#creditkarma

Text

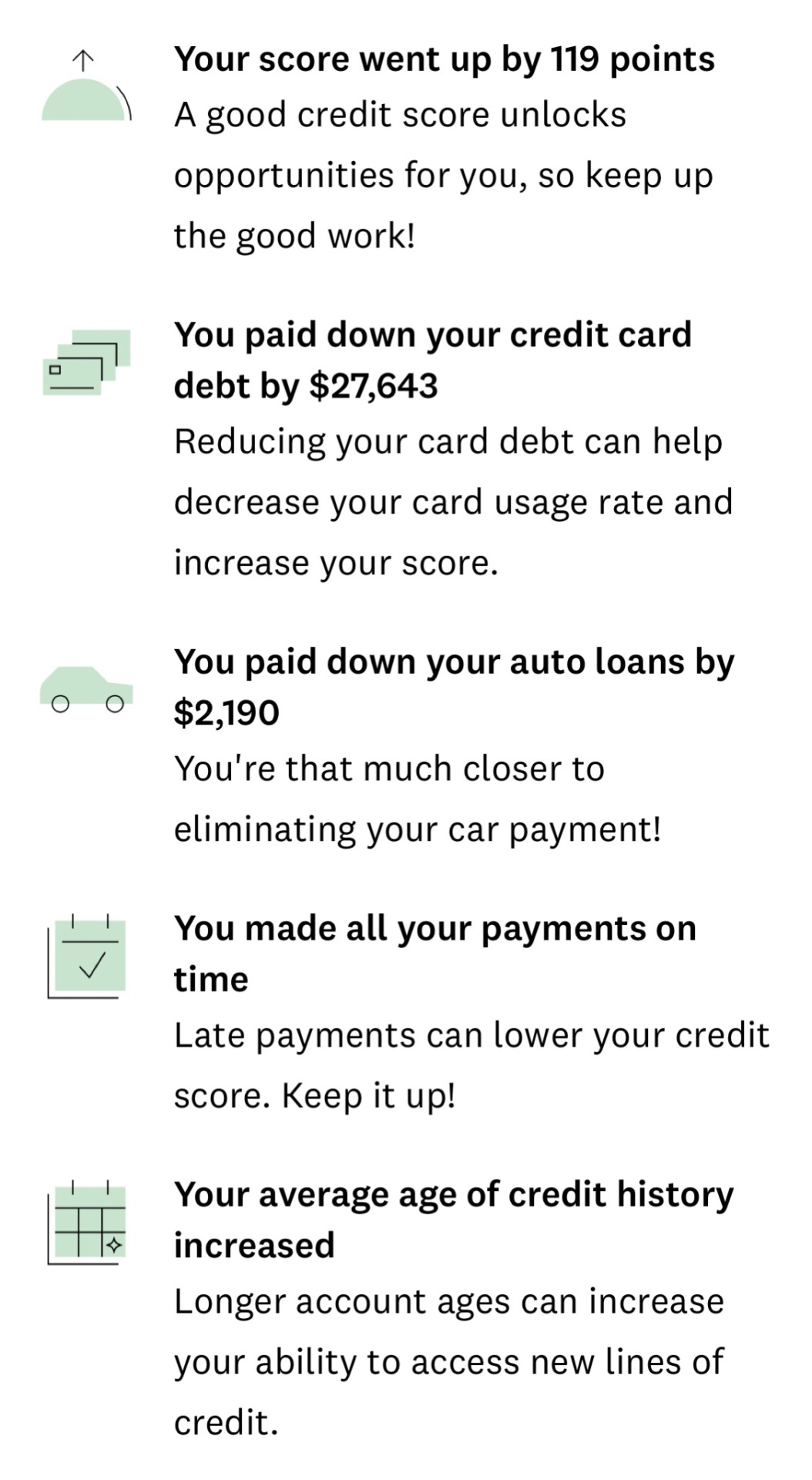

High five for all of us who have managed to make an improvement in our credit scores.

We're getting there, babes.

(And a reminder that creditkarma lets you see your credit score every damn day if you want. For free.)

#i had a good credit score at one point#and i have been clawing it back for awhile#very pleased with looking it up today and seeing it's not bad#creditkarma#if you know something shitty about credit karma#i probably don't care#the reward of easy access to something I should have instant access to at all times anyway is worth a fucking lot

14 notes

·

View notes

Link

Credit Karma, founded in 2007, revolutionized personal finance management by offering free access to credit scores and reports.

