#RobinhoodApp

Photo

New Post has been published on https://primorcoin.com/nearly-700m-worth-of-assets-linked-to-sam-bankman-fried-ftx-seized-by-us/

Nearly $700M Worth of Assets Linked to Sam Bankman-Fried, FTX Seized by US

United States prosecutors have seized nearly $700 million worth of assets either owned by collapsed crypto exchange FTX or tied to founder and former CEO Sam Bankman-Fried, authorities disclosed in a Friday court filing.

Federal authorities in the Southern District of New York have seized just over $698 million worth of assets linked to the disgraced crypto founder, according to the filing, which was first reported on by CNBC.

The bulk of the value comes from a stack of shares that Bankman-Fried purchased in Robinhood, the stock and crypto trading app, allegedly using stolen FTX customer funds.

The document submitted by U.S. Attorney Damian Williams details the holdings, with nearly 55.3 million shares of Robinhood stock seized on January 4. As of this writing, the shares are collectively worth about $526 million. They were held by Emergent Fidelity Technologies, a shell company that Bankman-Fried created with FTX co-founder Gary Wang.

In a December affidavit, Bankman-Fried wrote that he and Wang formed the new company—using funds loaned by FTX sister company Alameda Research—to acquire shares in Robinhood Markets Inc. totaling $546.4 million. FTX customer funds were reportedly used to plug a trading hole in Alameda’s balance sheet last summer, ahead of the exchange’s eventual collapse.

Other funds seized on January 4 include $20.7 million held by Emergent at ED&F Man Capital Markets, Inc, and another $49.9 million at Farmington State Bank, held under FTX Digital Markets. Between January 11 and 19, authorities seized just over $100 million of FTX’s funds held in Silvergate Bank.

Today’s court filings also list three accounts held at rival cryptocurrency exchange Binance and its Binance US affiliate. However, the value of the assets in those accounts was not specified.

FTX and Alameda filed for Chapter 11 bankruptcy in November following a liquidity crisis at FTX, with billions of dollars apparently missing from the once-popular crypto exchange. Bankman-Fried now faces various charges from the U.S. Department of Justice, Securities and Exchange Commission (SEC), and Commodity Futures Trading Commission (CFTC) related to his actions at the companies.

The FTX restructuring team, led by new company CEO John J. Ray III, said last week that it has separately recovered more than $5 billion worth of company assets between cryptocurrency, cash, and liquid investments in securities.

Stay on top of crypto news, get daily updates in your inbox.

Source link

#Binance #Blockchain #BNB #Crypto #CryptoExchange #CryptoNews #RobinhoodApp #TraedndingCrypto

#Binance#Blockchain#BNB#Crypto#CryptoExchange#CryptoNews#RobinhoodApp#TraedndingCrypto#CryptoPress#Trending Cryptos

0 notes

Photo

New Post has been published on https://coinprojects.net/polygons-matic-usd-recovers-support-what-next/

Polygon's MATIC/USD recovers support. What next?

Polygon’s native token MATIC has gained by 8.00%, underlining solid recovery.

Brokerage firm Robinhood said it would launch its Web3 wallet on Polygon

Bulls are in control, but it remains to be seen of price action at $0.90 and trendline

Polygon’s MATIC/USD could be back to winning ways if the latest gains are to go by. As of press time, MATIC had added 8.00% and looked increasingly bullish. There has been a string of positive developments for the Ethereum Layer-2 scaling solution. Let’s look at the latest.

Robinhood, an online brokerage firm that promises commission-free trading, remains a retail darling. Although the popular trading platform has taken a hit this year, it always elicits excitement on major news.

On September 27, Robinhood announced its Web3 wallet would launch on Polygon. That comes after, earlier, launching MATIC transactions on Polygon. However, MATIC remained largely bearish in September, coinciding with the weak crypto sentiment.

