#PFRDA

Link

#digitalinfluencers#Facebook#financialliteracy#finfluencers#Instagram#IRDA#LinkedIn#PFRDA#RBI#Sebi#SEBIconsultationpaperonfinfluencers#SecuritiesandExchangeBoardofIndia#socialmedia#stockexchange#Twitter#YouTube

1 note

·

View note

Text

Pension Fund Regulatory and Development Authority (PFRDA)

We are excited to launch our new competitive exam mock test website! Edunative is the best place to prepare for your upcoming exams. We offer a wide range of mock tests that are designed to help you ace your exams. With our mock tests, you can familiarize yourself with the exam format, test your knowledge and skills, and identify areas that need improvement. So what are you waiting for? Get started today and achieve your dreams!

0 notes

Text

PFRDA's assured return scheme launch may take another few months: Chairperson

PFRDA’s assured return scheme launch may take another few months: Chairperson

PFRDA is giving final touches to the assured return investment plan under the NPS architecture, while keeping the option to offer a fixed minimum return or benchmark it to a real-time rate open, a top official has said.

Pension Fund Regulatory and Development Authority is most likely to give the final shape to the product by the end of this month. However, the launching may take another few…

View On WordPress

0 notes

Text

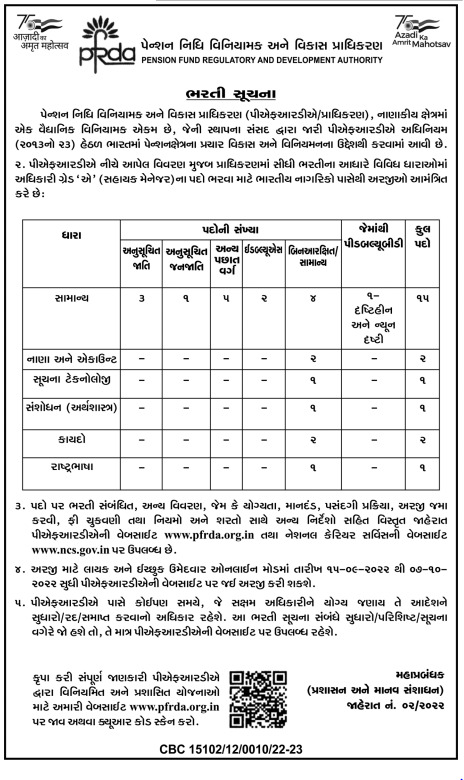

PFRDA Recruitment 2022 Apply Online For Manager Post

PFRDA Recruitment 2022 Apply Online For Manager Post

PFRDA Recruitment 2022 Notification has been Released For Various Vacancies In Delhi or Mumbai. Pension Fund Regulatory and Development Authority issued a Detailed Notification For PFRDA Grade A Recruitment 2022 on 9th September. Job Seekers Can Apply Online From 15th September 2022. More Info has Given Below.

PFRDA Recruitment 2022

Job Recruitment Board

Pension Fund Regulatory and Development…

View On WordPress

0 notes

Text

PFRDA Grade-A Assistant Manager Recruitment Notification 2022: Online Apply Sarkari naukari

PFRDA Grade-A Assistant Manager Recruitment Notification 2022: यदि आप भी एक ग्रेजुएट कैंडिडेट हैं और सरकारी नौकरी की तलाश कर रहे हैं तो आप इस भर्ती में अपना ऑनलाइन आवेदन कर सकते हैं जो पेंशन निधि विनियामक एवं विकास प्राधिकरण के अंतर्गत असिस्टेंट मैनेजर के

PFRDA Grade-A Assistant Manager Recruitment Notification 2022: यदि आप भी एक ग्रेजुएट कैंडिडेट हैं और सरकारी नौकरी की तलाश कर रहे हैं तो आप इस भर्ती में अपना ऑनलाइन आवेदन कर सकते हैं जो पेंशन निधि विनियामक एवं विकास प्राधिकरण के अंतर्गत असिस्टेंट मैनेजर के पद पर नियुक्ति की जाएगी तो चलिए देखते हैं इसकी पूरी डिटेल जैसे: PFRDA Grade A Education Qualification, Age limit, Exam pattern, Syllabus…

