#Medicare Part B Premiums

Text

How income affects your Medicare drug coverage premiums

You could pay a higher monthly premium for Medicare drug coverage (Part D) depending on your income. This includes Part D coverage you get from a Medicare drug plan, a Medicare Advantage Plan with drug coverage, or a Medicare Cost Plan that includes drug coverage. This is true even if your drug coverage is through your employer.

Download this bulletin to learn more about extra Medicare drug…

View On WordPress

#healthinsuranceinPA#healthinsurancenearby#HealthInsuranceNearMe#healthinsuranceNJ#Aetna Medicare#affordable care act#Blue Cross Medicare Plans#compliance#health insurance#Healthcare reform#Individual Mandate#medicare#Medicare Advantage#Medicare Donut Hole#Medicare OEP#medicare open enrollment#Medicare Part B#Medicare Part B Premiums#medicare part d#Medicare Part D Coverage Gap#Medicare Prescription Drug#medicare supplements#MSA: Medicare Savings Accounts#Pennie Health Insurance#Short Term Health Insurtnce

0 notes

Text

Understanding Form SSA-44 and Its Impact on Medicare Premiums

What is Form SSA-44?

Form SSA-44 is used to report a life-changing event to the Social Security Administration (SSA) that may result in a reduction of the income-related monthly adjustment amount (IRMAA) for Medicare coverage. This form is relevant for beneficiaries who experience a decrease in income due to specific events and are currently paying higher premiums for Medicare Part B and…

View On WordPress

#IRMAA adjustment#life-changing event Medicare#lower Medicare premiums#Medicare IRMAA appeal#Medicare Part B premium#Medicare premium reduction#Medicare prescription drug coverage#report income decrease#Social Security office#SSA-44 form

0 notes

Text

A big cost and concern for many seniors in the U.S. is the price of prescription drugs and other healthcare expenses—and this year, thanks to The Inflation Reduction Act, their costs may go down dramatically, especially for patients fighting cancer or heart disease.

I learned about the new benefits because my ‘Medicare birthday’ is coming up in a couple months when I turn 65. I was shocked that there were so many positive changes being made, which I never heard about on the news.

Thousands of Americans on Medicare have been paying more than $14,000 a year for blood cancer drugs, more than $10,000 a year for ovarian cancer drugs, and more than $9,000 a year for breast cancer drugs, for instance.

That all changed beginning in 2023, after the Biden administration capped out-of-pocket prescriptions at $3,500—no matter what drugs were needed. And this year, in 2024, the cap for all Medicare out-of-pocket prescriptions went down to a maximum of $2,000.

“The American people won, and Big Pharma lost,” said President Biden in September 2022, after the legislation passed. “It’s going to be a godsend to many families.”

Another crucial medical necessity, the shingles vaccine, which many seniors skip because of the cost, is now free. Shingles is a painful rash with blisters, that can be followed by chronic pain, and other complications, for which there is no cure

In 2022, more than 2 million seniors paid between $100 and $200 for that vaccine, but starting last year, Medicare prescription drug plans dropped the cost for shots down to zero.

Another victory for consumers over Big Pharma affects anyone of any age who struggles with diabetes. The cost of life-saving insulin was capped at $35 a month [for people on Medicare].

Medicare is also lowering the costs of the premium for Part B—which covers outpatient visits to your doctors. 15 million Americans will save an average of $800 per year on health insurance costs, according to the US Department of Health and Human Services.

Last year, for the first time in history, Medicare began using the leverage power of its large patient pool to negotiate fair prices for drugs. Medicare is no longer accepting whatever drug prices that pharmaceutical companies demand.

Negotiations began on ten of the most widely used and expensive drugs.

Among the ten drugs selected for Medicare drug price negotiation were Eliquis, used by 3.7 million Americans and Jardiance and Xarelto, each used by over a million people. The ten drugs account for the highest total spending in Medicare Part D prescription plans...

How are all these cost-savings being paid for?

The government is able to pay for these benefits by making sure the biggest corporations in America are paying their fair share of federal taxes.

In 2020, for instance, dozens of American companies on the Fortune 500 list who made $40 billion in profit paid zero in federal taxes.

Starting in 2023, U.S. corporations are required to pay a minimum corporate tax of 15 percent. The Inflation Reduction Act created the CAMT, which imposed the 15% minimum tax on the adjusted financial statement income of any corporation with average income that exceeds $1 billion.

For years, Americans have decried the rising costs of health care—but in the last three years, there are plenty of positive developments.

-via Good News Network, February 25, 2024

#united states#medicare#healthcare#healthcare access#big pharma#prescription drugs#health insurance#us politics#good news#hope#seniors#aging#healthy aging

2K notes

·

View notes

Text

youtube

Today we will discuss financial assistance to cover the cost of Medicare.

Explore Medicaid, a joint federal-and-state program that covers out-of-pocket expenses for dual-eligible individuals.

Learn about Medicare's four savings programs, aiding with Part A and Part B premiums, deductibles, copays, and charges based on your income.

If you're concerned about prescription costs, we discuss the Extra Help program that supports those with limited resources in covering Part D expenses.

To learn more, go to aarp.org/medicare.

225 notes

·

View notes

Text

youtube

Social Security and Medicare are two programs that help support us as we age. Social Security provides financial support in retirement, while Medicare ensures access to healthcare services.

Social Security offers income for retirees or those unable to work due to health reasons. It also extends support to families who've lost loved ones, providing survivor benefits.

Meanwhile, Medicare steps in to offer health insurance for individuals aged 65 and older, as well as those with certain disabilities or illnesses.

When it comes to enrolling, the Social Security Administration (SSA) partners with the Centers for Medicare and Medicaid Services (CMS) to guide older Americans through the process. SSA sends out enrollment packages before your Medicare enrollment period begins, typically three months before you turn 65.

