#MoneyManagementTips

Text

youtube

#FinancialIndependence#MoneyManagementTips#InvestmentAdvice#WealthCreation#BudgetingHacks#FinancialPlanning#SavingsStrategies#SmartSpending#FrugalLiving#DebtFreeJourney#RetirementPlanning#FinancialEmpowerment#EconomicFreedom#MoneyMindfulness#FinancialLiteracy#WealthBuildingTips#FinancialGoals#PersonalFinanceTips#BudgetingWisdom#FinancialWellness#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

0 notes

Text

Effective even after more than 100 years What is the secret to financial success taught by "The Millionaire of Babylon"?

“The Richest Man in Babylon” by George S. Clayson, translated by Yutaka Oshima

George Classen wrote the well-known self-help book The Millionairess of Babylon, which was first released in 1926. This novel uses a narrative style to teach financial success concepts while taking place in the fictional Babylonian metropolis. This book serves as a priceless manual for readers who want to achieve financial success and independence through the experiences and lessons gained by the characters.

Arcadias, a young, impoverished guy, visits Arcadias, a wealthy man, at the start of the story. The story demonstrates how Arcadius applies the money management lessons that the Babylonian merchants taught him to succeed. Arcadius teaches Arcadius these lessons. In the narrative, Arcadius accumulates money through saving, investing, and adhering to old Babylonian financial laws and principles.

Ten principles summarize the financial lessons Arcadius learnt and are given in this book. These include investing sensibly, controlling your risks, and setting aside 10% of your salary for savings. It also goes over key concepts for financial success, like the dangers of debt and the value of continuing education for oneself.

Contemporary readers have also been greatly impacted by this tale. The financial lessons Arcadius learnt are still relevant today, even in light of historical context, and they are crucial lessons for anybody aiming for success and financial independence. The timeless self-help book The Millionairess of Babylon, which highlights the significance of comprehending and putting basic financial ideas into practice, is still highly valued by many people today. still has an impact on people.

0 notes

Text

youtube

#moneymanagementtips#moneymakingtips#makingmoneytips#moneymakingtipss#makingmoneytipss#financialfreedom#financialfacts#Youtube

0 notes

Text

In today's fast-paced and dynamic world, managing debt and securing financial health is more crucial than ever. Akermon Rossenfeld, a seasoned financial expert, has graciously shared seven invaluable tips to guide you on the path to financial stability. Let's delve into these practical suggestions and empower ourselves to take control of our financial well-being.

#Moneymanagementtips#Financialwellness#Debtmanagement#Personalfinance#Budgetingtips#Financialfreedom#Creditmanagement

0 notes

Text

Boost your business success with Meru Accounting's top Financial Tips!

Master the art of bookkeeping for unparalleled Financial Management.

#MeruAccounting#bookkeepingcompany#bookkeepers#bookkeepingservices#bookkeepingtips#bookkeeping#accounting#accountingservices#financialmanagement#financial#financialservices#FinancialManagement#moneymanagementtips#financialtips

0 notes

Text

Unlocking the Secrets to Building Wealth: Proven Strategies for Financial Success

Welcome to our comprehensive guide on building wealth and achieving financial success. In this guide, we will explore the proven strategies and techniques that can help you pave the way for a prosperous future. Whether you're just starting your journey or looking to take your financial success to the next level, this guide has everything you need to know.

Building wealth is an achievable goal if you are willing to put in the effort and follow a proven strategy. This guide will provide you with actionable tips and insights to help you get started on your path to financial success. From setting clear financial goals to understanding how to invest wisely, we will cover everything you need to know to unlock the secrets of building wealth.

Key Takeaways:

Building wealth requires strategic planning and disciplined execution.

Setting clear financial goals is crucial for success.

Investing wisely can lead to long-term growth and wealth accumulation.

Passive income can generate additional streams of revenue.

Protecting your wealth through adequate insurance coverage and comprehensive estate planning is essential.

#financialsuccess101#moneymanagementtips#wealthcreationstrategies#smartinvestmentadvice#financialgoalsachiever#moneygrowthhacks#successfulmoneyhabits#financialfreedompath#moneywisdomsolutions#financialsuccessjourney

0 notes

Text

Managing Money in Your 20s

Hey there, fellow 20s! 🎉 Welcome to the exciting world of managing money in your 20s. It's a time when you're figuring out life, making big decisions, and perhaps dealing with your first taste of financial independence. Don't worry; we've got you covered with some tips, tricks, and valuable advice to help you navigate this financial journey. So grab your favorite beverage and let's dive right in!

