#homebuying

Text

Does anyone know if there are any grants for a first-time, disabled home buyer/owner ?

#disabilties#spoonie#chronically ill#invisible disability#disabled life#disability#disabled community#disabled people#disabled#actually disabled#disabled artist#disabled girl#disabled pride#disabled representation#disabled rights#physical disability#homebuying#homeownership#chronic illness#chronic disease#physically disabled#finance

15 notes

·

View notes

Text

Sorry, parents: The American dream is only for DINKS

Homebuyers with kids will likely spend 66% of their income on a mortgage and childcare this year.

Parents in Los Angeles and San Diego can expect to spend as much as 121% and 113%, respectively.

Some Californians have moved across the country to afford to buy a home.

Thinking about buying a home this year with kids already in the picture? Get ready to dig deep.

A recent study from Zillow found that potential homebuyers with children are likely to spend 66% of their income on mortgage payments and childcare expenses — an increase of nearly 50% from 2019.

The real-estate company estimated city- and state-level childcare costs from 2009 to 2022 for the typical American family with 1.94 children by analyzing data from the Women’s Bureau of the US Department of Labor and advocacy group Child Care Aware.

According to Zillow’s analysis, in 31 of the largest 50 US metropolitan areas with available childcare cost data, families looking to buy a home can expect to spend more than 60% of their income on mortgage and childcare costs.

Some areas are even costlier, with parents in cities like Los Angeles and San Diego needing to dedicate as much as 121% and 113%, respectively. (In those areas, the cost of buying a typical home and childcare is so big relative to the median income that Zillow's calculation results in figures over 100%.)

Zillow determined that a family earning a median household income of $6,640 per month can expect to allocate $1,984 of that to childcare. If the family purchased a house at a 6.61% interest rate — the rate in early January, when the US Department of Labor released its latest data on childcare costs — and made a 10% down payment, their monthly mortgage would amount to $1,973.

That leaves just $2,683 for additional expenses like food, transportation, and healthcare. This means many households with kids are financially strained; they're likely spending more than 30% of their income on housing, well above what experts recommend.

It all adds up to a costly reality that's making the American dream of homeownership seem farther out of reach for parents than ever before.

Parents can blame a yearslong battle with inflation, as well as stubbornly high home prices and mortgage rates, for contributing to their predicament.

Based on the study, a new buyer household in the United States, making the median income, would spend 30% of it on housing. It's paying for childcare, then, that adds so much on top of the housing budget.

The upshot: Another group, less encumbered financially, appears better poised to realize the dream of homeownership: "DINKS," an acronym that stands for "dual income, no kids."

Some child-free DINKS — who boast a median net worth above $200,000 according to the Federal Reserve's Survey of Consumer Finances — devote their disposable income to luxuries like boats and expensive cars.

Without the financial obligations of raising children, such as covering medical expenses or enrolling them in daycare or private school, DINKS can save thousands of dollars a year and build greater long-term wealth.

Some DINKS use their savings to finance vacations and travel the world, like Elizabeth Johnson and her husband, who, over the past couple of years, have hiked in the Swiss Alps, snorkeled in Hawaii, and enjoyed leaf peeping in Canada.

"We hang out with other people's kids every once in a while," Johnson previously told Business Insider's Bartie Scott and Juliana Kaplan, "but then we happily just give them back to their parents."

Some Americans with kids move to places where their money goes further

One solution to the high cost of both buying a home and raising a family?

Move.

In recent years, young Americans in higher-cost states have decided to move to places that offer them a cheaper cost of living.

Janelle Crossan moved to New Braunfels, Texas, from Costa Mesa, California, in 2020 following a divorce.

She was able to become a first-time homebuyer and found a safe community to raise her son.

"I paid $1,750 for rent in a crappy little apartment in California," Crossan told BI earlier this year. "Now, three years later, my whole payment, including mortgage and property taxes, is $1,800 a month for my three-bedroom house."

Pengyu Cheng, a program manager for a tech company, told BI in 2023 that moving from California to Texas allowed him and his wife to afford their first home, giving them the confidence and security to have their first child.

"Living in California has always been expensive," Cheng said. "I knew that when my wife and I eventually expanded our family, we wouldn't be able to afford San Francisco or the Bay Area in general — even though we both earn good salaries."