If you're already receiving Social Security benefits at age 65, you'll likely be automatically enrolled in Medicare. But if not, you'll need to apply through the SSA website.

Now, on to payments. Once enrolled, most individuals pay monthly premiums for Medicare Part B, that covers outpatient treatments. Social Security simplifies this process by deducting Part B premiums directly from benefit payments. If you have Medicare Advantage or Part D plans, you can also set up deductions from your benefits.

28 notes

·

View notes

Text

If You Don't Know Medicare Advantage Is a Scam, You're Not Paying Attention

We’re on the edge of the open enrollment period for Medicare, and the Advantage scammers will be carpet-bombing America with advertisements over the next few months. Don't be fooled about what it is—and who is profiting.

Thom Hartmann

Oct 07, 2023

Common Dreams

President George W. Bush and Republicans (and a handful of on-the-take Democrats) in Congress created the Medicare Advantage scam in 2003 as a way of routing hundreds of billions of taxpayer dollars into the pockets of for-profit insurance companies.

Those companies, and their executives, then recycle some of that profit back into politicians’ pockets via the Citizens United legalized bribery loophole created by five corrupt Republicans on the Supreme Court.

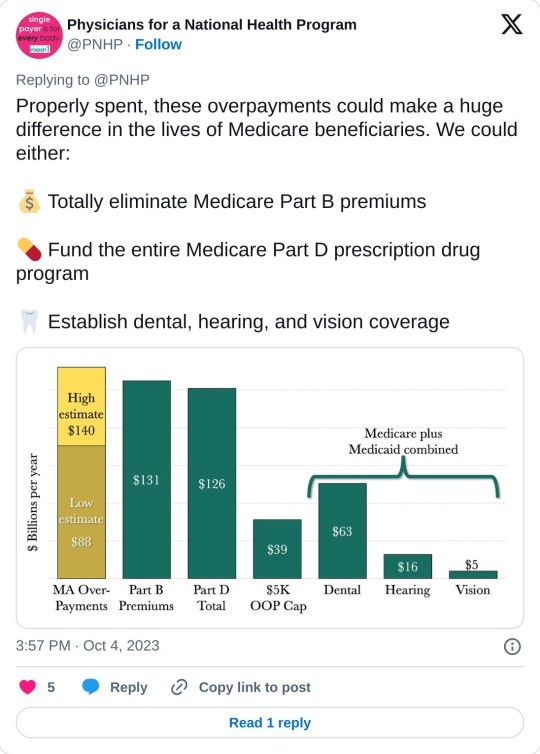

Just the overcharges happening right now in that scam are costing Americans over $140 billion a year: more than the entire budget for the Medicare Part B or Part D programs. These ripoffs — that our federal government seems to have no interest in stopping — are draining the Medicare trust fund while ensnaring gullible seniors in private insurance programs where they’re often denied life-saving care.

Real Medicare pays bills when they’re presented. Medicare Advantage insurance companies, on the other hand, get a fixed dollar amount every year for each of the people enrolled in their programs, regardless of how much they spent on each customer.

As a result, Medicare Advantage programs make the greatest profits for their CEOs and shareholders when they actively refuse to pay for care, something that happens frequently. It’s a safe bet that nearly 100 percent of the people who sign up for Advantage programs don’t know this and don’t have any idea how badly screwed they could be if they get seriously ill.

Not only that, when people do figure out they’ve been duped and try to get back on real Medicare, the same insurance companies often punish them by refusing to write Medigap plans (that fill in the 20% hole in real Medicare). They can’t do that when you first sign up when you turn 65, but if you “leave” real Medicare for privatized Medicare Advantage, it can be damn hard to get back on it.

The doctors’ group Physicians for a National Health Program (PNHP) just published a shocking report on the extent of the Medicare Advantage ripoffs — both to individual customers and to Medicare itself — that every American should know about.

The report, titled Our Payments, Their Profits, opens with this shocking exposé:

“By our estimate, and based on 2022 spending, Medicare Advantage overcharges taxpayers by a minimum of 22% or $88 billion per year, and potentially by up to 35% or $140 billion. By comparison, Part B premiums in 2022 totaled approximately $131 billion, and overall federal spending on Part D drug benefits cost approximately $126 billion. Either of these — or other crucial aspects of Medicare and Medicaid — could be funded entirely by eliminating overcharges in the Medicare Advantage program.

“Medicare Advantage, also known as MA or Medicare Part C, is a privately administered insurance program that uses a capitated payment structure, as opposed to the fee-for-service (FFS) structure of Traditional Medicare or TM. Instead of paying directly for the health care of beneficiaries, the federal government gives a lump sum of money to a third party (generally a commercial insurer) to ‘manage’ patient care.”

With real Medicare and a Medigap plan, you talk with your physician or hospital and decide on your treatment, they bill Medicare, and you never see or hear about the bill. There is nobody between you and your physician or hospital and Medicare only goes after the payment they’ve made if they sniff out a fraud.

With Medicare Advantage, on the other hand, your insurance company gets a lump-sum payment from Medicare every year and keeps the difference between what they get and what they pay out. They then insert themselves between you and your doctor or hospital to avoid paying for whatever they can.

Whatever you decide on regarding treatment, many Advantage insurance company will regularly second-guess and do everything they can to intimidate you into paying yourself out-of-pocket. Often, they simply refuse payment and wait for you to file a complaint against them; for people seriously ill the cumbersome “appeals” process is often more than they can handle.

As a result, hospitals and doctor groups across the nation are beginning to refuse to take Medicare Advantage patients. California-based Scripps Health, for example, cares for around 30,000 people on Medicare Advantage and recently notified all of them that Scripps will no longer offer medical services to them unless they pay out-of-pocket or revert back to real Medicare.