0 notes

Text

I have a brilliant idea for a Credit Karma ad:

1 person sitting in a chair in a tattoo shop getting the numbers “777” tattooed.

Someone comes up to them and says, “Angel numbers?”

And they shake their head no and say, “Credit score.”

And then it flashes to a white screen with the Credit Karma logo and a narrator says, “Know yours. Credit Karma.”

@creditkarma

#credit karma#creditkarma#credit score#777#angel numbers#corporate tumblr#@creditkarma please hire me

0 notes

Text

Akermon Rossenfeld Unraveling the 5 Effects of Unsettled Debt

Akermon Rossenfeld delves into the repercussions of unsettled debt, shedding light on five critical effects. His research exposes how unpaid obligations lead to financial stress, credit score deterioration, relentless collection efforts, limited financial prospects, and strained relationships. Rossenfeld's work underscores the importance of addressing and managing debt for improved financial well-being and personal relationships.

#debtcollector#debtcollection#creditcarddebt#creditscore#creditkarma#credittips#fixmycredit#badcredit#creditrepairservices#studentloans#creditrepair#mortgageloans#usaloans#nyloans#creitboost#debt#nostudentloans#badcreditloans#newcar#creditrestoration#debtfree#crditbuilding#creditscoreincrease#lowinterestrates#bootscredit#creditbuilding#debtcollectiondefense#debtrecovery#debts#baddebts

0 notes

Text

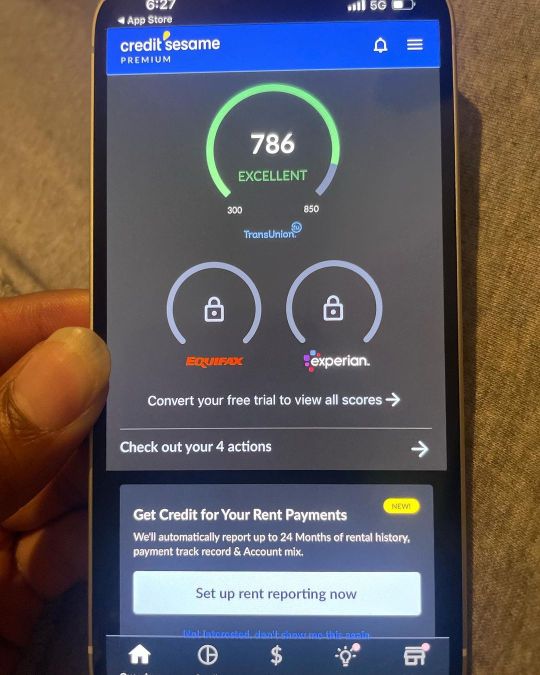

Big important wins 🙏🏼

0 notes

Text

Rebuild, Restore, Rejoice: Steps to Fixing Your Credit Report in Louisville, KY

Your credit report is a comprehensive summary of your credit history, including information about your payment habits, outstanding debts, and credit inquiries. It is essential to have a healthy credit report to enjoy financial stability and access to favorable credit opportunities. In this article, we will explore the steps you can take to Fix your credit report in Louisville, KY, and improve your overall creditworthiness.

Understanding Your Credit Report

Before diving into the process of fixing your credit report, it is crucial to understand its components. Your credit report consists of various sections, including personal information, account history, public records, and inquiries. Familiarize yourself with these sections to gain a comprehensive understanding of your credit standing.

Assessing Your Credit Situation

The first step in repairing your credit report is to assess your current credit situation. Obtain a copy of your credit report from one of the major credit bureaus and carefully review it for any errors or discrepancies. Make a note of any negative items, such as late payments, defaults, or collections, as these will require specific attention during the repair process.

Disputing Inaccurate Information

If you identify any inaccuracies or incorrect information on your credit report, it is essential to dispute them promptly. Contact the credit bureaus in writing, providing detailed explanations and supporting documentation to back up your claims. The credit bureaus are obligated to investigate and correct any errors within a reasonable timeframe.

Paying Off Outstanding Debts

Addressing outstanding debts is a crucial step in repairing your credit report. Create a strategy to pay off your debts systematically, starting with those that have the highest interest rates or are in collections. Consider negotiating with creditors for a favorable settlement or setting up payment plans to make the process more manageable.

