#between non relevant thus not developped

Text

Replying to an ask, I was realising -

We know more about Glenn (Govan Fraldarius?), the brother of a secondary character who died protecting one of the primary ones, than about Supreme Leader’s sibling who was the original heir of the Empire.

Supreme Leader, iirc, was born as Ionius’s ninth child, or fifth one? Something like that?

What about the First child, the heir of the Emperor, son of his wife (Supreme Leader mentions how her mother wasn’t Ionius’s wife, meaning he had one, it wasn’t just, Anselma) ? What about said wife?

Ionius was yeeted away in Nopes, but damn if we don’t know jack shit about Adrestia.

Sure sure, we know Leopold’n’Waldemar, yay - but bar the duo of clowns?

Rafiel is the first prince of Serenes, Reyson and Leanne often mention their older sister Lilia, but no one ever mentions Supreme Leader’s oldest sibling? Ionuis’s first child? Supreme Leader’s stepmother(s)?

Why would Ferdie have developed a rivalry with Supreme Leader, if she had older siblings already in line for the throne? Why would Hubert - the Vestra heir - be “given” to Supreme Leader, if the Imperial Heir was already around?

The more I think about it, the less Adrestia makes sense, or at least the Adrestia we were presented with.

I think those siblings really existed, but their absence in the plot maybe mean the “Vestra” tasked with overlooking, let’s call him (it’s a him because it’s Adrestia!) Hans 2, heir to the throne, wasn’t from Hubert’s dad’s line, but from a cadet line? Cadet line had a child “around the age” of Hans 2, so that cadet branch would have become the most important one, had Hans 2 survived, because cadet Vestra would have become the “Vestra of the Emperor” while Hubert would only be the Vestra of the ninth/fifth princess.

Ditto for Ludwig ?

He’d have championned Ferdie to show his talent and might and “nobility” to Hans 2 instead of Supreme Leader, but when Hans 2 was Arundel’d and only Supreme Leader survived, he switched his focus?

In FE Tellius, in FE10, Tibarn talks about it, passingly. But in FE Fodlan, there’s no rumours of a “plague” having befell the imperial family, mainly the “series of tragedies” in Rhea’s book.

Hans 2?

Even Rhea’s dead siblings are more relevant, they appear in the form of relics ! But Hans 2? His existence blows a hole in the Adrestia we know, its political landscape and Supreme Leader herself.

Of course you should compare what can be compared, but when ASOIAF’s Ned goes “this shit should never have been mine to dealt with, it should have been my dead older brother’s”, this is never mentionned in FE16.

We have Rhea feeling as inedaquate, being trusted in this position as the “Guardian” of Fodlan because her mom was deboned, but Supreme Leader never says this regarding Hans 2.

Ionius himself never mentions Hans 2 or his other children.

Tl;Dr : FE16 wrote a story where the Adrestian Empire’s heir is less important to people than House Fraldarius - a vassal of House Blaiddyd - ‘s first son.

GG guys, 10k years of lore.

#random thought#Adrestia stuff#at this point Adrestia exists in that limbo#between non relevant thus not developped#and 'has to exist to give a homebase and story to Supreme Leader'#it doesn't make any sense#I've seen fanart depicting Supreme Leader with her siblings#but why is it only in a fanart like why not a picture in her room or idk something in the Imperial Palace#they had time to make a willy statue#but no portrait for the Imperial children who died??#FE16#Fodlan nonsense

43 notes

·

View notes

Note

re: the grammaticalization of the future tense in english, what is the tense of "Thine kingdom come, thy will be done" in the Lord's Prayer? I thought it'd be future as it's not meant to suggest that the kingdom has come or that it's in the process of developing, but the second bit seems a little imperfecty to me. But also I'm not very good at grammar.

The answer is "no tense".

First of all, it's relevant to note that the grammatical construction in "thy kingdom come, thy will be done" is fossilized in English. This means that it only occurs in certain set phrases (for instance also "long live the king"), but not in ordinary speech.

It's not necessarily the case that fossilized expressions lack internal structure (such as tense)—there is a spectrum from constructions that are completely unproductive and impossible to analyze compositionally in the modern language, like methinks, and those that are semi-productive but archaic, like the one you're asking about here. But certainly it is the case that fossilized constructions need not play by the ordinary rules of a language's grammar, and do not necessarily permit analyses in terms of such. So we should proceed with caution here.

The modern paraphrase of "thy kingdom come" uses a modal verb, may: "may your kingdom come".

To begin with, the use of may neutralizes the distinction between the present and future tenses, because the future tense auxiliary will is also a modal and they cannot co-occur: "*may your kingdom will come", "*your kingdom may will come". Modals also require their argument to be a bare infinitive, and English's other future tense construction, be going to/be gonna, is dubiously grammatical in the bare infinitive form to begin with (at least for me): "*I may be gonna see it", "*I can be gonna see it". So the tense in modal constructions is a neutralized present/future, although I'm not sure what it typically gets called.

But beyond just that, "may your kingdom come" is a type of subjunctive construction, similar to the imperative, as in "go to school!". As such (basically by definition) it is unmarked for tense information entirely. Contrast this non-fronted uses of may, as in "I may have gone", which do permit a past/present contrast.

Anyway, insofar as "thy kingdom come" is an archaic equivalent to "may your kingdom come", it's a subjunctive and thus tenseless.

28 notes

·

View notes

Text

I really do find the jokes about Travis running from backstory tiresome because it's not even running, he isn't avoiding engaging with it. It's a more patient and slower pacing and choosing to engage with present (thus more urgent) matters. Generally, Travis characters operate on a pacing and rhythm that's very different from many other PCs at the table. Backstory arises when it would offer illumination or momentum, and this is true for all characters—but the flow and rhythm of this differs between characters.

Like? The alternative would be to awkwardly shoehorn the character backstory in? That would be disruptive to the narrative and especially to the development of the character Travis is playing.

Also, I feel like this sentiment unintentionally comes out of a bit of impatience and out of the fandom forgetting that information takes time to reveal? Do we remark this about backstory dodging for television main cast because they don't talk about everything in their pact or aren't as forthcoming as others? Or major characters in a novel? Backstory revelation serves the character and plot at hand, and if it's not relevant, it doesn't come up—and it feels very much like Travis is playing to that specific sort of rhythm.

The only time he exited a little early is at the end of pirates arc, and that was because he had an eye on overall narrative pacing, how long this arc was, and anxiety over having been the center of attention for like fifteen sessions. That's not really a reluctance to engage, it's a pacing and rhythm consideration.

And, Travis does often play characters who are unprepared to face their pasts. But there's a difference between the meta "Travis, the player" and the fictional "PC, the character". A character running from their past isn't the same as dodging dealing with (i.e. not engaging with) backstory. Choosing to run from a past is, actually, narratively engaging with it even if you don't name it—see: Caleb.

And, frankly, does not naming it mean the ways it is engaged with suddenly not count? Fjord clearly spends the entire campaign recovering from a horrific abuse he suffered in his childhood, but is this suddenly not dealing with backstory simply because Fjord never deigns to describe what he experienced? Is the history and backstory only considered dealt with and engaged with in the game if a literal specter or villain arrives on screen, if it is described in full?

Also, Travis plays characters that are so present tense but still feel like they act with the weight of an unspoken past that they don't necessarily require as much to name their backstories with great and explicit clarity. Fjord carries himself as a child who was belittled into compliance to the point he never developed a sense of self-worth. Chetney carries himself as someone who filled lengthy stretches of loneliness with obsessive work. These actually say a great deal about their histories. It even extends to many of his non-CR characters.

I find that Travis only names details when it provides more clarity—but he already provides great clarity in what is implied in the way he sketches his characters. There's an insistence on dealing with it as simply context, obliquely, because he has a preference for the now, his characters focus on what is current and what is next, not what is past even as it guides them. I often feel like the way Travis plays a character is about empty space, and what happens in that empty space—things unsaid but very much felt, important and unstated and weighing down, things we can and do glimpse the shape and form and color of enough to understand what it is, even if he never gives it a name. That's, frankly, backstory.

It's not running from engaging with it if you sketch your characters as always carrying it with them.

