Text

1、The Basics of Bitcoin and Crypto

①What is cryptocurrency:

(1)Types of Cryptocurrencies

As the cryptocurrency industry has grown, additional assets that utilize cryptography have emerged that have use cases beyond simply acting as a digital currency. Crypto assets are typically classified as the following:

Payment Currencies

Payment currencies are the original cryptocurrencies, used to pay merchants, send money to friends, or anything else you can do with cash. Payment currencies include Bitcoin (BTC), Litecoin (LTC), and Ripple (XLM).

Privacy Coins

These coins employ unique technology to obfuscate the details of cryptocurrency transactions such as receiver, sender, and total amount transacted. Privacy coins include ZCash (ZEC) and Monero (XMR).

Utility Tokens

Utility tokens act as the central currency required to power blockchain economies, decentralized applications, and more. Utility tokens include Basic Attention Token (BAT) and Golem (GNT).

Exchange Tokens

Exchange tokens are the native token issued by certain cryptocurrency exchanges. These tokens often provide unique benefits such as trading fee discounts, voting, or access to initial token offerings. Exchange tokens include Binance Coin (BNB) and KuCoin Shares (KCS).

Stablecoins

Stablecoins are typically backed by fiat currencies, namely the dollar, due to its global reserve currency status and commonality and familiarity. Stablecoin valuations are tied 1:1 against the dollar, and are often used as a safe haven during crypto market downturns. Stablecoins include Tether (USDT) and USD Coin (USDC).

Gold-Backed Tokens

To serve the increasing demand for gold and bring the asset into the digital era, many new tokens backed by a corresponding ounce or gram of gold have grown in popularity. Gold-backed tokens include Tether Gold (XAUT) and Digix Gold Token (DGX).

Security Tokens

Stocks, bonds, and other assets deemed as securities by the SEC’s Howey Test, once cryptographically tokenized to represent digital ownership, are security tokens.

————————————————————————————

#accounting#investor#stock market#startup#marketing#investors#crypto#blockchain#ethereum#defi#investment

1 note

·

View note

Text

(2)What is Bitcoin?

Bitcoin was created by Satoshi Nakamoto as the first successful form of “peer-to-peer electronic cash.”

While there were many precursors to the groundbreaking technology, Bitcoin was the first to solve the double-spend issue plaguing other unsuccessful attempts.

Bitcoin utilizes a process called proof-of-work that involves complex mathematical puzzles being solved by specially designed machines called miners.

Miners validate each block, then add its data to the blockchain permanently. The reward miners receive for securing the Bitcoin protocol is cut in half approximately every four years during an event called the halving. The block reward is currently 6.25 BTC.

Bitcoin was designed so that only 21 million BTC will ever exist. This digital scarcity, along with its decentralized, trustless design that operates without the need for a third party, is what gives the asset its value.

Bitcoin started its life virtually worthless in 2009, and reached an all-time high of $20,000 per BTC on December 17, 2017. The highly publicized peak put cryptocurrencies on the map, made the asset a serious contender in the financial world, and made Bitcoin a household name.

Today, Bitcoin has been featured on Jeopardy, in Coinstar machines, and is a valid answer in Scrabble according to the game’s official world list, powered by Merriam Webster – makers of the most well-known dictionary, which Bitcoin is also in.

Bitcoin is available as a trading pair against USD and other fiat currencies, and against several altcoins. Several platforms also allow for Bitcoin derivatives, futures, and other Bitcoin-based contracts or trading instruments.

————————————————————————————

#accounting#investor#stock market#startup#investors#crypto#poster#blockchain#ethereum#defi#investment

6 notes

·

View notes

Text

(3)What is a Torrent Coin?

Altcoins are alternative coins, or any crypto asset that isn’t Bitcoin or a stablecoin. The largest altcoin by market capitalization is Ethereum.