Budgeting: Your Financial GPS 📊

One of the first things you'll want to do is set up a budget. Think of it as your financial GPS, guiding you through the twists and turns of managing your money. Tools like Mint and YNAB can make budgeting a breeze.

Here's a simple budgeting checklist:

Income: List your sources of income, including your job, freelancing, or any side hustles.

Expenses: Track your monthly bills, groceries, transportation, and discretionary spending.

Savings: Allocate a portion of your income to savings and emergency funds.

Stick to Your Budget

Once you have a budget in place, stick to it! Avoid the temptation to overspend on non-essentials. Remember, every dollar you save today can help secure your financial future.

ALSO READ: Interesting stories

Pay Off High-Interest Debt💳

If you have high-interest debts, like credit card balances, tackle them ASAP. High-interest debts can be a financial burden. Consider consolidating or refinancing them for a lower interest rate.

Student Loans

If you're dealing with student loans, explore repayment options and consider refinancing if it makes sense for your situation. Tools like Student Loan Hero can be your allies.

Start Early🌟

Your 20s are an excellent time to start investing for your retirement. Check out options like a 401(k) if your employer offers one, or open an Individual Retirement Account (IRA).

Diversify Your Investments

Don't put all your eggs in one basket. Diversify your investments across different asset classes to spread risk. Websites like Vanguard and Betterment can help you get started.

LEARN MORE: Read blogs and articles here!!!

Emergency Fund: Your Financial Safety Net 💡

Life can throw curveballs, so having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses. Bankrate has more insights on building your financial safety net.

Financial Literacy 📚

Stay informed about personal finance. Websites like Investopedia and The Balance offer a wealth of information to expand your financial knowledge.

Managing money in your 20s is a thrilling adventure full of opportunities and challenges. By budgeting wisely, managing debt, saving for the future, and staying informed, you're setting yourself up for financial success. Remember, every small step you take today can lead to a brighter and more secure financial future.

ALSO CHECK: Affordable products

Happy money managing, and here's to your financial prosperity! 🌟

Read the full article

#Budgeting#CreditScore#DebtManagement#EmergencyFund#FinancialEducation#FinancialGoals#financialindependence#FinancialLiteracy#FinancialPlanning#FrugalLiving#Investmentstrategies#MoneyHabits#MoneyManagementTips#PersonalFinance#RetirementPlanning#SavingMoney#SideHustles#StudentLoans#TaxPlanning#wealthbuilding

0 notes

Text

https://secretofmoney.in/10-steps-to-financial-freedom/

0 notes

Text

money management tips: 5 useful tips to manage your money after a job loss

Thousands of job cuts have been announced in the first one-and-half months of 2023. The layoff wave has impacted not only startups but also big tech companies such as Amazon, Microsoft, Google, and Twitter. As many as 380 tech companies have axed 1,08,246 employees across the world this year, according to Layoffs.fyi, a tracking website.Being laid off can be devastating. But don't panic. You need to sketch a plan for how to pay your bills, and EMIs and manage your finances till you get a new job. Here are some useful tips to manage your money after a job loss.1) Cut your expenses

If you just got a pink slip, your monthly cash inflow will be reduced significantly. So, the first thing you need to do is slash your miscellaneous expenses. Stop ordering food frequently, cut down on going out every weekend and eating outside, and cancel the gym membership or OTT subscription that you hardly use, said experts. Eliminating all discretionary expenses in one go can be difficult, so try to reduce them to the bare minimum. For instance, plan a family movie night at home instead of a luxury meal outside.

2) Prepare a monthly balance sheet

Make sure that you prioritise your fixed expenses such as insurance premiums, loan EMIs, credit card repayments, and monthly instalments for mutual fund SIPs. First, take stock of the savings you have. Then, you need to calculate your monthly financial commitments and liabilities. "Check and budget your savings in such a way as to have at least six months of survival money. After being fired, in all probability, it will take time to get hired," said Ankit Mehra, CEO and Co-founder of GyanDhan, an NBFC. If you don't have enough savings, then you need to prioritise your investments. Stop your monthly SIP if the finances are too constrained. For home or vehicle loans, you can request the bank to reduce the EMI amount by increasing the loan tenure. You can also inform your insurance company about your situation. Check whether they can alter the periodicity of payment of the premium or reduce the cover amount temporarily, suggested experts.3) Review your investment portfolio with a long-term perspective

You need to cut down on your expenses. However, do not dig into your retirement corpus or long-term investment goals. "Look at how much you spend each month and see where you can save. Review your investment portfolio to ensure that it aligns with your current financial goals and risk tolerance. Make changes to your investment portfolio gradually and with a long-term perspective in mind and not make any drastic changes based on short-term market events or emotions," said Kartik Narayan, Chief Executive Officer - Staffing, TeamLease Services.

