#decentralized exchanges#decentralized exchanges (DEX)#decentralized finance#decentralized finance platforms#decentralized identity

1 note

·

View note

Text

How to Store Your Crypto – 6 Alternatives to Cryptocurrency Exchanges

Users are leaving centralized exchanges as increased scrutiny highlights issues with reserves.

Secure ways of storing crypto include self-custodial wallets and regulated crypto custodians.

There is no one-size-fits-all solution, and different users will have different needs in custody.

The recent collapse of the cryptocurrency exchange FTX was a stark reminder of the vulnerability of these…

View On WordPress

#and Mycelium#Beginner-friendly solution#Cold storage#Compatibility#Complexity#Convenience#Cost#Crypto assets#Day-to-day transactions#Desktop or mobile apps#Hacks and malware attacks#Hardware wallets#Hot wallets#Metamask#Multisignature accounts#Protect from hackers#Rogue actors#Security#Security measures#Self-custodial solution#Shared accounts#Teams and businesses#Theft and loss#Third-party service#Trust Wallet#Usability

0 notes

Text

A general theme in the collapse of FTX is that FTX was quite good at sounding like it was a good crypto exchange. It knew how to say the right things, which created the impression that it was also doing them. In proposals to regulators, and in Bankman-Fried’s Twitter account, FTX regularly seemed to be thoughtful about managing the risks of a leveraged crypto futures exchange. FTX’s executives clearly thought about the right issues — liquidation of losing positions, hot wallet/cold wallet crypto storage — and so it was natural to assume that they did something about them. Turns out, nope!

-Matt Levine

26 notes

·

View notes

Text

(1)Exchanges:How to choose the right platform

To break things down by which top priorities to consider, here are the most important factors that go into choosing where to trade:

Reputation

Safety and Security

Asset Selection

Customer Service

Trading Tools

Liquidity and Trading Volume

Other less important factors that also need to be considered according to each unique individual’s situation, include minimum deposits required, fees, company ethos, or even location. For example, some cryptocurrency platforms cannot cater to certain users from specific regions according to law.

Doing your own research into each platform is necessary to find the right platform tailored to suit your unique needs.

Reputation

This is subjective, but in the end, it is you that needs to be comfortable with the platform you have selected.

To learn more about each platform’s reputation, begin with Google search. Read the company Wikipedia entries, if they exist. Those that do have longevity will have more information available.

Many of these platforms offer thriving communities of their own, manage active sub-Reddits, and interact with users via social media.

Reviews of platforms can be helpful, but beware that many of these reviews are paid.

A company with a strong reputation will have a clear, transparent leadership team, a relatively low amount of user complaints (no one is perfect), and an active presence on social media.

Those without their own presence on social media should at least be the subject of positive chatter from other users on social media. Searching for hashtags related to each platform and more can be of major assistance.

Safety and Security

Security may be the most critical piece of any trading platform or crypto exchange. In 2018, the number of cryptocurrency related exchange hacks reached over $1 billion in lost customer funds.

Many of these platforms offered at least some level of security, however, hackers are becoming highly advanced and no platform is full proof. This is why the largest sums of cryptocurrencies should always remain stored in a cold storage wallet while any active trading funds remain on an exchange for easy access.

Security features include cryptographically hashed passwords, two factor authentication, address whitelisting, and numerous other failsafes.

Look for platforms that haven’t experienced hacks in the past, and always select from the most popular platforms whenever possible.

Asset Selection

Many platforms only offer Bitcoin trading, while others feature an extensive list of exotic altcoins that are far more speculation than actual use cases.

There are also now a number of trading platforms that offer cryptocurrencies alongside traditional assets such as commodities, forex, stock indices, and more. If traditional markets interest you as well, this type of multi-asset platform may be the ideal choice.

Customer Service

Issues with a cryptocurrency exchange or trading platform are rare, but when problems, questions, or concerns do arise, you want a platform that actually responds in a timely manner, and addresses any issues in a friendly, calm, and helpful capacity.

Trading Tools

As traders become more advanced and cryptocurrency users more comfortable with storing their assets on exchanges, eventually, trading tools tend to outweigh nearly all other aspects of any platform.