#Critical Role things#CR#I think a lot about how Fjord has several pages of backstory written and how Fjord absolutely feels like it. Every silence has history.#This is fine to rbelof as always. I just don't want to main tag it.#cr meta

188 notes

·

View notes

Text

I think one major potential weakness of the bonobo-like human social system is it might be less effective at preventing inbreeding.

A major Homo sapiens inbreeding-avoidance strategy is communities exchanging people through marriage. Historically, this was often gender-asymmetric, with women being exchanged more than men. I suspect this gender-asymmetrical exogamy pattern was a major contributor to the development of patriarchy; it meant women got their social connections disrupted more. One of my major worldbuilding challenges for bonobo-like humans is giving them features that would either prevent this gender-asymmetric exogamy pattern from emerging, mitigate its disruptive effects on female-female and male-female solidarity, or some combination of both.

@who-canceled-roger-rabbit some of this is kind of relevant re: that conversation we had a while back about matriarchies.

I suspect the causes of this gender-asymmetry in Homo sapiens exogamy are 1) male solidarity was more important to military power, 2) the last common ancestor of gorillas, chimps, and humans had silverback-centered social groups in which a single dominant male was the nucleus of the group and chimps and humans inherited a tendency toward females changing social groups at maturity from them. I'm not really worried about 2), human behavior is pretty flexible, but 1) seems like a probable huge obstacle to the emergence of a female-privilege society (which I suspect is a big part of the reason unambiguously female-privilege societies were rare to nonexistent in Earth history if the known historical record is anything to go by).

IIRC actual bonobos seem to have kept the social pattern inherited through 2) and went the mitigation route; female bonobos change social groups more than male bonobos, and the key to female power in bonobo society is strong solidarity between non-kin females reinforced through sexual bonding. It would be intensely on-brand if bonobo-like human women also use sexual bonding between women to build strong female solidarity between unrelated women and thus mitigate the disruptive effects of females changing communities as an inbreeding-avoidance strategy.

I don't think I'll make that the whole picture with them though, because my ideas on how they got a low-key female privilege society hinge on matrilineal kinship solidarity between mothers and their adult children being important. Importantly, that model would make matrilineal kinship solidarity between women and matrilineal kinship solidarity between women and males both important for maintaining the bonobo-like human social order, which would tend to discourage exogamy of any kind.

Regarding the second thing, I think one big leg-up bonobo-like human women might have over bonobo females there is being smarter. Bonobo-like women are smart and (through language) communicative enough to observe the deleterious effects of inbreeding, realize they are consequences of mating with relatives, and do deliberate and coordinated inbreeding-avoidance. I suspect actual bonobos do inbreeding-avoidance behaviors without realizing that's what they're doing, in an "adaptation executor, not fitness maximizer" way. Deliberate planning is much more flexible and optimizable than "adaptation executor, not fitness maximizer" behavior. A bonobo-like woman can conceptualize the social benefits of remaining in her natal social group while also conceptualizing the risks of mating with close relatives and then imagine a strategy for exploiting her capacity to track her menstruation/ovulation cycle to simultaneously have the former and avoid the latter; wait until she's near ovulation, then travel to another group and submit to a consensual gang-bang, then travel back to her natal group and rejoin them. That sort of "having their cake and eating it too" reproductive strategy would have big potential social benefits for women compared to changing groups, so once they got the idea I expect it'd become very popular - and older bonobo-like women would start encouraging their daughters and nieces to plan their futures around following it, so their daughters and nieces would stay in their natal group and keep contributing labor to their natal group.

Also, re: bonobo-like strategy of using sexual bonding to recruit unrelated women into strong female solidarity networks...

... An idea I like is bonobo-like women eventually got good enough at that to turn that strategy on males and assimilate outsider males into female-centered solidarity networks in the same way. Basically, male kinship solidarity was less important to the military power of small communities in bonobo-like humans because in their species the community's women could totally take some wandering mercenary, go to work on him, and turn him into a fiercely loyal ride-or-die human guard dog for their community in a few years. Actually, when I put it that way, I suspect Homo sapiens women have a social strategy like this too and it's part of what went into the knight/damsel thing and this and that whole women as civilizers/domesticators of dangerous wild men concept (Enkidu and Shamhat might be allegorically about this!) and a nontrivial amount of male misogyny is rooted in the fear that a woman might rewire your brain in ways your present self wouldn't like by doing this to you. But I guess the bonobo-like human version would be more powerful (when used on bonobo-like human males, at least) and less monogamish (sapiens versions of this kind of male domestication narrative seem to heavily emphasize couples, but that might be culture-specific). Ability to do that might have made ancient bonobo-like human communities much more gender-balanced in terms of bringing in new genes by assimilating outsider women vs. bringing in new genes by assimilating outsider males.

A lot of this wouldn't be directly relevant to bonobo-like human society today, when it's pretty peaceful, but bonobo-like human typical neurotype and culture would be influenced by the social conditions and physical conditions their ancestors lived in, just like our typical neurotype and culture are influenced by the social conditions and physical conditions our ancestors lived in.

Also, I like the idea that bonobo-like humans are a more genetically diverse species than us because they missed Toba and maybe a few other genetic bottlenecks that badly depleted our genetic diversity, so inbreeding would be less damaging to them. So that might help.

#bonobo-like humans#gender#my big ideas#for the “I suspect Homo sapiens women have a social strategy like this too” part

6 notes

·

View notes

Text

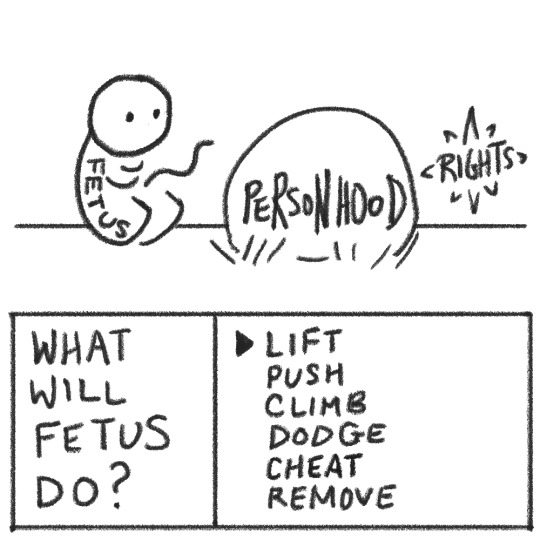

6 Responses to "A Fetus Isn't a Person"

An Illustrated Guide by a Former Fetus

So you’re a fetus-defender, and a troll has appeared from the bowels of the internet to gatekeep basic human rights.

“A human fetus doesn’t have rights unless it’s a person,” declares the troll, placing the obstacle of personhood between the fetus and their rights. “And if it’s not conscious like me then it’s not a person, so it’s not wrong to inhumanely destroy it.”

Fortunately, you have this guide, so you have the stats on 6 strategies to get past this obstacle. Which attack will you choose?

Pro-tip: Pro-abortion advocates often believe “only conscious beings are people” because it appeals to intuition. This intuition likely comes from two ideas: first, that if we met a rational non-human being (such as a spirit or an extraterrestrial) we would instinctively relate to them as another person; second, that we don’t relate to most irrational animals as other persons. So, since fetuses aren’t rational in a way that makes consciousness observable, we don’t intuitively relate to them as persons. Keep this in mind for your strategy.