7 notes

·

View notes

Text

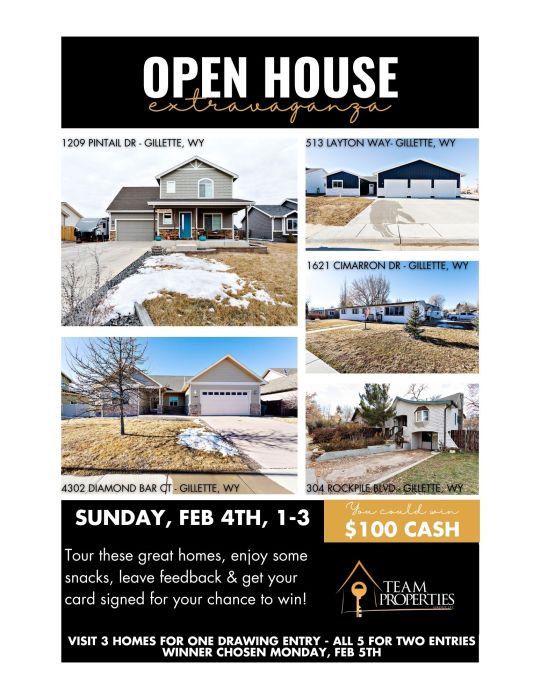

🎈𝕆𝕡𝕖𝕟 ℍ𝕠𝕦𝕤𝕖 𝐸𝓍𝓉𝓇𝒶𝓋𝒶𝑔𝒶𝓃𝓏𝒶🎈Join us in Gillette this Sunday, February 4th from 1-3! Tour homes, enjoy some snacks, leave feedback and be entered for a 𝓬𝓱𝓪𝓷𝓬𝓮 𝓽𝓸 𝔀𝓲𝓷 $𝟏𝟎𝟎 𝓬𝓪𝓼𝓱!

𝟏𝟔𝟐𝟏 𝐂𝐢𝐦𝐚𝐫𝐫𝐨𝐧 𝐃𝐫 - 3 BD, 2 BA, 1380 SQFT, 0.21 ACRES - $299,900

𝟒𝟑𝟎𝟐 𝐃𝐢𝐚𝐦𝐨𝐧𝐝 𝐁𝐚𝐫 𝐂𝐭 - 5 BD, 3.5 BA, 4072 SQFT, 0.18 ACRES - $499,000

𝟓𝟏𝟑 𝐋𝐚𝐲𝐭𝐨𝐧 𝐖𝐚𝐲 - 4 BD, 2.5 BA, 2080 SQFT, 0.26 ACRES - $549,900

𝟏𝟐𝟎𝟗 𝐏𝐢𝐧𝐭𝐚𝐢𝐥 𝐃𝐫 - 3 BD, 2.5 BA, 2215 SQFT, 0.23 ACRES - $440,000

𝟑𝟎𝟒 𝐑𝐨𝐜𝐤𝐩𝐢𝐥𝐞 𝐁𝐥𝐯𝐝 - 3 BD, 2 BA, 1568 SQFT, 0.16 ACRES - $248,000

**Get your card stamped at 3 homes for one drawing entry OR visit all 5 for two entries! Winner will be drawn & contacted on Monday, February 5th!**

Contact our agents at Team Properties Group for more info 📲307.685.8177

#openhouse#homesforsale#wyoming#wyomingrealestate#homesforsaleinwyoming#gillettewy#gilletterealestate#homesforsaleingillettewy#teamproperties#tpg#firsttimehomebuyers#homeownership#homesweethome#homesearch#househunting#homebuyers#homebuying#homesellers#homeselling#realtorsinwyoming#realtorsingillettewy#realestate#realestateagent#realtor#realestatemarket#winnerwinnerchickendinner

4 notes

·

View notes

Text

#home & lifestyle#home decor#business#interiors#houseandlandworld#home builders#living#real estate#homebuying#housing development finance corporation#mahercorp#eighthomes#urbanedge

89 notes

·

View notes

Text

💥New Listing💥 Enjoy peaceful rural living with room to roam! 3 bd, 2 ba, 1216 sqft, 2.59 acres. Check out 15 Smokey Ave in Rozet, WY👉 https://ow.ly/TSPn50QjOfq

Call Tonya Stahl at Team Properties Group for more info 📲307.299.1396

#wyoming#wyomingrealestate#ruralproperty#ruralresidential#rozetwy#homesforsale#homesforsaleinrozetwy#teamproperties#tpg#tonyastahl#northeastwyoming#homebuyers#homebuying#homesellers#homeselling#realestate#realestateagent#realtor#realestatemarket#housingmarket#homeswithacreage

4 notes

·

View notes

Text

If buying a house has taught me anything, the system is still very much rigged in favor of the banks and to penalize home buyers as much as possible, even when they say they want to help first time buyers.