Building Positive Credit History

To rebuild your credit, it is important to demonstrate responsible credit behavior. Start by making timely payments on your existing credit accounts. If you don't have any active credit, consider opening a secured credit card or becoming an authorized user on someone else's credit card to establish positive credit history.

Utilizing Secured Credit Cards

Secured credit cards are an excellent tool for rebuilding credit. With a secured credit card, you provide a security deposit, which becomes your credit limit. Use the card responsibly, making small purchases and paying off the balance in full each month. Over time, this will help improve your credit score.

Managing Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you are currently using. Aim to keep your credit utilization below 30% to demonstrate responsible credit management. Avoid maxing out your credit cards or carrying high balances, as this can negatively impact your credit score.

Creating a Budget and Sticking to It

Developing a budget is essential for maintaining healthy financial habits. Track your income and expenses to ensure you have a clear understanding of your financial situation. Allocate funds for essential expenses, debt repayment, and savings. By sticking to a budget, you can avoid overspending and reduce financial stress.

Seeking Professional Assistance

If you find the credit repair process overwhelming or need expert guidance, consider seeking professional assistance. Credit counseling agencies and reputable credit repair companies can provide valuable insights, personalized advice, and strategies tailored to your unique situation.

Monitoring Your Progress

As you embark on your credit repair journey, it is important to monitor your progress regularly. Keep track of your credit score and review your credit reports periodically to ensure that the changes you have made are reflected accurately. Celebrate small victories along the way, as every positive step contributes to a stronger credit profile.

The Importance of Patience and Persistence

Repairing your credit takes time and effort. It is crucial to maintain patience and persistence throughout the process. Understand that rebuilding your credit is a marathon, not a sprint. Stay committed to your financial goals, make responsible credit choices, and embrace the positive changes you are making in your financial life.

Conclusion

Fixing your credit report in Louisville, KY, is an achievable goal with the right strategies and mindset. By following the steps outlined in this article, you can rebuild and restore your credit, paving the way for a brighter financial future. Remember to stay informed, take proactive measures, and remain patient as you work towards improving your creditworthiness.

FAQs (Frequently Asked Questions)

Q1. How long does it take to fix a credit report?

A1. The time required to fix a credit report can vary depending on the complexity of your situation. It may take several months or even years to fully repair your credit. However, with consistent effort and responsible credit behavior, you can start seeing improvements within a few months.

Q2. Can I fix my credit report on my own, or do I need professional help?

A2. While you can fix your credit report on your own, professional help can provide valuable guidance and expertise. Credit counseling agencies and reputable credit repair companies can offer personalized strategies and assist you in navigating the process effectively.

Q3. Will fixing my credit report automatically improve my credit score?

A3. Repairing your credit report is a crucial step towards improving your credit score. However, other factors, such as payment history, credit utilization, and length of credit history, also influence your credit score. By addressing all aspects of your credit, you can work towards a better credit score.

Q4. Can I remove accurate negative information from my credit report?

A4. Accurate negative information, such as missed payments or defaults, generally cannot be removed from your credit report. However, it will have less impact over time as you build a positive credit history. Focus on making timely payments and establishing good credit habits to mitigate the effects of negative information.

Q5. How often should I check my credit reports?

A5. It is recommended to check your credit reports at least once a year. Regular monitoring allows you to detect any errors or fraudulent activities promptly. You can obtain free copies of your credit reports from each of the major credit bureaus once every 12 months.

Call today at (888) 803-7889 for a free consultation. We look forward to helping you, Bloom!

#CreditLawyer#Payingoffyourcollections#Creditcounseling#creditkarma#creditrepairservices#creditrestoration

0 notes

Photo

@creditkarma I need my money for this consumer violation frat!!! "For many of these offers, almost a third of consumers who received and applied for 'pre-approved' offers were subsequently denied based on the financial product companies' underwriting review," the agency said in a previously issued consent decree. Credit Karma, which provides users with tools to monitor their credit scores and reports, told some users that they had "90% odds" of being approved for credit products, according to the FTC. Such practices wasted consumers' time and could have damaged their credit scores, the agency said. Credit Karma disputed the FTC's claims in a strongly worded statement to CBS MoneyWatch. "We fundamentally disagree with the allegations the FTC makes in their complaint," a Credit Karma spokesperson said in an email. "We do not engage in so-called 'dark patterns,' there is no mention of this at all in our agreement with the FTC and their suggestion is entirely baseless. There are also no allegations that members paid unexpected fees or charges of any kind." The FTC, which first announced its complaint against Credit Karma in September 2022, has also ordered the credit services company to stop making these kinds of false claims. #pluggednnye🔌 #Creditkarma #creditkarmalawsuit https://www.instagram.com/p/Cnyk2WFOjWK/?igshid=NGJjMDIxMWI=

0 notes

Video

youtube

Protect Yourself From Predatory Lending! Don't Be A Victim of Loan Fraud.