View On WordPress

0 notes

Text

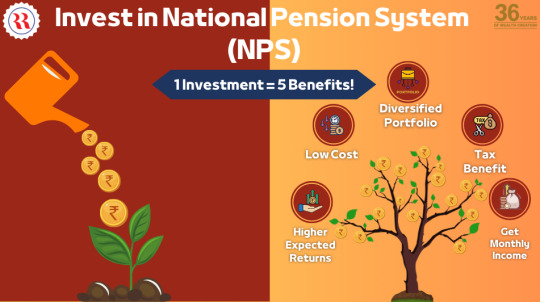

Create a Financially Secure Future, Open an NPS Account

We live in a digital and fast-paced era where financial planning has become a necessity for every individual. Financial security has become a top priority. One of the effective ways to plan your retirement is by opening a National Pension System (NPS) account. Numerous benefits are associated with NPS and also opening an NPS account is easy and less time-consuming.

In this blog, we’ll explore the benefits of NPS along with the step-by-step process for NPS registration.

Understanding the National Pension System (NPS)

The National Pension System is a voluntary retirement savings scheme and it is regulated by PFRDA (Pension Fund Regulatory and Development Authority). The primary objective of NPS is to provide financial security during your retirement years.

There are many advantages of NPS such as flexible investment options, and diversification which gives you the freedom to invest in equities, corporate bonds, government securities, and alternative investments. It allows you to tailor your portfolio according to your risk appetite and financial goals.

Benefits of NPS

Flexibility: When you invest in NPS, you have two investment options to choose from: active mode or auto mode. In active mode, you can select the allocation of your fund across asset classes. On the other hand, auto choice allocates your fund based on your age as it slowly shifts to lesser risk investment as you close to retirement.

Low-cost investment: NPS is known for its affordable retirement investment scheme. You can open an NPS tier 1 account with ₹500 to keep the account active you must deposit ₹1000 yearly. This makes NPS one of the lowest retirement investment schemes.

Tax benefits: The National Pension Scheme comes with various tax benefits. Your contributions made towards NPS are eligible for tax benefits under Section 80CCD(1) of the Income Tax Act. Moreover, there is an additional benefit of ₹50,000 under the Section 80CCD(1B).

How to open an NPS account online

Opening an NPS account online is an easy and hassle-free process. You can follow these steps:

Log onto a trusted eNPS portal: The first would be visiting a trusted eNPS portal online. You can open it through your laptop or mobile.

Register: The next step is to register yourself as a new ‘Subscriber’. This needs your details such as PAN card, Aadhaar Number, and other personal information.

Generate PRAN: After you successfully register yourself, you will receive a Permanent Retirement Account Number (PRAN). It is important to access your account online.

Contribute: Once your NPS account is activated, you can start contributing to it.

Monitor your investments: You can monitor your investments online regularly, track your portfolio performance, view transaction history, allocate your assets, and make changes as per your financial goals.

Conclusion

Opening an NPS account can be an easy way to start your retirement planning journey. With its tax benefits, flexibility, and affordability, NPS offers worry-free financial cover in your golden days. Take advantage of the eNPS portal and you can experience a financially secure retirement.

0 notes

Text

12 Safe Investment options with high returns in India?

Investment plans typically assist you in achieving your life goals if you select them by your financial plan. Regardless of your financial goal’s duration, take your financial milestones into account while selecting a plan.

Let’s have a look at the best Indian investment opportunities listed below.

Direct Equity- Stocks: For investors who are willing to take risks, direct equity stocks are among the greatest choices. Direct equity investment is the process of purchasing listed equity equities of businesses on stock exchanges. Direct stock investments can yield either dividends or capital gains. Stock performance is influenced by a variety of factors, including firm success and market position.