They made this decision because over $75 million worth of services and procedures their physicians had recommended to their patients were turned down by Medicare Advantage insurance companies. In many cases, Scripps had already provided the care and is now stuck with the bills that the Advantage companies refuse to pay.

Scripps CEO Chris Van Gorder told MedPage Today:

“We are a patient care organization and not a patient denial organization and, in many ways, the model of managed care has always been about denying or delaying care – at least economically. That is why denials, [prior] authorizations and administrative processes have become a very big issue for physicians and hospitals...”

Similarly, the Mayo Clinic has warned its customers in Florida and Arizona that they won’t accept Medicare Advantage any more, either. Increasing numbers of physician groups and hospitals are simply over being ripped off by Advantage insurance companies.

Not only is the Medicare Advantage scam a screw job for healthcare providers and people who are on the programs and are unfortunate enough to get sick, it’s also preventing Americans from getting expanded benefits from real Medicare.

As the PNHP report notes, for real Medicare to provide comprehensive vision, dental, and hearing benefits to all Medicare recipients would cost the system around $84 billion a year, according to the Congressional Budget Office.

Instead, though, the Medicare system is burdened with at least that amount of money in over-payments to Medicare Advantage providers — over-payments that have no health benefit whatsoever and merely inflate the companies’ profits.

A hundred billion dollars in excess profits can be put to a lot of uses, and the health insurance industry is quite good at it. The former CEO of UnitedHealth, “Dollar” Bill McGuire, for example, made off with over $1.5 billion dollars for his efforts.

And, because five corrupt Republicans on the Supreme Court legalized political bribery with their Citizens United decision, some of these companies allocate millions every year (a mere drop in the bucket) to pay off loyal members of Congress and to dangle high-paying future jobs to high-level employees of CMS who have the power to keep the gravy train going and thwart prosecutions.

As PNHP noted:

“Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American health care, siphoning money from vulnerable patients while delaying and denying necessary and often life-saving treatment. While there is obvious reason to fix these issues in MA and to expand Traditional Medicare for the sake of all beneficiaries, the deep structural problems with our health care system will only be fixed when we achieve improved Medicare for All.”

We’re on the edge of the open enrollment period for Medicare, and the Advantage scammers will be carpet-bombing America with advertisements over the next few months. Representatives Pocan, Khanna, and Schakowsky have introduced the “Save Medicare Act” that would ban Advantage companies from using the word Medicare in their advertising.

They made a video about it that’s well worth sharing with friends and family:

youtube

As Schakowsky, Khanna, and Pocan note, “Only Medicare is Medicare.” Don’t be fooled by the Medicare Advantage scam.

And now that you know, pass it on and save somebody else’s health!

41 notes

·

View notes

Text

President Joe Biden will call for expanding a new cap on insulin prices to all Americans as part of his State of the Union address, the White House said Monday.

During the Tuesday speech, Biden plans to tout his administration’s efforts to make health care more affordable, which included imposing a $35-per-month limit on insulin that took effect in January.

But that price cap, which was passed as part of last year’s Inflation Reduction Act, only applied to those beneficiaries covered by Medicare. Biden is now expected to renew his push for the policy to be applied to anyone with an insulin prescription, the White House said in a fact sheet.

“The President will call on Congress to extend this commonsense, life-saving protection to all Americans,” the fact sheet said.

Democrats had originally planned to pass a universal insulin price cap last year as part of the Inflation Reduction Act, which was passed along party lines last August. But the policy was scaled back after Republicans successfully challenged its inclusion. Democrats since then have vowed to continue to push for its passage, arguing that it’s broadly popular and crucial to ensuring that people can afford essential medicines.

Still, Biden’s fresh support for expanding the price cap is unlikely to result in much concrete progress. Republicans remain opposed to the measure, and are unlikely to even allow a vote on it in the House now that they control the chamber.

Biden during his State of the Union speech is also expected to highlight a handful of other health care accomplishments, including landmark legislation granting Medicare the right to negotiate drug prices and cap certain out-of-pocket pharmacy costs. He will celebrate the three latest states to expand their Medicaid programs, while urging Congress to pass legislation that would close coverage gaps in the 11 holdout states that have yet to expand Medicaid.

The President also plans to call for continuing to lower health insurance costs, pointing to expanded Obamacare subsidies that the administration estimates lowered customers’ premiums by an average of $800 per year and pushed the nation’s uninsured rate to an all-time low.

#us politics#news#politico#2023#president joe biden#biden administration#state of the union#affordable healthcare#us healthcare#Inflation Reduction Act#medicare#universal insulin price cap#the right to negotiate drug prices#cap out-of-pocket pharmacy costs#expand Medicaid#lower health insurance costs#expand Obamacare subsidies

171 notes

·

View notes

Note

I thought medicare was a single insurance? how are there 6???????

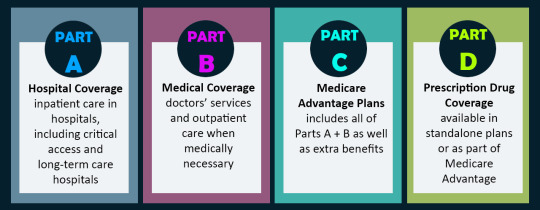

You would think so! But it does come in multiple parts, Parts A, B, C, D, Medigap, and Medicare Savings Program:

Medigap is not included in this infographic and wasn't included in many other graphics or sites. But Medigap helps pay for your insurance deductibles ($200-something for A/B and depends on your plan for part D or part C). The Medicare Savings Program helps pay for your premiums (mine are $165/mo) if you make under a certain amount. There is also Extra Help, which is separate and specifically for prescription assistance. Also to make things even More confusing for everyone involved, Medicare is not actually 100% the same nationwide. There are state specific contractors that decide whether certain things (like gender affirming care) are covered, but you wouldn't know this unless you looked up each contractor and found some way to speak to them. Makes things very difficult for you and for clinics trying to figure out if a treatment is covered.