4) Money crunch? Go for loan against your investments, borrow from friends and family

If you don't have an emergency corpus, use your bank savings to go through this period. If it is insufficient, you can start withdrawing from your existing investments. The interest on a loan against assets such as fixed deposit, PPF, insurance, gold, or property is usually cheaper than personal loans. For example, the loan from the PPF account has an interest rate that is 1 per cent higher than the current effective interest rate. So, if you request a loan against your PPF, the interest rate could be 8.1 per cent. Do note that other terms and conditions will be applicable to be eligible for a loan against PPF. At present, the interest rate on personal loans in any public or private sector bank usually starts from 10.5 per cent, depending on your income and assets. If you have invested in a mutual fund, you can also consider redeeming your investments. So, choose wisely in case you need some urgent cash flow."Ensure you don’t borrow money at high-interest rates thus getting into a debt trap," Sudhakar Raja, Founder, and CEO of TRST Score, a human risk mitigation platform.You can also reach out to friends and family to borrow some money to survive this period. You can always repay it later when you get a job again.5) Take care of your mental health

"Layoffs are brutal. They bring with them a range of negative emotions that will derail you. Take one day at a time. If you are feeling overwhelmed, get in touch with your friends, family, or even a therapist (free resources are available)," said Mehra. Don't be discouraged by job loss

Finally, do remember that being laid off is not necessarily a reflection of your performance. "Don't be discouraged by the job loss. Know that this is just one of the phases of an economic cycle. Apply for jobs in the sectors that are currently performing well. Hone your skills for higher job security," said Sumit Sabharwal, CEO, TeamLease HR Tech.

Source link

Read the full article

#googlelayoffemployees#howtomanageafterlayoff#howtomanagemoneyafterlayoff#itjobcut#layoffsinit#moneymanagementtips#teamleaseservices#techlayoff#twitterlayoffemployees

0 notes

Text

The Future of Money: What You Need to Know to Survive and Thrive

The Future of Money: What You Need to Know to Survive and Thrive

https://www.youtube.com/watch?v=OTqrOUjWejs

In this eye-opening video, we dive into the fascinating world of the future of money. From cryptocurrencies to digital wallets, our financial landscape is rapidly evolving, and staying informed is key to securing your financial future. Join us as we explore the latest trends, technologies, and strategies that will help you not only survive but thrive in the ever-changing world of money. Don't miss out on this essential information – hit that subscribe button and stay ahead of the game! 💸💡

🔔Ready to achieve Financial Independence by 2025? Click 'Subscribe' and embark on a transformative journey with us: https://www.youtube.com/@family.fire.by.2025

✅ For Business Inquiries: [email protected]

=============================

✅ Recommended Playlists

👉 Financial Independence Facts

https://www.youtube.com/watch?v=OSsqUU0UnJ8&list=PLFbNQzXkUGyw0P-rfVrdiC4-ph8ky3uL_&pp=iAQB

👉 Financial Independence

https://www.youtube.com/watch?v=VG-32QwZ1T0&list=PLFbNQzXkUGyytYLW5TZHFg_Kxdd-bEOfU&pp=iAQB

✅ Other Videos You Might Be Interested In Watching:

👉 Overcoming Money Setbacks Road to Financial Freedom!💰

https://www.youtube.com/watch?v=5avpEXdIbE8

👉 Supercharge Your F.I.R.E Journey: Unleashing the Power of Dividend Reinvestment!

https://www.youtube.com/watch?v=1Jq-nmMxplU

👉 Stop Losing Money! How Lifestyle Inflation Erodes Your Financial Freedom

https://www.youtube.com/watch?v=_uRVmjuZyWU

👉 A Surprising Way to Retire Early & Keep Your Luxury Life! Financial Independence Retire Early

https://www.youtube.com/watch?v=w0GfswvQmrI

👉 Location is the Key to Financial Freedom--But How? Financial Independence Retire Early

https://www.youtube.com/watch?v=SbGOvfoTptE

=============================

✅ About Family FIRE 2025.

