Text

Ready to master IFRS? Look no further! Finpro Consulting's expert-led training is your ticket to success. Plus, enjoy a 10% discount on Package-1! Don't miss out - enroll today!

#AccountingTraining#Savings#IFRS#FinproConsulting#GudiPadwaOffer#DipIFR#package-1#RecordedLectures#ifrsc#finpro#offersforyou#RegisterNow

0 notes

Text

Dive into the world of colorful accounting with FinPro Consulting! Happy Holi to all our accounting wizards out there!

#ifrs#diploma in ifrs#finproconsulting#dipifr course#ifrs online classes#acca#gaap#finpro consulting#dipifrs

0 notes

Text

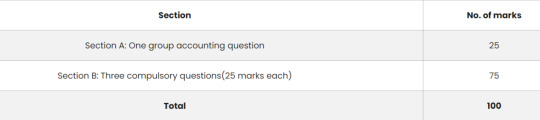

DipIFR exam is assessed by a single three-hour Computer Based Exam (CBE), which is held twice a year in June and December at ACCA’s exam centres, including Pune and other centres in India. The pass mark is 50%.

#DIPLOMA IN IFRS#FINANCIAL DOCUMENTS REQUIRED FOR EXAM#IFRS TRAINING IN INDIA#INDIAN ACCOUNTING STANDARD#WHO IS DIPIFR FOR#WHO IS ELIGIBILE FOR DIPIFR?#WHY ACCA DIPIFR

1 note

·

View note

Text

Why ACCA DipIFR :

More than 140 countries require or permit the use of International Financial Reporting Standards for their select class of companies. India has also mandated certain class of companies to follow Ind AS (converged with International Financial Reporting Standards) for financial reporting purpose.

The companies are currently focussing on recruiting the employees who have knowledge of Ind AS and other global financial reporting standards. Accordingly, the demand for professionals with knowledge in Global Financial Reporting Standards / Ind AS is increasing at rapid pace.

DipIFR is an international qualification in International Financial Reporting Standards accredited by the leading professional accounting organization – ACCA which is based in UK. DipIFR course is designed to develop working knowledge on International Financial Reporting Standards, providing an in-depth understanding of the concepts and principles and their practical application.

On Completion of This Program the Participants Will Acquire :

In-depth understanding of key International Financial Reporting Standards principles and rules.

Skills necessary for preparing financial statements.

Experience in developing professional judgment on practical application.

Understanding of key differences between Indian GAAP, Ind AS and International Financial Reporting Standards.

DipIFR exam is assessed by a single three-hour Computer Based Exam (CBE), which is held twice a year in June and December at ACCA’s exam centres, including Pune and other centres in India. The pass mark is 50%.

The exam paper is divided in two sections. It contains a mix of computational and discursive elements. Some questions adopt a scenario/case study approach. Section A includes a mainly computational question and Section B contains a mix of computational and discursive questions.

Who Is DipIFR For:

CFOs/ Finance Directors

Practicing CA, CS & CMA

Finance Controllers

Accountants and Analysts

Investment bankers

Professionals working in the Mergers and Acquisitions Department

Professionals involved in auditing, reporting, accounting and finance domain

Accounting professionals working in KPOs / BPOs, shared service centres and back offices

Who is Eligibile for DipIFR?

If you are a professional accountant or auditor engaged in practice or business, and are qualified according to national accounting standards, then you are eligible to take this ACCA financial reporting qualification (For e.g. Chartered Accountant holding valid membership certificate).

If you are a working professional, but not yet qualified as required above, then you may still be eligible. You will need to prove that you have one of the following:

A relevant degree plus two years’ relevant accounting experience*

An ACCA certificate in International Financial Reporting plus two years’ relevant accounting experience*

Three years’ relevant accounting experience*

ACCA affiliate status

*By submitting experience letter in a specified format. CA Article-ship experience of 3 years may be considered relevant for work experience criteria

Documents required for exam registration:

A. For a qualified Chartered Accountant (CA) with membership certificate:

CA Membership Certificate (Please note: Member Card / Marksheet is not accepted)

Date of birth proof (PAN / passport)

Address proof (Driver’s license / passport)

Identity proof (PAN / passport)

B. Qualified CA without a membership certificate:

It is required to share all the documents mentioned in the point “C” below i.e.,all the documents that a candidates other than qualified CA will provide.