A. This option has a high risk-return ratio and is among the most volatile investments.

B. Among the greatest ways to invest money to grow wealth adjusted for inflation

C. appropriate for a lengthy time frame

Having both a bank account and a Demat account is necessary to begin investing in this. A high-risk appetite is also necessary if you wish to continually invest in stocks and profit from them. Before beginning an investment, familiarize yourself with how equity stocks and markets operate.

2. Equity Mutual Funds: The main asset class of equity mutual funds is equity stocks and related instruments. These are among the greatest investment choices available in India for little individuals hoping to gain from the expansion of the equity market. With equities mutual funds, you can begin investing with as little as Rs 500 to start building well-diversified portfolios of equity companies.

Between 70 and 95 percent of the fund value may be allocated to equities stocks and similar securities by these funds. Due to their equity basis, these provide a high ratio of risk to return. Mutual funds that offer equity often fall into two categories:

a. Actively managed Mutual Fund: The fund manager is quite involved with these kinds of funds. The success of this fund is significantly influenced by the knowledge and skills of the fund management. They do research and analysis before selecting the stocks in which the fund will invest. Passive investment alternatives are seen as less risky than active funds.

b. Passively managed mutual funds: A large role is not played by the fund management in this kind of fund. The fund is predicated on a specific market portfolio or index. As an illustration, consider a fund composed of NIFTY50 stocks, etc. The performance of this fund is determined by the index’s performance.

3. Equity debt Funds: If you want to minimize volatility or don’t have a strong risk appetite, you might want to look into debt mutual funds or bond funds as investment options. These fixed-income instruments are also part of a diversified portfolio.

Debentures, corporate and government bonds, as well as other long-term fixed-income instruments, make up the amount invested in Debt Funds. Funds might have different risk profiles depending on the kind of securities they own in their portfolio. Prior to investing, you should evaluate the risk by looking up the ratings of the assets the fund owns.

If you desire the steadiness of returns with less risk, funds that hold government bonds or highly rated securities are appropriate. Therefore, you may think about debt funds when:

You avoid taking chances.

Relatively fixed returns are what you seek.

The principal’s safety comes first.

Keep in mind that all debt funds will still be subject to interest rate risk.

4. National Pension Scheme: One investing plan backed by the government that can help you protect your retirement is the National Pension System. The Pension Fund Regulatory and Development Authority (PFRDA) is in charge of regulating it.

This assists you in building a substantial retirement fund that you can use. As an investor who works for yourself or is salaried, you can use the NPS retirement account.

Two varieties of NPS accounts exist.

Retirement Account, Tier-I

Level II

The ability to aggressively grow your corpus is the main distinction between NPS and other provident fund investments. It uses an auto-rebalancing strategy to keep your portfolio risk-free as you become older. You can also receive a deduction for your contribution of up to Rs 2 lakhs.

The portfolio mixes you select and the duration of your investment will determine the risk-return on your NPS investment. Therefore, both risk-averse and aggressive investors can benefit from this retirement investment option.

5. Public Provided Funds: When looking for safe investment options to place their money in, PPF is one of the most well-liked and greatest options. The ideal investing plan for successfully reaching your long-term goals is the 15-year plan. The plan, which was first presented as a secure retirement investment option for independent contractors, has gained popularity among long-term investors since it offers:

Tax Effectiveness

Section 80C allows you to deduct up to Rs. 1.5 lakhs. The maturity value is tax-free as well.

Availability of liquid assets

During the first five years of the account, you are able to borrow against the accrued corpus. Partial withdrawals are permitted after five years.

A mix of Risk and Return

low-risk investment with an annual rate of return that is linked to the market.

Investment period

Minimum Investment Period of 15 Years; thereafter, accounts may be extended in 5-year increments.