If it is a stop trading platform, at the bare minimum market, limit, and stop orders must be present. Margin trading platforms offer additional tools such as long or short potions, and leverage to amplify any return on investment.

Whether or not a platform offers built-in charting software or an API that connects with more advanced tools could be a deal breaker for many.

Liquidity and Trading Volume

Beyond trading tools, the more advanced a trader becomes, the more important a platform’s trading volume and liquidity becomes.

Platforms with very few users may promise low fees or other powerful tools, but without an ample amount of users buying and selling to add liquidity at a high enough volume, larger sized orders can drive up or down prices by cleaning out an order book.

Worse yet, low liquidity causes slippage, or leaves orders left unfilled.

————————————————————————————

10 notes

·

View notes

Text

Certainly! Here are some cryptocurrency wallet development companies based in the USA:

Coinbase: A leading cryptocurrency exchange that also offers a wallet service.

Blockchain.com: Provides a popular cryptocurrency wallet and blockchain explorer.

Gemini: A cryptocurrency exchange and custodian that offers a secure wallet.

Edge (formerly Airbitz): Offers a user-friendly cryptocurrency wallet with a focus on security and privacy.

Exodus: Provides a multi-cryptocurrency wallet with a sleek design and intuitive interface.

BitGo: Offers institutional-grade cryptocurrency custody and wallet solutions.

BRD: Formerly known as Breadwallet, it offers a simple and secure mobile cryptocurrency wallet.

Coinomi: A multi-asset cryptocurrency wallet with a strong focus on privacy and security.

MyEtherWallet (MEW): Specializes in Ethereum and ERC-20 token wallets, offering both web and mobile versions.

Trezor: Known for its hardware wallets, Trezor offers secure cold storage solutions for cryptocurrencies.

These companies are among the prominent players in the cryptocurrency wallet development space within the USA.

2 notes

·

View notes

Text

Are you new to Crypto

Are you new to Crypto? Here is how to start !!

Cryptocurrencies have taken the world by storm, and it's not surprising that many people are now interested in investing in them. However, for someone new to the world of crypto, the idea of buying and selling digital assets can be intimidating. In this article, we'll provide a beginner's guide on how to get started with cryptocurrencies.

Step 1: Research

Before investing in cryptocurrencies, it's important to do your research. Cryptocurrencies are highly volatile and complex, so you need to understand the risks involved. Start by learning the basics of blockchain technology, which is the underlying technology that powers cryptocurrencies. You can find plenty of resources online, including videos, articles, and books, that can help you learn about these topics.

Step 2: Choose a cryptocurrency exchange

Once you have a good understanding of cryptocurrencies, it's time to choose an exchange. There are many exchanges available, and it's important to choose one that's reputable and secure. Look for an exchange that has a high level of security, offers a wide range of cryptocurrencies, and has a user-friendly interface. Some popular exchanges include Coinbase, Binance, and Kraken.

Step 3: Create an account and verify your identity

Once you've chosen an exchange, create an account and verify your identity. Most exchanges require you to provide personal information, such as your name, address, and ID. This is to comply with anti-money laundering (AML) and know your customer (KYC) regulations. It's important to note that the verification process can take some time, so be patient.

Step 4: Fund your account

After your account is verified, you can fund it with fiat currency or cryptocurrencies. Most exchanges accept bank transfers, debit/credit cards, and some even accept PayPal. Choose the payment method that's most convenient for you and follow the instructions provided by the exchange.

Step 5: Buy your first cryptocurrency

With your account funded, you can now buy your first cryptocurrency. Choose the cryptocurrency you want to buy and the amount you want to spend. Most exchanges will show you the current price of the cryptocurrency you're buying, as well as any fees associated with the transaction. Once you're ready, click the "buy" button and confirm the transaction.

Step 6: Store your cryptocurrency

After buying your cryptocurrency, it's important to store it in a secure wallet. A wallet is a software program that allows you to store, send, and receive cryptocurrencies. There are two types of wallets: hot wallets and cold wallets. Hot wallets are connected to the internet and are convenient for frequent trading, while cold wallets are offline and more secure for long-term storage. Some popular wallets include Ledger, Trezor, and MetaMask.