#i should be closing later today#homebuying#fuck capitalism#this was so painful#and my boomer parents talking about their experiences with buying in the 80s and 90s just shows how much it has changed

2 notes

·

View notes

Text

The reality of living in California

#livinginca#livingincalifornia#californialiving#poverty#homebuying#i will never financially recover from this#financially frustrated#fml#I quit

8 notes

·

View notes

Text

Selling or Buying a Home? Don't Skip the Mold Inspection Step!

Whether you're a seller or buyer, our mold inspection is critical to the home transaction process. Our professional mold inspection service provides peace of mind by identifying potential mold problems before they become costly. Ensure a smooth real estate transaction and protect your investment with a comprehensive mold inspection.

Know more at https://www.youtube.com/watch?v=WCnfb1Ih4jE

#funguymoldinspections#homeselling#homebuying#certifiedmoldinspection#inspection#professionalmoldinspection#moldinspectionservices#moldidentification#moldinspection#mold#moldgrowth#moldissues#home#property#molddetection#realestate

4 notes

·

View notes

Photo

💰Buy down loans R what it’s gonna take to get 👍 buyers into properties in this higher rate environment. ✅The strategy is helping Many homebuyers 🏡in 2023. 🙏Don’t let the opportunity to become a homeowner pass you by and don’t let the ⬆️higher rates discourage you there’s tremendous opportunity 🍾🎊 for buyers in this environment!!!!! click on my bio open up the link tree then click on YouTube and the video is on there . Then get in touch with me so I can help plan your home ownership future Teresa Tims, Broker | Mortgage Expert 🏡California, TX, AZ, OR, GA, FL, CO Home Loans ✅Out of State Investor Loans 📲909.920.3500 call / text 💰Apply TDR Mortgage.com 🌈All Social @teresatims #HomeLoans #MortgageBroker #RealestateBroker #TDRMortgage#MortgageTips #MortgageHacks #HomeBuying #MillionDollarListing #SellingOC #OC #socal #orangecounty #orangecountyrealestate#LosAngeles #NewportBeach #IE #Upland #LA #Entrepreneur #brokersarebetter#realtor #wearehiring #loanofficer @aime @uwmlending @arive (at Newport Beach, California) https://www.instagram.com/p/CpVyUaWvPvX/?igshid=NGJjMDIxMWI=

#homeloans#mortgagebroker#realestatebroker#tdrmortgage#mortgagetips#mortgagehacks#homebuying#milliondollarlisting#sellingoc#oc#socal#orangecounty#orangecountyrealestate#losangeles#newportbeach#ie#upland#la#entrepreneur#brokersarebetter#realtor#wearehiring#loanofficer

10 notes

·

View notes

Text

Tips to start the homebuying process! 🏠💰🤩

#kjnanray#kjnanrayrealtor#kjsellsvegas#lasvegasrealtor#realtor#lasvegasdesi#housingmarketexpert#lasvegas#lasvegashousingmarket#realestateagent#homebuyer#homebuying#home buying process

2 notes

·

View notes

Text

youtube

Beautiful Single Family 🏠 Home For Sale in Manteca, Lathrop & Tracy🏡 || 4 Bedroom || 3 Bath

#toprealtor#areaexpert#realtor#realestate#realestateagent#firsthomebuyer#firsthome#firsttimebuyer#homebuying#agents#home#buyingahome#DownPayment#homebuyers#Youtube

3 notes

·

View notes

Text

Have y’all heard about this program? I highly recommend you check it out!

6 notes

·

View notes

Photo

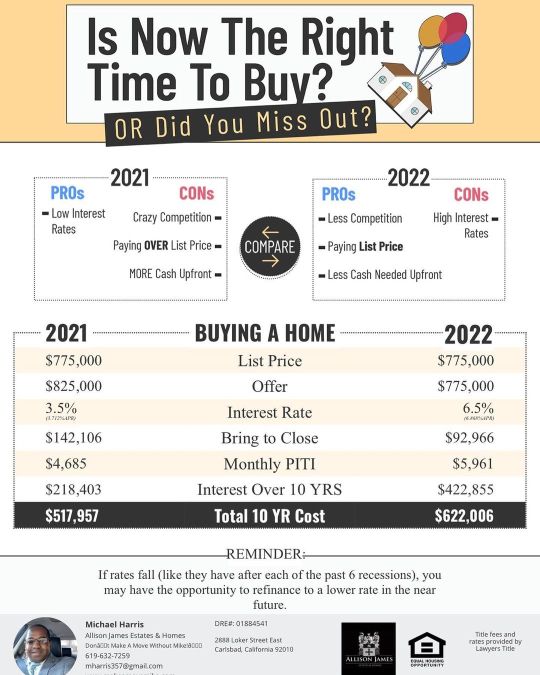

Some buyers may be hesitant to enter the market because of these high rates- but if we take a closer look at the numbers you can see that buying last year in a crazy "eBay bidding" style market is a lot more comparable to buying now with higher rates and less competition than you may think! Call/Text me today to discuss your situation and a strategy to ensure you accomplish your home buying goals. #homebuying #expertanswers #stayinformed #staycurrent #powerfuldecision #confidentdecisions #realestate #realestatetips #realestatelife #realestateagent #realestateexpert #realestatetipsoftheday #realestatetipsandadvice #makeamovemike #theveteransrealtor #sandiego #usnavy #veteran (at San Diego, California) https://www.instagram.com/p/CkrUYsbP_I_/?igshid=NGJjMDIxMWI=