C. For Candidates other than a qualified CA:

B. Com / M. Com degree certificate received from university.(Please note: Marksheet is not accepted)

Experience letter/certificate on company’s/organisation’s letterhead (mentioning tenure in the company & work profile)

Duly filled in and self-attested‘Experience Confirmation Form’(Pls find attached the format in PDF). Please note that experience is required in the field of accounting/ finance/ audit domain. Along-with,Form no.108 for CA article-ship / internship experience is considered as relevant experience (attached herewith is the sample form) for reference

Date of birth proof (PAN / passport)

Address proof (Driver’s license / passport)

Identity proof (PAN / passport)

#ACCA certificate#financial Documents required for exam#registration#Who Is DipIFR For#Who is Eligibile for DipIFR?#Why ACCA DipIFR

0 notes

Text

Celebrate Women's Day with FinPro Consulting! Empowerment and Equality Shine Brighter Together!

Exclusive Offer for Women: Enjoy 15% OFF!

Special Treat for Men: Avail 10% OFF!

Hurry! Register Now!

0 notes

Text

Dream big, Achieve bigger! Let Finpro Consulting be your partner in success with our comprehensive Diploma in IFRS. Elevate your career and accounting expertise with us!

#FinproConsulting#IFRS#ACCA#SuccessPartner#DiplomaInIFRS#DreamBigAchieveBigger#DipIFr Package 1#finpro consulting#ifrs online classes#gaap#diploma in ifrs

0 notes

Text

Republic Day Offer on IFRS Course | Finpro Consulting

Celebrate the spirit of Republic Day with knowledge and savings! Unlock the power of IFRS with Finpro Consulting's DipIFRS Training. Avail a 10% discount on Package 1 exclusively for this special occasion! Don't miss out on this limited-time offer.

For more details ,

Contact us on :

[email protected]

+91 8421438047

Visit us on : https://finproconsulting.in/

0 notes

Text

Wishing a Happy Makar Sankranti from Finpro Counsulting!

Happy Makar Sankranti! Soar to new intellectual heights with Finpro Consulting's DipIFRS training. May this festival illuminate your path to financial success.

For more details ,

Contact us on :

[email protected]

+91 8421438047

Visit us on : https://finproconsulting.in/

0 notes

Text

Elevate Your Finance Career with Finpro's IFRS Training !

Join us and empower yourself with the knowledge and skills needed to excel in the dynamic accounting world. Let's shape the future of your career together

For more details ,

Contact us on :

[email protected]

+91 8421438047

Visit us on : https://finproconsulting.in/

0 notes

Text

#accounting#finproconsulting#diploma in ifrs#ifrs online classes#dipifrs#ifrs#acca#gaap#financial instuments#ind as#IND As#compound financial

0 notes

Text

Accounting for compound financial instruments under the Ind AS – Part I

A. Background:

In recent times, many companies have chosen to raise money by issuing convertible instruments. A convertible instrument is a hybrid instrument that offers investors the option to redeem the security for cash at the end of (or during) its term or convert it to equity shares of the entity. Convertible instruments generally offer lower interest rates (because of the additional consideration by way of conversion option) than comparable conventional instruments, making them a cost-effective way for the entity to raise money. Convertible instruments are typically issued by companies that have high growth expectations and relatively lower credit ratings. The companies get access to money for expansion at a lower cost than they would have to pay for conventional instruments. Investors, in turn, get the flexibility of turning their convertible instruments into cash or equity shares of the entity. Examples of convertible instruments are optionally convertible preference shares, optionally convertible debentures / bonds, etc.

Under the Ind AS framework, Ind AS 32 – Financial instruments: Presentation (Ind AS 32), requires an issuer entity to present an issued instrument either as an equity or a financial liability depending on the features of that instrument. Equity instruments are instruments that evidence a residual interest in the assets of an entity after deducting all of its liabilities. Thus, instruments for which the entity has no obligation to deliver cash or can settle it by issuing fixed number of its own equity instruments are considered as “equity” instruments. Otherwise, when the entity has contractual obligation to deliver cash or another financial asset, or to deliver a variable number of the entity’s own equity instruments, the instruments are generally classified as “financial liabilities”.