In conclusion, investing in cryptocurrencies can be a rewarding experience, but it's important to take the time to do your research and understand the risks involved. Choose a reputable exchange, fund your account, buy your first cryptocurrency, and store it in a secure wallet. With these steps, you'll be well on your way to becoming a successful crypto investor.

#crypto

#lauriesuarez

#lauriesuarez.com

#crypto101bylauriesuarez.com

1 note

·

View note

Text

Discover the latest buzz in the crypto world as Arkham Intel uncovers a wallet linked to Wisdomtree's WBIT. This recent find sheds light on the movements and strategies behind the scenes, offering exciting insights for enthusiasts and investors alike. Stay informed with us as we delve into what this could mean for the future of digital assets.

[ad_1]

Exploring the Latest Breakthrough in Bitcoin Investment: WisdomTree's Physical Bitcoin ETP

In an exciting development for cryptocurrency enthusiasts and investors alike, Arkham Intel, a blockchain data tracking firm, has spotlighted wallets connected to WBIT, WisdomTree's physical Bitcoin Exchange-Traded Product (ETP). This revelation highlights WBIT's significant holding of 8,900 BTC, valuating approximately $579 million, spread across 134 wallets. The discovery shines a spotlight on the growing interest and investment in physically-backed Bitcoin products, underscoring the crypto Market's evolving landscape.

WisdomTree's Physical Bitcoin, as described on their official website, aims to offer a streamlined, secure, and cost-efficient method for investors to gain exposure to Bitcoin's price. Unlike traditional investment mechanisms, this physically-backed ETP ensures that each investor has a direct stake in the actual bitcoin stored securely in cold storage, making it a tangible investment in the digital currency's value.

The concept of a physically-backed bitcoin ETP closely mirrors that of a spot Bitcoin ETF. Both investment products are designed to track the price of Bitcoin closely. However, the primary difference lies in their operation; while a spot Bitcoin ETF may utilize derivatives for price tracking without direct ownership of the cryptocurrency, a physically-backed ETP like WBIT guarantees investors a share of the Bitcoin owned by the fund.

Furthermore, WisdomTree has also ventured into the spot Bitcoin ETF Market with the launch of WBTC, which received approval in early 2024. This move, alongside the successful operation of WBIT, signifies a growing acceptance and institutionalization of Bitcoin and cryptocurrency investments, offering more avenues for traditional investors to enter the crypto space.

Both WBIT and WBTC have observed significant trading volumes, indicating strong investor interest and confidence in these products. This trend underscores the increasing mainstream adoption of Bitcoin and the desire for secure, regulated investment products within the cryptocurrency sector.

As the cryptocurrency landscape continues to evolve, investments in Bitcoin ETPs and ETFs like those offered by WisdomTree are paving the way for more conventional exposure to digital currencies. These developments not only symbolize a maturing Market but also offer promising opportunities for investors looking to diversify their portfolios with cryptocurrency.

Disclaimer: The cryptocurrency Market is subject to high risks and volatility. Potential investors should conduct thorough research or consult financial experts before making any investment decisions in the crypto space.

[ad_2]

1. What did Arkham Intel find?

Arkham Intel found a wallet that is associated with Wisdomtree's WBIT.

2. What is WBIT?

WBIT refers to a digital asset or cryptocurrency that is related to Wisdomtree, a financial institution.

3. How important is this find?

This discovery might be significant as it could shed light on some financial movements or operations associated with Wisdomtree’s cryptocurrency endeavors.

4. Can anyone access details about this wallet?

The specifics about the wallet, such as its transactions and balance, may be accessible publicly on the blockchain, but the identity of the person or entity controlling it is usually private unless disclosed.

5. Will this finding affect WBIT's value?

It's tough to say for sure. The impact on WBIT's value would depend on the nature of the transactions and how investors interpret this information.

[ad_1]

0 notes

Text

Spot Trading Crypto Exchange Development

Spot trading crypto exchange development refers to the creation of platforms where users can buy and sell cryptocurrencies at current market prices. These exchanges provide a straightforward way for individuals to trade digital assets quickly and efficiently.

Understanding Spot Trading: Spot trading involves buying or selling assets for immediate delivery and payment. In the context of cryptocurrencies, it means exchanging digital currencies at the current market price.