What is Predatory Lending?

Predatory lending is a practice that involves mortgage loan programs that are dishonest and deceiving to the consumer. Excessive interest rates and fees, deceptive terms and conditions and pressure to refinance multiple times are all common signs of predatory lending practices.

Elegance Realty wants to help future homeowners avoid becoming victims by offering a resource they can use to identify and hopefully steer clear of predatory lenders. In communities across America, people have lost their homes and their investments because of predatory lenders, appraisers, mortgage brokers and home improvement contractors who:

Sell properties for much more than they are worth using false appraisals.

Encourage borrowers to lie about their income, expenses, or cash available for down payments in order to get a loan.

Knowingly lend more money than a borrower can afford to repay.

Charge high interest rates to borrowers based on their race or national origin and not on their credit history.

Charge fees for unnecessary or nonexistent products and services.

Pressure borrowers to accept higher-risk loans such as balloon loans, interest-only payments and steep pre-payment penalties.

Target vulnerable borrowers for cash-out refinance offers when they know borrowers are in need of cash due to medical, unemployment or debt problems.

“Strip” homeowners’ equity from their homes by convincing them to refinance again and again when there is no benefit to the borrower.

Use high pressure sales tactics to sell home improvements and then finance them at high interest rates.

Contact us for all your real estate needs.

Elegance Realty, LLC

(Atlanta Metro Real Estate Firm)

Licensed in: FL | GA | MS | NY | SC | TN | UT

We have Real Estate partners in all states.

http://www.facebook.com/elegancerealty

http://instagram.com/kemi_enterprises

678-757-5364

#atlanta#real estate#georgia#realtor#realtorlife#homebuying#lawrenceville#elegance realty#predatory lending#loan fraud#zillow#credit#creditkarma#homeownership#homeowner#homedecor#2023

0 notes

Photo

How is your personal credit? CPN credit? We can help boost your credit within 45 days. #creditrepair #credit #creditcard #creditscore #creditispower #creditreport #creditkarma #creditsweep #creditbuilder https://www.instagram.com/p/Ck6z2qVPXFu/?igshid=NGJjMDIxMWI=

#creditrepair#credit#creditcard#creditscore#creditispower#creditreport#creditkarma#creditsweep#creditbuilder

0 notes

Text

How to get Credit Reports in North Charleston, SC?

Credit reports are a type of report that you receive from companies that you have done business with. They usually contain information about your credit card and loan usage, as well as other important financial details.

There are some websites where you can get your credit reports, but they are not always accurate. You may be able to find the same information on your credit card statement or bank statement, so it is best to go directly to the company in order to get the most accurate report possible.

What is a Credit Report?

Credit reports can be used to determine the financial health of a person and establish creditworthiness.

Credit Reportsare used by lenders to assess a person's creditworthiness. The information gathered from these reports is used to decide whether or not to grant the application for a loan or other forms of financing.

A credit report is an important tool for lenders, as it helps them make informed decisions about who they should lend money to and also how much they should lend them.

How to Get Your Free Credit Report in North Charleston, SC?

Getting your free Credit Report in North Charleston, SCis not an easy task. But there are some ways to get it without having to pay for it. You can order your credit report by phone or online.

If you are looking for a way to get your free credit report, you should consider ordering one online or by phone. They will also be able to provide you with the information that you need in order to file a dispute if anything comes up on your report that is inaccurate or incomplete.

Call on (888) 804-0104& get your free credit report in North Charleston, SC now!

#creditscore#creditcard#creditrestoration#creditcarddebt#creditkarma#creditgoals#creditrepair#creditconsult

1 note

·

View note

Text

The Complete Guide to Credit Repair Services in Green Bay, WI

Credit repair services are a great way to get back on your feet. It can help you get a better credit score, loans, and more.