MATIC outlook as recovery continues above $0.76 support

Plus500

Plus500 is a leading provider of Contracts for Difference (CFDs), delivering Leveraged trading on +2,000 financial instruments, including Forex, Commodities, Indices, Shares, Options and Cryptocurrencies. CySEC license number (#250/14)

Buy MATIC with Plus500 today

Disclaimer

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

Buy MATIC with Binance today

If we turn to the technical side, MATIC has recovered the $0.76 support after the price slipped temporarily below. The level remains crucial to a technical reader since bulls have defended it since July. The latest surge could imply that buyers are getting active.

Source – TradingView

Looking at the moving average, MATIC has recovered above the 20-day MA. It is also moving above the 50-day MA. The MACD indicator remains in the bear zone but shows a bullish building momentum. However, MATIC remains trapped by a short-term descending trendline.

Concluding thoughts

A bull case scenario for MATIC could be confirmed by a bullish moving average crossover. The price has to move above the short-term descending trendline. Otherwise, a price rejection at the descending trendline would invalidate any bullish bias.

Another price point of interest is $0.90. It coincides with a minor resistance and could force a correction.

Share this articleCategoriesTags

Source link By Motiur Rahman

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange #RobinhoodApp

#Altcoin#Binance#Bitcoin#BlockChain#BlockchainNews#BNB#crypto#CryptoExchange#RobinhoodApp#Blockchain#CryptoPress

0 notes

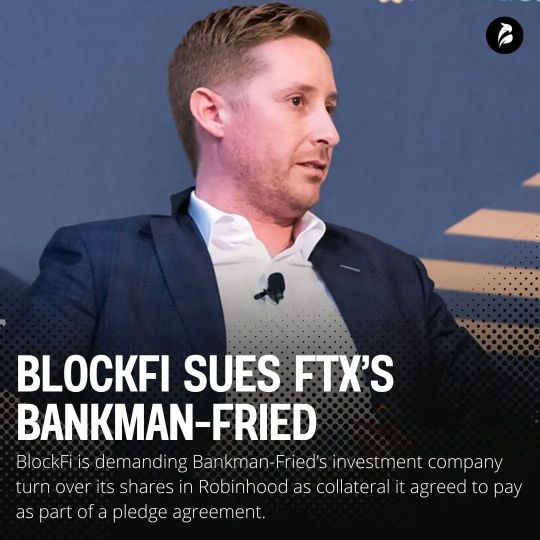

Photo

Newly-bankrupt crypto lending platform @blockfi has filed a lawsuit against Sam Bankman-Fried’s holding company Emergent Fidelity Technologies seeking his shares in @robinhoodapp that were pledged as collateral earlier in November. The suit was filed on Nov. 28 in the United States Bankruptcy Court for the District of New Jersey just hours after BlockFi filed for Chapter 11 bankruptcy in the same court. As per the filing, BlockFi is demanding Emergent turnover collateral as part of a Nov. 9 pledge agreement that saw Emergent agree to a payment schedule with BlockFi that it has allegedly failed to pay. BlockFi names the collateral as “including certain shares of common stock.” In May, Bankman-Fried acquired a 7.6% stake in the online brokerage firm Robinhood, buying a total of $648 million in Robinhood shares through his Emergent investment company. #Stoccoin #BlockFi #BankmanFried #Robinhood https://www.instagram.com/p/ClkWAbRBjbW/?igshid=NGJjMDIxMWI=

0 notes

Text

Khách hàng của Robinhood hiện có thể giao dịch Aave và Tezos

Khách hàng của Robinhood hiện có thể giao dịch Aave và Tezos

Ứng dụng giao dịch phổ biến hiện cung cấp 19 tài sản tiền điện tử.

Ứng dụng giao dịch Robinhood Markets (HOOD) đã bổ sung hỗ trợ cho tiền điện tử Aave ( AAVE ) và Tezos ( XTZ ) vào nền tảng của mình, công ty đã thông báo trên Twitter vào thứ Hai.