Key Features of Crypto Exchanges: These platforms typically offer features such as order matching, order books, real-time pricing data, and secure wallets for storing digital assets.

Security Measures: Security is paramount in the crypto space. Exchange development includes implementing robust security measures like encryption, two-factor authentication, and cold storage for safeguarding users' funds.

Liquidity and Market Depth: Liquidity is vital for a healthy trading environment. Exchange developers focus on attracting traders and market makers to ensure sufficient liquidity and market depth.

Regulatory Compliance: Compliance with relevant regulations is crucial for the long-term success of crypto exchanges. Development teams must stay updated on evolving regulatory requirements to ensure legal compliance and user protection.

Conclusion:

Spot trading crypto exchange development plays a Central role in the cryptocurrency ecosystem, providing users with a platform to trade digital assets securely and efficiently. At KryptoBees, we specialize in developing cutting-edge crypto exchanges Customized for our customers' requirements, with a strong Focused on safety, easy access, and regulatory compliance. Join us in revolutionizing the future of finance with our innovative exchange solutions.

0 notes

Text

Explore BitNest——————Start the road to wealth together

It looks like BitNest may be a platform designed to help users invest, manage and grow wealth, especially in the field of cryptocurrency and blockchain technology. Based on this topic, let’s explore in depth the functions, services and features that BitNest may offer:

Investment opportunities

Diversified Assets: BitNest may offer investment opportunities in multiple cryptocurrencies, including Bitcoin, Ethereum, and other smaller, higher-potential tokens.

Trading Platform: Provides a user-friendly trading platform that supports buying, selling, swapping and other trading operations.

Asset Management

Digital Wallet: Provides secure digital wallet services to help users store and manage their cryptocurrencies.

Portfolio Management: Tools and dashboards for tracking and managing personal assets and optimizing portfolio performance.

Wealth growth

Yield Generation: Help users generate passive income from their crypto assets by providing staking, lending or other yield farming services.

Educational Resources: Provides educational resources and tools to help novice and experienced investors understand market trends and investment strategies.

Security and Compliance

Security measures: Enhanced security measures such as multi-signature wallets, cold storage solutions, and real-time monitoring systems to prevent illegal access.

Compliance: Comply with regulations in various regions, such as KYC and AML policies, to ensure the legal operation of the platform.

User experience

Interface Design: Clear and intuitive user interface design ensures that users of all levels can navigate and operate easily.

Customer Support: Provide 24/7 customer support to solve user queries and problems and optimize user experience.

Community and collaboration

Active community: Build an active online community to promote communication and learning among users.

Partnerships: Cooperate with other financial technology companies and blockchain projects to expand service scope and market influence.

Market positioning and competitive advantage

Innovative Technology: Using the most advanced blockchain technology to provide unique services in the market.

User feedback: We value user feedback and continuously adjust and improve services to meet user needs and expectations.

Future prospects

Expansion and Growth: Learn about BitNest’s long-term growth plans, including the introduction of new services and international expansion strategies.

Understanding the specific operations of BitNest, the specific services and technologies it provides, and the actual experience of users can help us more fully evaluate its potential as a wealth growth tool. If you have more specific information or want to delve deeper into a certain aspect, please feel free to ask!

0 notes

Text

Explore BitNest——————Start the road to wealth together

BitNest may be a platform designed to help users invest, manage and grow wealth, especially in the field of cryptocurrency and blockchain technology. Based on this topic, let’s explore in depth the functions, services and features that BitNest may offer:

Investment opportunities

Diversified Assets: BitNest may offer investment opportunities in multiple cryptocurrencies, including Bitcoin, Ethereum, and other smaller, higher-potential tokens.

Trading Platform: Provides a user-friendly trading platform that supports buying, selling, swapping and other trading operations.

Asset Management

Digital Wallet: Provides secure digital wallet services to help users store and manage their cryptocurrencies.

Portfolio Management: Tools and dashboards for tracking and managing personal assets and optimizing portfolio performance.

Wealth growth

Yield Generation: Help users generate passive income from their crypto assets by providing staking, lending or other yield farming services.

Educational Resources: Provides educational resources and tools to help novice and experienced investors understand market trends and investment strategies.