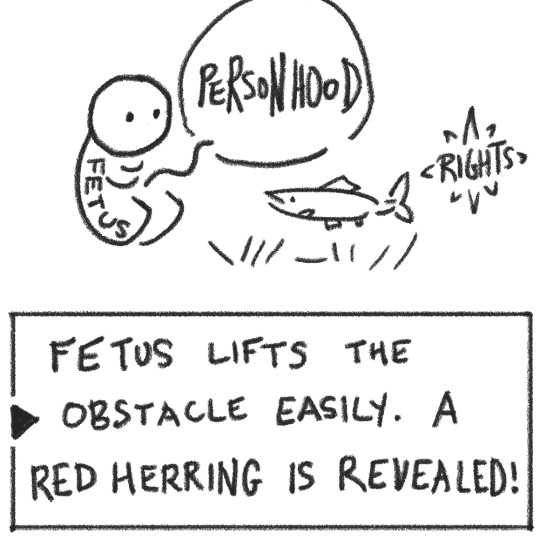

Strategy A: Significance

The Argument: As human beings grow, they develop not only conscious awareness of their own existence, but also many other advanced cognitive capabilities at the same time (such as learning and memory). Consciousness is of limited use in a person without all these other capabilities, so we don’t have sufficient reason to think consciousness is particularly special. The development of consciousness is just one event in the process of humans attaining the minds of persons. Further, a being does not have to value consciousness to be a person. Imagine two beings: the first can only think about itself relative to others, and the second can only think about its experience of the world. There is no obvious reason to give the first being rights and not the second. Consciousness is a distraction from focusing on what is actually significant about being a human person.

Why it works: Beyond their intuition, the pro-abort likely doesn’t have a reason that proves being conscious is enough to be a person– or, probably not a reason that is backed by both solid logic and strong evidence. Use this core weakness to refute the belief.

When to choose: When you are unfamiliar with the pro-abort’s stance. It’s a good strategy to “get a feel” for their perspective.

How to use: Ask, “what makes consciousness so special?” After they give reasons, point out why the reasons aren’t relevant or convincing.

Source: “The Moral Insignificance of Self-Consciousness” by Joshua Shepherd (2017)

Strategy B: Absurdity

The Argument: Human consciousness isn’t sophisticated enough for many months – if not years – after birth to be distinct from irrational animals. Thus, neither fetuses nor infants are meaningfully conscious enough to be identified as not “non-persons”. If for this reason we may abort a human fetus, then we may do the following to a human infant: abort it after birth, harvest its living organs, subject it to live experimentation, use its living body for sex, and selectively harm it for apparent gender or sexuality. Further, money could be made from these practices. This justifies infant sex trafficking. The infant will never become a victim if it is simply aborted before it becomes a person; as long as it doesn’t feel pain or suffer, this is humane.

Why it works: By reasonably extending its logic to illustrate its absurd implications, you show that the pro-abort’s belief that ‘non-conscious humans aren’t persons’ isn't reasonable after all!

When to choose: When the pro-abort is committed to the intuition that “consciousness” is necessary to be a person, or denies that it alone isn’t enough to be a person with rights.

How to use: Propose the five scenarios to the pro-abort. Ask, “do you find any of these unacceptably wrong? What makes them wrong, but not abortion?”

Source: “Beyond Infanticide” by Rodger, Blackshaw, and Miller (2018)

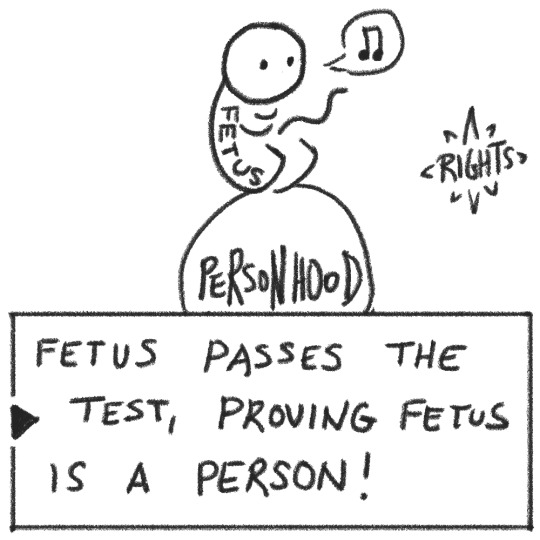

Strategy C: Active Relation

The Argument: A living human organism is always in the process of either attaining, retaining, or restoring the capabilities that make her a person. A human fetus actually has the present capacity for this process because it is a feature of humankind, to which she belongs. This establishes continuous active relation between every stage of her biological life cycle; her identity as the person exercising this capacity transcends each phase of her existence, from adult person to human embryo. Since there is no change in identity between the fetus and her born self, she should be recognized at conception as the same person she will be at birth.

Why it works: This rebuttal can tie in the pro-abort’s preexisting beliefs about when a human becomes a person; a fetus is in the active process of attaining [insert any capability that they believe makes us persons] through her actual capacity to do so as a member of humankind.

When to choose: When the pro-abort challenges you to prove that a fetus is a person, or claims that there’s no better reason than theirs that we are persons.

How to use: Boldly state, “a human fetus is always in the process of either attaining, retaining, or restoring the capabilities that make her a person, and so are we.” Then ask, “what about this doesn’t make her the same person she will be at birth?”

Pro-tip: We should accept this criterion for personhood because it’s not arbitrary or conditional. It doesn’t enable prejudice based on level of ability and dependence, age, body size, or location. It can be consistently applied in principle, without discrimination or bias, to all instances of human beings within every contingency. It is sufficient for qualification of persons but not necessary, thus it does not privilege a kind of being; any being with the inherent capacity for kinship with humankind also has active relation with personhood. It is demonstrative of personhood, not merely indicative. And most notably, it can explain unambiguously and analytically when and why a human is not a person.

Source: “Embryos & Metaphysical Personhood” by Kristina Artuković (2021)

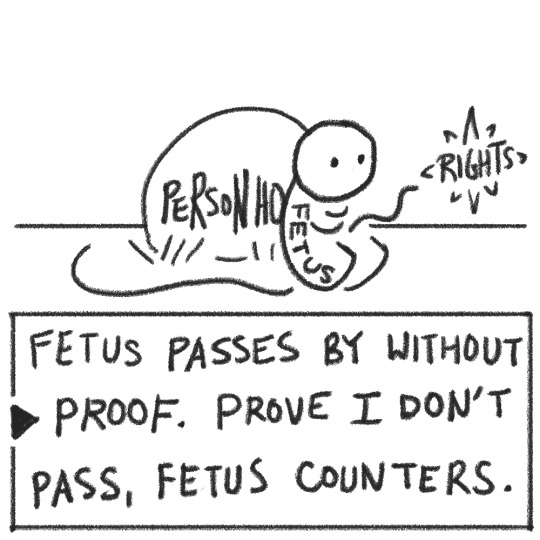

Strategy D: Uncertainty

The Argument: If a fetus is a person but you don't know that, then to abort would be manslaughter; if the fetus is not a person but you don't know that, then to abort would be criminal negligence; if a fetus is not a person and you know that, then abortion needs no justification. Only in this last scenario is abortion a reasonable, permissible, and responsible choice. The absence of living persons in the womb must be completely verified before abortion can take place; to abort with uncertainty is recklessly irresponsible. As long as any reasonable doubt exists that abortion doesn't kill a human person, abortion cannot be justified.

Why it works: This rebuttal puts the burden of proof on the pro-abort, calling out their imposition of beliefs. If they attempt to employ ambiguity or skepticism to shut you down, this turns their own strategy against them.

When to choose: When the pro-abort claims that “we can’t really know when the fetus becomes a person” or demands that you keep church and state separate.

How to use: Ask, “Which puts more on the line: presuming we might kill until proven that we won’t, or presuming we’re not killing until it’s proven that we’ve killed?”

Source: “The Apple Argument Against Abortion” by Peter Kreeft (2001)

Strategy E: Contingency

The Argument: The preborn aren’t persons, and out of fairness they still ought to have a protected right to freedom from deliberate violence. After all, it’s not to our credit that we became persons and a fetus has not yet, nor is it the fault of the fetus that it is not a person while we are fortunate enough to be persons. Any human contingently denied the opportunity to become or to remain a person ought not to be lethally penalized for having lesser fortune than the rest of us; that is simply unfair. It is not because non-persons are human that we ought to protect them from a violent end; it is our own humanity as persons that demands we treat less fortunate humans humanely.

Why it works: This rebuttal cheats the 'rules' by challenging the legitimacy of personhood as a necessary criterion for rights. It forces the pro-abort to reconsider what kind of living human being ought to be given moral consideration, and builds off their preexisting belief that the preborn aren’t persons.

When to choose: When the pro-abort is stubbornly committed to denying fetuses are persons or is an animal activist.