An issued instrument may contain features of both financial liability (e.g. an obligation to deliver cash, either towards interest or principal sum) and an equity (e.g. no obligation to deliver cash at all or option to convert the liability into entity’s fixed number of equity shares). Such an instrument is termed as a ‘compound financial instrument’.

As per Ind AS 32, the issuer of such compound financial instrument is required to present the liability component and the equity component separately in the balance sheet. This is commonly referred to as “split accounting”.

B. Accounting Issue:

How to account for and present a compound financial instrument under Ind AS in the books of an issuer on initial recognition and on subsequent reporting dates?

As part of this blog, we will try to evaluate how to separate the components of a compound financial instrument on initial recognition and on its subsequent reporting dates.

C. Relevant technical guidance under Ind AS

Ind AS 32 – Financial Instruments: Presentation

Para 28

The issuer of a non-derivative financial instrument shall evaluate the terms of the financial instrument to determine whether it contains both a liability and an equity component. Such components shall be classified separately as financial liabilities, financial assets or equity instruments.

Para 29

An entity recognises separately the components of a financial instrument that:

• creates a financial liability of the entity and

• grants an option to the holder of the instrument to convert it into an equity instrument of the entity.

For example, a bond or similar instrument convertible by the holder into a fixed number of ordinary shares of the entity is a compound financial instrument. From the perspective of the entity, such an instrument comprises two components: a financial liability (a contractual arrangement to deliver cash or another financial asset) and an equity instrument (a call option granting the holder the right, for a specified period of time, to convert it into a fixed number of ordinary shares of the entity). The economic effect of issuing such an instrument is substantially the same as issuing simultaneously a debt instrument with an early settlement provision and warrants to purchase ordinary shares, or issuing a debt instrument with detachable share purchase warrants. Accordingly, in all cases, the entity presents the liability and equity components separately in its statement of financial position.

Para 31 (Application Guidance)

A common form of compound financial instrument is a debt instrument with an embedded conversion option, such as a bond convertible into ordinary shares of the issuer, and without any other embedded derivative features. Paragraph 28 requires the issuer of such a financial instrument to present the liability component and the equity component separately in the balance sheet, as follows:

(a) The issuer’s obligation to make scheduled payments of interest and principal is a financial liability that exists as long as the instrument is not converted. On initial recognition, the fair value of the liability component is the present value of the contractually determined stream of future cash flows discounted at the rate of interest applied at that time by the market to instruments of comparable credit status and providing substantially the same cash flows, on the same terms, but without the conversion option.

(b) The equity instrument is an embedded option to convert the liability into equity of the issuer. The fair value of the option comprises its time value and its intrinsic value, if any. This option has value on initial recognition even when it is out of the money.

Para 32

The issuer of a bond convertible into ordinary shares first determines the carrying amount of the liability component by measuring the fair value of a similar liability that does not have an associated equity component. The carrying amount of the equity instrument represented by the option to convert the instrument into ordinary shares is then determined by deducting the fair value of the financial liability from the fair value of the compound financial instrument as a whole.

Para 30

Classification of the liability and equity components of a convertible instrument is not revised as a result of a change in the likelihood that a conversion option will be exercised, even when exercise of the option may appear to have become economically advantageous to some holders. Holders may not always act in the way that might be expected because, for example, the tax consequences resulting from conversion may differ among holders. Furthermore, the likelihood of conversion will change from time to time. The entity’s contractual obligation to make future payments remains outstanding until it is extinguished through conversion, maturity of the instrument or some other transaction.

Ind AS 109 – Financial Instruments

Effective interest method-The rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial asset or financial liability to the gross carrying amount of a financial asset or to the amortised cost of a financial liability. When calculating the effective interest rate, an entity shall estimate the expected cash flows by considering all the contractual terms of the financial instrument but shall not consider the expected credit losses. The calculation includes all fees and points paid or received between parties to the contract that are an integral part of the effective interest rate, transaction costs, and all other premiums or discounts. There is a presumption that the cash flows and the expected life of a financial instrument can be estimated reliably. However, in those rare cases when it is not possible to reliably estimate the cash flows or the expected life of a financial instrument, the entity shall use the contractual cash flows over the full contractual term of the financial instrument.