6. Bank Fixed Deposit: Another well-liked investment choice in India that guarantees the security of your funds and yields consistent returns is a bank fixed deposit. A set rate of interest will be provided for a predetermined period of time when you invest a lump sum amount. You will get the principal amount plus any compound interest accrued during the term when your term expires.

When investing in a bank fixed deposit, take into account the following:

Returns on bank FDs are guaranteed. The principal sum is therefore secure.

Your FD cannot be withdrawn until it matures. You risk paying penalties and missing out on compound interest if you withdraw before the term is up.

These are among India’s most adaptable investing choices. The duration of the investment can range from seven days to ten years.

In a bank savings account, the initial interest rate will be maintained for the duration of the agreement. As a result, your deposit’s return is set until it matures.

The interest can be reinvested or received.

Upon maturity, banks also let you have your FD automatically renewed.

7. Senior Citizen Saving Scheme: The Senior Citizen Savings Scheme, often known as SCSS, is one of the investment choices that assists participants in reaching their retirement objectives by providing a steady stream of income. You can make a lump sum investment in this scheme after reaching 60. It is one of the possibilities for small savings investments. Every quarter, you will be paid a fixed interest amount.

There are two ways to create a SCSS account:

through the post office

Through Bank

Seniors find it to be a very popular investment option because of its attractive and guaranteed returns. As of Q3 FY 2022-23, the rate of returns is 7.6%. There will be a quarterly adjustment to these rates.

Here are some SCSS characteristics to be aware of:

If you are older than sixty, you can invest in it. Those who have participated in the VRS (Voluntary Retirement Scheme) and are above 55 are also eligible to apply.

Rs 1000 is the minimum investment, meaning that you must deposit an amount greater than or equal to Rs 1000.

A maximum of Rs 15 lakh can be invested. This is the maximum amount that you can invest.

Interest is given out on a quarterly basis.

The five-year maturity term has the option to be extended by an additional three years.

8. Unit Linked Insurance Plans: Because it offers both insurance and a channel for investment, a Unit Linked Insurance Plan (ULIP) might be seen as an investment choice. The policyholder pays a portion of the premiums toward the life insurance and another portion toward the funds of their choice. Given that this life insurance plan delivers market-linked returns, a prospective investor should consider the plan’s advantages and disadvantages before making an investment.

A ULIP that provides both market-linked returns and life insurance is Canara HSBC Life Insurance Invest 4G. There are eight fund alternatives available, each with a partial withdrawal option.

9. Real estate Investment: In India, real estate is a wise choice for investors. But typically, it’s a significant financial commitment. Purchasing real estate, including houses, land, and plots, is referred to as investing. One of the finest ways to fight inflation with investments is to do this. You may be able to make both regular and capital gain income by investing in this.

You can generate additional revenue by renting out the building you recently bought. This will guarantee that you receive returns each month in the form of rent. You can sell your property for more money and make a capital gain if it has appreciated in value.

There is a well-known proverb that states that “location, location, location” are the three most crucial factors in real estate. This is the main element that determines whether or not your real estate investment is successful.

Although real estate in a prime location can be pricey, it also has higher potential for appreciation and can fetch a higher rent.

10. RBI Bonds: One of the safest investment alternatives available in India are RBI Bonds. To generate funds for the advancement of various government programs, the Reserve Bank of India, or RBI, issues bonds to the general public. There is a word attached to these bonds. Money is refunded along with interest earned upon maturity.

These bonds are available for purchase from four private banks as well as all twelve national chains. The RBI will give you a certificate of holding in recognition of your debt. Upon maturity, this certificate will serve as evidence.

These are for a period of seven years.

These can be non-cumulative, in which the interest is paid out as a regular income, or cumulative, in which the money is reinvested.

11. Pradhan Mantri Vaya Vandana Yojana: Seniors, particularly individuals 60 years of age and over, have access to investing choices such as the Pradhan Mantri Vaya Vandana Yojana (PMVVY). After sixty years of age, it provides you with a steady source of income.

It has a longer validity period but still offers interest at a rate of 7.4% annually. This is the current interest rate, good through March 31, 2023.