How to use: Declare, “we use lethal violence on human non-persons that we would never use on animal non-persons.” Then ask, “why don’t we strive to treat human non-persons as humanely as we do animal non-persons?”

Source: “In Defense of Speciesism” by Michael Wreen (1984) [PDF]

Strategy F: Abolition

The Argument: The construct of personhood has almost exclusively been used to disenfranchise vulnerable humans, not to extend them power. Personhood will always exclude certain humans – a fact which has been consistently and deliberately weaponized throughout history to dehumanize, discriminate, torture, and kill. The definition of who can or cannot be a person is ultimately a rhetorical debate that ignores scientific facts. No human is an illegal person. If there could ever be a category of “living humans who are not persons,” then personhood at best is a useless attribute – at worst, lethal. “Personhood” should be abolished.

Why it works: This delegitimizes the idea of “personhood” by restricting its use in the same manner many have called for the restriction of other lethal weapons. It also uses language that many pro-aborts will be familiar with from the context of other issues which they support.

When to choose: As a last resort in a worst-case scenario. If nothing else speaks to the pro-abort, destabilize the very foundation of their argument. They will probably point to valid reasons to not abolish personhood, so attempt this maneuver at your own risk.

How to use: Ask, “What if, because someone with power over you believed you are not a person, they could legally deprive you of oxygen and nutrition, poison you, burn you, exsanguinate you, or dismember you, as abortion procedures do to preborn humans?”

Source: “On Abortion” by Rehumanize International (2019)

Pro-Tip: If you have exhausted all of your strategies and the pro-abort still hasn’t budged, they may be a lost cause. Before focusing your efforts on more fertile ground, you can still sow seeds for further consideration with this pro-abort on the chance that, given time, they will mature into fruitful discourse. Leave them with this thought: “For now, we do not have a practical method to discern which beings are moral equals to us as we encounter them. We need a coherent argument, with systematic application, backed by irrefutable evidence. Until we agree on one, let’s work together to make this world more accommodating of fertility. Women deserve that.”

30 notes

·

View notes

Text

Tales From The Runescape Economy: The Trade Limit

The year was 2007, and the gold-farming industry that had built up around Runescape was running out of control. Huge swarms of bot accounts, with game subscriptions paid for using stolen credit cards, were set loose to engage in every viably-automatable activity the bot-makers could figure out how to turn a non-negligible ingame profit on. The coins accumulated by those bot accounts were then sold, in exchange for real-world-money, to players who wanted to buy stuff ingame but didn't want to bother with the parts of gameplay that would have enabled getting those coins on their own.

This had a substantial negative effect on the game's economy and on the gameplay more generally—the bots' item-farming was devaluing most of the items it generated, and the swarms of bots made it hard for non-bot players to engage with the relevant sectors of content—but the more serious problem laid outside the game: the part where the bot accounts were being funded with stolen credit cards was putting the game's funding in danger. The banks which handled credit-card-processing for Jagex—the company which developed and maintained Runescape—took note of the unusually-large number of chargebacks on payments to Jagex, and responded by substantially raising their processing fees and threatening to cut Jagex off from their services entirely if they couldn't solve the issue. To protect their profits and thus their ability to keep running Runescape at all, Jagex had to do something to break Runescape's gold-farming industry.

For years, they'd been doing their best to ban bot accounts, as well as anyone they could identify as a participant on either end of the "exchange real-world money for ingame money" transactions. But their bot-detection tech wasn't nearly effective enough to prevent the bots from continuing to swarm throughout the game, and it is, of course, very hard to determine via purely ingame monitoring whether a given bestowal of coins from one player to another was or wasn't motivated by external-to-the-game financial transactions. Furthermore, Jagex's owners at the time had strong philosophical convictions to the effect that real-money-for-ingame-benefit transactions were unfair, fun-reducing for the playerbase as a whole by way of devaluing otherwise-impressive financial accomplishments ingame; thus they were unwilling to get into the gold-selling industry themselves and destroy the third-party gold-farmers by undercutting them.

Instead, they set out to alter the game's economy in such a way as to prevent substantially-imbalanced exchanges between players. If the gold-farmers couldn't give players the gold they'd accumulated, after all, they would no longer have a product to sell, and would be forced to give up and move into some other line of business. So, starting in late 2007, a series of game updates were made to systematically restrict the means by which players could transfer items to one another.

First, the Grand Exchange was added to the game, to serve as a source of legibility on items' market prices. Instead of allowing people to offer to buy/sell an item for arbitrary prices, as it now does, the Grand Exchange at the time of release was far more restrictive: people could offer to buy/sell for any price within 5% in either direction of its current estimate of the market price. An item with a market price of 100 coins, for instance, could be bought/sold for between 95 and 105 coins. (Also, there were per-item price ceilings and floors on many particularly-heavily-traded items; but this was largely irrelevant to the task of preventing uneven trades, and instead was just an artifact of some sort of misunderstanding on Jagex's part regarding what would make for a healthier market.)

Second, the game's main PvP system—under which people in a large region called the Wilderness could attack one another, and anyone who successfully killed someone else there would gain all items dropped by their target on death—was removed and replaced with a variety of other systems. Of those other systems, only one kept the Wilderness's "people drop the stuff they're carrying when they die and whoever kills them gains it" pattern, and that one was engineered to make it very difficult for a pair of coordinated players to seek out and meet one another for a fight without a substantial risk of being intercepted and killed by other uninvolved parties.

And third, the big one, instituted right at the beginning of 2008: a limit on inter-player trading was instituted. When trading with one another directly (as opposed to via the Grand Exchange), the sum Grand Exchange market prices of the items offered by each trade participant had to be within a narrow range of the sum prices of the items offered by the other participant (initially 3,000 coins, increased over the course of several subsequent updates to 60,000) or else the trade wouldn't be allowed to go through. Even within the allowed range, the game would remember imbalanced trades a person had performed for the next fifteen minutes, rate-limiting attempts to bypass the limit through use of multiple successive small trades. This same limit also applied to stakes at the Duel Arena, to transference of items via dropping them on the ground for others to pick up, et cetera.

These limits were successful at impeding the gold-farmers of the time, and thus successfully saved Jagex's finances and at least somewhat dampened the bot-swarms that plagued the game. (Although people botting on their own personal accounts remained a rampant problem for several years afterwards, until Jagex's bot-detection tech was given a big upgrade in late 2011.) However, this came at the cost of substantial economic damage, as the trade limit and the Grand Exchange limits together served to massively limit items' market liquidity; many new market problems resulted from the trade limit's implementation and persisted until its removal in early 2011.

In this post, then, I'll chronicle a few of the particularly-interesting market behaviors which emerged during the three-year era of the trade limit, with a particular focus on three areas: bad initial prices on newly-introduced items, price-manipulation clans, and junk-trading.

1. Background: Dynamics of a Trade-Limited Market Bubble

Let's start with some exploration of the basic market dynamics the trade limit brought about, by way of a question: with the trade limit in place, what happened when an item's true price—its 'street price', in the parlance of the time—diverged from its market price as tracked on the Grand Exchange?

If the street price was within 5% of the market price, there wasn't any problem; people could just pass it around at the street price unimpeded via the Grand Exchange, despite the trade limit. If the street price was substantially higher or lower than the market price, though, then problems arose. What problems arose, exactly, depended on which of 'higher' or 'lower' it was; but problems arose either way.

If the street price was substantially higher than the market price, then the item was very hard to buy and very wasteful to sell. Inevitably, there were a few unwise or impatient sellers each day who were willing to sell even at an artifially-low price, and so the item's market price did crawl up 5% each day and a few lucky buyers were able to get the item for cheaper-than-street-price through that mechanism. But many sellers instead waited for the price to rise, as it predictably was going to. This limited supply; thus, many buyers ended up stuck unable to acquire the item even at the maximum price they were allowed to offer for it. Everyone suffered, and no one got what they wanted, until the item's market price caught up with its street price and ordinary trading resumed.

If the street price was substantially lower than the market price, meanwhile, the converse happened: the item was very wasteful to buy, and very hard to sell. It still dropped 5% per day thanks to the unwise and the impatient, but many buyers waited for its market price to finish crashing before buying. This limited demand; sellers were stuck unable to find buyers; and, once again, no one got what they wanted until the market price caught up with the street price.