D. Analysis and Conclusion

While accounting for an issued convertible instrument that offers the investors the option to redeem the instrument for cash at the end of (or during) its term or convert it into a fixed number of equity shares of the issuer entity, the issuer entity shall apply the principles of “split accounting” provided above under Ind AS 32 and Ind AS 109 as discussed below.

A. Presentation and measurement at initial recognition:

At the time of initial recognition, the liability component’s carrying value is determined by discounting the estimated cash flows (interest and principal payments) arising over the expected life of the financial instrument to the present value. When it is not possible to reliably estimate the cash flows or the expected life of a financial instrument, the entity shall use the contractual cash flows over the full contractual term of the financial instrument.

The discount rate shall be the current rate of interest applicable to instruments of comparable credit status and providing substantially the same cash flows on the same terms, but without the equity component (the equity conversion option).

When the terms of the convertible instruments provide an option to convert the instrument into fixed number of equity instruments, the other component in the instrument is considered as equity component. The equity component (the equity conversion option) is assigned the residual amount after deducting the fair value of the liability component from the fair value of the entire instrument.

The sum of the carrying amounts assigned to the liability and equity components on initial recognition is always equal to the consideration received. No gain or loss arises from initially recognising the instrument’s components separately.

B. Subsequent measurement:

The financial liability will be measured at amortised cost. This means that the liability’s effective rate of interest is charged as a finance cost to the statement of profit or loss over the expected life of the financial instrument (Ind AS 109).

The effective rate of interest is that rate which exactly discounts the estimated future cashflows (including any premiums or discounts) over the expected life of the financial liability to the gross carrying amount of the financial liability. The gross carrying amount of the financial liability will be adjusted for all the fees, transaction costs, and any other incremental costs that are incurred at the time of issuance.

The scheduled interest and principal payments (in cash) are deducted from the carrying value of the financial liability.

The equity component is excluded from the scope of Ind AS 109, and it is not remeasured after initial recognition.

E. Illustration

An entity issues 1,000 convertible debentures with a face value of INR 1,000. The face value of the debentures is also the fair value of the convertible debentures. The debentures bear a rate of interest of 8% per annum. The entire principal is repayable at the end of the tenure in one tranche. The holders of the debentures have the option to convert the outstanding debt into equity shares of the entity at the time of redemption, which is 5 years from the date of issue. The conversion ratio is pre-determined and allows one debenture to be converted into one equity share.

On initial recognition, the entity evaluates the terms and concludes that the instrument contains both a liability and equity component.

Debentures with similar terms but without the equity conversion option bear a rate of interest of 10% in the market. Hence, the entity calculates the fair value of the financial liability as the present value of the interest payments and the principal payment using 10% as the appropriate discount rate. The fair value of the financial liability is valued at INR 9.24 lakhs (PV of Interest CF: INR 3.03 lakhs & PV of Principal CF: INR 6.21 lakhs). The residual value, i.e., the difference between the fair value of the instrument and the fair value of the liability, INR 0.76 lakhs will be recognised as the equity component. The equity component is recognised as a component under the head ‘other equity’ as ‘Equity component in compound FI’.

Subsequently, finance cost of INR 3.03 lakhs will be charged to the statement of profit and loss over the tenure of the debentures using the effective interest method. The annual interest payments of INR 0.80 lakhs and the principal payment at the end of the tenure of INR 10 lakhs will be reduced from the carrying value of the financial liability.

Amortisation schedule using the effective interest method:

At the end of the tenure, entities have the option to transfer the equity component between reserves within equity (from the reserve related to the equity component to share premium or retained earnings as the case may be).

F. Resources

Indian Accounting Standards (Bare Text) as notified under section 133 of the Companies Act 2013.

(https://www.mca.gov.in/content/mca/global/en/acts-rules/ebooks/accounting-standards.html)

0 notes

Text

Wishing a Happy New Year from Finpro Counsulting !

Wishing you a Happy New Year filled with success, prosperity, and financial mastery!

May your financial aspirations soar in 2024! #HappyNewYear from the Finpro Consulting family!