The following are some qualities of PMVVY that could make you think about making this investment:

Pension payable on a quarterly, annual, or monthly basis

It will mature in ten years.

You can invest a maximum of Rs 9250 per month, and a minimum of Rs 1000 is required.

If you have owned this for more than three years, you can use it to offset loans up to a value of 75%.

12. Gold: In India, gold is frequently seen as the best investment choice for safeguarding a family’s legacy. However, purchasing gold as a family heirloom is now nearly impossible due to growing expenses and fees.

Alternatively, you can steadily increase your gold purchasing power over time by using investing choices like Gold ETFs. They are referred to as “paper gold” in general. It includes investments and gold stocks. In contrast to pricey gold, they can be purchased from the stock market based on your financial situation.

This is an Exchange Traded Fund (ETF), which means it is managed passively. It is a reflection of the real gold price movement of the same caliber. The NAV of the ETF will increase in tandem with rising gold rates.

0 notes

Text

Invest in the National Pension System (NPS)

Unlocking Future Financial Security: The Importance of Early National Pension System Investment

The National Pension System(NPS)stands as a beacon of financial security, offering Indian citizens a voluntary and contributory pension scheme to ensure a comfortable retirement. Launched by the Government of India, NPS aims to provide retirement income by allowing individuals to contribute regularly during their working years. Upon retirement, subscribers receive either a lump sum or periodic payments, known as a pension, based on their contributions and investment returns. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS offers a range of investment options, providing flexibility to contributors to choose between various asset classes such as equities, government bonds, and corporate debt. Available to citizens across all sectors, including public, private, and unorganized, as well as self-employed individuals, National Pension System offers tax benefits under Section 80CCD of the Income Tax Act, making it an attractive long-term savings avenue for retirement planning. The National Pension System details are given below.

Selecting the Right Mix : Asset Allocation in National Pension System

When it comes to planning for retirement through NPS, selecting the appropriate mix of asset classes and Pension Fund Manager (PFM) is crucial. NPS offers four primary asset classes under a single PFM, each with its unique characteristics and risk-return profiles:

Asset Class E – Equity and Related Instruments : Subscribers have the flexibility to allocate up to 75% of their Tier-I investment and 100% of their Tier-II investment to Equity, providing potential for higher returns over the long term.

Asset Class C – Corporate Debt and Related Instruments : This option allows subscribers to allocate a portion of their portfolio to corporate debt, enhancing stability and generating income.

Asset Class G – Government Bonds and Related Instruments : Subscribers can allocate a portion of their portfolio to government bonds, ensuring capital preservation while providing safety and stability.

Asset Class A - Alternative Investment Funds : Including instruments like CMBS, MBS, REITs, and AIFs, Alternative Investment Funds offer diversification and potential for higher returns. However, the allocation to Alternative Investment Funds cannot exceed 5% of the total portfolio value.

Exclusive Tax Benefits for NPS Subscribers -

NPS offers exclusive tax benefits to all subscribers under subsection 80CCD (1B) of the Income Tax Act, 1961. Subscribers can avail an additional deduction for investment up to Rs. 50,000 in NPS (Tier I account), over and above the deduction of Rs. 1.5 lakh available under section 80C. This makes NPS a tax-efficient investment avenue, providing an opportunity to save on taxes while building wealth for retirement.

The following are the benefits of NPS:

Investing in NPS at an early stage of life offers a multitude of benefits that can significantly impact one's financial future :

Harnessing the Power of Compounding : Early investment allows for maximum benefit from compounding, leading to substantial wealth accumulation over the long term.

Building a Sizeable Retirement Corpus : Starting NPS investments at a young age enables subscribers to build a sizeable retirement corpus through regular contributions and long-term investment growth, ensuring financial security during retirement

Availing Tax Benefits : NPS offers attractive tax benefits, including deductions under Section 80C, making it a tax-efficient investment avenue.