You only get part A and/or part B automatically. You technically are supposed to automatically be enrolled in the savings program and extra help if you qualify, but I didn't get automatically enrolled in the savings program despite qualifying and I got automatically enrolled last year in extra help but had to apply separately for the coming year. You have to apply separately for Part C, Part D, and Medigap.

If you're thinking "wow this is super inaccessible especially given that Medicare is the primary insurance of anyone aged 65+"...yeah.

#might as well put this in tags?#cripplepunk#disability#medicare#ask#anonymous#if someone wants to add an ID for the infographic that'd be nice

15 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Oct. 4, 2023

"Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American healthcare," says a new report from Physicians for a National Health Program.

A report published Wednesday estimates that privately run, government-funded Medicare Advantage plans are overcharging U.S. taxpayers by up to $140 billion per year, a sum that could be used to completely eliminate Medicare Part B premiums or fully fund Medicare's prescription drug program.

Physicians for a National Health Program (PNHP), an advocacy group that supports transitioning to a single-payer health insurance system, found that Medicare Advantage (MA) overbills the federal government by at least $88 billion per year, based on 2022 spending.

That lower-end estimate accounts for common MA practices such as upcoding, whereby diagnoses are piled onto a patient's risk assessment to make them appear sicker than they actually are, resulting in a larger payment from the federal government.

But when accounting for induced utilization—"the idea that people with supplemental coverage are likely to use more health care because their insurance pays for more of their cost"—PNHP estimated that the annual overbilling total could be as high as $140 billion.

"This is unconscionable, unsustainable, and in our current healthcare system, unremarkable," says the new report. "Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American healthcare, siphoning money from vulnerable patients while delaying and denying necessary and often lifesaving treatment."

Even if the more conservative figure is accurate, PNHP noted, the excess funding that MA plans are receiving each year would be more than enough to expand traditional Medicare to cover dental, hearing, and vision. Traditional Medicare does not currently cover those benefits, which often leads patients to seek out supplemental coverage—or switch to an MA plan.

The Congressional Budget Office has estimated that adding dental, vision, and hearing to Medicare and Medicaid would cost just under $84 billion in the most costly year of the expansion.

"While there is obvious reason to fix these issues in MA and to expand traditional Medicare for the sake of all beneficiaries," the new report states, "the deep structural problems with our healthcare system will only be fixed when we achieve improved Medicare for All."

Bolstered by taxpayer subsidies, Medicare Advantage has seen explosive growth since its creation in 2003 even as it has come under fire for fraud, denying necessary care, and other abuses. Today, nearly 32 million people are enrolled in MA plans—more than half of all eligible Medicare beneficiaries.

Earlier this year, the Biden administration took steps to crack down on MA overbilling, prompting howls of protest and a furious lobbying campaign by the industry's major players, including UnitedHealth Group and Humana. Relenting to industry pressure, the Biden administration ultimately agreed to phase in its rule changes over a three-year period.

Leading MA providers have also faced backlash from lawmakers for handing their top executives massive pay packages while cutting corners on patient care and fighting reforms aimed at rooting out overbilling.

As PNHP's new report explains, MA plans are paid by the federal government as if "their enrollees have the same health needs and require the same levels of spending as their traditional Medicare counterparts," even though people who enroll in MA plans tend to be healthier—and thus have less expensive medical needs.

"There are several factors that potentially contribute to this phenomenon," PNHP's report notes. "Patients who are sicker and thus have more complicated care needs may be turned off by limited networks, the use of prior authorizations, and other care denial strategies in MA plans. By contrast, healthier patients may feel less concerned about restrictions on care and more attracted to common features of MA plans like $0 premiums and additional benefits (e.g. dental and vision coverage, gym memberships, etc.). Insurers can also use strategies such as targeted advertising to reach the patients most favorable to their profit margins."

A KFF investigation published last month found that television ads for Medicare Advantage "comprised more than 85% of all airings for the open enrollment period for 2023."

"TV ads for Medicare Advantage often showed images of a government-issued Medicare card or urged viewers to call a 'Medicare' hotline other than the official 1-800-Medicare hotline," KFF noted, a practice that has previously drawn scrutiny from the U.S. Senate and federal regulators.

PNHP's report comes days after Cigna, a major MA provider, agreed to pay $172 million to settle allegations that it submitted false patient diagnosis data to the federal government in an attempt to receive a larger payment.

Dr. Ed Weisbart, PNHP's national board secretary, toldThe Lever on Wednesday that such overpayments are "going directly into the profit lines of the Medicare Advantage companies without any additional health value."

"If seniors understood that the $165 coming out of their monthly Social Security checks was going essentially dollar for dollar into profiteering of Medicare Advantage, they would and should be angry about that," said Weisbart. "We think that we pay premiums to fund Medicare. The only reason we have to do that is because we're letting Medicare Advantage take that money from us."