AAVE @AaveAave and XTZ @tezos are now on Robinhood #CryptoListinghttps://t.co/QtzBwskSdo

— Robinhood (@RobinhoodApp) October 24, 2022

Tiền điện tử gốc…

View On WordPress

#Aave#có#crypto#Cryptocurrency#của#dịch#Giao#Hàng#hiện#khách#Robinhood#Tezos#thế#tiền ảo#tiền kỹ thuật số#tiền thuật toán#và

0 notes

Text

Wallstreetbets lingo guide bloomberg

Wallstreetbets lingo guide bloomberg full#

Wallstreetbets lingo guide bloomberg free#

In order for a stock to get there certain conditions must be fulfilled.

Seemingly, despite any common sense its price is inflated beyond any reasonable proportions.

Once a critical mass is formed around a particular stock it becomes a stonk - a meme stock.

Our target audience is interested in trading and discussing very limited number of stocks.

We spent an entire afternoon scouring the internet, learning about NASDAQ, RobinHoodApp, WeBull, WallStreetBets lingo and culture, and the fascinating story of GME, Melvin Capital, Elon Musk, and stonks.

Wallstreetbets lingo guide bloomberg free#

In order to be able to fully grasp the reality within which we were operating, the first step in our research was to familiarize ourselves with financial markets, fee free online trading services, and the WallStreetBets saga. We asked ourselves how might we provide small investors a platform where they would be able to engage online, free to speak their mind, while being able to share opinions and memes with other investors in an environment which allows for their cultural affinities? Discover/Define Context

We need to validate our client‘s assumptions and find out if there’s more opportunities for problem solving.

We need better understanding of the context we’re operating in.

Given all of the above we came to understand some of the things that would need to be considered, and solved during the next phase of our project.

Wallstreetbets lingo guide bloomberg full#

These guys aren’t in love with Robert Reich least to say, and we would have to somehow prevent the impending culture clash between the financial elite and the unstoppable populist wave.Īpart from having only 3 weeks to complete our sprint, we had a serious problem - we didn’t know much about stock trading nor did we have full understanding of what WallStreetBets is really about. On TalkMarkets you can find articles by the likes of Robert Reich or Peter Schiff, while our target audience for TradeMob mainly consists of regular guys, a wave of new traders that joined the market trading thanks to the new business model that certain trading services provide - you can trade with no dollar fee, we will collect your data and sell it to big boys instead. Even at a first glance it’s clear that the two won’t click easily. TalkMarkets is, without any negative connotations, simply an elitist format in comparison with WallStreetBets. One thing we had to keep in mind was TalkMarket’s desire to drive traffic to its own website where they are able to monetize value that TalkMarket provides. We were to validate our clients initial research, solve the problems it implied, thus creating value for users that Reddit cannot offer. We internally referred to it as “ the perfect troll hovel”, but its official name was to be TradeMob. Our task was to create a brand new social forum space based on users’ needs and preferences. They would like to share their stock portfolio and be involved in a feedback loop feeding them information on what trends exist among the forum’s users, which is something that TalkMarkets could provide… And, well, brag about their gains (or losses - yes) by sharing their trading service info in a form of a chart or gain/loss breakdown. More importantly, they weren’t ecstatic about features that Reddit offers. Problem SpaceĪccording to the client’s research, the WallStreetBets guys weren’t too keen on Reddit’s “Big Brother” role when dealing with comments, presumably because that fine balance between so-called free speech and so-called censorship is debatable and to a large extent subjective category. In discussing this opportunity with users, our client received a lot of feedback that they aren’t happy with the outdated interface and lack of features on Reddit, that they would like to see a more modern and innovative forum, one that also includes financial integration, to better serve the needs of active investors. Seizing upon the craze created by WallStreetBets subreddit, our client, TalkMarkets wanted to create an opportunity for users to discuss trade ideas with each other. Status: Complete Project overview Project Brief My Role: UX Research Lead / UX Designer / Client Facing UX Team: Alejandro Arias, Allison Cohen, Gustavo Silva, Pallavi Deshpande, and myself

0 notes

Text

Here's How Much Dogecoin Now Held by Robinhood: Details

Here’s How Much Dogecoin Now Held by Robinhood: Details

According to the Twitter account @DogeWhaleAlertthe current combined total amount of Dogecoin held by stock brokerage app Robinhood on behalf of its investors is 40,508,384,607 DOGE, or $2,518,365,763, which represents 29.7% of the outstanding supply .