Many other altcoins are built on top of Ethereum as an ERC20 token. However, thousands of altcoins now exist either running on other protocols or even mainnets of their own.

Altcoins vary greatly in price, use case, design, distribution, and more. Altcoins are often broken up into large cap altcoins or “majors,” mid cap altcoins, and small cap altcoins.

Large cap altcoin examples include Ethereum, Ripple, Bitcoin, and Chainlink.

Mid-cap altcoin examples include NEO, Nano, THETA, or Vechain.

Small cap altcoin examples include Civic, Factom, FunFair, or Vertco————————————————————————————

1 note

·

View note

Text

(4)Why are cryptocurrencies and bitcoin important?

Cryptocurrency technology has the power to disrupt many industries. Bitcoin has the potential to replace cash to become the global reserve currency. However, many cryptocurrencies could just as easily go to zero.

Until each token provides utility, crypto remains primarily a speculative asset class with enormous potential. Over time, as each asset’s technology matures and adoption takes place, the network effect of each and their valuations will grow.

Bitcoin began as peer-to-peer electronic cash, but has become more of a store of value than a payment currency. While it is possible and even recommended to use Bitcoin for payments, more crypto investors and enthusiasts choose to hold Bitcoin or other cryptocurrencies as an investment vehicle.

Cryptocurrency’s use as an anti-correlated, or uncorrelated asset can help to diversity and even derisk a portfolio.

————————————————————————————

4 notes

·

View notes

Text

②Wallet: How to store, send and receive cryptocurrencies

IIf you have purchased cryptocurrency, you are ready to move on to learning about cryptocurrency wallets!

Where you ultimately store your Bitcoin or other cryptocurrencies will depend on a variety of factors and an individual’s unique needs and tastes.

If the plan is to simply buy and hold cryptocurrencies for the long-haul, the safest and most highly recommended storage method is via a cold storage hardware wallet.

A web-based hot wallet located at a reliable exchange may be sufficient for this type of user, depending on the total value of cryptocurrency held.

If the plan is to trade crypto assets on an exchange for profit, then the only option is storing assets directly on the platform itself.

However, there is added exposure to the risk of hacks or other issues associated with storing assets on an exchange. Ensuring any platform is trustworthy and secure is paramount to crypto storage safety.

As a general rule, if the private keys aren’t yours, then the assets technically aren’t either. Bitcoin and other cryptocurrencies are about individual ownership and decentralization.

Storing assets at centralized exchanges leaves them susceptible to seizure by the jurisdictions these exchanges operate within.

It is this rule as to why cold storage wallets are considered the safest and most secure options.

————————————————————————————

6 notes

·

View notes

Text

(1)What is a refrigerated hardware wallet?

A cold storage wallet hardware wallet is a highly secure device not connected directly to the internet, that allows for the safe storage of cryptocurrency assets. These devices connect to your computer or smartphone either via USB or bluetooth connection, but block unwanted access behind a secure element.

Seed phrases are generated by the wallet itself, and all private keys for each individual asset type are stored within the wallet.

Hardware wallets typically come equipped with an LED screen that prompts users to verify transactions and addresses before sending them.

It is imperative that any hardware wallets are purchased directly from the manufacturer or an authorized reseller to ensure there has been no tampering. If for any reason the wallet comes with a seed phrase already generated, return it immediately.

Examples of Cold Storage Hardware Wallets

Popular examples of hardware wallets include the Ledger Nano X, Ledger Nano S, Trezor Model T, KeepKey, and more.

How To Use a Cold Storage Hardware Wallet To Store Cryptocurrency

Be certain any hardware wallet is fully charged before using it. Boot up the device itself and the device you intend to connect it to. Connect the hardware wallet to your smartphone or computer following the manufacturer’s instructions.

Once a connection is established, applications specific for each asset may need to be installed. Firmware updates may also be required to ensure the wallet’s software is the latest and most secure.