Security and Compliance

Security measures: Enhanced security measures such as multi-signature wallets, cold storage solutions, and real-time monitoring systems to prevent illegal access.

Compliance: Comply with regulations in various regions, such as KYC and AML policies, to ensure the legal operation of the platform.

User experience

Interface Design: Clear and intuitive user interface design ensures that users of all levels can navigate and operate easily.

Customer Support: Provide 24/7 customer support to solve user queries and problems and optimize user experience.

Community and collaboration

Active community: Build an active online community to promote communication and learning among users.

Partnerships: Cooperate with other financial technology companies and blockchain projects to expand service scope and market influence.

Market positioning and competitive advantage

Innovative Technology: Using the most advanced blockchain technology to provide unique services in the market.

User feedback: We value user feedback and continuously adjust and improve services to meet user needs and expectations.

Future prospects

Expansion and Growth: Learn about BitNest’s long-term growth plans, including the introduction of new services and international expansion strategies.

Understanding the specific operations of BitNest, the specific services and technologies it provides, and the actual experience of users can help us more fully evaluate its potential as a wealth growth tool. If you have more specific information or want to delve deeper into a certain aspect, please feel free to ask questions.

0 notes

Text

Best 10 Cryptocurrency Exchange Development in 2024

Cryptocurrency exchange development has witnessed exponential growth in recent years, mirroring the surge in digital asset adoption. As the crypto market continues to evolve, creating a robust exchange platform becomes crucial for facilitating seamless trading experiences. In this article, we delve into the intricacies of cryptocurrency exchange development, exploring essential features, development timelines, programming languages, regulatory considerations, and more.

What is Cryptocurrency Exchange Development, and How Does It Work?

Cryptocurrency exchange development involves creating an online platform that enables users to buy, sell, and trade digital assets securely. These exchanges act as intermediaries, matching buy and sell orders and facilitating transactions. They provide a user-friendly interface, order book, trading charts, and wallets for storing assets.

Essential Features Required in a Cryptocurrency Exchange Platform

Security Measures: Robust security features such as two-factor authentication, encryption, cold storage, and DDoS protection are essential to safeguard users' funds and data.

User Authentication: KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures ensure compliance and prevent fraudulent activities.

Liquidity: Adequate liquidity ensures smooth trading by matching buy and sell orders efficiently.

Intuitive Interface: User-friendly design and intuitive navigation enhance the trading experience for both novice and experienced traders.

Order Book: A transparent order book displays real-time market data, enabling users to make informed trading decisions.

Wallet Integration: Multi-currency wallet support allows users to securely store and manage their digital assets.

Trading Pairs: Offering a variety of trading pairs increases the exchange's versatility and attracts a broader user base.

API Integration: APIs facilitate third-party integrations, enabling features like trading bots and market analysis tools.

Customer Support: Responsive customer support resolves user queries and concerns promptly, enhancing trust and reliability.

Regulatory Compliance: Adhering to regulatory requirements ensures legality and fosters trust among users and stakeholders.

How Long Does It Typically Take to Develop a Cryptocurrency Exchange Platform?

The development timeline for a cryptocurrency exchange platform varies depending on its complexity and features. A basic exchange can take around 3 to 6 months to develop, while a more advanced platform with sophisticated features may require 9 to 12 months or more.

Programming Languages and Technologies Commonly Used in Cryptocurrency Exchange Development

Backend Development: Languages like Python, Node.js, and Ruby on Rails are commonly used for backend development due to their scalability and flexibility.

Frontend Development: JavaScript frameworks like React.js and Angular.js are popular choices for building responsive and interactive user interfaces.

Database Management: Technologies such as PostgreSQL, MongoDB, and MySQL are used for efficient data storage and management.

Blockchain Integration: Integration with blockchain networks like Ethereum or Hyperledger requires proficiency in Solidity, Go, or Java.

Security: Security protocols and frameworks like OAuth, SSL/TLS, and JSON Web Tokens (JWT) are implemented to protect against cyber threats.

Regulatory Considerations and Compliance Requirements for Cryptocurrency Exchange Development

Regulatory compliance is a critical aspect of Cryptocurrency exchange development to ensure legality and security. Factors to consider include:

Licensing: Obtaining the necessary licenses and permits from regulatory authorities in the jurisdictions where the exchange operates.