Flexibility and Portability : NPS offers flexibility and portability, allowing subscribers to choose their investment options and adapt their strategy as their financial circumstances evolve over time.

Long-Term Investment Horizon : NPS is designed for the long term, allowing subscribers to take advantage of the long investment horizon and potential market upswings over time.

In conclusion, the national pension system benefits the investor by providing a secure and tax-efficient avenue for retirement planning, with early investment providing numerous benefits, including harnessing the power of compounding, building a sizeable retirement corpus, and availing tax benefits. Therefore, starting National Pension System investments early is essential for securing a financially stable retirement future.

For additional investment opportunities, kindly explore: https://www.rrfinance.com/

0 notes

Text

GIFT City (Gujarat International Finance Tec-City), located at Gandhinagar in Gujarat, is emerging as a global financial hub, redefining the financial landscape in India. It is an initiative of the Government of Gujarat supported by the Government of India for the development of a greenfield smart city and IFSC (International Financial Services Center).

Headquartered at GIFT IFSC, Gandhinagar in Gujarat, the International Financial Services Centres Authority (IFSCA) is established under the International Financial Services Centres Authority Act, 2019. India's maiden offshore financial centre. The regulatory powers of RBI, SEBI, IRDAI, and PFRDA have been vested in IFSCA for regulating financial institutions, products, and services in IFSC at GIFT City. It is a special financial jurisdiction in India that allows investors to conduct foreign currency transactions with ease.

GIFT IFSC is home to multiple services, to name a few - capital market, banking services, fintech companies, startups, and offshore asset management. It is designated as a Special Economic Zone (SEZ) and offers incentives to attract foreign investors and financial institutions. This includes tax benefits, regulatory ease, and world-class infrastructure that is a blend of sustainability and technology.

One of the key attractions within this ambitious project is the establishment and operation of offshore funds. In this blog, we will underline the significance of offshore funds in GIFT IFSC, as well as the numerous benefits that they bring to the table for investors looking to strengthen their portfolios.

0 notes

Text

Ministry of Finance

PFRDA notifies amendments to Trustee Bank (TB) and Central Recordkeeping Agency (CRA) Regulations for Good Governance with focus on subscriber protection, reduce cost of compliance and enhance ease of doing business

The Pension Fund Regulatory and Development Authority (PFRDA) has notified the Trustee Bank (TB) (Amendment) Regulations, 2023 and the Central Recordkeeping Agency…

View On WordPress

0 notes

Text

PFRDA Officer Grade A Assistant Manager

It's time to put your knowledge to the test! Our new competitive exam mock test is now available. With this test, you can see how you stack up against others who are preparing for the same exams. Take the mock test now and see where you rank. Then, start studying and get ready to ace the real thing!

0 notes

Text

youtube

Pension for All - NPS & APY from South Indian Bank

NPS and APY are the Pension schemes introduced by Govt of India, regulated by PFRDA, to secure old age of all Indian Citizens. All newly joined Central, State employees and bankers, who are eligible for pension will be getting pension through NPS only. NPS is open to all Indian Citizens (Resident or NRI) & OCIs between the ages of 18-70 and APY is open to all Indian Citizens (Resident or NRI) between the ages of 18-40. NPS is a voluntary defined contribution pension scheme, whereas APY is a minimum guaranteed pension scheme by Govt of India.

0 notes

Text

UTI Retirement Solutions Ltd. (UTI RSL)

UTI Retirement Solutions Ltd. (UTI RSL) is one of the Pension Fund Managers appointed by Pension Fund Regulatory & Development Authority (PFRDA) for managing Pension assets under the National Pension System (NPS). It manages the Pension Assets/Funds of Central Government Employees, State Government Employees and the Private Sector NPS Subscribers. For more information visit at https://www.utirsl.com/

1 note

·

View note

Text

PFRDA seeks tax breaks for employers' NPS flows

Pan India HNI database http://goo.gl/sh5Q5V http://dlvr.it/T11Vq7

0 notes

Text

NPS Contribution Made Easy: Utilize D-Remit QR Code for Quick and Convenient Transactions

Circular No: PFRDA/2023/35/Sup-CRA/11

6th Dec 2023

ToAll NPS subscribers

Subject: Convenience of NPS Contribution through Personalized QR Code of D-RemitAs part of PFRDA’s commitment to provide the NPS subscribers with an enhanced experience during their NPS journey, another digital mode of contribution has been enabled.