How To Use a Cold Storage Hardware Wallet To Receive Cryptocurrency

After all necessary applications and firmware updates are installed, follow the device’s prompts to receive cryptocurrency.

A wallet address will be generated on the device’s screen and/or on the connected computer or smartphone. This address is what you will need to provide to the sender of whom you expect to receive cryptocurrency from.

If you are sending crypto from another wallet you own, this address will act as your cold storage hardware wallet’s address specifically.

Depending on the hardware and related software, you may receive a notification when cryptocurrency arrives in the account. Some cryptocurrencies like Bitcoin require a minimum number of confirmations before it is available in the account.

How To Use a Cold Storage Hardware Wallet To Send Cryptocurrency

Follow the devices or on-screen computer or smartphone prompts to initiate sending cryptocurrencies.

Request an address from the receiver, copy and paste an address, or scan a QR code depending on the technology being utilized.

Be certain to double check that all address characters are correctly entered, and only send the corresponding cryptocurrency to the correct address. For example, only send Bitcoin to a BTC address. Sending Bitcoin to a RIpple address, for example, could result in loss of funds.

Finally, enter an amount to send, confirm the fees, and complete the transaction.

————————————————————————————

1 note

·

View note

Text

(2)What is a web-based hot wallet?

A web-based hot wallet is a wallet that is regularly connected to the internet in some capacity. These wide ranging types of wallets include cryptocurrency exchanges, app-based wallets, browser-based wallets, and more.

Hot wallets allow for fast, easy access to funds at any time for users. But it also makes it a lot easier for hackers to access the funds also. It also leaves funds susceptive to issues with the owner and operator of the web wallet.

Examples of Web-Based Hot Wallets

Most commonly hot wallets exist on cryptocurrency exchanges such as Coinbase, Binance, and countless others. Exodus and BitPay are examples of mobile solutions, while Blockchain.com | Buy Bitcoin, Ethereum and more with trust and MyEtherWallet are browser-based solutions.

How To Use a Web-Based Hot Wallet To Store Cryptocurrency

Buying cryptocurrency at any cryptocurrency exchange immediately will add crypto assets to your hot wallet balance.

Aside from better security due to individual ownership and a lack of direct connection to the internet, among other design features, storing cryptocurrencies on a web-based hot wallet is no different than a cold storage hardware wallet.

Both types of wallets will let users store, send, and receive cryptocurrencies.

How To Use a Web-Based Hot Wallet To Receive Cryptocurrency

Log into or enter your credentials on the wallet of choice. Sign up for a new account if you haven’t already. Navigate to the platform’s wallet or account page.

Look for the cryptocurrency you would like to receive. Select the cryptocurrency, and either copy and paste the supplied address or scan any supplied QR code.

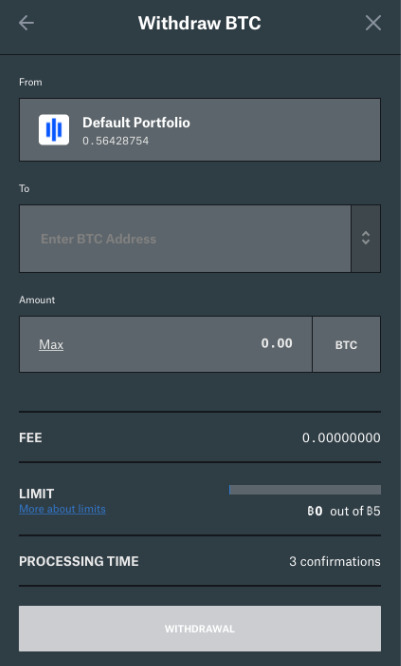

How To Use a Web-Based Hot Wallet To Send Cryptocurrency

Navigate to the platform’s wallet or account page.

Look for the cryptocurrency you would like to send. Select the cryptocurrency you would like to send. Enter an amount to send, confirm the fees, and complete the transaction.