These patterns were common recurring ones, all over the market, throughout the era of the trade limit. Sometimes, players would figure out some clever new use for an item, driving its price upward; sometimes, developer comments about upcoming updates, or player discoveries about recently-added content, would lead to massive shifts in items' values; et cetera. Any time anything along those lines happened in a substantially street-price-altering way to some item, these problems would come up; different permutations of these problems tie into all three of the upcoming sections.

2. Bad Initial Prices

Runescape is a frequently-updated game. New items are introduced over time at a non-negligible rate. Before the trade limit, this presented zero problem for the economy; buyers and sellers would estimate how much they thought the new items were worth, if their estimates overlapped then transactions would happen, opportunities for arbitrage would be exploited, and pretty quickly the items would have widely-agreed-upon prices and could operate normally in the market from there.

The trade limit, though, went and messed all of that up. Suddenly, instead of the initial price on an item being a function of a decentralized network of players trying to make good trades based on their own estimates of the item's value, it was set by a single central source: whatever number Jagex set its initial Grand Exchange market price to, when adding it to the game. And, for all that Jagex tried their best to do vaguely-sensible price estimates for the items they released, they sometimes got those estimates really egregiously wrong.

Probably the most memorable example of this error came with the release of a weapon called Dragon Claws. Dragon claws were a rare drop from a newly-released relatively-challenging high-level monster. As a weapon for ordinary sustained use in combat, dragon claws were unimpressive, following in the footsteps of all the lower-level claw weapons that came before them. Unlike those lower-level claws, however, dragon claws had a very good special attack: four approximately-simultaneous hits of varying strength, with expected damage more than twice that of an ordinary attack, usable twice in quick succession before needing a 5-minute recharge. This special attack was very solidly among the best in the game, for players seeking to deal out large quantities of damage quickly.

And the initial price they set, on this difficult-to-acquire weapon with a top-tier special attack, was 150,000 coins.

For months following the release of dragon claws, every day, a few unwise or impatient players would sell their newly-acquired dragon claws on the Grand Exchange for the maximum price; which is to say, for that day's market price plus 5%. Every day, the market price of dragon claws would be 5% higher than it was the previous day as a result of those transactions. This process started the day dragon claws were first released; this process ended only months later, when dragon claws' market price finally peaked at about 40,000,000 coins before re-falling and stabilizing around 25,000,000. Throughout that time, dragon claws were almost entirely inaccessible to ordinary buyers; the only three ways to get them were to be one of the immensely-lucky people to get them underpriced via the Grand Exchange, to get them directly by fighting the monsters which dropped them, or to somehow talk someone into trading them to oneself for far less than the street price.

(Junk-trading, which I'll be discussing below, would have allowed for mitigation of the problem, but as far as I'm managing to recall it hadn't yet come into its own as a well-developed social institution as of dragon claws' release. Perhaps some early pioneers were already using it in order to sell their dragon claws at a more reasonable rate; but, if so, I have no recollection of it, despite having actively followed the Dragon Claws situation as a whole.)

Eventually, the market stabilized, dragon claws became accessible via ordinary market means, and everyone was happy except for all the people annoyed at the changes dragon claws' special attack made in the game's PvP meta. But. You know. It took months, for a process which would have taken somewhere between a few hours and a few days pre-trade-limit. And while this may be a particularly extreme example, similar things happened pretty routinely on a smaller scale with new items' releases. Newly-released items were among the more common subjects of the sorts of market bubbles discussed in the previous section.

(To be clear: the issue happened in both directions, not just the "item starts too low" direction. Dragon claws happened to start out underpriced; but, for example, rock climbing boots (which were a whole other economic fiasco, in ways which would be too much of a tangent to cover here, since the core of the fiasco there was not trade-limit-related) were started off overpriced, added to the game at a price of 75,000 coins before immediately crashing down to 45,000 in a similar if less-prolonged sort of process.)

Having, between last section's summary and this section's deeper dive, covered most of the major sources of ordinary accidentally-emerging market bubbles, let's now move on to the perhaps-more-exciting topic of deliberately-manufactured market bubbles!

3. Price-Manipulation Clans

With the illiquidity of the market, there was an opportunity for a very interesting sort of market-manipulation-centric pyramid scheme to emerge: deliberate manufacture of market bubbles by coordinated groups of players, to the profit of those in charge and to the detriment both of those below them on the pyramid and of those uninvolved parties who happened to want to purchase items from relevant corners of the market.

In theory, as seen from the viewpoint of a credulous low-level participant (in the "low in the pyramid" sense, not in terms of stats), the scheme ran like this: a bunch of people (including you!) are coordinating to buy a useful item at maximum price in bulk, thereby driving its market price upward while also giving you a large supply of the item. At a certain agreed-upon date, the bunch of you will then go ahead and start selling your supplies of the item, at the now-highly-inflated price, to those outside parties who are trying to buy the item in order to use it rather than in order to market-manipulate with it. Mass profits ensue for the market-manipulators to the detriment of those outside parties, with the side effect that as the market-manipulators dump their stock the item's price will return down to normal. Repeat with a new item. Also, if you recruit people to join in on the scheme, you get rewarded with a higher rank in the price-manipulation clan that's engineering it, and higher-ranked members get to be told earlier than lower-ranked members what the next item is and when the dump date is, so they can accumulate more of it before the dump date, be better-prepared to dump right on schedule, and thereby turn an even bigger profit.

(I'm possibly misremembering details of the ranking system? In particular, I'm fuzzy in my recollection of whether the "higher-ranked members get earlier information on dump dates" bit was standard in the major price-manipulation clans. But I've got the big picture right here, I think, even if the details are off.)

...this scheme, as described, is, of course, nonsense. Negative expected value, in a way probably made clearest by an example where there's just one person involved, manipulating the price of an item traded at low enough volume that one person can manipulate it: for every day's buying-up of the item you do in order to drive its price upward, you only get a day of sales at that newly-increaed upward-driven price before it re-falls, and you'll be selling at lower volume than you bought at, because no one wants to buy a clearly-crashing item if they can instead get away with waiting for the crash to finish first. (This isn't an efficient liquid market, after all; an item can be predictably going-to-be-priced-lower-in-a-day without having its price thereby drop immediately, and it's sensible to avoid buying such items unless one needs them particularly urgently.) So you'll end up turning a loss, needing to sell off decent chunks of your built-up stock only after the price is finished crashing; the actual winners, if you try that sort of market-manipulation, will be the third parties who get to sell to you at higher-than-usual prices while you're driving the price upward.

The real scheme, as viewed from above, didn't look like that nonsensical negative-expected-value story that the low-level members were told. The real scheme looked like:

Buy up a whole bunch of some useful item.

After a few days or weeks, tell the lower-ranked people to start doing the same; their influence starts driving the market price up a bit.

After another few days or weeks, tell the people still lower-ranked, the new recruits who have yet to bring in many recruits of their own, to start doing the same; their influence starts driving the market price up a lot.

Start selling all your stockpiled copies of the item at the new now-higher maximum price, where they'll be picked up by said lower-ranked members. In the meantime, start spreading word down the ranks of the Official Dump Date for the item, aimed to land a few days or weeks after you expect your own stocks of the item to be fully sold off.

When your stocks are emptied, start the scheme from step 1 with a new item, aiming to have that new cycle's second step land right around the dump date from this cycle.

In the days following the dump date, comfort all the low-level recruits who predictably got left with a large pile of expensively-purchased now-crashing item which they can't sell, telling them that this was a fluke and/or a product of sabotage by malicious mid-ranked clan members who dumped earlier than they were supposed to, and that surely things will go better on the next go-around.

...so, at their core, the price-manipulation clans were essentially a very large and elaborate piece of social infrastructure to funnel money up from the low-level victims to the high-level management. But, not content to mess things up only for those who made the mistake of getting involved, they went a step further by messing things up for the entire playerbase. Because, remember, they weren't just buying out items no one used, but rather buying out useful items. Anyone who wanted to buy the items for their ordinary purposes would be out of luck for as long as the manipulation was going on, stuck buying at inflated prices if they were lucky, or potentially unable to buy at all if the market was sufficiently swamped with buy offers from the price-manipulators pre-dump.