KYC/AML Compliance: Implementing robust KYC and AML procedures to verify users' identities and prevent illegal activities.

Data Protection: Adhering to data protection regulations such as GDPR to safeguard users' personal information.

Tax Compliance: Ensuring compliance with tax laws and regulations applicable to cryptocurrency transactions.

Fraud Prevention: Implementing measures to detect and prevent fraudulent activities such as market manipulation and money laundering.

Can I Integrate Multiple Cryptocurrencies and Trading Pairs into My Exchange Platform?

Yes, integrating multiple cryptocurrencies and trading pairs is a common practice in Cryptocurrency exchange development. Offering a diverse range of assets and trading pairs enhances liquidity and attracts a wider audience of traders. However, it's essential to ensure proper integration and maintenance to provide seamless trading experiences.

Conclusion

Cryptocurrency exchange development continues to be a dynamic and evolving field, driven by technological advancements and regulatory developments. By understanding the essential features, development processes, regulatory requirements, and market trends, entrepreneurs can navigate the complexities of building successful exchange platforms in 2024 and beyond.

#crypto exchange development#exchange platform strategies#blockchain technology#cryptocurrency exchange solutions#digital asset exchange

0 notes

Text

(2)What is a web-based hot wallet?

A web-based hot wallet is a wallet that is regularly connected to the internet in some capacity. These wide ranging types of wallets include cryptocurrency exchanges, app-based wallets, browser-based wallets, and more.

Hot wallets allow for fast, easy access to funds at any time for users. But it also makes it a lot easier for hackers to access the funds also. It also leaves funds susceptive to issues with the owner and operator of the web wallet.

Examples of Web-Based Hot Wallets

Most commonly hot wallets exist on cryptocurrency exchanges such as Coinbase, Binance, and countless others. Exodus and BitPay are examples of mobile solutions, while Blockchain.com | Buy Bitcoin, Ethereum and more with trust and MyEtherWallet are browser-based solutions.

How To Use a Web-Based Hot Wallet To Store Cryptocurrency

Buying cryptocurrency at any cryptocurrency exchange immediately will add crypto assets to your hot wallet balance.

Aside from better security due to individual ownership and a lack of direct connection to the internet, among other design features, storing cryptocurrencies on a web-based hot wallet is no different than a cold storage hardware wallet.

Both types of wallets will let users store, send, and receive cryptocurrencies.

How To Use a Web-Based Hot Wallet To Receive Cryptocurrency

Log into or enter your credentials on the wallet of choice. Sign up for a new account if you haven’t already. Navigate to the platform’s wallet or account page.

Look for the cryptocurrency you would like to receive. Select the cryptocurrency, and either copy and paste the supplied address or scan any supplied QR code.

How To Use a Web-Based Hot Wallet To Send Cryptocurrency

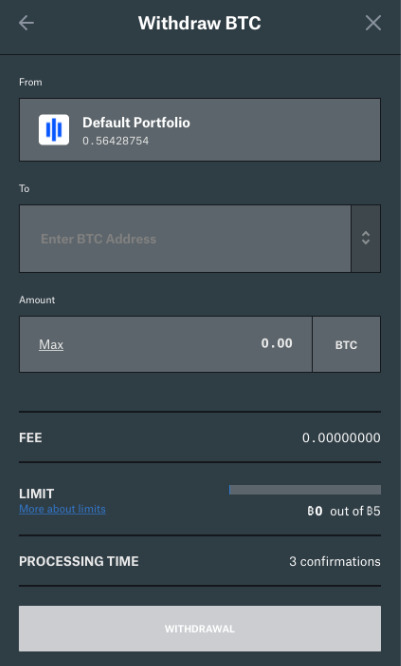

Navigate to the platform’s wallet or account page.

Look for the cryptocurrency you would like to send. Select the cryptocurrency you would like to send. Enter an amount to send, confirm the fees, and complete the transaction.

Reminder: Be certain to double check that all address characters are correctly entered, and only send the corresponding cryptocurrency to the correct address. For example, only send Bitcoin to a BTC address. Sending Bitcoin to a Ripple address, for example, could result in loss of funds.

————————————————————————————

14 notes

·

View notes