13 notes

·

View notes

Photo

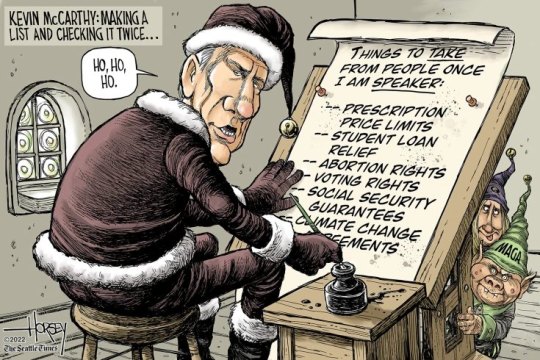

David Horsey, Seattle Times

* * * *

Today, President Joe Biden held an event in the Rose Garden at the White House to celebrate the lower drug costs possible thanks to the Inflation Reduction Act, which passed without any Republican votes in either the House or the Senate. Phasing in over the next few years, the measure will cap the out-of-pocket costs for prescription drugs at $2000 a year and make vaccinations free for seniors on Medicare. If the price of drugs rises faster than inflation, drug companies will have to rebate the difference to Medicare. And Biden noted that today, the Department of Health and Human Services announced that the premium for Medicare Part B, which pays for doctor visits, will decrease this year.

All of this was possible, he said, because the biggest corporations in America will have to pay a minimum corporate tax of 15%. “The days of billion-dollar companies paying zero taxes are over.” “And,” he added, “we’re doing all this by bringing down the deficit at the same time. You hear about us being ‘big spenders’? Well, they raised the debt by $2 trillion. We’ve reduced the deficit in my first year, 2021, by $350 billion.”

Biden called out the Republican budget plan, written by Florida senator Rick Scott, to sunset all federal legislation in five years, promising that Congress will reauthorize it if it is worthwhile. This means that every five years, Congress will have to vote to reauthorize Social Security and Medicare or they will end. Wisconsin senator Ron Johnson has gone further, calling for moving Social Security and Medicare spending from mandatory spending, which is protected, to discretionary spending, which must be reapproved every year, thus making it vulnerable to cuts or even elimination.

“I have a different idea,” Biden said. “I’ll protect those programs. I’ll make them stronger. And I’ll lower your cost to be able to keep them.”

Biden likely made this stand, at least in part, because Republican attack ads have been telling seniors that the Democrats have made cuts to Medicare. It is technically true that costs will drop: the government should save $237 billion between 2022 and 2031 from the Inflation Reduction Act’s drug policies. But these savings come from the fact that the IRA lets the federal government negotiate with pharmaceutical companies over prices, not because it will cut the benefits seniors receive.

Disinformation seems to be the hallmark of the midterm campaign.

[Letters From An American :: Heather Cox Richardson]

#corrupt GOP#Letters From An American#Heather Cox Richardson#David Horsey#Seattle Times#political Cartoons#midterms

74 notes

·

View notes

Text

A new cost of living adjustment (COLA) prediction for Social Security has many seniors scratching their heads at how they'll stretch their benefits amid inflation.

The Senior Citizens League (TSCL) just predicted the COLA for 2025, saying beneficiaries can expect a 2.66 percent bump in benefits. Earlier in the year, the estimate was set at 2.6 and 2.4 percent.

If a 2.66 percent boost is implemented, it would likely increase monthly payments by around $50 for most recipients.

While the jump in monthly benefits would be better than the earlier predictions, many seniors were expecting a higher boost to deal with the impacts of inflation.

The Social Security Administration adjusts Social Security payment amounts every year based on the consumer price index, but not everyone feels the change would be enough to get by.

"While COLA payments will increase to offset the effects of inflation, the problem many have with the potential percentage jump is it won't get far enough to meet most of the financial needs of seniors," Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, told Newsweek. "Obviously daily expenses for this age group continue to rise, but the uptick in healthcare costs are putting an additional strain on them, and COLA payments may not be enough to match that uptick."

Seniors will also likely be dealing with higher Medicare Part premiums, according to TSCL.

In the Medicare Trustee report from this month, Part B premiums were predicted to grow by $10.30 a month to a total of $185. That increase is on top of nationwide inflation on groceries, housing and transportation.

"For 2024, the average Social Security benefit rose by $50 and after subtracting $9.80 to cover Medicare Part B Premium increases, the total change in benefits came out to just $40.20 a month. With the forecast of a 2.66 percent COLA for 2025, it appears seniors will continue to suffer financial insecurity as much next year as they have this year," Shannon Benton, executive director of TSCL, said in a statement.

The COLA for each year depends on the rise of the consumer price index for urban wage earners and clerical workers (CPI-W) for the third quarter of the last year. That means the official COLA for 2025 won't be calculated until later in the year.

Many finance experts have questioned whether the CPI-W even stands as a good measure of what seniors can expect inflation wise, with many saying the consumer price index for the elderly (CPI-E)

In 2024, Social Security checks rose by 3.2 percent due to the COLA after a more generous increase of 8.7 percent last year. Many seniors, roughly 71 percent, reported in TSCL 2024 Senior Survey that the increase in household costs they saw went beyond the 3.2 percent jump from the COLA.

"The majority of seniors still feel like their costs are rising faster than those annual adjustments," Michael Ryan, a finance expert and founder/CEO of michaelryanmoney.com, told Newsweek. "So while the COLA certainly helps, it often still doesn't fully cover the real inflation draining seniors' buying power."

Due to the insufficient funds from Social Security for seniors, many will need additional income streams, including a 401(k), IRA or other investment accounts.

"At the end of the day, any COLA increase is better than none to prevent total Social Security stagnation," Ryan said. "But the 2.6 percent projection for 2025 underscores the need for policymakers to reexamine whether metrics like CPI-E would better serve seniors by more accurately reflecting their unique spending habits. We just want to make sure government benefits retain as much purchasing power over time as possible on those fixed incomes."

2 notes

·

View notes

Text

About that Medicare for All slogan

So I've been seeing 'Medicare for All' slogans again, and while I fully believe in universal health care I think they need to revise that slogan. Right now I also see a lot of people sneering because older Americans aren't glomming onto that slogan.