(Or, as sufficiently rich players eventually learned to do, made to keep large stockpiles of all useful items which seemed like plausible price-manipulation targets pre-banked, so that when the price-manipulators hit those items they'd be able to ride through the next few weeks on those stockpiles before restocking afterwards once they'd finished crashing. But this, too, was an expense: the expense of having some fraction of their capital tied up in backup item-stockpiles that only occasionally got used, rather than in liquid form where it could be turned towards other ends as convenient.)

Technically, this setup was against the game's no-scamming rule. In practice, though, the price manipulation clans' approach, wherein they scammed their targets through complex distributed economic processes rather than through more straightforwardly legible "talk person into making an unendorsed trade / unendorsedly going into a high-risk area while carrying valuable stuff"-type processes, left them safely out of the line of fire of Jagex's enforcement patterns; thus the price manipulation clans ended up being mostly unimpeded by the anti-scamming rule, and kept on doing their thing right up until the end of the trade limit. (At which point they rapidly folded, unable to keep up a convincing pretense of profitability for their low-level members in the face of a properly-liquid economy where there was no maximum buy price on items and where price crashes could happen in a span of hours instead of being drawn out over multiple weeks.)

4. Junk-Trading

Over the course of the last three sections, we've covered a range of market behaviors all following the general theme of "items' street prices and market prices are mismatched, and this causes problems". Let's now turn to the natural next step: if you're an aspiring trader in the era of the trade limit, how do you work around these limitations? If you want to buy something like dragon claws without waiting for its street and market prices to reach parity, for instance, what can you do to acquire it via mutually-beneficial trade, given that the trade limit prevents direct trade of the item at its street price?

The answer to this is a practice which came to be known as 'junk-trading'. It was a highly inconvenient kludge, and nonetheless a vast improvement over the strict constraint of the trade limit.

The core question which leads into junk-trading is this: suppose I want to buy some item whose street price is twice its market price, and which is expensive enough on an absolute scale that the difference between the two doesn't fit into my 60,000-coin unbalanced-trade allowance. One option is for me to wait two weeks while its market price crawls upward; but let's suppose I'm impatient. And let's suppose that I don't have any conveniently-generous friends who will sell the item to me for cheap; if I want the item, I need to pay for it in full. How can I do this, under the trade limit?

The core insight of junk-trading is this: at any given point in time, different items will be differently-misvalued, market-price-wise. Some items will be overvalued and others will be undervalued, simultaneously. To sell someone an undervalued item at a fair price, then, what you can do is pair it with an appropriate price-differential's worth of overvalued items (the titular 'junk', unsellable under normal circumstances for standard "selling overpriced items is impractical under the trade limit" reasons), selling the undervalued and overvalued items together as a bundle whose net market price is accurate even if none of its components' prices are.

Let's build a concrete example. Suppose I want to buy dragon claws, worth 30,000,000 coins according to current street price but thus far only 10,000,000 in terms of legibly-tracked market price. (This is possibly ahistorical; I don't remember exactly when the community figured out junk-trading, and it was plausibly only after the dragon claws incident was already resolved. But let's suppose it nonetheless, for the sake of example.) We can't just trade straightforwardly, or I'll only be allowed to buy the claws for a third of what the seller and I agree they're worth. And let's suppose that, in the meantime, price-manipulation clans have been doing their thing with prayer potions, leaving prayer potions recently dumped with a market price of 20,000 coins apiece while everyone knows their true value they're likely to crash back down to is about 10,000 coins apiece. All that needs to happen, then, to facilitate a fair trade, is this: the seller offers me dragon claws (market price 10,000,000 coins, street price 30,000,000) plus a stack of 2,000 prayer potions (market price 40,000,000 coins, street price 20,000,000). I offer, in return, a stack of 50,000,000 coins. And the trade goes through, as a genuine trade of 50,000,000 coins worth of value, even if the market prices happen to be misleading regarding how that value is distributed between the items.

This example also serves nicely, I think, to demonstrate why I say that junk-trading, despite its usefulness, was a horribly-inconvenient kludge. Because look at all the extra trouble that went into that trade, relative to the more straightforward trade that would be possible absent the trade limit.

For one thing, in that example, I needed an extra 20,000,000 coins of capital in order to be able to perform the trade; the need for junk-trading adds overhead to transactions, as compared with the slimmer junk-free transactions on items with accurate market prices (wherein no more capital is required than the value of the item being purchased).

And, for another thing, the player selling the claws needed to acquire those prayer potions somehow. The nature of junk-trading was that which items qualified as junk was in constant flux. Last week's junk would soon finish crashing and return to ordinary market status; identifying next week's junk in advance was a matter of speculative investment, of the sort which, if one could do it reliably, could also be done to more directly turn a profit, no junk-trading required. Thus the only two ways to end up with junk for junk-trading were being on the wrong end of a market crash (with junk-trading serving as a way to offload the crashing items before they finish their crash) and engaging in other junk-trading (I, having acquired those 2,000 prayer potions, could then proceed to use them as junk in my own junk-trading, if I preferred that over waiting for them to finish crashing and become salable thereby).

...and nonetheless, despite all that kludginess, junk-trading was still a massive boon to the economy. Because it really did enable something sort of vaguely resembling healthy market liquidity, at least among those traders able to keep a hold of sufficient junk supplies to engage in it on a routine basis.

5. Conclusion

The era of the trade limit was interesting. And, for all that I very much mean that in the "interesting times" sense of the phrase, for all that I'm very thoroughly glad that the trade limit is now far in the past and will, if all goes well, never return... well, it was, also, interesting in the fun sense. Fun to look back on in retrospect, to enjoy the elaborateness of its economic effects.

I don't know, exactly, what it was that changed between 2008 and 2011 to make the removal of the trade limit economically viable for Jagex. But, whatever it was, I hope those changes hold up forevermore, and that, for the remainder of my time as a player of Runescape and as a fan of its economy, I'll be able enjoy my memories of the trade limit as just that: memories, never again to be repeated in the present day.

28 notes

·

View notes

Text

Idea: dark edgy Pokémon game set in a pocket dimension, inspired by Uniquenameosaurus’s video

Unova Pokédex + B&W presentation style. You play as either of the two original protagonists on a special agent type mission where they get sucked into a horror-themed pocket dimension centered around a lonely mountain town with its own league (think Lavender Town X Silent Hill). Four gyms, Elite Duo, and Champion (along with secret final boss)

All battles are double battles or more. You select two Pokémon from your party as starting Pokémon.

Battle speed is greatly increased due to shorter animations and streamlined battle flow.

When two Pokémon fight together, their bond increases, offering new moves, battle-start status effects, and more. You can also build bonds at camps & towns.

When a Pokémon is KO’d, any overkill damage goes towards shrinking their health bar permanently (only reversed by a premium heal at a hospital or special rare items). If their health bar shrinks to 0, the Pokémon dies. This has the same effect as releasing them to the wild.

When a Pokémon dies, the other members of the party react in unique ways depending on their personality type. This gives them buffs and debuffs on relevant stats. The effect is stronger the greater their bond with the victim is. Buffs last for the fight, but debuffs stay (to a lesser extent) until a hospital heal or use of a special rare item. Ghost Pokémon are special in that they do not react in any way to death. However, this alienates the rest of the party and thus severely reduces all non-Ghost party members’ bond with the relevant Pokémon.

When your entire party is incapacitated (KO’d or killed) in a wild battle, you, the trainer, must fight to either escape or incapacitate the wild Pokémon. Because of this, certain weapons and equipment can be equipped to help with this, and you also have stats like a Pokémon that not only determine your performance in battle but also determine other factors including global stat increases to all of your Pokémon. A fifth of all XP that your Pokémon receive is also given to you, and you level up just like Pokémon. If you fight in a battle and defeat a Pokémon, you get the regular amount of XP.