The current combined total amount of #Dogecoin hold by @RobinhoodApp 🪶 on behalf of its investors is:

40 508 384 607 $DOGE$2,518,365,76329.70% of…

View On WordPress

0 notes

Text

Robinhood maakt handel in Cardano (ADA) mogelijk voor zijn 23 miljoen gebruikers

Investeringsplatform Robinhood blijft zijn ondersteuning voor verschillende cryptocurrencies uitbreiden, met Cardano (ADA) als de nieuwste token die in de lijst wordt opgenomen.

Robinhood verklaarde dat de notering het gevolg is van de vraag van gebruikers, waarbij de handel in het token naar verwachting onmiddellijk zal beginnen, zei het platform in een tweet op 1 september.

https://twitter.com/RobinhoodApp/status/1565323169409351681?s=20&t=Az2AVpU2qq5su9ZUWjNxag

Te midden van de aanhoudende crypto bearmarkt, is de notering nog geen doorslaggevende factor onder ADA-investeerders omdat de prijs van het token traag blijft. Tijdens dit schrijven, werd ADA verhandeld op $ 0,44, een daling van bijna 2,5% in de afgelopen 24 uur noterend.

Bron: Coinmarketcap

In het bijzonder komt de notering van ADA die voorloopt op Cardano's Vasil hard fork die gepland staat om later deze maand te worden uitgerold. De upgrade wordt beschouwd als bullish en zal meer schaalbaarheid introduceren op het platform.

Robinhood versnelt notering van nieuwe tokens

Het is het vermelden waard dat Robinhood, met ongeveer 22,9 miljoen gebruikers, de notering van nieuwe tokens in 2022 heeft versneld nadat het leek te vertragen.

Onder de veel voorkomende, recent genoteerde tokens zijn Shiba Inu (SHIB), Polygon (MATIC), Solana (SOL) en Compound (COMP), en Chainlink (LINK).

Maak een account of ga naar trading bot.

De meeste van de genoteerde tokens zijn deels een gevolg van de druk van de gemeenschap daar Robinhood's ondersteuning voor verschillende activa deels heeft geleid tot de rally van de genoemde cryptocurrencies.

Om een voorbeeld te noemen zoals eerder gerapporteerd, stroomde ongeveer $ 1 miljard aan kapitaal naar de meme coin Shiba Inu binnen een uur na het verdienen van een notering op Robinhood.

Leer alles over Crypto en NFT's met deze handleidingen

De verhoogde notering van activa op het platform is ook bedoeld om nieuwe gebruikers aan te trekken, terwijl het bedrijf probeert om de huidige marktvolatiliteit te manoeuvreren. Het bedrijf heeft de afgelopen weken een kwart van zijn personeel moeten ontslaan als gevolg van ongunstige economische omstandigheden.

Aurus biedt het perfecte decentrale alternatief ten opzichte van gemiddelde stablecoin en is daarmee de missende schakel tussen crypto en fiat, Klik hier en lees meer.

Word lid van de Bitcoin/Cryptocurrency Facebook groep om geen enkel nieuwsbericht te missen en kom naar de Telegram om mee te discussiëren.

Read the full article

0 notes

Text

#gamestop#robinhoodapp#wall street#leftist#anti capitalism#politics#usa#america#late stage capitalism#leftblr#progressive#socialist#economy#economics#hedge funds

750 notes

·

View notes

Video

Stock trading includes purchasing and selling stocks much of the time trying to time the market. The objective of stock traders is to gain by transient market occasions to sell stocks for a benefit or purchase stocks at a low. Some stock traders are day traders, which implies they purchase and sell a few times for the duration of the day.