Welcome to "Family Fire 2025"! Join our Singaporean family's quest for Financial Independence Retire Early (F.I.R.E) by 2025.

Our channel is your ultimate guide to understanding the F.I.R.E movement, achieving financial freedom, and exploring effective investment strategies, personal finance, budgeting, stock market investing, real estate, saving techniques, and essential financial tools.

We're on a mission to educate and inspire you by sharing our family's journey toward financial independence and demonstrating how smart money habits can lead to a life free from financial stress. We believe everyone can achieve F.I.R.E. with dedication and the right knowledge.

Subscribe to our channel, and let's ignite the F.I.R.E within you together!

Let us embark on this transformative journey, empowering you to take control of your financial destiny and attain the freedom you've always desired.

For Collaboration and Business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔From real estate to stock markets, discover the roadmap to financial freedom with us. Hit that subscribe button: https://www.youtube.com/@family.fire.by.2025

=================================

#FutureOfMoney

#FinancialRevolution

#CryptoTrends

#DigitalCurrency

#BlockchainTech

#InvestingSmart

#FintechInnovation

#CashlessSociety

#PersonalFinance

#MoneyMatters

#DigitalWallets

#CryptocurrencyNews

#EconomicOutlook

#FinancialEducation

#MoneyManagementTips

Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of our publications. You acknowledge that you use the information we provide at your own risk. Do your research.

Copyright Notice: This video and our YouTube channel contain dialog, music, and images that are the property of Family FIRE 2025. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to our YouTube channel is provided.

© Family FIRE 2025

via Family FIRE 2025 https://www.youtube.com/channel/UCUbT9IupjUO551P-H-NAH1g

October 30, 2023 at 01:00AM

#FinancialIndependence#Budgeting#SavingMoney#Investing#PassiveIncome#DebtReduction#WealthCreation#Entrepreneurship#FinancialFreedom#MoneyManagement#PersonalFinance

0 notes

Video

Ultimate purchasing decision

When you think you want something, you wait two weeks to buy it.

Read that again and think how much money you’d save with this mindset. This mentality will save you thousands in purchases you didn’t need.

#financetips #financialfreedom #moneymanagementtips #money #buyeragentfinder #abodefinder #directhomeselling

0 notes

Photo

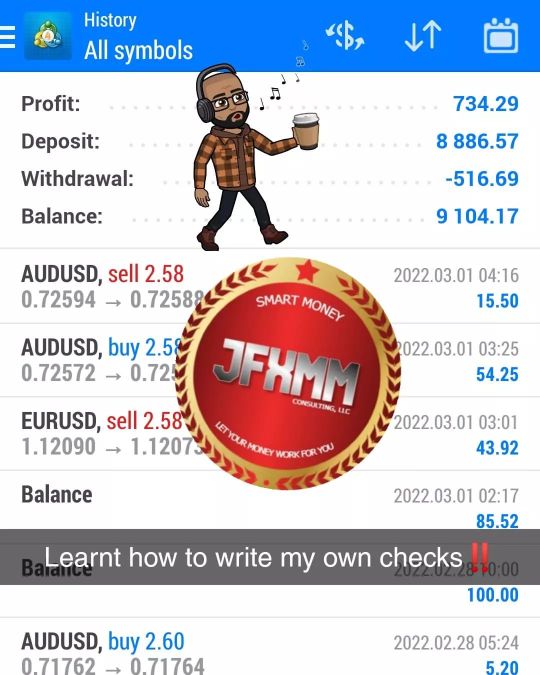

I know trading ain't for everybody but if you are young and not sure what you want to do with your career learning how to invest is something you want to look into super early baby, you can do this...you can walk these numbers down Patience is key 🗝️ Taking action is principle I AM #FXMasterMinds Automated trading is now available Earn passively or while you learn 45% to 50% Monthly gains on autopilot Earning passively in the market has never been this easy until now, Winning all 2022 long‼️ Click my link in the bio... #pamm #mamm #money #automatedtrading #EAforextrader #forex #forexsignals #forexsignal #forexschool #EAforex #forextrader #forextrading #forexanalysis #forexlifestyle #forexmarket #fxsignals #fxprofit #profit #moneymanagementtips #money #payday #currency #currencytrader #bullmarket #robottrading https://www.instagram.com/p/Cam56iTu68a/?utm_medium=tumblr