Certain types are swapped out for new ones that are either added to existing Pokémon or new Fakemon. There’s also more Ghost Pokémon in general because of course. Type-specific status effects are now even more likely to occur on super effective moves. Finally, PP changes depending on type: moves that match a Pokémon’s type will have more PP, while moves that contrast the Pokémon’s type will have less PP. This is important when considering who to use TM’s and HM’s on.

There will be a section of the game where you play as a young boy who can use Pokémon abilities, specifically as a Ghost type. In this case, all battles are performed with you and another Pokémon as partners, and bond is developed between you and your Pokémon. You earn a normal share of XP, level up, and unlock new moves just like regular Pokémon. You can even learn TM’s! If you are incapacitated, your Pokémon can fight on and, after the battle, use a healing item (by default, the worst one you have) to put you back on your feet. If you die or run out of healing items, the game is over.

From that section of the game onward, you can talk or make sounds to enemy Pokémon in order to influence their behavior, including making them easier to catch. After that section of the game, you can also step in on wild battles in place of one of your Pokémon to take an offensive action, with the risk of becoming a target and/or incapacitating the wild Pokémon you meant to catch.

If any of this sounds interesting let me know lol

2 notes

·

View notes

Text

Why Should Businesses Consider Having Their Own Blockchain Network?

Nowadays, in the digital era, companies are always looking for creative solutions that may help to increase efficiency, security, and transparency. The backbone behind cryptocurrencies like Bitcoin, the blockchain technology is quickly establishing itself as an innovative solution in many different sectors. Even though some business owners may see blockchain only as something related to crypto, it is capable of much more. In this article, we will delve into the top reasons why companies should have their own blockchain network.

Enhanced Security and Trust

Traditional databases typically intend the middleman to be the one managing and securing the data. This centralized approach increases the number of single attack points, thus making it vulnerable to hacking and manipulation. Unlike blockchain, the latter, however, uses a distributed ledger system. Information is encrypted and stored over a network of computers instead of humanizing the role of a central authority. Any change in a ledger means modifying it on all the copies stored on the network, thus keeping falsifications practically impossible.

One of the most salient features of digital currencies is their properties which enables people to trust the system. For example that, the traceability of goods via a blockchain-enabled supply chain from their address to their destination is ensured in real-time. This authenticates and prevents imitations and counterfeiting. Meanwhile, this transparency facilitates trust-building between companies and users.

Streamlined Processes and Reduced Costs

A lot of business processes have more than one entity providing access to data and confirming transactions. This is a tedious process that tends to be full of errors and involves 3rd party intermediaries for communication and validation purposes. Blockchain is capable of getting rid of middlemen by providing a secure and transparent ledger between the interacting parties.

Traditionally speaking, the trade finance process involves banks and institutions swapping documents and validating financial information. Automation of processes such as invoicing, and payment is possible through a blockchain-based platform, thereby reducing paperwork, delays, and associated costs. This is likely to translate into a substantial amount of cost reduction for most companies.

Improved Data Integrity and Traceability

Businesses from all spheres of influence depend on data integrity. Through a Blockchain’s distributed ledger network, any data coming in is non-modifiable, it cannot be changed or removed. This is because transactions are immutable and indelible, which makes them crucial in the auditing, compliance, and dispute resolution processes.

Moreover, blockchain greatly facilitates the keeping of the data with its full history. This traceability particularly is of relevance to areas like pharmaceuticals where it helps in verification of the product and its origin thus it reduces incidents of counterfeiting and improves the safety of the product.

Increased Efficiency and Automation

The implementation of blockchain technology can spell the end for many of the manual tasks performed by firms and replace them with automated actions. Self-enacting agreements written in a smart contract language, also known as smart contracts, can be configured to perform certain tasks once predefined conditions are met. This brings an added advantage of avoiding manual double-checks and interventions thus leading to increased effectiveness and faster processing times.

For instance, a smart contract is used to vitalize insurance claim payments upon a verified event. This avoids the need for a claim manager and shortens the procedure for the customers.

Fostering Innovation and Collaboration

Blockchain networks which are impenetrable and trustworthy can help develop cooperation among businesses. The public platform provided by a distributed ledger technology will enable businesses to exchange data without compromising privacy and to build trust among partners and suppliers through transaction verification. It is the source of the emergence of innovative colorful business models and the development of more efficient and collaborative ecosystems.

For instance, a consortium of banks could utilize a shared blockchain network to facilitate faster and more secure cross-border payments.

Building a Competitive Advantage

Early adoption of innovative technologies can become a critical competitive advantage for companies. Developing its own blockchain network will show that the company is serious about security, transparency, and efficiency aspects. This can win new customers and partners who put the values in high esteem. Besides, the learnings derived from implementing blockchain technology would not only guide strategic decision-making but also pave the way for the creation of new products.

On the one hand, blockchain is not a universal solution, but it should be mentioned that. Companies should thoroughly go into the matter and scrutinize their particular problems before thinking of their own blockchain network.

Here are some key factors to consider:

Industry: Some industries, like the supply chain management industry, the health sector, and the finance sector, have an inherent advantage in employing blockchain technology.

Scalability: Companies need to ascertain whether the blockchain platform they will that choose will be able to scale up to satisfy long-term growth requirements.

Integration: The potential blockchain platform should be flexible so that it can easily connect to the existing information technology setup.

Regulations: Companies who wish to implement any blockchain technology must be cautious of potential rules that govern their respective industry.

The factors outlined above and the benefits listed above offer businesses a platform to objectively determine whether their Own Blockchain Network is right for them. With the development of the blockchain technology and the increase of its application, the role of the blockchain technology in operating business will be more prominent.

0 notes

Text

High-Level Meeting on Sustainable Transport - General Assembly, Sustainability Week, 78th session.

The high-level meeting will highlight sustainable and effective solutions to improve the balance between economic, social, and environmental dimensions of sustainable transport, to take full advantage of sustainable transport in accelerating the implementation of the 2030 Agenda for Sustainable Development.

Opening

Ministerial segment

Interactive multi-stakeholder panel: Enhancing intermodal transport connectivity and developing socially inclusive and environmentally friendly transportation

Closing segment

Sustainable transport systems remain crucial for sustainable development. They support economic growth, facilitate global supply chains, including the delivery of goods and services to rural and urban communities, enhance international cooperation and trade, connect people and communities to jobs, schools and health care, and thus provide all with equal opportunities.

The meeting will be open to Member States and Observers, the United Nations system, ECOSOC-accredited non-governmental organizations and other relevant stakeholders.

Related Sites and Documents

UNGA Sustainability Week

Concept Note

Watch the High-Level Meeting on Sustainable Transport - General Assembly, Sustainability Week, 78th session

#choosesustainability#united nations general assembly#unga78#UNGAsustainabilityweek#sustainable transport#transport system#high-level meeting#ChooseSustainability#SustainableTransportation#urban transport#rural transport#high-level event#resilient transport#road infrastructure#sdg9#sdg11

0 notes

Text

Embedded Finance Market Surges with a 16.5% CAGR, Set to Reach US$ 291.3 Billion by 2033

It is projected that the embedded finance industry would grow at a robust 16.5% compound annual growth rate (CAGR) from 2023 to 2033. The market is anticipated to be valued at US$ 63.2 billion in 2023 and to have a market share of US$ 291.3 billion by 2033.

The technical advantages along with the expanding financial services including banking and non-banking options are flourishing the market growth. Furthermore, the rapid automation and adoption of smart platforms of different spaces for high productivity and efficiency are propelling growth.

Financial giants are partnering with technological platforms for innovative solutions. For example, Mastercard and Fabrick have signed a partnership to boost embedded finance. New services like buy now pay later (BNPL) and credit reporting are good examples of embedded finance.

The expanding sales and extended chains of banks and financial companies are expected to adopt these new systems in to improve the services offered. Alongside this, the increased convenience, quick transaction, and highly accessible interface is making embedded finance systems future-ready.

The growing sales of financial services have also increased the importance of data. Thus, the embedded finance systems also deliver a relevant collection of data while adding inclusion and convenience to the end user’s plate.

The other benefits include the generation of additional revenue streams while increasing the product’s stickiness, and enhanced customer experience.