They really should, IMHO, be making that slogan "EXPANDED or REFORMED Medicare for all" to get people on board. Because as it is, it can be really costly, and many seniors and disabled people are not able to afford healthcare even with it. Those thinking it's a panacea as it is, without reform? Well, let's have a peek and see.

1. Background: Medicare is a program mostly for seniors and disabled people receiving SSDI.

There are two basic ways to get Medicare: be over a certain age (right now 67) and receive Social Security Retirement. OR, be younger than 67, disabled and receive Social Security Disability Insurance (SSDI). Disabled people who receive only SSI are not eligible for Medicare.

Original Medicare functions like a PPO. For those outside the States, you can go to any doctor that accepts Medicare and there are little to no prior authorizations required. This makes it easier for people to obtain quality care because they can go anywhere, more or less, and aren't trapped in a narrow provider network.

BUT:

2. Medicare is fucking confusing.

There's Part A (hospital), Part B (outpatient), Part D (drug coverage), Part C (Advantage plans) and several other moving parts, each with their own fee schedules and rules.

3. Medicare isn't free.

Part A is free for most, but if you don't qualify for that, it can cost up to $506/month.

Part A also has a deductible of $1600 every single inpatient hospital stay. For those outside the USA, the deductible is the amount you have to pay out of pocket before the insurance will pay anything at all.

If someone is in the hospital for a while, they start paying copayments that begin at $400/day, starting on the 61st day. If they need to be in skilled nursing facilities for surgery/injury recovery, copayments of $200/day kick in after the 20th day.

Part B (outpatient) has a premium which, as of 2023, is $164.90 per month, as well as a once-yearly deductible of $226.

Medicare is an 80/20 scheme, which means they cover 80% of the bill and you get the rest. That might not sound too bad until you look at what medical care in the USA costs. A simple MRI might be billed at $3000. 20% of that is yours. Still sound reasonably priced?

4. Medicare doesn't cover everything.

Dental, optical and many other things are notoriously not covered by Medicare. That's why you will find people on Medicare buying separate coverage for these things - which means they're paying additional premiums every month.

5. We haven't even gotten to prescriptions yet.

So prescription coverage for Medicare is under Part D. You have to choose a prescription drug plan to administer your benefits and they are all different. Some might cost you nothing. Some might cost you a lot every month, so if you're keeping count, that's your fourth monthly premium after Part B, vision and dental. Some change their formulary every year. Those commercials about Medicare open enrollment? That's the period in the fall when people on Medicare have to sift through the formularies and see if their PDP is going to cover their meds next year. Some people do qualify for Extra Help from Medicare which covers the premiums and brings down the coinsurance for meds, but not everyone.

Oh, and the meds are tiered. Tier 1 are the most basic/common meds that will cost you nothing or very little. Tier 4 are meds that are barely covered, perhaps 30%.

Wait, there's more! There's a 'donut hole' or coverage cap built into plans. Essentially, when your med costs reach $4660 for the year, the coverage gap begins. Right now you pay no more than 25% of the drug costs, but it used to be a complete gap. This continues until you reach $7400 in drug costs, at which time you enter the 'catastrophic' tier where meds usually cost a lot less. And it resets annually.

Think this is a hard cap to reach? Remember, common meds for things like cardiac conditions and headaches can cost $1000 each per month. Take a few of them and you're up to that $4460 real quick.

This is why you may have read or heard stories about seniors taking bus trips to Canada to buy meds. It's honestly cheaper sometimes to take a trip across the border than navigate this shit.

6. This is why a lot of people get pressed into an HMO.

In order to navigate a lot of the above, a lot of people get pressed into optional Medicare Advantage plans, technically Part C. These are mostly HMOs run by major insurance companies. They offer the promise of consolidating benefits, eliminating the copays and drug coverage web - at the cost of pressing you back into an HMO with referrals and prior authorizations, as well as their limited network.

OR people get a 'Medigap' supplement that covers the costs that Medicare doesn't, while allowing them to remain with original (PPO style) Medicare. Those typically cost more than the Part C plans.

7. Some people do get help, but it may be hard to navigate.

Some people have secondary insurance they can keep through a job or spouse. That might have premiums attached to it.

Some states have Medicare Savings Programs to help people pay the costs. But not all.

Some people earn little enough for SSDI or retirement that they also qualify for Medicaid as a secondary insurance. Medicaid generally picks up that which Medicare doesn't - such as that 20% coinsurance and the deductible. Medi-Medis are often pressured into joining HMOs as well, which really don't benefit them.

Medicare also has some programs like Extra Help and such, which they can help you apply for. But this is a lot for people to navigate.

So- this is why Medicare for All might not thrill people the way you think it might. REFORMED Medicare for All on the other hand might make the same people jump right on board.

5 notes

·

View notes

Text

Medicare enrollees will shell out about $10 more next year for their monthly Part B premiums, the Centers for Medicare and Medicaid Services announced Thursday.

The standard monthly premium for Medicare Part B will be $174.70 for 2024, up from $164.90 this year.

2 notes

·

View notes

Note

Why did they discontinue your drug plan? Are you still on Medicare?

Turning this into a Medicare Explanation Thing since a lot of people don't know, feel free to save this if you/someone you know is waiting on SSI/SSDI case or thinking about it. Medicare comes in 5 separate parts because why not make disabled people jump through a bunch of complex unnecessary stuff.

Part A is hospital, covering specifically hospital bills not regular outpatient appointments. Part B is medical insurance which is your primary Dr and everything outpatient. When you get on disability they will give you Part A and/or Part B. If you have both they call it Original Medicare. Original Medicare also only covers 80% of the cost of everything, you have to pay 20% out of pocket and they don't have a limit meaning there's not a point where you stop paying the 20%. Oh and Original Medicare doesn't cover vision, dental, or hearing.