It is important that you find the right credit repair service for your needs. There are many different types of services out there, so it is important that you do your research before making a decision.

Credit Repair Services are provided by many Credit Repair Companies in Green Bay, WI. They all offer different packages and prices, so it is important to find the one that will work best for you.

What is Credit Repair and Why is it Important?

Credit repair is the process of repairing or improving a person's credit score.

There are many reasons why it is important to have a good credit score. A good credit score can help you pay less for loans, get better interest rates on loans, and even get better deals on insurance premiums.

If you are looking for ways to improve your credit score, then consider using the services of a reputable credit repair company.

How Do You Clean Up Your Credit Reports & Boost Your FICO Scores?

The first step to credit repair is to check your credit reports and identify the errors.

The next step is to dispute any inaccuracies in your report. If you have a dispute with a creditor, it's best to do so in writing. You can also contact the credit bureau and ask them for help resolving the dispute.

You should also consider contacting a credit repair service if you are not confident about handling the process on your own. These services will work with you on managing your debt, lowering interest rates, negotiating with creditors and more.

How Credit Repair Services in Green Bay, WI Improve Your Credit Score?

Credit repair services are a great way to improve your credit score. They help you in removing the negative entries from your credit report and help you get a better score.

Credit repair services are not easy to find these days, but if you look hard enough, there are many out there that can provide you with the services that you need. However, it is important that before choosing one, you research them thoroughly so as to find the best one for your needs.

Call on (888) 804-0104 & hire the best credit repair services in Green Bay, WI.

1 note

·

View note

Text

How to Get a Good Credit Score in Wichita Falls, TX?

There are a number of factors that affect your credit score. Your payment history is the most important factor, and it makes up 35% of your score. Paying your bills on time is the best way to maintain a good credit score.

If you have a low credit score, it’s worth taking some steps to improve it. You can do this by paying off debts and making on-time payments for at least six months in a row.

If you have an excellent credit score, you might be eligible for premium rewards cards that offer cash back or other perks.

What is a Credit Score & Why Does it Matter?

A credit score is a number that reflects your creditworthiness. It is based on the information in your credit report. The higher your score, the more likely you are to receive loans and other forms of credit at an affordable interest rate.

The importance of a good credit score cannot be overstated. A goodCredit Score in Wichita Falls, TX can help you get approved for a mortgage, rent an apartment or buy a car with lower interest rates.

Qualities of a Good Credit Score

A good credit score is a necessity in today's world. It may be difficult to attain at first, but there are many ways that you can improve your credit score over time.

There are many factors that go into determining your credit score. These include payment history, the amount of money you owe, and the length of time you have had an account open. Additionally, the type of account you have open can also affect your credit score.

An important thing to note about improving your credit score is that it does not happen overnight. It takes time and effort to get a good credit score, but with these tips it will be easier than ever before!

How to Improve Your Credit Score in Wichita Falls, TX?

There are many ways to increase your credit score. One of the most effective is to pay off your debts and avoid opening new lines of credit.

You can also improve your credit score by getting a secured card and making sure you only use it when necessary. You can also get a car loan, but make sure you have good enough credit to qualify for one.

What are the Most Common Causes of Low Credit Scores?

A low credit score can have a negative impact on your life. For example, it can make it difficult to get approved for loans and credit cards. It can also affect your ability to rent a home or apartment.

It is important to understand the most common causes of low credit scores so that you can address them in order to improve your score.

Some of the most common causes of low credit scores are:

- Late payments

- Too much debt relative to income

- Number of accounts with delinquencies (late or missed payments)

Call on (888) 804-0104 & improve your credit score fast.

#creditrestoration#creditcarddebt#creditkarma#creditgoals#creditrepair#creditconsult#creditrepairservices#businessdebtassistance#creditreportreviews

1 note

·

View note

Text

Empower Your Finances: Exploring Credit Counseling Services in Chicago, IL

In the bustling city of Chicago, IL, many individuals face financial challenges that can impact their overall well-being. From overwhelming debt to low credit scores, these financial burdens can create stress and hinder progress towards financial stability. However, there is a solution available: credit counseling services. This article aims to shed light on the benefits of credit counseling services in Chicago and how they can empower you to regain control of your finances and improve your financial future.

Understanding Credit Counseling

Credit counseling is a professional service designed to assist individuals in managing their finances effectively. Credit counselors are trained experts who assess your financial situation, provide personalized guidance, and develop strategies to address your specific financial challenges.