Get an overview of the market from industry experts to evaluate and develop growth strategies. Get your sample report here

https://www.futuremarketinsights.com/reports/sample/rep-gb-14548

Key Takeaways:

The United States market leads the embedded finance market in terms of market share in North America. The United States region held a market share of 22.3% in 2023. The growth in this region is attributed to expanding financial firms, and the government’s adoption of the latest technologies. North American region held a significant market share of 32.5% in 2022.

Germany’s market is another successful market in the Europe region. The market holds a market share of 12.3% in 2022. The growth is attributed to the presence of new embedded finance platforms such as Plaid, and Alviere Hive. Europe region held a market share of 25.4% in 2022

India embedded finance market booms at a CAGR of 19.5% during the forecast period. The market’s growth is attributed to the new banking policies, enlarged non-banking policies, and high penetration of non-banking platforms.

China’s market also thrives at a CAGR of 17.7% between 2023 and 2033. The growth is caused by the banking reforms and increased focus on consumer inclusivity.

Based on type, the embedded banking segment held a leading market share of 32.1% in 2022.

Based on end-user type, the investment banks and investments company segment perform well as it held a leading market share of 27.2% in 2022.

Competitive Landscape:

The key vendors focus on adding value to the embedded finance systems and easy deployment procedures. Moreover, key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Major Players in this Market:

Bankable

Banxware

Cross River

Resolve

Parafin

TreviPay

Balance

Stripe

Speak to Our Research Expert https://www.futuremarketinsights.com/ask-question/rep-gb-14548

Recent Market Developments:

Finix has introduced embedded payments and the vertical SaaS conundrum. The addition of embedded payments is increasing revenue, reducing the payment strike, and easy customer engagement.

Flywire embedded experience is using smart technologies to secure payments without leaving the website.

Key Segments Covered are:

By Type:

Embedded Banking

Embedded Insurance

Embedded Investments

Embedded Lending

Embedded Payment

By End User:

Loans Associations

Investment Banks & Investment Companies

Brokerage Firms

Insurance Companies

Mortgage Companies

By Key Regions:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

Revolutionizing Compliance: Agile Solutions for Startups

Introduction:

In today's dynamic business landscape, startups face a myriad of challenges, with compliance often being a significant hurdle. Navigating through regulatory frameworks while trying to innovate and scale can be daunting. However, Agile Compliance Solutions for Startups the adoption of agile compliance solutions is transforming the way startups approach regulatory requirements, offering flexibility, efficiency, and adaptability. In this article, we delve into the realm of agile compliance solutions tailored for startups, shedding light on their benefits and implementation strategies.

Understanding Agile Compliance:

Agile compliance is a methodology inspired by agile software development practices, emphasizing iterative approaches, collaboration, and responsiveness to change. Unlike traditional compliance approaches that are rigid and linear, agile compliance promotes continuous evaluation and adjustment to meet evolving regulatory demands. It enables startups to stay compliant while maintaining their agility and innovation.

Benefits of Agile Compliance for Startups:

Flexibility: Agile compliance allows startups to adapt quickly to changing regulations without disrupting their operations. It enables them to incorporate compliance requirements seamlessly into their development cycles, reducing the risk of non-compliance.

Efficiency: By breaking down compliance tasks into smaller, manageable increments, startups can achieve compliance milestones more efficiently. This iterative approach fosters continuous improvement and prevents overwhelming compliance burdens.

Cost-Effectiveness: Traditional compliance processes often incur substantial costs due to lengthy audits and remediation efforts. Agile compliance minimizes these costs by addressing compliance issues incrementally, thus reducing the financial strain on startups.

Enhanced Risk Management: Agile compliance encourages startups to identify and mitigate compliance risks early in the development process. By continuously monitoring and adjusting compliance measures, startups can proactively manage risks and prevent potential violations.

Competitive Advantage: Startups that embrace agile compliance gain a competitive edge by demonstrating their ability to adapt swiftly to regulatory changes. This enhances their reputation and instills trust among stakeholders, including investors, customers, and regulatory authorities.

Implementing Agile Compliance Solutions:

Implementing agile compliance solutions requires a strategic approach tailored to the unique needs and regulatory landscape of each startup. Key steps include:

Assessment: Conduct a comprehensive assessment of regulatory requirements relevant to the startup's industry and operations. Identify areas where agile compliance practices can be applied effectively.

Collaboration: Foster collaboration between compliance professionals, development teams, and stakeholders to align compliance objectives with business goals. Establish cross-functional teams to facilitate communication and coordination.

Iterative Planning: Break down compliance tasks into smaller iterations or sprints, each focusing on specific regulatory requirements or objectives. Prioritize tasks based on risk assessment and regulatory impact.

Continuous Monitoring: Implement mechanisms for continuous monitoring of compliance activities and outcomes. Utilize automated tools and dashboards to track progress, identify bottlenecks, and address issues promptly.

Feedback Loops: Encourage feedback loops to gather insights from stakeholders and incorporate them into future iterations. Embrace a culture of continuous improvement, where lessons learned from compliance experiences drive refinement and optimization.

Conclusion:

In the fast-paced world of startups, agile compliance solutions offer a paradigm shift in managing regulatory requirements. By embracing agility, startups can navigate complex compliance landscapes with confidence, efficiency, and innovation. Agile compliance not only ensures regulatory adherence but also fosters a culture of adaptability and resilience, Agile Compliance Solutions for Startups essential for long-term success in today's competitive market. For startups seeking to revolutionize their approach to compliance, embracing agile solutions is not just a choice but a strategic imperative.

0 notes

Text

Enhancing Your Digital Presence in Kent: The Role of SEO Agencies and Web Designers

In the heart of Kent, businesses are increasingly recognizing the pivotal role that digital marketing, particularly SEO and web design, plays in their growth and visibility. Kent SEO agencies and Web Designers Maidstone are at the forefront, offering bespoke solutions that not only enhance online presence but also drive meaningful engagement and sales.

The Role of Kent SEO Agencies

SEO, or Search Engine Optimization, is more than just a buzzword in today's digital age; it's the backbone of online success. Agencies in Kent specialize in devising strategies that catapult local businesses to the top of search engine rankings, ensuring they get noticed by their target audience.

Customized Solutions for Every Business

Understanding that each business is unique, Kent SEO agencies take a customized approach. They delve deep into the business's goals, market niche, and competition to craft strategies that are not just effective but also aligned with the business's core objectives.

Beyond Basic Optimization

These agencies go beyond mere keyword stuffing. They offer a comprehensive suite of services, including in-depth keyword research, content optimization, and continuous analysis of performance metrics. This holistic approach ensures that businesses not only reach the summit of search engine results pages (SERPs) but also maintain their lofty positions.

Web Designers in Maidstone: Crafting Digital Identities

In the realm of digital marketing, first impressions are crucial. Web designers in Maidstone understand this and are adept at creating websites that are not just visually appealing but also highly functional and user-friendly.

E-commerce Solutions

With the rise of online shopping, having an e-commerce platform is indispensable for retail businesses. Web designers in Maidstone are skilled in developing e-commerce sites that offer seamless shopping experiences, thus enabling local businesses to tap into broader markets and drive sales.

Branding and Visual Identity

A website is often the first point of contact between a business and its potential customers. Maidstone's web designers excel in creating websites that effectively communicate the brand's message, ethos, and values, thereby fostering brand recognition and loyalty.

Client-Centric Approach and Customized Solutions

Kent SEO agencies and web designers are renowned for their client-centric approach. They engage in detailed consultations with clients to understand their needs fully and then tailor their solutions accordingly, ensuring each project perfectly aligns with the client's business strategy.

Leveraging Cutting-Edge Technology

Utilizing state-of-the-art technologies like WordPress and WooCommerce, these professionals create digital platforms that are not just relevant today but also adaptable to future advancements, ensuring businesses remain competitive in the ever-evolving digital landscape.

Ensuring Quality and Client Satisfaction

At the heart of their service delivery is an unwavering commitment to quality and client satisfaction. Projects are executed with meticulous attention to detail, ensuring outstanding outcomes that consistently exceed client expectations.

Future Goals and Community Involvement