Currently, the subscribers are provided with the option of contributing…

View On WordPress

0 notes

Text

NPS Trust seeks Indian Officer Grade B & A for Risk, Investment, Research, Finance roles; apply online.

New Post has been published on https://www.jobsarkari.in/nps-trust-seeks-indian-officer-grade-b-apply-online/

NPS Trust seeks Indian Officer Grade B & A for Risk, Investment, Research, Finance roles; apply online.

The National Pension System Trust (NPS Trust) is seeking applications from eligible Indian citizens for Officer Grade B (Manager) and Grade A (Assistant Manager) positions. The NPS Trust is established by the Pension Fund Regulatory and Development Authority (PFRDA) to manage the assets and funds of the National Pension System (NPS) and other authorized schemes. There are vacancies in various streams, including Risk Management, Investment and Research, Finance & Accounts. The detailed advertisement with eligibility criteria, selection process, application submission, and payment of fees can be found on the NPS Trust website. Interested candidates can apply from 25.11.2023 to 24.12.2023. The NPS Trust reserves the right to modify or cancel the recruitment exercise at any stage. Any updates or corrections will be posted on the NPS Trust website.

National Pension System Trust (NPS Trust) is established by Pension Fund Regulatory and Development Authority (PFRDA) for managing assets and funds under the National Pension System (NPS).

NPS Trust is inviting applications for the positions of Officer Grade B (Manager) and Grade A (Assistant Manager).

The vacancies are available in various streams such as Risk Management, Investment and Research, Finance, and Accounts.

Eligible candidates can apply from 25.11.2023 to 24.12.2023.

The comprehensive advertisement with eligibility criteria and application details can be found on the website of NPS Trust at www.npstrust.org.in.

Introduction

National Pension System Trust (NPS Trust) manages assets and funds under the National Pension System (NPS)

NPS Trust is inviting applications for Officer Grade B and Grade A positions

Officer Grade B (Manager)

Vacancies available in Risk Management and Finance & Accounts streams

Eligible candidates can apply from 25.11.2023 to 24.12.2023

Detailed eligibility criteria and application process on the NPS Trust website

Officer Grade A (Assistant Manager)

Vacancies available in Investment and Research stream

Eligible candidates can apply from 25.11.2023 to 24.12.2023

Detailed eligibility criteria and application process on the NPS Trust website

Risk Management Stream (Grade B)

1 vacancy available

Join a dynamic team focused on managing risks effectively

Finance & Accounts Stream (Grade B)

1 vacancy available

Play a crucial role in managing financial operations

Investment and Research Stream (Grade A)

1 vacancy available

Contribute to investment strategies and research analysis

Important Dates

Application period: 25.11.2023 to 24.12.2023

Stay updated with any corrigendum on the NPS Trust website

Last date of submission: 24.12.2023

Eligibility Criteria

Refer to the comprehensive advertisement on the NPS Trust website for detailed eligibility requirements

Ensure you meet the necessary qualifications before applying

Application Process

Follow the instructions provided in the comprehensive advertisement

Submit your application online within the specified timeframe

NPS Trust Website

Visit www.npstrust.org.in for the comprehensive advertisement and further information

Stay informed about any updates or changes to the recruitment process

Exciting Opportunities Await at NPS Trust

Join a prestigious organization managing assets and funds under the National Pension System

Apply for Officer Grade B and Grade A positions in Risk Management, Investment and Research, and Finance & Accounts

Don’t miss the chance to contribute to the future of pension funds in India!

0 notes