Assessing Your Financial Situation

The first step in credit counseling is a thorough assessment of your financial situation. Credit counselors will review your income, expenses, debts, and credit history to gain a comprehensive understanding of your financial health. This assessment helps identify the root causes of your financial difficulties and enables credit counselors to provide tailored advice.

Creating a Personalized Financial Plan

Based on the assessment, credit counselors create a personalized financial plan that aligns with your goals and addresses your financial challenges. This plan may include strategies such as debt consolidation, budgeting techniques, and prioritizing debt repayment. A personalized financial plan sets you on the path towards financial stability and empowers you to make informed financial decisions.

Developing Effective Budgeting Strategies

Credit counseling services in Chicago emphasize the importance of budgeting. Credit counselors work with you to develop effective budgeting strategies that align with your income, expenses, and financial goals. By implementing a budget, you gain better control over your finances, track your spending, and ensure that you can meet your financial obligations.

Debt Management and Negotiation

Credit counseling services play a vital role in helping you manage and reduce your debt. Credit counselors negotiate with your creditors on your behalf to secure lower interest rates, reduced monthly payments, and potential waivers of late fees. They help you develop a debt management plan that outlines a structured approach to paying off your debts efficiently.

Improving Credit Scores

A low credit score can limit your financial opportunities and hinder your ability to obtain favorable loans or secure housing. Credit counseling services provide guidance on improving your credit score. By implementing effective credit management strategies and addressing negative items on your credit report, you can work towards rebuilding your credit and achieving a healthier credit score.

Providing Financial Education

Credit counseling services go beyond immediate financial assistance. They offer valuable financial education resources, workshops, and counseling sessions to enhance your financial literacy. These educational resources cover topics such as budgeting, savings, credit management, and responsible financial practices. By empowering you with knowledge, credit counselors equip you with the tools needed to make sound financial decisions.

Building Long-Term Financial Health

Credit counseling services focus not only on addressing immediate financial challenges but also on building long-term financial health. Credit counselors provide ongoing support, monitoring your progress, and adjusting your financial plan as needed. They help you establish good financial habits, set realistic goals, and develop a solid foundation for a brighter financial future.

Finding Reputable Credit Counseling Services in Chicago

To benefit from credit counseling services, it is important to find reputable and reliable providers in Chicago. Start by researching accredited credit counseling agencies that have a track record of success. Look for client testimonials, reviews, and certifications to ensure you choose a reputable service provider. Additionally, consider their expertise in handling specific financial challenges that align with your needs.

Frequently Asked Questions (FAQs)

What is credit counseling?

Credit counseling is a professional service that helps individuals manage their finances, address debt-related issues, and improve their overall financial well-being.

How can credit counseling services help with debt management?

Credit counseling services can assist with debt management by providing strategies such as debt consolidation, negotiation with creditors, and developing structured debt repayment plans.

Will credit counseling services affect my credit score?

Credit counseling services themselves do not directly impact credit scores. However, by following the guidance and strategies provided by credit counselors, you can improve your credit score over time.

How long does credit counseling take?

The duration of credit counseling varies depending on your unique financial situation. It may take several months to a few years to complete the program successfully. The duration is determined by your commitment and the complexity of your financial challenges.

How do I find reliable credit counseling services in Chicago?

To find reliable credit counseling services in Chicago, research accredited agencies, read client reviews and testimonials, and ensure that the agency adheres to ethical practices. It is also beneficial to seek recommendations from trusted sources.

Conclusion

Credit counseling services in Chicago offer a lifeline to individuals grappling with financial challenges. By providing personalized financial plans, effective budgeting strategies, debt management assistance, and financial education, credit counseling services empower you to take control of your finances. They pave the way for long-term financial health and help you build a stronger, more secure financial future. If you're facing financial difficulties in Chicago, consider seeking the assistance of credit counseling services to transform your financial life.

Give us a call today at (888) 803-7889.

0 notes

Text

Improve Your Credit Score The Definitive Guide for Centennial, CO

This guide will provide you with the steps you need to take in order to improve your credit score.

Credit scores are important because they can determine whether or not you are approved for certain loans and services. The higher your credit score, the more likely it is that you will be approved for a loan or service.

This will provide you with the steps that can be taken in order to improve your credit score.