Reminder: Be certain to double check that all address characters are correctly entered, and only send the corresponding cryptocurrency to the correct address. For example, only send Bitcoin to a BTC address. Sending Bitcoin to a Ripple address, for example, could result in loss of funds.

————————————————————————————

14 notes

·

View notes

Text

(3)Other Wallet Options

Desktop Clients

Many wallets can be installed directly to a desktop as a client.

Paper Keys

This is the original way to generate a cryptocurrency wallet, using nothing more than a pen and paper to write down any private key generated.

This method has since been deemed unsafe and outdated. The risks associated with this method includes losing the paper key, or it being damaged or made illegible in some way.

Custody Services

Custody services are available for large sums of cryptocurrencies and are typically made available for institutional investors. As a certain level of wealth, crypto platforms will handle all aspects of storage for you.

————————————————————————————

1 note

·

View note

Text

③Exchange: How to choose the right platform

Using your new knowledge of how to send and store cryptocurrency freely, it’s now time to select a trading platform or cryptocurrency exchange that’s right for you.

There are several factors that go into selecting a cryptocurrency trading platform, depending on personal risk tolerance, taste in assets, and more. Making matters even more confusing, there are dozens of cryptocurrency exchanges, trading platforms, and apps vying for your deposit.

5 notes

·

View notes

Text

(1)Exchanges:How to choose the right platform

To break things down by which top priorities to consider, here are the most important factors that go into choosing where to trade:

Reputation

Safety and Security

Asset Selection

Customer Service

Trading Tools

Liquidity and Trading Volume

Other less important factors that also need to be considered according to each unique individual’s situation, include minimum deposits required, fees, company ethos, or even location. For example, some cryptocurrency platforms cannot cater to certain users from specific regions according to law.

Doing your own research into each platform is necessary to find the right platform tailored to suit your unique needs.

Reputation

This is subjective, but in the end, it is you that needs to be comfortable with the platform you have selected.

To learn more about each platform’s reputation, begin with Google search. Read the company Wikipedia entries, if they exist. Those that do have longevity will have more information available.

Many of these platforms offer thriving communities of their own, manage active sub-Reddits, and interact with users via social media.

Reviews of platforms can be helpful, but beware that many of these reviews are paid.

A company with a strong reputation will have a clear, transparent leadership team, a relatively low amount of user complaints (no one is perfect), and an active presence on social media.

Those without their own presence on social media should at least be the subject of positive chatter from other users on social media. Searching for hashtags related to each platform and more can be of major assistance.

Safety and Security

Security may be the most critical piece of any trading platform or crypto exchange. In 2018, the number of cryptocurrency related exchange hacks reached over $1 billion in lost customer funds.

Many of these platforms offered at least some level of security, however, hackers are becoming highly advanced and no platform is full proof. This is why the largest sums of cryptocurrencies should always remain stored in a cold storage wallet while any active trading funds remain on an exchange for easy access.

Security features include cryptographically hashed passwords, two factor authentication, address whitelisting, and numerous other failsafes.

Look for platforms that haven’t experienced hacks in the past, and always select from the most popular platforms whenever possible.

Asset Selection

Many platforms only offer Bitcoin trading, while others feature an extensive list of exotic altcoins that are far more speculation than actual use cases.

There are also now a number of trading platforms that offer cryptocurrencies alongside traditional assets such as commodities, forex, stock indices, and more. If traditional markets interest you as well, this type of multi-asset platform may be the ideal choice.

Customer Service

Issues with a cryptocurrency exchange or trading platform are rare, but when problems, questions, or concerns do arise, you want a platform that actually responds in a timely manner, and addresses any issues in a friendly, calm, and helpful capacity.

Trading Tools

As traders become more advanced and cryptocurrency users more comfortable with storing their assets on exchanges, eventually, trading tools tend to outweigh nearly all other aspects of any platform.