For more details,

Visit us on : https://finproconsulting.in/

Contact us on :

[email protected]

+91 8421438047

#FinProNewYear#FinancialSuccess#DipIFRSCoaching#NewYearNewSkills#ProsperWithFinPro#FinancialMastery#HappyNewYear#FinProConsulting#DipIFRS#UnlockYourPotential#SuccessIn2024#FinancialBrilliance#NewYearGoals

0 notes

Text

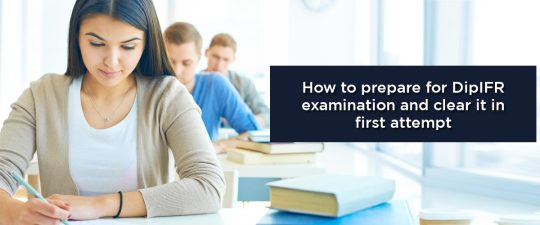

How to Prepare for DipIFR Examination in 2024

Thousands of accounting, audit and finance professionals apply for diploma in IFRS every year, and the biggest intimidation that a majority of them face is the preparation of June 2024 DipIFR examination to crack it in the very first attempt. While lack of time for preparation and inability to focus on studies at a stretch are generally behind this pre-examination stress, the right guidance may help them determine their course of preparation and experience a surprising outcome.

DipIFR students typically come up with questions like how much time does it take to complete DipIFR syllabus before the examination, is it possible for non-CA professionals to get well versed with IFRS (International Financial Reporting Standards) within such a short time span and how many hours should be dedicated to DipIFR study on a daily basis. Aspirants are often concerned about the magnitude and complexity of syllabus. Despite being professionals in the field of accounting, finance and audit, most of these students feel the pressure of writing the exam paper and completing the same within just three hours!

We have been successfully running IFRS certification courses in Pune and are recently conducting online IFRS courses and DipIFR trainings. We have answers to all such queries and confusions. With years of experience in getting thousands of students prepared for DipIFR and other similar examinations, we take it as responsibility to discuss the tried, tested and proven strategies and effective study techniques that would help students overcome these and many other challenges. Although the approach is subjective and study technique may differ from person to person, we believe that the below pointers would help you identify the best suitable one for yourself before you start preparing.

Finalising the date of exam and gathering study material

The date of examination is recommended to be decided well in advance, which would allow you for sufficient time to gather appropriate study material like books/e-books, coaching videos, and presentations. There are various options available for training videos in the market right from 60 hours to 120 hours of training. If you have prior knowledge of international financial reporting standards, you may opt for a 60 hours video. However, if you have no acquaintance with accounting standards, elaborate training videos may be the right choice for you. Books consist of questions and answers from past examinations and summary notes that assist with last-week revisions. It is imperative to select the training material provider wisely. We recommend learning partners of ACCA (Association of Chartered Certified Accountants).

Completing entire syllabus within two months

If you have opted for training videos, it is important that you complete one view of training videos for entire syllabus within the first two months. Take out 2.5 hours daily, thrice a week (on weekdays) and 7.5 hours collectively (on weekends), which makes up to nearly 15 hours a week to meticulously attend video lectures. This way, you will possibly complete training videos in a span of about two months. We recommend that the study should begin with simpler and basic topics like IAS 1 – Presentation of Financial Statements, IAS 16 – Property, Plant and Equipment and other asset related topics. Moving from simple to complex will boost your sense of confidence that you are aware of the concepts and can easily complete entire syllabus shortly.

Reading books and taking down your own notes

After completing video lectures, you may start with meticulous book reading sessions, preferably in the same sequence that you followed while watching videos earlier. Taking down your own notes in an A4 size notebook would help a lot in reading, writing and memorising concepts. It will enable you to understand everything even better and retain it.

Solving question papers of past examinations

Solving past examination question papers is vital to succeed in this examination. While solving, you may mark the tricky ones. Those that took a lot of your time can also be marked. Questions that are prone to mistakes are the most important in these paper solving sessions. Greater emphasis can be put on these, later. As ACCA mainly expects examinees to clearly explain the basis for their answers and signifies concepts rather than mere calculations, it is of paramount importance that you understand, comprehend and practice things a lot. Lack of clarity on various concepts and deficient explanation has been the most common reason behind failure in DipIFR, as reported by examiners so far.

Interlinking of topics and understanding the practical application

A question in the examination may not be related to a single standard and may require you to apply the knowledge of multiple financial reporting standards at a time. Thus, while studying, take time to thoroughly think over the impacts of one standard on another. Further, mere theoretical knowledge is of no use if one cannot apply the same practically. Thus, understanding the practical applicability of each concept should be practiced while studying, which would enhance your understanding to a different level.