Part D is prescription drug coverage. They usually do not immediately put you on this because it costs extra, but also if you fail to sign up for it and then sign up several months after getting Medicare you will be penalized with an extra cost for the rest of the time that you have Medicare (yay!). Part D is not directly through the govt, it's private insurances like United Healthcare that are contracted with the govt. If you only have Original Medicare, none of your meds are covered and you have to pay full price.

Part C is also called Medicare Advantage, it is optional where you get Part A, B, and D all bundled together but you do this through private insurers like UHC and BCBS. Some of them do not charge a premium but some of them do, which is important because you would be paying for Original Medicare and then also potentially paying another premium for Part C. There is also the downside that Medicare is accepted by a LOT of places, but if you do Medicare Advantage you have to go through drs that that insurer covers. That may/may not be an issue depending on where you live. Upside is it may cost less (because they often have limits on how much you pay before they cover 100%) or cover more things than Medicare.

Last one is Medigap which is a separate plan (that you also pay for and get penalized if you don't sign up in time) that helps pay for your deductible. The Original Medicare deductible is $200-something for 2023 meaning you have to pay that amount before Medicare even bothers covering 80%.

So for my specific circumstance, I still have Original Medicare and there's no issue with my govt disability payments either. I was auto-enrolled for Part D because I qualified for Extra Help (basically I am Extra Poor), but for some reason UHC gave me drug insurance for a state I don't live in. I called to correct it and they told me it was fine and they would just switch me to the correct state, except the contractor actually just cancelled the plan entirely without telling me that's what they were doing and also without signing me up for a new plan. Which I found out when I went to pick up from the pharmacy. If I did not qualify for Extra Help, which has Special Enrollment Periods, I would have had to go 4 months without drug insurance until Open Enrollment in October...I just lucked out so instead of waiting til Oct I only have to wait til next month.

#disability pride month#cripple punk#cripplepunk#medicare#disability#this is the bare bones of it too...not even talking about dual wielding Medicare/Medicaid#they send you basically a D&D player's handbook sized 'pamphlet' explaining it all#ask#anonymous

4 notes

·

View notes

Text

Senior Insurance Services in Florida

Whether you are looking for the latest Medicare plan information, or are considering Medicare Supplements, Senior Insurance Services in Florida can help you get the information you need. This company provides assistance with Claim and Carrier issues, and offers information on Medicare Part C (Medicare Advantage Plans) and Medicare Part D (prescription drug coverage).

Senior Life Services is an insurance company that offers final expense insurance. These plans pay medical bills that are incurred when a policyholder dies. They can also cover the cost of non-emergency medical transportation. These plans usually have affordable premiums, and have no health requirements. However, they are not the only options. In fact, there are many other life insurance companies that offer policies for the mature market.

Medicare Advantage plans are private insurance plans that combine Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) into one plan. These plans are usually offered through private insurance companies, and they offer nearly the same benefits as Original Medicare. These plans have a variety of eligibility requirements.

Medicare Advantage plans typically have a limited enrollment period. In addition, you may have to be enrolled in Original Medicare to apply. There are also different kinds of plans available, including health maintenance organizations (HMOs) and preferred provider organizations (PPOs). These plans stack multiple benefits onto a single plan, and have different out-of-pocket costs and referral rules.

Medicare Advantage plans have been very popular in Florida. The benefits of this type of insurance include nearly the same benefits as Original Medicare, along with valuable extra services. They can help pay for preventive health screenings and lab tests, and they may also cover services delivered during an inpatient hospital stay. In addition, they can offer additional benefits that are not included with Original Medicare, such as senior health sessions. However, Medicare Advantage plans are not free, and the cost can vary by ZIP code.

Medicare Advantage plans are often available as preferred provider organizations (PPOs) or health maintenance organizations (HMOs). However, there are also plans that are offered as free Medicare Advantage plans, such as those offered by the State of Florida. These plans may also offer additional benefits, such as non-emergency medical transportation and senior health sessions. However, these plans are not available in every county in Florida.

Medicare Advantage plans are a good choice for those who are on a fixed income. The monthly premiums can be affordable, and they can help pay for a variety of services. However, the annual out-of-pocket maximums vary, and most Part C plans have a maximum out-of-pocket limit. You may also be required to purchase a Medicare supplement, which will reduce your patient's portion of the bill to a near-zero amount.

This company is based in Vero Beach, Florida, and has more than 15 carriers to choose from. They offer products that cover the cost of long-term care, critical illness insurance, and annuities. They also provide free educational seminars, participate in community events, and offer free counseling.

2 notes

·

View notes

Text

HEATHER COX RICHARDSON

September 27, 2022 (Tuesday)

Today, President Joe Biden held an event in the Rose Garden at the White House to celebrate the lower drug costs possible thanks to the Inflation Reduction Act, which passed without any Republican votes in either the House or the Senate. Phasing in over the next few years, the measure will cap the out-of-pocket costs for prescription drugs at $2000 a year and make vaccinations free for seniors on Medicare. If the price of drugs rises faster than inflation, drug companies will have to rebate the difference to Medicare. And Biden noted that today, the Department of Health and Human Services announced that the premium for Medicare Part B, which pays for doctor visits, will decrease this year.

All of this was possible, he said, because the biggest corporations in America will have to pay a minimum corporate tax of 15%. “The days of billion-dollar companies paying zero taxes are over.” “And,” he added, “we’re doing all this by bringing down the deficit at the same time. You hear about us being ‘big spenders’? Well, they raised the debt by $2 trillion. We’ve reduced the deficit in my first year, 2021, by $350 billion.”