If it is a stop trading platform, at the bare minimum market, limit, and stop orders must be present. Margin trading platforms offer additional tools such as long or short potions, and leverage to amplify any return on investment.

Whether or not a platform offers built-in charting software or an API that connects with more advanced tools could be a deal breaker for many.

Liquidity and Trading Volume

Beyond trading tools, the more advanced a trader becomes, the more important a platform’s trading volume and liquidity becomes.

Platforms with very few users may promise low fees or other powerful tools, but without an ample amount of users buying and selling to add liquidity at a high enough volume, larger sized orders can drive up or down prices by cleaning out an order book.

Worse yet, low liquidity causes slippage, or leaves orders left unfilled.

————————————————————————————

10 notes

·

View notes

Text

I will share some of my experiences about investing here.

This includes the most basic concepts and trading techniques.

This includes five courses

1.The Basics of Bitcoin and Crypto

2.Introduction to Cryptocurrency Trading

3.Beginner Crypto Trading 101

4.Intermediate Crypto Trading 1015.Advanced Crypto Trading 101

13 notes

·

View notes

Text

(2)Top Cryptocurrency Exchanges and Trading Platforms

While we still fully recommend doing your own research when it comes to finding which platform is right for you, here is a list of trusted platforms that can get you started on your search.

Binance

SimpleFX

Coinbase

BitMEX

Bitfinex

Kraken

OKEX

FTX

ByBit

PrimeXBT

KuCoin

————————————————————————————

3 notes

·

View notes

Text

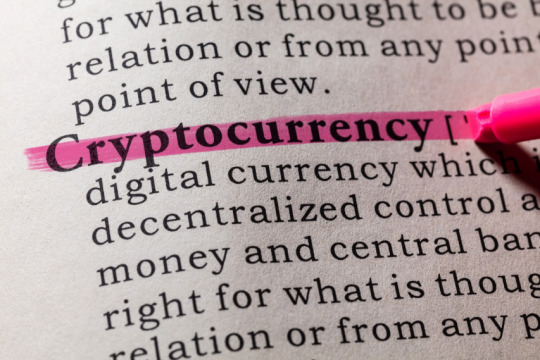

④Glossary: Common Crypto Terminology

The cryptocurrency industry has not only given birth to new technologies like blockchain and DeFi, but dozens of new buzzwords that the mainstream may not know. Here is list of the most commonly used cryptocurrency specific terms and what they mean.

#investor#investors#crypto#blockchain#ethereum#stock market#bitcoin#xrp#eth#usdt#coinbase#binance#bnb

6 notes

·

View notes

Text

(1)Glossary: Common Crypto Terminology

Now that you know the basics, it’s time to learn all about common cryptocurrency related terminology!

#

51% Attack

An attack involving a miner or group of miners that has gained control of over 51% of the network’s hash rate, and using it to exploit the blockchain.

A

Address

The location at which to send and receive cryptocurrencies to and from. Typically a string of numbers and letters based on cryptography.

Airdrop

Projects, exchanges, and more often distribute free coins for various reasons, such as ensuring equal distribution to achieve decentralization.

API

Stands for application programming interface, and is most commonly found in the crypto space as a connection between a crypto exchange, wallet, or service, with another exchange, wallet or service.

Altcoin

Any cryptocurrency that is not Bitcoin nor a coin backed by fiat, gold, or another asset.

AML

Stands for anti-money laundering and most commonly refers to the stringent laws that exchanges must comply with.

Ascending Triangle

A type of bullish chart pattern shaped like a triangle with a flat top.

Ascending Wedge

A type of bearish chart pattern with rising, converging trendlines.

Asset

A financial product or instrument representing ownership.

B

Bagholder

Someone who is down or flat on their initial investment and is still waiting for prices to recover.

Bear

A trader or investors that expects an asset’s price to go down.

Bear Trap

A move to the downside luring bearish traders into short positions, only for a surge of buying to force shorts to cover and price to squeeze upward.