How to Build Your Credit Score with a Little Effort?

Nowadays, individuals are more focused on their credit score. They want to know how they can build their credit score with a little effort.

The most important thing is to make sure that you are paying your bills on time, which will help you improve your credit score. You also need to have a good mix of different types of credit and loans in order to have a good credit rating.

What are the Requirements for Lenders When Determining Credit Scores?

Most lenders will use credit scores to determine whether or not a borrower is eligible for a loan and the interest rate that they will be charged. The higher the credit score, the better. The requirements for lenders when determining credit scores vary depending on the type of loan that is being applied for.

The three most popular types of loans are mortgages, car loans, and student loans. All three require different criteria to be met before they can be approved.

For example, in order to apply for a mortgage, you need to have enough income coming in each month and have at least 20% down payment saved up. In order to apply for a car loan, you need to have sufficient income coming in each month as well as proof of steady employment with an employer who has been around for at least two years.

To apply for a student loan, you need a high school diploma or GED certificate and either proof of enrollment or acceptance into an accredited college or university program that leads to a degree.

How Does Having Poor Credit Affect My Life?

Poor credit can affect your life in many ways. It can make it difficult to get a loan, or even a car or house. You may not be able to get a job or insurance. You may also be denied for an apartment rental because of your poor credit score.

The good news is that there are ways you can improve your credit score and get back on the right track. One way is by paying off any debts you have and making sure they are paid on time every month. Another way is by paying down any balances that are close to their limit, which will show lenders that you have more room to borrow money in the future if you need it. You can easily get Credit Repair Services in Centennial, CO with the litter bit more effort.

How credit repair company helps you in improve your credit score?

Credit repair company helps you in improve your credit score by removing negative items on your credit report and to help you build a good credit history.

Call on (855) 656-2963 to improve your credit score now!

#creditkarma#creditgoals#creditrepair#creditconsult#creditrepairservices#businessdebtassistance#creditreportreviews#debtsettlement#creditrestoration

1 note

·

View note

Text

Credit Score and Your Financial Management by Antioch, CA

Credit scores are important to managing your finances. A high credit score will help you get approved for a loan and may give you a lower interest rate. In this blog, we'll explore what goes into your credit score, and how you can work to improve it. We'll also discuss some strategies for financial management so that you can stay on top of your payments and maintain a good credit score.

What is Credit Score?

A credit score is a number that reflects your credit risk, or the likelihood that you will repay your debt on time. Your credit score is determined by a variety of factors, including your payment history, the amount of debt you have, and the number of inquiries on your credit report. A high credit score can help you get approved for a loan or mortgage, and may also qualify you for lower interest rates. Conversely, a low credit score can make it harder to obtain financing and may lead to higher interest rates. If you're looking to buy a home or car, or need to borrow money for any other reason, it's important to know what your credit score is and take steps to improve it if necessary.

Understanding Credit Scores and Why They Matter.

Your credit score is one of the most important numbers in your life. It dictates what kind of interest rates you'll get on a car loan or mortgage, and can even affect your ability to get a job. But what is a credit score, and why does it matter so much? In this blog, we'll answer those questions and more, so you can make the most informed decisions about your finances.

Call on (855) 656-2963 to improve your credit score now!

#creditscore#creditcard#creditcarddebt#creditkarma#creditgoals#creditrepair#creditconsult#creditrepairservices#businessdebtassistance

1 note

·

View note

Photo

“The Credit E-Book”, I’ve done all the work for you and made it AFFORDABLE. $40💋 How To Fix Your Credit From Poor to Excellent and Raising Your Credit Score to 720 or HIGHER. Credit helped me tap into that $8 Billion Trucking Industry making a minimum of over $300,000 in my first year. Anything worth having is worth working for. Stop depending on others or seeking someone else’s approval for your Interest and Desires. This one-time fee of $40 you spend today will change the quality of your life. No memberships I’ve even given you the Blue Print to have some of those Inquires removed that don’t belong for $10. https://www.athereshegotrucking.com/product-page/atsg-credit-credit-repair-e-book https://www.athereshegotrucking.com/product-page/express-removal-of-credit-inquires #credit #creditrepair #creditcards #credittips #creditkarma #creditscoresmatter #credentials #DIY #websites https://www.instagram.com/p/CjSlWkaOkDM/?igshid=NGJjMDIxMWI=

0 notes