Biden called out the Republican budget plan, written by Florida senator Rick Scott, to sunset all federal legislation in five years, promising that Congress will reauthorize it if it is worthwhile. This means that every five years, Congress will have to vote to reauthorize Social Security and Medicare or they will end. Wisconsin senator Ron Johnson has gone further, calling for moving Social Security and Medicare spending from mandatory spending, which is protected, to discretionary spending, which must be reapproved every year, thus making it vulnerable to cuts or even elimination.

“I have a different idea,” Biden said. “I’ll protect those programs. I’ll make them stronger. And I’ll lower your cost to be able to keep them.”

Biden likely made this stand, at least in part, because Republican attack ads have been telling seniors that the Democrats have made cuts to Medicare. It is technically true that costs will drop: the government should save $237 billion between 2022 and 2031 from the Inflation Reduction Act’s drug policies. But these savings come from the fact that the IRA lets the federal government negotiate with pharmaceutical companies over prices, not because it will cut the benefits seniors receive.

Disinformation seems to be the hallmark of the midterm campaign.

In June, Republicans championed the overturning of the 1973 Roe v. Wade decision protecting the right to abortion, at first insisting that the Dobbs v. Jackson Womens’ Health decision would simply send the question of abortion rights back to the states. Now, with Republican lawmakers calling for a national law outlawing abortion everywhere, those running for election are scrubbing their websites of their abortion stances and downplaying the issue.

But today a 2019 radio interview with Pennsylvania state senator Doug Mastriano, now the Republican nominee for Pennsylvania governor, emerged. In it, Mastriano said that women obtaining abortions should be charged with murder. Mastriano has tried to say that his personal views are “irrelevant” because the legislature is in charge of rewriting the laws, but last week at Pennsylvania’s March for Life he called abortion rights “the single most important issue…in our lifetime,” and he has said he looks forward to signing restrictive measures into law.

Mastriano has called his Democratic opponent, Pennsylvania attorney general Josh Shapiro, extreme, although Shapiro supports current state law.

Florida governor Ron DeSantis has also gotten in on the disinformation game. Texas governor Greg Abbott has been ferrying migrants from the southern border north, appealing to the right-wing base with the argument that such movement will illustrate to “liberal” cities the burdens such migrants impose on the border states. On September 14, DeSantis got into the act, flying 48 unsuspecting migrants to Martha’s Vineyard, off the coast of Massachusetts. As DeSantis said: “The minute even a small fraction of what those border towns deal with every day are brought to their front door, they all go berserk.”

In fact, the people of Martha’s Vineyard welcomed the migrants, fed and sheltered them, and got them back to the mainland where they could have access to housing and human services. More to the point, it is a myth that Republican-dominated border states are bearing the brunt of migrants seeking asylum. Greg Sargent of the Washington Post asked the Transactional Records Access Clearinghouse at Syracuse University (TRAC) to figure out where the asylum seekers in the U.S. are.

From court records, TRAC calculated that 750,000 people are awaiting asylum hearings. More than 125,000 of them are in California. More than 110,000 are in New York. About 98,000 are scheduled for hearings in Florida, while about 75,000 are waiting in Texas. Most of the rest are scheduled for court hearings in Democratic-dominated states, such as New Jersey, Massachusetts, and Maryland.

DeSantis’s political performance has drawn attention not only from those who like the cruelty he has displayed, but also from those who have asked questions about the $1.6 million contract his administration signed with air charter company Vertol Systems to move the migrants. NBC’s Marc Caputo noted that Vertol has contributed to DeSantis’s top allies and is well connected to Republican Florida lawmakers. A later plan to fly migrants to Delaware near Biden’s beach home was canceled, and the DeSantis administration refused to release a copy of the Vertol contract.

The Florida state budget that authorized $12 million for moving migrants specified that “unauthorized aliens” were to be flown from “this state”: Florida. The migrants taken to Martha’s Vineyard were not “illegal immigrants” as DeSantis’s office says; they were legally seeking asylum—and thus were “authorized” to be in the U.S.—and were flown not from Florida but simply touched down there on their trip from Texas to Massachusetts.

Shortly before midnight on the day DeSantis shipped the migrants, his deputy press secretary, Jeremy Redfern, tweeted a photograph of former president Barack Obama’s Martha’s Vineyard home, saying “7 bedrooms with 8 and a half bathrooms in a 6,892-square-foot house on nearly 30 acres. Plenty of space.”

Now, Hurricane Ian is about to make landfall in Florida either tomorrow or early Thursday and threatens to be one of the most dangerous and costliest storms in U.S. history. Tonight, forecasters at the National Hurricane Center warned that it would hit land as a Category 4 storm. In addition to hurricane-force winds, they predict a storm surge of up to 12 feet between Fort Myers and Sarasota, and up to 2 feet of rain.

In the Rose Garden today, Biden assured people that his administration “is on alert and in action to help the people of Florida.” Biden approved DeSantis’s request for emergency assistance as soon as he received it, sent in federal assistance before the storm hit, and spoke with the mayors of Tampa, St. Petersburg, and Clearwater, the areas most likely to be in the storm’s path.

The Federal Emergency Management Agency (FEMA) has already sent 700 personnel to Florida, along with 3.5 million liters of water, 3.7 million meals, and hundreds of generators. Biden urged people to obey the instructions of local officials: “Your safety is more important than anything.”

Tonight, White House press secretary Karine Jean-Pierre tweeted that President Biden spoke with DeSantis this evening about “the steps the Federal government is taking to help Florida prepare for Hurricane Ian. The President and the Governor committed to continued close coordination.”

Because of the storm, the public hearing of the House Select Committee to Investigate the January 6th Attack on the U.S. Capitol scheduled for Wednesday has been postponed.

1 note

·

View note