Bear Flag / Pennant

A bearish chart pattern with a long pole and either flag like channel or triangle pennant.

Bits

The smallest unit of measurement of Bitcoin. Also called a Satoshi or Sat.

Block

A container of transactions that gets added to the blockchain.

Block Explorer

An online tool that lets users search for and view blockchain transactions and their details.

Blockchain

A peer-to-peer computer network built on a transparent, distributed ledger.

Bollinger Bands

A commonly referenced technical analysis tool consisting of a simple moving average and two standard deviations that indicate volatility.

Bitcoin

The first ever cryptocurrency and leading crypto asset by market cap, created by Satoshi Nakamoto.

Bubble

A period where speculation consumes market participants and causes valuations to rise significantly past reality. When the bubbles burst, asset valuations plummet.

Bull

An investor or trader that expects an asset’s price to go up.

Bull Trap

A move to the upside luring bullish traders into long positions, only for a surge of buying to force longs to cover and price to cascade downward.

Bull Flag / Pennant

A bearish chart pattern with a long pole and either flag like channel or triangle pennant.

C

Candlesticks

Japanese candlesticks represent price action on charts. Red for decreases, green for increases.

Cold Storage

Offline wallets not connected to the internet.

Correction

A crash or decline in price, usually short lived.

Cryptography

The study of using secure communication in the presence of third-parties.

Cryptojacking

A type of malware that takes over computer resources to mine for cryptocurrencies, usually Monero.

Cypherpunk

A class of brilliant tech enthusiasts with a focus on privacy, money, and disruption.

D

Dapps

Decentralized applications such as CryptoKitties.

Dead Cat Bounce

After a large crash, the initial rebound that occurs before there is more downside.

Decentralized

Having no central authority and offering nearly full autonomy.

DeFi

A new type of financial movement involving locking up crypto assets in place of traditional finance.

Derivative

A type of financial contract that derives its value from the performance of an underlying asset.

DEX

Decentralized exchanges.

Divergences

An occurrence in price action where indicators move opposite from the price itself.

Dominance

The percentage of Bitcoin’s weight compared with the entire altcoin market.

Dump

Price drop, or the act of selling assets

Dust

Fractions of remaining cryptocurrencies not large enough to trade or meet minimum withdrawal requirements.

E

ERC-20

A type of Ethereum contract standard.

Ethereum

A smart-contract focused cryptocurrency and the largest altcoin in the space.

Exchange

A platform that enables fiat-to-crypto or crypto-to-crypto trading.

F

Fiat

The native paper currency of each major country.

Fiat onramp

Exchanges or apps that enable the direct purchase of crypto with cash.

FOMO

The fear of missing out.

FUD

Fear, uncertainty, and doubt.

Fundamentals

The underlying health indicators and statistics of an asset.

Funding

A rate at which determines if shorts pay longs for keeping their positions open or vice versa. If funding gets too high, it can force traders out of their positions.

Futures

A type of contract that allows for the betting on the price of an asset to change by the time the contract expires.

G

Gains

Return on investment or money made.

Genesis Block

The very first ever Bitcoin blockchain transaction.

GPU

Stands for graphical processing unit, often used for crypto mining but is also a common computer component.

H

Halving

An event occurring every four years at which Bitcoin’s block reward is cut in half.

Hard Fork

When a blockchain is split into two chains, thus creating two cryptocurrencies.

Hash Rate

The amount of processing power generated by a cryptocurrency network.

Head and Shoulders

A chart pattern top formation that resembles a head between two peaks and troughs acting as shoulders.

HODL

Hold on for dear life.

Hot Wallet

Crypto wallets that are regularly connected to the internet in some capacity.

I

ICO

Initial coin offering. A craze that was popular in 2017 but has since disappeared.

IEO

Stands for initial exchange offering. The replacement for ICOs, IEOs are launched with exchange support.