Read More

#stocktrading#tradingstocks#stockmarkettrading#stockstrading#investing#stocks#investingtips#tradingstrategy#investorsbank#robinhoodapp

1 note

·

View note

Photo

New Post has been published on https://primorcoin.com/bitcoin-firm-nydig-slashes-110-jobs-amid-ongoing-crypto-bear-market-report/

Bitcoin Firm NYDIG Slashes 110 Jobs Amid Ongoing Crypto Bear Market: Report

Bitcoin services company New York Digital Investment Group (NYDIG) has slashed about a third of its headcount, according to a Thursday report by The Wall Street Journal, citing people familiar with the matter.

The workforce cut affected approximately 110 of the NYDIG’s employees and was announced on September 22, people said. The firm is reportedly seeking to reduce expenses and narrow focus on more promising businesses.

Founded in 2017, NYDIG is a subsidiary of Stone Ridge Holdings. The firm offers Bitcoin trading, brokerage, custody, and asset management services to institutional investors.

The headcount cut, if confirmed, comes amid leadership changes at NYDIG, with former CEO Robert Gutmann and president Yan Zhao stepping down on October 3, replaced by Tejas Shah and Nate Conrad, respectively.

NYDIG did not immediately respond to a Decrypt request for comment.

NYDIG to defy the bear market?

NYDIG raised $1 billion last December at a valuation of more than $7 billion, announcing the fresh capital will be used to further develop the company’s institutional-grade Bitcoin platform, adding such features as Lightning Network payments, asset tokenization, and smart contracts functionality.

In a recent filing with the SEC, NYDIG said it secured $720 million for its Institutional Bitcoin Fund, with a total of 59 investors contributing to the raise.

Last week, the firm also said, among other things, it will focus on accelerating investments in its Bitcoin mining franchise serving North American miners.

Several prominent crypto companies already announced staff cuts this year, as the dramatic decline in the value of cryptocurrencies, coupled with the rising inflation, impacted their businesses.

These included Coinbase, Crypto.com, Gemini, Robinhood, Mercado Bitcoin, Immutable, and BlockFi.

NYDIG, however, insists its balance sheet is “the strongest it’s ever been” as the firm’s Bitcoin balance hit an all-time high in the third quarter, or up almost 100% compared to the same period last year.

NYDIGis yet to publish its Q3 2022 report, however, the company said it expected its revenue to increase further after the 130% growth through the second quarter.

Stay on top of crypto news, get daily updates in your inbox.

Source link

#Blockchain #Coinbase #CoinbaseNews #Crypto #CryptoNews #RobinhoodApp #TraedndingCrypto

#Blockchain#Coinbase#coinbaseNews#Crypto#CryptoNews#RobinhoodApp#TraedndingCrypto#CryptoPress#Trending Cryptos

0 notes

Photo

New Post has been published on https://coinprojects.net/binance-us-chief-explains-why-exchange-cut-fees/

Binance.US chief explains why exchange cut fees

Binance remains the largest cryptocurrency exchange in the world and continues to dominate in various aspects of the market.

Binance.US CEO Brian Shroder has revealed that the cryptocurrency exchange cut certain trading fees to drive more value to its customers. He made this known during an interview with CNBC a few hours ago.

Binance.US, the United States affiliate of the largest crypto exchange in the world by trading volume, announced earlier this week that it will allow users to make spot bitcoin trades for the US dollar and stablecoins USDT, USDC and Binance USD (BUSD) without paying spot trading fees.

The move led to a decline in the shares of rivals Coinbase and Robinhood over the past few days. The cryptocurrency exchange’s CEO has now come out to explain why the company made the move. Shroder said;

“Since our inception, Binance has been known as the low-cost exchange in the cryptocurrency space. With this announcement, we want to establish ourselves as the world’s clear leaders in pricing. What is innovative about what we are doing is that it is driving more value to our customers, the people we had in mind when we made the announcement.”