Form a study group or find a study buddy

Some of the international financial reporting standards are complex to understand and interpret. For better understanding and retention of these concepts, group discussions prove to be of immense help. You may also find out a study partner and carry out discussion and brainwashing sessions together rather than just book reading. Group study sessions will keep your brain active and motivated, thereby boosting your confidence level. However, to maintain high efficiency, it is imperative that you avoid overspending time on non-vital issues.

Understanding the marking scheme from past examination questions

Understanding the marking scheme is essential in order to perform better in examination. Solve past examination questions, self-evaluate and mark on your own with the help of marking schemes given on the ACCA website – under the past examination section. This will enhance your understanding on what do examiners expect of you and how you would be evaluated in the examination.

Practicing mock examination in computer based examination (CBE) environment

From December 2020, ACCA has changed the mode of conducting the examination from paper based to computer based. ACCA has switched to the use of the same kind of technology found in today’s workplaces, including specially designed spreadsheets and word processing response options for students in examination instead of paper-based response options. This means that this exam closely reflects the modern work style of finance professionals, which should again boost your employability skills.

Reading and practicing

Students often find themselves unable to retain the concepts and think that they will not be able to reproduce the same during the examination. Do not get demotivated due to this kind of thoughts. Keep reading and practicing till the final examination date. There will be many ups and downs till the day finally arrives. The secret of success in DipIFR examination lies in reading, re-reading and practicing constantly till you get it right.

Takeaway

In a nutshell, it will take around 4-5 months to prepare yourself well for the ACCA Diploma IFRS examination. Diploma IFRS is a widely accepted qualification and thus, should not be considered as a cake walk. It is thus important not to take it casually as well as not to be nervous at the same time. Consistent efforts and perseverance will definitely pave the way for you to clear the examination in first attempt. Gap between studies and exam attempts is not recommended. There is always high probability of success, if you maintain the momentum of preparation.

#diploma in ifrs#finproconsulting#ifrs online classes#how to crack IFRS#IFRS exam 2024#stratagy#study material#dipifr course

0 notes

Text

Merry Christmas !

Embrace the festive spirit with Finpro Consulting! This Christmas, give yourself the gift of knowledge and elevate your career with our expert coaching in Dip- IFRS.

Unwrap a brighter future with us!

#FinproChristmas#IFRScoaching#CareerElevation#ChristmasLearning#FestiveFinance#CareerDevelopment#FinancialEducation#SeasonOfSuccess#KnowledgeGifts#ChristmasGoals#IFRSExperts

0 notes

Text

Christmas & New Year Offer on IFRS Course | Finpro Counsulting

𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝗢𝗳𝗳𝗲𝗿: Get into the holiday spirit with a 10% discount on our DipIFRS coaching! Don't miss out on this merry opportunity to invest in your professional growth.

Hurry! This offer sleighs away on 2nd Jan 2024 Secure your spot now and step into 2024 with confidence and expertise.

For more details ,

Contact us on :

[email protected]

+91 8421438047

Visit us on : https://finproconsulting.in/

#FinproFestiveOffer#DipIFRS#ChristmasLearning#NewYearNewSkills#ProfessionalGrowth#MerryAndBrightEducation#FestiveDiscounts#UnlockYourPotential

0 notes

Text

#FinProConsulting#DipIFRSTraining#FinancialProwess#NavigateComplexity#EmbraceClarity#FinancialExcellence#ExpertCoaching#UnlockYourPotential

0 notes

Text

Announcing New-Live Online Batch | Diploma IFRS

Weekend Batch 31 starting from 20th January 2024 (Saturday – 6 hours, Sunday – 3 hours)

Live online training program on Diploma IFRS covers:

80 hours interactive live online sessions

Access to the recorded sessions on mobile app until June 2024 examiniation

Pen drive for 26 hours of video lectures with 2 views or 06 months validity

Study material (Study text, question bank, training slides handout book)

Mock examination (Self evaluation; marking scheme will provided separately)

Discount to FinPro students on ACCA registration and examination fees

Study material will be dispatched on the postal address mentioned in registration details

For more details,

Visit us on : https://finproconsulting.in/dipifr-live-online/

Contact us on :

[email protected]

+91 8421438047

0 notes