Inverse Head and Shoulders

A chart pattern top formation that resembles a head between two peaks and troughs acting as shoulders, but in inverse.

J

Note: No crypto terms that begin with J currently exist! But the industry is always growing and expanding, with new products, cryptocurrencies and terms being created regularly.

K

KYC

Know your customer is a policy that requires personal information and identification to comply with local laws.

L

Lambo

Short for Lamborghini, the most popular vehicle of choice by crypto investors.

Ledger

A brand of hardware wallet but also the distributed, transparent log of blockchain transactions.

Leverage

Using collateral to multiply position size and therefore any profit potential. Beware, as leverage also amplifies losses.

Lightning

A second-layer technology that speeds up Bitcoin transaction times.

Limit Order

A type of order that triggers when a specific price is reached.

Litecoin

An early altcoin designed similar to Bitcoin and is often referred to as the silver to Bitcoin as digital gold.

Liquidity

The amount of assets available to be traded at any given time.

Long

A contract betting that an asset price will rise.

M

Mainnet

A cryptocurrency protocol specifically designed for the underlying asset.

Market

The venue at which all financial assets are sold.

Market Cap

The cumulative total of an asset’s price multiplied by the total number of circulating supply.

Market Order

A type of order that executes immediately at market price.

Margin Call

When not enough margin is available to cover open position profit and loss.

Margin Trading

Trading using leverage to maximize ROI.

Max Supply

The total supply of cryptocurrencies that can ever exist, according to the asset’s code.

Miners

Operators of complex machinery designed to secure the Bitcoin network, validate each block, and earn a reward of BTC for doing so.

Mining

The process of operating complex machinery designed to secure the Bitcoin network, validate each block, and earn a reward of BTC for doing so.

Mixing

Moving around funds between various assets and exchanges in order to hide transaction traces and launder money.

Moon

The term for an asset going on an outrageous rally.

Moonshot

An altcoin that is selected solely to try to achieve the highest level of gains possible.

MACD

Stands for moving average convergence divergence, it is a popular technical analysis indicator. It is often considered a lagging indicator.

Mt. Gox

One of the original places to buy Bitcoin, that was notoriously hacked and became insolvent in the early days of the asset. Legal proceedings continue even today.

N

Node

A full installation of the Bitcoin core client.

No-coiner

An individual that doesn’t own any cryptocurrencies.

O

OCO Orders

Stands for one cancels the other, this type of order triggers another order type the moment a price level is reached.

Options

A contract giving buyers the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price.

Overbought

When buying pressure has reached a level at which a reversal may take place.

Oversold

When selling pressure has reached a level at which a reversal may take place.

OTC

Over the counter. The largest Bitcoin transactions take place OTC so large players can avoid slippage.

P

Pair

Two assets trading against one another. For example, BTC/USD.

Phishing

A phony communication or website designed to dupe users into entering sensitive information.

Ponzi Scheme

A scheme that relies on luring new investors into paying funds to old investors, giving the semblance of actual profits or product sales.

Portfolio

All of the assets an individual holds.

Proof of Work

A consensus algorithm designed to confirm transactions and add new blocks to each blockchain.

Pseudonymous

Hidden behind a false name.

Pump and Dumps

A coordinated plan to inflate prices just to later dump into the market.

Q

QR Codes

A type of matrix barcode that can be scanned with a smartphone app.

R

REKT

The sad state of a trader after taking a severe loss or after being liquidated.

ROI

Return on investment or the gains generated from a trade or investment.

RSI

Stands for relative strength index and is a commonly used technical analysis indicator.

S

Satoshi

The smallest unit of Bitcoin measurement, named after the creator of Bitcoin. Also called a sat.

Satoshi Nakamoto

The pseudonymous creator of Bitcoin.

SEC

The United States Securities and Exchange Commission.

Seed Phrase

A list of words that store all the information needed to recover Bitcoin funds on-chain.