Shroder lamented the lack of user education in the cryptocurrency space, especially in terms of the trading fees users are expected to pay. With Binance.US, users are now charged $0 for spot trading transactions, Shroder added.

When asked why exchanges like Coinbase charge users 4% for spot trading transactions, Shroder said most people don’t know they are paying 4% for such transactions.

Robinhood is another platform that operates on a $0 trading fees. However, Shroder said Binance.US’s model differs from that of Robinhood. He explained that;

“Robinhood makes money from spreads. They acquire say $98 worth of bitcoins from the market and sell it to the retail users for $100, making $2 in the process. However, Binance.US operates an open order book. We don’t get involved in the transactions at all. The transactions is amongst the users.”

Binance.US is one of the leading crypto exchanges in the world, with a daily trading volume of over $300 million.

Source link By Hassan Maishera

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange #RobinhoodApp

#Altcoin#Binance#Bitcoin#BlockChain#BlockchainNews#BNB#crypto#CryptoExchange#RobinhoodApp#Blockchain#CryptoPress

0 notes

Text

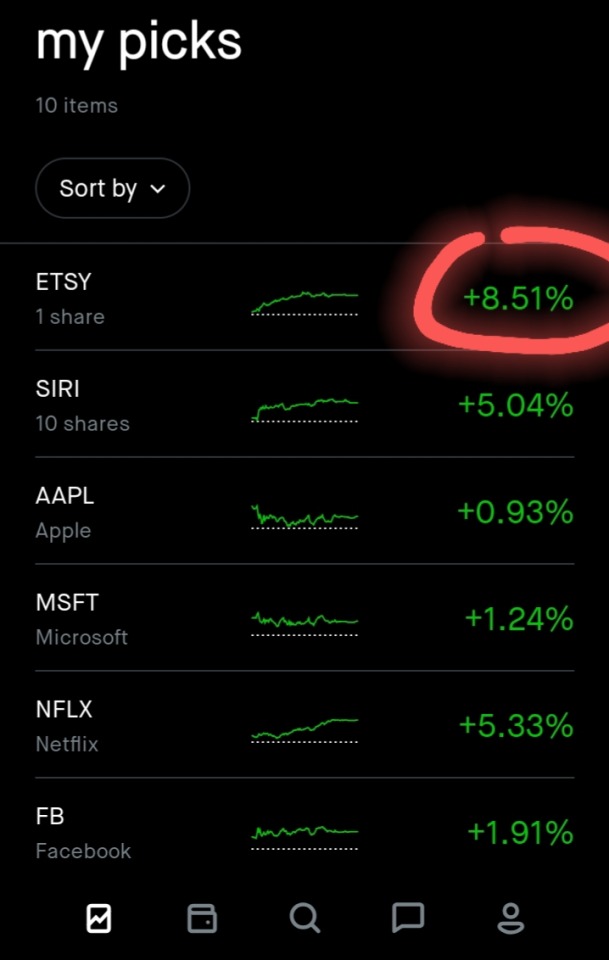

good to see my investments are doing well

2 notes

·

View notes

Text

Quick Investment Tip: If you are investing in the stock market. I'd advise you to invest in "Energy" stocks. It's the new wave. Trust Me. I seen CHK Chesapeake Energy go from $4/share to $64/share. I had 10 shares of it, but sold it. Due to losing money with it at first. Wish I would of held on to it. Could of quadrupled my funds. With that said, start investing in it now. Y'all see Tesla jumping up like crazy. What are they primary focus. The use of renewable #Energy. If you don't have stock or a stock account just yet. Join #Robinhood. It's free to join and you get a free stock once you sign up. You can even buy fractional shares if you don't have the funds right away. Sign Up Here: You now have a claim to a stock like Apple, Ford, or Facebook. In order to keep this claim to your stock, sign up and join Robinhood using my link. https://join.robinhood.com/alonzoh37

#TogetherAtHome #FreeStock #InvestNow #investmenttips

#investments#invest#investing#personal investing#investment#robinhoodapp#robinhood#robin hood#free stock#free Robinhood stock#investment tips#investment advisor#investment advice