#homebuying#expertanswers#stayinformed#staycurrent#powerfuldecision#confidentdecisions#realestate#realestatetips#realestatelife#realestateagent#realestateexpert#realestatetipsoftheday#realestatetipsandadvice#makeamovemike#theveteransrealtor#sandiego#usnavy#veteran

7 notes

·

View notes

Text

💥ℂ𝕦𝕤𝕥𝕠𝕞𝕖𝕣 𝔸𝕡𝕡𝕣𝕖𝕔𝕚𝕒𝕥𝕚𝕠𝕟 𝔹𝔹ℚ💥

Join us Saturday, August 26th, from 12-3 to celebrate YOU! 🥳

Food, Fun On The Go, Liberty Sweets, Games, Trivia & Prizes!

𝓣𝓱𝓪𝓷𝓴 𝔂𝓸𝓾 𝓯𝓸𝓻 𝔂𝓸𝓾𝓻 𝓬𝓸𝓷𝓽𝓲𝓷𝓾𝓮𝓭 𝓼𝓾𝓹𝓹𝓸𝓻𝓽!

#teamproperties#tpg#customerappreciation#clientappreciation#appreciation#blessed#funonthego#gillettewy#gilletterealestate#homebuyers#homebuying#homesellers#homeselling#realestate#realestateagent#realtor#realtorsinwyoming#realtorsingillettewy

5 notes

·

View notes

Photo

#Repost @loan_girl_rissa ... FHA JUST GOT MORE AFFORDABLE❗ YES, IT'S TRUE! FHA has announced a reduction in the Annual Mortgage Insurance Premium (MIP) rates. The reduction will apply to new loans, for case numbers assigned after March 20, and will result in a lower monthly payment for borrowers. For a loan amount of $400,000, the current monthly MIP payment is $266. With the new policy, the premium rate will decrease from 0.80% to 0.50%, resulting in a monthly payment of $166. This represents a significant reduction of $100 per month in mortgage insurance payments, which can make a substantial difference for many borrowers. The reduction in MIP rates is intended to make homeownership more affordable for more Americans, particularly first-time homebuyers. The FHA plays a critical role in making homeownership possible for many people who would otherwise struggle to qualify for a mortgage. The reduction in MIP rates is expected to make FHA loans even more attractive to borrowers, who will benefit from lower monthly payments and increased purchasing power. Marissa Nevis, NMLS 276162 🏠 Loan Officer | Nevis Team Lending 📞 (209) 366-3263 📧 [email protected] 📅 https://calendly.com/mnevis ✨ www.nevisteamlending.com #affordablehomeownership #home #homesweethome #homebuyers #homebuying #househunting #househuntingtips #homeowner #homeownership #finance #financetips #investment #investmentproperty #refinance #refinancemortgage #mortgage #mortgagebroker #mortgagelender #mortgagetips #loans #homeloans #mortgageloans #loanofficer #realestate #realestateagent #realestateinvesting #realestatelife #NevisTeamLending https://www.instagram.com/p/CpeeJqzMev0/?igshid=NGJjMDIxMWI=

#repost#affordablehomeownership#home#homesweethome#homebuyers#homebuying#househunting#househuntingtips#homeowner#homeownership#finance#financetips#investment#investmentproperty#refinance#refinancemortgage#mortgage#mortgagebroker#mortgagelender#mortgagetips#loans#homeloans#mortgageloans#loanofficer#realestate#realestateagent#realestateinvesting#realestatelife#nevisteamlending

5 notes

·

View notes

Text

🥳Congratulations to Steve and Rachel on the purchase of their new home! I'm so excited to see your vision come to life! Thank you for allowing me to help you with this new chapter! 🙌

#homeownership#homebuyers#homebuying#buyersagent#closingday#homesales#gillettewy#gilletterealestate#teamproperties#tpg#tonyastahl#congratulations#homesweethome#realtorsinwyoming#realtorsingillettewy#wyoming#wyomingrealestate#welcomehome#wyhomeing

2 notes

·

View notes