Shitcoin

Another name for Altcoins.

Short

A contract betting that an asset price will fall.

Silk Road

A dark web market that was popular for drugs and weapons. Bitcoin’s early success can be partly attributed to its use on that platform as the currency of choice.

Smart Contract

Code that acts as an agreement between two parties.

Spot Exchange

A platform that offers basic buying and selling of assets without added contracts or leverage.

Stablecoin

A type of cryptocurrency commonly tied to the value of the dollar. It is used as a safe haven for capital to avoid the wild volatility in crypto assets.

Symbol

The price ticker sign designated to each individual asset. For example, ETH.

T

Target Sir?

A common phrase among the cryptocurrency community in which a price target is requested.

Technical Analysis

The study of using chart patterns, Japanese candlesticks, trading indicators, Fibonacci retracement, and more. It’s used to help predict future price movements.

Tether

The sometimes controversial, leading stablecoin by market cap that is tied 1:1 to a corresponding dollar.

Ticker

The trading symbol of each asset. For example, BTC.

U

Unconfirmed

A transaction awaiting to be verified and added to the blockchain, which confirms the transaction.

V

Vaporware

A cryptocurrency project that has been abandoned and is no longer supported.

Volatility

Wild and explosive price movements in either direction.

Volume

The cumulative total of assets sold, multiplied by the price each asset is sold at during each session.

W

Wallet

A location to store, receive, and send cryptocurrencies.

Watchlist

A list of asset prices customized by a user.

Weak Hands

Investors that are prone to panic-selling at the first sign of a crash or someone who cannot withstand a crypto crash.

Whale

A large wealth investor capable of moving the market.

X

XBT

The ticker or symbol for collateralized Bitcoin.

Y

YTD

Stands for year-to-date in reference to performance.

Z

ZCash

A popular privacy focused altcoin.

————————————————————————————

First chapter only

1 note

·

View note

Text

2.Introduction to Cryptocurrency Trading

Cryptocurrency trading involves buying or selling an asset, or betting on the future price action of an asset via derivatives contacts. The goal here is to extract more profit from each price swing that takes place, rather than buying and holding through natural market ebb and flow.

1 note

·

View note

Text

①What is cryptocurrency trading?

(1)What is cryptocurrency trading?

Cryptocurrency is the practice of exchanging cryptocurrencies with other assets, either fiat currencies or other cryptocurrencies, in an attempt to profit from the price fluctuations that occur between each buy or sell order.

The asset class of cryptocurrencies is a speculative set of assets, which is the reason behind their notorious volatility. Because there are very few ways to come up with realistic valuations for these assets, the push and pull of buyers and sellers primarily drives price action.

Due to the wild volatility, investors often get sick of holding through downtrends or come to understand the profit potential they’re leaving behind by not buying low and selling high between each major swing.

Those who bought during the bull market as investors, commonly switched to trading during the bear market to both increase their BTC or other crypto holdings, while also either maintaining or even increasing USD capital all the while.

1 note

·

View note

Text

(2)How does cryptocurrency trading work?

To get started with cryptocurrency trading, you will utilize the information learned during Course One.

You must already own cryptocurrencies to begin trading them. Cryptocurrencies can be traded at most exchanges that allow the purchase of crypto assets like Bitcoin and Ethereum, or, any cryptocurrency can be sent to a cryptocurrency exchange with a corresponding supporting wallet and trading pair.

After buying crypto or sending it to a cryptocurrency exchange or trading platform, you can begin trading cryptocurrencies.

Each platform’s trading terminal will look relatively similar, and usually will include:

Price Chart

Order Book

Open Orders

Open Positions

Account Balance

Price Tickers

Depending on the platform, there may be additional tools available such as moving averages, widgets for customizations, and more.

Many platforms offer a mobile application or website, however, until you have become more comfortable with trading, it is recommended to use a desktop.

1 note

·

View note