#fxmasterminds#pamm#mamm#money#automatedtrading#eaforextrader#forex#forexsignals#forexsignal#forexschool#eaforex#forextrader#forextrading#forexanalysis#forexlifestyle#forexmarket#fxsignals#fxprofit#profit#moneymanagementtips#payday#currency#currencytrader#bullmarket#robottrading

0 notes

Text

Money management is an art. When a person has mastered this art, he becomes financially sound. Good money management be taught to our children. Therefore, they could learn money management from their early age and during their 20s, they could earn, save and invest too.

In this article, author Ms.Sowmya, young writer, has discussed 10 financial tips for youngsters the factors that influence youngsters saving behavior. Moreover, author has shared practical aspects about how to manage your money, regulate your expenses wisely and throws light on how to find financial advice.

To read the complete article, click here: https://www.mcqna365.com/10-financial-tips-for-youth/

0 notes

Text

#moneymanagementtips#moneymakingtips#makingmoneytips#moneymakingtipss#makingmoneytipss#financialfreedom#financialfacts

0 notes

Photo

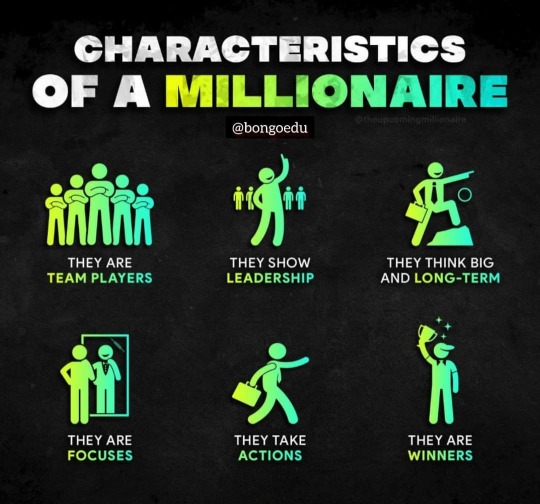

Thoughts on it ? 🤔 @bongoedu ------------ . 💎 Follow @bongoedu 💎 💎 Follow @bongoedu 💎 💎 Follow @bongoedu 💎 . . . . (𝐇𝐀𝐒𝐇𝐓𝐀𝐆𝐒) ⬇️ #assetmanagement #assetprotection #moneymanagementtips #moneymoves #businessowner #businessmotivation #businessopportunity #businessadvice #businessstrategy #businessofdesign #businesscasual #businessstructure #businessmentor #businessmindset https://www.instagram.com/p/CVert4FP5eI/?utm_medium=tumblr

#assetmanagement#assetprotection#moneymanagementtips#moneymoves#businessowner#businessmotivation#businessopportunity#businessadvice#businessstrategy#businessofdesign#businesscasual#businessstructure#businessmentor#businessmindset

0 notes

Text

Breaking the Cycle: Strategies to Overcome Bad Money Habits and Create Lasting Change

Are you tired of being stuck in a never-ending cycle of bad money habits? Do you want to break free and create lasting change? Look no further! In this article, we will explore effective strategies to overcome your bad money habits and take control of your financial future.

Managing money can be challenging, especially when we fall into unhealthy patterns and habits. But the good news is, with the right mindset and strategies, it's possible to break free from these patterns and create positive change.

Understanding the cycle of bad money habits

Bad money habits often develop over time and become deeply ingrained in our behavior. It's essential to understand the underlying cycle that keeps us trapped in these habits. The cycle typically starts with a trigger, such as stress, boredom, or a desire for instant gratification. This trigger leads to impulsive spending or overspending, which then results in guilt, stress, and financial instability. Unfortunately, these negative emotions often lead to seeking comfort in spending again, perpetuating the cycle.

To break free from this cycle, we must first recognize the patterns and triggers that lead to our bad money habits. By understanding the root causes, we can develop strategies to combat them effectively.

#breakingthecycle#overcomebadmoneyhabits#createlastingchange#moneymanagementtips#financialfreedomjourney#personalfinancegoals#financialhabits#moneymanagementstrategies#financialtransformation#financialwellbeing

0 notes