2 notes

·

View notes

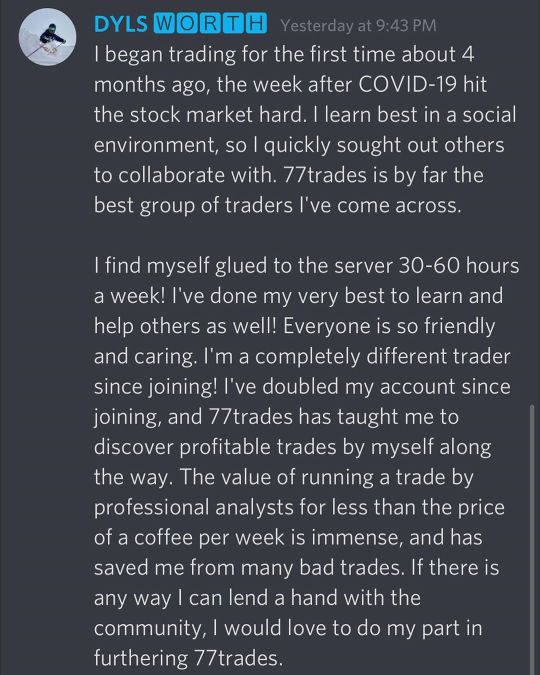

Photo

Wow what a great testimonial from @dylsphoto this group is so much bigger than me or any singal person. The fact that we have the ability to bring people together and help change lives is what makes us special!!💥 💵 💵 💵 Hashtags(ignore) 💵 💵 💵 #technicalanalysis #stocktwits #stockmarket #robinhoodapp #investment #daytrader #forex #money #robinhood #stock #investor #makeup #millionairemindset #nipseyhustle #newyork #atlanta #likeforlike #followforfollowback #invest #investing #optiontrading #daytrading #swingtrader #cali #miami #money #daytrade #grind #Covid #covid19 #blm https://www.instagram.com/p/CDoeFG4DhsS/?igshid=186tfupij7xvl

#technicalanalysis#stocktwits#stockmarket#robinhoodapp#investment#daytrader#forex#money#robinhood#stock#investor#makeup#millionairemindset#nipseyhustle#newyork#atlanta#likeforlike#followforfollowback#invest#investing#optiontrading#daytrading#swingtrader#cali#miami#daytrade#grind#covid#covid19#blm

1 note

·

View note

Text

3.2 Billion Dogecoin Reportedly Moved by Robinhood: Details

3.2 Billion Dogecoin Reportedly Moved by Robinhood: Details

According DogeWhaleAlerta data tracking service that gives alerts to whales for transactions over four million DOGE, 3.2 billion DOGE worth nearly $218 million was reportedly moved by Robinhood to cold storage.

Looks like @RobinhoodApp just moved 3.2B $DOGE (worth approximately US$218 million) possibly to cold storage. 👀#Dogecoin

– Ðogecoin Whale Alert (@DogeWhaleAlert) July 19, 2022

By keeping…

View On WordPress

0 notes

Text

📢Coinbase Believes Bitcoin Will Become True Store Of Value Post-Halving | Cryptoknowmics

Watch Full Video 👉https://www.cryptoknowmics.com/videos/coinbase-believes-bitcoin-will-become-true-store-of-value-post-halving-cryptoknowmics?utm_source=tumblr&utm_medium=Sakshi&utm_campaign=Promotion

#Coinbase#Bitcoin#CryptoLender#Crypto#Fluree#BlockchainTechnology#UsAirForce#DigitalAssets#secs#SecsRegulatory#AustralianExchanges#Bsv#RobinhoodApp#UkMarket#Advance#FtxCrypto#DigitalToken#AmlGuidelines#CryptoExchangeTransactions#JimmyWales#BsvTieUp#MissingCryptoqueen#OnecoinStory

5 notes

·

View notes